- Search Search Please fill out this field.

- What Is DeFi?

- How DeFi Works

Decentralized Finance Uses

How to get involved in defi, concerns about defi, the bottom line.

- Cryptocurrency

What Is Decentralized Finance (DeFi) and How Does It Work?

:max_bytes(150000):strip_icc():format(webp)/profilepic__rakesh_sharma-5bfc262dc9e77c00517eda0b.jpg)

Amilcar has 10 years of FinTech, blockchain, and crypto startup experience and advises financial institutions, governments, regulators, and startups.

:max_bytes(150000):strip_icc():format(webp)/amilcar-AmilcarChavarria-7c0945d94896428a8f57a6a56d4710c8.jpeg)

What Is Decentralized Finance (DeFi)?

Decentralized finance (DeFi) is an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies.

In the U.S., the Federal Reserve and Securities and Exchange Commission (SEC) define the rules for centralized financial institutions like banks and brokerages, which consumers rely on to access capital and financial services directly. DeFi challenges this centralized financial system by empowering individuals with peer-to-peer transactions.

Key Takeaways

- Decentralized finance, or DeFi, uses emerging technology to remove third parties and centralized institutions from financial transactions.

- The components of DeFi are cryptocurrencies, blockchain technology, and software that allow people to transact financially with each other.

- DeFi is still in its infancy and subject to hacks and thefts because of sloppy programming and a lack of security testing before applications are launched.

How Decentralized Finance (DeFi) Works

Through peer-to-peer financial networks, DeFi uses security protocols, connectivity, software, and hardware advancements. This system eliminates intermediaries like banks and other financial service companies. These companies charge businesses and customers for using their services, which are necessary in the current system because it's the only way to make it work. DeFi uses blockchain technology to reduce the need for these intermediaries.

A blockchain is a distributed and secured database or ledger. In the blockchain, transactions are recorded in blocks and verified through automated processes. If a transaction is verified, the block is closed and encrypted; another block is created with information about the previous block, along with information about newer transactions.

The blocks are "chained" together through the information in each proceeding block, giving it the name blockchain . Information in previous blocks cannot be changed without affecting the following blocks, so there is no way to alter a blockchain. This concept, along with other security protocols, provides the secure nature of a blockchain.

Using applications called wallets that can send information to a blockchain, individuals hold private keys to tokens or cryptocurrencies that act like passwords. These keys give them access to virtual tokens that represent value. Ownership of the tokens is transferred by 'sending' an amount to another entity via a wallet, whose wallet, in turn, generates a different private key for them. This secures their ownership of the token, and the blockchain design prevents the transfer from being reversed.

Applications

DeFi applications are designed to communicate with a blockchain, allowing people to use their money for purchases, loans, gifts, trading, or any other way they want without a third party. These applications are programs installed on a device like a personal computer, tablet, or smartphone that make it easier to use. Without the applications, DeFi would still exist, but users would need to be comfortable and familiar with using the command line or terminal in the operating system that runs their device.

DeFi applications provide an interface that automates transactions between users by giving them financial options to choose from. For example, if you want to make a loan to someone and charge them interest, you can select the option on the interface and enter terms like interest or collateral. If you need a loan, you can search for providers, which could range from a bank to an individual who could lend you some cryptocurrency after you agree on terms.

Some applications let you enter parameters for the services you're looking for and match you with another user. Because the blockchain is a global network, you could give or receive financial services to or from anywhere in the world.

Decentralized finance does not provide full anonymity. Transactions do not include an individual's name but are traceable by anyone with the knowledge to do so. This includes governments and law enforcement, which, at times, are necessary for protecting an individual's financial interests.

Goals of Decentralized Finance

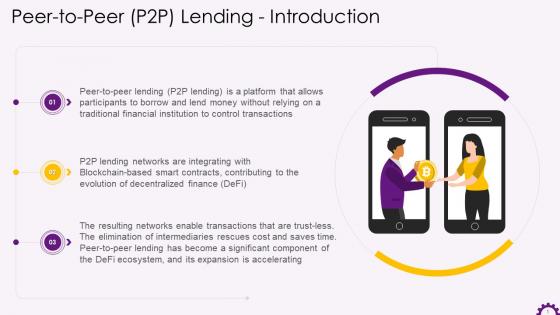

Peer-to-peer (P2P) financial transactions are one of the core premises behind DeFi, where two parties agree to exchange cryptocurrency for goods or services without a third party involved.

Using DeFi allows for:

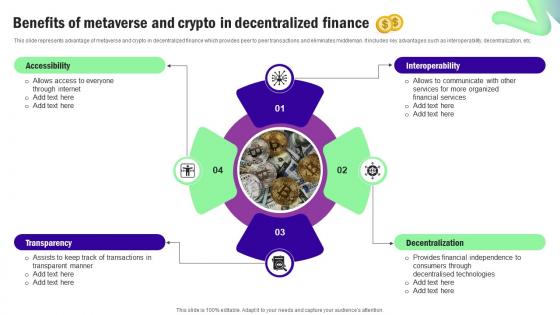

- Accessibility : Anyone with an internet connection can access a DeFi platform, and transactions occur without geographic restrictions.

- Low fees and high interest rates : DeFi enables any two parties to negotiate interest rates directly and lend cryptocurrency or money via DeFi networks.

- Security and Transparency : Smart contracts published on a blockchain and records of completed transactions are available for anyone to review but do not reveal your identity. Blockchains are immutable, meaning they cannot be changed.

- Autonomy : DeFi platforms don't rely on centralized financial institutions . The decentralized nature of DeFi protocols mitigates the need for and costs of administering financial services.

Peer-to-peer lending under DeFi doesn't mean there won't be any interest and fees. However, it does mean that you'll have many more options since the lender can be anywhere in the world.

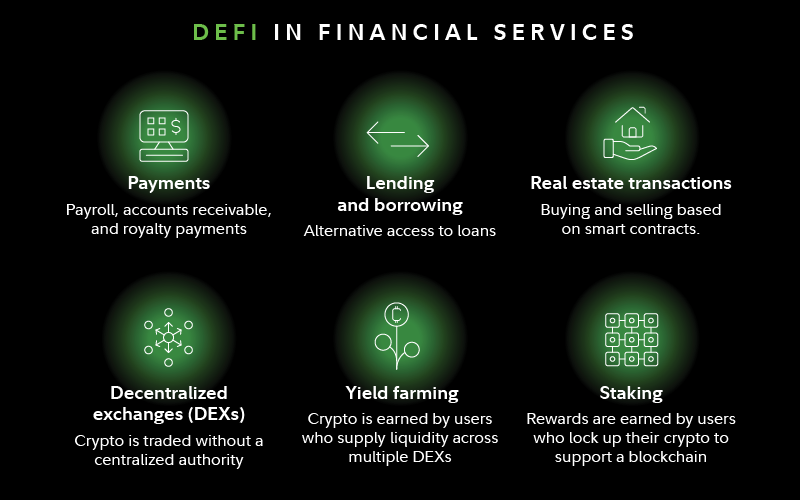

Decentralized finance, originally conceived of as a way to bring financial services like loans and banking to those who don't have access to them , has morphed into an industry where you can take part in many different sectors or endeavors. Here are a few of the most popular:

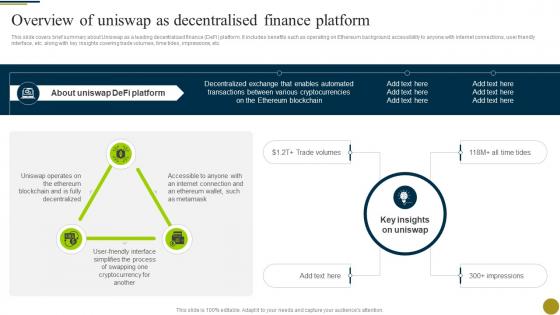

- Decentralized exchanges : The top preference for defi app users is accessing decentralized exchanges. Exchanges like Uniswap and PancakeSwap have apps that let you interact with other cryptocurrency users.

- Liquidity providers : Liquidity is the ability to sell assets quickly, a problem many cryptocurrency users have encountered. Liquidity providers are generally pools where users place funds so exchanges can provide selling opportunities for their users.

- Lending/Yield Farming: There are hundreds of defi apps available that provide lending. Generally, they operate the same way as a liquidity pool, where users lock their funds in a pool and let others borrow them, receiving interest on their loans—called yield farming. Many provide flash loans, where no collateral is required from the borrower.

- Gambling/Prediction Markets : Millions of dollars in cryptocurrency are used everyday gambling using defi apps like ZKasino, Horse Racing Slot Keno Roulett, Azuro, and UpvsDown. Prediction markets are platforms that let you place bets on the outcome of nearly any event.

- NFTs : The market for non-fungible tokens has cooled somewhat, but they are still popular with niche investors and collectors.

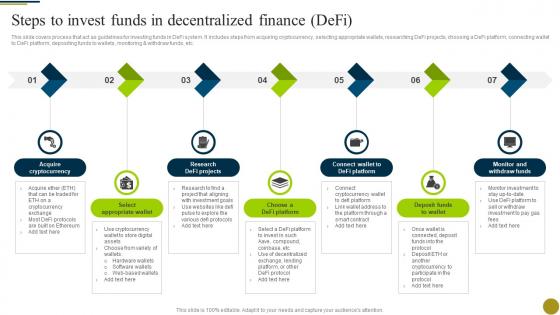

Becoming involved in decentralized finance might seem intimidating at first, but there are many ways to do so. The first thing you should do if you want to get into DeFi is to research the activities that interest you the most. You'll need a wallet, but because there are so many to choose from, you'll need to learn more about them and find the one that appeals to you.

Once you identify your wallet and activity, you can find a reputable exchange that provides the activity you want to get involved in or use, buy some cryptocurrency, and get started.

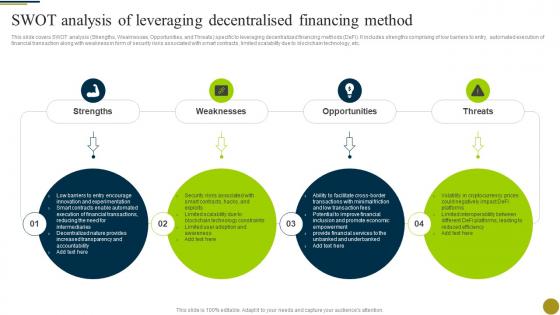

Decentralized finance is constantly evolving. It is unregulated, and its ecosystem is vulnerable to faulty programming, hacks, and scams. For example, one of the main ways hackers and thieves steal cryptocurrency is through weaknesses in DeFi applications.

Laws have not yet caught up with advances in technology. Most current laws were crafted based on the idea of separate financial jurisdictions, each with its own set of laws and rules. DeFi’s borderless transaction ability presents essential questions for this type of regulation. For example:

- Who is responsible for investigating a financial crime that occurs across borders, protocols, and DeFi apps?

- Who would enforce the regulations?

- How would they enforce them?

Just like other blockchain- and cryptocurrency-related projects, businesses, and activities, decentralized finance is subject to considerable hype, hoping to attract users and their money.

There is a considerable amount of money flowing through cryptocurrency exchanges, but it isn't nearly as much as you might be led to believe. Most people still use the traditional financial systems we are all used to. For example, only 0.56% of all money is tied up in cryptocurrency and decentralized finance—a very small figure that should encourage you to do your research to learn if using DeFi apps, platforms, and cryptocurrency is worth it.

It might be just what you're looking for regarding your finances. However, it might not—the decentralized finance industry is still in its infancy and evolving, making it somewhat of a gamble for most people.

What Does Decentralized Finance Do?

The goal of DeFi is to challenge the use of centralized financial institutions and third parties involved in all financial transactions.

Is Bitcoin Part of Decentralized Finance?

Bitcoin is a cryptocurrency. DeFi is designed to use cryptocurrency in its ecosystem, so Bitcoin isn't DeFi as much as it is a part of it.

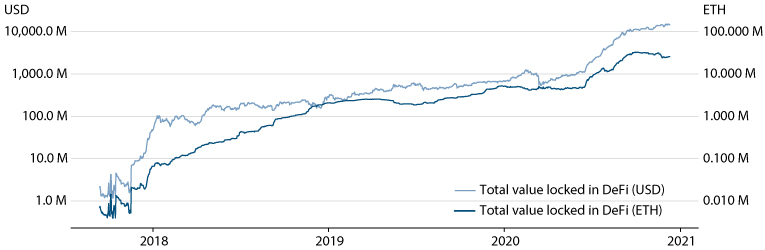

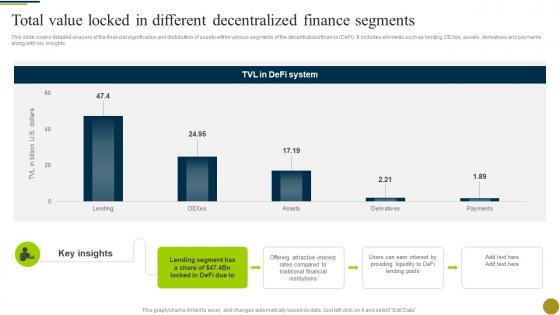

What Is Total Value Locked in DeFi?

Total value locked (TVL) is the sum of all cryptocurrencies staked, loaned, deposited in a pool, or used for other financial actions across all of DeFi. It can also represent the sum of specific cryptocurrencies used for financial activities, such as ether or bitcoin.

Decentralized finance (DeFi) is an emerging financial technology that challenges the current centralized banking system. DeFi attempts to eliminate the fees banks and other financial service companies charge while promoting peer-to-peer transactions.

DeFi, like the blockchains and cryptocurrencies it supports, is still in its infancy. Significant hurdles must be overcome before it can replace the existing financial system, which has its own issues that are difficult to resolve. Lastly, financial service companies and banks are not going to be replaced without a fight—if there is a way for them to profit from the transition to a blockchain-based financial system, they will find it and make sure they are part of it.

Uniswap. " How to Add Liquidity to Uniswap V3 ."

Uniswap. " Pools ."

DappRadar. " Top Gambling Dapps ."

Augur. " Augur: Your Global, No-Limit Betting Platform ."

- A Primer on Investing in Transformative Technology 1 of 25

- How to Use Artificial Intelligence in Your Portfolio in 2024 2 of 25

- Generative AI: How It Works, History, and Pros and Cons 3 of 25

- Semiconductors and Advancements Investors Should Watch Out For 4 of 25

- 10 Biggest Semiconductor Companies 5 of 25

- What Do Investors Need to Know About 5G? 6 of 25

- What Is a Block in the Crypto Blockchain, and How Does It Work? 7 of 25

- Investing in the Blockchain Boom 8 of 25

- 6 Biggest Blockchain Companies 9 of 25

- What Are Consensus Mechanisms in Blockchain and Cryptocurrency? 10 of 25

- How Does a Blockchain Prevent Double-Spending of Bitcoins? 11 of 25

- The Future of Fintech 12 of 25

- 4 Fintech Companies Disrupting Real Estate (Z, FISV) 13 of 25

- Financial Innovation: Definition, Role, Categories, and Examples 14 of 25

- Digital Transaction Definition, How It Works, Benefits 15 of 25

- Dual Interface Chip Card: What it Means, How it Works 16 of 25

- What Is Decentralized Finance (DeFi) and How Does It Work? 17 of 25

- How Fintech Is Disrupting Wealth Management 18 of 25

- Cybersecurity: Meaning, Types of Cyber Attacks, Common Targets 19 of 25

- Cyberattacks and the Risk of Bank Failures 20 of 25

- 6 Ways Cybercrime Impacts Business 21 of 25

- Robotic Process Automation (RPA): Definition and Benefits 22 of 25

- 3 Ways Robots Affect the Economy 23 of 25

- Quantum Computing: Definition, How It's Used, and Example 24 of 25

- What Is the Internet of Things (IoT)? How It Works and Benefits 25 of 25

:max_bytes(150000):strip_icc():format(webp)/INV_PeopleInvesting_GettyImages-1454431378-851ac53a478640abae4795235c5a047c.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is DeFi?

By Kevin Roose March 18, 2022

- Share full article

The Latecomer’s Guide to Crypto

Kevin Roose

This is part of “ The Latecomer’s Guide to Crypto ,” a mega-F.A.Q. about cryptocurrency and its offshoots. Kevin Roose, a Times technology columnist, is answering some of the most frequently asked questions he gets about NFTs , DAOs , web3 and other crypto concepts.

DeFi (pronounced dee-fye) is short for decentralized finance. It’s an umbrella term for the part of the crypto universe that is geared toward building a new, internet-native financial system, using blockchains to replace traditional intermediaries and trust mechanisms.

I am falling asleep.

Don’t! I promise it’s interesting.

OK, I’ll give it a chance. What do you mean by “using blockchains to replace traditional intermediaries and trust mechanisms?”

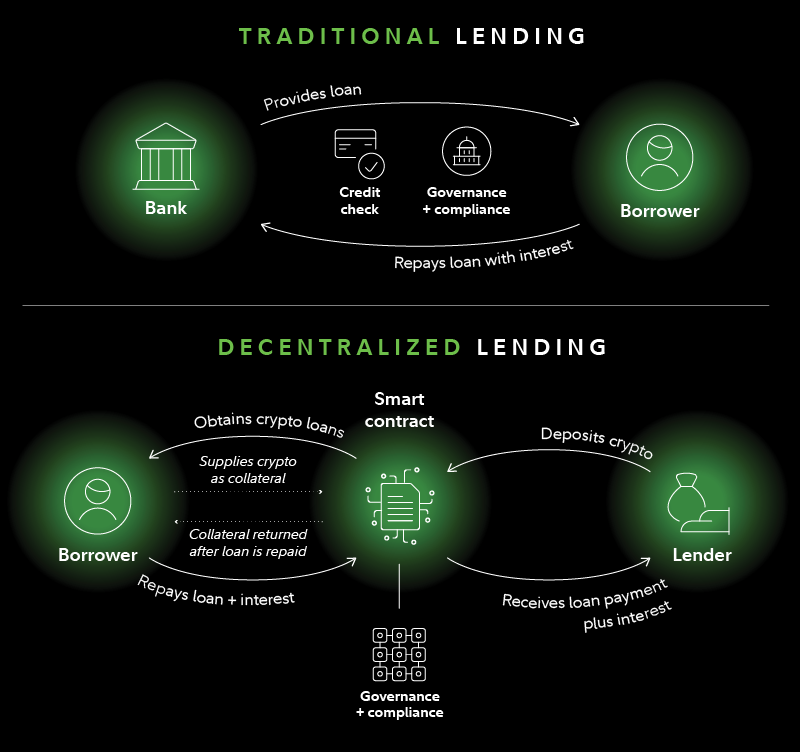

Let’s back up a bit. To send or receive money in the traditional financial system you need intermediaries, like banks or stock exchanges. And in order to feel comfortable doing the transaction, all parties need to trust that those intermediaries will act fairly and honestly.

In DeFi, those middlemen are replaced by software. Instead of transacting through banks and stock exchanges, people trade directly with one another, with blockchain-based “smart contracts” doing the work of making markets, settling trades and ensuring that the entire process is fair and trustworthy.

So DeFi is crypto’s version of a stock exchange?

That’s part of it. But DeFi also includes things like lending platforms, prediction markets, options and derivatives.

Basically, crypto people are building their own version of Wall Street — one that is largely decentralized and deals exclusively in crypto, with crypto versions of many of the products offered by traditional financial firms, and without much of the red tape and regulations that govern the existing financial system.

Wild West Wall Street! OK, now I’m interested. How big is DeFi?

DeFi’s total value locked or T.V.L. — a standard way of measuring the value of crypto held in DeFi projects — is currently about $77 billion, according to DeFi Pulse . That would make DeFi something like the 38th largest bank in the United States by deposits, if it were a bank.

So not huge, but not small either.

Right. And T.V.L. isn’t the only way to measure DeFi’s growth. You could also look at trading activity on decentralized exchanges, which has grown by triple-digit percentages in the past year.

Or you could take a cue from regulators and politicians, who are increasingly looking to DeFi’s growth with concern. Michael Hsu, the acting U.S. comptroller of the currency, said in a speech at a blockchain conference in September that many DeFi products reminded him of the credit default swaps and other complex derivatives that were popular on Wall Street in the years leading up to the 2008 financial crisis.

And Senator Elizabeth Warren, the Massachusetts Democrat, singled out DeFi in a December crypto hearing, calling it “the most dangerous part of the crypto world.”

Why are people so worried about DeFi?

In short, because DeFi is mostly unregulated, with few of the consumer protections and safeguards that exist in the traditional financial system.

Can you give me an example of something that would be regulated in the traditional financial system, but isn’t regulated in DeFi?

The best example is probably stablecoins. Stablecoins are cryptocurrencies whose value is pegged to the value of a government-backed currency, like the U.S. dollar.

Stablecoins are a critical part of DeFi markets, because if you’re a crypto investor, you don’t want to constantly be changing tokens back and forth to dollars, or keeping all your assets in cryptocurrencies whose values might fluctuate wildly. You want a crypto coin that behaves like a boring, stable dollar, which you can use without needing to interact at all with the TradFi system.

It’s what DeFi people jokingly call traditional finance.

Clever. So, back to stablecoins. What’s dangerous about them?

Well, regulators have argued that despite the name, stablecoins aren’t actually that stable.

As my colleague, Jeanna Smialek, explained in an article on stablecoins last year, the worry stems from the fact that stablecoin issuers aren’t legally required to back their coins one-to-one with safe, cash-like assets. Investors who buy stablecoins might reasonably assume that each USD Coin or Tether (the two most popular stablecoins pegged to the U.S. dollar) is worth $1, and that they will be able to redeem their stablecoins for actual dollars whenever they want.

But there’s nothing in the law, at present, that requires stablecoin issuers to have one-to-one backing. And if they don’t have enough reserves to cover the stablecoins they’re issuing, the whole thing could collapse if enough investors decide to pull their money out all at once.

That sounds bad!

It would be, especially since stablecoins are the backbone of DeFi trading. And there are questions among investors and regulators about whether some of the leading stablecoin issuers actually have enough assets to pay out their holders, in the event of a large-scale redemption.

So stablecoins might not be stable. What else is potentially worrisome about DeFi?

The crypto firms that issue loans, credit cards and savings accounts, without many of the protections or safeguards offered by conventional banks, are also drawing concern. Regulators in the United States have begun clamping down on firms that issue these products, saying they could represent a risk to consumers.

Regulators are also looking into decentralized exchanges , or DEXs, which allow users to swap crypto tokens with the help of market-making algorithms.

And then there are all the hacks and scams …

Yeah. DeFi, like crypto in general, is a big target for fraud. More than $10 billion was lost to hacks and scams in DeFi projects in 2021 alone, according to a report from the blockchain analytics firm Elliptic.

There typically isn’t much recourse for victims of DeFi scams. And unlike deposits in a regular bank, which are insured by the F.D.I.C., crypto tokens usually can’t be replaced or recovered once they’re gone.

So, let me get this straight. One of the fastest-growing areas of crypto is a Wild West version of Wall Street where there are no investor protections, where the things that are called “stablecoins” might not be stable, and where your money could be irreversibly stolen at any time?

That’s an unflatteringly phrased but largely accurate summary!

Why would anyone sign up for this?

Four reasons.

First, many people like DeFi because it’s so new and unregulated. Building an entirely new financial system from scratch is the kind of intellectual challenge that doesn’t come around every day, and lots of people are attracted to the sector’s wide open, blank slate potential. Plus, if you’re a clever trader or an experienced financial engineer, you could do all kinds of things in DeFi that you couldn’t do in the traditional financial system, and potentially make a lot of money very quickly.

Second, many DeFi fans argue that blockchains are technologically superior to the existing banking system, much of which runs on ancient databases and outdated code. (Most bank transactions, for example, still rely on programs written in COBOL , a programming language that dates back to the 1960s.) Crypto, they say, is the first form of money that is actually devised for the internet, and as it grows, it will need a new, internet-native financial system to support it.

Third, if you’ve bought into the crypto/web3 vision of a decentralized economy, DeFi is the financial architecture that makes all of the things you’re excited about possible. There’s no way, in the traditional financial system, for a DAO to create a membership token out of thin air and use it to raise millions of dollars. You can’t call up JPMorgan Chase or Goldman Sachs and ask them to give you a quote for Smooth Love Potion , priced in Dogecoin. (Well, you could, but they might have you committed.) But with DeFi platforms, you can find people who are willing to trade almost any crypto asset for almost any other crypto asset, with no central entity’s approval needed.

And fourth, there’s a more idealistic cohort of DeFi fans who see all of this heading in a much more utopian direction.

Decentralizing finance, these people say, could help fix what’s wrong with our current financial system, in part by eroding the power of big Wall Street banks over our economy and markets.

How would that work?

These optimists contend that because DeFi replaces human intermediaries and trust mechanisms with public blockchains and open-source software, it’s cheaper (fewer fees), more efficient (faster transaction times) and more transparent (less opportunity for corruption) than the traditional financial system.

They say it democratizes investing, placing tools in people’s hands that only professional investors had access to before. And because you can participate in crypto anonymously and without a bank’s approval, they say, DeFi is a way to provide financial services to people who aren’t well-served by the conventional banking sector, and avoid many of the discriminatory practices that have kept minorities from accessing financial services in the past.

Ultimately, the optimists say, DeFi will become safer and more robust over time, as more people use it and some of the early problems are ironed out. And just as they believe that web3 will replace greedy tech platforms with user-owned collectives, they believe that DeFi will replace today’s banks and brokerages with a better, fairer system.

That sounds great, but I’m still worried. Didn’t we learn our lesson in 2008 about the dangers of unregulated finance? Could DeFi bring about the next financial crisis?

Right now, it’s unlikely that DeFi could produce any disasters on the scale of the 2008 financial crisis. It’s still a relatively small piece of the crypto world (which is a relatively small piece of the overall economy), and many of the people pouring money into DeFi are the kind of deep-pocketed investors who could absorb even big losses.

But the possibility that DeFi could grow big enough to present a systemic risk isn’t lost on regulators, who are scrambling to make the Wild West of crypto a little less wild.

“Finance 3.0: DeFi, Dapps, and the Promise of Decentralized Disruption” Kevin Werbach, a professor at the Wharton School of the University of Pennsylvania, makes the case that DeFi will revolutionize the world of finance by “eliminating costly and controlling intermediaries from financial transactions.”

“Anyone Seen Tether’s Billions?” Bloomberg’s report on the mysterious dollar reserves of Tether, the stablecoin at the heart of the DeFi economy, helps explain why regulators are worried.

“The Defiant” This independent media company’s daily DeFi newsletter is an industry must-read.

Advertisement

Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets

Posted 2021-02-05

The term decentralized finance (DeFi) refers to an alternative financial infrastructure built on top of the Ethereum blockchain. DeFi uses smart contracts to create protocols that replicate existing financial services in a more open, interoperable, and transparent way. This article highlights opportunities and potential risks of the DeFi ecosystem. I propose a multi-layered framework to analyze the implicit architecture and the various DeFi building blocks, including token standards, decentralized exchanges, decentralized debt markets, blockchain derivatives, and on-chain asset management protocols. I conclude that DeFi still is a niche market with certain risks but that it also has interesting properties in terms of efficiency, transparency, accessibility, and composability. As such, DeFi may potentially contribute to a more robust and transparent financial infrastructure.

Fabian Schär is a professor for distributed ledger technologies and fintech at the University of Basel and the managing director of the Center for Innovative Finance at the Faculty of Business and Economics, University of Basel. The author thanks two anonymous reviewers for their valuable comments and especially Florian Bitterli, Raphael Knechtli, and Tobias Wagner for their support with data collection and visualization and Emma Littlejohn and Amadeo Brands for proofreading.

INTRODUCTION

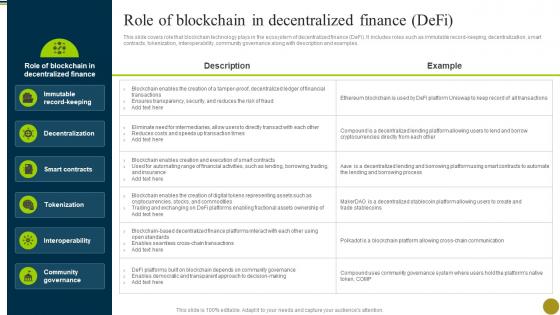

Decentralized finance (DeFi) is a blockchain-based financial infrastructure that has recently gained a lot of traction. The term generally refers to an open, permissionless, and highly interoperable protocol stack built on public smart contract platforms, such as the Ethereum blockchain (see Buterin, 2013). It replicates existing financial services in a more open and transparent way. In particular, DeFi does not rely on intermediaries and centralized institutions. Instead, it is based on open protocols and decentralized applications (DApps). Agreements are enforced by code, transactions are executed in a secure and verifiable way, and legitimate state changes persist on a public blockchain. Thus, this architecture can create an immutable and highly interoperable financial system with unprecedented transparency, equal access rights, and little need for custodians, central clearing houses, or escrow services, as most of these roles can be assumed by "smart contracts."

DeFi already offers a wide variety of applications. For example, one can buy U.S. dollar (USD)-pegged assets (so-called stablecoins) on decentralized exchanges, move these assets to an equally decentralized lending platform to earn interest, and subsequently add the interest-bearing instruments to a decentralized liquidity pool or an on-chain investment fund.

The backbone of all DeFi protocols and applications is smart contracts. Smart contracts generally refer to small applications stored on a blockchain and executed in parallel by a large set of validators. In the context of public blockchains, the network is designed so that each participant can be involved in and verify the correct execution of any operation. As a result, smart contracts are somewhat inefficient compared with traditional centralized computing. However, their advantage is a high level of security: Smart contracts will always be executed as specified and allow anyone to verify the resulting state changes independently. When implemented securely, smart contracts are highly transparent and minimize the risk of manipulation and arbitrary intervention.

To understand the novelty of smart contracts, we first must look at regular server-based web applications. When a user interacts with such an application, they cannot observe the application's internal logic. Moreover, the user is not in control of the execution environment. Either one (or both) could be manipulated. As a result, the user has to trust the application service provider. Smart contracts mitigate both problems and ensure that an application runs as expected. The contract code is stored on the underlying blockchain and can therefore be publicly scrutinized. The contract's behavior is deterministic, and function calls (in the form of transactions) are processed by thousands of network participants in parallel, ensuring the execution's legitimacy. When the execution leads to state changes, for example, the change of account balances, these changes are subject to the blockchain network's consensus rules and will be reflected in and protected by the blockchain's state tree.

Smart contracts have access to a rich instruction set and are therefore quite flexible. Additionally, they can store cryptoassets and thereby assume the role of a custodian, with entirely customizable criteria for how, when, and to whom these assets can be released. This allows for a large variety of novel applications and flourishing ecosystems.

The original concept of a smart contract was coined by Szabo (1994). Szabo (1997) used the example of a vending machine to describe the idea further and argued that many agreements could be "embedded in the hardware and software we deal with, in such a way as to make a breach of contract expensive…for the breacher." Buterin (2013) proposed a decentralized blockchain-based smart contract platform to solve any trust issues regarding the execution environment and to enable secure global states. Additionally, this platform allows the contracts to interact with and build on top of each other (composability). The concept was further formalized by Wood (2015) and implemented under the name Ethereum. Although there are many alternatives, Ethereum is the largest smart contract platform in terms of market cap, available applications, and development activity.

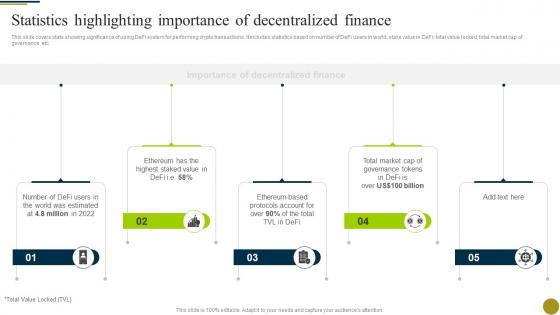

DeFi still is a niche market with relatively low volumes—however, these numbers are growing rapidly. The value of funds that are locked in DeFi-related smart contracts recently crossed 10 billion USD. It is essential to understand that these are not transaction volume or market cap numbers; the value refers to reserves locked in smart contracts for use in various ways that will be explained in the course of this paper. Figure 1 shows the Ether (ETH, the native cryptoasset of Ethereum) and USD values of the assets locked in DeFi applications.

Figure 1 Total Value Locked in DeFi Contracts (USD and ETH)

NOTE: M, million.

SOURCE: DeFi Pulse.

The spectacular growth of these assets alongside some truly innovative protocols suggests that DeFi may become relevant in a much broader context and has sparked interest among policymakers, researchers, and financial institutions. This article is targeted at individuals from these organizations with an economics or legal background and serves as a survey and an introduction to the topic. In particular, it identifies opportunities and risks and should be seen as a foundation for further research.

Read the full article .

Cite this article

Subscribe to Our Newsletter

Stay current with brief essays, scholarly articles, data news, and other information about the economy from the Research Division of the St. Louis Fed.

SUBSCRIBE TO THE RESEARCH DIVISION NEWSLETTER

Research division.

- Legal and Privacy

One Federal Reserve Bank Plaza St. Louis, MO 63102

Information for Visitors

Cryptocurrencies and decentralized finance (DeFi)

- Makarov & Schoar Final Paper & Online Appendix

- Gorton Comment

- Prasad Comment

- General Discussion

- Makarov & Schoar Conference Draft

- Makarov & Schoar Data

Subscribe to the Economic Studies Bulletin

Igor makarov and igor makarov associate professor of finance - london school of economics and political science antoinette schoar antoinette schoar stewart c. myers-horn family professor of finance and entrepreneurship - mit sloan school of management discussants: gary b. gorton and gary b. gorton frederick frank class of 1954 professor of management & professor of finance - yale school of management eswar prasad eswar prasad senior fellow - global economy and development @eswarsprasad.

March 23, 2022

The paper summarized here is part of the Spring 2022 edition of the Brookings Papers on Economic Activity (BPEA) , the leading conference series and journal in economics for timely, cutting-edge research about real-world policy issues. The conference draft of the paper was presented at the Spring 2022 BPEA conference . The final version was published in the Spring 2022 issue by Johns Hopkins University Press. The recording of the conference session can be found below. Read all papers published in this issue here . Submit a proposal to present at a future BPEA conference here .

The fast-growing decentralized finance (DeFi) system—the collection of finance applications built on blockchain technology—holds promise for a new financial architecture that can eliminate the need for traditional intermediaries (such as banks, brokers, and exchanges) and reduce rents (excess profits) in the financial sector. But it also generates formidable challenges for regulators, according to a paper discussed at the Brookings Papers on Economic Activity (BPEA) conference on March 24, 2022.

“DeFi applications might have the potential to democratize finance by creating a level playing field among providers of financial products and services,” write the authors—Igor Makarov of the London School of Economics and Antoinette Schoar of the Massachusetts Institute of Technology.

But, they warn in Cryptocurrencies and Decentralized Finance (DeFi) , the reduction of rents might not materialize automatically. Rents are often the result of inherent constraints to competition that arise from network externalities (the phenomenon that the value of a financial service or DeFi app increases as its use becomes more common) and economies of scale. These constraints exist both in the traditional financial system and the new architecture, and thus require careful regulation.

The permissionless and pseudonymous design of DeFi applications can severely limit the ability of regulators to oversee the industry and restrict unscrupulous actors. DeFi generates challenges for enforcing tax and money laundering laws and preventing financial malfeasance, and as a result can create negative spillovers on the rest of the economy.

The paper explains how decentralized finance works and the mechanics behind it, such as the security protocols of different cryptocurrency blockchains and smart contracts (embedded computer code that automatically executes transactions when predetermined conditions are met). The authors lay out potential benefits and challenges of the new system, including the difficulty of providing effective consumer financial protections.

The authors then highlight ways to regulate the DeFi system which would “preserve a majority of features of the blockchain architecture but support accountability and regulatory compliance.” They propose regulatory oversight of validators—the blockchain network participants who ensure the integrity of the blockchain ledger (the decentralized record of transactions) and who are paid in cryptocurrency for verifying transactions. Regulators could certify validators to ensure they check that addresses on cryptocurrency networks belong to certified entities and then only process transactions to and from certified addresses.

“If regulators wait too long, in effect cryptocurrencies and DeFi applications can become too-big-to-regulate.”

How the technology and regulation of the DeFi system evolve has important consequences for the global economy and ultimately to the United States’ standing in it, the authors write. They note that the United States enjoys “significant economic and strategic benefits” from the central role of the dollar and U.S. financial system and conclude, “therefore it is in the U.S. interest to encourage innovation and modern financial technologies but at the same time set standards that protect consumers and maintain the transparency and accountability of the system.”

However, the exponential growth of cryptocurrencies and the growing political clout of the crypto community means time is short for finding regulatory solutions, the authors caution. “If regulators wait too long,” they write, “in effect cryptocurrencies and DeFi applications can become too-big-to-regulate.”

Aknowledgment

David Skidmore authored the summary language for this paper.

Makarov, Igor and Antoinette Schoar. 2022. “Cryptocurrencies and Decentralized Finance (DeFi).” Brookings Papers on Economic Activity, Spring. 141-196.

Gorton, Gary. 2022. “Comment on ‘Cryptocurrencies and Decentralized Finance (DeFi)’.” Brookings Papers on Economic Activity, Spring. 197-205.

Prasad, Eswar. 2022. “Comment on ‘Cryptocurrencies and Decentralized Finance (DeFi)’.” Brookings Papers on Economic Activity, Spring. 206-212.

Gary Gorton is the Frederick Frank Class of 1954 Professor of Finance at the Yale School of Management. He was a cofounder and board member of TNB USA Inc. (The Narrow Bank), which was a Connecticut-based depository institution. The views expressed in the comment are those of the discussant and do not necessarily reflect those of Yale School of Management.

Related Content

Timothy G. Massad

March 18, 2019

Howell Jackson, Timothy G. Massad

March 10, 2022

Discussants

Economic Studies

Brookings Papers on Economic Activity

Amit Jain, Landry Signé

May 29, 2024

May 28, 2024

Darrell M. West, Nicol Turner Lee

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

What is DeFi?

Key takeaways

- Decentralized finance, or DeFi, is an emerging network of peer-to-peer financial services that uses blockchain technology to facilitate lending, borrowing, staking, and trading.

- Advocates believe DeFi may revolutionize the traditional financial system by cutting out intermediaries like banks and credit card companies.

- Skeptics cite regulatory uncertainty, technical complexities, and potential risks of hacks and fraudulent activity.

DeFi advocates have ambitious goals—many of them wish to rewire traditional financial systems like banking and credit card payments. They believe blockchain technology can help replace most, if not all, of the predominant parts of the financial establishment.

How do DeFi advocates plan on achieving this? And why should even the most passionate supporters be cautious right now? Let’s dive in.

What is DeFi and how does it work?

DeFi is an umbrella term for apps, platforms, and organizations that enable users to lend, borrow, stake (we’ll cover more on what staking is shortly), and trade crypto assets.

These functions are accomplished with smart contracts and blockchain technology . Smart contracts are digital contracts that can be programmed so that a predetermined action happens once certain requirements are met.

Here’s an example of how this works. Let’s say Jane wants to take out a loan. Typically, she might apply for one through her bank. With DeFi smart contracts , however, Jane can connect directly with a lender without the need for a bank. That’s because all the logistics of the loan, including the terms and the ability to track repayments, can be programmed into the smart contract.

DeFi aims to apply this way of operating to as many aspects of traditional finance as possible. Advocates think it can provide an open, transparent, and efficient alternative to the established financial system. Anyone with a smartphone or computer can take part, no matter where they’re located. There are no third-party entities that decide who can or can’t participate.

Most DeFi platforms are known as protocols, a term which describes the functions and rules of the service. Users mostly conduct transactions with DApps (short for decentralized applications), which are software-based apps built upon blockchains, most commonly on the Ethereum network . In simple terms, they’re like the apps on your smartphone or computer, but they operate with blockchain technology.

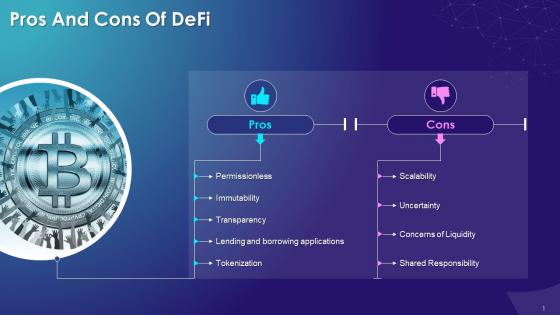

DeFi has gained significant attention in recent years, but the community’s aspiration to disrupt traditional finance faces skepticism for a variety of reasons. Critics warn that many DeFi projects are highly speculative and volatile. Furthermore, unlike traditional finance, DeFi platforms do not offer insurance—users potentially risk losing their investments in the event of a hack or a smart-contract failure. Additional drawbacks, according to skeptics, include regulatory concerns and scalability limitations.

Centralized finance vs. decentralized finance

As you learn about DeFi, you may come across the distinction between centralized finance and decentralized finance . Centralized finance—sometimes referred to as “CeFi” or “TradFi” by the crypto community—describes the world of traditional banks, brokers, insurers, and credit card companies.

Many DeFi supporters think CeFi has shortcomings, including creditworthiness requirements, high fees, lengthy wait times for wire transfers, limitations on access to funds, and other factors. They believe the remedy, of course, is DeFi—an ecosystem where developers are also able to create new products and services without the need for approval from centralized entities.

Yet this also means that DeFi lacks many of the built-in protections that existing centralized finance systems have. These include benefits like regulatory oversight, customer support, and more user-friendly interfaces. In addition, blockchains which host DeFi platforms can become congested, which may lead to higher transaction fees and slower confirmation times.

Subscribe to Decode Crypto

Boost your crypto knowledge. Sign up for monthly insights from crypto thought leaders.

What are some DeFi use cases?

DeFi is currently being applied to a variety of financial services. A few of these include:

DeFi supporters envision a future where smart contracts can automate payroll, accounts receivable, and royalty payments to ensure accuracy and timeliness. They believe this will also help cut down on the administrative costs required to manage these items.

For skeptics, the decentralized nature of DeFi comes with a lot of risks. For example, unlike centralized financial services, DeFi protocols don’t have customer support. There’s no central team that can resolve disputes or reverse transactions in case of error. This may make using DeFi for significant financial activities (i.e., payroll) riskier or less practical than traditional methods.

Decentralized exchanges (DEXs)

How do DEXs operate? Most crypto trading occurs via centralized exchanges (CEXs). Decentralized exchanges (DEXs), however, aim to allow trading without a centralized authority. They run on smart contracts, which supporters believe can make trading more trustworthy and allow participants to stay anonymous.

However, while decentralization may offer greater privacy, a main trade-off is that there is regulatory uncertainty, which can lead to greater risk of scams and frauds. For example, smart contracts are a relatively new technology and can potentially face technical vulnerabilities. In the last few years, several high profile DeFi protocols have been hacked for over 9 figures in losses. Skeptics believe it’s not worth putting your financial assets on the line assuming these kinds of risks.

Also, since DEXs have fewer participants than CEXs, users may experience lower trading volumes and lower liquidity, in addition to potential price disparities. Furthermore, custody of assets is also directly linked to users’ wallets —instead of an account on a CEX—leading to potential security risks.

Lending and borrowing

Advocates believe DeFi can make it easier for more people to access lending, as approval doesn’t rely on many of the strict criteria required by traditional lenders. DeFi lending involves supplying crypto to protocols which, in turn, can be borrowed in exchange for interest. Borrowers must provide collateral in the form of other crypto assets, which are sometimes worth more than the value of the amount they want to borrow. Why would a borrower do this? Hypothetically it supplies crypto liquidity to a borrower who may not wish to sell the specific crypto assets that are being put up for collateral.

As previously noted, DeFi lending platforms don’t have the typical consumer requirements that exist in traditional finance, which can be a double-edged sword, as those requirements are often implemented to protect the consumer. Additionally, crypto volatility may create unfavorable conditions for both borrowers and lenders.

Yield farming

Yield farming allows participants to earn crypto by supplying liquidity across multiple DEXs to increase returns. Users can choose to lock up their crypto in accounts known as liquidity pools, which helps make trading on DEXs run more smoothly.

However, skeptics note that DeFi products are currently complicated to use, requiring a deeper, more sophisticated knowledge of the crypto landscape and its unique ins and outs. Without technical knowledge of how smart contracts work, less experienced users may be at greater risk of making mistakes, and the slightest errors may result in losing access to their assets forever. In addition, yield volatility on certain platforms can potentially lead to rapid devaluation of returns.

Staking cryptocurrencies is a process that involves committing or “locking up” your crypto assets for specific periods of time to support a blockchain network and confirm transactions. Staking allows users to earn crypto rewards on the amount they lock up. This helps blockchains because the crypto that’s locked contributes to the network’s stability and security.

Still, given that some protocols require staked crypto to be locked up for a predetermined time, users may experience reduced liquidity and flexibility with their assets. In addition, due to the potential security vulnerabilities of smart contracts, stakers may be at risk of losing their locked-up funds.

Real estate transactions

Traditionally, buying and selling real estate can involve multiple intermediaries, which can make the process expensive and slow. DeFi supporters hope that smart contracts can open the door for faster and more cost-efficient transactions that don't need third parties. They also believe they can be used to verify ownership of the property more effectively than existing methods.

Given DeFi is still in its infancy, using it for large transactions like real estate may pose certain challenges, including security risks with smart contracts. In addition, the concept of tokenized real estate on blockchain is fairly new and may create obstacles for buyers and sellers. The property market is highly regulated and tax structures may create greater complexity for transactions, especially across different geographic regions.

What to consider before participating in DeFi

Before using any DeFi protocols, first learn how they work . As mentioned earlier, many of these platforms can be complex and intimidating for new users. For example, most DeFi activities require the use of a crypto wallet , which can be a complicated tool to figure out in and of itself. Remember: Even the slightest mistake could result in losing access to your assets for good. So be sure you‘re confident about how a platform functions before using it.

Also, note that crypto may be more susceptible to market manipulation than securities, and DeFi platforms may be more vulnerable to security concerns than centralized finance platforms. Crypto holders and DeFi users do not benefit from the same regulatory protections applicable to registered securities. Crypto is also not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation, meaning you should only buy crypto or interact with DeFi protocols with an amount you're willing to lose.

Fidelity Crypto ®

New to crypto? Not for long. Ease in with as little as $1.

More to explore

Crypto at fidelity, covering crypto livestream, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. finding stock and sector ideas investing for beginners crypto past performance is no guarantee of future results. fidelity crypto ® is offered by fidelity digital assets℠. investing involves risk, including risk of total loss. crypto as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. crypto may also be more susceptible to market manipulation than securities. crypto is not insured by the federal deposit insurance corporation or the securities investor protection corporation. investors in crypto do not benefit from the same regulatory protections applicable to registered securities. fidelity crypto ® accounts and custody and trading of crypto in such accounts are provided by fidelity digital asset services, llc, a limited liability trust company chartered by the new york department of financial services (nmls id 1773897). brokerage services in support of securities trading are provided by fidelity brokerage services llc (“fbs”), and related custody services are provided by national financial services llc (“nfs”), each a registered broker-dealer and member nyse and sipc. neither fbs nor nfs offer crypto as a direct investment nor provide trading or custody services for such assets. fidelity crypto and fidelity digital assets are service marks of fmr llc. fidelity brokerage services llc, member nyse, sipc , 900 salem street, smithfield, ri 02917 1109826.3.1 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

- Decentralized Finance Defi

- Popular Categories

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Powerpoint Templates and Google slides for Decentralized Finance Defi

Save your time and attract your audience with our fully editable ppt templates and slides..

Enthrall your audience with this Understanding Role Of Decentralized Finance Defi In A Digital Economy BCT CD. Increase your presentation threshold by deploying this well-crafted template. It acts as a great communication tool due to its well-researched content. It also contains stylized icons, graphics, visuals etc, which make it an immediate attention-grabber. Comprising ninety six slides, this complete deck is all you need to get noticed. All the slides and their content can be altered to suit your unique business setting. Not only that, other components and graphics can also be modified to add personal touches to this prefabricated set.

Presenting Peer to Peer lending with Decentralized Finance. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Download this professionally designed business presentation, add your content, and present it with confidence.

Presenting Exploring Centralized and Decentralized Finance. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts,and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Download this professionally designed business presentation,add your content,and present it with confidence.

Presenting Concept of Decentralized Finance DeFi in Web 3.0. Our PowerPoint experts have included all the necessary templates, designs, icons, graphs, and other essential material. This deck is well crafted by extensive research. Slides consist of amazing visuals and appropriate content. These PPT slides can be instantly downloaded with just a click. Compatible with all screen types and monitors. Supports Google Slides. Premium Customer Support is available. Suitable for use by managers, employees, and organizations. These slides are easily customizable. You can edit the color, text, icon, and font size to suit your requirements.

Presenting Importance of Decentralized Finance DeFi. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. You can add or delete the content as per your need.

Presenting Introduction to Decentralized Finance DeFi. These slides are 100 percent made in PowerPoint and are compatible with all screen types and monitors. They also support Google Slides. Premium Customer Support is available. Suitable for use by managers, employees, and organizations. These slides are easily customizable. You can edit the color, text, icon, and font size to suit your requirements.

Presenting Pros And Cons Of Decentralized Finance. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Download this professionally designed business presentation, add your content, and present it with confidence.

Presenting Introduction to DeFi Decentralized Finance. Our PowerPoint experts have included all the necessary templates, designs, icons, graphs, and other essential material. This deck is well crafted by extensive research. Slides consist of amazing visuals and appropriate content. These PPT slides can be instantly downloaded with just a click. Compatible with all screen types and monitors. Supports Google Slides. Premium Customer Support is available. Suitable for use by managers, employees, and organizations. These slides are easily customizable. You can edit the color, text, icon, and font size to suit your requirements.

Presenting Introduction to Decentralized Finance DeFi Lending. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. You can add or delete the content as per your need.

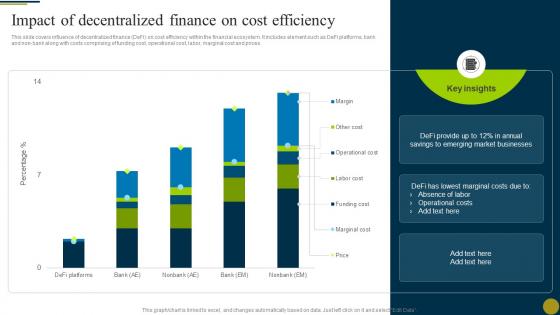

This slide covers influence of decentralized finance DeFi on cost efficiency within the financial ecosystem. It includes element such as DeFi platforms, bank and non-bank along with costs comprising of funding cost, operational cost, labor, marginal cost and prices. Present the topic in a bit more detail with this Impact Of Decentralized Finance On Cost Efficiency Understanding Role Of Decentralized BCT SS Use it as a tool for discussion and navigation on Decentralized Finance, Cost Efficiency This template is free to edit as deemed fit for your organization. Therefore download it now.

Introducing Table Of Contents Understanding Role Of Decentralized Finance Defi In A Digital Economy BCT SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Decentralized Finance, Market Outlook, Defi Platforms using this template. Grab it now to reap its full benefits.

This slide covers detailed analysis of the financial significance and distribution of assets within various segments of the decentralized finance DeFi. It includes elements such as lending, DEXes, assets, derivatives and payments along with key insights. Deliver an outstanding presentation on the topic using this Total Value Locked In Different Decentralized Finance Understanding Role Of Decentralized BCT SS Dispense information and present a thorough explanation of Defi System, Different Decentralized, Finance Segments using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

Presenting Decentralized Finance Traditional Finance In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase three stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Decentralized Finance Traditional Finance. This well structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

This vibrant coloured powerpoint icon is perfect for adding a burst of colour to your presentations. It is a great way to make your slides stand out and make your message more impactful. It is available on NFT Globe and is sure to be a great addition to your presentation.

Monotone PowerPoint Icon on NFT Globe - A unique and creative icon for your presentation. Perfect for making a statement and adding a touch of sophistication to your slides. High-quality design with a modern look and feel. Ideal for business, education, and other presentations.

This coloured PowerPoint icon is a perfect representation of an NFT wallet. It features a blue and white colour scheme with a wallet icon in the middle. It is a great way to illustrate the concept of an NFT wallet and its associated features.

This monotone PowerPoint icon is an ideal choice for representing an NFT wallet. It features a simple and modern design, perfect for any presentation or website. Its high-quality vector graphics make it easy to resize and customize.

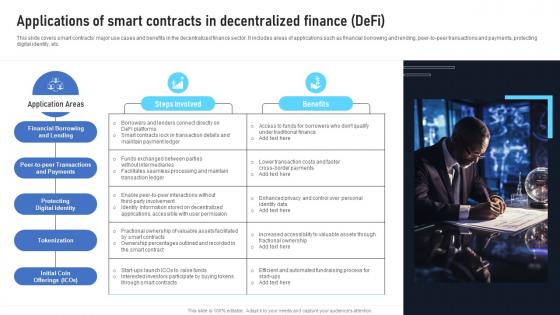

This slide covers smart contracts major use cases and benefits in the decentralized finance sector. It includes areas of applications such as financial borrowing and lending, peer to peer transactions and payments, protecting digital identity, etc. Introducing Applications Of Smart Contracts In Decentralized Finance Defi Exploring The Disruptive Potential BCT SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Financial Borrowing And Lending, Protecting Digital Identity, Tokenization, using this template. Grab it now to reap its full benefits.

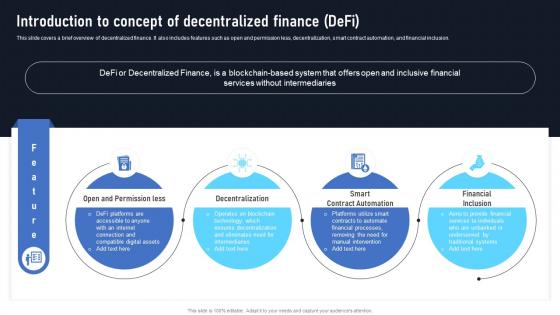

This slide covers a brief overview of decentralized finance. It also includes features such as open and permission less, decentralization, smart contract automation, and financial inclusion. Introducing Introduction To Concept Of Decentralized Finance Defi Exploring The Disruptive Potential BCT SS to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Decentralization, Smart Contract Automation, Financial Inclusion, using this template. Grab it now to reap its full benefits.

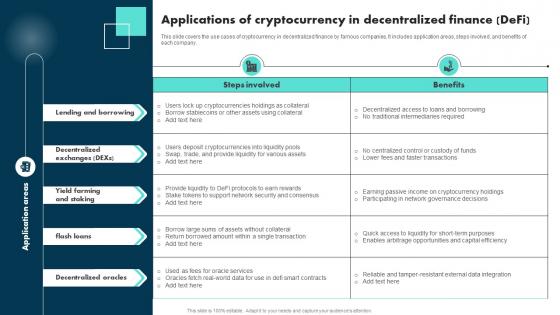

This slide covers the use cases of cryptocurrency in decentralized finance by famous companies. It includes application areas, steps involved, and benefits of each company. Present the topic in a bit more detail with this Applications Of Cryptocurrency In Decentralized Finance Defi Exploring The Role BCT SS. Use it as a tool for discussion and navigation on Lending And Borrowing, Farming And Staking, Decentralized Oracles. This template is free to edit as deemed fit for your organization. Therefore download it now.

Presenting Decentralized Finance Examples In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase four stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Decentralized Finance Examples. This well-structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

Presenting Decentralized Finance Stock In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase four stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Decentralized Finance Stock. This well structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

Presenting our Decentralized Finance Coins In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases Three stages. It is useful to share insightful information on Decentralized Finance Coins This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

This slide provides an overview of web 3 based decentralized finance ecosystem which is streamlining how financial transaction takes place over the internet. It includes statistics highlighting total value, market growth, spending patterns, total cryptocurrencies etc. Introducing Introduction To Web 3 0 Era Introduction To Decentralized Finance Technology BCT SS to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Decentralized Finance Technology, Market Growth, Financial Transaction, Efficiency And Reducing Costs, using this template. Grab it now to reap its full benefits.

Introducing Agenda For Understanding Role Of Decentralized Finance Defi In A Digital Economy BCT SS to increase your presentation threshold. Encompassed with six stages, this template is a great option to educate and entice your audience. Dispence information on Decentralized Finance, Determining Platforms, Analyzing Blockchain using this template. Grab it now to reap its full benefits.

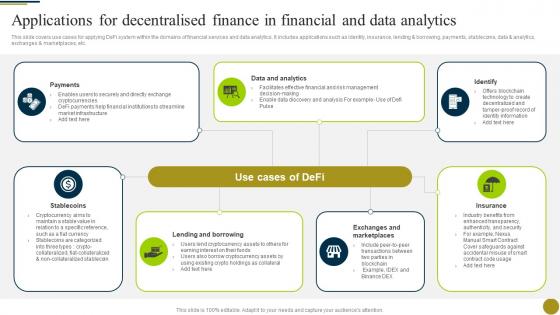

This slide covers use cases for applying DeFi system within the domains of financial services and data analytics. It includes applications such as identity, insurance, lending and borrowing, payments, stablecoins, data and analytics, exchanges and marketplaces, etc. Increase audience engagement and knowledge by dispensing information using Applications For Decentralised Finance In Financial And Data Understanding Role Of Decentralized BCT SS This template helps you present information on seven stages. You can also present information on Payments, Data And Analytics, Lending And Borrowing using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

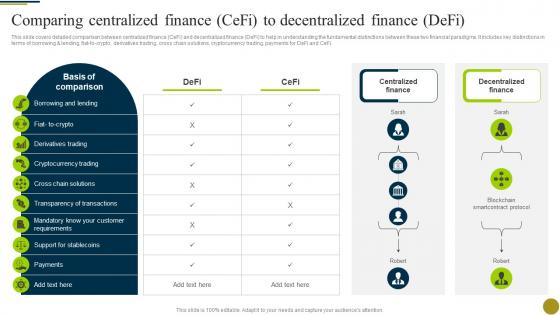

This slide covers detailed comparison between centralized finance CeFi and decentralized finance DeFi to help in understanding the fundamental distinctions between these two financial paradigms. It includes key distinctions in terms of borrowing and lending, fiat to crypto, derivatives trading, cross chain solutions, cryptocurrency trading, payments for DeFi and CeFi. Deliver an outstanding presentation on the topic using this Comparing Centralized Finance Cefi To Decentralized Understanding Role Of Decentralized BCT SS Dispense information and present a thorough explanation of Derivatives Trading, Transparency Of Transactions, Comparison using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

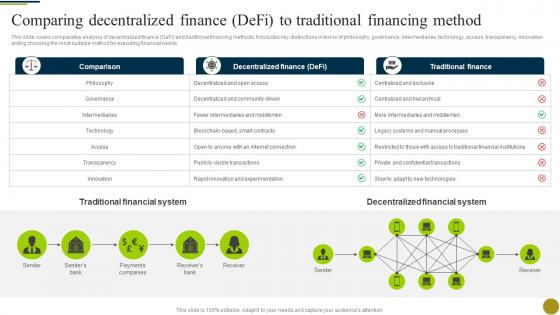

This slide covers comparative analysis of decentralized finance DeFi and traditional financing methods. It includes key distinctions in terms of philosophy, governance, intermediaries, technology, access, transparency, innovation aiding choosing the most suitable method for executing financial needs. Present the topic in a bit more detail with this Comparing Decentralized Finance Defi To Traditional Understanding Role Of Decentralized BCT SS Use it as a tool for discussion and navigation on Financial System, Comparison, Traditional Finance This template is free to edit as deemed fit for your organization. Therefore download it now.

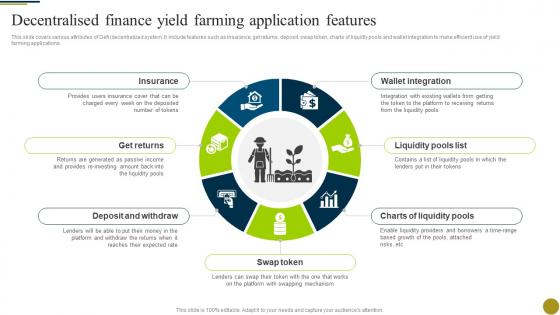

This slide covers various attributes of Defi decentralized system. It include features such as insurance, get returns, deposit, swap token, charts of liquidly pools and wallet integration to make efficient use of yield farming applications. Introducing Decentralised Finance Yield Farming Application Features Understanding Role Of Decentralized BCT SS to increase your presentation threshold. Encompassed with seven stages, this template is a great option to educate and entice your audience. Dispence information on Deposit And Withdraw, Charts Of Liquidity Pools, Wallet Integration using this template. Grab it now to reap its full benefits.

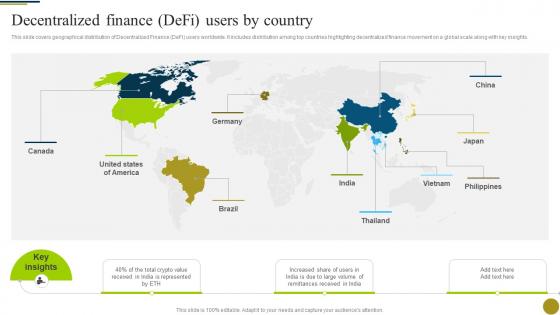

This slide covers geographical distribution of Decentralized Finance DeFi users worldwide. It includes distribution among top countries highlighting decentralized finance movement on a global scale along with key insights. Increase audience engagement and knowledge by dispensing information using Decentralized Finance Defi Users By Country Understanding Role Of Decentralized BCT SS This template helps you present information on one stage. You can also present information on Thailand, Philippines, Vietnam, Decentralized Finance using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

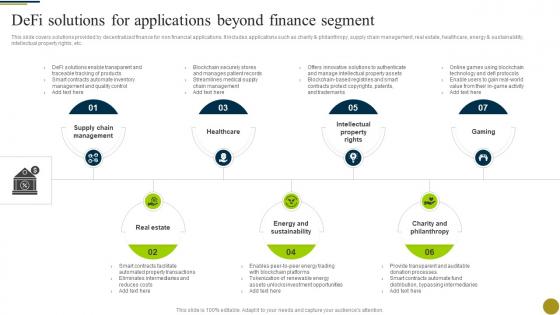

This slide covers solutions provided by decentralized finance for non financial applications. It includes applications such as charity and philanthropy, supply chain management, real estate, healthcare, energy and sustainability, intellectual property rights, etc. Introducing Defi Solutions For Applications Beyond Finance Segment Understanding Role Of Decentralized BCT SS to increase your presentation threshold. Encompassed with seven stages, this template is a great option to educate and entice your audience. Dispence information on Healthcare, Charity And Philanthropy, Real Estate using this template. Grab it now to reap its full benefits.

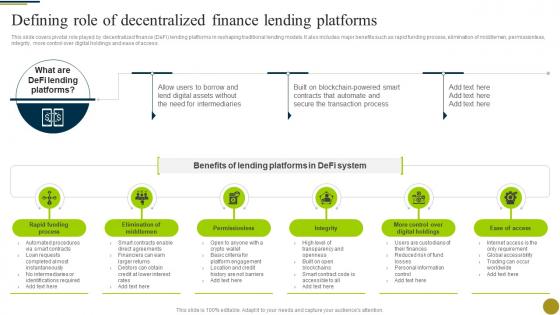

This slide covers pivotal role played by decentralized finance DeFi lending platforms in reshaping traditional lending models. It also includes major benefits such as rapid funding process, elimination of middlemen, permissionless, integrity, more control over digital holdings and ease of access. Introducing Defining Role Of Decentralized Finance Lending Platforms Understanding Role Of Decentralized BCT SS to increase your presentation threshold. Encompassed with six stages, this template is a great option to educate and entice your audience. Dispence information on Permissionless, Integrity, Ease Of Access using this template. Grab it now to reap its full benefits.

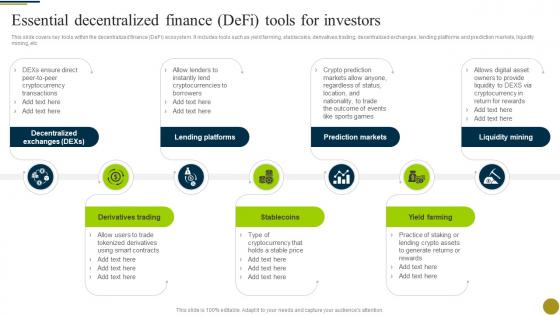

This slide covers key tools within the decentralized finance DeFi ecosystem. It includes tools such as yield farming, stablecoins, derivatives trading, decentralized exchanges, lending platforms and prediction markets, liquidity mining, etc. Introducing Essential Decentralized Finance Defi Tools For Investors Understanding Role Of Decentralized BCT SS to increase your presentation threshold. Encompassed with seven stages, this template is a great option to educate and entice your audience. Dispence information on Derivatives Trading, Lending Platforms, Prediction Markets using this template. Grab it now to reap its full benefits.

This slide covers key attributes of DeFi instruments that aids in shaping the decentralized financial ecosystem. It includes features such as decentralization, smart contracts, open source, global accessibility, liquidity pools and yield farming, etc. Increase audience engagement and knowledge by dispensing information using Features Of Decentralized Finance Defi Tools Understanding Role Of Decentralized BCT SS This template helps you present information on six stages. You can also present information on Decentralization, Smart Contracts, Global Accessibility using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

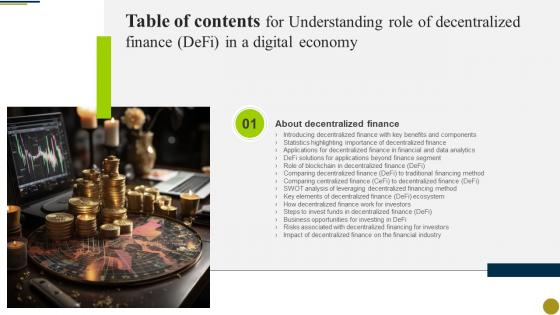

Introducing For Understanding Role Of Decentralized Finance Defi In A Digital Economy Table Of Contents BCT SS to increase your presentation threshold. Encompassed with one stage, this template is a great option to educate and entice your audience. Dispence information on Decentralized Finance, Business Opportunities, Risks Associated using this template. Grab it now to reap its full benefits.

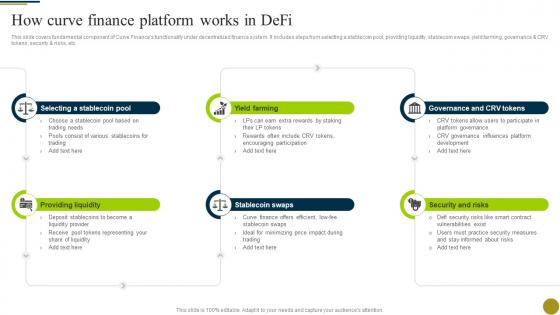

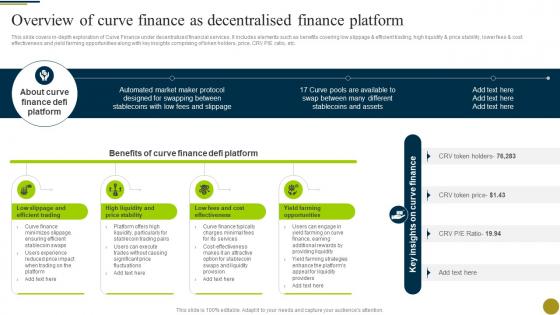

This slide covers fundamental component of Curve Finances functionality under decentralized finance system. It includes steps from selecting a stablecoin pool, providing liquidity, stablecoin swaps, yield farming, governance and CRV tokens, security and risks, etc. Increase audience engagement and knowledge by dispensing information using How Curve Finance Platform Works In Defi Understanding Role Of Decentralized BCT SS This template helps you present information on six stages. You can also present information on Stablecoin Pool, Providing Liquidity, Yield Farming using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

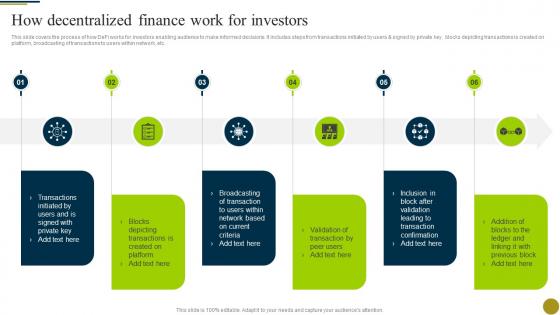

This slide covers the process of how DeFi works for investors enabling audience to make informed decisions. It includes steps from transactions initiated by users and signed by private key, blocks depicting transactions is created on platform, broadcasting of transactions to users within network, etc. Introducing How Decentralized Finance Work For Investors Understanding Role Of Decentralized BCT SS to increase your presentation threshold. Encompassed with six stages, this template is a great option to educate and entice your audience. Dispence information on Network Based, Transaction Confirmation, Platform using this template. Grab it now to reap its full benefits.

Introducing our well researched set of slides titled Icons Slide Understanding Role Of Decentralized Finance Defi In A Digital Economy BCT SS It displays a hundred percent editable icons. You can use these icons in your presentation to captivate your audiences attention. Download now and use it multiple times.

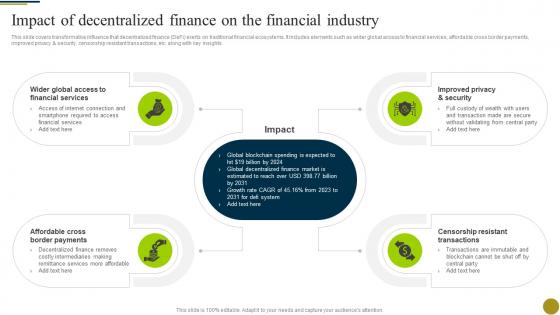

This slide covers transformative influence that decentralized finance DeFi exerts on traditional financial ecosystems. It includes elements such as wider global access to financial services, affordable cross border payments, improved privacy and security, censorship resistant transactions, etc. along with key insights. Introducing Impact Of Decentralized Finance On The Financial Industry Understanding Role Of Decentralized BCT SS to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Financial Services, Censorship Resistant, Improved Privacy using this template. Grab it now to reap its full benefits.

This slide covers comprehensive overview of decentralized finance DeFi with core benefits and the key components making up DeFi ecosystem. It includes benefits such as secured by cryptography, elimination of intermediaries, transparency of DeFi transactions along with components comprising of open ledger protocols, stablecoins, decentralized exchange platforms, platform for managing insurance investments, etc. Increase audience engagement and knowledge by dispensing information using Introducing Decentralized Finance With Key Benefits Understanding Role Of Decentralized BCT SS This template helps you present information on two stages. You can also present information on Benefits, Decentralised Finance, Defi Ecosystem using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

This slide covers key components that constitute the decentralized finance DeFi landscape. It includes elements such as open ledger standards, stablecoins, smart contracts, marketplaces and exchanges, asset management and insurance enabling DeFis decentralized and autonomous financial infrastructure. Introducing Key Elements Of Decentralized Finance Defi Ecosystem Understanding Role Of Decentralized BCT SS to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Stablecoins, Smart Contracts, Marketplaces And Exchanges using this template. Grab it now to reap its full benefits.

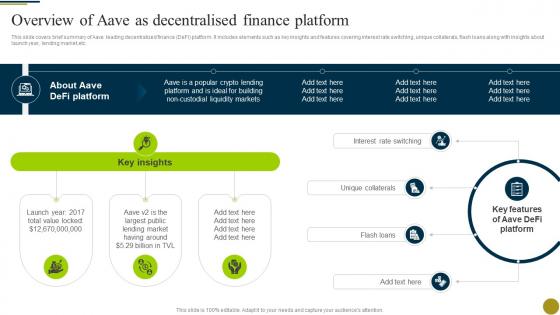

This slide covers brief summary of Aave leading decentralized finance DeFi platform. It includes elements such as key insights and features covering interest rate switching, unique collaterals, flash loans along with insights about launch year, lending market,etc. Increase audience engagement and knowledge by dispensing information using Overview Of Aave As Decentralised Finance Platform Understanding Role Of Decentralized BCT SS This template helps you present information on three stages. You can also present information on Key Insights, Interest Rate Switching, Unique Collaterals, Flash Loans using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

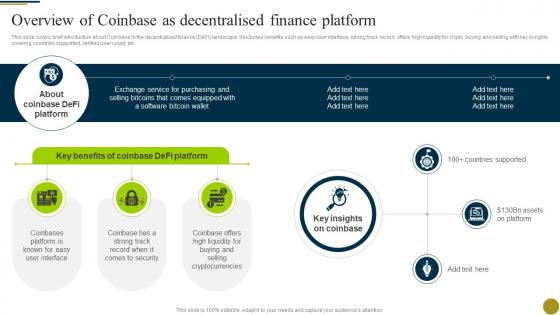

This slide covers brief introduction about Coinbase in the decentralized finance DeFi landscape. It includes benefits such as easy user interface, strong track record, offers high liquidity for crypto buying and selling with key insights covering countries supported, verified user count, etc. Introducing Overview Of Coinbase As Decentralised Finance Platform Understanding Role Of Decentralized BCT SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Coinbases Platform, Cryptocurrencies, Defi Platform using this template. Grab it now to reap its full benefits.

This slide covers brief summary of Compound as a leading decentralized finance DeFi platform. It includes elements such as benefits covering allowing users to lend and borrow cryptocurrencies, lenders can charge high interest rates, all transactions are publicly viewable, etc along with features such as interest earning accounts, borrowing cryptocurrencies against collateral, instant transaction settlement, etc. Increase audience engagement and knowledge by dispensing information using Overview Of Compound As Decentralised Finance Platform Understanding Role Of Decentralized BCT SS This template helps you present information on eight stages. You can also present information on Defi Platform, Involvement Of Intermediaries, Finance Platform using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.