Students enrolled in the Master of Liberal Arts program in Finance will gain a solid foundation in the principles of finance, becoming well informed of topics critical to financial planning, implementation, measurement, and investment.

- Utility Menu

44d3fa3df9f06a3117ed3d2ad6c71ecc

- Administration

Financial Economics

Robert Barro

Robert J. Barro is a visiting scholar at the American Enterprise Institute and a research associate of the National Bureau of Economic Research. Recent research involves rare macroeconomic disasters, corporate tax reform, religion & economy, empirical determinants of economic growth, and economic effects of public debt and budget deficits. Recent books include Religion and Economy (forthcoming with Rachel McCleary), Economic Growth (2nd edition, written with Xavier Sala-i-Martin), Nothing Is Sacred: Economic Ideas for the New Millennium, Determinants of Economic Growth, and Getting It Right: Markets and Choices in a Free Society. ... Read more about Robert Barro

Emily Breza

Emily Breza joined the Economics Department as an Assistant Professor in January 2017. She received her PhD in Economics from MIT and her BA from...

John Y. Campbell

John Campbell has published over 80 articles on various aspects of finance and macroeconomics, including fixed-income securities, equity valuation, and portfolio choice. His books include The Econometrics of Financial Markets (with Andrew Lo and Craig MacKinlay, Princeton University Press 1997), Strategic Asset Allocation: Portfolio Choice for Long-Term Investors (with Luis Viceira, Oxford University Press 2002), and The Squam Lake Report: Fixing the Financial System (with the Squam Lake Group of financial economists, Princeton University Press 2010).

Faculty Assistant: Mack Carroll

Gabriel Chodorow-Reich

Gabriel Chodorow-Reich's research focuses on macroeconomics, finance, and labor economics. Gabriel received his Ph.D. from the University of...

Xavier Gabaix

Xavier Gabaix is Pershing Square Professor of Economics and Finance at Harvard’s economics department. He received his undergraduate degree in mathematics from the Ecole Normale Supérieure (Paris) and obtained his PhD in economics from Harvard University.... Read more about Xavier Gabaix

David Laibson

David Laibson is a member of the National Bureau of Economic Research, where he is Research Associate in the Asset Pricing, Economic Fluctuations, and Aging Working Groups. Laibsonʼs research focuses on the topic of behavioral economics, and he is a co-leader of the Harvard University Foundations of Human Behavior Initiative. ... Read more about David Laibson

Neil Shephard

Neil Shephard is the Frank B. Baird, Jr. Professor of Science, in the Department of Economics and Department of Statistics. His broad research interests are in econometrics, finance and statistics, with a particular focus on financial econometrics. He has made particular advances in developing simulation based inference methods for online learning and has contributed methods to allow the mainstream use of high frequency financial data in economics. He joined the Harvard faculty in 2013, holding a professorship joint between the Economics and Statistics Departments. Professor Shephard is a fellow of the Econometric Society and the British Academy. He is an associated editor of Econometrica . Professor Shephard was a faculty member at the London School of Economics from 1988-1993 and Oxford University from 1991 to 2013.

Staff Support: Emily Palmer

Andrei Shleifer

Andrei Shleifer has worked in the areas of comparative corporate governance, law and finance, behavioral finance, as well as institutional economics. He has published six books, including The Grabbing Hand (with Robert Vishny), and Inefficient Markets: An Introduction to Behavioral Finance , as well as over a hundred articles. In 1999, Shleifer won the John Bates Clark medal of the American Economic Association.... Read more about Andrei Shleifer

Jeremy Stein

Jeremy Stein’s research has covered such topics as behavioral finance and stock-market efficiency, corporate investment and financing decisions, risk management, capital allocation inside firms, banking, financial regulation, and monetary policy. He was previously a co-editor of the Quarterly Journal of Economics and the Journal of Economic Perspectives , and has served on the editorial boards of several other economics and finance journals. He is a fellow of the American Academy of Arts and Sciences and research associate at the National Bureau of Economic Research. In 2008, he was president of the American Finance Association. He has served in the Obama Administration as a senior advisor to the Treasury Secretary and on the staff of the National Economic Council.... Read more about Jeremy Stein

- Behavioral Economics (11)

- Contracts and Organization (1)

- Economic Development (7)

- Econometrics (6)

- Economic History (7)

- Financial Economics (9)

- Industrial Organization (3)

- International Economics (6)

- Labor Economics (11)

- Macroeconomics (16)

- Political Economy (9)

- Public Economics (9)

- Theory (10)

Contact Information

Personal site, office staff, franklin barrera, alyssa boudreau, reginald cheatham, tracey gatton, maria gregory, eric hultmark, abebaye lema, andy urbina, evelyn wong, additional information.

- Utility Menu

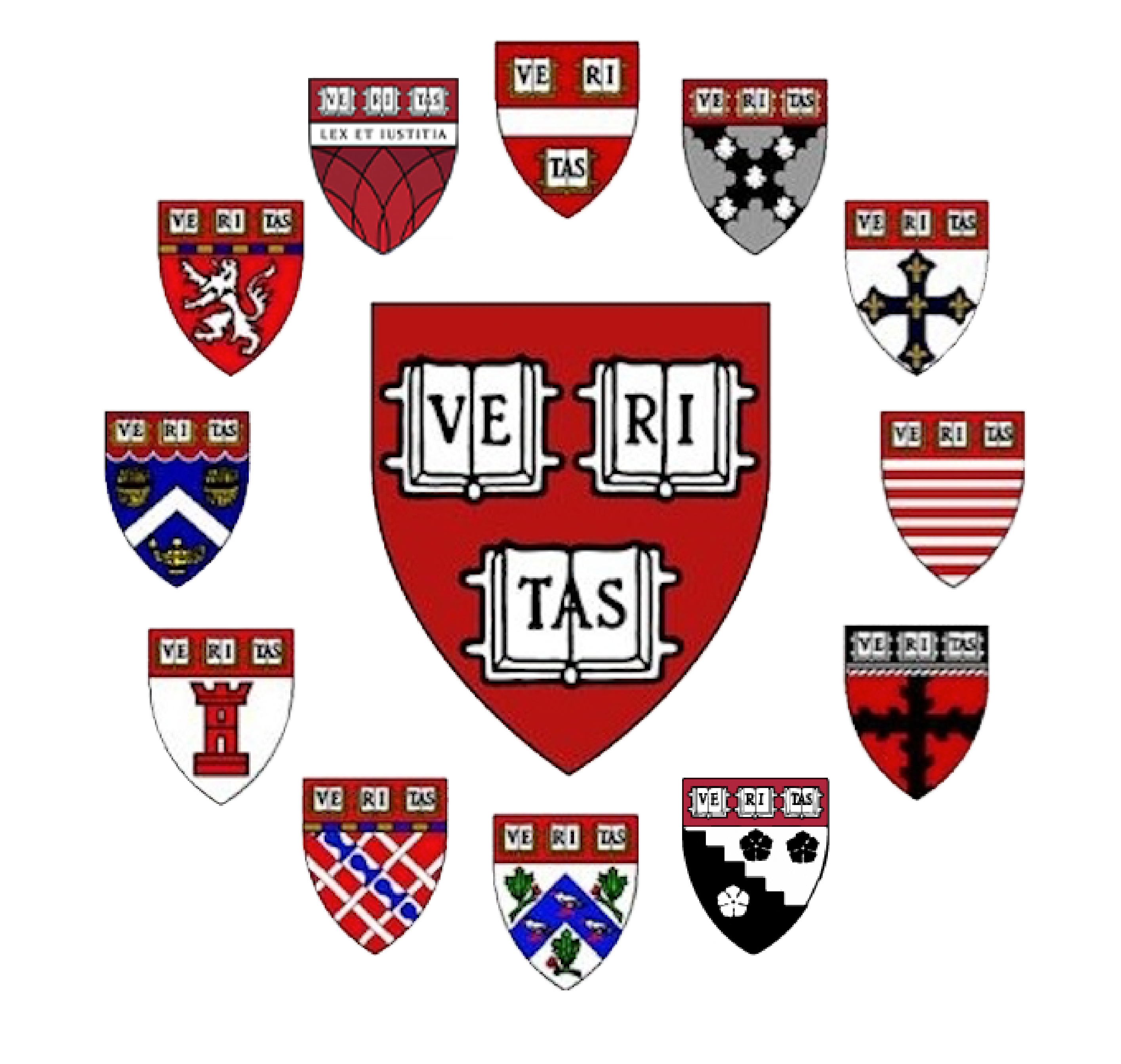

Harvard Graduate Council

Twelve Graduate Schools One Harvard

Serving as the financial backbone, HGC's finance committee orchestrates funding initiatives to support the diverse needs of Harvard University's graduate and professional schools. Through strategic planning, transparent budgeting, and collaborative efforts, we channel resources to various programming and projects that enhance the overall academic and extracurricular experience for students across the spectrum of disciplines. In essence, the finance committee plays a crucial role in fostering a thriving and well-supported environment for the entire Harvard graduate and professional community.

If you have any questions or suggestions regarding funding initiatives, please send an email to [email protected] and [email protected] .

- HGC Catalyst Fund

Investment Decisions and Behavioral Finance

Program Fee: The program fee includes tuition, curricular materials and most meals. Housing is not included.

Program Overview

Common biases. Irrational investment behaviors. Decision-trap situations. In today’s complex and rapidly changing financial markets, senior executives responsible for managing client assets need to understand these and other factors that can lead to sub-optimal outcomes for investors.

Investment Decisions and Behavioral Finance is an intensive two-day program from Harvard Kennedy School Executive Education. It will expose you to the central principles and latest findings of the psychology of decision making under conditions of risk and uncertainty.

Led by Faculty Chair Richard Zeckhauser, this on-campus program focuses on practical applications for professionals who manage assets and construct portfolios for investment clients.

Dinner Speaker:

- Seth Klarman , CEO & Portfolio Manager, The Baupost Group

Lunch Speaker:

- Owen Lamont , Senior Vice President and Portfolio Manager, Acadian Asset Management

Senior Professor Faculty Speakers:

- Larry Summers , University Professor, Harvard University

- Richard Zeckhauser , Harvard Kennedy School

- Jason Furman , Harvard Kennedy School and Economics Department

- Iris Bohnet , Harvard Kennedy School

- Robin Greenwood , Harvard Business School

- Samuel Hanson , Harvard Business School

- David Laibson , Harvard Economics Department

- Nicholas Barberis , Yale School of Management

- Michael Mauboussin , Morgan Stanley Investment Management, Columbia

- Annie Duke , Poker World Champion

PROGRAM CURRICULUM

Developed by Harvard Kennedy School faculty, Investment Decisions and Behavioral Finance explores the science behind investment decision making.

The program opens with a networking dinner, followed by two days of classroom sessions. You will take part in thought-provoking discussions and interactive learning exercises with leading behavioral finance professionals and academics.

Reflecting the most current research and issues in the financial markets, the curriculum focuses on:

- Behavioral insights into financial markets

- Crash beliefs from investor surveys

- Global outlook, debt cycles, and monetary policy

- The challenges and opportunities of the aging investor

- Gender retirement gaps

- Big data, smart beta, and other things investors fear

- Methods to improve decisions

LEARNING OBJECTIVES

Investment Decisions and Behavioral Finance will help you understand:

- The applied science of effective decision making

- How our brains are not wired to make the decisions that modern financial markets require—and ways to adjust for these shortcomings

- How and why financial bubbles develop and strategies for recognizing them

- The psychological reasons that lead investors to make severe investment errors

Application Information

Recommended applicants.

This on-campus program from Harvard Kennedy School Executive Education is designed for corporate executives in the financial and investment community who are interested in hearing the perspectives of intellectual thought leaders and leading practitioners.

Professionals who would find value in this program include:

- Investment company presidents

- Chief investment officers

- Investment strategists

- Portfolio and fund managers

- Pension plan executives

- Corporate investors

Sample Schedule

Immerse yourself with a cohort of fellow leaders on Harvard’s historic campus. View the draft program schedule . Note that module titles, speakers, and sequence may change.

WHAT PARTICIPANTS ARE SAYING

"as a board member of one of the largest pension funds in america, i found this to be the most valuable class i have ever taken.", bruce perelman, former secretary of the board of investments, hear from the faculty chair.

Faculty Chair Richard Zeckhauser and Harvard Kennedy School Professor Dan Levy discuss the triumphs and failures of making important decisions in groups.

Faculty & Research

Faculty chair.

Richard Zeckhauser

Harvard faculty and guest speakers.

Iris Bohnet

Robin Greenwood

Jason Furman

David Laibson

Samuel Hanson

Lawrence H. Summers

Nicholas Barberis

Seth Klarman

Owen Lamont

Michael J. Mauboussin

Arnold S. Wood

Related research.

- Larry Summers details how Senate plan will reduce inflation - Lawrence H. Summers

- Summers Warns Fed on 1970s-Style Mistake With CPI Set to Slow

- When Managers Change Their Tone, Analysts and Investors Change Their Tune

- Less is more when it comes to Federal Reserve policy

- ‘Dumb Money’ and the Meme Stock Phenomenon

- Investor Rewards to Climate Responsibility: Stock-Price Responses to the Opposite Shocks of the 2016 and 2020 U.S. Elections

- Investing in the Unknown and Unknowable

- Status Quo Bias in Decision Making

- The Value of Precision in Probability Assessment: Evidence from a Large-Scale Geopolitical Forecasting Tournament

- Issuer Quality and Corporate Bond Returns

- Predictable Financial Crises

- Incorporating DEI into Decision-Making

- Achieving Gender Balance at All Levels of Your Company

- How to Best Use Data to Meet Your DE&I Goals

Related Resources

Admissions & financial information, contact executive education.

Funding & Scholarship: Graduate Programs

Financial support for ph.d. students, all students admitted into our ph.d. program receive full financial support., this support includes tuition, fees, $1,000 in transportation and dental subsidies (as of ay24-25), and a cost-of-living stipend ($3655 per month in ay23-24 and $4083 per month before taxes in ay24-25)..

Support is independent of need provided a student remains in good academic standing and is making satisfactory progress towards his/her Ph.D. degree. Students are expected to complete their Ph.D. requirements in four to six years. Financial support takes several forms: fellowships, teaching fellowships, and research assistantships. Ordinarily, first-year Ph.D. students are supported with full fellowships so that they can devote their time to coursework.

For the class entering in Fall 2024 : SEAS PhD students are expected to complete two sections of teaching in SEAS in their second year or spread across their second and third years. Both sections may be completed concurrently in a single course. Their research assistantship will be adjusted accordingly during the semester(s) in which they are teaching fellow (TF). The academic requirement for the PhD degree is one section of teaching in SEAS. The student and their research advisor may arrange to replace the second section of teaching with a research assistantship. Beyond the first year, when students are in a better position to teach and assist in research, support is ordinarily provided through research assistantships, or a combination of a teaching fellowship and a research assistantship. For more detailed information, please visit the following pages: GSAS Tuition and Fees G SAS Financial Support for PhD Students

External financial support for Ph.D. students

Applicants and current students are encouraged and expected to apply for all non-Harvard scholarships for which they are eligible, especially those offered by the National Science Foundation (NSF) Graduate Research Fellowship Program and National Defense Science and Engineering Graduate Fellowship (NDSEG) .

Each year, many SEAS students secure fellowships from external agencies. Should an incoming student be awarded and accept any fellowship external to Harvard, it is the expectation that the student will utilize these funds in the first year of study in place of Harvard funding. In advanced (G2+) years in the graduate program, students with external fellowships are advised to have a discussion with their financial aid officers from Harvard Griffin GSAS and SEAS about how to best utilize the remaining years of funding based on their activities and academic requirements.

To ensure equitable treatment of all students, the coordination of external award benefits with a student’s existing funding package is determined by the Harvard Griffin GSAS financial aid officer in consultation with SEAS.

PhD students with external support are eligible for a SEAS-sponsored academic incentive. PhD students who bring in open, competitive external fellowships that are equal to 50% or more of total their support (tuition/fees + stipend) will receive a supplemental award of $3,000 in the first year of the external fellowship. PhD students who bring in open external competitive external fellowships that are not 50% or more of their total support and are at least $10,000 (tuition/fees + stipend or salary) will receive a supplemental award of $1,000. The full $3,000 bonus may also be awarded in certain cases of multi-year fellowships depending on the total amount of support provided.

Financial support for terminal masters students (M.E. & S.M.)

While financial aid is not available for master’s students in our M.E. and S.M. programs, there are a variety of funding opportunities available. Prospective students are encouraged to apply for independent grants and fellowships to fund their studies. Information about tuition and fees can be found here . Students in our Computational Science & Engineering or Data Science programs-should visit this page and also may contact the GSAS Financial Aid Office to learn more.

Students in the MS/MBA:Engineering Sciences program are eligible to apply for need-based HBS Fellowships and student loans in both years of the program.

Welcome to the Math PhD program at Harvard University and the Harvard Kenneth C. Griffin Graduate School of Arts and Sciences.

Learn more about Harvard’s Math community and our statement on diversity and inclusion.

The Harvard Griffin GSAS Office of Equity, Diversity, Inclusion & Belonging offers student affinity groups for graduate students and many other resources.

The Harvard University Office for Gender Equity has dedicated GSAS Title IX resource coordinators who work with and support graduate students.

open. The application deadline is December 15, 2021. -->

The application deadline for fall 2024 admission has passed. Applications for fall 2025 admission will open in September 2024.

For information on admissions and financial support, please visit the Harvard Harvard Kenneth C. Griffin Graduate School of Arts and Sciences.

Harvard Griffin GSAS is committed to ensuring that our application fee does not create a financial obstacle. Applicants can determine eligibility for a fee waiver by completing a series of questions in the Application Fee section of the application. Once these questions have been answered, the application system will provide an immediate response regarding fee waiver eligibility.

The Office of Finance is responsible for the Harvard Griffin GSAS operating budget, the graduate aid budget, financial operations, compliance, reporting, and planning and modeling. The Finance team provides financial services for leadership and staff and is the financial point of contact for offices and departments throughout the University. Geoff Tierney manages the team, establishing the team’s priorities. Liz Moss Levine assists with implementing those priorities, coordinating with colleagues and with central finance offices to meet deadlines, and serves as resource for staff finance and budget questions, including assisting with interpretation of financial policy. Belinda Chu administers most financial operations, including assisting with financial transactions (purchasing questions and approvals, reimbursement questions, and assistance with journal entries), reporting, and financial policy.

The Office of Finance strives to provide the financial services needed to meet the mission of Harvard Griffin GSAS and the University. The Office of Finance embraces a “no wrong door” policy. Please come to any of us for assistance.

We work with : Harvard Griffin GSAS staff and leadership, FAS Finance Office, FAS departmental colleagues, University financial offices, and other Harvard offices.

The role of our team is to:

- ensure compliance with Harvard University and Faculty of Arts and Sciences financial policies

- advise with purchasing and payment processing and assisting staff who process transactions

- support budget managers with the budgeting process and budget tracking

- guide the development of multi-year financial plans

- create financial reports and provide financial analysis to leadership

- provide financial policy guidance to staff

- work with staff to create useful tools for financial management and create ad hoc reports as needed.

Meet the Team

Explore Events

Related events, share this page.

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

The field of finance covers the economics of claims on resources. Financial economists study the valuation of these claims, the markets in which they are traded, and their use by individuals, corporations, and the society at large.

At Stanford GSB, finance faculty and doctoral students study a wide spectrum of financial topics, including the pricing and valuation of assets, the behavior of financial markets, and the structure and financial decision-making of firms and financial intermediaries.

Investigation of issues arising in these areas is pursued both through the development of theoretical models and through the empirical testing of those models. The PhD Program is designed to give students a good understanding of the methods used in theoretical modeling and empirical testing.

Preparation and Qualifications

All students are required to have, or to obtain during their first year, mathematical skills at the level of one year of calculus and one course each in linear algebra and matrix theory, theory of probability, and statistical inference.

Students are expected to have familiarity with programming and data analysis using tools and software such as MATLAB, Stata, R, Python, or Julia, or to correct any deficiencies before enrolling at Stanford.

The PhD program in finance involves a great deal of very hard work, and there is keen competition for admission. For both these reasons, the faculty is selective in offering admission. Prospective applicants must have an aptitude for quantitative work and be at ease in handling formal models. A strong background in economics and college-level mathematics is desirable.

It is particularly important to realize that a PhD in finance is not a higher-level MBA, but an advanced, academically oriented degree in financial economics, with a reflective and analytical, rather than operational, viewpoint.

Faculty in Finance

Anat r. admati, juliane begenau, jonathan b. berk, greg buchak, antonio coppola, peter m. demarzo, darrell duffie, steven grenadier, benjamin hébert, arvind krishnamurthy, hanno lustig, matteo maggiori, paul pfleiderer, joshua d. rauh, claudia robles-garcia, ilya a. strebulaev, vikrant vig, jeffrey zwiebel, emeriti faculty, robert l. joss, george g.c. parker, myron s. scholes, william f. sharpe, kenneth j. singleton, james c. van horne, recent publications in finance, make decisions with a vc mindset, behavioral responses to state income taxation of high earners: evidence from california, beyond the balance sheet model of banking: implications for bank regulation and monetary policy, recent insights by stanford business, how to: reject pitches like a venture capitalist, when the export-import bank closed up, u.s. companies saw global sales plummet, cashless: is digital currency the future of finance.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

The Harvard Crimson

- Editor's Pick

- Today's Paper

Protesters Won’t Say if Harvard Encampment Will Continue as Garber Threatens Major Disciplinary Action

- Harvard President Garber Breaks Silence on Encampment, Threatens ‘Involuntary Leave’ for Protesters

- Garber Is Taking a Patient Approach to the Harvard Encampment. So Far, It’s Working.

Cambridge City Manager Unveils Nearly $1 Billion 2025 Operating City Budget Proposal

Harvard Square Homeless Shelter Debuts Renovations To Adapt To 6-Month Stays

HUPD ‘Far More Vigilant’ on Campus Amid Increased Threats Against Students Following Oct. 7

‘Fresh Perspective’: Harvard Kennedy School Students, Faculty Hopeful About New HKS Dean Jeremy Weinstein

{shortcode-3ce40f30a1eaf1dccf8172671e3cf4add33735bc}

{shortcode-21cc3534b02e5a90dd1b6e61be0fe28423896a7e}s the pro-Palestine occupation of Harvard Yard approaches the end of its second week, interim University President Alan M. Garber ’76 has adopted a policy of strategic patience to avoid the controversies facing peer institutions.

While the encampment situation may still escalate, Garber earned initial praise from an array of Harvard affiliates for taking preventative steps to limit Harvard Yard access , not commenting on the occupation, and refraining from asking law enforcement to remove the protesters.

Since mid-April, pro-Palestine student protesters have set up encampments at more than 80 college campuses across the country. The responses from university leadership have varied from mass suspensions and arrests to offering protesters meaningful concessions, but both approaches have sparked fierce backlash.

Garber’s strategy has allowed him to chart a middle path to keep himself and Harvard out of the national spotlight. But it is unclear how long he will manage to avoid police action while also avoiding negotiations with protesters.

As the semester ends and Commencement draws closer, neither the University nor the protesters can sustain the encampment indefinitely. Harvard Out of Occupied Palestine Coalition, the unrecognized pro-Palestine student group organizing the encampment, gave Garber a Monday 5 p.m. deadline to begin negotiations over the group’s demands.

So far, Garber has given no indication that he will engage with the protesters. And with no threat behind the deadline, it is unclear whether HOOP will attempt some sort of escalation.

University spokesperson Jonathan L. Swain wrote in a statement that the University “remains committed to free speech, including the right to dissent and protest.”

“However, the ongoing protest encampment in Harvard Yard is a violation of university policy, one that continues to disrupt the normal academic and operational activities of Harvard’s community,” he added.

The Restrained Approach

For 13 days, members of Harvard Out of Occupied Palestine have held rallies and slept in tents in Harvard Yard to demand the University divest from Israel.

For 13 days, the University has let them.

Harvard’s actions contrast with at least 50 other colleges and universities across the country that have asked local authorities to arrest or detain student protesters.

Former American Civil Liberties Union President Nadine Strossen ’72 said Harvard is well within its rights to employ “the whole panoply of options from arrests to doing nothing.”

“The only question is: ‘Is it strategically wise?’” she added.

Though Harvard has begun the process of disciplining students through the Harvard College Administrative Board — an administrative body responsible for the application and enforcement of Harvard College policies — the encampment has been allowed to remain in place for almost two weeks. Administrators have repeatedly informed the group that they are in violation of University policies, but it remains unclear how the occupation will end.

But the most important action taken by Harvard was its preemptive decision to restrict access to Harvard Yard days prior to the start of the encampment and ensure that outside groups could not join or antagonize the protesters.

{shortcode-fccfb79cb2eae4bf1f26c0d89a469f4d0b632df6}

Harvard’s encampment has remained peaceful and, for the most part, rather quiet. Protesters respect quiet hours at night, take care to leave walkways clear, and — with the exception of briefly rising three Palestinian flags from the University Hall flag poles — the group has left University property alone.

In turn, the University has treated the encampment as little more than a nuisance.

Administrators took steps to relocate events and some final exams , but most of campus life remains uninterrupted. Even many freshmen who live in dorms just several feet from the encampment said it had not significantly impacted their daily routines.

The scene in the Yard has paled in comparison to clashes at universities where administrators asked police officers to break up pro-Palestine encampments.

At Columbia, President Nemat “Minouche” Shafik allowed the New York Police Department to arrest student protesters just one day into the encampment, triggering a larger wave of protests, a faculty revolt, and international condemnation of the police response.

At UCLA, a group of pro-Israel counterprotesters wielding metal pipes violently attacked encampment protesters Wednesday. One day later, administrators called the police to arrest at least 200 protesters.

While Garber has not ruled out the use of police, he said there is a “high bar” for such a response, specifically indicating that violence or threats of violence could lead to law enforcement action.

Former Harvard President Lawrence H. Summers wrote on X that while he believes the high bar for police action is appropriate, Harvard should do more to discipline students.

“The application of threatened academic discipline to clear infractions of university rules is long overdue at Harvard,” he wrote.

Swain wrote that “those participating in the ongoing encampment and associated protest activities will face disciplinary consequences, with repeated or sustained violations subject to increased sanctions.”

John K. Wilson, a former fellow at the University of California National Center for Free Speech and Civic Engagement, said Harvard’s handling of the campus protests has been successful for now.

“I think the best approach universities have done is to let people do this,” Wilson said.

Not Negotiating

Garber has also declined to follow in the footsteps of universities like Rutgers and Northwestern, where administrators ended encampments by agreeing to several of the protesters’ key demands.

Still, the peaceful end of the encampments did not allow university administrators to escape controversy. Northwestern President Michael Schill’s concessions to the pro-Palestine protesters sparked backlash from a range of Jewish affiliates and led to the resignation of nearly half of Northwestern’s antisemitism advisory group.

It seems increasingly unlikely that Garber and the pro-Palestine protesters in Harvard Yard will manage to reach a similar agreement.

In an April interview with The Crimson, Garber said he would “not entertain” divesting from Israel, though he defended the group’s right to suggest that they do.

“I’ll only say that there are various ways to express your views and it does not necessarily mean that the University needs to change its investment policy or engage in activities like academic boycotts that run contrary to academic principles and University principles,” he said.

{shortcode-14f04988a413e673d8c78f944a192dd203e2244d}

It is also possible that Garber can’t make any concessions to the pro-Palestine protesters, even if he wanted to.

The House Committee on Education and the Workforce is investigating Harvard for not doing enough to combat antisemitism on campus, and any concessions Garber makes will only serve as ammunition for the House Republicans leading the investigation.

Beyond the political dangers associated with brokering a deal, he would also face backlash from the very same donors and alumni that Garber is attempting to mend relations with .

But even if the University agrees to an initial conversation with protesters to hear their demands, it seems likely that Garber will delegate a lower-ranking administrator to lead the discussion.

Thus far, Garber has sought to deny the encampment any extra attention by not visiting the encampment or speaking to protesters. Instead, official communications about the encampment have come from spokespeople or Harvard College Dean of Students Thomas Dunne.

The encampment marked Garber’s first major test since assuming office in January as the first-large scale protest of his tenure.

While his initial handling of the protest has earned him praise from Harvard affiliates, he still faces several hurdles before he is able to proclaim that his administration successfully managed the protest.

The next challenge for Garber is to find a way to end the encampment without resorting to the measures that led to widespread controversy at Columbia, UCLA, and other universities where police arrested students.

As the end of the semester and Harvard’s commencement ceremonies draw nearer, both Garber and the protesters will be forced to make choices about how firm their positions really are.

Undergraduates will lose access to their housing on May 12, an incentive for protesters to leave the encampment in the coming week. Commencement — just a couple of weeks away — will make removing the encampment a greater priority for the University.

Disciplinary measures, in particular, will likely escalate in the coming weeks to prevent ceremonies from being disrupted by the protests or the Yard restrictions around it.

Garber’s handling of the encampment could influence whether he permanently becomes president of Harvard.

Especially as other university leaders now face votes of no confidence over their response, Garber’s ability to maintain campus calm would be a major win as the Harvard Corporation — the University’s highest governing body — looks toward its upcoming presidential search .

Paul Reville, a professor of education policy and administration at the Harvard Graduate School of Education, said Garber’s ability to control the situation will impact whether he will be viewed as a successful leader.

“Control is a key factor that those outside the school and those authorizing a president look at,” Reville said.

“There are a lot of potential challenges on the horizon,” he added.

—Staff writer Cam E. Kettles can be reached at [email protected] . Follow her on X @cam_kettles or on Threads @camkettles .

Read more in University News

- Harvard Employee Fired Following Online Heated Exchange With Jewish Student

- Harvard Out of Occupied Palestine Boycotts The Crimson Over Allegations of Anti-Palestinian Bias

- Encampment Protesters Set Monday Deadline for Harvard to Begin Negotiations

Popular Videos

Harvard's "Water Bottle Guy"

Beacon Street Takes the Stage at Harvard's Yardfest

Student Perspectives From the Pro-Palestine Harvard Yard Encampment

From our advertisers.

Check out our top picks for innovative apps like Cash App, Grammarly, Paradigm, and more — designed to make your life more convenient, productive and enjoyable!

With a consistently competitive pool of applicants submitting essays to top medical schools each year, it is essential to gain a high-level understanding of what a successful application reads like. Browse through our list of successful medical school applications below from students who were accepted to elite universities and hear from expert college consultants on what made these pieces a success.

In this article, Val Misra, Mr. MBA®, will break down the often stressful and challenging college application process and provide professional, practical advice for students and parents. After all, Val was once an ambitious high school student applying to his dream Finance school in NYC, NYU Stern School of Business.

Innovation in Taiwan is just one shining example of the ever-changing landscape of technological advancements happening around the world. However, Taiwan is unique—despite its small size, it boasts a history of being a powerhouse in hardware.

It’s the season of loving, of friendship, and of romantic rendezvous. Love is in the air at Harvard University, and there is no reason why everybody should not be a part of that love too!

- Harvard Business School →

- Faculty & Research →

- Academic Units

- Accounting & Management

- Business, Government & the International Economy

- Entrepreneurial Management

- General Management

- Negotiation, Organizations & Markets

- Organizational Behavior

- Technology & Operations Management

- Seminars & Conferences

- Awards & Honors

- Doctoral Students

- Doctoral Students →

Catherine Huang

Baiyun Jing

Nathan Kaplan

IMAGES

VIDEO

COMMENTS

The doctoral program in Business Economics, which includes Finance and Applied Economics tracks, provides scholars with rigorous training in economic theory and a particular focus on economic analysis as it applies to the business world. ... receiving the benefits of a PhD from Harvard's world-class Economics Department along with specialized ...

Graduate. Master of Liberal Arts (A.L.M.) Division of Continuing Education. Students enrolled in the Master of Liberal Arts program in Finance will gain a solid foundation in the principles of finance, becoming well informed of topics critical to financial planning, implementation, measurement, and investment.

The Ph.D. Program in the Department of Economics at Harvard is addressed to students of high promise who wish to prepare themselves in teaching and research in academia or for responsible positions in government, research organizations, or business enterprises. Students are expected to devote themselves full-time to their programs of study.

Graduate The doctoral program in Economics at Harvard University is one of the leading programs in the world. Supported by a diverse group of faculty who are top researchers in their fields and fueled by a vast array of resources, the PhD program is structured to train and nurture students to become leading economists in academia, government agencies, the technology industry, finance and ...

From corporate finance, industrial organization, and international business to markets, competition, and government regulation, you will delve into some of the most pressing and relevant topics in the field of economics through the practical lens of business. ... Harvard Griffin GSAS has offered PhD programs in collaboration with HBS since 1916 ...

Xavier Gabaix is Pershing Square Professor of Economics and Finance at Harvard's economics department. He received his undergraduate degree in mathematics from the Ecole Normale Supérieure (Paris) and obtained his PhD in economics from Harvard University.... Read more. Littauer Center 209. [email protected].

Harvard Griffin GSAS has offered PhD programs in collaboration with HBS since 1916. In addition to business administration, Harvard Griffin GSAS and HBS collaborate on programs in business economics , organizational behavior, and health policy (management track). Additional information on the graduate program is available from the Department of ...

Jane Eaton. Sr. Director of Financial Administration and Planning. Nichols House 203. (617) 495-0768. [email protected].

Business Economics (Includes Finance) Health Policy (Management) Management. Marketing. Organizational Behavior. Strategy. Technology & Operations Management. ... Doctoral Programs Harvard Business School Wyss House Boston, MA 02163 Phone: 1.617.495.6101 Email: doctoralprograms+hbs.edu

The content was inspired by the curriculum offered to incoming Harvard Business School students preparing for the MBA classroom. Admissions: Earn Your Way In. To begin the admission process, you register for CORe and then one graduate-level course with us: CORe (noncredit or credit). You apply for CORe directly with Harvard Business School Online.

Harvard's financial support package is typically for the first four years of study and the completion year, using a tiered tuition structure that reduces tuition over time as students progress through their degree programs. This multiyear funding package includes a combination of tuition grants, stipends, traineeships, teaching fellowships, research assistantships, and other academic appointments.

Finance. Serving as the financial backbone, HGC's finance committee orchestrates funding initiatives to support the diverse needs of Harvard University's graduate and professional schools. Through strategic planning, transparent budgeting, and collaborative efforts, we channel resources to various programming and projects that enhance the ...

Our Finance Master's Degree Program offers a wide range of courses that cover essential financial topics — from microeconomics to investment theory to business valuation. Under the instruction of expert faculty, you'll learn to make complex financial decisions. And you'll examine issues in finance through a local, regional, and global lens.

Investment Decisions and Behavioral Finance is an intensive two-day program from Harvard Kennedy School Executive Education. It will expose you to the central principles and latest findings of the psychology of decision making under conditions of risk and uncertainty. Led by Faculty Chair Richard Zeckhauser, this on-campus program focuses on ...

Financial support for Ph.D. students All students admitted into our Ph.D. program receive full financial support. This support includes tuition, fees, $1,000 in transportation and dental subsidies (as of AY24-25), and a cost-of-living stipend ($3655 per month in AY23-24 and $4083 per month before taxes in AY24-25). Support is independent of need provided a student remains in good academic ...

The application deadline for fall 2024 admission has passed. Applications for fall 2025 admission will open in September 2024. For information on admissions and financial support, please visit the Harvard Harvard Kenneth C. Griffin Graduate School of Arts and Sciences. Harvard Griffin GSAS is committed to ensuring that our application fee does ...

The Office of Finance is responsible for the Harvard Griffin GSAS operating budget, the graduate aid budget, financial operations, compliance, reporting, and planning and modeling. The Finance team provides financial services for leadership and staff and is the financial point of contact for offices and departments throughout the University.

The PhD program in finance involves a great deal of very hard work, and there is keen competition for admission. For both these reasons, the faculty is selective in offering admission. ... Harvard Business Review May 2024. Behavioral Responses to State Income Taxation of High Earners: Evidence from California. Joshua D. Rauh, Ryan Shyu ...

Harvard Extension School is a hidden gem. It . provides a practical education that can be applied right away." —Anwar Arsian. 2. average number of courses completed each term . Location while earning the certificate. 17%. Live in Massachusetts. 83%. Live outside Massachusetts. 29%. Live outside the United States. 59%. of students are employed

As the semester ends and Commencement draws closer, neither the University nor the protesters can sustain the encampment indefinitely. Harvard Out of Occupied Palestine Coalition, the unrecognized pro-Palestine student group organizing the encampment, gave Garber a Monday 5 p.m. deadline to begin negotiations over the group's demands.. So far, Garber has given no indication that he will ...

Harvard Business School Soldiers Field Boston, MA 02163. → Map & Directions. → More Contact Information