Best Ph.D. Student Loans

Expertise: Mortgages, real estate, investing, credit, debt, small businesses

Lauren Ward is a personal finance writer who regularly covers topics like mortgages, real estate, and investing.

Expertise: Insurance planning, education planning, retirement planning, investment planning, military benefits, behavioral finance

Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.

Ph.D. student loans offer a pathway to finance the extensive costs associated with higher education, covering everything from tuition to living expenses. We’ve identified the best Ph.D. student loans from the Department of Education and private lenders.

| Lender | Best for | Our rating |

| Federal student loans | Not rated | |

| Private student loans | 5/5 | |

| Cosigners | 4.8/5 | |

| Large loans | 4.7/5 |

Use federal Ph.D. student loans first

If you must borrow using Ph.D. student loans, always max out federal student aid as your first funding source. Federal student loans , offered by the U.S. Department of Education, tend to be cheaper, provide more repayment flexibility, and come with other borrower perks, such as the potential for loan forgiveness.

| Unsubsidized | Grad PLUS | |

| 7.05% | 8.05% | |

| Up to $20,500 per year | Up to 100% of certified costs |

Federal Direct Unsubsidized loans

The first federal loan option to consider is the Direct Unsubsidized Loan . These loans don’t require students to demonstrate any financial need and allow for up to $20,500 in annual federal funding toward your Ph.D. program, depending on your actual educational expenses.

One benefit is that you don’t need a cosigner or a credit check when you apply, which you do by filing the FAFSA .

Federal Grad PLUS loans

The Department of Education offers Direct PLUS Loans to graduate students to cover advanced education. If you’re eligible, you could borrow up to the school-certified cost of attendance, minus any grants or scholarships you’ve received.

Unlike some federal loans, however, Grad PLUS Loans aren’t available to you if you have an adverse credit history, and you’ll need to undergo a credit check to prove you don’t.

Best private Ph.D. student loans

After maxing out your federal student loans, you may still need more money to pay for your doctoral degree . If that’s the case, you’ll need to look into getting private Ph.D. loans.

Private student loans tend to have higher interest rates, can be harder to qualify for, and have less flexible repayment plans. However, they can cover shortfalls in funding that otherwise might make getting your Ph.D. impossible.

Our team spent hours evaluating the options to choose the best Ph.D. student loans. Among other factors, we considered their options for deferment, repayment plans, cosigner policies, and grace periods .

- Best overall: College Ave

- Best for cosigners: Sallie Mae

- Best for no fees: Earnest

College Ave: Best overall

LendEDU rating: 5 out of 5

- Choose between 20 different repayment schedules

- 36-month grace period

- Deferment during residency

College Ave is an online lender offering new student loans and refinancing. The company covers a variety of doctorate programs, including those for Ph.D.s.

It stands out in several ways, including a 36-month grace period. You can also get a cosigner release after just 24 consecutive on-time payments.

Repayment terms go up to 15 years, which is a little shorter than some other lenders who let you spread payments out over 20 years. However, you can borrow anywhere from $1,000 up to the total cost of attendance each year.

Sallie Mae: Best for cosigners

LendEDU rating: 4.8 out of 5

- Cosigner release after 12 months of consecutive on-time payments

- 48 months of deferment during residency and fellowship

- No origination or prepayment penalty

Sallie Mae is the largest private student loan lender in the country. It offers loans for graduate students seeking a range of degrees and certifications, covering up to 100% of your educational costs.

Sallie Mae doesn’t have a Ph.D.-specific student loan product, but it offers graduate loans for students in master’s and doctorate programs.

Sallie Mae provides loans for up to 100% of your certified educational expenses, with no maximum loan limit. Repayment terms are up to 15 years, and cosigners can be released after 12 months of on-time payments. Though Sallie Mae loans are not federal, student borrowers may still be eligible for loan payment deferment in 12-month increments.

Earnest: Best for large loans

LendEDU rating: 4.7 out of 5

- Skip a payment once per year, if needed

- Check your rate without affecting your credit

Earnest is a popular online lender offering private student loans and the ability to refinance existing student loans. The Earnest Graduate School Loan covers Ph.D. programs in all states except Nevada.

These can help cover between $1,000 and up to 100% of your school-certified educational costs. You can choose from five repayment terms, and Earnest provides a nine-month grace period.

Best Graduate Student Loans

How to get Ph.D. student loans

A graduate loan can be an important step in paying for your Ph.D. degree program. Whether you’re looking to cover tuition and fees, housing, or even miscellaneous expenses (such as a laptop for class), federal and private student loans can help.

Our expert’s take on loans for Ph.D. students

Erin Kinkade

The amount of student loans needed for a Ph.D. program will likely be more than a bachelor’s or master’s degree. But along with that, the earning potential could be greater and facilitate an easier repayment. It’s important to understand the repayment terms; try to make extra payments while pursuing the Ph.D., and don’t wait until you graduate or get a job, if possible. Of course, make room in your budget for this payment, and when job searching, ask whether the employer offers any benefits for paying back student loans, such as 401(K) employer plan matching , which takes effect on January 1, 2025. This will assist with “lost” retirement savings and help you gain traction to meet your retirement goals.

To gain access to these loans, you must do the following.

- Fill out the FAFSA. The Free Application for Federal Student Aid is a form you must fill out months in advance before the deadline for each year you want financial aid. It helps determine your financial need. This is required if you hope to take out federal loans for any part of your educational expenses.

- Consider federal loans. Federal student loans have protections and features that private loans don’t offer. While you may be limited in how much you can borrow based on financial need and annual limits, consider borrowing as much as you can with federal loans before turning to private loans.

- Shop around for a private loan. If you’ve exhausted all your other options (including scholarships, grants, educational savings, and federal loans), it may be time to turn to private loans. Shopping around is a wise step when looking for the right private student loan, and it can help you find the right loan with the right terms and rates.

- Add a cosigner. If your credit history is limited, you have a low score, or you don’t meet the income requirements for a particular lender, consider adding a creditworthy cosigner to your private loan(s). This cosigner will be held equally responsible for your loans until you refinance or release them, but adding them initially can often unlock lower rates and higher loan limits.

- Provide documentation. Before disbursing your loan, your new lender may want to see some documentation. This could include proof of employment, academic progress, identity, and more.

- Get your loan. Once approved, your loan funds will be sent directly to your school, where they’ll be applied to any outstanding balance. The difference will often be refunded to you after the start of the semester.

Alternatives to a Ph.D. student loan

If you’re looking for alternatives to Ph.D. student loans, consider these funding options that could help lower the cost of attendance.

Tuition reimbursement

Look into tuition reimbursement programs with your employer—where your employer will repay a portion of your tuition costs in exchange for an employment contract.

Program support

Some Ph.D. programs offer financial support, which can be structured in several ways. The first is a fully funded Ph.D. program, which covers tuition, fees, and a stipend for living expenses.

You can also search for Ph.D. fellowship programs. You get financial help during your studies based on merit, and there may be a service requirement attached to the funding.

Which Ph.D. student loan is the best?

When it comes to taking out loans for your Ph.D. program, federal student loans are usually the best place to start your search. Federal loans offer more benefits and protections than private student loans. They may even allow you to have some of your debt forgiven later on, particularly if you plan on working in public service.

If you must turn to private funding, the best Ph.D. student loan for you is the one that offers approval at the lowest interest rate, with the best repayment terms for your unique situation. This lender may be different for each student borrower, so it’s wise to shop around first.

Do I need a cosigner for Ph.D. student loans?

Depending on your credit history, credit score, and current income, you may need to add a cosigner to qualify for a private Ph.D. loan. In exchange for adding a creditworthy cosigner, you may be eligible for certain loans, rates, and repayment terms you didn’t qualify for on your own. Depending on the lender, you may be able to release your cosigner from this obligation later on, once you’ve made a certain number of on-time payments.

Do Ph.D. student loans cover living expenses?

A Ph.D. loan can help cover your school-certified expenses, which may include housing. It’s important to note that some lenders (including federal student loan lenders) may have annual or aggregate limits. If you take out too much for tuition and fees, you may need to consider adding a private loan to cover your living expenses, too.

How much can I borrow with Ph.D. student loans?

The amount you can borrow with a Ph.D. student loan depends on the type of loan and even the specific lender. With federal graduate loans, you are limited to a maximum of $20,500 per year (though certain healthcare fields may qualify for higher limits). With private loans, you may be able to take out up to 100% of your eligible expenses.

When does repayment on Ph.D. student loans start?

Once you drop below half-time enrollment or graduate (depending on the lender), your grace period will usually begin. This grace period often ranges from six to nine months in length, during which you don’t need to make any Ph.D. loan payments. After that grace period, repayment will typically start.

Recap of the best Ph.D. student loans

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Amazon Prime Day

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Compare Personal Loans

The best graduate student loans of july 2024, these top lenders can help graduate student loan borrowers of all types..

Deciding whether or not to go to graduate school is an expensive decision to make. Graduate degree programs typically cost more than undergraduate programs, plus some students enter their grad school era already carrying student loan debt from their undergrad years.

At the same time, however, grad school can pay off. Many people pursue an advanced degree to become more specialized in their field and, ideally, earn more money in the future.

To lessen the burden that an advanced degree can have on your finances, give good consideration to how you'll pay for it. The most favorable borrowing option for graduate students is generally federal direct unsubsidized loans through the government. But because there's an annual $20,500 limit, you'll likely need to turn to grad PLUS loans or private student loans to finance the rest.

CNBC Select set out to find the best graduate school student loans from private lenders. In choosing the top ones, we focused on lenders' loan amounts, loan specializations offered, credit requirements and eligibility, as well as repayment terms, interest rates and fees. (See our methodology for more information on how we made this list.)

Best graduate student loans

- Best for instant credit decision : College Ave

- Best for multi-year financing : Citizens Bank

- Best for applying with a co-signer : Sallie Mae

- Best for applying without a co-signer : Ascent

- Best for fair credit : Earnest

- Best for a grad-level certificate : SoFi

Compare offers to find the best student loan

Best for instant credit decision, college ave, eligible borrowers.

Undergraduate and graduate students, parents

Loan amounts

$1,000 minimum; maximum cost of attendance

Range from 5 to 20 years

Variable and fixed

Borrower protections

Deferment, forbearance and grace period options available

Co-signer required?

Only for international students

Offer student loan refinancing?

Yes - click here for details

Terms apply.

- High loan amount

- Flexible repayment terms

- Variable and fixed rates, so you can choose

- Borrowers have hardship protections

- No co-signer required for U.S. students

- Offers co-signer release

- No origination, application or prepayment fees

- 0.25% interest rate discount for autopay

- Offers student loan refinancing

- Accepts in-school payments

- Non-cosigned loans tend to charge higher interest rates

- Co-signer release can't be made until half of repayment term has passed

With College Ave , borrowers can apply within minutes and get an instant decision on their student loan so they can quickly know their next move.

[ Jump to more details ]

Best for multi-year financing

$150,000 maximum, or cost of attendance, whichever is lower

Range from 5 to 15 years

Forbearance options available

- No co-signer required

- Up to 0.50% interest rate discount for autopay

- Loan amount is limited to $150,000 maximum, or cost of attendance, whichever is lower

Instead of having to re-apply each year for grad school funding, Citizens Bank lets borrowers apply for all years in one go. This relieves the stress of worrying about how you'll pay for that next semester. (Borrowers may need to verify their continued eligibility.)

Best for applying with a co-signer

Sallie mae student loan.

Undergraduate and graduate students, borrowers seeking career training

$1,000 minimum; maximum up to cost of attendance

Range from 10 to 15 years

Deferment and forbearance options available

- Both fixed and variable rates

- Loans available to part-time students

- Co-signer release available

- Doesn't offer student loan refinancing

Sallie Mae offers a co-signer release option with a relatively easy-to-meet threshold: Borrowers can apply to let go of their co-signer after they graduate, make 12 on-time principal and interest payments and meet certain credit requirements. This could be an incentive for a co-signer to sign on, knowing they don't have to be on the hook the whole loan term.

Best for applying without a co-signer

Ascent® funding.

Qualifying undergraduate juniors and seniors, graduate students

Up to $200,000 for undergraduate and $400,000 for graduate loans

- Considers borrowers with no credit

- Up to 1% interest rate discount for autopay

- 1% cash back rewards

Ascent can be a good lender to consider if you don't have access to a co-signer. Borrowers without a co-signer must meet the following requirements to get a grad school loan: either a U.S. citizen, U.S. permanent resident or someone with DACA status, an annual income of at least $24,000 and at least two years of credit history. There are minimum credit score requirements as well, but these vary. To help with your grad school funding, Ascent also offers graduate school scholarships .

Best for good credit

Undergraduate and graduate students, parents, half-time students, international and DACA students

$1,000 minimum (or up to state); maximum up to cost of attendance

9-month grace period

- Applicants with fair credit can qualify

- No origination or prepayment fees

- Allows qualified borrowers to skip one payment every 12 months and make it up later

- No co-signer release option available

- Variable rates not available everywhere

Actual rate and available repayment terms will vary based on your income. Fixed rates range from 5.19% APR to 9.74% APR (excludes 0.25% Auto Pay discount). Variable rates range from 5.99% APR to 9.74% APR (excludes 0.25% Auto Pay discount). Earnest variable interest rate student loan refinance loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once per month. The maximum rate for your loan is 9.99% if your loan term is 10 years or less. For loan terms of more than 10 years to 15 years, the interest rate will never exceed 9.95%. For loan terms over 15 years, the interest rate will never exceed 11.95%. Please note, we are not able to offer variable rate loans in AK, IL, MN, NH, OH, TN, and TX. Our lowest rates are only available for our most credit qualified borrowers and contain our .25% auto pay discount from a checking or savings account.

Those with good credit should look to private lender Earnest to help finance their graduate degree. Earnest allows borrowers — or their co-signers — with a minimum FICO® Score of 665 to apply. Earnest also stands out for offering a Rate Match Guarantee where the lender will match a competing lender's rate, plus give a $100 Amazon gift card upon rate match confirmation.

Best for a grad-level certificate

Undergraduate and graduate students, parents, health professionals

$5,000 minimum (or up to state); maximum up to cost of attendance

Range from 5 to 15 years; up to 20 years for refinancing loans

Offer parent loan?

- 0.125% interest rate discount on any additional SoFi lending product

- Loan size minimum of $5,000

It can be harder to find financing for those seeking just a graduate certificate instead of a full-on graduate degree since not all graduate certificate programs qualify for federal aid. However, SoFi provides lending to eligible borrowers in graduate-level certificate programs, as well as to half-time graduate students (which not many private lenders accommodate).

More on our top graduate school student loans

College Ave offers competitive interest rates, plus no application, origination or prepayment fees. Borrowers can choose a fixed or variable rate and there's a 0.25% rate discount when signing up for autopay. College Ave also offers hardship protections like deferment, forbearance and grace period options. Borrowers with College Ave student loans can start repaying while still in school.

In addition to a generic graduate student loan, College Ave offers financing for those pursuing degrees in the following programs: dental, law, medical, MBA and health professions.

Eligible loans

Undergraduate and graduate loans, parent loans

5, 8, 10, 15 years; graduate loans up to 20 years

[ Return to account summary ]

Citizens Bank

Citizens Bank is a big bank that offers competitive student loan rates, plus no application, origination or prepayment fees. Citizens Bank also offers hardship protections like forbearance, and student loan borrowers can start repaying while still in school.

Citizens Bank provides loans for master's degrees, MBAs, law school, medical school and dental school.

5, 10, 15 years

Sallie Mae has interest rates that are competitive with other private lenders, and they can be variable or fixed. Borrowers can score a 0.25% autopay rate discount and take advantage of no origination, application or prepayment fees. Borrower protections include deferment and forbearance. Sallie Mae lets its borrowers start repaying their loans while still in school.

Sallie Mae offers general graduate school loans (for master's or doctoral degrees), MBA loans, medical school and medical residency loans, health professions loans, dental school and dental residency loans, law school and bar study loans.

Undergraduate and graduate loans

10, 15 years

Ascent borrowers can choose between a fixed or a variable rate, and there's an up to 1% interest rate discount for autopay. There are no fees for paying off your loan early, as well as no origination or application fee. Ascent also offers rewards like 1% cash back on principal loan amounts at graduation. There are also deferment and forbearance options available to borrowers. Ascent student loan borrowers can start making their payments while in school.

Ascent offers the following graduate school loan options: MBA loans, medical school loans, dental school loans, law school loans, doctorate and master's loans, plus health professional loans.

$2,001 minimum; maximum up to $200,000 for undergraduate loans and up to $400,000 for graduate loans

5, 7, 10, 12, 15, 20 years

With Earnest , there are competitive interest rates and the option to choose between variable or fixed. Borrowers will also get a 0.25% autopay rate discount. There are no origination fees or prepayment penalties. Borrower protections include a 9-month grace period and borrowers can make payments while in school.

Earnest offers general graduate student loans, MBA loans, medical school loans and law school loans.

Undergraduate and graduate loans, parent loans, international and DACA student loans

5, 7, 10, 12, 15 years

SoFi offers solid interest rates, both fixed and variable, as well as a 0.25% autopay rate discount. There are no application or origination fees and no prepayment penalties. Borrowers can get unemployment protection and other forbearance options, plus make student loan payments while still in school.

SoFi offers general graduate school loans, law school loans, MBA loans and health professions loans. As a SoFi student loan borrower, you'll get exclusive member benefits like premium travel offers, personalized career advice, financial planning from real-life advisors and more.

5, 7, 10, 15 years; refinancing loans up to 20 years

Compare offers to find the best personal loan

Types of graduate school loans.

Graduate student loans consist of both federal and private loans. Under the federal student loan umbrella, there are federal direct unsubsidized loans and grad PLUS loans. (Unlike undergraduate borrowers, graduate borrowers can't access federal direct subsidized loans.)

Federal direct unsubsidized loans are low-interest, fixed loans that don't have any credit requirements and come with federal benefits like income-driven repayment (IDR) plans and loan forgiveness programs. Borrowers can only borrow up to $20,500 per year, however.

To finance the rest of grad school after reaching this limit, borrowers can either turn to the other federal loan option, grad PLUS loans or private student loans.

Grad PLUS loans and private student loans both require a credit check but should be weighed against one another. PLUS loans come with federal borrower protections but charge a loan origination fee. Meanwhile, many private lenders offer zero origination fees and lower interest rates for those with good credit. Plus, private lenders tend to have loans for specialized programs such as law school, medical school, dental school, residencies, MBAs or certain health professions, as well as general graduate loans for those pursuing a master's or doctoral degree.

What kind of loan is best for graduate school?

The loan that's best for graduate school is a federal student loan from the government, also known as federal direct unsubsidized loans. Note that grad students can't get access to subsidized loans like undergraduate students can. Federal direct unsubsidized loans have low, fixed interest rates and come with all the typical federal benefits like income-driven repayment (IDR) plans and loan forgiveness programs. Borrowers aren't required to meet any credit requirements like they have to with private student loans.

What is a good interest rate for grad school loans?

A good interest rate for grad school loans is in line with the current rate on federal direct unsubsidized loans for graduate students, which, at the time of this writing, is 7.05% .

How can I get the best student loans for graduate school?

To get the best student loans for graduate school, start by filling out and submitting the FAFSA ® form (Free Application for Federal Student Aid) to see what federal aid you qualify for. This type of aid can include federal student loans, scholarships, grants and work-study. After you exhaust all federal aid — and any college savings you have — then move on to a private lender on this list to fill in any financial gaps.

What is the maximum federal loan for graduate school?

The maximum federal loan for graduate school is up to $20,500 per year (unsubsidized only).

Bottom line

The best graduate school student loans are federal direct unsubsidized loans from the government. But because they have a funding limit of up to $20,500 per year, to fill in the remaining gap consider the private student loan lenders on this list.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every student loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of student loan products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best graduate school student loans.

Our methodology

To determine the best graduate school student loans, CNBC Select analyzed and compared private student loan funding from national banks, credit unions and online lenders. We narrowed down our ranking by only considering those that offer competitive student loan rates and prequalification tools that don't hurt borrowers' credit.

While the companies we chose in this article consistently rank as having some of the market's lower interest rates, we also compared each company on the following features:

- Broad availability: All of the companies on our list offer undergraduate and graduate private student loans, and they all offer variable and fixed interest rates to choose from

- Flexible loan terms: Each company provides a variety of financing options that borrowers can customize based on their monthly budget and how long they need to pay back their student loan. Each company also allows borrowers to start repaying their student loans while still in school, ultimately saving them money

- No origination or signup fee: None of the companies on our list charge borrowers an upfront "origination fee" for taking out their loan

- No early payoff penalties: The companies on our list do not charge borrowers prepayment penalties for paying off loans early

- Streamlined application process: We made sure companies offered a fast online application process

- Autopay discounts: All of the companies listed offer an autopay interest rate discount

- Private student loan protections: Each company on our list offers some type of financial hardship protection for borrowers

- Loan sizes: The above companies offer private student loans in an array of sizes, all the way up to the cost of college attendance. Each company advertises its respective loan sizes, and completing a preapproval process can give borrowers an idea of what their interest rate and monthly payment would be

- Credit requirements/eligibility: We took into consideration the minimum credit scores and income levels required if this information was available

- Customer support: Every company on our list provides customer service available via telephone, email or secure online messaging. We also opted for lenders with an online resource hub or advice center to help borrowers educate themselves about student loans in general

After reviewing the above features, we sorted our recommendations by best for instant credit decision, best for multi-year financing, best for applying with a co-signer, best for applying without a co-signer, best for fair credit and best for a grad-level certificate.

Note that the rates and fee structures for private student loans are not guaranteed forever; they are subject to change without notice and they often fluctuate in accordance with the Fed rate. Choosing a fixed-rate APR will guarantee that one's interest rate and monthly payment will remain consistent throughout the entire term of the loan.

A borrower's interest rate depends on their credit score, income, debt-to-income (DTI) ratio, savings, payment history and overall financial health. To take out private student loans, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- These are the lenders that offer the fastest co-signer release Elizabeth Gravier

- How much does car insurance go up after an accident? Brian Sloan

- Best FHA Mortgage lenders of July 2024 Kelsey Neubauer

Best graduate school loan rates in June 2024

- • Personal finance

- • Personal loans

Bankrate's ranking for the best student loan lender for graduate school considers lender terms, interest rates and additional features to help you find a loan that is right for you.

A graduate school loan is a type of student loan specifically designed for graduate studies, including a traditional master’s degree, a Ph.D, law degree, an MBA or a medical degree. Graduate school loans are used to pay for tuition and fees, although most lenders let you use the funds for books, supplies, housing and other expenses.

Graduate school loans are a great option for people who don't have the money to pay for college out of pocket and who have exhausted scholarships, grants and other aid opportunities. If you're searching for a loan, it's generally best to start with federal loans, as they offer flexible repayment options and you may qualify for forgiveness. However, private student loans can also be a good option. Many lenders don’t charge application or origination fees and borrowers with good credit could secure lower rates than those offered by federal loans.

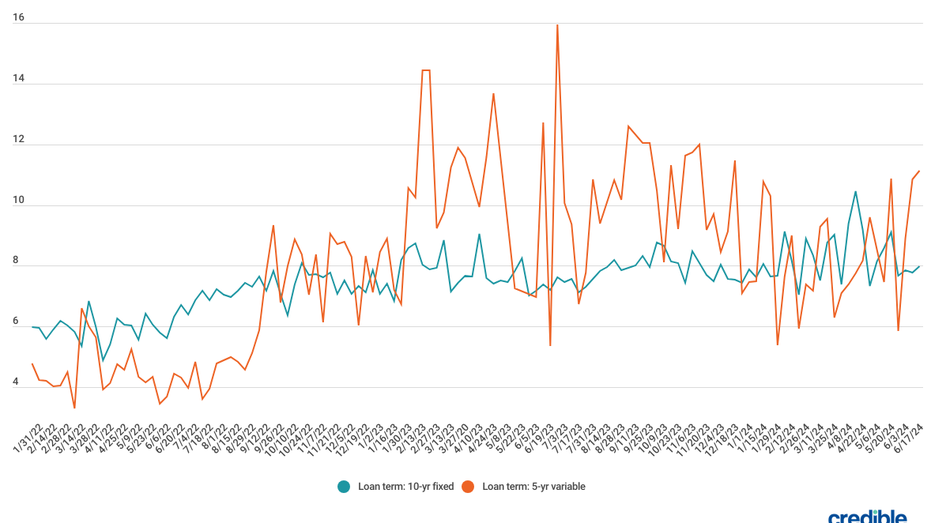

Federal student loans for graduate school in the 2023-2024 school year have an interest rate of 7.05 percent for direct unsubsidized loans and 8.05 percent for PLUS loans. Private student loans typically have rates ranging from 3 percent to 15 percent.

How to apply for a student loan

Fill out the fafsa., get prequalified with private lenders., submit an application., sign loan documents., how to choose a student loan, look at federal student loan options., compare offers from a few private lenders., consider interest rates and terms., look into unique features., on this page, the bankrate promise.

The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products. Bankrate does not endorse or recommend any companies.

- Student loan refinancing Refinance

- Private student loan Private

| Hover to learn more about our lenders. The Bankrate scoring system evaluates lenders' affordability, availability and customer experience based on 11 data points selected by our editorial team. | Hover to learn more about fixed apr. An annual percentage rate (APR) represents the interest and fees you'll pay on top of your initial amount every month. A fixed rate will not change during your repayment period. | Hover to learn more about loan amount. The range of loan amounts that a lender will service. The maximum value is the largest amount a lender will give although this amount may not be available to borrowers who don’t have good or excellent credit. Amount ranges may vary for non-loan products. Term refers to the amount of time you have to repay the loan. | |

|---|---|---|---|

| Fixed APR from 4.17- 16.69% | Loan amount $1k |

College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC.. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply.

All rates shown include the autopay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation.

$5,000 is the minimum requirement to refinance. The maximum loan amount is $300,000 for those with medical, dental, pharmacy or veterinary doctorate degrees, and $150,000 for all other undergraduate or graduate degree.

This informational repayment example uses typical loan terms for a refi borrower with a Full Principal & Interest Repayment and a 10-year repayment term, has a $40,000 loan and a 5.5% Annual Percentage Rate (“APR”): 120 monthly payments of $434.11 while in the repayment period, for a total amount of payments of $52,092.61. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary.

Information advertised valid as of 06/14/2024. Variable interest rates may increase after consummation. Approved interest rate will depend on the creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of full principal and interest payments with the shortest available loan term.

College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC.. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply.

As certified by your school and less any other financial aid you might receive. Minimum $1,000.

Rates shown are for the College Ave Undergraduate Loan product and include autopay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation.

This informational repayment example uses typical loan terms for a freshman borrower who selects the Flat Repayment Option with an 8-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 7.78% fixed Annual Percentage Rate (“APR”): 54 monthly payments of $25 while in school, followed by 96 monthly payments of $176.21 while in the repayment period, for a total amount of payments of $18,266.38. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary.

This informational repayment example uses typical loan terms for a freshman borrower who selects the Deferred Repayment Option with a 10-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 8.35% fixed Annual Percentage Rate (“APR”): 120 monthly payments of $179.18 while in the repayment period, for a total amount of payments of $21,501.54. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary.

Information advertised valid as of 06/14/2024. Variable interest rates may increase after consummation. Approved interest rate will depend on the creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of full principal and interest payments with the shortest available loan term. 4.17- 16.69%$1k | |

| Fixed APR from 4.25- 15.49% | Loan amount $1k |

The Private Student Loan comparison chart displays combined APRs and loan terms for our loan products. See below for APR ranges and the loan terms for each loan product.

Lowest rates shown include the auto debit discount.

Undergraduate loan: Variable rates: 5.37% - 15.70% APR and Fixed rates: 4.25% – 15.49% APR with the loan term of 10-15 years. Lowest rates shown include the auto debit discount.

Advertised APRs for undergraduate students assume a $10,000 loan to a student who attends school for 4 years and has no prior Sallie Mae-serviced loans. Interest rates for variable rate loans may increase or decrease over the life of the loan based on changes to the 30-day Average Secured Overnight Financing Rate (SOFR) rounded up to the nearest one-eighth of one percent. Advertised variable rates are the starting range of rates and may vary outside of that range over the life of the loan. Interest is charged starting when funds are sent to the school. With the Fixed and Deferred Repayment Options, the interest rate is higher than with the Interest Repayment Option and Unpaid Interest is added to the loan’s Current Principal at the end of the grace/separation period. To receive a 0.25 percentage point interest rate discount, the borrower or cosigner must enroll in auto debit through Sallie Mae. The discount applies only during active repayment for as long as the Current Amount Due or Designated Amount is successfully withdrawn from the authorized bank account each month. It may be suspended during forbearance or deferment.

Graduate and MBA loans: Variable rates: 5.37% - 14.97% APR and Fixed rates: 4.25% – 14.48% APR with the loan term of 15 years. Lowest rates shown include the auto debit discount.

Advertised APRs for Graduate School Loan and MBA Loans assume a $10,000 loan with a 2-year in-school period. Interest rates for variable rate loans may increase or decrease over the life of the loan based on changes to the 30-day Average Secured Overnight Financing Rate (SOFR) rounded up to the nearest one-eighth of one percent. Advertised variable rates are the starting range of rates and may vary outside of that range over the life of the loan. Interest is charged starting when funds are sent to the school. With the Fixed and Deferred Repayment Options, the interest rate is higher than with the Interest Repayment Option and Unpaid Interest is added to the loan’s Current Principal at the end of the grace/separation period. To receive a 0.25 percentage point interest rate discount, the borrower or cosigner must enroll in auto debit through Sallie Mae. The discount applies only during active repayment for as long as the Current Amount Due or Designated Amount is successfully withdrawn from the authorized bank account each month. It may be suspended during forbearance or deferment.

Medical loan: Variable rates: 5.37% - 14.96% APR and Fixed rates: 4.25% - 14.46% APR with the loan term of 20 years. Lowest rates shown include the auto debit discount.

Advertised APRs for Medical School Loan assume a $10,000 loan with a 4-year in-school period. Interest rates for variable rate loans may increase or decrease over the life of the loan based on changes to the 30-day Average Secured Overnight Financing Rate (SOFR) rounded up to the nearest one-eighth of one percent. Advertised variable rates are the starting range of rates and may vary outside of that range over the life of the loan. Interest is charged starting when funds are sent to the school. With the Fixed and Deferred Repayment Options, the interest rate is higher than with the Interest Repayment Option and Unpaid Interest is added to the loan’s Current Principal at the end of the grace/separation period. To receive a 0.25 percentage point interest rate discount, the borrower or cosigner must enroll in auto debit through Sallie Mae. The discount applies only during active repayment for as long as the Current Amount Due or Designated Amount is successfully withdrawn from the authorized bank account each month. It may be suspended during forbearance or deferment.

Law loan: Variable rates: 5.37% - 14.97% APR and Fixed rates: 4.25% - 14.47% APR with the loan term of 15 years. Lowest rates shown include the auto debit discount.

Advertised APRs for Law School Loan assume a $10,000 loan with a 3-year in-school period. Interest rates for variable rate loans may increase or decrease over the life of the loan based on changes to the 30-day Average Secured Overnight Financing Rate (SOFR) rounded up to the nearest one-eighth of one percent. Advertised variable rates are the starting range of rates and may vary outside of that range over the life of the loan. Interest is charged starting when funds are sent to the school. With the Fixed and Deferred Repayment Options, the interest rate is higher than with the Interest Repayment Option and Unpaid Interest is added to the loan’s Current Principal at the end of the grace/separation period. To receive a 0.25 percentage point interest rate discount, the borrower or cosigner must enroll in auto debit through Sallie Mae. The discount applies only during active repayment for as long as the Current Amount Due or Designated Amount is successfully withdrawn from the authorized bank account each month. It may be suspended during forbearance or deferment.

Although we do not charge a penalty or fee if you prepay your loan, any prepayment will be applied as outlined in your promissory note—first to Unpaid Fees and costs, then to Unpaid Interest, and then to Current Principal.

Only the borrower may apply for cosigner release. To do so, they must first meet the age of majority in their state and provide proof of graduation (or completion of certification program), income, and U.S. citizenship or permanent residency (if their status has changed since they applied). In the last 12 months, the borrower can’t have been past due on any loans serviced by Sallie Mae for 30 or more days or enrolled in any hardship forbearances or modified repayment programs. In addition, the borrower must have paid ahead or made 12 on-time principal and interest payments on each loan requested for release. The loan can’t be past due when the cosigner release application is processed. The borrower must also demonstrate the ability to assume full responsibility of the loan(s) individually and pass a credit review when the cosigner release application is processed that demonstrates a satisfactory credit history including but not limited to no: bankruptcy, foreclosure, student loan(s) in default or 90-day delinquencies in the last 24 months. Requirements are subject to change.

For applications submitted directly to Sallie Mae, loan amount cannot exceed the cost of attendance less financial aid received, as certified by the school. Applications submitted to Sallie Mae through a partner website will be subject to a lower maximum loan request amount. Miscellaneous personal expenses (such as a laptop) may be included in the cost of attendance for students enrolled at least half-time.

3 repayment options: Deferred payment; $25 Fixed repayment; Interest repayment:

Smart Option Student Loan: Examples of typical costs for a $10,000 Smart Option Student Loan with the most common fixed rate, fixed repayment option, 6-month separation period, and two disbursements: For a borrower with no prior loans and a 4-year in-school period, it works out to a 10.28% fixed APR, 51 payments of $25.00, 119 payments of $182.67 and one payment of $121.71, for a Total Loan Cost of $23,134.44. For a borrower with $20,000 in prior loans and a 2-year in-school period, it works out to a 10.78% fixed APR, 27 payments of $25.00, 179 payments of $132.53 and one payment of $40.35 for a total loan cost of $24,438.22. Loans that are subject to a $50 minimum principal and interest payment amount may receive a loan term that is less than 10 years. A variable APR may increase over the life of the loan. A fixed APR will not.

Graduate Loan: Example of a typical transaction for a $10,000 Graduate School Loan with the most common fixed rate, Fixed Repayment Option, and two disbursements. For borrowers with a 27-month in-school and separation period, it works out to 14.30% fixed APR, 27 payments of $25.00, 178 payments of $172.22 and one payment of $115.59, for a total loan cost of $31,445.75. Loans that are subject to a $50 minimum principal and interest payment amount may receive a loan term that is less than 15 years. A variable APR may increase over the life of the loan. A fixed APR will not.

Medical Loan: Example of a typical transaction for a $10,000 Medical School Loan with the most common fixed rate, Fixed Repayment Option, and two disbursements. For borrowers with a 81-month in-school and separation period, it works out to 10.71% fixed APR, 81 payments of $25.00, 238 payments of $175.31 and one payment of $89.74, for a total loan cost of $43,838.52. Loans that are subject to a $50 minimum principal and interest payment amount may receive a loan term that is less than 20 years. A variable APR may increase over the life of the loan. A fixed APR will not.

Law Loan: Example of a typical transaction for a $10,000 Law School Loan with the most common fixed rate, Fixed Repayment Option, and two disbursements. For borrowers with a 42-month in-school and separation period, it works out to 11.44% fixed APR, 42 payments of $25.00, 179 payments of $155.95 and one payment of $57.28, for a total loan cost of $29,022.33. Loans that are subject to a $50 minimum principal and interest payment amount may receive a loan term that is less than 15 years. A variable APR may increase over the life of the loan. A fixed APR will not.

MBA Loan: Example of a typical transaction for a $10,000 MBA Loan with the most common fixed rate, Fixed Repayment Option, and two disbursements. For borrowers with a 27-month in-school and separation period, it works out to 14.30% fixed APR, 27 payments of $25.00, 178 payments of $172.22 and one payment of $115.59, for a total loan cost of $31,445.75. Loans that are subject to a $50 minimum principal and interest payment amount may receive a loan term that is less than 15 years. A variable APR may increase over the life of the loan. A fixed APR will not.

Borrow responsibly

We encourage students and families to start with savings, grants, scholarships, and federal student loans to pay for college. Evaluate all anticipated monthly loan payments, and how much the student expects to earn in the future, before considering a private student loan.

Loans for Undergraduate & Career Training Students are not intended for graduate students and are subject to credit approval, identity verification, signed loan documents, and school certification. Student must attend a participating school. Student or cosigner must meet the age of majority in their state of residence. Students who are not U.S. citizens or U.S. permanent residents must reside in the U.S., attend school in the U.S., apply with a creditworthy cosigner (who must be a U.S. citizen or U.S. permanent resident), and provide an unexpired government-issued photo ID. Requested loan amount must be at least $1,000.

Graduate School Loan and Graduate School Loan for Health Professions are for graduate students at participating degree-granting schools and are subject to credit approval, identity verification, signed loan documents, and school certification. Student or cosigner must meet the age of majority in their state of residence. Students who are not U.S. citizens or U.S. permanent residents must reside in the U.S., attend school in the U.S., apply with a creditworthy cosigner (who must be a U.S. citizen or U.S. permanent resident), and provide an unexpired government-issued photo ID. Requested loan amount must be at least $1,000.

Medical School Loans are for graduate students in an M.D., D.O., D.V.M., V.M.D., or D.P.M. program at participating degree-granting schools and are subject to credit approval, identity verification, signed loan documents, and school certification. Graduate Certificate/Continuing Education coursework is not eligible. Student or cosigner must meet the age of majority in their state of residence. Students who are not U.S. citizens or U.S. permanent residents must reside in the U.S., attend school in the U.S., apply with a creditworthy cosigner (who must be a U.S. citizen or U.S. permanent resident), and provide an unexpired government-issued photo ID. Requested loan amount must be at least $1,000.

Law School Loans are for graduate students in a J.D. or L.L.M. program at participating degree-granting schools and are subject to credit approval, identity verification, signed loan documents, and school certification. Graduate Certificate/Continuing Education coursework is not eligible. Student or cosigner must meet the age of majority in their state of residence. Students who are not U.S. citizens or U.S. permanent residents must reside in the U.S., attend school in the U.S., apply with a creditworthy cosigner (who must be a U.S. citizen or U.S. permanent resident), and provide an unexpired government-issued photo ID. Requested loan amount must be at least $1,000.

MBA Loans are for graduate students in an M.B.A. program at participating degree-granting schools and are subject to credit approval, identity verification, signed loan documents, and school certification. Student or cosigner must meet the age of majority in their state of residence. Students who are not U.S. citizens or U.S. permanent residents must reside in the U.S., attend school in the U.S., apply with a creditworthy cosigner (who must be a U.S. citizen or U.S. permanent resident), and provide an unexpired government-issued photo ID. Requested loan amount must be at least $1,000.

Information advertised valid as of 06/21/2024.

SLM Corporation and its subsidiaries, including Sallie Mae Bank, are not sponsored by or agencies of the United States of America.

SALLIE MAE RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS, SERVICES, AND BENEFITS AT ANY TIME WITHOUT NOTICE.

Sallie Mae, the Sallie Mae logo, and other Sallie Mae names and logos are service marks if Sallie Mae Bank. All other names and logos used are the trademarks or service marks of their respective owners.

Credible is not the creditor for these loans and is compensated by Sallie Mae for the referral of Sallie Mae loan customers. 4.25- 15.49%$1k | |

| Fixed APR from 4.29- 15.96% | Loan amount $2k |

Ascent's undergraduate and graduate student loans are funded by Bank of Lake Mills or DR Bank, each Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations; and terms and conditions may apply.

For Ascent Terms and Conditions please visit:

Rates are effective as of 6/3/2024 and reflect an automatic payment discount of either 0.25% (for credit-based loans) OR 1.00% (for undergraduate outcomes-based loans). Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: . 1% Cash Back Graduation Reward subject to terms and conditions. Cosigned Credit-Based Loan student must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest rates require full principal and interest payments, the shortest loan term, a cosigner, and are only available for our most creditworthy applicants and cosigners with the highest average credit scores. Actual APR offered may be higher or lower than the repayment examples above, based on the amount of time you spend in school and any grace period you have before repayment begins.

*The minimum amount is $2,001 except for the state of Massachusetts. Minimum loan amount for borrowers with a Massachusetts permanent address is $6,001 4.29- 15.96%$2k | |

| Fixed APR from 4.39- 15.45% | Loan amount $1k- $350K | Student Lending Eligibility Criteria: Applicants must be a U.S. citizen, permanent resident, or eligible non-citizen with a creditworthy U.S. citizen or permanent resident co-signer. For applicants who have not attained the age of majority in their state of residence, a co-signer is required. Citizens reserves the right to modify eligibility criteria at any time. Citizens private student loans are subject to credit qualification, completion of a loan application/Promissory Note, verification of application information, and if applicable, self-certification form, school certification of the loan amount, and student’s enrollment at a Citizens participating school. Education Refinance Loan Eligibility: Applicants must have attained a bachelor’s degree or higher to refinance their loan. Education Refinance Loan for Medical Residency Eligibility: Applicants must have graduated from medical school and be matched to a MD, DO, DDS, DMD, DPM, DVM, VMD, PharmD, OD residency or fellowship program at the time of application. Education Refinance Loan for Parents Eligibility: The primary applicant must be the primary borrower or co-signer on the loan to be refinanced. Student Loan Eligibility: Applicants must be enrolled at least half-time in a degree-granting program at an eligible institution. Student Loan for Parents Eligibility: The student whose education expenses will be paid for with the loan proceeds must be a U.S. citizen or permanent resident and must be enrolled at least half-time in a degree granting program at a Citizens-participating school.

Variable Rate Disclosure: Variable interest rates are based on the 30-day average Secured Overnight Financing Rate (“SOFR”) index, as published by the Federal Reserve Bank of New York. As of Jun 01, 2024, the 30-day average SOFR index is 5.32%. Variable interest rates will fluctuate over the term of the loan with changes in the SOFR index, and will vary based on applicable terms, level of degree and presence of a co-signer. The maximum variable interest rate is the greater of 21.00% or the prime rate plus 9.00%. Fixed Rate Disclosure: Fixed rate ranges are based on applicable terms, level of degree, and presence of a co-signer. Lowest Rate Disclosure: Lowest rates are only available for the most creditworthy applicants, require a 5-year repayment term, interest-only repayment, and include our Loyalty and Automatic Payment discounts of 0.25 percentage points each, as outlined in the Loyalty Discount and Automatic Payment Discount disclosures. Rates are subject to additional terms and conditions, and are subject to change at any time without notice. Such changes will only apply to applications taken after the effective date of change. Education Refinance Loan Rate Disclosure: Variable interest rates range from 7.02% - 12.41% (7.02% - 12.42% APR). Fixed interest rates range from 6.49% - 10.98% (6.49% - 10.99% APR). Medical Residency Refinance Loan Rate Disclosure: Variable interest rates range from 7.02% - 11.52% (7.02% - 11.53% APR). Fixed interest rates range from 6.49% - 10.09% (6.49%- 10.10% APR). Education Refinance Loan for Parents Rate Disclosure: Variable interest rates range from 7.81% - 11.52% (7.81% - 11.53% APR). Fixed interest rates range from 7.28% - 10.09% (7.28% - 10.10% APR). Student Loan Rate Disclosure: Variable interest rates range from 5.97% - 16.48% (5.97% - 16.47% APR). Fixed interest rates range from 4.39% - 15.50% (4.39% - 15.46% APR). Undergraduate Loan Rate Disclosure: Variable interest rates range from 5.97% - 16.48% (5.97% - 16.47% APR). Fixed interest rates range from 4.39% - 15.50% (4.39% - 15.46% APR). Graduate Loan Rate Disclosure: Variable interest rates range from 5.97% - 14.98% (5.97% - 14.95% APR). Fixed interest rates range from 4.39% - 14.00% (4.39% - 13.97% APR). Business/Law Loan Rate Disclosure: Variable interest rates range from 5.97% - 14.98% (5.97% - 14.94% APR). Fixed interest rates range from 4.39% - 14.00% (4.39% - 13.96% APR). Medical/Dental Loan Rate Disclosure: Variable interest rates range from 5.97% - 14.98% (5.97% - 14.47% APR). Fixed interest rates range from 4.39% - 14.00% (4.39% - 13.82% APR). Parent Loan Rate Disclosure: Variable interest rates range from 9.03% - 9.53% (9.03% - 9.54% APR). Fixed interest rates range from 9.05% - 9.55% (9.05% - 9.56% APR).

Wireless Charges: Wireless carrier, text, and/or data charges may apply. Loyalty Discount: The borrower will be eligible for a 0.25 percentage point interest rate reduction on their loan if the borrower or their co-signer (if applicable) has a qualifying account in existence with us at the time the borrower and their co-signer (if applicable) have submitted a completed application authorizing us to review their credit request for the loan. The following are qualifying accounts: any checking account, savings account, money market account, certificate of deposit, automobile loan, home equity loan, home equity line of credit, mortgage, credit card account, or other student loans owned by Citizens Bank, N.A. Please note, our checking and savings account options are only available in the following states: CT, DC, DE, FL, MA, MD, MI, NH, NJ, NY, OH, PA, RI, VA, and VT and some products may have an associated cost. This discount will be reflected in the interest rate disclosed in the Loan Approval Disclosure that will be provided to the borrower once the loan is approved. Limit of one Loyalty Discount per loan and discount will not be applied to prior loans. The Loyalty Discount will remain in effect for the life of the loan. Investors Bancorp, Inc. Loyalty Discount: To receive the Loyalty Discount for having a qualifying account with Investors Bancorp, Inc., borrowers must contact Citizens by telephone prior to signing the promissory note. Student loan borrowers please call (877) 291-6385 and education refinance borrowers please call (888) 411-2413. Automatic Payment Discount: Borrowers will be eligible to receive a 0.25 percentage point interest rate reduction on their student loans owned by Citizens Bank, N.A. during such time as payments are required to be made and our loan servicer is authorized to automatically deduct payments each month from any bank account the borrower designates. Discount is not available when payments are not due, such as during forbearance. If our loan servicer is unable to successfully withdraw the automatic deductions from the designated account three or more times within any 12-month period, the borrower will no longer be eligible for this discount. Get My Rate: Selecting “Get My Rate” only requires a “soft credit pull“ which does not affect your credit score. Submitting a full application will result in an inquiry on your credit report. Multi-Year Approval: Funds available for future use are subject to a soft credit inquiry at time of your next request to verify continued eligibility. After we make the initial Loan to you, you must continue to meet eligibility criteria to obtain additional funds under the Multi-Year Approval feature. Terms and conditions are outlined in the promissory note. Multi-Year Approval borrowers have a 99% approval rate on future requests for additional funds. The additional funds approval rate is based on the percentage of approved Multi-Year borrowers from Citizens between October 1, 2022 and October 1, 2023. The approval rate represents only borrowers who had previously accepted the Multi-Year Approval offer. Co-signer Release: Borrowers may apply for co-signer release after making 36 consecutive on-time payments of principal and interest. For the purpose of the application for co-signer release, on-time payments are defined as payments received within 15 days of the due date. Interest only payments do not qualify. The borrower must meet certain credit and eligibility guidelines when applying for the co-signer release. Borrowers must complete an application for release and provide income verification documents as part of the review. Borrowers who use deferment or forbearance will need to make 36 consecutive on-time payments after reentering repayment to qualify for release. The borrower applying for co-signer release must be a U.S. citizen or permanent resident. If an application for co-signer release is denied, the borrower may not reapply for co-signer release until at least one year from the date the application for co-signer release was received. Terms and conditions apply. Borrowers whose loans were funded prior to reaching the age of majority may not be eligible for co-signer release. Note: co-signer release is not available on the Student Loan for Parents or Education Refinance Loan for Parents. Student Loan Aggregate Limits: You may borrow up to the maximum qualified loan amount or the total cost of education, whichever is lower. Our student loan does have lifetime aggregate limits (including both federal and private loan debt) of: Undergraduate Degree: $150,000, Graduate Degrees: $150,000, MBA and Law: $225,000, Healthcare: $180,000 or $350,000 depending on your degree (Aggregate limits up to $350,000 for MD, DMD/DDS, OD, DO, DPM, PharmD, and DVM degrees. Aggregate limits up to $180,000 for cardiac perfusion, chiropractic, cytotechnology, nurse practitioner, occupational therapy, physical therapy, and physician assistant degree). Employer & Organizational Partnerships: To qualify for the principal balance reduction, the borrower or co-signer (if applicable) must have applied, be approved, and disburse a Citizens Education Refinance Loan, Education Refinance Loan for Parents, or a Medical Residency Refinance Loan through the employer’s dedicated Citizens website. The principal balance reduction will be calculated as 1% of the amount financed with a maximum of $1,000. The loan must be in good standing at the time the Principal Balance Reduction Benefit is applied. Only one Principal Balance Reduction Benefit is allowed per borrower. If you receive a Principal Balance Reduction Benefit on a Citizens Student Loan or Student Loan for Parents you will not be eligible for another Principal Balance Reduction Benefit on a Citizens Education Refinance Loan, Education Refinance Loan for Parents or a Medical Residency Refinance Loan. Principal balance reduction will be applied with an effective date equal to the loan’s first disbursement date. Principal balance reduction may take up to the second month following the loan’s final disbursement date to be applied and may be reduced if the loan amount is reduced or cancelled. The Principal Balance Reduction Benefit will be processed as a reduction of the loan’s principal balance and will not impact the required monthly payment. The borrower is solely responsible for any taxes that may be owed as a result of the principal balance reduction earned. A tax advisor should be consulted. Citizens Bank, N.A. does not provide tax advice. Offer cannot be combined with other promotions, discounts or offers – automatic payment and loyalty discounts excluded. Citizens reserves the right to modify these terms or cancel this offer at any point in the future for new applications. Federal Loan vs. Private Loan Benefits: Some federal student loans include unique benefits that the borrower may not receive with a private student loan, some of which we do not offer. Borrowers should carefully review federal benefits, especially if they work in public service, are in the military, are considering possible loan forgiveness options, are currently on or considering income based repayment options or are concerned about a steady source of future income and would want to lower their payments at some time in the future. When the borrower refinances, they waive any current and potential future benefits of their federal loans. For more information about federal student loan benefits and federal loan consolidation, visit . We also have several resources available to help the borrower make a decision on our including and our FAQs. includes a comparison of federal and private student loan benefits that we encourage the borrower to review. U.S. Dept. of Education Fee: The Federal Direct PLUS Loan fee is a percentage of the loan amount and is proportionately deducted from each loan disbursement. For Loans first disbursed between October 1, 2020 and October 1, 2024 the origination fee is 4.228%. Student Loan Repayment: Student borrowers can make full payments or pay interest only while in school or defer payments until after graduation (interest continues to accrue during deferment periods). Medical Residency Refinance Loan Repayment Example with $100 Monthly Payment: Based on a 48 month residency, a fixed rate 5 year loan for $10,000 at 5.00% APR results in 54 monthly payments of $100 (includes residency period and 6-month grace period), followed by 60 monthly payments of $123.61. $100 monthly payment begins immediately after loan disbursement for the duration of the residency or fellow program period up to 48 months, plus 6 month grace period. Citizens Scholarship: No purchase necessary. Void where prohibited. The Citizens Scholarship Sweepstakes is open to legal residents of the 50 United States, D.C., and U.S. Territories, who are 16 years of age or older, are students or prospective students, or parents/guardians of students intending to enroll or enrolled at least half-time in an accredited undergraduate/graduate post-secondary institution. To be eligible for a chance to win the Citizens Diversity, Equity & Inclusion Scholarship, entrants must also be an: American Indian or Alaskan Native, African American or Black, Hispanic or Latino/a, Asian, Native Hawaiian, or other Pacific Islander, women, member of the LGBTQ+ community, individual with disabilities, and/or a Veteran. Sweepstakes begins at 12:00 AM ET on 7/1/23 and ends at 11:59 p.m. ET on 6/30/24. Sponsored by Citizens. See for details. Citizens Student Credit Builder™: Citizens Student Credit Builder™ refers to loans with either an Immediate or Interest Only repayment option chosen at the time the loan is originated. Credit scores are based on established borrower payment behaviors. By choosing a loan repayment option that requires payment while the student is in school, the borrower begins their history of payments earlier than a corresponding borrower that chooses a deferred repayment option. Additionally, an equally qualified borrower and/or cosigner with similar loan terms will receive a lower interest rate with an Immediate or Interest Only repayment option.

Education Refinance Loan Average Monthly Payment Savings: The average monthly and annual payment savings estimated amount is based on 2,914 Citizens Education Refinance Loan customers who refinanced their loans between March 1, 2023 and March 1, 2024 and who received a lower payment. The calculation is derived by averaging the monthly payments prior to refinancing minus the monthly payments after refinancing. Excluded are monthly savings reported from customers that exceeded $9,375 or were lower than $20 to minimize risk of data error skewing the savings amounts. Savings vary based on interest rates, balances and remaining repayment term of loans to be refinanced. Your overall repayment amount may be higher than the loans you are refinancing even if your monthly payments are lower. Education Refinance Loan Weighted Average Interest Rate Savings: Weighted average interest rate savings is based on 2,776 Citizens Education Refinance Loan customers who lowered their interest rate on loans between March 1, 2023 and March 1, 2024. The calculation is derived by averaging the rate savings across Citizens Education Refinance Loan customers whose interest rates decreased after refinancing, calculated by taking the weighted average interest rate prior to refinancing minus the interest rate after refinancing. We excluded rate savings from customers that exceeded 14.51% and were lower than 0.25% to minimize risk of data error skewing the rate savings amounts. Your interest rate savings might vary based on the interest rates you qualify for, chosen terms and previous interest rate of the loans you are seeking to refinance. Your overall interest rate may be higher than the interest rate on the loans you are refinancing even if your monthly payments are lower. Education Refinance Loan for Parents and Federal Loan Savings Comparison: Interest rate savings are calculated as the difference between the Citizens Education Refinance Loan for Parents’ lowest offered fixed rate of 7.28% (7.28% APR) and the Federal Parent PLUS Loan interest rate of 8.05% for loans first disbursed between July 1, 2023 and June 30, 2024. The Citizens Education Refinance Loan for Parents lowest rate includes the available Citizens loyalty and automatic payment discounts for eligible and creditworthy applicants. Parent Loan Savings: Origination fee savings of $737 are calculated using the Federal Direct Plus Loan origination fee of 4.228% (for loans first disbursed between 10/1/22 and 9/30/23) and an average amount financed of $17,429 as compared to the Citizens Student Loan for Parents, which has no origination fees. Graduate Loan Savings: Origination fee savings of $806 are calculated using the Federal Direct Plus Loan origination fee of 4.228% (for loans first disbursed between 10/1/22 and 9/30/23) and an average amount financed of $19,067 as compared to the Citizens Student Loan, which has no origination fees.

The site for Application Solicitation Disclosures is under construction. For more information, please call the Customer Service Team at (877) 464-6329 and copies of the disclosures will be provided via email. Our hours are Monday through Friday, 8:00am - 9:00pm EST and Saturday, 8:30am - 5:00pm. Closed Sunday. 4.39- 15.45%$1k- $350K | |

| Fixed APR from 4.43- 14.04% | Loan amount $1k- $100K |

Before applying for a private student loan, Citizens and Monogram recommend exhausting all financial aid alternatives including grants, scholarships, and federal student loans.

The Custom Choice Loan® is made by Citizens (“Lender”). All loans are subject to individual approval and adherence to Lender’s underwriting guidelines. Program restrictions and other terms and conditions apply. LENDER AND MONOGRAM LLC EACH RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. TERMS, CONDITIONS AND RATES ARE SUBJECT TO CHANGE AT ANY TIME WITHOUT NOTICE.

Interest rates and APRs (Annual Percentage Rates) depend upon (1) the student’s and cosigner’s (if applicable) credit histories, (2) the repayment option and repayment term selected, (3) the expected number of years in deferment, (4) the requested loan amount and (5) other information provided on the online loan application. If approved, applicants will be notified of the rate applicable to your loan. Rates and terms are effective as of 6/1/24. The variable interest rate for each calendar month is calculated by adding 30-Day Average Secured Overnight Financing Rate (“SOFR”) index, or a replacement index if the SOFR index is no longer available, plus a fixed margin assigned to each loan. The SOFR index is published on the website of the Federal Reserve Bank of New York. The current SOFR index is 5.32% as of 6/1/24. The applicable index or margin for variable rate loans may change over time if the SOFR index changes or if a new index is chosen, and result in a different APR than shown. The fixed rate and APR assigned to a loan will never change except as required by law or if you request and qualify for the auto pay discount. The APR typically differs from the interest rate since it accounts for fees, the rate, length of the loan and the timing of all payments and reflects the cost as a yearly rate.

APRs displayed as a range in the rate table assume a $10,000 loan with one disbursement. The high APRs assume a 7-year term with the Flat Payment Repayment option, a 1 month deferment period, and a six-month grace period before entering repayment. The low APRs assume a 7-year term, and the Immediate Repayment option with payments beginning 30-60 days after the disbursement via auto pay (see auto pay details in Discounts footnote below).

Loan Terms: The 15-year term is only available for loan amounts of $5,000 or more. Certain repayment terms and/or options may not be available depending on the applicant’s enrollment status and/or debt-to-income ratio. Payment examples (all assume a 14-month deferment period, a six-month grace period before entering repayment, no rate reduction for auto pay and the Interest Only Repayment option): 7-year term: $10,000 loan, one disbursement, with a 7-year repayment term (84 months), and 9.50% APR would result in a monthly principal and interest payment of $163.44. 10-year term: $10,000 loan, one disbursement, with a 10-year repayment term (120 months) and 9.30% APR would result in a monthly principal and interest payment of $128.31. 15-year term: $10,000 loan, one disbursement, with a 15-year repayment term (180 months) and 9.29% APR would result in a monthly principal and interest payment of $103.16.

Loan Amounts: The minimum loan amount is $1,000 except for student applicants who are permanent residents of Iowa in which case the minimum loan amount is $1,001. The maximum annual loan amount to cover in-school expenses for each academic year is determined by the school’s cost of attendance, minus other financial aid, such as federal student loans, scholarships, or grants, up to $99,999 annually. The loan amount must be certified by the school. The loan amount cannot cause the aggregate maximum student loan debt (which includes federal and private student loans) to exceed $180,000 per applicant (on cosigned applications, separate calculations are performed for the student and cosigner).