How to Create a Law Firm Business Plan Aimed at Success

Want a successful law firm? Start with a solid business plan. Our guide covers everything that will help you create a roadmap for success.

A firm exists to serve people—so its business plan must take into account those it aims to help. A law firm's business plan lays out the key pillars that will support a practice, from operational details to marketing strategies to financial projections. Furthermore, it should provide a clear roadmap for where the firm hopes to be in the coming years.

In this blog, we will guide you through the process of creating a comprehensive law firm business plan that will help you achieve your goals . Additionally, in our latest Grow Law Firm podcast, our host Sasha Berson conversed with Omar Ochoa, the founding attorney of Omar Ochoa Law Firm, to discuss the topic of creating a law firm business plan aimed at success. Be sure to listen to another insightful episode featuring Tom Lenfestey, where he discusses crafting a sellable and profitable law firm.

Why Is a Business Plan Important for Law Firms?

A business plan is a vital tool for any law firm to achieve success. It outlines goals, strategies, and the feasibility of business ideas, providing a clear direction and focus for the firm. The plan can be used to secure funding from investors or financial institutions by demonstrating the potential for growth and profitability.

Moreover, a business plan supports decision-making by evaluating the feasibility of new ventures and assessing potential risks and rewards. It helps to manage resources effectively by setting financial goals and tracking progress, ensuring the firm is making the most of its resources and achieving objectives.

Lastly, a law firm's business plan enables growth by identifying new opportunities and developing strategies to capitalize on them. By planning for the future and setting realistic growth targets, law firms can take their businesses to the next level. Overall, a well-developed business plan is critical for success in the legal industry, providing direction and focus, supporting decision-making, managing resources effectively, and enabling growth.

General Tips for Creating an Attorney Business Plan

Building a business plan for law firms is not an easy or intuitive process. By considering the following issues before opening your doors to clients, you have a much better chance of having a stable firm that matches your values and has a clear set of goals.

— Stay Focused

Forming a law firm can feel overwhelming. You have a lot of freedom and can easily get sidetracked into issues that either can wait or do not deserve your attention.

If having a strong law firm website design is important enough for you to include in your plan, you will spend time on that instead of less important matters.

A plan also includes a budget. The process of planning your firm's finances can ensure that you do not overspend (or underspend) as you start your own firm.

The attention to detail that comes from having a plan will help you avoid spreading yourself too thin by focusing on every issue or the wrong issues. Instead, you will maintain your focus on the important issues.

Whether you have law partners or develop a solo law firm business plan, the plan will help you stay focused on your end goals.

— Keep Track of Goals and Results

It is easy to set goals when you start a law firm and then promptly forget about them.

Your plan will set out your goals and the metrics you will use to determine your progress toward meeting them. The plan should also explain how you will know when you have met them.

For example, you might have a growth goal of reaching five lawyers within two years. Or you might have a revenue goal of collecting $200,000 your first year.

Too many businesses, including law firms, meander on their developmental path. By setting goals and the path for meeting them, you will have guardrails to keep your firm on track.

"If you want to be the number one law firm in the country by revenue right in a 20 year time period, have that be your goal and everything that you do right is in service of that goal. You might not get there, but you're gonna find that you're gonna be very successful either way."

"If you want to be the number one law firm in the country by revenue right in a 20 year time period, have that be your goal and everything that you do right is in service of that goal. You might not get there, but you're gonna find that you're gonna be very successful either way." — Omar Ochoa

— Sort Out Your Own Law Firm Strategy

Developing a clear vision is important for establishing a strategic law firm plan aimed at long-term goals . As Omar Ochoa discusses in the podcast, having very specific milestone visions like where you want to be in five, ten, or fifteen years helps drive the strategy and actions needed to get there.

It's easy to say that you'll run your law firm better. But a plan actually helps you identify how to improve by articulating a concrete strategy. The process of creating the plan will help you pinpoint problems and solutions.

A plan forces consideration of operational details often overlooked. It equates to defining your firm's purpose and then pursuing that vision with purpose-driven strategies and actions. As Omar notes, marrying vision to action through knowledge of other successful law firm models is key to achieving goals.

One area that is frequently overlooked in plans is the inclusion of law firm marketing strategies . Developing this aspect is critical for attracting clients and sustaining growth.

Level Up Your Brand

Book a Free Consultation

— Move Forward

You should view your plan as a law firm business development plan that will guide the formation and growth of your firm .

You can review the document periodically to remind you and your law partners of your growth and expansion projections. After this review, you can ensure your growth and expansion remain on track to carry you to your goals.

The review will also tell you whether you need to update your firm's goals. When you started your law firm, you might have been unduly pessimistic or optimistic in your projections. Once you have some time to operate according to your plan, you can update your goals to keep them realistic. You can also update your processes to focus on what works and discard what does not.

The review can provide your projections for what you hope to accomplish and the roadmap for accomplishing it.

Law Firm Business Plan Template

Each of the websites below includes at least one attorney business development plan template:

- Business Plan Workbook

- PracticePro

- Smith & Jones, P.A.

- Wy'East Law Firm

You can use a law firm strategic plan example from these sites to start your firm's plan, then turn the plan into a document unique to your circumstances, goals, and needs.

What to Consider before Starting Law Firm Business Plans

Before starting a law firm business plan, think through a few key issues, including:

— Setting the Goals

Reflect deeply on your firm's purpose. Think about who you represent and how you can best meet their needs. A law firm exists for its clients. As you think about your law firm goals , think about goals for providing legal services to your clients.

"We continue to try to have the biggest impact that we can because ultimately, in my opinion at least, that's what lawyers are for, is to be able to help people and be able to move us forward." — Omar Ochoa

You need to set realistic and achievable goals. These goals should reflect your reasons for starting your law firm. Thus, if you started your law firm because you expected to make more money on your own than working for someone else, set some goals for collections.

While you are setting your goals, think about how you will reach them and the ways you will measure your success. For example, if you want to expand to include ten lawyers within three years, think about intermediate goals at the end of years one and two. This helps measure your progress.

— Choosing Partnership Structure

For lawyers considering a partnership structure, it's important to select partners that complement each other's strengths and weaknesses to help the firm function effectively.

There are 2 main partnership structure options:

- A single-tier model provides equal decision-making power and liability between partners.

- Meanwhile, a two-tier structure offers tiers like equity and non-equity partners, providing flexibility and career progression opportunities.

While similarly skilled individuals may clash, partners with differing abilities can succeed together. Some attorneys also choose to run their own firm for flexibility. This allows them to leverage different specialists through occasional joint ventures tailored for specific cases, without the constraints of a single long-term partnership. Furthermore, it highlights how the law firm partnership structures impacts freedom and sustainability.

— Thinking of the Revenue You Need

Calculate how much revenue you need to cover your overhead and pay your salary. Suppose your expenses include:

- $2,000 per month for office rent

- $36,000 per year for a legal assistant salary

- $600 per month for courier expenses

- $400 per month for a copier lease

Assume you want the median annual salary for lawyers of $127,990. You need $199,990 per year in revenue to cover your salary and expenses.

But revenue is not the end of the story. Your landlord, vendors, and employees expect to get paid monthly. So, you should also calculate how much cash flow you need each month to cover your hard expenses.

You also need a reserve. Clients expect you to front expenses like filing fees. Make sure you have a reserve to pay these costs and float them until clients reimburse you.

— Defining the Rate of Payment

You need to make some difficult decisions when it comes to setting your own fee structure. If you choose a higher billing rate, you will need to work less to meet your revenue goals. But you might not find many clients who are able to pay your fees.

Whether you charge a flat fee, contingent fee, or hourly fee, you should expect potential clients to compare your fees to those of your direct and indirect competitors. Remember, your firm competes against other lawyers, online services like LegalZoom , and do-it-yourself legal forms books.

Finally, you need to comply with your state's rules of professional conduct when setting your fees. The ABA's model rules give eight factors to determine the reasonableness of a fee. These factors include the customary fee for your location and the skill required to provide the requested legal services.

— Making the Cases in Your Law Practice Meet the Revenue Needs

Figure out how much you need to work to meet your revenue target . If you charge a flat fee, you can simply divide your revenue target by your flat fee.

Hourly fee lawyers can calculate the number of hours they need to bill and collect. However, law firm owners rarely bill 100% of the hours they work due to the administrative tasks they perform to run a firm. Also, you will probably not collect 100% of your billings, and clients could take 90 days or longer to pay.

Contingency fee lawyers will find it nearly impossible to project the cases they need. You have no way of knowing the value of your cases in advance. You also have no idea when your cases will settle. You could work on a case for years before you finally get paid.

The Founder of Omar Ochoa Law Firm

Omar Ochoa is a founding attorney with extensive experience in complex litigation, including antitrust, class actions, and securities cases. He has recovered hundreds of millions of dollars for clients and has been nationally recognized as one of the best young trial lawyers in the country.

Omar graduated from the University of Texas at Austin with degrees in business administration, accounting, and economics. He later earned his law degree from the university, serving as editor-in-chief of the Texas Law Review. He has clerked for two federal judges and has worked at the prestigious law firm Susman Godfrey L.L.P. Omar is dedicated to seeking excellence. He has been recognized for his outstanding achievements in antitrust litigation.

Parts of a Business Plan for Law Firm Formation: Structure

A law firm business plan is a written document that lays out your law firm goals and strategies.

For many businesses, a business plan helps secure investors. But the ethical rules prohibit law firms from seeking funding from outside investors or non-lawyer shareholders .

Your business plan is for you and your law partners. It will help you manage everyone's expectations and roles in the firm. Here is a law firm business plan example to help you see the parts and pieces in action.

— Executive Summary

An executive summary combines the important information in the business plan into a single-page overview. Your plan will include details like projections, budgets, and staffing needs. This section highlights the conclusions from those detailed analyses.

Your executive summary should include :

- A mission statement explaining the purpose of your firm in one or two sentences

- A list of the core values that your firm will use whenever it makes decisions about its future

- The firm's overarching goals for itself, its lawyers, and the clients it serves

- The unique selling proposition that sets your firm apart from other firms in the legal industry

You should think of this section as a quick way for people like lenders, potential law partners, and merger targets, to quickly understand the principles that drive your firm.

— Law Firm Description and Legal Structure

First, you will describe what your law firm does. You will describe your law practice and the clients you expect to serve.

Second, you will describe how your firm operates. The organization and management overview will explain your legal structure and the management responsibilities of you and your law partners.

This section should fill in the details about your firm's operation and structure by:

- Describing the scope of the legal services you offer and your ideal clients

- Restating your mission statement and core values and expanding upon how they will guide your firm

- Explaining your location and where your clients will come from

- Describing your business entity type and management structure

- Detailing your unique selling proposition , including the features that distinguish your firm from your competitors

When someone reads this section, they should have a clear picture of what you will create.

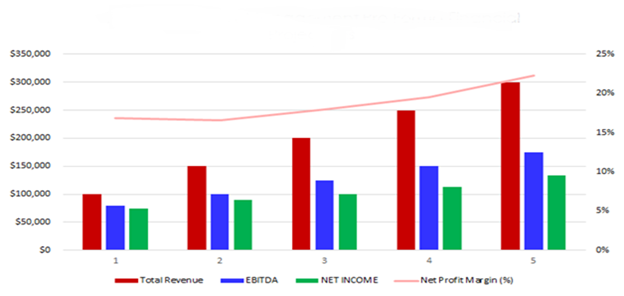

— Financial Calculations

Your attorney business plan explains where your firm's revenue comes from and where it goes. This is where your skills as a lawyer begin to diverge from your skills as a business owner. You may need to learn a few new accounting concepts so you can perform the analyses expected in a financial plan.

You will need a financial plan for at least the first year.

If you plan to seek a bank loan or line of credit, your bank may need a financial plan that covers three years or longer.

You will need more than a few rough numbers for a useful business plan. Instead, you will need to estimate your expenses and revenues as accurately as possible.

"Take some financial statements courses, take some managerial accounting courses that teach you how to track costs, how to frame costs in a way that you're looking at the important costs." — Omar Ochoa

You might need to contact vendors and service providers to get precise costs. You will probably need to track your billings with your prior firm to predict your revenues. If you are opening a law firm after law school or an in-house job, you may need a competitive analysis to show what similar law firms earn in your location and practice area.

Some reports you may need in your business plan include:

- Revenue analysis listing the fees you will collect each month

- Budget describing your monthly and annual expenses

- Financial projections combining the revenue analysis and budgeted expenses to predict your profit margins

- Cash flow statement showing how your revenues and expenses affect your cash on hand.

Your cash flow statement might be the most important financial report because it explains how your bank balance will fluctuate over time. If your clients take too long to pay their bills or you have too many accounts payable due at the same time, your cash flow statement will show you when money might get tight.

— Market Analysis

A market analysis will tell you where you fit into the legal market in your location and field. You need a competitive analysis to understand the other lawyers and law firms that will compete with you for potential clients. You can also analyze their marketing messages to figure out how to stand out from the competition.

A competitive analysis will tell you what services other firms offer, how much they charge, and what features help your competitors succeed.

Your analysis should include a discussion about your :

- Ideal clients and what you can do to help them

- Market size and whether you offer something clients need

- Competitors and what they offer to clients

- Competitive advantages and how you can market them to potential clients

You can also develop and hone your marketing strategy based on the benefits you offer to clients over your competitors. Finally, a market analysis can tell you the locations and practice areas in which your firm may expand in the future.

Your market analysis helps you focus your efforts on your legal niche.

— Marketing Plan

A marketing plan sets out the steps you will take to reach your target market. Your marketing strategy will take your market analysis and turn it into a plan of action.

You will start with the results of your market analysis identifying your clients, your competitors, and your competitive advantages. You will then discuss the message you can deliver to potential clients that captures the advantages you have over your competition.

Some advantages you might have over other lawyers and law firms might include tangible benefits like lower billing rates or local office locations. Other advantages might provide some intangible benefits like more years of experience or state-bar-certified specialists in those states that allow specialization.

You will then discuss your marketing plan. A marketing plan explains :

- Characteristics of the target market you want to reach

- What your competition offers

- The distinct benefits you offer

- A message you can use to explain what separates you from your competition

- Your action plan for delivering your message

- Your goals for your action plan, such as the number of client leads, new clients, or new cases per month

Your action plan will include the marketing channels you want to use to spread your message. Marketing specialists can help you identify the best channels for your marketing message and client base.

For example, if you practice intellectual property law, you need to reach business owners and in-house lawyers who want to protect their companies' brands, inventions, artistic works, and trade secrets. A marketing agency may help you create a marketing strategy geared toward trade publications and business magazines.

However, IP lawyers require an entirely different marketing strategy than firms that practice family law. Family lawyers need to market to individuals and will tailor their marketing efforts toward different marketing channels and messages.

Even if you expect most of your client leads to come from referrals, you still need brand recognition for those leads to find you. You should consider a website, basic SEO, legal directory, and bar association listings.

— Your Law Firm Services

You will outline the services your law firm offers to clients. Lawyers with established clients and an existing legal practice can simply describe what they already do.

Any new law firm or lawyer transitioning from other practice areas should consider:

- Practice areas you know and enjoy

- Overlapping practice fields that will not require extra staff, such as personal injury and workers' comp

- Related legal services your clients may need, such as wills and guardianship

By offering needed services you can competently provide, you can gain clients and avoid referring existing clients out to other lawyers.

— Your Law Firm Budget

You should approach your budget as a living document. You will spend more money as you add more lawyers and staff members to your firm. But you can also look for ways to reduce your operating costs through investments in technology services and other cost-saving measures .

Your budget should set out the amount you expect to initially spend on start-up expenses. As you create your start-up budget, remember many of these expenses are not recurring. Furniture, computers, and office space build-outs can last several years. In short, your budget should answer the question, "What do you need to open a law firm?"

It should also lay out the amount you plan to spend each month to operate your firm. Here, you will include your recurring expenses, such as rent, staff salaries, insurance premiums, and equipment leases.

Using your operating budget, you will determine the amount of money you need to start and run your firm. This, in turn, will tell you whether you need to take out a loan or tap into your savings to start your law firm. You will need a plan for paying your expenses and day-to-day costs while your firm gets onto its feet.

Let us help you create a digital marketing strategy and a growth plan

.webp)

Some Useful Tips on Creating a Business Plan for Law Firm Creation and Development

As you draft your law firm business plan, you should focus on the process. By putting your thoughts down in writing, you will often identify issues you had not previously considered.

Some other tips for drafting your business plan include:

— Describe Both Strengths and Weaknesses

You want to project confidence as you prepare your business plan. Remember, you will use this plan to approach potential law partners, lenders, and merger targets. You need to show that you have a solid plan backed up by your financial projections.

At the same time, you need to remain realistic. Write a business plan that describes your business challenges as well as your competitive advantages.

For example, if you have a strong competitor that has a solid law firm reputation management and many of the clients you will target, acknowledge the difficulty of getting those clients to switch law firms. Describe your marketing strategies for approaching and pitching your law firm to those clients.

— Think Ahead

Remember that your business plan sets out the roadmap for both the establishment and operation of your law firm . Think about issues that could arise as your firm grows and matures.

For example, you may have a goal of reaching ten lawyers in three years. But as your staff grows, you may need a human resources manager. You may also seek to handle your payroll in-house instead of outsourcing it to a payroll provider. These changes will create ripple effects throughout your business plans. You will incur costs when you add staff members. You will also realize benefits like increased attorney efficiency.

At the same time, any projections more than five years into the future will likely be useless. Your firm and its clients will evolve, and technology will change how you practice law.

"A law firm that actually does something in the unique way that is an actual measurable advantage to their clients or to their firm." — Tom Lenfestey

— Be Clear about Your Intentions

As you develop your plan, you should keep its purpose in mind. First, you want to outline your core values and goals for your law firm. Set out the reasons why you started your law firm and what you intend to accomplish with it.

"You can't just be doing something because you want prestige. There's gotta be more to that, right? You have to have a purpose that you're following. And if you've got that, that purpose is like gravity, right? You will always be grounded." — Omar Ochoa

Second, you set out your path to achieving those goals. This will include boring technical information like how much you spend on legal research every month. But it will also explain your approach to solving problems consistent with your mission statement and philosophy for law firm management.

— Consult and Update If Necessary

Your plan should guide you as you build your firm. It contains your goals and the roadmap for reaching them. But your plan is not carved in stone.

As you face challenges, you will consult your plan to make sure you approach these challenges in a way consistent with achieving your goals. But under some circumstances, you might find that the plan no longer provides the right solution.

As you work with your firm and your law partners, your goals, processes, and solutions to problems may evolve. The technology your firm uses may change. Your law firm's costs may go up with inflation or down as you realize economies of scale. You should update your plan when this happens.

— Develop a Succession Plan for Your Law Firm

Creating a succession plan for a law firm is essential for ensuring a smooth transition and preserving the firm’s value. Drawing from the experiences of professionals in other fields, it is clear that lawyers often face unique challenges in succession planning. A well-structured exit strategy can help lawyers realize the value of their practice, whether they plan to retire or pursue other interests.

Firms generating over $2 million in revenue typically have invested in systems that make them more attractive and easier to transition. These systems are crucial in creating value and attracting buyers. A transition-based sale, where the selling attorney remains involved for a period, ensures a smooth handover of clients and referral sources, reducing the risk of value loss. Additionally, specialized, systematized, and profitable firms command higher valuations. By investing in robust systems and considering your exit strategy early, you can create lasting value, financial security, and peace of mind, making your law firm more sellable in the future.

Building High-Value Law Firms with Tom Lenfestey, the CEO of Law Practice Exchange

This podcast episode features a discussion between Sasha Berson and Tom Lenfestey about the Law Practice Exchange, a marketplace for buying and selling law firms. Tom, an attorney and CPA, explains how his experience with other professionals inspired the creation of this marketplace. They discuss the importance of building systems to enhance a firm's value, the challenges of succession planning, and strategies for creating a smooth transition and maximizing value during a sale.

"You make more money with hopefully more consistency and less stress. And so that's also part of it is enjoy it. Build to better, right, overall, but build that firm that you want." — Tom Lenfestey

Tom Lenfestey

The CEO of Law Practice Exchange

Tom Lenfestey is an attorney and CPA who founded the Law Practice Exchange, a marketplace for buying and selling law firms. With a background in assisting dentists and CPAs in selling their practices, Tom identified the need for a similar platform for lawyers. His work focuses on helping attorneys realize the value of their practices, providing structured exit strategies, and facilitating smooth transitions.

Final Steps

There is no recipe for creating a business plan for law firm development. What goes into your mission statement and plan will depend on several factors, including your law firm's business model. But this is a feature, not a bug of developing a business plan.

The process of business planning will help you develop solutions to issues you might have overlooked. If you have law partners, just going through the process of creating a law firm business plan can ensure that everyone is on the same page.

As you create your plan, the process itself should provoke thoughts and ideas so you can have a unique law firm tailored to your goals and values. This will help you get exactly what you wanted when you started in the legal industry.

To learn how to expand your client base as your firm grows, check out Grow Law Firm, a professional law firm SEO agency .

- Easy steps you can take to bring in more clients and up this year’s revenue

- The top website and marketing mistakes holding your law firm back

Find out how much demand there is in your geographical area

To view the calculation tailored to your law firm's needs, please provide your email address

Consult with Sasha Berson, a legal marketing expert , to address your marketing needs.

You May Also Like

Law Firm Marketing Budget: How Much Should You Spend?

Unlocking the Secrets of Law Firm Partnership Structures: A Must-Read Guide for Success-Driven Lawyers

Lawyers Against Unbillable Hours: Joshua Lennon Maximizes Attorney Billable Hours

How to Start a Law Firm in 2024 and Succeed

Starting a Law Firm: LLP vs. PC

Don't just wait for clients, attract them!

Get our FREE Marketing Audit to find bold new ways to boost your caseload.

Contact us today to speak with one of our experts and learn more about how we can help you grow your firm.

Stay ahead of the competition!

Compare your law firm's performance to Local competitors with our instant assessment tool

Get a clear picture of your firm's performance

Boost your online presence

.webp)

Law Firm Business Plan Template

Written by Dave Lavinsky

Law Firm Plan

Over the past 20+ years, we have helped over 1,000 lawyers to create business plans to start and grow their law firms. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a law firm business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Law Firm Business Plan?

A business plan provides a snapshot of your law firm as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Law Firm

If you’re looking to start a law firm, or grow your existing law firm, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your law firm in order to improve your chances of success. Your law firm plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Law Firms

With regards to funding, the main sources of funding for a law firm are personal savings, credit cards and bank loans. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

Finish Your Business Plan Today!

How to write a business plan for a law firm.

If you want to start a law firm or expand your current one, you need a business plan. Below are links to each section of your law firm plan template:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of law firm you are operating and the status. For example, are you a startup, do you have a law firm that you would like to grow, or are you operating law firms in multiple cities?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the law firm industry. Discuss the type of law firm you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of law firm you are operating.

For example, you might operate one of the following types of law firms:

- Commercial Law : this type of law firm focuses on financial matters such as merger and acquisition, raising capital, IPOs, etc.

- Criminal, Civil Negligence, and Personal Injury Law: this type of business focuses on accidents, malpractice, and criminal defense.

- Real Estate Law: this type of practice deals with property transactions and property use.

- Labor Law: this type of firm handles everything related to employment, from pensions/benefits, to contract negotiation.

In addition to explaining the type of law firm you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, number of cases won, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the law firm industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the law firm industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your law firm plan:

- How big is the law firm industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your law firm? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your law firm plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: businesses, households, and government organizations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of law firm you operate. Clearly, households would respond to different marketing promotions than nonprofit organizations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most law firms primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Law Firm Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other law firms.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes accounting firms or human resources companies. You need to mention such competition as well.

With regards to direct competition, you want to describe the other law firms with which you compete. Most likely, your direct competitors will be law firms located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What types of cases do they accept?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better legal advice and services?

- Will you provide services that your competitors don’t offer?

- Will you provide more responsive customer interactions?

- Will you offer better pricing or flexible pricing options?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a law firm plan, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of law firm company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to in-person consultation, will you provide virtual meetings, or any other services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the products and services you offer and their prices.

Place : Place refers to the location of your law firm company. Document your location and mention how the location will impact your success. For example, is your law firm located in a busy business district, office building, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your law firm marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your law firm, including filling and filing paperwork, researching precedents, appearing in court, meeting with clients, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to file your 100th lawsuit, or be on retainer with 25 business clients, or when you hope to reach $X in revenue. It could also be when you expect to expand your law firm to a new city.

Management Team

To demonstrate your law firm’ ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing law firms. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with legal experience or with a track record of successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you file 25 lawsuits per month or sign 5 retainer contracts per month? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your law firm, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a law firm:

- Location build-out including design fees, construction, etc.

- Cost of licensing, software, and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or your certificate of admission to the bar.

Putting together a business plan for your law firm is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert and know everything you need about starting a law firm business plan; once you create your plan, download it to PDF to show banks and investors. You will really understand the law firm industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful law firm.

Don’t you wish there was a faster, easier way to finish your Law Firm business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

- Support Center

- System Status

A business plan for lawyers: How to write one and what to include

- June 21, 2024

Jennifer Anderson

If you’re reading this article, Congratulations! You must be thinking about starting a law firm and are looking for examples of a business plan for lawyers.

Of course, if you’re serious about this prospect, one of the first things you’ll need to do is sit down and draft a business plan. And, as luck would have it, that’s why we’re here today.

In this post, we’re going to walk you through the steps of creating a business plan for your new firm. As Aristotle once said, “For the things we have to learn before we can do them, we learn by doing them.”

Sound advice.

A simple guide for a business plan for lawyers

So, we’ll provide you with the key parts and pieces for creating a law firm business plan along with a sample plan intended to show you how to create your own plan.

Now, in order to walk you through this, we’ve created a hypothetical firm using certain assumptions, which we’ll list below. Your new firm almost certainly has different factors at play.

That’s alright. We trust you’ll be able to plug in the particulars that suit your business. For now, here’s what our fictional new law firm looks like:

- This California-based law firm is founded by four partners who were all business owners before going to law school. Using our fictional founders’ last names, we’ll call the firm Smith, Jones, Jackson, & Wyle, LLP.

- The firm aims to have multiple practice areas including business litigation, labor and employment, technology, and real estate.

- The target clients will be small-to-midsize regional businesses throughout the state.

- The partners’ goal is to hire up to 10 associates over the next five years.

- The firm’s main competitors are other small, regional business-focused firms.

- Initial marketing ideas include social media, networking with former business contacts, and becoming thought leaders in various areas of the law through blogging and public speaking.

- The partners envision being highly tech dependent, utilizing CRMs, AI, and other tech tools as much as possible.

- The founding partners’ goal is to launch the firm in 6 months and to be profitable within a year.

With those basic facts in mind, let’s break down the various components that we’ll include in our business plan:

1. Executive summary

A business plan for lawyers, like any plan, should start with an e xecutive summary . This section concisely outlines a business plan’s key points, goals, and strategies. Ultimately, it serves as a snapshot for quick understanding and decision-making and should include the following parts:

Mission statement

A Mission Statement is like the elevator speech for your new firm. It charts the course for your goals, objectives, clients – and also quickly lays out your proposed methods for reaching those goals. A sample Mission Statement for our firm might say:

At Smith, Jones, Jackson, & Wyle, LLP (“SJJW”) we are dedicated to empowering small-to-midsize businesses in California with comprehensive legal solutions. With a foundation built on the rich business acumen and legal expertise of our founding partners, we aim to bridge the gap between business challenges and legal success. Our mission is to provide personalized, effective, and technology-driven legal services that not only address today’s legal needs but also anticipate tomorrow’s challenges. We are committed to becoming trusted advisors to our clients who leverage our unique background as former business owners to offer practical, actionable legal advice. Through innovation, integrity, and a client-focused approach, SJJW strives to achieve excellence in all aspects of our service, fostering long-term partnerships with our clients and contributing to their success.

Here, you will outline the firm’s growth objectives and provide a snapshot of the firm’s operations.

SJJW aims to become the leading legal advisor for California’s small to mid-sized businesses, expand our team with 10 associates within five years, and leverage technology to enhance efficiency and client satisfaction.

Brief overview

Some business plans also include a brief overview of the business. Our hypothetical firm’s overview might look like this:

Founded by four partners with business ownership backgrounds, our California-based law firm specializes in serving small-to-midsize businesses, emphasizing technology-driven solutions and personalized legal services to navigate complex challenges.

2. Firm description

Your law firm description will provide a bit more detail about the make-up of your business. This section should include information on: (1) legal structure and history; (2) location and areas of practice; and (3) vision for the future:

SJJW is a dynamic legal partnership founded by four seasoned attorneys who are also experienced business owners. Based in California, our firm offers comprehensive legal services tailored to the needs and challenges of small-to-midsize businesses across the state. Our firm practices in four distinct areas: Business Litigation, Labor and Employment, Technology, and Real Estate. With a deep understanding of both the legal landscape and the entrepreneurial journey, our team is uniquely positioned to provide strategic, effective solutions across this range of legal disciplines. As an LLP, we emphasize collaboration, integrity, and innovation, leveraging cutting-edge technology to deliver exceptional service and outcomes for our clients. Our commitment to excellence, combined with our business-savvy approach, makes us a trusted partner for businesses seeking to navigate legal complexities with confidence.

3. Market analysis

The next part of our business plan for lawyers is the market analysis. Your market analysis is where you do the heavy lifting around how your firm fits into California’s extensive legal market. It should include information on your target market, a competitive analysis, and the need for your particular firm within the region.

Target market

SJJW’s primary target market consists of small-to-midsize businesses in California, spanning various industries such as technology, retail, real estate, energy, and manufacturing. These businesses often encounter unique legal challenges that require personalized attention and expertise. With the state’s diverse economic landscape, there is a substantial demand for legal services that cater specifically to the nuanced needs of these entities, from regulatory compliance and intellectual property protection to labor disputes and contract negotiations.

Competitive landscape

The legal services market in California is highly competitive, with numerous firms vying for the business sector’s attention. Small, regional law firms similar to ours form the bulk of this competition, offering a range of general and specialized services. However, our differentiation lies in the unique blend of legal expertise and real-world business experience possessed by our founding partners. This combination positions us to offer unparalleled insights and practical solutions that resonate with business owners.

Market trends

The increasing complexity of regulatory environments, coupled with the rapid evolution of technology and the digital economy, has led businesses to seek legal partners who are not only advisors but also innovators. There’s a growing trend towards legal services that are highly specialized yet broadly knowledgeable about the cross-functional impacts of legal decisions.

Opportunities

Given our firm’s unique positioning and expertise, significant opportunities exist to capture market share by:

- Offering specialized services that address the intersection of business operations and legal requirements, such as compliance, data privacy, and e-commerce.

- Developing niche expertise in emerging areas of law that are particularly relevant to California’s business environment, such as tech startups, renewable energy, and digital media.

- Leveraging technology to provide more efficient, transparent, and cost-effective legal services, appealing to the tech-savvy and cost-conscious small-to-midsize business sector.

- Building strong relationships through networking and thought leadership, establishing the founding partners as go-to experts in legal matters relating to business.

Key challenges include establishing a distinct brand in a crowded market, continually adapting to rapidly changing legal and technological landscapes, and ensuring the firm remains accessible and appealing to the target market’s cost and value expectations.

In summary, the market analysis underscores the potential for SJJW to carve out a significant presence in California’s legal services sector for small-to-midsize businesses. By focusing on our strengths and strategically addressing the market’s needs, we can achieve substantial growth and success.

4. Marketing and sales strategy

The marketing and sales strategy is a crucial but often neglected aspect of any business plan for lawyers. This is where you lay out how you’re going to attract clients, convince them to use your firm’s services, and – importantly – how you’re going to retain those clients long term:

Our objective is to establish SJJW as the premier legal service provider for small to mid-sized businesses in California, leveraging our unique blend of business acumen and legal expertise.

Marketing strategy

Brand positioning

Position the firm as not just legal experts, but as partners in our clients’ business success, emphasizing our founding partners’ background as business owners.

Digital marketing

- Website : Develop a professional website highlighting our expertise, services, and the unique value we bring to businesses.

- Content marketing : Regularly publish blogs, articles, and whitepapers on legal issues affecting our target market, positioning us as thought leaders.

- Social media : Engage with our audience on platforms like LinkedIn and Twitter, sharing insights, legal updates, and participating in discussions relevant to our target industries.

Networking and partnerships

- Leverage the existing business contacts of our founding partners and actively participate in industry events, seminars, and local business associations to build relationships and referrals.

- Establish partnerships with complementary service providers (e.g., accounting firms, business consultants) to offer bundled services or referrals.

Public relations

- Engage in speaking opportunities at industry conferences, webinars, and local business events to increase visibility and establish credibility.

- Utilize press releases for significant firm milestones, new service offerings, or significant case wins to build brand awareness.

Sales strategy

Client acquisition

- Implement a CRM system to manage leads and opportunities effectively and utilize personalized follow-up and engagement strategies.

- Offer free initial consultations to prospective clients that provide immediate value and foster trust from the first interaction.

Client retention

- Provide exceptional client service with a focus on transparency, regular communication, and technology-driven solutions for ease of access and efficiency.

- Implement a client feedback loop to continuously improve services and address client needs proactively.

Cross-selling and up-selling

Once a client relationship is established, SJJW will identify additional legal needs or areas where the firm can provide value. The goal is to make sure all clients are aware of the full range of services offered.

By executing this comprehensive marketing and sales strategy, SJJW aims to rapidly grow its client base while maintaining high levels of client satisfaction and loyalty.

5. Operations plan

An operations plan outlines the day-to-day activities required to run your law firm. It details things like processes, technology, staffing, and resources needed to achieve business objectives.

To ensure efficient, effective, and client-focused legal service delivery through advanced technology integration and streamlined processes.

Legal operations

Case managemen t: Implement a state-of-the-art Case Management System (CMS) to track and manage all cases efficiently, ensuring deadlines are met, and clients are kept informed.

Document management : Utilize a secure, cloud-based Document Management System (DMS) for storing, retrieving, and sharing documents with clients and within the team, enhancing collaboration and security.

Client communication : Adopt Customer Relationship Management (CRM) software to manage client interactions, ensuring personalized and timely communication across all touchpoints.

Technology integration

Artificial Intelligence (AI) : Leverage AI tools for legal research, document review, and predictive analytics to increase accuracy and reduce turnaround times.

Automation tools : Implement automation in routine tasks such as billing, client notifications, and document drafting to improve efficiency and reduce the risk of human error.

Human resources

Team structure : SJJW will initially be comprised of four partners and support staff, with plans to expand to up to 10 associates within five years. It is our goal to foster a culture of teamwork and continuous learning.

Professional development : Invest in ongoing training and professional development opportunities for all staff, ensuring the team remains at the forefront of legal and technological advancements.

Client service

Service delivery model : Offer flexible service models including traditional hourly billing and alternative arrangements like flat fees for defined services.

Client feedback system : Implement a system for collecting and acting on client feedback to continually refine and improve service offerings.

Compliance and quality assurance

Regulatory compliance : Ensure strict adherence to legal and ethical standards, with regular reviews of compliance protocols, especially regarding data protection and privacy laws.

Quality control : Establish a quality control framework to review legal work internally, guaranteeing the highest standards of legal service.

6. Financial plan

Your financial plan is one of the most critical aspects of a business plan for lawyers. There are too many factors at play here for us to create a meaningful sample plan for our hypothetical firm, but here are the details you definitely want to include in your plan:

Initial capital and use

Detail how the initial capital provided by the founding partners will be allocated (e.g., office space, technology, marketing, initial payroll).

Financial projections

Include projections for revenue, expenses, and profitability for the first 1-5 years. Use realistic assumptions based on the size of your target market, expected client acquisition rates, billing rates, and operational costs.

Revenue projections

Estimate potential earnings from client work, taking into account the growth in associate numbers and the capacity to handle more cases and matters.

Expense projections

Forecast expenses, including salaries, technology investments, office overhead, and marketing costs.

Profitability analysis

Calculate when the firm expects to become profitable. Our hypothetical firm, for example, aims to be profitable within the first year.

7. Legal and regulatory compliance

What kind of lawyers would you be if your plan didn’t include a section on legal and regulatory compliance ? A business plan for lawyers should always cover compliance, particularly in an environment where it is becoming increasingly important for firms to accommodate it .

This is where you’ll provide details regarding legal practice, data protection, and any relevant regulations for your areas of practice.

To uphold the highest standards of legal and ethical integrity by ensuring full compliance with all applicable laws, regulations, and professional guidelines governing the practice of law in California.

Compliance framework

State Bar of California : SJJW will strictly adhere to the rules and ethical standards set forth by the State Bar of California, including those related to client confidentiality, conflict of interest, and professional conduct.

Data protection and privacy : We will implement powerful data security measures compliant with the California Consumer Privacy Act (CCPA) and any relevant federal laws. We will also protect client information through encrypted storage and secure communication channels.

Business operations compliance : As an LLP, SJJW will maintain compliance with California’s business operation laws, including partnership registration requirements, financial reporting, and tax obligations.

Employment law : It is our steadfast aim to follow all state and federal employment laws, ensuring fair labor practices, workplace safety, and equal opportunity employment within the firm.

Continuous monitoring and education

Regular training : We will conduct or host ongoing legal education and training for all partners and staff on compliance matters, changes in the law, and best practices in legal ethics and data protection.

Compliance audits : The firm will perform regular internal audits to review and assess compliance with all legal, regulatory, and ethical standards, identifying and rectifying any potential issues proactively.

Risk management

Professional liability insurance : Before beginning operations, SJJW will secure comprehensive professional liability insurance to protect the firm and its clients against potential legal malpractice claims or other claims.

Conflict of interest checks : The firm will implement a rigorous system for conducting conflict of interest checks for every new client and case, with the goal of preventing ethical breaches and maintaining the firm’s integrity.

Client confidentiality and trust

Confidentiality protocols : SJJW will establish strict confidentiality protocols to protect client information, including secure document handling procedures and restricted access to sensitive data.

Client trust accounts : In accordance with California law, the firm will manage client funds with the utmost care, adhering to the State Bar’s guidelines for handling and accounting for trust accounts, ensuring transparency and accountability.

8. Milestones and timeline

Finally, a business plan for lawyers should include a section that details the timing involved in getting your law firm up and running. Again, there are probably too many details to give an effective sample here, but at the very least, your plan should include the following components:

Launch timeline

Here, you’ll plot out the key steps leading up to your launch date , including legal organization, the establishment of your office space, technology implementation, and initial marketing.

Growth milestones

Lawyers love deadlines and the growth milestones section is a good place to create them. Set specific goals for things like client acquisition, revenue targets, and team expansion to be reached within the first year and beyond.

Obviously, your firm’s business plan will include a lot more detail than our hypothetical plan for SJJW. We hope, however, that this sample plan gets you started on an enjoyable journey to starting a successful law firm.

Starting a law firm is a challenging yet rewarding endeavor. A well-crafted business plan for lawyers means getting all the essentials in place to guide your firm’s growth and success.

Get your executive summary, firm description, market analysis, marketing and sales strategy, operations plan, financial plan, and legal compliance all covered before embarking.

With careful planning and execution, you can build a firm that not only meets but exceeds your expectations, providing exceptional legal services to your clients.

One Legal: Delightfully easy eFiling

Share this article on social media:

More to explore.

A handy guide to legal due diligence

Tips and resources for handling international litigation

What you need to know about being a tech lawyer

What is one legal.

We’re California’s leading litigation services platform, offering eFiling, process serving, and courtesy copy delivery in all 58 California counties. Our simple, dependable platform is trusted by over 20,000 law firms to file and serve over a million cases each year.

All of your litigation support needs at your fingertips

© InfoTrack US, Inc.

- Accessibility statement

- Privacy policy

- Terms of service

You're invited!

Join us the second week of September for the next Beyond the Serves office hour session. Our One Legal customer success team will be on hand to answer all your questions. Don’t miss out on this opportunity to get the insights you need!

Legal Up Virtual Conference

Register now to get actionable strategies and inspiration to level up your legal career.

Client Management

Case management, billing & payments, accounting & report, e-signature.

- Help Center

Starting a law firm can be a rewarding and lucrative venture, but it requires careful planning and strategy. A well-crafted business plan is a crucial tool for any law firm looking to establish itself, secure funding, or grow its practice. The business plan will serve as a roadmap, outlining the law firm’s objectives, strategies, and unique selling proposition

Why Every Law Firm Needs a Business Plan

A well-structured business plan is imperative for every law firm, regardless of its size or specialization. While legal expertise is undoubtedly crucial, having a clear vision and strategic direction is equally essential. A business plan serves as a guiding light, defining the firm’s mission, values, and long-term goals. This clarity is vital for aligning the entire firm towards a common purpose, ensuring that everyone understands the objectives and the path to achieving them. Without a business plan, a law firm may find itself navigating uncertain waters, reacting to circumstances rather than proactively pursuing its ambitions.

The Key Components of a Law Firm Business Plan

A well-structured law firm business plan consists of several key components, each playing a crucial role in guiding the firm’s operations and ensuring its long-term success. Here are the essential elements of a comprehensive law firm business plan:

- Executive summary

- Law firm description

- Market analysis

- Organization and management

- Services

- Marketing Strategy

- Financial plan

- Start-up budget

Section One: Executive Summary

The executive summary is arguably the most critical section of your law firm’s business plan. While it appears at the beginning, it is often written last, as it serves as a concise yet comprehensive overview of your entire plan. This section should capture the reader’s attention, providing them with a clear understanding of your law firm’s essence, mission, and what to expect from the rest of the document. In your executive summary:

- Introduce your law firm: Briefly describe your law firm’s name, location, and legal specialization.

- Mission and vision: State your firm’s mission and vision, highlighting your commitment to serving clients’ legal needs effectively.

- Your unique selling proposition: Clearly state your USP, and present what is unique about your firm that will ensure success.

The executive summary sets the stage for your entire business plan. It should be a concise yet compelling introduction to your firm’s mission, values, and potential. If crafted well, it can grab the reader’s attention and encourage them to explore other sections in detail. If you feel overwhelmed by this, you can write this section last.

Section Two: Law Firm Description

This section of your business plan provides a deeper dive into your firm’s background, history, legal specializations, and legal structure and ownership. This section should provide a concise yet informative overview of your firm’s identity and history. Here’s what this section should cover:

- Mission Statement: Briefly reiterate your law firm’s mission statement. This statement should encapsulate your firm’s overarching purpose and guiding principles.

- Geographic Location: State out the physical location of your law firm’s office(s). This should include the city or region where your primary office is situated.

- Legal Structure and Ownership: State the legal structure of your law firm, whether it’s an LLC, S-Corp, or another legal entity. This choice is a fundamental aspect of your business model, influencing ownership, liability, and taxation. If your firm’s ownership is not that of a sole proprietorship, provide details on the ownership structure. Explain how the chosen structure aligns with your firm’s business model, decision-making processes, and long-term goals.

- Firm History: Provide the history of your law firm. Highlight key milestones, achievements, and notable moments in your firm’s journey. If your firm is well-established, briefly summarize its history, showcasing your accomplishments and contributions to the legal field.

Remember that brevity is key in this section. Don’t spend too much time, just touch on important points and achievements.

Section Three: Market Analysis

A well-conducted market analysis will not only demonstrate your understanding of the legal industry but also inform your law firm’s strategies and decision-making. It goes beyond understanding your competition; it delves deep into your potential clients’ needs and expectations.

Through market analysis, you can segment your target market based on demographics, industry, legal needs, and preferences. This segmentation allows you to tailor your services to meet the specific needs of different client groups. It also helps you identify the pain points and challenges that potential clients face. By understanding their concerns, you can offer solutions that directly address these pain points.

Your market analysis should also reveal the pricing strategies of your competitors. By benchmarking your pricing against theirs, you can position your services competitively. You can choose to price higher if you offer unique value or lower if you aim to attract price-sensitive clients. Your market analysis should reveal areas where your competitors may be falling short. Use this information to frame your services as the solution to these weaknesses. For example, if competitors have slow response times, emphasize your firm’s commitment to timely communication.

Showcase your firm’s USPs that directly address client needs and preferences. If you excel in a particular practice area, have a reputation for excellent client service, or offer innovative fee structures, use these strengths to attract your preferred clientele. Ultimately, a well-documented market analysis not only informs your law firm’s business model but also guides your approach to client acquisition, pricing, and service delivery. It ensures that your legal services align with client expectations and positions your firm for success in a competitive legal industry

Section Four: Organization and Management

Image Source – Creately

This section provides a clear picture of your firm’s internal structure and leadership. Name the key stakeholders in your law firm and what they bring to the table. Highlight any unique experiences or expertise that each partner brings to the firm. This could include prior work at prestigious law firms, involvement in landmark cases, or specialized knowledge in a specific area of law. Explain how these experiences set your firm apart and enhance its capabilities. You can also include an organizational chart that visually represents your law firm’s structure. This chart should showcase the hierarchy, roles, and reporting lines within the firm. By including the names, educational backgrounds, unique experiences, and organizational chart, you paint a comprehensive picture of your law firm’s leadership and structure. This not only builds confidence in your team’s capabilities but also showcases the depth and expertise of your staff to potential clients, partners, or investors.

Section Five: Services

This section is the core of your law firm business plan. Here, you will go into detail about all aspects of your services. Present in simple words:

- The problem(s) your law firm is addressing and your approach to how to alleviate those pain points? Answer these questions, and provide in detail how your firm is in the best position to tackle this problem.

- The solution(s) you are providing. This should describe how your law firm resolves your prospective market’s needs. This should include the work you do, and the benefits that each client will receive if they work with your firm.

- Your law firm competition. This should describe what advantages your law firm has over your competitors? What you do differently when providing your solutions and how your clients will gain additional benefits when they work with your law firm.

Section Six: Marketing Strategy

As you craft your business plan, keep these four essential questions in mind:

- What Is Your Firm’s Value Proposition? Clearly define what sets your law firm apart from others. This should guide your marketing and sales strategies, emphasizing the unique value you offer to clients.

- Who Is Your Target Audience? Identify your ideal client profile. Understanding your target audience helps tailor your marketing efforts to reach those most likely to benefit from your services.

- What Are Your Growth Goals? Set specific, measurable growth goals for your firm. These goals should inform your sales and marketing strategies, outlining how you plan to achieve them.

- How Will You Measure Success? Determine key performance indicators (KPIs) to measure the success of your marketing and sales efforts. Whether it’s tracking client acquisition rates, website traffic, or revenue growth, having measurable metrics will help you gauge your progress and make informed adjustments.

It is also valuable to perform a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to assess your law firm’s internal and external factors. Describe your online marketing efforts, including your website, social media presence, and email marketing campaigns. Explain how you plan to leverage marketing to reach and engage potential clients effectively. You should also define your pricing structure and fee arrangements. This may include hourly rates for specific legal services, retainer agreements for ongoing representation, or flat fees for standardized services.

Section Seven: Financial Plan

If you want to expand your law firm and ensure a steady income, it’s essential to create a financial strategy for your practice. While you might not have all the answers regarding your firm’s finances, provide comprehensive details. Your goal should be to establish a financial plan, particularly for the initial year of your firm’s operation.

Provide comprehensive financial projections that cover the anticipated income, expenses, and cash flow for your law firm. These forecasts should offer a clear picture of how your firm expects to perform financially. You should also Incorporate income statements, which show your firm’s revenue and expenses, balance sheets that detail your assets and liabilities, and cash flow projections, which illustrate how money moves in and out of your business. These financial statements offer a holistic view of your firm’s financial health.

Explain the assumptions underlying your financial projections. This may include factors like growth rates, market trends, client acquisition strategies, and pricing models. Describe your strategies for achieving growth and how they translate into financial outcomes. This section is critical for demonstrating your law firm’s financial preparedness and sustainability. Investors, lenders, or partners will scrutinize these sections to assess the viability of your firm, making it essential to provide detailed and well-supported financial information.

Section Eight: Start-up Budget

When developing a business plan for your law firm, it is essential to create a realistic startup budget. This involves carefully considering various initial and ongoing expenses and factoring them into your revenue objectives. Here are some instances of expenses to incorporate into your budget:

- Hardware costs, such as laptops, printers, scanners, and office furniture.

- Office space expenses, whether you plan to rent space or work from home.

- Malpractice insurance fees.

- Staff salaries, including potential hires like administrative assistants or paralegals.

- Utility expenses, covering phone and internet services, among others.

- Expenses on practice management software or other tech tools

After itemizing these costs, review them thoroughly. Clearly state the total amount of funding you require to start and sustain your law firm. Explain how this funding will be allocated, including how much goes into covering startup costs and how much is reserved for ongoing operations. Be specific about the purpose of each funding component.