EXCLUSIVE SUMMIT OFFER Join foundr+ and get Ecommerce Kickstarter program free!

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, how to write a business plan (tips, templates, examples).

Written by Jesse Sumrak | May 14, 2023

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Business plans might seem like an old-school stiff-collared practice, but they deserve a place in the startup realm, too. It’s probably not going to be the frame-worthy document you hang in the office—yet, it may one day be deserving of the privilege.

Whether you’re looking to win the heart of an angel investor or convince a bank to lend you money, you’ll need a business plan. And not just any ol’ notes and scribble on the back of a pizza box or napkin—you’ll need a professional, standardized report.

Bah. Sounds like homework, right?

Yes. Yes, it does.

However, just like bookkeeping, loan applications, and 404 redirects, business plans are an essential step in cementing your business foundation.

Don’t worry. We’ll show you how to write a business plan without boring you to tears. We’ve jam-packed this article with all the business plan examples, templates, and tips you need to take your non-existent proposal from concept to completion.

Table of Contents

What Is a Business Plan?

Tips to Make Your Small Business Plan Ironclad

How to Write a Business Plan in 6 Steps

Startup Business Plan Template

Business Plan Examples

Work on Making Your Business Plan

How to Write a Business Plan FAQs

What is a business plan why do you desperately need one.

A business plan is a roadmap that outlines:

- Who your business is, what it does, and who it serves

- Where your business is now

- Where you want it to go

- How you’re going to make it happen

- What might stop you from taking your business from Point A to Point B

- How you’ll overcome the predicted obstacles

While it’s not required when starting a business, having a business plan is helpful for a few reasons:

- Secure a Bank Loan: Before approving you for a business loan, banks will want to see that your business is legitimate and can repay the loan. They want to know how you’re going to use the loan and how you’ll make monthly payments on your debt. Lenders want to see a sound business strategy that doesn’t end in loan default.

- Win Over Investors: Like lenders, investors want to know they’re going to make a return on their investment. They need to see your business plan to have the confidence to hand you money.

- Stay Focused: It’s easy to get lost chasing the next big thing. Your business plan keeps you on track and focused on the big picture. Your business plan can prevent you from wasting time and resources on something that isn’t aligned with your business goals.

Beyond the reasoning, let’s look at what the data says:

- Simply writing a business plan can boost your average annual growth by 30%

- Entrepreneurs who create a formal business plan are 16% more likely to succeed than those who don’t

- A study looking at 65 fast-growth companies found that 71% had small business plans

- The process and output of creating a business plan have shown to improve business performance

Convinced yet? If those numbers and reasons don’t have you scrambling for pen and paper, who knows what will.

Don’t Skip: Business Startup Costs Checklist

Before we get into the nitty-gritty steps of how to write a business plan, let’s look at some high-level tips to get you started in the right direction:

Be Professional and Legit

You might be tempted to get cutesy or revolutionary with your business plan—resist the urge. While you should let your brand and creativity shine with everything you produce, business plans fall more into the realm of professional documents.

Think of your business plan the same way as your terms and conditions, employee contracts, or financial statements. You want your plan to be as uniform as possible so investors, lenders, partners, and prospective employees can find the information they need to make important decisions.

If you want to create a fun summary business plan for internal consumption, then, by all means, go right ahead. However, for the purpose of writing this external-facing document, keep it legit.

Know Your Audience

Your official business plan document is for lenders, investors, partners, and big-time prospective employees. Keep these names and faces in your mind as you draft your plan.

Think about what they might be interested in seeing, what questions they’ll ask, and what might convince (or scare) them. Cut the jargon and tailor your language so these individuals can understand.

Remember, these are busy people. They’re likely looking at hundreds of applicants and startup investments every month. Keep your business plan succinct and to the point. Include the most pertinent information and omit the sections that won’t impact their decision-making.

Invest Time Researching

You might not have answers to all the sections you should include in your business plan. Don’t skip over these!

Your audience will want:

- Detailed information about your customers

- Numbers and solid math to back up your financial claims and estimates

- Deep insights about your competitors and potential threats

- Data to support market opportunities and strategy

Your answers can’t be hypothetical or opinionated. You need research to back up your claims. If you don’t have that data yet, then invest time and money in collecting it. That information isn’t just critical for your business plan—it’s essential for owning, operating, and growing your company.

Stay Realistic

Your business may be ambitious, but reign in the enthusiasm just a teeny-tiny bit. The last thing you want to do is have an angel investor call BS and say “I’m out” before even giving you a chance.

The folks looking at your business and evaluating your plan have been around the block—they know a thing or two about fact and fiction. Your plan should be a blueprint for success. It should be the step-by-step roadmap for how you’re going from Point A to Point B.

How to Write a Business Plan—6 Essential Elements

Not every business plan looks the same, but most share a few common elements. Here’s what they typically include:

- Executive Summary

- Business Overview

- Products and Services

- Market Analysis

- Competitive Analysis

- Financial Strategy

Below, we’ll break down each of these sections in more detail.

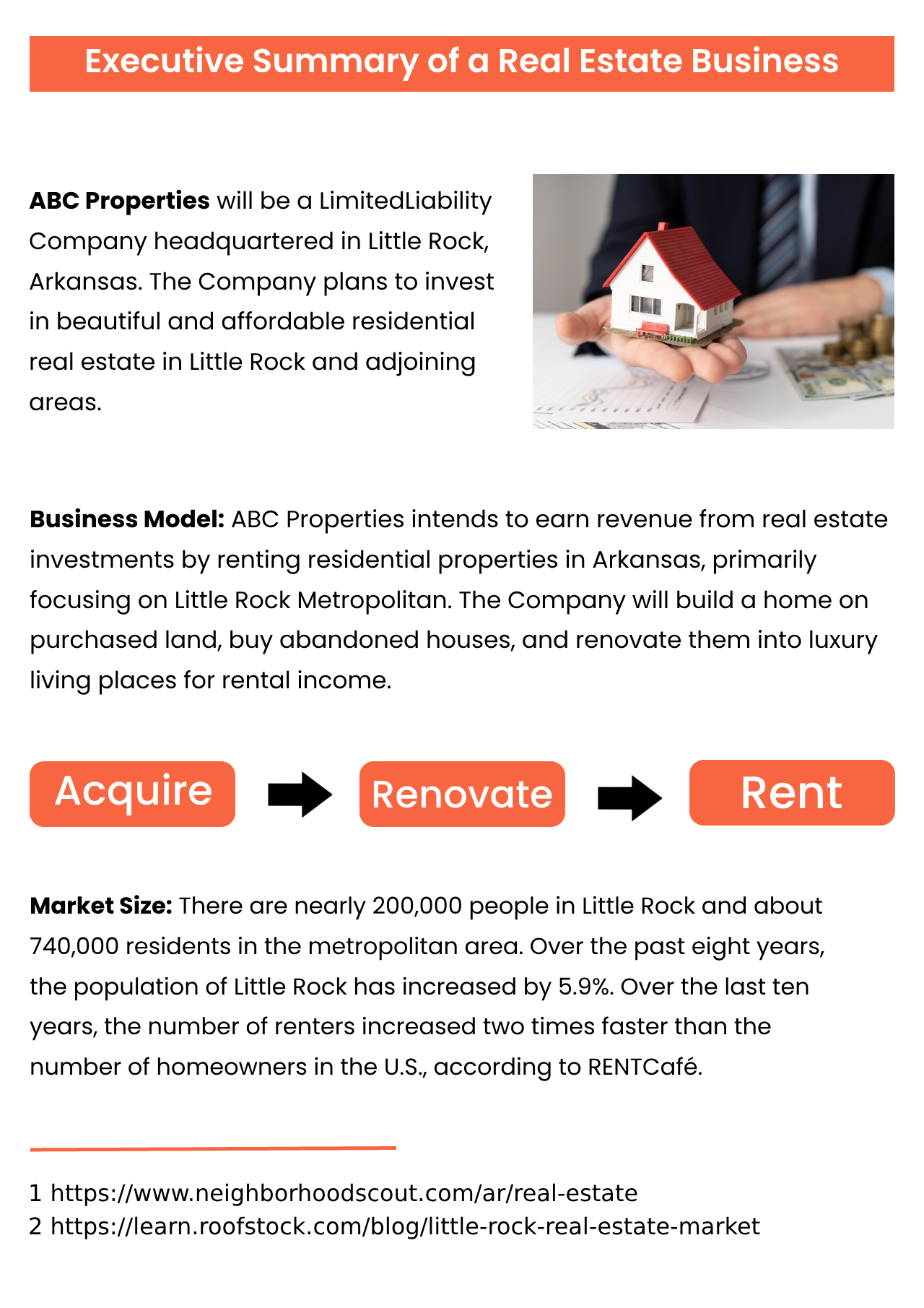

1. Executive Summary

While your executive summary is the first page of your business plan, it’s the section you’ll write last. That’s because it summarizes your entire business plan into a succinct one-pager.

Begin with an executive summary that introduces the reader to your business and gives them an overview of what’s inside the business plan.

Your executive summary highlights key points of your plan. Consider this your elevator pitch. You want to put all your juiciest strengths and opportunities strategically in this section.

2. Business Overview

In this section, you can dive deeper into the elements of your business, including answering:

- What’s your business structure? Sole proprietorship, LLC, corporation, etc.

- Where is it located?

- Who owns the business? Does it have employees?

- What problem does it solve, and how?

- What’s your mission statement? Your mission statement briefly describes why you are in business. To write a proper mission statement, brainstorm your business’s core values and who you serve.

Don’t overlook your mission statement. This powerful sentence or paragraph could be the inspiration that drives an investor to take an interest in your business. Here are a few examples of powerful mission statements that just might give you the goosebumps:

- Patagonia: Build the best product, cause no unnecessary harm, use business to inspire and implement solutions to the environmental crisis.

- Tesla: To accelerate the world’s transition to sustainable energy.

- InvisionApp : Question Assumptions. Think Deeply. Iterate as a Lifestyle. Details, Details. Design is Everywhere. Integrity.

- TED : Spread ideas.

- Warby Parker : To offer designer eyewear at a revolutionary price while leading the way for socially conscious businesses.

3. Products and Services

As the owner, you know your business and the industry inside and out. However, whoever’s reading your document might not. You’re going to need to break down your products and services in minute detail.

For example, if you own a SaaS business, you’re going to need to explain how this business model works and what you’re selling.

You’ll need to include:

- What services you sell: Describe the services you provide and how these will help your target audience.

- What products you sell: Describe your products (and types if applicable) and how they will solve a need for your target and provide value.

- How much you charge: If you’re selling services, will you charge hourly, per project, retainer, or a mixture of all of these? If you’re selling products, what are the price ranges?

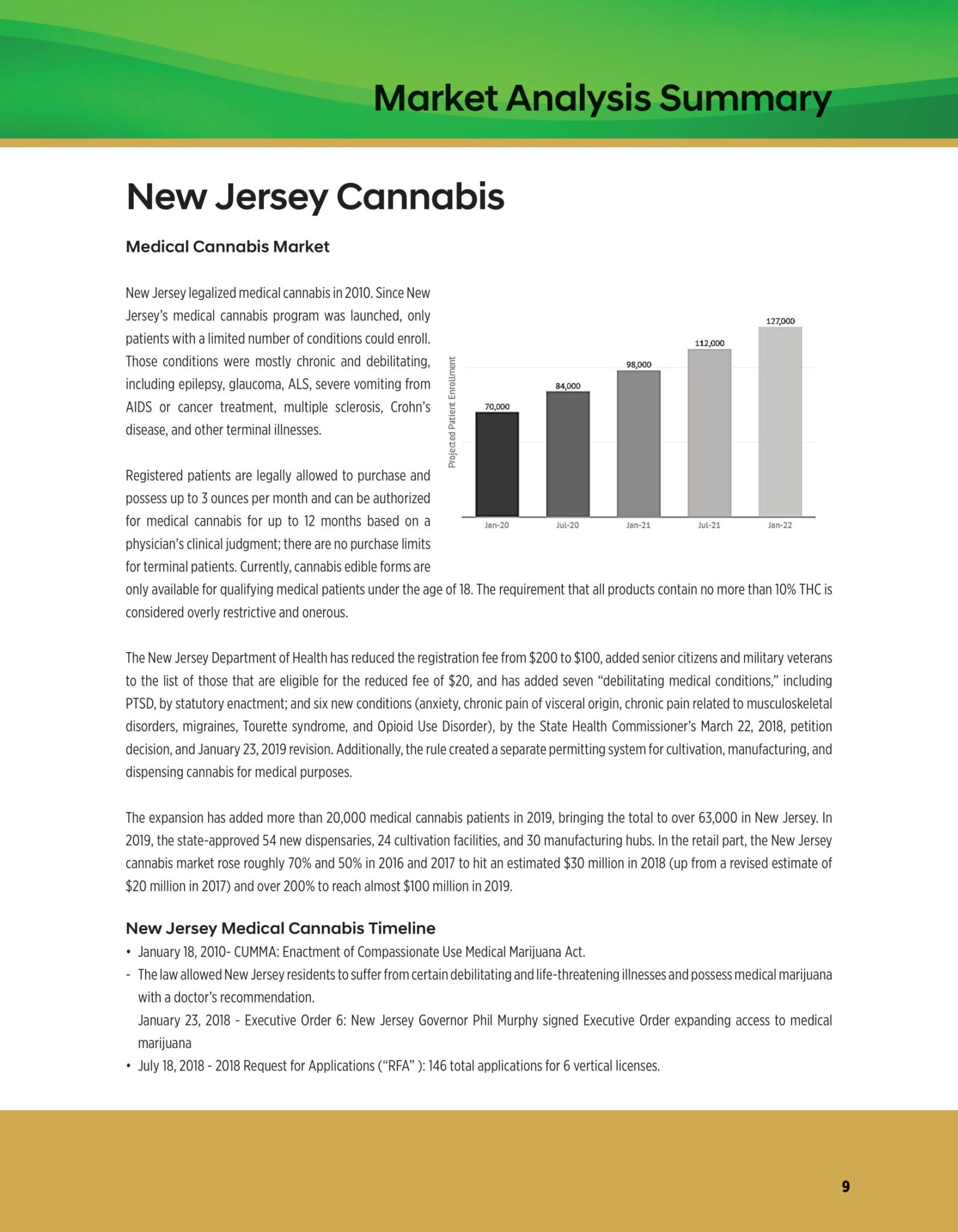

4. Market Analysis

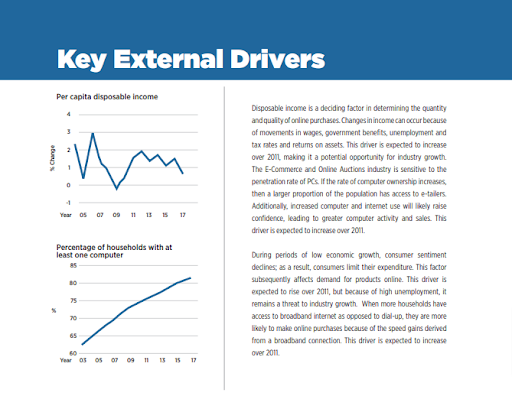

Your market analysis essentially explains how your products and services address customer concerns and pain points. This section will include research and data on the state and direction of your industry and target market.

This research should reveal lucrative opportunities and how your business is uniquely positioned to seize the advantage. You’ll also want to touch on your marketing strategy and how it will (or does) work for your audience.

Include a detailed analysis of your target customers. This describes the people you serve and sell your product to. Be careful not to go too broad here—you don’t want to fall into the common entrepreneurial trap of trying to sell to everyone and thereby not differentiating yourself enough to survive the competition.

The market analysis section will include your unique value proposition. Your unique value proposition (UVP) is the thing that makes you stand out from your competitors. This is your key to success.

If you don’t have a UVP, you don’t have a way to take on competitors who are already in this space. Here’s an example of an ecommerce internet business plan outlining their competitive edge:

FireStarters’ competitive advantage is offering product lines that make a statement but won’t leave you broke. The major brands are expensive and not distinctive enough to satisfy the changing taste of our target customers. FireStarters offers products that are just ahead of the curve and so affordable that our customers will return to the website often to check out what’s new.

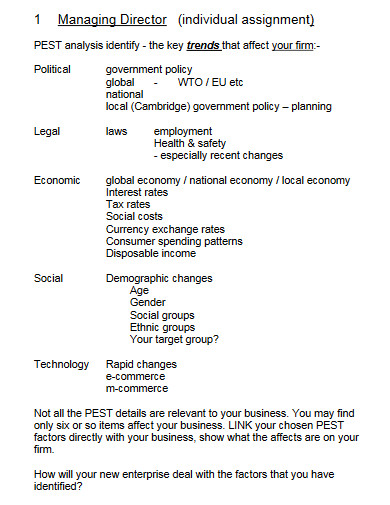

5. Competitive Analysis

Your competitive analysis examines the strengths and weaknesses of competing businesses in your market or industry. This will include direct and indirect competitors. It can also include threats and opportunities, like economic concerns or legal restraints.

The best way to sum up this section is with a classic SWOT analysis. This will explain your company’s position in relation to your competitors.

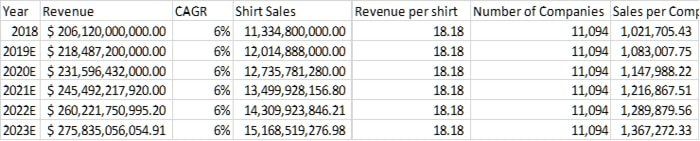

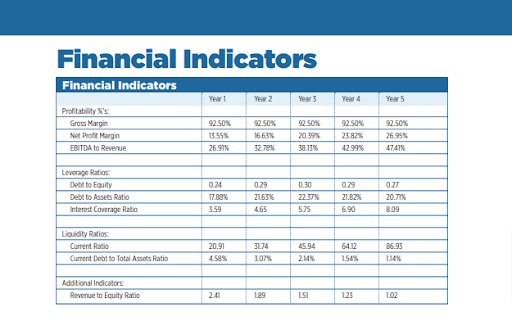

6. Financial Strategy

Your financial strategy will sum up your revenue, expenses, profit (or loss), and financial plan for the future. It’ll explain how you make money, where your cash flow goes, and how you’ll become profitable or stay profitable.

This is one of the most important sections for lenders and investors. Have you ever watched Shark Tank? They always ask about the company’s financial situation. How has it performed in the past? What’s the ongoing outlook moving forward? How does the business plan to make it happen?

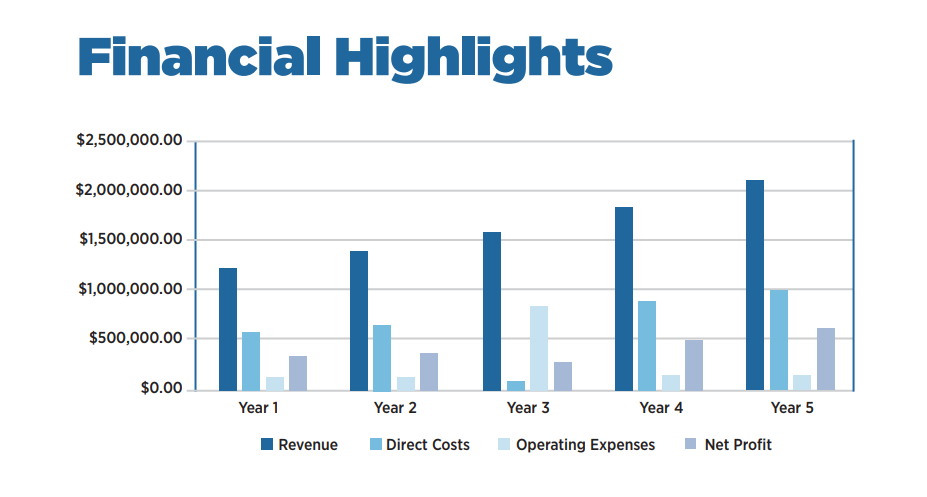

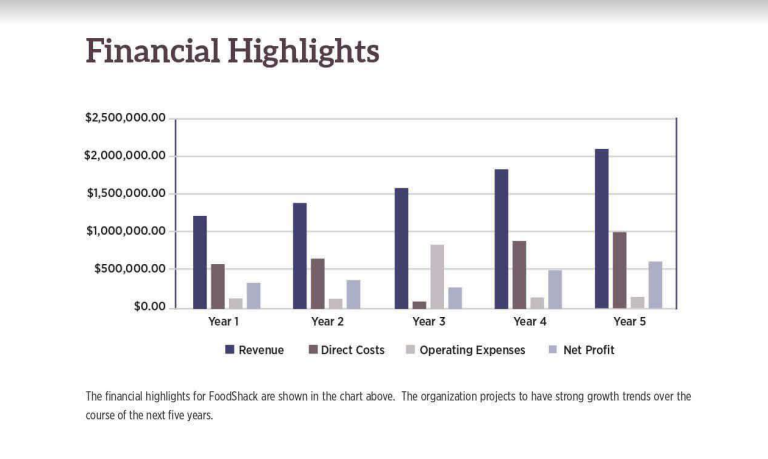

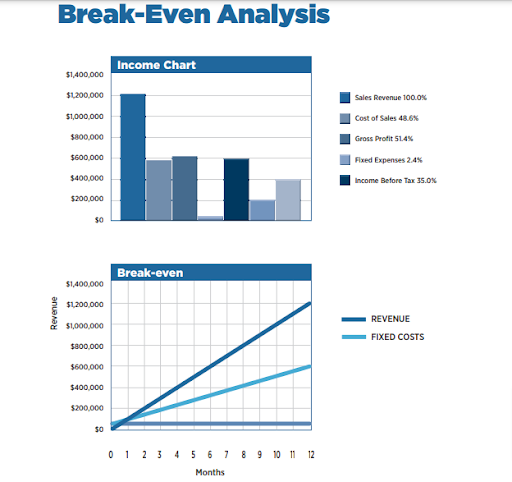

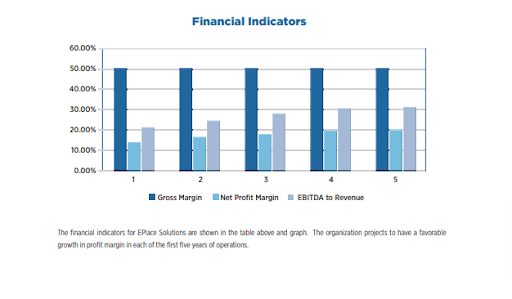

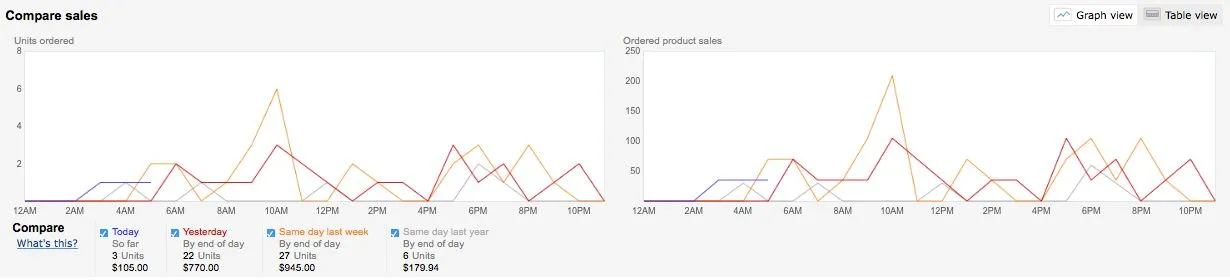

Answer all of these questions in your financial strategy so that your audience doesn’t have to ask. Go ahead and include forecasts and graphs in your plan, too:

- Balance sheet: This includes your assets, liabilities, and equity.

- Profit & Loss (P&L) statement: This details your income and expenses over a given period.

- Cash flow statement: Similar to the P&L, this one will show all cash flowing into and out of the business each month.

It takes cash to change the world—lenders and investors get it. If you’re short on funding, explain how much money you’ll need and how you’ll use the capital. Where are you looking for financing? Are you looking to take out a business loan, or would you rather trade equity for capital instead?

Read More: 16 Financial Concepts Every Entrepreneur Needs to Know

Startup Business Plan Template (Copy/Paste Outline)

Ready to write your own business plan? Copy/paste the startup business plan template below and fill in the blanks.

Executive Summary Remember, do this last. Summarize who you are and your business plan in one page.

Business Overview Describe your business. What’s it do? Who owns it? How’s it structured? What’s the mission statement?

Products and Services Detail the products and services you offer. How do they work? What do you charge?

Market Analysis Write about the state of the market and opportunities. Use date. Describe your customers. Include your UVP.

Competitive Analysis Outline the competitors in your market and industry. Include threats and opportunities. Add a SWOT analysis of your business.

Financial Strategy Sum up your revenue, expenses, profit (or loss), and financial plan for the future. If you’re applying for a loan, include how you’ll use the funding to progress the business.

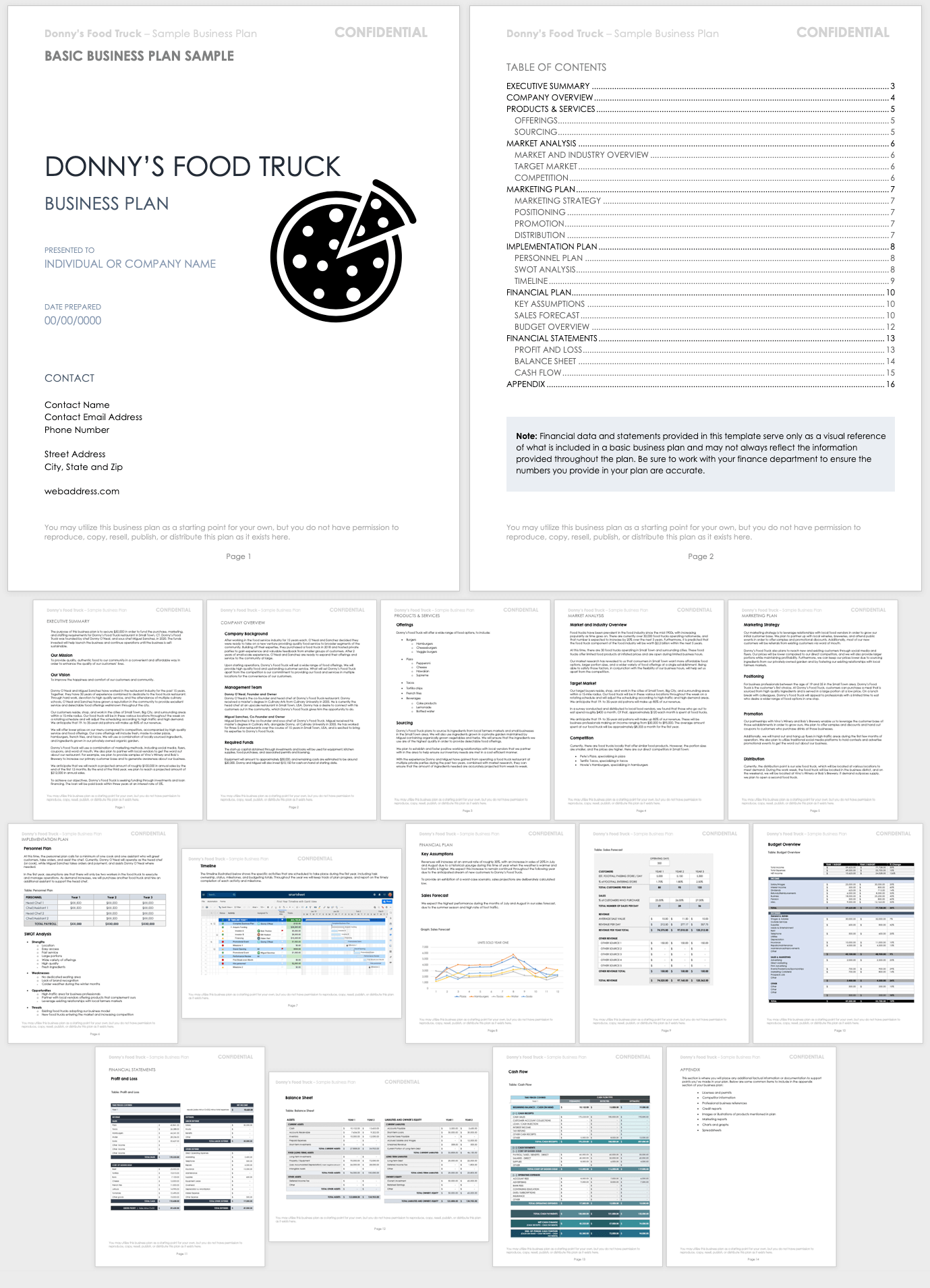

5 Frame-Worthy Business Plan Examples

Want to explore other templates and examples? We got you covered. Check out these 5 business plan examples you can use as inspiration when writing your plan:

- SBA Wooden Grain Toy Company

- SBA We Can Do It Consulting

- OrcaSmart Business Plan Sample

- Plum Business Plan Template

- PandaDoc Free Business Plan Templates

Get to Work on Making Your Business Plan

If you find you’re getting stuck on perfecting your document, opt for a simple one-page business plan —and then get to work. You can always polish up your official plan later as you learn more about your business and the industry.

Remember, business plans are not a requirement for starting a business—they’re only truly essential if a bank or investor is asking for it.

Ask others to review your business plan. Get feedback from other startups and successful business owners. They’ll likely be able to see holes in your planning or undetected opportunities—just make sure these individuals aren’t your competitors (or potential competitors).

Your business plan isn’t a one-and-done report—it’s a living, breathing document. You’ll make changes to it as you grow and evolve. When the market or your customers change, your plan will need to change to adapt.

That means when you’re finished with this exercise, it’s not time to print your plan out and stuff it in a file cabinet somewhere. No, it should sit on your desk as a day-to-day reference. Use it (and update it) as you make decisions about your product, customers, and financial plan.

Review your business plan frequently, update it routinely, and follow the path you’ve developed to the future you’re building.

Keep Learning: New Product Development Process in 8 Easy Steps

What financial information should be included in a business plan?

Be as detailed as you can without assuming too much. For example, include your expected revenue, expenses, profit, and growth for the future.

What are some common mistakes to avoid when writing a business plan?

The most common mistake is turning your business plan into a textbook. A business plan is an internal guide and an external pitching tool. Cut the fat and only include the most relevant information to start and run your business.

Who should review my business plan before I submit it?

Co-founders, investors, or a board of advisors. Otherwise, reach out to a trusted mentor, your local chamber of commerce, or someone you know that runs a business.

Ready to Write Your Business Plan?

Don’t let creating a business plan hold you back from starting your business. Writing documents might not be your thing—that doesn’t mean your business is a bad idea.

Let us help you get started.

Join our free training to learn how to start an online side hustle in 30 days or less. We’ll provide you with a proven roadmap for how to find, validate, and pursue a profitable business idea (even if you have zero entrepreneurial experience).

Stuck on the ideas part? No problem. When you attend the masterclass, we’ll send you a free ebook with 100 of the hottest side hustle trends right now. It’s chock full of brilliant business ideas to get you up and running in the right direction.

About Jesse Sumrak

Jesse Sumrak is a writing zealot focused on creating killer content. He’s spent almost a decade writing about startup, marketing, and entrepreneurship topics, having built and sold his own post-apocalyptic fitness bootstrapped business. A writer by day and a peak bagger by night (and early early morning), you can usually find Jesse preparing for the apocalypse on a precipitous peak somewhere in the Rocky Mountains of Colorado.

Related Posts

Dany Garcia on Building Her Business Empire with Dwayne Johnson

The 12 Best Business Startup Books Every Entrepreneur Needs

Business Ideas for Teens: Start Your Side Hustle Early

What to Sell in 2024: Unearth Profitable Products

How Reid Hoffman Became a Silicon Valley Icon

Shopping Cart Abandonment: Why It Matters and What to Do for Recovery

How To Develop a Million-Dollar Pitch Deck For Potential Investors

How Shipt Founder Bill Smith Had Three Exits Before 40

What to Sell on eBay: 5 Reliable Product Categories for Your eBay Store

How to Sell on eBay: A Detailed Step-by-Step Guide

Product Testing: It’s Worth Investing

How to Manufacture a Product: A Detailed Breakdown

How to Find USA Suppliers

How to Find Chinese Manufacturers to Bring Your Product to Life

AI Tools For Business: 6 Tools to Start from Scratch With

FREE TRAINING FROM LEGIT FOUNDERS

Actionable Strategies for Starting & Growing Any Business.

BUILD SOMETHING FOR YOU

Gretta van riel will help create your ecomm brand from scratch..

Small Business Trends

How to create a business plan: examples & free template.

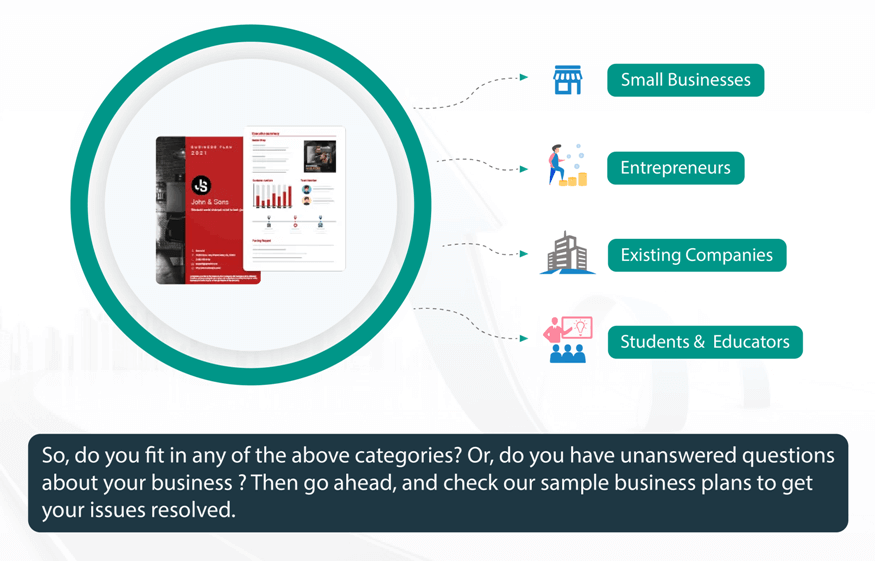

This is the ultimate guide to creating a comprehensive and effective plan to start a business . In today’s dynamic business landscape, having a well-crafted business plan is an important first step to securing funding, attracting partners, and navigating the challenges of entrepreneurship.

This guide has been designed to help you create a winning plan that stands out in the ever-evolving marketplace. U sing real-world examples and a free downloadable template, it will walk you through each step of the process.

Whether you’re a seasoned entrepreneur or launching your very first startup, the guide will give you the insights, tools, and confidence you need to create a solid foundation for your business.

Table of Contents

How to Write a Business Plan

Embarking on the journey of creating a successful business requires a solid foundation, and a well-crafted business plan is the cornerstone. Here is the process of writing a comprehensive business plan and the main parts of a winning business plan . From setting objectives to conducting market research, this guide will have everything you need.

Executive Summary

The Executive Summary serves as the gateway to your business plan, offering a snapshot of your venture’s core aspects. This section should captivate and inform, succinctly summarizing the essence of your plan.

It’s crucial to include a clear mission statement, a brief description of your primary products or services, an overview of your target market, and key financial projections or achievements.

Think of it as an elevator pitch in written form: it should be compelling enough to engage potential investors or stakeholders and provide them with a clear understanding of what your business is about, its goals, and why it’s a promising investment.

Example: EcoTech is a technology company specializing in eco-friendly and sustainable products designed to reduce energy consumption and minimize waste. Our mission is to create innovative solutions that contribute to a cleaner, greener environment.

Our target market includes environmentally conscious consumers and businesses seeking to reduce their carbon footprint. We project a 200% increase in revenue within the first three years of operation.

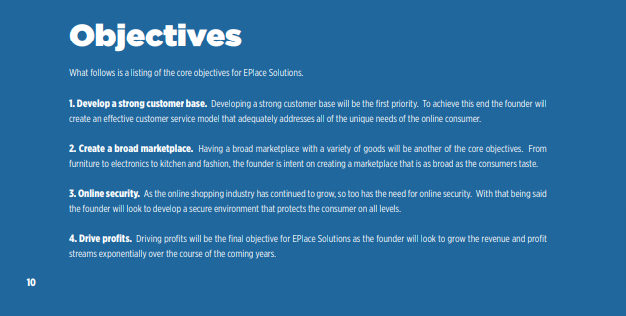

Overview and Business Objectives

In the Overview and Business Objectives section, outline your business’s core goals and the strategic approaches you plan to use to achieve them. This section should set forth clear, specific objectives that are attainable and time-bound, providing a roadmap for your business’s growth and success.

It’s important to detail how these objectives align with your company’s overall mission and vision. Discuss the milestones you aim to achieve and the timeframe you’ve set for these accomplishments.

This part of the plan demonstrates to investors and stakeholders your vision for growth and the practical steps you’ll take to get there.

Example: EcoTech’s primary objective is to become a market leader in sustainable technology products within the next five years. Our key objectives include:

- Introducing three new products within the first two years of operation.

- Achieving annual revenue growth of 30%.

- Expanding our customer base to over 10,000 clients by the end of the third year.

Company Description

The Company Description section is your opportunity to delve into the details of your business. Provide a comprehensive overview that includes your company’s history, its mission statement, and its vision for the future.

Highlight your unique selling proposition (USP) – what makes your business stand out in the market. Explain the problems your company solves and how it benefits your customers.

Include information about the company’s founders, their expertise, and why they are suited to lead the business to success. This section should paint a vivid picture of your business, its values, and its place in the industry.

Example: EcoTech is committed to developing cutting-edge sustainable technology products that benefit both the environment and our customers. Our unique combination of innovative solutions and eco-friendly design sets us apart from the competition. We envision a future where technology and sustainability go hand in hand, leading to a greener planet.

Define Your Target Market

Defining Your Target Market is critical for tailoring your business strategy effectively. This section should describe your ideal customer base in detail, including demographic information (such as age, gender, income level, and location) and psychographic data (like interests, values, and lifestyle).

Elucidate on the specific needs or pain points of your target audience and how your product or service addresses these. This information will help you know your target market and develop targeted marketing strategies.

Example: Our target market comprises environmentally conscious consumers and businesses looking for innovative solutions to reduce their carbon footprint. Our ideal customers are those who prioritize sustainability and are willing to invest in eco-friendly products.

Market Analysis

The Market Analysis section requires thorough research and a keen understanding of the industry. It involves examining the current trends within your industry, understanding the needs and preferences of your customers, and analyzing the strengths and weaknesses of your competitors.

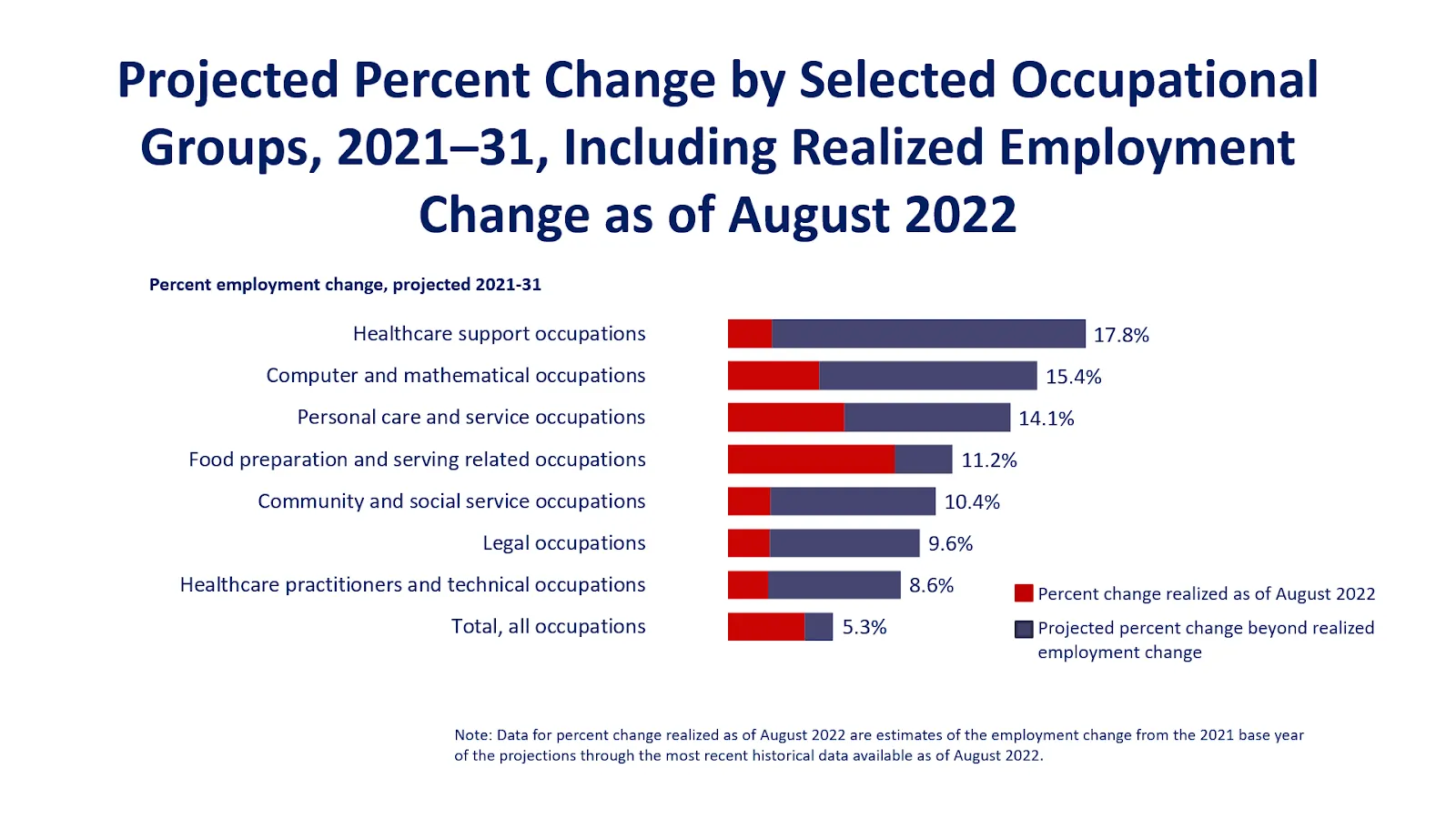

This analysis will enable you to spot market opportunities and anticipate potential challenges. Include data and statistics to back up your claims, and use graphs or charts to illustrate market trends.

This section should demonstrate that you have a deep understanding of the market in which you operate and that your business is well-positioned to capitalize on its opportunities.

Example: The market for eco-friendly technology products has experienced significant growth in recent years, with an estimated annual growth rate of 10%. As consumers become increasingly aware of environmental issues, the demand for sustainable solutions continues to rise.

Our research indicates a gap in the market for high-quality, innovative eco-friendly technology products that cater to both individual and business clients.

SWOT Analysis

A SWOT analysis in your business plan offers a comprehensive examination of your company’s internal and external factors. By assessing Strengths, you showcase what your business does best and where your capabilities lie.

Weaknesses involve an honest introspection of areas where your business may be lacking or could improve. Opportunities can be external factors that your business could capitalize on, such as market gaps or emerging trends.

Threats include external challenges your business may face, like competition or market changes. This analysis is crucial for strategic planning, as it helps in recognizing and leveraging your strengths, addressing weaknesses, seizing opportunities, and preparing for potential threats.

Including a SWOT analysis demonstrates to stakeholders that you have a balanced and realistic understanding of your business in its operational context.

- Innovative and eco-friendly product offerings.

- Strong commitment to sustainability and environmental responsibility.

- Skilled and experienced team with expertise in technology and sustainability.

Weaknesses:

- Limited brand recognition compared to established competitors.

- Reliance on third-party manufacturers for product development.

Opportunities:

- Growing consumer interest in sustainable products.

- Partnerships with environmentally-focused organizations and influencers.

- Expansion into international markets.

- Intense competition from established technology companies.

- Regulatory changes could impact the sustainable technology market.

Competitive Analysis

In this section, you’ll analyze your competitors in-depth, examining their products, services, market positioning, and pricing strategies. Understanding your competition allows you to identify gaps in the market and tailor your offerings to outperform them.

By conducting a thorough competitive analysis, you can gain insights into your competitors’ strengths and weaknesses, enabling you to develop strategies to differentiate your business and gain a competitive advantage in the marketplace.

Example: Key competitors include:

GreenTech: A well-known brand offering eco-friendly technology products, but with a narrower focus on energy-saving devices.

EarthSolutions: A direct competitor specializing in sustainable technology, but with a limited product range and higher prices.

By offering a diverse product portfolio, competitive pricing, and continuous innovation, we believe we can capture a significant share of the growing sustainable technology market.

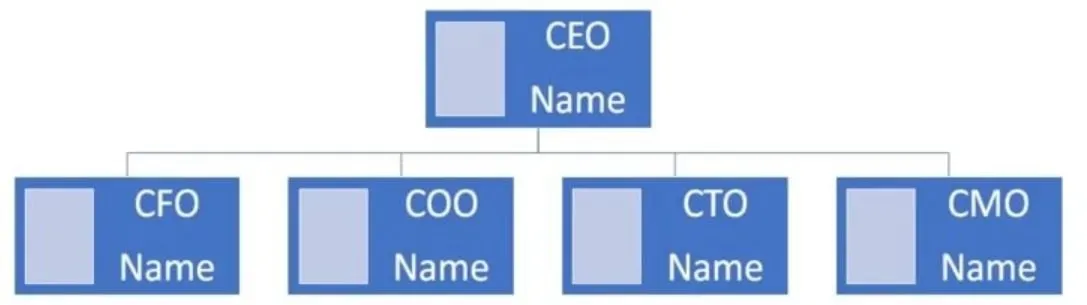

Organization and Management Team

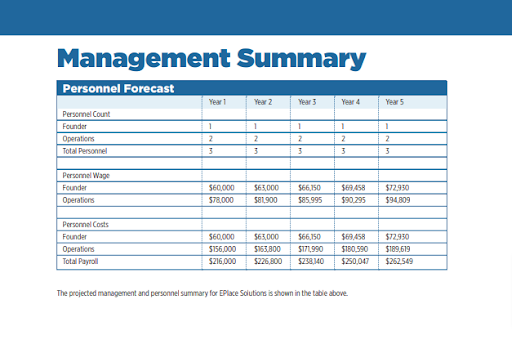

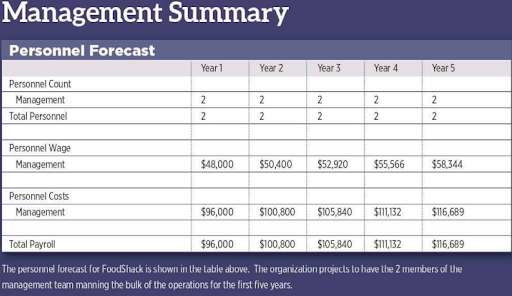

Provide an overview of your company’s organizational structure, including key roles and responsibilities. Introduce your management team, highlighting their expertise and experience to demonstrate that your team is capable of executing the business plan successfully.

Showcasing your team’s background, skills, and accomplishments instills confidence in investors and other stakeholders, proving that your business has the leadership and talent necessary to achieve its objectives and manage growth effectively.

Example: EcoTech’s organizational structure comprises the following key roles: CEO, CTO, CFO, Sales Director, Marketing Director, and R&D Manager. Our management team has extensive experience in technology, sustainability, and business development, ensuring that we are well-equipped to execute our business plan successfully.

Products and Services Offered

Describe the products or services your business offers, focusing on their unique features and benefits. Explain how your offerings solve customer pain points and why they will choose your products or services over the competition.

This section should emphasize the value you provide to customers, demonstrating that your business has a deep understanding of customer needs and is well-positioned to deliver innovative solutions that address those needs and set your company apart from competitors.

Example: EcoTech offers a range of eco-friendly technology products, including energy-efficient lighting solutions, solar chargers, and smart home devices that optimize energy usage. Our products are designed to help customers reduce energy consumption, minimize waste, and contribute to a cleaner environment.

Marketing and Sales Strategy

In this section, articulate your comprehensive strategy for reaching your target market and driving sales. Detail the specific marketing channels you plan to use, such as social media, email marketing, SEO, or traditional advertising.

Describe the nature of your advertising campaigns and promotional activities, explaining how they will capture the attention of your target audience and convey the value of your products or services. Outline your sales strategy, including your sales process, team structure, and sales targets.

Discuss how these marketing and sales efforts will work together to attract and retain customers, generate leads, and ultimately contribute to achieving your business’s revenue goals.

This section is critical to convey to investors and stakeholders that you have a well-thought-out approach to market your business effectively and drive sales growth.

Example: Our marketing strategy includes digital advertising, content marketing, social media promotion, and influencer partnerships. We will also attend trade shows and conferences to showcase our products and connect with potential clients. Our sales strategy involves both direct sales and partnerships with retail stores, as well as online sales through our website and e-commerce platforms.

Logistics and Operations Plan

The Logistics and Operations Plan is a critical component that outlines the inner workings of your business. It encompasses the management of your supply chain, detailing how you acquire raw materials and manage vendor relationships.

Inventory control is another crucial aspect, where you explain strategies for inventory management to ensure efficiency and reduce wastage. The section should also describe your production processes, emphasizing scalability and adaptability to meet changing market demands.

Quality control measures are essential to maintain product standards and customer satisfaction. This plan assures investors and stakeholders of your operational competency and readiness to meet business demands.

Highlighting your commitment to operational efficiency and customer satisfaction underlines your business’s capability to maintain smooth, effective operations even as it scales.

Example: EcoTech partners with reliable third-party manufacturers to produce our eco-friendly technology products. Our operations involve maintaining strong relationships with suppliers, ensuring quality control, and managing inventory.

We also prioritize efficient distribution through various channels, including online platforms and retail partners, to deliver products to our customers in a timely manner.

Financial Projections Plan

In the Financial Projections Plan, lay out a clear and realistic financial future for your business. This should include detailed projections for revenue, costs, and profitability over the next three to five years.

Ground these projections in solid assumptions based on your market analysis, industry benchmarks, and realistic growth scenarios. Break down revenue streams and include an analysis of the cost of goods sold, operating expenses, and potential investments.

This section should also discuss your break-even analysis, cash flow projections, and any assumptions about external funding requirements.

By presenting a thorough and data-backed financial forecast, you instill confidence in potential investors and lenders, showcasing your business’s potential for profitability and financial stability.

This forward-looking financial plan is crucial for demonstrating that you have a firm grasp of the financial nuances of your business and are prepared to manage its financial health effectively.

Example: Over the next three years, we expect to see significant growth in revenue, driven by new product launches and market expansion. Our financial projections include:

- Year 1: $1.5 million in revenue, with a net profit of $200,000.

- Year 2: $3 million in revenue, with a net profit of $500,000.

- Year 3: $4.5 million in revenue, with a net profit of $1 million.

These projections are based on realistic market analysis, growth rates, and product pricing.

Income Statement

The income statement , also known as the profit and loss statement, provides a summary of your company’s revenues and expenses over a specified period. It helps you track your business’s financial performance and identify trends, ensuring you stay on track to achieve your financial goals.

Regularly reviewing and analyzing your income statement allows you to monitor the health of your business, evaluate the effectiveness of your strategies, and make data-driven decisions to optimize profitability and growth.

Example: The income statement for EcoTech’s first year of operation is as follows:

- Revenue: $1,500,000

- Cost of Goods Sold: $800,000

- Gross Profit: $700,000

- Operating Expenses: $450,000

- Net Income: $250,000

This statement highlights our company’s profitability and overall financial health during the first year of operation.

Cash Flow Statement

A cash flow statement is a crucial part of a financial business plan that shows the inflows and outflows of cash within your business. It helps you monitor your company’s liquidity, ensuring you have enough cash on hand to cover operating expenses, pay debts, and invest in growth opportunities.

By including a cash flow statement in your business plan, you demonstrate your ability to manage your company’s finances effectively.

Example: The cash flow statement for EcoTech’s first year of operation is as follows:

Operating Activities:

- Depreciation: $10,000

- Changes in Working Capital: -$50,000

- Net Cash from Operating Activities: $210,000

Investing Activities:

- Capital Expenditures: -$100,000

- Net Cash from Investing Activities: -$100,000

Financing Activities:

- Proceeds from Loans: $150,000

- Loan Repayments: -$50,000

- Net Cash from Financing Activities: $100,000

- Net Increase in Cash: $210,000

This statement demonstrates EcoTech’s ability to generate positive cash flow from operations, maintain sufficient liquidity, and invest in growth opportunities.

Tips on Writing a Business Plan

1. Be clear and concise: Keep your language simple and straightforward. Avoid jargon and overly technical terms. A clear and concise business plan is easier for investors and stakeholders to understand and demonstrates your ability to communicate effectively.

2. Conduct thorough research: Before writing your business plan, gather as much information as possible about your industry, competitors, and target market. Use reliable sources and industry reports to inform your analysis and make data-driven decisions.

3. Set realistic goals: Your business plan should outline achievable objectives that are specific, measurable, attainable, relevant, and time-bound (SMART). Setting realistic goals demonstrates your understanding of the market and increases the likelihood of success.

4. Focus on your unique selling proposition (USP): Clearly articulate what sets your business apart from the competition. Emphasize your USP throughout your business plan to showcase your company’s value and potential for success.

5. Be flexible and adaptable: A business plan is a living document that should evolve as your business grows and changes. Be prepared to update and revise your plan as you gather new information and learn from your experiences.

6. Use visuals to enhance understanding: Include charts, graphs, and other visuals to help convey complex data and ideas. Visuals can make your business plan more engaging and easier to digest, especially for those who prefer visual learning.

7. Seek feedback from trusted sources: Share your business plan with mentors, industry experts, or colleagues and ask for their feedback. Their insights can help you identify areas for improvement and strengthen your plan before presenting it to potential investors or partners.

FREE Business Plan Template

To help you get started on your business plan, we have created a template that includes all the essential components discussed in the “How to Write a Business Plan” section. This easy-to-use template will guide you through each step of the process, ensuring you don’t miss any critical details.

The template is divided into the following sections:

- Mission statement

- Business Overview

- Key products or services

- Target market

- Financial highlights

- Company goals

- Strategies to achieve goals

- Measurable, time-bound objectives

- Company History

- Mission and vision

- Unique selling proposition

- Demographics

- Psychographics

- Pain points

- Industry trends

- Customer needs

- Competitor strengths and weaknesses

- Opportunities

- Competitor products and services

- Market positioning

- Pricing strategies

- Organizational structure

- Key roles and responsibilities

- Management team backgrounds

- Product or service features

- Competitive advantages

- Marketing channels

- Advertising campaigns

- Promotional activities

- Sales strategies

- Supply chain management

- Inventory control

- Production processes

- Quality control measures

- Projected revenue

- Assumptions

- Cash inflows

- Cash outflows

- Net cash flow

What is a Business Plan?

A business plan is a strategic document that outlines an organization’s goals, objectives, and the steps required to achieve them. It serves as a roadmap as you start a business , guiding the company’s direction and growth while identifying potential obstacles and opportunities.

Typically, a business plan covers areas such as market analysis, financial projections, marketing strategies, and organizational structure. It not only helps in securing funding from investors and lenders but also provides clarity and focus to the management team.

A well-crafted business plan is a very important part of your business startup checklist because it fosters informed decision-making and long-term success.

Why You Should Write a Business Plan

Understanding the importance of a business plan in today’s competitive environment is crucial for entrepreneurs and business owners. Here are five compelling reasons to write a business plan:

- Attract Investors and Secure Funding : A well-written business plan demonstrates your venture’s potential and profitability, making it easier to attract investors and secure the necessary funding for growth and development. It provides a detailed overview of your business model, target market, financial projections, and growth strategies, instilling confidence in potential investors and lenders that your company is a worthy investment.

- Clarify Business Objectives and Strategies : Crafting a business plan forces you to think critically about your goals and the strategies you’ll employ to achieve them, providing a clear roadmap for success. This process helps you refine your vision and prioritize the most critical objectives, ensuring that your efforts are focused on achieving the desired results.

- Identify Potential Risks and Opportunities : Analyzing the market, competition, and industry trends within your business plan helps identify potential risks and uncover untapped opportunities for growth and expansion. This insight enables you to develop proactive strategies to mitigate risks and capitalize on opportunities, positioning your business for long-term success.

- Improve Decision-Making : A business plan serves as a reference point so you can make informed decisions that align with your company’s overall objectives and long-term vision. By consistently referring to your plan and adjusting it as needed, you can ensure that your business remains on track and adapts to changes in the market, industry, or internal operations.

- Foster Team Alignment and Communication : A shared business plan helps ensure that all team members are on the same page, promoting clear communication, collaboration, and a unified approach to achieving the company’s goals. By involving your team in the planning process and regularly reviewing the plan together, you can foster a sense of ownership, commitment, and accountability that drives success.

What are the Different Types of Business Plans?

In today’s fast-paced business world, having a well-structured roadmap is more important than ever. A traditional business plan provides a comprehensive overview of your company’s goals and strategies, helping you make informed decisions and achieve long-term success. There are various types of business plans, each designed to suit different needs and purposes. Let’s explore the main types:

- Startup Business Plan: Tailored for new ventures, a startup business plan outlines the company’s mission, objectives, target market, competition, marketing strategies, and financial projections. It helps entrepreneurs clarify their vision, secure funding from investors, and create a roadmap for their business’s future. Additionally, this plan identifies potential challenges and opportunities, which are crucial for making informed decisions and adapting to changing market conditions.

- Internal Business Plan: This type of plan is intended for internal use, focusing on strategies, milestones, deadlines, and resource allocation. It serves as a management tool for guiding the company’s growth, evaluating its progress, and ensuring that all departments are aligned with the overall vision. The internal business plan also helps identify areas of improvement, fosters collaboration among team members, and provides a reference point for measuring performance.

- Strategic Business Plan: A strategic business plan outlines long-term goals and the steps to achieve them, providing a clear roadmap for the company’s direction. It typically includes a SWOT analysis, market research, and competitive analysis. This plan allows businesses to align their resources with their objectives, anticipate changes in the market, and develop contingency plans. By focusing on the big picture, a strategic business plan fosters long-term success and stability.

- Feasibility Business Plan: This plan is designed to assess the viability of a business idea, examining factors such as market demand, competition, and financial projections. It is often used to decide whether or not to pursue a particular venture. By conducting a thorough feasibility analysis, entrepreneurs can avoid investing time and resources into an unviable business concept. This plan also helps refine the business idea, identify potential obstacles, and determine the necessary resources for success.

- Growth Business Plan: Also known as an expansion plan, a growth business plan focuses on strategies for scaling up an existing business. It includes market analysis, new product or service offerings, and financial projections to support expansion plans. This type of plan is essential for businesses looking to enter new markets, increase their customer base, or launch new products or services. By outlining clear growth strategies, the plan helps ensure that expansion efforts are well-coordinated and sustainable.

- Operational Business Plan: This type of plan outlines the company’s day-to-day operations, detailing the processes, procedures, and organizational structure. It is an essential tool for managing resources, streamlining workflows, and ensuring smooth operations. The operational business plan also helps identify inefficiencies, implement best practices, and establish a strong foundation for future growth. By providing a clear understanding of daily operations, this plan enables businesses to optimize their resources and enhance productivity.

- Lean Business Plan: A lean business plan is a simplified, agile version of a traditional plan, focusing on key elements such as value proposition, customer segments, revenue streams, and cost structure. It is perfect for startups looking for a flexible, adaptable planning approach. The lean business plan allows for rapid iteration and continuous improvement, enabling businesses to pivot and adapt to changing market conditions. This streamlined approach is particularly beneficial for businesses in fast-paced or uncertain industries.

- One-Page Business Plan: As the name suggests, a one-page business plan is a concise summary of your company’s key objectives, strategies, and milestones. It serves as a quick reference guide and is ideal for pitching to potential investors or partners. This plan helps keep teams focused on essential goals and priorities, fosters clear communication, and provides a snapshot of the company’s progress. While not as comprehensive as other plans, a one-page business plan is an effective tool for maintaining clarity and direction.

- Nonprofit Business Plan: Specifically designed for nonprofit organizations, this plan outlines the mission, goals, target audience, fundraising strategies, and budget allocation. It helps secure grants and donations while ensuring the organization stays on track with its objectives. The nonprofit business plan also helps attract volunteers, board members, and community support. By demonstrating the organization’s impact and plans for the future, this plan is essential for maintaining transparency, accountability, and long-term sustainability within the nonprofit sector.

- Franchise Business Plan: For entrepreneurs seeking to open a franchise, this type of plan focuses on the franchisor’s requirements, as well as the franchisee’s goals, strategies, and financial projections. It is crucial for securing a franchise agreement and ensuring the business’s success within the franchise system. This plan outlines the franchisee’s commitment to brand standards, marketing efforts, and operational procedures, while also addressing local market conditions and opportunities. By creating a solid franchise business plan, entrepreneurs can demonstrate their ability to effectively manage and grow their franchise, increasing the likelihood of a successful partnership with the franchisor.

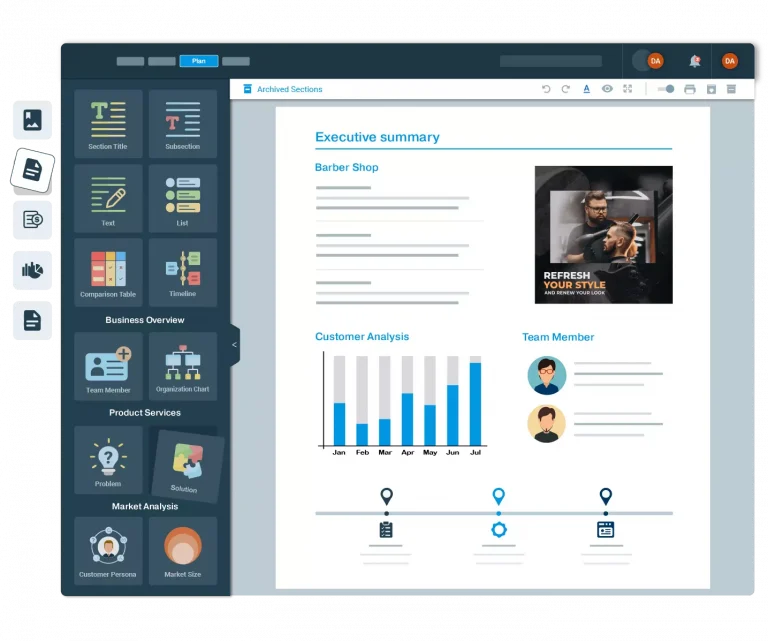

Using Business Plan Software

Creating a comprehensive business plan can be intimidating, but business plan software can streamline the process and help you produce a professional document. These tools offer a number of benefits, including guided step-by-step instructions, financial projections, and industry-specific templates. Here are the top 5 business plan software options available to help you craft a great business plan.

1. LivePlan

LivePlan is a popular choice for its user-friendly interface and comprehensive features. It offers over 500 sample plans, financial forecasting tools, and the ability to track your progress against key performance indicators. With LivePlan, you can create visually appealing, professional business plans that will impress investors and stakeholders.

2. Upmetrics

Upmetrics provides a simple and intuitive platform for creating a well-structured business plan. It features customizable templates, financial forecasting tools, and collaboration capabilities, allowing you to work with team members and advisors. Upmetrics also offers a library of resources to guide you through the business planning process.

Bizplan is designed to simplify the business planning process with a drag-and-drop builder and modular sections. It offers financial forecasting tools, progress tracking, and a visually appealing interface. With Bizplan, you can create a business plan that is both easy to understand and visually engaging.

Enloop is a robust business plan software that automatically generates a tailored plan based on your inputs. It provides industry-specific templates, financial forecasting, and a unique performance score that updates as you make changes to your plan. Enloop also offers a free version, making it accessible for businesses on a budget.

5. Tarkenton GoSmallBiz

Developed by NFL Hall of Famer Fran Tarkenton, GoSmallBiz is tailored for small businesses and startups. It features a guided business plan builder, customizable templates, and financial projection tools. GoSmallBiz also offers additional resources, such as CRM tools and legal document templates, to support your business beyond the planning stage.

Business Plan FAQs

What is a good business plan.

A good business plan is a well-researched, clear, and concise document that outlines a company’s goals, strategies, target market, competitive advantages, and financial projections. It should be adaptable to change and provide a roadmap for achieving success.

What are the 3 main purposes of a business plan?

The three main purposes of a business plan are to guide the company’s strategy, attract investment, and evaluate performance against objectives. Here’s a closer look at each of these:

- It outlines the company’s purpose and core values to ensure that all activities align with its mission and vision.

- It provides an in-depth analysis of the market, including trends, customer needs, and competition, helping the company tailor its products and services to meet market demands.

- It defines the company’s marketing and sales strategies, guiding how the company will attract and retain customers.

- It describes the company’s organizational structure and management team, outlining roles and responsibilities to ensure effective operation and leadership.

- It sets measurable, time-bound objectives, allowing the company to plan its activities effectively and make strategic decisions to achieve these goals.

- It provides a comprehensive overview of the company and its business model, demonstrating its uniqueness and potential for success.

- It presents the company’s financial projections, showing its potential for profitability and return on investment.

- It demonstrates the company’s understanding of the market, including its target customers and competition, convincing investors that the company is capable of gaining a significant market share.

- It showcases the management team’s expertise and experience, instilling confidence in investors that the team is capable of executing the business plan successfully.

- It establishes clear, measurable objectives that serve as performance benchmarks.

- It provides a basis for regular performance reviews, allowing the company to monitor its progress and identify areas for improvement.

- It enables the company to assess the effectiveness of its strategies and make adjustments as needed to achieve its objectives.

- It helps the company identify potential risks and challenges, enabling it to develop contingency plans and manage risks effectively.

- It provides a mechanism for evaluating the company’s financial performance, including revenue, expenses, profitability, and cash flow.

Can I write a business plan by myself?

Yes, you can write a business plan by yourself, but it can be helpful to consult with mentors, colleagues, or industry experts to gather feedback and insights. There are also many creative business plan templates and business plan examples available online, including those above.

We also have examples for specific industries, including a using food truck business plan , salon business plan , farm business plan , daycare business plan , and restaurant business plan .

Is it possible to create a one-page business plan?

Yes, a one-page business plan is a condensed version that highlights the most essential elements, including the company’s mission, target market, unique selling proposition, and financial goals.

How long should a business plan be?

A typical business plan ranges from 20 to 50 pages, but the length may vary depending on the complexity and needs of the business.

What is a business plan outline?

A business plan outline is a structured framework that organizes the content of a business plan into sections, such as the executive summary, company description, market analysis, and financial projections.

What are the 5 most common business plan mistakes?

The five most common business plan mistakes include inadequate research, unrealistic financial projections, lack of focus on the unique selling proposition, poor organization and structure, and failure to update the plan as circumstances change.

What questions should be asked in a business plan?

A business plan should address questions such as: What problem does the business solve? Who is the specific target market ? What is the unique selling proposition? What are the company’s objectives? How will it achieve those objectives?

What’s the difference between a business plan and a strategic plan?

A business plan focuses on the overall vision, goals, and tactics of a company, while a strategic plan outlines the specific strategies, action steps, and performance measures necessary to achieve the company’s objectives.

How is business planning for a nonprofit different?

Nonprofit business planning focuses on the organization’s mission, social impact, and resource management, rather than profit generation. The financial section typically includes funding sources, expenses, and projected budgets for programs and operations.

Image: Envato Elements

Your email address will not be published. Required fields are marked *

© Copyright 2003 - 2024, Small Business Trends LLC. All rights reserved. "Small Business Trends" is a registered trademark.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

How to Write a Business Plan (Plus Examples & Templates)

- 3 years ago

Have you ever wondered how to write a business plan step by step? Mike Andes, told us:

This guide will help you write a business plan to impress investors.

Throughout this process, we’ll get information from Mike Andes, who started Augusta Lawn Care Services when he was 12 and turned it into a franchise with over 90 locations. He has gone on to help others learn how to write business plans and start businesses. He knows a thing or two about writing business plans!

We’ll start by discussing the definition of a business plan. Then we’ll discuss how to come up with the idea, how to do the market research, and then the important elements in the business plan format. Keep reading to start your journey!

What Is a Business Plan?

A business plan is simply a road map of what you are trying to achieve with your business and how you will go about achieving it. It should cover all elements of your business including:

- Finding customers

- Plans for developing a team

- Competition

- Legal structures

- Key milestones you are pursuing

If you aren’t quite ready to create a business plan, consider starting by reading our business startup guide .

Get a Business Idea

Before you can write a business plan, you have to have a business idea. You may see a problem that needs to be solved and have an idea how to solve it, or you might start by evaluating your interests and skills.

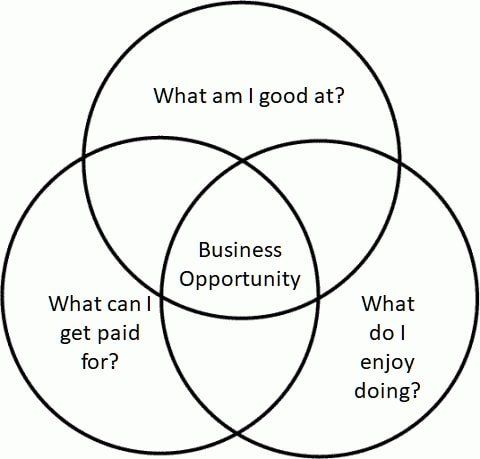

Mike told us, “The three things I suggest asking yourself when thinking about starting a business are:

- What am I good at?

- What would I enjoy doing?

- What can I get paid for?”

If all three of these questions don’t lead to at least one common answer, it will probably be a much harder road to success. Either there is not much market for it, you won’t be good at it, or you won’t enjoy doing it.

As Mike told us, “There’s enough stress starting and running a business that if you don’t like it or aren’t good at it, it’s hard to succeed.”

If you’d like to hear more about Mike’s approach to starting a business, check out our YouTube video

Conduct Market Analysis

Market analysis is focused on establishing if there is a target market for your products and services, how large the target market is, and identifying the demographics of people or businesses that would be interested in the product or service. The goal here is to establish how much money your business concept can make.

Product and Service Demand

A search engine is your best friend when trying to figure out if there is demand for your products and services. Personally, I love using presearch.org because it lets you directly search on a ton of different platforms including Google, Youtube, Twitter, and more. Check out the screenshot for the full list of search options.

With quick web searches, you can find out how many competitors you have, look through their reviews, and see if there are common complaints about the competitors. Bad reviews are a great place to find opportunities to offer better products or services.

If there are no similar products or services, you may have stumbled upon something new, or there may just be no demand for it. To find out, go talk to your most honest friend about the idea and see what they think. If they tell you it’s dumb or stare at you vacantly, there’s probably no market for it.

You can also conduct a survey through social media to get public opinion on your idea. Using Facebook Business Manager , you could get a feel for who would be interested in your product or service.

I ran a quick test of how many people between 18-65 you could reach in the U.S. during a week. It returned an estimated 700-2,000 for the total number of leads, which is enough to do a fairly accurate statistical analysis.

Identify Demographics of Target Market

Depending on what type of business you want to run, your target market will be different. The narrower the demographic, the fewer potential customers you’ll have. If you did a survey, you’ll be able to use that data to help define your target audience. Some considerations you’ll want to consider are:

- Other Interests

- Marital Status

- Do they have kids?

Once you have this information, it can help you narrow down your options for location and help define your marketing further. One resource that Mike recommended using is the Census Bureau’s Quick Facts Map . He told us,

“It helps you quickly evaluate what the best areas are for your business to be located.”

How to Write a Business Plan

Now that you’ve developed your idea a little and established there is a market for it, you can begin writing a business plan. Getting started is easier with the business plan template we created for you to download. I strongly recommend using it as it is updated to make it easier to create an action plan.

Each of the following should be a section of your business plan:

- Business Plan Cover Page

- Table of Contents

- Executive Summary

- Company Description

- Description of Products and Services

SWOT Analysis

- Competitor Data

- Competitive Analysis

- Marketing Expenses Strategy

Pricing Strategy

- Distribution Channel Assessment

- Operational Plan

- Management and Organizational Strategy

- Financial Statements and/or Financial Projections

We’ll look into each of these. Don’t forget to download our free business plan template (mentioned just above) so you can follow along as we go.

How to Write a Business Plan Step 1. Create a Cover Page

The first thing investors will see is the cover page for your business plan. Make sure it looks professional. A great cover page shows that you think about first impressions.

A good business plan should have the following elements on a cover page:

- Professionally designed logo

- Company name

- Mission or Vision Statement

- Contact Info

Basically, think of a cover page for your business plan like a giant business card. It is meant to capture people’s attention but be quickly processed.

How to Write a Business Plan Step 2. Create a Table of Contents

Most people are busy enough that they don’t have a lot of time. Providing a table of contents makes it easy for them to find the pages of your plan that are meaningful to them.

A table of contents will be immediately after the cover page, but you can include it after the executive summary. Including the table of contents immediately after the executive summary will help investors know what section of your business plan they want to review more thoroughly.

Check out Canva’s article about creating a table of contents . It has a ton of great information about creating easy access to each section of your business plan. Just remember that you’ll want to use different strategies for digital and hard copy business plans.

How to Write a Business Plan Step 3. Write an Executive Summary

An executive summary is where your business plan should catch the readers interest. It doesn’t need to be long, but should be quick and easy to read.

Mike told us,

How long should an executive summary bein an informal business plan?

For casual use, an executive summary should be similar to an elevator pitch, no more than 150-160 words, just enough to get them interested and wanting more. Indeed has a great article on elevator pitches . This can also be used for the content of emails to get readers’ attention.

It consists of three basic parts:

- An introduction to you and your business.

- What your business is about.

- A call to action

Example of an informal executive summary

One of the best elevator pitches I’ve used is:

So far that pitch has achieved a 100% success rate in getting partnerships for the business.

What should I include in an executive summary for investors?

Investors are going to need a more detailed executive summary if you want to secure financing or sell equity. The executive summary should be a brief overview of your entire business plan and include:

- Introduction of yourself and company.

- An origin story (Recognition of a problem and how you came to solution)

- An introduction to your products or services.

- Your unique value proposition. Make sure to include intellectual property.

- Where you are in the business life cycle

- Request and why you need it.

Successful business plan examples

The owner of Urbanity told us he spent 2 months writing a 75-page business plan and received a $250,000 loan from the bank when he was 23. Make your business plan as detailed as possible when looking for financing. We’ve provided a template to help you prepare the portions of a business plan that banks expect.

Here’s the interview with the owner of Urbanity:

When to write an executive summary?

Even though the summary is near the beginning of a business plan, you should write it after you complete the rest of a business plan. You can’t talk about revenue, profits, and expected expenditures if you haven’t done the market research and created a financial plan.

What mistakes do people make when writing an executive summary?

Business owners commonly go into too much detail about the following items in an executive summary:

- Marketing and sales processes

- Financial statements

- Organizational structure

- Market analysis

These are things that people will want to know later, but they don’t hook the reader. They won’t spark interest in your small business, but they’ll close the deal.

How to Write a Business Plan Step 4. Company Description

Every business plan should include a company description. A great business plan will include the following elements while describing the company:

- Mission statement

- Philosophy and vision

- Company goals

Target market

- Legal structure

Let’s take a look at what each section includes in a good business plan.

Mission Statement

A mission statement is a brief explanation of why you started the company and what the company’s main focus is. It should be no more than one or two sentences. Check out HubSpot’s article 27 Inspiring Mission Statement for a great read on informative and inspiring mission and vision statements.

Company Philosophy and Vision

The company philosophy is what drives your company. You’ll normally hear them called core values. These are the building blocks that make your company different. You want to communicate your values to customers, business owners, and investors as often as possible to build a company culture, but make sure to back them up.

What makes your company different?

Each company is different. Your new business should rise above the standard company lines of honesty, integrity, fun, innovation, and community when communicating your business values. The standard answers are corporate jargon and lack authenticity.

Examples of core values

One of my clients decided to add a core values page to their website. As a tech company they emphasized the values:

- Prioritize communication.

- Never stop learning.

- Be transparent.

- Start small and grow incrementally.

These values communicate how the owner and the rest of the company operate. They also show a value proposition and competitive advantage because they specifically focus on delivering business value from the start. These values also genuinely show what the company is about and customers recognize the sincerity. Indeed has a great blog about how to identify your core values .

What is a vision statement?

A vision statement communicate the long lasting change a business pursues. The vision helps investors and customers understand what your company is trying to accomplish. The vision statement goes beyond a mission statement to provide something meaningful to the community, customer’s lives, or even the world.

Example vision statements

The Alzheimer’s Association is a great example of a vision statement:

A world without Alzheimer’s Disease and other dementia.

It clearly tells how they want to change the world. A world without Alzheimers might be unachievable, but that means they always have room for improvement.

Business Goals

You have to measure success against goals for a business plan to be meaningful. A business plan helps guide a company similar to how your GPS provides a road map to your favorite travel destination. A goal to make as much money as possible is not inspirational and sounds greedy.

Sure, business owners want to increase their profits and improve customer service, but they need to present an overview of what they consider success. The goals should help everyone prioritize their work.

How far in advance should a business plan?

Business planning should be done at least one year in advance, but many banks and investors prefer three to five year business plans. Longer plans show investors that the management team understands the market and knows the business is operating in a constantly shifting market. In addition, a plan helps businesses to adjust to changes because they have already considered how to handle them.

Example of great business goals

My all time-favorite long-term company goals are included in Tesla’s Master Plan, Part Deux . These goals were written in 2016 and drive the company’s decisions through 2026. They are the reason that investors are so forgiving when Elon Musk continually fails to meet his quarterly and annual goals.