What to Include in Your Business Plan Appendix

Candice Landau

4 min. read

Updated July 2, 2024

While not required, a well-structured business plan appendix goes a long way toward convincing lenders and investors that you have a great business idea and a viable business.

This article will cover what to include in your appendix and best practices to make it a useful part of your business plan .

- What is a business plan appendix?

A business plan appendix provides supporting documentation for the other sections of your business plan .

The appendix typically comes last and includes any additional documents, spreadsheets, tables, or charts that don’t fit within the main sections of your plan.

What goes in the appendix of a business plan?

In general, here is some of the information you might include in your business plan appendix:

- Charts, graphs, or tables that support sections of your business plan

- Financial statements and projections

- Sales and marketing materials

- Executive team resumes

- Credit history

- Business and/or personal tax returns

- Agreements or contracts with clients or vendors

- Licenses, permits , patents, and trademark documentation

- Product illustrations or product packaging samples

- Building permit and equipment lease documentation

- Contact information for attorneys , accountants, and advisors

You may include some, all, or none of these documents in your appendix. It depends on your business needs and who you share your business plan with.

Similar to your executive summary , adjusting what’s in your appendix may be helpful based on the intended audience.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Business plan appendix best practices

Here are a few tips to help you create an appendix that supports your business plan.

Make it easy to navigate

If your appendix is more than a few pages long or contains a variety of documents, you may want to consider adding a separate table of contents.

Don’t forget security

If you share confidential information within the business plan appendix, you will also want to keep track of who has access to it.

A confidentiality statement is a good way to remind people that the content you share should not be distributed or discussed beyond the agreed parties. You can include it as a separate page or as part of your business plan cover page .

Make the appendix work as a separate document

Given that the appendix is the last part of the business plan, it’s quite likely your readers will skip it.

For this reason, it’s important to ensure your business plan can stand on its own. All information within the appendix should be supplementary.

Ask yourself: if the reader skipped this part of my plan, would they still understand my idea or business model ? If the answer is no, you may need to rethink some things.

Connect the appendix to sections of your business plan

Make sure that anything you include in the appendix is relevant to the rest of your business plan. It should not be unrelated to the materials you’ve already covered.

It can be useful to reference which section of your plan the information in your appendix supports. Use footnotes, or if it’s digital, provide links to other areas of your business plan.

Keep it simple

This is good general advice for your entire business plan.

Keep it short.

You don’t need to include everything. Focus on the relevant information that will give your reader greater insight into your business or more detailed financial information that will supplement your financial plan.

Free business plan template with appendix

Remember, your appendix is an optional supporting section of your business plan. Don’t get too hung up on what to include. You can flag documents and information you believe are worth including in your appendix as you write your plan .

Need help creating your business plan?

Download our free fill-in-the-blank business plan template with a pre-structured format for your appendix.

And to understand what you should include based on your industry—check out our library of over 550 business plan examples .

Business plan appendix FAQ

How do you write an appendix for a business plan?

Gather relevant documents like financial statements, team resumes, and legal permits. Organize them logically, possibly mirroring your business plan’s structure. If long, include a table of contents, ensure each item is relevant, and focus on keeping it simple. If you’re sharing sensitive information, add a confidentiality statement.

Why is a business plan appendix important?

An appendix provides supporting evidence for your business plan. It keeps your main plan more concise, enhances credibility with additional data, and can house all-important business documents associated with your business.

What additional information would appear in the appendix of the business plan?

The following can appear in your appendix:

- Financial projections

- Marketing materials

- Team resumes

- Legal documents (like permits and patents)

- Product details (like prototypes and packaging)

- Operational documents (like building permits)

- Professional contact information.

Candice Landau is a marketing consultant with a background in web design and copywriting. She specializes in content strategy, copywriting, website design, and digital marketing for a wide-range of clients including digital marketing agencies and nonprofits.

Table of Contents

- What goes in the appendix?

- Best practices

- Free template

Related Articles

6 Min. Read

How to Write Your Business Plan Cover Page + Template

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

How to Write the Company Overview for a Business Plan

How to Set and Use Milestones in Your Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

What is an Appendix in a Business Plan?

Appendix is an optional section placed at the end of a document, such as a business plan, which contains additional evidence to support any projections, claims, analysis, decisions, assumptions, trends and other statements made in that document, to avoid clutter in the main body of text.

What is Included in an Appendix of a Business Plan?

Appendix commonly includes charts, photos, resumes, licenses, patents, legal documents and other additional materials that support analysis and claims made in the main body of a business plan document around market, sales, products, operations, team, financials and other key business aspects.

The appendix is the perfect place to showcase a wide range of information, including:

- Supporting documentation: References and supporting evidence to substantiate any major projections, claims, statements, decisions, assumptions, analysis, trends and comparisons mentioned throughout the main body of a business plan.

- Requested documentation: Information, documents or other materials that were specially requested by the business plan readers (e.g., lenders or investors) but are too large to place in the main body of text.

- Additional information: Any other materials or exhibits that will give readers a more complete picture of the business.

- Visual aids: Photos, images, illustrations, graphs, charts, flow-charts, organizational charts, resumes.

After reviewing the appendices, the reader should feel satisfied that the statements made throughout the main body of a business plan are backed up by sufficient evidence and that they got even fuller picture of the business.

How Should You Write a Business Plan Appendix? (Insider Tip)

The fastest way to pull the Appendix chapter together is to keep a list of any supporting documents that come to mind while you are in the process of writing the business plan text.

For example, while writing about the location of your business, you may realize the need for a location map of the premises and the closest competitors, demographic analysis, as well as lease agreement documentation.

Recording these items as you think of them will enable you to compile a comprehensive list of appendix materials by the time you finish writing.

Remember to keep copies of the original documents.

Template: 55 Business Plan Appendix Content Samples

For your inspiration, below is a pretty exhaustive list of supporting documentation that typically gets included in the business plan appendix. But please do not feel like you have to include everything from the list. In fact, you definitely shouldn’t!

The purpose of the appendix is to paint a fuller picture of your business by providing helpful supporting information, not to inundate yourself or the readers of your business plan. So, take care to only include what is relevant and necessary .

Company Description

1. Business formation legal documents (e.g., business licenses, articles of incorporation, formation documents, partnership agreements, shareholder agreements)

2. Contracts and legal agreements (e.g., service contracts and maintenance agreements, franchise agreement)

3. Intellectual property (e.g., copyrights, trademark registrations, licenses, patent filings)

4. Other key legal documents pertaining to your business (e.g. permits, NDAs, property and vehicle titles)

5. Proof of commitment from strategic partners (e.g., letters of agreement or support)

6. Dates of key developments in your company’s history

7. Description of insurance coverage (e.g. insurance policies or bids)

Target Market

8. Highlights of relevant industry and market research data, statistics, information, studies and reports collected

9. Results of customer surveys, focus groups and other customer research conducted

10. Customer testimonials

11. Names of any key material customers (if applicable)

Competition

12. List of major competitors

13. Research information collected on your competitors

14. Competitive analysis

Marketing and Sales

15. Branding collateral (e.g., brand identity kit designs, signage, packaging designs)

16. Marketing collateral (e.g., brochures, flyers, advertisements, press releases, other promotional materials)

17. Social media follower numbers

18. Statistics on positive reviews collected on review sites

19. Public relations (e.g., media coverage, publicity initiatives)

20. Promotional plan (e.g., overview, list and calendar of activities)

21. List of locations and facilities (e.g., offices, sales branches, factories)

22. Visual representation of locations and facilities (e.g., photos, blueprints, layout diagrams, floor plans)

23. Location plan and documentation related to selecting your location (e.g., traffic counts, population radius, demographic information)

24. Maps of target market, highlighting competitors in the area

25. Zoning approvals and certificates

26. Detailed sales forecasts

27. Proof of commitment from strategically significant customers (e.g., purchase orders, sales agreements and contracts, letters of intent)

28. Any additional information about the sales team, strategic plan or process

Products and Services

29. Product or service supporting documentation – descriptions, brochures, data sheets, technical specifications, photos, illustrations, sketches or drawings

30. Third-party evaluations, analyses or certifications of the product or service

31. Flow charts and diagrams showing the production process or operational procedures from start to finish

32. Key policies and procedures

33. Technical information (e.g., production equipment details)

34. Dependency on third-party entities (e.g., materials, manufacturing, distribution) – list, description, statistics, contractual terms, rate sheets (e.g., sub-contractors, shippers)

35. Risk analysis for all major parts of the business plan

Management and Team

36. Organizational chart

37. Job descriptions and specifications

38. Resumes of owners, key managers or principals

39. Letters of reference and commendations for key personnel

40. Details regarding human resources procedures and practices (e.g., recruitment, compensation, incentives, training)

41. Staffing plans

42. Key external consultants and advisors (e.g., lawyer, accountant, marketing expert; Board of Advisors)

43. Board of Directors members

44. Plans for business development and expansion

45. Plan for future product releases

46. Plan for research and development (R&D) activities

47. Strategic milestones

48. Prior period financial statements and auditor’s report

49. Financial statements for any associated companies

50. Personal and business income tax returns filed in previous years

51. Financial services institutions’ details (name, location, type of accounts)

52. Supporting information for the financial model projections, for example:

- Financial model assumptions

- Current and past budget (e.g., sales, marketing, staff, professional services)

- Price list and pricing model (e.g., profit margins)

- Staff and payroll details

- Inventory (e.g., type, age, volume, value)

- Owned fixed assets and projected capital expenditure (e.g., land, buildings, equipment, leasehold improvements)

- Lease agreements (e.g., leases for business premises, equipment, vehicles)

- Recent asset valuations and appraisals

- Aged debtor receivable account and creditor payable account summary

- Global financial considerations (exchange rates, interest rates, taxes, tariffs, terms, charges, hedging)

53. Debt financing – documentation regarding any loans, mortgages, or other debt related financial obligations

54. Equity financing – capital structure documentation (e.g., capitalization table, 409A, investor term sheets, stock and capital related contracts and agreements)

55. Personal finance – information regarding owners’ capital and collateral (e.g., Personal Worth Statement or Personal Financial Statement, loan guarantees, proof of ownership)

Related Questions

How do you finish a business plan.

Business plan is finished by summarizing the highlights of the plan in an Executive Summary section located at the beginning of the document. The business plan document itself is finished by an Appendix section that contains supporting documentation and references for the main body of the document.

What is bibliography?

A bibliography is a list of external sources used in the process of researching a document, such as a business plan, included at the end of that document, before or after an Appendix. For each source, reference the name of the author, publication and title, the publishing date and a hyperlink.

What are supporting documents included in a business plan appendix?

Supporting documents in a business plan appendix include graphs, charts, images, photos, resumes, analyses, legal documents and other materials that substantiate statements made in a business plan, provide fuller picture of the business, or were specifically requested by the intended reader.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent posts.

How to Write a Business Plan: Your Step-by-Step Guide

So, you’ve got an idea and you want to start a business —great! Before you do anything else, like seek funding or build out a team, you'll need to know how to write a business plan. This plan will serve as the foundation of your company while also giving investors and future employees a clear idea of your purpose.

Below, Lauren Cobello, Founder and CEO of Leverage with Media PR , gives her best advice on how to make a business plan for your company.

Build your dream business with the help of a high-paying job—browse open jobs on The Muse »

What is a business plan, and when do you need one?

According to Cobello, a business plan is a document that contains the mission of the business and a brief overview of it, as well as the objectives, strategies, and financial plans of the founder. A business plan comes into play very early on in the process of starting a company—more or less before you do anything else.

“You should start a company with a business plan in mind—especially if you plan to get funding for the company,” Cobello says. “You’re going to need it.”

Whether that funding comes from a loan, an investor, or crowdsourcing, a business plan is imperative to secure the capital, says the U.S. Small Business Administration . Anyone who’s considering giving you money is going to want to review your business plan before doing so. That means before you head into any meeting, make sure you have physical copies of your business plan to share.

Different types of business plans

The four main types of business plans are:

Startup Business Plans

Internal business plans, strategic business plans, one-page business plans.

Let's break down each one:

If you're wondering how to write a business plan for a startup, Cobello has advice for you. Startup business plans are the most common type, she says, and they are a critical tool for new business ventures that want funding. A startup is defined as a company that’s in its first stages of operations, founded by an entrepreneur who has a product or service idea.

Most startups begin with very little money, so they need a strong business plan to convince family, friends, banks, and/or venture capitalists to invest in the new company.

Internal business plans “are for internal use only,” says Cobello. This kind of document is not public-facing, only company-facing, and it contains an outline of the company’s business strategy, financial goals and budgets, and performance data.

Internal business plans aren’t used to secure funding, but rather to set goals and get everyone working there tracking towards them.

As the name implies, strategic business plans are geared more towards strategy and they include an assessment of the current business landscape, notes Jérôme Côté, a Business Advisor at BDC Advisory Services .

Unlike a traditional business plan, Cobello adds, strategic plans include a SWOT analysis (which stands for strengths, weaknesses, opportunities, and threats) and an in-depth action plan for the next six to 12 months. Strategic plans are action-based and take into account the state of the company and the industry in which it exists.

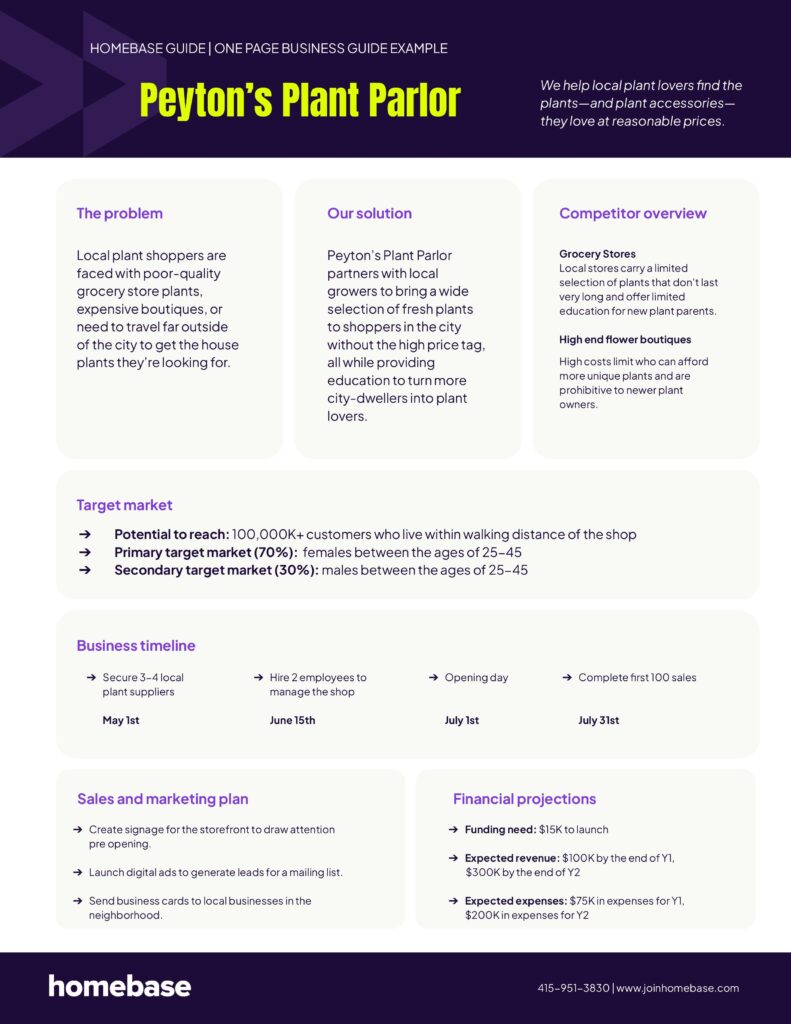

Although a typical business plan falls between 15 to 30 pages, some companies opt for the much shorter One-Page Business Plan. A one-page business plan is a simplified version of the larger business plan, and it focuses on the problem your product or service is solving, the solution (your product), and your business model (how you’ll make money).

A one-page plan is hyper-direct and easy to read, making it an effective tool for businesses of all sizes, at any stage.

How to create a business plan in 7 steps

Every business plan is different, and the steps you take to complete yours will depend on what type and format you choose. That said, if you need a place to start and appreciate a roadmap, here’s what Cobello recommends:

1. Conduct your research

Before writing your business plan, you’ll want to do a thorough investigation of what’s out there. Who will be the competitors for your product or service? Who is included in the target market? What industry trends are you capitalizing on, or rebuking? You want to figure out where you sit in the market and what your company’s value propositions are. What makes you different—and better?

2. Define your purpose for the business plan

The purpose of your business plan will determine which kind of plan you choose to create. Are you trying to drum up funding, or get the company employees focused on specific goals? (For the former, you’d want a startup business plan, while an internal plan would satisfy the latter.) Also, consider your audience. An investment firm that sees hundreds of potential business plans a day may prefer to see a one-pager upfront and, if they’re interested, a longer plan later.

3. Write your company description

Every business plan needs a company description—aka a summary of the company’s purpose, what they do/offer, and what makes it unique. Company descriptions should be clear and concise, avoiding the use of jargon, Cobello says. Ideally, descriptions should be a few paragraphs at most.

4. Explain and show how the company will make money

A business plan should be centered around the company’s goals, and it should clearly explain how the company will generate revenue. To do this, Cobello recommends using actual numbers and details, as opposed to just projections.

For instance, if the company is already making money, show how much and at what cost (e.g. what was the net profit). If it hasn’t generated revenue yet, outline the plan for how it will—including what the product/service will cost to produce and how much it will cost the consumer.

5. Outline your marketing strategy

How will you promote the business? Through what channels will you be promoting it? How are you going to reach and appeal to your target market? The more specific and thorough you can be with your plans here, the better, Cobello says.

6. Explain how you’ll spend your funding

What will you do with the money you raise? What are the first steps you plan to take? As a founder, you want to instill confidence in your investors and show them that the instant you receive their money, you’ll be taking smart actions that grow the company.

7. Include supporting documents

Creating a business plan is in some ways akin to building a legal case, but for your business. “You want to tell a story, and to be as thorough as possible, while keeping your plan succinct, clear, interesting, and visually appealing,” Cobello says. “Supporting documents could include financial projects, a competitive analysis of the market you’re entering into, and even any licenses, patents, or permits you’ve secured.”

A business plan is an individualized document—it’s ultimately up to you what information to include and what story you tell. But above all, Cobello says, your business plan should have a clear focus and goal in mind, because everything else will build off this cornerstone.

“Many people don’t realize how important business plans are for the health of their company,” she says. “Set aside time to make this a priority for your business, and make sure to keep it updated as you grow.”

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

- Business planning

How to write a business plan

24 April 2024

- More like this Less like this

If you're planning to launch a start-up or small business, this guide on how to write a business plan will help you create an effective road map to success. A thoughtfully researched, well-structured business plan can give you greater clarity on your business’s vision, help you avoid potential pitfalls and can help ensure you stay on track for your business goals. Read on to discover the essential elements of business planning, common mistakes to avoid, and business plan tips on how to make your plan compelling and ready for investors.

What is a business plan? Why is a business plan important? What to consider when writing a business plan? What to include in a business plan? Business plan formats How to write a business plan How to start a business plan What does a business plan look like? How long should a business plan be? Common business plan mistakes FAQ on creating a business plan

What is a business plan?

A business plan is a strategic document that details your business's objectives and the steps you’ll take to achieve them.

It is a tool that covers everything from your business strategy and key goals to financial projections and management structure. A business plan is also your opportunity to describe your company or proposed project in detail, showcasing both your short-term and long-term goals, budget details, and unique selling propositions (USPs).

Let's dive into understanding what a business plan looks like, why it's so important, and how you can create one for your business.

Why is a business plan important?

A business plan is important because it helps you create an effective plan for your new enterprise that allows you to make informed decisions, set clear goals, and manage your enterprise effectively.

The importance of a business plan becomes clear when you want to set your business apart from the competition.

Here’s how a business plan can help:

- Guidance and structure: A plan outlines your goals and strategies, providing a roadmap for your business.

- Attracting investment: It's essential for attracting investors and lenders who need to understand your strategy before funding it.

- Identifying strengths and weaknesses: Business plan writing helps identify potential pitfalls and strengths in your business idea.

- Planning for growth: Creates a strategy for facilitating future growth and expansion.

- Understanding your market: Includes research that helps you understand your target audience and competition.

What to consider when writing a business plan

When you write a business plan, there are important questions you need to consider.

Step 1. Understand your target market

The first step is understanding your target market. Who are they? What do they need? How will your product or service cater to these needs?

Your business plan should be designed to serve this audience. You’ll need to conduct thorough market research and include this data in your plan.

Step 2. Define your business goals

The second step is to clearly define your business goals. What do you want to achieve in the next year, five years, or ten years?

Having clear, measurable objectives will guide your business plan and help you stay focused on your end goal.

Step 3. Know your USP

Next, consider your unique selling proposition (USP). This is what sets you apart from the competition. Highlighting your USP in your business plan will not only help you stand out but also attract potential investors.

The financial aspect is another key factor. You need to have a clear understanding of your financial needs, cash flow projections, and profitability forecasts. This information is particularly important if you're seeking funding from investors or lenders.

Lastly, remember that your business plan is a living document. It should evolve as your business grows and changes.

Be prepared to review and update it regularly to reflect new goals, strategies, or market conditions. This flexibility will ensure that your business plan remains relevant and effective.

What should you include in a business plan?

When developing a business plan, it can be helpful to first look at business plan examples in your relevant industry. There is no fixed business plan template, but many plans will include the following elements:

1. Executive summary

Your business plan should start with a succinct overview of your plan that highlights the key points and creates a strong initial impression. It should be compelling enough to encourage readers to read further.

2. Company description

This section should provide an overview of what your business does, the problems it solves, and the market it serves.

3. Market analysis

The market analysis section requires a thorough understanding of your industry, target market, and competition. You should demonstrate knowledge of market trends, customer needs, and the competitive landscape.

4. Business goals

Define both your short-term and long-term objectives to provide a clear vision of where you want your business to be in the future. You can also describe how you plan to achieve these goals.

5. Products and services

You should describe what you're selling or what services you offer, highlighting how your offerings stand out from the competition.

6. Financial plan

You should include a detailed overview of your finances, including cash flow statements and profit projections. This section shows potential investors that you have a solid understanding of the financial aspects of running a business.

Your business plan is a marketing document. It should be concise, engaging, and persuasive, convincing potential investors, partners, and employees of the viability and potential of your business.

Business plan formats

Business plan format can vary depending on industry. For instance, a restaurant's business plan might feature a sample menu and location demographics, while a tech start-up may focus on development timelines and patent protections.

A small business plan is likely to look very different to a large business plan. Tailor your business plan to your specific industry and business type.

The complexity of your business plan might also depend on its purpose. If you're seeking significant investment, you'll need detailed financial projections. However, if the plan is mainly for internal use, you might focus more on strategy and team organisation.

In short, while there are common components in every business plan, the specifics can vary widely. Ensure your business plan is relevant to your industry, audience, and business needs.

Writing a business plan requires research and attention to detail for each section. Below, you’ll find a 9-step guide for researching and defining each element in the plan.

- Write an executive summary

- Draft a business description

- Conduct market analysis

- List your management and organisation structure

- Outline services or products

- Define your marketing and sales strategy

- Describe your funding needs

- Plan financial projections

- Appendix of supporting documents

1. Write an executive summary

This is a brief overview of your business plan. It should include your business’s name, location, and the products or services you offer. Also mention your mission statement and your business’s USP (unique selling proposition). Remember, the executive summary should be concise yet compelling, persuading the reader to learn more about your business.

Your executive summary should include:

- Business concept: What does your company do? What are your products or services? This section should clearly articulate your business’s core concept.

- Company information: Include the company’s name, when it was founded (if applicable), the names of the founders and their roles, the team and size, and location of premises.

- Growth highlights: If your business is already established, describe how much it has grown since inception, including financial or market highlights.

- Products/services: Describe what you sell or the service you offer. Explain how it benefits your customers and what makes it unique to the market.

- Financial information: If you’re seeking funding from investors, include a brief overview of your projections and what you’re asking for.

- Future plans: Summarise where you plan to take your business in the future. This could include potential growth, new products or services, or expansion into new markets.

2. Draft a business description

Describe your business in detail. Include the business structure (sole trader, partnership, limited company), the nature of your business, and the marketplace needs that your business aims to fulfil.

3. Conduct market analysis

This is where you demonstrate that you understand your industry and market. Include information about your target customers, including their demographics and buying habits. Also analyse your competition, outlining their strengths and weaknesses.

What else to include:

- Industry overview: This gives a broad view of your industry. You can include its size, growth rate, trends, and outlook.

- Target market: Identify who your customers are. You should define them by demographic factors like age, gender, income level, and geographic location. Also consider psychographic factors such as lifestyle, values, and attitudes.

- Market need: Determine what problem your product or service solves for your target market. This could be a gap in the market, an unfulfilled need, or an improvement on existing products or services.

- Competition analysis: Identify your direct and indirect competitors. Analyse their strengths and weaknesses, and how your business compares.

- Pricing and forecast: Set your pricing strategy based on your understanding of the market and competition. Include a forecast for your potential market share and sales.

- Regulatory environment: Understand any laws or regulations that could impact your industry. This includes permits, licenses, or regulatory compliance requirements.

- SWOT analysis: Identify your business's Strengths, Weaknesses, Opportunities, and Threats (SWOT). This helps you understand your business's position within the marketplace.

4. List your management and organisation structure

Outline your business's organisational structure. Identify the owners, management team, and any key employees. Include an organisational chart if possible.

5. Outline services or products

Describe what your business offers. If you sell products, explain how they are produced, their cost, and how you will sell them. If you provide services, describe them in detail, and list any associated costs.

6. Define your marketing and sales strategy

Detail how you plan to attract and retain customers. Include your sales strategy and the marketing channels you plan to use. Here's what it should include:

- Target market: Define who your customers are - their demographics, behaviours, and needs – and what kinds of marketing message they are likely to respond to. This will guide your marketing efforts.

- Unique selling proposition (USP): Identify what makes your product or service unique. How does it stand out from the competition? How will you convey this in your marketing?

- Pricing strategy: Explain how you have priced your products or services and why this will appeal to your target market.

- Sales plan: Detail how you'll sell your product. Will it be online, in a physical store, or both? Will you have a sales team? How will you bring your business to the target market?

- Promotional strategy: Describe how you will promote your business. This could include social media marketing, SEO, content marketing, advertising, public relations, and more.

- Retention strategy: Outline how you plan to keep your customers coming back. This could involve excellent customer service, loyalty programs, regular updates or improvements to the product or service, etc.

- Partnerships and collaborations: If applicable, discuss any partnerships or collaborations that will play a role in your marketing and sales plan.

- Measurement: Define how you'll measure the success of your marketing and sales efforts. This could be through key performance indicators (KPIs) like website traffic, conversion rates, customer acquisition cost, customer lifetime value, etc.

Your marketing and sales strategy should be flexible. As you learn more about your market and customers, adjust your strategies accordingly.

7. Describe your funding needs

If you are seeking investors or applying for business loans, you should include a funding request section within your business plan. It should include:

- Funding request: Start with the exact amount of funding you are seeking. Be clear and specific.

- Use of funds: Explain in detail how you plan to use the funds. This could be for starting costs, working capital, business expansion, or any other business expenses.

- Future funding: If you anticipate needing additional funding in the future, mention this. Provide an estimate of how much you might need, when you might need it, and what for.

- Business financials: Provide a snapshot of your financial statements and forecasts. Include your income statement, balance sheet, cash flow statement, business loans, and any other relevant financial data.

- Exit strategy: If you're seeking equity investment, describe your exit strategy. This could be selling the company, merging with another company, or going public with an IPO (initial public offering).

- Repayment plan: If you're requesting a loan, outline your plan for repaying it. Provide a schedule and method of repayment.

When considering where to secure funding, it's essential to explore your options. You may want to consider our app-based HSBC Kinetic Current Account for sole traders and single director shareholder businesses, or our Small Business Bank Account for small enterprises. Eligibility criteria apply.

Both accounts are designed to support the growth and financial management of your business. These platforms provide a range of services that cater to your business's needs, from daily transactions to long-term financial planning.

8. Plan financial projections

Provide a forecast of your business's financial future. This can include balance sheets, income statements, and cash flow statements for the next three to five years. Consider incorporating HSBC Kinetic into your financial planning for a comprehensive and digital-first approach to managing your business finances. Eligibility criteria apply.

Here are examples of what to include:

- Sales forecast: This is the amount of money you anticipate from sales of your products or services. It should be broken down monthly for the first year, then annually for the following two to five years.

- Income statement (profit and loss statement): This document shows your business’s profitability over time. It should include revenue, costs of goods sold, operating expenses, and net income.

- Cash flow statement: This demonstrates where your business is earning and spending money by highlighting how balance sheets and income affect your cash or cash equivalents.

- Balance sheet: This document provides a snapshot of your business's financial position at a particular moment in time. It lists your assets, liabilities, and equity.

- Capital expenditure budget: If there are large expenses for long-term assets such as property or equipment, these should be detailed here.

- Break-even analysis: This analysis shows when your company can cover all the expenses and make a profit.

- Financial ratios: These ratios compare financial metrics from your financial statements to assess your company’s financial health. They can provide valuable insights into how well the company is performing.

Your projections should be realistic, with all assumptions clearly stated. If you're a start-up with no financial history, base your projections on research and industry averages. If you're an existing business, use your past financial performance as a guide.

It can be beneficial to seek professional advice when preparing this section of your business plan, as it will be scrutinised by investors and lenders.

9. Appendix of supporting documents

An optional section that includes any additional supporting documents such as legal documents, permits, and contracts.

Writing a business plan is not a one-time event. It should be updated regularly as your business grows and changes.

How to start a business plan

Starting a business plan generally involves seven practical steps and may require consultation with other professionals. Here's a step-by-step guide on how to start:

Understand the purpose of your plan:

Research your industry:, outline your plan:, write the plan:, review and edit:, get feedback:, finalise your plan:.

Here are some people you might want to talk to when you write a business plan:

- Industry peers or mentors: People with experience in your field can provide valuable insights and advice.

- Business advisors or coaches: These professionals can offer guidance and help you avoid common pitfalls.

- Accountants: They can assist with the financial aspects of your plan, including projections and identifying potential costs.

- Potential customers: Speaking with your target audience can help you understand their needs and preferences, which can inform your marketing and sales plan.

- Legal advisors: If your business has any legal considerations, such as patents or regulations, a legal advisor can ensure these are properly addressed in your plan.

A business plan isn't a static document - it should evolve with your business. Regularly updating your plan can help you adapt to changes and stay on track towards your goals.

How long should a business plan be?

The recommended length of a business plan can vary depending on the complexity of your business model and the purpose of the plan. However, a typical business plan ranges from 15 to 35 pages.

What does a business plan look like?

Your business plan can and should be branded to reflect your business identity. Here's how:

Cover page:

Headers and sub-headers:, colour scheme:, images and graphics:, tone of voice:, consistency:.

Your plan is a reflection of your business. By incorporating your brand into the design, you're not just creating a strategy document - you're showcasing your business's identity.

FAQ on creating a business plan

You may have many questions when creating your new business plan. Below we look at some of the common ones.

How much information should I include in my business plan?

Your business plan should be concise yet comprehensive, providing all the necessary information. The length might also depend on whether you're writing the plan for internal use, for potential investors, or for a loan application, as each audience might have different expectations.

It can be helpful to mark out which sections are for which audience, so that you can edit into a new document as required, rather than starting a new business plan from scratch.

What is the proper business plan format?

Printed versions of your business plan should be on standard A4 paper, bound neatly, and presented in a professional manner. All electronic versions should be in a PDF format and have a clear file name for ease of sharing.

The layout should be clear and easy to navigate, with headers, sub-headers, bullet points, and plenty of white space to make the document easy to read.

Common business plan mistakes

There are common mistakes that businesses can make when writing a plan. These include:

Lack of planning:

Wrong audience:, it’s too long:, insufficient market research:, unrealistic financial projections:, not addressing potential risks:, poor grammar, spelling, and punctuation:, unclear business model:.

Writing a business plan may seem like a daunting task at first, but with careful planning, thorough research, and thoughtful consideration of each section - from the executive summary to financial projections - you can create a powerful document that serves as a roadmap for your business's success.

Business plan template

Remember, a business plan is not a static document. As your business grows and evolves, so too should your business plan. Regular reviews and updates will ensure your plan remains relevant and continues to guide your strategic decision-making.

Whether you're seeking investment, planning for growth, or simply setting the course for your day-to-day operations, a well-crafted business plan is an invaluable tool for every business owner. With the advice and guidance provided in this guide, you're now well-equipped to create a robust and compelling business plan.

HSBC Business Bank Accounts

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

Contents of a Business Plan

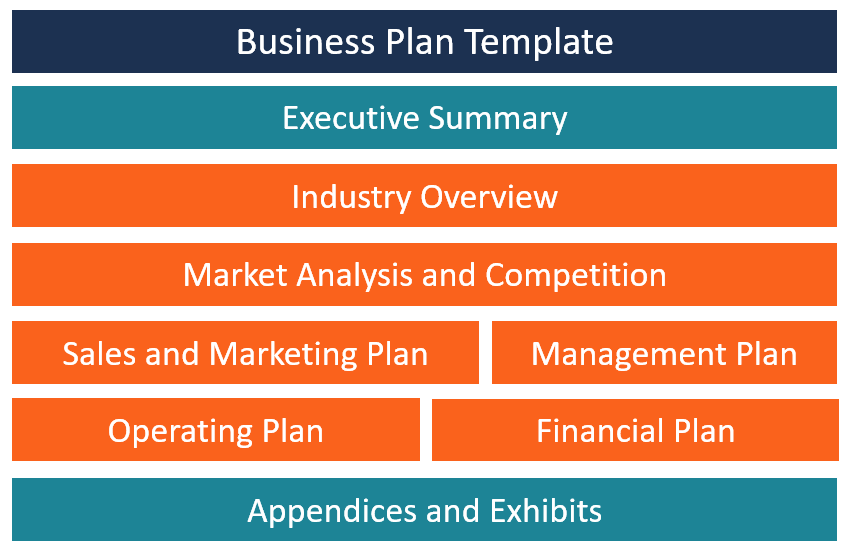

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide