Powered by Kisi

The WeWork Business Model

Despite very public ups and downs over the last few years, WeWork remains at the forefront of the shared workspace industry. By quickly becoming the driving force behind the industry's growth—and thriving despite a worldwide pandemic—WeWork's success proves definitively that coworking is the new normal. At only a little more than a decade old, the brand is poised to keep growing in the coming years, especially with new CEO Sandeep Mathrani.

Today, WeWork is still shaking up the industry at every turn. Over the past few years, it has acquired tech startups such as office sign-in system Welkio and physical data software company Euclid in a move toward domination in the business sphere. The brand's app, WeWork On Demand, expanded in late 2020 and is now available in 17 major U.S. cities. And despite a disastrous downfall under founder Adam Neumann, WeWork is now on track to be profitable once again by the end of 2021.

If there is anything that the controversial story of WeWork can teach us, is that resilience is key in growing a business, as recently revealed an early strategy of WeWork was to walk into Starbucks and pitch to people working on their laptops .

WeWork's unprecedented success has prompted dozens of questions: Who are the investors behind WeWork? How does WeWork make money? What are the financial risks associated with its business model? Why do landlords decide to take WeWork as a tenant as opposed to leasing directly? The answers might surprise you.

What is WeWork?

WeWork was founded in New York in 2010 with a goal to offer coworking spaces to entrepreneurs, startup companies, freelancers, and even larger enterprises . The company grew rapidly since its establishment, making it one of the largest and most visible coworking chains in the world. It now has thousands of employees and over 800 locations worldwide, including outposts in 40 of U.S. cities and 32 countries, like Brazil, Germany, and Thailand.

What are its membership options?

Flexibility is key in WeWork’s business model: They ensure that clients no longer need to worry about long-term leases. The company offers six levels of membership: All Access, On Demand, dedicated desks, small private offices, office suites, and custom full-floor offices.

For single workers, the all-access subscription option provides access to open workspaces across the world, so members can show up whenever they wish, pick any available seat in a common area, and start working immediately. Alternatively, the on-demand option allows you to pay only when you use a space, like a desk or a conference room, on a day-to-day or hourly basis. For those who want a little more stability, WeWork offers dedicated desks that they lease to one client or one business only.

Teams and businesses of all sizes can also opt for private offices, which come equipped with furniture and can accommodate dozens of workers as businesses grow. The most personalized option is a custom build-out, which presents maximum freedom for groups that want to customize their workspace with features like CEO suites, conference rooms, or labs. WeWork scouts buildings and then transforms them, for businesses big and small: They've already done this for Facebook, Microsoft, HSBC, and Deloitte.

Who are the investors behind WeWork?

WeWork's investors have included a number of global entities, including holding conglomerate SoftBank, private equity firm Hony Capital, and real estate developer Greenland Holdings. In August 2017, SoftBank and its founder, Masayoshi Son, poured a massive $4.4 billion investment into WeWork. This included $3 billion for WeWork itself, namely through primary investment and the purchase of existing shares, and $1.4 billion dedicated to WeWork’s expansion into the Asian market: WeWork China, WeWork Japan, and WeWork Pacific. In August 2018, WeWork announced yet another $1 billion in funds from SoftBank.

As of 2019, WeWork had raised nearly $47 billion in private equity and venture capital funding in the years since its founding. The immense interest by Asian companies such as Hony Capital, Legend Holdings, and China Oceanwide represents WeWork’s promising expansion into Eastern markets. Apart from its Asian investors, Western companies like Goldman Sachs, J.P. Morgan, and T. Rowe Price have also invested in the Manhattan-based WeWork. Unfortunately, when founder Adam Neumann greatly mismanaged the company in late 2019, WeWork lost its chance at an IPO as its valuation dropped more than 90% .

After a very public demise under Neumann's leadership, the company has made an unexpected turnaround. CEO Sandeep Mathrani, who took over in February 2020, is now looking towards a possible IPO for the company once again.

How does WeWork make money?

In a nutshell, WeWork rents buildings from property owners at one price and then rents them out to clients at higher prices. Not all of the locations WeWork uses are similarly priced; buying up real estate in Baltimore or Nashville, for example, is cheaper than in New York City. These price discrepancies help keep WeWork's overhead from getting too high.

After renting the buildings, WeWork transforms them, updating everything inside and adding features like cafés, offices, and community spaces. Once finished, the company rents out the spaces for significantly higher prices. Apart from making money on rent, WeWork also provides additional services for a fee, such as partnerships with local businesses, car rentals, and other à la carte amenities.

What are the financial risks of WeWork’s business model?

WeWork pays landlords a huge amount of money and sinks even more into cosmetic updates, so it relies heavily on the revenue from renting to its clients to cover its high costs. If a location does not onboard enough clients to fill the available spaces or if the client's rental income does not cover WeWork's own rent, the company finds itself in a risky position.

As of 2019, WeWork had signed $18 billion worth of leases over the next few years and committed to renting 14 million square feet of office space worldwide. The company had written off massive losses as the cost of massive growth and valued itself at $47 billion at its peak. After a rocky few months in late 2019 and early 2020, today the company is back in the black and sees a promising future ahead. It's important to note that loss periods are not abnormal for startups, especially in the case of WeWork's unusual business model.

Why do landlords take WeWork as a tenant?

A look into the future of Coworking Spaces

The co-working market is about to be disrupted. Let's see how

From the perspective of a landlord , WeWork's business model makes sense despite the high fixed costs and long-term lease agreements. For commercial property owners and managers, it's easier to have one contract with a single large company for a fixed period than to find and lease to several different tenants for shorter periods, especially if the building is in a challenging real estate market. Overall, the managing efforts and negotiation processes are much less troublesome with one tenant, and WeWork usually leases properties for 10 years. This takes less time and resources away from the building owner while taking care of the biggest concern for landlords—vacancy rates. WeWork has also garnered enormous media exposure by attracting young, innovative businesses and curating established corporate clients.

What happened to WeWork under Adam Neumann's leadership?

There’s no arguing that WeWork , which was managing millions of square feet of office space as of late 2019, has grown astronomically since its launch in 2010.

Once one of the fastest-growing companies in the world, WeWork was on top of the coworking food chain. In late 2019, a series of shocking events surrounding Neumann's leadership decisions put the future of the company and its massive workforce in question, along with the general perception of the coworking industry and its implications on the commercial real estate market.

Below, we take a look at how and why this coworking giant went from being one of the most highly valued startups to contemplating bankruptcy in the space of 6 weeks, before Mathrani swooped in and helped bring the company back to stability in 2020.

From WeWork to The We Company

Valued at $47 billion (Softbank being the largest investor), the company rebranded from WeWork to “The We Company” early in 2019. According to reports, the decision was made to help the firm grow and reach a wider audience.

Many business journals and analysts questioned the brand's ability to turn a profit after it lost more than $2 billion in 2018. For years, industry experts in the commercial real estate and tech industry questioned the vacancy rates of WeWork locations and the overall viability of the business model amid its rapid expansion into co-living, education, childcare, and several other sectors.

What Went Wong?

In August 2019, The We Company submitted its S-1 filing in preparation for an IPO (initial public offering). Almost immediately, headlines and reactions from tech bloggers and economics experts alike criticized the prospectus and the company for its complex corporate structure, questionable business practices, negative financial projections, and inflated language.

After the filing, the company faced more scrutiny of its leadership and finances from both investors and potential shareholders. Conflicts of interest were revealed in CEO and co-founder Adam Neumann’s ownership of the “We” trademark and several stakes of the company’s real estate holdings, raising red flags among stakeholders, employees, and observers alike.

By the second week after the IPO filing, these revelations and criticisms of the company had severely damaged the outlook of the IPO, putting the company in a very fragile position along with Softbank’s $10 billion investment. Amid reports of self-dealing, sexism, and unprofessional behavior, Neumann eventually had to step down from his role as CEO and chair of The We Company in September 2019, just a few days after the company decided to delay its IPO.

As a result, WeWork’s value plummeted from $47 billion to just over $8 billion.

Adam Neumann steps down

Neumann’s reported behavior and business practices were at the heart of much of the criticisms the company received in the press. The fact that he personally trademarked the word 'We' and licensed the use of the word to his own company for $5.9 million raised red flags among executives and business experts, prompting a rollback of this arrangement soon after it came to light.

Neumann was also reported to have frequently encouraged employees to drink shots of tequila and smoke marijuana at work. This carefree attitude from the CEO, coupled with reports of an increasing lack of gender diversity among the company’s managerial staff and high-level executives, severely damaged the public perception of the company culture. Even before the planned IPO, WeWork was heavily criticized for its lack of female board members or decision-makers in general.

WeWork’s valuation plummeted more and more with every negative report about WeWork’s corporate governance practices and Neumann’s behavior, further disconcerting investors and delaying the official IPO. The turning point occurred after marijuana was found on Neumann’s company jet after it landed in Japan (where it is illegal). Shortly after this incident Neumann stepped down as CEO and drastically reduced his voting power on the board from 10:1 to 3:1. As co-founder of the company, he now only retains a non-executive chair on the board of directors, but no controlling stake in the company.

Though many company decision-makers sought to quell investor’s fears and save the IPO by removing Neumann, his exit package drew even more criticism. By leaving WeWork, the 40-year-old entrepreneur walked away with more than $1.7 billion by selling his shares to SoftBank, earning a sizeable consulting fee in the process.

SoftBank, WeWork’s biggest investor, took control of the company, with former Amazon exec Sebastian Gunningham and CFO Artie Minson filling the CEO position temporarily. Its top investors and executives re-evaluated WeWork’s path to profitability and implemented more conservative strategies to attain positive revenue in conjunction with the company’s drastically reduced valuation. These strategies include cost-saving measures like laying off of over 2,000 employees worldwide, the sale of several companies that WeWork previously acquired, and an immediate halting of the aggressive expansion of the company into new markets. Upon stepping into the CEO role in February 2020, Mathrani has continued building the company back up by cutting costs and righting the company culture.

What this means to the coworking industry

This scaling back of one of the world’s fastest-growing companies and its IPO troubles bear many similarities to large tech businesses facing the ultimate test of going public. Many coworking space operators are worried about how WeWork’s failed IPO will affect the public’s outlook on the industry.

Though recent events may be disheartening to potential investors in coworking spaces, studies show that WeWork barely scratched 2% market share in the flexible office space sector, with many of its clients being large corporations like Google, Microsoft, and Salesforce. As a whole, the coworking industry has grown steadily year-over-year and demand for local, independent flexible workspaces with strong communities remains stable, and demand is expected to rise again after the COVID-19 pandemic.

If anything, the controversies surrounding WeWork serve as an example to other expanding coworking brands, highlighting the necessity of creating a sustainable company culture and a clear path to profitability in order to earn the trust of members and stakeholders alike.

Carlo Belloni

Carlo is the Project Manager and SEO Specialist at Kisi.

Save your community manager 41 hours each week—learn how The Yard did it with cloud-based access control.

Most Viewed

Largest Coworking Companies

Alberto Di Risio

Thriving In Smaller Markets

Access Control vs Smart Locks

Offering More Value

Protecting Network Security

Are Coworking Spaces Safe?

The Guide to Make Your Space More Profitable

Including interviews with experts and consultants.

Related Articles

Starting an Innovation Lab?

Dangers in work space security

Leveraging Social Data

Get expert advice on setting up and scaling your space

Free access to our best guides, industry insights and more.

We use cookies to enhance your experience and for marketing purposes. By clicking “accept”, you agree to this use.

- Financial Acumen

- Marketing Acumen

- New Manager Workshop

- Change Management Skills

- Virtual Business Acumen (Foundations)

- Strategic Business Selling Skills

- High Potential Leadership

- Onboarding New Hires

- Business Acumen eLearning Courses

- Learning Journeys

- Virtual Learning Journeys

- Customized Learning

- Learning Modalities

- Training Reinforcement Tools

- Measurement

- Why Business Simulation?

- Simulation Catalog

- SaaS Simulation

- Zodiak Pro - Digital Game Board Simulation

- Foundations of Business Acumen Simulation

- Pricing Simulation

- Pharmaceutical Marketing Simulation

- Leading Psychological Safety Simulation

- Coaching Simulation

- Delivering Effective Presentations

- Fundamentals of Business Change

- Blanchard SLII Simulation

- Resolving Business Conflict

- Leading Strategic Execution Simulation

- New Manager Leadership Simulation

- Level Five Sales Coaching Simulation

- Sales Prospecting

- Industry Business Simulations

- Pharmaceutical Business Simulation Suite

- Assessment Simulations

- Virtual Role Play Simulations

- Custom Simulations

- AdvantEdge White papers

- Advantexe Podcast

- Virtual Learning Journey Resources

- The Power of Practice - Business Simulations

- What is Business Acumen

- Why Business Acumen Matters

- Why We Are Different

- Industries Served

- Advantexe Team

- Careers @Advantexe

- Advantexe Events

The Advantexe Advisor Blog - providing a deep and applicable understanding of the system of business.

5 business lessons everyone can learn from the wework case study.

By Robert Brodo | Jun 1, 2022 7:45:23 AM |

Founded in 2010, WeWork grew rapidly into a New York-based business that provided co-working spaces for entrepreneurs and freelancers. In 2019 it had achieved a paper corporate valuation of $ 47 billion. That was based on revenues of 2 billion and expenses of $2.4 billion. The company was ready to go IPO, but then there were issues related to fraudulent accounting and extravagant spending by the CEO, Neumann, and the IPO was withdrawn. After a corporate restructuring, and with the support of the largest shareholder Softbank Group, the company was listed in October 2021 for about $9 billion.

Besides being extremely well done, Jared Leto’s performance of transforming himself into Neumann was mesmerizing. Despite all the really stupid things Neumann did to almost destroy his company and billions of dollars in value, you still feel empathy for the sheer willpower of the character and the possibility that he actually may have been right.

This fascinating story makes for a great case study, so I wanted to share five business acumen lessons that can apply to anyone in business:

Embrace failure and uncertainty

Adam Neumann never feared failure. He embraced it because he was able to learn from it and “manifest” further growth and development. In today’s large organizations, too many people play it safe and don’t think of ways to challenge the orthodoxy and disrupt the status quo. If you want to succeed, you need to have a growth mindset that sees the positive and can learn from mistakes quickly.

Self Confidence doesn’t require cash or capital

As chaotic as things got, Neumann never ever lost his confidence in his ideas and himself. Even when things turned darkest, he had the same self-confidence and belief in his key people. Although knowing you will still have 3-4 billion in the worst case can tend to take the edge off of things, but it was quite apparent that he never ever lost his confidence. It was almost like his fuel, and he was able to leverage it with other people to make them even more self-confident. This includes his work partner and his wife who were extremely key characters in the story.

It starts with a winning aspiration

One of the most influential strategy books of our time, Playing to Win: How Strategy Really Works by Martin and Lafley proposes that everything in business must start with a winning aspiration. WeWork’s winning aspiration was understanding that they weren’t selling shared office space, they were creating communities of connected workers. That aspiration never was compromised.

You grow through scale

Adam Neumann’s downfall wasn’t related to growing too quickly which is what some of his investors thought. As a matter of fact, and in retrospect, he could have accelerated the growth even faster if he pushed it. Incremental growth is nice, but scaled growth is the way to go if you have enough cash and leadership to execute for the long term. You need to look no further than Amazon as the classic case study that did that the best ever.

Too much of a good thing never works in the long run

Talk about “drinking the Kool-Aid!” There were times during the WeCrashe show when the employees of WeWork looked like they were part of a cult. Many former employees described it that way. The overzealous spending and living like there is no tomorrow eventually caught up to them when they ran out of cash and needed to go back to investors one last time.

In summary, this is a show worth investing 10 hours in. It’s insightful, interesting, and packed full of great business lessons for us all.

About The Author

Robert Brodo is co-founder of Advantexe. He has more than 20 years of training and business simulation experience.

SUBSCRIBE VIA EMAIL

About advantexe, posts by topic.

- Business Acumen (47)

- Business Simulation (25)

- Business Acumen Skills (23)

- Business Strategy (22)

- Business Leadership (18)

- leadership development (15)

- Business Simulations (4)

- Leadership (4)

- Value Discipline (4)

- customer intimacy (4)

- value proposition (4)

- Business acumen tips (3)

- product leadership (3)

- Leadership Training (2)

- Leading by example (2)

- Psychological Safety (2)

- Talent Development (2)

- Virtual Learning (2)

- marketing (2)

- Advanced Business Acumen (1)

- Brand Equity (1)

- Business Skills Assessment (1)

- Coaching (1)

- Cyber Security (1)

- Sales Training (1)

- Social Selling (1)

- Stronger Business Acumen (1)

- Talent Management (1)

- Virtual Selling (1)

- customer service (1)

- digital marketing (1)

RECENT ARTICLES

Popular articles.

- Talent Development

- How We Help

- Simulations

- Point of View

1001 Conshohocken State Road, West Conshohocken, Pennsylvania 19428

Copyright by Advantexe Learning Solutions , 2024.

All Rights Reserved

- Terms & Conditions

Recent Posts

WeWork Case Study: A Fall From the Pinnacle of Success

Devashish Shrivastava , Anga Mahatara

Here's a thorough WeWork case study briefing the history, business model, and the fall of WeWork from the pinnacle of success. WeWork is an American organization that gives shared workspaces to other companies and organizations.

Established in 2010, it is headquartered in New York City. WeWork oversaw 46.63 million square feet of space in 2018. WeWork structures and fabricates physical and virtual shared spaces and office administrations for people and companies. WeWork has over 700 locations in 38 countries for workspace.

In January 2019, the firm declared its plan to rebrand as "The We Company"; it was valued at $47 billion at that time. In that year, troubles started brewing for the company.

Adam Neumann left his position as the CEO and surrendered a greater part of ballot control in WeWork from 26 September 2019. WeWork also postponed its arranged securities exchange posting until the end of 2019 as issues began to arise in its corporate administration, valuation, and other business aspects.

On September 30, 2019, WeWork officially pulled back its S-1 documentation. The proposed IPO was thus delayed. The organization's valuation fell below $10 billion, not exactly the $12.8 billion it had raised since 2010.

How Was WeWork Founded? Rapid Expansion of WeWork Business Model of WeWork WeWork Business Growth WeWork IPO Failure Future of WeWork In India

How Was WeWork Founded?

In May 2008, Adam Neumann and Miguel McKelvey started GreenDesk, an "eco-accommodating coworking space" in Brooklyn. In 2010, Neumann and McKelvey sold the business and began WeWork. Its first area was New York's SoHo district with halfway financing from Manhattan land designer Joel Schreiber who obtained a 33% stake in the organization for $15 million.

By 2014, WeWork was considered "the quickest developing renter of new office space in New York", and was on track to turn into "the quickest developing tenant of new space in America. "During the monetary emergencies, there were these vacant structures and these individuals outsourcing or beginning organizations," Neumann told the New York Daily News.

"I knew there was an approach to coordinate the two. What isolates us, however, is community." WeWork collaborated with several organizations, including new businesses such as Consumer, HackHands, Whole Whale, Turf, Fitocracy, Reddit, and New York Tech Meetup. In 2011, PepsiCo put a couple of representatives in the SoHo WeWork, who went about as guides to littler WeWork part companies.

The first WeWork Labs opened in New York's SoHo in April 2011. WeWork Labs works as a startup hatchery , furnishing an open workspace to empower joint efforts among individuals who "don't have their business-related thoughts completely cooked."

Rapid Expansion of WeWork

The company had 51 cooperating areas in the US, Europe, and Israel in January 2015– twice the same number as it had towards the end of 2014.

On June 1, 2015, WeWork reported that Artie Minson, previous Chief Financial Officer of Time Warner Cable, would join the organization as President and Chief Operating Officer.

On March 9, 2016, WeWork declared that it raised $430 million in another round of financing from Legend Holdings and Hony Capital Ltd., pegging the organization at $16 billion at that time.

By October 2016, the organization had raised $1.7 billion in private capital. In October 2016, the organization reported its arrangements to open a fourth area in Cambridge/Boston region. It opened workspaces in Boston's Leather District and Fort Point in 2014.

On January 30, 2017, the Wall Street Journal composed that SoftBank Group Corporation is gauging speculation of well over $1 billion in WeWork Corporation, in what could be among the principal bargains from its new $100 billion innovation fund."

In April 2017, the organization began offering wellness classes in some of its areas and opened an exercise center at a New York location. In July 2017, the valuation of the organization came to around $20 billion .

Later that month, it was reported that WeWork would expand to China using $500 million contributed by SoftBank , Hony Capital, and different loan specialists to shape "WeWork China".

In September 2017, WeWork ventured into Southeast Asia through the acquisition of Singapore-based SpaceMob , and it put aside a financial limit of $500 million to develop in Southeast Asia, the home of more than 600 million people. The association's top rival in China is Ucommune, the main Chinese unicorn in the coworking space.

In late October 2017, WeWork purchased the Lord and Taylor Building on Fifth Avenue in Manhattan from the Hudson's Bay Company for $850 million. The arrangement incorporated the use of floors of certain HBC-claimed retail chains in New York, Toronto, Vancouver, and Germany as WeWork's shared office workspaces . The deal was formally finished in February 2019.

Business Model of WeWork

WeWork was established in New York in 2010 to offer cooperating spaces to business visionaries, new businesses, specialists, and enterprises. WeWork has developed quickly, making it one of the biggest and most obvious cooperating chains on the planet.

It presently has representatives in over 700 areas around the world, incorporating stations in many U.S. urban areas and 38 nations that include Brazil, Germany, and Thailand.

How Does It Work

Superficially, WeWork's business model resembles a moderately ordinary land play. Over the 700+ areas it operates in, everybody from solo business people to enormous organizations can lease everything from a work area to a private floor. WeWork is not the same as your normal land organization — it conveys an incentive to the inhabitants and the landowners.

WeWork gives its occupants something that is conventionally elusive, an on-request adaptable space with momentary leases (even on a month-to-month premise at times). This takes care of the problem of continuous shifting, one that affects developing businesses.

The process of shifting involves finding another office space, moving in, marking a long-haul rent, rebuilding the space , and moving out to begin everything once more elsewhere.

At the point when an organization exceeds its WeWork participation, it can move up to a progressively extensive alternate space, a private office, or even a private floor — diminishing erosion from changes. Clients don't need to consider all the particulars of leasing office space, and they gain admittance to a lot of office advantages (free espresso, quick web, etc).

For landowners, WeWork offers huge incentives , including higher rents, an extended inhabitant pool, and increments in land esteem. In a blog entry distributed in 2018, the organization announced lease premiums between 15-29% in structures it managed in New York and Los Angeles. WeWork claimed a generation of $250 million in extra income for proprietors in New York, Chicago, and Los Angeles alone.

Space Used by WeWork

WeWork feels managing a business workspace is an intense issue regardless of how enormous (or little) your association is— and it's once in a while a center competency. Consultants and the employees of nascent stage companies don't have the financial backing to pay for office space, and end up telecommuting or working out of some stop-hole arrangement.

A below-standard working space could restrain joint effort and profitability. Small and medium-sized organizations battle with spending requirements and restricted assets, and development directions can make space needs a moving objective.

Venture associations face close consistent strain to cut expenses and increment productivity — land and activity costs can be a difficult barrier to cross. WeWork positions itself as the answer to these issues. By giving turnkey, versatile workspace arrangements, the organization vows to wipe out the contact associated with finding, involving, and dealing with a workspace.

Consultants and new companies get the advantages and preferences of having an office space without the expenses and obligations that accompany it. Small organizations get adaptable, reasonable space alternatives that can be reconfigured as needed.

WeWork rents a couple of floors of a structure from a property director in a high-thickness urban zone. It revamps the space to incorporate a blend of private workplaces, meeting rooms, parlors, and open workspaces.

It adds additional facilities such as espresso, office supplies, and brew on tap. WeWork pivots and leases workplaces to a blend of specialists, solopreneurs, new companies, and huge organizations.

WeWork essentially fits a larger number of bodies into its spaces than a run-of-the-mill corporate office. The normal per-individual office space in the United States is just shy of 200 square feet, as indicated by the US General Services Administration.

WeWork individuals can anticipate under 100 square feet. WeWork does this without yielding specialist profitability or fulfillment. Indeed, a central guarantee at WeWork is that its spaces are deliberately intended to cultivate greater efficiency and more development.

Services Added With Value by WeWork

Another factor adding to WeWork's guarantee of "greater profitability, more development" is the worth-added administrations the organization offers to individuals. In 2018, it relaunched WeWork Labs, a hatchery-style program for new companies planned for helping them develop their business.

In February 2019, the organization reported a redo of the WeWork application, complete with new ability-sharing highlights planned for making it simpler for clients to discover, interface, and team up with different individuals.

Once individuals enter the WeWork environment, it becomes hard for them to leave owing to the benefits. The organization's open recording archives report a net enrollment consistency standard of 119%.

WeWork's developing exhibit of significant worth included administrations — going from espresso and office supplies to showcasing programming and an administrations commercial center — push it past a basic landowner into a sort of full-administration proficient "hatchery" where an individual can arrange, and develop their business, adopt new abilities, and have the everyday details of dealing with a workspace dealt with.

On the off chance that an organization or individual moves to another city, there will be another WeWork space sitting tight for them . If a vital accomplice or specialist organization is required, WeWork can help find the ideal option. What's more, as the organization develops from a little startup to a large organization, WeWork's administration scales to keep up with the upgrade.

Analysis of Data

An essential piece in the WeWork ecosystem is the utilization of information. WeWork has for quite some time been utilizing information to advise participating organizations on areas, where they ought to be set, and what the blend of workplaces, workspaces, and courtesies should be like.

WeWork started to create products out of its information capacities with the "space-as-an-administration" offering "Powered by We". Presented in 2017, Powered by We denotes a critical change for WeWork.

Earlier, WeWork's administrations were limited to the spaces that it involved. Through Powered by We, the organization started to grow its range outside its leases into the organization's current spaces.

This has a one-two-punch impact, empowering the organization to order the more significant expenses that accompany serving endeavor customers, while simultaneously shedding one of its most noteworthy wellsprings of both expense and hazard — the leases themselves.

Share of Workspace

The common workspace level is the least worth offering that WeWork has — not the organization's most beneficial part, but a significant establishment for what's worked above it.

These mutual workspace collaborations are what many pictures when they hear the words "cooperating space." Members come in every morning and either snatch any accessible work area space in a typical zone if they have what WeWork alludes to as a "sweltering work area" enrollment or, for $100 or so extra a month, settle in at their very own committed work area in the common workspace.

As indicated by the WeWork site, these common workspaces are intended for new businesses and little organizations, specialists, advisors, and telecommuters. Hot work area participation starts at $190 every month and can reach upwards of $600 in costly urban communities like San Francisco. Committed work areas run from $300 to $700.

Central Station by WeWork

The level above office suites, central station by WeWork will be WeWork's "white name" answer for big business customers. Instead of setting the organization up with a space inside a current WeWork premise, the central station is set up in independent areas sourced by WeWork in an area of the customer's decision.

Customer organizations pick one of four "configurable designs," running from an open warm-up area to official suites. Customers also pick inner staff to oversee everyday tasks for their area, with WeWork taking what the site alludes to as an "in the background" job.

WeWork Labs

A striking case of how WeWork uses esteem-added administrations to draw organizations into the WeWork system comes as WeWork Labs. WeWork Labs is WeWork's "worldwide development stage" — an in-house startup hatchery that enlarges the central WeWork workspace offering extra highlights, including devoted program directors, week-after-week occasions, pitch evenings, workshops, and financial specialist presentations.

Relaunched in 2018, the program is at present offered in more than 700 areas — 154 in the United States and others in significant urban communities over the world, incorporating Brazil, China , Israel, Singapore , the UK , and Thailand, among others.

The organization said 1,000 new businesses have been brooded through the program as of December 2018.

The key factor that separates WeWork Labs from other startup quickening agents is the plan of action; instead of the standard hatchery model of taking value in the business, WeWork Labs charges a level expense, basically an up-charge to what the startup would some way or another compensation for space at WeWork.

Costs for the program's US areas go from $300 - $600 every month. There's a key measurement to WeWork Labs too as effective organizations move on from the program and develop into undeniable organizations, they become potential clients for WeWork's growing suite of administrations.

WeWork Business Growth

The We Co., the American firm which works collaborating office spaces under the WeWork brand, has posted vigorous income development in India, even as it reels under huge misfortunes universally, demonstrating the organization's first open administrative recording.

We Co. posted an overall deficit of around $689.7 million and an income of $1.54 billion in the initial half-year of 2019. According to a report by Reuters, it is hoping to raise $3-4 billion through the first sale of stock (IPO), which is probably going to be propelled in September this year.

Since its entrance in India in 2016 through an organization with Bengaluru-based Embassy Group, WeWork has been forcefully extending its impression. At present, its services are available in over 40 locations in 6 cities.

Internationally, We Co. is available in over 700 areas in 38 nations. According to the recording, the organization earned $3.5 million in the executive's expenses in the half-year finished on June 30, enlisting a 118% bounce from $1.6 million in the year-back period.

In January 2019, the organization's valuation was expressed as $47 billion, however by September when an IPO was arranged and deferred, the valuation was decreased to $10-12 billion.

Throughout the final quarter of 2019, WeWork's evaluated market capitalization has kept on falling to a limited extent because of various examinations of Neumann's conduct and strategic approaches.

In 2018, WeWork's misfortunes and income both multiplied. As per the Financial Times, the organization lost $219,000 every hour of every day from March 2018 to March 2019 .

As of December 20, 2022, WeWork's net worth is $1.03 billion only a drop from $21.76 billion (2021).

WeWork IPO Failure

In January 2019, WeWork declared that it would move into a two-story structure in Tampa Heights in 2020 as a component of its venture into Tampa.

On April 29, 2019, WeWork was documented privately for an IPO . On July 18, 2019, Wall Street Journal detailed that Adam Neumann sold $700 million of his WeWork stock before its IPO. The organization was hoping to raise over $3.5 billion from its IPO.

The We Company recorded S-1 desk work to go public. Media inclusion featured the organization's overwhelming misfortunes uncovered by the S-1 documenting disclosures, while experts communicated apprehensions over WeWork's capacity to end up productive later on. The IPO unveiled that WeWork faced $2 billion in losses in 2018.

Smartkarma, an expert on speculation research expressed, "We can't understand the reshaping's that would be important to verbalize a way to gainfulness here," and noted it didn't anticipate that the organization's valuation should go beyond $20 billion.

Future of WeWork In India

WeWork India has its services available in over 40 locations in 6 cities with over 62,000 members occupying over 5 million square feet of space.

Since the dispatch of the American shared workspaces supplier in India, the Bengaluru-based Embassy Group had put $181 million into the WeWork partner. The target at present is the six main markets in the nation, including Bengaluru and Mumbai.

The raising support plans come amid discussion around WeWork's first sale of stock. WeWork's parent, The We Company, pulled back its IPO seven days after the SoftBank-backed adaptable office startup removed author Adam Neumann as its CEO.

"Despite everything, we keep up a great association with WeWork all-inclusive and will hold the brand," said Karan Virwani, chief of WeWork India.

The organization had hold of the establishment for WeWork in India till the end of 2021. It might want to hold onto the brand; however, WeWork holds the main right of refusal and can purchase out the Indian Realty designer.

International Haven Group had paid around $200 million for the establishment two years prior. The Realty conglomerate holds an 80% stake in the establishment.

Independently, Embassy Group intends to concentrate on business, modern, collaborating, and co-living portions to grow its impression in the nation.

Does SoftBank still own WeWork?

Yes, Softbank holds about 65% of the equity in WeWork .

What happened to Adam from WeWork?

Adam Neumann resigned from the position of CEO and gave up majority voting control in 2019.

Can WeWork be profitable?

It is hard to tell that WeWork will be profitable ever. The company has a negative cash flow. According to WeWork's initial-public-offering disclosures, its losses are running ahead of its revenue. WeWork is not profitable on its preferred metrics either.

What is the problem with WeWork?

The problem is it has a negative cash flow. According to WeWork's initial-public-offering disclosures, its losses are running ahead of its revenue. WeWork is not profitable on its preferred metrics either. Also, its whole business model is flawed with excessive leverage.

Does WeWork make money?

WeWork expects revenue of around $5 billion in 2022. On other hand as of December 20, 2022, WeWork's net worth is $1.03 billion only a drop from $21.76 billion (2021).

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace

24 Ways To Make Money Online in 2024

Online work is counted as one of the easiest and the most efficient ways to make money provided that you are equipped with the required skills and pledge to update yourself with each passing moment. Working online received a new boost with the recent wave of digitization that proved to

List of Top 17 Instant Loan Apps in India [2024]

At many points in our lives, we require loans to meet our needs. As per a CIC report published in June 2021, around half of India's working population has taken loans in some form. Among all types, a personal loan is quite convenient as it can be taken without any

Push Sports: How Is It Revolutionizing Sports Education and Safe Play Across India?

The Indian sports tech market is expected to grow from USD 1.2 billion in 2022 to USD 3.5 billion in 2027. In this industry, a company making a great name for itself is Push Sports. Push Sports is one of the fastest-growing sports-tech companies in India. The company

A Compassionate Approach: Launching a Successful Elderly Care Business

This article has been contributed by MP Deepu, Co-Founder & COO, SeniorWorld. In today's rapidly aging population, the need for innovative elderly care solutions has never been more pressing. As we strive to meet the diverse needs of seniors, it's crucial to approach the development of these services with empathy, compassion,

Why did WeWork fail, and what is next for the company?

- Medium Text

Sign up here.

Reporting by Kannaki Deka and additional reporting by Susan Mathew in Bengaluru; Editing by Anil D'Silva

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

France's Capgemini Q1 sales fall in slowing market

French IT consulting group Capgemini reported lower first-quarter revenue on Tuesday, compared with the same period last year, citing an expected slowdown in the market.

- Find a Location

WeWork Takes Significant Steps Toward Emergence from Chapter 11

Receives conditional approval of disclosure statement secures $450m of new money financing to fund emergence and provide post-emergence capital on track to emerge as a strong and sustainable company, positioned for continued industry leadership.

New York, NY – April 29, 2024 – Today, WeWork received court approval of its Disclosure Statement and several additional key motions, paving the way for the company to conclude its financial and operational restructuring and successfully emerge from Chapter 11 by the end of May.

As part of the Disclosure Statement, the Company shared it has secured a $450 million new-money financing facility that will support operations during its Chapter 11 cases and enable WeWork to promptly emerge from restructuring upon confirmation of the Plan. Securing this financing demonstrates the support and confidence in WeWork’s business model and value proposition from its largest stakeholders. Additionally through its Plan, WeWork expects to eliminate all of its $4 billion of outstanding, prepetition debt obligations.

“WeWork is and has always been an industry leader. Over the past six months, we have worked extremely hard to develop a Plan for a reorganized WeWork that is better capitalized, more operationally efficient, and positioned for continued investment in our products and services and a return to long term growth,” said David Tolley, Chief Executive Officer. “I am sincerely thankful to our Board, financial stakeholders, management team, and employees for their continued efforts to re-establish WeWork as a strong and sustainable company. I also want to thank our members and continuing landlord partners for their loyalty and support throughout this process.”

WeWork also secured approval to extend its Plan exclusivity and lease assumption periods, ensuring the Company’s continued control over the final weeks of its restructuring process. WeWork will immediately begin to solicit votes on the Plan and has requested final approval of the Disclosure Statement and confirmation of the Plan to occur at a hearing now scheduled for May 30, 2024.

About WeWork

WeWork was founded in 2010 with the vision to create environments where people and companies come together and do their best work. Since then, we’ve become the leading global flexible space provider committed to delivering technology-driven turnkey solutions, flexible spaces, and community experiences. For more information about WeWork, please visit us at wework.com .

Related articles

Vrio Analysis of Wework Case Study Solution

Home >> Vrio Analysis >> Wework

Wework, an Argentinean Wework Case Study Help business has actually seen rapid development throughout the years with its branches running in near various shopping center, business offices, hypermarts etc. Business has development by expanding through franchising which has been the distinguishing strategy utilized for expansion along with their environmentally friendly cars and truck Business service. While this fast growth has been there, the business has actually likewise been confronted with issues due to this rapid growth. Among the most considerable challenges to have actually resulted from Vrio Analysis's of Wework growth is related to the evaluation of their websites under this franchising design. The execution of a Balance Scorecard is being thought about for standardizing operations, the fact that there is diversity across areas has led to the need for additional weighing this choice prior to going ahead with the execution plan. The following areas focus on an internal and external analysis for Vrio Analysis of Wework for examining the company's macro and micro environment in order to clarify whether the Balance Scorecard would be ideal option for this franchising model or not.

Vrio Analysis of Wework Internal and External Analysis

ProtoBusiness with its prevalent network, globally and regionally is based upon the principle of using a prospective client's idle time in the parking lots of mall, workplaces or hypermarts for using the a Vrio Analysis of Wework Case Study Help service. Unlike the standard model of expecting a customer to discover time for a Vrio Analysis of Weworkuses the idea of availing the time which the client has actually currently taken out from his hectic schedule for other activities, hence supplying a value-added service with the consumer's other activities concurrently. The tools used by the company consist of the a full service van in a blue and yellow truck called 'cart Business' which can move from cars and truck to car within the premises of the respective place for using services such as fundamental Vrio Analysis of Wework Case Study Analysis, detailing and maintenance of the car etc . The concept used by Vrio Analysisof Wework optimizes making use of water while using environmentally friendly items for cleaning the cars which offers an one-upmanship to this service design over other particularly as the waste of water has actually ended up being a major issue in a lot of areas. Additional advantages of the business design consist of the use of low pressure sprays for getting rid of dust from lorries while minimal water is wasted while doing so with just 1 liter of water utilized for each Business in contrast to roughly 60 to 100 liters squandered throughout self-service for automobile cleans. Replacements like automated vehicle Businesses use roughly 300 liters of water for Businessing vehicles which offers an edge to Vrio Analysis over particular competitive Wework Case Study Analysis models. The Vrio Analysis of Wework Case Study Solution market normally includes automobile Business services in your home, automated self-self-service at professional Vrio Analysis Case Study Helpes or specialized organisation designs which include detailing along with automated Vrio Analysis of Wework Case Study Analysises. The following section makes use of a PESTEL analysis to determine obstacles in the external environment while the industry has been studied by means of Porter's Five Forces Analysis.

Wework Case Study Help Amarica

Wework case study analysis checklist.

- Wework Case Study Analysis

- Executive Summary Of Wework Case Study Solution

Porters Five Forces Analysis Of Wework Case Study Analysis

Pestel analysis of wework case study solution.

- Financial Analysis Of Wework Case Study Help

Generic Strategy Of Wework Case Study Help

- Vrine Analysis Of Wework Case Study Solution

- Recommendation Of Wework Case Study Solution

Wework Case Study Help

Executive Summary Of Wework Case Study Help

Financial Analysis Of Wework Case Study Analysis

Vrine Analysis Of Wework Case Study Help

Recommendation Of Wework Case Study Help

CASETHOR.COM

Wework Case Study Solution and Analysis

Experts at CaseThor.com are ready to assist you round the clock

- Get Started

Wework Case Study Help

Wework financial analysis.

Wework PESTEL Analysis

Swot analysis, porter's five forces analysis, wework recommendations.

Finance & Accounting Case Studies

Marketing & management cases help, business case analyses.

Wework Case Study Analysis

Home >> Kelloggs >> Wework >>

Background and Facts

Wework Case Study Analysis

Home >> Kelloggs >> Wework >>

Wework Case Study Solution

Wework is presently one of the biggest food cycle worldwide. It was founded by Kelloggs in 1866, a German Pharmacist who initially released "FarineLactee"; a mix of flour and milk to feed infants and reduce mortality rate. At the very same time, the Page brothers from Switzerland likewise discovered The Anglo-Swiss Condensed Milk Company. The two ended up being competitors initially but in the future combined in 1905, resulting in the birth of Wework. Business is now a global company. Unlike other international business, it has senior executives from various nations and attempts to make choices thinking about the whole world. Wework presently has more than 500 factories worldwide and a network spread across 86 countries.

The function of Wework Corporation is to boost the lifestyle of individuals by playing its part and providing healthy food. It wants to help the world in shaping a healthy and better future for it. It also wishes to encourage individuals to live a healthy life. While making sure that the company is being successful in the long run, that's how it plays its part for a better and healthy future

Wework's vision is to supply its clients with food that is healthy, high in quality and safe to consume. It wishes to be ingenious and all at once comprehend the requirements and requirements of its customers. Its vision is to grow fast and offer products that would please the needs of each age group. Wework envisions to develop a trained labor force which would help the company to grow .

Wework's mission is that as presently, it is the leading business in the food industry, it thinks in 'Excellent Food, Great Life". Its mission is to provide its customers with a variety of options that are healthy and best in taste. It is focused on providing the very best food to its clients throughout the day and night.

Business has a vast array of items that it offers to its customers. Its products include food for infants, cereals, dairy products, snacks, chocolates, food for family pet and bottled water. It has around 4 hundred and fifty (450) factories around the world and around 328,000 employees. In 2011, Business was listed as the most gainful organization.

Goals and Objectives

• Remembering the vision and mission of the corporation, the business has actually laid down its goals and objectives. These objectives and objectives are listed below. • One objective of the business is to reach zero landfill status. (Business, aboutus, 2017). • Another objective of Wework is to waste minimum food during production. Usually, the food produced is squandered even prior to it reaches the consumers. • Another thing that Business is working on is to enhance its packaging in such a way that it would help it to reduce those issues and would likewise guarantee the shipment of high quality of its items to its customers. • Meet international requirements of the environment. • Develop a relationship based upon trust with its customers, organisation partners, workers, and government.

Critical Issues

Recently, Business Business is focusing more towards the strategy of NHW and investing more of its revenues on the R&D technology. The country is investing more on acquisitions and mergers to support its NHW method. The target of the business is not achieved as the sales were expected to grow higher at the rate of 10% per year and the operating margins to increase by 20%, offered in Exhibit H. There is a need to focus more on the sales then the innovation technology. Otherwise, it might result in the decreased profits rate. (Henderson, 2012).

Situational Analysis.

Analysis of current strategy, vision and goals.

The existing Business technique is based upon the concept of Nutritious, Health and Wellness (NHW). This method handles the concept to bringing modification in the consumer preferences about food and making the food things much healthier worrying about the health problems. The vision of this method is based on the secret technique i.e. 60/40+ which simply implies that the items will have a rating of 60% on the basis of taste and 40% is based upon its dietary worth. The products will be manufactured with additional nutritional worth in contrast to all other items in market gaining it a plus on its dietary content. This method was embraced to bring more tasty plus nutritious foods and beverages in market than ever. In competition with other business, with an objective of retaining its trust over consumers as Business Business has actually gotten more trusted by costumers.

Quantitative Analysis.

R&D Spending as a portion of sales are decreasing with increasing actual quantity of costs reveals that the sales are increasing at a greater rate than its R&D spending, and permit the company to more invest in R&D. Net Profit Margin is increasing while R&D as a portion of sales is declining. This indicator also shows a thumbs-up to the R&D spending, mergers and acquisitions. Financial obligation ratio of the business is increasing due to its costs on mergers, acquisitions and R&D development rather than payment of financial obligations. This increasing debt ratio present a hazard of default of Business to its investors and could lead a decreasing share costs. For that reason, in terms of increasing debt ratio, the company must not invest much on R&D and must pay its current debts to reduce the danger for financiers. The increasing risk of investors with increasing debt ratio and decreasing share prices can be observed by substantial decline of EPS of Wework stocks. The sales growth of business is also low as compare to its mergers and acquisitions due to slow understanding structure of consumers. This sluggish development likewise hinder business to further invest in its mergers and acquisitions.( Business, Business Financial Reports, 2006-2010). Keep in mind: All the above analysis is done on the basis of calculations and Graphs given up the Displays D and E.

TWOS Analysis

TWOS analysis can be utilized to obtain numerous strategies based upon the SWOT Analysis provided above. A brief summary of TWOS Analysis is given in Exhibition H.

Strategies to exploit Opportunities using Strengths

Business ought to introduce more ingenious items by big amount of R&D Spending and mergers and acquisitions. It could increase the market share of Business and increase the earnings margins for the company. It might also supply Business a long term competitive benefit over its rivals. The worldwide growth of Business ought to be concentrated on market catching of developing countries by growth, attracting more consumers through consumer's loyalty. As establishing countries are more populous than industrialized countries, it could increase the consumer circle of Business.

Strategies to Overcome Weaknesses to Exploit Opportunities

Strategies to use strengths to overcome threats

Business ought to transfer to not only establishing but also to developed countries. It ought to expands its geographical growth. This large geographical growth towards establishing and developed countries would decrease the threat of prospective losses in times of instability in different nations. It must widen its circle to numerous nations like Unilever which operates in about 170 plus nations.

Strategies to overcome weaknesses to avoid threats

It ought to obtain and combine with those countries having a goodwill of being a healthy company in the market. It would also allow the company to utilize its possible resources efficiently on its other operations rather than acquisitions of those companies slowing the NHW strategy growth.

Segmentation Analysis

Demographic segmentation.

The demographic division of Business is based on four aspects; age, gender, income and profession. For instance, Business produces numerous products associated with infants i.e. Cerelac, Nido, and so on and associated to adults i.e. confectionary products. Wework products are quite economical by almost all levels, but its significant targeted clients, in regards to income level are middle and upper middle level customers.

Geographical Segmentation

Geographical division of Business is composed of its presence in almost 86 countries. Its geographical division is based upon two primary elements i.e. average income level of the customer in addition to the environment of the region. For example, Singapore Business Business's segmentation is done on the basis of the weather condition of the area i.e. hot, warm or cold.

Psychographic Segmentation

Psychographic division of Business is based upon the character and life style of the consumer. For example, Business 3 in 1 Coffee target those consumers whose life style is rather hectic and don't have much time.

Behavioral Segmentation

Wework behavioral segmentation is based upon the mindset knowledge and awareness of the customer. Its highly nutritious items target those customers who have a health mindful attitude towards their intakes.

Wework Alternatives

Wework Conclusion

Wework Exhibits

- Skip to main content

- Keyboard shortcuts for audio player

- Your Health

- Treatments & Tests

- Health Inc.

- Public Health

Reproductive rights in America

What's at stake as the supreme court hears idaho case about abortion in emergencies.

Selena Simmons-Duffin

The Supreme Court will hear another case about abortion rights on Wednesday. Protestors gathered outside the court last month when the case before the justices involved abortion pills. Tom Brenner for The Washington Post/Getty Images hide caption

The Supreme Court will hear another case about abortion rights on Wednesday. Protestors gathered outside the court last month when the case before the justices involved abortion pills.

In Idaho, when a pregnant patient has complications, abortion is only legal to prevent the woman's death. But a federal law known as EMTALA requires doctors to provide "stabilizing treatment" to patients in the emergency department.

The Biden administration sees that as a direct conflict, which is why the abortion issue is back – yet again – before the Supreme Court on Wednesday.

The case began just a few weeks after the justices overturned Roe v. Wade in 2022, when the federal Justice Department sued Idaho , arguing that the court should declare that "Idaho's law is invalid" when it comes to emergency abortions because the federal emergency care law preempts the state's abortion ban. So far, a district court agreed with the Biden administration, an appeals court panel agreed with Idaho, and the Supreme Court allowed the strict ban to take effect in January when it agreed to hear the case.

Supreme Court allows Idaho abortion ban to be enacted, first such ruling since Dobbs

The case, known as Moyle v. United States (Mike Moyle is the speaker of the Idaho House), has major implications on everything from what emergency care is available in states with abortion bans to how hospitals operate in Idaho. Here's a summary of what's at stake.

1. Idaho physicians warn patients are being harmed

Under Idaho's abortion law , the medical exception only applies when a doctor judges that "the abortion was necessary to prevent the death of the pregnant woman." (There is also an exception to the Idaho abortion ban in cases of rape or incest, only in the first trimester of the pregnancy, if the person files a police report.)

In a filing with the court , a group of 678 physicians in Idaho described cases in which women facing serious pregnancy complications were either sent home from the hospital or had to be transferred out of state for care. "It's been just a few months now that Idaho's law has been in effect – six patients with medical emergencies have already been transferred out of state for [pregnancy] termination," Dr. Jim Souza, chief physician executive of St. Luke's Health System in Idaho, told reporters on a press call last week.

Those delays and transfers can have consequences. For example, Dr. Emily Corrigan described a patient in court filings whose water broke too early, which put her at risk of infection. After two weeks of being dismissed while trying to get care, the patient went to Corrigan's hospital – by that time, she showed signs of infection and had lost so much blood she needed a transfusion. Corrigan added that without receiving an abortion, the patient could have needed a limb amputation or a hysterectomy – in other words, even if she didn't die, she could have faced life-long consequences to her health.

Attorneys for Idaho defend its abortion law, arguing that "every circumstance described by the administration's declarations involved life-threatening circumstances under which Idaho law would allow an abortion."

Ryan Bangert, senior attorney for the Christian legal powerhouse Alliance Defending Freedom, which is providing pro-bono assistance to the state of Idaho, says that "Idaho law does allow for physicians to make those difficult decisions when it's necessary to perform an abortion to save the life of the mother," without waiting for patients to become sicker and sicker.

Still, Dr. Sara Thomson, an OB-GYN in Boise, says difficult calls in the hospital are not hypothetical or even rare. "In my group, we're seeing this happen about every month or every other month where this state law complicates our care," she says. Four patients have sued the state in a separate case arguing that the narrow medical exception harmed them.

"As far as we know, we haven't had a woman die as a consequence of this law, but that is really on the top of our worry list of things that could happen because we know that if we watch as death is approaching and we don't intervene quickly enough, when we decide finally that we're going to intervene to save her life, it may be too late," she says.

2. Hospitals are closing units and struggling to recruit doctors

Labor and delivery departments are expensive for hospitals to operate. Idaho already had a shortage of providers, including OB-GYNS. Hospital administrators now say the Idaho abortion law has led to an exodus of maternal care providers from the state, which has a population of 2 million people.

Three rural hospitals in Idaho have closed their labor-and-delivery units since the abortion law took effect. "We are seeing the expansion of what's called obstetrical deserts here in Idaho," said Brian Whitlock, president and CEO of the Idaho Hospital Association.

Since Idaho's abortion law took effect, nearly one in four OB-GYNs have left the state or retired, according to a report from the Idaho Physician Well-Being Action Collaborative. The report finds the loss of doctors who specialize in high-risk pregnancies is even more extreme – five of nine full time maternal-fetal medicine specialists have left Idaho.

Administrators say they aren't able to recruit new providers to fill those positions. "Since [the abortion law's] enactment, St. Luke's has had markedly fewer applicants for open physician positions, particularly in obstetrics. And several out-of-state candidates have withdrawn their applications upon learning of the challenges of practicing in Idaho, citing [the law's] enactment and fear of criminal penalties," reads an amicus brief from St. Luke's health system in support of the federal government.

"Prior to the abortion decision, we already ranked 50th in number of physicians per capita – we were already a strained state," says Thomson, the doctor in Boise. She's experienced the loss of OB-GYN colleagues first hand. "I had a partner retire right as the laws were changing and her position has remained open – unfilled now for almost two years – so my own personal group has been short-staffed," she says.

ADF's Bangert says he's skeptical of the assertion that the abortion law is responsible for this exodus of doctors from Idaho. "I would be very surprised if Idaho's abortion law is the sole or singular cause of any physician shortage," he says. "I'm very suspicious of any claims of causality."

3. Justices could weigh in on fetal "personhood"

The state of Idaho's brief argues that EMTALA actually requires hospitals "to protect and care for an 'unborn child,'" an argument echoed in friend-of-the-court briefs from the U.S. Conference of Catholic Bishops and a group of states from Indiana to Wyoming that also have restrictive abortion laws. They argue that abortion can't be seen as a stabilizing treatment if one patient dies as a result.

Thomson is also Catholic, and she says the idea that, in an emergency, she is treating two patients – the fetus and the mother – doesn't account for clinical reality. "Of course, as obstetricians we have a passion for caring for both the mother and the baby, but there are clinical situations where the mom's health or life is in jeopardy, and no matter what we do, the baby is going to be lost," she says.

The Idaho abortion law uses the term "unborn child" as opposed to the words "embryo" or "fetus" – language that implies the fetus has the same rights as other people.

Shots - Health News

The science of ivf: what to know about alabama's 'extrauterine children' ruling.

Mary Ziegler , a legal historian at University of California - Davis, who is writing a book on fetal personhood, describes it as the "North Star" of the anti-abortion rights movement. She says this case will be the first time the Supreme Court justices will be considering a statute that uses that language.

"I think we may get clues about the future of bigger conflicts about fetal personhood," she explains, depending on how the justices respond to this idea. "Not just in the context of this statute or emergency medical scenarios, but in the context of the Constitution."

ADF has dismissed the idea that this case is an attempt to expand fetal rights. "This case is, at root, a question about whether or not the federal government can affect a hostile takeover of the practice of medicine in all 50 states by misinterpreting a long-standing federal statute to contain a hidden nationwide abortion mandate," Bangert says.

4. The election looms large

Ziegler suspects the justices will allow Idaho's abortion law to remain as is. "The Supreme Court has let Idaho's law go into effect, which suggests that the court is not convinced by the Biden administration's arguments, at least at this point," she notes.

Trump backed a federal abortion ban as president. Now, he says he wouldn't sign one

Whatever the decision, it will put abortion squarely back in the national spotlight a few months before the November election. "It's a reminder on the political side of things, that Biden and Trump don't really control the terms of the debate on this very important issue," Zielger observes. "They're going to be things put on everybody's radar by other actors, including the Supreme Court."

The justices will hear arguments in the case on Wednesday morning. A decision is expected by late June or early July.

Correction April 23, 2024

An earlier version of this story did not mention the rape and incest exception to Idaho's abortion ban. A person who reports rape or incest to police can end a pregnancy in Idaho in the first trimester.

- Abortion rights

- Supreme Court

VIA Technologies, Inc.

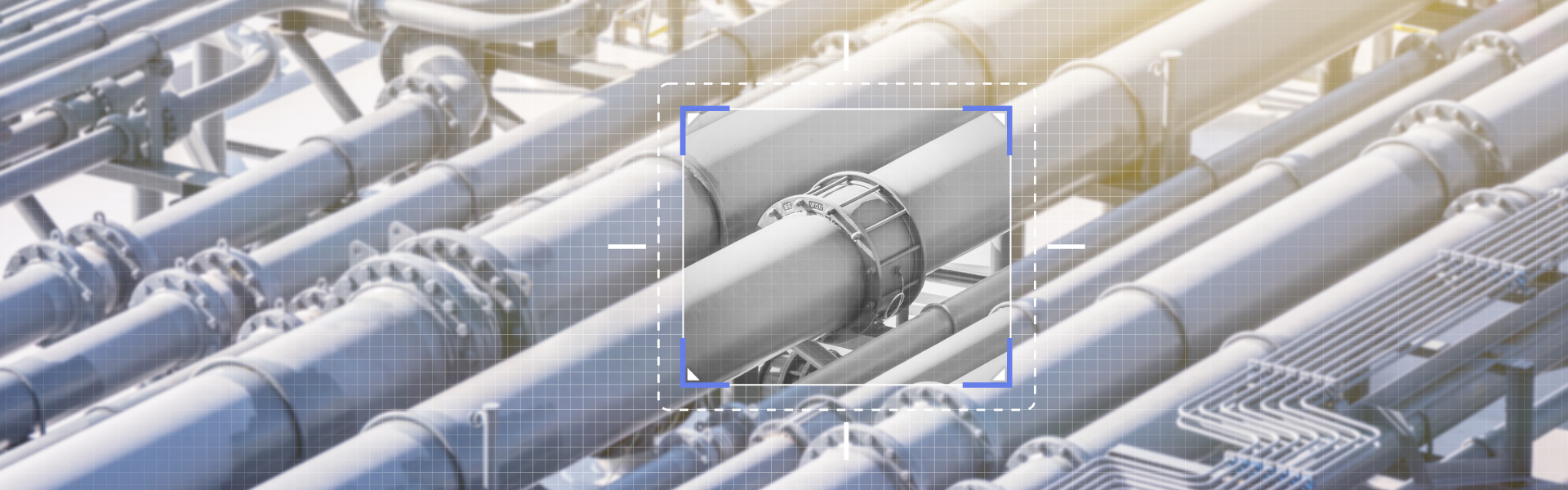

AI-Powered Pipeline Weld Inspection Solution Case Study

April 29, 2024 Perspectives

In the high-stakes world of petrochemicals, maintaining weld integrity is critical. Even minor defects can lead to costly leaks, serious environmental damage, and even catastrophic failures. Even the most comprehensive traditional manual inspection methods can be time-consuming, prone to human error, and ultimately hinder production efficiency. The VIA Pipeline Weld Inspection Solution offers a more reliable and cost-effective alternative, leveraging AI and edge computing for unmatched speed, accuracy, and consistency.

The Challenge: Optimizing Pipeline Weld Inspection

Detecting potential pipeline weld defects across large petrochemical facilities poses several challenges:

Subjectivity and Fatigue: Even experienced inspectors can miss subtle defects due to fatigue or judgment calls, leading to undetected risks.

Time and Cost: Manual inspections are slow and labor-intensive, creating bottlenecks and increasing operational costs.

Inconsistent Results: Variations in inspector skill levels and environmental factors can lead to inconsistent outcomes and difficulty in pinpointing the root causes of defects.

The VIA Solution: AI-Powered Weld Inspection

The VIA Pipeline Weld Inspection Solution addresses these challenges head-on with a cutting-edge combination of AI, edge computing, and precision imaging:

Image Capture: Utilizing a specialized industrial camera, the system captures high-resolution radiographic testing (RT) images of pipeline welds.

Edge AI Analysis: A powerful, optimized AI model analyzes the captured images. Trained on a vast dataset of weld imagery, it can identify a wide range of defects with exceptional accuracy.

Rapid Results: In mere seconds, the system provides a clear pass/fail judgment for each weld, along with detailed defect classification for any identified issues.

Cloud Integration: Cloud Integration: The solution seamlessly integrates with on-premise or hybrid cloud systems, enabling data aggregation for deeper insights into trends and process optimization.

The Impact: Transformation Across the Value Chain

The VIA Pipeline Weld Inspection Solution delivers compelling benefits for operators of petrochemical facilities:

Speed and Efficiency: Inspection times are slashed from minutes to seconds, eliminating bottlenecks and accelerating throughput.

Unmatched Accuracy: AI-powered detection achieves near-100% accuracy, exceeding human capabilities and safeguarding against costly downstream consequences.

Standardized Quality: The system eliminates subjective judgments, ensuring objective, consistent inspections regardless of operator experience.

Data-Driven Insights: Historical data on defects helps pinpoint trends and optimize upstream processes to prevent future issues.

Enhanced Safety: Reducing defective welds minimizes the risk of leaks, ruptures, and the associated safety and environmental hazards.

Real-World Success

One of the world’s leading global petrochemical companies has experienced the transformative impact of the VIA Pipeline Weld Inspection solution. By deploying this powerful and scalable AI-powered edge solution, they achieved:

Near-Perfect Defect Detection: Ensuring operational integrity and compliance.

Significant Cost Savings: Drastically reduced labor expenses and avoided costly downtime.

Cleaner, Safer Operations: Minimized environmental risks and bolstered workplace safety.

The Future of Quality Assurance

The VIA Pipeline Weld Solution exemplifies the power of AI and edge computing in industrial settings. With its ability to augment human capabilities, this powerful AI-powered solution redefines quality control, making inspection processes faster, more reliable, and safer than ever before.

Contact VIA today to learn how our intelligent industrial inspection solutions can elevate your operations!

Get in Touch

+886-2-2218-5452

8F, No. 533, Zhongzheng Rd., Xindian Dist., New Taipei City, Taiwan, 231

Contact us for the latest news and updates from VIA

EOL Products

RMA Service

VIA Gallery

Announcements

Perspectives

Press Releases

Internships

Investor Relations

IMAGES

VIDEO

COMMENTS

The solution: space to get work done. In collaboration with their broker, Slack and WeWork built a custom, 15,231 square foot private floor office, which was completed and moved in to just eight weeks after the deal was signed. The team now resides in a private WeWork space in a prime New York City neighborhood.

The WeWork Business Model. Despite very public ups and downs over the last few years, WeWork remains at the forefront of the shared workspace industry. By quickly becoming the driving force behind the industry's growth—and thriving despite a worldwide pandemic—WeWork's success proves definitively that coworking is the new normal.

The results: deepening our partnership. RBC quickly recognized WeWork shared their goal of finding innovative solutions to clients' unique business problems. "From our own experience, we understand space can foster innovation, creativity, and disruptive thinking," says Vivekanandan. "Clients are time-starved, and WeWork helps eliminate ...

Unicorn is the term used in the venture capital industry to describe a startup company with a value of over $1 billion. Founded in 2010, WeWork grew rapidly into a New York-based business that provided co-working spaces for entrepreneurs and freelancers. In 2019 it had achieved a paper corporate valuation of $ 47 billion.

WeWork has seen a decade of growth with a disruptive new service business model in a rapidly transforming industry: shared office space for start-ups (and increasingly for big companies) thanks to its understanding of workplace trends such as the 'gig' economy, the rise of millennials and Generation Z in the workforce, more collaborative office work and tech-enabled mobility of employees ...

Here's a thorough WeWork case study briefing the history, business model, and the fall of WeWork from the pinnacle of success. WeWork is an American organization that gives shared workspaces to other companies and organizations. Established in 2010, it is headquartered in New York City. WeWork oversaw 46.63 million square feet of space in 2018.

4. Figure 2: WeWork's revenue, loss and EBITDA growth rates (Lietz, 2019) The figure h ighlights the accelerating growth of WeWork. From 2016 to 2017, WeWork's. revenue doubled and then ...

Nov 7 (Reuters) - Flexible workspace provider WeWork (WE.N) sought U.S. bankruptcy protection on Monday, crippled by a large debt pile and soaring losses due to lower demand for office space from ...

In it, he proposed the creation of a culture operations team, and he announced that he would take the title of chief culture officer to lead it. In this case, which describes the founding and growth of WeWork from 2010, we encounter McKelvey planning for his new role with co-founder Adam Neumann and envisioning a "culture OS" that he and ...

The company's acquisitions of architecture technology firm Case Inc. and of construction management platform FieldLens to form its Physical Products team have been essential to improving the design and build out phase. Before being acquired by WeWork, Case was a technology consultancy for the architecture industry. Its team specializes in ...

WeWork's growth has been explosive by a number of metrics. Its appetite for growth is rapacious. WeWork's Vice Chairman, Michael Gross, reported that the Company's annual compound growth (CAGR) has been over 100% for each of the past eight years. Its ability to scale has been akin to other "unicorn" tech companies.