Kalamazoo Zoo

- Budgeting and Finance

Educator Access

A review copy of this case is available free of charge to educators and trainers. Please create an account or sign in to gain access to this material.

Permission to Reprint

Each purchase of this product entitles the buyer to one digital file and use. If you intend to distribute, teach, or share this item, you must purchase permission for each individual who will be given access. Learn more about purchasing permission to reprint .

Abstract: Variance analysis is widely used in budgeting and managerial accounting, and is a required skill to be taught in any introductory budget course. The Kalamazoo Zoo is a short, amusing case for use in teaching variance analysis. The case is best taught after students have already learned the basics of variance analysis, using a standard text. [Recommended material is Variance Analysis and Flexible Budgeting, Harvard Business School Publishing, Note 9-101-039, c 2000, and the on-line HBS tutorial on variance analysis]. The Kalamazoo case may be used as a short homework assignment or an in-class group exercise. In the case, students must determine why the Zoo is losing money. Using variance analysis, students can examine the impact of the Zoo's successful animal breeding program (which has produced a higher number of animals) and the quantity of food the animals are consuming. From this simple premise, the case can be used to discuss the revenue and expenditure implications for the Zoo, and to discuss how further variance analysis is necessary to fully understand the drivers of financial performance. The case also allows for a discussion of simple budget options that would enhance revenues and/or decrease expenditures. Learning Objective: Rory Lyons, the director of the Kalamazoo Zoo, must analyze the performance of the zoo in 2009, comparing the actual budget results to the expected budget forecast. The case asks students to perform basic variance analysis on ticket revenues and animal food expenditures, to analyze a number of options for closing the budget shortfall, and to recommend further areas in the budget for investigation.

Other Details

Related cases.

Give and Take: Philanthropy and the Central Park Children's Zoo

The marketplace for case solutions.

Kalamazoo Zoo – Case Solution

This case study analysis seeks to identify the reasons why Kalamazoo Zoo is losing money. It looks into the effect of the Zoo's program on animal breeding and the amount of food consumed by the animals. It also discusses the options related to budgeting which may help in a revenue increase or may lessen expenditures. With the application of variance analysis, students would be able to understand the factors affecting financial development.

Linda Bilmes Harvard Business Review ( KS1126-PDF-ENG ) April 15, 2015

Case questions answered:

- Perform a revenue and expenditure variance on the 2009 Kalamazoo Zoo budget based on the information provided in Table 1. State whether the revenue variance is favorable or unfavorable. State whether the expenditure variance is favorable or unfavorable. Use template #1 below to guide your analysis

- Using the additional operating data on Kalamazoo provided in Table 2, compute revenue quantity variance and price variance for annual ticket revenue and state whether each is favorable or unfavorable. What do we know about the zoo from doing this analysis?

- Using the data provided in Table 2, compute expenditure quantity and price variance for animal food expenditures and state whether each is favorable or unfavorable. What do we learn about the Kalamazoo Zoo from doing this analysis?

- What is the overall situation at the zoo that we see from performing these variances? Reviewing these issues and the budget, what else should Rory Lyons investigate? What information is needed to be able to perform these analyses?

Not the questions you were looking for? Submit your own questions & get answers .

Kalamazoo Zoo Case Answers

This case solution includes an Excel file with calculations.

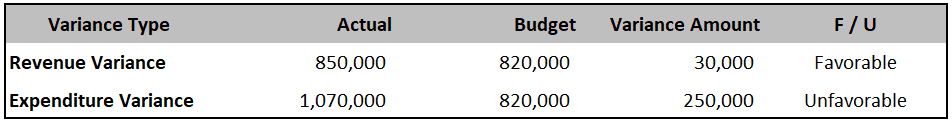

Perform a revenue and expenditure variance on the 2009 Kalamazoo Zoo budget based on the information provided in Table 1.

State whether the revenue variance for Kalamazoo Zoo is favorable or unfavorable. State whether the expenditure variance is favorable or unfavorable. Use template #1 below to guide your analysis

Using the additional operating data on Kalamazoo provided in Table 2, compute revenue quantity variance and price variance for annual ticket revenue and state whether each is favorable or unfavorable.

What do we know about the zoo from doing this analysis?

The Kalamazoo Zoo estimated the number of tickets sold to be 15,000 tickets. However, they actually sold 5,000 fewer tickets than expected. Thus resulting in an unfavorable variance of $40,000.

On the other hand, the zoo sold tickets at a higher price than expected ($10.00 compared to $8.00), possibly because…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

Kalamazoo Zoo

Case solution.

Linda Bilmes Harvard Kennedy School ( KS1126-PDF-ENG ) April 15, 2015

We don‘t have the case solution, but we pay up to $50 for yours!

- Set a reminder to receive an email after your university‘s case study deadline.

- Upload your case study solution. We will review it for quality.

- Get your money via PayPal or to your bank account.

Kalamazoo Zoo

- Harvard Case Studies

Kalamazoo Zoo Case Study Solution & Analysis

In most courses studied at Harvard Business schools, students are provided with a case study. Major HBR cases concerns on a whole industry, a whole organization or some part of organization; profitable or non-profitable organizations. Student’s role is to analyze the case and diagnose the situation, identify the problem and then give appropriate recommendations and steps to be taken.

To make a detailed case analysis, student should follow these steps:

STEP 1: Reading Up Harvard Case Study Method Guide:

Case study method guide is provided to students which determine the aspects of problem needed to be considered while analyzing a case study. It is very important to have a thorough reading and understanding of guidelines provided. However, poor guide reading will lead to misunderstanding of case and failure of analyses. It is recommended to read guidelines before and after reading the case to understand what is asked and how the questions are to be answered. Therefore, in-depth understanding f case guidelines is very important.

Harvard Case Study Solutions

STEP 2: Reading The Kalamazoo Zoo Harvard Case Study:

To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done. Initial reading is to get a rough idea of what information is provided for the analyses. Then, a very careful reading should be done at second time reading of the case. This time, highlighting the important point and mark the necessary information provided in the case. In addition, the quantitative data in case, and its relations with other quantitative or qualitative variables should be given more importance. Also, manipulating different data and combining with other information available will give a new insight. However, all of the information provided is not reliable and relevant.

When having a fast reading, following points should be noted:

- Nature of organization

- Nature if industry in which organization operates.

- External environment that is effecting organization

- Problems being faced by management

- Identification of communication strategies.

- Any relevant strategy that can be added.

- Control and out-of-control situations.

When reading the case for second time, following points should be considered:

- Decisions needed to be made and the responsible Person to make decision.

- Objectives of the organization and key players in this case.

- The compatibility of objectives. if not, their reconciliations and necessary redefinition.

- Sources and constraints of organization from meeting its objectives.

After reading the case and guidelines thoroughly, reader should go forward and start the analyses of the case.

STEP 3: Doing The Case Analysis Of Kalamazoo Zoo:

To make an appropriate case analyses, firstly, reader should mark the important problems that are happening in the organization. There may be multiple problems that can be faced by any organization. Secondly, after identifying problems in the company, identify the most concerned and important problem that needed to be focused.

Firstly, the introduction is written. After having a clear idea of what is defined in the case, we deliver it to the reader. It is better to start the introduction from any historical or social context. The challenging diagnosis for Kalamazoo Zoo and the management of information is needed to be provided. However, introduction should not be longer than 6-7 lines in a paragraph. As the most important objective is to convey the most important message for to the reader.

After introduction, problem statement is defined. In the problem statement, the company’s most important problem and constraints to solve these problems should be define clearly. However, the problem should be concisely define in no more than a paragraph. After defining the problems and constraints, analysis of the case study is begin.

STEP 4: SWOT Analysis of the Kalamazoo Zoo HBR Case Solution:

SWOT analysis helps the business to identify its strengths and weaknesses, as well as understanding of opportunity that can be availed and the threat that the company is facing. SWOT for Kalamazoo Zoo is a powerful tool of analysis as it provide a thought to uncover and exploit the opportunities that can be used to increase and enhance company’s operations. In addition, it also identifies the weaknesses of the organization that will help to be eliminated and manage the threats that would catch the attention of the management.

This strategy helps the company to make any strategy that would differentiate the company from competitors, so that the organization can compete successfully in the industry. The strengths and weaknesses are obtained from internal organization. Whereas, the opportunities and threats are generally related from external environment of organization. Moreover, it is also called Internal-External Analysis.

In the strengths, management should identify the following points exists in the organization:

- Advantages of the organization

- Activities of the company better than competitors.

- Unique resources and low cost resources company have.

- Activities and resources market sees as the company’s strength.

- Unique selling proposition of the company.

WEAKNESSES:

- Improvement that could be done.

- Activities that can be avoided for Kalamazoo Zoo.

- Activities that can be determined as your weakness in the market.

- Factors that can reduce the sales.

- Competitor’s activities that can be seen as your weakness.

OPPORTUNITIES:

- Good opportunities that can be spotted.

- Interesting trends of industry.

- Change in technology and market strategies

- Government policy changes that is related to the company’s field

- Changes in social patterns and lifestyles.

- Local events.

Following points can be identified as a threat to company:

- Company’s facing obstacles.

- Activities of competitors.

- Product and services quality standards

- Threat from changing technologies

- Financial/cash flow problems

- Weakness that threaten the business.

Following points should be considered when applying SWOT to the analysis:

- Precise and verifiable phrases should be sued.

- Prioritize the points under each head, so that management can identify which step has to be taken first.

- Apply the analyses at proposed level. Clear yourself first that on what basis you have to apply SWOT matrix.

- Make sure that points identified should carry itself with strategy formulation process.

- Use particular terms (like USP, Core Competencies Analyses etc.) to get a comprehensive picture of analyses.

STEP 5: PESTEL/ PEST Analysis of Kalamazoo Zoo Case Solution:

Pest analyses is a widely used tool to analyze the Political, Economic, Socio-cultural, Technological, Environmental and legal situations which can provide great and new opportunities to the company as well as these factors can also threat the company, to be dangerous in future.

Pest analysis is very important and informative. It is used for the purpose of identifying business opportunities and advance threat warning. Moreover, it also helps to the extent to which change is useful for the company and also guide the direction for the change. In addition, it also helps to avoid activities and actions that will be harmful for the company in future, including projects and strategies.

To analyze the business objective and its opportunities and threats, following steps should be followed:

- Brainstorm and assumption the changes that should be made to organization. Answer the necessary questions that are related to specific needs of organization

- Analyze the opportunities that would be happen due to the change.

- Analyze the threats and issues that would be caused due to change.

- Perform cost benefit analyses and take the appropriate action.

Pest analysis

PEST FACTORS:

- Next political elections and changes that will happen in the country due to these elections

- Strong and powerful political person, his point of view on business policies and their effect on the organization.

- Strength of property rights and law rules. And its ratio with corruption and organized crimes. Changes in these situation and its effects.

- Change in Legislation and taxation effects on the company

- Trend of regulations and deregulations. Effects of change in business regulations

- Timescale of legislative change.

- Other political factors likely to change for Kalamazoo Zoo.

ECONOMICAL:

- Position and current economy trend i.e. growing, stagnant or declining.

- Exchange rates fluctuations and its relation with company.

- Change in Level of customer’s disposable income and its effect.

- Fluctuation in unemployment rate and its effect on hiring of skilled employees

- Access to credit and loans. And its effects on company

- Effect of globalization on economic environment

- Considerations on other economic factors

SOCIO-CULTURAL:

- Change in population growth rate and age factors, and its impacts on organization.

- Effect on organization due to Change in attitudes and generational shifts.

- Standards of health, education and social mobility levels. Its changes and effects on company.

- Employment patterns, job market trend and attitude towards work according to different age groups.

case study solutions

- Social attitudes and social trends, change in socio culture an dits effects.

- Religious believers and life styles and its effects on organization

- Other socio culture factors and its impacts.

TECHNOLOGICAL:

- Any new technology that company is using

- Any new technology in market that could affect the work, organization or industry

- Access of competitors to the new technologies and its impact on their product development/better services.

- Research areas of government and education institutes in which the company can make any efforts

- Changes in infra-structure and its effects on work flow

- Existing technology that can facilitate the company

- Other technological factors and their impacts on company and industry

These headings and analyses would help the company to consider these factors and make a “big picture” of company’s characteristics. This will help the manager to take the decision and drawing conclusion about the forces that would create a big impact on company and its resources.

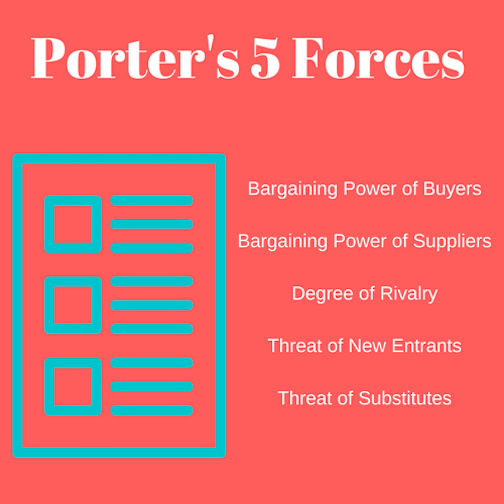

STEP 6: Porter’s Five Forces/ Strategic Analysis Of The Kalamazoo Zoo Case Study:

To analyze the structure of a company and its corporate strategy, Porter’s five forces model is used. In this model, five forces have been identified which play an important part in shaping the market and industry. These forces are used to measure competition intensity and profitability of an industry and market.

porter’s five forces model

These forces refers to micro environment and the company ability to serve its customers and make a profit. These five forces includes three forces from horizontal competition and two forces from vertical competition. The five forces are discussed below:

- THREAT OF NEW ENTRANTS:

- as the industry have high profits, many new entrants will try to enter into the market. However, the new entrants will eventually cause decrease in overall industry profits. Therefore, it is necessary to block the new entrants in the industry. following factors is describing the level of threat to new entrants:

- Barriers to entry that includes copy rights and patents.

- High capital requirement

- Government restricted policies

- Switching cost

- Access to suppliers and distributions

- Customer loyalty to established brands.

- THREAT OF SUBSTITUTES:

- this describes the threat to company. If the goods and services are not up to the standard, consumers can use substitutes and alternatives that do not need any extra effort and do not make a major difference. For example, using Aquafina in substitution of tap water, Pepsi in alternative of Coca Cola. The potential factors that made customer shift to substitutes are as follows:

- Price performance of substitute

- Switching costs of buyer

- Products substitute available in the market

- Reduction of quality

- Close substitution are available

- DEGREE OF INDUSTRY RIVALRY:

- the lesser money and resources are required to enter into any industry, the higher there will be new competitors and be an effective competitor. It will also weaken the company’s position. Following are the potential factors that will influence the company’s competition:

- Competitive advantage

- Continuous innovation

- Sustainable position in competitive advantage

- Level of advertising

- Competitive strategy

- BARGAINING POWER OF BUYERS:

- it deals with the ability of customers to take down the prices. It mainly consists the importance of a customer and the level of cost if a customer will switch from one product to another. The buyer power is high if there are too many alternatives available. And the buyer power is low if there are lesser options of alternatives and switching. Following factors will influence the buying power of customers:

- Bargaining leverage

- Switching cost of a buyer

- Buyer price sensitivity

- Competitive advantage of company’s product

- BARGAINING POWER OF SUPPLIERS:

- this refers to the supplier’s ability of increasing and decreasing prices. If there are few alternatives o supplier available, this will threat the company and it would have to purchase its raw material in supplier’s terms. However, if there are many suppliers alternative, suppliers have low bargaining power and company do not have to face high switching cost. The potential factors that effects bargaining power of suppliers are the following:

- Input differentiation

- Impact of cost on differentiation

- Strength of distribution centers

- Input substitute’s availability.

STEP 7: VRIO Analysis of Kalamazoo Zoo:

Vrio analysis for Kalamazoo Zoo case study identified the four main attributes which helps the organization to gain a competitive advantages. The author of this theory suggests that firm must be valuable, rare, imperfectly imitable and perfectly non sustainable. Therefore there must be some resources and capabilities in an organization that can facilitate the competitive advantage to company. The four components of VRIO analysis are described below: VALUABLE: the company must have some resources or strategies that can exploit opportunities and defend the company from major threats. If the company holds some value then answer is yes. Resources are also valuable if they provide customer satisfaction and increase customer value. This value may create by increasing differentiation in existing product or decrease its price. Is these conditions are not met, company may lead to competitive disadvantage. Therefore, it is necessary to continually review the Kalamazoo Zoo company’s activities and resources values. RARE: the resources of the Kalamazoo Zoo company that are not used by any other company are known as rare. Rare and valuable resources grant much competitive advantages to the firm. However, when more than one few companies uses the same resources and provide competitive parity are also known as rare resources. Even, the competitive parity is not desired position, but the company should not lose its valuable resources, even they are common. COSTLY TO IMITATE : the resources are costly to imitate, if other organizations cannot imitate it. However, imitation is done in two ways. One is duplicating that is direct imitation and the other one is substituting that is indirect imitation. Any firm who has valuable and rare resources, and these resources are costly to imitate, have achieved their competitive advantage. However, resources should also be perfectly non sustainable. The reasons that resource imitation is costly are historical conditions, casual ambiguity and social complexity. ORGANIZED TO CAPTURE VALUE : resources, itself, cannot provide advantages to organization until it is organized and exploit to do so. A firm (like Kalamazoo Zoo) must organize its management systems, processes, policies and strategies to fully utilize the resource’s potential to be valuable, rare and costly to imitate.

STEP 8: Generating Alternatives For Kalamazoo Zoo Case Solution:

After completing the analyses of the company, its opportunities and threats, it is important to generate a solution of the problem and the alternatives a company can apply in order to solve its problems. To generate the alternative of problem, following things must to be kept in mind:

- Realistic solution should be identified that can be operated in the company, with all its constraints and opportunities.

- as the problem and its solution cannot occur at the same time, it should be described as mutually exclusive

- it is not possible for a company to not to take any action, therefore, the alternative of doing nothing is not viable.

- Student should provide more than one decent solution. Providing two undesirable alternatives to make the other one attractive is not acceptable.

Once the alternatives have been generated, student should evaluate the options and select the appropriate and viable solution for the company.

STEP 9: Selection Of Alternatives For Kalamazoo Zoo Case Solution:

It is very important to select the alternatives and then evaluate the best one as the company have limited choices and constraints. Therefore to select the best alternative, there are many factors that is needed to be kept in mind. The criteria’s on which business decisions are to be selected areas under:

- Improve profitability

- Increase sales, market shares, return on investments

- Customer satisfaction

- Brand image

- Corporate mission, vision and strategy

- Resources and capabilities

Alternatives should be measures that which alternative will perform better than other one and the valid reasons. In addition, alternatives should be related to the problem statements and issues described in the case study.

STEP 10: Evaluation Of Alternatives For Kalamazoo Zoo Case Solution:

If the selected alternative is fulfilling the above criteria, the decision should be taken straightforwardly. Best alternative should be selected must be the best when evaluating it on the decision criteria. Another method used to evaluate the alternatives are the list of pros and cons of each alternative and one who has more pros than cons and can be workable under organizational constraints.

STEP 11: Recommendations For Kalamazoo Zoo Case Study (Solution):

There should be only one recommendation to enhance the company’s operations and its growth or solving its problems. The decision that is being taken should be justified and viable for solving the problems.

- Order Status

- Testimonials

- What Makes Us Different

Kalamazoo Zoo Harvard Case Solution & Analysis

Home >> Finance Case Studies Analysis >> Kalamazoo Zoo

Variance analysis is popular in budgeting and managerial accounting , and is a required skill to be instructed in any opening budget course. The Kalamazoo Zoo is a brief, amusing instance to be used in teaching variance analysis. The case is best taught after students have learned the basics of variance analysis, using a regular text. [Recommended content is "Variance Analysis and Flexible Budgeting," Harvard Business School Publishing, Note 9-101-039, c 2000, and the on line HBS tutorial on variance analysis].

Kalamazoo Zoo Case Study Solution

The Kalamazoo case may act as a brief homework assignment or an in-class group exercise. In the case, pupils must determine why the Zoo is losing cash. Using variance analysis, students can examine the impact of the Zoo's successful animal breeding application (which has produced a higher number of animals) and the amount of food the creatures are consuming. From this easy premise, the case can be utilized to discuss how additional variance analysis is essential to fully understand the drivers of financial performance, and to discuss the expenditure and revenue implications for the Zoo. The case also allows for a discussion of simple budget choices that would enhance earnings and reduce costs.

PUBLICATION DATE: April 15, 2015 PRODUCT #: KS1126-HCB-ENG

This is just an excerpt. This case is about FINANCE & ACCOUNTING

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Finance Case Studies Analysis

- HP Labs in Singapore

- Alibaba's IPO Dilemma: Hong Kong or New York?

- CHINT Group (C): CHINT Going Global

- The Pitcairn Family Heritage Fund

- Great Eastern Toys (B)

- Northstar Aerospace

- El Centro de la Raza

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

2. Company growth trends:

This will help you obtain an understanding of the company's current stage in the business cycle and will give you an idea of what the scope of the solution should be.

3. Company culture:

Work culture in a company tells a lot about the workforce itself. You can understand this by going through the instances involving employees that the HBR case study provides. This will be helpful in understanding if the proposed case study solution will be accepted by the workforce and whether it will consist of the prevailing culture in the company.

Kalamazoo Zoo Financial Analysis

The third step of solving the Kalamazoo Zoo Case Study is Kalamazoo Zoo Financial Analysis. You can go about it in a similar way as is done for a finance and accounting case study. For solving any Kalamazoo Zoo case, Financial Analysis is of extreme importance. You should place extra focus on conducting Kalamazoo Zoo financial analysis as it is an integral part of the Kalamazoo Zoo Case Study Solution. It will help you evaluate the position of Kalamazoo Zoo regarding stability, profitability and liquidity accurately. On the basis of this, you will be able to recommend an appropriate plan of action. To conduct a Kalamazoo Zoo financial analysis in excel,

- Past year financial statements need to be extracted.

- Liquidity and profitability ratios to be calculated from the current financial statements.

- Ratios are compared with the past year Kalamazoo Zoo calculations

- Company’s financial position is evaluated.

Another way how you can do the Kalamazoo Zoo financial analysis is through financial modelling. Financial Analysis through financial modelling is done by:

- Using the current financial statement to produce forecasted financial statements.

- A set of assumptions are made to grow revenue and expenses.

- Value of the company is derived.

Financial Analysis is critical in many aspects:

- Decision Making and Strategy Devising to achieve targeted goals- to determine the future course of action.

- Getting credit from suppliers depending on the leverage position- creditors will be confident to supply on credit if less company debt.

- Influence on Investment Decisions- buying and selling of stock by investors.

Thus, it is a snapshot of the company and helps analysts assess whether the company's performance has improved or deteriorated. It also gives an insight about its expected performance in future- whether it will be going concern or not. Kalamazoo Zoo Financial analysis can, therefore, give you a broader image of the company.

Kalamazoo Zoo NPV

Kalamazoo Zoo's calculations of ratios only are not sufficient to gauge the company performance for investment decisions. Instead, investment appraisal methods should also be considered. Kalamazoo Zoo NPV calculation is a very important one as NPV helps determine whether the investment will lead to a positive value or a negative value. It is the best tool for decision making.

There are many benefits of using NPV:

- It takes into account the future value of money, thereby giving reliable results.

- It considers the cost of capital in its calculations.

- It gives the return in dollar terms simplifying decision making.

The formula that you will use to calculate Kalamazoo Zoo NPV will be as follows:

Present Value of Future Cash Flows minus Initial Investment

Present Value of Future cash flows will be calculated as follows:

PV of CF= CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + …CFn/(1+r)^n

where CF = cash flows r = cost of capital n = total number of years.

Cash flows can be uniform or multiple. You can discount them by Kalamazoo Zoo WACC as the discount rate to arrive at the present value figure. You can then use the resulting figure to make your investment decision. The decision criteria would be as follows:

- If Present Value of Cash Flows is greater than Initial Investment, you can accept the project.

- If Present Value of Cash Flows is less than Initial Investment, you can reject the project.

Thus, calculation of Kalamazoo Zoo NPV will give you an insight into the value generated if you invest in Kalamazoo Zoo. It is a very reliable tool to assess the feasibility of an investment as it helps determine whether the cash flows generated will help yield a positive return or not.

However, it would be better if you take various aspects under consideration. Thus, apart from Kalamazoo Zoo’s NPV, you should also consider other capital budgeting techniques like Kalamazoo Zoo’s IRR to evaluate and fine-tune your investment decisions.

Kalamazoo Zoo DCF

Once you are done with calculating the Kalamazoo Zoo NPV for your finance and accounting case study, you can proceed to the next step, which involves calculating the Kalamazoo Zoo DCF. Discounted cash flow (DCF) is a Kalamazoo Zoo valuation method used to estimate the value of an investment based on its future cash flows. For a better presentation of your finance case solution, it is recommended to use Kalamazoo Zoo excel for the DCF analysis.

To calculate the Kalamazoo Zoo DCF analysis, the following steps are required:

- Calculate the expected future cash inflows and outflows.

- Set-off inflows and outflows to obtain the net cash flows.

- Find the present value of expected future net cash flows using a discount rate, which is usually the weighted-average cost of capital (WACC).

- If the value calculated through Kalamazoo Zoo DCF is higher than the current cost of the investment, the opportunity should be considered

- If the current cost of the investment is higher than the value calculated through DCF, the opportunity should be rejected

Kalamazoo Zoo DCF can also be calculated using the following formula:

DCF= CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + …CFn/(1+r)^n

In the formula:

- CF= Cash flows

- R= discount rate (WACC)

Kalamazoo Zoo WACC

When making different Kalamazoo Zoo's calculations, Kalamazoo Zoo WACC calculation is of great significance. WACC calculation is done by the capital composition of the company. The formula will be as follows:

Weighted Average Cost of Capital = % of Debt * Cost of Debt * (1- tax rate) + % of equity * Cost of Equity

You can compute the debt and equity percentage from the balance sheet figures. For the cost of equity, you can use the CAPM model. Cost of debt is usually given. However, if it isn't mentioned, you can calculate it through market weighted average debt. Kalamazoo Zoo’s WACC will indicate the rate the company should earn to pay its capital suppliers. Kalamazoo Zoo WACC can be analysed in two ways:

- From the company's perspective, it can be analysed as the cost to be paid to the capital providers also known as Cost of Capital

- From an investor' perspective, if the expected return on the investment exceeds Kalamazoo Zoo WACC, the investor will go ahead with the investment as a positive value would be generated.

Kalamazoo Zoo IRR

After calculating the Kalamazoo Zoo WACC, it is necessary to calculate the Kalamazoo Zoo IRR as well, as WACC alone does not say much about the company’s overall situation. Kalamazoo Zoo IRR will add meaning to the finance solution that you are working on. The internal rate of return is a tool used in investment appraisal to calculate the profitability of prospective investments. IRR calculations are dependent on the same formula as Kalamazoo Zoo NPV.

There are two ways to calculate the Kalamazoo Zoo IRR.

- By using a Kalamazoo Zoo Excel Spreadsheet: There are in-built formulae for calculating IRR.

IRR= R + [NPVa / (NPVa - NPVb) x (Rb - Ra)]

In this formula:

- Ra= lower discount rate chosen

- Rb= higher discount rate chosen

- NPVa= NPV at Ra

- NPVb= NPV at Rb

Kalamazoo Zoo IRR impacts your finance case solution in the following ways:

- If IRR>WACC, accept the alternative

- If IRR<WACC, reject the alternative

Kalamazoo Zoo Excel Spreadsheet

All your Kalamazoo Zoo calculations should be done in a Kalamazoo Zoo xls Spreadsheet. A Kalamazoo Zoo excel spreadsheet is the best way to present your finance case solution. The Kalamazoo Zoo Calculations should be presented in Kalamazoo Zoo excel in such a way that the analysis and results can be distinguished to the viewers. The point of Kalamazoo Zoo excel is to present large amounts of data in clear and consumable ways. Presenting your data is also going to make sure that you don't have misinterpretations of the data.

To make your Kalamazoo Zoo calculations sheet more meaningful, you should:

- Think about the order of the Kalamazoo Zoo xls worksheets in your finance case solution

- Use more Kalamazoo Zoo xls worksheets and tables as will divide the data that you are looking at in sections.

- Choose clarity overlooks

- Keep your timeline consistent

- Organise the information flow

- Clarify your sources

The following tips and bits should be kept in mind while preparing your finance case solution in a Kalamazoo Zoo xls spreadsheet:

- Avoid using fixed numbers in formulae

- Avoid hiding data

- Useless and meaningful colours, such as highlighting negative numbers in red

- Label column and rows

- Correct your alignment

- Keep formulae readable

- Strategically freeze header column and row

Kalamazoo Zoo Ratio analysis

After you have your Kalamazoo Zoo calculations in a Kalamazoo Zoo xls spreadsheet, you can move on to the next step which is ratio analysis. Ratio analysis is an analysis of information in the form of figures contained in the financial statements of a company. It will help you evaluate various aspects of a company's operating and financial performance which can be done in Kalamazoo Zoo Excel.

To conduct a ratio analysis that covers all financial aspects, divide the analysis as follows:

- Liquidity Ratios: Liquidity ratios gauge a company's ability to pay off its short-term debt. These include the current ratio, quick ratio, and working capital ratio.

- Solvency ratios: Solvency ratios match a company's debt levels with its assets, equity, and earnings. These include the debt-equity ratio, debt-assets ratio, and interest coverage ratio.

- Profitability Ratios: These show how effectively a company can generate profits through its operations. Profit margin, return on assets, return on equity, return on capital employed, and gross margin ratio is examples of profitability ratios.

- Efficiency ratios: Efficiency ratios analyse how efficiently a company uses its assets and liabilities to boost sales and increase profits.

- Coverage Ratios: These ratios measure a company's ability to make the interest payments and other obligations associated with its debts. Examples include times interest earned ratio and debt-service coverage ratio.

- Market Prospect Ratios: These include dividend yield, P/E ratio, earnings per share, and dividend payout ratio.

Kalamazoo Zoo Valuation

Kalamazoo Zoo Valuation is a very fundamental requirement if you want to work out your Harvard Business Case Solution. Kalamazoo Zoo Valuation includes a critical analysis of the company's capital structure – the composition of debt and equity in it, and the fair value of its assets. Common approaches to Kalamazoo Zoo valuation include

- DDM is an appropriate method if dividends are being paid to shareholders and the dividends paid are in line with the earnings of the company.

- FCFF is used when the company has a combination of debt and equity financing.

- FCFE, on the other hand, shows the cash flow available to equity holders only.

These three methods explained above are very commonly used to calculate the value of the firm. Investment decisions are undertaken by the value derived.

Kalamazoo Zoo calculations for projected cash flows and growth rates are taken under consideration to come up with the value of firm and value of equity. These figures are used to determine the net worth of the business. Net worth is a very important concept when solving any finance and accounting case study as it gives a deep insight into the company's potential to perform in future.

Alternative Solutions

After doing your case study analysis, you move to the next step, which is identifying alternative solutions. These will be other possibilities of Harvard Business case solutions that you can choose from. For this, you must look at the Kalamazoo Zoo case analysis in different ways and find a new perspective that you haven't thought of before.

Once you have listed or mapped alternatives, be open to their possibilities. Work on those that:

- need additional information

- are new solutions

- can be combined or eliminated

After listing possible options, evaluate them without prejudice, and check if enough resources are available for implementation and if the company workforce would accept it.

For ease of deciding the best Kalamazoo Zoo case solution, you can rate them on numerous aspects, such as:

- Feasibility

- Suitability

- Flexibility

Implementation

Once you have read the Kalamazoo Zoo HBR case study and have started working your way towards Kalamazoo Zoo Case Solution, you need to be clear about different financial concepts. Your Mondavi case answers should reflect your understanding of the Kalamazoo Zoo Case Study.

You should be clear about the advantages, disadvantages and method of each financial analysis technique. Knowing formulas is also very essential or else you will mess up with your analysis. Therefore, you need to be mindful of the financial analysis method you are implementing to write your Kalamazoo Zoo case study solution. It should closely align with the business structure and the financials as mentioned in the Kalamazoo Zoo case memo.

You can also refer to Kalamazoo Zoo Harvard case to have a better understanding and a clearer picture so that you implement the best strategy. There are a number of benefits if you keep a wide range of financial analysis tools at your fingertips.

- Your Kalamazoo Zoo HBR Case Solution would be quite accurate

- You will have an option to choose from different methods, thus helping you choose the best strategy.

Recommendation and Action Plan

Once you have successfully worked out your financial analysis using the most appropriate method and come up with Kalamazoo Zoo HBR Case Solution, you need to give the final finishing by adding a recommendation and an action plan to be followed. The recommendation can be based on the current financial analysis. When making a recommendation,

- You need to make sure that it is not generic and it will help in increasing company value

- It is in line with the case study analysis you have conducted

- The Kalamazoo Zoo calculations you have done support what you are recommending

- It should be clear, concise and free of complexities

Also, adding an action plan for your recommendation further strengthens your Kalamazoo Zoo HBR case study argument. Thus, your action plan should be consistent with the recommendation you are giving to support your Kalamazoo Zoo financial analysis. It is essential to have all these three things correlated to have a better coherence in your argument presented in your case study analysis and solution which will be a part of Kalamazoo Zoo Case Answer.

Arbaugh, W. (2000). Windows of vulnerability: A case study analysis. Retrieved from Colorado State University Web site: http://www.cs.colostate.edu/~cs635/Windows_of_Vulnerability.pdf

Choi, J. J., Ju, M., Kotabe, M., Trigeorgis, L., & Zhang, X. T. (2018). Flexibility as firm value driver: Evidence from offshore outsourcing. Global Strategy Journal, 8(2), 351-376.

DeBoeuf, D., Lee, H., Johnson, D., & Masharuev, M. (2018). Purchasing power return, a new paradigm of capital investment appraisal. Managerial Finance, 44(2), 241-256.

Delaney, C. J., Rich, S. P., & Rose, J. T. (2016). A Paradox within the Time Value of Money: A Critical Thinking Exercise for Finance Students. American Journal of Business Education, 9(2), 83-86.

Easton, M., & Sommers, Z. (2018). Financial Statement Analysis & Valuation. Seattle: amazon.com.

Gotze, U., Northcott, D., & Schuster, P. (2016). Investment Appraisal. Berlin: Springer.

Greco, S., Figueira, J., & Ehrgott, M. (2016). Multiple criteria decision analysis. New York: Springer.

Hawkins, D. (1997). Corporate financial reporting and analysis: Text and cases. Homewood, IL: Irwin/McGraw-Hill.

Hribar, P., Melessa, S., Mergenthaler, R., & Small, R. C. (2018). An Examination of the Relative Abilities of Earnings and Cash Flows to Explain Returns and Market Values. Rotman School of Management Working Paper, 10-15.

Kaszas, M., & Janda, K. (2018). The Impact of Globalization on International Finance and Accounting. In Indirect Valuation and Earnings Stability: Within-Company Use of the Earnings Multiple (pp. 161-172). Berlin, Germany: Springer, Cham.

King, R., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The quarterly journal of economics, 108(3), 717-737.

Kraus, S., Kallmuenzer, A., Stieger, D., Peters, M., & Calabrò, A. (2018). Entrepreneurial paths to family firm performance. Journal of Business Research, 88, 382-387.

Laaksonen, O., & Peltoniemi, M. (2018). The essence of dynamic capabilities and their measurement. International Journal of Management Reviews, 20(2), 184-205.

Lamberton, D. (2011). Introduction to stochastic calculus applied to finance. UK: Chapman and Hall.

Landier, A. (2015). The WACC fallacy: The real effects of using a unique discount rate. The Journal of Finance, 70(3), 1253-1285.

Lee, L., Kerler, W., & Ivancevich, D. (2018). Beyond Excel: Software Tools and the Accounting Curriculum. AIS Educator Journal, 13(1), 44-61.

Li, W. S. (2018). Strategic Value Analysis: Business Valuation. In Strategic Management Accounting. Singapore: Springer.

Magni, C. (2015). Investment, financing and the role of ROA and WACC in value creation. European Journal of Operational Research, 244(3), 855-866.

Marchioni, A., & Magni, C. A. (2018). Sensitivity Analysis and Investment Decisions: NPV-Consistency of Straight-Line Rate of Return. Department of Economics.

Metcalfe, J., & Miles, I. (2012). Innovation systems in the service economy: measurement and case study analysis. Berlin, Germany: Springer Science & Business Media.

Oliveira, F. B., & Zotes, L. P. (2018). Valuation methodologies for business startups: a bibliographical study and survey. Brazilian Journal of Operations & Production Management, 15(1), 96-111.

Pellegrino, R., Costantino, N., & Tauro, D. (2018). Supply Chain Finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. Journal of Purchasing and Supply Management, 1-10.

Pham, T. N., & Alenikov, T. (2018). The importance of Weighted Average Cost of Capital in investment decision-making for investors of corporations in the healthcare industry.

Smith, K. T., Betts, T. K., & Smith, L. M. (2018). Financial analysis of companies concerned about human rights. International Journal of Business Excellence, 14(3), 360-379.

Teresa, M. G. (2018). How the Equity Terminal Value Influences the Value of the Firm. Journal of Business Valuation and Economic Loss Analysis, 13(1).

Yang, Y., Pankow, J., Swan, H., Willett, J., Mitchell, S. G., Rudes, D. S., & Knight, K. (2018). Preparing for analysis: a practical guide for a critical step for procedural rigour in large-scale multisite qualitative research studies. Quality and Quantity, 52(2), 815-828.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here .

9416 Students can’t be wrong

PhD Experts

Mansi Arora

My friends and I comment about this service that this service is attached to its clients and always drafts the paper that is close to the instructions of the students. Thanks!

Sunil Victor

They formulated the assignment without misinterpreting it. I'm grateful for critical analysis and pithy headings!

Received the paper without mistake and on time. Excellent quality and full extension of all subjects. Lots of thanks for this help!

Chiara Mario

Asked them to edit my assignment and this service did a great job. The writer almost rewrite the 70% of paper. Thank you so much!

Calculate the Price

(approx ~ 0.0 page), total price €0, next articles.

- Street League Skateboarding: The Challenges Facing A New Sports League Case Solution

- Everything Is Connected: A New Era Of Sustainability At Li & Fung Case Solution

- Yasuni ITT Trust Fund (C), Spanish Version Case Solution

- Yasuni ITT Trust Fund (A) Case Solution

- Yasuni ITT Trust Fund (B), Spanish Version Case Solution

- AgFeed Industries Inc From Reverse Merger To Reversal Of Fortune Case Solution

- The Climate Corporation: New Options For Farmers Case Solution

- Steve Jobs: Leader Strategist Case Solution

- YU Ranch: Growing A Sustainable Business Case Solution

- Tirumala Tirupati: Wait A Moment Case Solution

Previous Articles

- The Toliza Museum Of Art Case Solution

- SimpliFlying (A): Making A Great Idea Take Flight Case Solution

- Novartis Pharmaceuticals Corp: Redefining Success In The U.S. (B) Case Solution

- Key Elements For Excellence In Classroom Cases And Teaching Notes Case Solution

- SimpliFlying: Making A Great Idea Take Flight (A) Case Solution

- Disruption In The Air: Surf Air's All You Can Fly Business Model Case Solution

- BPI Globe Banko: Reshaping The Philippines Rural Banking System Case Solution

- The Great Divergence: Europe And Modern Economic Growth Case Solution

- The CAT Project Case Solution

- Haier: Zero Distance To The Customer (A), Chinese Version Case Solution

Be a great writer or hire a greater one!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Case48 with BIG enough reputation.

Our Guarantees

Zero plagiarism, best quality, qualified writers, absolute privacy, timely delivery.

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!

Allow Our Skilled Essay Writers to Proficiently Finish Your Paper.

We are here to help. Chat with us on WhatsApp for any queries.

Customer Representative

The Kalamazoo Zoo Case Solution & Answer

Home » Case Study Analysis Solutions » The Kalamazoo Zoo

The Kalamazoo Zoo Case SolutionÂ

Based on the overall analysis made, the performance of the zoo has been very disappointing. Most of the budget estimations were not achieved in the actual performance. The revenues are less than estimated, as well as costs are higher than expected. Overall, this is a bad year for the zoo. The breed program was, however, favorable with more new born animals.

There might be two possible reasons for the bad performance;firstly, the weather condition might attract fewer visitors to the zoo than usual as well as the increased inflation might be the reason for the increased prices for food. There might also be a possibility that the budget that was made was unrealistic and did not incorporate many other available information and facts.

Moreover, another element of revenue was donations, as per calculation the donations have unfavorable variance. This should also be considered by the management of the zoo.

| Quantity | 1000 | 500 | 200 | 100000 | Favorable |

| Price | 50 | 200 | 1000 | -150000 | Unfavorable |

Another problem is with the overtime cost. As per the budget and as per the operating cost data given, these costs were not in resemblance, therefore Rory Lyons should investigate in this matter. The information of the workers and the overtime hours worked should be obtained. The rate that is $434 per day is also suspected to be manipulated.

None of the options will help to achieve a break even point. However, as per the analysis based on the actual budget, the best option with least deficit is option 3, which is to fire one of the two assistant zookeepers.

As per option 1 the net impact on the deficit is increment of $80,000 more in the current deficit.

| -220000 | |

| -300,000 | |

| -80,000 |

As per option 2 the net impact on the deficit is increment of $60,000 more in the current deficit.

| -220000 | |

| -280,000 | |

| -60,000 |

As per option 3 the net impact on the deficit is increment of $46,875 more in the current deficit.

| -220000 | |

| -266,875 | |

| -46,875 |

Therefore, option 3 with least increment on deficit is the best option. Moreover, in option 3 there is no data available as per fringe benefits,hence the assumption is taken that the fringe benefit is applicable to 8 employees (2 zoo keepers, 2 animal handlers and 4 other staff members). Thus, these 8 employees would share these benefits in an equal proportion……………….

This is just a sample partial work. Please place the order on the website to get your own originally done case solution

Related Case Solutions:

LOOK FOR A FREE CASE STUDY SOLUTION

Kalamazoo Zoo Case Porter’s Five Forces Analysis

Home >> Chicago Booth >> Kalamazoo Zoo >> Porters Analysis

Kalamazoo Zoo Case Study Help

Kalamazoo Zoo has obtained a variety of business that assisted it in diversification and development of its item's profile. This is the thorough description of the Porter's model of 5 forces of Kalamazoo Zoo Business, given in Exhibit B.

Competitiveness

Kalamazoo Zoo is one of the leading company in this competitive industry with a number of strong rivals like Unilever, Kraft foods and Group DANONE. Kalamazoo Zoo is running well in this race for last 150 years. The competitors of other business with Kalamazoo Zoo is rather high.

Threat of New Entrants

A variety of barriers are there for the brand-new entrants to occur in the customer food industry. Just a few entrants succeed in this industry as there is a requirement to comprehend the customer requirement which needs time while current competitors are aware and has actually advanced with the customer loyalty over their products with time. There is low hazard of brand-new entrants to Kalamazoo Zoo as it has quite big network of distribution internationally controling with well-reputed image.

Bargaining Power of Suppliers

In the food and drink market, Kalamazoo Zoo owes the biggest share of market needing higher number of supply chains. In response, Kalamazoo Zoo has likewise been concerned for its suppliers as it thinks in long-term relations.

Bargaining Power of Buyers

There is high bargaining power of the buyers due to fantastic competitors. Changing cost is rather low for the consumers as numerous companies sale a variety of similar items. This appears to be a terrific threat for any business. Thus, Kalamazoo Zoo makes certain to keep its customers pleased. This has led Kalamazoo Zoo to be one of the faithful company in eyes of its purchasers.

Threat of Substitutes

There has actually been an excellent risk of replacements as there are alternatives of some of the Nestlé's products such as boiled water and pasteurized milk. There has actually likewise been a claim that a few of its items are not safe to use resulting in the decreased sale. Hence, Kalamazoo Zoo started highlighting the health advantages of its products to cope up with the replacements.

Competitor Analysis

To avoid any plagiarism, we check our completed papers three times — after writing, editing and proofreading — using reliable plagiarism detection software, Turnitin.com. We have strict policies against plagiarism. We only provide customized 100 percent original case studies.

IMAGES

VIDEO

COMMENTS

Case Study case study kalamazoo presented to amanda simmers instructor, school of business st. lawrence university prepared emma davy, kurtis emma jackson, ... Exam 5 December 2018, questions and answers; Gerontology Textbook Summary Notes; MKTG 4071 - A&W Case Study; Related Studylists DONE. Preview text. Case Study # "The Kalamazoo Zoo" ...

Kalamazoo Zoo Case Study ks1126 case number 2001.0 the kalamazoo zoo it was cold drizzly morning in early march 2010 when rory lyons, the director of the. Skip to document. ... QUESTION 5: As he was working on his budget analysis, Rory Lyons received a phone call from the Mayor. The Mayor said that due to state budget cutbacks.

The Kalamazoo Zoo is a short, amusing case for use in teaching variance analysis. The case is best taught after students have already learned the basics of variance analysis, using a standard text. [Recommended material is Variance Analysis and Flexible Budgeting, Harvard Business School Publishing, Note 9-101-039, c 2000, and the on-line HBS ...

Accounting questions and answers. The Kalamazoo Zoo It was a cold drizzly morning in early March 2010 when Rory Lyons, the director of the Kalamazoo Zoo, received the zoo's financial information for the year ending December 31, 2009. The situation was quite different from what Rory had expected. As he folded his umbrella, he wondered whether ...

The Kalamazoo Zoo is a short, amusing case for use in teaching variance analysis. The case is best taught after students have already learned the basics of variance analysis, using a standard text. [Recommended material is "Variance Analysis and Flexible Budgeting," Harvard Business School Publishing, Note 9-101-039, c 2000, and the on-line HBS ...

Kalamazoo Zoo - Case Solution. This case study analysis seeks to identify the reasons why Kalamazoo Zoo is losing money. It looks into the effect of the Zoo's program on animal breeding and the amount of food consumed by the animals. It also discusses the options related to budgeting which may help in a revenue increase or may lessen ...

The Kalamazoo Zoo Case Solution,The Kalamazoo Zoo Case Analysis, The Kalamazoo Zoo Case Study Solution, The Kalamazoo Zoo QUESTION 1: Revenue and expenditure variance on the 2009 Kalamazoo budget based on the information Provided in Table 1. Variance Type ... this may be due to new born animal babies and increase in the purchase of animals at ...

Question 5: As the total state subsidies will be reduced by almost $100,000, the shortfall of the Kalamazoo Zoo will be greater. In order toreduce the shortfall of $100,000, there are three proposals available to Mr. Rory, all the three proposals have various implications on a number ofshortfalls which are evaluated below.

www.thecasesolutions.com

The Kalamazoo Zoo is a brief, fun case to be used in coaching variance evaluation. The case is first-class taught after college students have already discovered the fundamentals of variance evaluation, the usage of a trendy text. [Recommended material is "Variance Analysis and Flexible Budgeting," Harvard Business School Publishing, Note 9 ...

Harvard Case Study Solutions. STEP 2: Reading The Kalamazoo Zoo Harvard Case Study: To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done.

Case Study #1 - The Kalamazoo Zoo Facts: Kalamazoo Zoo is facing a though economic situation. Their expenditure is greater than revenue. ... Question #5 - Option 1. Increase ticket price to $15.00, and number of visitors might be reduced by 20% Actual number of visitors - 8,000(10,000 x 20%) x $15 = $120,000 ...

The objective of the case should be focused on. This is doing the Kalamazoo Zoo Case Solution. This analysis can be proceeded in a step-by-step procedure to ensure that effective solutions are found. In the first step, a growth path of the company can be formulated that lays down its vision, mission and strategic aims.

View Essay - KALAMAZOO ZOO CASE STUDY.docx from ACC 202 at University of North Carolina, Greensboro. KALAMAZOO ZOO CASE STUDY Summary This case looks into the financial information of the Kalamazoo ... From the analysis in Question 2, we are able to understand that the zoo's budgeted quantity of 15,000 and actually quantity of 10,000 made the ...

The Kalamazoo Zoo is a brief, amusing instance to be used in teaching variance analysis. The case is taught after students have learned the fundamentals of variance analysis, using a regular text. Kalamazoo Zoo Case Solution. The Kalamazoo case could serve as a quick homework assignment or an in-class group activity.

The Kalamazoo Zoo Case Solution. Food expense: Expenditure Variance: Actual Quantity: Budgeted Quantity: Budgeted Price: Variance: Favorable/Unfavorable: Quantity: 120: 100: 2400-48000: Unfavorable: ... LOOK FOR A FREE CASE STUDY SOLUTION. JUST REGISTER NOW AND GET 50% OFF ON EACH CASE STUDY .

The Kalamazoo Zoo is a brief, amusing instance to be used in teaching variance analysis. The case is best taught after students have learned the basics of variance analysis, using a regular text. [Recommended content is "Variance Analysis and Flexible Budgeting," Harvard Business School Publishing, Note 9-101-039, c 2000, and the on line HBS ...

Accounting Case Study - The Kalamazoo Zoo Katelyn Visockis... Pages 3. Identified Q&As 2. Solutions available. Total views 100+ Western Michigan University. ACTY. ACTY 2110. jozlinjjohnson. ... Favorable/Unfavorable Price $25.00 $24.00 120 120* $72,000 Unfavorable Question 4 The overall issue the zoo is having is too much costs.

The formula that you will use to calculate Kalamazoo Zoo NPV will be as follows: Present Value of Future Cash Flows minus Initial Investment. Present Value of Future cash flows will be calculated as follows: PV of CF= CF1/ (1+r)^1 + CF2/ (1+r)^2 + CF3/ (1+r)^3 + …CFn/ (1+r)^n. where CF = cash flows.

The Kalamazoo Zoo Case SolutionÂ. Question 4. Based on the overall analysis made, the performance of the zoo has been very disappointing. Most of the budget estimations were not achieved in the actual performance. The revenues are less than estimated, as well as costs are higher than expected. Overall, this is a bad year for the zoo.

Kalamazoo Zoo company has about 280,000 workers and functions in more than 197 nations edging its rivals in lots of areas. Kalamazoo Zoo has also minimized its cost of supply by introducing E-marketing in contrast to its rivals. Note: A brief contrast of Kalamazoo Zoo with its close rivals is given up Display C. Exhibit B: Porter's Five ...

View case-study-kalamazoo-zoo.pdf from MARKETING 121 at IIT Kanpur. lOMoARcPSD|5575364 Case Study - Kalamazoo Zoo Accounting for Managerial Decision Making (Laurentian University) StuDocu is not ... QUESTION 1: Revenue and Expenditure Variance Actual Budget Variance Amount F/U Revenue Variance $850,000 $820,000 $30,000 F Expenses Variance ...

Kalamazoo Zoo Question 1. Revenue and Expenditure Variance Revenue Variance Expenditure. AI Homework Help. Expert Help. Study Resources. Log in Join. Case Study- Kalamazoo Zoo.xlsx - Kalamazoo Zoo Question 1.... Pages 4. Total views 14. North Carolina A&T State University. ACCT. ACCT ACCT-326. JusticeTeam19561. 10/5/2021. 100% (2) View full ...