Newly Launched - AI Presentation Maker

Researched by Consultants from Top-Tier Management Companies

AI PPT Maker

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 ESG Framework Templates to Build an Eco-friendly Enterprise [Free PDF Attached]

![presentations on esg Top 10 ESG Framework Templates to Build an Eco-friendly Enterprise [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/02/Top-10-ESG-Framework-Templates_1-1013x441.png)

Lakshya Khurana

Swedish power company Vattenfall, a government-owned utility, is facing an unprecedented environmental crisis that threatens its existence. It wanted to sell electricity from three of its hydroelectric power stations on the bed of the Dalälven river. It is a World Heritage Site.

The Swedish government and the United Nations Education, Scientific and Cultural Organisation (UNESCO) were now committed to protecting the site, and power generation there would make these organizations lose face.

The Swedish government was also under pressure from local politicians and environmental campaigners to reduce its stake in Vattenfall. They claimed that the company, among Europe’s largest generators of electricity from renewable energy, was producing more hydroelectric power than the country’s grids could use.

With the government on the verge of issuing an order on reducing its stake, Vattenfall is in the process of implementing its new business model of ESG that will allay all environmental concerns, while allowing it to continue to be in business.

ESG, in fact, is a major go-to way for most businesses today. Why did Vattenfall choose ESG? Let’s understand…

What is ESG and why is important?

The acronym ESG stands for Environmental Social and Corporate Governance. It is the shared responsibility of the three parties involved in the business — government, stockholders/investors, and companies. Not working within ESG policies has damaged the reputation of a number of multinational companies.

ESG practices have been shown to improve both financial performance and business resilience in the long term. The risks that arise from its non-compliance are significant, but so are the benefits in terms of improved reputation and enhanced resilience.

Additionally, the ESG framework is becoming increasingly popular among financial professionals as they seek to provide investors with differentiated products that also consider social values in addition to traditional monetary values.

If you, too, want to benefit from the ESG framework, create a robust plan of action. To help you strategize effectively, we present our visually captivating templates.

Customizable Templates to Bring Your ESG Plan to Fruition

Creating a PowerPoint presentation from scratch is tasking and it might not turn out to be as eye-catching as you would like. This is where our professional PowerPoint services come in handy.

We have selected the most effective ESG framework PPT designs that will help you get started on educating your audience on the benefits of integrating an ESG plan. Let’s take a look at them.

Template 1: ESG Strategies Map Human Rights Product Responsibility

This PowerPoint layout uses an interactive map interface (strategy, KPIs, key constituents, etc) to identify key areas of risk and opportunity, as well as track your progress over time. With this PPT design, you can assess and manage your company's social and environmental responsibilities. So download it now.

Download this template

Template 2: Community Impact Annual Report PPT Slides

This PPT deck is perfect for organizations who wish to track their community impact and share the findings with funders and other stakeholders. You can use this design to cover snapshots of major CSR achievements, an overview of CSR initiative outcomes, the corporate profile of the company, etc. Download it now.

Grab this template

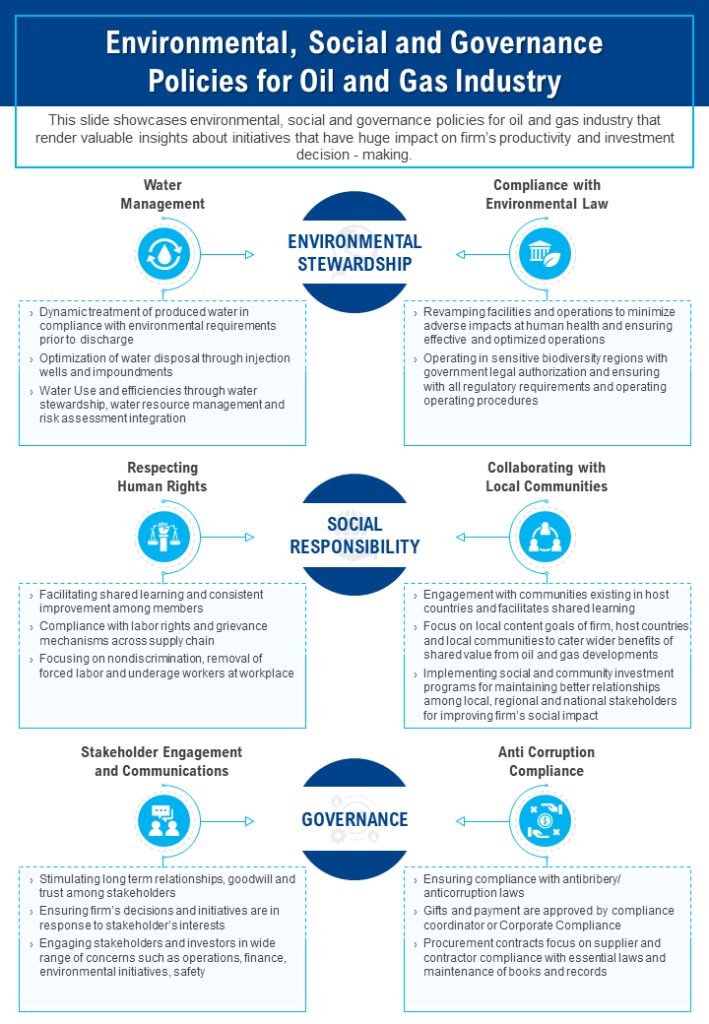

Template 3: Environmental Stewardship Social Responsibility And Governance Policies For Oil And Gas Industry PPT

This creative PowerPoint set will help you outline your policies and procedures for being a good steward of the environment and acting with social responsibility. Additionally, the design is completely editable and you can tailor it to your specific needs. This one-page document is perfect for sharing the policies of the oil and gas industry. So incorporate it now.

Download this template

Template 4: Environmental Social And Governance Policies For Oil And Gas Industry Document

This PPT theme is perfect for helping oil and gas companies adhere to the highest environmental and social standards. This design is concise, easy to use, and covers all the key points. This PowerPoint preset contains everything you need to get started, from an overview of ESG policies to a checklist of considerations. Therefore, employ it now.

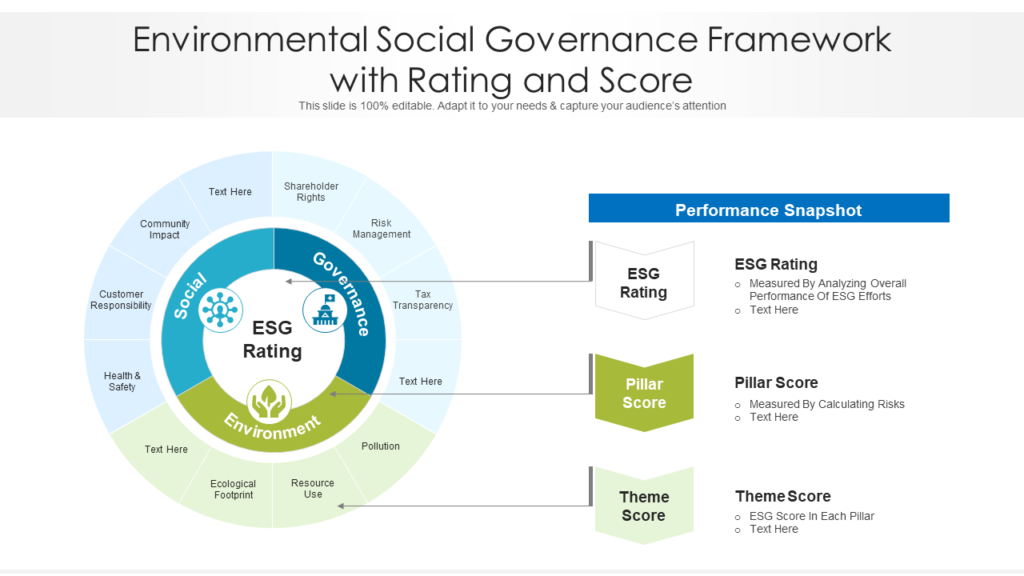

Template 5: ESG Framework With Rating And Score

This creative PowerPoint bundle provides an accurate and timely rating/score of your company's performance in relation to environmental and social responsibility. You can use this design to identify areas of strength and weakness. The PPT layout covers the ESG score, pillar score, and theme score. So get it now.

Template 6: ESG Strategy For Business Organisation

This PPT preset will help you develop a strategy that is tailored to your specific business needs, so you can make a real difference in your community and the world. You can use it to illustrate the elements for each of the ESG verticals, such as strict standards, people, transparency, regulation, etc. Download it now.

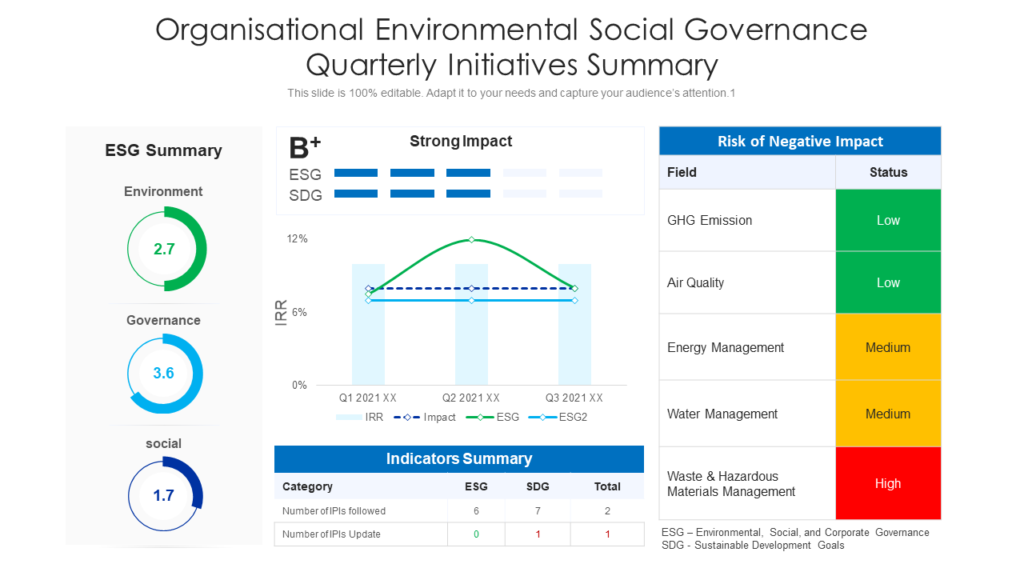

Template 7: Organisational ESG Quarterly Initiatives Summary

This PPT preset provides an up-to-date summary of the latest progress in the key areas, so you can stay informed about the latest developments in sustainability. You can use it to stay ahead of the curve including, an ESG summary, the negative impact risks, and an indicators summary. Download it now.

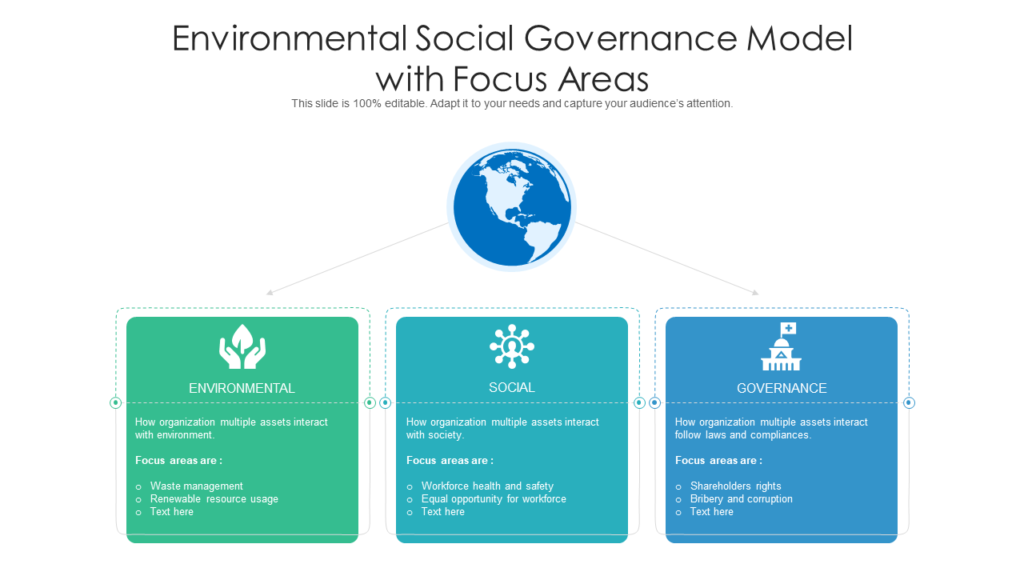

Template 8: ESG Model With Focus Areas

This PPT layout will help you identify and focus on key areas of the ESG metrics and implement best practices to create a socially aware work environment. Some of the focus areas covered in this presentation are waste management, renewable resources, workforce health, safety, etc. This PowerPoint layout also helps businesses identify and address critical sustainability issues. So get it now.

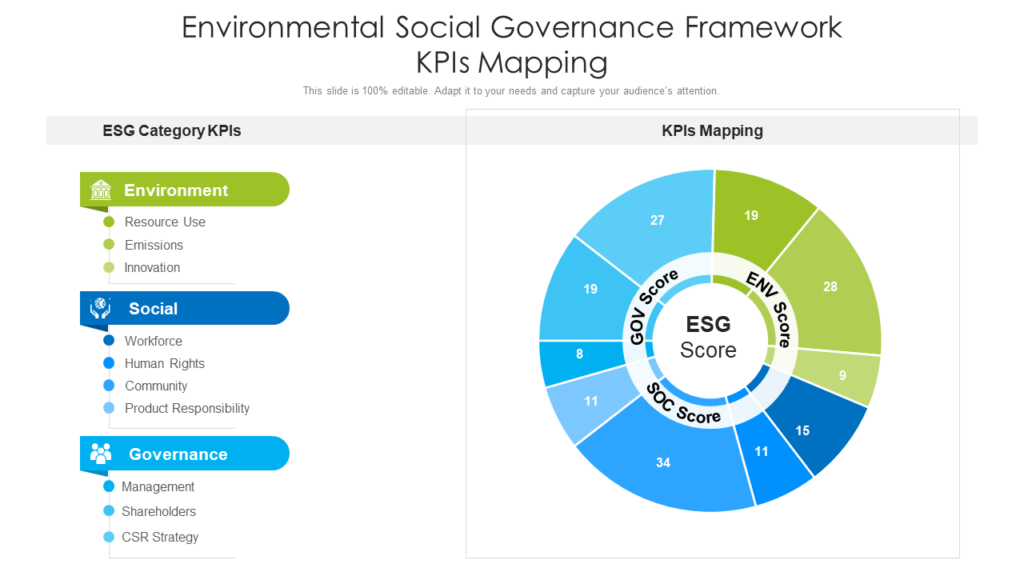

Template 9: ESG Framework KPIs Mapping

Pick this template to illustrate how ESG is a critical part of responsible investing. In this PPT layout, the KPI mapping will help you track your progress and identify areas of improvement. Besides, this design includes metrics, such as resource use, emissions, human rights, management, etc. Get it now.

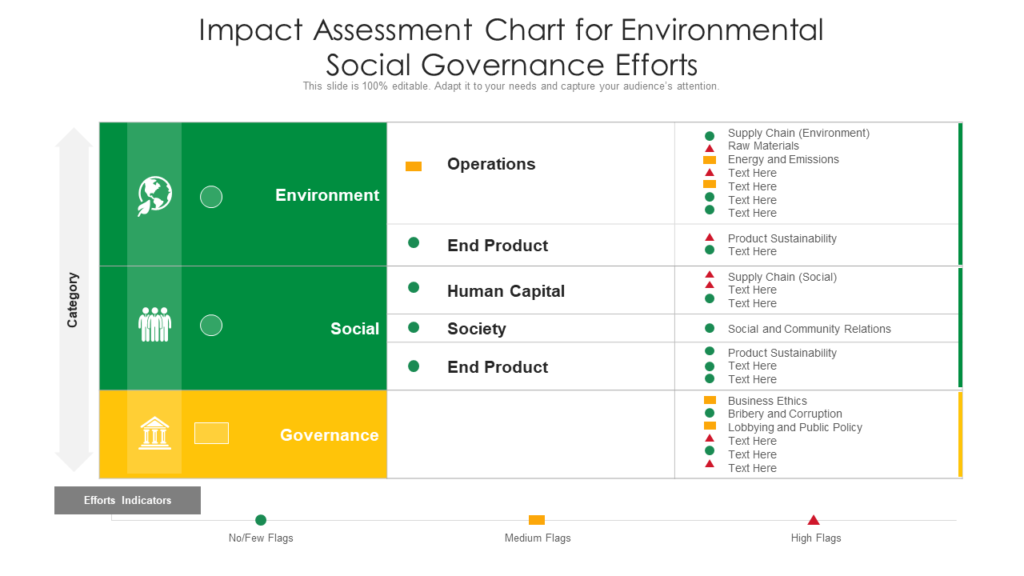

Template 10: Impact Assessment Chart For ESG Efforts

You can use this PPT design to keep track of your company's environmental and social governance efforts. With this PowerPoint preset, you can see at-a-glance how well your business is performing in terms of sustainability, operations, end product, human capital, etc. Download it now.

Modern businesses exist only to earn revenue but in this current global economy, that attitude is not enough. Especially if the consumer opinion is anything different, blind profits aren’t received well by the customer base that is more aware of worldwide issues. It is the duty of the companies and shareholders to make good on their investments.

However, many organizations have come under criticism recently because they are struggling to create profit for their shareholders along with minimizing the negative impact on the environment.

But you can use our stunning ESG framework templates to determine whether or not your operations are adequately protecting environmental and social interests. Download these stunning presentations right away and advocate an eco-friendly turn to your business.

P.S: To add sustainability and climate change to the social pivot plan of your company check out these amazing templates featured in this guide .

Download the free ESG Framework Templates .

Related posts:

- [Updated 2023] Top 25 Green Renewable Energy PowerPoint Templates for a Sustainable Coexistence

- Top 20 Sustainability, Social Responsibility and Climate Change Presentation Templates for Business and Environment Presentations!!

- 10 Elements of A Successful Corporate Sponsorship Proposal (With Presentation Templates)

- How To Create A Corporate Pitch Deck With Sample Templates and Examples

Liked this blog? Please recommend us

Top 10 Poka-Yoke PPT Templates for Fool-Proof Business Operations

![presentations on esg [Updated 2023] The 5 Leadership Styles Along (With PPT Templates Included)](https://www.slideteam.net/wp/wp-content/uploads/2021/10/with-logo-1-1013x441.jpg)

[Updated 2023] The 5 Leadership Styles Along (With PPT Templates Included)

Top 15 Business Card Templates to Represent Your Brand

Top 10 PPT Templates to Propagate the Benefits of Retirement Planning

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

--> Digital revolution powerpoint presentation slides

--> Sales funnel results presentation layouts

--> 3d men joinning circular jigsaw puzzles ppt graphics icons

--> Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

--> Future plan powerpoint template slide

--> Project Management Team Powerpoint Presentation Slides

--> Brand marketing powerpoint presentation slides

--> Launching a new service powerpoint presentation with slides go to market

--> Agenda powerpoint slide show

--> Four key metrics donut chart with percentage

--> Engineering and technology ppt inspiration example introduction continuous process improvement

--> Meet our team representing in circular format

Environmental Social Governance PowerPoint Template

The Environmental Social Governance PowerPoint Template features slide designs for presenting ESG analysis, risks, and opportunities. ESG is the acronym for Environmental, Social, and Governance. Using these three aspects, investors and analysts deduce the functioning quality of the company. The environmental aspect deals with how the procedures or production at the company is impacting the immediate environment, e.g., waste management and emissions. The S in ESG corresponds to the social interaction of the company with the customers & employees. It also involves other parameters like data privacy and policies. The governance in ESG points to the management team and leadership. This aspect primarily attracts investors, as they will put more trust in organizations with a consolidated team of directors and leaders.

Our ESG Slide Template features nine editable slides in two background color variations (white and dark). The color palette chosen for this presentation template has green shades representing the ESG concept. The template begins with a cover slide showing the green earth illustration with a human hand and leaves around it. Professionals can opt for how to start a presentation by introducing the presentation title and company name on this slide. Following this slide is a semi-circle three-segment diagram with icons to note descriptions. Similarly, this semi-circle diagram is enriched with more relevant icons on the next slide. These icons can help in the visual communication of the concept before the audience.

This Environmental Social Governance PowerPoint Template also includes individual slides for E, S, and G with editable text boxes having a green color scheme. These slides carry icons and an engaging design. Presenters can also use the three-column and table slides to discuss the ESG analysis. The last slide is a summary presentation slide with donut charts, bar graphs, and color-coded bars. So, this ESG Presentation template can help consultants and analysts showcase the ESG status of the company in both descriptive and numerical data forms. Using the text boxes, they can demonstrate environmental impacts or governance setup risks.

Similarly, they can discuss the opportunities for investing. The company executives can also use this PPT Template to discuss the ESG status and development of management strategies accordingly. Hence, download this best PPT template and customize it with all PowerPoint versions and Google Slides. Alternatively, you can download other sustainability PowerPoint templates and presentation slides.

You must be logged in to download this file.

Favorite Add to Collection

Subscribe today and get immediate access to download our PowerPoint templates.

Related PowerPoint Templates

Organizational Climate Diagram PowerPoint Template

Stairs Infographic PowerPoint Template

6-Component Governance Operating Model

5S Plan Diagram Template for PowerPoint

- Contributors

Introduction to ESG

Mark S. Bergman , Ariel J. Deckelbaum , and Brad S. Karp are partners at Paul, Weiss, Rifkind, Wharton & Garrison LLP. This post is based on a recent Paul Weiss memorandum by Mr. Bergman, Mr. Deckelbaum, Mr. Karp, David Curran , Jeh Charles Johnson , and Loretta E. Lynch . Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here ) and Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here ).

Interest on the part of investors and other corporate stakeholders in environmental, social and governance (“ESG”) matters has surged in recent years, and the current economic, public health and social justice crises have only intensified this focus. ESG, at its core, is a means by which companies can be evaluated with respect to a broad range of socially desirable ends. ESG describes a set of factors used to measure the non-financial impacts of particular investments and companies. At the same time, ESG also provides a range of business and investment opportunities.

Net flows into ESG funds available to U.S. investors have skyrocketed, totalling $20.6 billion in 2019, nearly four times the previous annual record set in 2018, [1] while ESG funds in Europe also attracted record inflows of $132 billion in 2019. [2] More than 70% of funds focused on ESG investments outperformed their counterparts in the first four months of 2020, [3] and nearly 60% of ESG funds outperformed the wider market over the past decade. [4] Consumers and investors are placing a growing value on ESG, and industry leaders have responded in a number of ways, including issuing comprehensive sustainability reports and expanding ESG disclosures in their annual reports, providing information to ESG rating agencies and publicly communicating ESG commitments.

This post, the first in a series focused on ESG disclosure and regulatory developments, provides an introduction to ESG and identifies several critical issues for companies and their in-house counsel to keep in mind in evaluating and monitoring ESG actions and statements.

The Fundamentals of ESG

ESG grew out of investment philosophies clustered around sustainability and, thereafter, socially responsible investing. Early efforts focused on “screening out” (that is, excluding) companies from portfolios largely due to environmental, social or governance concerns, while more recently ESG has favorably distinguished companies that are making positive contributions to the elements of ESG, premised on treating environmental and social issues as core elements of strategic positioning. While climate figures prominently in ESG discussions, there is no single list of ESG goals or examples, and ESG concepts often overlap. That being said, the three categories of ESG are increasingly integrated into investment analysis, processes and decision-making.

- The “E” captures energy efficiencies, carbon footprints, greenhouse gas emissions, deforestation, biodiversity, climate change and pollution mitigation, waste management and water usage.

- The “S” covers labor standards, wages and benefits, workplace and board diversity, racial justice, pay equity, human rights, talent management, community relations, privacy and data protection, health and safety, supply-chain management and other human capital and social justice issues.

- The “G” covers the governing of the “E” and the “S” categories—corporate board composition and structure, strategic sustainability oversight and compliance, executive compensation, political contributions and lobbying, and bribery and corruption.

ESG metrics have evolved in recent years to measure risk as well as opportunity. In his “Dear CEO” letter in 2018, BlackRock Chairman and CEO Larry Fink wrote that:

[s]ociety is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate.

He goes on to say that:

Companies must ask themselves: What role do we play in the community? How are we managing our impact on the environment? Are we working to create a diverse workforce? Are we adapting to technological change? Are we providing the retraining and opportunities that our employees and our business will need to adjust to an increasingly automated world? Are we using behavioral finance and other tools to prepare workers for retirement, so that they invest in a way that will help them achieve their goals? [5]

Other leading business leaders have also supported more expansive views regarding the purpose of a corporation. In August 2019, the Business Roundtable, a non-profit organization comprised of corporate CEOs, released a new Statement on the Purpose of a Corporation (the “BRT Statement”). [6] The BRT Statement was signed by the CEOs of nearly 200 leading U.S. companies and identified shareholders as one of five key stakeholders—along with customers, workers, suppliers and communities. The BRT Statement supersedes prior statements that endorsed shareholder primacy (the idea that corporations exist principally to serve shareholders), and “outlines a modern standard for corporate responsibility.” [7]

ESG in Practice

Under the current disclosure regime applicable to public companies listed in the United States, there is no affirmative duty to provide disclosures on ESG matters. As a practical matter, however, it can be anticipated that important stakeholders, such as investors, insurance companies, lenders, regulators and others, will increasingly look to companies’ disclosures to allow them to evaluate whether those companies have embraced ESG agendas. And, even in the absence of an affirmative duty to disclose, the substance of the information that companies do elect to report regarding their actions to identify and manage ESG risks and opportunities will be subject to the securities laws.

As we will discuss in future posts in this series, the ESG regulatory landscape regarding disclosure is rapidly evolving. While there is a general recognition of the value of, and the imperative for, consistent and decision-critical information to more easily evaluate how companies are overseeing and managing ESG-related risks and opportunities, most companies have yet to achieve that level of consistency. Moreover, ESG factors cover a broad range of activities that may or may not be relevant to particular businesses and their performance, or their potential positive effect on communities, or more broadly, societies. These metrics need to be refined. Accordingly, a prudent public company will find it desirable to establish its own criteria for determining the scope and content of its ESG disclosures, both to mitigate legal risk and identify future opportunities that ESG presents in terms of growth and differentiation.

In the absence of international consensus regarding ESG disclosures, a number of frameworks and indices have emerged to guide company disclosures and inform investors. Some of the leading international frameworks include the Global Reporting Initiative standards, the Sustainability Accounting Standards Board (SASB) standards, the United Nations Principles for Responsible Investment and the United Nations Sustainable Development Goals. Ratings have also proliferated over the last decade. Morgan Stanley Capital International (MSCI) and specialist firms such as Sustainalytics have recently been joined by traditional credit rating agencies such as Moody’s and S&P Global. A recent estimate suggests that the “global market for ESG ratings is currently worth about $200m and could grow to $500m within five years.” [8] The influence of these frameworks and rating agencies is such that they may shape regulation to come.

ESG is also influenced by public opinion. ESG issues are inherently reputational, especially given recent societal events. As more companies provide ESG disclosures and commitments, and given the speed of social media responses and the news cycle, observations about a company’s ESG actions or inactions are often published and sometimes go viral. Companies that are out of step with public opinion and market demands may face punishing reputational consequences.

Matching Aspiration and Action

We will describe in subsequent alerts the challenges faced by companies in developing a disclosure posture that satisfies the needs of a growing number of stakeholders, as well as the challenges faced by many of those stakeholders in obtaining information that is consistent and decision-critical. While ESG disclosures today are, from an SEC perspective, purely voluntary, over time that could change, and in the meantime there may be increasing pressure from a range of stakeholders to incorporate ESG statements. If a company’s ESG disclosures (for example, those in relation to compliance with legal, regulatory or voluntary standards or a particular commitment to achieve an ESG-positive outcome) later appear to be false or misleading, the company could face reputational backlash, shareholder lawsuits or possibly regulatory enforcement. Putting aside which disclosure standards they adopt, companies should ensure that they take a systematic approach to ESG reporting.

We highlight below considerations that should facilitate tying aspirations to actions and mitigating legal and reputational risks for commitments that cannot realistically be achieved:

- Monitor internal ESG disclosures and commitments . Management should appoint a team tasked with monitoring the company’s ESG disclosures and commitments, recognizing that these statements can appear in a variety of formal communications ( g. , SEC filings, or in documents incorporated by reference in SEC filings, sustainability reports and corporate responsibility reports) as well as informal communications ( e.g. , communications to employees, social media posts, media interviews and website postings). The team should identify existing ESG commitments to establish a baseline. Thereafter, the team should have a procedure in place to monitor ESG disclosures of the company as well as of peer firms.

- ESG statements made publicly should be vetted for factual accuracy and context in the same way as any other statement of fact.

- Forward-looking commitments should be qualified as such, much as other forward-looking statements are (with aspirational qualifiers and appropriate disclaimers).

- Management should consider extending the internal disclosure controls and procedures process to ESG statements, since some statements may well find their way into SEC filings.

- Even though ESG disclosure standards are not mandatory, the SEC has noted that it will be comparing information that is voluntarily provided with disclosures made in SEC reports and registration statements, which is consistent with its general approach of monitoring analyst and investor calls as well as other statements made outside of SEC filings (for example, to police the use of non-GAAP financial measures and selective disclosure rules).

- As with all material statements that are included in public disclosure, coordination among the relevant internal constituencies is critical and collaboration should be encouraged.

- Educate employees on the risks associated with ESG disclosures . Employees responsible for preparing and updating ESG disclosures should be sensitized to the risks associated with public disclosures and to the importance of ensuring that ESG statements are consistent with the company’s description of its business, its MD&A and its risk factors in annual and quarterly reports, even if those latter disclosures have no apparent ESG themes.

- Measure ESG performance . The ESG team should establish procedures to determine whether the company’s actions match its public ESG goals, the standards set by industry leaders and the frameworks established by third parties that the company has committed to—or is required to—follow. Doing so can help a company identify any vulnerabilities in order to mitigate potential legal and reputational risks.

1 See Greg Iacurci, “Money moving into environmental funds shatters previous record,” CNBC (January 14, 2020) , available here . (go back)

2 Lucca De Paoli, “European ESG Funds Pulled in Record $132 Billion in 2019,” Bloomberg (January 31, 2020), available here . (go back)

3 See Madison Darbyshire, “ESG funds continue to outperform wider market,” Financial Times (April 3, 2020), available here . (go back)

4 See Siobhan Riding, “Majority of ESG funds outperform wider market over 10 years,” Financial Times (June 13, 2020), available here . (go back)

5 Larry Fink, Blackrock, “‘Dear CEO Letter” (2018), available here . (go back)

6 Business Roundtable, “Business Roundtable Redefines the Purpose of a Corporation to Promote ‘An Economy That Serves All Americans’” (August 19, 2019), available here . (go back)

7 Id . (go back)

8 Billy Nauman, “Credit rating agencies join battle for ESG supremacy,” Financial Times (September 17, 2019), available here . (go back)

One Comment

Common ESG metrics by Deloitte, EY, KPMG, PwC: Please show business case.

The Big Four accounting firms EY, PwC, KPMG, and Deloitte have unveiled on 22 September 2020 a paper proposing to harmonize ESG reporting standards. However, they have not presented any business case. Real data with real companies is what is needed.

Author: Sharafat A. Paracha, 25 September 2020.

Many years ago, before ESG was even coined, I was a young graduate with a Masters’ in Sustainability and I proposed Bordier & Cie, one of the oldest private banks in Geneva (and the only one to have maintained its unlimited liability status), to develop a Corporate Social Responsibility Index for one of its clients. That was 1999 and again in 2000. Claude Morgenegg, the person who hired me, had a Ph.D. in mathematics and in charge of the analysis team. He looked at the general framework I submitted to and then said: you have a model. Great! Now prove it works by collecting the data. That is when reality kicked me in the face and showed me that it was easier said than done.

So, I had to design a system for collecting the data I needed that was not publicly available. Remember, this was before sustainability reports were a common staple. Only a few Scandinavian companies were informing the public on CSR issues. I had to design a questionnaire to give to companies and follow-up with them to obtain answers. Answers from companies were not enough. No, no, no. I had to validate their answers by conducting investigations into their activities around the world, comparing their reports from what NGOs and other sources said. Then I had to convert it all into understandable, measurable and comparable metrics before arriving at a final selection. Then, there was the process of analyzing all the information I had, filtering it and assessing it before it could be ready to be transcribed into a system of notation. This CSR index needed also to be reproducible in the future. Only then one could use it for decision making in portfolio selection. I still have the work I did for them in a diskette. Remember those? I cannot read it as the technology is now obsolete. It was hard work which I did alone but with good guidance and serious oversight. It was necessary as what was at stake was tens of millions of Swiss francs and Bordier & Cie reputation to deliver to the client and to the rest of the private banks. Bordier & Cie became among the first private banks in Switzerland to offer CSR analysis to its clients.

The situation in ESG now in 2020 is completely different from 20 years ago. Sustainability reports have become a staple for corporations. There are a plethora of sustainability standards. There are now teams of ESG analysts who work in banks and for specialized funds producing streams of reports regularly. There is an overload of sustainability perspectives, systems and data. Complexity in ESG has become the norm.

The big four accounting firms EY, PwC, KPMG, and Deloitte are not facing the challenges I faced. They are not alone and are not operating with limited resources. They have access to every ESG source and data. They have substantial resources. They have knowledge, experience and clout. Together with the World Economic Forum they have unveiled on 22 September 2020 a paper proposing to harmonize ESG reporting standards. However, they fail to provide any data, any case study, any business model to back their proposal. Putting a table of metrics together is the easy part. The harder part is getting companies to agree, getting the data, independently validating the data (be in no doubt that if you don’t do this you expose yourself to serious risks – after all, there are also short sellers), getting banks to find them useful, getting clients to put their money.

This is a welcome first step, don’t get me wrong. ESG needs this to take-off and anything that starts the ball rolling is to be encouraged. But I believe a solid business case is necessary. When I developed the Bordier & Cie CSR system, I looked into more than 20 companies. It is reasonable to ask the Big Four accounting firms and the World Economic Forum to commit to providing 20 ESG evaluations of diverse types of corporations based on their harmonized metrics for IBC’s Winter Meeting in January 2021.

Supported By:

Subscribe or Follow

Program on corporate governance advisory board.

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Elina Tetelbaum

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Holger Spamann

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

July special: Financial Reporting PPT Templates. Save with bundles 30%

How to Present Social Sustainability of ESG Report With Visual PowerPoint Slides

- January 26, 2023

- PowerPoint templates for download , Sustainability, ESG, Climate Change presentations

Last Updated on June 28, 2024 by Barbara

While presenting ESG issues in your sustainability report, they may be a moment when you’ll need to go in-depth with the social sustainability aspects of the study. Listing your company’s goals, actions, and achievements in this field could end with a bunch of similar descriptions.

Using visuals to support your messages proves to be an effective way to stand out. They help in creating logic across your slides, color-coding crucial information, and winning your audience’s attention. Not to mention emphasizing the professionalism of the presenter.

Feel encouraged to convince yourself of these statements by checking our example slides in the following paragraphs. For your inspiration, we present a detailed design analysis of some of our topic-related diagrams:

- a list of target social beneficiaries

- a social sustainability examples

- a list of diversity & inclusion achievements

- a presenting employee satisfaction

- explaining GDPR policy areas

Get all the graphics presented here – click on the slide pictures to see and download the source illustration. Check the complete Social Sustainability Report ESG Presentation here .

Why Use Visual Way of Presenting Social Sustainability in ESG Report?

Presentation composed of similar-looking content slides often causes a loss of interest in your audience. In the case of text descriptions and lists, alteration possibilities are constrained.

It is generally accepted to limit font types, colors, and sizes; therefore, graphic elements come in handy when there is a need for differing slides from each other. Conscious use of colors, text containers, or icons allows the creation of a coherent deck of slides with similar content but varied appearance. This way, we can juice up the presentation to everyone’s benefit.

If you struggle with diversifying your data-rich slides or searching for visual ideas for your social sustainability report, this blog post may be a great source of inspiration.

Present a List of Target Beneficiaries of the Social Responsibility Strategy

Defining the beneficiaries of social sustainability policy may help open a chapter of the ESG report. This topic is closely linked with defining goals, conducting a SWOT analysis, or understanding supply chain connections. Describing actors in the social responsibility scene (employees, community, suppliers, and customers) lays the foundation for further discussing their relations.

In order to make the list of elements more appealing to the audience, we propose to present its items horizontally on our example slide. It creates an effect of personas cards which fits the topic very well. On top of that, we used meaningful outline icons illustrating each card to make the information memorable. Bold titles and detailed descriptions introduce participants before moving on to the detailed lists of their benefits. Such reading logic is achieved through the horizontal listing and popping out dark text backgrounds, which attract attention.

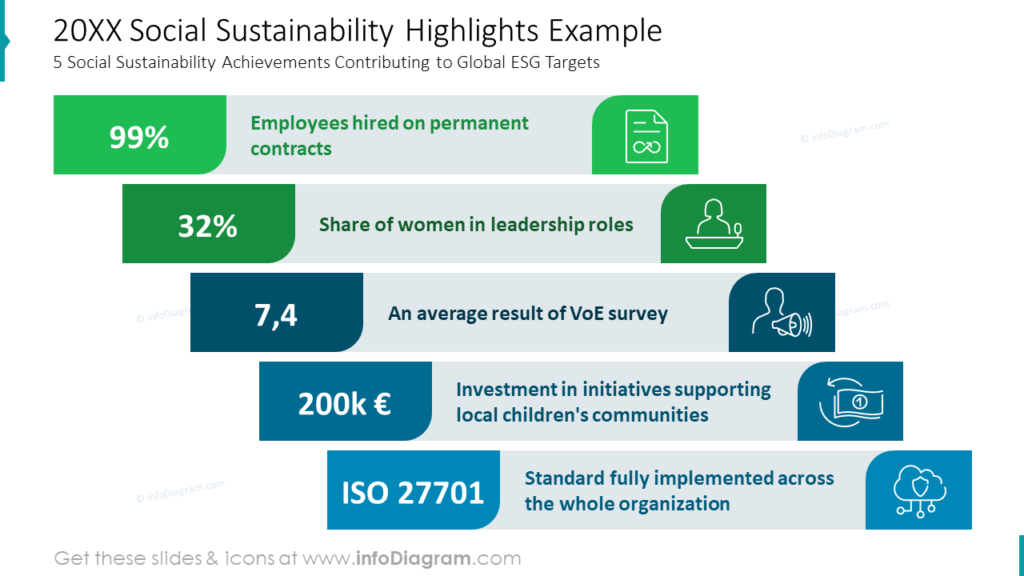

Highlight Social Sustainability Achievements Contributing to Global ESG Targets

Lists of short text descriptions related to numbers find use in chapter summaries and are meant to fall into the reader’s memory. In social sustainability reporting, they can be used to highlight metrics such as percentage shares, rating results, financial investments, or ISO standards.

Such slides are an excellent opportunity for creating solid visual messages of great resonance. The following diagram illustrates how adding colors, icons, and big numbers transforms a simple list into an appealing infographic. In this example, all elements were combined into long horizontal tickets designed in the presentation color palette and arranged diagonally using the entire slide area. We know from our professional experience that information conveyed in this way is easy to read, engaging, and impactful.

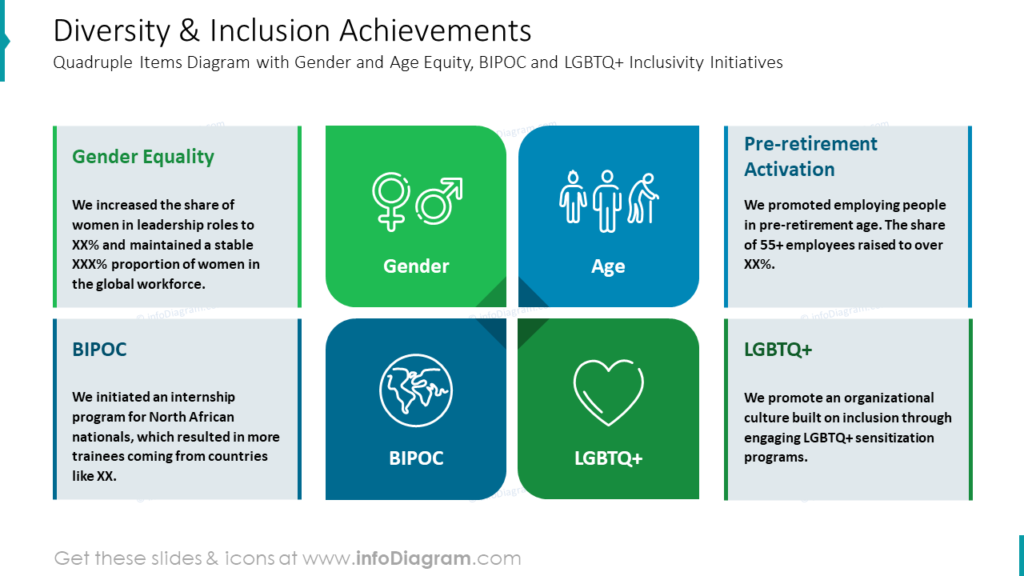

Illustrate the Company’s Diversity & Inclusion Initiatives With Quadruple Diagram

Inclusivity initiatives have become a flag achievement for many businesses nowadays. It is one of the most critical aspects of social sustainability, and this is why we are sharing our example slide covering this topic. Take a closer look and notice how design decisions enriched content that would be more of a simple list.

The first decision that catches the eye is distributing list elements in the matrix layout. This approach allows for utilizing the entire slide space. The second visible design decision is assigning colorful title tiles to each description and illustrating it with extensive outline icons suitable for topics such as:

- LGBTQ+

The last visual decision noticeable on this slide is linking text container graphical titles and additions with illustrative tiles mentioned before. This action results in a clear and coherent slide conveying the message effortlessly.

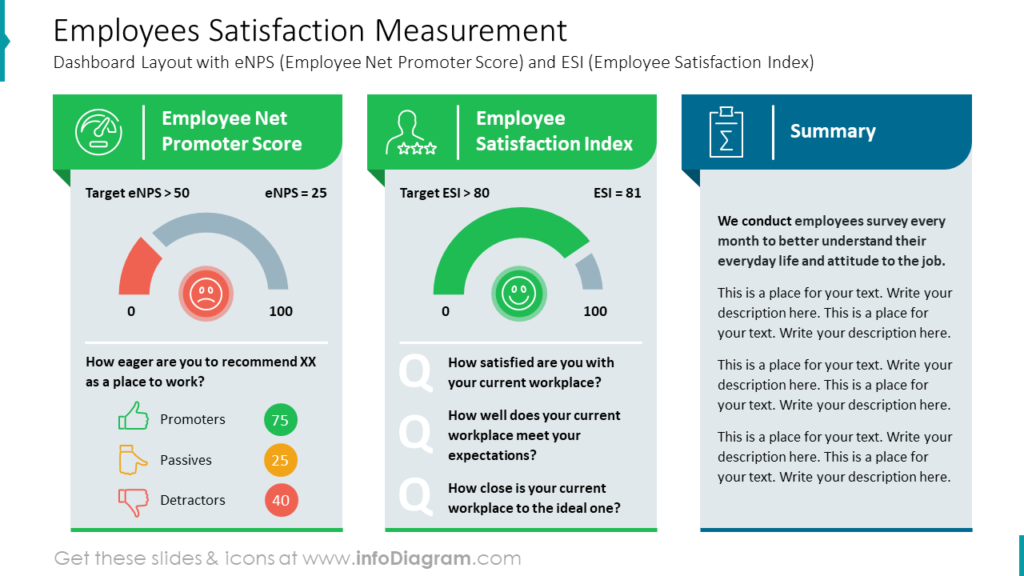

Employees Satisfaction Measurement Dashboard Example

When thinking about how social sustainability is obtained conducting the research plays a fundamental role. One of the aspects of social balance in the working environment is employee satisfaction which can be rated in terms of employee net promoter score and employee satisfaction index. Displaying statistics data becomes interesting when visuals are incorporated. Let’s analyze the slide below and check how it works.

In this example slide space has been divided into three sections – two for presenting eNPS and ESI measures and one for a written summary. They can be easily distinguished thanks to the dedicated use of green and navy graphics. What’s special about the result section is the application of gauge charts and icons supporting the message. Also, the conscious use of red, yellow, and green among evaluation graphics refers to universally used color coding expressing success or failure. Replacing text data with visuals resulted in an orderly and legible dashboard of human resources metrics.

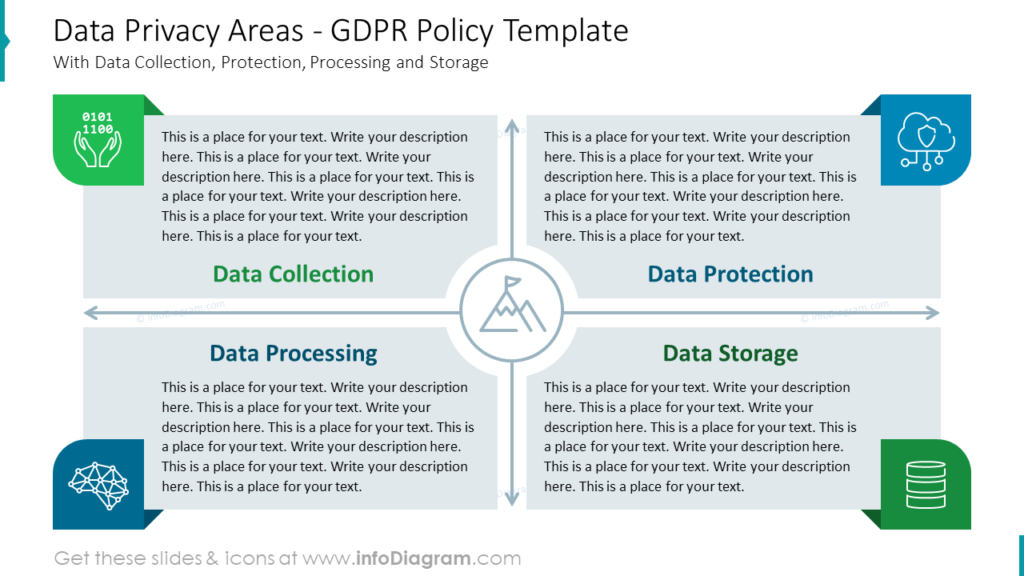

Compose GDPR Policy Slide With Descriptions of Data Privacy Areas

Data management is considered part of social sustainability policy. Whenever people are involved, some information starts circulating, especially in the business environment. Employees and customers became genuinely concerned about their privacy and the security of sensitive data collected about them. Presenting a company’s attitude to GDPR Policy is nowadays often included in ESG reporting and covers topics such as:

- data collection,

- data protection,

- data processing,

- data storage.

When you add a text description to each topic, you will get a pretty dense text slide. Such text-rich slides may be overwhelming to the audience, so we prepared an example of a visual template helping to solve that problem. You can see how even and total usage of the slide area created an interesting structure for detailed descriptions. Narrow paragraphs are easier to read than full-width-long ones and adding large titles, colors, and icons to the composition make it easy to navigate the content quickly. As the whole slide is about the company’s goals, there has been a symbol of a mountain with arrows in all directions added in the central area.

Summary of Design Tips for Social Sustainability Report ESG Presentation

Sustainability reports usually contain an extensive amount of information. Using PowerPoint format for such ESG reports gives you the opportunity to introduce graphical structure and elements that help comprehension of more complex documents.

Composing the presentation of text-rich slides often requires a dose of imagination to diversify them and keep the audience interested. The horizontal layout of PowerPoint documents may be challenging when filling in descriptions and lists. Some design tricks help to enrich slides and use the whole slide space; others make the composition more readable and engaging. Check the summary below and feel free to draw from it as you’ll be working on your following social sustainability report:

- distribute elements of your lists alternately in horizontal, vertical, diagonal, or distracted order

- keep your color pallet simple and coherent throughout the whole presentation

- choose colors symbolizing harmony, responsibility, and trust to discuss social sustainability

- use large titles to help readers navigate slides easily

- support the content with meaningful icons to make slides memorable

- use text containers to implement a structure to your slides

- illustrate data metrics with color-compatible data charts

Resource: Social Sustainability Report ESG PowerPoint Presentation Template and Layouts

The social sustainability report ESG layouts presented on this blog are available for download in the format of a PowerPoint file within the infoDiagram collection of ready-to-use PPTX templates. You will find many slides appropriate for institutional, business, and civil audiences in this presentation, including social sustainability definitions, ESG achievements, employees policy, diversity & inclusion, employees satisfaction, community engagement, company CSR investments, circular consumption, GDPR policy, supply chain management, and more. Don’t hesitate to check the details and click the link to the Social Sustainability Report ESG Presentation Template below:

If you look for more visuals to illustrate sustainability topics try our template for the circular economy and sustainability .

Chief Diagram Designer, infoDiagram co-founder

Related Posts

How to Visually Present B2B Segmentation in PowerPoint

- April 26, 2024

How to Present Real Estate Property with Impact Using PowerPoint

- April 15, 2024

How to Present Quoted Company Financial Report in PowerPoint

- April 10, 2024

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

31 templates

business pitch

696 templates

65 templates

158 templates

cybersecurity

6 templates

43 templates

Sustainability Strategy

It seems that you like this template, sustainability strategy presentation, free google slides theme, powerpoint template, and canva presentation template.

Sustainability and caring for the environment are increasingly present in business strategies. This template will help you point out the value of the measures you implement. Its design in green tones reminds of nature, with leaf motifs. Its top index will help the reader not to get lost. Use the different icons and illustrations to explain your projects visually, and the tables, diagrams and maps to expose the most relevant data.

Features of this template

- 100% editable and easy to modify

- 33 different slides to impress your audience

- Contains easy-to-edit graphics such as graphs, maps, tables, timelines and mockups

- Includes 500+ icons and Flaticon’s extension for customizing your slides

- Designed to be used in Google Slides, Canva, and Microsoft PowerPoint

- 16:9 widescreen format suitable for all types of screens

- Includes information about fonts, colors, and credits of the free resources used

How can I use the template?

Am I free to use the templates?

How to attribute?

Attribution required If you are a free user, you must attribute Slidesgo by keeping the slide where the credits appear. How to attribute?

Register for free and start downloading now

Related posts on our blog.

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

Boardroom Secrets and Invitations Magazine!

7 Tips for Creating an Effective ESG Board of Directors presentation

An Effective ESG Board of Director’s presentation:

An Environmental, Social, and Governance (ESG) Board of Director's presentation is a critical communication tool for sustainability and good governance organizations. It can educate directors about the organization's ESG performance, assess progress relative to goals, and make decisions about future priorities.

What is ESG?

ESG is the acronym for environmental, social, and governance. It's a term that refers to the overall performance and its stakeholders. ESG includes things like environmental impact, social responsibility, and economic sustainability.

Boardroom Secrets and Invitations Magazine! is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

ESG can measure the effectiveness of your company's environmental, social, and governance (ESG) performance. ESG can inform decision-making for your company and its stakeholders.

How can you measure your business's ESG performance?

There are several ways you can measure your business's ESG performance. You can use financial performance metrics to monitor your progress, such as net income or cash flows. You can also use other metrics, such as social media likes and shares, environmental impact factors (EI), and public disclosure factors (PDFs). You can also use ESG indicators to measure the success of your business initiatives.

What types of data should you collect to assess your business's ESG performance?

To assess your business's ESG performance, you should collect data about customers, employees, the environment, and other stakeholders . This data can help you make informed decisions about improving your ESG performance.

How can you present your business's ESG performance?

There are a few different ways to present your business's ESG performance. One way is to have an ESG report prepared by an independent consultant. An independent consultant's report can provide a more comprehensive and accurate picture of your business's ESG performance than a report created by you or your team.

Additionally, an ESG board presentation can provide a more specific and concise snapshot of your business's ESG performance than could be found in a report from a consultant.

A slide show is another way to present your business's ESG performance. Slideshows can help you depict the various aspects of your business's ESG performance in an easy-to-read format. Slideshows can also visually represent how well your business meets its environmental, social, and governance obligations.

What are the benefits of having an effective ESG board?

Having practical ESG board presentational tools will help you make better decisions, but it can also help you assess the progress of your company's ESG performance.

By having an effective ESG board, you can:

Assess the progress of your business's environmental, social, and governance (ESG) performance.

Identify areas in which your company needs to improve.

Find ways to reduce environmental, social, and governance (ESG) risks.

Create a strategy for increasing the effectiveness of your company's environmental, social, and governance (ESG) initiatives.

Evaluate the effectiveness of your company's environmental, social, and governance (ESG) efforts regularly.

Recommend changes to your company's management that would improve the effectiveness of your ESG performance.

Use an effective ESG board presentation to understand your business and its stakeholders better.

Here are the best 7 tips for creating an effective ESG Board of Director's presentation:

#1 Cater to the Different skills of your board of directors

Cater your ESG presentation to the varied skill sets of your board members . Understand every board member will mix every board member's ESG skills, interest level on the topic, and understanding?

- For example, if your board is vital in finance, you can focus on the financial aspects of ESG. Include examples of how ESG Factors effects the Credit Worthiness of your organization? Ratings and Scores.

If your board is vital in marketing, you can focus on how ESG is communicated to the public.

#1 How ESG Data Points span cross-functionally can be highlighted in the presentation.

The board members should be educated on how ESG Data points and factors span Enterprise-wide functions; HR, Finance, Legal, Marketing, IT, Supply Chains, and varied Functions and the jurisdictions it operates.

#2 Every board should understand how the company will be evaluated in that industry.

How is the company operating, culture, ESG metrics, how the company is doing, and how are we doing to improve on ESG factors? Jane Bomba serves Clarivate and two different public companies in the USA. What ESG factors are we measuring, and how are we doing in those ESG factors?

My recommendation would be an analysis, a strategic road map with tangible action items planned by the CEO, CFO, and C-Suite , on how we will improve those baseline measurements?

ESG presentation with factors highlighted should be tailored to the specific company and industry. For example, a pharmaceutical company will have different ESG priorities than a food company. An environmental presentation for a power company will be other than one for a renewable energy company.

#4 ESG Systems being Implemented to Capture Baseline Measurements.

According to Jane Bomba, The board needs to know, like any new ERP implementation , what ESG systems are we implementing in the company and how are we doing with them are relevant to the board.

#5 Creating an ESG Department and Agenda for Chief Sustainability Officer

The Chief Sustainability Officer (CSO) is a new role in most organizations that create an ESG agenda.

- The CSO should be able to report how the company is doing against its NetZero 2030, 2050 commitment goals and what progress has been made with materiality assessments

- The CSO should also be able to report on the effectiveness of different ESG factors, initiatives and policies established

The board presentation is crucial for the CSO to report on progress and get buy-in from the board for future endeavours.

#6 Some Metrics / Measurements relevant to the industry - Analysts covering the stocks in their analysis

ESG Data points factors most pertinent to the Institutional Investors , Analysts covering the stocks in their analysis

- Example: CDP Water Disclosure Scorecard, Carbon Disclosure Project (CDP) Climate Change Report,

The organization's carbon footprint, water usage, and waste production

Community engagement metrics

Employee satisfaction and retention rates

#7 How ESG and Company Culture are being affected/measured against ESG factors

The company culture is a crucial driver of ESG. For example A company with a strong safety culture will have lower workers' compensation

- How are we doing?

- What can be done better?

- Are employees happy with the way things are going?

- What does the future look like?

Tags: sec esg comment letter, esg disclosure examples, sec esg task force, sec esg disclosure requirements

Ready for more?

One Time Code

< Go back to Login

Forgot Password

Please enter your registered email ID. You will receive an email message with instructions on how to reset your password.

ESG framework PowerPoint Templates

- Environment-Social-Governance-01 - 4x3 – $4.99

- Environment-Social-Governance-01 - 16x9 – $4.99

Environment Social Governance 01 PowerPoint Template

Environment Social Governance 01 Presentation Template Use this Environment Social Governance 01 PowerPoint template to create visually appealing....

- Environment-Social-Governance-03 - 4x3 – $4.99

- Environment-Social-Governance-03 - 16x9 – $4.99

Environment Social Governance 03 PowerPoint Template

Environment Social Governance 03 Presentation Template Use this Environment Social Governance 03 PowerPoint template to create visually appealing....

- Environment-Social-Governance-02 - 4x3 – $4.99

- Environment-Social-Governance-02 - 16x9 – $4.99

Environment Social Governance 02 PowerPoint Template

Environment Social Governance 02 Presentation Template Use this Environment Social Governance 02 PowerPoint template to create visually appealing....

- ESG 01 - 4x3 – $6.99

- ESG 01 - 16x9 – $6.99

ESG 01 PowerPoint Template

ESG 01 Presentation Template Use this ESG 01 PowerPoint template to create visually appealing presentations in any professional setting. Its mini....

- ESG-02 - 4x3 – $4.99

- ESG-02 - 16x9 – $4.99

ESG 02 PowerPoint Template

ESG 02 Presentation Template Use this ESG 02 PowerPoint template to create visually appealing presentations in any professional setting. Its mini....

- Sustainable Initiatives PowerPoint Template - 4x3 – $4.99

- Sustainable Initiatives PowerPoint Template - 16x9 – $4.99

Sustainable Initiatives PowerPoint Template

Sustainable Initiatives Presentation Template Use this Sustainable Initiatives PowerPoint template to create visually appealing presentations in ....

- Sustainability-Quote-PowerPoint-Template - 4x3 – $4.99

- Sustainability-Quote-PowerPoint-Template - 16x9 – $4.99

Sustainability Quote PowerPoint Template

Sustainability Quote Presentation Template Use this Sustainability Quote PowerPoint template to create visually appealing presentations in any pr....

- Green-Sustainability-PowerPoint-Template - 4x3 – $4.99

- Green-Sustainability-PowerPoint-Template - 16x9 – $4.99

Green Sustainability PowerPoint Template

Green Sustainability Presentation Template Use this Green Sustainability PowerPoint template to create visually appealing presentations in any pr....

- Recycle-Diagram-PowerPoint-Template - 4x3 – $4.99

- Recycle-Diagram-PowerPoint-Template - 16x9 – $4.99

Recycle Diagram PowerPoint Template

Recycle Diagram Presentation Template Use this Recycle Diagram PowerPoint template to create visually appealing presentations in any professional....

- Simple-Recycle-PowerPoint-Template - 4x3 – $4.99

- Simple-Recycle-PowerPoint-Template - 16x9 – $4.99

Simple Recycle PowerPoint Template

About Simple Recycle PowerPoint Template The best-in-class Simple Recycle Template for PowerPoint is a slide set with recycled logos designed in ....

- World Environment Day 02 - 4x3 – $4.99

- World Environment Day 02 - 16x9 – $4.99

World Environment Day 02 PowerPoint Template

World Environment Day 02 Presentation Template Use this World Environment Day 02 PowerPoint template to create visually appealing presentations i....

- World Environment Day 03 - 4x3 – $4.99

- World Environment Day 03 - 16x9 – $4.99

World Environment Day 03 PowerPoint Template

World Environment Day 03 Presentation Template Use this World Environment Day 03 PowerPoint template to create visually appealing presentations i....

Related Presentations

Human resource.

920 templates >

Sustainability

28 templates >

19 templates >

5,698 templates >

SWOT Analysis

130 templates >

ESG PowerPoint Templates For Presentations:

The ESG PowerPoint templates go beyond traditional static slides to make your professional presentations stand out. Given the sleek design and customized features, they can be used as PowerPoint as well as Google Slides templates . Inculcated with visually appealing unique and creative designs, the templates will double your presentation value in front of your audience. You can browse through a vast library of ESG Google Slides templates, PowerPoint themes and backgrounds to stand out in your next presentation.

Product Pricing

What is a esg powerpoint template.

A ESG PowerPoint template is a ready-made presentation template that provides a structured framework for creating professional ESG presentations. The ESG PPT presentation template includes design elements, layouts, and fonts that you can customize to fit your content and brand.

How To Choose The Best ESG Presentation Templates?

Keep the following points in mind while choosing a ESG Presentation template for PowerPoint (PPT) or Google Slides:

- Understand your presentation goals and objectives.

- Make sure the ESG template aligns with your visual needs and appeal.

- Ensure the template is versatile enough to adapt to various types of content.

- Ensure the template is easily customizable.

Are ESG PowerPoint Templates Compatible With Google Slides?

Yes, all our ESG presentation templates are compatible and can be used as ESG Google Slides templates.

What Are The Advantages Of ESG Presentation Templates?

ESG PPT presentation templates can be beneficial because they:

- Add multiple visual and aesthetic layers to your slides.

- Ensure that complex information, insights and data is presented in a simplistic way.

- Enhance the overall visual appeal of the content.

- Save you a lot of time as you don’t have to start editing from scratch.

- Improve the professional outlook of your presentation.

Can I Edit The Elements In ESG PowerPoint Templates?

Yes, our ESG PowerPoint and Google Slides templates are fully editable. You can easily modify the individual elements including icons, fonts, colors, etc. while making your presentations using professional PowerPoint templates .

How To Download ESG PowerPoint Templates For Presentations?

To download ESG presentation templates, you can follow these steps:

- Select the resolution (16*9 or 4*3).

- Select the format you want to download the ESG template in (Google Slides or PowerPoint).

- Make the payment (SlideUpLift has a collection of paid as well as free ESG PowerPoint templates).

- You can download the file or open it in Google Slides.

Forgot Password?

Privacy Overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Does ESG really matter—and why?

Since the acronym “ESG” (environmental, social, and governance) was coined in 2005, and until recently, its fortunes were steadily growing. To take one example, there has been a fivefold growth in internet searches for ESG since 2019, even as searches for “CSR” (corporate social responsibility)—an earlier area of focus more reflective of corporate engagement than changes to a core business model—have declined. Across industries, geographies, and company sizes, organizations have been allocating more resources toward improving ESG. More than 90 percent of S&P 500 companies now publish ESG reports in some form, as do approximately 70 percent of Russell 1000 companies. 1 Sustainability reporting in focus , G&A Institute, 2021. In a number of jurisdictions, reporting ESG elements is either mandatory or under active consideration. In the United States, the Securities and Exchange Commission (SEC) is considering new rules that would require more detailed disclosure of climate-related risks and greenhouse-gas (GHG) emissions. 2 Release Nos. 33-11042, 34-94478, File No. S7-10-22, US Securities and Exchange Commission (SEC), March 21, 2022. The proposed rule would not come into effect until fiscal year 2023 and could face legal challenges; “We are not the Securities and Environment Commission—At least not yet,” statement of Commissioner Hester M. Peirce, SEC, March 21, 2022; Dan Papscun, “SEC’s climate proposal tees up test of ‘material’ info standard,” Bloomberg Law, March 23, 2022. Additional SEC regulations on other facets of ESG have also been proposed or are pending. 3 See “SEC response to climate and ESG risks and opportunities,” SEC, modified April 11, 2022; “SEC proposes to enhance disclosures by certain investment advisers and investment companies about ESG investment practices,” SEC press release, May 25, 2022.

The rising profile of ESG has also been plainly evident in investments, even while the rate of new investments has recently been falling. Inflows into sustainable funds, for example, rose from $5 billion in 2018 to more than $50 billion in 2020—and then to nearly $70 billion in 2021; these funds gained $87 billion of net new money in the first quarter of 2022, followed by $33 billion in the second quarter. 4 “Global Sustainable Fund Flows: Q2 2022 in Review,” Morningstar Manager Research, July 28, 2022; Cathy Curtis, “Op-ed: While green investments are underperforming, investors need to remain patient,” CNBC, March 28, 2022. Midway through 2022, global sustainable assets are about $2.5 trillion. This represents a 13.3 percent fall from the end of Q1 2022 but is less than the 14.6 percent decline over the same period for the broader market. 5 “Global Sustainable Fund Flows: Q2 2022 in Review,” Morningstar Manager Research, July 28, 2022; Cathy Curtis, “Op-ed: While green investments are underperforming, investors need to remain patient,” CNBC, March 28, 2022.

A major part of ESG growth has been driven by the environmental component of ESG and responses to climate change. But other components of ESG, in particular the social dimension, have also been gaining prominence. One analysis found that social-related shareholder proposals rose 37 percent in the 2021 proxy season compared with the previous year. 6 Richard Vanderford, “Shareholder voices poised to grow louder with SEC’s help,” Wall Street Journal , February 11, 2022.

In the wake of the war in Ukraine and the ensuing human tragedy, as well as the cumulative geopolitical, economic, and societal effects, critics have argued that the importance of ESG has peaked. 7 Simon Jessop and Patturaja Murugaboopathy, “Demand for sustainable funds wanes as Ukraine war puts focus on oil and gas,” Reuters, March 17, 2022; Peggy Hollinger, “Ukraine war prompts investor rethink of ESG and the defence sector,” Financial Times , March 9, 2022. Attention, they contend, will shift increasingly to the more foundational elements of a Maslow-type hierarchy of public- and private-sector needs, 8 Bérengère Sim, “Ukraine war ‘bankrupts’ ESG case, says BlackRock’s former sustainable investing boss,” Financial News , March 14, 2022. and in the future, today’s preoccupation with ESG may be remembered as merely a fad and go the way of similar acronyms that have been used in the past. 9 Charles Gasparino, “Russian invasion sheds light on hypocrisy of Gary Gensler, woke investment,” New York Post , March 5, 2022; James Mackintosh, “Why the sustainable investment craze is flawed,” Wall Street Journal , January 23, 2022; David L. Bahnsen, “Praying that ESG goes MIA,” National Review , March 17, 2022. Others have argued that ESG represents an odd and unstable combination of elements and that attention should be only focused on environmental sustainability. 10 See, for example, “ESG should be boiled down to one simple measure: emissions,” Economist , July 21, 2022. In parallel, challenges to the integrity of ESG investing have been multiplying. While some of these arguments have also been directed to policy makers, analysts, and investment funds, the analysis presented in this article (and in the accompanying piece “ How to make ESG real ”) is focused at the level of the individual company. In other words: Does ESG really matter to companies ? What is the business-grounded, strategic rationale?

A critical lens on ESG

Criticisms of ESG are not new. As ESG has gone mainstream and gained support and traction, it has consistently encountered doubt and criticism as well. The main objections fall into four main categories.

1. ESG is not desirable, because it is a distraction

Perhaps the most prominent objection to ESG has been that it gets in the way of what critics see as the substance of what businesses are supposed to do: “make as much money as possible while conforming to the basic rules of the society,” as Milton Friedman phrased it more than a half-century ago.” 11 Milton Friedman, “The social responsibility of business to increase its profits,” New York Times Magazine , September 13, 1970. Viewed in this perspective, ESG can be presented as something of a sideshow—a public-relations move, or even a means to cash in on the higher motives of customers, investors, or employees. ESG is something “good for the brand” but not foundational to company strategy. It is additive and occasional. ESG ratings and score provider MSCI, for example, found that nearly 60 percent of “say on climate” votes 12 Say-on-climate votes are generally nonbinding resolutions submitted to shareholders (similar to “say-on-pay” resolutions), which seek shareholder backing for emissions reductions initiatives. See, for example, John Galloway, “Vanguard insights on evaluating say on climate proposals,” Harvard Law School Forum of Corporate Governance, June 14, 2021. in 2021 were only one-time events; fewer than one in four of these votes were scheduled to have annual follow-ups. 13 “Say on climate: Investor distraction or climate action?,” blog post by Florian Sommer and Harlan Tufford, MSCI, February 15, 2022. Other critics have cast ESG efforts as “greenwashing,” “purpose washing,” 14 Laurie Hays, et al., “Why ESG can no longer be a PR exercise,” Harvard Law School Forum on Corporate Governance, January 20, 2021. or “woke washing.” 15 See Owen Jones, “Woke-washing: How brands are cashing in on the culture wars,” Guardian , May 23, 2019; Vivek Ramaswamy, Woke Inc.: Inside Corporate America’s Social Justice Scam , New York, NY: Hachette Book Group, 2021. One Edelman survey, for example, reported that nearly three out of four institutional investors do not trust companies to achieve their stated sustainability, ESG, or diversity, equity, and inclusion (DEI) commitments. 16 Special report: Institutional investors , Edelman Trust Barometer, 2021.

2. ESG is not feasible because it is intrinsically too difficult

A second critique of ESG is that, beyond meeting the technical requirements of each of the E, S, and G components, striking the balance required to implement ESG in a way that resonates among multiple stakeholders is simply too hard. When solving for a financial return, the objective is clear: to maximize value for the corporation and its shareholders. But what if the remit is broader and the feasible solutions vastly more complex? Solving for multiple stakeholders can be fraught with trade-offs and may even be impossible. To whom should a manager pay the incremental ESG dollar? To the customer, by way of lower prices? To the employees, through increased benefits or higher wages? To suppliers? Toward environmental issues, perhaps by means of an internal carbon tax? An optimal choice is not always clear. And even if such a choice existed, it is not certain that a company would have a clear mandate from its shareholders to make it.

3. ESG is not measurable, at least to any practicable degree

A third objection is that ESG, particularly as reflected in ESG scores, cannot be accurately measured. While individual E, S, and G dimensions can be assessed if the required, auditable data are captured, some critics argue that aggregate ESG scores have little meaning. The deficiency is further compounded by differences of weighting and methodology across ESG ratings and scores providers. For example, while credit scores of S&P and Moody’s correlated at 99 percent, ESG scores across six of the most prominent ESG ratings and scores providers correlate on average by only 54 percent and range from 38 percent to 71 percent. 17 Florian Berg, Julian Kölbel, and Roberto Rigobon, “Aggregate confusion: The divergence of ESG ratings,” Review of Finance , forthcoming, updated April 26, 2022. Moreover, organizations such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) can measure the same phenomena differently; for example, GRI considers employee training, in part, by amounts invested in training, while SASB measures by training hours. It is to be expected, therefore, that different ratings and scores providers—which incorporate their own analyses and weightings—would provide diverging scores. Moreover, major investors often use their own proprietary methodologies that draw from a variety of inputs (including ESG scores), which these investors have honed over the years.

4. Even when ESG can be measured, there is no meaningful relationship with financial performance

The fourth objection to ESG is that positive correlations with outperformance, when they exist, could be explained by other factors and, in any event, are not causative. It would indeed challenge reason if ESG ratings across ratings and scores providers, measuring different industries, using distinct methodologies, weighting metrics differently, and examining a range of companies that operate in various geographies, all produced a near-identical score that almost perfectly matched company performance. Correlations with performance could be explained by multiple factors (for example, industry headwinds or tailwinds) and are subject to change. 18 See, for example, James Mackintosh, “Credit Suisse shows flaws of trying to quantify ESG risks,” Wall Street Journal , January 17, 2022. Several studies have questioned any causal link between ESG performance and financial performance. 19 See, for example, Chart of the Week , “Does ESG outperform? It’s a challenging question to answer,” blog post by Raymond Fu, Penn Mutual, September 23, 2021; Gregor Dorfleitner and Gerhard Halbritter, “The wages of social responsibility—where are they? A critical review of ESG investing,” Review of Financial Economics , Volume 26, Issue 1, September 2015. While, according to a recent metastudy, the majority of ESG-focused investment funds do outperform the broader market, 20 Ulrich Atz, Casey Clark, and Tensie Whelan, ESG and financial performance: Uncovering the relationship by aggregating evidence from 1,000 plus studies published between 2015 – 2020 , NYU Stern Center for Sustainable Business, 2021. some ESG funds do not, and even those companies and funds that have outperformed could well have an alternative explanation for their outperformance. (For example, technology and asset-light companies are often among broader market leaders in ESG ratings; because they have a relatively low carbon footprint, they tend to merit higher ESG scores.) The director of one recent study 21 Giovanni Bruno, Mikheil Esakia, and Felix Goltz, “‘Honey, I shrunk the ESG alpha’: Risk-adjusting ESG portfolio returns,” Journal of Investing , April 2022. proclaimed starkly: “There is no ESG alpha.” 22 Steve Johnson, “ESG outperformance narrative ‘is flawed,’ new research shows,” Financial Times , May 3, 2021.

In addition to these four objections, recent events and roiled markets have led some to call into question the applicability of ESG ratings at this point. 23 See James Mackintosh, “War in Ukraine reveals flaws in sustainable investing,” Wall Street Journal , March 27, 2022. It is true that the recognized, pressing need to strengthen energy security in the wake of the invasion of Ukraine may lead to more fossil-fuel extraction and usage in the immediate term, and the global collaboration required for a more orderly net-zero transition may be jeopardized by the war and its aftermath. It is also likely that patience for what may be called “performative ESG,” as opposed to what may be called true ESG, will likely wear thin. True ESG is consistent with a judicious, well-considered strategy that advances a company’s purpose and business model (exhibit).

Yet, many companies today are making major decisions, such as discontinuing operations in Russia, protecting employees in at-risk countries, organizing relief to an unprecedented degree, and doing so in response to societal concerns. They also continue to commit to science-based targets and to define and execute plans for realizing these commitments. That indicates that ESG considerations are becoming more —not less—important in companies’ decision making.

Sustainable performance is not possible without social license

The fundamental issue that underlies each of the four ESG critiques is a failure to take adequate account of social license—that is, the perception by stakeholders that a business or industry is acting in a way that is fair, appropriate, and deserving of trust. 24 “‘Corporate diplomacy’: Why firms need to build ties with external stakeholders,” Knowledge at Wharton , May 5, 2014; and Witold J. Henisz, Corporate Diplomacy: Building Reputations and Relationships with External Stakeholders , first edition, London, UK: Routledge, 2014; see also Robert G. Boutilier, “Frequently asked questions about the social license to operate,” Impact Assessment and Project Appraisal , Volume 32, Issue 4, 2014. It has become dogma to state that businesses exist to create value in the long term. If a business does something to destroy value (for example, misallocating resources on “virtue signaling,” or trying to measure with precision what can only be imperfectly estimated, at least to date, through external scores), we would expect that criticisms of ESG could resonate, particularly when one is applying a long-term, value-creating lens.

But what some critics overlook is that a precondition for sustaining long-term value is to manage, and address, massive, paradigm-shifting externalities . Companies can conduct their operations in a seemingly rational way, aspire to deliver returns quarter to quarter, and determine their strategy over a span of five or more years. But if they assume that the base case does not include externalities or the erosion of social license by failing to take externalities into account, their forecasts—and indeed, their core strategies—may not be achievable at all. Amid a thicket of metrics, estimates, targets, and benchmarks, managers can miss the very point of why they are measuring in the first place: to ensure that their business endures, with societal support, in a sustainable, environmentally viable way.

ESG ratings: Does change matter?

Among the most sharply debated questions about environmental, social, and governance (ESG) is the extent to which ESG, as measured by ratings, can offer meaningful insights about future financial or TSR performance—particularly when ratings and scores providers use different, and sometimes mutually inconsistent, methodologies. A number of studies find a positive relationship between ESG ratings and financial performance. 1 Florian Berg, Julian Kölbel, and Roberto Rigobon, “Aggregate confusion: The divergence of ESG ratings,” Review of Finance, forthcoming, updated April 2022; Ulrich Atz, Casey Clark, and Tensie Whelan, ESG and financial performance: Uncovering the relationship by aggregating evidence from 1,000 plus studies published between 2015–2020 , NYU Stern Center for Sustainable Business, 2021. Other research suggests that while scoring well in ESG does not destroy financial value, the relationship between ESG ratings at any given time, and value creation at the identical time, can be tenuous or nonexistent. 2 See Chart of the Week , “Does ESG outperform? It’s a challenging question to answer,” blog post by Raymond Fu, Penn Mutual, September 23, 2021; Giovanni Bruno, Mikheil Esakia, and Felix Goltz, “‘Honey, I shrunk the ESG alpha’: Risk-adjusting ESG portfolio returns,” Journal of Investing , April 2022. Because of the short time frame over which the topic has been studied, and the resulting lack of robust analyses, conclusions from the analyses should be tempered. 3 When the ESG characteristic of a company changes, based on MSCI ESG data, it may be a useful financial indicator for generating alpha. Guido Giese et al., “Foundations of ESG investing: How ESG affects equity valuation, risk, and performance,” Journal of Portfolio Management , July 2019, Volume 45, Number 5.

In exploring the connection between ESG ratings and financial performance, another approach is to look at the effect of a change in ESG ratings. This approach mitigates issues deriving from differences among various ESG rating methodologies (assuming the methodologies are relatively consistent over time). It stands to reason that demonstrating real improvement—if reflected in the scores—could, in turn, drive TSR outperformance for multiple reasons, including those we explore in this article. Our initial research indicates, however, that it is too soon to tell. We found that on average companies that show an improvement in ESG ratings over multiyear time periods may exhibit higher shareholder returns compared with industry peers in the period after the improvement in ESG scores. We found, too, that the effect of this result has increased in recent years (exhibit). This initial finding is in line with some of the recent academic research and was also generally consistent across data from multiple ratings and scores providers.

Still, the findings are not yet conclusive. For example, only 54 percent of the companies we categorize as “improvers” and less than one-half of those categorized as “slight improvers” demonstrated a positive excess TSR. The research also does not prove causation. It is important to bear in mind that ESG scores are still evolving, observations in the aggregate may be less applicable to companies considered individually, and exogenous factors such as headwinds and tailwinds in industries and individual companies cannot be fully controlled for.