Free Business Plan Excel Template [Excel Download]

Written by Dave Lavinsky

A business plan is a roadmap for growing your business. Not only does it help you plan out your venture, but it is required by funding sources like banks, venture capitalists and angel investors.

Download our Ultimate Business Plan Template here >

The body of your business plan describes your company and your strategies for growing it. The financial portion of your plan details the financial implications of your business: how much money you need, what you project your future sales and earnings to be, etc.

Below you will be able to download our free business plan excel template to help with the financial portion of your business plan. You will also learn about the importance of the financial model in your business plan.

Download the template here: Financial Plan Excel Template

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less! It includes a simple, plug-and-play financial model and a fill-in-the-blanks template for completing the body of your plan.

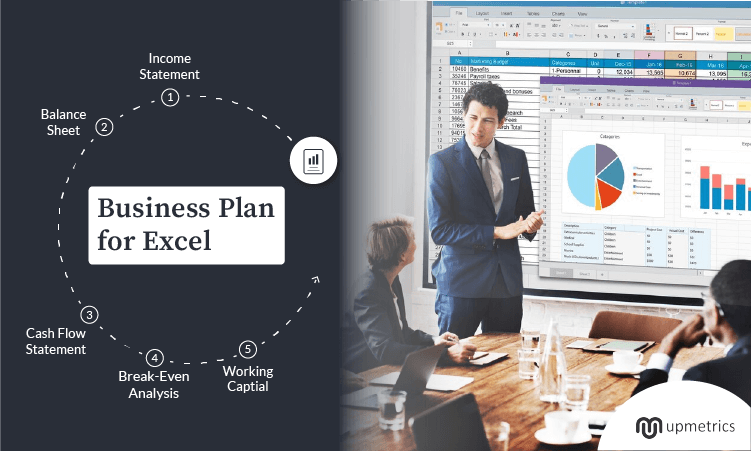

What’s Included in our Business Plan Excel Template

Our business plan excel template includes the following sections:

Income Statement : A projection of your business’ revenues, costs, and expenses over a specific period of time. Includes sections for sales revenue, cost of goods sold (COGS), operating expenses, and net profit or loss.

Example 5 Year Annual Income Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Revenues | $368,306 | $402,786 | $440,494 | $481,732 | $526,831 | |

| Direct Costs | ||||||

| Direct Costs | $10,475 | $10,901 | $11,343 | $11,804 | $12,283 | |

| Salaries | $58,251 | $60,018 | $61,839 | $63,715 | $65,648 | |

| Marketing Expenses | $0 | $0 | $0 | $0 | $0 | |

| Rent/Utility Expenses | $0 | $0 | $0 | $0 | $0 | |

| Other Expenses | $12,135 | $12,503 | $12,883 | $13,274 | $13,676 | |

| Depreciation | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | |

| Amortization | $0 | $0 | $0 | $0 | $0 | |

| Interest Expense | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $273,443 | $305,362 | $340,428 | $378,938 | $421,222 | |

| Income Tax Expense | $95,705 | $106,877 | $119,149 | $132,628 | $147,427 | |

| Net Profit Margin (%) | 48.3% | 49.3% | 50.2% | 51.1% | 52% |

Cash Flow Statement : A projection of your business’ cash inflows and outflows over a specific period of time. Includes sections for cash inflows (such as sales receipts, loans, and investments), cash outflows (such as expenses, salaries, and loan repayments), and net cash flow.

Example 5 Year Annual Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Net Income (Loss) | $177,738 | $198,485 | $221,278 | $246,310 | $273,794 | |

| Change in Working Capital | ($24,912) | ($2,754) | ($3,025) | ($2,052) | ($3,523) | |

| Plus Depreciation | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | |

| Plus Amortization | $0 | $0 | $0 | $0 | $0 | |

| Fixed Assets | ($30,000) | $0 | $0 | $0 | $0 | |

| Intangible Assets | $0 | $0 | $0 | $0 | $0 | |

| Cash from Equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from Debt financing | $80,000 | $0 | $0 | $0 | ($80,000) | |

| Cash at Beginning of Period | $0 | $208,826 | $410,557 | $634,809 | $885,067 | |

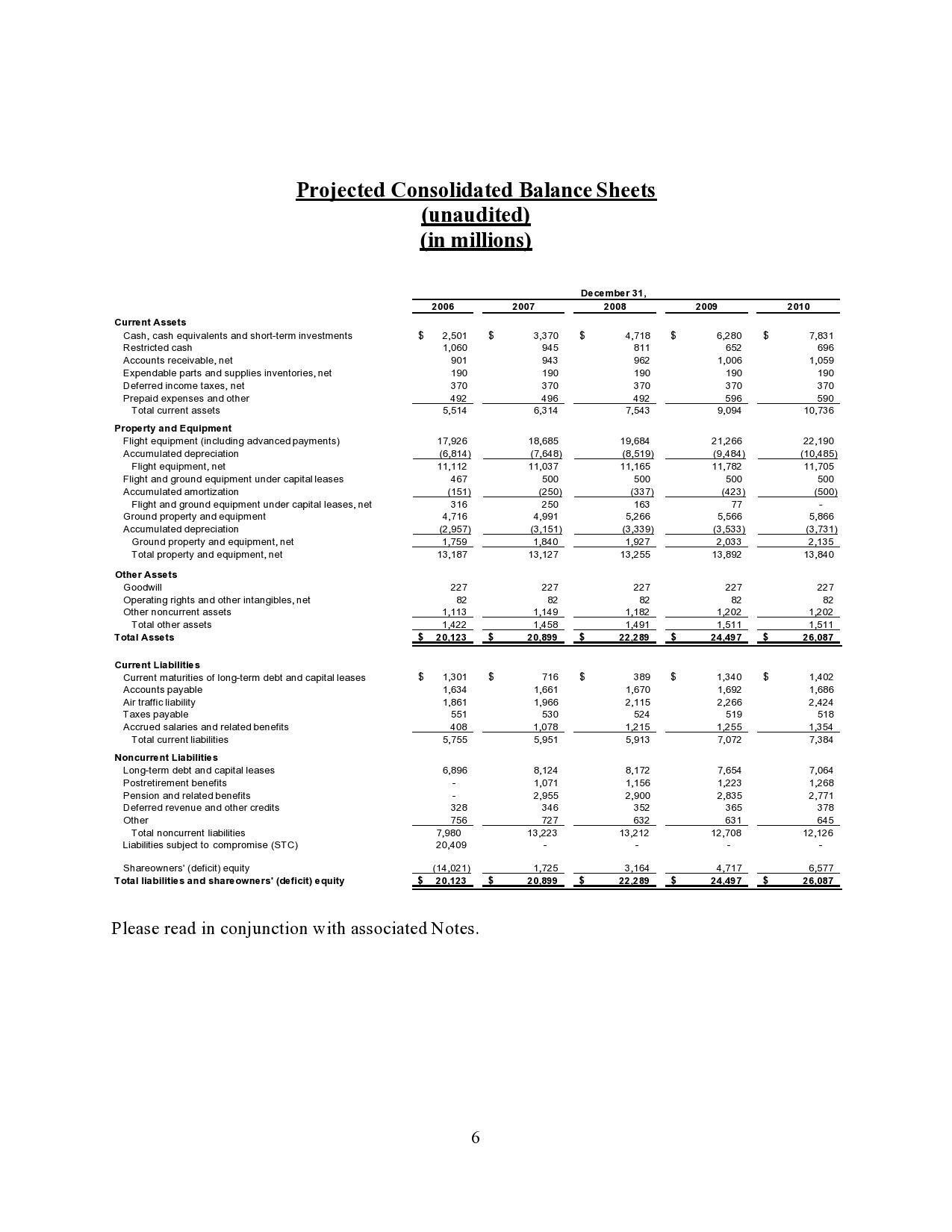

Balance Sheet : A snapshot of your business’ financial position at a specific point in time. Includes sections for assets (such as cash, inventory, equipment, and property), liabilities (such as loans, accounts payable, and salaries payable), and owner’s equity (such as retained earnings and capital contributions).

Example 5 Year Annual Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Cash | $208,826 | $410,557 | $634,809 | $885,067 | $1,081,338 | |

| Other Current Assets | $31,729 | $34,700 | $37,948 | $40,144 | $43,902 | |

| Intangible Assets | $0 | $0 | $0 | $0 | $0 | |

| Acc Amortization | $0 | $0 | $0 | $0 | $0 | |

| Fixed Assets | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | |

| Accum Depreciation | $6,000 | $12,000 | $18,000 | $24,000 | $30,000 | |

| Preliminary Exp | $0 | $0 | $0 | $0 | $0 | |

| Current Liabilities | $6,817 | $7,033 | $7,256 | $7,399 | $7,634 | |

| Debt outstanding | $80,000 | $80,000 | $80,000 | $80,000 | $0 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $177,738 | $376,224 | $597,502 | $843,812 | $1,117,606 | |

Download the template here: Business Plan Excel Template

The template is easy to customize according to your specific business needs. Simply input your own financial data and projections, and use it as a guide to create a comprehensive financial plan for your business. Remember to review and update your financial plan regularly to track your progress and make informed financial decisions.

Finish Your Business Plan Today!

The importance of the financial model in your business plan.

A solid financial model is a critical component of any well-prepared business plan. It provides a comprehensive and detailed projection of your business’ financial performance, including revenue, expenses, cash flow, and profitability. The financial model is not just a mere set of numbers, but a strategic tool that helps you understand the financial health of your business, make informed decisions, and communicate your business’ financial viability to potential investors, lenders, and other stakeholders. In this article, we will delve into the importance of the financial model in your business plan.

- Provides a roadmap for financial success : A well-structured financial model serves as a roadmap for your business’ financial success. It outlines your revenue streams, cost structure, and cash flow projections, helping you understand the financial implications of your business strategies and decisions. It allows you to forecast your future financial performance, set financial goals, and measure your progress over time. A comprehensive financial model helps you identify potential risks, opportunities, and areas that may require adjustments to achieve your financial objectives.

- Demonstrates financial viability to stakeholders : Investors, lenders, and other stakeholders want to see that your business is financially viable and has a plan to generate revenue, manage expenses, and generate profits. A robust financial model in your business plan demonstrates that you have a solid understanding of your business’ financials and have a plan to achieve profitability. It provides evidence of the market opportunity, pricing strategy, sales projections, and financial sustainability. A well-prepared financial model increases your credibility and instills confidence in your business among potential investors and lenders.

- Helps with financial decision-making : Your financial model is a valuable tool for making informed financial decisions. It helps you analyze different scenarios, evaluate the financial impact of your decisions, and choose the best course of action for your business. For example, you can use your financial model to assess the feasibility of a new product launch, determine the optimal pricing strategy, or evaluate the impact of changing market conditions on your cash flow. A well-structured financial model helps you make data-driven decisions that are aligned with your business goals and financial objectives.

- Assists in securing funding : If you are seeking funding from investors or lenders, a robust financial model is essential. It provides a clear picture of your business’ financials and shows how the funds will be used to generate revenue and profits. It includes projections for revenue, expenses, cash flow, and profitability, along with a breakdown of assumptions and methodology used. It also provides a realistic assessment of the risks and challenges associated with your business and outlines the strategies to mitigate them. A well-prepared financial model in your business plan can significantly increase your chances of securing funding as it demonstrates your business’ financial viability and growth potential.

- Facilitates financial management and monitoring : A financial model is not just for external stakeholders; it is also a valuable tool for internal financial management and monitoring. It helps you track your actual financial performance against your projections, identify any deviations, and take corrective actions if needed. It provides a clear overview of your business’ cash flow, profitability, and financial health, allowing you to proactively manage your finances and make informed decisions to achieve your financial goals. A well-structured financial model helps you stay on top of your business’ financials and enables you to take timely actions to ensure your business’ financial success.

- Enhances business valuation : If you are planning to sell your business or seek investors for an exit strategy, a robust financial model is crucial. It provides a solid foundation for business valuation as it outlines your historical financial performance, future projections, and the assumptions behind them. It helps potential buyers or investors understand the financial potential of your business and assess its value. A well-prepared financial model can significantly impact the valuation of your business, and a higher valuation can lead to better negotiation terms and higher returns on your investment.

- Supports strategic planning : Your financial model is an integral part of your strategic planning process. It helps you align your financial goals with your overall business strategy and provides insights into the financial feasibility of your strategic initiatives. For example, if you are planning to expand your business, enter new markets, or invest in new technologies, your financial model can help you assess the financial impact of these initiatives, including the investment required, the expected return on investment, and the timeline for achieving profitability. It enables you to make informed decisions about the strategic direction of your business and ensures that your financial goals are aligned with your overall business objectives.

- Enhances accountability and transparency : A robust financial model promotes accountability and transparency in your business. It provides a clear framework for setting financial targets, measuring performance, and holding yourself and your team accountable for achieving financial results. It helps you monitor your progress towards your financial goals and enables you to take corrective actions if needed. A well-structured financial model also enhances transparency by providing a clear overview of your business’ financials, assumptions, and methodologies used in your projections. It ensures that all stakeholders, including investors, lenders, employees, and partners, have a clear understanding of your business’ financial performance and prospects.

In conclusion, a well-prepared financial model is a crucial component of your business plan. It provides a roadmap for financial success, demonstrates financial viability to stakeholders, helps with financial decision-making, assists in securing funding, facilitates financial management and monitoring, enhances business valuation, supports strategic planning, and enhances accountability and transparency in your business. It is not just a set of numbers, but a strategic tool that helps you understand, analyze, and optimize your business’ financial performance. Investing time and effort in creating a comprehensive and robust financial model in your business plan is vital for the success of your business and can significantly increase your chances of achieving your financial goals.

5-Year Financial Plan Template

Whether you are already running a business, or making plans to start one up, financial planning is a vital part of ensuring your success. Not knowing your expected income and expenditure will make it difficult to plan, and hard to find investors.

This 5-Year Financial Plan spreadsheet will make it easy for you to calculate profit and loss, view your balance sheet and cash flow projections, as well as calculate any loan payments you may have. Whilst the wording on this spreadsheet is focussed around products, it can just as easily be used for businesses who largely provide services to their customers.

5-Year Financial Plan Projection

How to use Financial Plan

Model inputs.

Use the Model Inputs sheet to enter information about your business that will be used to model results seen on the other pages.

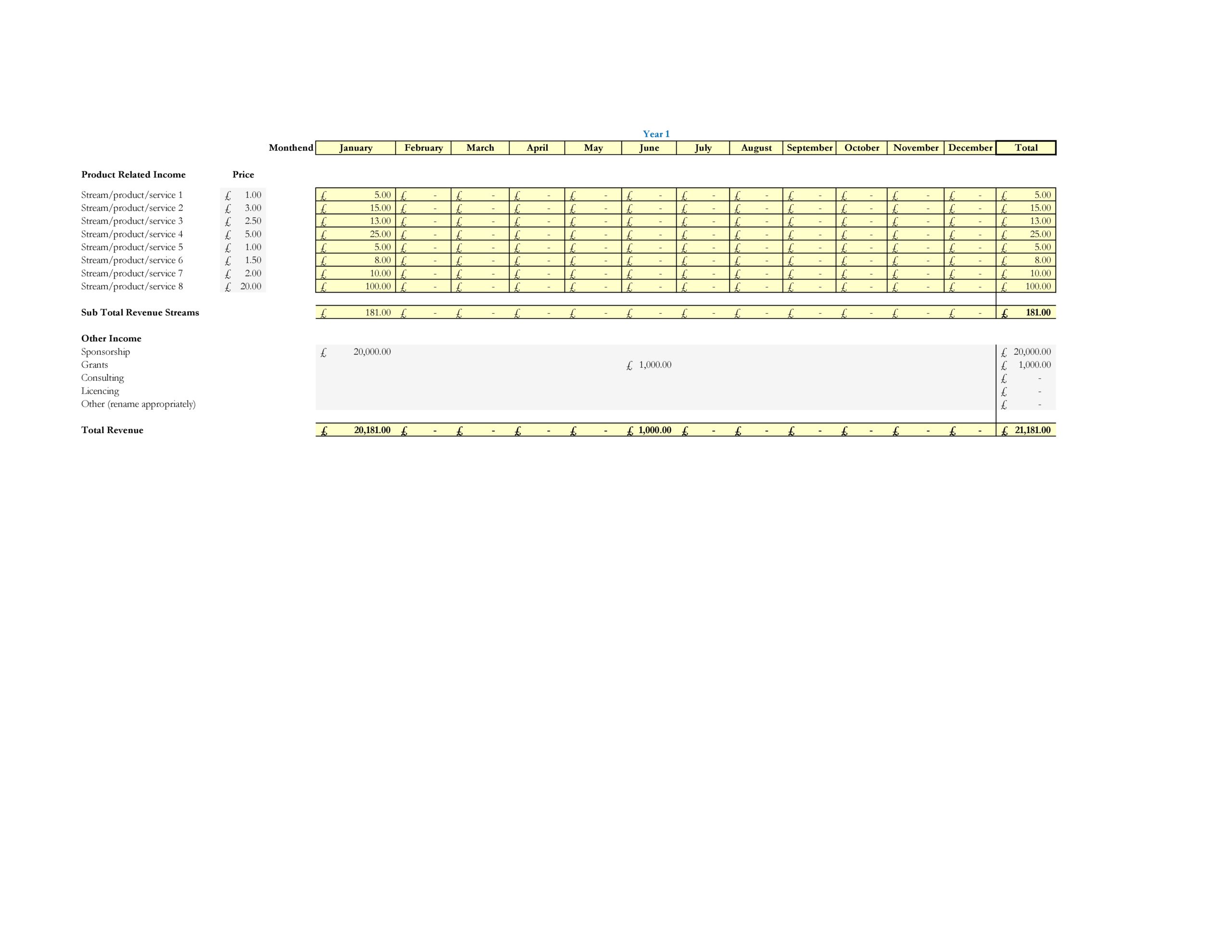

Forecasted Revenue

The forecasted revenue section allows you to estimate your revenue for 4 different products. Simply use the white boxes to enter the number of units you expect to sell, and the price you expect to sell them for, and the spreadsheet will calculate the total revenue for each product for the year. If you want to give your products names, simply type over the words "Product 1", "Product 2" etc. and these names will be carried through to the rest of the spreadsheet.

Cost of Goods Sold

Your margins are unlikely to be the same on all of your products, so the cost of goods sold allows you to enter your expected gross margin for each product into the white boxes in Column B. The spreadsheet will automatically calculate the annual cost of goods sold based on this information, along with your forecasted revenue.

Annual Maintenance, Repair and Overhaul

As the cost of annual maintenance, repair and overhaul is likely to increase each year, you will need to enter a percentage factor on your capital equipment in the white box in Column B. This will be used to calculate your operating expenses in the profit and loss sheet.

Asset Depreciation

Use the white box to enter the number of years you expect your assets to depreciate over. This may vary greatly from business to business, as assets in some sectors depreciate much more quickly than they do in others.

In most parts of the world, you will have to pay income on your earnings. Enter the annual tax rate that applies to your circumstances in the white box in Column B. If you have to pay any other taxes, these can be entered later on the Profit and Loss sheet.

Although you cannot be certain of the level of inflation, you will still need to try and plan for it when coming up with a 5-year financial plan. The International Monetary Fund provide forecasts for a number of countries, so is a good place to look if you are unsure what to enter here. Simply enter your inflation rate in the white box.

Product Price Increase

As a consumer, you are no doubt aware that the price of products goes up over time. Enter a number in the white box to show the expected annual price increase of your products to enable the spreadsheet to calculate income in future years. If you are unsure what to put here, increasing your product price in line with inflation is a good starting point. If your business is just starting out, you may be able to command higher prices for your products or services as the years go on, as you build up brand recognition and a good reputation.

The funding section allows you to enter information about your business loan. To use this section, simply fill in the three white boxes representing the amount of the loan, the annual interest rate and the term of the loan in months - for example, 12 for 1 year, 24 for 2 years, 36 for 3 years, 48 for 4 years, or 60 for a 5 year loan.

Profit and loss

This sheet calculates your profit and loss for each year over a 5 year period. The profit and loss assumptions, along with income, are automatically calculated using information entered in the model inputs sheet.

Non-Operation Income

You may have, or be expecting some income in addition to your operating income. These can be entered manually in the white cells in Column B for Year 1, Column C for Year 2 and so on. There are pre-entered categories for rental, lost income and loss (or gain) on the sale of assets, as well as an additional row where you can enter your own non-operation income.

Operating Expenses

Some parts of this are already filled in based on information you put on the Model Inputs, for example, depreciation, maintenance and interest on long-term debt. Years 2-5 are also filled in for you across all categories based on the inflation information entered in the Model Inputs sheet. You therefore only need to enter your Sales and Marketing, Insurance, Payroll and Payroll Tax, Property Taxes, Utilities, Administration Fees and any Other Expenses into the white cells in Column B for Year 1.

Non-recurring Expenses

This section is for entering any expenses that you will not be paying on an annual basis. The Unexpected Expenses row allows you to enter a contingency for unexpected expenses, whilst the Other Expenses row allows you to enter any other one off expenses you may be expecting to make, for example the purchase of new equipment part way into your 5 year plan.

Income Tax is filled in based on the information you enter into the model inputs. Depending on where your business is based, you may find yourself having to pay other taxes. These can be entered in the Other Tax row. You can rename this row by typing over the "Other Tax (specify)" text.

Balance Sheet

The annual balances for Years 1-5 are, in most cases, filled in for you, based on the information you have entered on the Model Inputs sheet and in the Initial Balance column of the Balance Sheet column itself. This makes it very easy to use.

Current Assets

This is where you can enter the value of any of your current assets, with spaces to enter information about Cash and Short-term Investments, Accounts Receivable, Inventory, Prepaid Expenses and Deferred Income Tax. At the bottom of this section is a space for you to enter any other current assets you may have that do not fall into any of these categories.

Property and Equipment

Depending on the nature of your business, you may have assets such as Buildings, Land, Capital Improvements and Machinery. Enter the value of these assets into Column B, and these values will be copied over to each of the 5 years of the plan. The depreciation information entered into the Model Inputs sheet will be used to calculate the depreciation expenses, which allows a total for property and equipment to be calculated automatically.

Other Assets

This section is for entering information on any assets that don't fit in the other sections. These could be Goodwill Payments, Deferred Income Tax, Long-term Investments, Deposits, or any Other long-term assets. Enter the information into Column B, and it will be carried across to the yearly columns automatically.

Current Liabilities

As well as assets, your business is likely to have liabilities. There are spaces to enter Accounts Payable, Accrued Expenses, Notes Payable and Short-term Debt, Capital Leases and Other current liabilities. Just leave blank any rows where you do not have any liabilities, and the totals will be calculated for you.

Your long-term debt/loan information will have already been entered in the Model Inputs sheet, so the only thing to do here is to enter any other long-term debt. Unlike much of the rest of the Balance Sheet, you can manually enter different amounts for each year, as you may, for example, be expecting to take on another loan to purchase some new equipment in Year 3 as your business expands.

Other Liabilities

Use this section to enter any liabilities not covered by the pre-defined labels. You can amend the text in Column A, in order to specify the liabilities, and then enter the cost of these liabilities in Column B.

Your business is likely to have some equity, and this can be entered into this section. You can fill out the Owner's Equity, Paid-in Capital and Preferred Equity in Column B. Your retained earnings are automatically calculated based on the Profit and Loss sheet.

Much of the information on the cash flow sheet is based on calculations in the Balance Sheet. It is important to plan your cash flow carefully, so that you know what funds you will have available to buy new stock and equipment.

Operating Activities

Much of this section is automatically filled in based on your balance sheet. There are only three rows to fill out, which are Amortization, Other Liabilities and Other Operating Cash Flow. You only need to fill out the white boxes in Column B for Year 1, as these values will automatically be carried over into subsequent years for you.

Investing Activities

Your capital expenditures and sale of fixed assets will be automatically populated if you have filled out the relevant sections of the Balance Sheet. They will be blank if they do not apply. As investing activities can vary year on year, you will need to fill out any investment activities for each of the 5 years in the appropriate columns for Acquisition of Business, and any Other Investing Cash Flow items.

Financing Activities

The long-term debt/financing row will be pre-filled based on the loan information previously entered. Use Column B to fill out your Preferred Stock, Total Cash Dividends Paid, Common Stock and Other Financing Cash Flow items for Year 1. This information will automatically carried over to Years 2-5.

Loan Payment Calculator

There is nothing to enter on this sheet, as it is for information only. Whether or not you already have a loan, or are using this spreadsheet as a part of a business plan to help you obtain one, it allows you to easily see how much you will be paying each month, showing how much you are paying off your loan, and how much you are paying in interest. This will allow you to get an idea of whether or not you can afford to borrow a bit extra, if you feel it would allow you to push your business into higher places, or whether you need to shop around for a better interest rate or adjust the loan term in order to afford the loan payments.

Related Templates

- TemplateLab

Financial Projections Templates

34 simple financial projections templates (excel,word).

A financial projections template is a tool that is an essential part of managing businesses as it serves as a guide for the various team to achieve the desired goals. The preparation of these projections seems like a difficult task, especially for small businesses. If you can come up with financial statements , then you can also make financial projections.

Table of Contents

- 1 Financial Projections Templates

- 2 When do you need a financial projections template?

- 3 Business Projections Templates

- 4 What to include in financial projections?

- 5 Financial Forecast Templates

- 6 How do I make a financial projection?

- 7 Revenue Projection Templates

When do you need a financial projections template?

A financial projections template uses estimated or existing financial information to forecast the future expenses and income of your business. These projections don’t just consider a single scenario but different ones so you can determine how the changes in one part of your finances might affect the profitability of your company.

If you have to create a financial business projections template for your business, you can download a template to make the task easier. Financial projection has become an important tool in business planning for the following reasons:

- If you’re starting a business venture, a financial projection helps you plan your start-up budget.

- If you already have a business, a financial projection helps you set your goals and stay on track.

- If you’re thinking about getting outside financing, you need a financial projection to convince investors or lenders of the potential of your business.

Business Projections Templates

What to include in financial projections?

A financial projections template usually includes a few financial statements that will help you achieve better financial performance for your business:

- Income Statement Also called the Profit and Loss Statement , this focuses on your company’s expenses and revenues generated for a specific period of time. A typical income statement includes expenses, revenue, losses, and gains. The sum of all these is the net income, a measure of your company’s profitability.

- Cash Flow Statement Taking a look at a cash flow statement makes you understand how your company’s operations work. The statement explains in detail how much money goes in and out of your business in the form of either expense or income. This document includes the following: Operating Activities The cash flow from operating activities reports cash outflows and inflows from your company’s daily operations. This includes changes in accounts receivable, cash, inventory, accounts payable, and depreciation. Investing Activities You use the cash flows from investing activities for your company’s investments into the long-term future. This includes cash outflows for purchases of fixed assets like equipment and property and cash inflows for sales of assets. Financing Activities The financial activities in a cash flow statement show your business’ sources of cash from either banks or investors along with expenditures of cash you have paid to your shareholders. Total these at the end of each period to determine either a loss or a profit. The cash flow statement gets connected to the income statement through net income. To make this document, it requires the reconciliation of the two documents. You can calculate net profitability or income in the income statement which you then use to start the cash flow from the operations category in your cash flow statement.

- Balance Sheet This is a statement of your business’ liabilities, assets, and capital at a specific point in time. It details the balance of expenditure and income over the preceding period. This document provides you with a general overview of your business’ financial health. Here is an overview of these components: Assets These are your business’ resources with economic value that your business owns and which you believe will provide some benefit in the future. Examples of such future benefits include reducing expenses, enhancing sales, or generating cash flow. Assets typically include inventory, property, and cash. Liabilities In general, these refer to the obligations of your business to other entities. In more common terms, these are the debts that your business incurs in your daily operations. It typically includes loans and accounts payable. You can classify liabilities either as short-term or long-term. Owner’s Equity This is the amount you have left after you have paid off your liabilities. It is usually classified as retained earnings – the sum of your net income earned minus all the dividends you have paid since the start of your business.

Together with your break-even analysis and financial statements, you can include any other document that will help explain the assumptions behind your cash flow and financial forecast template.

Financial Forecast Templates

How do I make a financial projection?

The creation of a financial projections template requires the same information to use whether your business is still in its planning stages or it’s already up and running. The difference is whether you’re creating your revenue projection template using historical financial information or if you need to start from scratch.

This includes the creation of projections based on your own experiences or by conducting market research in the industry in which your business will operate. Here are some tips for creating an effective business plan financial projections template:

- Create the sales projection An important component of your business projections template is the sales projections. A business that’s already running can base its projections on its past performance, which you can derive from financial statements. When creating your sales projections, you must consider some external factors like the projected and current health of your company, if your inventory will get affected by additional tariffs, or if there is a downturn in your industry. Even if you want to remain optimistic about your business, you have to make realistic plans.

- Create the expense projection At the onset, the creation of an expense projection seems simpler because it’s much easier to predict the possible expenses of your business than it is to predict potential customers or their buying habits. If you have experience working in a certain industry, you can predict with some degree of accuracy what your fixed expenses are and any recurring expenses. But when it comes to one-time expenses that have the potential to bring down your business, these are much harder to predict. The best thing you can do in this scenario is to project expenses to the best of your ability then increase this value by 15%.

- Come up with a balance sheet for your financial projections template If you have a business that has been in operation for a couple of months, you can come up with a balance sheet using accounting software. The balance sheet shows your business’ financial status, listing its liabilities, equity, and assets balance for a certain time period. Use the current totals in your balance sheet when making your financial projections, In doing so, you will make better predictions on where your business will be a few years in the future. If you’re still in the planning stage of a business, you can create a balance sheet based on the data you’ve gathered from industry research.

- Create the income statement projection If you have a business that is currently in operation, you can create an income statement projection using your existing income statements to create an estimate of your business’ projected numbers. This is a logical move since an income statement provides a picture of your business’s net income after subtracting things like taxes, cost of goods, and other expenses. One of the main purposes of the income statement is to provide an idea of your business’ current performance. It also serves as the basis for estimating your net income for the next couple of years. If your business is still in the planning stages, the creation of a potential income statement shows that you have conducted extensive research and created a diligent and well-crafted estimate of your income in the next couple of years. If you have uncertainties on how to start creating an income statement projection, you can consult with market research firms in your locale. They can provide you with an overview of your targeted industry which includes target markets, expected and current industry growth levels, and sales.

- Come up with a cash flow projection The creation of this document is the final step leading to the completion of your financial projection. The cash flow statement is directly connected to the balance sheet and the net income statement, showing any cash-related or cash activities that can affect your industry. One of the purposes of this statement is to show how much money your business spends. This is a must for businesses obtaining financing or looking for investors. You can use this cash flow statement if your business has been in operation for a minimum of six months, but if your business is still in the planning stages, you can use the information you have gathered to create a credible projection. To make things easier for you, consider using spreadsheet software. Chances are, you’re already using spreadsheets. Using a spreadsheet will be the starting point for your financial projections. In addition, it offers flexibility that allows you to quickly judge alternative scenarios or change assumptions. Be as clear and reasonable as possible with your financial projections. Remember that financial projection is as much science as art. At some point, you will have to make assumptions on certain things like how administrative costs and raw materials will grow, revenue growth, and how efficient you will be at gathering accounts receivable for your business.

Revenue Projection Templates

More Templates

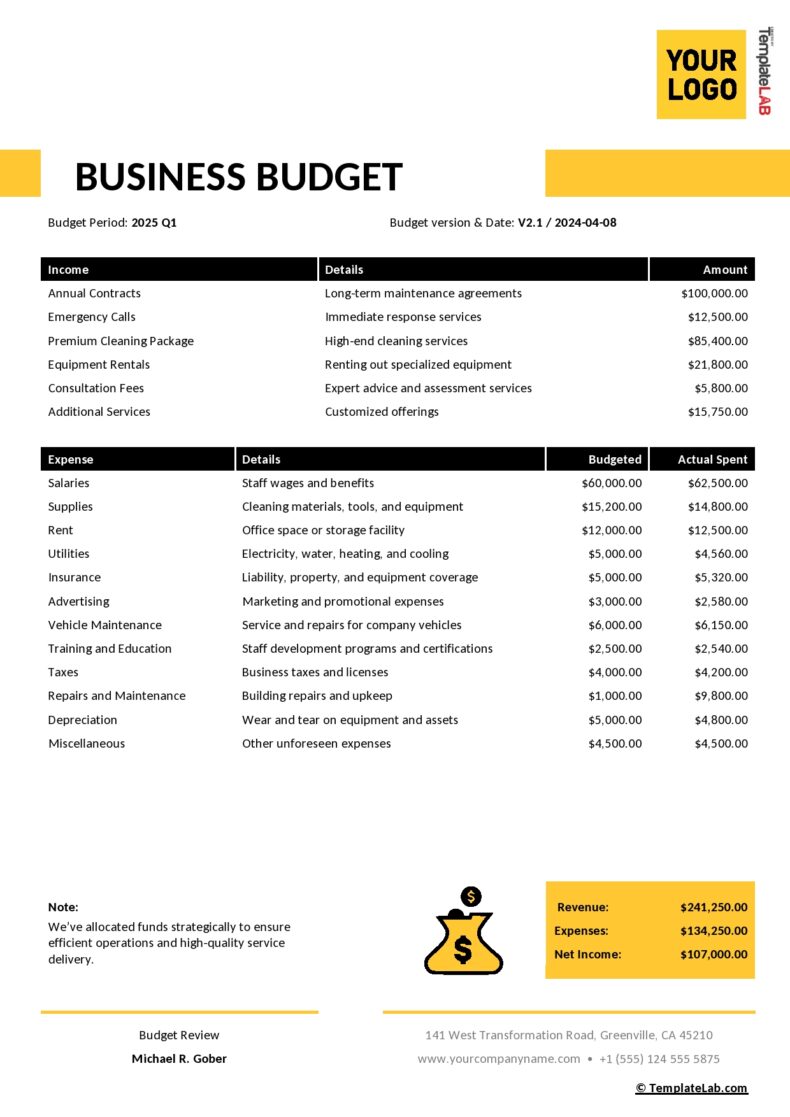

Business Budget Templates

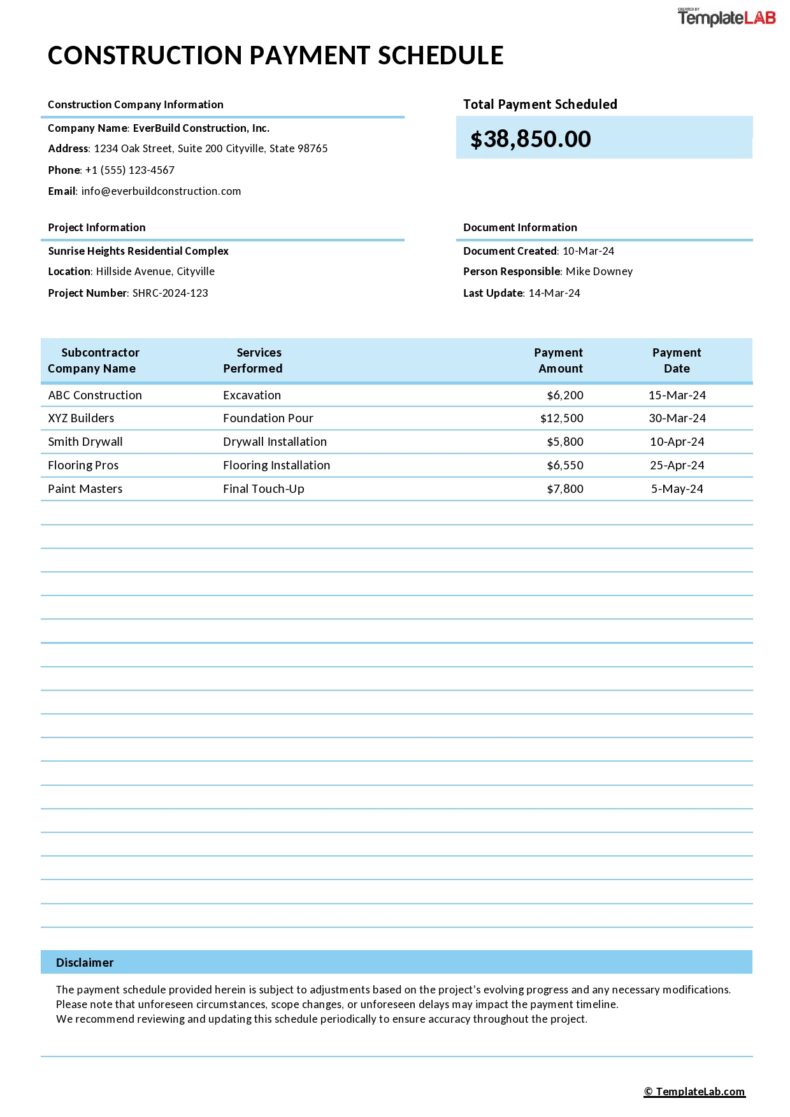

Payment Schedule Templates

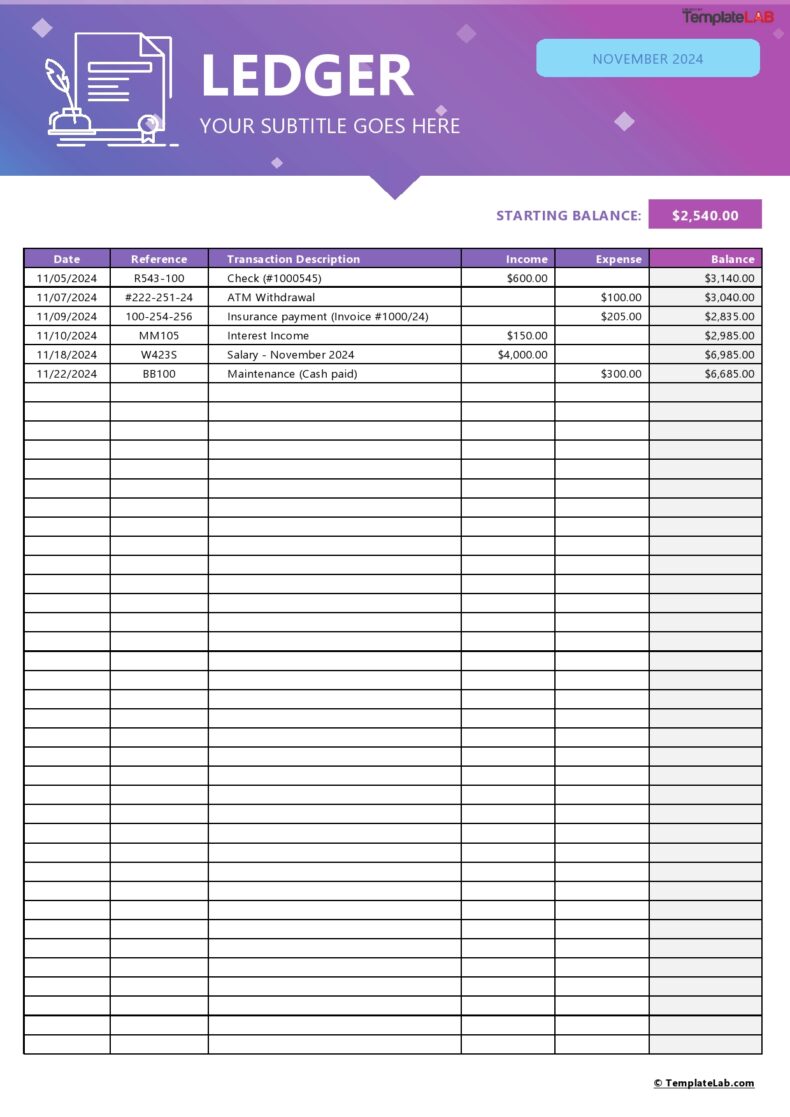

General Ledger Templates

Bill Pay Checklists

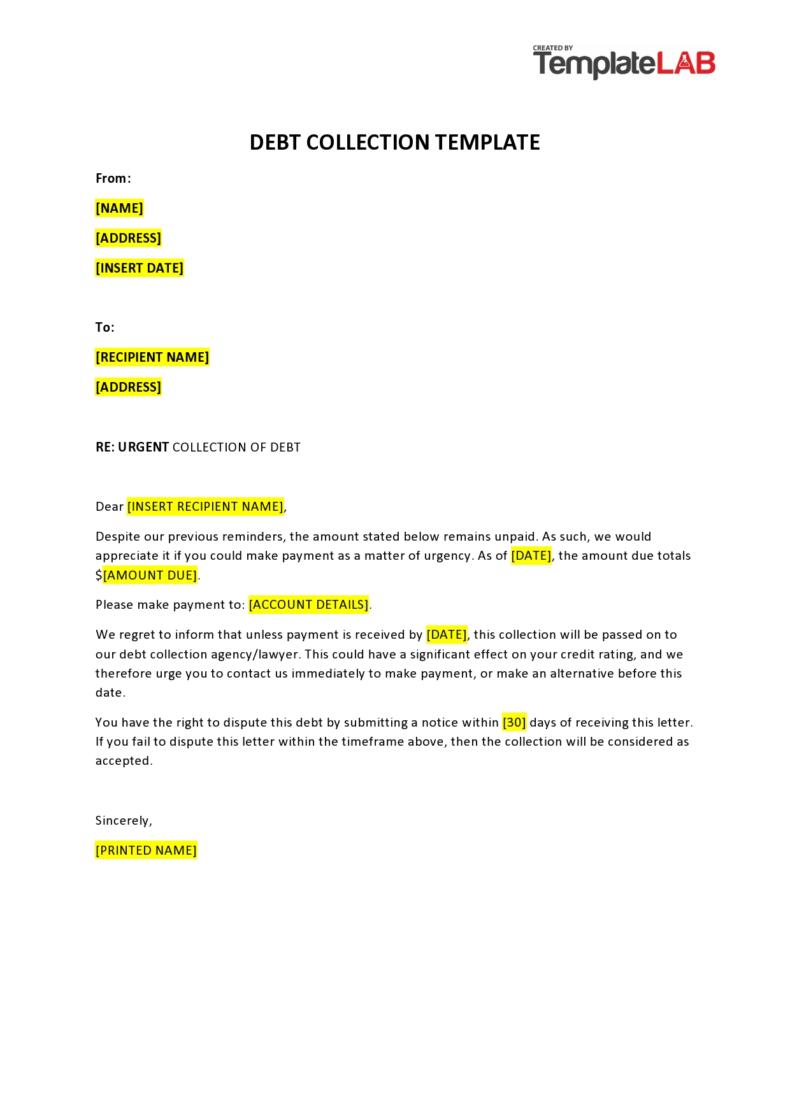

Collection Letter Templates

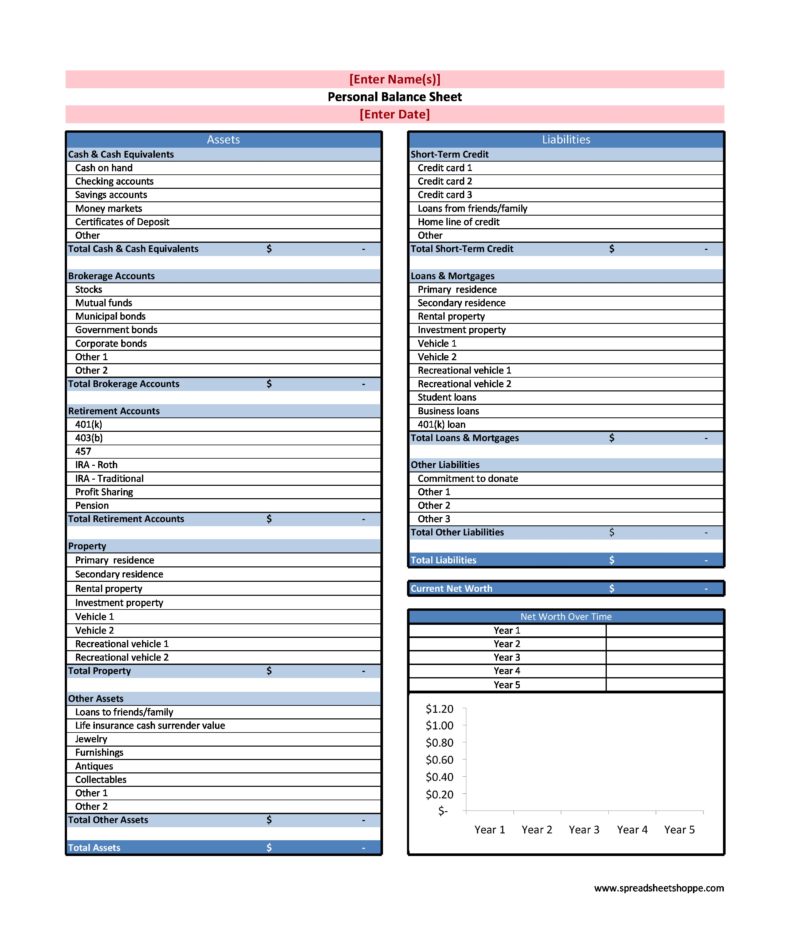

Personal Balance Sheets

Free Business Plan Templates in Excel

By Joe Weller | September 27, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up an extensive list of free business plan templates and samples for organizations of all sizes. You can download all of the plans in Excel.

Included on this page, you’ll find business plan templates in Excel , business plan checklists in Excel , business plan financial templates in Excel , and more.

Business Plan Templates in Excel

These Excel business plan templates are designed to guide you through each step of a well-rounded strategy that supports your marketing, sales, financial, and operational goals.

Business Plan Template in Excel

This Excel business plan template has all the traditional components of a standard business plan, with each section divided into tabs. This template includes space to provide the executive summary, target audience characteristics, product or service offering details, marketing strategies, and more. The plan also offers built-in formulas to complete calculations for sales forecasting, financial statements, and key business ratios.

Download Business Plan Template

Excel | Smartsheet

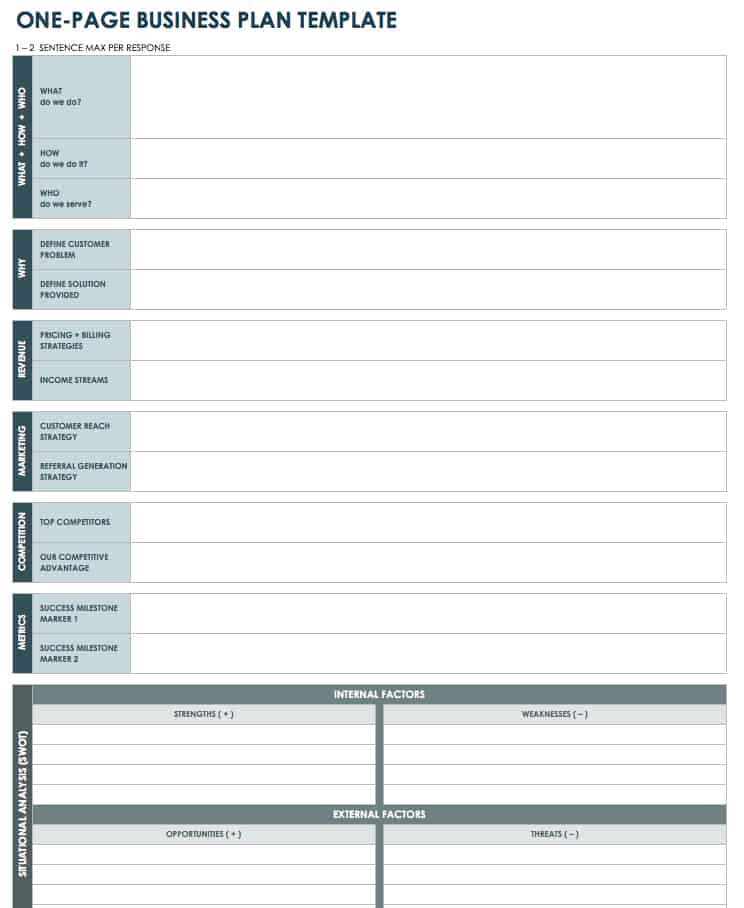

One-Page Business Plan in Excel

To check the feasibility of your business concept, use this single-page business plan template. The template allows you to jot down the core details related to your idea. This template also includes room for you to provide concise information about what you do, how you do it, why you do it, who your idea serves, your competitive advantage, your marketing strategies, and your success factors. At the bottom of this one-page plan, you’ll find a table to conduct a SWOT (strengths, weaknesses, opportunities, and threats) analysis. Find more downloadable single-page plans and examples at “ One-Page Business Plan Templates with a Quick How-To Guide .”

Download One-Page Business Plan

Excel | Word | PDF | Smartsheet

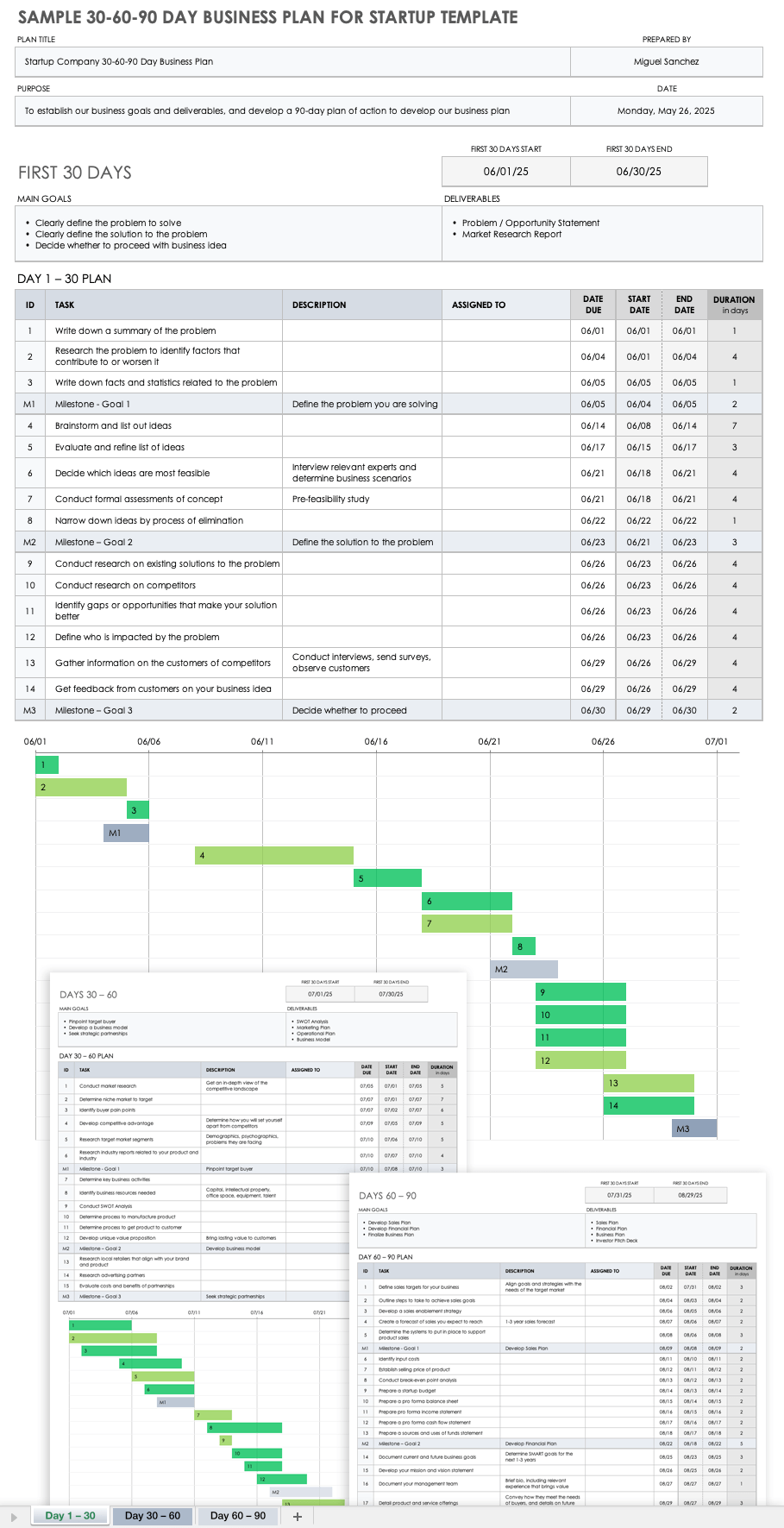

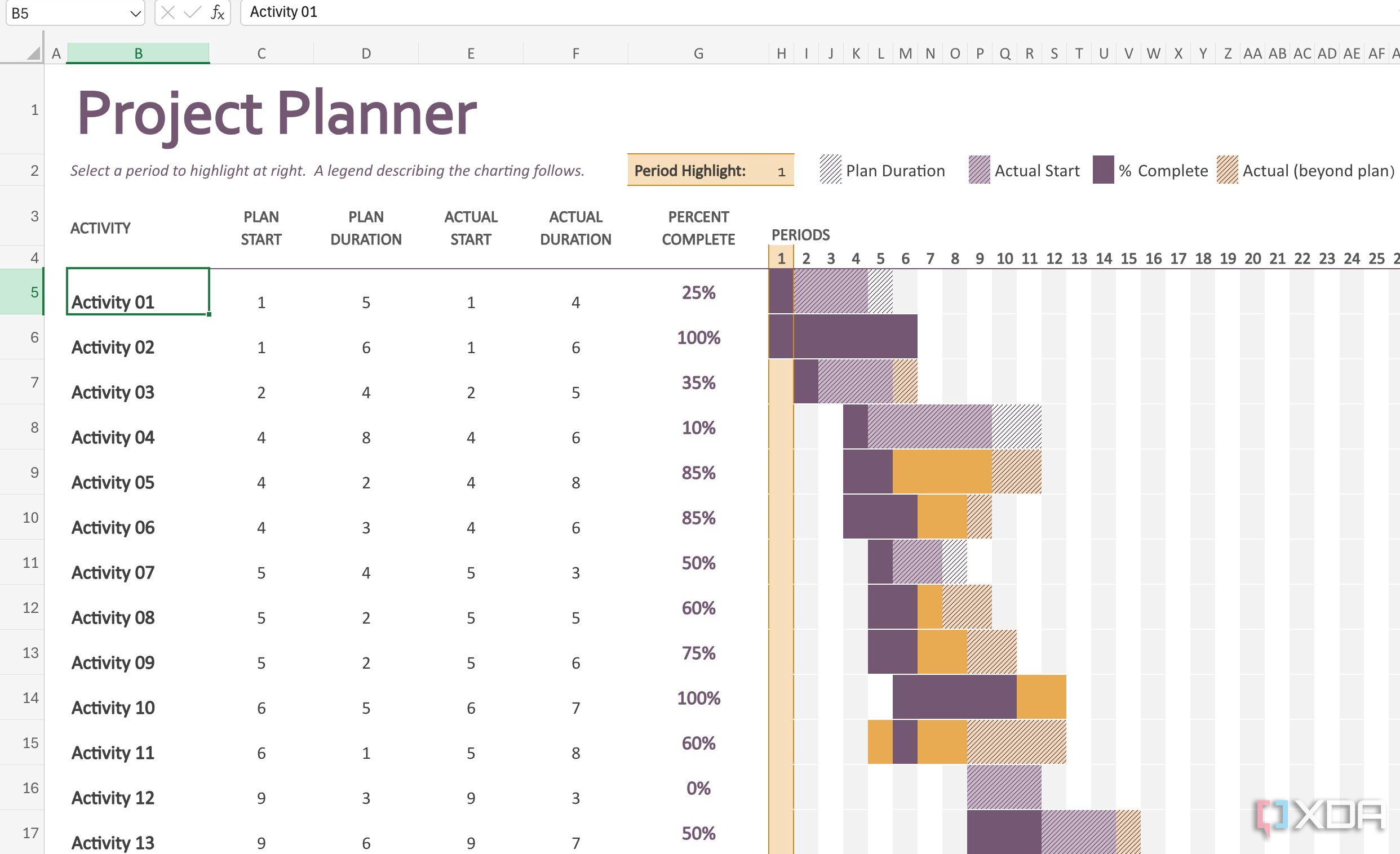

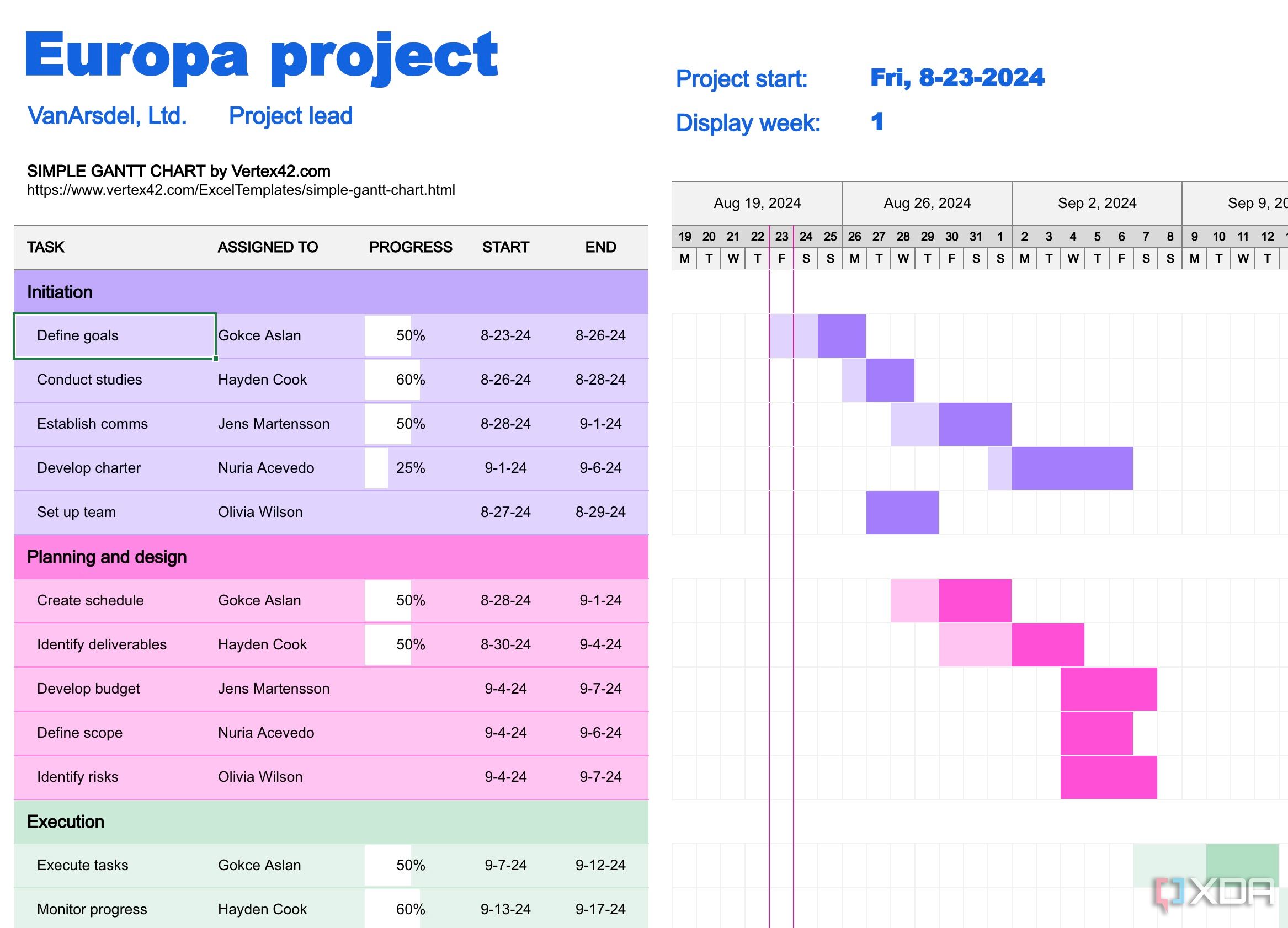

Sample 30-60-90-Day Business Plan for Startup in Excel

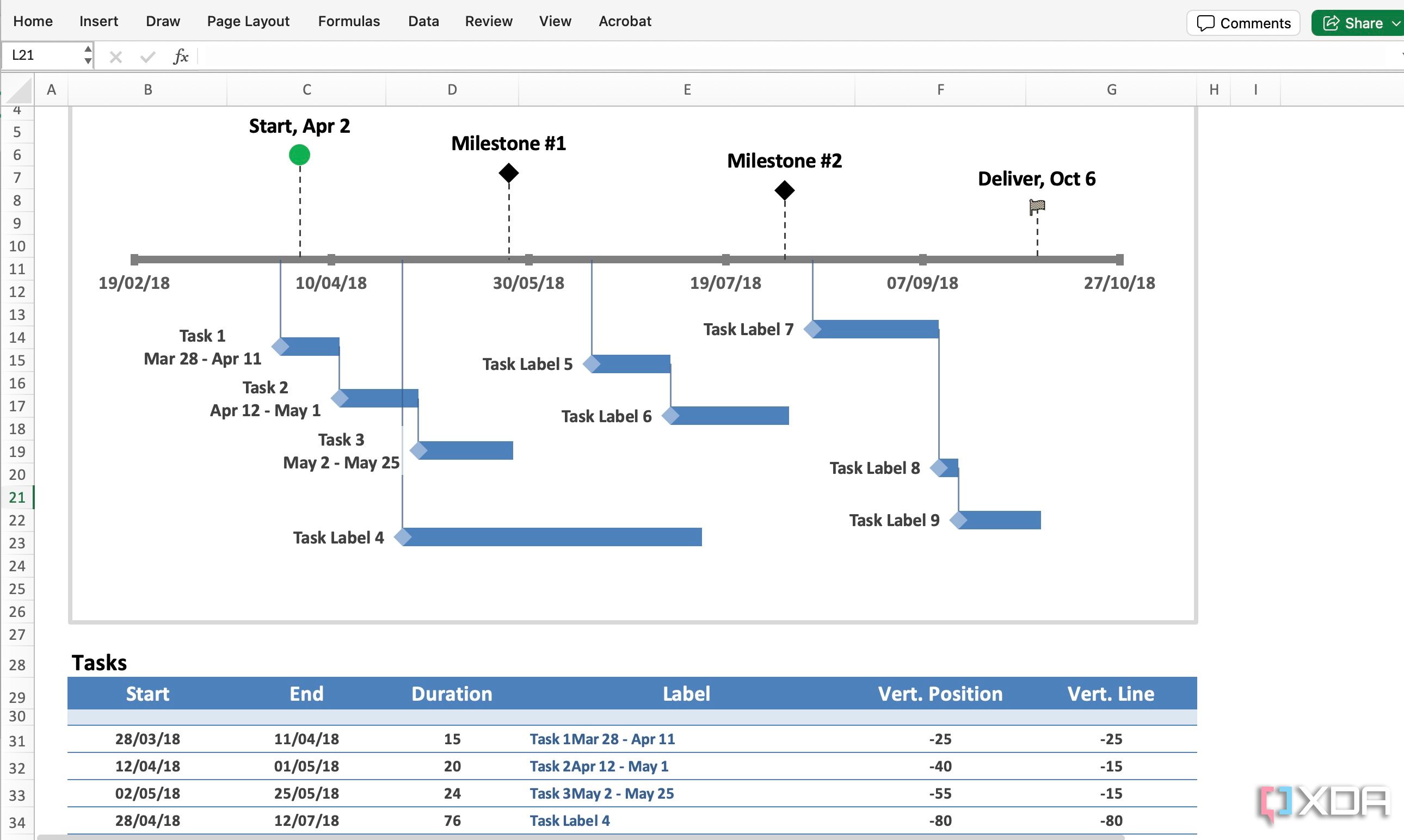

This 90-day business plan is designed for startup companies to develop a 90-day action plan. This template gives you room to outline the following: main goals and deliverables for each 30-day increment; key business activities; task ownership; and deadlines. This template also includes a built-in Gantt chart that adjusts as you enter dates. Visit “ 30-60-90-Day Business Plan Templates and Samples ” to download more free plans.

Download 30-60-90-Day Business Plan for Startup

For more free business plans in a wider variety of formats, visit “ Simple Business Plan Templates .”

Business Plan Checklists in Excel

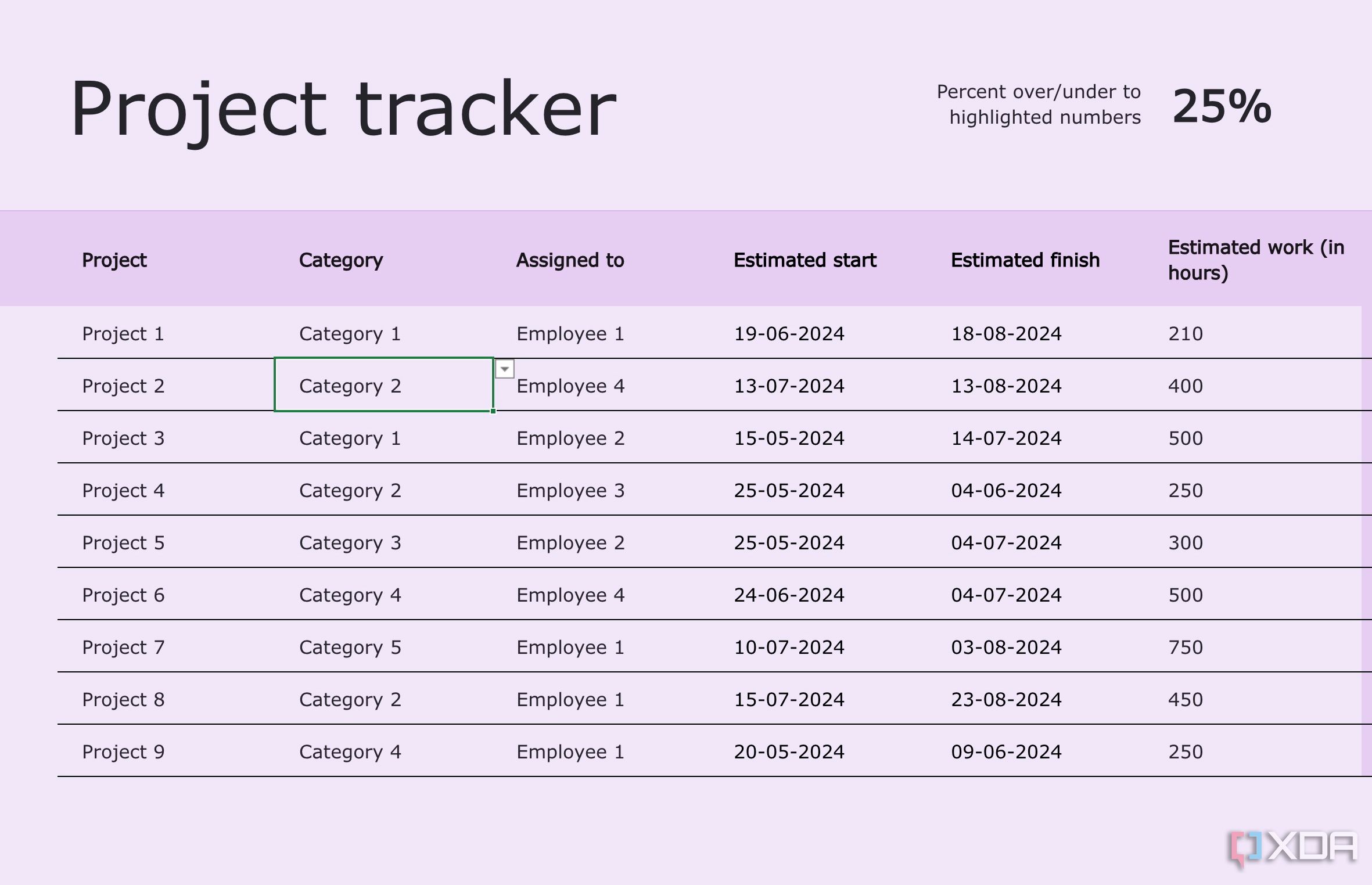

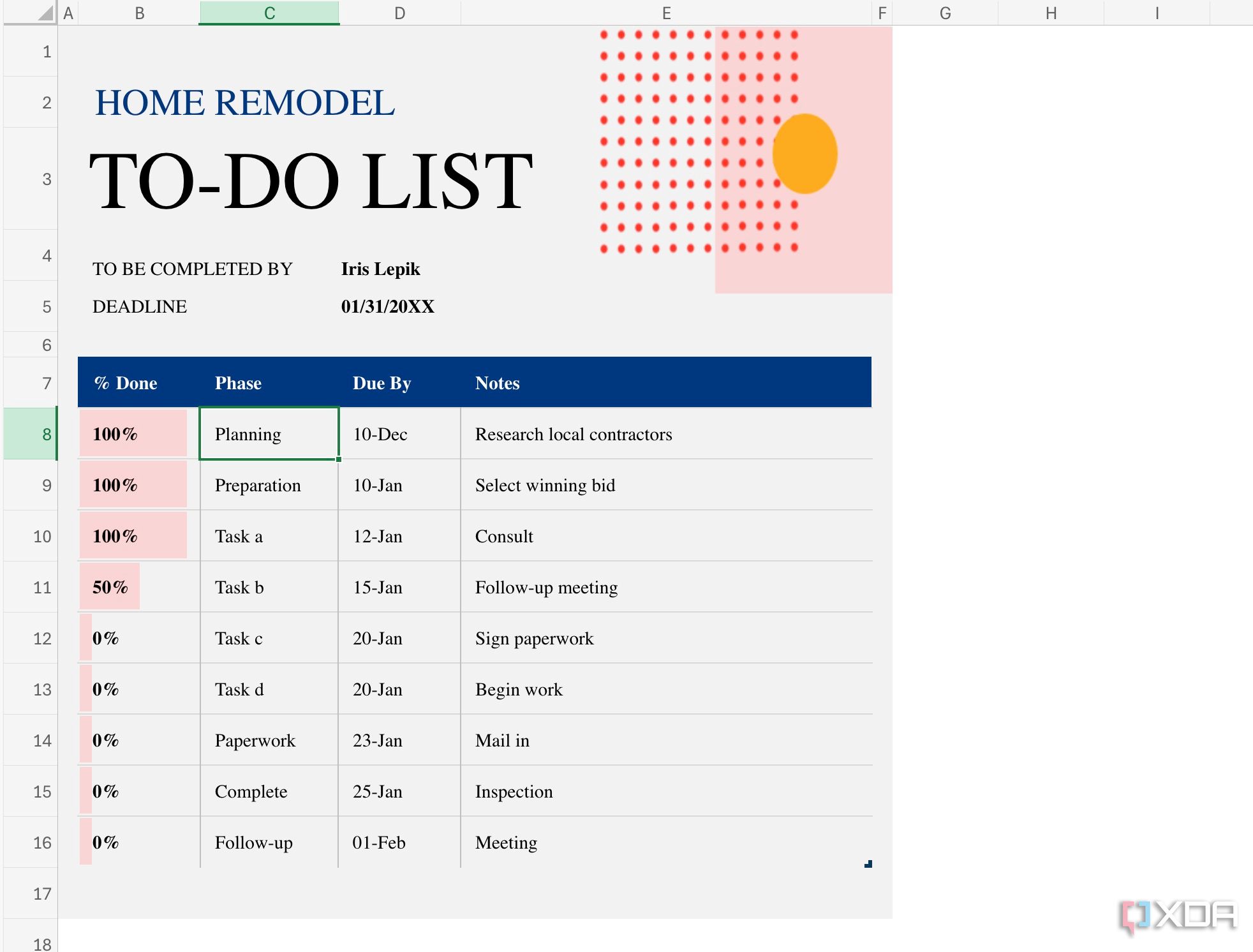

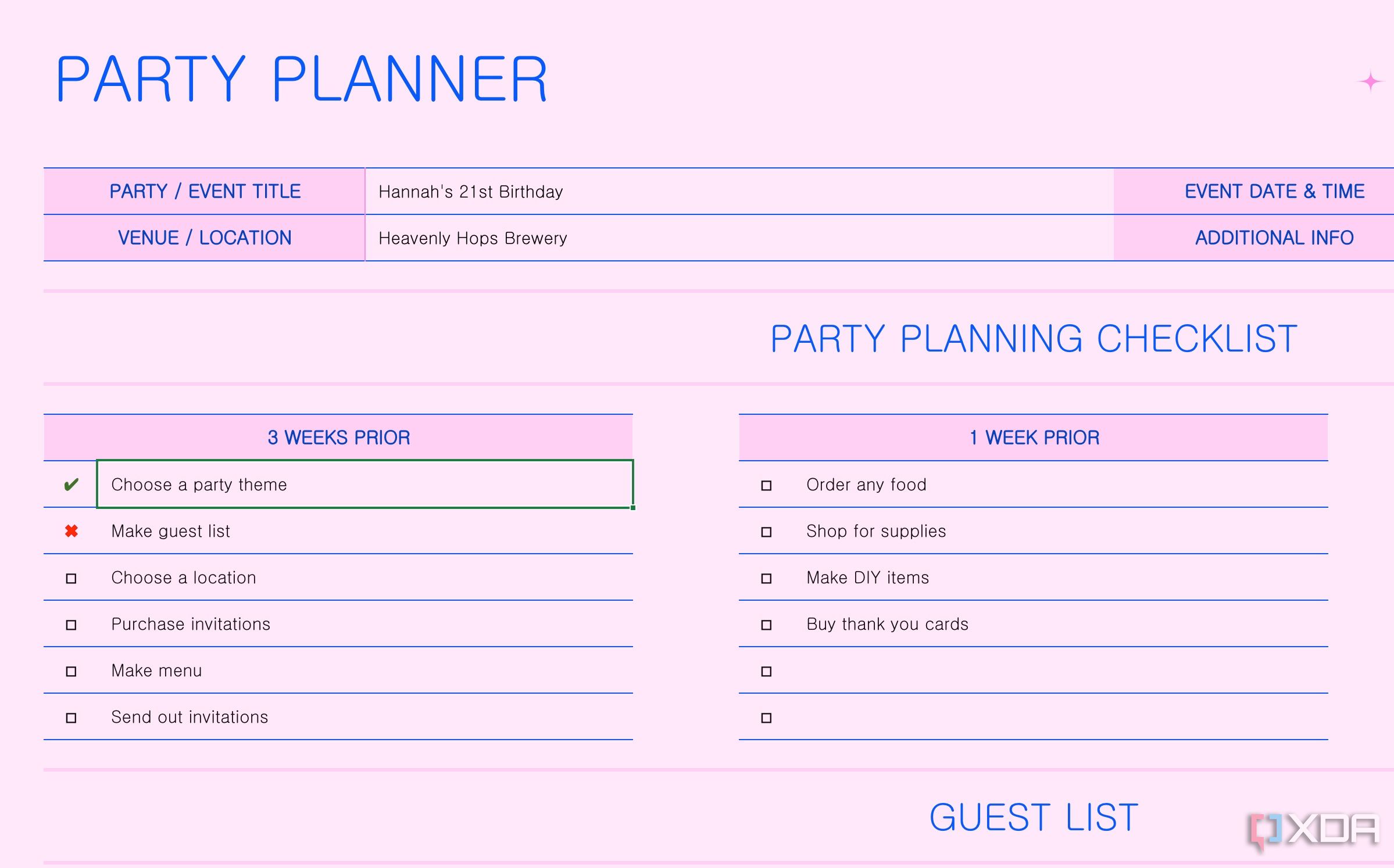

These business plan checklists are useful for freelancers, entrepreneurs, and business owners who want to organize and track the progress of key business activities.

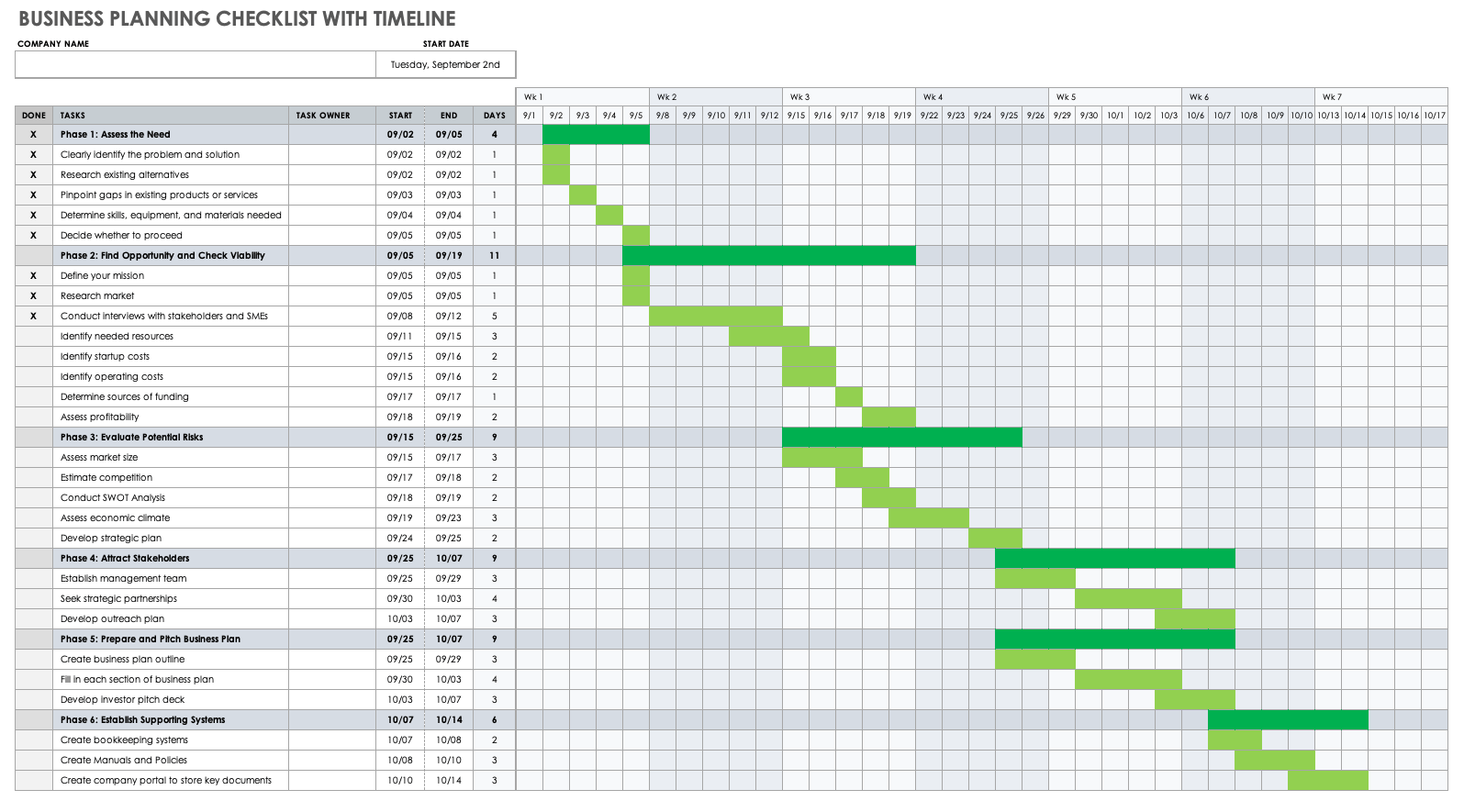

Business Planning Checklist with Timeline in Excel

Use this checklist to keep your business planning efforts on track. This template enables you to add tasks according to each phase of your plan, assign an owner to each task, and enter the respective start and end dates. The checklist also enables you to create and color-code a visual timeline when you highlight the start and end dates for each task.

Download Business Planning Checklist with Timeline Template

Business Plan Checklist with SWOT Analysis in Excel

Use this business plan checklist to develop and organize your strategic plan. Add the name of the business activity, along with its status, due date, and pertinent notes. This template also includes a separate tab with a SWOT analysis matrix, so you can evaluate and prioritize your company’s strengths, weaknesses, opportunities, and threats.

Download Business Plan Checklist with SWOT Analysis - Excel

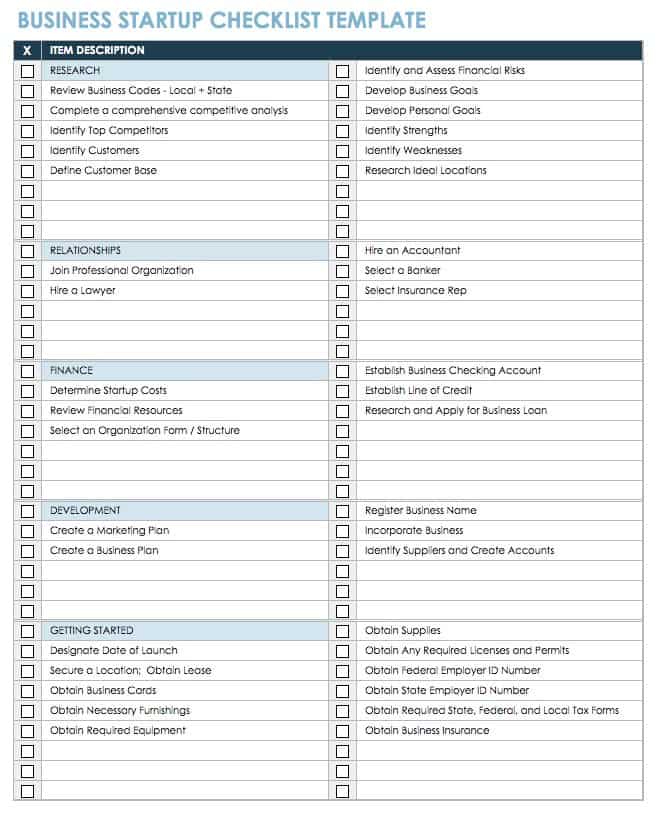

Business Startup Checklist in Excel

This checklist template is ideal for startup organizations. It allows you to list and categorize key tasks that you need to complete, including items related to research, strategic relationships, finance, development, and more. Check off each task upon completion to ensure you haven’t missed or overlooked any important business activities. Find additional resources by visiting “ Free Startup Plan, Budget & Cost Templates .”

Download Business Startup Checklist Template

Business Plan Financial Templates in Excel

Use these customizable templates to develop your organization’s financial plan.

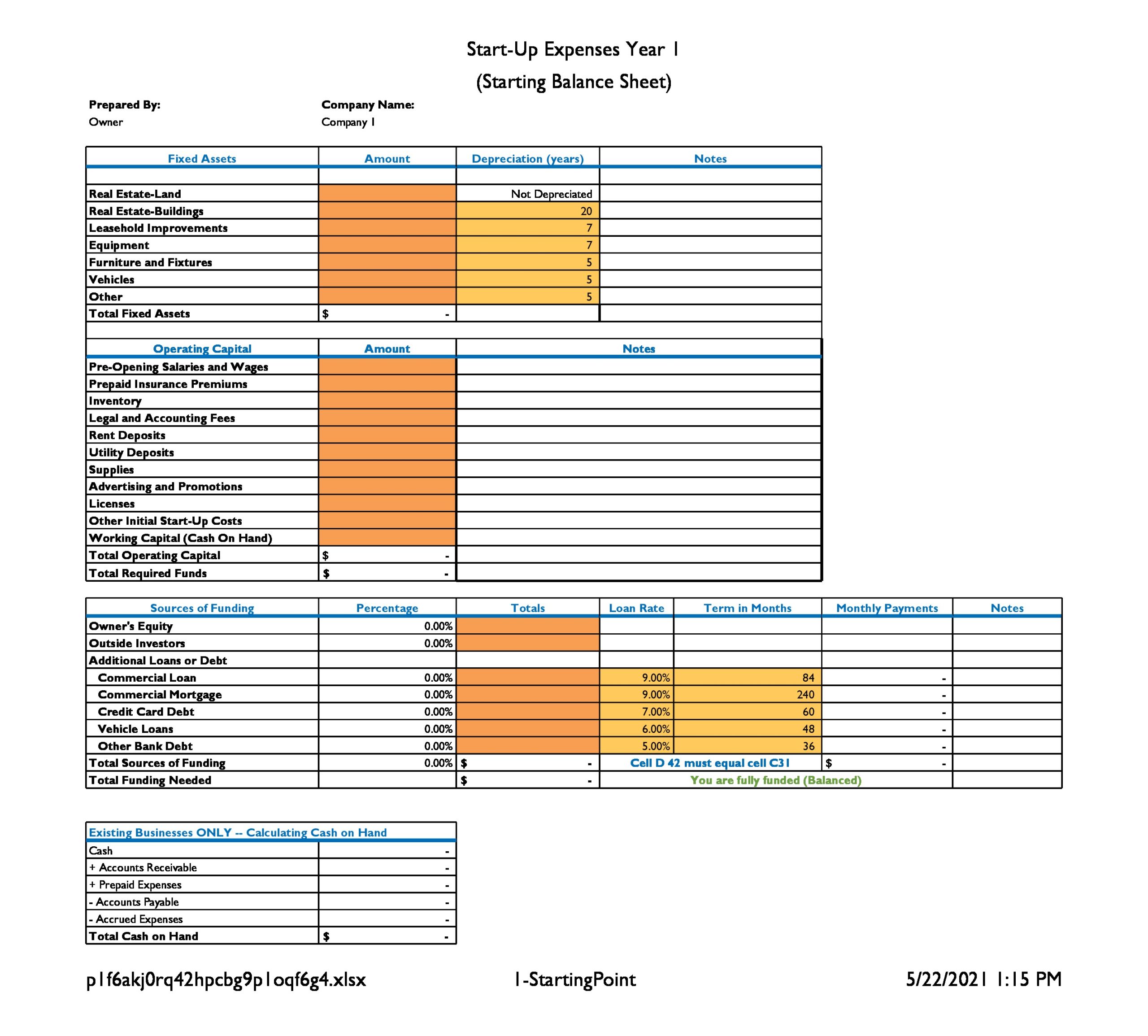

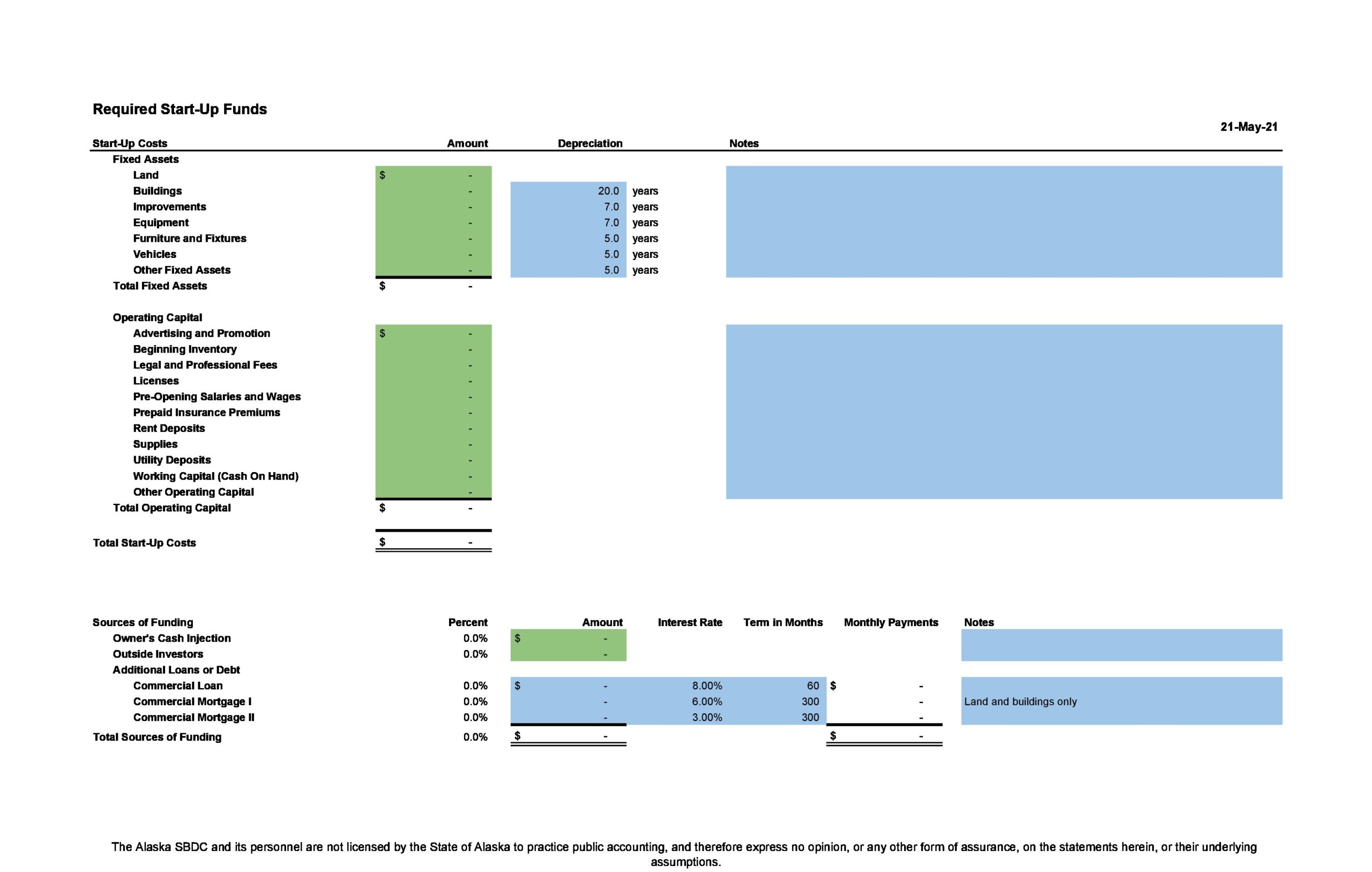

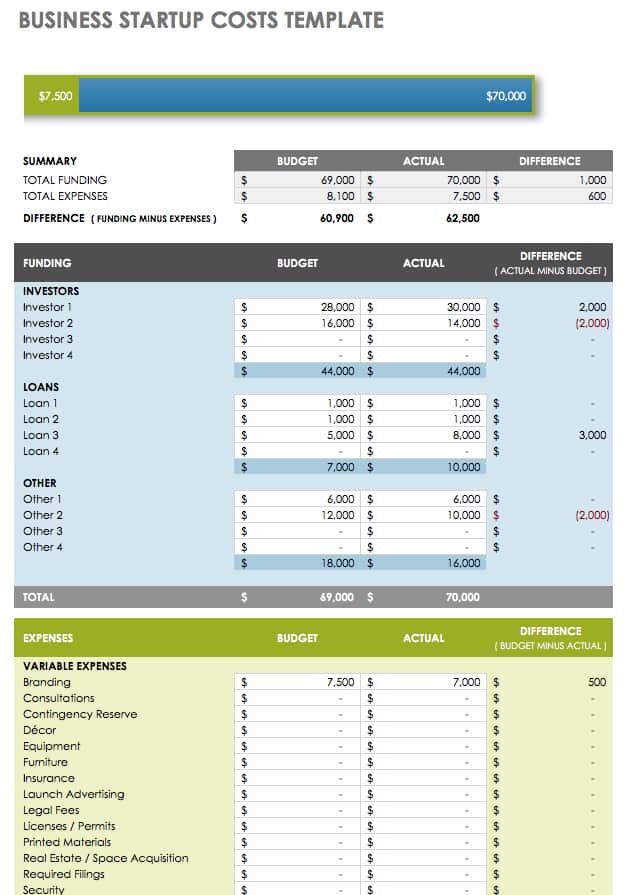

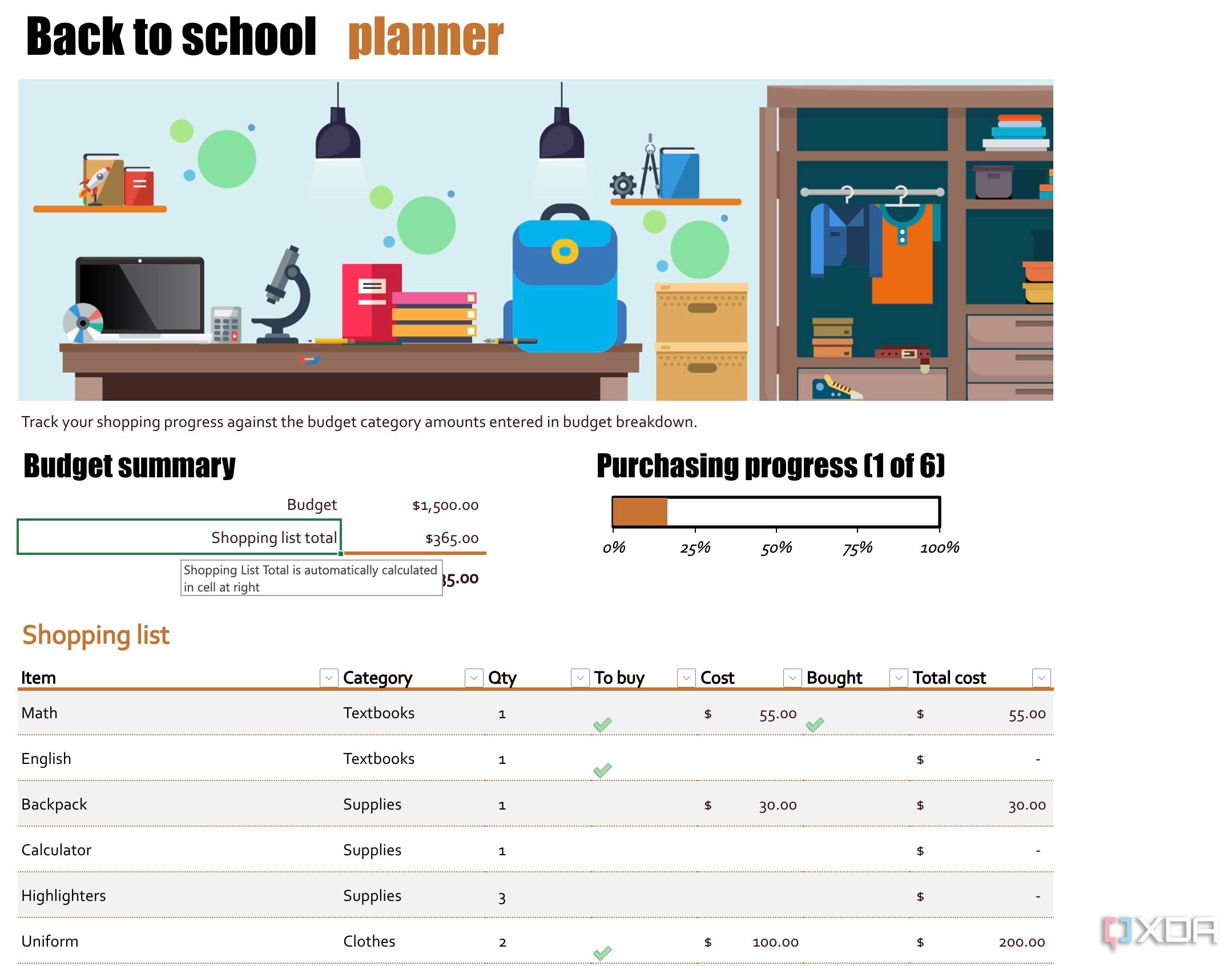

Business Startup Costs Template in Excel

Use this template to estimate and track your startup and operational costs. This template gives you room to list line items for both funding and expenses; you can automatically calculate totals using the built-in formulas. To avoid overspending, compare budgeted amounts against actual amounts to determine where you can cut costs or find additional funding.

Download Business Startup Costs Template

Small-Business Budget Template in Excel

This simple business budget template is designed with small businesses in mind. The template helps you track the income and expenses that you accrue on a monthly and yearly basis. To log your cash balances and transactions for a given time frame, use the tab for cash flow recording.

Download Small-Business Budget Template - Excel

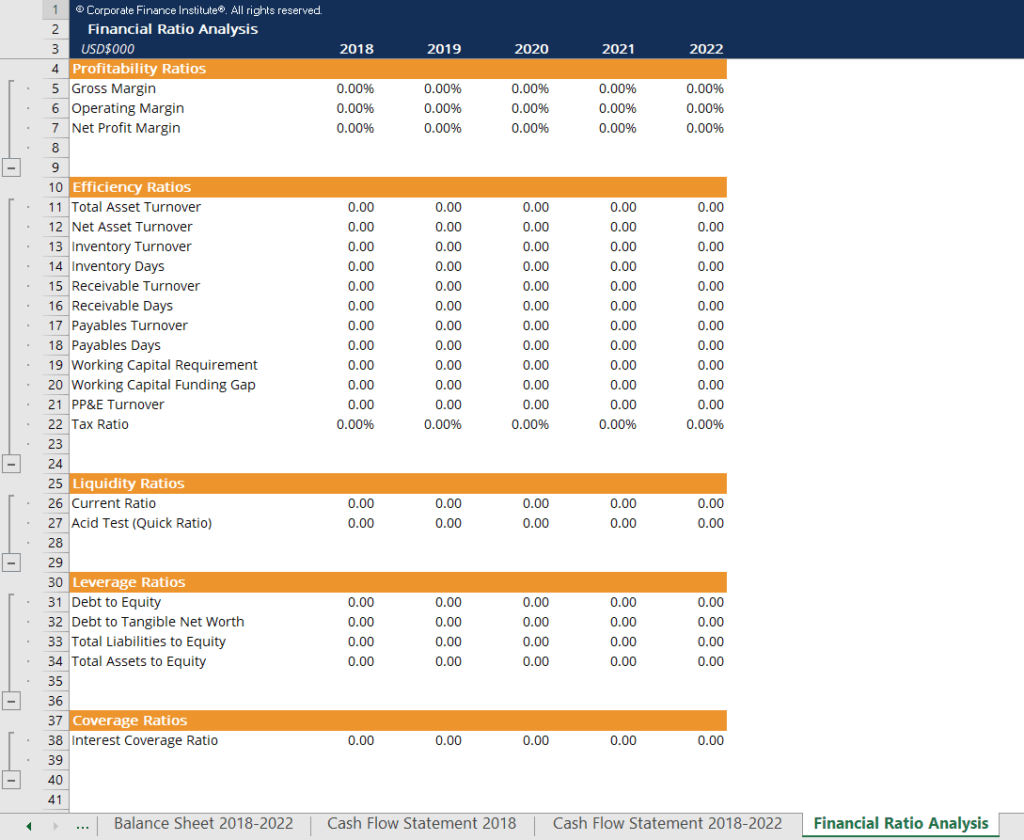

Startup Financial Statement Projections Template

This financial statement projections template includes a detailed profit and loss statement (or income statement), a balance sheet with business ratios, and a cash flow statement to analyze your company’s current and future financial position. This template also comes with built-in formulas, so you can calculate totals as you enter values and customize your statement to fit the needs of your business.

Download Startup Financial Statement Projections Template

For additional templates to help you produce a sound financial plan, visit “ Free Financial Templates for a Business Plan .”

Business Plan Marketing and Sales Templates in Excel

Use these downloadable templates to support and reinforce the marketing and sales objectives in your business plan.

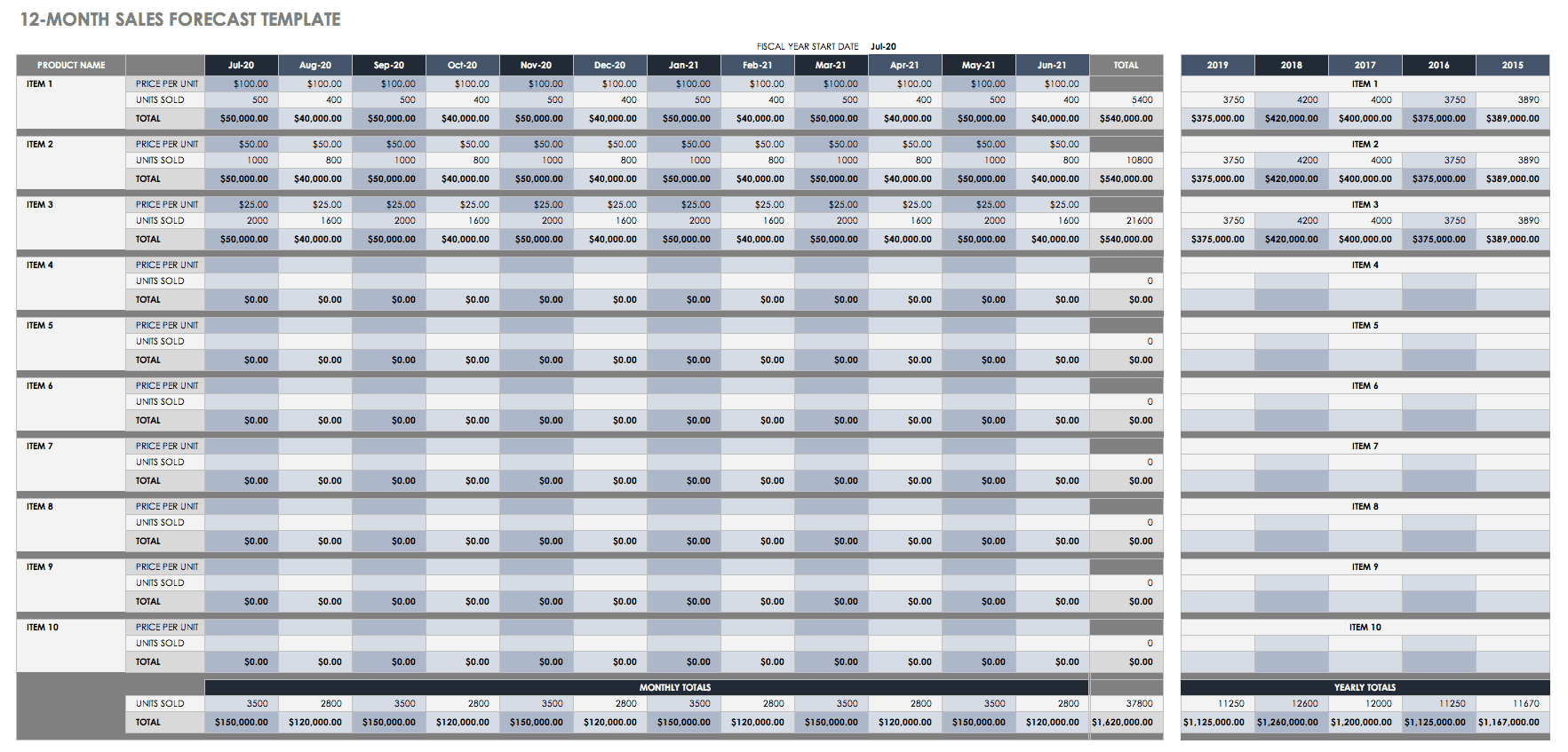

Sales Forecast Template in Excel

This sales forecast template allows you to view the projected sales of your products or services at both individual and combined levels over a 12-month period. You can organize this template by department, product group, customer type, and other helpful categories. The template has built-in formulas to calculate monthly and yearly sales totals. For additional resources to project sales, visit “ Free Sales Forecasting Templates .”

Download Sales Forecast Template

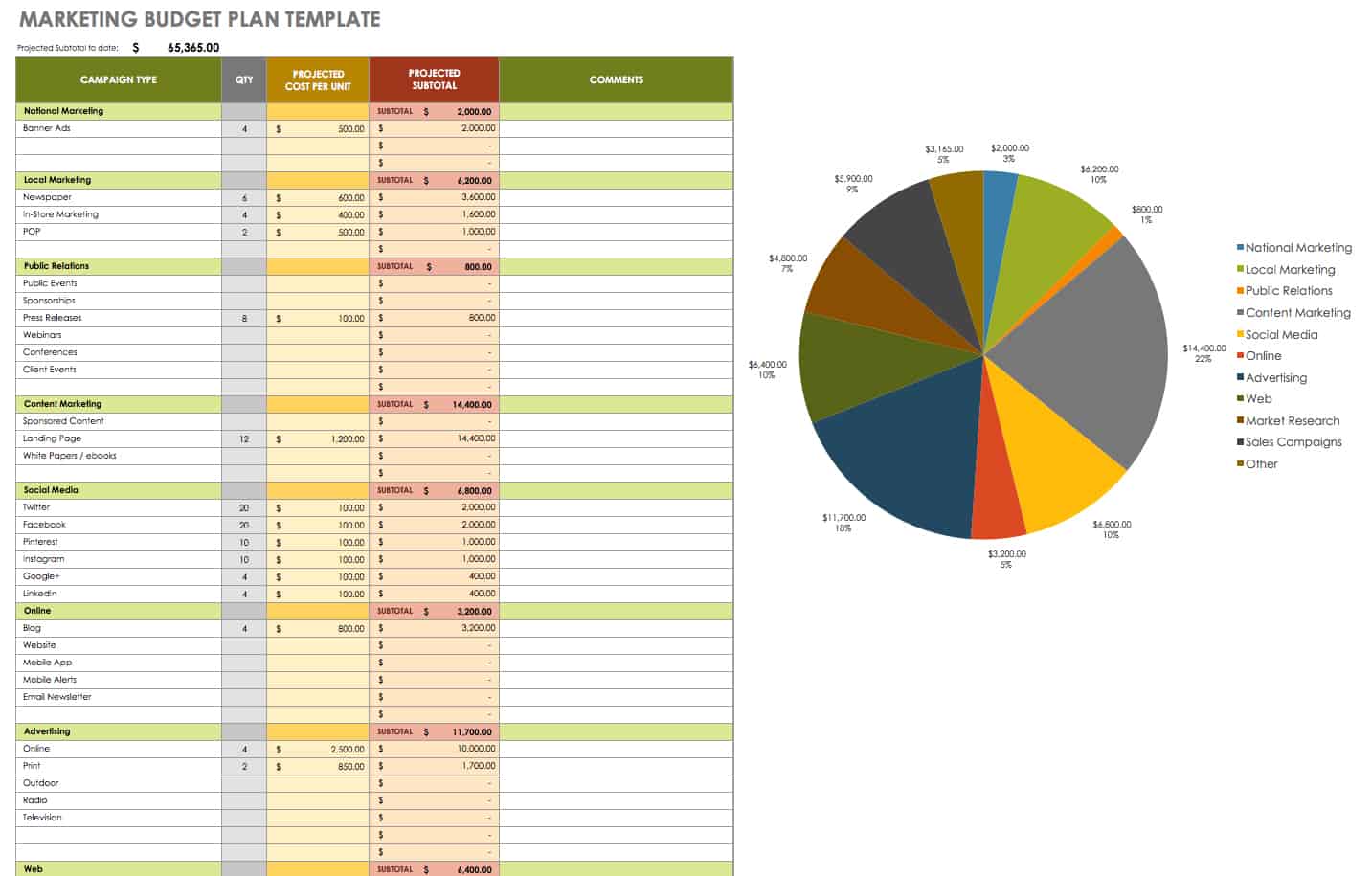

Marketing Budget Plan in Excel

This marketing budget plan template helps you organize and plan your campaign costs for key marketing activities, such as market research, advertising, content marketing , and public relations. Enter the projected quantity and cost under each campaign category; the built-in formulas enable you to calculate projected subtotals automatically. This template also includes a graph that auto-populates as you enter values, so you can see where your marketing dollars are going.

Download Marketing Budget Plan Template

Other Business Plans in Excel

Use these business plan templates to conduct analyses and develop a plan of action that aligns your strategy with your main business objectives.

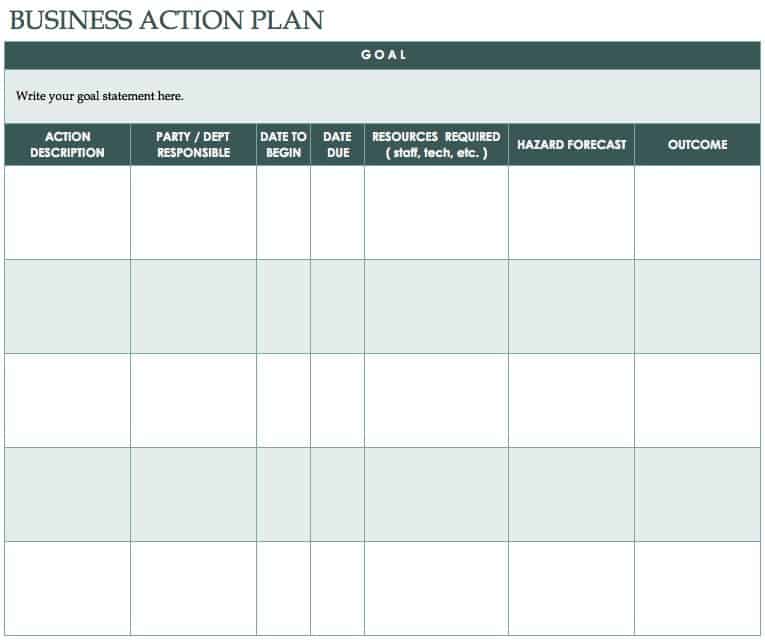

Business Action Plan Template in Excel

Use this basic action plan template to develop a roadmap for reaching your goals. Add a description of each action item, assign the responsible party, and list the required resources, potential hazards, key dates, and desired outcome. You can use this template to develop an action plan for marketing, sales, program development, and more.

Download Business Action Plan Template

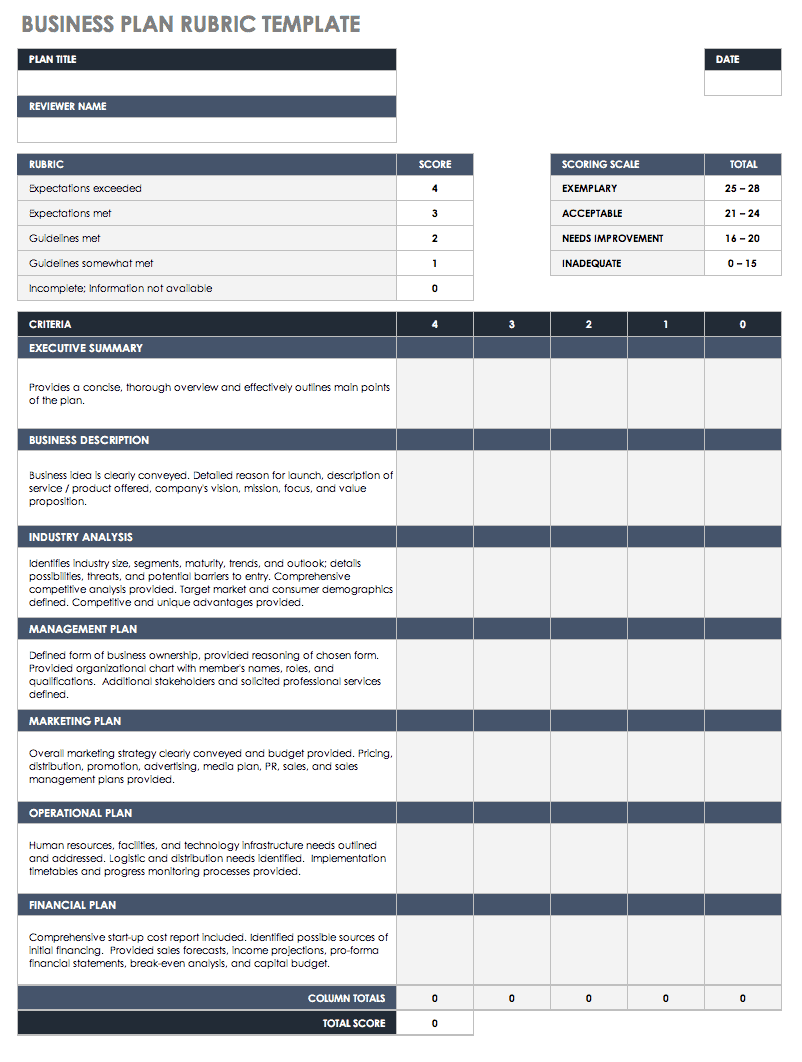

Business Plan Rubric in Excel

Once you complete your business plan, use this rubric template to score each section to ensure you include all the essential information. You can customize this rubric to fit the needs of your organization and provide insight into the areas of your plan where you want to delve more deeply or remove unnecessary details. By following these steps, you can make certain that your final business plan is clear, concise, and thorough.

Download Simple Business Plan Rubric

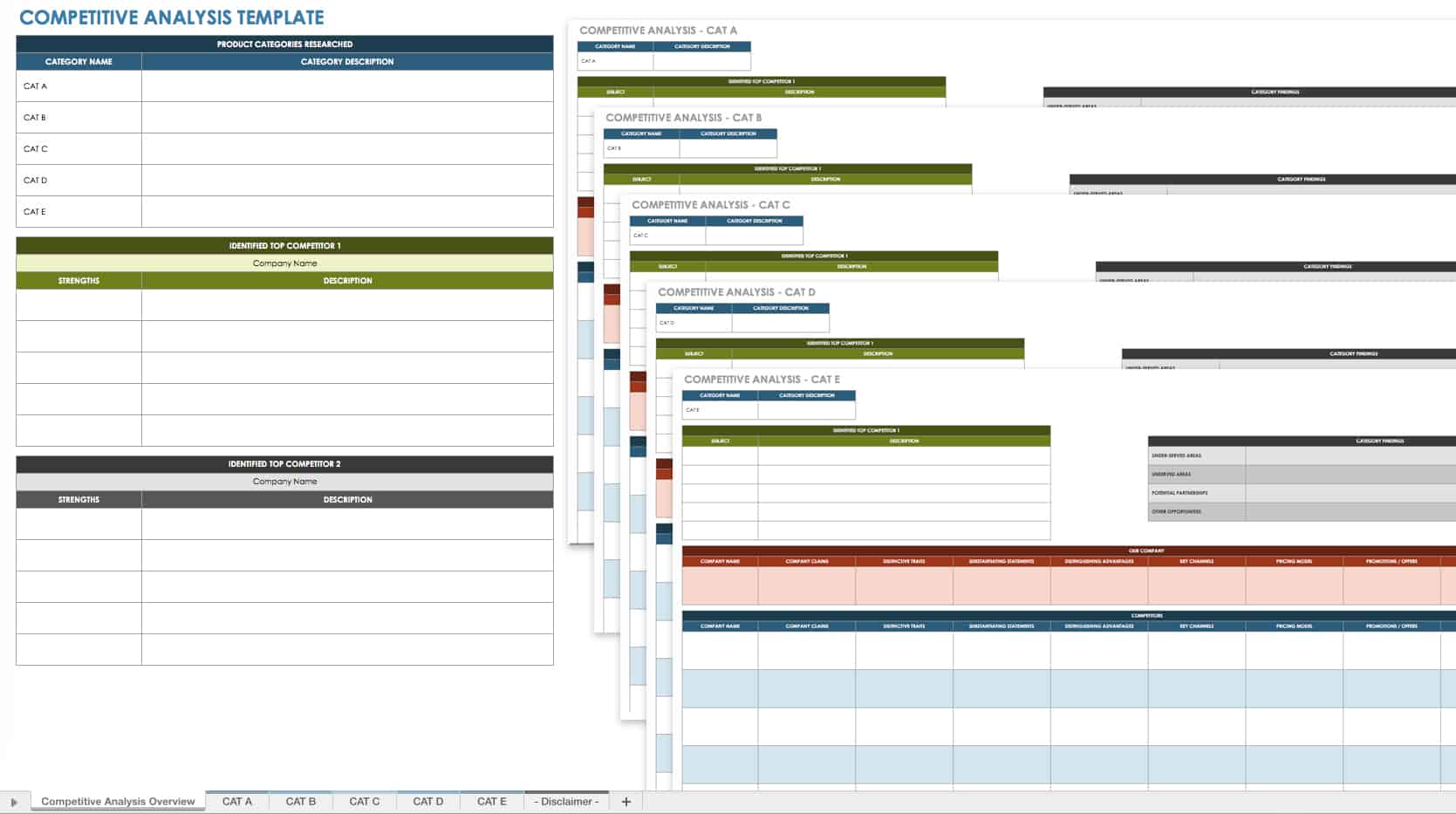

Competitive Analysis Template in Excel

This template enables you to analyze the competitive landscape and industry for your business. By providing details related to your company and competitors, you can assess and compare all key areas, including the target market, marketing strategies, product or service offerings, distribution channels, and more.

Download Competitive Analysis Template

Excel | Smartsheet

For additional free templates for all aspects of your business, visit “ Free Business Templates for Organizations of All Sizes .”

Turbo-Charge Your Business Plans with Templates from Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Free 1-year Financial Projection Template

Complete the form to get your copy of this free resource!

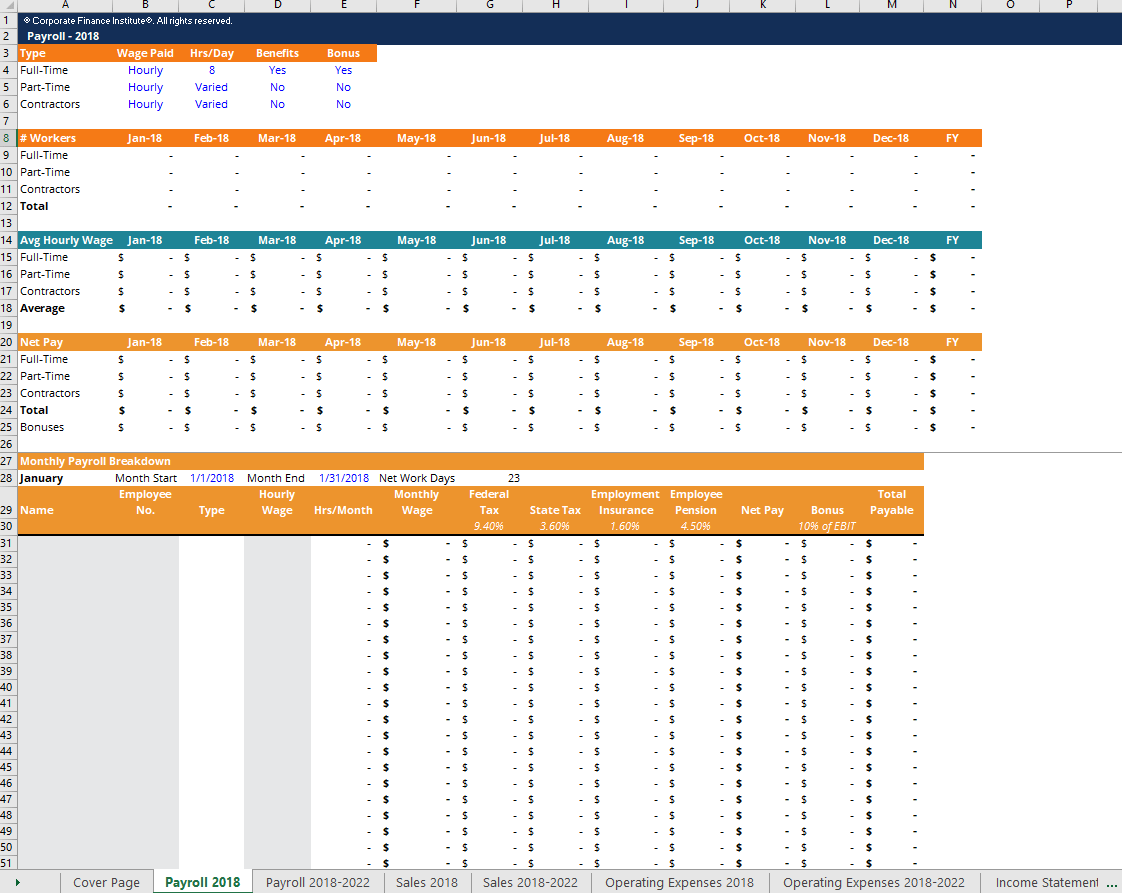

Free excel template to create financial projections for any business startup and first year. Forecast revenue, expenses, employee costs and generate an income statement, balance sheet, and cash flow pro forma automatically

Join 15,000+ founders and consultants who have used our free resources and tools

Free 1 Year Pro Forma Template

Download our 12 months financial projection template for free. This tool will allow you to:

- Forecast startup costs

- Project your first 12 months of product or service revenue

- Forecast your operating expenses

- Add Salary Forecasts for your employees

Once you have input all of your own assumptions, you will be able to generate:

- 12 month pro forma income statement

- 12 month cash flow forecast

- 12 month balance sheet projection

- Basic graphs and charts

This free financial model is industry agnostic. If you need an industry specific financial model you can check out ProjectionHub’s premium pro forma templates .

Below you will be able to see some examples of the input and outputs of the projection spreadsheet.

Financial Model Input Examples

Below you will be able to see examples of the input tabs for startup costs, fixed assets, revenue, operating expenses and salaries.

Example of Startup Cost Forecast

The financial model input assumptions tab will include general assumptions and startup costs like your fixed assets like buildings, equipment, leasehold improvements and vehicles. On the input assumptions tab you will also be able to include startup cost assumptions like initial inventory.

12 Month Revenue Forecast Example

Our revenue assumptions tab will allow you to forecast your number of customers, the products or services they purchase, the purchase price and the percentage of total units sold represented by each product. You can see a quick example of our revenue model below:

Startup Operating Expense Projections Example

You can enter in your operating expense projections for your startup in the table below. It will allow you to add expenses as a fixed monthly expense or a percentage of revenue.

Startup Salary Forecasting Example

The last input tab is our salary forecast assumptions. You can set a salary, employer taxes, benefits, the month the employee starts and ends, and the number of the particular employee.

Projection Template Output Examples

Our free financial model spreadsheet will produce 12 months of income statement, cash flow and balance sheet projections. You can see examples of each of these outputs below along with some of the basic charts and graphs that will be included.

Example of a 12 Month Pro Forma P&L

Below you will see an example of our income statement pro forma output.

Cash Flow Forecast 12 Month Example

Next you will see an example of our cash flow forecast output with cash from operating activities, financing and investing activities.

Balance Sheet Forecast Example for 12 Months

The balance sheet forecast output will include 12 months of forecasted assets and liabilities as seen below:

Pro Forma Graphs

Finally, our free template includes a profit and loss at a glance, a monthly sales forecast and graph to display monthly sales, gross profit and net income.

If you are needing a more tailored template to your industry as well as 5 years of projections, we have 100+ different industry templates to choose from as well:

Examples: Restaurant, Trucking, SaaS, Airbnb, Brewery, Dentist, etc.

Check out our Highly Rated Financial Projection Templates

Cash Flow - Business Plan Forecast Template

Use our business plan financial projections template to create financial projections for a business plan which includes 12 monthly periods and 5 annual periods. The template includes a detailed income statement, cash flow statement and balance sheet in Excel. Cash flow projections are based on user defined turnover, gross profit and expense values and automated calculations based on a series of assumptions.

- Includes 12 monthly & 5 annual periods

- Suitable for service and trade based businesses

- Reporting periods based on a single user input cell

- User input limited to basic template assumptions

- Expense accounts can be customized & more accounts added

- Automated income statement, cash flow statement & balance sheet

- Accommodates loan amortization or interest-only loans

- Includes sales tax, income tax, payroll accruals & dividends

How to use the Cash Flow - Business Plan Forecast template

This template enables users to create cash flow projections for a business plan which includes 12 monthly periods and five annual periods. The template includes a monthly income statement, cash flow statement and balance sheet. The cash flow projections are based on turnover, gross profit and expense values that are entered by the user as well as a number of default assumptions which are used to create an automated balance sheet. These assumptions include opening balance sheet balances, working capital ratios, payroll accruals, sales tax, income tax, dividends and loans. The monthly reporting periods are based on any user defined start date.

Note: We have included 12 monthly and 5 annual reporting periods in this template because this format is frequently required by financial institutions when submitting business plans. If you only require annual cash flow projections, refer to our Annual Cash Flow Projections template and if you only require monthly cash flow projections, refer to our Monthly Cash Flow Projections template.

The following sheets are included in the template: Assumptions - this sheet includes the default assumptions on which the monthly & annual cash flow projections are based. IncState - this sheet includes a detailed monthly income statement for 12 monthly periods and 5 annual periods. All the rows that are highlighted in yellow in column A require user input and the codes in column A are mainly used in the sales tax, receivables & payables calculations. The rows that do not contain yellow highlighting in column A contain formulas and are therefore calculated automatically. CashFlow - as with the income statement, only the rows with yellow highlighting in column A require user input. All the other rows contain formulas and are therefore calculated automatically. BalanceSheet - all balance sheet calculations are based on the template assumptions and the income statement & cash flow statement calculations. No user input is therefore required on this sheet. Loans1 to Loans3 & Leases - these sheets include detailed amortization tables which are used to calculate the interest charges and capital repayment amounts that are included on the income statement and cash flow statement. Each sheet provides for a different set of loan repayment terms to be specified.

Note: If you do not want to include any of the line items that are listed on the income statement, cash flow statement or balance sheet, we recommend hiding these items instead of deleting them. If you delete items which are used in other calculations, these calculations will result in errors which you then need to fix or remove.

Business Name & Reporting Periods

The business name and the start date for the cash flow projections need to be entered at the top of the Assumptions sheet. The business name is included as a heading on all the sheets and the reporting periods which are included in the template are determined based on the start date that is specified. This date is used as the first month and the 11 subsequent months and four subsequent years are added to form the 5 year projection period.

The income statement and cash flow statement only require user input where there is yellow highlighting in column A and the user input only relates to the 12 monthly periods. All annual totals are calculated automatically and all rows without yellow highlighting are calculated automatically in both the monthly and annual columns.

Income Statement

All monthly income statement projections need to be entered exclusive of any sales tax that may be applicable.

Turnover & Gross Profits

Monthly turnover values need to be entered on the IncState sheet for the first 12 months. The projected monthly gross profit percentages also need to be entered on this sheet and are used in order to calculate the gross profit values. The monthly cost of sales projections are calculated by simply deducting the gross profit values from the monthly turnover values.

The year 2 to 5 turnover amounts are calculated based on the totals for the first year and adjusted by the annual turnover growth rates that are specified on the Assumptions sheet. Gross profit percentages for each turnover line need to be entered on the IncState sheet. Gross profit values and cost of sales totals are calculated automatically.

The template includes two default lines in each of these sections - one for a typical product based item and one for a typical service based item. The template can therefore be used for both service and trade based businesses. There are no cost of sales and gross profit values in service based businesses and a gross profit percentage of 100% can therefore be specified. You can also hide the cost of sales and gross profit sections if you do not want to include them in your cash flow projections.

Note: You can insert as many additional line items as required by inserting the required number of items in each section and then entering the appropriate values where user input is required or copying the formulas from one of the existing lines. We recommend inserting additional line items between the two existing default line items.

Note: The codes in column A are used in the sales tax and trade receivables calculations. The first two characters represent the sales tax code and the last two characters represent the payment status. Refer to the Balance Sheet - Sales Tax and Balance Sheet - Trade Receivables sections for more information on these codes.

Other Income

Monthly projections of other income should be entered in this row. Note that other income may consist of items like interest or dividends received and this line item is therefore not included in trade receivables and sales tax calculations. If you want to include other income in the trade receivables or sales tax calculations, you need to add the income to the Turnover section as an additional line item.

The year 2 to 5 totals for other income are calculated by applying the annual turnover growth percentages on the Assumptions sheet to the previous year's total.

Operating Expenses

All the monthly operating expense projections need to be entered in the operating expenses section of the income statement. The template contains 22 default operating expense line items but you can add as many additional items as required or delete the line items that you do not need. When adding additional line items, remember to copy the formulas in the total columns from one of the existing line items.

The year 2 to 5 totals for operating expenses are calculated by applying the annual expense inflation percentages on the Assumptions sheet to the previous year's total.

Note: The codes in column A are used in the sales tax and trade payables calculations. The first two characters represent the sales tax code and the last two characters represent the payment status. Refer to the Balance Sheet - Sales Tax and Balance Sheet - Trade Payables sections for more information on these codes.

Staff Costs

All the monthly staff cost projections need to be entered in the staff costs section of the income statement. The template contains 2 default staff cost line items but you can add as many additional items as required or delete the line items that you do not need.

The year 2 to 5 totals for staff costs are calculated by applying the annual expense inflation percentages on the Assumptions sheet to the previous year's total.

Note: Staff costs have been included in a separate section on the income statement in order to be able to calculate payroll accruals. If you do not need to include payroll accruals in your cash flow projections, we recommend entering nil values and hiding these rows. If you delete the section, some of the payroll accrual formulas may result in errors and you therefore may need to delete them as well.

Depreciation & Amortization

Monthly & annual projections for depreciation and amortization charges need to be calculated independently of the template and included in this section. We unfortunately cannot include default depreciation or amortization calculations because some businesses may have very different asset bases than others with existing assets which may already have been depreciated over a number of years. Any calculation which is based on a percentage of the balance sheet asset value may therefore not be accurate.

If you already have a sheet which is used for depreciation or amortization calculations, you can include it in this template and add formulas in the depreciation & amortization section of the income statement to include your calculations in the appropriate line items.

The monthly depreciation & amortization charges for the first 12 months need to be included on the IncState sheet and the totals for year 2 to 5 need to be included on the Assumptions sheet.

We also realize that some users may want to include depreciation and amortization as part of their operating expenses. We have therefore provided for this in that the depreciation and amortization calculations on the cash flow statement are based on the default code which is included in column A. You can therefore enter nil values in the depreciation & amortization section on the income statement, hide the section and include these line items in the operating expenses section and as long as you also include the default codes in column A, the cash flow statement values for depreciation and amortization will be calculated correctly.

Interest Paid

All interest paid calculations are automated and based on the amortization tables on the Loans1 to Loans3 and Leases sheets. The template accommodates the inclusion of loans & leases based on four different sets of loan repayment terms which need to be specified on the Assumptions sheet.

Opening loan balances are based on the balance sheet opening balances section on the Assumptions sheet and additional loan amounts can be entered in column C of the appropriate amortization table.

You do not need to use all four loan amortization sheets - if you only need to include loans based on one set of repayment terms, you can delete the other loan amortization sheets, delete the other interest paid rows on the income statement, delete the other proceeds from loans rows on the cash flow statement, delete the other repayment of loans rows on the cash flow statement and delete the other loan balances from the balance sheet.

The template provides for four sets of loan repayment terms - the same amortization table can basically be used for all loans with the same repayment terms by adding additional loan amounts as proceeds to the cash flow statement in order to add new loans to the appropriate amortization table.

If you need to add more than four sets of loan repayment terms, you will need to copy one of the amortization sheets, change it to reflect the appropriate loan terms and then change the formulas in the amortization table to be based on the correct loan repayment terms at the top of the sheet. This means that you need to add another set of repayment terms to the Assumptions sheet and link the fields at the top of the new amortization table to the appropriate cells on the Assumptions sheet.

If there is an opening balance for the required additional loan terms, you need to include a new code in the balance sheet opening balances section on the Assumptions sheet and base the opening balance calculation in the first period of the amortization schedule on this code. You also need to add new rows to the interest paid section on the income statement, the loan proceeds section on the cash flow statement, the loan repayment section on the cash flow statement and the loan balances section on the balance sheet. The appropriate formulas can be copied from one of the existing items and the sheet reference in the copied formula can then just be replaced by the sheet name of the new amortization table that you've added.

The taxation line item on the income statement is automatically calculated based on the profit before tax and the income tax assumptions which are specified on the Assumptions sheet. If you do not want to include income tax in the cash flow projections, simply enter an income tax rate of 0%. This will result in no income tax being calculated.

If you do want to include income tax calculations, the appropriate income tax percentage needs to be entered in the Income Tax section on the Assumptions sheet. You can also enter a value for an assessed loss (as a positive value) which may have been carried over from a previous tax year which would result in income tax only being calculated after profits exceed the value of the assessed loss.

You also need to specify the payment frequency in months and the first calendar month in which a payment needs to be included. The template automatically provides for income tax based on what is due and includes the income statement amount and a provision for taxation on the balance sheet. The payment frequency and month of payment assumptions are then used to determine when the income tax liability will be settled which will result in the appropriate cash outflow being recorded on the cash flow statement and the provision for taxation being reduced.

The template can accommodate income tax calculations based on current and subsequent month payments. If you select the Current option, the income tax payment amount will be calculated based on all amounts that have accrued up to and including the month of payment. If you select the Subsequent option, the income tax payment amount will only be calculated based on all amounts which have accrued up to the previous month end.

Example: If you select the Current option in the Income Tax section of the Assumptions sheet, all income tax amounts up to and including the current month will be included in the income tax payment amount. This means that the provision for taxation at the end of the particular month will be nil. The Current setting is therefore usually appropriate for provisional taxpayers.

Example: If you select the Subsequent option, all amounts up to and including the previous month end will be included in the income tax payment amount. The provision for taxation balance on the balance sheet will therefore not be nil at the end of the month of payment and include the current month's income tax charge.

The template also includes automated dividends calculations. If you do not want to include any dividends in your cash flow projections, you can simply specify a dividend percentage of zero percent.

If you want to include dividend calculations, you need to specify a dividend percentage which will be applied to the profit for the period in order to calculate the dividend value. You also need to specify the frequency in months of dividend payments and the first payment month. The frequency of dividends determines when the dividends are included on the income statement and the first month of payment determines when the dividend payment is included on the cash flow statement (only has an effect if the dividend payment option is Subsequent).

You can also specify whether the dividend is paid in the month of calculation (Cash option), the month after calculation (Next option) or in a subsequent month. When you elect the subsequent month option, the payment of the dividend will be included based on the relative position of the first month of payment in relation to the year-end period (which is determined based on the template start date at the top of the Assumptions sheet).

Example: If you want to include a dividend in the last month of each financial year, select a payment frequency of 12 months and month 12 as the first payment month. Then select the Cash option in order to include both the dividend on the income statement and the payment in the last month of the year.

Example: If you want to include a dividend in the last month of each financial year but delay payment to the first month of the next financial year, select a payment frequency of 12 months and month 12 as the first payment month. Then select the Next option in order to include the dividend on the income statement in the last month of the financial year and the payment in the first month of the next financial year. A dividend payable amount will then automatically be included on the balance sheet at year-end.

Balance Sheet

All the calculations on the balance sheet are automated and no user input is therefore required.

Opening Balances

If you need to compile cash flow projections for an existing business, you will need to include the opening balance sheet balances at the start of the cash flow projection period. This is facilitated in the Balance Sheet Opening Balances section on the Assumptions sheet. The opening balances that are entered here are included in the first column on the balance sheet.

You can use the trial balance as at the end of the period immediately before the start of the cash flow projection period for this purpose. All assets should have positive balances and all equity & liabilities should have negative balances. The opening balances should also balance to a total of nil as with any accounting system trial balance. If you enter balances and the total of all balances is not nil, the entire opening balances section on the Assumptions sheet will be highlighted in orange.

You then need to fix the imbalance by adjusting the opening balances so that the total comes to a total of nil. The orange highlighting will then be removed automatically. Also note that the cash flow projection balance sheet cannot balance if the opening balances do not balance.

Note: If you are preparing a cash flow projection for a new business, you can include zero balances for all the balance sheet items in the opening balances section.

Non-Current Assets

The property, plant & equipment balances on the balance sheet are calculated by adding the purchases of property, plant & equipment (entered on the cash flow statement for the first 12 months and on the Assumptions sheet for year 2 to 5) and then deducting the appropriate depreciation charges that are included on the income statement.

Intangible assets balances are calculated in much the same way by adding the purchases of intangible assets (as per the cash flow statement for the first 12 months and the Assumptions sheet for year 2 to 5) and deducting the appropriate amortization charges as per the income statement. The calculation of the investments balances on the balance sheet is a bit simpler in that only the purchases of new investments (as per the cash flow statement for the first 12 months and the Assumptions sheet for your 2 to 5) are added to the previous period's balance and there is no depreciation or amortization on investments.

Note: Purchases of property, plant & equipment, intangible assets and investments all need to be entered as negative values. The purchases for the first 12 months need to be entered on the cash flow statement and the purchases for year 2 to 5 need to be entered on the Assumptions sheet.

Current Assets - Inventory

The inventory balances on the balance sheet are calculated based on the inventory days assumption which is specified on the Assumptions sheet. The number of days that are entered here is applied to the monthly cost of sales in order to calculate the appropriate inventory balance. This calculation is based on the actual number of days in each month if the inventory days assumption is greater than the number of days in the appropriate month.

Example: If you enter an inventory days assumption of 60 days and the month is April, the entire cost of sales value for April will be included in the inventory balance because April only has 30 days. After including the 30 days in April, there is a difference of 30 days between the 60 days assumption and the 30 days in April. The March cost of sales balance will therefore be used, divided by the 31 days in March and multiplied by the 30 remaining days. The inventory balance at the end of April will therefore consist of the cost of sales total for April and an equivalent of 30 days of the 31 day cost of sales of March.

Note: The above calculation principle is applied regardless of the number of days which are entered as the inventory days assumption on the Assumptions sheet even if the value of the inventory days assumption requires the inclusion of more than 2 months. This method of calculation is the most accurate way of projecting inventory balances even for businesses where there is significant sales volatility.

Note: If your business does not carry inventory, you can simply enter a nil value in the inventory days assumption on the Assumptions sheet. The inventory line on the balance sheet will then also contain nil values.

If you want to include variable monthly inventory days, you can do so by changing the inventory days assumption in the Workings section of the balance sheet which has been included below the section with the ratios. Simply replace the formula which links the inventory days assumption to the value on the Assumptions sheet by overwriting it with the appropriate inventory days value.

The year 2 to 5 inventory balances are calculated by applying the annual turnover growth percentage to the inventory balance at the end of year 1. This method ensures that the monthly trend in year 1 is reflected in the year 2 to 5 balances. If you amend the inventory days in the Workings section of the balance sheet, the amended days for the appropriate year will be used in the calculation.

Current Assets - Trade Receivables

The trade receivables balances on the balance sheet are calculated based on the debtors days assumption which is specified on the Assumptions sheet. The debtors days number can be determined based on the average trading terms which has been negotiated with customers. The debtors days is applied to the monthly turnover in order to calculate the appropriate trade receivables balance. This calculation is based on the actual number of days in each month if the debtors days assumption is greater than the number of days in the appropriate month.

Example: If you enter a debtors days assumption of 60 days and the month is April, the entire turnover value for April will be included in the trade receivables balance because April only has 30 days. After including the 30 days in April, there is a difference of 30 days between the 60 days assumption and the 30 days in April. The March turnover balance will therefore be used, divided by the 31 days in March and multiplied by the 30 remaining days. The trade receivables balance at the end of April will therefore consist of the turnover total for April and an equivalent of 30 days of the 31 day turnover of March.

Note: The above calculation principle is applied regardless of the number of days which are entered in the debtors days assumption on the Assumptions sheet even if the value of the debtors days assumption requires the inclusion of more than 2 months. This method of calculation is the most accurate way of projecting trade receivable balances even for businesses where there is significant sales volatility.

Where sales tax is applicable, the appropriate sales tax value relating to monthly turnover will be added to the trade receivables balance. Sales tax codes are defined on the Assumptions sheet and the codes in column A next to the turnover amounts on the income statement are used to determine the appropriate rate of sales tax to be used.

The trade receivables calculation will also only include lines that are coded with a sales tax rate code (in the first two characters) and a "C1" at the end of the code. The C1 part of the code refers to credit sales while the inclusion of a C0 code at the end refers to cash sales. Cash sales do not need to be included in the trade receivables calculation and turnover lines with C0 or no code in column A are therefore ignored when calculating trade receivable balances.

Example: If the standard rate sales tax code is V1 and the appropriate turnover line needs to be included in the calculation of trade receivables, the code V1C1 needs to be added in column A of the appropriate turnover line on the income statement. If you do not want to add sales tax in the trade receivables calculation but you do want a trade receivables line to be included in the balance sheet, you can add a code which refers to a 0% sales tax calculation as well as the C1 credit sales indicator.

Example: If you do not want a particular turnover line to be included in the trade receivables calculation, you can include any sales tax rate followed by C0 in order to exclude the line in the trade receivables calculations. For example, a turnover line with a code of V1C0 would not form part of the trade receivables calculations.

Note: If your business has no trade receivables, you can simply enter a nil value in the debtors days assumption on the Assumptions sheet. The trade receivables line on the balance sheet will then also contain nil values.

If you want to include variable monthly debtors days, you can do so by changing the debtors days assumption in the Workings section of the balance sheet which has been included below the section with the ratios. Simply replace the formula which links the debtors days assumption to the value on the Assumptions sheet by overwriting it with the appropriate debtors days value.

The year 2 to 5 trade receivables balances are calculated by applying the annual turnover growth percentage to the trade receivables balance at the end of year 1. This method ensures that the monthly trend in year 1 is reflected in the year 2 to 5 balances. If you amend the debtors days in the Workings section of the balance sheet, the amended days for the appropriate year will be used in the calculation.

Current Assets - Loans & Advances, Other Receivables

The loans and advances & other receivables balances cannot be calculated by basing them on specific income statement items and they are therefore calculated by adding the movements in these balances (as per the cash flow statement for the first 12 months and the Assumptions sheet for year 2 to 5) to the balances of the previous month. If you therefore want to increase or decrease these balances, you need to add the amount of the increase or decrease to the line with a matching description on the cash flow statement (under the changes in operating assets section) for the first 12 months or the Assumptions sheet for year 2 to 5.

Current Assets - Cash & Cash Equivalents

The cash & cash equivalents balances on the balance sheet are linked to the closing cash balances on the cash flow statement. If the resulting cash & cash equivalents balance has a negative value, it will automatically be included in the bank overdraft line in the Current Liabilities section of the balance sheet.

Equity - Shareholders Contributions, Reserves

The shareholders contributions & reserves balances cannot be calculated by basing them on income statement items and they are therefore calculated by adding the movements in these balances (as per the cash flow statement for the first 12 months and the Assumptions sheet for year 2 to 5) to the balances of the previous month. If you therefore want to increase or decrease these balances, you need to add the amount of the increase or decrease to the line with a matching description on the cash flow statement or Assumptions sheet.

Note: The shareholders contribution line on the cash flow statement can be found under the cash flow from financing activities and the reserves line on the cash flow statement under the non-cash adjustments.

Equity - Retained Earnings

The retained earnings balances on the balance sheet are linked to the retained earnings for the year which is calculated on the income statement.

Non-Current Liabilities - Loans 1 to 3, Leases

The template provides for loans & leases to be included based on 4 different sets of loan repayment terms. Loans with the same repayment terms can be grouped together in the appropriate line item. There is no difference between the treatment of loans 1 to 3 and leases. If you do not have finance leases and have loans with 4 different sets of repayment terms, you can use the Leases sheet and rename the appropriate line items accordingly.

Note: The loan repayment period in years is limited to a maximum period of 30 years. If you want to include a loan repayment period which exceeds this period, you need to change the data validation settings in the appropriate input cell by selecting the data validation feature from the Data tab on the Excel ribbon and editing the maximum value of 30 which has been set in the loan repayment period cells.

Each of the loan repayment terms can be specified in the Loan Terms section on the Assumptions sheet. The loan terms include the annual interest rate, loan repayment period in years and a selection field which can be used to indicate interest-only loans. These loan repayment terms are then included at the top of the appropriate loan amortization sheet on the Loans1 to Loans3 and Leases sheets.

Note: A set of loan terms can be specified as interest-only by selecting the "Yes" option from the interest-only drop-down list in the appropriate loan terms on the Assumptions sheet. If this selection is made, the loan will be interest only and not include any loan repayments.

All the calculations on the amortization sheets are fully automated. The only user input that is required on these sheets is entering the additional loan amounts in column C. The loan terms are taken from the Assumptions sheet and the opening balances in the first row of the amortization table are based on the opening balances that are entered in the balance sheet opening balances section of the Assumptions sheet.

The loan repayments, interest charged and capital repayments are calculated based on the outstanding balances at the beginning of each period. The outstanding loan or lease balances at the end of the appropriate monthly or annual period are then included in the appropriate lines on the balance sheet.

Current Liabilities - Bank Overdraft

The bank overdraft as well as cash & cash equivalents are based on the closing cash balances which are calculated on the cash flow statement. If the appropriate monthly closing balance is negative, the balance is included as a bank overdraft and if it is positive, it is included as cash under current assets on the balance sheet.

Current Liabilities - Trade Payables

The trade payables balances on the balance sheet are calculated based on the creditors days assumption which is specified on the Assumptions sheet. The number of days that are included here can be determined based on the average trading terms which has been negotiated with suppliers.

The monthly cost of sales, operating expenses and staff costs on the income statement are added together in order to determine a monthly value on which the trade payables calculations should be based. Expenses and costs which are paid on a cash basis can be excluded from the trade payables calculation by entering a code which ends in C0 in column A on the income statement. The codes in column A start with the appropriate two character sales tax code and end with the two character payables code.