- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

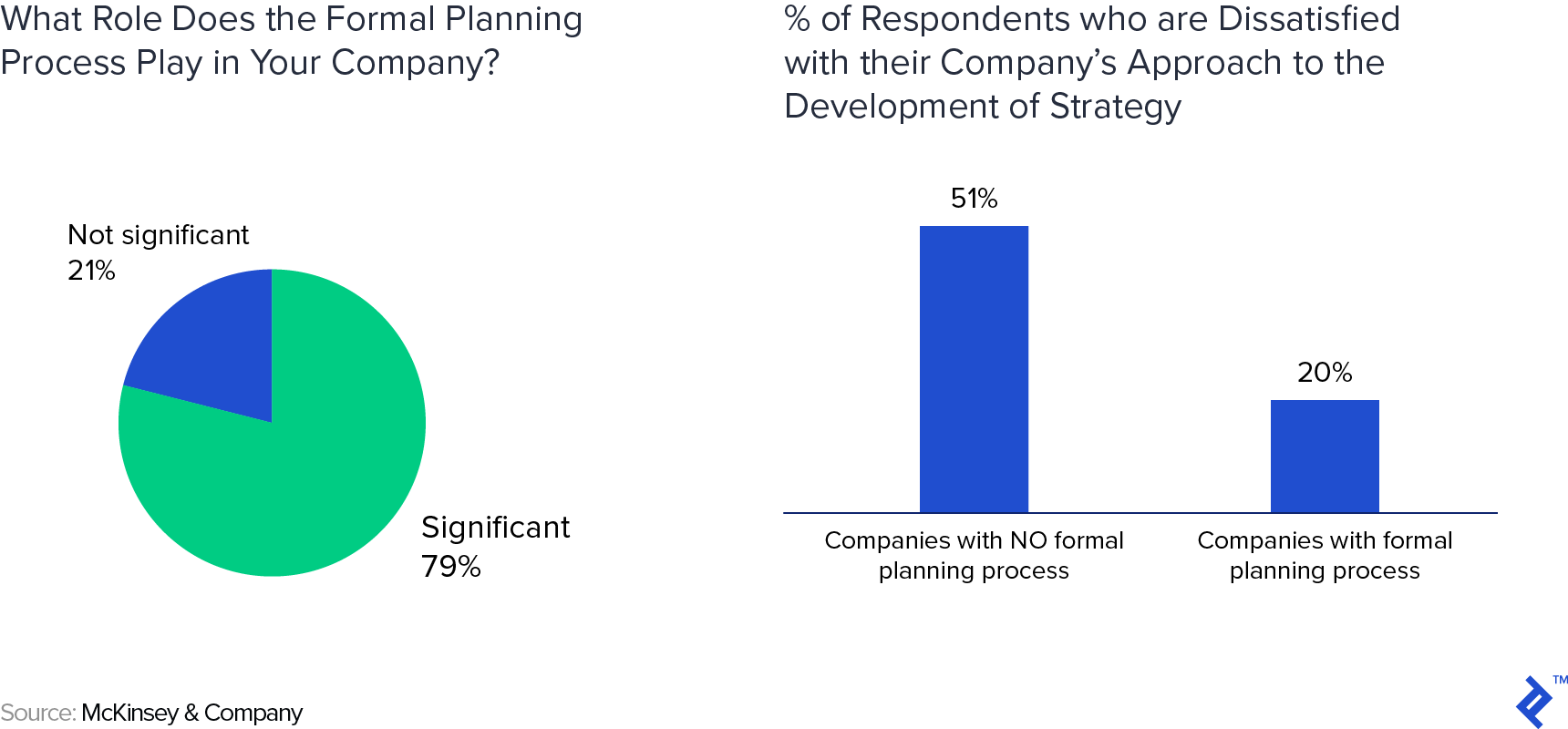

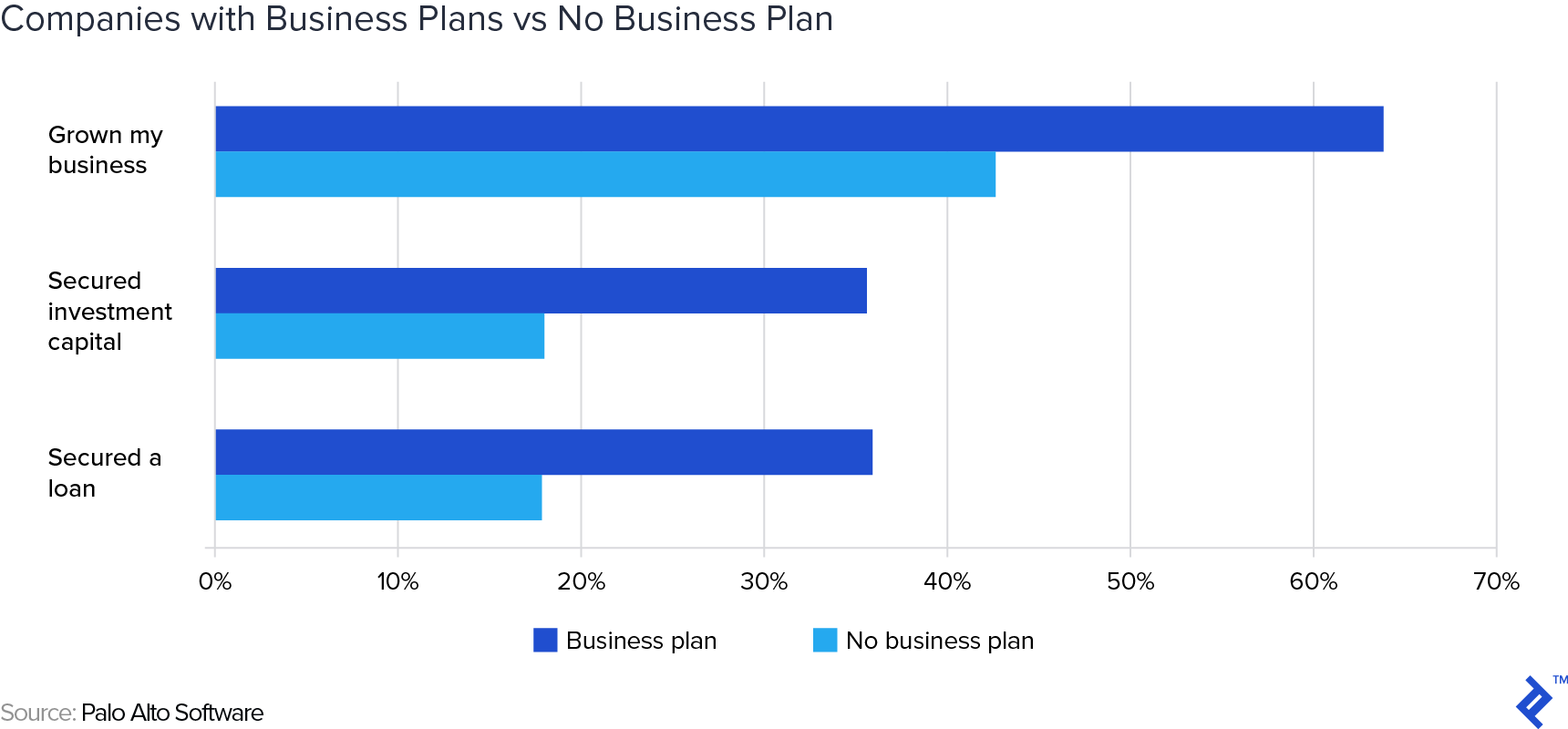

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

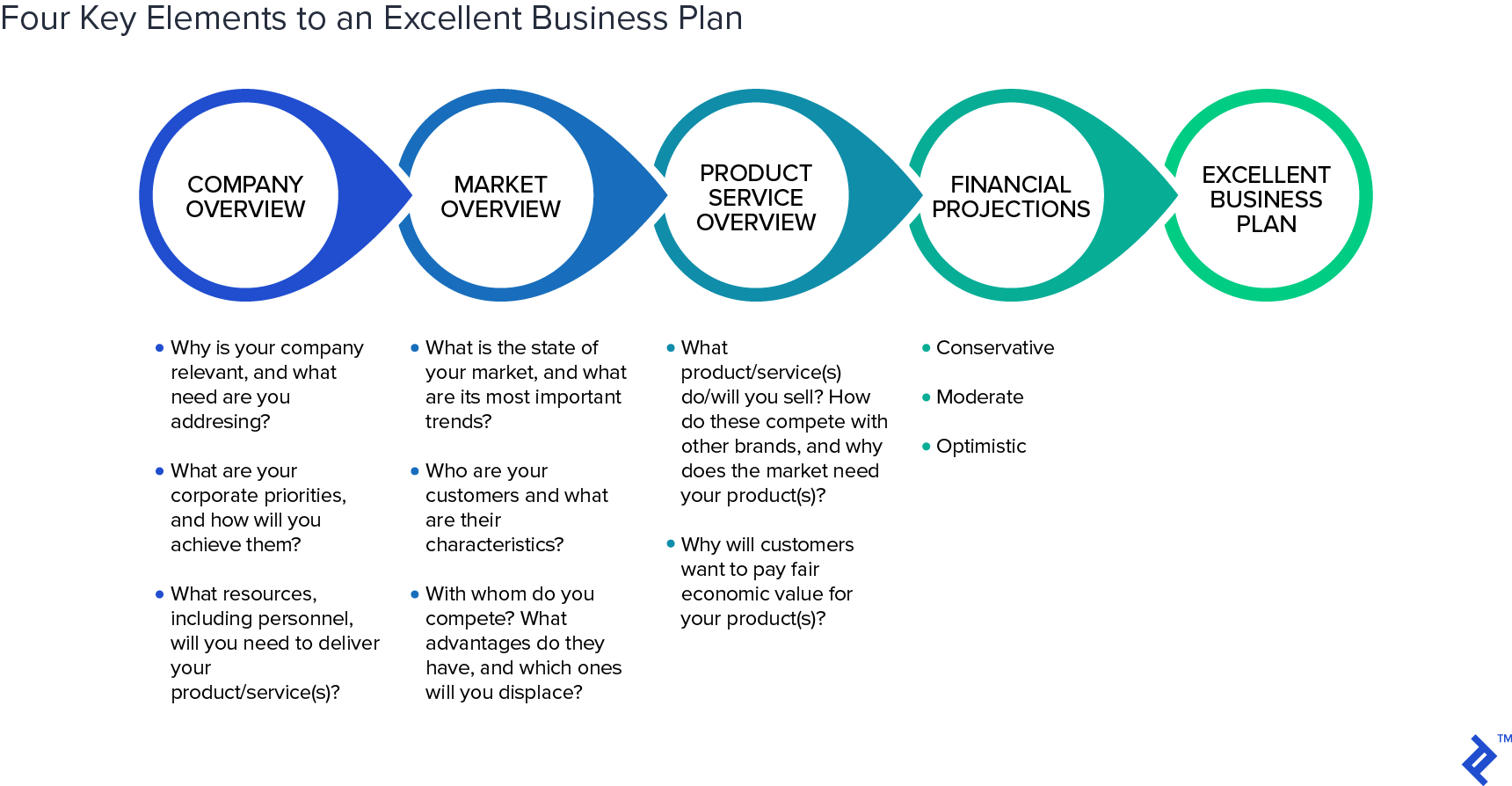

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1222648303-e00f14f235ba4c63aa222a87f430e345.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Hot Summer Savings ☀️ 60% Off for 4 Months. Buy Now & Save

60% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

The importance of business plan: 5 key reasons.

A key part of any business is its business plan. They can help define the goals of your business and help it reach success. A good business plan can also help you develop an adequate marketing strategy. There are a number of reasons all business owners need business plans, keep reading to learn more!

Here’s What We’ll Cover:

What Is a Business Plan?

5 reasons you need a well-written business plan, how do i make a business plan, key takeaways.

A business plan contains detailed information that can help determine its success. Some of this information can include the following:

- Market analysis

- Cash flow projection

- Competitive analysis

- Financial statements and financial projections

- An operating plan

A solid business plan is a good way to attract potential investors. It can also help you display to business partners that you have a successful business growing. In a competitive landscape, a formal business plan is your key to success.

Check out all of the biggest reasons you need a good business plan below.

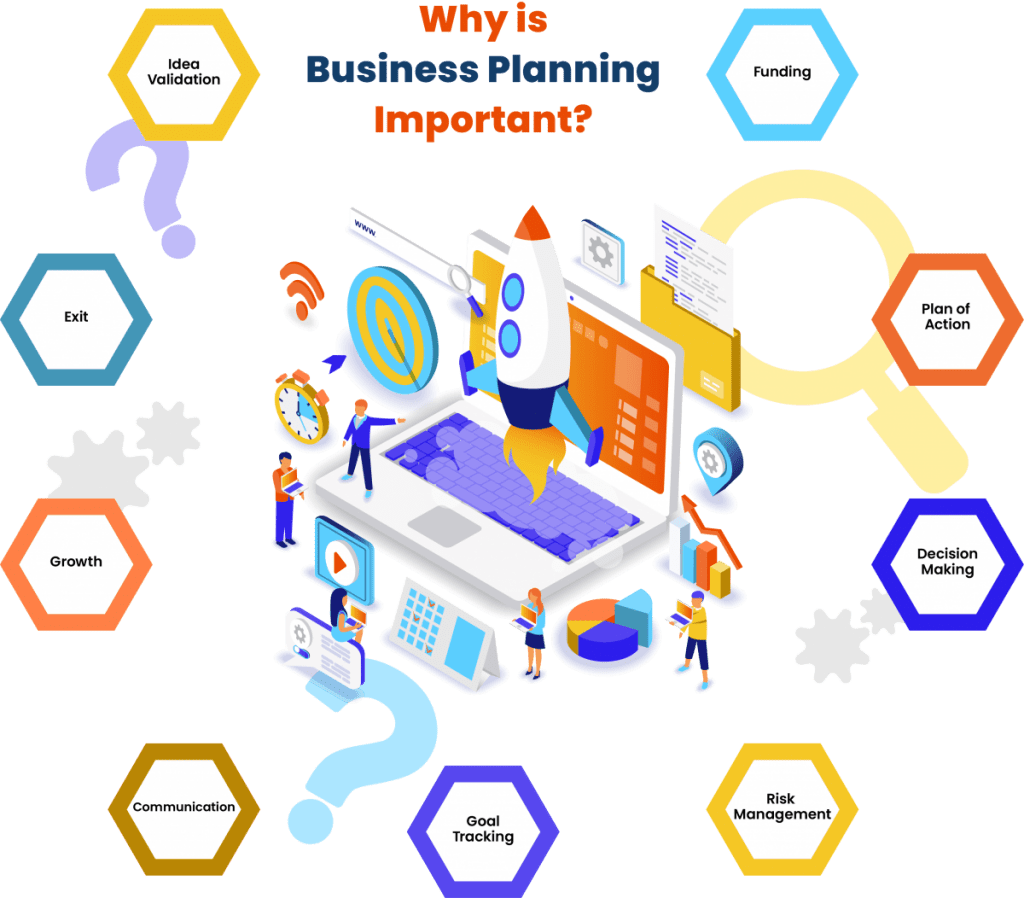

1. To Secure Funding

Whether you’re seeking funding from a venture capitalist or a bank, you’ll need a business plan. Business plans are the foundation of a business. They tell the parties that you’re seeking funding from whether or not you’re worth investing in. If you need any sort of outside financing, you’ll need a good business plan to secure it.

2. Set and Communicate Goals

A business plan gives you a tangible way of reviewing your business goals. Business plans revolve around the present and the future. When you establish your goals and put them in writing, you’re more likely to reach them. A strong business plan includes these goals, and allows you to communicate them to investors and employees alike.

3. Prove Viability in the Market

While many businesses are born from passion, not many will last without an effective business plan. While a business concept may seem sound, things may change once the specifics are written down. Often, people who attempt to start a business without a plan will fail. This is because they don’t take into account all of the planning and funds needed to get a business off of the ground.

Market research is a large part of the business planning process. It lets you review your potential customers, as well as the competition, in your field. By understanding both you can set price points for products or services. Sometimes, it may not make sense to start a business based on the existing competition. Other times, market research can guide you to effective marketing strategies that others lack. To have a successful business, it has to be viable. A business plan will help you determine that.

4. They Help Owners Avoid Failure

Far too often, small businesses fail. Many times, this is due to the lack of a strong business plan. There are many reasons that small businesses fail, most of which can be avoided by developing a business plan. Some of them are listed below, which can be avoided by having a business plan:

- The market doesn’t need the business’s product or service

- The business didn’t take into account the amount of capital needed

- The market is oversaturated

- The prices set by the business are too high, pushing potential customers away

Any good business plan includes information to help business owners avoid these issues.

5. Business Plans Reduce Risk

Related to the last reason, business plans help reduce risk. A well-thought-out business plan helps reduce risky decisions. They help business owners make informed decisions based on the research they conduct. Any business owner can tell you that the most important part of their job is making critical decisions. A business plan that factors in all possible situations helps make those decisions.

Luckily, there are plenty of tools available to help you create a business plan. A simple search can lead you to helpful tools, like a business plan template . These are helpful, as they let you fill in the information as you go. Many of them provide basic instructions on how to create the business plan, as well.

If you plan on starting a business, you’ll need a business plan. They’re good for a vast number of things. Business plans help owners make informed decisions, as well as set goals and secure funding. Don’t put off putting together your business plan!

If you’re in the planning stages of your business, be sure to check out our resource hub . We have plenty of valuable resources and articles for you when you’re just getting started. Check it out today!

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

Sign up for our newsletter for product updates, new blog posts, and the chance to be featured in our Small Business Spotlight!

The importance of a business plan

Business plans are like road maps: it’s possible to travel without one, but that will only increase the odds of getting lost along the way.

Owners with a business plan see growth 30% faster than those without one, and 71% of the fast-growing companies have business plans . Before we get into the thick of it, let’s define and go over what a business plan actually is.

What is a business plan?

A business plan is a 15-20 page document that outlines how you will achieve your business objectives and includes information about your product, marketing strategies, and finances. You should create one when you’re starting a new business and keep updating it as your business grows.

Rather than putting yourself in a position where you may have to stop and ask for directions or even circle back and start over, small business owners often use business plans to help guide them. That’s because they help them see the bigger picture, plan ahead, make important decisions, and improve the overall likelihood of success.

Why is a business plan important?

A well-written business plan is an important tool because it gives entrepreneurs and small business owners, as well as their employees, the ability to lay out their goals and track their progress as their business begins to grow. Business planning should be the first thing done when starting a new business. Business plans are also important for attracting investors so they can determine if your business is on the right path and worth putting money into.

Business plans typically include detailed information that can help improve your business’s chances of success, like:

- A market analysis : gathering information about factors and conditions that affect your industry

- Competitive analysis : evaluating the strengths and weaknesses of your competitors

- Customer segmentation : divide your customers into different groups based on specific characteristics to improve your marketing

- Marketing: using your research to advertise your business

- Logistics and operations plans : planning and executing the most efficient production process

- Cash flow projection : being prepared for how much money is going into and out of your business

- An overall path to long-term growth

What is the purpose of a business plan?

A business plan is like a map for small business owners, showing them where to go and how to get there. Its main purposes are to help you avoid risks, keep everyone on the same page, plan finances, check if your business idea is good, make operations smoother, and adapt to changes. It's a way for small business owners to plan, communicate, and stay on track toward their goals.

10 reasons why you need a business plan

I know what you’re thinking: “Do I really need a business plan? It sounds like a lot of work, plus I heard they’re outdated and I like figuring things out as I go...”.

The answer is: yes, you really do need a business plan! As entrepreneur Kevin J. Donaldson said, “Going into business without a business plan is like going on a mountain trek without a map or GPS support—you’ll eventually get lost and starve! Though it may sound tedious and time-consuming, business plans are critical to starting your business and setting yourself up for success.

To outline the importance of business plans and make the process sound less daunting, here are 10 reasons why you need one for your small business.

1. To help you with critical decisions

The primary importance of a business plan is that they help you make better decisions. Entrepreneurship is often an endless exercise in decision making and crisis management. Sitting down and considering all the ramifications of any given decision is a luxury that small businesses can’t always afford. That’s where a business plan comes in.

Building a business plan allows you to determine the answer to some of the most critical business decisions ahead of time.

Creating a robust business plan is a forcing function—you have to sit down and think about major components of your business before you get started, like your marketing strategy and what products you’ll sell. You answer many tough questions before they arise. And thinking deeply about your core strategies can also help you understand how those decisions will impact your broader strategy.

Send invoices, estimates, and other docs:

- via links or PDFs

- automatically, via Wave

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for the first 10 transactions of each month of your subscription, then 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions for the US and Canada . See Wave’s Terms of Service for more information.

Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software.

2. To iron out the kinks

Putting together a business plan requires entrepreneurs to ask themselves a lot of hard questions and take the time to come up with well-researched and insightful answers. Even if the document itself were to disappear as soon as it’s completed, the practice of writing it helps to articulate your vision in realistic terms and better determine if there are any gaps in your strategy.

3. To avoid the big mistakes

Only about half of small businesses are still around to celebrate their fifth birthday . While there are many reasons why small businesses fail, many of the most common are purposefully addressed in business plans.

According to data from CB Insights , some of the most common reasons businesses fail include:

- No market need : No one wants what you’re selling.

- Lack of capital : Cash flow issues or businesses simply run out of money.

- Inadequate team : This underscores the importance of hiring the right people to help you run your business.

- Stiff competition : It’s tough to generate a steady profit when you have a lot of competitors in your space.

- Pricing : Some entrepreneurs price their products or services too high or too low—both scenarios can be a recipe for disaster.

The exercise of creating a business plan can help you avoid these major mistakes. Whether it’s cash flow forecasts or a product-market fit analysis , every piece of a business plan can help spot some of those potentially critical mistakes before they arise. For example, don’t be afraid to scrap an idea you really loved if it turns out there’s no market need. Be honest with yourself!

Get a jumpstart on your business plan by creating your own cash flow projection .

4. To prove the viability of the business

Many businesses are created out of passion, and while passion can be a great motivator, it’s not a great proof point.

Planning out exactly how you’re going to turn that vision into a successful business is perhaps the most important step between concept and reality. Business plans can help you confirm that your grand idea makes sound business sense.

A critical component of your business plan is the market research section. Market research can offer deep insight into your customers, your competitors, and your chosen industry. Not only can it enlighten entrepreneurs who are starting up a new business, but it can also better inform existing businesses on activities like marketing, advertising, and releasing new products or services.

Want to prove there’s a market gap? Here’s how you can get started with market research.

5. To set better objectives and benchmarks

Without a business plan, objectives often become arbitrary, without much rhyme or reason behind them. Having a business plan can help make those benchmarks more intentional and consequential. They can also help keep you accountable to your long-term vision and strategy, and gain insights into how your strategy is (or isn’t) coming together over time.

6. To communicate objectives and benchmarks

Whether you’re managing a team of 100 or a team of two, you can’t always be there to make every decision yourself. Think of the business plan like a substitute teacher, ready to answer questions any time there’s an absence. Let your staff know that when in doubt, they can always consult the business plan to understand the next steps in the event that they can’t get an answer from you directly.

Sharing your business plan with team members also helps ensure that all members are aligned with what you’re doing, why, and share the same understanding of long-term objectives.

7. To provide a guide for service providers

Small businesses typically employ contractors , freelancers, and other professionals to help them with tasks like accounting , marketing, legal assistance, and as consultants. Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, while ensuring everyone is on the same page.

8. To secure financing

Did you know you’re 2.5x more likely to get funded if you have a business plan?If you’re planning on pitching to venture capitalists, borrowing from a bank, or are considering selling your company in the future, you’re likely going to need a business plan. After all, anyone that’s interested in putting money into your company is going to want to know it’s in good hands and that it’s viable in the long run. Business plans are the most effective ways of proving that and are typically a requirement for anyone seeking outside financing.

Learn what you need to get a small business loan.

9. To better understand the broader landscape

No business is an island, and while you might have a strong handle on everything happening under your own roof, it’s equally important to understand the market terrain as well. Writing a business plan can go a long way in helping you better understand your competition and the market you’re operating in more broadly, illuminate consumer trends and preferences, potential disruptions and other insights that aren’t always plainly visible.

10. To reduce risk

Entrepreneurship is a risky business, but that risk becomes significantly more manageable once tested against a well-crafted business plan. Drawing up revenue and expense projections, devising logistics and operational plans, and understanding the market and competitive landscape can all help reduce the risk factor from an inherently precarious way to make a living. Having a business plan allows you to leave less up to chance, make better decisions, and enjoy the clearest possible view of the future of your company.

Business plan FAQs

How does having a business plan help small business owners make better decisions.

Having a business plan supports small business owners in making smarter decisions by providing a structured framework to assess all parts of their businesses. It helps you foresee potential challenges, identify opportunities, and set clear objectives. Business plans help you make decisions across the board, including market strategies, financial management, resource allocation, and growth planning.

What industry-specific issues can business plans help tackle?

Business plans can address industry-specific challenges like regulatory compliance, technological advancements, market trends, and competitive landscape. For instance, in highly regulated industries like healthcare or finance, a comprehensive business plan can outline compliance measures and risk management strategies.

How can small business owners use their business plans to pitch investors or apply for loans?

In addition to attracting investors and securing financing, small business owners can leverage their business plans during pitches or loan applications by focusing on key elements that resonate with potential stakeholders. This includes highlighting market analysis, competitive advantages, revenue projections, and scalability plans. Presenting a well-researched and data-driven business plan demonstrates credibility and makes investors or lenders feel confident about your business’s potential health and growth.

Understanding the importance of a business plan

Now that you have a solid grasp on the “why” behind business plans, you can confidently move forward with creating your own.

Remember that a business plan will grow and evolve along with your business, so it’s an important part of your whole journey—not just the beginning.

Related Posts

Now that you’ve read up on the purpose of a business plan, check out our guide to help you get started.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

Tor Vs. VPN: What’s The Difference?

Best Massachusetts Registered Agent Services Of 2024

Best Pennsylvania Registered Agent Services Of 2024

Best Utah Registered Agent Services Of 2024

Best New Mexico Registered Agent Services Of 2024

Best Maine Registered Agent Services Of 2024

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.

Cash Flow It is essential that a business carefully plans and manages cash flows to ensure that there are optimal levels of cash in the bank at all times and avoid situations where the business could run out of cash and could not afford to pay its bills.

Revenues v. Expenses In addition, your business plan will compare your revenue forecasts to the budgeted costs to make sure that your financials are healthy and the business is set up for success.

5. Make Decisions

Whether you are starting a small business or expanding an existing one, a business plan is an important tool to help guide your decisions:

Sound decisions Gathering information for the business plan boosts your knowledge across many important areas of the business:

- Industry, market, customers and competitors

- Financial projections (e.g., revenue, expenses, assets, cash flow)

- Operations, technology and logistics

- Human resources (management and staff)

- Creating value for your customer through products and services

Decision-making skills The business planning process involves thorough research and critical thinking about many intertwined and complex business issues. As a result, it solidifies the decision-making skills of the business owner and builds a solid foundation for strategic planning , prioritization and sound decision making in your business. The more you understand, the better your decisions will be.

Planning Thorough planning allows you to determine the answer to some of the most critical business decisions ahead of time , prepare for anticipate problems before they arise, and ensure that any tactical solutions are in line with the overall strategy and goals.

If you do not take time to plan, you risk becoming overwhelmed by countless options and conflicting directions because you are not unclear about the mission , vision and strategy for your business.

6. Manage Risk

Some level of uncertainty is inherent in every business, but there is a lot you can do to reduce and manage the risk, starting with a business plan to uncover your weak spots.

You will need to take a realistic and pragmatic look at the hard facts and identify:

- Major risks , challenges and obstacles that you can expect on the way – so you can prepare to deal with them.

- Weaknesses in your business idea, business model and strategy – so you can fix them.

- Critical mistakes before they arise – so you can avoid them.

Essentially, the business plan is your safety net . Naturally, business plan cannot entirely eliminate risk, but it can significantly reduce it and prepare you for any challenges you may encounter.

7. Communicate Internally

Attract talent For a business to succeed, attracting talented workers and partners is of vital importance.

A business plan can be used as a communication tool to attract the right talent at all levels, from skilled staff to executive management, to work for your business by explaining the direction and growth potential of the business in a presentable format.

Align performance Sharing your business plan with all team members helps to ensure that everyone is on the same page when it comes to the long-term vision and strategy.

You need their buy-in from the beginning, because aligning your team with your priorities will increase the efficiency of your business as everyone is working towards a common goal .

If everyone on your team understands that their piece of work matters and how it fits into the big picture, they are more invested in achieving the objectives of the business.

It also makes it easier to track and communicate on your progress.

Share and explain business objectives with your management team, employees and new hires. Make selected portions of your business plan part of your new employee training.

8. Communicate Externally

Alliances If you are interested in partnerships or joint ventures, you may share selected sections of your plan with the potential business partners in order to develop new alliances.

Suppliers A business plan can play a part in attracting reliable suppliers and getting approved for business credit from suppliers. Suppliers who feel confident that your business will succeed (e.g., sales projections) will be much more likely to extend credit.

In addition, suppliers may want to ensure their products are being represented in the right way .

Professional Services Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, including attorneys, accountants, and other professional consultants as needed, to make sure that everyone is on the same page.

Advisors Share the plan with experts and professionals who are in a position to give you valuable advice.

Landlord Some landlords and property managers require businesses to submit a business plan to be considered for a lease to prove that your business will have sufficient cash flows to pay the rent.

Customers The business plan may also function as a prospectus for potential customers, especially when it comes to large corporate accounts and exclusive customer relationships.

9. Secure Funding

If you intend to seek outside financing for your business, you are likely going to need a business plan.

Whether you are seeking debt financing (e.g. loan or credit line) from a lender (e.g., bank or financial institution) or equity capital financing from investors (e.g., venture or angel capital), a business plan can make the difference between whether or not – and how much – someone decides to invest.

Investors and financiers are always looking at the risk of default and the earning potential based on facts and figures. Understandably, anyone who is interested in supporting your business will want to check that you know what you are doing, that their money is in good hands, and that the venture is viable in the long run.

Business plans tend to be the most effective ways of proving that. A presentation may pique their interest , but they will most probably request a well-written document they can study in detail before they will be prepared to make any financial commitment.

That is why a business plan can often be the single most important document you can present to potential investors/financiers that will provide the structure and confidence that they need to make decisions about funding and supporting your company.

Be prepared to have your business plan scrutinized . Investors and financiers will conduct extensive checks and analyses to be certain that what is written in your business plan faithful representation of the truth.

10. Grow and Change

It is a very common misconception that a business plan is a static document that a new business prepares once in the start-up phase and then happily forgets about.

But businesses are not static. And neither are business plans. The business plan for any business will change over time as the company evolves and expands .

In the growth phase, an updated business plan is particularly useful for:

Raising additional capital for expansion

- Seeking financing for new assets , such as equipment or property

- Securing financing to support steady cash flows (e.g., seasonality, market downturns, timing of sale/purchase invoices)

- Forecasting to allocate resources according to strategic priority and operational needs

- Valuation (e.g., mergers & acquisitions, tax issues, transactions related to divorce, inheritance, estate planning)

Keeping the business plan updated gives established businesses better chance of getting the money they need to grow or even keep operating.

Business plan is also an excellent tool for planning an exit as it would include the strategy and timelines for a transfer to new ownership or dissolution of the company.

Also, if you ever make the decision to sell your business or position yourself for a merger or an acquisition , a strong business plan in hand is going to help you to maximize the business valuation.

Valuation is the process of establishing the worth of a business by a valuation expert who will draw on professional experience as well as a business plan that will outline what you have, what it’s worth now and how much will it likely produce in the future.

Your business is likely to be worth more to a buyer if they clearly understand your business model, your market, your assets and your overall potential to grow and scale .

Related Questions

Business plan purpose: what is the purpose of a business plan.

The purpose of a business plan is to articulate a strategy for starting a new business or growing an existing one by identifying where the business is going and how it will get there to test the viability of a business idea and maximize the chances of securing funding and achieving business goals and success.

Business Plan Benefits: What are the benefits of a business plan?

A business plan benefits businesses by serving as a strategic tool outlining the steps and resources required to achieve goals and make business ideas succeed, as well as a communication tool allowing businesses to articulate their strategy to stakeholders that support the business.

Business Plan Importance: Why is business plan important?

The importance of a business plan lies in it being a roadmap that guides the decisions of a business on the road to success, providing clarity on all aspects of its operations. This blueprint outlines the goals of the business and what exactly is needed to achieve them through effective management.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?