How Gillette Became The Most Used Razor Blade In India?

Anurag Gade

Gillette is one such brand that you have most definitely heard of, through your parents or in your friend circle. Over the years, Gillette has managed to become a common household name thanks to its popularity across all demographics. I have personally seen my grandfather use the same Gillette brand, which my dad has been fond of too for ages. So Gillette has been a part of this hierarchical journey in my family and is being passed on for three generations and would most probably be in use by the fourth generation soon.

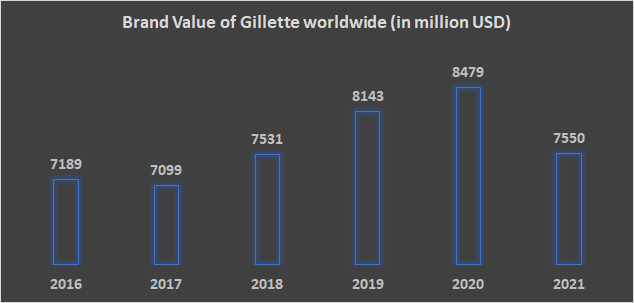

Although Gillette is an American brand that sells personal care products, including shaving supplies, a large sum of customer base and profits comes from India. Gillette has an approximate global brand value of around 7.55 billion U.S. dollars. The Gillette Company was founded in Boston, Massachusetts, United States, by King C. Gillette in 1901 as a safety razor manufacturer. King Camp Gillette was a salesman and investor who came up with the idea of disposable safety razor blades way back in 1895.

History of Gilette Razor in Indian Market How Gillette Razor Changed The Indian Mindset? Gillete Implementing The Golden Strategy Future of Gillette in India FAQs

History of Gilette Razor in Indian Market

Gillette entered Indian markets in 1984 when it was bought by Procter & Gamble. Gillette had to tackle and overcome various problems if they had to survive in India. The company's main hurdle wasn't any brand or competition. Instead, it was the Indian mindset that had to be changed. Gillette has only started its advertising journey in the late 2000s and has believed solely in providing high-quality, uber premium, and longer-lasting products. Midinstead low-income Indian customers would hesitate to get their hands on any Gillette's premium double-edges shaving system products as they were priced at premium rates and would rather get the same shaving services by any local barber at a nominal price.

Concerns such as it were time-consuming, caused skin irritation, and was an unpleasant experience were the main highlighted reasons which were found after extensive consumer research. Over the years, Gillette evolved and moulded itself to adjust to this weird Indian terrain and tried to educate Indians regarding grooming products. Gillette's top ten competitors are:

- Harry's, 800Razors

- Schick, Edgewell

- Grooming Lounge

- Dollar Shave Club

- Custom Shave

Only a handful of Indians know about these brands, this is the current hold which the brand has over the Indian market.

How Gillette Razor Changed The Indian Mindset?

Gillette usually relies on extensive market research and development in order to cater to a global customer base through a single product. Still, this approach was bound to fail in India, and therefore the company dropped this worldwide strategy and instead focused on India as a whole and soon after saw dramatic growth in market share. Gillette launched various campaigns in India to make people think over specific questions like:- Are clean-shaven men more successful? Did the nation prefer clean-shaven celebrities? And the big one: do women prefer clean-shaven men? It's questions like these that made men think over their choices and consciously make an effort to look better.

Upon research, Gillette came to an understanding that customers want not only affordable products but also safe and easy to use products, and Gillette was able to deliver just that in October 2010 when it launched Gillette Guard, which was the first product created for the Indian market, pricing at just 15rs per razor and 5rs for the refill cartridge.

It had of a kind and unique tagline.

"The best a man can get" is known to most people as it's unique and evokes a feeling of responsibility. It focuses on individuals trying to be the best version of themselves by making the right move and choosing Gillette. Gillette also played around the survey, which suggested that men who groom themselves and take care of their hygiene are looked at as more responsible, attractive and of higher status.

Additionally, getting young Indian celebrities ranging from film actors and actresses to athletes also helped them build a company image and cater to a younger consumer base. The advertising and marketing department of Gillette also did a fabulous job of making ad films, such as the one with an army official talking about his close call during the war and proudly boasting his 7-inch battle scar and gliding his Gillette blade over it without any hesitation. It is because of advertising like this that the brand image and its perception have been absolutely top-notch and unshakeable.

Gillete Implementing The Golden Strategy

Gillette could very well have been one of many international brands which tried and failed to adapt in the Indian market, but what helped Gillett was their open-minded and flexible approach. Gillette's business model in India shows that they dropped the idea and approach of a "one-size-fits-all strategy" wherein they would mass-produce a product and sell it globally.

They took their time and contributed it to research and development for the future of Gillette in India. Gillette spent time, money, and resources in trying to understand the Indian market and customers’ wants and needs. This understanding helped Gillette innovate and develop new and improved products and various unique methods of communication to engage and attract new and existing customers .

Future of Gillette in India

The company is showing no signs of stopping or even slowing down anytime soon with their market share as huge as it is, no other brand is even in close comparison to Gillette. The brand keeps on coming up with new and improved ideas for marketing and advertising , with the recent one including rising young talents of the Indian cricket team. The company's ever-evolving strategy and ability to adapt in any situation helps them keep a clean and smooth track and glide across smoothly. Because of this approach from Gillette, it is not only dominant in India, but it is completely dominating across the world.

Which is the best Gillette razor in India?

Gillette Mach 3 Turbo is the most trusted razor in India.

Who are Gillette competitors?

The top 10 competitors in Gillette's competitive set are:

How did Gillette enter India?

Gillette was launched in February 1993 with the launch of Gillette Shaving Products in India.

What was the firstly launched product of Gillette in India?

Gillette launched its first shaving product in India - Gillette Presto Readyshaver.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace

Open or Closed? The Debate Over Apple's Approach to AI Development

Apple, the iconic tech behemoth synonymous with sleek design and user-friendly interfaces, has quietly become a major player in the ever-evolving field of Artificial Intelligence (AI). While companies like Google and Microsoft boast high-profile AI research labs and widely used AI products, Apple has taken a different approach – Strategic Acquisitions.

A Guide to High-Paying Careers in Artificial Intelligence

The field of Artificial Intelligence (AI) is booming. Fueled by advancements in computing power and vast amounts of data, AI is transforming industries and creating a wealth of new career opportunities. If you're passionate about technology and eager to be at the forefront of innovation, an AI job could be

Carving a Brand Logo Through Artificial Intelligence: Here Are the Top AI Logo Generators

A logo's dual function as a representation of the brand and an indicator of the company's values makes it an indispensable tool in the branding process. To create the ideal logo that would leave an indelible impression on customers, numerous major organizations and sectors have shelled out billions of dollars.

Best Event Planning Business Ideas

Embarking on the event planning journey is not just a business venture but a path to personal fulfilment. It's a chance to bring your visions to life, all while minimizing the stress and logistics that come with it. With new trends and technologies constantly emerging, experienced and innovative event planners

- Business Today

- India Today

- India Today Gaming

- Cosmopolitan

- Harper's Bazaar

- Brides Today

- Aajtak Campus

- Magazine Cover Story Editor's Note Deep Dive Interview The Buzz

- BT TV Market Today Easynomics Drive Today BT Explainer

- Market Today Trending Stocks Indices Stocks List Stocks News Share Market News IPO Corner

- Tech Today Unbox Today Authen Tech Tech Deck Tech Shorts

- Money Today Tax Investment Insurance Tools & Calculator

- Mutual Funds

- Industry Banking IT Auto Energy Commodities Pharma Real Estate Telecom

- Visual Stories

INDICES ANALYSIS

Mutual funds.

- Cover Story

- Editor's Note

- Market Today

- Drive Today

- BT Explainer

- Trending Stocks

- Stocks List

- Stocks News

- Share Market News

- Unbox Today

- Authen Tech

- Tech Shorts

- Tools & Calculator

- Commodities

- Real Estate

- Election with BT

- Economic Indicators

- BT-TR GCC Listing

How Gillette innovated and improved its market share in India

This case study looks at how gillette innovated in india by tailoring advertising and inventing a new product development process to reflect local shaving habits..

- Print Edition: Apr 13, 2014

Executive Summary : Traditionally, Gillette relied on extensive research and development to create a single product for global distribution. The product was supported by a marketing premise that it would be equally valuable to customers globally. But Gillette set aside its global strategy in India and grew its market share dramatically. This case study looks at how Gillette innovated by tailoring advertising and inventing a new product development process to reflect local shaving habits.

Gabriela Berner, Jade Chang, Marina Dunaeva, and Leonardo Scamazzo.

Although Gillette entered the Indian market in 1984 and launched its newest triple-blade system, Mach3 in 2004, sales were flat for a long time. The product did not go through any changes and kept its key features - such as long lasting diamond-like coating blades, 'PowerGlide' smoothness, ergonomic handles, pivoting precision heads - and premium price, which was 10 times more than its two-blade competitors.

Even though the target customers were professional men with higher disposable incomes than the average Indian, the traditional, double-edged razor, could not be dislodged. Indian men do not consider shaving a significant enough activity to justify such a premium. Gillette's Mach3 value proposition was based on extensive consumer research, which highlighted key concerns men had about shaving: it was time-consuming, caused skin irritation and was generally unpleasant. Mach3 promised "the closest shave ever in fewer strokes - with less irritation". Research and development served as the key value network component supporting this value proposition, as it was crucial to deliver the promised performance. Manufacturing, distribution, marketing and advertising were geared for the global introduction through increased production capacity and aligned promotional material.

With such indifference towards shaving, Gillette had to focus on changing the consumer's attitude, leading to some creative marketing campaigns. For example, the launch of the newest Gillette Mach3 in 2009 was supported by the 'Shave India Movement 2009' campaign which included several initiatives. Gillette created the platform 'India Votes... to shave or not' to support this campaign, which asked three controversial questions: Are clean-shaven men more successful? Did the nation prefer clean-shaven celebrities? And the big one: do women prefer clean-shaven men? For two months, various media channels picked up on the campaign and ran interviews, discussions, editorials and news stories, which triggered popular interest. The main purpose was to create a debate around shaving.

The company created the Women Against Lazy Stubble (WALS) association, where women were encouraged to ask their men to shave, capitalising on their role as influencers of men in this aspect. Gillette recruited Bollywood celebrities such as Arjun Rampal and Neha Dhupia to support the campaign. This innovative way of marketing proved to be effective and as awareness grew, sales and market share increased by 38 per cent and 35 per cent respectively.

Until 2010, Gillette India had been following a strategy of marketing cheaper-end US-developed razors. However, low-income Indian customers who could not afford Gillette's premium price relied on the outdated, but traditional, double-edged razor shaving systems. An estimated 400 million customers not happy with existing market offerings provided a promising growth opportunity for Gillette. Thus, it focused on understanding its customers and the challenges they faced, which required spending hours visiting and interviewing consumers in order to understand the role of grooming in their lives and their needs.

The company realised that apart from affordability, customers also valued safety and ease of use. Those customers' needs would not be satisfied by Gillette's existing offering - most lacked running water, had to manage longer facial hair and sit on the floor while shaving. Nor were they satisfied with the existing double-razor solution as they caused frequent cuts.

Once Gillette understood this consumer segment, the company created a new customised product. Gillette Guard, the first product created just for the Indian market, was introduced in October 2010. It was priced at just Rs15 per razor - less than 35 cents and three per cent of the top-ofthe-range Fusion ProGlide price. At Rs5 for a refill cartridge, Gillette Guard met customer expectations on safety and ease of use.

Gillette made several changes to Gillette Guard from the traditional razor systems produced in the developed world. Extra blades were eliminated. Gillette Guard's single-blade system does not follow the trend of increasing the number of blades in a razor made for developed countries. Design complexity was reduced. Gillette Guard is a much simpler design with fewer parts to assemble during the manufacturing process.

Features such as easy-rinse cartridges and lightweight, ribbed handles were designed. Easy-rinse cartridges help customers save water and ensure the blades are clean, even if running water is not available. The new handle has a better grip, making the experience easier and safer. Safety comb and hang hole in the handle was introduced. Designing a safety comb tackles the problem of frequent cuts, especially for men who are not daily shavers and deal with longer hair. The hang hole was introduced as a response to less convenient conditions and to allow for easy drying and storage.

Gillette's success in India hinged on its capacity to innovate. Firstly, it used innovative ways to communicate with its consumers in 2009 in order to attract a once indifferent segment. Through a creative use of traditional ads and marketing campaigns that supported the launch of the new Gillette Mach3, Gillette was able to change consumers' indifference towards shaving and create a true momentum for its products. In this way, Gillette shifted from a market-driven to a market-driving approach.

Secondly, in 2010, Gillette did something the Harvard Business Review described as "reverse innovation" to develop a product that would satisfy the needs of the lower income customer. After failing to gain significant market share in India by selling its lower and mid-tier American razors in different packaging, Gillette adopted a different approach. It went back to the source by making significant investments in market research to better understand the needs and preferences of target consumers.

Gillette understood that Indian consumers' needs, culture and attitude towards shaving were radically different from those of Western consumers. Rather than lowering performance, Gillette kept the valued customer at the core of its strategy and introduced an innovative value proposition for the value-for-money customer. Moreover, Gillette was able to deliver its promise to customers by putting in place an appropriate value network. In addition to a customised product, all the elements of the business model were coherent with the value proposition and mutually reinforcing.

Local manufacturing enabled Gillette to lower its cost structure and maintain low prices. The distribution model, not based on few large retailers, but on millions of local shops called kiranas, allowed Gillette to achieve a higher market penetration. The Gillette Guard case in India is the typical success story suitable for a marketing strategy book. However, there are some aspects of the strategy that appear to be controversial. One is related to environmental sustainability. Guard uses disposable cartridges which makes it not exactly an environmentally-friendly product.

A mistake that multinationals make is to push global brands in a one-size-fits-all strategy. Gillette's strategy of spending time and resources understanding Indian consumers' needs proved to be the key to its success.

To remain competitive, Gillette must keep the valued customer at the core of its strategy and adapt its business model accordingly.

Other companies can learn from Gillette's case in India. A recurrent mistake that multinationals make is to push global brands in a one-sizefits-all strategy. Gillette's strategy of spending time and resources understanding Indian consumers' needs proved to be the key to its success. This understanding helped it innovate through developing new products and creative communication ways to attract and engage Indian consumers.

TOP STORIES

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Press Releases

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today

Add Business Today to Home Screen

Gillette Marketing Strategy of product innovation

If you scratch your head to recall names other than Gillette when asked about shaving razors & blades, you are like most of us. Gillette has been a brand synonymous with men’s grooming for more than 116 years & is still going strong. Such was the genius brand marketing strategy of Gillette.

It held about 70% market share in the razors & blades market at the beginning of the 21 st century. In 2005, Procter & Gamble acquired Gillette at a whopping $57 bn , the largest acquisition of any consumer goods brand to date. Razors business offers a high margin of 25-30% to P&G on account of the 750 million men across 200 countries who use Gillette blades & razors for shaving.

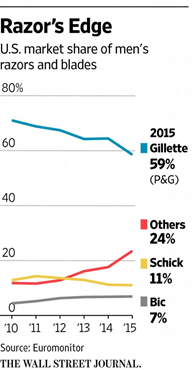

Naturally, this brings forth the question, if the size of the prize was so large, why were other players unable to join the party sooner? Was Gillette’s playbook so comprehensive that it kept competition at bay for over a century? If yes, why could that playbook not guard against a nearly 20% drop in market share over the last decade in the US? Let us understand the chain of events that led to Gillette’s dominance in the 20 th century and how the landscape changed in 2012.

A brief history of Gillette – The First Mover Advantage

King C. Gillette came up with the idea of a safety razor with disposable blades in 1895. It took him 6 years to design & apply for the first patent on disposable razors & blades. In 1903, the company sold less than 300 blades & razors, which then shot up to more than 200K in the second year.

However, it was still an expensive product for the masses until 1921, when Gillette introduced an improved version of its earlier product due to the patent expiry of its initial design. It then slashed prices of the older razor from $5 to $1 & priced the new razor at $5. This price reduction led to the massive recruitment of consumers for the brand Gillette. This marked the well-known ‘Razor & blade strategy’ genesis where razors are sold cheap while blades are priced at a premium.

Gillette’s early marketing strategy included promotion in World Series in the 1940s – the annual sporting event between the US & Canada. The consequent overachievement of their sales targets surprised the makers.

This blazed the trail for the high-voltage Super Bowl Gillette ad spots. Gillette promoted shaving as a superior experience and a route to building a confident man. In the 1989 Super Bowl, Gillette launched its biggest marketing campaign with the tagline “The Best a Man can get.”

Gillette hired the best scientists from across the world & invested heavily in blade design. In 1971, Gillette revolutionized the razor market by introducing the first twin-blade razor system named Trac II.

Gillette reaped the benefits of being a First Mover in the category; whenever it was not, it quickly developed similar versions, patented with agility & launched in geographies faster than the competition.

For instance, in the case of stainless steel alloy blades & disposable razors, the Gillette team quickly invented similar products in a year & leveraged their distribution to arrive first in many geographies. Gillette maintained high barriers to entry for competition by patenting designs, innovating regularly & acquiring small competitors.

View this post on Instagram A post shared by Gillette India (@gilletteindia)

Enter 21 st century – the Modern Marketing Strategy & Mix of Gillette

Product was always at the core of the marketing mix for Gillette. This was proven by each new launch that was an improvement over the previous one. For example, Mach 3 shaving system launched in 1998 was an improved version of the Sensor model marking a shift from a 2-blade to a 3-blade system.

It took seven years and an astounding $750 million to develop. Gillette invested $300 million in a 360-degree marketing campaign to promote this on TV, radio, print, outdoor & internet to capture a share of voice.

An innovative product requires an equally strong value proposition to occupy consumer mind space. After extensive research for 2 years , Team Gillette arrived at the value proposition for Mach 3. The key insight was that shaving was unpleasant, mundane & time-consuming. Men wanted fewer strokes with minimum cuts while shaving.

Hence, Mach 3 was born – “the closest shave ever in fewer strokes and with less irritation.” It was launched globally in a span of just one year with consistent messaging with minor local variations. Trade was incentivized handsomely for stocking up & displaying in-store banners. This ensured that the fourth pillar of the marketing mix was taken care of – distribution.

For a disruptive consumer product with a great marketing engine, pricing becomes a critical leg of the marketing mix . Gillette followed value-based pricing for all its variants. Mach 3 was launched with a price 35% higher than the Sensor Excel model. And the results exceeded everyone’s expectations. Mach 3 became the highest-selling razor and blade in just six months of launch in Europe & North America, quickly becoming the first billion-dollar razor & blade brand in the world . In fact, it grew at four times the pace of its predecessor.

To pre-empt competition & increase profits, in 2005, Gillette, under P&G, launched Fusion, the world’s first 5-blade razor with the promise of an even better shaving experience, priced at a 40% price premium over Mach 3. An interesting marketing strategy executed to promote Gillette Fusion was a combination of mass & targeted campaigns.

Gillette called out the better experience and value of Fusion versus Mach 3 & urged its loyalists to upgrade to an improved shaving system. Piggybacking on its reputation in men’s grooming, Gillette ventured into categories such as shaving gels, foams, aftershave lotion for men, and Venus range for women.

The rise of Challenger brands

In 2012, a simple quirky 90-second video by an upstart took Gillette by surprise. The video was about the CEO of a company talking about razors and blades available at $1, about a monthly subscription of blades – a first in the razors & blades industry.

Yes, the Dollar Shave was a promising direct-to-consumer (D2C) startup which sold simple razors & blades good enough for a satisfactory shave. Dollar Shave Club Business Model: Pioneering the D2C industry

Harry’s was a similar venture riding the D2C wave to sell cheap but good quality razors to the socially active segment, which also acted as the early movers for the new brands.

The collective impact of these companies was such that P&G lost more than 10% market share between 2010-2015, a spectacle of the classic David and Goliath story. Gillette filed a patent infringement lawsuit against Dollar Shave, to which Dollar Shave responded by filing a countersuit eventually leading Gillette to drop the case.

In 2016, Unilever acquired Dollar Shave for $1bn, signaling the potential D2C brands commanded in the space. Gillette slashed prices by about 15% for its products later & made explicit communication to consumers about price reduction. It launched Gillette Club on the lines of Dollar Shave Club. Such open acknowledgment of competition was unprecedented from the house of Gillette.

The below chart explains what the upstarts did to the legacy of the 100-year old giant.

What went wrong in the genius marketing strategy of Gillette?

While it undoubtedly continues to be one of the best marketing organizations in the world, the competition had outdone P&G with smarter new-age marketing strategies. Here are the reasons that changed the game for Gillette so drastically in the last decade:

- Losing relevance among younger consumers: The early users of Gillette razors were getting older & a new class of users with new values & lifestyles was afoot. For the youth, Gillette signified an old-fashioned brand that their parents used. Upstarts were cool & offered customisations to the product & pricing

- Rise of Social Media & online shopping: Amazon Web Services, Facebook and YouTube started between 2004 to 2006 connected people & businesses like never before. With booming ecommerce, subscription-led model gained prominence

- Shaving razors need to be just good enough: People were ready to use a cheaper product coupled with convenience with slightly fewer features which could ensure a decent shave.

- Cost saving in Manufacturing & distribution : Bypassing the traditional distribution system to reach out to millions in a short span meant that the D2C companies could invest resources in the most important element – consumers. They also identified high quality sourcing from China & Japan.

A bold attempt to refresh the Brand Ideol ogy

In its largest marketing pivot in the last 30 years, Gillette changed its tagline from ‘The best a man can get’ to ‘The best men can be’ & released an ad campaign titled ‘Toxic Masculinity’ in 2019. The ad painted all men with the same color with references to bullying, ‘Me Too’ campaign & had a preachy tone to what good men should do.

It faced the ire of its loyalists, who vowed not to repurchase Gillette blades on social media platforms. Even today, the dislike to like ratio is 2:1 on a total base of 2.4 mn votes & 37 mn views.

Later in July 2019, P&G announced an $8bn write-down in Gillette, citing negative growth in the category due to the beard-sporting culture as a key reason. While the razors & blades category is shrinking, the impact of mass alienation of loyalists caused by ‘Toxic Masculinity’ in addition to rising new-age competition cannot be ignored.

Later, P&G moved to stories of local heroes. This strategy led to some great campaigns like Man Enough & The Barbershop Girls of India. The ‘Man Enough’ ad is worth mentioning as it touched the right chords with the people & was received positively.

The Indian ad with 38 million views on YouTube has garnered more views than the Global ‘Toxic Masculinity’ ad to date, with a much higher like to dislike ratio.

‘The best men can be’ campaign followed the introduction of the fifth P of Marketing by Gillette – Purpose, focusing on sustainability. Gillette launched a new brand in 2021 under the name – Planet KIND. The new brand will focus on preventing 10 million plastic bottles from entering oceans every year. The 5th P Behind the Success of Bombay Shaving Company

The Gillette story is a case that reminds us how marketing strategy is evolving continuously & brands need to reinvent and redefine value to stay relevant to changing consumer base. Value is always about the competition. Value erodes if competition prices the product much below the category norm .

While consumers will always be at the core of any brand evolution, the nuances of serving the consumer needs will vary. With the new brand ideology, focus on sustainability, a slew of start-ups now rising in many countries, and flourishing internet commerce & social media, only time will tell how brand Gillette continues to unlock more value for men around the world to give them the perfect shave.

While Gillette has always believed in providing a better value to consumers, to maintain that, new levers in the category need to be created continuously. To capture a higher pie of the market, Gillette can target the lower end of the market with cheaper variants.

The success of Gillette Guard in India, a made-for-India product keeping in mind the Indian rural user behavior, was a masterstroke. A cheaper variant can act as an entry point for many value-conscious consumers who might later upgrade within the brand.

The task for team Gillette with such a strategy would be to manage the laddering of products across aspirational and affordable spaces while managing profits for its shareholders. Aggressive product line extensions to own the complete shower space for men can be another interesting strategy. They can also work towards becoming more relevant for women in the future.

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

Subir is a Senior Category Manager by profession & a Creator by passion. He loves to connect the dots and develop new perspectives in the field of E-commerce, Sales, Marketing & Technology. With a career spanning across sales, category management, consulting & engineering over the course of 7 years, Subir continues to explore emerging sectors & trends. He has a deep interest in music, behavioral psychology & writing. In his leisure time, he writes poetry & creates music to soothe the soul.

Related Posts

Dior Marketing Strategy: Redefining Luxury

Dunkin-licious marketing mix and Strategy of Dunkin Donuts

Healthy business model & marketing strategy of HelloFresh

Twist, Lick, and Dunk- Oreo’s Marketing Strategy

The Inclusive Marketing Strategy of ICICI Bank

Nestle’s Marketing Strategy of Expertise in Nutrition

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

How does DoorDash make money | Business Model

Innovation focused business strategy of Godrej

How does Robinhood make money | Business Model

How does Venmo work & make money | Business Model

How does Etsy make money | Business Model & Marketing Strategy

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Developing new products A Gillette case study First mover: advantages and risks The Gillette Company has a long history of being 'the first to market...' in its own areas of operation. Its achievements include producing the first successful

Related Papers

David Tarin

Cinética Reacción Orden Forma integrada í µí°´→ í µí± 0 í µí° ¶ í µí°´0 − í µí° ¶ í µí°´= í µí±í µí±¡, para í µí±¡ < í µí° ¶ í µí°´0 /í µí± í µí°´→ í µí± 1 − ln í µí° ¶ í µí°´í µí° ¶ í µí°´0 = í µí±í µí±¡, í µí° ¶ í µí°´= í µí° ¶ í µí°´0 í µí± −í µí±í µí±¡ í µí°´→ í µí± n í µí° ¶ í µí°´1−í µí± − í µí° ¶ í µí°´0 1−í µí± = (í µí± − 1)í µí±í µí±¡, í µí± ≠ 1 í µí°´+ í µí±í µí°µ → í µí± 2 1 í µí° ¶ í µí°´− 1 í µí° ¶ í µí°´0 = í µí±í µí±í µí±¡, í µí± = í µí±, í µí± = í µí° ¶ í µí°µ0 í µí° ¶ í µí°´0 1 í µí° ¶ í µí°´0 (í µí± − í µí±) ln í µí° ¶ í µí°µ í µí° ¶ í µí°´0 í µí° ¶ í µí°µ0 í µí° ¶ í µí°´= í µí±í µí±¡, í µí± ≠ í µí± í µí°´⇄ í µí± 1 − ln í µí° ¶ í µí°´− í µí° ¶ í µí°´í µí± í µí° ¶ í µí°´0 − í µí° ¶ í µí°´í µí± = í µí° ¶ í µí°´0 + í µí° ¶ í µí± 0 í µí° ¶ í µí°´0 + í µí° ¶ í µí± 0 − í µí° ¶ í µí°´í µí± í µí± 1 í µí±¡ í µí° ¶ í µí°´í µí± = í µí° ¶ í µí°´0 + í µí° ¶ í µí°µ0 í µí°¾ í µí±í µí± + 1 , í µí°¾ í µí±í µí± = í µí± 1 í µí± 2 Reactores ideales General Densidad constante Discontinuo í µí±í µí± í µí°´í µí±í µí±¡ = í µí± í µí°´í µí± í µí±¡ = í µí± í µí°´0 ∫ í µí±í µí± í µí°´(−í µí± í µí°´)í µí± í µí± í µí°´í µí±í µí±í µí± í µí± í µí°´í µí±í µí±í µí± í µí±í µí° ¶ í µí°´í µí±í µí±¡ = í µí± í µí°´í µí±¡ = ∫ í µí±í µí° ¶ í µí°´(−í µí± í µí°´) í µí° ¶ í µí°´í µí±í µí±í µí± í µí° ¶ í µí°´í µí±í µí±í µí± Mezcla perfecta í µí°¹ í µí°´í µí±í µí±¢í µí±¡ − í µí°¹ í µí°´í µí±í µí± í µí¼ = í µí±£ 0 í µí± í µí°´í µí¼ = í µí° ¶ í µí°´0 (í µí± í µí°´í µí±í µí±¢í µí±¡ − í µí± í µí°´í µí±í µí±) (−í µí± í µí°´) í µí± í µí° ¶ í µí°´í µí±í µí±¢í µí±¡ − í µí° ¶ í µí°´í µí±í µí± í µí¼ = í µí± í µí°´í µí¼ = í µí° ¶ í µí°´í µí±í µí± − í µí° ¶ í µí°´í µí±í µí±¢í µí±¡ (−í µí± í µí°´) Flujo de pistón í µí±í µí°¹ í µí°´í µí±í µí¼ = í µí±£ 0 í µí± í µí°´í µí¼ = í µí° ¶ í µí°´0 ∫ í µí±í µí± í µí°´(−í µí± í µí°´) í µí± í µí°´í µí±í µí±¢í µí±¡ í µí± í µí°´í µí±í µí± í µí±í µí° ¶ í µí°´í µí±í µí¼ = í µí± í µí°´í µí¼ = ∫ í µí±í µí° ¶ í µí°´(−í µí± í µí°´) í µí° ¶ í µí°´í µí±í µí± í µí° ¶ í µí°´í µí±í µí±¢í µí±¡

Gospodarka Narodowa

Izabela Krystyna Kowalik

Quaternary International

Amos Frumkin

Endah Wahjuningsih

Background: Candida albicans is normal flora of oral cavity that can be pathogenic due to predisposition influence so that trigger Oral candidiasis. Stichopus hermanii suspected as an Oral candidiasis therapy because it contain antioxidant compound, antitumor and antifungi. Objective: Analyzing the effectiveness of Stichopus hermanii supplementation as a protective effect of oral candidiasis in Rats exposure to smoke. Materials and Methods: This experiment is post test only group control design using 35 male rats divided into 5 groups(X). X1 (negative control), X2 (positive control), X3 (Stichopus hermanii powder 0,0225mg/kgBB), X4 (Stichopus hermanii powder 0,045mg/kgBB), X5 (Stichopus hermanii powder 0,09mg/kgBB). Candida albicans induced into the mouth by an oral swab using cotton bud 3 times a week for 8 weeks. Smoke exposure as a predisposition factor be given 3 bars per day for 8 weeks. The rats being killed and tongue biopsies measure the thickness of tongue epithelium. The o...

CHUNGSEOK KIM

This study presents the nonlinear ultrasonic technique to evaluate structure health of nuclear facilities. Recently, a dissimilar welds cracking in the aging of nuclear power plant has become a big issue. For this reason, this study was performed for dissimilar welds composed of SA508 cl.3 low alloy steel, Inconel 82 weld, and AISI 316L stainless steel damaged by high temperature long-term aging. Structure health was evaluated through the measurement of nonlinear ultrasonic characteristic. Microstructural changes of material have an effect on nonlinear ultrasonic characteristic and generate second harmonics that is twice the fundamental frequency. Ultrasonic oblique incidence measurement technique was used to measure ultrasonic nonlinearity. Keyword : Nonlinear ultrasonic(NLU), dissimilar metal welds, nuclear facilities, oblique incidence technique

Eric Sprokkereef

Bilal Momani

Neurosurgical Review

Vincenzo Esposito

Journal of Information, Information Technology, and Organizations (Years 1-3)

Haryati Hisham

Ayesha Razzaq 45

In this article, we presented the notion of M-parameterized N-soft set (MPNSS) to assign independent non-binary evaluations to both attributes and alternatives. The MPNSS is useful for making explicit the imprecise data which appears in ranking, rating, and grading positions. The proposed model is superior to existing concepts of soft set (SS), fuzzy soft sets (FSS), and N-soft sets (NSS). The concept of M-parameterized N-soft topology (MPNS topology) is defined on MPNSS by using extended union and restricted intersection of MPNS-power whole subsets. For these objectives, we define basic operations on MPNSSs and discuss various properties of MPNS topology. Additionally, some methods for multi-attribute decision making (MADM) techniques based on MPNSSs and MPNS topology are provided. Furthermore, the TOPSIS (technique for order preference by similarity to an ideal solution) approach under MPNSSs and MPNS topology is established. The symmetry of the optimal decision is illustrated by ...

RELATED PAPERS

Riccardo Mancinelli

2018 XLIV Latin American Computer Conference (CLEI)

Francisco Torres Rojas

Communications Faculty Of Science University of Ankara Series A1Mathematics and Statistics

Burcu Ungor

Carina Dennis

Syarif Ahmad

CAS 2010 Proceedings (International Semiconductor Conference)

Mariana Braic

Judith Cervantes

Revista Musical Chilena

Miguel Valdés

Boniface Hlabano

Uludağ Üniversitesi Tıp Fakültesi Dergisi

Melda Yardimoglu

Estela Pasuquin (IRRI)

Sian Sullivan

Regina Welch386

VIVIAN COROMOTO ROJAS CEBALLOS

Serge Brédart

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

The Brand Hopper

All Brand Stories At One Place

A Case Study on Gillette: “The Best Men Can Be” Campaign

A Case Study on Gillette: “The Best Men Can Be” Campaign 7 min read

Since its founding 118 years ago, Gillette has grown to become the dominant men’s shaving brand, fueled by ever-pricier new razor systems, regular price increases and, since the 1989 Super Bowl, “The Best a Man Can Get” ad tagline from BBDO . But given its relatively high prices, the brand ran into trouble starting with the Great Recession of 2008 and particularly since the 2012 launch of Dollar Shave Club (now owned by Unilever) and Harry’s a year later.

Gillette still holds a commanding lead among older men but has a weaker hold on millennials and Generation Z. So in a digital video campaign from Grey last January—targeted disproportionately toward younger men—Gillette reframed its old tagline as “The Best Men Can Be,” informed by the #MeToo movement and the call to end “toxic masculinity.”

The ad provoked a backlash among conservative commentators. Yet Gillette has stuck with the campaign and even expanded it, while tweaking the messaging and tactics. Right-wing commentators are still expressing contempt, but Gillette has made progress with the targeted millennial and Gen Z demographic, improved online sales and delivered strong sales growth last quarter.

The Marketing Challenge

The Gillette razor business was the highest-margin big brand in packaged goods when it was the crown jewel of a $57 billion acquisition by Procter & Gamble in 2005. That deal also included Braun shaving, Oral-B toothbrushes and Duracell batteries (the last of which was divested in 2016). But the deal proved disappointing on the top line, dragged down mainly by the non-Gillette brands.

Then Gillette’s game plan of raising prices on replacement blades 3 to 4 percent annually and upselling customers to pricier systems like Fusion in 2006 faced challenges due to the Great Recession— during which some men shaved less simply because they weren’t working or balked at Gillette’s prices— as well as from from Dollar Shave Club and Harry’s.

Globally, Gillette’s market share has fallen from 70 percent in 2010 to less than 50 percent last year, according to Euromonitor. Gillette also faces an overall decline in the frequency of men shaving, particularly in the U.S.

The Insights

“The challenge we have on the brand is to reconnect with the millennial and Gen Z generations,” says Gary Coombe, CEO of Global Grooming at P&G. “Our brand awareness among that group was low, [as were] afnity and equity. We know this group of consumers expects brands to stand for more than the delivery of their functional benefit. They expect these brands to have a point of view that resonates positively with their point of view on social or environmental causes.”

The Campaign

Thus was born the “We Believe” ad that broke in mid-January in 2019. “Men need to hold other men accountable,” says actor Terry Crews—a sexual assault survivor and former pitchman for P&G’s Old Spice— during Congressional testimony shown in the ad. The spot also depicts catcalling, sexual harassment of a maid in a faux 1950s sitcom as a studio audience cheers on the harasser; humiliating mansplaining in a boardroom and other examples of the worst men can get—at least through the first 50 seconds. Then various men, including Crews, stand up to call for better behavior.

The ad dovetailed with the launch of Gillette’s TheBestMenCanBe.org , a site that celebrates “men who are advocates, mentors and leaders in their communities, demonstrating what it means to be a great man, every day,” backed by a $1 million-plus annual commitment for three years to organizations that help men be “their personal best.”

The backlash

After an early story on “We Believe” in The Wall Street Journal, many conservatives—including one of the paper’s op-ed columnists—criticized the ad at best as phony “virtue signaling,” at worst as unfairly tarring most men as bullies and rapists.

Reactions were particularly harsh on Twitter and YouTube. Marketing intelligence firm BrandTotal found social media sentiment in the days immediately after the ad broke as negative by a 63 percent to 8 percent margin, while social listening firm Converseon found the negative-positive ratio a more balanced 45 percent to 34 percent. Celebrities weighed in, with Piers Morgan, James Woods, Ann Coulter and Meghan McCain among the detractors, and Bette Midler, Chrissy Teigen, Rainn Wilson and Arianna Hufngton among the supporters.

Although negative reactions on YouTube still outweigh the positive nearly two to one as of September (1.5 million to 802,000) on 32.4 million views , the initial negative social-media reaction became more favorable over time.

The battle lingers

Compared with most social-media firestorms, Gillette’s has lingered far longer. That’s in part because the brand and company held their ground, never apologized for any ofense taken and continued with the campaign.

Perhaps because the controversy persisted, the initial ad seemed to incite several weeks of negative brand perception. Initial Morning Consult tracking data in January showed relatively little awareness of the controversy or negative impact on the brand.

But by February, net favorability toward Gillette (percentage of people favorable less those unfavorable to the brand) had declined 10 points to 58 percent. That score rebounded to 67 percent by May and stood at 64 percent in August, exactly where it was a year earlier.

Coombe sees the ad’s impact as overwhelmingly positive both in perception and sales. “We think what we’ve chosen here—to portray men in a modern, contemporary, progressive way—is appropriate for Gillette,” he says. “And it seems to be working, so we’re going to continue with that, and we’re proud of the work. And if there’s a small minority out there who have a different view, that’s just something we’re going to have to bear, because we believe for the brand, this is absolutely the right choice.” The 4 percent organic sales growth Gillette posted globally for the April-June quarter was “our best quarterly growth for some time,” Coombe says. “We’re growing in North America and around the world.”

Outside direct-to-consumer e-commerce, Gillette holds a commanding 76 percent share of razor sales on Amazon, according to Evercore, which sees signs that e-commerce growth is ofsetting Gillette’s challenges in ofine sales. “We’ve grown sales and users online every month since the ad was launched,” Coombe says. “That’s a good indicator that the brand is strengthening and in good health. Sales are impacted by many things, but that new campaign has been one of the key drivers. I’m certain of it.”

The Lessons

Gillette and P&G have taken steps to mitigate negative social media effects from subsequent ads. Gillette has left comments enabled on the initial “We Believe” ad on YouTube, but has removed comments deemed offensive. The brand also disabled YouTube comments for subsequent videos in the U.S., such as “Every Hero Sweats” from Grey Midwest—even though the story line was more likely to please conservatives by portraying everyday heroism of dads in the armed forces or other jobs.

A five-minute-plus #TheBestMenCanBe ad for Gillette—featuring John Legend, along with the musician’s father and son, in June for Father’s Day—was likewise less controversial. The ad has only about 32,000 views on YouTube, but BrandTotal says Gillette invested heavily in so-called “dark social” targeted placements on Facebook and Instagram.

The targeting seems to be working. When Gillette’s videos reached selected social audiences between May 9 and August 7, BrandTotal shows sentiment was 65 percent positive vs. 9 percent negative. The same ads, when posted to broader, non-targeted audiences, earned 46 percent negative sentiment vs. 14 percent positive.

Coombe notes that Gillette isn’t shielding all online video from social media or turning of comments everywhere, particularly outside the U.S. For example, “The Barbershop Girls of India,” which combats gender stereotypes by depicting the true story of two sisters who run their father’s barbershop, has 16.5 million YouTube views. Positive comments outweigh negative more than 10 to one.

What’s next

Gillette has expanded “The Best Men Can Be” campaign to India, South Africa and Spain. Portraying men in a new, more progressive light figured prominently in videos backing the recent launch of Treo, a line Gillette developed to help caregivers shave the elderly or disabled men. Grey continues as Gillette’s primary agency of record. The Gillette creative account, which Grey has held since 2013 after beating out longtime incumbent BBDO in a review, is not currently in review, a P&G spokeswoman says, but she adds that “consistent with the direction of many P&G brands, Gillette does leverage additional agencies at the project level.”

Also Read: A Case Study on Apple: “Get a Mac” Brand Campaign

To read more content like this, subscribe to our newsletter

Note: This article was first published and is being inspired by the following source

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Posts

A Case Study on “Fitbit: Find Your Reason” Marketing Campaign

A Case Study on “P&G: Thank You, Mom” Brand Campaign

Case Study – Burger King: Subservient Chicken Brand Campaign

Terms and Conditions

Procter & Gamble’s Acquisition of Gillette

- First Online: 30 November 2018

Cite this chapter

- B. Rajesh Kumar 2

Part of the book series: Management for Professionals ((MANAGPROF))

6160 Accesses

3 Altmetric

On January 28, 2005, P&G announced the largest acquisition in its history to buy Gillette in a $57 billion deal. The deal combined some of the world’s top brands. P&G was the largest consumer products company in the world. P&G products ranged from Crest toothpaste to Head & Shoulders shampoo. The major products of Gillette included its signature razors, Duracell batteries, Braun, and Oral-B brands dental care products. The merger created the largest consumer products company in the world. The deal gave P&G more control over shelf space at the nation’s retailers and grocers and real estate which was at premium. P&G added Duracell batteries, Right Guard deodorant, and Gillette razors to more than 300 consumer brands which included Ivory soap, Head & Shoulders shampoo, Pringles, Crest toothpaste, and Bounty paper towels. P&G paid 0.975 share of its common stock for each share of Gillette common stock. On the basis of the closing price of $55.32 per share on January 28, 2005, the deal valued Gillette at about $54 per share which represented an 18% premium over its closing price. With Gillette acquisition, P&G had 10 billion dollar brands in Beauty and Health and 12 billion dollar brands in Baby, Family and Household segments. P&G leveraged Gillette’s strong in store presence in channels and with customers where P&G brands are not fully developed such as home improvement channels. The cumulative returns were negative in the shorter time window period and positive in the longer time window period. The average net earnings margin in the post-merger period improved to 13.6% from 10.7% in the premerger period.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Annual Reports of P&G 2005–2010

Google Scholar

Isdore C (2005) P&G to buy Gillette for $57 B. http://money.cnn.com/2005/01/28/news/fortune500/pg_gillette . Accessed 26 Feb 2018

Neff J (2005) P&G acquires Gillette for $57 billion. http://adage.com/article/news/p-g-acquires-gillette-57-billion/41996/ . Accessed 26 Feb 2018

P&G Annual Report (2017). http://www.pginvestor.com/CustomPage/Index?KeyGenPage=1073748359

Vries L (2005) Procter & Gamble acquires Gillette. https://www.cbsnews.com/news/procter-gamble-acquires-gillette/ . Accessed 26 Feb 2018

Download references

Author information

Authors and affiliations.

Institute of Management Technology, Dubai, United Arab Emirates

B. Rajesh Kumar

You can also search for this author in PubMed Google Scholar

Rights and permissions

Reprints and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this chapter

Kumar, B.R. (2019). Procter & Gamble’s Acquisition of Gillette. In: Wealth Creation in the World’s Largest Mergers and Acquisitions. Management for Professionals. Springer, Cham. https://doi.org/10.1007/978-3-030-02363-8_28

Download citation

DOI : https://doi.org/10.1007/978-3-030-02363-8_28

Published : 30 November 2018

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-02362-1

Online ISBN : 978-3-030-02363-8

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Done For You Services

- Done With You Services

- Ecommerce Ecosystem Live

- Double Your Sales Workshop

- Resource Library

- Future of eCommerce Whitepaper

- 81 Point Scorecard

- Email Marketing Workflow

- Case Studies

- Book A Strategy Call

- [Case Study] How Gillette convinced consumers to switch to a more expensive razor

Last updated on May 18, 2023

Gillette is one of the most successful consumer brands in history. It’s been at the forefront of the razor category in the men’s grooming department for over a century.

However, when it launched its new Gillette Fusion, it struggled to convert current customers to the newer, sleeker, improved and more expensive model.

Coupled with the 2008 Financial Crisis and lack of product awareness, people were holding back. The razor brand stubbled… I mean stumbled to get itself back up.

We break down their marketing and advertising campaign that ended up giving Gillette 20% increase in total sales in Walmart.

How they used market segmentation and targeting in their campaigns can be applied in small businesses as well.

Let’s get shaving.

Topics Covered:

- The customer avatar worksheet

- Marketing at different stages of the funnel

Defining campaign objectives

- Marketing for awareness and conversion campaigns

Using the Customer Avatar Worksheet

Marketing Week columnist Mark Ritson explains how, in 2010, Gillette used a combination of mass marketing that built on its brand image as ‘the best a man can get’ and targeted advertising to grow sales.

Gillette could have easily said, “but I don’t just serve men from 18-34, I serve any man who has facial hair”.

If you’re thinking this about your product too, you’ll probably want to pay a little attention here.

Sure Gillette’s razors could be USED by everyone, but if they wanted to be the ONLY LOGICAL CHOICE for anyone in that age group, they had to target them specifically. And it was through target market segmentation that they were able to identify their:

- Goals and Aspirations

- Desires for themselves and those around them

- What’s their average day like

- Spending habits

- Challenges when it comes to maintaining facial hair

- Obstacles when buying a razor

- Brands, influencers and activities they resonate with

- Must-haves in a shaver

- Deal killers when choosing a shaving appliance

It’s easy for business owners to get so focused on WHAT they’re selling that they forget to think about WHO they’re selling to.

You might be interested in: The Customer Avatar Worksheet: Clarify Your Message & Attract More Leads

If a big brand like Gillette, with hundreds of thousands of customers, could still focus on the individual customer avatar, there’s no reason why small businesses can’t.

You could have the greatest product on earth, but if you’re trying to sell it to the wrong person, you’re never going to hit your sales numbers.

Through understanding the demographics and psychographics of their target customer…

Gillette was able to associate themselves with the right brands (NFL, PGA, NBA) and the right influencers (Thierry Henry, Roger Federer, Tiger Woods) to create an aspirational identity their target audience had an affinity with.

Marketing at the different stages of the funnel

Any business owner who tracks their numbers knows that acquisition is the highest cost to their business. And it’s easiest to sell to existing customers who’ve already experienced their brand.

1. For new customers, they needed an awareness campaign. It was crucial that more people needed to know about their brand.

And so, they tapped on the captive audience of NFL, PGA, FIFA and NHL fans who played video games. And they chose these platforms because of the customer avatar activity that they’ve already identified to be their target audience.

2. The other group would be their existing customers and people who had a high purchase intent. Gillette employed a Point-of-Purchase advertising campaign with the same messaging.

At this point, people are very ready to buy. They’re problem aware, solution aware and brand aware. They just need a little push and a logical reason to make the final decision.

And when they’re so far down the sales funnel, they’re usually comparing products. For instance, someone looking for a new pair of CrossFit shoes might search for Nike Metcon vs Reebok Nano.

In this case, Gillette used a comparison against their own product that they wanted to upsell – getting Mach 3 users to switch to Fusion Power.

The company had 3 outcomes they wanted to achieve.

1) Disrupt the men’s grooming market

2) Convert Mach3 users to Fusion

3) Increase Fusion share at Walmart

But they realised many of their customers were looking for more cost-effective options.

If you’ve been in business for long enough, you’d have come across your fair share of bargain hunters too.

They’re just shopping around for the cheapest option, not paying attention to value, but focusing on price.

How to overcome consumers looking for cheap?

The first method could be… not targeting them at all.

Let’s be real, if they don’t have the spending power, you might want to consider focusing your attention elsewhere. But Gillette decided they’d still like to include this group.

So what they did was a mix of mass marketing and niche marketing campaigns.

Mass marketing vs target market segmentation

Marketing channels for awareness and conversion.

Here’s how Gillette executed their mass marketing and target marketing strategies:

Above the line (Awareness)

Below the line (conversion, ascension)

- Digital ads (ecommerce, banner ad, google search, digital sponsorships)

- Point of purchase advertising

In his book Marketing to Mindstates , Founder and CEO of Trigger-Point Will Leach, breaks down the 4 factors that drive buying decisions:

Location : Is your customer in a place where they can buy your product?

For example, if they’re driving, they probably can’t purchase it right now

People : Is there a customer around them that can sway their motivation to buy?

For example, are they around other men who are already using Fusion

Feelings : What mood is the customer in right now as they are reading your website, ad, email, etc.?

For example, did they shave wrong and now they’re chin’s all itchy

Framing : Does your message frame their problem and the solution you’re going to give them?

For example, Gillette frames its solutions based on the troubles men face when shaving and after shaving

With market segmentation and targeting, you can very specifically control how that message is framed. And target market segmentation works!

- 91% of consumers are more likely to shop with brands giving relevant offers and recommendations

- 36% of consumers believe brands should be giving a more personalized marketing experience

- Personalization has led to:

- 55% increase in visitor engagement

- 55% increase in customer experience

- 39% improvement in brand perception

- 51% increase in conversion rates

- 46% increase in lead generation and customer acquisition

Lessons from Gillette

- Understand the market and segments. Then target that specific market segment.

- You can promote without cutting price . Instead, promote by brand association.

- Ideally, you’ll want to be everywhere and do everything.

But as a small business owner, chances are, you don’t have the same marketing budget and resources as Gilette.

So opt for segmented marketing since it would give you the best ROI on your campaigns.

Note: Market segmentation and targeting is perfectly tailored to your customer avatar. It’s content that your customer avatar is dying to read, watch, and listen to… And ads your target market is waiting to see, even!

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

- Case Studies

- Member Login

- Select Case Studies open to all users

- Become a Member Today

- Member Case Studies

- My Case Study Hub

Gillette: How Gillette Appealed to Gen Z

Campaign Summary

Gillette, a century-old global men's grooming brand, dominates the wet shaving category. The increase of current sales largely relies on the growth of unit price, but the sales volume rises slowly in the industry, particularly with gen Z users whose proportion and growth rate are lower than other users. Thus, the company needed to appeal to the younger demographic.

Younger people regard Gillette as a traditional stereotype. How to appeal to more new users in the young market became an important business issue for Gillette. Gillette teamed up with Honor of King, China's top esports mobile game with 300 million active users, to renew the brand image, enhance the brand's youthful attributes, create a cool and trendy image, and close the distance with the younger generation.

Target Audience:

Attracting new users is the key to brand growth, and capturing young users means starting where most young people are. Thus, Gillette chose to leverage mobile games, a hand-held market with over half a billion active users daily. In the world of hand-held games, young people are willing to empower their characters, persevere for better results, work as a team, and even show confidence and face diverse challenges.

The brand's target audience for the campaign focused on men between the ages of 18 and 30 who are also mobile esports fans across city tiers in China.

Across cities, Chinese men between the ages of 18 and 22 are heavy users of the game Honor of King, and spend more than five days per week on the game. As such, they seek out news and updates, follow livestreams, and participate in competitions.

Creative Strategy:

The campaign focused on portraying Gillette as one of the necessary items to help young people feel confident and active. Through the creative theme of "#Equipment for your skin, carry you to be king#," young people connect their confidence, positivism, and sense of conviction. The message showed that Gillette enables young people to better organize their image in front of the mirror, helps them face critical moments in life, and empowers them to have more confidence and the energy to overcome challenges.

From the in-depth combination of Gillette's star products and the characteristics of the game heroes, the product embodied the spirit of heroes, customizing high-value co-branded products, and leveraged the custom creative short film that correlates the shaving technique and hero skills.

In the past three years, Gillette Greater China continuously invested in the mobile esports area, such as a collaboration with Cross Fire in 2018, with KPL (official competition of Honor of King) in 2019, with KPL team Estarpro in 2020, and with Honor of King itself in 2021.

From previous learnings, Gillette found that consumers are more interested in the game and characters itself. Therefore, the cooperation between Gillette and Honor of King is on the excavation of players' spiritual demands in the game, catching the best fit with the brand role, empowering players to have more spiritual experiences, and sublimating the game spirit of Honor of King.

Overall Campaign Execution:

Ninety percent of the advertising budget was spent on mobile devices. Based on the rapid development of domestic mobile communication, the viewing traffic and viewing time of mobile content are higher than traditional communication methods.

Also, according to the characteristics of the hand-held game and the target group, the company used refined content customization with multidimensional contact placement to precisely launch the traditional category into the game player's circle.

With full coverage touchpoints in the game players, the co-branded products merged into the game scene, opening the whole chain of consumption and entertainment, and merged both worlds together.

Mobile Execution:

The players preferred social platforms such as Weibo, TikTok, and Douyu. As such, the company launched interactive topics and competitions to create discussion among players. Yinuo, the popular e-sports player, worked as the spokesperson recommending millions of fans.

Business Impact (including context, evaluation, and market impact)

Pre-events accounted for 17.9 percent of young people's top-of-mind awareness (TOMA) in first-tier cities and ranked third in the shaving category. The marketing campaign reached over 200 million players with strong exposure and garnered 50 million views on the Douyu platform, surging to No. 2 on the platform ranking.

Gillette's brand awareness in first-tier cities increased by 8.6 percent compared to the same period last year and ranked No. 1 in the shaving category (including electric shavers). Young people's brand preference for Gillette increased significantly by 50 percent, and users have a higher favorable opinion of the co-branding, praising the product appearance and advertising creativity, with a better seeding effect (17 percent). The campaign attracts more discussions among younger groups (82 percent of which are under 25 years old).

Also, in the sales performance, new customers account for 70 percent during the campaign period, of which the highest percentage was the main target group of gen Z (66 percent higher than before the campaign), and the actual sales performance in April exceeded the forecast by 276 percent. The brand's collaborations helped sales exceed 10 million.

The campaign was promoted at a tight pace, with posters released on Weibo and a live broadcast on Douyu. At the peak of the campaign, a co-branded video was released on Gillette's official blog announcing the official sale of the product, as well as the promotion of the product through Weibo's hot search for new equipment and recommendations.

Categories: | Industries: | Objectives: Lead Generation | Awards: X Finalist

Add This To Your Own Case Study Hub

More related case studies.

- Harvard Business School →

- Faculty & Research →

- August 2002 (Revised February 2005)

- HBS Case Collection

Gillette Company (A): Pressure for Change

- Format: Print

- | Pages: 12

About The Author

Rosabeth M. Kanter

Related work.

- Faculty Research

Gillette Company (B): Leadership for Change

Gillette company (c): strategies for change, gillette company (d): implementing change, gillette company (a), (b), (c), (d) and (e ) (tn).

- Gillette Company (B): Leadership for Change By: Rosabeth M. Kanter and James Weber

- Gillette Company (C): Strategies for Change By: Rosabeth M. Kanter and James Weber

- Gillette Company (D): Implementing Change By: Rosabeth M. Kanter

- Gillette Company (A), (B), (C), (D) and (E ) (TN) By: Rosabeth M. Kanter and Matthew Bird

MBA Knowledge Base

Business • Management • Technology

Home » Management Case Studies » Case Study on Consumer Behavior: Gillette

Case Study on Consumer Behavior: Gillette

When most people hear “GILLETTE”, one thing comes to mind–Razors. That’s to be expected, since safety razors were invented by King C. Gillette in 1903, and the product in various forms has been the core of the company’s business ever since. Few firms have dominated an industry so completely and for so long. Wet-razor shaving (as distinct from electric razors) is a $900 million market. Gillette’s share is 62 percent, with the remainder divided among SCHICK–15 percent, BIC–11 percent, WILKINSON sword–2 percent, and a number of private brands.

Gillette would like to achieve a similar position in the men’s toiletries with a new line of products called the GILLETTE Series. However, its record that market is spotty at best.

One Gillette success, Right Guard Deodorant, was market leader in the 1960’s. Right Guard was one of the first Aerosols, and it became a family product which was used both by men and women. However, the product has not changed although the deodorant market has become fragmented with the introduction of antiperspirants, various product forms and applicators, and many different scents. As a result, Gillette slipped to third position in deodorant sales behind P & G and Colgate–Palmolive.

An even more embarrassing situation is Gillette’s foamy shaving cream, a natural fit with the razor business. S. C Johnson and Sons Edge Gel have supplanted that brand as the leading seller. These experiences created frustration at Gillette. Despite its preeminence in razors and blades, the company has been unable to sustain a leading position across the full range of toiletries.

Gillette is using its most recent success, the sensor razor, as a springboard for its new toiletries. The Sensor story provides the background necessary to understand the marketing of the Gillette Series, and also offers some insight into Gillette’s marketing prowess.

Sensor- a high technology cartridge razor- was a gamble for Gillette because it ran counter to consumers’ buying preferences. Disposable razors, which were produced by the French firm BIC in 1974, had gained control in nearly 80 % of the razor market by 1990. Gillette’s analysis showed that disposables provide a worse shave than a cartridge blade, cost more to make than a blade and are sold at a lower profit margin. Despite its disdain for the product, competitive pressure forced Gillette to introduce its own disposable, Good News.

As concern about the squeeze that disposables were putting on profit margins grew, Gillette began looking for a way to displace them. The company spent $ 300 million to develop a technology to significantly improve on the three attributes desired in shaving- closeness, comfort and safety. They came up with the Sensor, a razor with independently moving twin blades. The Sensor produces a superior shave, but it is also more expensive to produce than a disposable. So Gillette’s gamble was that a better shave would be enough to justify a premium price, and in the process, displace the successful but not a very comfortable disposable razor. In addition to the R & D investment, Gillette spent $ 110 in the first year to advertise Sensor. The strategy paid off. Estimated 1992 sales for the brand was $ 390 million, and equally important, the share of the market held by the disposables has gone down to 42%.

Gillette then moved to capitalize on the success of Sensor. The company had a line of toiletries in development, and the decision was made to tie them closely to sensor. The line consists of 14 items:

- two shaving gels for sensitive and regular skin

- two shaving creams

- two concentrated shaving gels

- a clear gel anti- perspirant

- a clear gel deodorant

- an anti- perspirant stick

- a deodorant stick

- An after- shave gel

- An after-shave lotion

- An anti- perspirant aerosol and a deodorant body spray available only in Europe.

The products in the Gillette series were developed over a three year period at a cost of $ 75 million. They were tested on 70000 consumers. An indication of their newness is the fact that Gillette has 20 patents pending with them. Consideration had been given to introducing the line in 1992, but the introduction was cancelled by Gillette’s CEO, Alfred Zeien. He insisted that the line not be launched until consumer tests showed that each of the 14 products was preferred to the best- performing brand in its category.

All the products have a common fragrance that Gillette calls Cool Wave. They come in silver and blue packages like the Sensor, and the black lines on the packages match the grooved sides of the Sensor Razor handle.

The items retail at $ 2.69 each, 10- 20 % higher than the prices of major competing items. As was the case with Sensor, Gillette hopes that the products’ innovation will convince men to switch brands and pay the higher prices.

During the Gillette Series first year, the company spent $ 60 million on a joint advertising campaign with Sensor. Just like Sensor, the line was to introduce in January with ads on the Super Bowl. The campaign uses the same theme as Sensor. “The Best a man can get”. Initial TV commercials were one minute in length. They started with 15 seconds on shaving gels, and cream, followed by 30 seconds on Sensor and 15 seconds on aftershaves. The deodorants are advertised separately.

The Gillette series faces two major problems:

- Convincing consumers that the line is actually better and the higher price justified will be more difficult than with SENSOR. With the razor, Gillette had name recognition as the dominant firm in the industry. In addition, the design differences the sensor were visible, and a consumer can directly enjoy a closer shave. With the toiletries, Gillette does not have a strong position in the consumers’ minds, nor are the benefits provided by the products obvious. Furthermore, the men’s toiletries market is extremely competitive . Powerful firms with proven marketing skills have taken a greater interest un this category. P & G has acquired Old Spice and Noxzema; Colgate owns Mennen, and Unilever purchased Brut. It’s unlikely the rest of the firms in the market will sit back and ignore Gillette’s activity.

- Gillette is tying, the new product line to the Sensor but using a different brand name. If consumers do not associate the Gillette Series with the innovativeness and success of Sensor, the new line may just be another brand in an already cluttered market.

According to a Gillette Vice President, one of the most compelling aspects of the Gillette series is its synergy with the company’s core business—razors. If the new line is successful, Gillette anticipates adding other men’s grooming products such as hair sprays and shampoos. The firm’s CEO, Zeien says, “ we’re already the worldwide leader in blades, Will we be the world leader in other (toiletries) or not? That’s our goal.”

- How is the Gillette Series being positioned with respect to (a) competitors, (b) the target market, (c) the product class, (d) price and quality? What other positioning possibilities are there?

- Is Gillette making the best use of the brand equity that has been created with Sensor?

- What strategies do you propose to Gillette? Address the entire marketing mix.

Related Posts:

- Case Study: An Assessment of Wal-Mart's Global Expansion Strategy

- Case study- “Merger of HDFC Bank and Times Bank”

- Case Study: Can DSS Help Master Card Master the Credit Card Business?

- Case Study of Dell: Driving for Industry Leadership

- Case Study: L'Oreal Global Branding Strategy

- Case Study of Kellog's: Marketing Strategy for Latin America

- Case Study: Social Anxiety Disorder Campaign by SmithKline Beecham

- Case Study of Nike: Building a Global Brand Image

- Case Study on E-Business Transformation: Cisco Systems

- Case Study: Starbucks Social Media Marketing Strategy

One thought on “ Case Study on Consumer Behavior: Gillette ”

Sensitivity to others’s reactions, mood, and indicators comes naturally in my experience.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Lawsuits test Tesla claim that drivers are solely responsible for crashes

San Francisco — As CEO Elon Musk stakes the future of Tesla on autonomous driving, lawyers from California to Florida are picking apart the company’s most common driver assistance technology in painstaking detail, arguing that Autopilot is not safe for widespread use by the public.