Wholesale Grains: Starting a Wholesale Grains Business

About 12,000 years ago, the Agricultural Revolution changed the landscape of the world. Since then, grains have been an important part of our diet. Things are not likely to change in the near future. Crops will be part of our meals for millennia to come. Production of both food and beverage services and products is highly dependent on grains. In this article, we’ll examine the topic of wholesale grains, what they are, and how you can profit by starting a successful wholesale distribution business in that niche. If you’re currently a business owner in that field, you’ll probably find some useful information as well.

What Are Wholesale Grains?

Buying grains in bulk quantities is a standard business practice used by restaurants and other companies. The main benefit of bulk buying is that it usually comes at a lower price. Furthermore, the prices of commodities such as wheat, oat, and rice are constantly changing. Therefore, if businesses believe they’re about to increase, it might be better to stock these agricultural products while the prices are low.

Some of the most popular grains are wheat, corn, rice, barley, and oats. Wholesale vendors of these products trade primarily with food producers, food industry suppliers, retailers, and animal food producers. Since grains have a fairly long shelf life if stored properly, it can be beneficial for companies to buy bulk grains .

Key takeaway: Starting a wholesale grains business requires a fairly big investment. However, as the need for food is constantly expanding, there are many growth opportunities , and it can prove to be a very profitable one.

What Is Needed to Start a Wholesale Grains Business?

If you want to start a company in the field of wholesale grain trade, there are a few main steps to prepare the enterprise.

Develop a Detailed Business Plan

It should include major components such as goals, competition, financial projections, and marketing channels. A wholesale grains business requires an investment of tens of thousands of dollars. Therefore, things such as the current macro environment should also be taken into consideration. The business plan needs to have future predictions on key metrics such as business growth, revenue, and profit. This way, it will serve as a roadmap for the business.

Research the Market Regulations

Before you start your wholesale grains business, check how the grains should be stored, what permits are needed to buy and sell them, and how long it will take to obtain the needed licenses. Getting a tax ID number and business license are fairly common procedures. The ones that might require more time and additional investments are the certifications required to operate a grains business. They depend on the scale, the types of traded products, and other factors.

Find the Right Producers

A wholesale grains company acts as a middleman between agricultural producers and businesses such as food manufacturers. This means you need to take care of finding both clients and producers. Make sure to establish partnerships with farming companies in places such as trade shows or via membership in industry associations.

Additionally, choose the right types of grains to buy and sell. If your business investment is not very big, you should start with the most common types such as corn and wheat.

The Location Shouldn’t Be Underestimated

Finding a proper location is very important. It should be with good logistics in terms of roads. Proximity to railway stations and ports is also a bonus. Probably the main factor is the space itself. It should be enough to store the different grains. Also, cold temperatures and dry conditions are required in any grain storage .

Tools and Machinery

The main investments in that regard should be related to trucks, forklifts, pallet jacks, and other tools related to warehouse management.

Marketing and Pricing

If you’re planning to sell bulk grains , you should create a detailed marketing plan. It should include channels, personas, and ad budgets. In this business niche, attending local and international conferences can be a great way to find new customers and partners. Also, benefit from the opportunity to become a member of all relevant associations.

Consider your pricing carefully. As mentioned above the price of agricultural commodities is constantly changing. Thus, you need to be flexible and base your prices not only on business costs and competition but also on factors such as future crop yields.

What Clients Does a Wholesale Grains Business Aim For?

A variety of businesses can be clients of a wholesale grains business. Let’s check the main ones.

- Food manufacturers . Whole grains are key ingredients in a variety of foods like whole grain breakfast cereal. Manufacturers usually buy bulk quantities so acquiring even a few clients in that market has the potential to maximize revenue .

- Retailers . Grocery stores and supermarkets sell packaged grains in small and large quantities. If your business has the right packaging equipment, you can offer your products to supermarkets.

- Restaurants and catering businesses . A lot of recipes have grains as the main ingredients. That’s why restaurants are valuable potential clients to a wholesale grains business .

- Animal feed producers . These companies buy wholesale grains in very large quantities. Corn, barley, and wheat are used in the animal feeding of poultry and livestock. Keep in mind that animal feed producers or livestock management companies primarily focus on the price, and you should consider giving a discount for long-term commitment or large quantities ordered.

- Exporters . The US is the biggest producer and exporter of corn in the world. But corn is not the only thing exported. The fertile soils of America combined with modern agricultural solutions equal high yields. Ergo, a wholesale grains business should aim to partner with exporters and international buyers. This is especially true for countries with worse climates or regions that have suffered a drought as the prices there might be higher.

Can You Sell Wholesale Grains Online?

Nowadays, the eCommerce market is growing rapidly. All kinds of products and services can be bought online and grains are no exception. Having a modern website can be a big benefit for a grain wholesaler. It allows using modern digital marketing channels such as email marketing , social media, or search engine optimization.

One of the reasons why a grains wholesale business should have a website is the fact this is your online business card. If you’re attending trade shows or international conferences, businesses and potential customers will look you up online. Additionally, an online store will help your business sell directly to customers as well. If your plan includes being both B2B and B2C business, a well-maintained eCommerce solution is a must.

Among the most important eCommerce marketing channels for a wholesale gran business is eCommerce email marketing . You can collect customer data and create different audiences based on your B2B or B2C customers. Furthermore, you can promote informational content such as blogs to your current customers. This creates brand loyalty and increases the likelihood of people buying again.

Frequently Asked Questions about Wholesale Grains

Are you considering starting a grains wholesale business? Or maybe you’re generally interested in this market niche? Either way, allow us to answer some of the most common questions on this topic.

Where to Buy Wholesale Grains?

You can find wholesale vendors in online marketplaces such as BlueCart . Additionally, there are many websites, such as Webstaurant Store, that specialize in products for the food industry.

Should I Buy Bulk Grains?

There are many benefits to buying large quantities of grains. For starters, they have a long shelf life if stored properly. Additionally, food prices are always rising and bulk buying makes fiscal sense.

How Are Grains Traded?

Like most commodities, a large part of grains trade is in the futures market. That makes sense as businesses plan for how many grains they will require in the future. On the other hand, producers benefit from the opportunity to sell their future yields.

- United States

- The Americas

- Special Report: How to Lead the Changing Japan

- Middle East & Africa

- Banking Innovation

- Global Capital Markets

- Financial Management

- Cryptocurrencies

- Regulation & Compliance

- Personal Finance

- Responsible Finance

- Legal Services

- Frontier Markets

- Digital Transformation

- Cyber Security

- Healthcare & Innovation

- Climate Change & Society

- World Politics

- International Relations

- International Law

- Capitalism in the 21st Century

- World Development

Power Influencers

- Best Partners for Business Growth

- Strategies for the Changing World

- Productivity

- Marketing & Communication

- Culture & People

- Entrepreneurs & SMEs

- Career & Learning

Wise Decision Maker Guide

- Dr. Kalim Siddiqui’s Critique of Political Economy of International Development

- Dan Steinbock on the Multipolar World

- Leverett on International Relations

- Sustainable Development in the 21st Century

- Understanding War by Joseph Mazur

- Gaming & Leisure

- Home Improvement

- Product & Service Review

- Health & Wellbeing

- Our Mission

- Guidelines For Authors

- Advertising

- Privacy Policy

- Terms and Conditions

FINANCE & BANKING

Understanding the basics of grain trading in the us.

Grain trading is an essential aspect of the agricultural industry in the United States. The country is the world’s largest producer and exporter of corn, soybeans, and wheat, making it a significant player in international grain markets. Understanding the basics of grain trading in the US is crucial for farmers, traders, and investors who are involved in the industry.

What is Grain Trading?

US Grain trading refers to the buying and selling of grain commodities such as corn, soybeans, wheat, and other crops. The trading is done in futures contracts, and the prices are determined by supply and demand factors in the market. Futures contracts are agreements to buy or sell a specific commodity at a predetermined price and date in the future.

Grain Exchanges in the US

Grain trading in the US is conducted on organized exchanges, the most prominent being the Chicago Board of Trade (CBOT), the Kansas City Board of Trade (KCBT), and the Minneapolis Grain Exchange (MGEX). These exchanges provide a platform for trading futures and options contracts on various grain commodities.

Factors Affecting Grain Prices

The prices of grain commodities are influenced by various factors, including:

Supply and demand, weather conditions, government policies, transportation costs, and global market trends. The availability of crops and the level of demand for them can impact the price of grain commodities. Weather conditions such as drought or flooding can reduce crop yields, leading to lower supply and higher prices. Government policies such as subsidies or trade agreements can also affect prices. Transportation costs, including fuel prices and logistics, can impact the price of grain commodities as well. Finally, global market trends, such as changes in consumption patterns or currency fluctuations, can also impact the prices of grain commodities.

Types of Grain Trading

There are two main types of grain trading in the US: cash trading and futures trading.

Cash trading involves the actual physical exchange of grain between buyers and sellers at a specific location and time, typically with payment made at the time of delivery. Futures trading, on the other hand, involves contracts for the future delivery of grain at a predetermined price. This allows farmers and grain buyers to manage their price risk, as they can lock in a price for future delivery, regardless of market fluctuations. Both types of trading are important for the agricultural industry and play a significant role in global food supply chains.

Grain Trading Strategies

Grain trading strategies vary depending on the market conditions and the trader’s risk tolerance. Some common strategies include:

- Trend following – This strategy involves analyzing the market trends and trading in the direction of the trend. For example, if the market is trending upwards, the trader will buy grain contracts and vice versa.

- Mean reversion – This strategy involves buying or selling grain contracts when prices deviate significantly from their historical averages. The trader believes the prices will eventually revert to their mean values.

- Spread trading – This strategy involves taking positions in two or more related grain contracts to profit from the price difference between them. For example, the trader may buy wheat contracts and sell corn contracts if he believes wheat prices will rise relative to corn prices.

- Options trading – This strategy involves buying or selling options contracts to hedge against price fluctuations or to profit from them. For example, the trader may buy a call option if he thinks that grain prices will rise, or a put option if he thinks that they will fall.

- Scalping – This strategy involves making small profits by buying and selling grain contracts quickly. The trader profits from the small price movements that occur throughout the day.

Overall, successful grain trading requires a combination of technical analysis, fundamental analysis, and risk management techniques. Traders must also stay up-to-date on market news and events that could impact grain prices.

Risks of Grain Trading

Grain trading involves risks that are inherent in any investment activity. Some common risks include:

Commodity price fluctuations, weather-related risks, geopolitical risks, credit risks, and operational risks. Commodity price fluctuations are the most significant risk, as the prices of grains can be affected by various factors such as supply and demand, currency fluctuations, and political events. Weather-related risks include droughts, floods, and other natural disasters that can impact crop yields and quality. Geopolitical risks can arise from political instability, trade disputes, and sanctions that can affect the trade and transportation of grains. Credit risks involve the possibility of a counterparty defaulting on a payment or failing to fulfill a contract. Operational risks can arise from errors, fraud, or other problems in the trading process. To mitigate these risks, grain traders use various risk management tools such as futures contracts, options, and insurance.

The basics of grain trading in the US involve understanding the market dynamics, the trading platforms, and the risks involved. Grain trading provides a means for farmers, grain elevators, and other market participants to hedge against price fluctuations in the cash market. The industry is influenced by various factors such as weather conditions, supply and demand, government policies, and international markets. Successful grain traders employ various strategies such as hedging, speculation, and spread trading to maximize profits and minimize risks.

RELATED ARTICLES MORE FROM AUTHOR

How Generative AI Will Impact Payments in 2024

Exploring the Impact of Trade Wars on International Trade and Economic Growth with Kavan Choksi

Dear Next PM: Here’s a Blueprint for Fintech Growth, Exploring How the UK can Nurture and Support its World-class Sector Post-election

What Market Dynamics Will Drive Banking-as-a-Service Adoption in 2024?

How to Keep Investors from Walking Out the Door when Performance is Down

How Russia Has Kept from Going Bankrupt After Two Years of War in Ukraine

Crafting High-Performance Remote Teams

Ketamine Brightens the Future of Mental Health

Unveiling the Future of Inclusion for HR Leaders

The Future of Frontline Work: Transforming Challenges into Opportunities

Don’t Treat Remote Meeting Participants as Second-Class Citizens

Solving the Trust Gap in Remote Work

The “Salonpreneur” Revolution: Empowering Independent Pros Through Entrepreneurship

Listen to Your Employees to Achieve DE&I Goals

The Disruption of Generative AI in Expert-Driven Media Platforms

The Danger of Generative AI for Online Fraud

Power Influencers in Tech in 2024

The Future Role of the World Bank: Some Views on Strategy...

Compliance Without the Pain: Financial Regulation Made Easy

Putting Black Women on the Technology Map: Interview with Flavilla Fongang,...

Ultratech Capital Partners – At the Vanguard of Effective Investments in...

Claudia Goldin’s Nobel Prize Win Is a Victory for Women in...

Safeguarding Your Digital Legacy: Interview with Paul Rossini, Co-founder & CEO...

Future of Human Leadership in the AI age

The Efforts of the West to Tackle the Sustainability Issue are...

Helping People to Feel Good About Spending Their Money: Interview with...

Top investment destinations.

Bluemina Annual Citizenship and Residency Summit: A Gathering of Opportunities in...

Why is Finland the Happiest Country in the World for the...

Revisiting the Japan’s Economic Stagnation

Young Georgians’ Cultural Journey to the West

Caribbean: Economic Prospects and Impacts on Foreign Direct Investment

Exploring the Post-Growth Economy to Advance Mexico’s International Automotive Industry

Unveiling Dubai: Beyond Glitz and Glamour – Your Perfect Itinerary

Metal Sourcing in Vietnam: Opportunities and Financial Challenges

How International Trade Can Unlock the Potential of the Cultural Economy...

Ukraine Reconstruction Project: Challenges and Opportunities for Foreign Businesses

Emerging trends.

Governments & Technology Companies Collaborating for Ethical Migration

Why Capitalism Should Become More Balanced

How AI Makes the Work of Quants More Enjoyable and Productive

Accommodating Different Generations in the Workplace: A Blueprint for Success

How Advanced Rotational Molding Techniques Are Shaping the Future of Eco-Friendly...

How COVID-19 and Ukraine War Could Help Us Fight Climate Change...

Global Food Security after the COVID-19 Pandemic in Times of Climate...

Renewable Energy Use after the Pandemic

BUSINESS AND INNOVATION

Bookkeeping: An Excellent Work From Home Opportunity

Tips to Check Website Stats and Why it is Important?

Reducing Risks and Increasing Resilience: Supply Chain Specialist Strategies

A Quick Guide to International Invoicing for Small Businesses

Meet Your Entrepreneurial Renaissance Partner: Tailor Brands

6 Things You Didn’t know About Vector Databases

How To Drive Employee Engagement Through A Culture of Innovation

The Power of Accounting Automation in Business Growth Beyond Numbers

Maximizing ROI with Web Test Automation Services

Honoring Service: Exploring Special Loans for US Army Veterans

Navigating Financial Challenges: Understanding the Consumer Proposal Process

Quality Assurance in Home Buying: The Importance of Thorough Inspections

Unlocking Financial Security: The Advantages of a Total and Permanent Disability (TPD) Payout

8 Ways to Maximize Your Investment Portfolio

When Is It Time to File Bankruptcy or Find a Bankruptcy Alternative?

The Ultimate Midwest Homebuyers Companion

AML and KYC in Crypto: Compliance Essentials

Privacy overview.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

INDAME GRAINS MARKET BUSINESS PLAN

Business plan igaragaza uko wacunga warehouse business

Related Papers

AJHSSR Journal

According to Corral, Díaz, Monagas andGarcía (2017),the objective of increasing agricultural incomes in developing countries ranks high on the political agenda. Especially, in Sub-Saharan Africa (SSA), the majority of the population lives in rural areas with higher levels of poverty than in urban areas, and almost all rural households depend directly or indirectly on agriculture. Rwanda " s agricultural policies are embedded in a frame work of conventions and protocols such as the Millennium Development Goals (MDGs), Sustainable Development Goals (SDGs), the New Partnership for African Development (NEPAD), Common Markets for Eastern andSouthern Africa (COMESA), the East African Community (EAC), Vision 2020, the Economic Development and Poverty Reduction strategy(EDPRS) and finally the Plan for Strategic Transformation of Agriculture (PSTA). The government has initiatedCrop Intensification Program (CIP) to increase productivity for six priority crops namely Maize, Wheat, Rice, Irish potato, Beans and Cassava. Taking Maize as a case study, the present research analyzed the role of agriculture policies in improving maize production in Rwanda during 1995 to 2018. The data were provided by the National Institute of Statistics of Rwanda (NISR) and Index Mundi and they were analyzed using Eviews 8 software. The research found that agriculture policies have led to important achievements: Maize production passed from 57 metric ton to 660 metric tons; The individual consumption of maize passed from an estimation of 9.87 kg per year to 43.24 kg; Maize importation passed from 4 metric tons to 107 metric tons; Rwanda started exporting maize since 2010 starting from 5 metric tons to 10 metric ton since 2012 up to 2017. However, despite such impressive achievements, the research noted that many efforts have to be engaged because the production remains lower that required to satisfy the food security for the population.

kayitana fred

chrisco rwanda

Rwanda Biomass fuel supply baseline

Chris Huggins

Land‐scarce Rwanda is an unlikely place in which to find ‘land grabbing’. However, an ongoing legal, institutional and financial re‐configuration of the agricultural sector in Rwanda facilitates increased penetration of rural smallholder farming systems by Rwandan and international capital which may include some large‐scale ‘land grabbing’ by foreign corporations. More often, foreign agricultural investment in Rwanda is likely to take the form of involvement in contract farming arrangements with cooperatives. Such contracts are facilitated by the state, which when necessary uses coercive mechanisms as well as highly interventionist strategies (such as regional crop specialization policies and mandatory land use consolidation)to create an ‘enabling environment’ for agricultural investment. The Rwandan government has adapted neo‐liberal tools, such as ‘performance management contracts’, through which it makes local public administrators accountable for agricultural ‘development’ targets, which are often explicitly linked to corporate interests. Philanthropic activities by international development agencies are also often intertwined with the activities of the state and foreign capital, so that a variety of actors and objectives are collaboratively changing the relations between land and labour, and exposing smallholder farmers to regional and global markets. Such processes suggest that the global ‘land grab’ is only one aspect of broader patterns of reconfiguration of control over land and labour in the Global South, and that critical attention should be paid to various modes of ‘agricultural investment’, not just acquisition of large areas of land.

Joris Schapendonk

KABANDA Callixte

Hilda Vasanthakaalam , M. Sankaranarayanan

Rwanda is implementing the self-sustaining extension system through Farmer Field Schools (FFS) and Farmer Promoters (FP) approaches. The objective of this paper was to find out the impact of self-sustaining extension system in order to help stakeholders to improve its current implementation. The methodology includes a desk review of reports, face to face interview with 60 participants and 5 focus group discussions between February and May 2016. It also includes the interview of 400 trained farmers and 400 non-trained farmers. It was found that 92% of the trained FFS facilitators and 62% of the farmer promoters were very active in extension services. It was also found that for beans, the highest average yield was 1.2 t/ha for non-trained farmers, 1.5 t/ha for FFS farmers, 1.3 t/ha for FP farmers and the average yield of all the farmers was worked out to be 1.4 t/ha. It was found that FFS trained farmers produce 37.5% more than non-trained farmers while farmers trained by Farmer Promoters produce 10.8% more than non-trained farmers. In general, 37.8% of farmers apply Good Agricultural Practices (GAP) among the non-trained farmers, 73% of FFS farmers use the GAP and 68.3% of the FP farmers adopt the GAPs. It was found that 20% of the FFS group activities are involved in various income generating activities compared to non-trained farmers (10%). It is concluded that the implementation of self-sustaining agricultural extension system in Rwanda has a strong impact in agricultural development through motivation and increased trainings of farmer promoters.

Christopher Huggins

Godfrey Manasseh

Strategic Plan

RELATED PAPERS

Molecular Autism

Arvid Heiberg

Jurnal Manajemen Indonesia

Sisilia Sari Dewi

Borce Trenovski

International Journal of Environmental Research and Public Health

Jan Hutchinson

Management & Economics Research Journal

Amrane Becherair

Anatoly Shvidenko

Joaquim Veciana

Journal of Thoracic Disease

Gianluca Perroni

PLoS Genetics

VIKRANT KUMAR

Impact Studies

Adriana Ocampo

Jorge Gomes

Khaled Al Masaeed

Journal of Cereal Science

Maria Flores

Soil and Tillage Research

ROMINA THARJA BENDEZU FERNANDEZ

Cancer Science

antonia aranega

International Journal of Technology Assessment in Health Care

Viviane Pereira

Cancer Research

Valeria Poli

Mirko Diksic

CNS Neuroscience & Therapeutics

Nada Alamri

Clinical Nuclear Medicine

Robert Steuart

Mochammad Firdaus

快速办理毕业证, 各种各类的毕业证齐全

akhmam fahmi

The Geographical Journal

Ella Harris

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Follow us on Twitter

Find us on facebook

Connect on Linkedin

The Three Pillars of Grain Trading

Date Posted: Oct 18, 2023

Fundamental Analysis | Technical Analysis | Seasonality

Uncertainty and volatility in the grain markets can be difficult to navigate, due in part to ever-changing fundamental and technical landscapes.

Using fundamental and technical analysis, along with seasonality, are the three pillars of grain trading. The first step toward honing your grain trading strategy is understanding the basic fundamentals that impact grain markets. From there, you can tie in technical analysis to help define potential entry and exit points and manage a position around your market bias and your risk appetite.

Lastly, you can view seasonal tendencies as the cherry on top. The alignment of all three pillars results in a high-conviction trade setup.

Grain Market Fundamentals: Yields, Acres, and Production

Corn and soybean yields get all the attention when it comes to discussing the grain markets, but to make those numbers mean anything, we also need to look at planted and harvested acres. Those numbers combine to give us the all-important production number, which is the supply side of the equation.

Inventories

Alongside production, we need to look at the stocks-to-usage ratio, which gives us an understanding of what global end users have at their disposal. If stocks are relatively high, then prices likely will be depressed, as there is no immediate demand for replacement.

Stocks-To-Usage Ratios

Once a broad-based picture of the supply situation is painted, analyzing how much of that production is currently being utilized, compared to how much of it is being stored for later usage, is paramount.

Global stocks-to-usage ratios have an inverse correlation between season-average- farm-prices (SAFP) received domestically. The chart at the top of p. 69 displays the previous 30 years of data relating to global stocks-to-usage ratios compared to SAFP for corn.

The job here is to delve into specifics – we need to define what ending stocks and usage means. Simply put, ending stocks for corn or soybeans is simply the difference between total supply (foreign and domestic) and usage (again, foreign and domestic). There are myriad components to usage, but the relationship between total supply and usage is paramount.

Blue Line Futures is adamant in employing a “quanti-mental” approach to market analysis. Fundamental analysis provides an overarching direction of the trend, but technical analysis is imperative to determine the health within that fundamental trend. Knowing where you are within a trend is imperative for making entry and exit decisions or managing a position, no matter what contract you are trading.

Support and Resistance

Support is found in downward trends and represents a price, or range of prices, in which bulls historically re-enter the market.

By re-entering the market, bulls have the capacity to either halt or reverse the downtrend. Support can be found via trendlines, significant moving averages, and price history where clusters of prices are traded numerous times.

Resistance is effectively the opposite of support. It is found in upward trending markets, and it represents a price, or range of prices, in which bears historically re-enter the market. When a market hits resistance, it puts the uptrend in jeopardy because it can halt or stop a rally. In trading, when a market reaches a resistance pocket, traders may look to reduce

Pivot Pockets

In futures trading, pivot pockets are viewed as “no man’s land” or an inflection point for the market, meaning that the market has an equal likelihood of moving in either direction. Pivot pockets can be utilized as entry targets for breakouts (up or down). Put differently, a bullish trader may place an entry order just above the higher boundary of a pivot pocket, then have a profit target toward the middle or lower boundary of the nearest resistance pocket.

Seasonality

Seasonality is one of the most important concepts when it comes to grains and other physical commodities. The term “seasonality” refers to recurring patterns and trends that occur in prices over the duration of a year.

For example, grain markets typically trend lower in the fall as harvest progresses because there is more available supply coming to the market. Conversely, grain markets trend higher ahead of planting season as supply is lower, and the degree of uncertainty regarding the new crop year’s production is at its highest. A comprehensive database on seasonal tendencies can be an incredibly valuable to gain a greater understanding of seasonality.

The chart provides an example of a higher-conviction seasonal setup. The black line represents the current year, while the other lines represent prices averages for the last five, 10, 15, 20, and 30 years. Having this type of information at your fingertips or working with someone who does can be extremely helpful.

Matt Bresnahan is a market strategist for Blue Line Futures, Chicago, IL, (312) 858-7305 .

Blue Line Futures is a dedicated futures brokerage that takes pride in assisting grain producers, intermediaries, and end-users in navigating futures markets, and mitigating their exposure to commodity price risk. Are you ready to take your trading to higher highs? Reach out to us at [email protected] or call into our trade desk at (312) 858-0500 .

Grain Journal Exclusives

- How AI Is Impacting Our Digital World

- Ask the Expert: Johnny Wilson, Ph.D.: Mitigating Potential Pest Infestations

- Keeping Pace: Encompass Grain and Rail

- On Track: Longer trains arrive at Oregon coop

- Optimizing Operations: Central Farm Service St. James Feed Mill

- GEAPS Leadership Conference Heads to Texas

- GEAPS Exchange 2024

- One for the Road

- Ask the Experts: Navigating Labor Challenges

- Better, Faster, Smoother

More Grain Journal Exclusives ►

- Visit the University of Nebraska–Lincoln

- Apply to the University of Nebraska–Lincoln

- Give to the University of Nebraska–Lincoln

Search Form

Developing a grain marketing plan in 5 easy steps.

If you didn’t know where to start or thought developing your own grain marketing plan was too difficult, check out these tips for writing and using a plan throughout the year to meet your goals.

1. Break the total amount you have to sell down into smaller units.

Break the total amount of grain you have to market down into smaller units. Most producers think in 1,000- or 5,000-bushel segments, depending on how much grain has to be sold.

Post-Harvest : If you are post-harvest marketing, you can only sell the grain that is unpriced in the grain bin.

Pre-Harvest : If you are pre-harvest marketing, do not sell more than you have insured. You do not have to sell any bushels before harvest. To calculate how many bushels you have insured, multiply the Actual Production History (APH) by the number of acres of the commodity you plan to plant or have planted in a given field. This gives you the expected production. Then multiply the expected production by the insurance rate.

For example, let’s say you have a 200-acre corn field with an APH of 180 bushels per acre and a 70% insurance rate. The expected production is 36,000 bushels (200 X 180 = 36,000). However, the insured amount is 25,200 bushels (36,000 X 0.70 = 25,200). The insured amount can be broken into five units, each approximately 5,000 bushels.

2. Set price targets.

The next step is to determine an average price you want to sell at and then create price targets around that average.

Let’s say the average price you want to obtain is $3.50 per bushel. If you have five equal quantities to sell, you could set price targets at $3.30, $3.40, $3.50, $3.60 and $3.70.

It is important that you set realistic price targets. Setting prices too high or too low may be detrimental to your plan. At minimum, your price targets (pre- or post-harvest) should exceed your established cash flow price.

Post-Harvest : When determining price targets after harvest, you will want to set targets above the price you could have obtained at harvest, plus any additional expenses accrued by storage. Expenses to consider are bin rental, insurance on grain in storage, and additional interest expense on operating notes.

Pre-Harvest : When setting pre-harvest price targets, you want to price grain above your cost of production. Some marketers suggest that you do not pre-price grain if you cannot break even.

3. Set sale deadlines.

If prices do not rise enough to meet your price target, you need to set sales deadlines to ensure you are proactive about pricing. Target prices and sales deadlines work together to help you make sales throughout the year.

Commodity prices typically have a defined seasonal price pattern. Setting sales deadlines that correspond with periods when prices are traditionally highest will help make marketing easier. Price patterns vary by commodity. Corn prices are typically highest in the spring (March-June,) and soybean prices are traditionally highest during the summer (June-July).

Your cash flow needs are another consideration when selecting sales deadlines. Are there certain times of the year that you need to make sales in order to make payments? Plan ahead and have this cash ready by setting sales deadlines ahead of payment dates.

4. Know your marketing tools.

There are several types of contracts you can use to sell grain. We call these marketing tools. You should work with your local elevator or broker to determine what marketing tools are available to you and what tools you should be using to achieve your price targets and sales deadlines. The common marketing tools offered by most local elevators are cash sales, forward cash contracts, basis contracts, and hedge-to-arrive (HTA) contracts. You can also work with a broker to establish hedges, puts, or calls.

5. Share your plan with someone else.

Once you have written your plan, share it with someone else. Sharing your goals with your spouse, merchandiser, or banker will help keep you accountable to your marketing goals.

Marketing plans can become more complex. However, this basic outline will help you get started. Remember: the goal of a marketing plan is to keep you on track with the goals you determined at the beginning of the crop cycle.

Online Master of Science in Agronomy

With a focus on industry applications and research, the online program is designed with maximum flexibility for today's working professionals.

How to write a business plan for a grain mill?

Writing a business plan for a grain mill can be an intimidating task, especially for those just starting.

This in-depth guide is designed to help entrepreneurs like you understand how to create a comprehensive business plan so that you can approach the exercise with method and confidence.

We'll cover: why writing a grain mill business plan is so important - both when starting up, and when running and growing the business - what information you need to include in your plan, how it should be structured, and what tools you can use to get the job done efficiently.

Let's get started!

In this guide:

Why write a business plan for a grain mill?

- What information is needed to create a business plan for a grain mill?

- What goes in the financial forecast for a grain mill?

- What goes in the written part of a grain mill business plan?

- What tool can I use to write my grain mill business plan?

Being clear on the scope and goals of the document will make it easier to understand its structure and content. So before diving into the actual content of the plan, let's have a quick look at the main reasons why you would want to write a grain mill business plan in the first place.

To have a clear roadmap to grow the business

It's rarely business as usual for small businesses. The economy follows cycles where years of growth are followed by recessions, and the business environment is always changing with new technologies, new regulations, new competitors, and new consumer behaviours appearing all the time...

In this context, running a business without a clear roadmap is like driving blindfolded: it's dangerous at best. That's why writing a business plan for a grain mill is essential to create successful and sustainable businesses.

To write an effective business plan, you will need to take stock of where you are (if you are already in business) and where you want the business to go in the next three to five years.

Once you know where you want your grain mill to be, you'll have to identify:

- what resources (human, equipment, and capital) are needed to get there,

- at what pace the business needs to progress to get there in time,

- and what risks you'll face along the way.

Going through this process regularly is beneficial, both for startups and existing companies, as it helps make informed decisions about how best to allocate resources to ensure the long-term success of the business.

To anticipate future cash flows

Regularly comparing your actual financial performance to the projections in the financial forecast of your grain mill's business plan gives you the ability to monitor your business's financial health and make necessary adjustments as needed.

This practice allows you to detect potential financial issues, such as unexpected cash shortfalls before they escalate into major problems. Giving you time to find additional financing or put in place corrective measures.

Additionally, it helps you identify growth opportunities, like excess cash flow that could be allocated to launch new products and services or expand into new markets.

Staying on track with these regular comparisons enables you to make well-informed decisions about the amount of financing your business might require, or the excess cash flow you can expect to generate from your main business activities.

To secure financing

A detailed business plan becomes a crucial tool when seeking financing from banks or investors for your grain mill.

Investing and lending to small businesses are very risky activities given how fragile they are. Therefore, financiers have to take extra precautions before putting their capital at risk.

At a minimum, financiers will want to ensure that you have a clear roadmap and a solid understanding of your future cash flows (like we just explained above). But they will also want to ensure that your business plan fits the risk/reward profile they seek.

This will off-course vary from bank to bank and investor to investor, but as a rule of thumb. Banks will want to see a conservative financial management style (low risk), and they will use the information in your business plan to assess your borrowing capacity — the level of debt they think your business can comfortably handle — and your ability to repay the loan. This evaluation will determine whether they'll provide credit to your grain mill and the terms of the agreement.

Whereas investors will carefully analyze your business plan to gauge the potential return on their investment. Their focus lies on evidence indicating your grain mill's potential for high growth, profitability, and consistent cash flow generation over time.

Now that you recognize the importance of creating a business plan for your grain mill, let's explore what information is required to create a compelling plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

Information needed to create a business plan for a grain mill

Drafting a grain mill business plan requires research so that you can project sales, investments and cost accurately in your financial forecast, and convince the reader that there is a viable commercial opportunity to be seized.

Below, we'll focus on three critical pieces of information you should gather before starting to write your plan.

Carrying out market research for a grain mill

Carrying out market research before writing a business plan for a grain mill is essential to ensure that the financial projections are accurate and realistic.

Market research helps you gain insight into your target customer base, competitors, pricing strategies and other key factors which can have an impact on the commercial success of your business.

In particular, it is useful in forecasting revenue as it provides valuable data regarding potential customers’ spending habits and preferences.

You may find that people are interested in grain mills that have multiple functions, such as the ability to grind multiple types of grains. Additionally, market research might reveal that people are looking for grain mills that are easier to use and require less maintenance, which could indicate a preference for automated or electric grain mills.

This information can then be used to create more accurate financial projections which will help investors make informed decisions about investing in your grain mill.

Developing the sales and marketing plan for a grain mill

As you embark on creating your grain mill business plan, it is crucial to budget sales and marketing expenses beforehand.

A well-defined sales and marketing plan should include precise projections of the actions required to acquire and retain customers. It will also outline the necessary workforce to execute these initiatives and the budget required for promotions, advertising, and other marketing efforts.

This approach ensures that the appropriate amount of resources is allocated to these activities, aligning with the sales and growth objectives outlined in your business plan.

The staffing and capital expenditure requirements of a grain mill

Whether you are starting or expanding a grain mill, it is important to have a clear plan for recruitment and capital expenditures (investment in equipment and real estate) in order to ensure the success of the business.

Both the recruitment and investment plans need to be coherent with the timing and level of growth planned in your forecast, and require appropriate funding.

Staffing costs for a grain mill might include salaries for mill workers, maintenance personnel, and management staff. Equipment costs might include the purchase of grinding equipment, such as grinders, sifters, and mixers, as well as storage tanks, conveyor belts, and other necessary tools and machines.

In order to create a realistic financial forecast, you will also need to consider the other operating expenses associated with running the business on a day-to-day basis (insurance, bookkeeping, etc.).

Once you have all the necessary information to create a business plan for your grain mill, it is time to start creating your financial forecast.

What goes into your grain mill's financial forecast?

The financial forecast of your grain mill will enable you to assess the profitability potential of your business in the coming years and how much capital is required to fund the actions planned in the business plan.

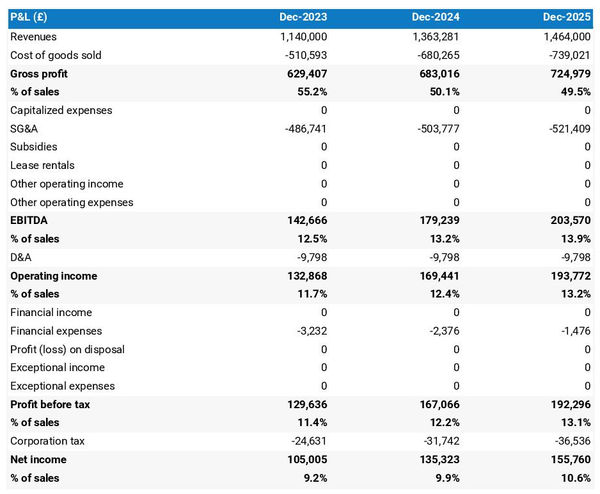

The four key outputs of a financial forecast for a grain mill are:

- The profit and loss (P&L) statement ,

- The projected balance sheet ,

- The cash flow forecast ,

- And the sources and uses table .

Let's take a closer look at each of these.

The projected P&L statement

Your grain mill forecasted P&L statement enables the reader of your business plan to get an idea of how much revenue and profits your business is expected to make in the near future.

Ideally, your reader will want to see:

- Growth above the inflation level

- Expanding profit margins

- Positive net profit throughout the plan

Expectations for an established grain mill will of course be different than for a startup. Existing businesses which have reached their cruising altitude might have slower growth and higher margins than ventures just being started.

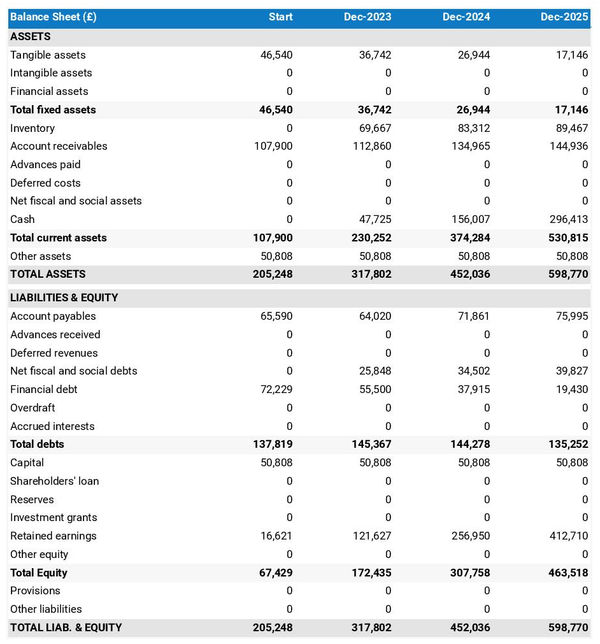

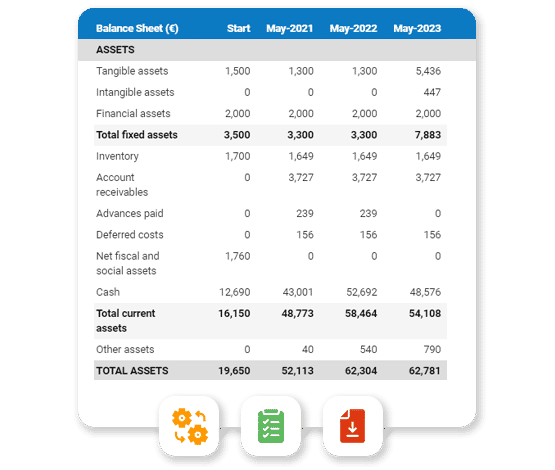

The forecasted balance sheet of your grain mill

The projected balance sheet of your grain mill will enable the reader of your business plan to assess the overall financial health of your business.

It shows three elements: assets, liabilities and equity:

- Assets: are productive resources owned by the business, such as equipment, cash, and accounts receivable (money owed by clients).

- Liabilities: are debts owed to creditors, lenders, and other entities, such as accounts payable (money owed to suppliers).

- Equity: includes the sums invested by the shareholders or business owners and the profits and losses accumulated by the business to date (which are called retained earnings). It is a proxy for the value of the owner's stake in the business.

Analysing your grain mill projected balance sheet provides an understanding of your grain mill's working capital structure, investment and financing policies.

In particular, the readers of your plan can compare the level of financial debt on the balance sheet to the equity value to measure the level of financial risk (equity doesn't need to be reimbursed, while financial debt must be repaid, making it riskier).

They can also use your balance sheet to assess your grain mill's liquidity and solvency:

- A liquidity analysis: focuses on whether or not your business has sufficient cash and short-term assets to cover its liabilities due in the next 12 months.

- A solvency analysis: takes and longer view to assess whether or not your business has the capacity to repay its debts over the medium-term.

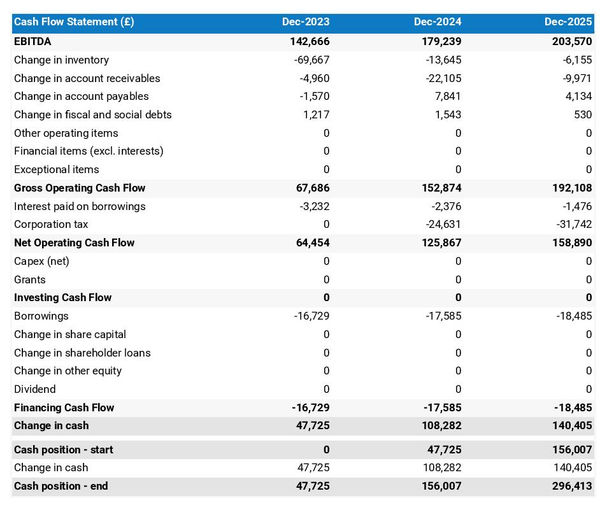

The cash flow forecast

A projected cash flow statement for a grain mill is used to show how much cash the business is generating or consuming.

The cash flow forecast is usually organized by nature to show three key metrics:

- The operating cash flow: do the core business activities generate or consume cash?

- The investing cash flow: how much is the business investing in long-term assets (this is usually compared to the level of fixed assets on the balance sheet to assess whether the business is regularly maintaining and renewing its equipment)?

- The financing cash flow: is the business raising new financing or repaying financiers (debt repayment, dividends)?

As we discussed earlier, cash is king and keeping an eye on future cash flows an imperative for running a successful business. Therefore, you can expect the reader of your grain mill business plan to pay close attention to your cash flow forecast.

Also, note that it is customary to provide both yearly and monthly cash flow forecasts in a business plan - so that the reader can analyze seasonal variation and ensure the grain mill is appropriately funded.

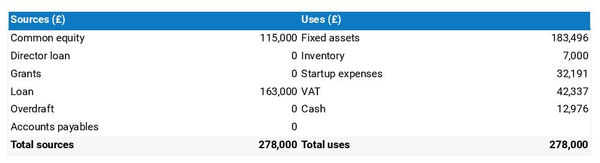

The initial financing plan

The sources and uses table or initial financing plan is a key component of your business plan when starting a grain mill.

It shows where the capital needed to set up the business will come from (sources) and how it will be spent (uses).

This table helps size the investment required to set up the grain mill, and understand how risks will be distributed between the business owners, and the financiers.

The sources and uses table also highlights what the starting cash position will be. This is key for startups as the business needs to have sufficient funding to sustain operations until the break-even point is reached.

Now that you have a clear understanding of what will go into the financial forecast of your grain mill business plan, let's have a look at the written part of the plan.

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

The written part of a grain mill business plan

The written part of a grain mill business plan is composed of 7 main sections:

- The executive summary

- The presentation of the company

- The products and services

- The market analysis

- The strategy

- The operations

- The financial plan

Throughout these sections, you will seek to provide the reader with the details and context needed for them to form a view on whether or not your business plan is achievable and your forecast a realistic possibility.

Let's go through the content of each section in more detail!

1. The executive summary

The first section of your grain mill's business plan is the executive summary which provides, as its name suggests, an enticing summary of your plan which should hook the reader and make them want to know more about your business.

When writing the executive summary, it is important to provide an overview of the business, the market, the key financials, and what you are asking from the reader.

Start with a brief introduction of the business, its name, concept, location, how long it has been in operation, and what makes it unique. Mention any services or products you plan to offer and who you sell to.

Then you should follow with an overview of the addressable market for your grain mill, current trends, and potential growth opportunities.

You should then include a summary of your key financial figures such as projected revenues, profits, and cash flows.

Finally, you should detail any funding requirements in the ask section.

2. The presentation of the company

As you build your grain mill business plan, the second section deserves attention as it delves into the structure and ownership, location, and management team of your company.

In the structure and ownership part, you'll provide valuable insights into the legal structure of the business, the identities of the owners, and their respective investments and ownership stakes. This level of transparency is vital, particularly if you're seeking financing, as it clarifies which legal entity will receive the funds and who holds the reins of the business.

Moving to the location part, you'll offer a comprehensive view of the company's premises and articulate why this specific location is strategic for the business, emphasizing factors like catchment area, accessibility, and nearby amenities.

When describing the location of your grain mill, you could emphasize the potential for growth in the region. You may point out that the area has a large population of people who could be potential customers for your grain mill, and that the area is expected to grow in the near future. Additionally, you could highlight the excellent access to transportation and infrastructure that could make it easier to move your product around. Finally, you could mention the potential for other business opportunities in the area, such as other food-related businesses that could be potential customers for your grain mill.

Lastly, you should introduce your esteemed management team. Provide a thorough explanation of each member's role, background, and extensive experience.

It's equally important to highlight any past successes the management team has achieved and underscore the duration they've been working together. This information will instil trust in potential lenders or investors, showcasing the strength and expertise of your leadership team and their ability to deliver the business plan.

3. The products and services section

The products and services section of your grain mill business plan should include a detailed description of what your company sells to its customers.

For example, your grain mill might offer organic grains, specialty flours, and grain milling services to its customers. Organic grains are guaranteed to be free of synthetic pesticides, fertilizers, and other chemicals. Specialty flours include flours for baking, such as almond, coconut, and oat flours, that offer unique flavors and textures to baked goods. Grain milling services provide freshly milled grains for customers, preserving the natural flavor, texture, and nutritional value of the grain.

The reader will want to understand what makes your grain mill unique from other businesses in this competitive market.

When drafting this section, you should be precise about the categories of products or services you sell, the clients you are targeting and the channels that you are targeting them through.

4. The market analysis

When presenting your market analysis in your grain mill business plan, you should detail the customers' demographics and segmentation, target market, competition, barriers to entry, and any regulations that may apply.

The goal of this section is to help the reader understand how big and attractive your market is, and demonstrate that you have a solid understanding of the industry.

You should start with the demographics and segmentation subsection, which gives an overview of the addressable market for your grain mill, the main trends in the marketplace, and introduces the different customer segments and their preferences in terms of purchasing habits and budgets.

The target market section should follow and zoom on the customer segments your grain mill is targeting, and explain how your products and services meet the specific needs of these customers.

For example, your target market might include people interested in baking their own bread. This market may be drawn to the grain mill because of the freshness and quality of the ingredients. They might also be attracted to the convenience of being able to mill their own grains at home.

Then comes the competition subsection, where you should introduce your main competitors and explain what differentiates you from them.

Finally, you should finish your market analysis by giving an overview of the main regulations applicable to your grain mill.

5. The strategy section

When writing the strategy section of a business plan for your grain mill, it is essential to include information about your competitive edge, pricing strategy, sales & marketing plan, milestones, and risks and mitigants.

The competitive edge subsection should explain what sets your company apart from its competitors. This part is especially key if you are writing the business plan of a startup, as you have to make a name for yourself in the marketplace against established players.

The pricing strategy subsection should demonstrate how you intend to remain profitable while still offering competitive prices to your customers.

The sales & marketing plan should outline how you intend to reach out and acquire new customers, as well as retain existing ones with loyalty programs or special offers.

The milestones subsection should outline what your company has achieved to date, and its main objectives for the years to come - along with dates so that everyone involved has clear expectations of when progress can be expected.

The risks and mitigants subsection should list the main risks that jeopardize the execution of your plan and explain what measures you have taken to minimize these. This is essential in order for investors or lenders to feel secure in investing in your venture.

Your grain mill may face a variety of risks. For example, your company could be exposed to the risk of theft. Grain is a valuable commodity, and your company could be vulnerable to theft if proper security measures are not taken. Additionally, your grain mill could also be exposed to the risk of a natural disaster. Floods, fires, and other disasters could damage equipment, buildings, and the grain itself, leading to significant financial losses. Taking steps to protect against these risks can help to reduce the potential impact of any unfortunate event.

6. The operations section

The operations of your grain mill must be presented in detail in your business plan.

The first thing you should cover in this section is your staffing team, the main roles, and the overall recruitment plan to support the growth expected in your business plan. You should also outline the qualifications and experience necessary to fulfil each role, and how you intend to recruit (using job boards, referrals, or headhunters).

You should then state the operating hours of your grain mill - so that the reader can check the adequacy of your staffing levels - and any plans for varying opening times during peak season. Additionally, the plan should include details on how you will handle customer queries outside of normal operating hours.

The next part of this section should focus on the key assets and IP required to operate your business. If you depend on any licenses or trademarks, physical structures (equipment or property) or lease agreements, these should all go in there.

You may have key assets in the form of physical infrastructure or machinery, such as grain storage silos or grinding machines. You could also have intellectual property such as proprietary grain milling processes or unique recipes for the finished product. These assets and IP might give your grain mill a competitive edge in the market.

Finally, you should include a list of suppliers that you plan to work with and a breakdown of their services and main commercial terms (price, payment terms, contract duration, etc.). Investors are always keen to know if there is a particular reason why you have chosen to work with a specific supplier (higher-quality products or past relationships for example).

7. The presentation of the financial plan

The financial plan section is where we will include the financial forecast we talked about earlier in this guide.

Now that you have a clear idea of the content of a grain mill business plan, let's look at some of the tools you can use to create yours.

What tool should I use to write my grain mill's business plan?

In this section, we will be reviewing the two main solutions for creating a grain mill business plan:

- Using specialized online business plan software,

- Outsourcing the plan to the business plan writer.

Using an online business plan software for your grain mill's business plan

Using online business planning software is the most efficient and modern way to write a grain mill business plan.

There are several advantages to using specialized software:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you're interested in using this type of solution, you can try The Business Plan Shop for free by signing up here .

Need a solid financial forecast?

The Business Plan Shop does the maths for you. Simply enter your revenues, costs and investments. Click save and our online tool builds a three-way forecast for you instantly.

Hiring a business plan writer to write your grain mill's business plan

Outsourcing your grain mill business plan to a business plan writer can also be a viable option.

Business plan writers are experienced in writing business plans and adept at creating financial forecasts without errors. Furthermore, hiring a consultant can save you time and allow you to focus on the day-to-day operations of your business.

However, hiring business plan writers is expensive as you are paying for the software used by the consultant, plus their time, and their profit margin of course.

From experience, you need to budget at least £1.5k ($2.0k) excluding tax for a complete business plan, more if you need to make changes after the initial version (which happens frequently after the initial meetings with lenders or investors).

You also need to be careful when seeking investment. Investors want their money to be used to grow the business, not spent on consulting fees. Therefore, the amount you spend on business plan writing services (and other consulting services such as legal services) needs to be negligible relative to the amount raised.

The other drawback is that you usually don't own the business plan itself: you just get the output, while the actual document is saved in the consultant's business plan software - which makes it difficult to maintain the document up to date without hiring the consultant on a retainer.

For these reasons, outsourcing the grain mill business plan to a business plan writer should be considered carefully, weighing both the advantages and disadvantages of hiring outside help.

Ultimately, it may be the right decision for some businesses, while others may find it beneficial to write their business plan using online software.

Why not create your grain mill's business plan using Word or Excel?

I must advise against using Microsoft Excel and Word (or their Google, Apple, or open-source equivalents) to write your grain mill business plan. Let me explain why.

Firstly, creating an accurate and error-free financial forecast on Excel (or any spreadsheet) is highly technical and requires a strong grasp of accounting principles and financial modelling skills. It is, therefore, unlikely that anyone will fully trust your numbers unless you have both a degree in finance and accounting and significant financial modelling experience, like us at The Business Plan Shop.

Secondly, relying on spreadsheets is inefficient. While it may have been the only option in the past, technology has advanced significantly, and software can now perform these tasks much faster and with greater accuracy. With the rise of AI, software can even help us detect mistakes in forecasts and analyze the numbers for better decision-making.

And with the rise of AI, software is also becoming smarter at helping us detect mistakes in our forecasts and helping us analyse the numbers to make better decisions.

Moreover, software makes it easier to compare actuals versus forecasts and maintain up-to-date forecasts to keep visibility on future cash flows, as we discussed earlier in this guide. This task is cumbersome when using spreadsheets.

Now, let's talk about the written part of your grain mill business plan. While it may be less error-prone, using software can bring tremendous gains in productivity. Word processors, for example, lack instructions and examples for each part of your business plan. They also won't automatically update your numbers when changes occur in your forecast, and they don't handle formatting for you.

Overall, while Word or Excel may seem viable for some entrepreneurs to create a business plan, it's by far becoming an antiquated way of doing things.

- A business plan has 2 complementary parts: a financial forecast showcasing the expected growth, profits and cash flows of the business; and a written part which provides the context needed to judge if the forecast is realistic and relevant.

- Having an up-to-date business plan is the only way to keep visibility on your grain mill's future cash flows.

- Using business plan software is the modern way of writing and maintaining business plans.

We hope that this practical guide gave you insights on how to write the business plan for your grain mill. Do not hesitate to get in touch with our team if you still have questions.

Also on The Business Plan Shop

- In-depth business plan structure

- Key steps to write a business plan?

- Free business plan template

Know someone who owns or wants to start a grain mill? Share this article with them!

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

- Search Search Please fill out this field.

- Manage Your Subscription

- Markets Analysis

Review and evaluate your 2022 grain marketing plan

January is a good time to review and evaluate how well your farm did last year. Here are suggestions on how to first review and then evaluate your marketing plan.

In this era of spreadsheets and QuickBooks accounting, I still like to take a pen and pad and write down trading strategies and ideas for future articles. I find it rewarding to write and then review my ideas as I update my hand-drawn charts. Only then do I pull out my laptop.

- READ MORE: How 2022 lessons can help you plan for 2023 uncertainty

I have been working with farmers to help them make better marketing decisions for more than 40 years. I even have third-generation customers! I have watched some of these farms grow from 320 acres to over 3,000 acres.

The farms that expand and stay profitable do a lot of things right. They know how to maximize yields, how to hire and retain key employees, how to adapt to new technologies, and how to create a flexible marketing plan.

The grain markets have been very volatile in the past year. It has been interesting to see how farmers manage the decisions they make. For farmers with a good marketing plan — and good execution of their plan — the volatile markets can create a sense of pride as prices and profits work higher. On other farms, the day-to-day volatility creates a sense of anxiety: They have sold too soon, and they are frustrated by not hitting "the top."

This corn monthly continuation chart shows the high, low, and close over the past 10 years. The highest high came in August 2012 at $8.44. The low came in April 2020 at $3.00. (This chart shows only the closing price each month so it does not show the highest high and lowest low.) The 10-year high-to-low is $5.44 per bushel. The bottom third of the 10-year range is $3.00 to $4.81. The middle third is $4.81 to $6.62, and the top third is $6.62 to $8.44. With higher production costs in 2023, going into the bottom third of the 10-year trading range will take prices below most farmers' cost of production.

But each year can be a new beginning.

January is a good time to review and evaluate how well your farm did last year. Here are suggestions on how to first review and then evaluate your plan. Grab a pad and pen. (As a bonus, getting this material together now will save you time when you are preparing for your tax appointment in February.)

Start by making a list, month by month, for 2022. For each month, record your grain sales, how many bushels you sold, the futures price and basis the day you sold, and, most importantly, why you made the sale. Be very honest about why you made the sale. This is key to improving your plan next year.

Farmers who struggle with marketing and find that it creates a lot of anxiety — and even family conflicts — will often sell when they panic. Others sell when they need money or make a sale based on something they read on the internet. They are reluctant to make a series of sales as prices move higher because they have FOMO (fear of missing out) about not hitting the top. This sets up panic sales when prices turn lower, especially if the news they read on the internet turns super bearish (as it usually does at the bottom). A lot of these farmers will make only cash sales.

- READ MORE: How Starlink is a reliable internet service for rural America

The farmers who have success in marketing have a plan. Even more important, they use the plan. They control their emotions and have realistic expectations. These farmers are willing to sell as prices go up, knowing that each sale is at a higher profit level. They manage their FOMO.

They still have FOMO, but in a different way: They are not worried about prices going higher, but about what happens if prices turn lower and they are left holding too much inventory. These successful farms usually turn to a combination of marketing tools, including cash sales, hedges, hedge-to-arrive contracts, and put options.

This soybean monthly continuation chart shows the high, low, and close over the past 10 years. The highest high came in August 2012 at $17.94. The low came in May 2019 at $7.80. (This chart shows only the closing price each month so it does not show the highest high and lowest low.) The 10-year high-to-low is $10.14 per bushel. The bottom third of the 10-year range is $7.80 to $11.18. The middle third is $11.18 to $14.56, and the top third is $14.56 to $17.94. As with corn, if prices move to the bottom third of the 10-year trading range, it will take prices below most farmers' cost of production.

Once you complete your review and evaluation, it is time for the next logical question: How do I improve my marketing plan in 2023? Here are three steps.

Step One: Make a marketing team, if you haven't already.

Create a team to share the decision-making process. Involving your spouse, children, or in-laws in talking through decisions is beneficial. It is also likely to reduce your anxiety — and theirs. Building teams is a normal routine in any well-run company. It is even more important in a farm operation, where your marketing team members have a stake — and often a lifelong investment — in the business.

I had to learn this the hard way for my business early in my career. My publishing and brokerage businesses were starting to grow. I had a trusted employee who had to move on for positive reasons. After he left, I wanted his insight, so I called and asked him, "What is it like to work for Al?" After a long pause, he said, "Well, ah ... it is like working for a benevolent dictator." Wow, at least he used the word benevolent. I changed and made an effort to have weekly staff meetings. I sought and used the input from all the team members. It helped me make better decisions.

Step Two: Make time each week to review and update your plan together.

Do this even if it's just you and one other team member. Don't dwell on your marketing during a sleepless night. Instead, sit with your team and talk marketing. On every farm, it takes planning to get the bushels hauled in at the right time. You need to monitor who has the best basis, be aware of how much and what percent you have sold, and know what you still need to price. To do this right, it takes a team. Just the act of saying the plan and goals out loud in your meetings will make it more likely to work. There is a real power in writing down a plan and then saying it out loud. Give it a try.

Step Three: Keep a grain marketing journal.

You need to write why you are making your decisions. Putting a gut feeling into words is very difficult sometimes, especially if that gut feeling is simply panic. But trying to put it into words makes it become more clear to you, whether you like it or not. An important (and sometimes unpleasant) part of this process is being aware of how you are making decisions. That's how you can make better decisions and build a stronger and more profitable farm operation.

Remember that the news is always bullish as prices are going higher and bearish as prices are going lower. Your journal of notes from your weekly team meetings can help you avoid panic sales at the bottom and instead make better decisions in the future. You need to think of your crops like money, because they are.

Final thoughts

I like to teach my Kluis Grain Trading Academy each winter. It is always rewarding for me to see how farmers can change and improve their marketing when they learn and adopt new marketing concepts. A lot of the long-term success of your farm will depend on the financial and marketing decisions you make. Make sure the next generation is learning more each year.

Note: The risk of loss in trading futures and/or options is substantial, and each investor and/or trader must consider whether this is a suitable investment. Past performance — whether actual or indicated by simulated historical tests of strategies — is not indicative of future results. Trading advice reflects good- aith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice given will result in profitable trades.

Al Kluis, Commodity Trader

Al Kluis has been trading grain futures since 1974. Sign up for a free trial to his daily morning email and weekly "Kluis Report" by going to kluiscommodities.com .

Kluis Commodity Advisors 901 - 12 Oaks Center Drive Suite 907, Wayzata, MN 55391

888/345-2855

kluiscommodities.com

Agricultural Business Plan Template

Written by Dave Lavinsky

Agricultural Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their agricultural companies.

If you’re unfamiliar with creating an agricultural business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an agricultural business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is an Agricultural Business Plan?

A business plan provides a snapshot of your agricultural business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Agriculture Business