Banking cover letter examples

If you’re hoping to land your next banking role, then you need a cover letter that’s right on the money.

In our step-by-step guide, we’ll share our top tips and advice for writing an impressive application.

We’ve also created some banking cover letter examples to inspire your own. Check them out below.

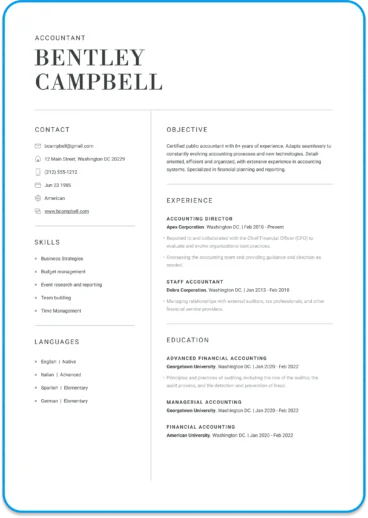

CV templates

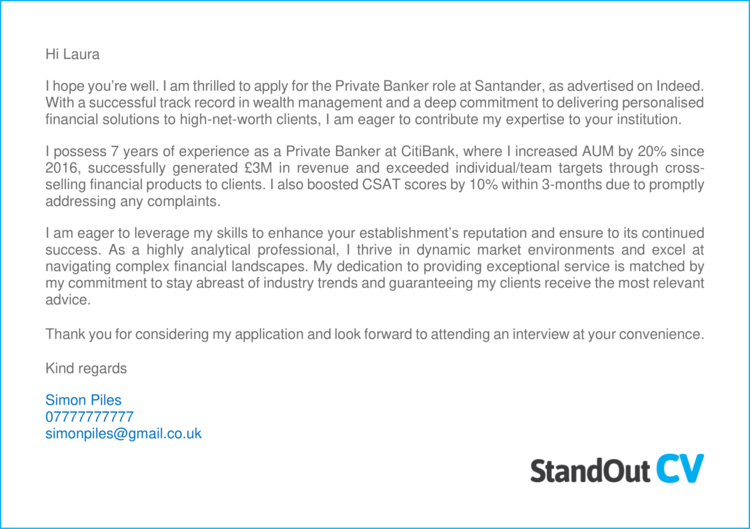

Banking cover letter example 1

Build your CV now

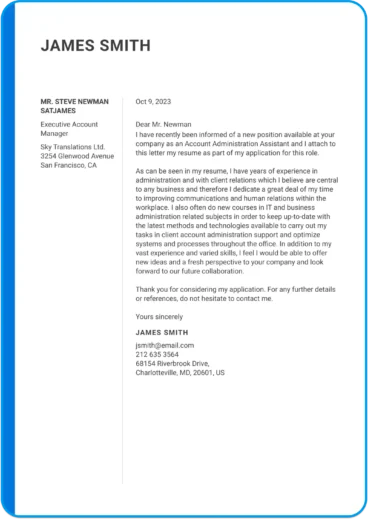

Banking cover letter example 2

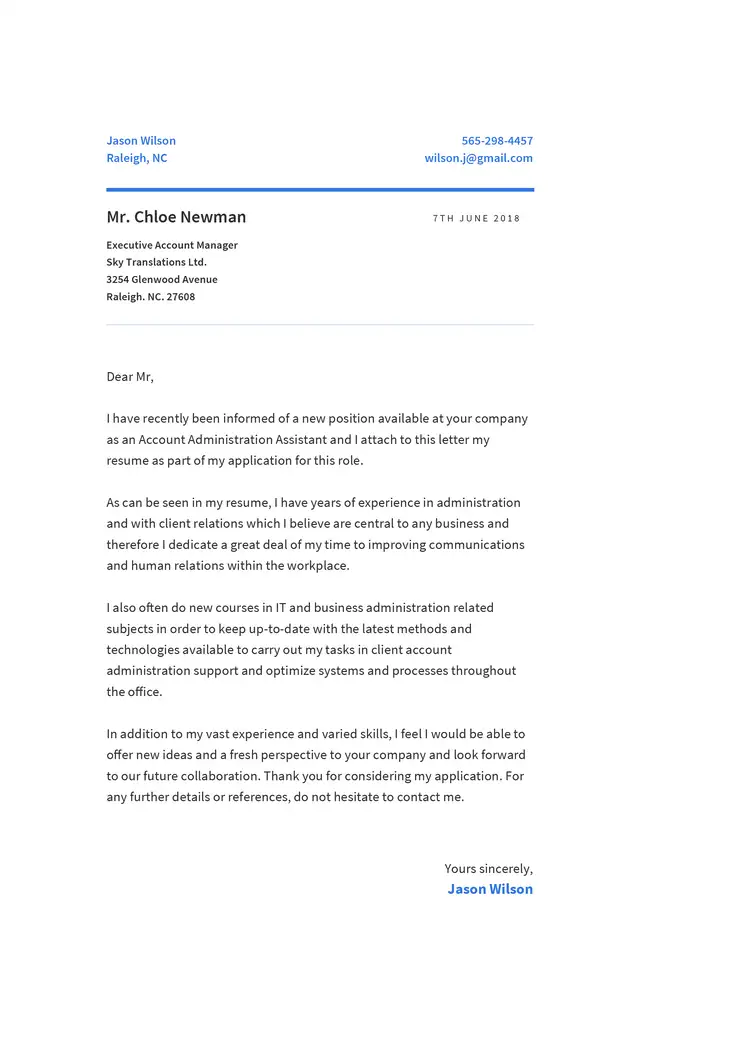

Banking cover letter example 3

These 3 Banking cover letter example s should provide you with a good steer on how to write your own cover letter, and the general structure to follow.

Our simple step-by-step guide below provides some more detailed advice on how you can craft a winning cover letter for yourself, that will ensure your CV gets opened.

How to write a Banking cover letter

A simple step-by-step guide to writing your very own winning cover letter.

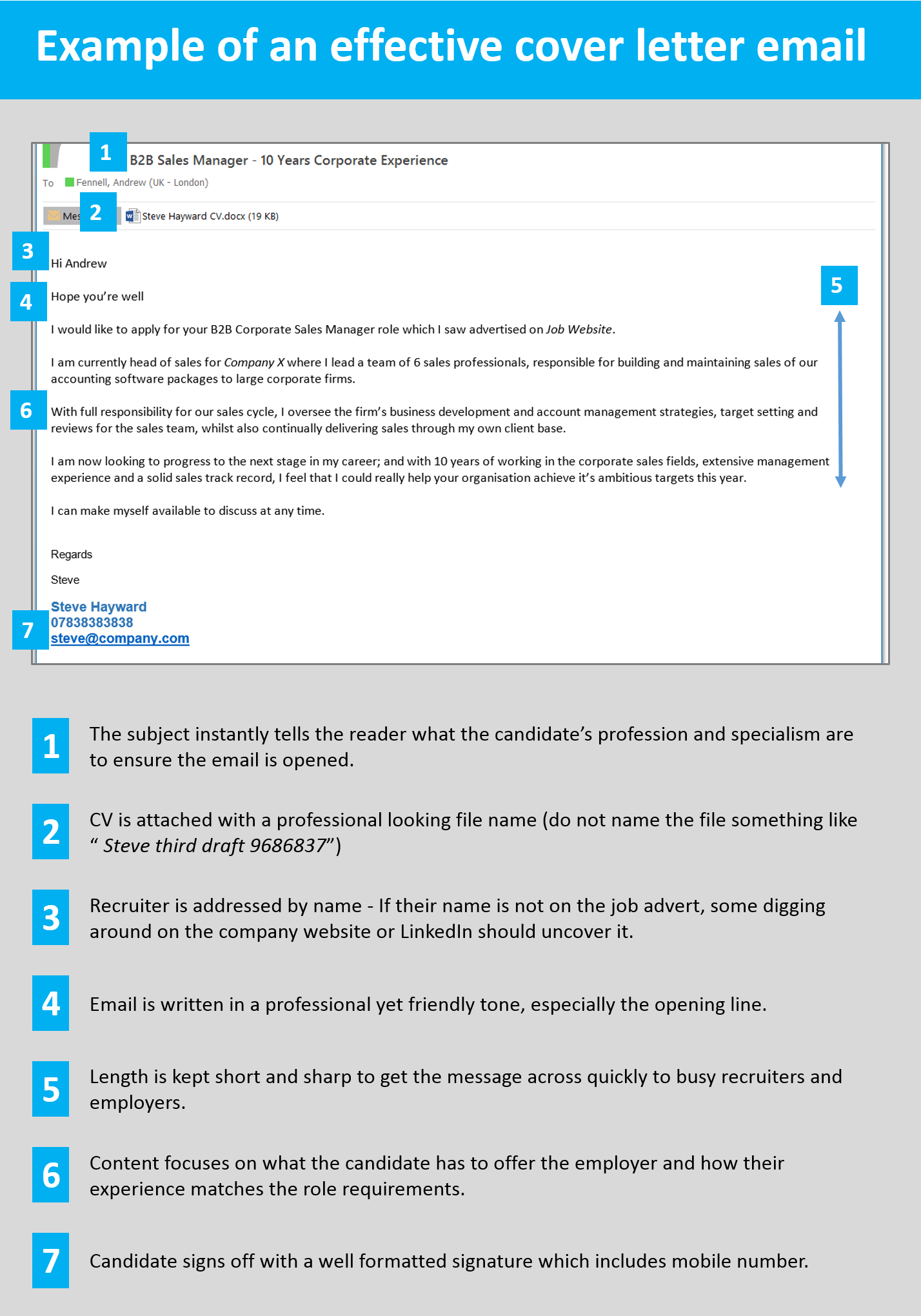

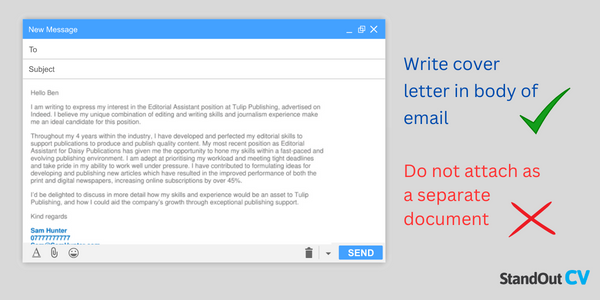

Write your cover letter in the body of an email/message

When writing your Banking cover letter, it’s best to type the content into the body of your email (or the job site messaging system) and not to attach the cover letter as a separate document.

This ensures that your cover letter gets seen as soon as a recruiter or employer opens your message.

If you attach the cover letter as a document, you’re making the reader go through an unnecessary step of opening the document before reading it.

If it’s in the body of the message itself, it will be seen instantly, which hugely increases the chances of it being read.

Start with a friendly greeting

To start building rapport with the recruiter or hiring manager right away, lead with a friendly greeting.

Try to strike a balance between professional and personable.

Go with something like…

- Hi [insert recruiter name]

- Hi [insert department/team name]

Stay away from old-fashioned greetings like “Dear sir/madam ” unless applying to very formal companies – they can come across as cold and robotic.

How to find the contact’s name?

Addressing the recruitment contact by name is an excellent way to start building a strong relationship. If it is not listed in the job advert, try to uncover it via these methods.

- Check out the company website and look at their About page. If you see a hiring manager, HR person or internal recruiter, use their name. You could also try to figure out who would be your manager in the role and use their name.

- Head to LinkedIn , search for the company and scan through the list of employees. Most professionals are on LinkedIn these days, so this is a good bet.

Identify the role you are applying for

Once you’ve opened up the cover letter with a warm greeting to start building a relationship, it is time to identify which role you want to apply for.

Recruiters are often managing multiple vacancies, so you need to ensure you apply to the correct one.

Be very specific and use a reference number if you can find one.

- I am interested in applying for the position of *Banking role* with your company.

- I would like to apply for the role of Sales assistant (Ref: 406f57393)

- I would like to express my interest in the customer service vacancy within your retail department

- I saw your advert for a junior project manager on Reed and would like to apply for the role.

See also: CV examples – how to write a CV – CV profiles

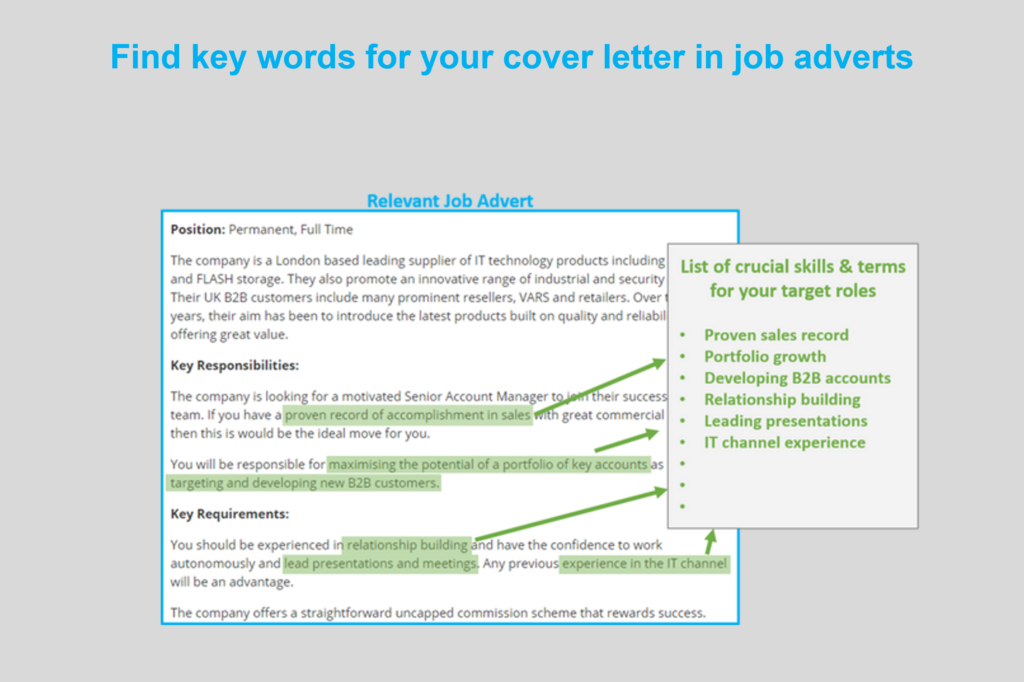

Highlight your suitability

The sole objective of your cover letter is to motivate recruiters into to opening your CV. And you achieve this by quickly explaining your suitability to the roles you are applying for.

Take a look at the job descriptions you are applying to, and make note of the most important skills and qualifications being asked for.

Then, when crafting your cover letter, make your suitability the central focus.

Explain why you are the best qualified candidate, and why you are so well suited to carry out the job.

This will give recruiters all the encouragement they need to open your CV and consider you for the job.

Keep it short and sharp

A good cover letter is short and sharp, getting to the point quickly with just enough information to grab the attention of recruiters.

Ideally your cover letter should be around 4-8 sentences long – anything longer will risk losing the attention of time-strapped recruiters and hiring managers .

Essentially you need to include just enough information to persuade the reader to open up your CV, where the in-depth details will sit.

Sign off professionally

To round of your CV, you should sign off with a professional signature.

This will give your cover letter a slick appearance and also give the recruiter all of the necessary contact information they need to get in touch with you.

The information to add should include:

- A friendly sign off – e.g. “Kindest regards”

- Your full name

- Phone number (one you can answer quickly)

- Email address

- Profession title

- Professional social network – e.g. LinkedIn

Here is an example signature;

Warm regards,

Jill North IT Project Manager 078837437373 [email protected] LinkedIn

Quick tip: To save yourself from having to write your signature every time you send a job application, you can save it within your email drafts, or on a separate documents that you could copy in.

What to include in your Banking cover letter

Here’s what kind of content you should include in your Banking cover letter…

The exact info will obviously depend on your industry and experience level, but these are the essentials.

- Your relevant experience – Where have you worked and what type of jobs have you held?

- Your qualifications – Let recruiters know about your highest level of qualification to show them you have the credentials for the job.

- The impact you have made – Show how your actions have made a positive impact on previous employers; perhaps you’ve saved them money or helped them to acquire new customers?

- Your reasons for moving – Hiring managers will want to know why you are leaving your current or previous role, so give them a brief explanation.

- Your availability – When can you start a new job ? Recruiters will want to know how soon they can get you on board.

Don’t forget to tailor these points to the requirements of the job advert for best results.

Banking cover letter templates

Copy and paste these Banking cover letter templates to get a head start on your own.

Hello Harry

I am keen to showcase my interest in the Bank Manager position at Investec. With a distinguished career in the financial service industry spanning over 15 years, I am excited about the opportunity to lead a dynamic team, steer exceptional customer experiences, and contribute to the success of your company.

Throughout my career at Metro Bank, I have held progressively responsible roles, where I honed my expertise in optimising branch operations, client service, team management, and business development across all activities. Some of the significant contributions I have played throughout my time at Metro Bank include, increasing deposits by 30% through integrating targeted marketing campaigns and relationship-building strategies, developing training programs which enhanced branch staff’s cross-selling of bank products by 50%, and lessening annual expenses by £80K by negotiating favourable contracts with suitable vendors.

My passion for fostering a customer-centric culture has been the driving force behind my success, and I am confident that my collaborative approach and ability to build and maintain relationships will ensure continued growth for Investec as a whole. Thank you very much for considering my application and I hope to hear from you very soon regarding scheduling an interview.

Kind regards

Ellen Mount ¦ 07777777777 ¦ [email protected]

I hope you’re well. I am thrilled to apply for the Private Banker role at Santander, as advertised on Indeed. With a successful track record in wealth management and a deep commitment to delivering personalised financial solutions to high-net-worth clients, I am eager to contribute my expertise to your institution.

I possess 7 years of experience as a Private Banker at CitiBank, where I increased AUM by 20% since 2016, successfully generated £3M in revenue and exceeded individual/team targets through cross-selling financial products to clients. I also boosted CSAT scores by 10% within 3-months due to promptly addressing any complaints.

I am eager to leverage my skills to enhance your establishment’s reputation and ensure to its continued success. As a highly analytical professional, I thrive in dynamic market environments and excel at navigating complex financial landscapes. My dedication to providing exceptional service is matched by my commitment to stay abreast of industry trends and guaranteeing my clients receive the most relevant advice.

Thank you for considering my application and look forward to attending an interview at your convenience.

Simon Piles ¦ 07777777777 ¦ [email protected]

Good morning, Gary

I am excited to apply for the Junior Teller role at Fidelity Bank. I am eager to leverage my skills and commitment towards maintaining the high standards of service associated with your institution.

Throughout my academic journey and part-time experiences, I have developed a deep understanding of banking procedures, where I gained valuable insights into the importance of accuracy, confidentiality, and efficiency in handling transactions. As a recent HND Banking Graduate from Lincoln College, I possess theoretical knowledge in financial accounting and economics.

Additionally, I completed a one-year internship at TD Group where I was exposed to real-world cash handling, account management, and customer interactions. During this internship I assisted in the implementation of a new process for addressing inquiries that reduced wait times by 20%, as well as assuring a 100% record of compliance with bank policies which led to successful audits with no major findings.

Please feel free to reach out to me via email or by phone at your convenience to schedule an interview. Thank you for considering my application.

Lisa McKenzie ¦ 07777777777 ¦ [email protected]

Writing an impressive cover letter is a crucial step in landing a Banking job, so taking the time to perfect it is well worth while.

By following the tips and examples above you will be able to create an eye-catching cover letter that will wow recruiters and ensure your CV gets read – leading to more job interviews for you.

Good luck with your job search!

Entry-Level Finance Cover Letter and Resume Samples

Hero Images / Getty Images

- Cover Letters

- Skills & Keywords

- Salary & Benefits

- Letters & Emails

- Job Listings

- Job Interviews

- Career Advice

- Work-From-Home Jobs

- Internships

When you are applying for a job in finance , be sure to follow the instructions in the job posting exactly. If a cover letter is required, make sure yours is a good one. It can help to look at a sample of an entry-level finance cover letter to help you know what to include. It’s also helpful to review resume examples so you can see how yours compares. The following is an example of a cover letter for an entry-level finance position.

When you're applying for an entry-level job that doesn't require significant work experience, include information on the related courses you've taken, any internships you've done, and the finance skills you've gained while in college.

It's important to be specific and to take the time to match your qualifications to the job description. The closer the match, the better your chances will be of getting picked for an interview. Here is an example of a cover letter for a finance position, followed by a sample resume.

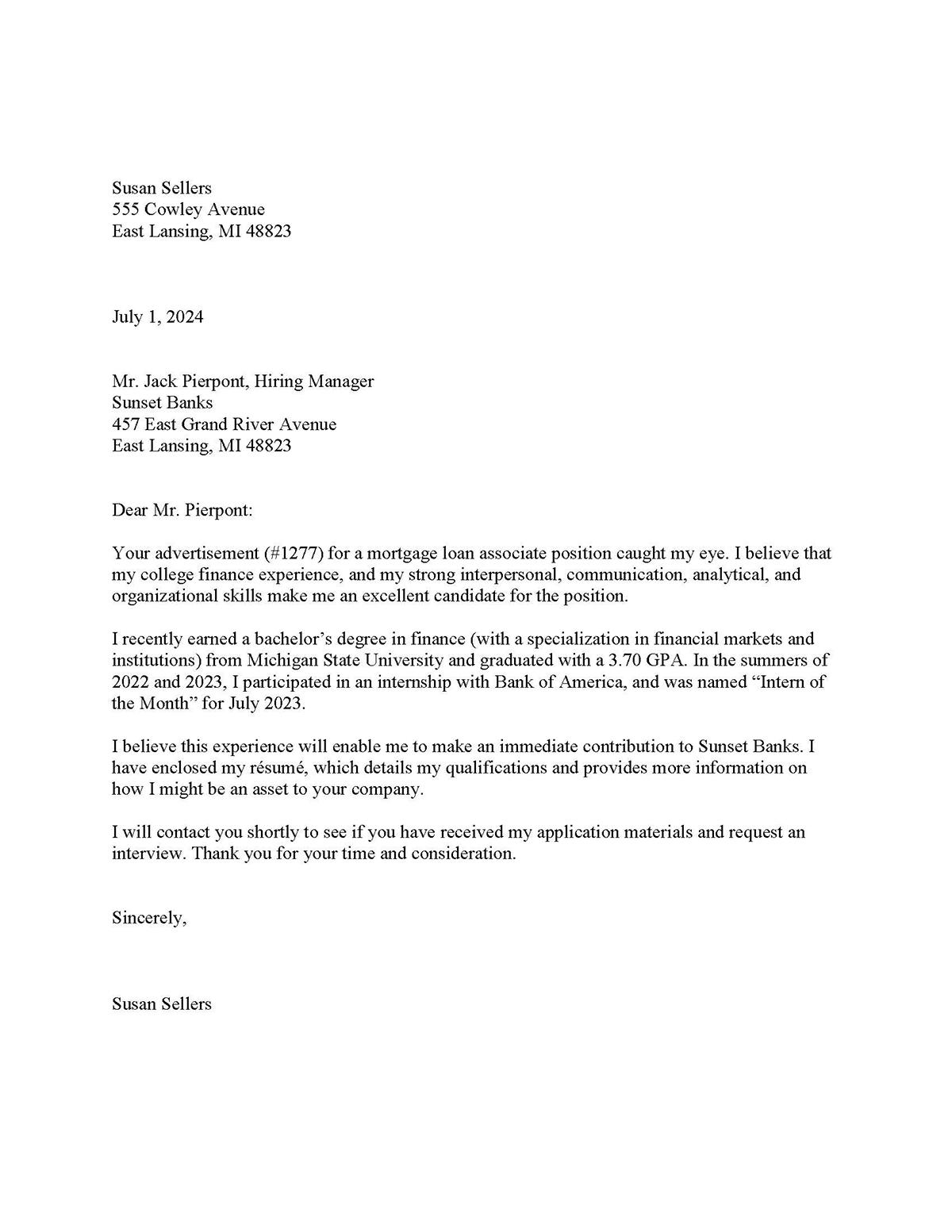

Sample Cover Letter for an Entry-Level Finance Position

This is a cover letter example for an entry-level finance position. Download the entry-level finance position cover letter template (compatible with Google Docs and Word Online) or see below for more examples.

Sample Cover Letter for an Entry Level Finance Position (Text Version)

Ashley Applicant 123 Main Street, Anytown, CA 12345 555-555-5555 555-555-1234 ashley.applicant@email.com

September 1, 2018

Thomas Lee Director, Finance ABC Investment Partners 123 Business Rd. Business City, NY 54321

Dear Mr. Lee,

I am very interested in the entry-level position that is available at ABC Investment Partners. I recently graduated from XYZ University College and am actively seeking employment with firms in the San Francisco area. My courses in investments, finance, and business have given me a solid base upon which I plan to build my career.

During my college internships, I dealt with a variety of budgets and conducted market research while handling numerous administrative duties. The experience allowed me to learn important skills and to develop the confidence needed to succeed in a competitive environment.

I have enclosed my resume for your review. Thank you for your time and consideration.

It would be a pleasure to interview with you and I look forward to hearing from you soon.

Signature (hard copy letter)

Ashley Applicant

Sample Finance Resume

This is an example of an entry-level finance resume. Download the resume template (compatible with Google Docs and Word Online) or see below for more examples.

Sample Finance Resume (Text Version)

Ashley Applicant 123 Main Street Little Rock, AR 24680 (123) 456-7890 ashley.applicant@email.com

FINANCIAL ANALYST

Building solid investment strategies for a broad range of clients

Analytical and detail-oriented emerging professional positioned to excel in a challenging entry-level finance position requiring solid knowledge of investment strategies and international financial markets.

Computer skills include:

- Sage 50 Accounting

- PrevisionEPM Financial Reporting

PROFESSIONAL EXPERIENCE

SECOND STREET BANK, Little Rock, Ark. TELLER (January 2018—Present)

Concurrent with education, gaining practical experience for an established banking firm. Provide first-class customer service to clients and handle cash transactions with 100 percent accuracy.

FRANK FINANCIAL SERVICES, Little Rock, Ark. INTERN (September 2017—December 2017)

Structured, researched, and presented individual and group case studies of corporate financial structures, futures markets, commodities pricing, and trading strategies.

PREMIUM TAX SERVICES, Rye, New York INTERN (January 2017—April 2017)

Assisted with filing tax returns for clients.

EDUCATION & CREDENTIALS

UNIVERSITY OF ARKANSAS AT LITTLE ROCK , Little Rock, Ark. Bachelor of Business Administration in Finance, 2018

Relevant coursework included:

- Financial Econometrics

- Macroeconomics

- Corporate finance

- Asset pricing

SOUTHERN TECHNICAL COLLEGE , Little Rock, Ark. Associate of Applied Science in Business Management, 2016

Sending an Email Cover Letter and Resume

If you're sending your cover letter via email, list your name and the job title in the subject line of the email message:

Subject: Job Title - Your Name

Include your contact information in your email signature, and don't list the employer contact information. Start your email message with the salutation.

- Sample Cover Letter for an Entry-Level Position

- Cover Letter and Resume for a Summer Cashier

- Nanny Resume and Cover Letter Examples

- Consulting Cover Letter Samples and Writing Tips

- Public Relations Cover Letter Example

- Write Interview Winning Resumes and Cover Letters

- Librarian Cover Letter and Resume Examples

- Speech Pathologist Resume and Cover Letter Examples

- How to Write a Cover Letter for an Insurance Analyst Trainee Position

- Retail Management Cover Letter and Resume Examples

- Event Planner Resume and Cover Letter Examples

- Software Engineer Cover Letter and Resume Example

- Finance Internship Cover Letter Example

- Admissions Counselor Cover Letter and Resume Examples

- Photographer Cover Letter and Resume Examples

- How to Write an Academic Cover Letter With Examples

3 Bank Teller Cover Letter Examples: Experienced, Entry-Level, And Generic Cover Letters.

3 Bank Teller cover letter examples for Experienced Bank Tellers, Entry-Level Bank Tellers, And Generic Bank Teller Cover Letters.

When writing your bank teller cover letter, put all your work around managing and handling cash at the top and then your experience with the customers.

A banker is interested in a candidate who is helpful, extrovert, well-spoken, easily builds rapport, and works with the cash effortlessly but carefully.

You will also benefit from having used excel sheets to enter data into columns and rows for organization and to enable its use in the analysis.

All of the above experiences come to your aid with or without a relevant college degree. Based on what you have studied you can highlight what is closest to the required experience for a bank teller job.

Write your bank teller cover letter in 150-200 words which is sufficient to list everything that needs a mention.

There can be an advantage for you if you are bilingual. Since you will speak to customers, understanding and speaking different local languages will only be helpful and make you look articulate in customer service.

Let’s now look at some cover letters for the bank teller position.

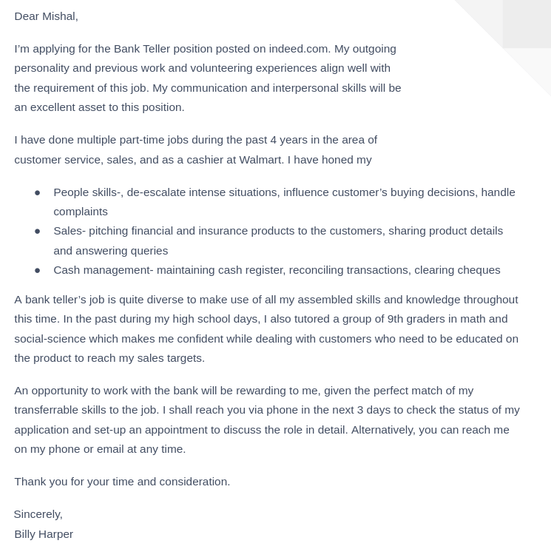

Bank Teller Cover Letter With No Experience

Dear Mishal,

I’m applying for the Bank Teller position posted on indeed.com. My outgoing personality and previous work and volunteering experiences align well with the requirement of this job. My communication and interpersonal skills will be an excellent asset to this position.

I have done multiple part-time jobs during the past 4 years in the area of customer service, sales, and as a cashier at Walmart. I have honed my

- People skills-, de-escalate intense situations, influence customer’s buying decisions, handle complaints

- Sales- pitching financial and insurance products to the customers, sharing product details and answering queries

- Cash management- maintaining cash register, reconciling transactions, clearing cheques

A bank teller’s job is quite diverse to make use of all my assembled skills and knowledge throughout this time. In the past during my high school days, I also tutored a group of 9th graders in math and social-science which makes me confident while dealing with customers who need to be educated on the product to reach my sales targets.

An opportunity to work with the bank will be rewarding to me, given the perfect match of my transferrable skills to the job. I shall reach you via phone in the next 3 days to check the status of my application and set-up an appointment to discuss the role in detail. Alternatively, you can reach me on my phone or email at any time.

Thank you for your time and consideration.

Sincerely, Billy Harper

Cover Letter for Entry-Level Bank Teller

Dear James,

I would like to apply for the position of Bank Teller at Wells Fargo advertised on Dice.com. I graduated in 2018 with a BABS and stayed in Vernon of California to be with my family. During the 2 years that I have lived in Vernon after graduation, I have worked for a summer camp project as a research assistant, and at a supermarket outside the town as a cashier. My experiences, though not into a bank, have a lot to transfer to a bank teller’s position.

As a summer camp research assistant for a psychology research study examining youth involvement throughout the camp, I interacted with a diverse range of people, including campers and parents in UBC’s camp. I gave brief overviews of our study and obtained parental consent for participation. I collected and transferred all the survey data into the computer for analysis while maintaining accuracy and participant’s privacy. In the year before, I was hired as a part-time help-desk executive and cashier at the only superstore near Vernon where I greeted and directed customers to the right area for their shopping needs, billing, and return transactions. My experiences working with customers developed my people skills and the part-time job of cashier and help-desk executive taught me how to wear many hats and change the priorities quickly in the hour of need.

As a Bank Teller, I see myself utilizing my skills to their full potential and learning more in the process from where there is a plethora of activities and skills to obtain. I look forward to discussing this further in an interview at your earliest convenience. Please feel free to contact me through phone or email should any questions arise.

Thank you for your time in reading my letter.

Sincerely, Sara Fernandes

Experienced Sample Cover Letter for Bank Teller

This is to apply for the position of Bank Teller at JPMorgan Chase which I found posted on your website. I bring 3 years of experience serving as a Bank Teller at the Bank of America and Ally Bank which are both known for their excellent customer service which is of chief importance at JPMorgan. Besides, my own passion to provide value to every customer aligns with the bank’s and I would love to work towards a conjoint mission.

In my experience with the Bank of America, this position was about being a guide and a companion to revenue generation apart from recording and processing the daily transactions of cash and cheque. Over time, I learned about various financial products and how they benefited customers and with that, I also became more resourceful in terms of matching the needs of the customer with the products of the bank. I was offered a share in the bonus of the sales team in return for the converted leads I generated.

Before this, I sold life insurance as an agent for multiple insurance companies offering customers the product that suited their needs from my portfolio of eight life insurance products. Being the face of multiple financial institutions for my customers made me more aware of the differences in the conduction of business by various companies. I’m able to wear multiple hats and conduct a diverse range of activities simultaneously.

I understand that being resourceful is the key to success in terms of both career progression and revenue generation. Which is why I’m open to learning at all times. I seek an opportunity for an interview with JPMorgan to contribute to its corporate goals through my holistic customer service skills.

Thank you for reviewing my application. I hope to hear from you soon.

Sincerely, Olivia Swift

Copyright © 2024 Workstory Inc.

Select Your Language:

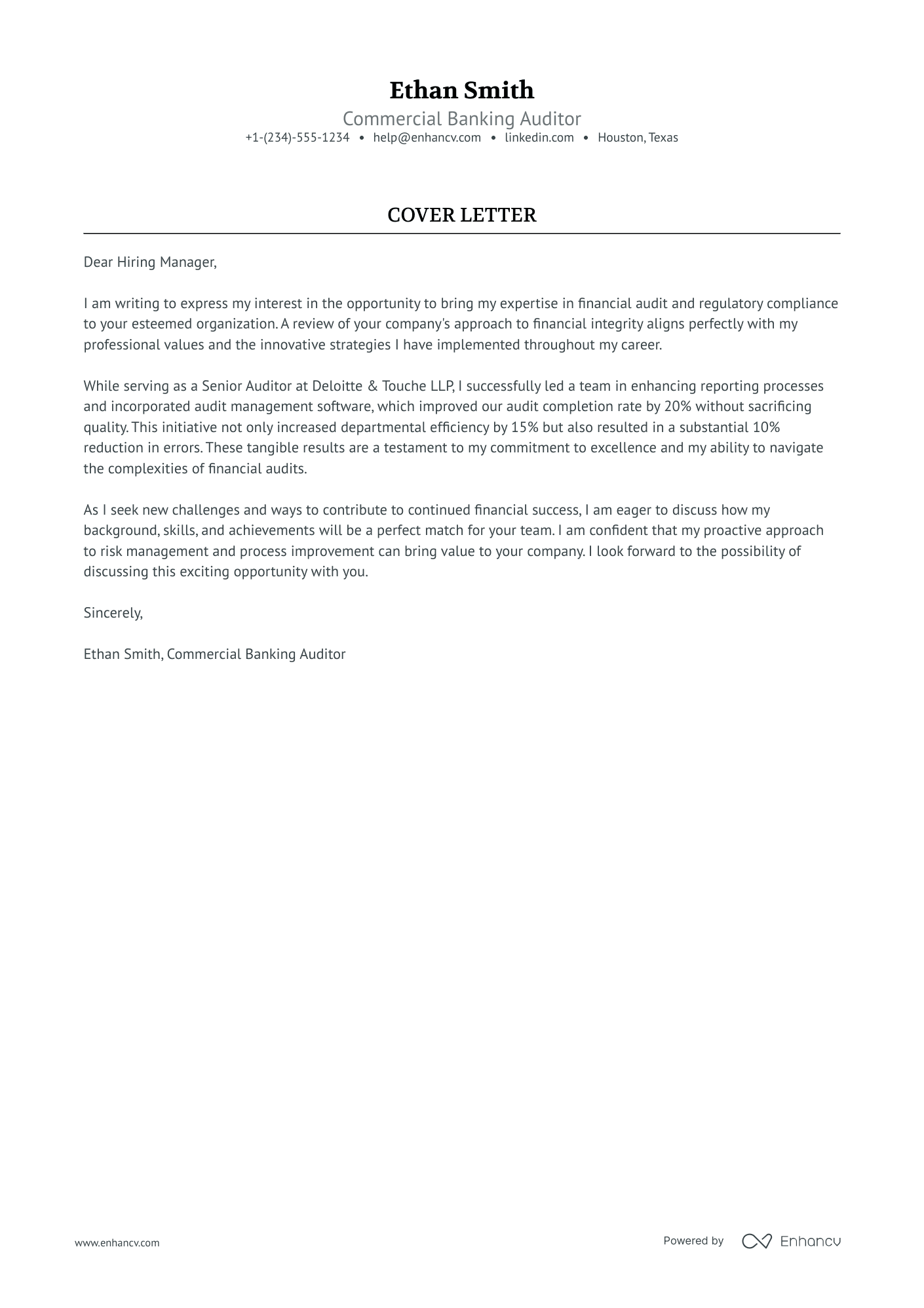

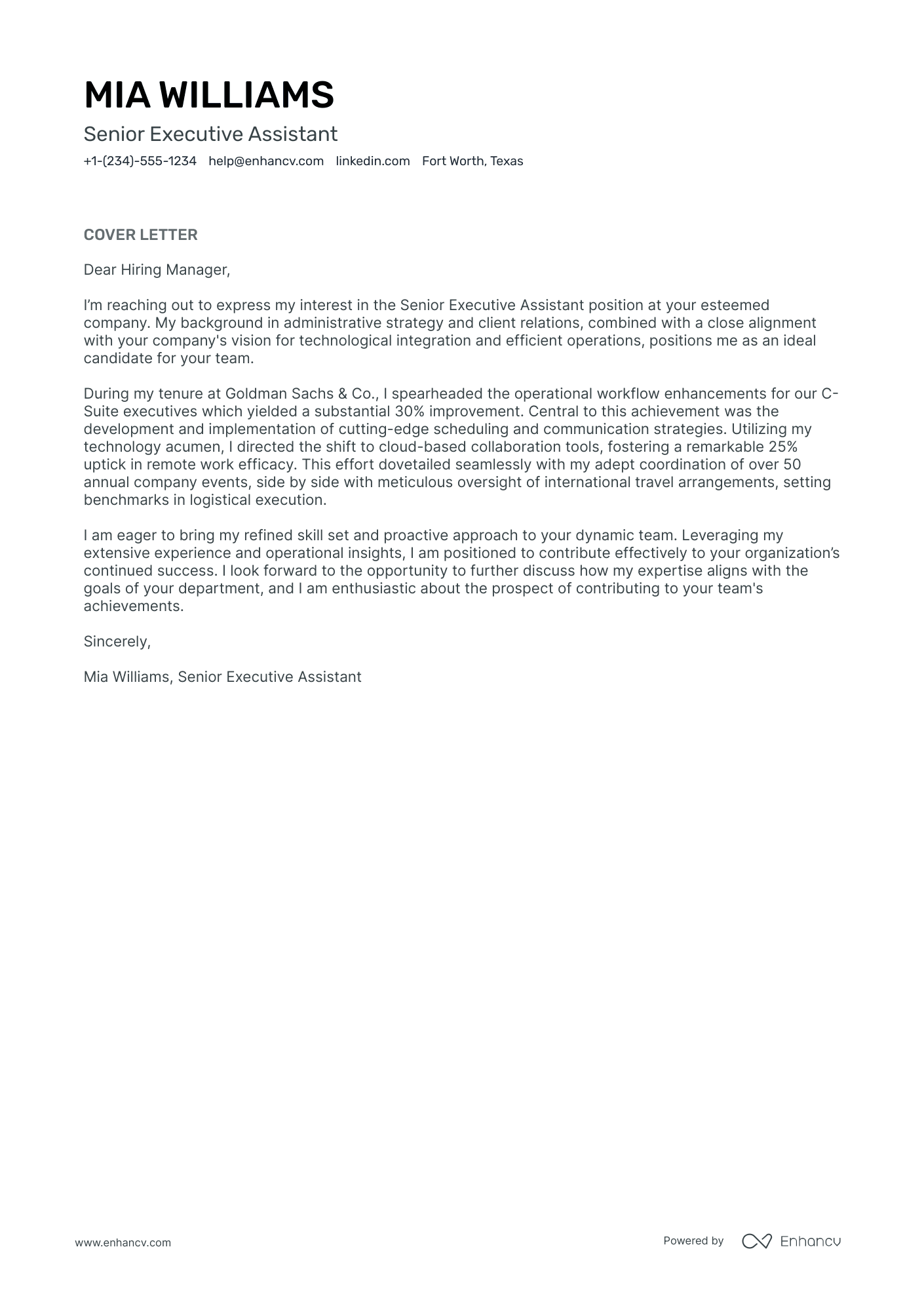

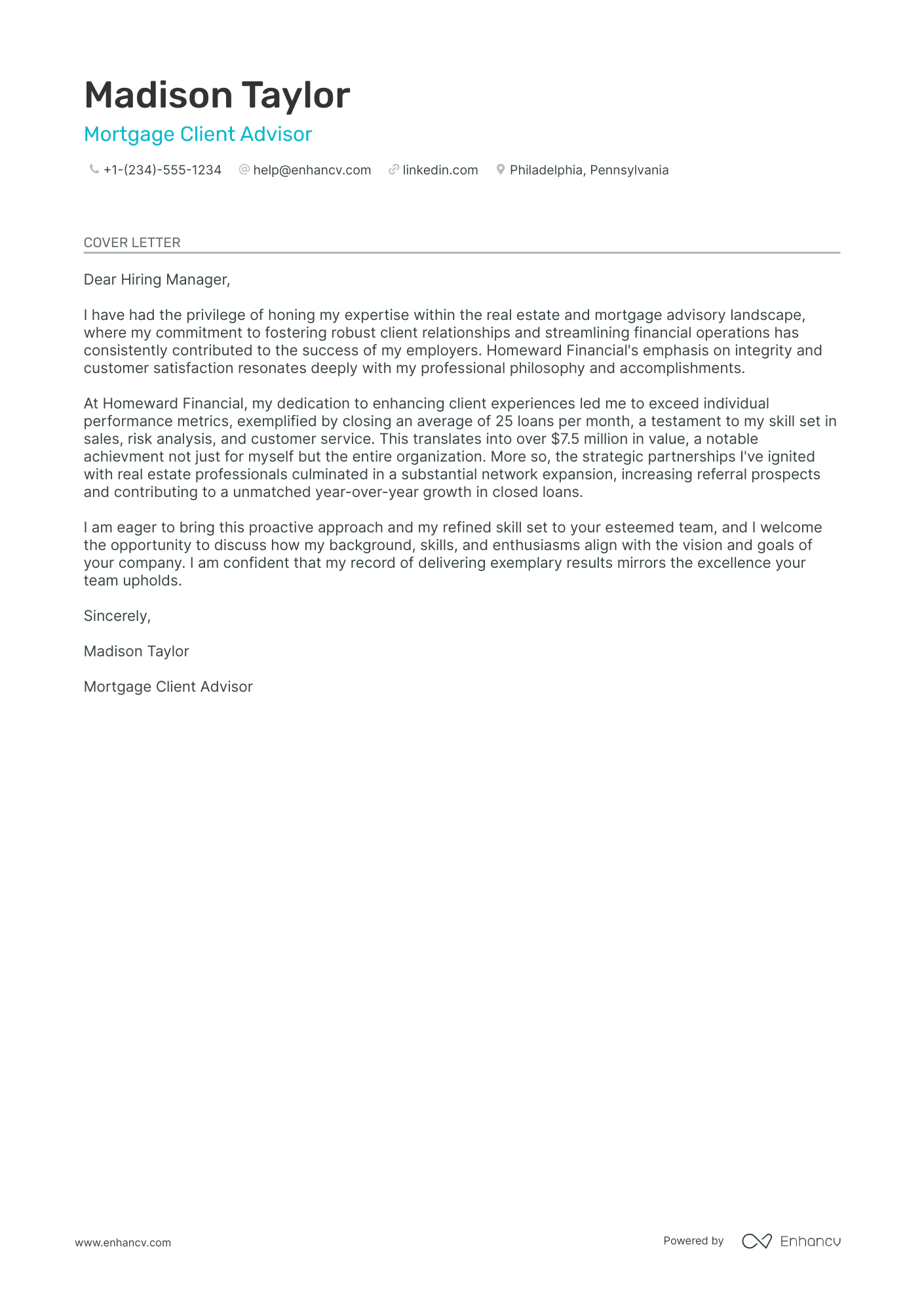

6 Professional Banking Cover Letter Examples for 2024

Your banking cover letter must immediately highlight your understanding of financial trends and economic regulations. It should demonstrate familiarity with the specific banking institution to which you're applying. Be sure to showcase your previous banking experience and your ability to foster client relationships. Your cover letter needs to reflect both your analytical skills and your commitment to customer service excellence.

All cover letter examples in this guide

Commercial Banking

Corporate Banking

Loan Officer

Loan Processor

Phone Banking

Cover letter guide.

Banking Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Banking Cover Letter

Key Takeaways

Crafting a banking cover letter can often feel daunting. You might have already dived into job applications, only to realize a punchy cover letter is a must-have. It's not about echoing your resume; it's about showcasing a key professional triumph and bringing your journey to that success to life. Remember, formality is key, but dodging clichés will make you stand out. And keeping it concise to one page is crucial. Let's guide you through writing a cover letter that opens doors.

- Create a banking cover letter to persuade the recruiters you're the best candidate for the role;

- Use industry-leading banking cover letter templates and examples to save time;

- Dedicate your banking cover letter space to your best achievement;

- Make sure your banking cover letter meets recruiters' expectations and standards.

Avoid starting at the blank page for hours by using Enhancv's AI - just upload your resume and your banking cover letter will be ready for you to (tweak and) submit for your dream job.

If the banking isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Banking resume guide and example

- Financial Accountant cover letter example

- Public Accounting Auditor cover letter example

- Finance Coordinator cover letter example

- Corporate Accounting cover letter example

- Bank Manager cover letter example

- VP of Finance cover letter example

- Tax Manager cover letter example

- Cost Accounting cover letter example

- Finance Manager cover letter example

- Tax Director cover letter example

Banking cover letter example

Alex Johnson

New York, NY

+1-(234)-555-1234

- Explicitly stating relevant previous experience, such as managing relationships with over 500 customers at Chase Bank, provides concrete evidence of capability in the field and assures the hiring manager of the candidate's qualifications for the customer relationship role.

- Quantifying achievements, like citing a 95% customer satisfaction rate and a 30% reduction in customer complaints, helps to objectively demonstrate the candidate's impact and effectiveness in the previous position.

- Identifying a specific initiative, such as leading the integration of a new CRM system, exhibits the candidate’s ability to innovate and improve processes, which could translate into similar successes in the new role.

- Expressing eagerness to apply strategic vision and skills to the potential employer's institution, and aligning personal commitment with the company's core values, shows the hiring manager that the candidate is not only qualified but also genuinely interested in the company's mission.

What about your banking cover letter format: organizing and structuring your information

Here is one secret you should know about your banking cover letter assessment. The Applicant Tracker System (or ATS) won't analyze your cover letter.

You should thus focus on making an excellent impression on recruiters by writing consistent:

- Introduction

- Body paragraphs (and explanation)

- Promise or Call to action

- Signature (that's optional)

Now, let's talk about the design of your banking cover letter.

Ensure all of your paragraphs are single-spaced and have a one-inch margins on all sides (like in our cover letter templates ).

Also, our cover letter builder automatically takes care of the format and comes along with some of the most popular (and modern) fonts like Volkhov, Chivo, and Bitter.

Speaking of fonts, professionals advise you to keep your banking cover letter and resume in the same typography and avoid the over-used Arial or Times New Roman.

When wondering whether you should submit your banking cover letter in Doc or PDF, select the second, as PDF keeps all of your information and design consistent.

The top sections on a banking cover letter

- Header: This should include your contact information, the date, and the employer's contact details, providing a professional appearance and ensuring that the recruiter can easily identify and get in touch with you.

- Greeting: A personalized greeting addressing the hiring manager by name demonstrates that you have done your research and are genuinely interested in the position at their banking institution.

- Introduction: In this section, you should clearly state the banking position you are applying for and give a brief overview of your relevant experience, capturing the recruiter's interest and showing immediate relevance.

- Body: Here, you elaborate on your previous banking experience, quantitative achievements, and understanding of financial principles, showing how your background makes you the right fit for the specific banking role you are pursuing.

- Closing: The closing should reiterate your enthusiasm for the role, include a call to action politely prompting an interview, and thank the hiring manager for considering your application, leaving a professional and courteous final impression.

Key qualities recruiters search for in a candidate’s cover letter

Understanding of Financial Regulations: Banks must adhere strictly to financial regulations, and showing knowledge in this area indicates a candidate's readiness to operate within legal and ethical boundaries.

Attention to Detail: Handling financial transactions requires precision, and even small errors can have significant repercussions, making this trait critical in banking roles.

Customer Service Skills: Bankers often interact with customers, requiring the ability to manage relationships, address concerns effectively, and maintain customer satisfaction and trust.

Sales Experience: Many banking positions have sales components, such as promoting credit cards or loans, hence experience in sales reflects the potential for revenue generation.

Risk Management: The ability to identify and mitigate financial risks is crucial in banking to protect the institution's assets and maintain financial stability.

Numeracy and Analytical Skills: A strong aptitude for numbers and the ability to analyze financial data are essential for making informed decisions in a banking context.

What greeting should you use in your banking cover letter salutation

A simple "Hello" or "Hey" just won't work.

With your banking cover letter salutation , you set the tone of the whole communication.

You should thus address the hiring managers by using their first (or last name) in your greeting.

But how do you find out who's recruiting for the role?

The easiest way is to look up the role on LinkedIn or the corporate website.

Alternatively, you could also contact the organization via social media or email, for more information.

Unable to still obtain the recruiter's name?

Don't go down the "To whom it may concern path". Instead, start your cover letter with a "Dear HR team".

List of salutations you can use

- Dear Hiring Manager,

- Dear [Bank Name] Recruitment Team,

- Dear [Hiring Manager's Name],

- Dear [Department Name] Team,

- Dear Mr./Ms. [Last Name],

- Dear [Position Title] Hiring Committee,

Your banking cover letter intro: showing your interest in the role

On to the actual content of your banking cover letter and the introductory paragraph .

The intro should be no more than two sentences long and presents you in the best light possible.

Use your banking cover letter introduction to prove exactly what interests you in the role or organization. Is it the:

- Company culture;

- Growth opportunities;

- Projects and awards the team worked on/won in the past year;

- Specific technologies the department uses.

When writing your banking cover letter intro, be precise and sound enthusiastic about the role.

Your introduction should hint to recruiters that you're excited about the opportunity and that you possess an array of soft skills, e.g. motivation, determination, work ethic, etc.

Structuring your banking cover letter body to add more value

You've hinted at your value as a professional (this may be your passion for the job or interest in the company) in your introduction.

Next, it's time to pan out the body or middle of your banking cover letter .

When creating your resume, you've probably gone over the advert a million times to select the most relevant skills.

Well, it's time to repeat this activity. Or just copy and paste your previous list of job-crucial requirements.

Then, select one of your past accomplishments, which is relevant and would impress hiring managers.

Write between three and six paragraphs to focus on the value your professional achievement would bring to your potential, new organization.

Tell a story around your success that ultimately shows off your real value as a professional.

Finishing off your banking cover letter with what matters most

So far, you've done a fantastic job in tailoring your banking cover letter for the role and recruiter.

Your final opportunity to make a good impression is your closing paragraph.

And, no, a "Sincerely yours" just won't do, as it sounds too vague and impersonal.

End your banking cover letter with the future in mind.

So, if you get this opportunity, what do you plan to achieve? Be as specific, as possible, of what value you'd bring to the organization.

You could also thank recruiters for their interest in your profile and prompt for follow-up actions (and organizing your first interview).

No experience banking cover letter: making the most out of your profile

Candidates who happen to have no professional experience use their banking cover letter to stand out.

Instead of focusing on a professional achievement, aim to quantify all the relevant, transferrable skills from your life experience.

Once again, the best practice to do so would be to select an accomplishment - from your whole career history.

Another option would be to plan out your career goals and objectives: how do you see yourself growing, as a professional, in the next five years, thanks to this opportunity?

Be precise and concise about your dreams, and align them with the company vision.

Key takeaways

Writing your banking cover letter doesn't need to turn into an endless quest, but instead:

- Create an individual banking cover letter for each role you apply to, based on job criteria (use our builder to transform your resume into a cover letter, which you could edit to match the job);

- Stick with the same font you've used in your resume (e.g. Raleway) and ensure your banking cover letter is single-spaced and has a one-inch margin all around;

- Introduce your enthusiasm for the role or the company at the beginning of your banking cover letter to make a good first impression;

- Align what matters most to the company by selecting just one achievement from your experience, that has taught you valuable skills and knowledge for the job;

- End your banking cover letter like any good story - with a promise for greatness or follow-up for an interview.

Banking cover letter examples

Explore additional banking cover letter samples and guides and see what works for your level of experience or role.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

How to Write a 'Thank You' Email After Interview

Church volunteer experience on resume, 300+ industry-specific soft skills to include in your resume in 2024, cv på en sida: 3 exempel som visar hur effektivt det är, how to quantify your achievements on your resume +examples, what is an unsolicited resume.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Banking Cover Letter Examples Landing Jobs in 2024

- Banking Cover Letter

- Banking Cover Letters by Experience

- Banking Cover Letters by Type

- Write Your Banking Cover Letter

The banking industry requires a detail-oriented mindset with compliance as a top concern. You shine in that role by overseeing client accounts, monitoring transactions, and providing excellent customer service.

Are your banking resume and cover letter helping you connect with hiring managers to show you’re right for the job?

When banks are looking for skilled employees, they’ll perform detailed reviews to ensure they bring in the most qualified applicants for interviews. To ensure you stand out, use our banking cover letter examples as templates, or leverage the power of our free cover letter builder to help display your abilities successfully.

Banking Cover Letter Example

USE THIS TEMPLATE

Microsoft Word

Google Docs

Block Format

Copy this text for your Banking cover letter!

123 Fictional Avenue Austin, TX 76208 (123) 456-7890

November 5, 2023

Zoey Mitchell Citibank 123 Fictional Lane Oakland, CA 94601

Dear Mr. Mitchell:

Having long admired Citibank’s commitment to precision and customer service excellence, I’m thrilled at the opportunity to contribute to your mission of delivering exceptional banking experiences that serve clients and promote financial success. I share your goal of providing reliable and accurate financial services to individuals globally. My valuable experience in this field can help enhance customer satisfaction, streamline banking procedures, and foster stronger client relationships as your bank teller.

As an operations associate at 1st United Credit Union, I handled, on average, $267,124 in cash transactions daily. This task necessitated meticulous cash management and record keeping, aiding a 24% reduction in transaction anomalies.

With a penchant for technology integration, I was instrumental in implementing Jack Henry Check processing software at First Republic Bank. Adopting this systematic check-processing tool optimized our transaction processing correctness by 32% and decreased check fraud occurrences by 17%. Furthermore, at First Republic, I strategized an efficient record-keeping system that increased record retrieval speed by 22%.

Grasping the criticality of trust in the banking industry, I tread beyond my role-given responsibilities to ensure transparency, accuracy, and respectful collaboration. It would be an honor to champion these values as a bank teller at Citibank, and I’m eager to share more about how my expertise will beef up the operational excellence of your Oakland team. Thank you.

Leila Hassan

Enclosures: Resume Application 2 letters of recommendation Academic transcript

Why this cover letter works

- Speaking of the structure, craft a compelling intro diving into your passion, motivations, and possibly, company knowledge; a middle highlighting your professional experiences in reverse chronological order, and a conclusion reinstating your interest and encouraging further discussion.

Pair Your Cover Letter with a Matching Banking Resume

or download as PDF

Level up your cover letter game

Relax! We’ll do the heavy lifting to write your cover letter in seconds.

Mortgage Banking Intern Cover Letter Example

Copy this text for your Mortgage Banking Intern cover letter!

123 Fictional Avenue Minneapolis, MN 55401 (123) 456-7890

John Perez Wells Fargo 123 Fictional Lane Minneapolis, MN 55401

Dear Mr. Perez:

Wells Fargo’s emphasis on innovation in the mortgage banking landscape commands my attention as a budding professional eager to advance my expertise in credit analysis, loan documentation, and regulatory compliance. A crucial part of my approach to internships is the driving desire to grow and learn while empowering clients with practical financial tools to streamline their home ownership ambitions. This ethos is embedded in all my academic projects and past roles. I’m eager to cultivate these skills further at Wells Fargo, intertwining my individual growth with the bank’s objective to lead in mortgage services.

During my internship at Affinity Plus, I gained hands-on experience in credit analysis. Within a five-month window, I effectively assessed borrower creditworthiness for 73 unique cases, using tools like Moody’s and RiskCalc. The first-hand experience of understanding borrower credit profiles and mitigating risk reinforced my belief in the importance of sound credit analysis in the loan approval process.

At the University of Minnesota, I contributed to streamlining a loan documentation process for a hypothetical firm. The project was acknowledged for its efficiency, and we observed a decrease in error rate by 14% in our simulation.

Financial Regulations was a particularly enlightening module during my course at the University of Minnesota. It offered me a deep understanding of risk and compliance norms in the banking sector. Utilizing financial risk management software such as IBM OpenPages within class simulations, my peers and I improved adherence to financial regulations by 18% across various hypothetical portfolios.

My dedication to assisting clients to achieve their dream homeownership fuels me to seek further opportunities to enhance my knowledge and skills. I’m confident that my drive and acquired knowledge would contribute meaningfully as Wells Fargo’s next mortgage banking intern. I eagerly anticipate discussing my candidacy further with you. Thank you.

Anton Ivanov

- Following Anton’s lead, kick off by strategically aligning your career aspirations with the hiring company’s mission and values. From there, intertwine your objectives for the roles with the shared values, showing your readiness to inject passion and drive into the role.

Electronic Banking Specialist Cover Letter Example

Copy this text for your Electronic Banking Specialist Cover Letter Example cover letter!

123 Fictional Avenue Tulsa, OK 74101 (123) 456-7890

Madison Roberts Bank of Oklahoma 123 Fictional Lane Tulsa, OK 74101

Dear Mr. Roberts

I agree with the belief that finance is the backbone of the modern world, and I stand in awe of the Bank of Oklahoma’s mission to provide seamless, intuitive, and secure banking experiences at the tip of anyone’s fingers. My penchant for conquering novel problems and challenges makes me a natural fit for the electronic banking specialist position. With five years of diverse experience in electronic banking, I’m prepared to work independently, lead assertively, and bridge the gap between your technology and client-facing teams at the Bank of Oklahoma.

My passion for the financial industry burgeoned at TTCU Federal Credit Union, where I contributed significantly to its fraud detection and prevention department. I immersed myself in implementing state-of-the-art measures aided by tools such as FICO Falcon Fraud Manager. My commitment and results-driven approach led to a significant 31% decrease in financial losses, a testament to the potency of refined risk mitigation efforts.

At QuikTrip, I was entrusted with database management using SQL Server. My responsibilities extended to enhancing database performance and guaranteeing data integrity—a task I fulfilled by advancing an initiative to streamline our data management processes. Notably, I spearheaded an initiative that streamlined data management processes, improving database efficiency by 17%.

I refined my data analysis expertise at ONEOK. Utilizing Tableau and Python for data visualization and analysis, I provided insight that facilitated nimble decision-making and strategic alignment. This process led to actionable business improvements with a notable 29% increase in operational efficiency. This statistic validates my contributions and underscores the tremendous impact of data-driven strategy on organizational performance.

The prospect of contributing to the Bank of Oklahoma’s vision by improving electronic banking services, creating meaningful client journeys, and reinforcing security safeguards sparks great enthusiasm in me. I’m thrilled at the potential of contributing to the financial growth within Tulsa, OK, and beyond. Looking forward to connecting with you soon to discuss how I can foster your drive. Thank you.

Freja Larsen

- Quickly draw attention to your career’s landmarks that saw you apply relevant industry-relevant skills, such as fraud detection and prevention, database management, and data visualization and analysis, solidifying each experience with numbers. Did you slash financial losses by 31%? Improved operational efficiency by 29%? Flaunt these triumphs, but concisely.

Deutsche Bank Cover Letter Example

Copy this text for your Deutsche Bank cover letter!

123 Fictional Avenue New York, NY 10005 (123) 456-7890

August 14, 2024

Grace Hill Deutsche Bank 123 Fictional Lane New York, NY 10005

Dear Ms. Hill:

A fervent desire to devise cutting-edge financial strategies propels me toward a position on Deutsche Bank’s vibrant corporate banking team. The esteemed record of Deutsche Bank in forward-thinking and placing clients at the forefront resonates with my professional goals. Analyzing intricate financial environments and a solid background in fostering relationships, I stand poised to enhance your team’s capabilities.

At Bank of America, supervisory responsibilities for teller operations fell under my purview. I meticulously processed transactions that often summed up to $138,000+ daily, maintaining unwavering accuracy. A focus on maximizing teller team performance led to the honing of customer satisfaction, enhanced sales techniques, and strict adherence to regulatory practices, all crucial for a corporate banker.

My initiative at Popular Bank bore fruit as sales surged by 12% within a single quarter, a testament to my knack for engaging customers and intelligently recommending products. The seamless initiation of 79 new accounts reflects my adeptness at spotting and nurturing potential business opportunities. It’s this acute understanding of client needs and delivery of bespoke financial solutions that I’m excited to bring to Deutsche Bank to fuel further growth.

At HSBC, the challenges of problem-solving and precise attention to detail were my daily companions, ensuring clients’ needs were met seamlessly. Partnering with account managers and loan officers, I facilitated top-notch service, managed cash reserves and ATMs without error, and meticulously organized transaction documentation for efficient processing. My demonstrated proficiency in credit evaluations, financial proposals, and credit risk oversight will serve well in the intricate landscape of corporate banking.

The opportunity to drive growth and innovation at Deutsche Bank ignites a sense of enthusiasm in me. I’m deeply appreciative of your consideration of my candidacy and am looking forward to elaborating on the ways my experience, skills, and qualifications will resonate with the unique demands of the corporate banker role.

Felix Larsen

Enclosures: Resume Transcript Letter of recommendation

- Ditch those overused phrases like “I work hard.” Show your potential employer the real deal, instead. Perhaps toss in quantified metrics such as “… processed transactions that often summed up to $138,000+ daily” and “seamless initiation of 79 new accounts.” In addition, mimic the hiring company’s language in your piece—simply dive into the job ad and pick keywords and phrases that precisely echo their needs.

World Bank Cover Letter Example

Copy this text for your World Bank Cover Letter Example cover letter!

123 Fictional Avenue Washington, DC 20433 (123) 456-7890

Jackson Rodriguez The World Bank 123 Fictional Lane Washington, DC 20433

Dear Mr. Rodriguez:

Driven by a fervent zeal for global finance and sustainable development, the role of investment officer at the World Bank appears to be a perfect arena for me to apply my deep well of expertise. Having navigated the complex world of investment banking with a keen focus on nurturing economic growth in emerging markets, my career trajectory seems to be in harmonious alignment with the ambitions and aspirations of your esteemed organization.

During my tenure at Wells Fargo, the complex labyrinth of teller operations was my battlefield, where I led the charge in implementing cutting-edge cash management techniques and tackling high-stakes customer service dilemmas. Tasked with the reconciliation and processing of daily transactions that sometimes soared to $223K, my initiatives to refine operational processes and foster staff development boosted efficiency by 26%.

At United Bank, my leadership catalyzed a team of tellers to consistently surpass our upselling goals, achieving an impressive 94% completion rate each quarter. This feat underscored my prowess in negotiation and deal structuring, skills directly transferable to the elaboration and negotiation of investment agreements and the crafting of proposals for the World Bank.

While at JPMorgan Chase, my role entailed rigorous management of client accounts, where precision and operational efficacy were paramount. My strategies yielded an 18% increase in portfolio returns over a year, underlining my aptitude for portfolio management. This experience is invaluable for overseeing the Bank’s investments, ensuring robust governance, and optimizing returns.

To conclude, my journey through financial operations, customer service, and leadership landscapes has sculpted me into an ideal candidate for the investment officer position at the World Bank. Fueled by a dedication to sustainable investing, I’m keen to explore how my array of skills and experiences will resonate with the foundational goals of the World Bank. I appreciate your consideration and look forward to adding value to your team.

- You see that line about being the golden child at a former workplace: “Everyone loved me at United Bank because I was clearly a catch”)? It doesn’t belong to your cover letter. Try something like this: “At United Bank, my leadership catalyzed a team of tellers to consistently surpass our upselling goals, achieving an impressive 94% completion rate each quarter.”

Related cover letter examples

- Banking resume

- Bank teller

- Financial analyst

How to Optimize Your Banking Cover Letter

While all banks have standardized processes to ensure compliance, that doesn’t mean that each one won’t have unique qualifications they’re looking for applicants to possess.

For instance, one bank may be seeking a reconciliation expert, whereas another may be looking for a customer-centric teller who can create a great experience for everyone who walks through their doors. You’ll want to customize each cover letter you submit based on the job description .

Write an attention-grabbing intro to your banking cover letter

When someone walks into the bank, you know the importance of creating a friendly atmosphere since every customer makes a first impression quickly. The same is true when bank hiring managers are reviewing cover letters.

The first step to stand out is greeting a specific hiring manager by name if it’s listed in the job description or on the bank’s website. It’s the same as connecting with customers by learning their names before discussing investment opportunities.

Then, once you get into the first paragraph, you’ll want to show how you connect with the bank’s mission and where your skills fit in. For instance, how you want to use your knowledge of debt consolidation and index funds to help customers make smart financial decisions.

The intro below doesn’t make enough of a connection since it lacks key details about the applicant’s specific mortgage banking skills and the company’s mission.

Not connecting enough!

Hello Mr. Halbert,

Upon seeing the mortgage banking job you have available, I immediately thought this sounded like a great role for my skills. This sounds like a great company to work for, and I would be excited to join your team.

The opener below makes a better connection since the applicant showcases an evident passion for Citibank’s commitment to customer service excellence and exceptional banking experiences.

A well-connected opener based on the bank’s mission!

Dear Mr. Mitchell,

How to make the body of your banking cover letter more impactful

As you get into the body section when writing a cover letter , it’s time to think about how you can share more details about the customer service and financial solutions skills you highlighted in the opening paragraph.

A great way to illustrate your impact as a banker is by using metrics since every financial solution requires data to make accurate decisions. Depending on your role in the bank’s success, everything from customer satisfaction rates to loan-to-asset ratios could work well in this section.

Additionally, if you’re applying to a role like a mortgage banker or investment banker that requires some education, you could also explain how your degree in finance or related fields has equipped you to succeed.

A well-formed body paragraph with banking metrics!

Make the closer of your banking cover letter stand out

As you begin the closing paragraph of your banking cover letter, you’ll want to relate back to some of the key financial solutions skills and your connection to the bank’s mission. For example, your passion for the bank’s commitment to excellence and how you want to use your financial analysis skills to provide accurate service to every customer.

After that, it’s a good idea to thank the bank’s hiring manager for their time and end with a light call to action. It’s similar to thanking customers for banking with you and saying you look forward to seeing them again to increase customer retention rates.

The closer below lacks impactfulness since the applicant doesn’t use a call to action or reference the bank’s mission.

Lacking impactfulness here!

Overall, I believe my experience as a mortgage banker will be a valuable addition to your team. Thank you for considering my qualifications.

Lucy Carlson

The closer below makes a much better impact by referencing the applicant’s passion for helping clients achieve their dream of homeownership.

An impactful closer relating to the bank’s needs!

My dedication to assisting clients to achieve their dream of homeownership fuels me to seek further opportunities to enhance my knowledge and skills. I’m confident that my drive and acquired knowledge would contribute meaningfully as Wells Fargo’s next mortgage banking intern. I eagerly anticipate discussing my candidacy further with you. Thank you.

Reviewing the job description and understanding the bank’s needs is the best way to include job skills that stand out. For instance, if the position requires cross-selling, you could write about previous experiences cross-selling credit cards or business banking solutions.

The best way to optimize the tone you write in is by reviewing the job description and trying to match the tone each bank uses. For instance, if a bank uses a formal and logical tone, matching that shows how you’ll fit in with their professional and knowledgeable work culture.

If you haven’t worked in banking before, you could emphasize translatable skills like other jobs involving customer service or data entry. Or you could emphasize relevant education like a bachelor’s degree in finance that equipped you with the necessary skills.

Resume Templates

Resume samples

Create and edit your resume online

Generate compelling resumes with our AI resume builder and secure employment quickly.

Write a cover letter

Cover Letter Examples

Cover Letter Samples

Create and edit your cover letter

Use our user-friendly tool to create the perfect cover letter.

Featured articles

- How to Write a Motivation Letter With Examples

- How to Write a Resume in 2024 That Gets Results

- Teamwork Skills on Your Resume: List and Examples

- What Are the Best Colors for Your Resume?

Latests articles

- How To Add a Promotion on LinkedIn: Steps and Example

- The Highest Paying Blue-Collar Jobs Offer Stability, While Nearly 300,000 Layoffs Are Blamed on AI

- How To Prepare Your Resume for a Promotion in 2024

- The Essential Guide To Giving Two Weeks’ Notice in 2024

Dive Into Expert Guides to Enhance your Resume

Bank Teller Cover Letter Example

Start a Bank Teller cover letter that gets employers to act and helps you get the job faster. Impress hiring managers with the aid of ResumeCoach’s Bank Teller example letter template and professional tips and tricks for success.

Congratulations! You’ve stumbled upon a Bank Teller job opening with excellent benefits and working hours, what’s next?

First, start by making sure you have an outstanding resume that fits the job description. If you do not have it, take advantage of our easy-to-use resume builder and get a customized version in minutes.

Besides a resume, it’s critical that you include a cover letter with your application that highlights your strengths and accomplishments to grab the recruiter’s attention and get you the interview.

In this guide, you’ll learn how to:

- Create a cover letter that sets you apart from other applicants

- Write a Bank Teller cover letter with or without experience

- Address any employment gaps

Plus access to expertly written samples tailored for Bank Teller positions!

How to Write a Cover Letter for Bank Teller with Experience

If you have previous job experience, writing a cover letter may seem like a straightforward task.

However, it’s essential to ensure that your cover letter effectively highlights your skills and qualifications for the position you’re applying for.

Looking over the Experience section on your resume can help you know exactly what to mention, such as your past responsibilities and results .

Below are some tips on how to write a Bank Teller cover letter with experience.

1. Customize Your Cover Letter for the Job Posting

Tailoring your letter to the specific job posting can help you stand out from other applicants. Point out the abilities and work history that are most relevant to the job.

For example, if the job advertisement mentions cash handling as a requirement, mention in your cover letter how your experience relates to that.

Here is one way to do it:

I was pleased to see in the job posting that you are looking for someone who is comfortable working with customers and has experience in handling cash transactions.

During my previous job as a cashier, I learned how to provide excellent customer service while accurately processing transactions. I also have experience in reconciling cash drawers and preparing daily deposits, which I believe will be beneficial in this role.

Ensure that you use the same keywords used in the job advertisement to avoid Applicant Tracking System (ATS) filters and getting disqualified.

2. Start With a Strong Opening

Your opening should grab the reader’s attention and clearly state the position you’re applying for. You may also want to briefly explain why you’re interested in the job or why you’re a good fit for the company.

The examples below provide some effective ways to start your Bank Teller cover letter:

- I am thrilled to apply for the Bank Teller position at your Chatham branch. With over three years of experience in customer service and cash handling, I am confident that I possess the skills and expertise necessary to excel in this role.

- I am writing to express my interest in the Bank Teller position at your Chatham branch. With a strong background in cash handling and customer service, including three years of experience in a similar role, I strongly believe I would be a valuable addition to your team.

- I am excited to apply for the Bank Teller position at your Chatham branch. With a proven track record of success in customer service and cash handling, including three years of experience in a similar role, I believe I have the skills and knowledge necessary to thrive in this position.

Remember that the purpose of the first paragraph is to get the reader’s attention so that they want to read the rest of your cover letter!

3. Provide Specific Examples

Use specific examples from your previous job experience to demonstrate your skills and accomplishments. This could include projects you’ve worked on, awards you’ve received, or specific metrics that show how you’ve contributed to your previous company.

Don’t just say “ I collaborated in a project to improve cash handling ”.

Say “ I collaborated with my team to develop and implement a new process for reconciling cash drawers and preparing deposits, which resulted in a 20% reduction in errors and discrepancies ”.

The more specifics you provide, the more credible your claims become.

4. Emphasize your transferable skills

Even if your previous job experience isn’t directly related to the position you’re applying for, you likely have transferable skills that are relevant . Make sure to emphasize these abilities and explain how they would be valuable in the new role.

The list below showcases some basic skills all Bank Tellers should have:

- Active listening

- Strong verbal communication abilities

- An ability to satisfy customers while adhering to bank standards

According to the Bureau of Labor Statistics , some similar occupations where applicants can acquire these abilities include cashier, customer service representative, receptionist, or information clerk.

5. Close With a Strong Call to Action

Your closing paragraph should reiterate your interest in the position and include a call to action, such as requesting an interview or expressing your availability to discuss the position further.

When closing your cover letter for a Bank Teller position, a powerful call to action can help you stand out from other applicants and showcase your enthusiasm for the job.

For example, you could write something like, “ I am eager to contribute my strong communication skills and passion for customer service to your bank. I would welcome the opportunity to discuss my qualifications with you further and answer any questions you may have. Please feel free to contact me at your convenience to schedule an interview ”.

Mastering the Art of Bank Teller Cover Letters: Illustrative Examples

Now, let’s take a look at another 2 examples to recap and get a deeper understanding of how to write a powerful Bank Teller cover letter:

I am applying for the Bank Teller position at West Coast Bank. I have worked as a Bank Teller for two years. I am familiar with handling cash and providing customer service. I am also a quick learner and work well under pressure.

The previous example lacks specific details about the applicant’s achievements or contributions in their previous Bank Teller roles.

The statement merely points out basic job duties and traits that are expected of a Bank Teller, which does not make the applicant stand out or showcase their unique qualifications.

During my two years as a Bank Teller at West Side People’s Bank, I consistently exceeded my sales goals and achieved a 98% customer satisfaction rating. I also implemented a new cash management system that reduced cash handling errors by 30% and saved the bank over $8,000 annually.

This example is very effective because it points out the candidate’s ability to perform well, provide excellent service, and think critically about their work. It’s also very specific by mentioning numbers and percentages, adding a lot of credibility.

Example Cover Letter for Bank Teller With Experience

To familiarize yourself with the elements of a strong cover letter for a Bank Teller with experience, you can examine the sample cover letter below.

Hiring Manager’s name

Company name

Company address

Dear Mr/Ms. [Hiring Manager Name]

I am writing to apply for the Bank Teller position being advertised by [Company]. As an accomplished Teller with over three years of experience working with customers and financial services, I am certain that I fit the profile perfectly.

In my current position with [Current Company], I have played an active part in helping the branch achieve a record increase in revenue. During the last 3 sales campaigns, intake and sales have increased by around 12% on average.

Furthermore, I demonstrably showed my abilities to enhance customer service in-branch. My personal customer feedback score has never fallen below 90% and my performance has often helped to improve repeat trade by over 30%.

My resume is enclosed with further details on my career successes so far. Naturally, I would be delighted to talk in person to discuss any queries you may have about my credentials.

Please feel free to contact me via my personal phone number and email address. I look forward to hearing from you.

Sincerely, Name

Address Phone number Email address

Along with reviewing these types of examples, using a cover letter writing guide to assist you can significantly streamline the entire writing process.

How to Write a Cover Letter for Bank Teller with No Experience

Many job applicants are discouraged from applying when they come across job postings that require prior job experience.

It’s no wonder that fresh graduates and those looking to transition into a Bank Teller position ask themselves, “How do I write a cover letter for a Bank Teller with no experience?”

It’s important not to give up on applying even if you don’t have any relevant work history.

Instead, you can create a compelling cover letter that highlights how your skills and qualities align with the job requirements.

To do this, you need to thoroughly understand the company’s needs and goals.

Take some time to analyze what they are looking for in an employee. Use your education and any relevant internship experience to demonstrate how you are a good fit for the position.

In your cover letter, focus on 3 key areas :

- the company’s needs

- your relevant achievements,

- and your valuable skills.

By addressing these points, you can show the hiring manager that you understand what they are looking for and that you have the potential to be a valuable addition to their team.

If you don’t have as much experience as other applicants, you can still demonstrate your enthusiasm and willingness to learn.

Use your cover letter as an opportunity to showcase your motivation and dedication, and convince the employer that you are the best candidate for the job.

Look at the following examples tailored to Bank Teller positions to get some ideas:

I have no experience as a Bank Teller, but I am a quick learner and am excited to start my career in banking. I have great customer service skills and am a team player.

Unfortunately, it doesn’t provide any specific examples or evidence of skills or qualifications that would make the candidate a good fit for the position.

Also, the statements “I am a quick learner” and “I have great customer service skills” are generic and overused phrases that don’t provide any tangible evidence of the candidate’s abilities.

Although I don’t have direct experience as a Bank Teller, my previous customer service internship at Amazonics taught me how to interact with customers, solve problems efficiently and handle cash transactions accurately. I am excited to bring these skills to your team at Atlantica Bank.

This is an excellent example because it highlights transferable skills gained from a previous customer service internship and shows enthusiasm for the position .

It also specifically mentions relevant abilities such as handling cash transactions accurately, which are important for a Bank Teller role.

Example Cover Letter for Bank Teller With No Experience

When you are just starting in the profession , the blank page before you begin typing your letter may be nerve-wracking!

We get that, but there are tricks for writing a great cover letter when you have little to no experience.

Refer to the sample Bank Teller cover letter for fresh graduates provided below to familiarize yourself with the components of an effective letter for someone who would like to get a job as a teller in a bank but has no prior experience.

I am writing to express my interest in the Bank Teller position at [Bank Name]. Although I do not have any direct experience in the banking industry, I am excited about the opportunity to learn and grow in this role.

As a recent graduate with a degree in finance, I have developed strong analytical and problem-solving skills that I believe will be valuable in the position. Additionally, my part-time job as a retail sales associate has provided me with customer service experience and sales skills.

During my time as a retail sales associate at Mediazon, I consistently met my sales targets and was able to upsell to customers, resulting in a 15% increase in revenue compared to the previous quarter. I also maintained a 99% accuracy rate when handling cash and credit card transactions, ensuring that there were no discrepancies in the store’s financial records.

My experience in retail sales and customer service, combined with my attention to detail and accuracy when handling financial transactions, make me a strong candidate for the Bank Teller position at [Bank Name].

While I understand that the role of a Bank Teller requires a specific set of skills and knowledge, I am confident in my ability to learn quickly and adapt to new situations. I am a detail-oriented individual who takes pride in providing excellent customer service and ensuring accuracy in all tasks.

I am excited about the prospect of joining a team of professionals at [Bank Name] and contributing to the success of the organization. Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further.

Please let me know if you require any further information or if there are any next steps I should be aware of.

Cover Letter for Bank Teller with Employment Gap

If you have experienced a gap in your employment history, you may struggle to determine what to include in your Bank Teller cover letter and resume. It can be disheartening to think that this gap may decrease your chances of landing the job.

However, a gap in your career does not necessarily disqualify you from the job. There are various legitimate reasons why someone may not have worked for a certain amount of time, such as to take care of a sick family member.

When applying for a Bank Teller position, it’s crucial to clarify any employment gaps since banks value attention to detail, accuracy, and credibility in their highly formal work environments.

Providing clear explanations for any gaps in your employment history is important when applying for a role, particularly in highly regulated industries such as banking where adherence to strict protocols and guidelines is essential .

By demonstrating professionalism, honesty, and commitment to the job application process, you can establish yourself as a trustworthy and reliable candidate for the position.

There are some things you should and shouldn’t include in your cover letter to address the issue:

- Explain why: Briefly describe the reason for the gap. A hiring manager may find out about it anyway and draw their own conclusions. You’re better off taking the first step.

- Don’t worry about old or really short gaps: It’s important to note that not every single gap needs to be addressed in your cover letter.

During the interview process, be prepared to answer any questions related to your employment gap. You could even try to turn it into a positive by shortly mentioning any relevant skills you acquired during that time.

Remember to adhere to the proper cover letter and resume format when creating your documents.

Let’s analyze 2 examples customized to Bank Teller roles for deeper insights:

I have a gap in my employment history, but I am eager to start working as a Bank Teller. I have great customer service skills and can handle cash transactions efficiently. I am a quick learner and can adapt to new situations easily.

Simply stating that you have gaps in your employment history without providing any context or explanation may raise concerns for the employer.

Additionally, the example does not provide any information about what the candidate has been doing during their time away, which could be perceived as a lack of productivity or commitment.

During my previous employment, I took a break to care for a family member who was ill. During that time, I volunteered at a local non-profit organization where I gained experience in cash handling and customer service.

I also took online courses to keep my skills up-to-date. I am excited to bring my experience and dedication to your team at Southern Entrepreneurs Bank.

The candidate mentions that they took a break to care for a sick family member, which is a valid reason for a gap in employment history.

The applicant also explains that they spent their time productively volunteering at a non-profit organization and taking online courses to improve their skills, which emphasizes their dedication and positions them as a strong candidate.

Example Cover Letter for Bank Teller With Employment Gap

If you are a Bank Teller with an employment gap in your resume, you may be wondering how to explain this to potential employers.

While taking time off from work can be a great opportunity for personal growth and development , it can also be a challenge when it comes to job searching.

However, with the right approach, it is possible to address the gap in a way that highlights your strengths and shows your commitment to your career .

In this example cover letter for a Bank Teller position, you can learn how to approach such an employment gap in a positive and professional manner .

I am excited to apply for the Bank Teller position at Bankomatic. I am confident that my experience and skills make me a strong candidate for this role and I am eager to contribute to your team’s success.

After several years working as a Bank Teller, I took a sabbatical to travel around Asia and gain new experiences. During this time, I had the opportunity to visit many different countries, learn about different cultures and customs, and enhance my communication and problem-solving skills.

I believe that these experiences have made me a more well-rounded and adaptable person, and have given me a fresh perspective that I can bring to my work.

Although I took time off to travel, I have stayed up-to-date on industry trends and have continued to develop my skills and knowledge. I have taken online courses to improve my understanding of financial regulations and procedures, and have stayed connected with the banking industry through networking events and industry publications.

As a Bank Teller, I am committed to providing excellent service to customers, building strong relationships with clients, and ensuring that their needs are met efficiently and effectively. I am also a quick learner, and am always looking for opportunities to grow and develop my skills.

I am excited about the opportunity to join ABC Bank and am confident that my experience, skills, and passion for customer service make me a great candidate for this position. Thank you for considering my application. I look forward to the opportunity to discuss my qualifications in further detail.

Creating a Bank Teller Cover Letter That Speaks to Employers: Key Takeaways

Are you ready to unlock the vault to your dream job as a bank teller? Your cover letter holds the key to making a lasting impression.

Here are some key takeaways for crafting an effective cover letter that will present your cash-handling skills, customer service experience, and passion for the banking industry:

- Powerful opening: Highlight your relevant experience, skills, and passion for banking, while also emphasizing why you are a good fit for the specific Bank Teller position you are applying for.

- Experience in other fields: Even if your previous work experience may not seem directly applicable to banking, demonstrate how your skills can benefit you in your new role.

- Specificity: Showcase your banking skills in action and provide concrete details about your achievements in the banking industry. Include metrics to make your claims more credible.

- Tailor your letter to the position: Use the same keywords and phrases that are used in the job advertisement to emphasize your relevant skills and experience in banking.