| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

- Student Loans

Your Guide To The Federal Work-Study Program

Updated: Aug 25, 2020, 7:44am

Compare Personalized Student Loan Rates

Takes Up To 3 Minutes

The federal work-study program offers eligible students the ability to earn financial aid by working in university-approved, part-time jobs. Like other forms of federal aid, students apply for the work-study program as part of the Free Application for Federal Student Aid (FAFSA), which can be completed online. Federal work-study eligibility is determined by a student’s demonstrated financial need.

Once awarded aid under the work-study program, students who accept the award must identify an eligible role through their school’s financial aid or career services office. Average work-study awards are typically around $1,850 and are paid over the course of the school year. Unlike student loans , work-study funds do not have to be repaid.

What Is Federal Work-Study?

Federal work-study is a financial aid program that’s offered by the U.S. Department of Education and available to undergraduate, graduate and professional students. The program enables students to cover education expenses by earning at least minimum wage in part-time jobs that may even be related to their area of study.

Like a normal job, work-study funds are paid to the student in weekly, bi-weekly or monthly paychecks over the course of employment—not as a lump sum tuition payment to the university. Plus, while work-study wages aren’t usually enough to live on, income earned under the work-study program is exempt from FICA, so Social Security and Medicaid taxes won’t be withheld.

Who Is Eligible for Work-Study?

To be eligible for work-study, students must file the FAFSA each year they’re in school. While all students can submit a FAFSA, only students who demonstrate a financial need will be eligible for work-study and certain other types of federal student aid . Applicants also must indicate in the FAFSA that they are interested in work-study, so check with your school’s financial aid office to confirm you’re completing the application properly.

Finally, not all schools participate in the federal work-study program, so check with the financial aid offices at your schools of choice to confirm the availability of work-study aid. Once confirmed, apply early for the greatest chance of receiving an award—many schools offer aid and jobs on a first-come, first-served basis.

Check Your Eligibility

To get an idea of whether you’ll qualify for federal work-study—or how much work-study you’re eligible for—check out the FAFSA4caster tool on the Federal Student Aid website. This calculates how much work-study aid you’re likely to qualify for based on financial information and national award averages. Plus, you’ll be able to see how work-study aid might compare to other types of federal student aid.

If you don’t qualify for federal work-study, you may still be a candidate for institutional work-study. These opportunities are typically offered by various academic offices or departments and are paid for by university funds, rather than a combination of institutional and federal monies. Plus, even those who are ineligible for federal and institutional work-study can still apply for the typical part-time jobs you may find in and around campus while pursuing a degree.

How to Apply for Work-Study

Follow these steps to complete your FAFSA online at the Federal Student Aid website and apply for work-study:

1. Collect the necessary documents. Before you start working on your application, compile your federal income tax returns, W-2s and records of any other money you have earned. This may include bank statements, records of investments and documentation for untaxed income. If you’re a dependent you’ll also need to gather most of these records for your parents’ finances.

2. Log in to the Federal Student Aid website. Start by logging in to the Federal Student Aid (FSA) website . If you’ve logged in before, simply enter your FSA ID and password. Otherwise, begin the process by creating an FSA account with your Social Security number and contact information.

3. Start filling out the FAFSA. The application for the upcoming school year is typically available in October of the preceding year. It usually takes less than an hour to complete but you can save your form for up to 45 days while you work on it.

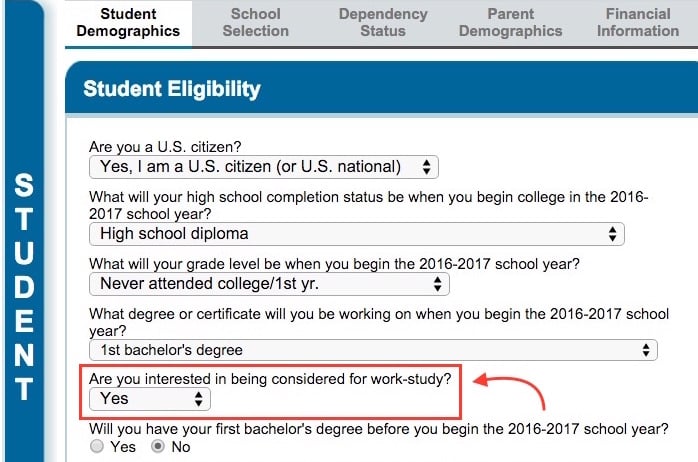

4. Select “yes” to opt into work-study. As part of the Student Demographics portion of the application, indicate whether you are interested in being considered for work-study. If you want to be considered for work-study aid, select “Yes.” Keep in mind, this does not guarantee you a work-study job. If you’re unsure, you can also select “I don’t know”—but check with each school’s financial aid office to determine the best way to qualify for work-study.

5. Choose where to send your application. To qualify for work-study, you must demonstrate financial need, attend a school that offers the program and have your FAFSA sent to that institution. If you don’t know your school’s Federal School Code, you can search by city, state and name. Applicants can send their FAFSA to up to 10 schools, so if you’re not sure where you’re going yet, add all of your possible choices.

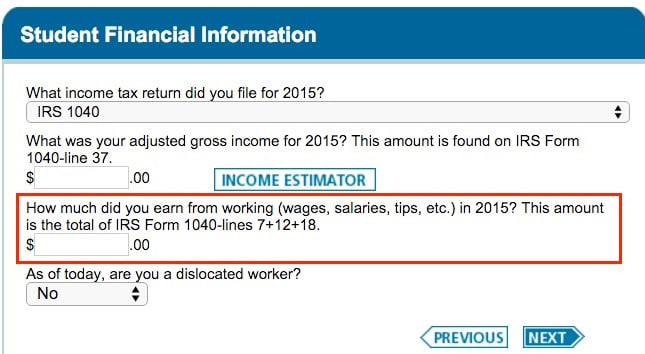

6. Provide financial information. After answering some questions about demographics, you’ll be prompted to enter information about your relevant tax returns and other information to evaluate your financial need. If you’re applying as a dependent, you’ll complete the Parent Financials section of the form.

7. Sign and submit your application. Once you submit all of the required information, agree to the FAFSA certification statement and sign your application by the filing deadline—typically on or before June 30. Check with your school’s financial aid office to determine the correct deadlines as they may be university-specific.

8. Reapply every school year. Because work-study eligibility is based on demonstrated financial need, students are required to resubmit their FAFSA each year. For that reason, work-study aid is not guaranteed from year to year.

How to Find an Eligible Work-Study Job

Your federal student aid award letter will indicate how much in work-study aid you are eligible for for each semester. However, students who qualify for federal work-study are responsible for identifying their own jobs and are not guaranteed to earn all of the work-study funds included in the award letter.

To find eligible jobs, start by contacting your university’s financial aid office or career center to learn about available work-study resources. Some schools also offer students online directories for work-study jobs or hold job fairs and other events to introduce students to eligible roles—like tutoring jobs, computer lab and library positions, research roles and off-campus positions. You should also check with your school to determine the deadline by which you must identify a work-study job—it’s usually about a month after classes start.

Keep in mind that work-study jobs are often limited and in high demand, so popular jobs are likely to fill up quickly. It’s best to start the job search early—especially if you’re looking for a role that’s related to your course of study.

How Much Can I Earn? Typical Federal Work-Study Award

Students who qualify for work-study aid and find an eligible job are guaranteed to make at least the federal minimum wage—currently $7.25 an hour—but you can earn more than that. Undergraduates are limited to hourly pay, but graduate students may earn hourly wages or a salary, depending on the specific role and employer. However, students receiving a federal work-study award can only work part-time and, on average, only earn around $1,800 to $1,850 per year.

Because of the somewhat limited availability of work-study funds, work-study wages usually aren’t enough to live on. However, it’s still worth considering—especially because income earned under the work-study program is exempt from FICA taxes so Social Security and Medicaid taxes won’t be withheld.

Work-Study Benefits

- Helps cover the cost of school. Work-study can help students earn money to pay educational expenses or otherwise support themselves during school.

- May be related to your course of study. Depending on the jobs available at your school—and when you apply for aid—you may be able to find a job that’s related to your area of study.

- Hours work with school schedule. Work-study jobs are limited to part-time and can typically be scheduled around school commitments.

- Can build your network. Working during school is a great opportunity to build your network before graduation. For this reason, work-study can also be an easy way to get recommendations when you apply for internships or a full-time job after graduation.

Work-Study Drawbacks

- Funds are not unlimited. Work-study aid and jobs are granted on a first-come, first-served basis. For that reason, aid applicants who otherwise qualify for work-study may not receive all—or any—of their award.

- Not enough to live on. Hourly rates for work-study jobs start at minimum wage and many do not exceed that. Plus, a student’s work-study earnings are capped based on need and, on average, top out around $1,850 per year.

- May overburden a student. Some students may find that maintaining a full course load and a part-time job is simply too much to handle. If possible, students who are overwhelmed by the prospect of going to school and working should focus on other forms of aid like grants or scholarships.

Get Forbes Advisor’s ratings of the best lending platforms and helpful information on how to find the best loan based on your credit score.

Frequently Asked Questions

Is federal work-study a loan.

Unlike scholarships, money earned as part of the federal work-study program does not have to be repaid. After receiving an award letter that includes work-study, a student can accept the award and is then responsible for finding an eligible job. Once hired, she’ll receive work-study payments in the form of regular paychecks over the course of employment during the school year.

Who pays for federal work-study?

Funds for the federal work-study program come from both the U.S. Department of Education and the individual student’s school or employer. Generally speaking, the school or employer pays up to 50% of the student’s work-study wages. However, in some cases—like for certain tutoring jobs—100% of the funds may come from the federal government.

How does work-study pay?

Work-study income is often paid on a biweekly basis but, depending on the school, may be paid weekly or monthly. In contrast to scholarship and grant money, work-study funds are paid to the student as they are earned—not in a lump sum at the beginning of the semester. This means that funds are paid directly to the student—often via direct deposit—and are not applied directly to tuition and fees.

Do I have to accept a work-study offer?

Students do not have to accept any of the federal aid that is offered to them. Once you receive your financial aid award letter, you must follow the instructions on the letter to accept or decline each of the awards individually. Just because you are offered work-study or another form of federal aid does not mean you have to take it. For example, you can opt to accept grants, scholarships and work-study that are offered to you but decline loans.

- Best Private Student Loans

- Best Student Loan Refinance Lenders

- Best Low-Interest Student Loans

- Best Student Loans For Bad or No Credit

- Best Parent Loans For College

- Best Graduate Student Loans

- Best Student Loans Without A Co-Signer

- Best International Student Loans

- Best 529 Plans

- SoFi Student Loans Review

- College Ave Student Loans Review

- Earnest Student Loans Review

- Ascent Student Loans Review

- Citizens Bank Student Loans Review

- Student Loan Calculator

- Student Loan Refinance Calculator

- Net Price Calculator

- What Is The FAFSA ?

- Applying Financial Aid Using The FAFSA

- When Is The FAFSA Deadline ?

- Answers To Biggest FAFSA Questions

- FAFSA Mistakes To Avoid

- Guide To Hassle-Free FAFSA Renewal

- How To Correct Or Change Your FAFSA

- How Do Student Loans Work?

- How To Get A Private Student Loan

- How To Refinance Student Loans

- How To Get A Student Loan Without Co-Signer

- How To Apply For Federal & Private Student Loans

- How To Pay Off Student Loan Debt

- How To Recover From Student Loan Default

- How Much Can You Borrow In Student Loans?

How To Pay For College With No Money

Can You Use Student Loans To Pay Past-Due Tuition?

Private Student Loan Rates: July 23, 2024—Loan Rates Move Up

Private Student Loan Rates: July 16, 2024—Loan Rates Slip

Private Student Loan Rates: July 8, 2024—Loan Rates Slip

Private Student Loan Rates: July 2, 2024—Loan Rates Decrease

Kiah Treece is a small business owner and personal finance expert with experience in loans, business and personal finance, insurance and real estate. Her focus is on demystifying debt to help individuals and business owners take control of their finances. She has also been featured by Investopedia, Los Angeles Times, Money.com and other financial publications.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is Work-Study?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Work-study is a federally and sometimes state-funded program that helps college students with financial need get part-time jobs.

It won’t cover all your college costs — you’ll need a combination of personal savings, scholarships, grants and student loans, too — but it’s beneficial for students who qualify.

» MORE: Your guide to financial aid

“Work experience at any level while you’re in college is going to be a benefit,” says Megan FitzGibbon, manager of state scholarship programs at the Minnesota Office of Higher Education. “Especially if it’s related to your degree.”

» MORE: Which to Borrow: Subsidized vs. Unsubsidized Student Loans

Top Private Student Loan Lenders

Best private student loan overall.

3.99-17.99% College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC.. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply. As certified by your school and less any other financial aid you might receive. Minimum $1,000. Rates shown include autopay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation. This informational repayment example uses typical loan terms for a freshman borrower who selects the Flat Repayment Option with an 8-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 7.78% fixed Annual Percentage Rate (“APR”): 54 monthly payments of $25 while in school, followed by 96 monthly payments of $176.21 while in the repayment period, for a total amount of payments of $18,266.38. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary. This informational repayment example uses typical loan terms for a freshman borrower who selects the Deferred Repayment Option with a 10-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 8.35% fixed Annual Percentage Rate (“APR”): 120 monthly payments of $179.18 while in the repayment period, for a total amount of payments of $21,501.54. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary. Information advertised valid as of 7/10/2024. Variable interest rates may increase after consummation. Approved interest rate will depend on the creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of full principal and interest payments with the shortest available loan term.

Variable APR

5.59-17.99% College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC.. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply. As certified by your school and less any other financial aid you might receive. Minimum $1,000. Rates shown include autopay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation. This informational repayment example uses typical loan terms for a freshman borrower who selects the Flat Repayment Option with an 8-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 7.78% fixed Annual Percentage Rate (“APR”): 54 monthly payments of $25 while in school, followed by 96 monthly payments of $176.21 while in the repayment period, for a total amount of payments of $18,266.38. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary. This informational repayment example uses typical loan terms for a freshman borrower who selects the Deferred Repayment Option with a 10-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 8.35% fixed Annual Percentage Rate (“APR”): 120 monthly payments of $179.18 while in the repayment period, for a total amount of payments of $21,501.54. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary. Information advertised valid as of 7/10/2024. Variable interest rates may increase after consummation. Approved interest rate will depend on the creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of full principal and interest payments with the shortest available loan term.

Min. credit score

on College Ave's Visit this lender's site to take next steps.

on Credible Credible lets you check with multiple student loan lenders to get rates with no impact to your credit score. Visit their website to take the next steps.

4.15-15.49% Lowest rates shown include the auto debit. Advertised APRs for undergraduate students assume a $10,000 loan to a student who attends school for 4 years and has no prior Sallie Mae-serviced loans. Interest rates for variable rate loans may increase or decrease over the life of the loan based on changes to the 30-day Average Secured Overnight Financing Rate (SOFR) rounded up to the nearest one-eighth of one percent. Advertised variable rates are the starting range of rates and may vary outside of that range over the life of the loan. Interest is charged starting when funds are sent to the school. With the Fixed and Deferred Repayment Options, the interest rate is higher than with the Interest Repayment Option and Unpaid Interest is added to the loan’s Current Principal at the end of the grace/separation period. To receive a 0.25 percentage point interest rate discount, the borrower or cosigner must enroll in auto debit through Sallie Mae. The discount applies only during active repayment for as long as the Current Amount Due or Designated Amount is successfully withdrawn from the authorized bank account each month. It may be suspended during forbearance or deferment. Advertised APRs are valid as of 7/12/2024. Loan amounts: For applications submitted directly to Sallie Mae, loan amount cannot exceed the cost of attendance less financial aid received, as certified by the school. Applications submitted to Sallie Mae through a partner website will be subject to a lower maximum loan request amount. Miscellaneous personal expenses (such as a laptop) may be included in the cost of attendance for students enrolled at least half-time. Examples of typical costs for a $10,000 Smart Option Student Loan with the most common fixed rate, fixed repayment option, 6-month separation period, and two disbursements: For a borrower with no prior loans and a 4-year in-school period, it works out to a 10.28% fixed APR, 51 payments of $25.00, 119 payments of $182.67 and one payment of $121.71, for a Total Loan Cost of $23,134.44. For a borrower with $20,000 in prior loans and a 2-year in-school period, it works out to a 10.78% fixed APR, 27 payments of $25.00, 179 payments of $132.53 and one payment of $40.35 for a total loan cost of $24,438.22. Loans that are subject to a $50 minimum principal and interest payment amount may receive a loan term that is less than 10 years. A variable APR may increase over the life of the loan. A fixed APR will not.

5.37-15.70% Lowest rates shown include the auto debit. Advertised APRs for undergraduate students assume a $10,000 loan to a student who attends school for 4 years and has no prior Sallie Mae-serviced loans. Interest rates for variable rate loans may increase or decrease over the life of the loan based on changes to the 30-day Average Secured Overnight Financing Rate (SOFR) rounded up to the nearest one-eighth of one percent. Advertised variable rates are the starting range of rates and may vary outside of that range over the life of the loan. Interest is charged starting when funds are sent to the school. With the Fixed and Deferred Repayment Options, the interest rate is higher than with the Interest Repayment Option and Unpaid Interest is added to the loan’s Current Principal at the end of the grace/separation period. To receive a 0.25 percentage point interest rate discount, the borrower or cosigner must enroll in auto debit through Sallie Mae. The discount applies only during active repayment for as long as the Current Amount Due or Designated Amount is successfully withdrawn from the authorized bank account each month. It may be suspended during forbearance or deferment. Advertised APRs are valid as of 7/12/2024. Loan amounts: For applications submitted directly to Sallie Mae, loan amount cannot exceed the cost of attendance less financial aid received, as certified by the school. Applications submitted to Sallie Mae through a partner website will be subject to a lower maximum loan request amount. Miscellaneous personal expenses (such as a laptop) may be included in the cost of attendance for students enrolled at least half-time. Examples of typical costs for a $10,000 Smart Option Student Loan with the most common fixed rate, fixed repayment option, 6-month separation period, and two disbursements: For a borrower with no prior loans and a 4-year in-school period, it works out to a 10.28% fixed APR, 51 payments of $25.00, 119 payments of $182.67 and one payment of $121.71, for a Total Loan Cost of $23,134.44. For a borrower with $20,000 in prior loans and a 2-year in-school period, it works out to a 10.78% fixed APR, 27 payments of $25.00, 179 payments of $132.53 and one payment of $40.35 for a total loan cost of $24,438.22. Loans that are subject to a $50 minimum principal and interest payment amount may receive a loan term that is less than 10 years. A variable APR may increase over the life of the loan. A fixed APR will not.

Mid-600's

on Sallie Mae's Visit this lender's site to take next steps.

Federal work-study FAQ

You have to fill out the Free Application for Federal Student Aid ( FAFSA ) to be eligible.

Students are typically responsible for securing their own work-study jobs. Just because your financial aid award says you qualify for work-study doesn’t mean you’re guaranteed a job.

Around 3,400 colleges and universities have a Federal Work-Study Program, according to the U.S. Department of Education, but not all schools do. Check with the financial aid offices at the schools you’re interested in to see if they offer work-study.

» MORE: What is need-based financial aid?

How to apply for federal work-study

When you fill out the FAFSA , select the box on the application that indicates you want to be considered for work-study. You should fill out the FAFSA as soon as possible because some aid is awarded on a first-come, first-served basis.

Selecting this option doesn’t guarantee that a work-study option will be included in your financial aid award, and it doesn’t bind you to accepting the work-study if it’s offered.

Within a few weeks or months of filling out the FAFSA, you’ll get a financial aid award listing the amounts you’re eligible to get from loans, grants and work-study. Colleges award work-study funds based on availability of funds, student financial need and other financial aid a student is eligible for.

Although your aid financial aid award letter may list a certain amount allocated for work-study — say, $5,000 — that doesn’t mean you automatically get that money. You have to find a work-study-eligible job and then work enough hours to earn that amount.

» MORE: How to get more financial aid

Do I have to accept work-study aid?

If work-study is on your financial aid award and you don’t intend to use it, you can decline the award. However, in most cases, getting a work-study job is a good idea, especially if it decreases your student loan borrowing and the amount of student debt you’ll face after graduation.

“We would much rather have our students turn to grants, work-study — any other source of aid — before they turn to loans,” says Austin Gentry, admissions advisor at New Mexico State University.

» MORE: Types of student loans: Which is best for you?

Where to find an eligible work-study job

After you’re offered a work-study opportunity, you have to find a job that qualifies for the program.

Many work-study gigs are on-campus and can include research assistantships, administrative duties in a campus office or working in the library. Other work-study jobs may be off-campus at nonprofit organizations or private companies. A portion of work-study positions are community-service jobs, including tutoring, child care and health care.

Many schools have online portals with work-study job listings, and students are encouraged to apply for jobs that are related to their field of study. Work-study jobs promise flexible hours so you can more easily balance work and school.

Typically you can only earn as much through work-study as the financial aid award stipulates, although some employers make exceptions.

For example, if your award allocated $5,000 for work-study, you could work as many hours as it takes to earn that amount. But say you reached that amount with two weeks left in the semester. Some employers may allow you to continue working for the remainder of the semester and exceed your allocated amount, but it depends on the employer, Gentry says.

Average work-study award

With a work-study job, you’re guaranteed to earn at least the federal minimum wage, $7.25 an hour. If the state minimum wage is higher, you’ll earn at least the state minimum wage.

The average work-study award for a student with an eligible job earned $1,821 in 2023, according to the annual Sallie Mae report "How America Pays for College." One in five (20%) families used work-study as part of an overall strategy to pay for college, the report found.

How does work-study pay?

You can opt to get paid by check or direct deposit, or have the money credited to your school account to cover tuition, fees or room and board. There’s no requirement that you use the money for anything specific; FitzGibbon says many students use their work-study paychecks to cover day-to-day living costs.

Does work-study affect future financial aid?

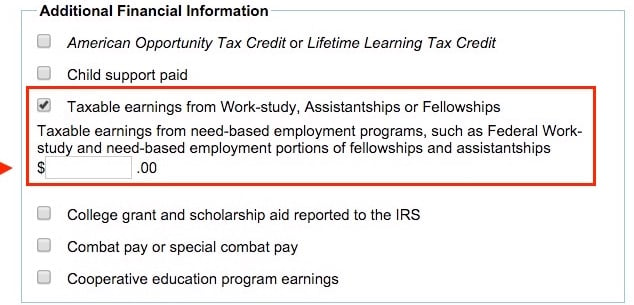

The money you earn through work-study is taxable, and you should report it on your FAFSA the following year in two places. First, include your work-study earnings when you report your total income earned from work that year.

Second, a later question asks how much you earned through work-study the previous year. Fill that out, too, because the money you earn through work-study won't count in the calculation that determines how much aid you're eligible for the following year.

» MORE: How to get free Pell Grant money to pay for college

Fill out the FAFSA. The application for the 2022-23 school year is available Oct. 1, 2021. If you’ve already been approved for the work-study program, check with your college for job listings.

On a similar note...

- Work-Study Explained: How it Works (A Simple Guide)

The term “work-study” can seem self-explanatory: It’s a program designed to help people obtain employment while in college. Because so many students struggle to afford basic necessities, these part-time gigs are a helpful source of income. Simple enough, right?

Unfortunately, this straightforward concept can get complicated quickly . Dig into the details of work-study opportunities, and you’ll encounter a world of forms and intersecting bureaucracies.

Which applications do you need to complete? Who runs the program, your school, or the government? Does a private student loan affect your eligibility? If you qualify for work-study, are you guaranteed a gig? Does your paycheck go towards tuition, or directly into your pocket?

Every year, thousands of students grapple with the federal work-study system, navigating its demands successfully. With a little help, you can do the same, seizing a great opportunity to offset the costs of being in college.

In this guide, we’ll take you through everything you need to know about the federal work-study program . We’ll explain how it’s funded and intended to function, showing how it actually helps students make ends meet. From there, we’ll get into the details of applying for work-study and actually getting a gig. Once you’re done with this article, you’ll be able to decide if work-study is right for you.

- Work-Study Basics: What It Is and What It Does

The Federal Work-Study program (sometimes called the FWS) is designed to help college students find part-time work and offset education expenses. The program is overseen by the U.S. Department of Education and represents one form of financial aid that the government makes available to students who need help with college expenses.

While the program relies on federal funding, participating schools play a large role in allocating money to their students and administering work-study opportunities. Currently, about 3,400 colleges, universities, and professional schools participate in the work-study program to some extent.

The administrative technicalities of work-study differ somewhat from school to school, and extensive regulations govern the program. But the fundamentals of the program can be summed up in relatively simple terms:

- The Department of Education provides money to schools participating in work-study programs. The amount given to each school reflects the financial needs of the student body and the number of work-study jobs available.

- Schools determine which students should receive work-study as part of their broader financial aid package (which also includes loans and grants). If students are awarded work-study, the school designates the maximum amount that they can earn through the program.

- Students find designated work-study jobs on campus or in the local community. Once hired, students begin earning the amount of money specified in their work-study award. These jobs include a diverse set of roles, but they are all part-time positions that students can balance with their studies.

This system may seem a lot like applying for any part-time job, and it is in many respects. But the work-study program is distinct from other employment opportunities because of the role of federal funding . For each work-study job, the federal government chips in a portion of the student’s payment , while the school pays the rest. In some cases, the government foots most (or all) of the bill.

That means that schools have a big incentive to hire work-study students for a variety of positions across campus. They can help their students make ends meet through solid part-time gigs — and pay a lot less for the labor.

For students, the benefits are significant as well . Many work-study positions are interesting, fun, or fulfilling, and they’re designed to be flexible enough to accommodate your studies. Moreover, these jobs are designated for work-study students specifically, so the pool of competition is much smaller.

Most importantly, work-study can be an excellent way to bolster your resume while earning the cash you need to afford student life. As you look towards life after graduation, who wouldn’t want less debt and more work experience?

- Who Is Eligible for Work-study, and How Do I Apply?

Work-study opportunities are available to a wide array of students on many educational paths. Ultimately, schools decide which of their students will be offered work-study awards, and how much they’ll be able to earn. To be considered for work-study, you must meet these basic eligibility criteria.

- You must be a current undergraduate, graduate, or professional student (students enrolled in vocational programs qualify as professional students).

- You must be enrolled part-time or full-time in a degree-seeking program.

- You must be accepted or currently enrolled in a school that participates in the Federal Work-Study Program.

- You must demonstrate a need for financial assistance in affording the costs of college and associated expenses.

To apply for financial aid, you must complete the Free Application for Federal Student Aid , better known as the FAFSA . This extensive document gives schools a sense of your financial resources. Once you complete it, you’ll need to send it to the schools to which you are applying (or the one you currently attend).

To apply for work-study specifically, you’ll need to indicate your interest on the FAFSA. There is a specific question about work-study (question 31 at the time of this writing), and you’ll need to select “Yes” for schools to consider you for a work-study award.

- If I’m Awarded Work-study, Am I Guaranteed a Job?

In effect, a work-study grant is really a green light to hunt for opportunities. Your school is committing to give you a certain amount of funds if you are hired for a work-study position. Unfortunately, that “if” can make all the difference.

A work-study grant does not guarantee that you will be hired for a work-study job. You will still need to find an appropriate opportunity, apply for it, and get hired (the next section covers this process specifically). Only once you’re hired will the work-study money start to flow in your direction.

Don’t get discouraged, however. After all, schools want their students to utilize work-study awards: If work-study funds go unused, these institutions are leaving federal money on the table, and key jobs around campus go unfilled. Accordingly, colleges generally strive to help students find suitable opportunities, as we’ll discuss in more detail below.

It’s also worth noting that you are not obligated to accept a work-study position just because your school awards you work-study funding . If you find another form of employment that seems more promising, you can ignore the work-study option entirely.

- How Do I Find and Apply for Work-study Jobs?

If you’re awarded work-study, your school will provide instructions pertaining to searching for and obtaining a suitable position. In some instances , this process will entail logging into a digital platform on which work-study jobs are listed. In many cases, you can apply for jobs directly within the platform.

Other institutions post all available positions publicly, and it’s incumbent upon students to reach out about job openings. However they choose to do it, schools are in charge of specific job listings and assignments, not the federal government.

At most schools, this system is administered by a department intended to help students find employment (whether in a work-study capacity or not). It could be part of your school’s financial aid office, or nestled under another umbrella, such as the “career services department.” If you’re struggling to find a solid work-study job, reach out to them to see if they can aid in your search.

Whatever the process at your school, it will be helpful to have an updated resume on hand . Even if a resume isn’t explicitly required, you’ll impress by providing one.

- What Kinds of Work-study Jobs are Available?

Many students are surprised to learn just how numerous and varied work-study positions can be. Indeed, while each institution determines its own approach to work-study, most colleges offer a mix of service, administrative, research, and teaching roles.

As one might expect, the qualifications necessary for work-study jobs can differ significantly . Some jobs require a great attitude, but no particular aptitude. Other demands specific skills and experience and, therefore, may be tied to a student’s past academic performance.

Here are some popular and/or desirable work-study roles performed by students on their respective campuses. This list is by no means exhaustive, but it should provide a good sense of the opportunities available:

- Teaching and tutoring roles: Teaching assistants and tutors are often work-study recipients. They usually earn these positions by excelling in the subjects they teach to others.

- Research roles: From the lab to the library, many students earn money by helping faculty complete research projects. Again, these students earn their spots through academic excellence.

- Admissions and student life roles: Want to lead campus tours for prospective students? How about leading orientation groups for freshman or serving as a resident assistant (RA)? Work-study students often perform these gigs.

- Administrative roles: From managing paperwork and correspondence to handling incoming calls, every department needs a work-study student to handle business.

- Other services: Maybe you’re the tech-savvy type destined for I.T. services or an athlete who’d feel at home checking IDs at the gym. In many such roles, work-study students keep colleges running.

If these options don’t speak to you, you can also look off-campus for work-study fulfillment . At most colleges, a portion of work-study funding is reserved for jobs in the local community, usually at public agencies or nonprofits dedicated to public service.

- How Do I Get Paid for Work-study, and How Much Can I Make?

According to the Department of Education regulations , students employed in work-study jobs cannot make less than the federal minimum wage ($7.25 at the time of this writing). Additionally, in places where the state or local laws mandate a higher minimum wage, work-study pay must satisfy those laws. While all undergraduates are paid on an hourly basis, some graduate-level work-study positions may be salaried.

Schools are usually accountable for paying students and must do so at least once a month. If a student works in an off-campus position, however, they are paid by their employer instead. In most instances, students receive payment for their hours via check or direct deposit , though students can request that their earnings be debited directly to their student account.

These earnings can be substantial: In one recent study , students earned an average of $2,649 per year in their work-study jobs. However, you can’t earn more than the total work-study grant awarded by your school.

You should keep this in mind as you search for a work-study role. You’ll need to find a job in which the hours and hourly rate won’t surpass your total award. If you can earn a maximum of $1,500 for the academic year, for example, you might look for a gig requiring just a few hours per week.

- Do I Have to Apply for Work-study Again Every Year?

Federal work-study opportunities are part of the broader range of student aid provided by the U.S. government. To stay eligible for these benefits, you must complete the FAFSA every year and submit it to your school. Thankfully, the FAFSA website doesn’t make you start from scratch: With the “Renewal” option, much of the info from the year before carries over.

Your school will then review your financial circumstances, determining whether you still qualify for work-study. Because funding varies annually, you may not be offered the same work-study grant as you were the year before, even if your financial needs haven’t changed. Accordingly, experts recommend submitting the FAFSA early to maximize your chances of a work-study grant.

Once granted work-study, you’ll need to navigate your school’s process for obtaining a specific position. If you love your work-study position and want to keep it next year, let your supervisor know. They may be able to coordinate with you and save the position for you.

- Are There Other Kinds of Work-study Programs?

So far, we’ve discussed federal work-study programs, which utilize funds from the U.S. Department of Education. But certain students may benefit from a slightly different category of employment opportunity: state work-study programs.

These programs function much like federal work-study, but they’re funded by state legislatures instead. Eligibility criteria and funding levels differ, and some states don’t have their own work-study programs at all.

However, some basic rules generally apply: These opportunities are usually open only to residents attending schools in their home states. Both public and private institutions can participate in state work-study programs, and these institutions generally determine which students will be offered work-study as part of their financial aid packages.

In short, the federal government may not be your only shot at a work-study opportunity. Research your own state’s approach , because you may need to complete an additional application to be eligible for state work-study positions.

- Offsetting Expenses: As a Student — and Beyond

After reading through this guide, you should have a basic understanding of how work-study operates. More importantly, we hope you’ve gained some sense of whether a work-study position might be advantageous to you.

As we’ve noted throughout this article, work-study jobs differ tremendously, compensating at different levels, and demanding various skills. But they share some key advantages for students, such as a limited pool of eligible applicants and the flexibility to accommodate class schedules. If you hope to depart college with a degree and some valuable work experience, a work-study position may be the perfect solution.

That being said, work-study roles are hardly the only form of viable employment available to students . If you’re ineligible for work-study or can’t find a position that suits your preferences, there are plenty of other part-time jobs to consider. Plus, as the gig economy presents new opportunities, you have more ways than ever to make ends meet.

Even once you graduate, you may need to get creative about managing expenses while launching your career. For many young professionals, it can be tough to pay down student loans on an entry-level salary. But whether you’re still in school or repaying your loans right now, you don’t have to tackle these issues alone. At CollegeFinance.com , we’ve got the insights and straightforward advice you need to make smart money decisions — before, during, or after college.

Table of contents

Related articles.

Ascent Private Student Loan Review

CU Student Choice Private Student Loan Review

Abe Private Student Loan Review

Online Students

For All Online Programs

International Students

On Campus, need or have Visa

Campus Students

For All Campus Programs

What Is Work-study and Is It Worth It?

Whether you're planning to head to college right after high school or want to go back to school after some time away, paying for college can hold you back from attaining your degree. There are options for you, though, to get the financial aid you need to set you on the right track to achieve your goals. One financial aid option many don't know about or take advantage of is work-study.

So what exactly is work-study, and how does it work?

What Does Work-Study Mean?

Federal work-study is part of the government's Title IV financial aid assistance program with funds administered by the U.S. Department of Education (DOE). Work-study allows students to work an approved part-time job on or off campus and earn either a weekly, bi-weekly or monthly paycheck.

To be eligible for work-study, you must be a student enrolled in a degree program at a community college or 4-year university and have also applied for Free Application for Federal Student Aid (FAFSA) . Not all students who complete a FAFSA will be eligible for work-study as it's based on a student's financial need.

Work-study is an option that's available for both online and campus students. If you're on campus, you can work in positions like an equipment and events staff member for the athletics department or at the library's front desk, or as a change agent for your school's Office of Diversity , just to name a few examples.

If you're an online student with work-study, you might take advantage of remote jobs for your university. Anyone with work-study can also work at an approved off-campus position.

For online students, a remote work-study job is a great opportunity to work and grow in a different work environment.

"I’ve worked with Qualtrics and in quality assurance," said Mahnken. "I have also had the wonderful opportunity to build a spatial gallery for guided and self-guided tours relating to a virtual reality project the team designed."

While students are mainly responsible for securing their own work-study job, speaking with the Student Financial Services department at your university ensures you are applying for the best work-study job for you.

A work-study job is just like any other job. When looking for a position, you should consider your interests along with your future career plans. During your work-study role, you can learn valuable soft skills while earning your degree and gaining experience and knowledge for your personal and professional goals.

Is Federal Work-Study the same as FAFSA?

"Federal work-study is part of the financial aid package, and students must complete a FAFSA form to be considered for work-study," said Mary Young , associate director of Student Employment for Student Financial Services at SNHU.

When filling out your FAFSA , ensure you are indicating you are interested in a work-study to be considered for the aid.

In your financial aid offer, you may also be awarded different loans and grants that will need to be paid back to the government, which is different from a federal work-study.

"Work-study does not need to be paid back while loans will go into repayment," said Young. "Students will receive a bi-weekly paycheck based on the number of hours that they work. The money goes directly to them whereas loans are applied to the student's bill."

Is it Worth it To Do a Work-Study?

If you are offered a work-study in your financial aid award , you do not have to accept it, but you should consider it. According to Mahnken, "the value is incredible."

Your work-study can provide you with essential knowledge for your career. Mahnken said her work-study has allowed her to prepare for her future career. She learned about academic writing, storytelling, education technology and more.

"I have been so blessed and lucky to have this chance," said Mahnken.

Another online student Zachary Briggler '22 worked as a video editor for the School of Business at SNHU found his experience valuable, too. He learned how to work in a team environment and collaborate with others while doing something he loved.

"I think a work-study is worth it… I got experience working with people, and I got paid for doing something I already enjoyed, which was editing videos," said Briggler.

Your work-study position may not only teach you the skills necessary for your future career goals, but it could end up being your future career.

Young, who works with SNHU students who have federal work-study, has had students go on to gain full-time positions from their jobs.

She had one student spend four years as a shelter assistant at an Animal Rescue League through the federal work-study program. After graduation, the shelter hired the student full-time as an adoption counselor, where they still work today.

"Students are going to gain transferrable skills that any employer will be looking for when they graduate," said Young. "For example, time management , critical thinking and problem-solving are just a few skills to be learned in a work-study position."

Work-study is a good opportunity to work and go to school simultaneously. If you receive the financial aid offer a work-study is a great way to help alleviate your financial needs in college while allowing you to prepare for future personal and professional goals and make the most of your college experience.

Online. On campus. Choose your program from 200+ SNHU degrees that can take you where you want to go.

Alexa Gustavsen '21 is a writer at Southern New Hampshire University. Connect with her on LinkedIn .

Explore more content like this article

The Importance of Critical Thinking Skills, For Students and Ourselves

How Much Sleep Should a College Student Get?

What is a BS Degree and What Can You Do With It?

About southern new hampshire university.

SNHU is a nonprofit, accredited university with a mission to make high-quality education more accessible and affordable for everyone.

Founded in 1932, and online since 1995, we’ve helped countless students reach their goals with flexible, career-focused programs . Our 300-acre campus in Manchester, NH is home to over 3,000 students, and we serve over 135,000 students online. Visit our about SNHU page to learn more about our mission, accreditations, leadership team, national recognitions and awards.

Work-Study Programs

- Federal Work-Study

- CalWORKs Work-Study

- Next-Up Work-Study

Federal Work Study

One of several federal student aid programs offered through the Financial Aid Office. FWS is a need-based federally funded part-time employment program, which allows eligible students to earn money to help pay for education expenses. In addition to providing financial assistance, FWS also helps students gain valuable work experience while pursuing a college education. Students must complete the Free Application for Federal Student Aid (FAFSA) each year to be considered for federal student aid, including FWS funding.

For questions about eligibility for the Chaffey College Federal Work-Study program, please contact the Financial Aid Office .

CalWORKs Work-Study The CalWORKs (California Work Opportunity and Responsibility to Kids) Work-Study program aims to connect eligible CalWORKs students with entry-level employment opportunities. The focus is to provide work opportunities that develop and/or strengthen workplace skills while the students complete their educational goals. Funding for the CalWORKs Work-Study program can vary from year to year and position placements are re-evaluated regularly. When funding is available, and a qualified student is identified to fill an opening, CalWORKs funding covers a percentage of wages on average 75% (with the employing department providing the remainder). Departments that may be interested in employing a CalWORKs Work-Study student employee should contact the CalWORKs department directly to inquire about the current availability of funding and to discuss potential placements.

For questions about eligibility for the CalWORKs Work-Study program, please contact Cacey Douglas at (909) 652-6049 or [email protected]

NextUp Work-Study NextUp Work-Study is a new opportunity which aims to connect eligible NextUp (qualified foster youth) with entry-level employment opportunities. The focus is to provide work opportunities that develop and/or strengthen workplace skills while the students complete their educational goals. Funding for the NextUp Work-Study program can vary from year to year and position placements are re-evaluated regularly. When funding is available, and a qualified student is identified to fill an opening, NextUp funding covers a percentage of wages, on average 75% (with the employing department providing the remainder). Departments that may be interested in employing a NextUp Work-Study student employee should contact NextUp directly to inquire about the current availability of funding and to discuss potential placements.

For questions about eligibility for the NextUp Work-Study program, please contact Cacey Douglas at (909) 652-6049 or [email protected]

Where Will I Work?

There are a variety of on-campus jobs available through the work-study programs. Chaffey College offices and departments hire students to provide services such as clerical support, reception, lab assistance, food service, cashiering, and peer advising.

Am I Guaranteed A Position?

Obtaining a work-study position can be a competitive process. Applicants are considered for positions based on their level of skill and their abilities to perform the required job duties. Also, due to a limited number of available positions throughout the campus, not all who are eligible for a work-study award will be able to secure employment in the program. The application is submitted and eligibility is verified by the Student Employment Office and the hiring department interviews and selects their employee.

Welcome to Chaf f ey

- Request Info

- James C. Kirkpatrick Library

- Campus Maps

- University Calendars

| To increase your chance of receiving this type of aid, file your FAFSA by April 1st each academic year. |

Federal Work Study (FWS) is a Federal Student Aid program that provides funding for part-time employment to some eligible students. This give you the opportunity to earn money to help pay educational expenses. The Work Study award (not a grant or loan), represents an employment earnings allotment, for part-time work, up to 20 hours per week.

This resource is awarded to eligible students with financial need according to federal guidelines. Due to the limited availability of program funding, to increase your chance of receiving this type of aid, file your FAFSA by April 1st each academic year. To find more information about the Work Study Program, visit Federal Student Aid.

Additional Work Study Information

If you receive this award, you can apply for on-campus jobs through the UCM job search (Student Position Type) or off-campus jobs through Handshake .

To be eligible for FWS, you must meet the following criteria:

- Must be enrolled at UCM,

- Have a FAFSA received date of April 1 or earlier,

- Have an Expected Family Contribution (EFC) between 0 and 7000,

- Indicated "Yes" or "Don't Know" on the FAFSA when asked about Work Study, and

- Must have Unmet Need after EFC and all other aid is considered.

If you meet all of the criteria above, the financial aid office automatically awards FWS to you. Check the award letter you receive from Financial Aid to see if you are a recipient. If awarded FWS, after you secure qualified employment and begin working, you will receive a paycheck just as you would for any job. Since 75% of the funding for your paycheck comes from the Federal Government with the remaining 25% coming from the University of Central Missouri, many departments on-campus have an added incentive to provide employment opportunities. You are free to use those funds for any living or educational expense you have while attending college.

Work Study earnings are used by students to pay miscellaneous and living expenses throughout the semester . Therefore, a student's allotment is not assistance that is credited to his/her UCM Student Account at the beginning of a term toward payment of tuition, fees, residence hall, or meal plan expenses.

What if I don't qualify for work study?

Students who may not qualify for Federal Work Study earnings allotment, but still wish to work part-time while attending UCM, are encouraged to explore University-funded part-time employment opportunities .

- Financing Your Education

- Policies and Procedures

- Dropping a Class

- Online Application Instructions

- UCM Scholarship Finder

- Future Freshman

- Current Undergraduate

- Undergraduate Transfer

- UCM Out-of-State Scholarship

- Transfer Scholarships

- Graduate Scholarships

- International Scholarships

- Scholarship Calculator

- Financial Tools & Tips

- What is the FAFSA?

- 2024-2025 FAFSA Changes

- Tuition and Costs

- Cost Calculators

- Semester Payment Information

- Outstanding Student Account Balance

- Perkins Loan Repayment

- 2024-2025 Approved Tuition & General Fees Rate List

- 2023-2024 BOG Approved Tuition & General Fees Rate List

- Federal Financial Aid

- Scholarships

- Tuition & Costs

- Contact the Office of Student Financial Services

social-section

Visit the Health Advisories website for the latest vaccination and mask information and to Report a Case.

Questions about FAFSA and CADAA?

Visit our Financial Aid and Scholarship Office for updated information, workshops and FAQs.

Financial Aid and Scholarship Office

Federal Work-Study Program

The Federal Work-Study Program (FWS) allows SJSU students to gain valuable work experience while earning money to help pay for college. A focus is placed on providing community service jobs both on and off campus.

One of the advantages of the FWS is that earnings are excluded when re-applying for financial aid. Thus, FWS earnings do not affect future financial aid eligibility. However, FWS earnings are taxable. The minimum work-study award is $5,000.

Who is Eligible?

Students who have unmet financial need based on their FAFSA will be considered for Federal Work Study.

Students may also request to have loans converted to Federal work-study, but must have financial need as determined by the FAFSA to be eligible. Submit the Student Information Update Form to the Financial Aid and Scholarship Office to request loan conversion.

Eligibility does not guarantee employment. Actual employment is contingent upon availability of jobs, skill level, work hours, etc.

How to Find Jobs

Jobs are available with on-campus employers such as Spartan Shops, University Housing Services, Student Union, Event Center, and various academic and administrative offices. Work-study jobs are also available off-campus with school districts, social service agencies, city and county government, etc.

- Visit the Career Center for job listings. It is important to know that if you do not work an authorized work-study job, you will not receive any portion of your FWS award.

- Locate advertised FWS jobs (via the Internet or hard-copy job listings)

- Call the specified employers and schedule a job interview

- Print your Financial Aid Award Notice from MySJSU and bring it with you to each job interview. Print your award notice by accessing: MySJSU>Self Service>Student Center> under Finances, select "View Financial Aid" and click on the appropriate aid year.

Summer Federal Work-Study

Students who are planning on working under the Federal Work Study program beyond May 21st must first receive a summer federal work-study (FWS) clearance. This will allow students to work the months of June, July, and August.

To apply for a summer clearance, students must complete and submit the Summer Federal Work-Study Allocation Application . To be considered, students will need to first complete the Financial Aid application process, (submit FAFSA and all requested financial aid verification forms) as well as be determined to have financial need for the academic year.

Frequently Asked Questions

The summer clearance is used to determine and inform students of their eligibility for summer federal work-study. To obtain a clearance, students must first complete and submit the Summer Federal Work-Study application to the Financial Aid and Scholarship Office.

Only students who plan on working under the Federal Work-Study Program need apply for a summer clearance by submitting the Summer Federal Work-Study application to the Financial Aid and Scholarship Office. Students who do not plan on working will not have to apply.

You will not be able to work as a Federal Work-Study student during the summer.

- No. However, students must be currently enrolled in Spring courses, and enroll in Fall courses.

- The Summer Federal Work-Study Clearance form will be provided to students one week after they have submitted the Summer Federal Work Study Allocation Application and will be available for pick up at the Financial aid and Scholarship Office

Federal Work-Study information for Employers

HUBSPOT CUSTOMER PLATFORM

Grow better with HubSpot

Software that's powerful, not overpowering. Seamlessly connect your data, teams, and customers on one AI-powered customer platform that grows with your business.

Get a demo of our premium software, or get started with free tools.

216,000+ customers in over 135 countries grow their businesses with HubSpot

What is HubSpot?

HubSpot is an AI-powered customer platform with all the software, integrations, and resources you need to connect your marketing, sales, and customer service. HubSpot's connected platform enables you to grow your business faster by focusing on what matters most: your customers.

Get a demo to learn about our premium software, or get started with our full suite of free tools and upgrade as you grow.

.webp?width=907&height=468&name=crm-platform-asset-alt@2x%20(1).webp)

Your whole front office. One customer platform.

Marketing hub ®.

AI-powered marketing software that helps you generate leads and automate marketing.

Popular Features

- AI-powered lead generation

- Marketing automation

Sales Hub ®

Easy-to-adopt sales software that leverages AI to build pipelines and close deals.

- Prospecting workspace

- Deal management

- Sales automation

Service Hub ®

Customer service software powered by AI to scale support and drive retention.

- Omni-channel help desk

- Customer success workspace

Content Hub ™

All-in-one, AI-powered content marketing software that helps marketers create and manage content.

- Content remix

- Brand voice

- AI-powered content creation

Operations Hub ®

Operations software that leverages AI to help you activate and manage your data.

- Programmable automation

- AI-powered data quality automation

Commerce Hub ™

B2B commerce software designed to help you collect payments and automate billing.

- Invoices & subscriptions

- Payment links

Small Business Bundle

The Starter edition of every HubSpot product, bundled together at a discounted price for your startup or small business. Find and reach customers, grow sales and get paid faster, and organize customer data — all on one unified platform.

Solutions for every business

Growing a business isn’t easy, but we’ve got your back. Explore some of our customers’ top business challenges and learn how HubSpot’s integrated software and solutions can help you leave these problems in the past.

Generate High-Quality Leads and Maximize Revenue

Discover how to use AI-powered marketing tools to attract and convert more leads without multiplying your marketing spend.

Accelerate Your Sales and Close More Deals Faster

Start closing more deals faster and streamlining your sales process with HubSpot’s AI-powered deal management tools.

Create Content for Every Stage of the Customer Journey

Fuel the entire customer journey with content across formats and channels with all-in-one, AI-powered content marketing software.

What’s new at HubSpot

Growing a business is hard. Your software shouldn't make it harder.

1,500+ ways to connect your tools.

Voted #1 in 318 Categories

Popular blog posts.

The Psychology of Short-Form Content: Why We Love Bite-Sized...

Erica Santiago

Learn from My Mistakes: 7 Digital Course Pitfalls to Skip

Amy Porterfield

How To Do Representation in Marketing the Right Way (+ Consu...

Sonia Thompson

How to Use AI For a More Effective Social Media Strategy, Ac...

Ross Simmonds

HubSpot is already easy to use. But we’re still here for you.

We’re here to help your whole team stay ahead of the curve as you grow.

24/7 Customer Support

Onboarding services, free courses & certifications, developer tools, hubspot for startups.

Apply for special pricing, resources, and support for your startup.

Ebooks, Guides & Templates

Grow better with hubspot today.

- Search Search icon

- Majors & Programs

- Tuition & Aid

- Student Life

- Christian Formation

☰ In This Section

Social Work Student Opportunities

Undergrad Majors & Programs Social Work

Social Work

- + Majors & Minors

- Social Work Major

- Social Welfare Studies Minor

- Accreditation Data

- Field Experience and Placements

- Global Engagement

Hands-on learning is at the core of all our majors. In all our social work programs, you’ll be able to explore numerous opportunities to apply what you’re learning and gain experience through practicums, study abroad, internships, and more. It’s all part of how we equip you with skills that transfer to any career.

And you’ll be able to get involved right away. Bethel’s size and vibrant community present opportunities for you to get involved from your first day on campus.

Here are some of the opportunities you’ll have at Bethel:

Hands on learning and field experience

In addition to the classroom, you’ll complete two field practicum experiences to develop your confidence and competence. In your junior year, you’ll do 180 hours to build general social work experience in a multi-service, community-based agency serving an ethnically diverse population. In your senior year, you’ll do 400 hours in a setting tailored to your passions, interests and career goals. These provide an opportunity to network with over 600 alums and other social workers in the community, often obtaining a job immediately after graduation.

A few locations Bethel students have gained practicum experience:

- St Paul Public School

- Guild Incorporated

- Family Alternatives

- Rape and Sexual Assault Center

- MN Council of Churches Refugee Resettlement Program

- Alexandra House

- Minneapolis Veterans Administration

- Minneapolis Crisis Nursery

Student clubs

Study abroad.

In the social work program, you’ll have the opportunity to study in an international setting and pursue opportunities to learn from other cultures for a full semester, January session, or summer. You’ll gain a broader understanding of social justice issues, global social structures, and international justice initiatives. Most students study abroad spring semester of their sophomore or junior years in order to accommodate social work practicum hours. The following programs have been approved by the Department of Social Work:

- MN Social Work Consortium Program offers Social Work in the Latin American Context (CGE) in Mexico

- Uganda Studies Program (CCCU) offers the Social Work Emphasis (SWE) semester. Social work majors will develop primary cross-cultural relationships through their social work internship in addition to their involvement in campus life at Uganda Christian University.

- Bridge Connect Act (BCA) Study Abroad offers a social work semester in Chennai, India.

- American Institute for Foreign Study offers London Internship Program offers courses in social work study.

For more information about these programs, visit the Office of International and Off-Campus Programs.

Become a Bethel Student

- Student Success

- Life After College

Undergraduate Research Experience Increases Retention, Engagement at WVU

An apprenticeship initiative at West Virginia University has shown success at retaining learners of all backgrounds.

By Ashley Mowreader

You have / 5 articles left. Sign up for a free account or log in.

Students at West Virginia University who participate in a two-semester research apprenticeship retain at higher rates than their peers who do not, according to recent data.

Jennifer Shephard/WVU Photo

Undergraduate research opportunities can help students identify their passions and see themselves as academics and researchers while enrolled in their bachelor’s degree programs. The experiences also help build students’ confidence and make them feel they belong at the institution, resulting in higher persistence and completion rates.

A recently published report from the Council on Undergraduate Research highlights West Virginia University’s undergraduate research program and its impact on student retention, particularly for students from underrepresented minority backgrounds. The model removes barriers to participation through personalized outreach, compensation for students’ work and staff support.

The background: Colleges in West Virginia, in general, report below-national rates of student success, falling behind in persistence and degree completion for undergraduate students. The National Center for Education Statistics reported , in fall 2022, the full-time retention rate at postsecondary institutions was 76.5 percent, compared to West Virginia’s 74.2 percent .

WVU trends highest among its counterparts, with, as of fall 2022, an 81.4 percent retention rate for students who start at the university, according to state data.

Students who participate in undergraduate research often retain at a higher level, complete their degrees faster and are more likely to pursue graduate education.

How it works: The Office of Undergraduate Research launched the Research Apprenticeship Program (RAP) in 2017 to provide first- and second-year students the opportunity to explore faculty-mentored research and creative activities.

The two-semester program is open to any WVU student, regardless of major.

Faculty members who conduct research are recruited each summer via email, and those interested in hosting a student complete a survey in which they detail their availability to host an apprentice and the projects available to learners. Staff input this data to a RAP mentors database, which provides a common location for all project information dating back to the launch of the program.

The research projects vary by faculty member and discipline, but all apprentices learn to carry out an investigation or creative inquiry, learn research methods and make scholarly or artistic contributions to knowledge, according to the program’s website .

During the two terms, students work as apprentices for faculty mentors conducting research as well as enroll in an accompanying course, Introduction to Research.

First-semester content focuses on introducing students to research, setting expectations, providing tools to have a good relationship with a mentor and helping develop their identity as a researcher. Second semester, students learn about how to apply for future opportunities and present their research to a larger audience.

The experience culminates with a universitywide undergraduate research symposium in which all RAP participants contribute their research or creative work. Students also receive a badge for completing all coursework and research criteria.

The secret sauce: RAP works to eliminate barriers to participation in several ways, including:

- Intentional outreach. Potential participants receive emails, text messages and social media messages, with those belonging to certain groups (such as those eligible for federal work-study) receiving more targeted outreach.

- Staff support. RAP has two dedicated staff members and a half-time graduate student who work with participants throughout the project. This begins with helping students find a project of interest, mediating initial contact between faculty and students, and preparing learners for an interview. “This approach has been particularly important for historically marginalized students who may not have experience with research or feel comfortable approaching faculty,” the study says.

- Financial aid. All participants are paid or receive class credits for working a minimum of four hours a week with their faculty mentor. Around half of participants receive federal work-study money, earning $15 per hour, and others are funded with National Science Foundation dollars (namely the INCLUDES First2 Network and the Louis Stokes Alliance for Minority Participation). Those who are not eligible for these funds receive class credit.

- No selection criteria. There is no minimum requirement to participate, and any student who secures a mentor is eligible. Around 100 new students join the program each semester.

Editors’ Picks

- DEI Spending Banned, Sociology Scrapped in Florida

- My Take on the AP African American Studies Course Framework and the American Historical Review’s 1619 Forum

- Harris Has Championed Loan Forgiveness, For-Profit Crackdowns and Free College

Methodology

Data was collected from 2017 to 2022 on 868 students to compare RAP participants’ next-year retention rate with institutional averages across similar demographic groups.

The impact: The results showed retention rates for RAP participants across the board were higher (94 percent) compared to their peers who didn’t participate (74 percent), and this was true across minority groups.

Among first-generation students, 90 percent of RAP participants retained from fall to fall compared to 72 percent of their peers. Students from historically marginalized racial and ethnic groups—including Black, Hispanic, American Indian/Alaska Native, Asian and Hawaiian/Pacific Islander— who participated in RAP also retained at 94 percent, and their peers who did not retained at 75 percent.

“Although higher than institutional averages, retention among Black participants was not statistically significant,” the report noted. “This represents a demographic group that requires additional attention from RAP moving forward.”

Low-income students and rural students also saw high retention numbers (91 percent and 95 percent, respectively), though the university did not provide comparative data for their nonparticipant classmates.

Get more content like this directly to your inbox every weekday morning. Subscribe here.

‘Supercommunicators’ and the Challenges of Hybrid Professional Academic Work

Why hybrid university work is better but feels worse, and where learning to be better digital communicators may help.

Share This Article

More from life after college.

Majority of Grads Wish They’d Been Taught AI in College

A new survey shows 70 percent of graduates think generative AI should be incorporated into courses.

Positive Partnership: Students Provide Mental Health Support for the Community

A virtual practicum opportunity for social work students helps them gain field experience while providing in-demand c

3 Ways for Colleges to Prepare Students for Meaningful Work

Higher ed institutions must teach students how to find meaning and value in their work and in their lives, writes stu

- Become a Member

- Sign up for Newsletters

- Learning & Assessment

- Diversity & Equity

- Career Development

- Labor & Unionization

- Shared Governance

- Academic Freedom

- Books & Publishing

- Financial Aid

- Residential Life

- Free Speech

- Physical & Mental Health

- Race & Ethnicity

- Sex & Gender

- Socioeconomics

- Traditional-Age

- Adult & Post-Traditional

- Teaching & Learning

- Artificial Intelligence

- Digital Publishing

- Data Analytics

- Administrative Tech

- Alternative Credentials

- Financial Health

- Cost-Cutting

- Revenue Strategies