Magazine Business Plan Template

Written by Dave Lavinsky

Magazine Business Plan

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their magazine companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a magazine business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Magazine Business Plan?

A business plan provides a snapshot of your business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your business plans.

Why You Need a Business Plan for a Magazine Business

If you’re looking to start a new magazine business, or grow your existing magazine publishing company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the revenue growth of your business in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Magazine Companies

With regards to funding, the main sources of funding for a magazine business are personal savings, credit cards, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financial projections are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

Personal savings is the other most common form of funding for a new magazine business. Venture capitalists will usually not fund a magazine business, but they might consider funding a one with a national presence, but never an individual location. This is because most venture capitalists are looking for millions of dollars in return when they make an investment, and an individual location could never achieve such results. With that said, using a savings account and bank loans are the most common funding paths for magazine businesses.

Finish Your Business Plan Today!

How to write an effective business plan for a magazine business.

If you want to start a magazine business or expand your current one, you need a business plan. Each of the key components of a magazine publishing business plan are detailed below:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of business you are operating and the status. For example, are you a startup, do you have a digital magazine business that you would like to grow, or are you starting an online magazine business?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the magazine industry. Discuss the type of business you are operating. Detail your direct competitors. Give an overview of your target audience. Provide a snapshot of your marketing strategy. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of business you are operating.

For example, you might operate one of the following types of magazine businesses:

- Entertainment magazine : this type of magazine business focuses on topics such as arts, culture, fashion and leisure

- Academic and professional magazine: this type of magazine business focuses on subjects like finance, health, or science

- Home and living magazine: this type of magazine is devoted to cooking, home decorating, etc.

- Business magazine: this type of magazine typically focuses on business people, companies, emerging business or technology trends, etc.

- Digital magazine: this type of magazine is accessible via an electronic device, whether it be a smartphone, tablet, or computer. An internet connection is required to access or download the content, but once downloaded, it is available for viewing offline.

- Online magazine: this type of electronic magazine is similar to a digital magazine, but typically comes with fewer features. An internet connection is required to access the content.

In addition to explaining the type of magazine startup you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, number of positive reviews, number of annual subscriptions, etc.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the magazine industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the magazine industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the magazine industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your magazine business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: advertisers, consumers of varying ages and with varying interests, and authors.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of magazine business you operate. Clearly, business people would respond to different marketing promotions than teens, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most magazine businesses primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Magazine Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other magazine businesses.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes social media platforms, other reading material, or alternative leisure activities. You need to mention such competition as well.

With regards to direct competition, you want to describe the other magazine businesses with which you compete. Most likely, your direct competitors will be house flippers located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What interest or niche do they specialize in?

- What formats are their publications available in?

- How often is the magazine published?

- What is their pricing strategy (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better articles, features, and/or photos?

- Will you provide more opportunities for guest authors?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a magazine business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of magazine company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to printed magazines, will you offer a digital version?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the services you offer and their prices.

Place : Place refers to the location of your magazine company. Document your location and mention how the location will impact your success. For example, is your magazine business located near a distribution center, or in an area known as a “hub” for the content you specialize in, etc. Discuss how your location might be ideal for attracting and retaining customers.

Promotions : The final part of your magazine marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your magazine business, including selling ad space, creating quality content, finding contributors, designing each issue, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to land your 10 th major magazine advertising account, or when you expect to have 5,000 subscribers, or when you hope to reach $X in revenue. It could also be when you expect to expand your magazine distribution to a new city.

Management Team

To demonstrate your magazine business’ ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing magazine businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in publication or marketing or successfully running small businesses.

Financial Plan

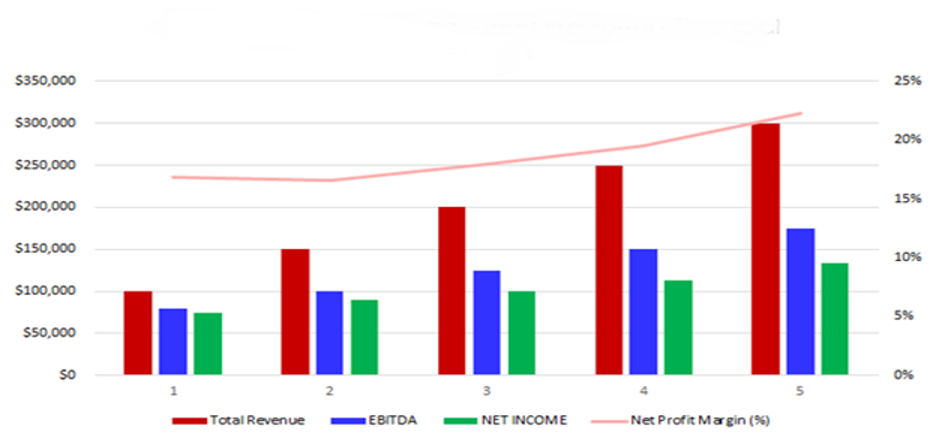

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you publish one issue per month or four? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your magazine business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a magazine business:

- Location build-out including design fees, construction, etc.

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or the wireframe for your digital publication.

Putting together a business plan for your magazine business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the magazine industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful magazine business.

Magazine Business Plan FAQs

What is the easiest way to complete my magazine business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Magazine Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of magazine business you are operating and the status; for example, are you a startup, do you have a magazine business that you would like to grow, or are you operating a chain of magazine businesses?

Don’t you wish there was a faster, easier way to finish your Magazine business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

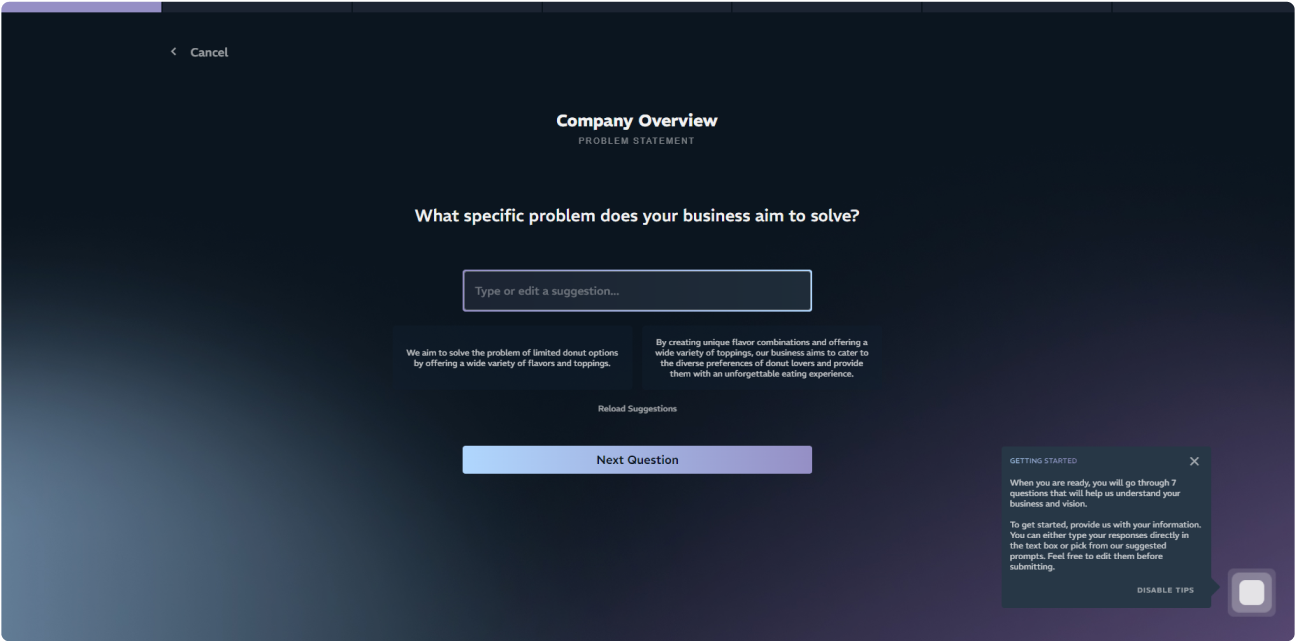

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

- Sample Business Plans

- Retail, Consumers & E-commerce

Magazine Business Plan

Running a magazine business enables you to share your thoughts with a larger audience that shares your interests in a particular topic. Also, it keeps you in the company of creative people.

Do you want everything perfect for your magazine business, then why not write a business plan first?

Need help writing a business plan for your magazine business? You’re at the right place. Our magazine business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write A Magazine Business Plan?

Writing a magazine business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Products and services:.

Highlight the magazine services you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information. Describe what kind of magazine business you run and the name of it. You may specialize in one of the following magazine businesses:

- Online magazine business

- Print magazine business

- Lifestyle magazine business

- Fashion magazine business

- Business and Finance magazine

- Travel magazine business

- Sports magazine business

- Health and wellness magazine business

- Technology magazine business

- Describe the legal structure of your magazine business, whether it is a sole proprietorship, LLC, partnership, or others.Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established magazine service provider, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

For instance, individuals with hobbies or interests or professionals would be an ideal target audience for a magazine business.

Market size and growth potential

Competitive analysis:, market trends:.

Analyze emerging trends in the industry, such as changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your magazine business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your content:

Mention the magazine content your business will offer. This list may include content like,

- Opinion pieces

- Other formats of content

Any interactive features:

Frequency & distribution:, additional services:.

In short, this section of your magazine plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

For example, exclusive content, high-quality visuals, or customization could be some of the great USPs for a professional magazine business.

Pricing Strategy

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your magazine publisher business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your magazine business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & software:.

Include the list of equipment and software required for the magazine business, such as computers, print production equipment, videography equipment & software, online publishing & digital equipment, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively..

7. Management Team

The management team section provides an overview of your magazine business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your magazine business, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your magazine business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample magazine business plan will provide an idea for writing a successful magazine plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our magazine business plan pdf .

Related Posts

Subscription Box Business Plan

Retail Store Business Plan

Writing a Business Plan in Simple Steps

400+ Business Plans Template

How to Analysis Customer for Business Plan

Strategic Marketing Method Guide

Frequently asked questions, why do you need a magazine business plan.

A business plan is an essential tool for anyone looking to start or run a successful magazine business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your magazine business.

How to get funding for your magazine business?

There are several ways to get funding for your magazine business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your magazine business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your magazine business plan and outline your vision as you have in your mind.

What is the easiest way to write your magazine business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any magazine business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Magazine Business Plan Template

Written by Dave Lavinsky

Magazine Business Plan

You’ve come to the right place to create your Magazine business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Magazine businesses.

Below is a template to help you create each section of your Magazine business plan.

Executive Summary

Business overview.

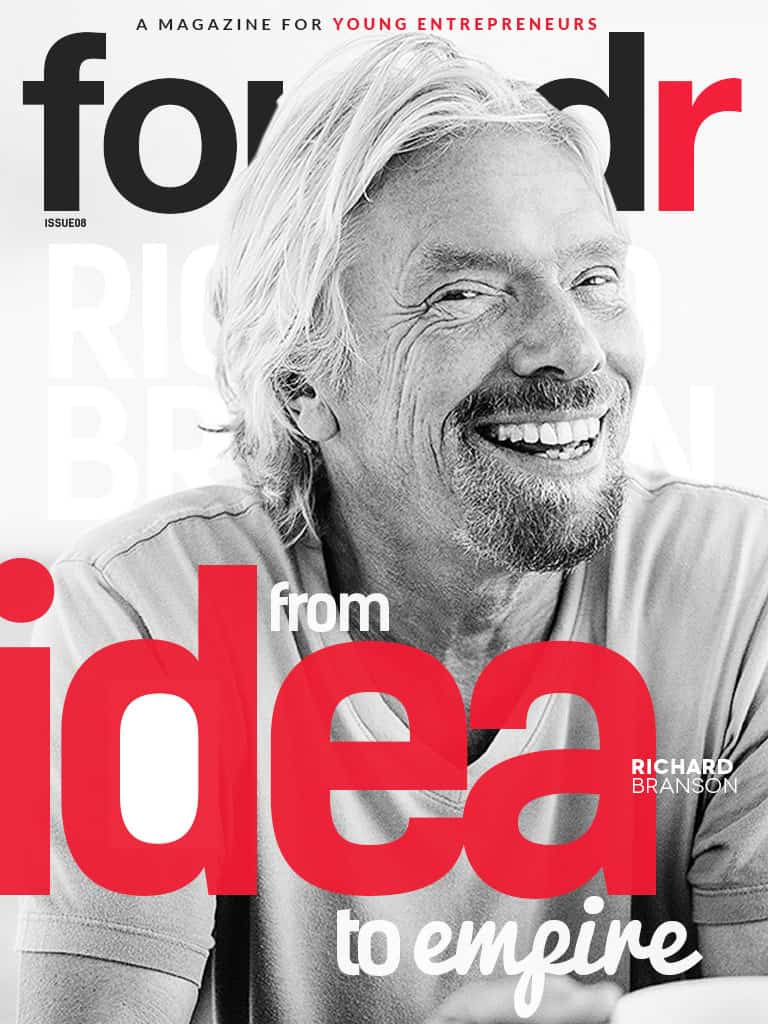

Happy Trails Magazine is a startup magazine company located in New York City, New York. The company is founded by Lawrence MacGuire, who has experience in traveling and offering podcasts from around the world. Now, with the expertise of knowledge and business acumen, he has determined he can confidently start and effectively grow a successful magazine company. He believes his experience of strategic planning, marketing skills, financial capabilities, and wide and deep knowledge of traveling practices will provide everything needed for long-term growth and profitability.

Happy Trails Magazine will provide a comprehensive array of articles of interest for a wide variety of travel-loving customers. The Happy Trails Magazine will be the premiere travel magazine, providing services and products to each customer, while supporting the strategic goals of the company. Happy Trails Magazine will be the ultimate choice in tourist travel for customers to ensure that every need and desire of all travelers is fully and completely met.

Product Offering

The following are the services and products that Happy Trails Magazine will provide:

- Unique and exclusive content creation

- Experienced writers who provide superior journalism and reporting

- Photography from around the world

- Art and illustrations that support the travel articles

- Special offers of travel and related products for publication subscribers

- Online magazine offered in addition to hard copy publication

- Fun quiz and explorer’s facts for readers

- On-time delivery every month

Customer Focus

Adults within the New York City region. Customers who love to travel. Global customers who want to read about travel and enjoy excellent magazine articles. Advertisers who will purchase space and positions in the monthly magazine release. Collaborators who partner with Happy Trails Magazine to effectively market products and services.

Management Team

Happy Trails Magazine is owned and operated by Lawrence MacGuire. He recruited managers from his former place of employment at a nationally-known magazine company, including Derek Flanagan, as his Operations Manager, and Sherry Culver, as the Senior Administrative Manager.

Lawrence MacGuire is a graduate of Cambridge University in the United Kingdom, where he earned a degree in the Art of Hospitality and Travel. He has been employed by a global resort chain with over 500 hotels for the past ten years.

Tracey Newthorn is a graduate of University of Ohio, where she obtained a bachelor’s degree in business in the hospitality industry. She has spent the past two summer sessions in international travel and is an accomplished photographer. She will be the Artistic & Photographic Manager of Happy Trails Magazine.

Alex Hawkins, an experienced magazine editor, will be the Executive Manager & Senior Editor of the Happy Trails Magazine. His former position was as the Senior Manager of Horizons Over Hawaii Magazine for over 20 years. His experience with travel and journalism leads to the new position of executive management.

Success Factors

Happy Trails Magazine will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of Happy Trails Magazine

- Comprehensive menu of accurate and complete travel-related stories, as well as multiple photographic demonstrations of places to visit and things to see.

- Additional value added with each subscription via a number of special offers found in Happy Trails Magazine labeled, “For Subscribers Only!”

- Outstanding photography and illustrations that highlight the beauty of world travel

- Happy Trails Magazine offers the best pricing in town. Their pricing structure is the most cost effective compared to the competition.

Financial Highlights

Happy Trails Magazine is seeking $200,000 in debt financing to launch its magazine. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

The following graph outlines the financial projections for Happy Trails Magazine.

Company Overview

Who is happy trails magazine.

Happy Trails Magazine is a newly established, full-service consumer magazine published in New York City, New York. Happy Trails Magazine will be the most beautiful, consumer-relatable, and cost-effective choice for a global reading and subscribing community. Happy Trails Magazine will provide a comprehensive menu of editorial articles, In-Style pictorials, Go-To suggestions for hotel/travel bargains and special discounts for any reader to enjoy. Their full-service approach includes a comprehensive website with multiple gateways to information and related services.

Happy Trails Magazine will be the premier travel magazine in the publications industry. Led by the team of experienced professionals, the magazine will entice travelers to explore the world, while advertisers and interested parties will enjoy purchasing ads, placing click through ads and offering specials throughout the hard copy and digital magazine. Happy Trails Magazine removes all headaches and issues of traveling globally and ensures all travel negatives are addressed and diminished, while delivering the best customer service.

Happy Trails Magazine History

Lawrence MacGuire is a graduate of Cambridge University in the United Kingdom, where he earned a degree in the Art of Hospitality and Travel. He has been employed by a global resort chain with over 500 hotels for the past ten years. During his prior employment, he recognized that many of the world’s finest destinations have been passed over in favor of traditional, favored locations. After much research and industry information-gathering, he started the Happy Trails Magazine to appeal to youthful travelers and old alike as they traveled the world.

Since incorporation, Happy Trails Magazine has achieved the following milestones:

- Registered magazine, Happy Trails Magazine, LLC to transact business in the state of New York.

- Has a contract in place for a 10,000 square foot office at one of the midtown buildings

- Reached out to numerous contacts to include Happy Trails as a source for advertising.

- Began recruiting a staff of 3 and 2 office personnel to work at Happy Trails Magazine.

Happy Trails Magazine Services

The following will be the services and products the Happy Trails Magazine will provide:

Industry Analysis

The travel magazine industry is expected to grow over the next five years to over $24684 billion. The growth will be driven by an exponential interest in travel exhibited during the recent pandemic years, as most consumers were sequestered with no ability to travel. The industry is also expected to grow now as people begin to explore once again, looking for places off the beaten path. While travel costs remain high due to shipping and supply line issues and the economy, consumers find delight in exploring travel magazines and the pleasure of escape they offer.

Costs will likely be reduced as the process of production and print continue to fall due to technology advancements. The software that drives the consumer-provider relationships will also change, as most redundant or fairly simple administrative tasks will be given software solutions rather than handed over to a live publication agent.

Customer Analysis

Demographic profile of target market, customer segmentation.

Happy Trails Magazine will primarily target those young adults and adults who live within the New York City region. They will also target customers who love to travel, including global customers who want to read about travel and enjoy excellent magazine articles. Advertisers who will purchase space and positions in the monthly magazine release will be welcomed. Collaborators who partner with Happy Trails Magazine to effectively market products and services.

- Young adults through seniors

- Those who love to travel

- Those who want to travel to exotic, almost unknown destinations

- Those who enjoy viewing beautiful photography

- Those who like to read magazine articles about travel

- Advertisers and interested parties who want to sell through or collaborate with Happy Trails Magazine

Competitive Analysis

Direct and indirect competitors.

Happy Trails Magazine will face competition from other companies with similar business profiles. A description of each competitor company is below.

Sunset Magazine

Sunset Magazine, started in 1953 by a married couple, Ernest and Columbine Trentom, who were experienced global travelers. They began the magazine in a home office and quickly built their subscriber base to over fifteen million at the height of popularity. In recent years, the popularity of Sunset Magazine has waned, due to the loss of advertisers and poor construction of the magazine during production. The subscriber base has moved to new, more trendy, travel accommodations and travel styles.

Sports Illuminated

Sports Illuminated was founded by Cissy Travers, an ardent sportswoman and enthusiast of global sports events. With distribution to over 10 million readers, Ms Travers maintains complete control of the magazine and related ventures, which include sporting goods sales, sports apparel sales and global sports items.

The magazine was founded in 2001, when Cissy Travers took a medium-grade local magazine in upstate New York, and began to manage the content within. During the following five years, she single handedly engaged sports writers of the highest caliber and photographers who traveled the world on behalf of the magazine to shoot pivotal sporting events. Since that time, the magazine has continued to grow as new sporting events are added globally every year.

Taft & Hanson

Taft & Hanson Magazine was established in 2003 by Rogert Taft and Renee Hanson, a couple who traveled throughout the United States in their luxury recreational vehicle. The magazine is dedicated to the ultra-expensive and luxurious recreational vehicles manufactured and on the roads of America, with each monthly edition highlighting both the features of the vehicles and the features of traveler’s retreats around the nation.

The magazine is published once each quarter and is available by subscription only. Each edition is priced at $125 per copy. Designed to entice readers to purchase new recreational vehicles as they are released from manufacturing, the magazine makes it’s return on investment by selling to manufacturers and consumers alike.

Rogert Taft and Renee Hanson travel extensively throughout the nation, each reporting and writing about various aspects of living the “luxurious recreational vehicle life,” and the accommodations in which they choose to stay, which is used by the magazine publishers as another form of revenue in advertising. The magazine has earned a five-star rating by the Travelers Trailers International and has a following of over 100,000 subscribers.

Competitive Advantage

Happy Trails Magazine will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Happy Trails Magazine will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who are able to provide a comprehensive travel experience via the magazine and website.

- Additional value added with each subscription via a number of special offers found in Happy Trails Magazine labeled, “For Subscribers Only!”

- Unbeatable pricing for customers; subscribers are offered the lowest pricing of any travel magazine on the market.

Promotions Strategy

The promotions strategy for magazine is as follows:

Word of Mouth/Referrals

Happy Trails Magazine has built up an extensive list of contacts over the years by providing exceptional service and expertise to hospitality and lodging clients. The contacts and clients will follow them to this new company and help spread the word of Happy Trails Magazine.

Professional Associations and Networking

Trade Associations for travel and travel accommodations will be joined and actively pursued by the Happy Trails Magazine staff. Professional Networking in the New York City region will also be conducted to increase visibility and engage additional subscribers and advertisers.

Print Advertising

Limited print advertising will be offered within travel magazines and news periodicals. The bulk of the advertising will be found on the internet within various social network channels.

Website/SEO Marketing

Happy Trails Magazine will fully utilize their website. The website will be well organized, informative, and list all the services and products that the magazine provides. The website will also list their contact information and list their top-rated travel spots and special discounts for subscribers. The website will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “travel magazine” or “travel reading near me,” magazine will be listed at the top of the search results.

The pricing of the magazine will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for the Happy Trails Magazine. Operation Functions:

- Happy Trails Magazine is owned and operated by Lawrence MacGuire. He recruited managers from his former place of employment at a nationally-known magazine company.

- Lawrence MacGuire is a graduate of Cambridge University in the United Kingdom, where he earned a degree in the Art of Hospitality and Travel. He has been employed by a global resort travel magazine affiliated with over 500 hotels for the past ten years.

- Derek Flanagan will take on the position of Operations Manager, with a professional background of several years in management within the travel magazine world.

- Tracey Newthorn is the Artistic & Photographic Manager of Happy Trails Magazine. She is a graduate of University of Ohio, where she obtained a bachelor’s degree in business in the hospitality industry. She has spent the past two summer sessions in international travel and is an accomplished photographer.

Milestones:

Happy Trails Magazine will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for the magazine

- 6/1/202X – Finalize contracts for magazine advertisers

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into magazine office

- 7/1/202X – magazine opens its doors for business

Financial Plan

Key revenue & costs.

The revenue drivers for Happy Trails Magazine are the fees they will charge to subscribers for their services, in addition to charges they solicit from advertisers who place ads in their publications. .

The cost drivers will be the overhead costs required in order to staff the magazine. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Happy Trails Magazine is seeking $200,000 in debt financing to launch its travel magazine. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Subscribers Per Month: 750

- Number of Advertising Accounts Per Month: 50

- Average Revenue per Month: $550,000

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, magazine business plan faqs, what is a magazine business plan.

A magazine business plan is a plan to start and/or grow your magazine business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections. You can easily complete your Magazine business plan using our Magazine Business Plan Template here .

What are the Main Types of Magazine Businesses?

There are a number of different kinds of magazine businesses, some examples include: Entertainment magazine, Home and living magazine, Business magazine, Digital magazine, and Online magazine.

How Do You Get Funding for Your Magazine Business Plan?

Magazine businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Magazine Business?

Starting a magazine business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster. 1. Develop A Magazine Business Plan - The first step in starting a business is to create a detailed magazine business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast. 2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your magazine business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your magazine business is in compliance with local laws. 3. Register Your Magazine Business - Once you have chosen a legal structure, the next step is to register your magazine business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws. 4. Identify Financing Options - It’s likely that you’ll need some capital to start your magazine business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms. 5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations. 6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events. 7. Acquire Necessary Magazine Equipment & Supplies - In order to start your magazine business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation. 8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your magazine business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful magazine business:

- How to Start a Magazine Company

We earn commissions if you shop through the links below. Read more

Back to All Business Ideas

How to Start a Magazine

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on June 4, 2022 Updated on May 5, 2024

Investment range

$2,850 - $6,300

Revenue potential

$54,000 - $180,000 p.a.

Time to build

0 – 3 months

Profit potential

$49,000 - $108,000 p.a.

Industry trend

Print magazines do still exist, but they’re quickly being taken over by digital magazines, the market for which is expected to expand 40% by 2025. People look to magazines for news, entertainment, and advice. If you can create an innovative concept and have a talent for the written word, you could start your own digital magazine from home and make a good living.

But before you start writing, you’ll need to learn the business launch process. Luckily, this step-by-step guide will fill you in on all the information you need to start a successful magazine.

Looking to register your business? A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple.

Form your business immediately using ZenBusiness LLC formation service or hire one of the Best LLC Services .

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a magazine has pros and cons to consider before deciding if it’s right for you.

- Creative Outlet – Choose your own concept and articles

- Provide Value – Use your magazine to educate

- Flexibility – Run your magazine from home

- Crowded Market – Compete with a host of other digital magazines

- Delayed Revenue – Must build a following before you make money

Magazine industry trends

Industry size and growth.

- Industry size and past growth – The global digital magazine industry was worth $628.72 million in 2020 after growing steadily in recent years.(( https://www.globenewswire.com/news-release/2021/03/25/2199572/0/en/Digital-Magazine-Publishing-Platform-Market-Research-Report-by-Type-by-Application-Global-Forecast-to-2025-Cumulative-Impact-of-COVID-19.html ))

- Growth forecast – The global digital magazine industry is projected to expand 41% by 2025 to reach $892.67 million.

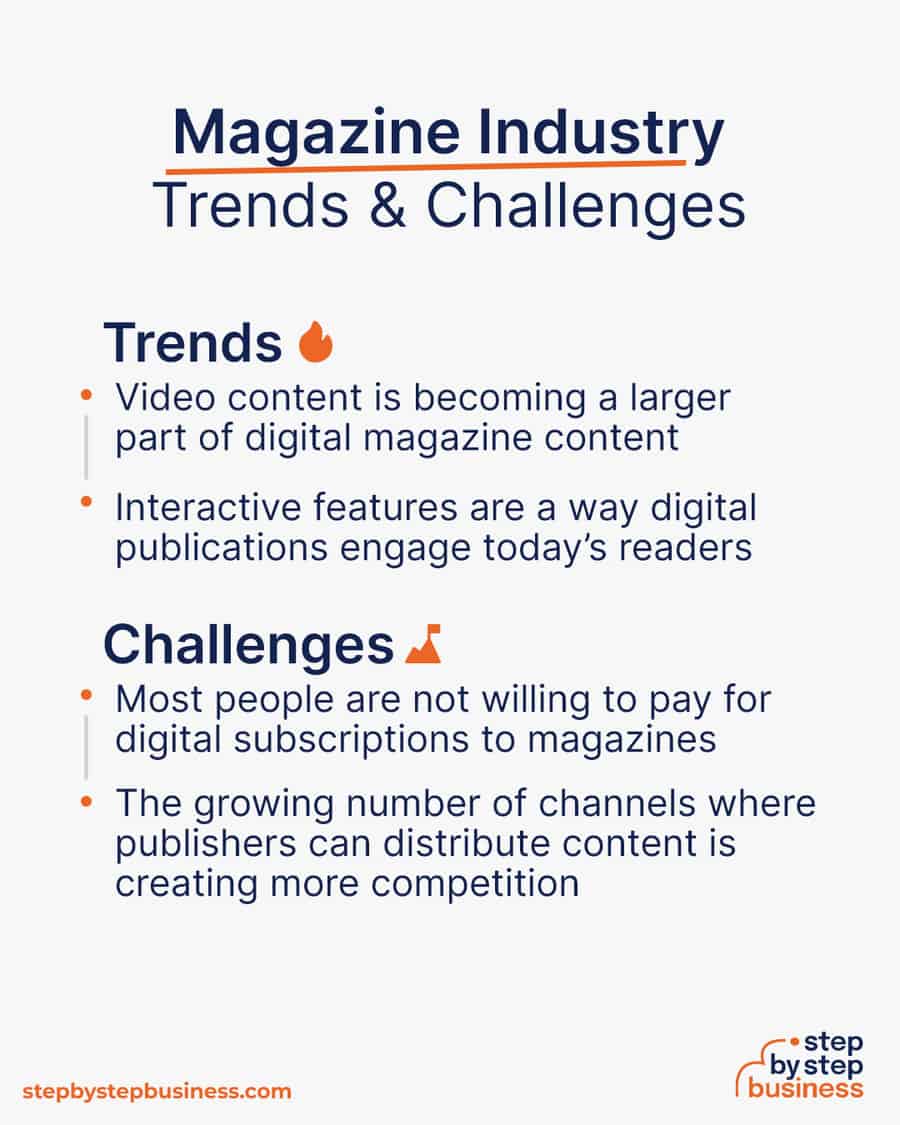

Trends and challenges

Trends in the magazine industry include:

- Video content is becoming a larger part of digital magazine content.

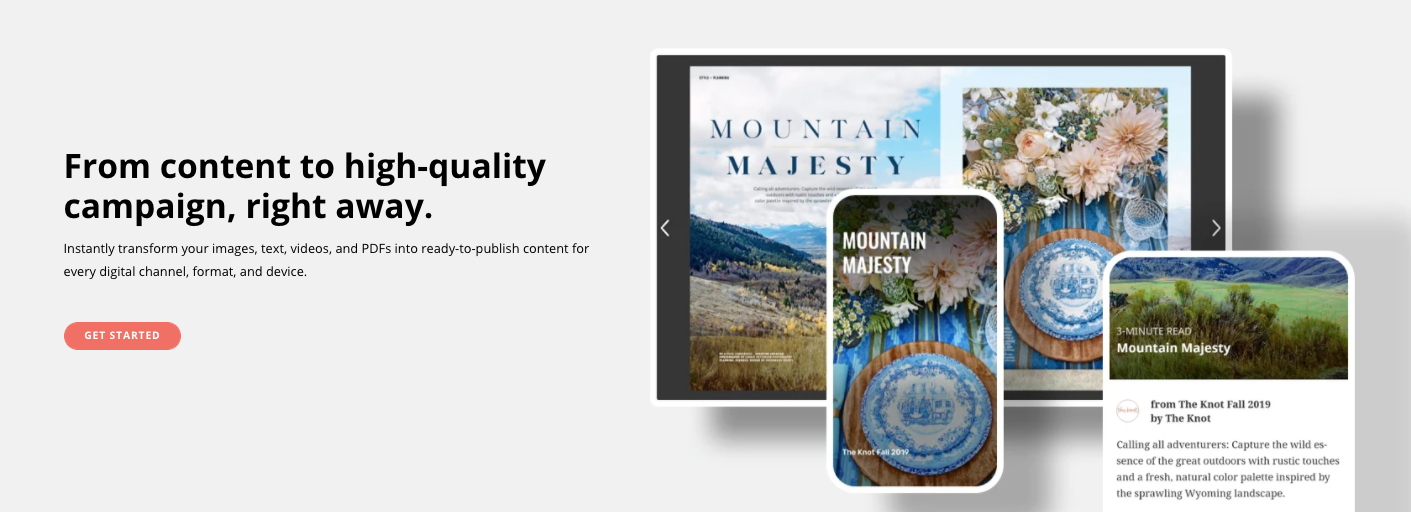

- Interactive features, such as puzzles, are a way digital publications engage today’s readers.

Challenges in the magazine industry include:

- Most people are not willing to pay for digital subscriptions to magazines, so digital magazines have to rely on ad revenue.

- The growing number of channels where publishers can distribute content is creating more competition for digital magazines.

How much does it cost to start a magazine business?

Startup costs for a magazine range from $2,800 to $6,300. Costs include a computer and design software for your magazine graphics.

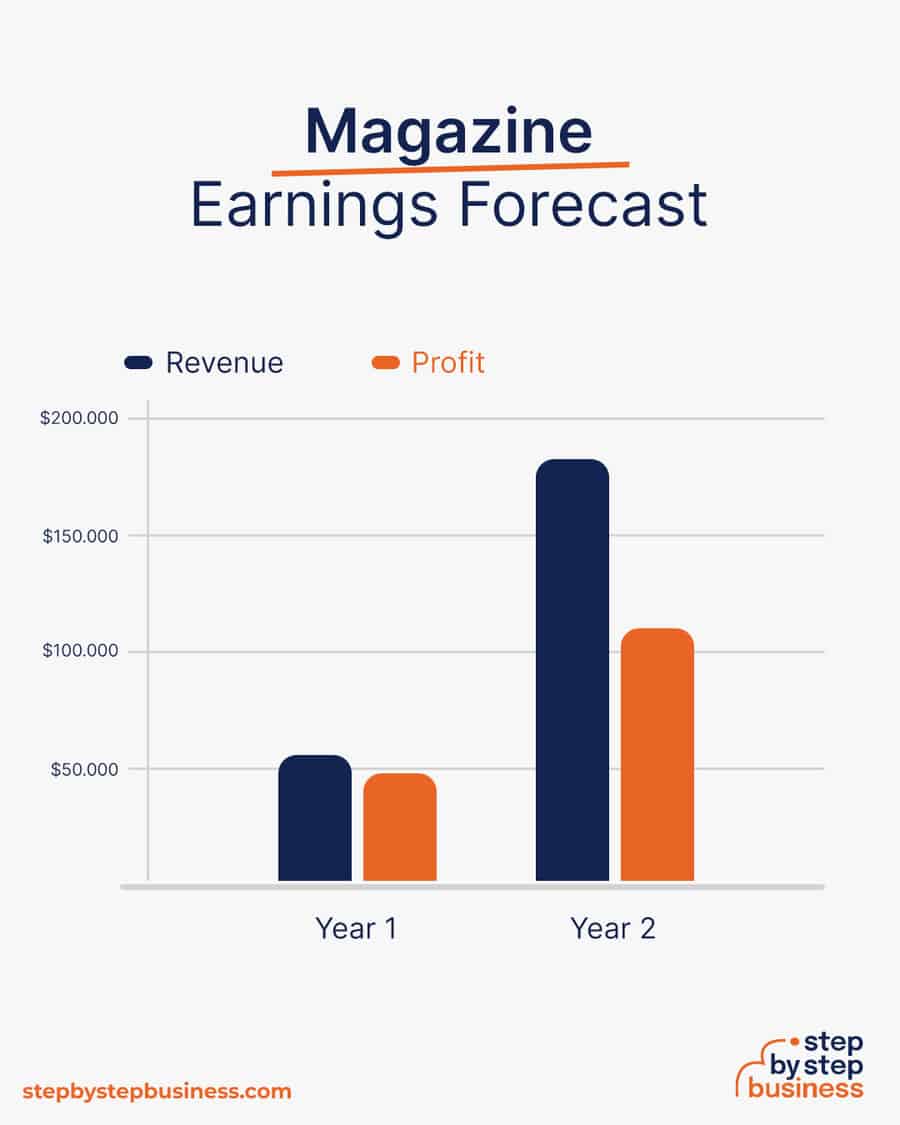

How much can you earn from a magazine business?

You can make money from your magazine by using Google AdSense, which will pay you 68% of what Google makes on each ad. Google offers tips to maximize your ad revenue. The average per ad click you’ll make is $3. Your profit margin will be high if you’re writing all the articles and doing the graphics yourself and should be around 90%.

In your first year or two, you might have 1,500 ad clicks per month, bringing in $54,000 in annual revenue. This would mean $49,000 in profit, assuming that 90% margin. As your magazine gains traction, you might get 5,000 ad clicks per month. At this stage, you might outsource some of the writing, reducing your profit margin to around 60%. With annual revenue of $180,000, you’d make a handsome profit of $108,000.

What barriers to entry are there?

There are a few barriers to entry for a magazine. Your biggest challenges will be:

- The writing skills needed to create informative and engaging content

- Drawing eyeballs from existing online magazines

Related Business Ideas

How to Start a Publishing Business

How to Start a Journal Business

How to Start a Freelance Writing Business

Step 2: hone your idea.

Now that you know what’s involved in starting a magazine, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research magazines online to examine their content and customer reviews. You’re looking for a market gap to fill. For instance, maybe the market is missing a digital publishing company that features personal essays or an educational digital publication on entrepreneurship that has interactive features.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as DIY articles or video content.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine your products or services

Your products will be the digital content that you create. You’ll just need to decide on a theme for your magazine, and what features you want to add, like interactive features or video content.

You could also offer your magazine as a subscription so that you’re not completely reliant on ad revenue.

How much should you charge for your magazine?

Your ad revenue will be based on Google AdSense rules and how much traffic your magazine gets. If you decided to offer your magazine as a subscription, you might be able to charge $2 to $4 monthly. Your profit margin when you’re working by yourself should be about 90%.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Your potential subscribers and readers will depend on the type of content you provide. If your content targets younger people, you should focus your marketing on TikTok and Instagram.

Where? Choose your business premises

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in your area on sites such as Craigslist , Crexi , and Instant Offices .

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a Magazine Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “magazine” or “digital magazine”, boosts SEO

- Name should allow for expansion, for ex: “Insight Magazine” over “Tech Trends”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Magazine Business Plan

Here are the key components of a business plan:

- Executive Summary : A brief summary of your business plan, highlighting its key points and objectives.

- Business Overview : An introduction to your business, its purpose, and the industry it operates in.

- Product and Services : Details about what your business offers and how it meets customer needs.

- Market Analysis : An assessment of your target market, including its size, trends, and opportunities.

- Competitive Analysis : Examination of your competitors and their strengths and weaknesses.

- Sales and Marketing : Strategies for promoting and selling your products or services.

- Management Team : Information about the key individuals running the business and their qualifications.

- Operations Plan : How your business will function day-to-day and the necessary resources and processes.

- Financial Plan : Projections and analysis of your business’s financial performance, including revenue, expenses, and profitability.

- Appendix : Supplementary information, such as supporting documents or detailed research, to provide additional context to the business plan.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to magazines.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your magazine will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC , which just need to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization , and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number , or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank and SBA loans are probably the best option, other than friends and family, for funding a magazine business. You might also try crowdfunding if you have an innovative concept.

Step 8: Apply for Publishing Licenses and Permits

Starting a magazine business requires obtaining a number of licenses and permits from local, state, and federal governments.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account .

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your magazine business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as The Magazine Manager , Chargebee , or Ad Sales Genius , to manage your projects, sales, and billing.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

For your magazine, the marketing strategy should focus on showcasing the unique content, quality of journalism, and the specific niche or audience you cater to. Highlight the magazine’s themes, such as lifestyle, fashion, business, culture, or a specific hobby, and emphasize the value it brings to readers. Here are some powerful marketing strategies for your future business:

Kickstart Marketing

- Professional Branding : Your branding should reflect the style and tone of your magazine. This includes an eye-catching logo, a well-designed magazine layout, and a visually appealing website.

- Direct Outreach : Connect with potential readers at events, through online communities, and via collaborations with influencers or figures relevant to your magazine’s niche.

Digital Presence and Online Marketing

- Professional Website and SEO : Develop a website that showcases sample articles, features, and subscription options. Use SEO best practices to rank for searches related to your magazine’s themes and key topics.

- Social Media Engagement : Utilize platforms like Instagram, Twitter, and Facebook to share content, engage with readers, and promote magazine issues, digital content, and events.

Content Marketing and Engagement

- Online Articles and Blogs : Share articles or blog posts that reflect the magazine’s content and attract potential subscribers. This content can drive traffic to your website and increase subscriptions.

- Email Newsletters : Regular newsletters can keep subscribers informed about new issues, exclusive online content, and special offers.

- Video Content : Create videos that provide a behind-the-scenes look at the magazine, interviews with contributors, or cover stories.

Experiential and In-Person Engagements

- Launch Events and Reader Meetups : Host events for issue launches, reader meetups, or discussions. These events can strengthen the magazine community and attract new readers.

- Participation in Industry Events : Take part in book fairs, festivals, and industry conferences relevant to your magazine’s niche.

Collaborations and Community

- Collaborations with Influencers and Brands : Collaborate with influencers, writers, and brands that align with your magazine’s content to expand your reach and add credibility.

- Community Engagement : Engage in community events, sponsor local activities, or collaborate with educational institutions, depending on your magazine’s focus.

Customer Relationship and Loyalty Programs

- Subscription Incentives : Offer incentives for new subscribers, such as discounts, gift items, or access to exclusive content.

- Loyalty Rewards for Existing Subscribers : Provide special offers, exclusive content, or discounts on merchandise to loyal subscribers.

Promotions and Advertising

- Targeted Advertising : Use targeted online advertising to reach potential subscribers interested in your magazine’s niche. Platforms like Facebook and Google Ads can be effective for this.

- Partnerships for Distribution : Partner with bookstores, cafes, and other relevant venues to distribute your magazine and reach a broader audience.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that sets it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your magazine meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your magazine business could be:

- All you need to know about DIY!

- Get all your entertainment news first here

- The latest tech news — with quizzes to test your knowledge

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a magazine business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in magazines for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in magazines. You’ll probably generate new customers or find companies with which you could establish a partnership. Online businesses might also consider affiliate marketing as a way to build relationships with potential partners and boost business.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a magazine business include:

- Writers – write articles

- Designers – design the graphics of the content

- General Manager – staff management, accounting

- Marketing Lead – SEO strategies, social media

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Magazine – Start Making Money!

Digital magazines are seeing rapid growth, providing readers with valuable information and entertainment that can be accessed even on a mobile device. If you’re a writer and have always dreamed of starting a magazine, there’s no need for the expense of paper – you can create your own digital magazine for very little money and maybe build a national brand!

You’ve gained valuable insights by reading this guide, so now it’s time to start writing your way to magazine success.

- Magazine Business FAQs

Magazines generally rely on ad revenue, which digital magazines can earn by using Google AdSense. They can also charge for subscriptions.

Generally, digital magazine subscriptions cost $2 to $4 per month. Magazines, however, mainly rely on advertisements to make money.

Starting a magazine can be profitable, but it depends on various factors such as the target audience, advertising revenue, circulation, production costs, and competition in the market. Conducting market research and developing a solid business plan can help evaluate the potential profitability of a magazine.

To ensure the quality and relevance of content offered in a magazine, consider the following strategies: conduct extensive research and interviews to provide accurate and informative content, utilize experienced and knowledgeable writers and editors, develop a consistent and recognizable editorial voice and style, solicit feedback from readers and industry professionals, and regularly assess and adapt to changes in industry trends and audience interests.