The Business Planning Process: 6 Steps To Creating a New Plan

In this article, we will define and explain the basic business planning process to help your business move in the right direction.

What is Business Planning?

Business planning is the process whereby an organization’s leaders figure out the best roadmap for growth and document their plan for success.

The business planning process includes diagnosing the company’s internal strengths and weaknesses, improving its efficiency, working out how it will compete against rival firms in the future, and setting milestones for progress so they can be measured.

The process includes writing a new business plan. What is a business plan? It is a written document that provides an outline and resources needed to achieve success. Whether you are writing your plan from scratch, from a simple business plan template , or working with an experienced business plan consultant or writer, business planning for startups, small businesses, and existing companies is the same.

Finish Your Business Plan Today!

The best business planning process is to use our business plan template to streamline the creation of your plan: Download Growthink’s Ultimate Business Plan Template and finish your business plan & financial model in hours.

The Better Business Planning Process

The business plan process includes 6 steps as follows:

- Do Your Research

- Calculate Your Financial Forecast

- Draft Your Plan

- Revise & Proofread

- Nail the Business Plan Presentation

We’ve provided more detail for each of these key business plan steps below.

1. Do Your Research

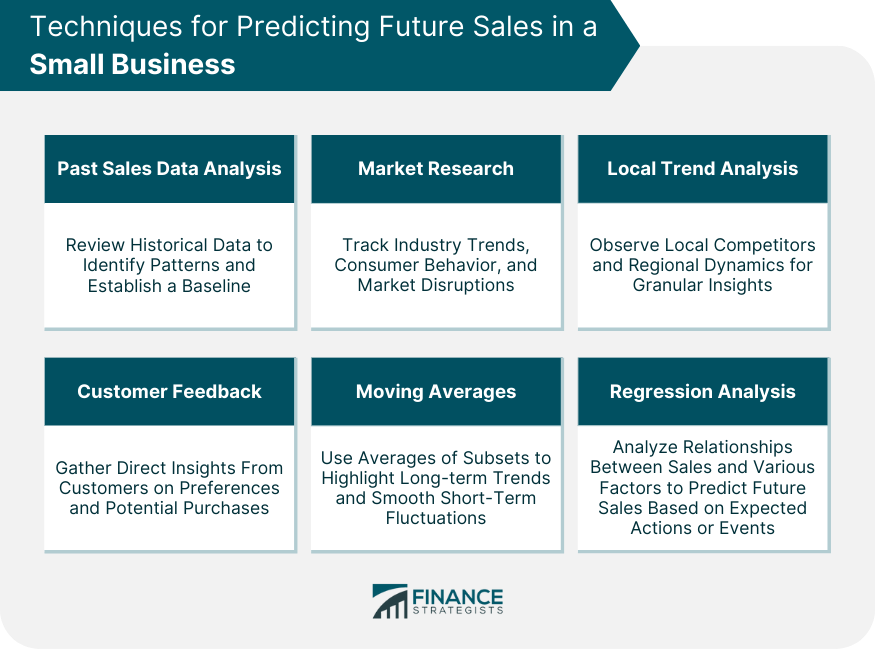

Conduct detailed research into the industry, target market, existing customer base, competitors, and costs of the business begins the process. Consider each new step a new project that requires project planning and execution. You may ask yourself the following questions:

- What are your business goals?

- What is the current state of your business?

- What are the current industry trends?

- What is your competition doing?

There are a variety of resources needed, ranging from databases and articles to direct interviews with other entrepreneurs, potential customers, or industry experts. The information gathered during this process should be documented and organized carefully, including the source as there is a need to cite sources within your business plan.

You may also want to complete a SWOT Analysis for your own business to identify your strengths, weaknesses, opportunities, and potential risks as this will help you develop your strategies to highlight your competitive advantage.

2. Strategize

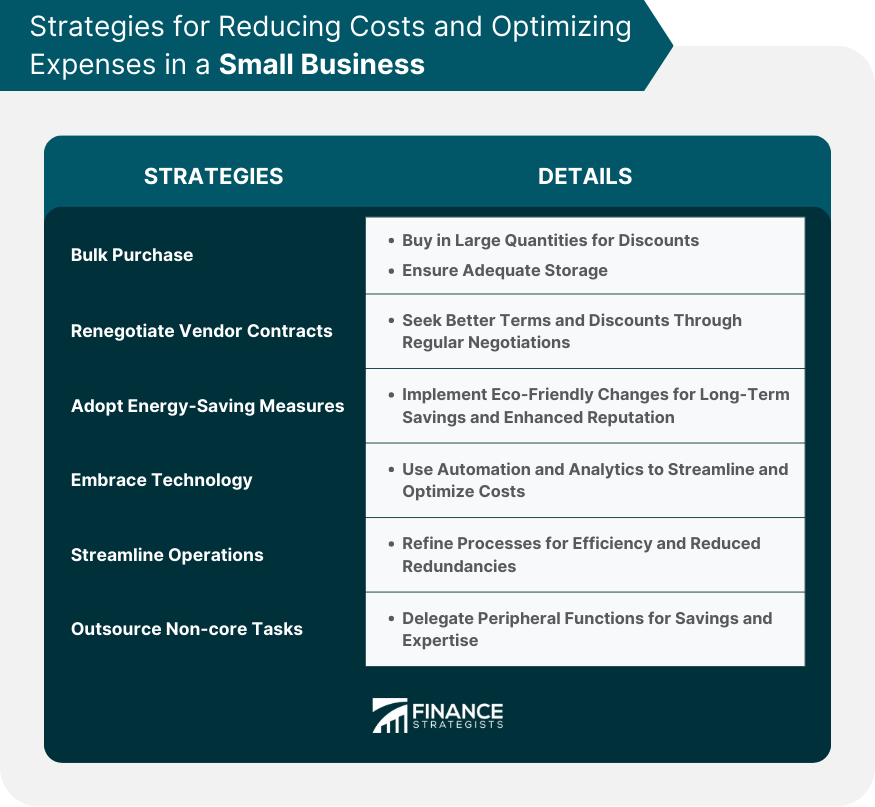

Now, you will use the research to determine the best strategy for your business. You may choose to develop new strategies or refine existing strategies that have demonstrated success in the industry. Pulling the best practices of the industry provides a foundation, but then you should expand on the different activities that focus on your competitive advantage.

This step of the planning process may include formulating a vision for the company’s future, which can be done by conducting intensive customer interviews and understanding their motivations for purchasing goods and services of interest. Dig deeper into decisions on an appropriate marketing plan, operational processes to execute your plan, and human resources required for the first five years of the company’s life.

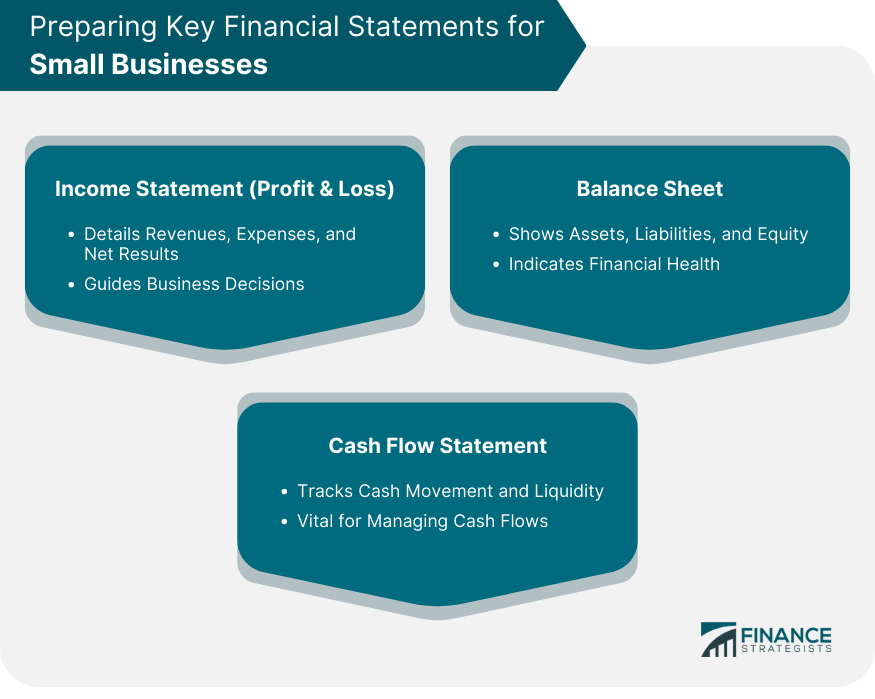

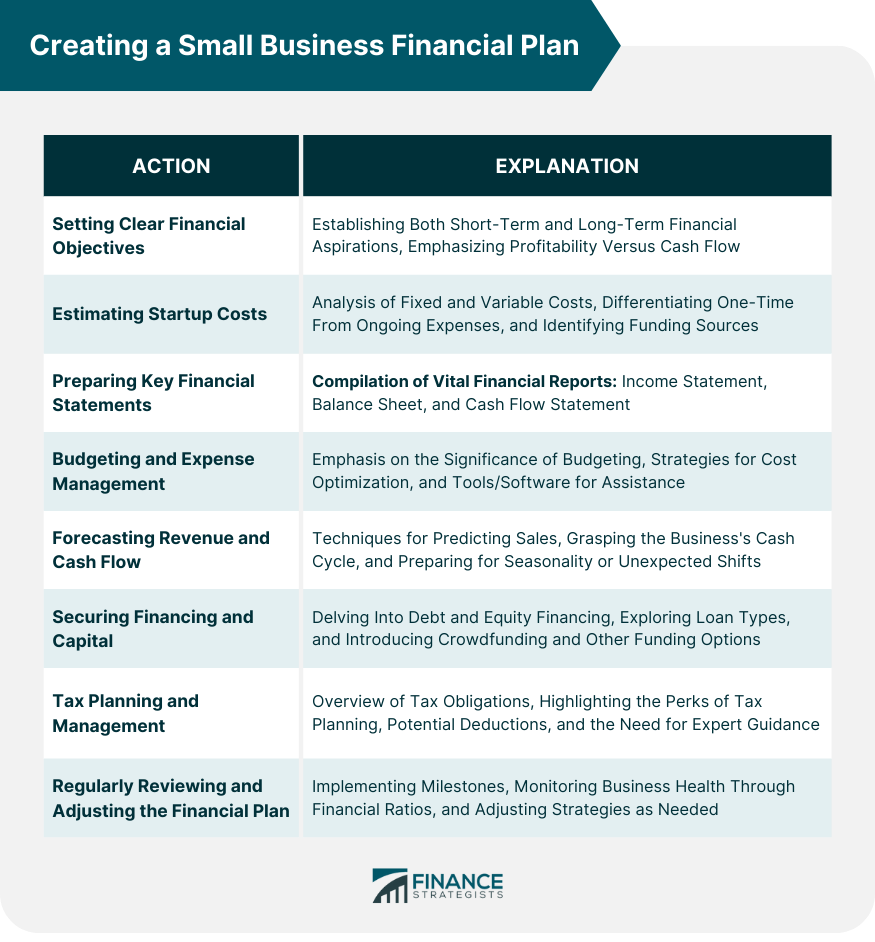

3. Calculate Your Financial Forecast

All of the activities you choose for your strategy come at some cost and, hopefully, lead to some revenues. Sketch out the financial situation by looking at whether you can expect revenues to cover all costs and leave room for profit in the long run.

Begin to insert your financial assumptions and startup costs into a financial model which can produce a first-year cash flow statement for you, giving you the best sense of the cash you will need on hand to fund your early operations.

A full set of financial statements provides the details about the company’s operations and performance, including its expenses and profits by accounting period (quarterly or year-to-date). Financial statements also provide a snapshot of the company’s current financial position, including its assets and liabilities.

This is one of the most valued aspects of any business plan as it provides a straightforward summary of what a company does with its money, or how it grows from initial investment to become profitable.

4. Draft Your Plan

With financials more or less settled and a strategy decided, it is time to draft through the narrative of each component of your business plan . With the background work you have completed, the drafting itself should be a relatively painless process.

If you have trouble writing convincing prose, this is a time to seek the help of an experienced business plan writer who can put together the plan from this point.

5. Revise & Proofread

Revisit the entire plan to look for any ideas or wording that may be confusing, redundant, or irrelevant to the points you are making within the plan. You may want to work with other management team members in your business who are familiar with the company’s operations or marketing plan in order to fine-tune the plan.

Finally, proofread thoroughly for spelling, grammar, and formatting, enlisting the help of others to act as additional sets of eyes. You may begin to experience burnout from working on the plan for so long and have a need to set it aside for a bit to look at it again with fresh eyes.

6. Nail the Business Plan Presentation

The presentation of the business plan should succinctly highlight the key points outlined above and include additional material that would be helpful to potential investors such as financial information, resumes of key employees, or samples of marketing materials. It can also be beneficial to provide a report on past sales or financial performance and what the business has done to bring it back into positive territory.

Business Planning Process Conclusion

Every entrepreneur dreams of the day their business becomes wildly successful.

But what does that really mean? How do you know whether your idea is worth pursuing?

And how do you stay motivated when things are not going as planned? The answers to these questions can be found in your business plan. This document helps entrepreneurs make better decisions and avoid common pitfalls along the way.

Business plans are dynamic documents that can be revised and presented to different audiences throughout the course of a company’s life. For example, a business may have one plan for its initial investment proposal, another which focuses more on milestones and objectives for the first several years in existence, and yet one more which is used specifically when raising funds.

Business plans are a critical first step for any company looking to attract investors or receive grant money, as they allow a new organization to better convey its potential and business goals to those able to provide financial resources.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink business plan consultants can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Looking for AI in local government? See our newest product, Madison AI.

More Like this

The top 10 strategic planning best practices.

In order to make sure your strategic planning process is a success, it’s best to check out some tips from folks who’ve done it before. In fact, even if you have done it before, it’s still a good idea to review best practices from time to time just to identify areas where you could improve.

Does Your Strategy Suck? Get this Free Guide to Find Out.

Before you get too far into your strategic planning process, check out our top 10 tips below — your quick guide to getting the most out of your strategic planning process:

- Pull together a diverse, yet appropriate, group of people to make up your planning team. Diversity leads to a better strategy. Bring together a small core team — between six and ten people — of leaders and managers who represent every area of the company.

- Allow time for big picture, strategic thinking. We tend to try to squeeze strategic planning discussions in between putting out fires and going on a much needed vacation. But to create a strategic plan, your team needs time to think big. Do whatever it takes to allow that time for big-picture thinking (including taking your team off-site).

- Get full commitment from key people in your organization. You can’t do it alone. If your team doesn’t buy into the planning process and the resulting strategic plan, you’re dead in the water.

- Allow for open and free discussion regardless of each person’s position within the organization. (This tip includes you — the CEO.) Don’t lead the planning sessions. Hire an outside facilitator, someone who doesn’t have any stake in your success. When you do, people wonder whether you’re trying to lead them down the path you wanted all along. Encourage active participation, but don’t let any one person dominate the session.

- Think about execution before you start. It doesn’t matter how good the plan is if it isn’t executed.

- Use a facilitator, if your budget allows . Hire a trained professional who has no emotional investment in the outcome of the plan. An impartial third party can concentrate on the process instead of the end result and can ask the tough questions that others may fear to ask.

- Make your plan actionable. To have any chance at implementation, the plan must clearly articulate goals, action steps, responsibilities, accountability, and specific deadlines. And everyone must understand the plan and their role in it.

- Don’t write your plan in stone. Good strategic plans are fluid, not rigid and unbending. They allow you to adapt to changes in the marketplace. Don’t be afraid to change your plan as necessary.

- Clearly articulate next steps after every session. Before closing the strategic planning session, clearly explain what comes next and who’s responsible for what. When you walk out of the room, everyone must fully understand what they’re responsible for and when to meet deadlines.

- Make strategy a habit, not just a retreat. Review the strategic plan for performance achievement no less than quarterly and as often as monthly or weekly. Focus on accountability for results and have clear and compelling consequences for unapproved missed deadlines.

Thanks, helpful to review others successes.

very helpful and practical

Comments Cancel

Join 60,000 other leaders engaged in transforming their organizations., subscribe to get the latest agile strategy best practices, free guides, case studies, and videos in your inbox every week..

Leading strategy? Join our FREE community.

Become a member of the chief strategy officer collaborative..

Free monthly sessions and exclusive content.

Do you want to 2x your impact.

Table of Contents

How to make a business plan

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

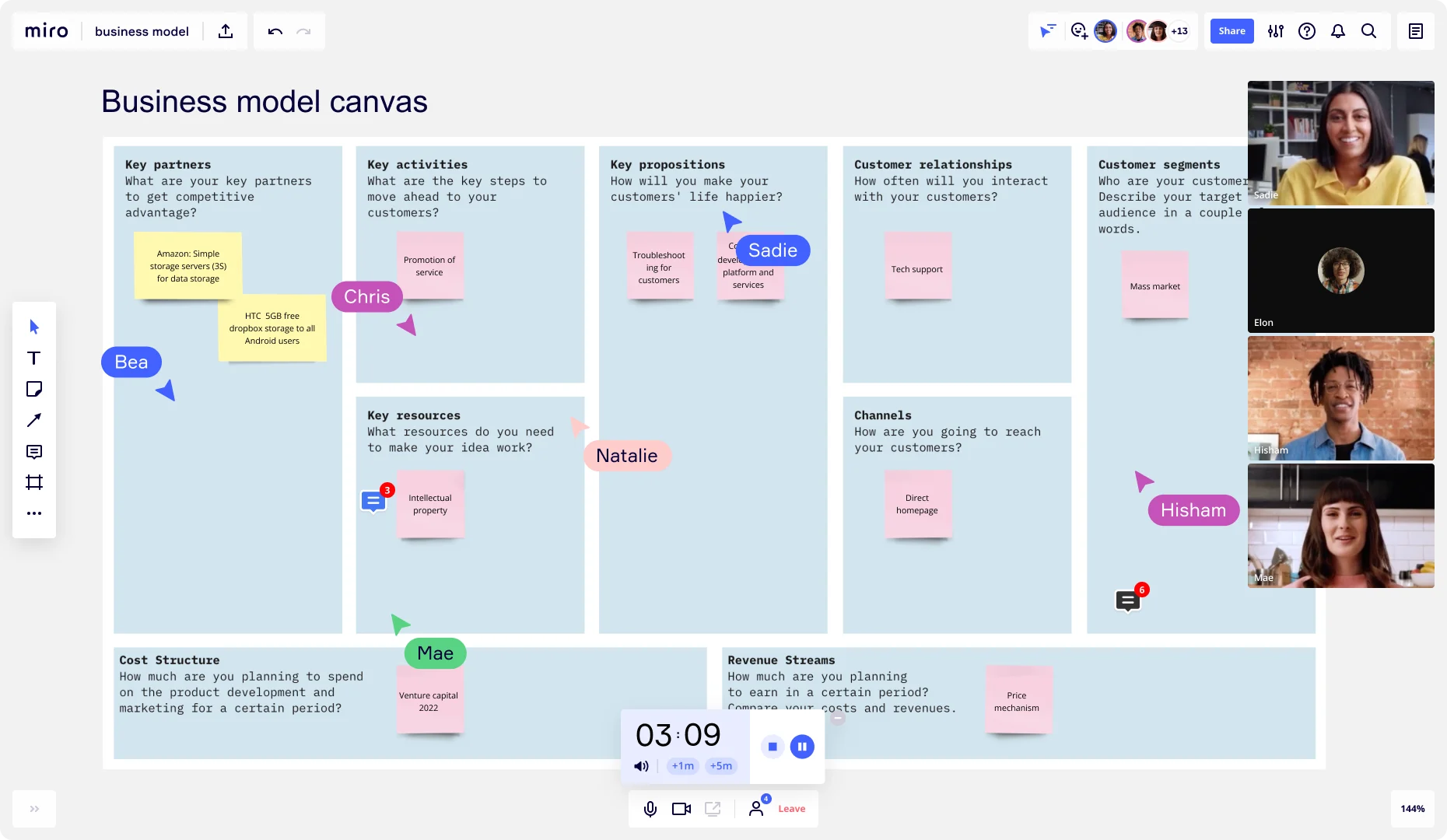

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Plans and pricing.

- Certifications

- Associate Business Strategy Professional

- Senior Business Strategy Professional

- Examination

- Partnership

- For Academic Affiliation

- For Training Companies

- For Corporates

- Help Center

- Associate Business Strategy Professional (ABSP™)

- Senior Business Strategy Professional (SBSP™)

- Certification Process

- TSI Certification Examination

- Get your Institution TSI Affiliated

- Become a Corporate Education Partner

- Become a Strategy Educator

- Frequently Asked Questions

7 Key Strategic Planning Skills for Business Success

Deft strategic planning confers a sizable competitive advantage by sharpening enterprise focus, revealing blindspots early, and seamlessly aligning organization-wide efforts towards shared goals. Thus, honing strategic plan thinking capabilities becomes pivotal for leaders charting ambitious growth trajectories.

This blog covers why strategic planning matters, which underlying competencies it demands, and how professionals can systematically strengthen strategic acumen, steering their firms to unprecedented heights.

Why Does Strategic Planning Matter?

Strategic planning is a critical process that helps organizations define ambitious yet achievable long-term goals and lay out step-by-step roadmaps to reach them. It provides immense value in several key ways:

- Channels Energy Towards Key Goals Strategic planning brings a sharp focus on the handful of make-or-break goals that matter most for an organization’s success. This prevents resources and efforts from getting diffused across less impactful peripheral initiatives that merely seem urgent. Strategic planning sets apart the vital few from the trivial many.

- Anticipates Emerging Risks and Opportunities By mandating that strategy designers envision potential scenarios - both positive and negative - strategic planning builds organizational agility and resilience. It prompts proactive identification of looming threats that may require contingency planning. Similarly, it reveals openings for first-mover advantage through breakthrough initiatives in adjacent spaces.

- Ensures Organization-wide Alignment By transparently communicating enterprise-wide priorities identified through systematic strategic planning, organizations resolve departmental misalignments where siloed units may otherwise work at cross purposes. It brings coherence to collective efforts.

- Enables Course Corrections The regular reviews and progress tracking processes inherent in strategic planning cycles allow organizations to rapidly detect early signals when realities deviate materially from projections. This allows timely course corrections through informed pivots, saving precious time and resources. Meticulous strategic planning ensures budgetary, talent, and operational capabilities get efficiently channeled towards differentiated goals and minimize waste. Pitfalls like over-investing in non-core activities or duplicative competing efforts are averted through judicious allocation.

- Attracts Top Talent By boldly articulating an ambitious vision for the future, organizations inspire both current and prospective talent. Employees feel pride in contributing to outsized goals and team bonds while overcoming shared challenges. An aura of pioneering spirit retention and recruitment. In summary, separating hype from reality, strategic planning confers durable competitive strength to firms intentionally building this organizational capability. It is no panacea but ignored at one’s own peril. With disciplined adherence to its tenets and principles, business strategy unlocks immense latent potential for teams aligned around inspirational goals empowering their future.

What Competencies Shape Strategic Planning Excellence?

While different models exist, several fundamental capabilities remain vital for any successful strategic planning approach. Mastering these multidimensional strategic planning skills separates mediocre incrementalists from transformational strategic thinkers driving enduring growth.

Diagnostic Acumen

Strategic leaders boast the perceptiveness to read weak signals within steady trends and see early warnings of impending changes ahead of peers. Key aspects include:

- Subtle Pattern Spotting - Identify nuanced inflections in contextual factors from subtle cues. This allows for an accurate assessment of situational dynamics.

- Transition Sensing - Spot transitions from one maturity stage to another in the market lifecycle curve by analyzing business growth patterns.

- Opportunities/Threats Detection - Uncover latent niche opportunities or existential threats in the longer term from seemingly random data points today.

Systems Thinking

Top strategic thinkers conceptually connect disparate dots, creatively configuring them into ambitious yet viable future systems displaying seasoned judgment.

- Future Conceptualization - Design structured goal scenarios expanding capabilities balancing realism with idealism avoiding incrementalism.

- Inspirational Visioning - Portray desired future states vividly, appealing at emotional levels to rally collective spirit.

- Contingency Planning - Codify crisis response protocols for extreme scenarios, from wild card events to liquidity crunches.

Change Leadership

Beyond technical analysis, strategic leaders leverage political and cultural change management savvy to drive transformation.

- Stakeholder Alignment - Overcome resistance by appealing to the interests/values of influencers and securing requisite buy-in.

- Motivational Communication - Share reality while restoring hope, conveying authentic confidence in the collective capacity to prevail against challenges.

- Sustained Commitment - Remain resilient in adherence to strategic direction without wavering or diffusion during uncertainty typical of transitions.

Flawless Alignment

Ensuring strategic priorities in shared goals cascade down enterprises simplified into specific accountabilities prevents disjointed efforts.

- Goals Breakdown - Granularly decompose top-level goals into departmental, team, and individual OKRs enterprise-wide.

- Conflict Resolution - Foster harmony across functions by jointly resolving differences that hinder cross-departmental collaboration.

- Interdependence Identification - Intentionally structure workflows by identifying touchpoints demanding enterprise-wide synchronization.

Results Orientation

Instilling zeal for surpassing existing standards avoids complacency, while progress bars continually elevate as organizations evolve capabilities over time.

- Stretch Metrics - Institutionalize a chronic sense of constructive discontent with the status quo fueled by hunger for ambitious stretch goals.

- Ruthless Prioritization - Maintain unwavering focus on outcomes without distraction by peripheral matters or pet initiatives.

- Virtuous Progression - Raise performance bars as competencies strengthen in perpetuity while celebrating small wins, shaping a culture of excellence.

Together, these diverse but symbiotic capabilities make for strategic planning proficiency at scale, distinguishing outperforming entities. While ingrained early in childhood, components can be systematically nurtured later through dedicated grooming.

7 Ways Professionals Can Level Up Strategic Planning Skills

For both individuals and organizations seeking strategic planning elevation, the following are 7 actionable tactics:

1. Adopt Helicopter Perspectives

Rather than getting mired in granular everyday details, consciously zoom out to spot emerging sector patterns promising first-mover advantages or reductionist tactics missing the big picture.

- Carve out contemplation time pondering existential questions facing business.

- Debate strategy priorities with thought leaders beyond usual peer circles.

- Map core assumptions driving decisions and stress test them.

2. Learn Proven Frameworks

While no formulaic solutions exist in strategy, time-tested models provide guardrails for avoiding previous pitfalls.

- Master renowned foundations like Porter’s 5 Forces , SWOT , PESTEL, etc.

- Audit past successful and failed initiatives, discerning differentiating factors.

- Enroll in formal strategy programs offered by leading faculties.

3. Sharpen Analytical Capabilities

Help cohorts sift signals from noise by honing fact-based evaluation proficiency.

- Take courses elevating statistical analysis, financial modeling, and data science skills.

- Take up puzzles and participate in case competitions, building cognitive muscles.

- Take up advisory roles guiding strategy for early-stage ventures.

4. Design Scenarios Exhaustively

Stress test growth plans by charting scenarios spanning best, worst, and most likely cases given identifiable conditions.

- Use techniques like simulation modeling to form probabilistic assumptions.

- Red team proposed ideas of having contrarians poke holes, unearthing hidden flaws.

- Benchmark against analog contexts where similar plays unfolded successfully or flopped.

5. Secure Alignment Nimble Execution

Foster coherence across layers via transparent communications while empowering teams executing plans through distributed authority.

- Cascade goals into specific accountabilities across the hierarchy, preventing diffusion.

- Equip frontline colleagues closest to market realities with autonomy, taking decisive actions.

- Encourage surfacing deviations from projections quickly without fear of repercussions.

6. Plan For Pivots

In dynamic times, planning must evolve from rigid roadmaps to flexible playbooks deftly adapting momentum.

- Build contingency responses for high-impact scenarios rather than dismiss them as improbable.

- Accept key assumptions will be invalidated and represent temporary best knowledge.

- Maintain war chests, allowing capitalization should breakthrough opportunities arise.

7. Instill Accountability

Celebrate milestones met by linking progress to formal incentives and informal recognitions, enhancing morale.

- Quantify contributions via OKR goal fulfillment over relativistic model rewards.

- Share stories of teams overcoming setbacks through grit rather than glory for successes alone.

- Discuss missteps openly as learnings without ascribing blame.

Combined, such steps ingrain strategic planning excellence at individual and organizational levels, promising prudent vision setting and flawless execution.

The capacity to formulate robust strategies and align collective efforts toward ambitious targets represents an invaluable capability conferring market leadership. By studying concepts, shaping strategy, honing supporting skill sets, and applying learnings through guided practice, professionals unlock coveted strategic planning mastery, elevating their leadership impact and accelerating their ascent up organizational ladders.

Recent Posts

How Data Analytics Can Revolutionize Your Business - A Strategist's Guide

Download this Strategist's Guide to empower yourself with resourceful insights:

- Roadblocks to Data Usage

- Advantages that Data Analytics offer for businesses

- Elements of a Data Analytics Strategy

- Top reasons why businesses must adopt a Data Analytics Strategy

- Case studies, Scenarios, and more

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Verify A Credential

Please enter the License Number/Unique Credential Code of the certificant. Results will be displayed if the person holds an active credential from TSI.

Stay Informed!

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.

Start Your Journey with The Strategy Institute by Creating Your myTSI Account Today.

- Manage your professional profile conveniently.

- Manage your credentials anytime.

- Share your experiences and ideas with The Strategy Institute.

Account Login

- Remember Password

- Forgot Password?

Forgot Password

Organizational Planning Guide: Types of Plans, Steps, and Examples

Organizational planning is like charting your company’s path on a map. You need to know what direction you’re headed to stay competitive.

But what exactly is organizational planning and how do you do it effectively? This guide will cover:

The Different Components or Types of Organizational Plans?

The 5 Process Steps of Organizational Planning

Organizational planning examples.

Organizational Planning Tools

What is Organizational Planning?

Organizational planning is the process of defining a company’s reason for existing, setting goals aimed at realizing full potential, and creating increasingly discrete tasks to meet those goals.

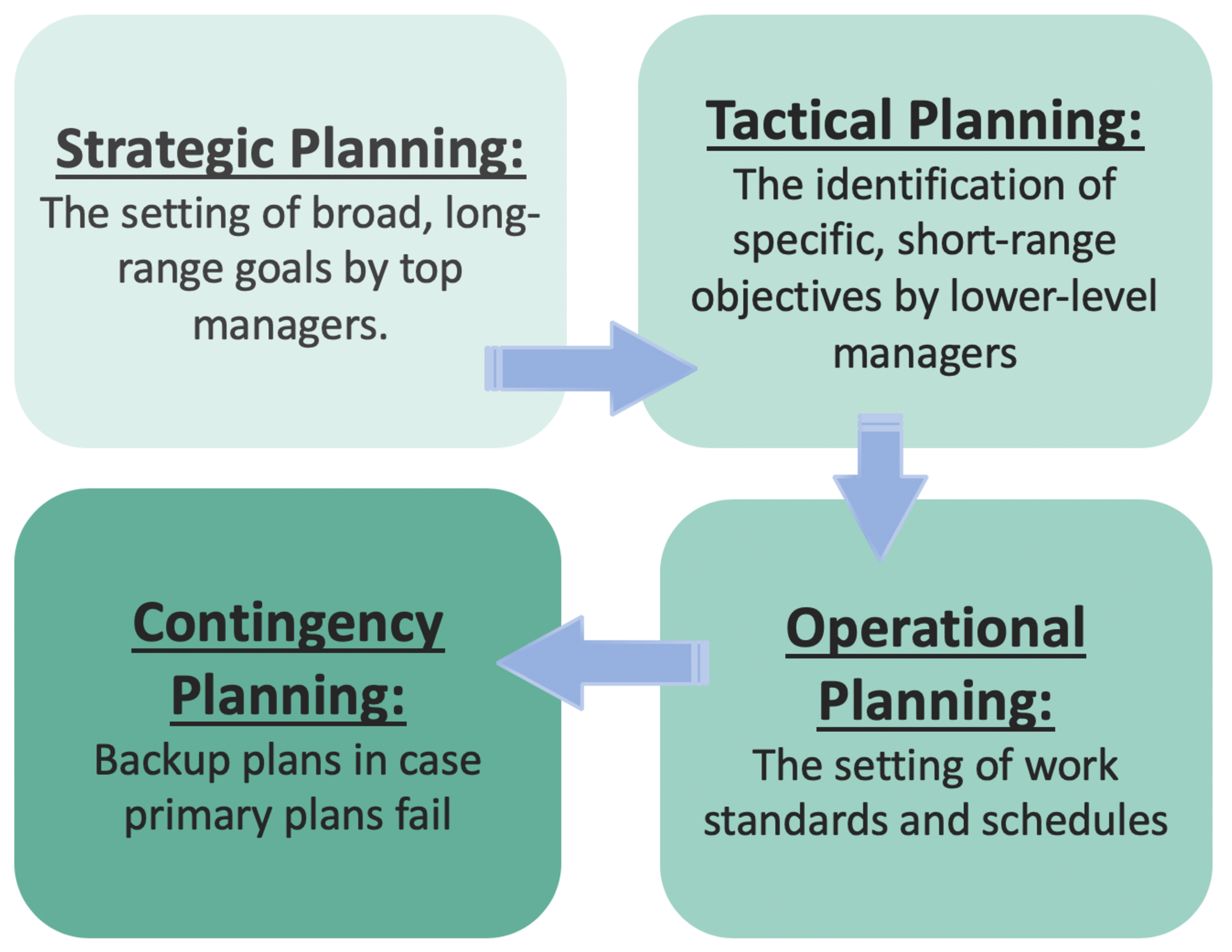

Each phase of planning is a subset of the prior, with strategic planning being the foremost

There are four phases of a proper organizational plan: strategic, tactical, operational, and contingency. Each phase of planning is a subset of the prior, with strategic planning being the foremost.

Types of Organizational Planning

A strategic plan is the company’s big picture. It defines the company’s goals for a set period of time, whether that’s one year or ten, and ensures that those goals align with the company’s mission, vision, and values. Strategic planning usually involves top managers, although some smaller companies choose to bring all of their employees along when defining their mission, vision, and values.

The tactical strategy describes how a company will implement its strategic plan. A tactical plan is composed of several short-term goals, typically carried out within one year, that support the strategic plan. Generally, it’s the responsibility of middle managers to set and oversee tactical strategies, like planning and executing a marketing campaign.

Operational

Operational plans encompass what needs to happen continually, on a day-to-day basis, in order to execute tactical plans. Operational plans could include work schedules, policies, rules, or regulations that set standards for employees, as well as specific task assignments that relate to goals within the tactical strategy, such as a protocol for documenting and addressing work absences.

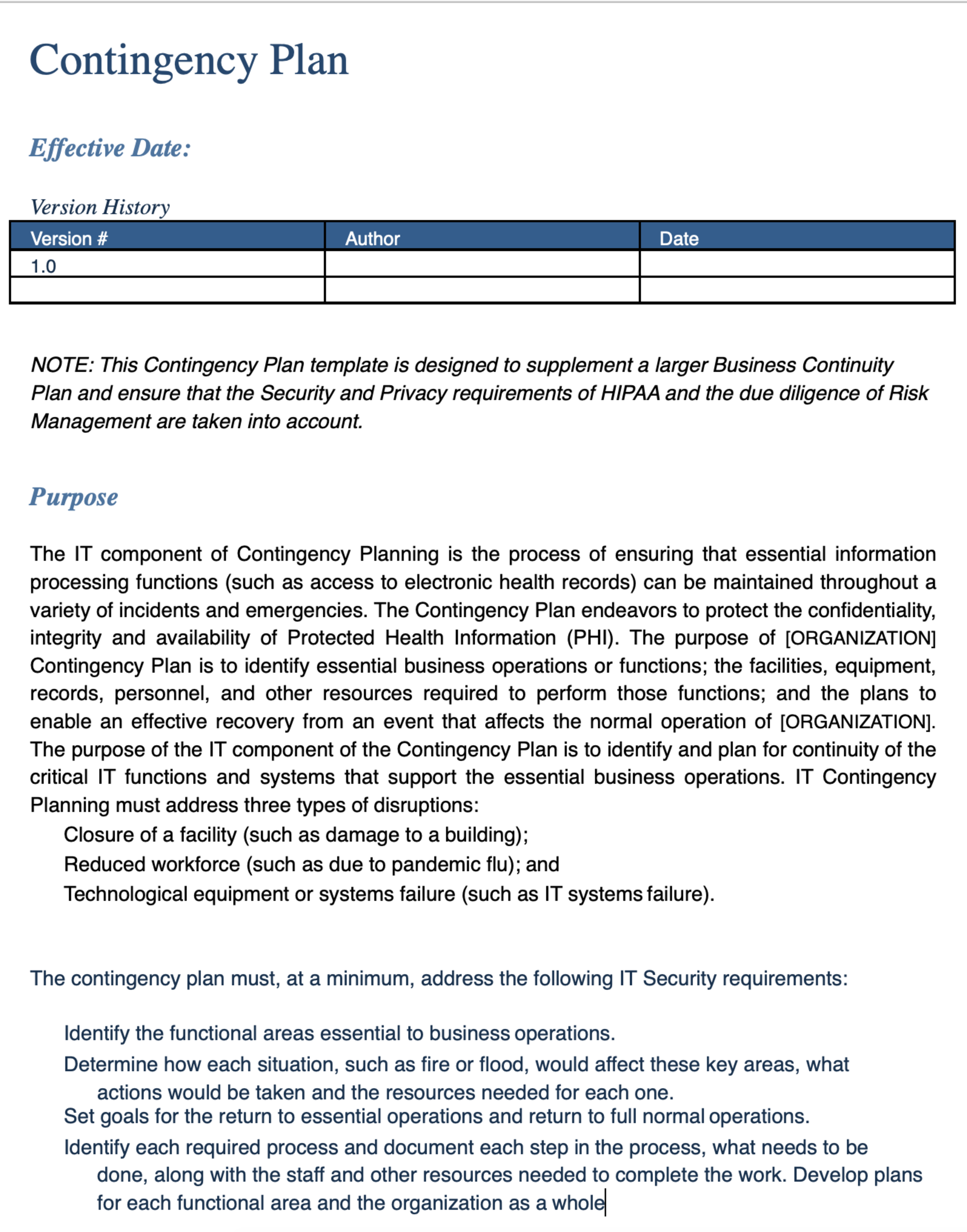

Contingency

Contingency plans wait in the wings in case of a crisis or unforeseen event. Contingency plans cover a range of possible scenarios and appropriate responses for issues varying from personnel planning to advanced preparation for outside occurrences that could negatively impact the business. Companies may have contingency plans for things like how to respond to a natural disaster, malfunctioning software, or the sudden departure of a C-level executive.

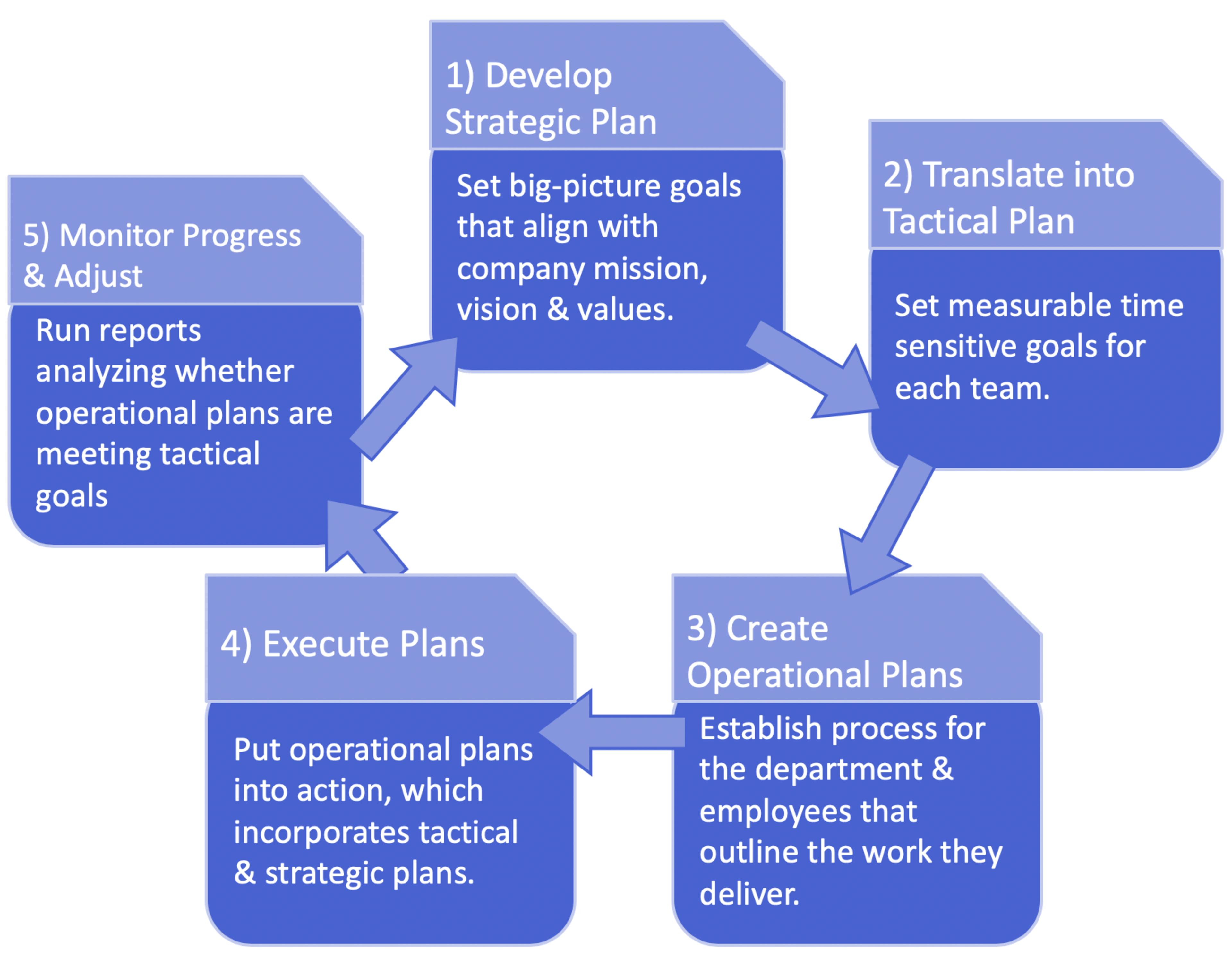

The organizational planning process includes five phases that, ideally, form a cycle.

Strategic, tactical, operational, and contingency planning fall within these five stages.

1. Develop the strategic plan

Steps in this initial stage include:

Review your mission, vision, and values

Gather data about your company, like performance-indicating metrics from your sales department

Perform a SWOT analysis; take stock of your company’s strengths, weaknesses, opportunities, and threats

Set big picture goals that take your mission, vision, values, data, and SWOT analysis into account

2. Translate the strategic plan into tactical steps

At this point, it’s time to create tactical plans. Bring in middle managers to help do the following:

Define short-term goals—quarterly goals are common—that support the strategic plan for each department, such as setting a quota for the sales team so the company can meet its strategic revenue goal

Develop processes for reviewing goal achievement to make sure strategic and tactical goals are being met, like running a CRM report every quarter and submitting it to the Chief Revenue Officer to check that the sales department is hitting its quota

Develop contingency plans, like what to do in case the sales team’s CRM malfunctions or there’s a data breach

3. Plan daily operations

Operational plans, or the processes that determine how individual employees spend their day, are largely the responsibility of middle managers and the employees that report to them. For example, the process that a sales rep follows to find, nurture, and convert a lead into a customer is an operational plan. Work schedules, customer service workflows, or GDPR policies that protect prospective customers’ information all aid a sales department in reaching its tactical goal—in this case, a sales quota—so they fall under the umbrella of operational plans.

This stage should include setting goals and targets that individual employees should hit during a set period.

Managers may choose to set some plans, such as work schedules, themselves. On the other hand, individual tasks that make up a sales plan may require the input of the entire team. This stage should also include setting goals and targets that individual employees should hit during a set period.

4. Execute the plans

It’s time to put plans into action. Theoretically, activities carried out on a day-to-day basis (defined by the operational plan) should help reach tactical goals, which in turn supports the overall strategic plan.

5. Monitor progress and adjust plans

No plan is complete without periods of reflection and adjustment. At the end of each quarter or the short-term goal period, middle managers should review whether or not they hit the benchmarks established in step two, then submit data-backed reports to C-level executives. For example, this is when the manager of the sales department would run a report analyzing whether or not a new process for managing the sales pipeline helped the team reach its quota. A marketing team, on the other hand, might analyze whether or not their efforts to optimize advertising and landing pages succeeded in generating a certain number of leads for the sales department.

Depending on the outcome of those reviews, your org may wish to adjust parts of its strategic, tactical, or operational plans. For example, if the sales team didn’t meet their quota their manager may decide to make changes to their sales pipeline operational plan.

These templates and examples can help you start thinking about how to format your organizational plan.

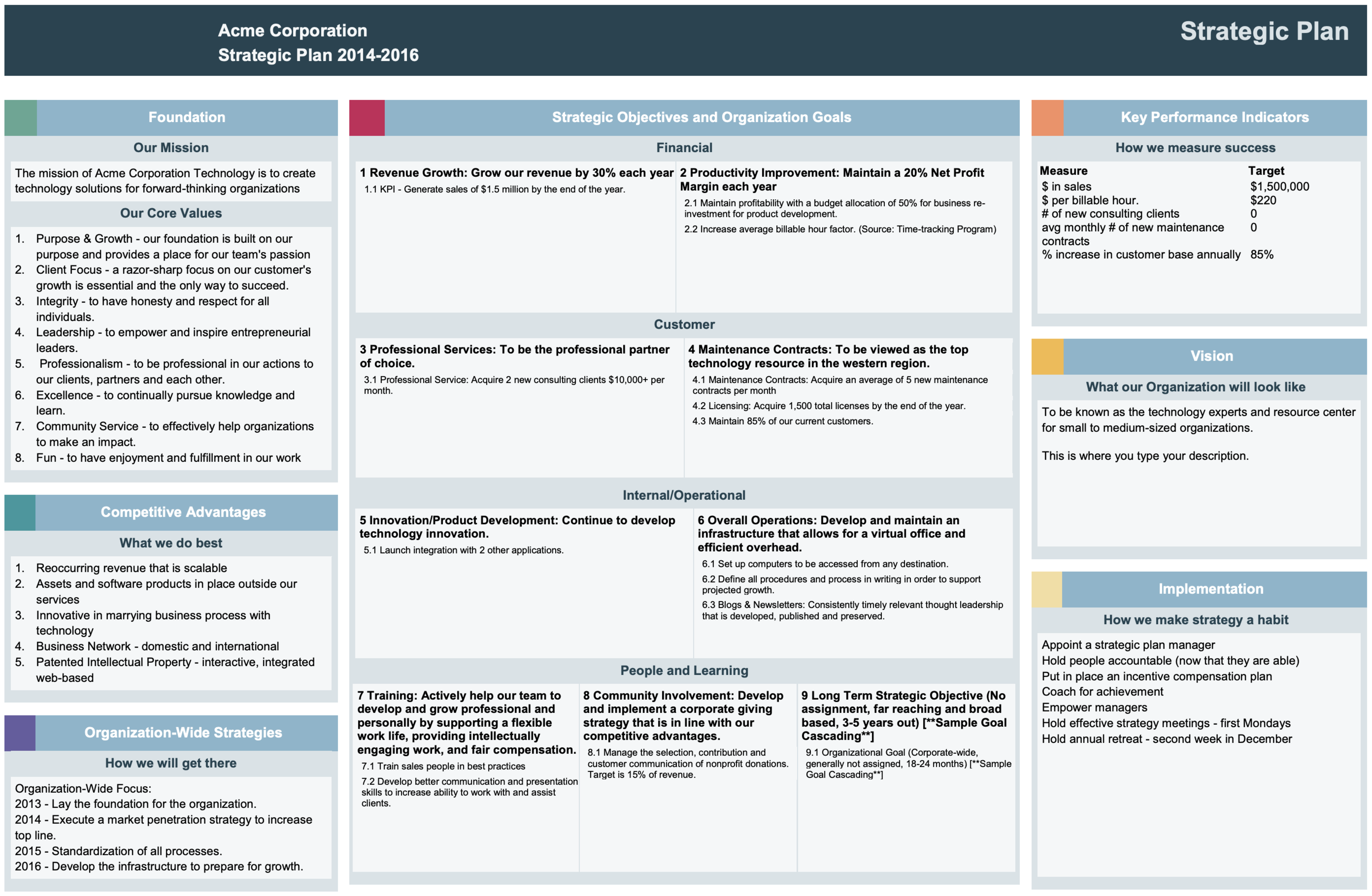

This is a single page two-year strategic plan for a fictional corporation. Notice that the goals listed in the “Strategic Objectives and Organization Goals” section follow the SMART goals model: They’re specific, measurable, actionable, relevant, and time-based.

Workforce Planning

Companies need to use workforce planning to analyze, forecast, and plan for the future of their personnel. Workforce planning helps identify skill gaps, inefficiencies, opportunities for employee growth, and to prepare for future staffing needs.

Use Pingboard as a tool to plan and unite your workforce. Start today for free !

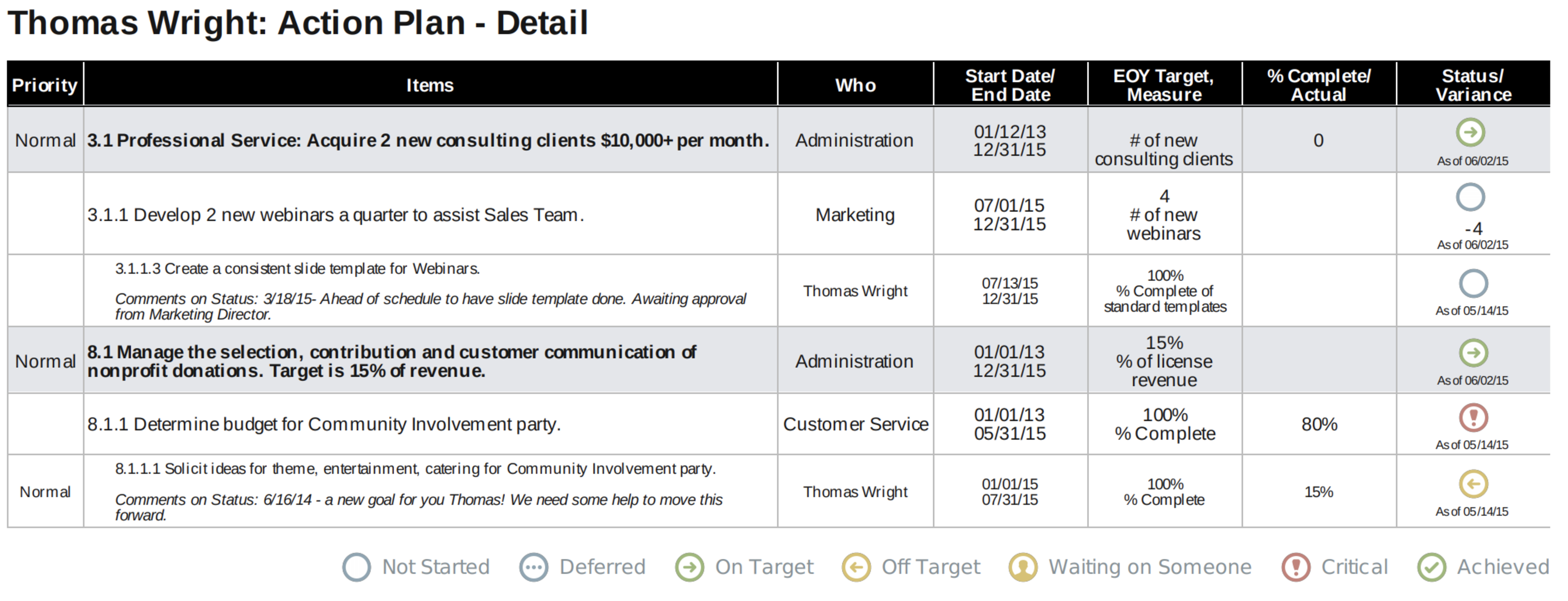

This is a two-year action plan for an administration, which could also be described as a tactical plan. Organization-wide goals—aka strategic goals—that are relevant to this department are listed in the top section, while the more tactical goals for the manager of this department are listed below.

Check out this strategic plan template . You’ll notice that tasks for an individual employee fall under operational planning. Note the space within each item for the manager to leave feedback for the employee.

Organizational Planning is Vital for a Successful Business

While organizational planning is a long and complex process, it’s integral to the success of your company. Luckily, the process becomes more automatic and intuitive with regular planning and review meetings.

Use Pingboard’s org chart software to help you plan and communicate your strategy. With Pingboard users can build and share multiple versions of their org chart to help with succession plans, organization redesigns, merger and acquisitions plans. Pingboard also helps with hiring plans by allowing you to communicate open roles in your live org chart so employees understand where their company is growing and what roles they can apply for. Pingboard’s employee directory helps find successors for specific roles by allowing managers to search through their workforce for the skills and experience needed to fill a position.

Start planning today – risk free!

Connect your people now with Pingboard

You might also like....

Sign up for a free trial today

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

- Why crowdspring

- Trust and Security

- Case Studies

- How it Works

- Want more revenue? Discover the power of good design.

- Brand Identity

- Entrepreneurship

- Small Business

10 Game-Changing Tips for Crafting an Unbeatable Business Plan

Will your business idea succeed? Take our quiz - completely confidential and free!

Whether you’re starting your first business or a seasoned entrepreneur, a solid business plan is the foundation for success. It can help you anticipate essential issues and challenges before you start your business.

Studies show that entrepreneurs who take the time to write a business plan are 2.5 times more likely to follow through and get their business off the ground.

With over two decades of experience as an entrepreneur, I’ve crafted or assisted in developing business plans for countless startups and small businesses. From traditional 100-page plans to concise one-page strategies, my business plans have secured millions of dollars from investors. As a mentor, I’ve guided thousands of entrepreneurs in the U.S. and across the globe, helping them establish, manage, and expand their businesses.

Over the past three decades, I’ve tackled countless challenges in building successful businesses. In this guide, I share my experience, insights, and best practices for crafting traditional and one-page business plans.

What is a business plan, and why does it matter?

What is a business plan.

A business plan is a vital strategic tool that outlines a company's goals, strategies, and resources required to achieve those goals. It is essentially a blueprint for the future of the business, providing detailed plans in areas such as marketing, finance, operations, and management.

How can a business plan help you?

A well-crafted business plan provides clarity and direction for your team and helps attract potential investors by showcasing the viability and growth potential of the business. Furthermore, it helps identify potential risks and provides a roadmap for mitigating them.

A business plan can help you in the following ways:

- Clarity of vision. A well-crafted business plan serves as a roadmap, providing clear direction for the business. For instance, an organic skincare brand can use a business plan to detail how it will source ethically-produced ingredients and establish partnerships with eco-conscious retailers. A tech startup may use its business plan to illustrate the development pathway of its revolutionary app, from prototyping to market launch.

- Mitigating risks. Business plans can identify potential risks and provide strategies to reduce them through a risk management process . A restaurant, for instance, can outline risks such as food safety concerns or fluctuating food prices and propose risk management strategies. Meanwhile, a manufacturing company can use its business plan to address potential supply chain disruptions or machinery breakdowns and outline contingency plans.

- Attracting investors. Business plans can be invaluable tools for attracting investment. For example, a biotech firm might detail its innovative research and projected market share to attract investors. On the other hand, a sustainable fashion brand can highlight its unique business model and commitment to ethical practices to attract socially responsible investors.

- Strategic planning. A business plan is essential for strategic planning. A digital marketing agency, for instance, can outline its strategies for acquiring new clients and retaining current ones. Similarly, a logistics company could use its business plan to strategize about optimizing routes and improving delivery efficiency.

- Performance monitoring. Business plans can be used as benchmarks to monitor the company’s performance. For example, a fitness studio might have membership growth and retention targets, which can be tracked against the business plan. A retail business could similarly set sales targets for each product line and compare actual sales to projections in the plan.

In this article, we will distill the key concepts from our comprehensive guide on how to write a business plan . However, we strongly recommend you read the complete guide to gain an in-depth understanding and effectively tailor a plan to your unique business needs.

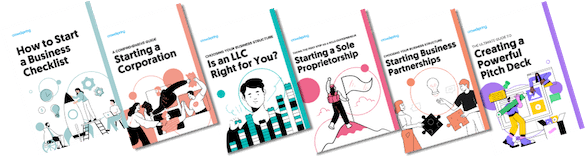

Free Business Startup Kit

Receive six actionable guides, including a how to start a business checklist, detailed comparisons of LLCs, corporations, sole proprietorships, and partnerships to determine the best fit for your business, plus insights on crafting a compelling pitch deck to attract investors.

- How to Start a Business Checklist

- Starting a Corporation Guide

- Is an LLC Right for You?

- Starting a Sole Proprietorship

- Starting Business Partnerships

- Creating a Powerful Pitch Deck

Ten business plan types

Although most people think there’s only one type of business plan, this isn’t accurate. Businesses have different needs, and some require specialized business plan types. Here are some common types:

Mini business plans. These are short, concise plans that provide a high-level overview of a business. For a consultancy firm, a mini-plan could quickly outline services, target clients, and revenue streams.

Working plans. These are more detailed and include operational information. A retail store might use a working plan to detail its inventory management, supply chain logistics, and day-to-day operations.

Presentation plans are formal business plans that are presented to outsiders like investors or banks. A tech startup seeking venture capital would likely prepare a presentation plan emphasizing market potential and growth strategy.

Growth plans. These plans are for businesses that intend to scale. An e-commerce platform planning to expand its market might use a growth plan to chart out customer acquisition strategies and operational scalability.

Feasibility plans. These plans are used to determine if a business idea is worth pursuing. A restaurant chain looking to introduce a new menu item could create a feasibility plan to analyze cost, demand, and potential return.

Operations plans. These focus on the logistics of running a business. A manufacturing company could use an operations plan to detail production processes, equipment maintenance, and quality control measures.

Strategic plans. These provide an overview of a company’s strategy and how it plans to achieve its goals. A digital marketing agency might use a strategic plan to set client acquisition and retention targets and outline strategies to meet those targets.

Internal plans. These are designed for internal use to track the implementation of a strategy or project. An events management company could use an internal plan to track progress on organizing a major conference, detailing tasks, responsibilities, and timelines.

Lean startup plans. These are high-level summaries of your business strategy, often used by startups. A software development company might use a lean startup plan to summarize its business model, target customer segments, and key performance indicators (KPIs).

Exit plans. These outline a business’s strategy for exiting the market, usually through a sale, merger, or IPO. A health tech startup could have an exit plan detailing potential paths, such as acquisition by a larger company or an IPO.

How to develop a business plan and the six sections every plan needs

A traditional business plan has six sections. You might need to add other sections depending on your business and industry. But be sure you include at least the six sections we list below:

1. Executive summary

The Executive Summary is the first section of your business plan, but you should write it last. It’s a concise overview of your plan, covering the critical points in a high-level snapshot.

For example, a food delivery service’s executive summary might highlight the unique selling proposition of delivering locally sourced, organic meals. A tech startup, on the other hand, might emphasize its innovative AI-powered product that disrupts current market practices.

2. The opportunity

This section describes the problem your business solves or the need it fulfills. It should detail your target market and explain why your solution is uniquely positioned to address the problem.

For instance, a biotech firm might discuss the opportunity to develop a new drug to treat a prevalent health condition. Meanwhile, a children’s educational toy company might highlight the need for entertaining and cognitively stimulating toys for children’s development.

3. Marketing and sales plan

You outline your strategies for reaching your target audience and driving sales here. This can include pricing, promotion, distribution, and sales strategies.

A retail clothing store, for example, might focus on social media marketing and host pop-up events in trendy neighborhoods. A B2B software company might emphasize inbound marketing through content creation and a direct sales model targeting specific industries. It’s also essential to deliberate on whether or not to put your prices on your website .

4. The management team and company

This section presents your team’s qualifications and your company’s organizational structure. Highlight the skills and experience that each team member brings.

A fintech startup can emphasize its founders’ expertise in tech and finance. On the other hand, a restaurant should spotlight its team’s culinary and hospitality expertise.

5. Financial plan

The Financial Plan provides detailed projections of your business’s revenue, expenses, and profitability. It also outlines your funding requirements and how you plan to use the funds.

An e-commerce startup should present sales forecasts based on website traffic and conversion rates. A real estate development company could outline projected property sales and rental revenue.

6. Appendix

The Appendix contains supporting documents or additional information not included in the main body of the plan. This could include product photos, legal documents, or detailed market research.

For a manufacturing company, you could include product specifications or patent documentation. A service-based business like a consulting firm could include case studies demonstrating past success so that you can quickly show prospective investors supporting documents reinforcing the likelihood your business will succeed.

With a clear understanding of the traditional components of a business plan, let’s look at the process of constructing your plan. Here are ten crucial principles to guide you in crafting a business plan that fulfills its intended purpose and is a valuable reference in future years.

10 Tips for Crafting an Unbeatable Business Plan

Tip 1: Keep it simple and focused Tip 2: Conduct thorough market research Tip 3: Set realistic financial projections Tip 4: Define your operational processes Tip 5: Create a strong marketing plan Tip 6: Address legal and regulatory considerations Tip 7: Develop a financial plan Tip 8: Establish a marketing strategy Tip 9: Plan for scalability and growth Tip 10: Include an exit strategy

Here are ten proven tips to help you write a great business plan:

Tip 1: Keep it simple and focused

People are busy. Few read 50-page business plans. Even fewer read 100-page business plans. Most will read only the high-level executive summary and flip through other sections of your business plan.

A business plan doesn’t have to be complicated. Keep it simple, clear, and focused on your goals. Use readable fonts and a clean layout.

Your plan is a roadmap to guide your business, so make sure it’s easy to understand and follow.

Remember, you’re not reinventing the wheel here. For example, you can get a free business plan template for a traditional business plan and a one-page business plan .

And remember that there’s no universal business plan format. Use examples to compare what you like and don’t like, look at each plan’s business and revenue models, and build a business plan following the best practices you find in the example plans you read.

Pay special attention to executive summaries.

The executive summary of a business plan is designed to capture the reader’s attention and briefly explain your business, the problem you are solving, the target market, and critical financial projections. You can also include a brief mission statement in the summary.

If the executive summary lacks specific information or does not capture the reader’s attention, the rest of the plan might not be read.

If your executive summary is strong, you increase the prospects of having a further conversation with a potential investor or partner to make your pitch in person. So,

- Write the executive summary after you have written the rest of the business plan. This will allow you to summarize the larger details quickly.

- Keep it short. Include the essential steps with as little extra language as possible. Your goal is to excite the reader to read all the specific details in your business plan.

- Organize the executive summary based on the most vital points.

- Don’t talk about your management team’s passion for hard work. These qualities are the minimum shared by all entrepreneurs.

- Don’t say you will be the next Facebook, Uber , or Amazon. Amateurs make this comparison to try and show how valuable their company could be. Instead, in your mission statement and business plan copy, focus on providing facts proving you have a strong company. It’s better if the investor gives you this accolade because they see the opportunity.

Here are five examples of how to keep focus and clarity when writing your business plan:

Example 1: Retail Clothing Store. A retail clothing store’s business plan should focus on its target market, the types of products it will offer, and its strategies for attracting customers. The plan should outline store location, pricing strategy, and merchandising techniques. Additionally, it should address seasonality and inventory management to ensure a balanced product offering throughout the year.

Example 2: E-commerce Business Selling Handmade Crafts. An e-commerce business selling handmade crafts should outline its product offerings, target audience , and marketing strategies for driving online traffic and sales. The plan must address shipping and fulfillment logistics, customer service policies, and procedures for dealing with returns and exchanges. Also, it should cover how the company will scale production to meet increased demand.

Example 3: Mobile App Development Company. A mobile app development company’s business plan should focus on the types of apps it specializes in, its target clientele, and its approach to app development and project management. The plan should outline the company’s pricing model, strategies for attracting clients, and methods for staying up-to-date with industry trends and technological advancements.

Example 4: Event Planning Agency. An event planning agency should focus its business plan on the types of events it specializes in (e.g., wedding planning , corporate events, nonprofit events ), its target market, and its approach to event management. The plan should outline the agency’s marketing and networking strategies, as well as its vendor relationships and strategies for managing event logistics, budgets, and client expectations.

Example 5: Boutique Fitness Studio. A boutique fitness studio’s business plan should focus on its fitness niche (e.g., yoga, pilates), target market, and strategies for attracting and retaining clients. The plan should outline the studio’s class offerings, membership options, and pricing strategy. Additionally, it should address instructor recruitment and training, facility management, and strategies for maintaining a positive and engaging studio atmosphere.

Tip 2: Conduct thorough market research

Market research is vital for understanding your industry, target audience, and competition. Gather market size, trends, and consumer preferences data for business decisions.

Don’t mess around – research everything thoroughly.

If you are launching a new business and expect to be the market leader in 2 years, you must demonstrate why this is possible and how you’ll meet this goal.

If you say your product will be viral , you must support this statement with facts.

If you say your management team is experienced and qualified to help the business succeed, you have to support that claim with resumes that demonstrate the experience of your team members.

It’s easy to lose credibility – and investors – if you’re making claims you can’t fully support.

Need specific insights on how to write a great business plan?

Here are five examples of the type of research businesses in different industries must do when writing a business plan:

Example 1: New Restaurant . To identify market gaps and opportunities, a new restaurant should research the local food scene, competitors, and customer preferences. The plan should include an analysis of the area’s demographics, popular cuisine types, and existing restaurants’ strengths and weaknesses. This research will inform menu development, pricing strategy, and overall restaurant concept .

Example 2: Online Tutoring Service. An online tutoring service should analyze the market for similar services, the demand for tutors in various subjects, and the target demographic’s preferences for online learning. The plan should address strategies for attracting tutors, developing a user-friendly platform, and marketing to students and parents. Additionally, it should consider differentiating itself from competitors by offering specialized subject matter expertise or personalized learning plans.

Example 3: Green Cleaning Service. A green cleaning service should research the demand for eco-friendly options, local competitors, and potential customers’ preferences and concerns. The plan should outline the company’s environmental policies, its selection of non-toxic cleaning products, and strategies for marketing its eco-friendly services. Additionally, it should consider potential partnerships with environmentally conscious organizations or businesses.

Example 4: Coworking Space. A coworking space should research the demand for shared office spaces in its target area, the existing supply, and potential customer’s preferences and needs. The plan should address the coworking space’s design, amenities, membership plans, and pricing strategy. It should also outline strategies for attracting and retaining members and potential partnerships with local businesses or networking events to foster a sense of community.

Example 5: Subscription Box Service. A subscription box service should research the market for similar offerings, target customer preferences, and trends in the subscription box industry. The plan should outline the service’s product curation process, packaging design, pricing strategy, and shipping logistics. It should also address marketing strategies to attract and retain subscribers and potential partnerships with influencers or niche communities to grow its customer base.

Tip 3: Set realistic financial projections

Accurate financial projections are crucial for securing funding and managing your business’s growth. Be realistic about your revenue, expenses, and growth potential, and be prepared to adjust your projections as your business evolves.

Here are five examples of the types of financial projections businesses in different industries must make in their business plan:

Example 1: Food Truck Business. A food truck business should create financial projections that account for the initial investment in the truck, equipment, and inventory. The plan should also factor in ongoing expenses such as fuel, permits, insurance, and staffing. Revenue projections should consider the truck’s daily sales, seasonality, and potential catering opportunities.

Example 2: Digital Marketing Agency. A digital marketing agency should create financial projections considering client acquisition costs, retainer fees, and potential project-based revenue. The plan should factor overhead costs such as office space, equipment, and staffing. Projections should also account for the time needed to establish a client base and the potential for fluctuating income based on client retention and project completion.

Example 3: Independent Bookstore. An independent bookstore should create financial projections considering the initial investment in inventory, store fixtures, and leasehold improvements. The plan should also consider ongoing expenses such as rent, utilities, and staffing. Revenue projections should consider the store’s sales, the potential for hosting events, and additional income streams like in-store cafes or merchandise sales.

Example 4: Home-Based Catering Business. A home-based catering business should create financial projections considering the initial kitchen equipment and inventory investment. The plan should also factor in ongoing expenses such as food costs, permits, insurance, and marketing. Revenue projections should consider the number and size of catering events, potential corporate clients, and seasonal demand.

Example 5: Mobile App Startup. A mobile app startup should create financial projections for the initial investment in app development, marketing, and user acquisition. The plan should also factor in ongoing expenses such as app maintenance, updates, and staffing. Revenue projections should consider potential income streams like in-app purchases, advertising, and subscription fees.

Tip 4: Define your operational processes

Clearly outline your business’s operational processes to ensure efficiency and consistency.

Detail how you will manage production, inventory, staffing, and distribution to provide a seamless experience to customers .

Here are five examples of the operational processes businesses in different industries must define in their business plan:

Example 1: Bakery. A bakery should detail its production schedule, inventory management, staff roles, and distribution channels to ensure consistent product availability and quality. The plan should also address strategies for managing seasonal demand, such as offering holiday-themed products or adjusting staffing levels.

Example 2: Software Development Company. A software development company must define its project management processes, team structure, and communication channels to keep projects on track and meet client expectations. The plan should also address strategies for acquiring new clients, such as networking events, online marketing, and strategic partnerships.

Example 3: Real Estate Agency. A real estate agency should outline its processes for listing properties, managing client relationships, and closing transactions. The plan should also address strategies for attracting new clients, such as hosting open houses, utilizing digital marketing, and participating in local community events.

Example 4: Pet Grooming Business. A pet grooming business should detail its grooming process, appointment scheduling, and inventory management to ensure a smooth and efficient customer experience. The plan should also address strategies for attracting new clients, such as offering loyalty programs, partnering with local pet stores or veterinarians, and utilizing social media marketing.

Example 5: Online Coaching Business. An online coaching business should outline its processes for onboarding new clients, delivering coaching sessions, and tracking clients’ progress. The plan should also address strategies for attracting new clients, such as offering free discovery calls, leveraging social media marketing , and creating valuable content like blog posts or webinars.

Tip 5: Create a strong marketing plan

A well-defined marketing plan is crucial for attracting and retaining customers.

Develop a plan that outlines your target audience, competitors, marketing channels, and strategies for promoting your products or services.

Some business owners avoid talking about potential competitors.

This is a mistake.

Unless you’re creating a new industry, you will have competitors. And you’ll need to figure out how to beat or compete with them.

You must do market research to understand your competitors and the industry. A good business plan that carefully lays out this information in a detailed target market analysis appears more credible and will better prepare you for success with your new business.

And potential investors and banks tend to trust business owners more when they see a detailed target market analysis in a business plan and a strategy for finding potential customers. They are more comfortable seeing this level of detail because they will see that the business owner is better prepared to launch their business and make money over the long term.

There are multiple methods for conveying this data, referred to as TAM, SAM, and SOM .

TAM is the Total Addressable Market. This would show investors the yearly revenue opportunity or units sold for your product or service if you achieved 100% of the available market. It’s a quick way to address the potential size of your operating space.

SAM is the Serviceable Addressable Market. You intend to serve this subset of TAM (Total Addressable Market) with your service or product.

SOM is the Serviceable Obtainable Market. This is the subset of SAM (Serviceable Addressable Market) that is realistic to achieve. If you can get your business to meet this goal, you will have succeeded.

Invest some time and effort and do it correctly. A business can’t succeed if the owners don’t understand their industry, target customers, or the competition.

Here are five examples of the ways to focus the marketing plan of your business plan:

Example 1: Specialty Coffee Shop. A specialty coffee shop should develop a marketing plan that targets coffee enthusiasts, local professionals, and students. The plan should leverage social media, local print media, and in-store promotions to showcase its unique offerings, such as artisanal coffee, specialty drinks, and a cozy atmosphere.

Example 2: Graphic Design Studio. A graphic design studio should create a marketing plan that targets local businesses, entrepreneurs, and organizations. The plan should utilize online marketing (e.g., social media, email marketing), networking events, and local partnerships to showcase the studio’s design expertise in creating unique company logos and website design , and attracting new clients.

Example 3: Organic Skin Care Brand. An organic skincare brand should develop a marketing plan that targets eco-conscious consumers and those interested in natural beauty products . The plan should leverage influencer marketing, content marketing, and online advertising to promote the brand’s unique selling points , such as sustainable packaging and ethically sourced ingredients.

Example 4: Fitness Center. A fitness center should create a marketing plan that targets local residents interested in improving their health and wellness. The plan should utilize traditional advertising (e.g., billboards and local radio ads) and digital marketing (e.g., social media and email campaigns ) to promote its membership options, class offerings, and state-of-the-art facilities.

Example 5: Virtual Reality Arcade. A virtual reality arcade should develop a marketing plan that targets gamers, tech enthusiasts, and families looking for unique entertainment options. The plan should utilize online advertising, social media, and local partnerships to showcase the arcade’s cutting-edge technology and immersive gaming experiences.

Tip 6: Address legal and regulatory considerations

Outline any legal and regulatory requirements relevant to your industry, the type of business structure you’ve selected, and how your business will meet these requirements.

Here are five examples of the legal and regulatory requirements businesses in different industries should address in a business plan:

Example 1: Food Truck Business. A food truck business must comply with local health department regulations, obtain necessary permits, and adhere to zoning requirements. The business plan should outline the steps required to obtain the necessary permits and the strategy for ensuring ongoing compliance with health and safety regulations.

Example 2: E-commerce Store. An e-commerce store must navigate various legal considerations, including privacy policies, data protection regulations, and sales tax collection. The business plan should outline how the store will comply with these requirements and any additional industry-specific rules that may apply.

Example 3: Home Health Care Agency. A home health care agency must adhere to strict licensing and accreditation requirements and HIPAA regulations for protecting patient information. The business plan should detail the steps required to obtain proper licensing, maintain accreditation, and ensure ongoing compliance with healthcare regulations.

Example 4: Real Estate Agency. A real estate agency must comply with state licensing requirements, adhere to fair housing laws, and maintain proper records. The business plan should outline how the agency will obtain the necessary licenses, ensure compliance with fair housing laws, and establish record-keeping procedures.

Example 5: Craft Brewery. A craft brewery must navigate a complex landscape of federal, state, and local regulations related to alcohol production, distribution, and sales. The business plan should detail how the brewery will obtain the required permits, maintain compliance with alcohol regulations, and establish relationships with distributors and retailers.

Tip 7: Develop a financial plan

A comprehensive financial plan is essential for any business. Include a detailed financial forecast outlining your revenue projections, expenses, and cash flow analysis.

Here are five examples of what a financial plan for businesses in different industries should address in a business plan:

Example 1: Subscription Box Service. A subscription box service should include a financial plan detailing the costs of sourcing products, packaging, shipping, and marketing. The plan should also outline revenue projections based on the number of subscribers, average customer lifetime value, and potential upsell opportunities.

Example 2: Clothing Boutique. A clothing boutique should develop a financial plan for inventory costs, rent, utilities, marketing expenses, and employee wages. The plan should also include revenue projections based on foot traffic, average transaction value, and seasonal trends.