principlesofaccounting.com

Using A Worksheet To Prepare A Statement Of Cash Flows

- Goals Achievement

- Fill in the Blanks

- Multiple Choice

Given enough time and careful thought, one can generally prepare a statement of cash flows by putting together a rough shell that approximates the statements illustrated throughout this chapter, and then filling in all of the bits and pieces that can be found. Ultimately, the correct solution is reached when the change in cash is fully explained. This is like working a puzzle without reference to a supporting picture. But, complex tasks are simplified by taking a more organized approach. To that end, consider the value of a worksheet for preparing the statement of cash flows.

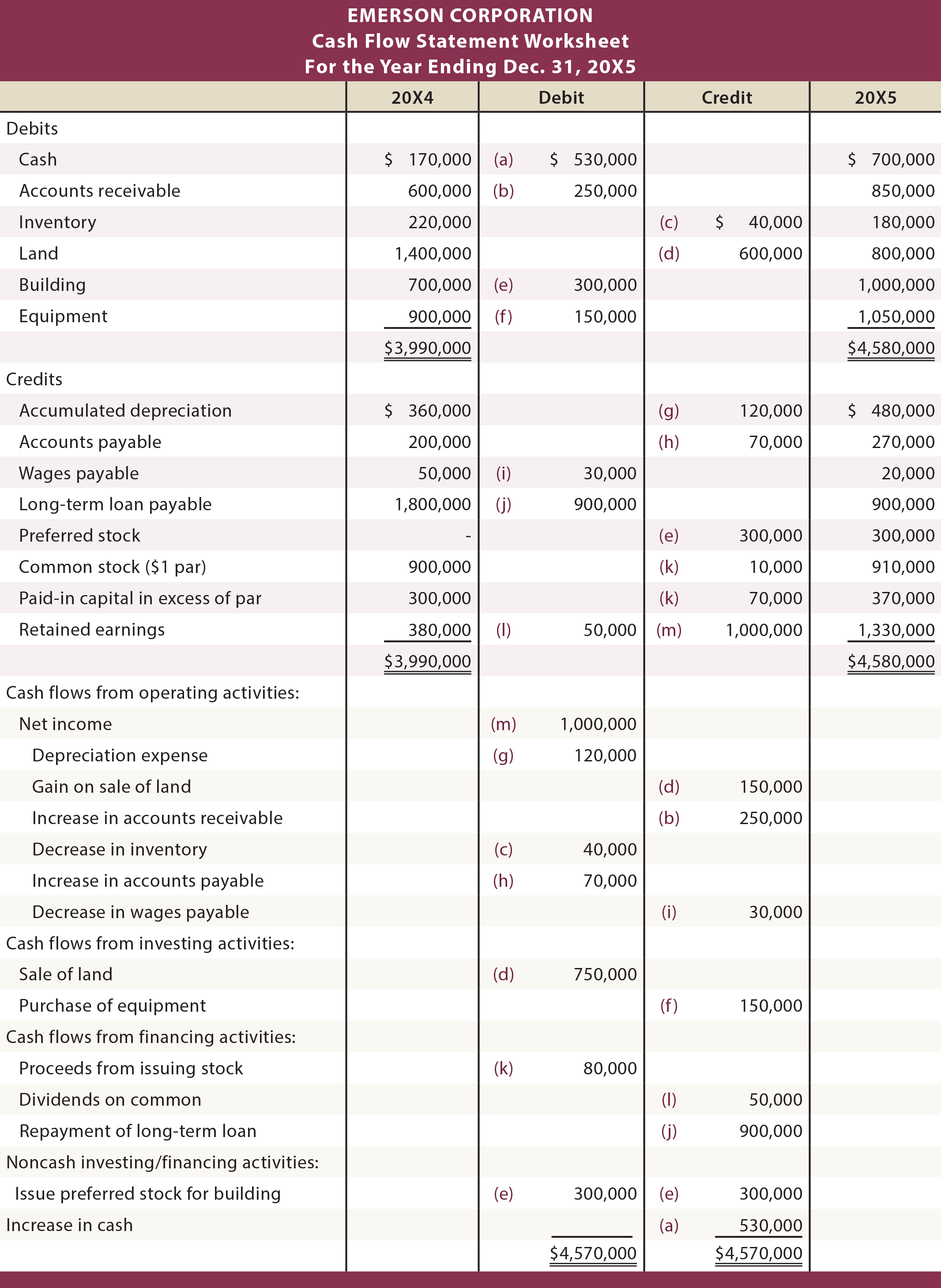

The worksheet examines the change in each balance sheet account and relates it to any cash flow statement impacts. Once each line in the balance sheet is contemplated, the ingredients of the cash flow statement will be found! A sample worksheet for Emerson is presented on the following page.

In this worksheet, the upper portion is the balance sheet information, and the lower portion is the cash flow statement information. The change in each balance sheet row is evaluated and keyed to a change(s) in the cash flow statement. When one has explained the change in each balance sheet line, the accumulated offsets (in the lower portion) reflect the information necessary to prepare a statement of cash flows.

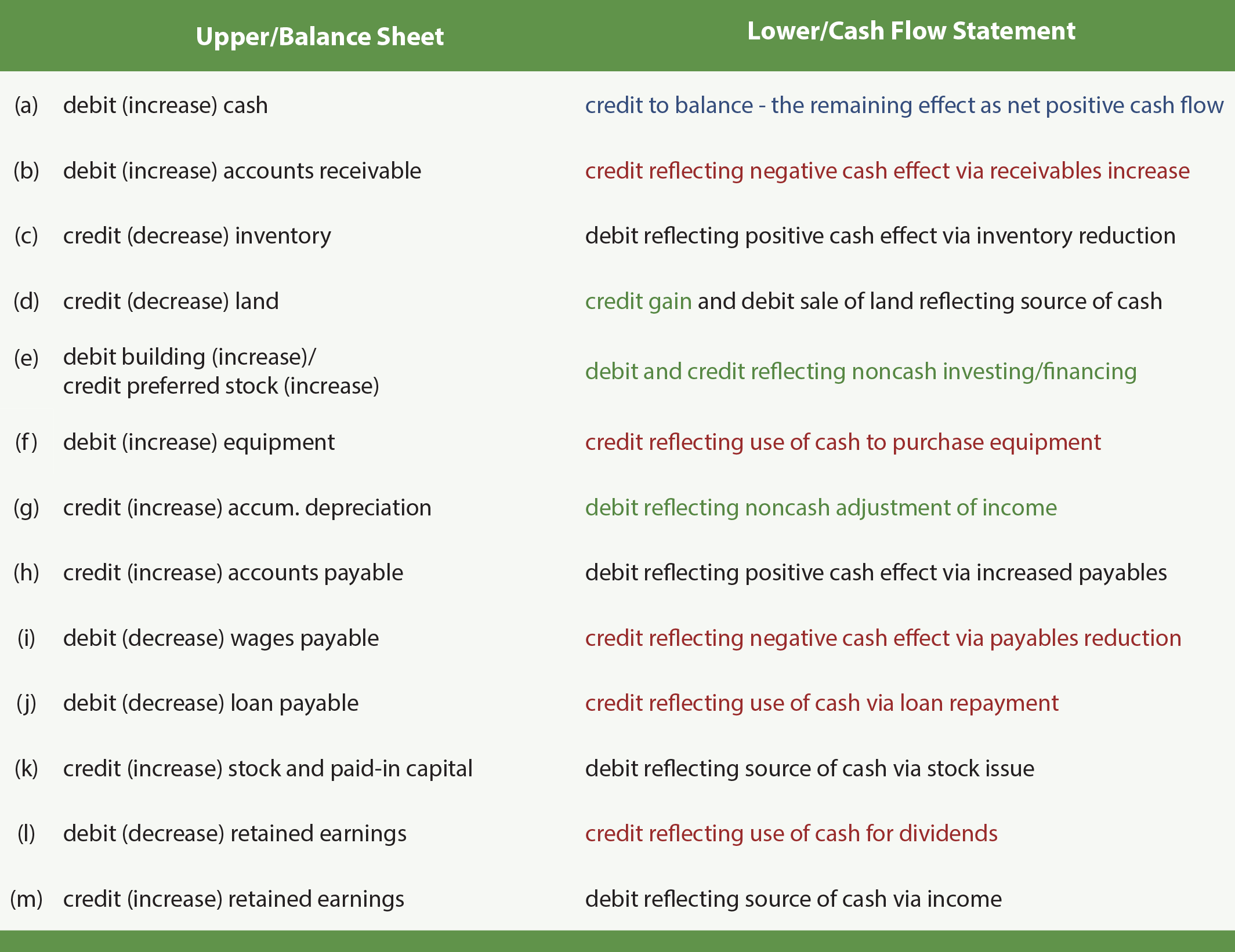

Specific explanations for each keyed item in the worksheet are found in the following table. The cash flow statement explanations are color coded such that blue is the final balancing step, red is cash outflow, black is cash inflow, and green is special.

If you're seeing this message, it means we're having trouble loading external resources on our website.

If you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked.

To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

Finance and capital markets

Course: finance and capital markets > unit 5.

- Balance sheet and income statement relationship

- Interpreting the Balance Sheet

- Interpreting the Income Statement

Basic cash flow statement

- Doing the example with accounts payable growing

- Fair value accounting

Want to join the conversation?

- Upvote Button navigates to signup page

- Downvote Button navigates to signup page

- Flag Button navigates to signup page

Video transcript

BUS103: Introduction to Financial Accounting

Practice Problems: Statement of Cash Flows

Demonstration problem.

The following comparative balance sheets are for Dells Corporation as of 2010 June 30, and 2009 June 30. Also provided is the statement of income and retained earnings for the year ended 2010 June 30, with additional data.

Equipment with a cost of USD 20,000, on which USD 10,000 of depreciation had been recorded, was sold for USD 3,000 cash. Additional equipment was purchased for USD 220,000.

Stock was issued for USD 250,000 cash.

The USD 50,000 bank note was paid. Using the data given for Dells Corporation:

a. Prepare a statement of cash flows - indirect method.

b. Prepare a working paper to convert net income from an accrual basis to a cash basis. Then prepare a partial statement of cash flows - direct method, showing only the cash flows from operating activities section.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Read & Understand a Cash Flow Statement

- 30 Apr 2020

Whether you’re a working professional, business owner, entrepreneur, or investor, knowing how to read and understand a cash flow statement can enable you to extract important data about the financial health of a company.

If you’re an investor, this information can help you better understand whether you should invest in a company. If you’re a business owner or entrepreneur, it can help you understand business performance and adjust key initiatives or strategies. If you’re a manager, it can help you more effectively manage budgets , oversee your team, and develop closer relationships with leadership—ultimately allowing you to play a larger role within your organization.

Not everyone has finance or accounting expertise. For non-finance professionals , understanding the concepts behind a cash flow statement and other financial documents can be challenging.

To facilitate this understanding, here’s everything you need to know about how to read and understand a cash flow statement.

Access your free e-book today.

What is a Cash Flow Statement?

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

The cash flow statement is typically broken into three sections:

- Operating activities

- Investing activities

- Financing activities

Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Investing activities include cash flow from purchasing or selling assets—think physical property, such as real estate or vehicles, and non-physical property, like patents—using free cash, not debt. Financing activities detail cash flow from both debt and equity financing.

Based on the cash flow statement, you can see how much cash different types of activities generate, then make business decisions based on your analysis of financial statements .

Ideally, a company’s cash from operating income should routinely exceed its net income, because a positive cash flow speaks to a company’s ability to remain solvent and grow its operations.

It’s important to note that cash flow is different from profit , which is why a cash flow statement is often interpreted together with other financial documents, such as a balance sheet and income statement.

How Cash Flow Is Calculated

Now that you understand what comprises a cash flow statement and why it’s important for financial analysis, here’s a look at two common methods used to calculate and prepare the operating activities section of cash flow statements.

Cash Flow Statement Direct Method

The first method used to calculate the operation section is called the direct method , which is based on the transactional information that impacted cash during the period. To calculate the operation section using the direct method, take all cash collections from operating activities, and subtract all of the cash disbursements from the operating activities.

Cash Flow Statement Indirect Method

The second way to prepare the operating section of the statement of cash flows is called the indirect method . This method depends on the accrual accounting method in which the accountant records revenues and expenses at times other than when cash was paid or received—meaning that these accrual entries and adjustments cause the cash flow from operating activities to differ from net income.

Instead of organizing transactional data like the direct method, the accountant starts with the net income number found from the income statement and makes adjustments to undo the impact of the accruals that were made during the period.

Essentially, the accountant will convert net income to actual cash flow by de-accruing it through a process of identifying any non-cash expenses for the period from the income statement. The most common and consistent of these are depreciation , the reduction in the value of an asset over time, and amortization , the spreading of payments over multiple periods.

Related: Financial Terminology: 20 Financial Terms to Know

How to Interpret a Cash Flow Statement

Whenever you review any financial statement, you should consider it from a business perspective. Financial documents are designed to provide insight into the financial health and status of an organization.

For example, cash flow statements can reveal what phase a business is in: whether it’s a rapidly growing startup or a mature and profitable company. It can also reveal whether a company is going through transition or in a state of decline.

Using this information, an investor might decide that a company with uneven cash flow is too risky to invest in; or they might decide that a company with positive cash flow is primed for growth. Similarly, a department head might look at a cash flow statement to understand how their particular department is contributing to the health and wellbeing of the company and use that insight to adjust their department’s activities. Cash flow might also impact internal decisions, such as budgeting, or the decision to hire (or fire) employees.

Cash flow is typically depicted as being positive (the business is taking in more cash than it’s expending) or negative (the business is spending more cash than it’s receiving).

Related: How Learning About Finance Can Jumpstart Your Career No Matter Your Industry

Positive Cash Flow

Positive cash flow indicates that a company has more money flowing into the business than out of it over a specified period. This is an ideal situation to be in because having an excess of cash allows the company to reinvest in itself and its shareholders, settle debt payments, and find new ways to grow the business.

Positive cash flow does not necessarily translate to profit, however. Your business can be profitable without being cash flow-positive, and you can have positive cash flow without actually making a profit.

Negative Cash Flow

Having negative cash flow means your cash outflow is higher than your cash inflow during a period, but it doesn’t necessarily mean profit is lost. Instead, negative cash flow may be caused by expenditure and income mismatch, which should be addressed as soon as possible.

Negative cash flow may also be caused by a company’s decision to expand the business and invest in future growth, so it’s important to analyze changes in cash flow from one period to another, which can indicate how a company is performing overall.

Cash Flow Statement Example

Here's an example of a cash flow statement generated by a fictional company, which shows the kind of information typically included and how it's organized.

Go to the alternative version .

This cash flow statement shows Company A started the year with approximately $10.75 billion in cash and equivalents.

Cash flow is broken out into cash flow from operating activities, investing activities, and financing activities. The business brought in $53.66 billion through its regular operating activities. Meanwhile, it spent approximately $33.77 billion in investment activities, and a further $16.3 billion in financing activities, for a total cash outflow of $50.1 billion.

The result is the business ended the year with a positive cash flow of $3.5 billion, and total cash of $14.26 billion.

The Importance of Cash Flow

Cash flow statements are one of the most critical financial documents that an organization prepares, offering valuable insight into the health of the business. By learning how to read a cash flow statement and other financial documents, you can acquire the financial accounting skills needed to make smarter business and investment decisions, regardless of your position.

Are you interested in gaining a toolkit for making smart financial decisions and the confidence to clearly communicate those decisions to key internal and external stakeholders? Explore our online finance and accounting courses and download our free course flowchart to determine which best aligns with your goals.

Data Tables

Company a - statement of cash flows (alternative version).

Year Ended September 28, 2019 (In millions)

Cash and cash equivalents, beginning of the year: $10,746

OPERATING ACTIVITIES

Investing activities, financing activities.

Increase / Decrease in Cash and Cash Equivalents: 3,513

Cash and Cash Equivalents, End of Year: $14,259

Go back to the article .

About the Author

- Search Search Please fill out this field.

What Is a Cash Flow Statement (CFS)?

- Using the Cash Flow Statement

How Cash Flow Is Calculated

- Limitations

- Income Statement & Balance Sheet

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Cash Flow Statement: What It Is and Examples

:max_bytes(150000):strip_icc():format(webp)/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

A cash flow statement tracks the inflow and outflow of cash, providing insights into a company's financial health and operational efficiency.

The CFS measures how well a company manages its cash position, meaning how well the company generates cash to pay its debt obligations and fund its operating expenses. As one of the three main financial statements, the CFS complements the balance sheet and the income statement. In this article, we’ll show you how the CFS is structured and how you can use it when analyzing a company.

Key Takeaways

- A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

- The CFS highlights a company's cash management, including how well it generates cash.

- This financial statement complements the balance sheet and the income statement.

- The main components of the CFS are cash from three areas: Operating activities, investing activities, and financing activities.

- The two methods of calculating cash flow are the direct method and the indirect method.

How the Cash Flow Statement Is Used

The cash flow statement paints a picture as to how a company’s operations are running, where its money comes from, and how money is being spent. Also known as the statement of cash flows, the CFS helps its creditors determine how much cash is available (referred to as liquidity ) for the company to fund its operating expenses and pay down its debts. The CFS is equally important to investors because it tells them whether a company is on solid financial ground. As such, they can use the statement to make better, more informed decisions about their investments.

Structure of the Cash Flow Statement

The main components of the cash flow statement are:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

- Disclosure of non-cash activities, which is sometimes included when prepared under generally accepted accounting principles (GAAP) .

Cash From Operating Activities

The operating activities on the CFS include any sources and uses of cash from business activities. In other words, it reflects how much cash is generated from a company’s products or services.

These operating activities might include:

- Receipts from sales of goods and services

- Interest payments

- Income tax payments

- Payments made to suppliers of goods and services used in production

- Salary and wage payments to employees

- Rent payments

- Any other type of operating expenses

In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity.

Changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are generally reflected in cash from operations.

Cash From Investing Activities

Investing activities include any sources and uses of cash from a company’s investments. Purchases or sales of assets, loans made to vendors or received from customers, or any payments related to mergers and acquisitions (M&A) are included in this category. In short, changes in equipment, assets, or investments relate to cash from investing.

Changes in cash from investing are usually considered cash-out items because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. But when a company divests an asset, the transaction is considered cash-in for calculating cash from investing.

Cash From Financing Activities

Cash from financing activities includes the sources of cash from investors and banks, as well as the way cash is paid to shareholders. This includes any dividends, payments for stock repurchases , and repayment of debt principal (loans) that are made by the company.

Changes in cash from financing are cash-in when capital is raised and cash-out when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing. However, when interest is paid to bondholders , the company is reducing its cash. And remember, although interest is a cash-out expense, it is reported as an operating activity—not a financing activity.

There are two methods of calculating cash flow: the direct method and the indirect method.

Direct Cash Flow Method

The direct method adds up all of the cash payments and receipts, including cash paid to suppliers, cash receipts from customers, and cash paid out in salaries. This method of CFS is easier for very small businesses that use the cash basis accounting method.

These figures can also be calculated by using the beginning and ending balances of a variety of asset and liability accounts and examining the net decrease or increase in the accounts. It is presented in a straightforward manner.

Most companies use the accrual basis accounting method. In these cases, revenue is recognized when it is earned rather than when it is received. This causes a disconnect between net income and actual cash flow because not all transactions in net income on the income statement involve actual cash items. Therefore, certain items must be reevaluated when calculating cash flow from operations.

Indirect Cash Flow Method

With the indirect method , cash flow is calculated by adjusting net income by adding or subtracting differences resulting from non-cash transactions. Non-cash items show up in the changes to a company’s assets and liabilities on the balance sheet from one period to the next. Therefore, the accountant will identify any increases and decreases to asset and liability accounts that need to be added back to or removed from the net income figure, in order to identify an accurate cash inflow or outflow.

Changes in accounts receivable (AR) on the balance sheet from one accounting period to the next must be reflected in cash flow:

- If AR decreases, more cash may have entered the company from customers paying off their credit accounts—the amount by which AR has decreased is then added to net earnings.

- An increase in AR must be deducted from net earnings because, although the amounts represented in AR are in revenue, they are not cash.

What about changes in a company's inventory ? Here's how they are accounted for on the CFS:

- An increase in inventory signals that a company spent more money on raw materials. Using cash means the increase in the inventory's value is deducted from net earnings.

- A decrease in inventory would be added to net earnings. Credit purchases are reflected by an increase in accounts payable on the balance sheet, and the amount of the increase from one year to the next is added to net earnings.

The same logic holds true for taxes payable, salaries, and prepaid insurance . If something has been paid off, then the difference in the value owed from one year to the next has to be subtracted from net income. If there is an amount that is still owed, then any differences will have to be added to net earnings.

Limitations of the Cash Flow Statement

Negative cash flow should not automatically raise a red flag without further analysis. Poor cash flow is sometimes the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future.

Analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success. The CFS should also be considered in unison with the other two financial statements (see below).

The indirect cash flow method allows for a reconciliation between two other financial statements: the income statement and balance sheet.

Cash Flow Statement vs. Income Statement vs. Balance Sheet

The cash flow statement measures the performance of a company over a period of time. But it is not as easily manipulated by the timing of non-cash transactions. As noted above, the CFS can be derived from the income statement and the balance sheet . Net earnings from the income statement are the figure from which the information on the CFS is deduced. But they only factor into determining the operating activities section of the CFS. As such, net earnings have nothing to do with the investing or financial activities sections of the CFS.

The income statement includes depreciation expense, which doesn't actually have an associated cash outflow. It is simply an allocation of the cost of an asset over its useful life. A company has some leeway to choose its depreciation method , which modifies the depreciation expense reported on the income statement. The CFS, on the other hand, is a measure of true inflows and outflows that cannot be as easily manipulated.

As for the balance sheet, the net cash flow reported on the CFS should equal the net change in the various line items reported on the balance sheet. This excludes cash and cash equivalents and non-cash accounts, such as accumulated depreciation and accumulated amortization. For example, if you calculate cash flow for 2019, make sure you use 2018 and 2019 balance sheets.

The CFS is distinct from the income statement and the balance sheet because it does not include the amount of future incoming and outgoing cash that has been recorded as revenues and expenses . Therefore, cash is not the same as net income , which includes cash sales as well as sales made on credit on the income statements.

Example of a Cash Flow Statement

Below is an example of a cash flow statement:

Investopedia / Sabrina Jiang

From this CFS, we can see that the net cash flow for the 2017 fiscal year was $1,522,000. The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors. It means that core operations are generating business and that there is enough money to buy new inventory.

The purchasing of new equipment shows that the company has the cash to invest in itself. Finally, the amount of cash available to the company should ease investors’ minds regarding the notes payable, as cash is plentiful to cover that future loan expense.

What Is the Difference Between Direct and Indirect Cash Flow Statements?

The difference lies in how the cash inflows and outflows are determined.

Using the direct method , actual cash inflows and outflows are known amounts. The cash flow statement is reported in a straightforward manner, using cash payments and receipts.

Using the indirect method , actual cash inflows and outflows do not have to be known. The indirect method begins with net income or loss from the income statement, then modifies the figure using balance sheet account increases and decreases, to compute implicit cash inflows and outflows.

Is the Indirect Method of the Cash Flow Statement Better Than the Direct Method?

Neither is necessarily better or worse. However, the indirect method also provides a means of reconciling items on the balance sheet to the net income on the income statement. As an accountant prepares the CFS using the indirect method, they can identify increases and decreases in the balance sheet that are the result of non-cash transactions.

It is useful to see the impact and relationship that accounts on the balance sheet have to the net income on the income statement, and it can provide a better understanding of the financial statements as a whole.

What Is Included in Cash and Cash Equivalents?

Cash and cash equivalents are consolidated into a single line item on a company's balance sheet. It reports the value of a business’s assets that are currently cash or can be converted into cash within a short period of time, commonly 90 days. Cash and cash equivalents include currency, petty cash, bank accounts, and other highly liquid, short-term investments. Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with a maturity of three months or less.

A cash flow statement is a valuable measure of strength, profitability, and the long-term future outlook of a company. The CFS can help determine whether a company has enough liquidity or cash to pay its expenses. A company can use a CFS to predict future cash flow, which helps with budgeting matters.

For investors, the CFS reflects a company’s financial health , since typically the more cash that’s available for business operations, the better. However, this is not a rigid rule. Sometimes, a negative cash flow results from a company’s growth strategy in the form of expanding its operations.

By studying the CFS, an investor can get a clear picture of how much cash a company generates and gain a solid understanding of the financial well-being of a company.

Financial Accounting Standards Board. " Summary of Statement No. 95 ."

- Accounting Explained With Brief History and Modern Job Requirements 1 of 51

- What Is the Accounting Equation, and How Do You Calculate It? 2 of 51

- What Is an Asset? Definition, Types, and Examples 3 of 51

- Liability: Definition, Types, Example, and Assets vs. Liabilities 4 of 51

- Equity Definition: What it is, How It Works and How to Calculate It 5 of 51

- Revenue Definition, Formula, Calculation, and Examples 6 of 51

- Expense: Definition, Types, and How Expenses Are Recorded 7 of 51

- Current Assets vs. Noncurrent Assets: What's the Difference? 8 of 51

- What Is Accounting Theory in Financial Reporting? 9 of 51

- Accounting Principles Explained: How They Work, GAAP, IFRS 10 of 51

- Accounting Standard Definition: How It Works 11 of 51

- Accounting Convention: Definition, Methods, and Applications 12 of 51

- What Are Accounting Policies and How Are They Used? With Examples 13 of 51

- How Are Principles-Based and Rules-Based Accounting Different? 14 of 51

- What Are Accounting Methods? Definition, Types, and Example 15 of 51

- What Is Accrual Accounting, and How Does It Work? 16 of 51

- Cash Accounting Definition, Example & Limitations 17 of 51

- Accrual Accounting vs. Cash Basis Accounting: What's the Difference? 18 of 51

- Financial Accounting Standards Board (FASB): Definition and How It Works 19 of 51

- Generally Accepted Accounting Principles (GAAP): Definition, Standards and Rules 20 of 51

- What Are International Financial Reporting Standards (IFRS)? 21 of 51

- IFRS vs. GAAP: What's the Difference? 22 of 51

- How Does US Accounting Differ From International Accounting? 23 of 51

- Cash Flow Statement: What It Is and Examples 24 of 51

- Breaking Down The Balance Sheet 25 of 51

- Income Statement: How to Read and Use It 26 of 51

- What Does an Accountant Do? 27 of 51

- Financial Accounting Meaning, Principles, and Why It Matters 28 of 51

- How Does Financial Accounting Help Decision-Making? 29 of 51

- Corporate Finance Definition and Activities 30 of 51

- How Financial Accounting Differs From Managerial Accounting 31 of 51

- Cost Accounting: Definition and Types With Examples 32 of 51

- Certified Public Accountant: What the CPA Credential Means 33 of 51

- What Is a Chartered Accountant (CA) and What Do They Do? 34 of 51

- Accountant vs. Financial Planner: What's the Difference? 35 of 51

- Auditor: What It Is, 4 Types, and Qualifications 36 of 51

- Audit: What It Means in Finance and Accounting, and 3 Main Types 37 of 51

- Tax Accounting: Definition, Types, vs. Financial Accounting 38 of 51

- Forensic Accounting: What It Is, How It's Used 39 of 51

- Chart of Accounts (COA) Definition, How It Works, and Example 40 of 51

- What Is a Journal in Accounting, Investing, and Trading? 41 of 51

- Double Entry: What It Means in Accounting and How It's Used 42 of 51

- Debit: Definition and Relationship to Credit 43 of 51

- Credit: What It Is and How It Works 44 of 51

- Closing Entry 45 of 51

- What Is an Invoice? It's Parts and Why They Are Important 46 of 51

- 6 Components of an Accounting Information System (AIS) 47 of 51

- Inventory Accounting: Definition, How It Works, Advantages 48 of 51

- Last In, First Out (LIFO): The Inventory Cost Method Explained 49 of 51

- The FIFO Method: First In, First Out 50 of 51

- Average Cost Method: Definition and Formula with Example 51 of 51

:max_bytes(150000):strip_icc():format(webp)/financialstatements-final-d1268249b5284b3989c979ee82f2869e.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- What is a cash flow statement?

Components of a cash flow statement

What is negative cash flow.

- How to read a cash flow statement

What to watch for in a cash flow statement

- The significance of cash flow

- Cash flow vs. profit: Understanding the difference

- The role of cash flow in assessing company health

- Preparing a cash flow statement

Cash flow statement FAQs

Understanding a cash flow statement.

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate investing products to write unbiased product reviews.

- A cash flow statement is one of three key documents used to determine a company's financial health.

- Cash flow statements provide details about all the cash coming into and exiting a company.

- A cash flow statement alone will not show all the necessary financial data to accurately analyze a company.

Companies with stocks that trade on public exchanges are required to periodically disclose a wide range of documents with detailed information about their operations. The cash flow statement is one of the most important to understand.

What is a cash flow statement?

Definition and overview.

Cash flow statements are financial accounting statements that provide a detailed picture of the movement of money through a company — both what comes in and what goes out — during a certain period of time. Using the information contained in a cash flow statement, business owners, shareholders, and potential investors can see how much cash a business is bringing and how much it's spending in a given period. In conjunction with other documents, cash flow statements can help you understand how financially healthy a company is.

Usually, cash flow is divided into three main categories: operations, investment, and financing. "Cash flow statements really just show business operations' impact to cash," says Dondrea Owens, CPA and founder of The Creative's CFO .

A company's cash flow statement is one of three key reports that investors and other interested parties use to determine its financial performance. The others are the income statement and balance sheet. Together, they depict a company's finances. In the US, the Securities and Exchange Commission (SEC) requires publicly traded companies to provide them.

Though all three documents deal with a company's money, they look at it from different angles. "We find that a lot of folks start with the balance sheet and the income statement," says Meredith Tucker , CPA at Kaufman Rossin . "And yet, I think the cash flow statement is one of the most helpful."

Cash flow provides important context to information that might not be apparent on a different financial statement. If a business makes a sale to a customer, that revenue often goes on an income statement and contributes to the company's overall profit or loss. However, if an invoice isn't due right away or the company extends a line of credit to the customer, the actual cash may not hit the company's bank account for months. This is why understanding cash flow is so important.

In general, cash flow statements show a company's ability to operate. If an organization doesn't have enough cash to pay its expenses during a given period, it may not matter how many realized sales it has made.

"From an investor standpoint, I want to know how a company is using the money I'm going to give them," Tucker explains. This is another reason cash flow statements can be important. They don't just show how much money was spent, but where it was spent.

"Are they diverting cash to repay debt? Are they distributing it out to shareholders? Are they losing money because they're extending more and more credit to their customers? Those are the kinds of things we want to see," Tucker says.

Knowing the key components of a cash flow statement is important for anyone who wants to understand the financial health of a company. Cash flow statements start with the amount of cash an organization had at the beginning of an accounting period and finish with the amount of cash the organization has at the end of the period. Everything in the middle details cash transactions as money entered and left the company.

In general, this middle portion will be separated into three distinct categories: operating activities, investment activities, and financing activities. Within each category, line items show where money went or came from.

Not every company will have the exact same line items on its cash flow statement, which Owens says is normal and not a cause for concern. Usually, money entering the company will be written as a numeral, and money exiting the company will include parentheses around the amount.

Operating activities

"The operating section is going to tell you about all the run-of-the-mill things that affect cash," Tucker says. These are the types of cash activities many people automatically associate with running a business: income from customers, wages to staff, inventory purchases, and income taxes, for example.

In the statement above, you can see that within the last year, $975,000 was paid to the company from customers, and the organization spent a total of $563,050 on all operating expenses. In this example, the organization's operating costs come from inventory purchases, operating and administration expenses, wages, interest, and income taxes. The net cash flow from operations lines shows the difference between these two numbers, in this case, $411,950.

Investing activities

The net cash flow from the investing line shows the change in cash flow from all investing activities. In a business, investment activities may include the purchase or sale of physical assets, investment in securities, or the sale of securities.

In the example above, the business only had two items that could be categorized as investment activities: selling property or equipment for $33,600 and purchasing property or equipment for $125,000. In this category, the company spent $91,400 more than it brought in, making that number its net cash flow from operations.

Financing activities

The final category on the balance sheet shows all cash transactions that had to do with financing activities. Things that would go in this category include activities that involve debt, equity, or dividends. In our example above, the company paid $38,000 and $52,000 to loan repayments and dividends, respectively. The organization didn't bring in any money through financing activities, so the net cash flow from financing is negative $90,000.

Negative cash flow appears when a company spends more than it generates in a certain period. A company may have an overall negative cash flow or any one of the sections may have negative cash flow, as the previous example shows in the investing and financing sections.

"Negative cash flow isn't always bad," Owens says. "Companies do go through growth phases where they are spending money to make money." As long as the negative cash flow is planned, it's not an immediate red flag.

Negative cash flow could also come down to a timing issue. "An accounting firm is a perfect example," Tucker explains. The busy season for accountants is often the beginning of the year when taxes are due, but most of those receivables won't be paid immediately. Though the business is generating revenue, the cash isn't in the account yet.

On the other hand, if there is a pattern of cash flow issues, that could be a warning sign that the company isn't managing its money well. If you see a negative cash flow, it's worth looking into the reason to determine whether or not it's cause for concern.

How to read a cash flow statement

Identifying cash sources and uses .

Businesses can obtain cash from various activities, ranging from selling their goods and services to selling securities at a profit. The most basic sources of cash, for example receiving income from customers, are outlined in the operating activities section of the cash flow statement.

Companies can also generate cash flow by issuing equity or borrowing money. Both of these come with their own unique costs and benefits. Issuing equity does not come with the same obligations as taking on debt. If a company borrows money from a bank and is unable to pay that money back, the lending institution could go after the organization's assets in an attempt to recover the funds it lent out in the first place.

Analyzing the company's liquidity and financial flexibility

You can get a good sense of a company's liquidity by using the cash flow statement to determine working capital, funds that are used to ensure that a business can operate in the short-term. To determine working capital, subtract its liabilities from its assets.

Assets are composed of cash and near-cash assets such as short-term liabilities, while liabilities would include money you owe to vendors and employees, as well as taxes you must pay.

Though a cash flow statement can't tell you everything about a company's financial viability, there are some things to watch out for in them that can be particularly telling. "A green flag for me is if there is positive cash flow coming from operations," Owens says. "That's a good sign that the company is generating cash just from its operations."

On the flip side, he explains that negative cash flow from operations could be an indicator that something isn't going well with the company and might require additional research.

Owens also recommends looking at the financing section, particularly to see if the business is bringing in most or all of its cash from loans or other sources of financing. "This isn't always a bad thing," she says. For example, it might be normal in a startup. But if most of the money is coming from financing, it's worth taking a second look, especially if the money will eventually need to be repaid. In general, the more cash that comes from operations, the better, Owens says.

The significance of cash flow

Cash flow vs. profit: understanding the difference .

Cash flow represents the money moving in and out of a business, whereas profit is what an organization has after subtracting all of its expenses from its revenue.

Both of these terms can be either positive or negative. A company can have positive or negative cash flow, or alternatively, it can be generating positive profits or negative profits, which are generally described as losses.

The role of cash flow in assessing company health

Reviewing a company's cash flow will help an investor obtain a sense of how well-prepared that organization is to cover its financial liabilities. It can also help give investors greater insight into whether an organization is expanding or is in decline. If a company is repeatedly experiencing negative cash flow, this could hamper its ability to put money toward activities that would generate expansion, for example marketing, sales and public relations.

Further, a company that keeps generating negative cash flow might have to lay off employees in order to generate positive cash flow. These cutbacks could in turn impact an organization's ability to function.

Cash flow statement vs. income statement vs. balance sheet

Though cash flow statements include plenty of helpful information, they alone will not tell you a company's entire financial picture. They work best when analyzed in conjunction with the income statement, which shows its profit or loss, and balance sheet, which details assets and liabilities. At times, one statement may answer a question the other poses. For example, if you look at a company's balance sheet from one year to the next and see its cash assets went from $1 million to $500,00, at first glance, this could look alarming. But, if you follow up with the cash flow statement, you may see the money was used as part of an investing activity and went toward the purchase of another facility that could increase the company's profitability long-term. "Make sure you understand the story that these financial reports are presenting to you," Tucker says. "You really need the interplay to interpret the full story."

Preparing a cash flow statement

Steps and key considerations .

The first step in preparing a cash flow statement is determining how much cash (and cash equivalents) a business has at the beginning of the period in question. This gives you the starting balance.

The next step is to determine cash flow from operating activities. One way of assessing this, called the direct method, involves calculating the cash brought in through operations and subtracting the cash spent through such activities. This method involves accounting for all transactions that resulted in cashing going into (or out of) a business during the specified time frame.

After that, determine cash flows associated with investing activities, which involves the purchase or sale of any assets like securities or real estate.

Creating the next section of a cash flow statement involves calculating any cash that went in or out of a business as a result of financing, for example issuing equity or taking on debt.

Once you have calculated the aforementioned amounts, you can use it to determine how much cash (and cash equivalents) a business has at the end of the period in question. You can subtract the starting cash flow from this amount to figure out how much cash a company made (or lost) during the period.

A cash flow statement provides information on a company's financial health and liquidity, as well as its ability to function in the short-term.

A cash flow statement includes actual cash transactions, while an income statement can list non-cash receipts. The balance sheet, alternatively, offers a summary of a company's assets and liabilities during a certain period.

Negative cash flow can potentially indicate a company putting money toward its own expansion. However, sustained negative cash flow can signal that an organization is struggling financially.

SEC regulations obligate publicly traded companies to produce cash flow statements on a quarterly and annual basis.

Small businesses can most certainly benefit from creating cash flow statements, as these documents can help them keep track of how easily they can pay for their short-term obligations and make long-term strategic plans.

- Main content

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

13.3: Preparing a Statement of Cash Flow

- Last updated

- Save as PDF

- Page ID 45988

Learning Objectives

- Prepare a statement of cash flow using the indirect method

Ok, so let’s put together all of the great stuff we have learned about cash flow! A reminder the indirect method is working from the bottom of the income statement and adjusting it to the cash basis. So we would take the net income, and work from there.

So here is our income statement on the accrual basis:

Our net income is $10,250, so we will start there and work up to our cash flow statement

The first step is to add back our depreciation, because that is a non-cash expense!

This balance will move to the cash flow statement!

The second step is to analyze the net changes in the balance sheet accounts that we discussed earlier. Accounts receivable, accounts payable and the other current assets and liabilities will also affect the cash flow of the company.

So let’s assume the following changes:

This information will come in handy in the next step!

So how do these items affect cash? Going back to our chart from our discussion about indirect cash flow analysis we know that:

So, here is the final deal!

Cash Flow Statement: Operating Activities-Indirect Method

So the income statement and balance sheet only show part of the picture. A company can have awesome sales, but if they struggle to collect on their accounts receivable, they may have issues with their cash flow! It is important as a manager to look at the big picture, in order to find ways to increase profits and create a positive cash flow!

Practice Questions

https://assessments.lumenlearning.co...sessments/9686

- Preparing a Statement of Cash Flow. Authored by : Freedom Learning Group. Provided by : Lumen Learning. License : CC BY: Attribution

Prepare a statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.) (Show amounts in the investing and financing sections that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) CORONADO INC. STATEMENT OF CASH FLOWS For the Year Ended December 31, 2025 Cash Flows from Operating Activities Cash Received from Customers Cash Payments to Suppliers Cash Payments for Operating Expenses Cash Payments for Interest Cash Payments for Income Taxes Cash Flows from Operating Activities Cash Received from Customers Add Cash Payments to Suppliers Cash Payments for Operating Expenses Cash Payments for Interest Cash Payments for Income Taxes Net Cash Provided by Operating Activities Cash Flows from Investing Activities Cash Flows from Financing Activities Sale of Equipment Purchase of Equioment Sale of Available-for-Sale Investments Net Cash Used by Investing Activities Net Cash Used by Investing Activities Cash Flows from Financing Activities Sale of Equipment Purchase of Equipment Sale of Available-for-Sale Investments Net Cash Used by Investing Activities Cash Flows from Financing Activities Net Decrease in Cash Net Increase in Cash 0000 Coronado Inc., a greeting card company, had the following statements prepared as of December 31, 2025. Coronado Inc. Comparative Balance Sheet As of December 31, 2025 and 2024 12/31/25 12/31/24 Cash $5,900 $7,000 Accounts receivable 62,500 51,200 Short-term debt investments (available-for-sale) 35,300 17,900 Inventory 39,800 60,100 Prepaid rent 5.100 3,900 Equipment 155,200 130,400 Accumulated depreciation-equipment (34,700) (25,200) Copyrights 45,500 50,400 Total assets $314,600 $295,700 Coronado Inc. Income Statement For the Year Ending December 31, 2025 Sales revenue Cost of goods sold $340,650 175,900 Gross profit Operating expenses 164,750 121.000 Operating income 43,750 Interest expense $11,500 Gain on sale of equipment 2,000 9,500 Income before tax 34,250 Income tax expense 6,850 Net income $27,400 Additional information: 1. Dividends in the amount of $6,000 were declared and paid during 2025. 2. 3. Depreciation expense and amortization expense are included in operating expenses. No unrealized gains or losses have occurred on the investments during the year. 4. Equipment that had a cost of $20,200 and was 70% depreciated was sold during 2025. Prepare a statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.) (Show amounts in the investing and financing sections that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

A: Detailed explanation:The accounting equation shows that total assets is always equal to the total of…

A: To solve this problem, we need to calculate the net cost of the merchandise after applying the trade…

Q: Answer Please

A: Let's break down the steps to find the incremental annual cash flow from operations for Ford if they…

Q: Copr., Goed GreenWay is considering investing in a new machine to provide a new residential cleaning…

A: Step 1: Identify the cash flowsInitial investment: -$350,000 (cost of the machine)Annual revenue:…

A: The Cherrylawn Corporation experienced a favorable total sales variance of $137,000, mainly due to…

Q: Perez Electronics is considering investing in manufacturing equipment expected to cost $310,000. The…

A: Here's how to find NPV and PVI for each depreciation method:For both methods (straight-line and…

Q: How much would be the tax credit if the amount of donation is $2,500 in 2023? Taxable income is…

A: Step 1: Identify what is the marginal tax bracket of the taxable income $80,000. (I searched the…

Q: Strong Arm Steve, a cash basis calendar year taxpayer, runs an illegal protection business.…

A: Let's break down the deductions for Strong Arm Steve's expenses:Operating expenses in conducting his…

Q: Sales and production budgets Bowser Inc. manufactures two models of speakers, Rumble and Thunder.…

A: Detailed explanation:a.Sales budget is a forecast of the volume of units the company expects to sell…

Q: Dineshbhai

A: Let's go through each part step by step.Step-11. Standard labor-hours allowed (SH) to prepare 6,300…

Q: deposited $11,500 into a fund at the beginning of every quarter for 15 years. She then stopped…

A: Given;• Quarterly deposit (P): $11,500• Annual interest rate (r): 2.69% or 0.0269 as a decimal•…

A: To determine which investment alternative to recommend, compare the NPVs:3. Recommendation:If NPV_A…

Q: Break-even sales and sales to realize operating income For the current year ended March 31, Kadel…

A: Detailed explanation:Breakeven sales in units is the number of units sold where revenue is equal to…

Q: Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,400 cases of Oktoberfest-style…

A: Pacifico Company, an importer of beer and wine situated in the United States, is exposed to the risk…

Q: Froya Fabrikker A/S of Bergen, Norway, manufactures specialty heavy equipment for use in North Sea…

A: Each individual product or batch of goods is handled as if it were a distinct job in a job-order…

Q: December 31, 2024 and 2023 ($ in millions) 2024 2023 Assets Cash $ 43 $ 49 Accounts receivable 76 80…

A: ### Operating Activities1. **Net Income Adjustment** We start with the company's Net Income,…

Q: On January 1, 2025, the ledger of Sunland Company contained these liability accounts. Accounts…

A: Sunland Company Journal Entries for January 2025Here are the journal entries for Sunland Company's…

Q: Flag question Alexis decided to purchase a new automobile. Being concerned about environmental…

A: The correct answer is c. -$156.68.Here's how to calculate the net present value (NPV) to determine…

Q: Norfolk Sporting Goods purchases merchandise with a catalog list price of $12, 801. The retailer…

A: Hello student! Inventory is always debited AT COSTS or simply the amount paid for its acquisition.…

A: > Gain on sale of land is an adjustment to net income in operating activities when using indirect…

Q: Pittman Company is a small but growing manufacturer of telecommunications equipment. The company has…

A: Here's an explanation of each step:Step 1: Computing the break-even point assuming the agents'…

Q: Required information Problem 11-44 (LO 11-3, LO 11-4) (Algo) [The following information applies to…

A: To solve this problem, we need to determine the amount and character of the gain or loss recognized…

Q: Brandon had only earned income for 2023 and was interesting if he could be eligible for the earned…

A: Brandon is eligible for the earned income credit (EIC), which is a tax credit that can be refunded…

Q: are presented below. End of Year Beginning of Year Cash and cash equivalents $1,135 $112 Accounts…

A: Ratio Calculations:1. Current Ratio:Current Ratio = Current Assets / Current LiabilitiesCurrent…

Q: During 2022 (its first year of operations) and 2023, Fieri Foods used the FIFO inventory costing…

A: Step 1: Beginning Retained Earnings for 2022: We'll assume it's $0 unless provided otherwise.Balance…

Q: Vikarm bahi

A: Joe and Jessie's Adjusted Gross Income (AGI) is calculated by adding up all their sources of income,…

Q: Sound Tek Inc. manufactures electronic stereo equipment. The manufacturing process includes printed…

A: Approach to Solving the Question:This question can be solved by following these steps:Identify…

Q: Information concerning the capital structure of Pharoah Corporation is as follows: 2025 2026 Common…

A: **Step-by-Step Calculation for Diluted EPS**:1. **Calculate Adjusted Common Shares**: Start with…

Q: please answer in text form and in proper format answer with must explanation , calculation for each…

A: Part 2: Explanation:Step 1: Calculate the Increase in Net Assets Without Donor RestrictionsPatient…

Q: Answer in all option

A: Step 1)Based on the options provided, the following would typically be reported as a cash sale:"Sale…

Q: 1 porn You are in middle of a payroll cheque run, and are trying to add overtime hours for an…

A: "This employee is not entitled to any overtime," indicates that the employee in question is not…

Q: A retired 67-year-old, low-income client makes an appointment with you, a tax professional, to have…

A: Tax preparation can be difficult for a retired 67-year-old client with limited income, especially…

A: 1. Number of Outstanding Shares of Common Stock at Year-End:Add up the amounts of common stock…

Q: Problem 11-10 (Algo) [LO 11-4] Hallick, Incorporated has a fiscal year ending June 30. Taxable…

A: To compute the regular tax liability for Hallick, Incorporated, we need to use the corporate tax…

Q: The following data relates to Campus Goods Inc:  Required: Based on the above data determine the…

A: 8C. Operating Expenses:We cannot determine the Operating Expenses with the provided data. Operating…

Q: At the end of the first quarter, the accountant for David Fly Fishing Outfitters determines that the…

A: ### 1. Recording Sales Tax PayableWhen a business sells taxable goods or services, they typically…

Q: Domestic

A: Step 1: Facts Increase in sales = New revenue - Old revenueIncrease in sales = $60,000 -…

A: Approach to solving the question: Thanks positive rating is very important to us. Please avoid…

A: 1. Identify Expenses:Expense: Description of the cost incurred.Amount: Dollar amount spent on each…

Q: Auto Suppliers Inc. provides the following information: Data Table Accounts Totals Invested…

A: Step 1: To calculate the profit margin for Auto Suppliers Inc., you would first need to find the…

Q: Arthur Wesson, an unmarried individual who is age 58, reports taxable income of $510,000 in 2023. He…

A: To compute Arthur's Alternative Minimum Tax (AMT) for 2023, we first calculate his Alternative…

Q: All details related to an employee's earnings, deductions, and net pay throughout the year would be…

A: The most detailed information on an employee's earnings, deductions, and net pay throughout the year…

Q: Answer in All option

A: A batch status that captures the interim stage between preparation and final processing is "Prov.…

Q: REQUIRED Study the information given below and answer the following questions independently: 3.1 Use…

A: Part 2:Explanation:Step 1: Calculate the contribution margin per unit. - Contribution margin per…

Q: The four people below have the following investments. Invested Amount Interest Rate…

A: Approach to solving the question: For better clarity of the solution, I have attached the Excel…

A: Tom & Jerry Publishers: Department Cost Allocation (April 20X1)We'll calculate the final costs…

Q: A company's average cost per unit when x units are produced is defined to be Average cost =…

A: We know that the average cost is: A=xTwhere: A = average cost T = total cost From the…

Q: For the year ended December 31, 2021, Finco Incorporated reported earnings per share of $2.28.…

A: Step 1: a. For a 3-for-1 stock split in 2022, the 2021 earnings per share reported for comparative…

Please solve this. Please don't use Chatgpt.

Step by step

Solved in 2 steps

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 loss Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement. Refer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith Corporation bonds has a market value of 12,500. Prepare the year-end journal entry to record the unrealized gain or loss.

- Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callable Klynveld Companys balance sheet shows total liabilities of 94,000,000, total stockholders equity of 75,000,000, and total assets of 169,000,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio. Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.

- Soto Industries Inc. is an athletic footware company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Soto Industries Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure? Whirlie Inc. issued $300,000 face value, 10% paid annually, 10-year bonds for $319,251 when the market of interest was 9%. The company uses the effective-interest method of amortization. At the end of the year, the company will record ________. A. a credit to cash for $28,733 B. a debit to interest expense for $31,267 C. a debit to Discount on Bonds Payable for $1,267 D. a debit to Premium on Bonds Payable for $1.267 Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. Saverin, Inc. produces and sells outdoor equipment. On July 1, 2016, Saverin, Inc. issued 62,500,000 of 10-year, 9% bonds at a market (effective) interest rate of 8%, receiving cash of 66,747,178. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Instructions 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds. 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, 2016, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, 2017, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) 3. Determine the total interest expense for 2016.

IMAGES

VIDEO

COMMENTS

Be able to use a worksheet to facilitate preparation of a statement of cash flows. The statement of cash flows worksheet examines the change in each balance sheet account and relates it to any cash flow statement impacts. Once each line in the balance sheet is contemplated, the ingredients of the cash flow statement will be found.

Note the section of the statement of cash flow, if applicable, and if the transaction represents a cash source, cash use, or noncash transaction. PA 8 . LO 16.4 Use the following excerpts from Zowleski Company's financial information to prepare a statement of cash flows (indirect method) for the year 2018.

LO3 - Interpret a statement of cash flows. Details about the amount of cash received and paid out during an accounting period are not shown on the balance sheet, income statement, or statement of changes in equity. This information is disclosed on the statement of cash flows (SCF). This chapter discusses the purpose of the statement of cash ...

ACCT 101 - Statement of Cash Flows Lecture Notes - Chapter 12 - Prof. Johnson The statement of cash flows is a required component of financial statements. ... completing the homework! (In class, we will go over a skeleton format that will be much easier to remember than the

The final part of the statement of cash flows is to calculate a Net Increase (or Decrease if negative) in Cash by adding the net cash from operating, investing and financing. Cash flows from Operating is $7,000 + Investing $(217,000) + Financing $160,000 which gives a net decrease in cash of $(50,000). We then take this increase (or decrease ...

The increase of $27,000 will be subtracted from net income. A company uses the indirect method to prepare the statement of cash flows. It presents the following data on its financial statements: [End of this year] Accounts receivable$115,000. Cost of goods sold $560,000. Sales revenue $ 830,000.

Statement of Cash Flows Example. Below is an example from Amazon's 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities. Learn how to analyze Amazon's consolidated statement of cash flows in CFI's Amazon Advanced Financial Modeling course.

The Cash Flow Statement just proves that everything balances out. So when you read the Cash Flow Statment you cross-check the numbers on it against the other two statements, and make sure they match. Also, you would be looking for numbers that were too high or low, like liabilities far in excess of the revenue, as compared with other business ...

Equipment with a cost of USD 20,000, on which USD 10,000 of depreciation had been recorded, was sold for USD 3,000 cash. Additional equipment was purchased for USD 220,000. Stock was issued for USD 250,000 cash. The USD 50,000 bank note was paid. Using the data given for Dells Corporation: a. Prepare a statement of cash flows - indirect method.

ACCT1210 Chapter 2 Cengage Homework. Match each financial statement item with its financial statement: balance sheet, income statement, retained earnings statement, or statement of cash flows. a. Liabilities. b. Net change in cash. d. Revenue. e.

Cash Flow Statement Example. Here's an example of a cash flow statement generated by a fictional company, which shows the kind of information typically included and how it's organized. Go to the alternative version. This cash flow statement shows Company A started the year with approximately $10.75 billion in cash and equivalents.

A cash flow statement is a valuable measure of strength, profitability, and the long-term future outlook of a company. The CFS can help determine whether a company has enough liquidity or cash to ...

5) Paid a cash dividend of $50,000 2020 1) Sold equipment for $25,000 cash 2) Purchased a vehicle for $32,000 cash. 3) Issued bonds payable in exchange for $1,500,000 cash 4) Pald a cash dividend of $100,000 Homework 10 - Statement of Cash Flows (2 points) Overview of assignment (on multiple sheets) 1) Fill in the Table on the worksheet labled ...

Prepare the operating activities section of a statement of cash flows using the direct method. LO3. Prepare the investing activities section of a statement of cash flows. LO4: Prepare the financing activities section of a statement of cash flows. To learn more about the book this website supports, please visit its Information Center.

Cash flows from investing activities involve increases and decreases in long-term asset accounts. These include outlays for the acquisition of property, plant, and equipment, as well as proceeds from their disposal. Figure 11.3 illustrates the effect of these items on the SCF.

Ericson Corporation Statement of Cash Flows - Indirect Method For Year Ended December 31 Cash flows from operating activities: Net income $41, Adjustments to reconcile net income to cash basis: Depreciation expense $ 20, Increase in current assets other than cash (6,000) Decrease in current liabilities (9,000) Total reconciling adjustments 5 ...

Statement of Cash Flows and Ratios 1. Compute the current cash debt coverage for each company. Current cash debt coverage ratio = net cash flow from operating activities / average current liabilities Coca-Cola's current cash debt coverage ratio in 2020 = $9,844/$$20,787 = 0.

Explore the fundamentals of cash flow statements in 2024, including their structure, significance, and the insights they provide into a company's financial health.

This balance will move to the cash flow statement! The second step is to analyze the net changes in the balance sheet accounts that we discussed earlier. Accounts receivable, accounts payable and the other current assets and liabilities will also affect the cash flow of the company. So let's assume the following changes:

Homework help starts here! Search ASK AN EXPERT. Prepare a statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.) (Show amounts in the investing and financing sections that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) ... STATEMENT OF CASH FLOWS For the Year Ended ...

Question: \r\nFrom this information, prepare a worksheet for a statement of cash flows. Make reasonable assumptions as appropriate. The short-\r\n\r\n\r\n\r\nBelow is the comparative balance sheet for Carla Corporation. Dividends in the amount of \\ ( \\$ 14,900 \\) were declared and paid in 2025 . From this information, prepare a worksheet for ...

Question: Statement of Cash Flows -- Troubleshooting Homework Balance sheet End of Beginning year of year Change Cash 76,000 Accounts receivable 116,000 Inventory 88,000 Total current assets 280,000 Equipment, at cost 280,000 Less: Accum. depreciation (80,000) Net book value of equipment 200,000 Total assets 480,000 42.000 34.000 107,000 9,000 94,000 (6,000) 243,000'

Statement of Cash Flows -- Troubleshooting Homework Why doesn't this balance? Please fix it. (There could be up to 5 mistakes.) Current year Balance sheet Income statement Cash Accounts receivable Inventory Total current assets Equipment, at cost Less: Accum. depreciation Net book value of equipment Total assets End of Beginning year of year 76,000 42,000 116,000 107,000 88,000 94,000 280,000 ...