Trading Business Plan Template

Written by Dave Lavinsky

Trading Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their trading companies.

If you’re unfamiliar with creating a trading business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a trading business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Trading Business Plan?

A business plan provides a snapshot of your trading company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Trading Company

If you’re looking to start a trading company or grow your existing company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your trading business to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Trading Companies

With regards to funding, the main sources of funding for a trading company are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for trading companies.

Finish Your Business Plan Today!

How to write a business plan for a trading company.

If you want to start a trading business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your trading business plan.

Executive Summary

Your executive summary provides an introduction to your trading business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of trading company you are running and the status. For example, are you a startup, do you have a trading business that you would like to grow, or are you operating a chain of trading companies?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the trading industry.

- Discuss the type of trading business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail what type of trading business you are operating.

For example, you might specialize in one of the following types of trading businesses:

- Retail trading business: This type of business sells merchandise directly to consumers.

- Wholesale trading business: This type of business sells merchandise to other businesses.

- General merchandise trading business: This type of business sells a wide variety of products.

- Specialized trading business: This type of business sells one specific type of product.

In addition to explaining the type of trading business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, the number of products sold, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the trading industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the trading industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the trading industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your trading business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of trading business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Trading Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other trading businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes other types of retailers or wholesalers, re-sellers, and dropshippers. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of trading business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for customers to acquire your product or service?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a trading company, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of trading company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you sell jewelry, clothing, or household goods?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your trading company. Document where your company is situated and mention how the site will impact your success. For example, is your trading business located in a busy retail district, a business district, a standalone facility, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your trading marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your trading business, including answering calls, scheduling shipments, ordering inventory, and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your trading business to a new city.

Management Team

To demonstrate your trading business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing trading businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a trading business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you charge per item or per pound and will you offer discounts for bulk orders? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your trading business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and traders don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a trading business:

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your facility location lease or a list of your suppliers.

Writing a business plan for your trading business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the trading industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful trading business.

Trading Business Plan Template FAQs

What is the easiest way to complete my trading business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your trading business plan.

How Do You Start a Trading Business?

Starting a trading business is easy with these 14 steps:

- Choose the Name for Your Trading Business

- Create Your Trading Business Plan (use a trading business plan template or a forex trading plan template)

- Choose the Legal Structure for Your Trading Business

- Secure Startup Funding for Trading Business (If Needed)

- Secure a Location for Your Business

- Register Your Trading Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Trading Business

- Buy or Lease the Right Trading Business Equipment

- Develop Your Trading Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Trading Business

- Open for Business

What is a Trading Business?

There are several types of trading businesses:

- Retail trading business- sells merchandise directly to consumers

- Wholesale trading business- sells merchandise to other businesses

- General merchandise trading business- sells a wide variety of products

- Specialized trading business- sells one specific type of product

Don’t you wish there was a faster, easier way to finish your Trading business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan advisors can give you a winning business plan.

Other Helpful Business Plan Articles & Templates

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

- Sample Business Plans

Trading Business Plan

Starting a trading business can be challenging because you have to build contacts, negotiate, and whatnot. But amidst worrying about all these things, planning is the last thing you want to worry about.

While anyone can start a new business, you need a detailed business plan when it comes to raising funding, applying for loans, and scaling it like a pro!

Need help writing a business plan for your trading business? You’re at the right place. Our trading business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write A Trading Business Plan?

Writing a trading business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Mention your product range:.

Highlight the product range of your trading business you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

Describe what kind of trading company you run and the name of it. You may specialize in one of the following trading businesses:

- Retail trading

- Wholesale trading

- Export-import

- Dropshipping

- Describe the legal structure of your trading company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established trading business, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Describe your market size and growth potential and whether you will target a niche or a much broader market.

Competitive Analysis:

Market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your trading business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your products:

Mention the trading products your business will offer. This may include product categories, product range, product features, product sourcing, etc.

Describe each service:

Mention the trading services your business will offer. This may include:

- Logistics & shipping

- Warehousing & storage

- Distribution & fulfillment

Additional Services

In short, this section of your trading plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your trading business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your trading business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & machinery:.

Include the list of equipment and machinery required for trading, such as office equipment, warehouse equipment, transportation vehicles, packaging & testing equipment, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your trading business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your trading business, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your trading business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample trading business plan will provide an idea for writing a successful trading plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our trading business plan pdf .

Related Posts

Bookkeeping Business Plan

Notary Business Plan

How to write a Business Plan Cover Page

Write Business Plan Using ChatGPT

Business Plan Presentation Tips

Problem Statement in Business with Solution

Frequently asked questions, why do you need a trading business plan.

A business plan is an essential tool for anyone looking to start or run a successful trading business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your trading company.

How to get funding for your trading business?

There are several ways to get funding for your trading business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your business, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought startup options.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your trading business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your trading business plan and outline your vision as you have in your mind.

What is the easiest way to write your trading business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any trading business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Trading Business Plan

Mar.29, 2024

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

According to a report, 13% of day traders maintain consistent profitability over six months, and a mere 1% succeed over five years. This is primarily due to inadequate planning and undercapitalization. A well-crafted trading business plan can help you avoid these pitfalls, and this article will guide you.

In this article, you’ll learn:

- The current trends and growth forecasts in the stock trading industry

- A breakdown of the costs involved in starting a trading company

- The key components of a trading business plan (with a trading business plan example)

- Strategies for securing funding and overcoming the barriers to entry

By the end of this article, you’ll understand what it takes to create a business plan for an investment company , positioning your trading business for long-term success in this lucrative but highly competitive industry.

Pros and Cons of Trading Company

Let’s explore the pros and cons associated with running a trading company before diving into the specifics of a trading site business plan. Understanding them will help you make informed decisions:

- Potential for significant profits.

- Flexibility in terms of time and location.

- Opportunity for continuous learning and skill development.

- High risk due to market volatility.

- Emotional stress and psychological pressure.

- Requirement for constant vigilance and discipline.

Trading Industry Trends

Industry size and growth forecast.

According to a report , the global stock trading and investing applications market size was at around $37.27 billion in 2022 and projects to grow at a CAGR of 18.3% from 2023 to 2030 (Source: Grand View Research). The following factors drive this growth:

- Increasing internet penetration

- Rising disposable income

- Growing awareness of investment opportunities.

(Image Source: Grand View Research)

The Services

As per our private equity firm business plan , a stock trading business offers various services, including:

- Facilitating Trades on behalf of clients

- Algorithmic trading services to automatically execute trades

- Market Insights (research reports, market analysis, and economic forecasts)

- Technical and Fundamental Analysis (price charts, historical data, and company fundamentals)

- Investment Recommendations

- Seminars and Webinars

- Online Courses

- Demo Accounts

- Portfolio Diversification

- Stop-Loss Orders

- Hedging Strategies

- Direct Market Access (DMA)

- Global Market Access

- Trading Platforms

- Mobile Apps

- High-Frequency Trading (HFT)

- Legal and Compliance Services

- Educate clients about Risk Disclosure

How Much Does It Cost to Start a Trading Company

According to Starter Story, you can expect to spend an average of $12,272 for a stock trading business. Some key startup costs include:

How Much Can You Earn from a Trading Business?

Earnings in the trading business can vary significantly and depend heavily on:

- Trading strategy and approach

- Market conditions and volatility

- Risk management techniques

- Capital allocation and leverage

While specific income figures are difficult to predict due to these factors. However, here are some statistics showing the earning potential of a stock trading business:

- According to Investopedia, only around 5% to 20% of day traders consistently make money.

- According to Indeed Salaries, the average base salary for a stock trader in the U.S. is $80,086 per year.

- 72% of day traders ended the year with financial losses, according to FINRA.

- Among proprietary traders, only 16% were profitable, with just 3% earning over $50,000. (Source: Quantified Strategies)

What Barriers to Entry Are There to Start a Trading Company

Barriers to entry into the stock trading business include:

- Regulatory Requirements: Obtaining necessary licenses and registrations from governing bodies like the SEC and FINRA is a complex and time-consuming process.

- Capital Requirements: Trading activities require significant capital to manage risks and leverage opportunities, which can be a substantial challenge for new or small firms.

- Technological Expertise: Developing or acquiring sophisticated trading platforms, algorithms, and data analysis tools is costly and requires specialized expertise.

- Market Knowledge and Experience: Gaining in-depth knowledge and practical experience in the complex and dynamic financial markets takes years of dedicated study.

- Competitive Landscape: Breaking into the highly competitive trading industry dominated by established firms and well-funded proprietary trading desks is challenging for new entrants.

You can overcome these barriers by developing unique strategies, leveraging innovative technologies, and offering competitive and specialized services to differentiate yourself in the market. Do check our financial advisor business plan to learn more.

Creating a Trading Business Plan

A well-researched stock trading business plan is crucial to start a trading business. A general trading company business plan is a comprehensive document that defines your goals, strategies, and the steps needed to achieve them. It helps you stay organized and focused and increases your chances of securing funding if you plan to seek investors or loans.

Steps to Write a Trading Business Plan

You can use a business plan template for a trading company or follow these steps to prepare a business plan for a personal trading business:

Step 1: Define Your Goals and Investment Objectives

Step 2: Conduct Market Research

Step 3: Develop Your Trading Strategy

Step 4: Establish Your Business Structure

Step 5: Develop a Financial Plan

Step 6: Outline Your Operational Procedures

Step 7: Create a Marketing and Growth Strategy

Step 8: Implement Risk Management

Step 9: Create an Exit Strategy

What to Include in Your Trading Business Plan

Executive summary, company overview.

- Market Analysis

- Trading Strategy and Risk Management

- Operations and Technology

- Financial Projections

- Management and Organization

- Appendices (e.g., research, charts, legal documents)

Here’s an online trading business plan sample of ABC Trading:

ABC Trading, a recently established stock trading firm, provides online trading services to individuals and institutional investors. Key highlights of our business include:

- Vision – Becoming a leading online trading platform with a wide range of trading products and services.

- Values – Our core focus is innovation, excellence, integrity, and customer satisfaction.

- Target market – Tech-savvy and risk-tolerant investors looking for alternative ways to invest their money and diversify their portfolios.

- Revenue model – Commissions and fees for each trade, as well as subscription fees for premium features and services.

- Financial goal – Break even in the second year of operation and generate a net profit of $1.2 million in the third year.

ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team.

Company Name: ABC Trading

Founding Date: January 2024

Location: Delaware, USA

Registration: Limited Liability Company (LLC) in the state of New York

Regulated By: Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA)

Our team comprises seasoned professionals with diverse finance, mathematics, computer science, and engineering backgrounds.

Marketing Plan

Marketing Strategy: We aim to leverage online channels, such as social media, blogs, podcasts, webinars, and email newsletters, to create awareness, generate leads, and convert prospects into customers.

Marketing Objectives:

- Reach 100,000 potential customers in the first year of operation

- Achieve a 10% conversion rate from leads to customers

- Retain 80% of customers in the first year and increase customer lifetime value by 20% in the second year

The customer profile of ABC Trading includes the following characteristics:

- Age: 25-65 years old

- Gender: Male and female

- Income: Above $100,000 per year

- Education: Bachelor’s degree or higher

- Occupation: Professionals, entrepreneurs, executives, or retirees

- Location: US or international

- Trading experience: Intermediate to advanced

- Trading goals: Income generation, capital appreciation, risk diversification, or portfolio optimization

- Trading preferences: Stocks, options, or both

- Trading style: Technical, trend following, or volatility trading

- Trading frequency: Daily, weekly, or monthly

- Trading risk: Low, medium, or high

Marketing Tactics:

- Create and distribute engaging and informative content on social media platforms

- Offer free trials, discounts, referrals, and loyalty programs

- Collect and analyze customer feedback and data to improve and personalize the customer experience

- Partner with influencers, experts, and media outlets in the trading and finance niche

Marketing Budget:

We will allocate $10,000 for our marketing campaign, which we will use for the following purposes:

Operations Plan

ABC Trading’s operations plan ensures the smooth and efficient functioning of the company’s platform and services and compliance with the relevant laws and regulations.

Operation Objectives:

- Maintain a 99% uptime and availability of the company’s platform and services

- Ensure the security and privacy of the company’s and customers’ data and funds

- Provide timely and professional customer support and service

Operation Tactics:

- Use cloud-based servers and services

- Implement encryption, authentication, and backup systems

- Hire and train qualified and experienced customer service representatives and technicians

- Monitor and update the company’s platform and services regularly

- Follow the best practices and standards of the industry and adhere to the applicable laws and regulations

Operation Standards:

Financial Plan

ABC Trading’s financial plan is to provide a realistic and detailed projection of the company’s income, expenses, and cash flow for the next three years, as well as the key financial indicators and assumptions that support the projection.

Financial Objectives:

- Achieve a positive cash flow in the second year of operation.

- Reach a break-even point in the second year of operation.

- Generate a net profit of $1.2 million in the third year of operation.

- Maintain a healthy financial ratio of current assets to current liabilities of at least 2:1.

Financial Assumptions:

- Launch its platform and services in the first quarter of 2024

- Acquire 10,000 customers in the first year, 20,000 customers in the second year, and 30,000 customers in the third year

- Average revenue per customer will be $50 per month, based on the average number and size of trades and the subscription fees

- Average operating expense per customer will be $10 per month, based on the average cost of salaries, rent, utilities, marketing, and legal fees

- Pay a 25% tax rate on its net income

- Reinvest 50% of its net income into the company’s growth and development

Projected Income Statement:

Projected Cash Flow Statement

Projected Balance Sheet

Fund a Trading Company

To successfully establish and operate a trading company, raising funds to finance daily operations and business expansion is crucial. There are different ways with their advantages and disadvantages:

1. Self-funding (Bootstrapping)

Self-funding, also known as bootstrapping, is when the founder or owner of the trading company uses their own personal savings, family business ideas , assets, or income to finance the business. This is the most common and simplest way to fund a trading company, especially in the early stages.

- Complete ownership and control

- Flexibility in decision-making

- Potential for higher long-term returns

- Limited access to capital

- Personal financial risk

- Slower growth potential

2. Debt Financing

Debt financing involves borrowing money from lenders, such as banks, credit unions, or microfinance institutions, to fund the trading company’s operations. The borrowed funds must be repaid with interest over a specified period.

- Retain ownership and control

- Potential tax benefits from interest deductions

- Disciplined approach due to repayment obligations

- Debt burden and interest payments

- Collateral requirements and personal guarantees

- Difficulty in securing financing for startups

3. Angel Investors

Angel investors are wealthy individuals who invest their own money into early-stage or high-potential trading companies in exchange for equity or convertible debt. Angel investors typically provide smaller funding than venture capitalists and offer mentorship, guidance, and access to their network.

- Access to capital and industry expertise

- Potential for additional mentorship and guidance

- Lower risk compared to traditional investors

- Dilution of ownership and control

- Potential for conflicting visions and expectations

- Limited resources compared to larger investors

4. Venture Capital (VC) Funding

Venture capital firms are professional investment firms that provide capital to high-growth startups in exchange for equity ownership. They typically invest large sums of money and are active in the company’s management and strategic direction.

- Access to substantial capital for growth

- Expertise and industry connections from the VC firm

- Validation and credibility for the business

- Significant dilution of ownership and control

- Intense pressure for rapid growth and return on investment

Depending on your business model, goals, and needs, you may also consider other options, such as grants, subsidies, partnerships, etc. Ensure to check for relevant documents, like the hedge fund private placement memorandum . The best way to fund your trading company is the one that suits your situation and preferences.

OGSCapital: Your Strategic Partner for Business Success

At OGSCapital, we specialize in professional business plans that empower startups, established companies, and visionary entrepreneurs. With over 15 years of experience, our seasoned team combines financial acumen, industry insights, and strategic thinking to craft comprehensive plans tailored to your unique vision. Whether you’re seeking funding, launching a new venture, or optimizing your existing business, we’ve got you covered.

If you have any further questions regarding how to write a business plan for your trading business, feel free to contact us. Our team at OGSCapital is here to support you on your entrepreneurial journey. You can also check our hedge fund business plan sample here.

Download Trading Business Plan Template in PDF

Frequently Asked Questions

What does a trading business include?

A trading business involves trading stocks and other financial instruments under a legal business structure. It includes:

- Market analysis

- Trading strategy

- Risk management

How does a trading company work?

A stock trading company facilitates the buying and selling of stocks (shares) on behalf of investors. These companies operate within stock exchanges, executing trades based on specific trading strategies.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

How To Write A Textile Manufacturing Business Plan

Start a Vending Machine Business in 2024: A Detailed Guide

Oil and Gas Business Plan

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Analyzing Alpha

Setup a Trading Business: The Complete Guide

By Leo Smigel

Updated on October 13, 2023

Trading as a business involves trading stocks and other financial instruments under a legal business structure, such as a sole proprietor, partnership, or limited liability company (LLC).

Everyone wants to make money, and everyone wants to be free.

You can accomplish both if you’re a successful trader.

And you’re in luck because there’s one thing I know how to do exceptionally well – it’s trading as a business.

You might say, Leo, I don’t need to start a trading business – I’m a new trader. Well then, I’ve got a question: How many successful companies do you think started without a plan? Sure, there are some, but I would bet those with a sound plan faired better over the long run.

And trading is no different. Trading is most successful when it’s done most businesslike.

And for those who are already profitable and ready to go full-time, I’ve got some massive tax-saving tips for you, so stay tuned.

I’ve also sprinkled secrets about becoming a full-time trader that you’ll be hard-pressed to find elsewhere.

I will explain everything you need to know step by step and show you how to become a professional trader running your own successful trading company, whether you’re incorporated.

Before You Can Start Trading

Before creating any business, you need to start with a solid plan and understand where you fit in the market.

But before we jump into the nitty-gritty details of running your trading business, you need to answer five show-stopping questions.

1. What Is Your Why?

Why do you want to be a trader? Many traders start trading because they want to get rich.

Now, it’s possible to become rich trading; however, understand that if you’re not a profitable trader already, the chances of success are slim.

Most studies say that only 5% of traders become profitable. And according to the Small Business Association, this is in stark contrast to starting a business where 33% are still around after year ten.

In other words, if it’s money you’re after, it’s much easier to create an online business than to become a profitable trader.

And no matter how smart you are, trading will slap you around until you’re begging to quit.

You need more than the pursuit of money to keep you in this game.

You need an unwavering passion to play, and you need an advantage.

2. What’s Your Trading Edge?

A trading edge is an observation or approach that creates an advantage over the rest of the market players. Anything that can add a few points to the winning side of the equation builds an edge in your favor.

Most traders lose money in the financial markets because they lack an edge.

I’m also going to say something controversial here:

Risk management isn’t an edge – it’s just good trading – and I can prove it.

Let’s play the coin toss game. If you guess correctly, you get a dollar and lose a dollar if you don’t. You can play this game all day long and cut your losses short, but you’re never going to make a million dollars.

Why? Because you have no edge. The probabilities are not stacked in your favor.

You need an edge to make it full-time, and you need multiple to make it a career.

You need to be the casino – you need to have multiple edges that compound over time. Don’t be a gambler with the odds stacked against you.

So how do you find an edge?

Most edges come from a better understanding of market structure, faster execution speed, or better data and analysis.

For example, a market structure edge may be an exceptional ability to exploit the post-earnings announcement drift (PEAD) anomaly. Another may be the early identification of trends through sophisticated technical or data analysis.

You want to ensure you are on the right side of the stock market as much as you can.

And if you’re struggling to find an edge, I’ve got you covered.

I backtested Scot1and’s slingshot trading strategy at a high level to verify if it has an edge – which it does. If you’re not familiar with Scot1and, he’s a professional trader. He shares his trades publicly on Twitter and has multiple triple-digit years under his belt, with his highest being 305% and last year (2021) being 150%.

Scot1and wanted to find a way to get into solid stocks before the runup and invented the slingshot trading setup. That’s one of his many edges. And this setup can work for you, too, assuming it meshes with your market philosophy and psychological makeup – but more on that later.

Once you have successfully identified and defined your edge, or better yet, edges, it’s time to consider your risk tolerance.

3. What’s Your Risk Tolerance?

Risk tolerance refers to the degree of risk you’re able to take. And while there are multiple ways to define risk, we’ll consider volatility and drawdown for our purpose.

Since your comfort level with uncertainty determines risk tolerance, it can be challenging to be aware of your risk appetite until faced with a potential loss.

You should strive to gain a clear understanding of your risk appetite and your ability to stomach large swings in the value of your portfolio.

When traders trade above their risk tolerance levels, at best, they’ll lose sleep and make suboptimal decisions the next day, and at worst, they’ll sell out at the exact wrong time.

Risk tolerance is all about understanding yourself – a key characteristic you should possess as a flourishing trading business owner.

And let me tell you when you start a trading business, and it becomes your primary source of income, your risk appetite will change a lot – even for algorithmic traders.

Most traders’ greatest struggle in establishing a profitable trading business revolves around trading psychology.

Finding edges in the market isn’t difficult. I just showed you the slingshot strategy, which is a potential edge that you can incorporate into your trading.

What’s hard isn’t knowing what you should do; it’s doing what you should do – it’s trading like a business.

And risk tolerance is just one aspect of trading psychology.

Psychology And Trading

Trading psychology refers to the emotional aspects of an investor or trader’s decision-making process – it’s how emotions affect your trading, and trading affects your emotions.

There are some important considerations to make here.

Most traders fall into thinking they can achieve trading success with little thought of their psychological makeup.

Successfully aligning your trading strategy with your psychology implies you may need to give up on or change some of your values and beliefs.

For instance, do you value your need to be “right”?.

A trader who values being “right” is more likely to refuse to set a stop and take a slight percentage loss in case the trade goes haywire.

Do overnight moves keep you up at night?

Then perhaps day trading is a better style for you.

You need to find a trading style that suits your trading psychology and addresses your strengths and weaknesses.

This doesn’t mean a risk-averse person can’t adopt a swing-trading style. It also doesn’t mean that if you value being right, you’re perpetually wrong when following your stops.

It just means that traders need to understand why they’re embracing a trading approach and have safeguards against their deficiencies – often, you can flip a weakness on its head.

For example, let’s go back to someone struggling to stop out.

The first issue might be that they do not understand what they’re trading and why they’re trading it. If they’re trading specific mean reversion scenarios, they shouldn’t be using stops – position sizing is the key to risk management; however, let’s assume that the trader was a long-only swing trader.

If they’re a breakout trader not following their stops, likely, they don’t have a deep understanding of what a breakout is and how they work.

Now I could spend hours discussing breakouts, but for now, let’s understand two things:

- Roughly 70% of breakouts fail.

- Successful breakouts rarely retrace to the low of the day.

With this market knowledge, this trader that has to be right now understands that her win percentage should be between 25-35% and where to place their stop. Additionally, their understanding aligns with their market understanding allowing her to be correct and less likely to pull the cord on the stop.

I find deep understanding solves most trading psychology challenges – but just because you’ve got your edge and your psychology in order doesn’t mean you can trade like a business just yet.

4. What Are Your Return Assumptions?

Return assumptions refer to the returns a trader or investor expects to make from a particular investment or their trading activities via their trading efforts in the financial markets.

All active traders share one common goal: to utilize their trading capital to make as much money as possible while assuming a certain level of risk.

For that reason, it’s critical to set your expectations right and figure out a rough idea of what kind of return you might achieve before you kick off your trading endeavors.

So, how do you determine a reasonable rate of return?

Whether you’re a business or a trader, the answer is the same.

Look at you and your competition’s average annual returns per each different system or setup, and determine a number you think you can realistically achieve.

Target Compound Annual Growth Rate (CAGR)

This average annual return is the target compound annual growth rate or CAGR. It’s the average return or profit you make divided by your capital.

To keep the math easy, if you make $10,000 on a $100,000 account, your annual return is 10%.

You need to calculate an appropriate CAGR accurately as it flows through to all of your other business calculations, like how much money your trading business needs to generate each year to cover its expenses.

Without history to back it up, investors shouldn’t set their target CAGR above 15%, and traders shouldn’t set their CAGR above 40%.

And yes, good traders have the potential to compound their capital faster than investors due to the structural advantages of having less money to move.

Here are the top ten filers by 10-year annualized performance to give you context.

Now, I know for some of you, these CAGR numbers are tiny, but exceptional returns are the exception, not the rule.

Minimum Absolute Return

Understanding what you can likely achieve makes it time to figure out precisely what you need to succeed.

The absolute minimum return refers to the minimum return that a trader sets over a predetermined time frame.

This return needs to cover your business expenses, which I’ll cover shortly, and the owner’s draw. The draw is the salary you need for yourself and your dependent’s living expenses.

The minimum absolute return is typically your breakeven level. It’s not the target.

Target Absolute Return

The target is your target absolute return. This is the profit you want your trading business to create over the period, typically a year.

You calculate your target absolute profit target by multiplying your target CAGR by starting capital and subtracting fees, which we’ll cover shortly.

I would advise against creating a profit target and working backward since you may need to inflate your CAGR artificially.

The last thing you want to do is overestimate your trading income and underestimate your trading loss.

Maximum Drawdown

Maximum drawdown refers to your maximum downside risk over a period. It’s the maximum observed loss from a peak to a trough.

For instance, if your portfolio value is $100,000 and you lose $30,000, your drawdown would be ($30,000 – $100,000) / $100,000 = 30% or $30,000 in dollar terms.

It’s important to note that maximum drawdown only measures the extent of the most considerable loss, excluding the frequency of significant losses.

Maximum drawdown determines how much capital you’ll need to start your trading business, assuming you’ve included multiple market cycles in your analysis.

Capital Required

Armed with an understanding of your absolute minimum return and maximum drawdown, we can finally determine how much capital you’ll need to start your trading business.

Capital required refers to the amount of money a trader needs to carry out trading activities within the financial markets.

Consider your capital as the raw material that powers your trading activity in the stock market or any business.

So let’s go through the math.

If you need to generate $50,000 per year and expect your minimum CAGR to be 10%, you would need $50,000 / 10% = $500,000 without a drawdown.

Keep in mind if your CAGR return is that low, it’s likely you don’t possess enough of an edge, but I kept the numbers simple for explanation purposes!

But that’s not all. If your maximum drawdown is 20% or $200,000, you’ll also need to add that to your initial capital.

And with all businesses, you’ll need to put in a considerable amount of time.

5. Time Commitment

Time commitment refers to the number of hours per week applied to your new trading business.

It’s essential to treat and act “businesslike” at all times.

Only by approaching each trading day with full intent and purpose can you aspire to succeed.

This extends beyond just executing your trading strategies.

It also includes learning, studying, researching new strategies, and improving your mindset as a trader.

Can you fit it all into your schedule? Do you have enough time to make it work?

These are critical questions to ask yourself before starting your trading startup.

Let’s think about this a little more.

Understanding A Trading Business

Although different from the traditional brick-and-mortar business, a trading business’s anatomy can be broken down similarly.

Think of your trading strategies as your new products and services.

Through these strategies, you’ll be generating your trading income.

And just like how traditional businesses need to constantly improve their products and services based on customer and market feedback, you’ll be doing the same, which leads me to my next point…

Trading Losses Are Expenses

Trading losses are going to be inevitable. You want to take advantage of this market feedback to improve your product. Be sure to analyze each loss and learn from them. They will be your best teacher.

But at the same time, you simply want to treat your losses as a cost of doing business.

Think of the casino business and a game of roulette.

Of course, the casino makes money when the player loses.

But does the player always lose?

So, if we have a player who is always betting on the color red, they have an almost 50-50 chance of winning each time.

There will be times when the player hits lots of reds in the short-run, and the casino loses money.

However, the house always wins.

In the long run, given that the roulette contains a neutrally colored zero, the casino has the edge (remember, we spoke about the edge earlier).

Act like a casino; if you have an edge in the financial markets, you will win long-term.

Short-term losses are simply the cost of conducting business.

Capital Preservation

But continued losses should signal to the management team that it’s time to rethink the plans.

Intelligent management knows preserving your capital to live another day is more important than making more money in the short term.

New traders often have this backward.

The truth is that the only aspect of the trading process you have significant control over is how much money you will lose in a trade.

It’s critical to size your bets correctly.

And speaking of plans, let’s go over what your trading business plan should include.

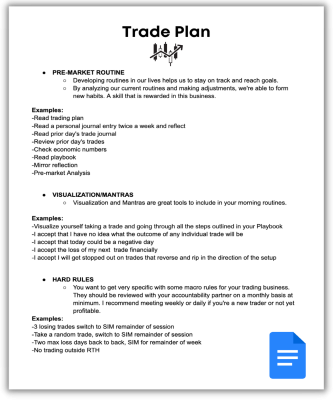

Your Trading Business Plan

A trading business plan, similar to a typical business plan, is a document that details everything that you need to know to run your trading business. It includes your objectives, how you intend to make money, your edge, what you will trade and why, and how you will grow your business.

It’s time to address the actual birth of your business as a new independent trader.

What Is Your Company’s Mission Statement?

A company’s mission statement defines its culture, values, ethics, fundamental goals, and agenda. The statement outlines what the company does, how it does it, and why. Prospective investors may also refer to the mission statement to see if the company’s values align with theirs.

A well-crafted mission statement articulates the purpose of your business.

It helps to serve as a framework for your business. Outlining what your business stands for, along with your objectives and values.

What is your mission statement? Why are you doing this? Is it just for the money? What’s your driving purpose for embarking on a trading career?

It’s critical to understand the why because it empowers the how.

What Is Your Company’s Philosophy?

A company philosophy refers to “the way we do things around here.” Conventionally, it relates to the fundamental beliefs of the people and the organization.

Your company’s philosophy boils down to your market beliefs.

Do you believe that it is fundamentals or emotions that drive the markets?

Or is it the Fed?

Your trading edges come from a deep understanding of how you view the market. And you need this deep understanding to stick to your strategies during a drawdown.

The last thing you want to do is have a shaky market philosophy and jump ship at the wrong time.

So what is your market philosophy? These will guide your principles.

What Are Your Company’s Principles?

Company principles refer to the principles that a company abides by throughout its day. These could be building a great workplace culture, conservative cash flow use, or taking significant, calculated risks.

What principles does your company abide by throughout your trading day?

These should stem from your philosophy.

For instance, if you believe that the Fed moves the market, are you selling your positions if the Fed is not printing money?

If you’re a trend follower, do you implement Paul Tudor Jones’ rule of refusing to purchase any stock below its 200-day moving average?

Having the various principles aligned with your market philosophy and mission will help you maintain the necessary discipline with your trading.

It will also help you understand what assets to trade.

Your Trading Universe

This is the range of financial instruments that a trader plans to trade across the investable universe, including all tradable assets. In reality, most investors do not invest so broadly and have a narrower universe that could be constrained to event-driven biotech stocks.

This is your total addressable market, and your edge governs it.

Assuming the above, if biotech is in a long-term downtrend, do your edges still allow you to make a profit? If not, you may need to grow your edges and the total addressable trading universe.

What Are Your Company Rules?

Company rules refer to the established rules, in writing, made by the company’s higher level of authority and bound to follow by all employees and stakeholders.

Often these rules revolve around conduct, hours worked, and customer service levels. And larger trading organizations should define these; however, the rules I’m referring to for a trading business help you protect your capital and add discipline to your trading operations to boost profitability — essentially money management rules, which I like to think of in four distinct categories.

1. Portfolio Management Rules

Portfolio management entails building and overseeing a selection of investments or investment strategies that will meet the long-term goals set above.

Most investors take the approach of diversifying their assets, which is a reliable measure.

However, a superior alternative is implementing uncorrelated strategies within the same asset class.

For instance, buyers tend to reduce their leverage during sell-offs, which causes both stocks and bonds to drop, even though these two asset classes are generally uncorrelated.

Therefore, having a mix of long and short stock strategies can help you offset this risk.

What are your portfolio management rules?

An example would never be allocating more than 25% of capital to a single strategy.

2. Risk Management Rules

Risk management is the process of identifying, assessing, and controlling threats to an organization’s capital and earnings. These risks stem from various sources, including financial uncertainties, legal liabilities, technology issues, strategic management errors, accidents, and natural disasters.

Remember that the aspect of trading you have considerable control over is how much you’re willing to lose on any given trade.

So, always go into a trade knowing your pre-defined price targets to take profits and the price points you’re willing to get out for a small loss if the trade goes against you.

The worst thing you can do is hold on to a losing trade that invalidates your thesis, hoping it will eventually become a winner.

An example of a breakout strategy risk management rule would be to set your stop at the low of the day, invalidating the idea if it moves against you, but never more than the average daily range.

3. Position Sizing Rules

Position sizing refers to the size of a position within a particular portfolio or the dollar amount that an investor will trade. Investors utilize position sizing to determine how many security units they can purchase, which helps them control their risk and maximize returns.

How much you will earn or lose from your trades is directly tied to the size of your trading positions.

Your position size will also impact your ability to diversify your trading positions.

If too large a portion of your trading account is tied up in one trading position, you won’t have the necessary capital to open other trades.

We never know which of our positions will be the big winners.

There is no worse feeling than watching the market rally, and you are in 3-4 positions that decide to sit out the rally.

Keep in mind that even with proper position sizing, there is a risk that an active trader’s position loses more than their specified risk if a stock gaps below the stop-loss order.

This is why it’s essential to position size correctly, especially around earnings announcements, which you may want to avoid altogether.

A common position sizing rule is to never risk more than 25% of your account on any single trade.

4. Leverage Trading Rules

Leveraged trading, also known as margin trading, margin finance, or trading on margin, allows you to open a trading position with a broker using a small amount of capital to take a much larger position.

Suppose you commit $10,000 on a 10X leveraged financial instrument. You’ll be trading as if you had put in $100,000.

Thus, any capital gains you make have a tenfold effect, but the same applies to losses, so using leverage implies an element of risk.

If you’re taking on leverage, ensure that your edges are well defined and diversified, and you have a clear leverage rule.

I will never go above 500% leverage, and this scales down as the volatility of the instrument increases.

Leverage is extremely risky in almost all cases. But there is one exception to this:

When trading crypto, using leverage can help mitigate the risk of an exchange hack at the cost of margin interest fees.

SWOT Analysis

With your rules established, it’s time to perform a SWOT analysis.

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and so a SWOT analysis is a technique for assessing these four aspects of your business.

SWOT analysis is a simple tool that can help you analyze what your company currently does best and devise a successful strategy for the future.

1. What Are Your Strengths?

Strengths define what you excel at.

Perhaps you have a programming background, and you can create trading algorithms.

Perhaps you’re a decisive person who can make solid, carefully constructed decisions rather quickly.

Perhaps you’re able to stay calm and collected and perform under pressure.

For me, as you’ve probably guessed, it’s the first one that helps mitigate my weakness.

2. What Are Your Weaknesses?

Weaknesses prevent you from operating at your prime.

For instance, you may have difficulty dealing with market sell-offs and tend to get “sucked in” by the emotion of everyone else panicking.

The best way to mitigate this is to have a plan to take advantage of these opportunities.

The second best way is to reread your business plan and stay away from the news and social media on such days.

Plus, keep in mind that these sell-offs are often an opportunity in the market. Smart institutions often accumulate on sell-off days due to their liquidity constraints. If you’re a breakout trader, you should identify what stocks are acting stronger than the market.

As they say, one man’s misfortune is another man’s opportunity.

So, take note of your weaknesses and negative triggers. That way, you’ll be able to easily spot them and make logical decisions rather than emotional, irrational ones that will hurt your profitability.

My weakness?

I pay both my living and business expenses from my trading income. I would feel immense pressure to make money every day and override my trading systems in the early days.

I’m sure you can all guess what happened.

Understand what your weaknesses are, that they may change over time, and figure out how to mitigate them.

3. What Are Your Opportunities?

These refer to favorable external factors to grow your business or competitive advantage.

For instance, can your trading strategies be applied to additional trading instruments or different markets?

Crypto trading is attractive as an algorithmic trader as it trades 24/7 against relatively unsophisticated traders.

4. What Are Your Threats?

In contrast to opportunities, threats refer to factors that potentially harm your business.

Government measures towards reducing fossil fuel use towards energy production in favor of renewable energy sources pose a threat to any non-renewable energy sector business or energy stock in your portfolio.

And these types of risks apply to your trading business.

Changes in capital gains tax laws, crypto regulation, or even black swan events are threats.

Do you have proper hedging strategies in place?

With an understanding of your strengths, weaknesses, opportunities, and threats, it’s time to do some benchmarking.

Performance Measurement

Performance measurement is the process of collecting, analyzing, and reporting information regarding the performance of an individual, group, organization, system, or component.

They say what gets measured gets improved. And like other traditional businesses, trading businesses are no different.

To monitor your trading performance, you require data.

You can collect data manually from your trading platform and record it in a spreadsheet, but I highly recommend that discretionary traders use journal software that records the information.

Although there are hundreds of metrics you could track, you should track the following key performance indicators (KPIs) classified by market and strategy at a bare minimum:

- Profit & Loss

- Total number of trades

- Win percentage

- Average time in trade

- Largest winning trade

- Largest losing trade

- Average winner

- Average loser

- Maximum drawdown

- Profit factor

- Gain-to-Pain Ratio

Feel free to check out my website for definitions and example calculations for these metrics if you have questions.

Operating Costs

As promised earlier, we need to understand your trading business’s fixed and variable costs to determine the absolute minimum return.

Fixed costs are expenses that remain constant for a period of time irrespective of the level of outputs. Variable costs are expenses that change directly and proportionally to business activity level or volume changes.

So, what do these look like for your new trading business?

Fixed Costs

Here are some fixed costs trading businesses have at varying degrees:

- Computer & equipment

- Trading software

- Administration software

- Internet & telephone

You’re most likely already paying for the trading software, and the good news is that most of the home office expenses are relatively inexpensive.

But don’t forget to consider the most significant expense of them all — paying your managing member.

To understand your trading business’s true profitability, you need to track your monthly draw in your accounting software.

Variable Costs

Here are some variable costs involved with your trading business:

- Transaction fees

- Slippage costs

- One-time data costs

Office Location

Another aspect you also want to think about is if and where to set up an office.

As a trader, you can set up an office anywhere you like across the globe — granted, some time zones are more convenient than others.

You can set up your own home office.

You can also buy or rent your own business office.

A big driver of this decision is how well you can balance life and work while at home.

If you’ve got kiddos at home and cannot concentrate, the answer is typically straightforward.

Additionally, scaling to multiple employees is a little easier if you’re an algorithmic trader, as you can more easily separate roles.

These aspects determine whether it makes sense to stay at home or hang up a shingle somewhere outside of your personal space.

Regardless of where your office is, you’ll want to make sure you maximize the tax benefits.

Benefits For Incorporating