- Business Cycle

- Business Environment

- Consumer Protection

- Corporate Responsibility

- External Influences

- Globalisation

- Government Influence

- International Business

- Financial Risk

- Investment Appraisal

Sources of Finance

- Competitive Advantage

- Customer Focus

- International Marketing

- Market Research

- Marketing Planning

- Marketing Strategies

- Product Launch

- Product Life Cycle

- Product Portfolio

- Segmentation

- The Marketing Mix

- Continuous Improvement

- Customer Service

- Health and Safety

- Lean Production

- Location of Business

- Management of Change

- Merger and Acquisition

- New Product Development

- New Technology

- Product Development

- Production Process

- Research and Development

- Supply Chain

- Communications

- Developing People

- Equal Opportunities

- Managing Change

- Organising People

- Protecting People

- Recruitment and Selection

- Roles and Responsibilities

- Skills and Competencies

- Aims and Objectives

- Business Expansion

- Business Organisation

- Business Planning

- Business Start-Up

- Business Strategy

- Decision Making

- Sectors of Industry

- Stakeholders

- Strategic Planning

- Types of Organisation

- External environment

- External Environment

- eBook Collections

- Audio Case Studies

- Printed Books By Edition

- Employee Retention

- HR Software

- Hybrid Working

- Managing People

- Motivating People

- Performance Management

- Recruitment

- Time Management

- Training and Development

- Business Acquisition

- Business Growth

- Business Plan

- Business Startup

- Entrepreneurship

- Small Business

- Strategic management

- Types of Business

- Accountants

- Bookkeeping

- Budgeting and Cash Flow

- Business Debt

- Business Financing

- Business Funding

- Business Insurance

- Business Investment

- Business Loans

- Business Payments

- Business Taxation

- Market Trading

- Advertising

- Affiliate Marketing

- Business Branding

- Business Events

- Content Marketing

- Conversion Rate Optimisation

- Customer Experience

- Digital Marketing

- Email Marketing

- Lead Generation

- Link Building

- Marketing Agencies

- Marketing Strategy

- Pay Per Click Advertising

- Public Relations

- Social Media

- Business Efficiency

- Business Innovation

- Business Location

- Business Management

- Business Security

- Manufacturing

- Outsourcing

- Project Management

- Quality Management

- The Supply Chain

- Business Law

- Coronavirus

- Sustainable Business

- The Economy

- Stakeholder

- Ethical Business

- Business of Gambling

- Casino Bonuses

- Casino Games

- Casino Guides

- Mobile Gambling

- Online Casino

- Sports Betting

- Tips and Tricks

- Online Learning

- Schools and Colleges

- Students and Teachers

- Studying Internationally

- Universities

- Writing Services

- Cosmetic Procedures

- Cannabidiol (CBD)

- Cannabis/Marijuana

- Dental Care

- Mental Health

- Office Wellbeing

- Relationships

- Supplements

- Banking and Savings

- Credit Cards

- Credit Score and Report

- Debt Management

- International Money Transfers

- Investments

- Payday Loans

- Personal Insurance

- Personal Law

- Motor Accidents

- Motor Finance

- Motor Insurance

- Motoring Accessories

- Virtual Reality

- Gaming Accessories

- Mobile Gaming

- Online Gaming

- Video Games

- Buying Selling and Renting Property

- Construction

- Property Cleaning

- Property Investments

- Property Renovation

- Business Travel

- Camping Activities

- Travel Guides

- Travel Safety

- Visas and Citizenship

- Antiques and Art

- TV, Film & Music

- Mobile Apps

- Mobile Phone

- Photography

- Digital Transformation

- Crypto Exchange

- Crypto in Business

- Crypto Mining

- Crypto Regulation

- Crypto Trading

- Accessories

- Artificial Intelligence

- Programming

- Security & Privacy

- Software Development

- Web Analytics

- Website Design

- Website Development

- Website guides

- Website Hosting

- Guest Posting

- Membership Billing

- Membership Cancel

- Membership Invoice

- membership levels

- Your Profile

- Account Details

- Lost Password

No products in the basket.

Sources of Business Finance: An Overview

Any company needs funds to purchase fixed assets, meet working capital needs, and implement corporate growth and expansion plans. This chapter explains the owner’s fund in detail and also talks about the various sources of finance and how they are categorised in the real world.

Owner’s funds refer to the funds that the owners of an enterprise provide. Also known as the company’s accumulated profit. The company has no liability to return these funds.

Classification of Sources of Funds

The Classification of sources of Funds is generally done using different basis, Period basis sources, Ownership basis sources, and Generation basis sources. A brief explanation of these classifications and the sources are provided as follows:

1. Period-based Sources

Short-term Funds: These funds are required for a period not exceeding one year. This includes trade credits, commercial bank loans, and commercial paper.

Medium-term Funds: These funds are required for a period of no less than 1 year and no more than 5 years. Borrowings from commercial banks, lease financing, and loans from financial institutions are the type of medium-term sources of finance.

Long-term Funds : These funding sources cover the company's financial needs for over five years. It includes stocks, bonds, long-term loans, loans from financial institutions, etc.

2. Ownership-based Sources

Owner’s Fund: Owner's funds mean funds provided by the owners of an enterprise.

Borrowed Fund: Borrowed funds are raised through loans and borrowings. These sources provide funds for a specific period of time. Loans from commercial banks, public deposits, and trade credit are some examples of borrowed funds.

3. Generation-based Sources

Internal Sources: Internal sources funds refer to those funds that are generated from within the business. A business can generate funds internally by disposing of surplus inventories and retained earnings.

External Sources: External sources include funding that is external to your organisation. The funds raised from external sources are considered costly compared to the internal source of funds. These include issues of debentures and borrowing from commercial banks and financial institutions.

What Do You Mean by Owner’s Fund?

The financing required for a company to start and operate a business is known as Business finance. Therefore, it is said that finance is the lifeblood of any business. A business cannot function without sufficient funds available. The initial capital brought in by the entrepreneur is not always enough to cover all the company's financial needs. Entrepreneurs should therefore seek out a variety of other sources that can meet their funding needs. Funds can be raised from personal sources or by borrowing from banks, friends, etc.

Owner’s funds mean funds provided by the owners of an enterprise, which may be sole traders, partners, or shareholders of a company. In addition to capital, this includes profits reinvested in the company. The owner's capital remains invested in the company for a long time and does not have to be repaid during the life of the company. This capital forms the basis for the owner to acquire the right to control the business. Issue of equity shares and retained earnings are the two essential sources from which the owner’s funds can be obtained.

Sources of Funds

Some of the sources of funds are discussed below:

1. Retained Earnings: Retained earning refers to a part of the profit which is not distributed among the shareholders as dividends but is retained in the business for use in the future. Also referred to as ploughing back of profits.

A continuous source of funding available to an organisation.

It has no explicit cost in the form of interest, dividends, or floatation costs.

The funds are generated internally; that is why there is greater operational freedom and flexibility.

It improves the business's ability to absorb unexpected losses, and it may increase the market price of a company's equity shares.

Disadvantages

Excessive ploughing back may cause shareholder dissatisfaction because it results in lower dividends.

It is an uncertain source of funds because business profits fluctuate.

Many firms do not recognise the opportunity cost associated with these funds. This may result in inefficient use of funds.

2. Trade Credit: Trade credit is credit extended by one trader to another to buy and sell goods and services. The buyer of goods' records appears as various creditors or accounts payable.

Advantages

Trade credit is an easy and consistent source of funds.

Trade credit may be readily available if the seller knows the customers' creditworthiness.

An organisation's sales must be promoted through trade credit.

If a company wants to increase its inventory level to meet an expected increase in sales volume in the near future, it can use trade credit to finance it; it does not charge the company's assets while providing funds.

The availability of simple and flexible trade credit facilities may induce a firm to engage in overtrading, which may increase the firm's risks.

Trade credit can only generate a limited amount of funds; it is generally a costly source of funds when compared to most other methods of raising funds.

2. Commercial Papers: Commercial papers (CP) are unsecured money market instruments that take the form of a promissory note. It was first introduced in India in 1990 to allow highly rated corporate borrowers to diversify their sources of short-term borrowings and to provide investors with an additional instrument.

A commercial paper is sold unsecured and without any restrictive conditions; it has high liquidity because it is a freely transferable instrument, and it provides more funds than other sources.

The cost of commercial paper to the issuing firm is generally lower than commercial bank loans; commercial paper provides a continuous source of funds.

This is due to the fact that their maturity can be tailored to the needs of the issuing firm.

Furthermore, maturing commercial paper can be repaid by selling new commercial paper; businesses can park excess funds in commercial paper, earning a good return on the money raised.

Commercial papers are only available to financially sound and highly rated companies.

This method is ineffective for raising funds for new and moderately rated businesses.

The amount of money that can be raised through commercial paper is limited by the excess liquidity available with fund suppliers at any given time.

Jane saw her father watching the news on TV. She asked his father why he was so focused on the news today. Jane’s father told her that the news was about the stock market as he had invested in some shares. However, Jane could not understand anything that her father explained about shares. Can you explain to Jane what shares are? Also, clarify important types of shares.

Ans: A company's capital is divided into small units known as shares. Share capital is the capital obtained by the issue of shares. We can divide the shares into equity shares and preference shares.

Equity Shares: These shares represent the ownership of the company. Such shareholders do not get a fixed dividend and are known as residual owners. After all other claims on the company’s income and assets have been settled, they are entitled to what is left.

Preference Shares: Holders of these shares get priority over equity shareholders in two ways:

Receiving a fixed rate of dividend.

Receiving their capital after the claims of the company’s creditors have been settled at the time of winding up.

Summary

Businesses are engaged in producing and distributing goods and services to meet the needs of society. You cannot operate a business without sufficient funds. Once the decision to start a business is made, the need for funding begins. Finance is said to be the lifeline of a company. Assessing your organisation's financial needs and identifying various sources of funds is critical.

FAQs on Sources of Business Finance

1. Distinguish between shares and debentures.

To start a business, a company must make large investments, which are referred to as capital. Because one person can't bring in such a large amount of capital, the capital is divided into small units known as shares, with each person holding shares referred to as a shareholder. Shares/stocks are associated with the owner's fund, whereas debenture is borrowed funds.

A share has an interest return, whereas a debenture has a fixed interest rate paid to the company.

2. What do you mean by Public Deposit? State some of its advantages.

Public deposits are deposits that organisations raise directly from the public. While depositors earn more than banks, the company deposits cost is less than the cost of bank borrowings. The RBI is in charge of overseeing it. Companies usually seek public contributions for three years. The advantages are mentioned below:

It acts as permanent capital as it must be repaid in liquidation.

Democratic control of corporate governance is given to shareholders through voting rights.

Equity establishes the company's creditworthiness and gives potential lenders confidence.

3. What are the benefits of adequate finance for any business?

Adequate finance is needed in any business. Without adequate working capital, no business can be successful. The following are the primary benefits of maintaining an adequate amount of working capital.

It also helps to meet liabilities on time.

It helps to adopt the latest technology easily.

Helps to make use of various business opportunities.

Easy Replacing of machinery and assets whenever necessary.

A company with adequate working capital can make regular payments of salaries, wages, and other day-to-day commitments, which boosts employee morale, increases efficiency, reduces waste and costs, and increases productivity and profits.

5. What are the examples of Sources of Business Finance?

The sources of Business Finance have retained earnings, equity, term loans, debt, letter of credit, debentures, euro issue, working capital loans, and venture funding, etc.

7. Why does Business Need Finance?

Finance is the main fuel of every business, no matter what size. However, sometimes a Business can face monetary constraints and a shortage of funds. In such a scenario, taking a loan can help power up the enterprise. The influx of cash can be used for multiple purposes. It could range from enhancing working capital, expansion, purchasing new assets, replenishing a stock, hiring more staff, or refinancing to pay off existing debt.

- Browse All Articles

- Newsletter Sign-Up

- 18 Jun 2024

- Cold Call Podcast

How Natural Winemaker Frank Cornelissen Innovated While Staying True to His Brand

In 2018, artisanal Italian vineyard Frank Cornelissen was one of the world’s leading producers of natural wine. But when weather-related conditions damaged that year’s grapes, founder Frank Cornelissen had to decide between staying true to the tenets of natural wine making or breaking with his public beliefs to save that year’s grapes by adding sulfites. Harvard Business School assistant professor Tiona Zuzul discusses the importance of staying true to your company’s principles while remaining flexible enough to welcome progress in the case, Frank Cornelissen: The Great Sulfite Debate.

- Research & Ideas

Central Banks Missed Inflation Red Flags. This Pricing Model Could Help.

The steep inflation that plagued the economy after the COVID-19 pandemic took many economists by surprise. But research by Alberto Cavallo suggests that a different method of tracking prices—a real-time model—could predict future surges better.

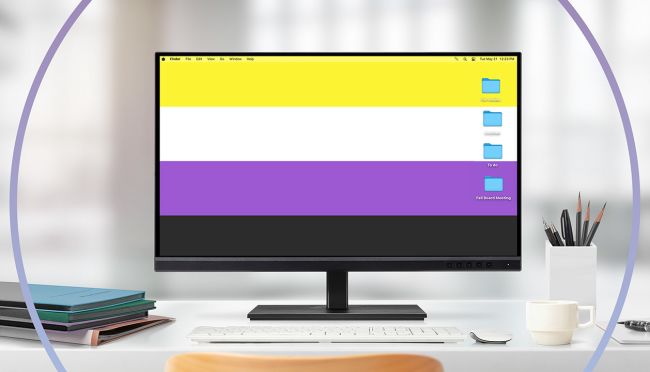

What Your Non-Binary Employees Need to Do Their Best Work

How can you break down gender boundaries and support the non-binary people on your team better? A study by Katherine Coffman reveals the motivations and aspirations of non-binary employees, highlighting the need for greater inclusion to unlock the full potential of a diverse workforce.

- 04 Jun 2024

How One Insurtech Firm Formulated a Strategy for Climate Change

The Insurtech firm Hippo was facing two big challenges related to climate change: major loss ratios and rate hikes. The company used technologically empowered services to create its competitive edge, along with providing smart home packages, targeting risk-friendly customers, and using data-driven pricing. But now CEO and president Rick McCathron needed to determine how the firm’s underwriting model could account for the effects of high-intensity weather events. Harvard Business School professor Lauren Cohen discusses how Hippo could adjust its strategy to survive a new era of unprecedented weather catastrophes in his case, “Hippo: Weathering the Storm of the Home Insurance Crisis.”

- 22 Apr 2024

When Does Impact Investing Make the Biggest Impact?

More investors want to back businesses that contribute to social change, but are impact funds the only approach? Research by Shawn Cole, Leslie Jeng, Josh Lerner, Natalia Rigol, and Benjamin Roth challenges long-held assumptions about impact investing and reveals where such funds make the biggest difference.

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 Sep 2023

How Can Financial Advisors Thrive in Shifting Markets? Diversify, Diversify, Diversify

Financial planners must find new ways to market to tech-savvy millennials and gen Z investors or risk irrelevancy. Research by Marco Di Maggio probes the generational challenges that advisory firms face as baby boomers retire. What will it take to compete in a fintech and crypto world?

- 17 Aug 2023

‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy Crypto

Bitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?

- 17 Jul 2023

Money Isn’t Everything: The Dos and Don’ts of Motivating Employees

Dangling bonuses to checked-out employees might only be a Band-Aid solution. Brian Hall shares four research-based incentive strategies—and three perils to avoid—for leaders trying to engage the post-pandemic workforce.

- 20 Jun 2023

Elon Musk’s Twitter Takeover: Lessons in Strategic Change

In late October 2022, Elon Musk officially took Twitter private and became the company’s majority shareholder, finally ending a months-long acquisition saga. He appointed himself CEO and brought in his own team to clean house. Musk needed to take decisive steps to succeed against the major opposition to his leadership from both inside and outside the company. Twitter employees circulated an open letter protesting expected layoffs, advertising agencies advised their clients to pause spending on Twitter, and EU officials considered a broader Twitter ban. What short-term actions should Musk take to stabilize the situation, and how should he approach long-term strategy to turn around Twitter? Harvard Business School assistant professor Andy Wu and co-author Goran Calic, associate professor at McMaster University’s DeGroote School of Business, discuss Twitter as a microcosm for the future of media and information in their case, “Twitter Turnaround and Elon Musk.”

- 06 Jun 2023

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 16 May 2023

- In Practice

After Silicon Valley Bank's Flameout, What's Next for Entrepreneurs?

Silicon Valley Bank's failure in the face of rising interest rates shook founders and funders across the country. Julia Austin, Jeffrey Bussgang, and Rembrand Koning share key insights for rattled entrepreneurs trying to make sense of the financing landscape.

- 27 Apr 2023

Equity Bank CEO James Mwangi: Transforming Lives with Access to Credit

James Mwangi, CEO of Equity Bank, has transformed lives and livelihoods throughout East and Central Africa by giving impoverished people access to banking accounts and micro loans. He’s been so successful that in 2020 Forbes coined the term “the Mwangi Model.” But can we really have both purpose and profit in a firm? Harvard Business School professor Caroline Elkins, who has spent decades studying Africa, explores how this model has become one that business leaders are seeking to replicate throughout the world in her case, “A Marshall Plan for Africa': James Mwangi and Equity Group Holdings.” As part of a new first-year MBA course at Harvard Business School, this case examines the central question: what is the social purpose of the firm?

- 25 Apr 2023

Using Design Thinking to Invent a Low-Cost Prosthesis for Land Mine Victims

Bhagwan Mahaveer Viklang Sahayata Samiti (BMVSS) is an Indian nonprofit famous for creating low-cost prosthetics, like the Jaipur Foot and the Stanford-Jaipur Knee. Known for its patient-centric culture and its focus on innovation, BMVSS has assisted more than one million people, including many land mine survivors. How can founder D.R. Mehta devise a strategy that will ensure the financial sustainability of BMVSS while sustaining its human impact well into the future? Harvard Business School Dean Srikant Datar discusses the importance of design thinking in ensuring a culture of innovation in his case, “BMVSS: Changing Lives, One Jaipur Limb at a Time.”

- 18 Apr 2023

What Happens When Banks Ditch Coal: The Impact Is 'More Than Anyone Thought'

Bank divestment policies that target coal reduced carbon dioxide emissions, says research by Boris Vallée and Daniel Green. Could the finance industry do even more to confront climate change?

The Best Person to Lead Your Company Doesn't Work There—Yet

Recruiting new executive talent to revive portfolio companies has helped private equity funds outperform major stock indexes, says research by Paul Gompers. Why don't more public companies go beyond their senior executives when looking for top leaders?

- 11 Apr 2023

A Rose by Any Other Name: Supply Chains and Carbon Emissions in the Flower Industry

Headquartered in Kitengela, Kenya, Sian Flowers exports roses to Europe. Because cut flowers have a limited shelf life and consumers want them to retain their appearance for as long as possible, Sian and its distributors used international air cargo to transport them to Amsterdam, where they were sold at auction and trucked to markets across Europe. But when the Covid-19 pandemic caused huge increases in shipping costs, Sian launched experiments to ship roses by ocean using refrigerated containers. The company reduced its costs and cut its carbon emissions, but is a flower that travels halfway around the world truly a “low-carbon rose”? Harvard Business School professors Willy Shih and Mike Toffel debate these questions and more in their case, “Sian Flowers: Fresher by Sea?”

Is Amazon a Retailer, a Tech Firm, or a Media Company? How AI Can Help Investors Decide

More companies are bringing seemingly unrelated businesses together in new ways, challenging traditional stock categories. MarcAntonio Awada and Suraj Srinivasan discuss how applying machine learning to regulatory data could reveal new opportunities for investors.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 31 Mar 2023

Can a ‘Basic Bundle’ of Health Insurance Cure Coverage Gaps and Spur Innovation?

One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency.

45,000+ students realised their study abroad dream with us. Take the first step today

Here’s your new year gift, one app for all your, study abroad needs, start your journey, track your progress, grow with the community and so much more.

Verification Code

An OTP has been sent to your registered mobile no. Please verify

Thanks for your comment !

Our team will review it before it's shown to our readers.

- Class 11th /

Class 11 Sources of Business Finance

- Updated on

- Mar 22, 2021

What are the sources of business finance? The sources of business finance can vary from long-term funds to medium-term and short-term funds. Class 11 Business Studies comprises an important chapter on the Sources of Business Finance focuses on the integral features and characteristics of financial investment and management for a business organisation. While setting up a business, it is essential to accumulate funds for it. If you want to do well in this chapter, you must be through with the basics of the business world as well as financial concepts. Through this blog, we aim to present you with all the key pointers as well as the study notes on class 11 sources of business finance.

This Blog Includes:

What is business finance, need for business finance, sources of business finance, period basis sources of business finance, ownership basis of business finance, sources of business generation, retained earnings, trade credits, lease financing, public deposits , equity shares, preference share, class 11 sources of business finance project.

The term ‘finance’ can simply be elaborated as money or fund and when combined with business, it means that business finance refers to the funds needed for the operations of a business. This is because a business cannot really function without enough funds and finances.

Finance is an integral component of every business. Let us have a look at some of the pointers as per class 11 sources of business finance:

- Starting a business requires money to purchase goods or setting up shop somewhere. This is called the Fixed Capital Requirement.

- You need sources of working capital for everyday operations. This is called the Working Capital Requirement

- Expansion/Diversification of products and operations require funds

- Finance is an essential part of an enterprise’s growth, and you cannot grow your business without paying close heed to your financial sources

Here are all the sources of Business Finance as per this chapter in Class 11:

Sources of Business Finance as per the basis of period

- Equity shares

- Preference Shares

- Loan from Financial Institutions

- Loan from Banks

- Public Deposits

- Trade Credit

- Commercial Paper

Sources of Business Finance on the Basis of Ownership

- Loans from Banks

- Loans from Financial Institutions

- Commercial Papers

Sources of Business Finance on the Basis of Sources of Generation

- Financial Institutions

- Preferences Shares

As derived from class 11 sources of business finance, based on period, business finance can be further divided into three classes:

Long-Term Fund These sources sustain the finances of business for more than five years. Sources of long term financing are equity shares, debentures & loans.

Medium-Term Funds When the funds are needed for less than five years. Medium-term funds can be secured through borrowings from commercial banks, public deposits, and shorter loans.

Short-Term Funds The period of these funds should not exceed one year. Some short fund sources are trade credit or loans and commercial papers.

Depending upon the types of fund a business gets, the funds can be classified into two sets- ‘owner’s funds’ and ‘borrowed funds’.

Owner Funds If the funds are provided by the business or shareholders or partners’ creator, then it is the Owner’s funds. Profits used to invest again in the business also fall under this. Owner funds usually do not need to be refunded and remain invested in the business’s life period. Two important sources of owner funds include Equity shares and Retained earnings. This type of investment grants controls over the enterprise. It carries risk with the investment as the principal amount and returns are not guaranteed.

Borrowed Funds If the investment source comes from outside the business, it is called Borrowed funds. It cannot be a permanent source of capital because it has to be returned. Even though it carries less risk because the principal and returns are guaranteed, it does not grant control. A fixed interest rate is also levied on borrowed funds, and it can put a lot of burden to payback when the company/business is not raising enough funds.

Whilst one is planning to obtain funding for their ongoing or upcoming business, the class 11 sources of business finance also provides the major sources of finance generation you should know:

- Internal Sources: Funds that get generated within the business can be controlled by management as an investment. It can be used in emergencies as well

- External Sources: Funds that get generated out of business. There is no control over these funds by management. They can be a good source of finance for entrepreneurs

Business Studies Class 11 chapter on Sources of Business Finance also familiarizes students with various sources to raise funds. It is important to understand that there is no one perfect source, and depending on your requirements & needs, your financial sources should fit the mould. Here are some of the most important ones.

Factors Affecting the Choice of Sources of Fund

Now that we have discuss the various sources of funds, latest take a look at some of the factors that affect the choice of sources of fund-

- Time period and purpose

- Effect on credit worthiness

- Operations stability and financial strength

- Risk profile

- Tax benefits

- Flexibility and is

- Form of legal status and organisation

- Control

Out of the company’s total earnings, a certain section of the total profits can be saved for the future. This part is not divided among shareholders and is a source of self-financing. It depends heavily on the net profits and age of the organization.

Merits A permanent source of funds without any explicit cost. It allows free panning of options for the investors as funds are internal. The eventual increase in equity share value is a possibility.

Limitations It might cause internal conflict if done improperly. It becomes an unreliable source due to fluctuating profits .

Trade credits refer to sources of short term finances where a business extends credit for purchasing goods and services to the other. According to class 11 sources of business finance chapter, it appears as a record for an account payable and isn’t taken immediately. It is based on goodwill and a decent financial situation.

Merit It is very convenient and cultivates trust. It promotes the sales of the business. Allows inventory expansion avenues. No interest rate levied on the charge.

Limitations Limits the transaction usually done for short-term needs. It can induce reliability on convenience and may cause over-indulgence.

Factoring

It is referred as a financial service within which the ‘ factor’ provides various services like-

- Discounting the bill as well as collecting clients’ debt through which the receivables on the account of sales of goods or services will be sold to the factor at a variable discount.

- It also provides information about the creditworthiness of the prospective clients, etc. along with very factors that possess information regarding the trading history of the firm.

Merits: Obtaining points through factoring is cheaper as compared to bank credits. With the fluent cash flow through factoring, clients are able to meet their liabilities. It doesn’t create any charge on the assets of the firm.

Limitations: Factoring is expensive when the bills are higher in number and smaller in amount. The advance Finance that factor forms receive is generally levied at higher interest than usual rates. Sometimes, third party customers do not feel comfortable dealing with this.

Now that you are familiar with the major aspects of short-term financial sources, let us understand lease financing. A periodic payment is set up between two parties allowing the temporary use of an asset owned by another company. This also allows the renting of assets. A fixed periodic amount is called lease rental. The asset is returned after the contract time.

Merits Usually, a lower investment gives Lessee the right to an asset than buying it would take. Lease rentals are deductible by taxes. No debt raising capacity is accounted into the agreement.

Limitations Restrictions on asset usage. If the lease arrangement breaks down, it can hurt the business operation of Lessee. The Lessee can never own the asset.

When an organisation raises certain deposits directly from the public, it is known as public deposits. Usually, the rate of interest offered on public deposits is higher than that offered on the bank deposits. Those who are interested in investing in an organisation, they can do so by filling the Vantazo designated form.

Merits: The process for obtaining deposits is simpler as compared to loan agreements. As compared to the cost of borrowing from banks and other financial institutions, the cost of public deposits is lower. They do not create any charge on the assets of the organisation.

Limitations: It is difficult for new companies to find funds through public deposits. As compared to other sources, public deposits are unreliable sources as the public may not respond in the right way when the money is needed by the organisation.

Issue of Share

Also known as share capital, where capital is divided into small marketable units known as shares. Each share gets a variant value fixed at one point. According to sources of business finance chapter class 11, there are two types of share, i.e., Equity Share and Preference Shares. Let us take a detailed look at the key features of Equity Shares and Preference Shares.

- A most important form of the sources of long term financing

- They fall under ownership capital and represent a share in the company

- They are essential conditions for making a company. Stakeholders are paid on the profits of the company, thus also called ‘residual owners.’

- They get the right to management in the company and make them liable up to the point of their contribution to capital raised

Merits No compulsory payment of dividends required. Permanent capital lasting lifetime of the company till the liquidation. Equity capital is a reliable judging criterion for loan providers and other investors. No charge on assets of the company in the creation of equity funds. The voting and management powers gained are very important.

Limitations No fixed/steady income guaranteed. The initial amount to be invested in the equity share is higher than other fundraising options. A complicated fundraising method not suitable for quick funds.

- Preferential Position receives a fixed cut in dividends out of the profit. At the time of liquidation, they enjoy a later claim to capital.

- They get the first preference in repayment and dividend. They have a fixed rate of return, like debentures that you will learn about in detail in Business studies class 11.

Merits According to class 11 sources of business finance chapter, the primary merit is to get a cut and a steady income. No voting rights mean no liability. In good times they get a higher rate of dividend. Even in liquidation, they have a preference. No charge levied against the assets.

Limitations Not suitable for risk-takers. The rate of dividend is higher than the rate of interest on debentures. No assured return if the company doesn’t gain profit. No tax saving.

Thus, we hope that through this blog about class 11 sources of business finance, we have helped you have a clear idea about the chapter. If you are exploring the best courses in Business Studies and Finance after 12th, our Leverage Edu experts are here to assist you. We will help you find an ideal course and university as per your interests and preferences thus ensuring that you take an informed decision to embark on the next phase of your academic journey! Sign up for a free career counselling session with us today!

Team Leverage Edu

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Contact no. *

Leaving already?

8 Universities with higher ROI than IITs and IIMs

Grab this one-time opportunity to download this ebook

Connect With Us

45,000+ students realised their study abroad dream with us. take the first step today..

Resend OTP in

Need help with?

Study abroad.

UK, Canada, US & More

IELTS, GRE, GMAT & More

Scholarship, Loans & Forex

Country Preference

New Zealand

Which English test are you planning to take?

Which academic test are you planning to take.

Not Sure yet

When are you planning to take the exam?

Already booked my exam slot

Within 2 Months

Want to learn about the test

Which Degree do you wish to pursue?

When do you want to start studying abroad.

September 2024

January 2025

What is your budget to study abroad?

How would you describe this article ?

Please rate this article

We would like to hear more.

IMAGES

VIDEO

COMMENTS

Learn about sources of finance in the business studies curriculum, see real-life examples within our case studies with downloads.

Sources of Business Finance: An Overview. Any company needs funds to purchase fixed assets, meet working capital needs, and implement corporate growth and expansion plans. This chapter explains the owner’s fund in detail and also talks about the various sources of finance and how they are categorised in the real world.

Today we are going to discuss the new chapter of business studies CBSE class 11 that is the sources of business finance. Also, we are going to give you study notes, video lectures, and also PDF of handly lecture notes.

Sources of Business Finance - Case Studies Series (L-5) | Class 11th Business Studies | CMA Disha Dua Ma'am | Vedantu Commerce. Hello guys, today Disha Ma'am...

04 Jun 2024. Cold Call Podcast. How One Insurtech Firm Formulated a Strategy for Climate Change. Re: Lauren H. Cohen. The Insurtech firm Hippo was facing two big challenges related to climate change: major loss ratios and rate hikes.

Class 11 Business Studies comprises an important chapter on the Sources of Business Finance focuses on the integral features and characteristics of financial investment and management for a business organisation. While setting up a business, it is essential to accumulate funds for it.