StudyMonkey

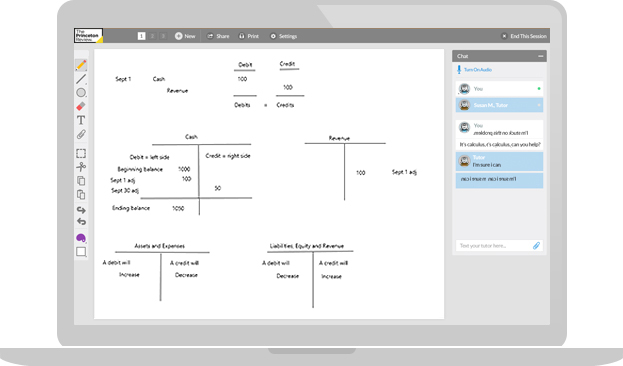

Your personal ai accounting tutor.

Learn Smarter, Not Harder with Accounting AI

Introducing StudyMonkey, your AI-powered Accounting tutor .

StudyMonkey AI can tutor complex Accounting homework questions, enhance your essay writing and assess your work—all in seconds.

No more long all-nighters

24/7 solutions to Accounting questions you're stumped on and essays you procrastinated on.

No more stress and anxiety

Get all your Accounting assignments done with helpful answers in 10 seconds or less.

No more asking friends for Accounting help

StudyMonkey is your new smart bestie that will never ghost you.

No more staying after school

AI Accounting tutoring is available 24/7, on-demand when you need it most.

Accounting is the systematic and comprehensive recording of financial transactions pertaining to a business, and it also refers to the process of summarizing, analyzing, and reporting these transactions to oversight agencies and tax collection entities.

AI Tutor for any subject

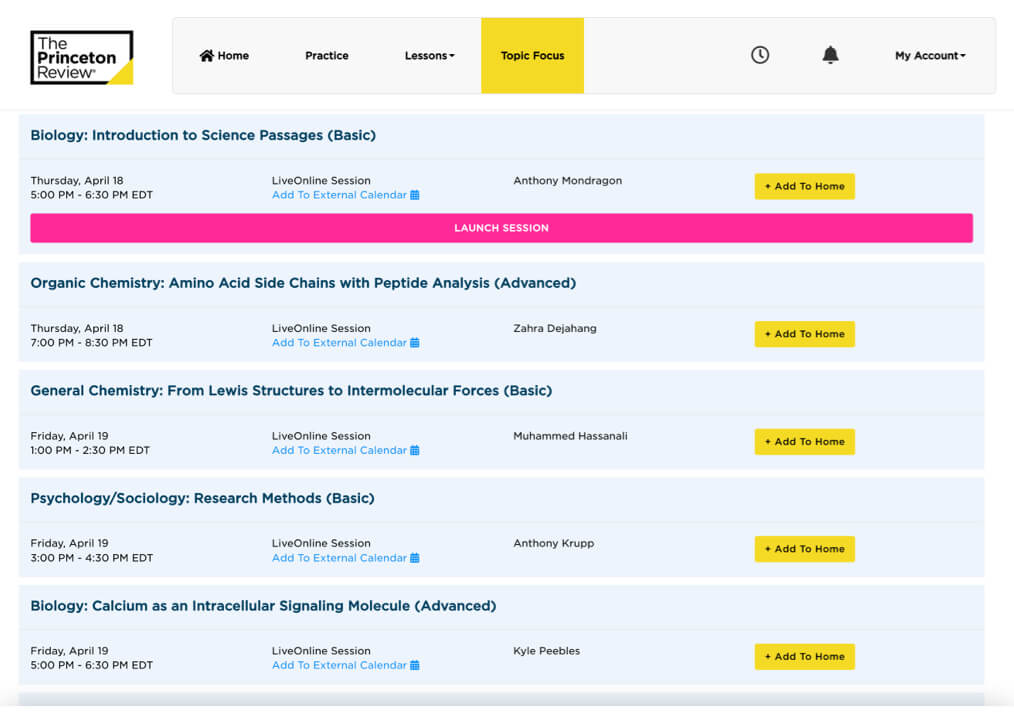

American college testing (act), anthropology, advanced placement exams (ap exams), arabic language, archaeology, biochemistry, chartered financial analyst (cfa) exam, communications, computer science, certified public accountant (cpa) exam, cultural studies, cyber security, dental admission test (dat), discrete mathematics, earth science, elementary school, entrepreneurship, environmental science, farsi (persian) language, fundamentals of engineering (fe) exam, gender studies, graduate management admission test (gmat), graduate record examination (gre), greek language, hebrew language, high school entrance exam, high school, human geography, human resources, international english language testing system (ielts), information technology, international relations, independent school entrance exam (isee), linear algebra, linguistics, law school admission test (lsat), machine learning, master's degree, medical college admission test (mcat), meteorology, microbiology, middle school, national council licensure examination (nclex), national merit scholarship qualifying test (nmsqt), number theory, organic chemistry, project management professional (pmp), political science, portuguese language, probability, project management, preliminary sat (psat), public policy, public relations, russian language, scholastic assessment test (sat), social sciences, secondary school admission test (ssat), sustainability, swahili language, test of english as a foreign language (toefl), trigonometry, turkish language, united states medical licensing examination (usmle), web development, step-by-step guidance 24/7.

Receive step-by-step guidance & homework help for any homework problem & any subject 24/7

Ask any Accounting question

StudyMonkey supports every subject and every level of education from 1st grade to masters level.

Get an answer

StudyMonkey will give you an answer in seconds—multiple choice questions, short answers, and even an essays are supported!

Review your history

See your past questions and answers so you can review for tests and improve your grades.

It's not cheating...

You're just learning smarter than everyone else

How Can StudyMonkey Help You?

Hear from our happy students.

"The AI tutor is available 24/7, making it a convenient and accessible resource for students who need help with their homework at any time."

"Overall, StudyMonkey is an excellent tool for students looking to improve their understanding of homework topics and boost their academic success."

Upgrade to StudyMonkey Premium!

Why not upgrade to StudyMonkey Premium and get access to all features?

- Introduction to Financial Accounting

(4 reviews)

David Annand, Athabasca University

Henry Dauderis

Copyright Year: 2017

Last Update: 2021

Publisher: Lyryx

Language: English

Formats Available

Conditions of use.

Learn more about reviews.

Reviewed by Katheryn Zielinski, Assistant Professor, Minnesota State University Mankato on 6/14/23

The text reading follows typical financial accounting flow. Beginning with the foundational introduction to what accounting is through the full accounting cycle, while including financial statement analysis towards the end of the book. Students... read more

Comprehensiveness rating: 5 see less

The text reading follows typical financial accounting flow. Beginning with the foundational introduction to what accounting is through the full accounting cycle, while including financial statement analysis towards the end of the book. Students will find the format helpful; the voice is student-friendly. There is online homework help for students. Instructors will find the text format friendly to semester-long class as concepts broken down into 13 chapters. The chapters explain the learning outcomes, use examples to express concepts, with chapter summary at end. The topics included are consistent with intro accounting courses.

Content Accuracy rating: 5

No issues noticed with accuracy. The text includes accurate financial accounting information.

Relevance/Longevity rating: 5

For an introductory accounting class with focus on US the concepts covered are typical.

Clarity rating: 5

The content is presented in a student friendly manner. Answers are provided. The extra information is helpful for students wanting extra practice.

Consistency rating: 5

The format and layout of the book chapters are consistent. All users will quickly understand the format as it is applied the same to each chapter. This helps provide consistency for students learning introductory accounting.

Modularity rating: 5

The content within the chapters can be broken-down and assigned as instructor plans for the course length. The manner is which the material is presented flows easily as reading.

Organization/Structure/Flow rating: 5

The text organization is consistent and coherent. Each chapter is presented in same manner.

Interface rating: 5

No observed tech issues. PDF downloaded and used with ease.

Grammatical Errors rating: 5

No grammar or language issues.

Cultural Relevance rating: 5

No cultural insensitive or offensive context noted.

This is a student friendly text. However, students might find a glossary helpful, as well as an index.

Reviewed by Lawrence Overlan, Part-time Professor, Bunker Hill Community College on 6/4/20

I appreciate how the Statement of Cash Flows has a separate chapter towards the end of the book. Might be better to wait until that chapter instead of also discussing it in Chapter One.....lots of material for opening week.... read more

Comprehensiveness rating: 4 see less

I appreciate how the Statement of Cash Flows has a separate chapter towards the end of the book. Might be better to wait until that chapter instead of also discussing it in Chapter One.....lots of material for opening week....

I sampled several problems...all correct.

Hard to make accounting obsolete. All the required material is present.

Problems are presented clearly and with good font size. Excellent color schemes and graphics.

Yes....no problems detected in this area. Very straightforward.

Chapters contain the right amount of content. Not too long with out breakup diagrams or examples etc.

Standard flow of chapters with excellent subdivisions.

To the contrary, the graphics and flow charts break up the material very nicely.

No issues noticed in this area.

Nice work! I will definitely consider adopting.

Reviewed by Patty Goedl, Associate Professor, University of Cincinnati Clermont College on 3/27/18

The text covers all of the topics normally found in an introductory financial accounting (principles of accounting I) text. The table of contents essentially mirrors the table of contents found in the leading texts in this field. I like that... read more

The text covers all of the topics normally found in an introductory financial accounting (principles of accounting I) text. The table of contents essentially mirrors the table of contents found in the leading texts in this field. I like that this text also covers the classified balance sheet, financial disclosures and partnerships.

Content is error-free, accurate, and unbiased.

Relevance/Longevity rating: 4

The content is up-to-date. Introductory accounting does not change often so future updates should be minimal. The authors used the year 2015 in most of the problem and examples. This might make the text "seem" out-of-date in a few years.

The book is clear and concise. The topics are clearly explained and the technical terminology is appropriate for an introductory level.

The writing, style, and formatting are consistent throughout this text.

The text is divided into topical chapters, which is appropriate considering that the concepts build on each other. The chapters are further subdivided into sub-topics. This makes it easy for an instructor to pick which sub-topics to cover.

Excellent organization and flow. The concepts logically build upon each other and the material is presented in a clear fashion.

The HTML interface is excellent. The book has good graphics, end of chapter content, and even video examples.

I did not notice grammatical errors.

The text is not culturally insensitive or offensive in any way

Excellent book that is comparable to any of the leading financial accounting titles. The authors even provide end of chapter problems, videos, and interactive Excel problems for students. Overall, a great resource! I commend the authors for making something of this caliber freely available.

Reviewed by Margarita Maria Lenk, Associate Professor, Colorado State University on 1/7/16

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It is written by Canadian authors, but is relevant to US students. The text begins by explaining the role of financial... read more

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It is written by Canadian authors, but is relevant to US students. The text begins by explaining the role of financial accounting in society, and then describes the underlying structure of double entry accounting systems and the process of recording economic events that impact the value of the organization through the journals and the ledger. The records of these events are then summarized into the primary financial statements. The numeric subtotals and totals on these statements are used to calculate standard financial measures and ratios used to evaluate the organization's performance. The text's organization then proceeds sequentially through the balance sheet accounts, explaining in more detail how the accounting for each category of economic value is recorded and reported. The author's decision to move the most complex content to the end of the book matches how most faculty choose to organize their coverage of these topics.

My reviewed resulted in highest marks regarding accuracy. The only possible concern I would mention here is that the authors use a commonly used technique in chapter two which sometimes leads to students misunderstanding that revenues and expenses are not part of owners' equity until the revenues and expenses are closed at year end to retained earnings. It is my preference to teach introductory students that revenues and expenses are distinct and separate from equity, and then explain that revenues and expenses ultimately get closed to equity. So, this is not an inaccuracy by the authors, just a point that some instructors may want to know before adopting the textbook.

It is my opinion that the content of this textbook will be relevant and current for at least a decade. Any changes made to accounting principles, Canadian or International, will be very easy and straightforward to update.

It is my opinion that the clarity of this text is very high. The authors are succinct and use visuals often to highlight the theoretical structures.

This test is very consistent with the framework that is set up by the authors in the beginning of the text.

The textbook is very clearly divided into separable modules, making it easy for both students to read and for instructors to choose which modules to include in their course.

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It begins by explaining the role of financial accounting in society, and then describes the underlying structure of double entry accounting systems and the process of recording economic events that impact the value of the organization through the journals and the ledger. The records of these events are then summarized into the primary financial statements. The numeric subtotals and totals on these statements are used to calculate standard financial measures and ratios used to evaluate the organization's performance. The text's organization then proceeds sequentially through the balance sheet accounts, explaining in more detail how the accounting for each category of economic value is recorded and reported. The author's decision to move the most complex content to the end of the book matches how most faculty choose to organize their coverage of these topics.

The online text worked perfectly in my Chrome browser. The end of chapter exercises and problems are perfectly formatted on the screen. All assessment materials (quizzes, exams, etc.) are located on a different site that requires registration to have access.

I found the grammar to be very clear, concise and very effective. Because the book is written by Canadians, expenses are sometimes referred to as revenue expenditures, which does not match how US textbooks refer to expenses, but is perhaps a better learning tool, as the expenses are always recorded in the period in which they match the revenue generation, so I support the authors' choices regarding how they refer to the difference between assets (capital expenditures) and expenses (revenue expenditures).

The textbook adequately refers to the international accounting standards. That is the only cultural relevance which is relevant to introductory financial accounting.

I found this textbook and its exercises to be a useful teaching and learning tool. Instructors and students have access to pre-made PowerPoint slides, exercises and problems, and there is the option to enrol in an online service for online assessments, which seem to have student feedback capabilities in addition to assessment gathering capabilities.

Table of Contents

- The Accounting Process

- Financial Accounting and Adjusting Entries

- The Classified Balance Sheet and Related Disclosures

- Accounting for the Sale of Goods

- Assigning Costs to Merchandise

- Cash and Receivables

- Long-lived Assets

- Debt Financing: Current and Long-term Liabilities

- Equity Financing

- The Statement of Cash Flows

- Financial Statement Analysis

- Proprietorships and Partnerships

Ancillary Material

About the book.

This textbook is an adaptation by Athabasca University of the original text written by D. Annand and H. Dauderis. It is intended for use in entry-level college and university courses in financial accounting. A corporate approach is utilized consistently throughout the book.

The adapted textbook includes multiple ancillary student and instructor resources. Student aids include solutions to all end-of-chapter questions and problems, and randomly-generated spreadsheet problems that cover key concepts of each chapter. These provide unlimited practice and feedback for students. Instructor aids include an exam bank, lecture slides, and a comprehensive end-of-term case assignment. This requires students to prepare 18 different year-end adjusting entries and all four types of financial statements, and to calculate and analyze 16 different financial statement ratios. Unique versions can be created for any number of individual students or groups. Tailored solutions are provided for instructors.

The original Annand/Dauderis version of the textbook including .docx files and ancillary material remains available upon request to D. Annand ([email protected]).

About the Contributors

David Annand, EdD, MBA, CA, is a Professor of Accounting in the Faculty of Business at Athabasca University. His research interests include the educational applications of computer-based instruction and computer mediated communications to distance learning, the effects of online learning on the organization of distance-based universities, and the experiences of instructors in graduate-level computer conferences.

David completed his Doctorate in Education in 1998. His thesis deals with the experiences of instructors in graduate-level computer conferences.

Contribute to this Page

US South Carolina

Recently viewed courses

Recently viewed.

Find Your Dream School

This site uses various technologies, as described in our Privacy Policy, for personalization, measuring website use/performance, and targeted advertising, which may include storing and sharing information about your site visit with third parties. By continuing to use this website you consent to our Privacy Policy and Terms of Use .

COVID-19 Update: To help students through this crisis, The Princeton Review will continue our "Enroll with Confidence" refund policies. For full details, please click here.

- Homework Help

- Find a Tutor

- How It Works

- Pre-Med GPA Booster

- Need a test prep tutor? Call us: 888-231-7737

24/7 Online Accounting Tutors

Ask any accounting question and get help in minutes. Our tutors are online 24/7 to help you ace your accounting class.

Try A Free Session

Get On-Demand Accounting Help

Whatever you're working on, your online tutor will walk you step-by-step through the problem and the solution. Ask a quick question, get help with a tricky concept, or let us help you study for your next accounting test. Watch how it works.

Ace Your Accounting Classes

Your Accounting Tutor is Waiting

Get 24/7 accounting help—no appointment needed. Our accounting tutors are online now.

*Based on 2016 survey of students of Princeton Review/Tutor.com

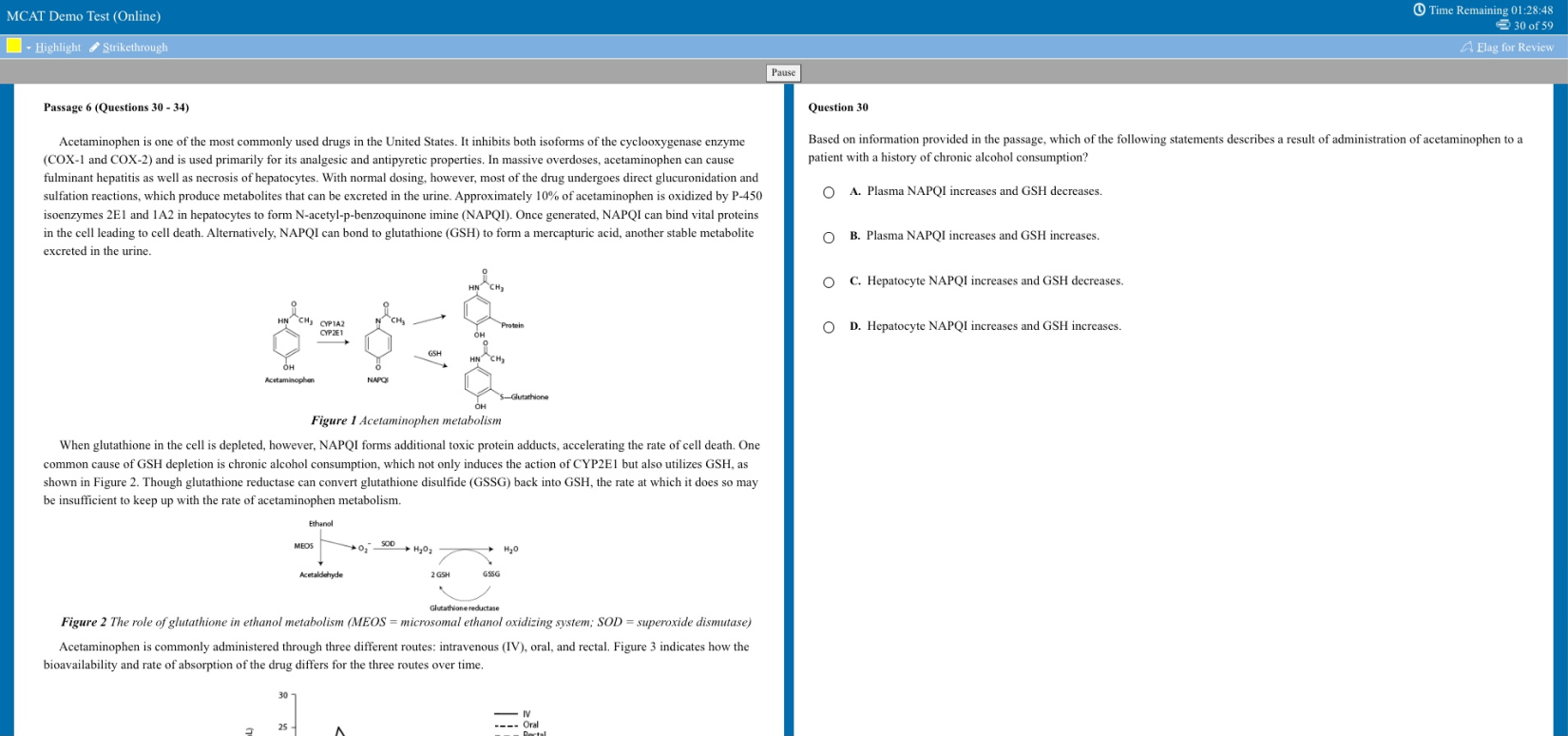

Free MCAT Practice Test

I already know my score.

MCAT Self-Paced 14-Day Free Trial

Enrollment Advisor

1-800-2REVIEW (800-273-8439) ext. 1

1-877-LEARN-30

Mon-Fri 9AM-10PM ET

Sat-Sun 9AM-8PM ET

Student Support

1-800-2REVIEW (800-273-8439) ext. 2

Mon-Fri 9AM-9PM ET

Sat-Sun 8:30AM-5PM ET

Partnerships

- Teach or Tutor for Us

College Readiness

International

Advertising

Affiliate/Other

- Enrollment Terms & Conditions

- Accessibility

- Cigna Medical Transparency in Coverage

Register Book

Local Offices: Mon-Fri 9AM-6PM

- SAT Subject Tests

Academic Subjects

- Social Studies

Find the Right College

- College Rankings

- College Advice

- Applying to College

- Financial Aid

School & District Partnerships

- Professional Development

- Advice Articles

- Private Tutoring

- Mobile Apps

- Local Offices

- International Offices

- Work for Us

- Affiliate Program

- Partner with Us

- Advertise with Us

- International Partnerships

- Our Guarantees

- Accessibility – Canada

Privacy Policy | CA Privacy Notice | Do Not Sell or Share My Personal Information | Your Opt-Out Rights | Terms of Use | Site Map

©2024 TPR Education IP Holdings, LLC. All Rights Reserved. The Princeton Review is not affiliated with Princeton University

TPR Education, LLC (doing business as “The Princeton Review”) is controlled by Primavera Holdings Limited, a firm owned by Chinese nationals with a principal place of business in Hong Kong, China.

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

Financial Accounting and Reporting Classroom Materials

Financial Accounting and Reporting is an important part of the accounting curriculum. The skills students learn in your classroom will not only prepare them for more advanced courses, but to one day succeed in a career. The below are supplemental curriculum resources that the AICPA Academics team have reviewed and think can be used in the classroom.

Award-Winning Curricula

The Academics team is proud to offer award-winning curricula designed to encourage faculty and expand the knowledge of accounting students. The curricula below is from the Accounting Professors Curriculum Resource tool and has been recognized for excellence with the Bea Sanders/AICPA Innovation and Teaching Award , the George Krull/Grant Thornton AAA Innovation in Junior and Senior-Level Teaching Award, or the Mark Chain/FSA Innovation in Graduate Teaching Award .

- A Better Way to Teach Effective Interest Method Related Problems in Accounting This resource presents a simpler method of teach accounting problems involving the use of the effective interest method. The method stimulates student interest by focusing on the economics of the transaction and relating it to real-life examples.

- Accounting in the Headlines: A News Blog for the Introductory Accounting Classroom This resource shares Wendy Tietz's "Accounting in the Headlines" blog in which she writes stories about real-life companies and events that can be used in the accounting classroom to illustrate introductory financial and managerial accounting concepts.

- Accounting Challenge (ACE): Mobile-Gaming App for Learning Accounting Accounting Challenge is the first mobile-gaming app for teaching financial accounting. ACE aims to enhance learning of accounting outside the classroom by engaging students to play and learn accounting on the go.

- A FASB Accounting Standards Codification Project for Introductory Financial Accounting This exercise is designed as a team project in which introductory accounting students act as a consultants to a client seeking guidance on issues surrounding a start-up venture. Students must access and cite the Codification as the basis for the materials they submit in fulfillment of the project requirements.

- Attracting the Best and Brightest to Accounting: Establishing an Honors Accounting Course This resource presents one school's approach to attracting and recruiting the best and brightest students toward accounting by offering an honors accounting course.

- Beyond Debits and Credits... Service Learning in Accounting This resource presents a service learning project implemented in two accounting courses to enhance student skills in communication and teamwork.

- Business From the Idea to the Seasoned Offering: Accounting and Financial Statements Reflecting Business Activities This project takes accounting education from bookkeeping to holistic active business learning including how financial statements build to reflect the business.

- Chocolate: Accounting as a First year Seminar This resource provides a thematic approach at combining first year seminars and accounting programs using student activities that are simultaneously engaging and assessable.

- Creative Strategies for Teaching MBA Level Accounting This resource presents a new concept for teaching accounting to MBA level students. At its heart, accounting centers on measurement of historical transactions or the measurement of future opportunities. this course turns the focus from rules, to the tools leaders need to manage a complex organization.

- Cultivating Deep Learning in the Principles of Accounting Classes through Philanthropy-Based Education This philanthropy project goes beyond service learning or volunteerism. Students make real decisions that have immediate impacts on their community. Students award funding to not-for-profit agencies based on a competitive proposal process.

- Digital Storytelling for Engaged Student Learning This resource uses digital story telling, a movie, to enhance students' technical competence in accounting. The story uses 12 episodes to follow three young business graduates who started their own business and discover along the way the role of financial information in managing a business venture.

- FASB Accounting Standards Codification: Student-Authored Research Exercises This resource is based on the notion that the best way to learn something is to teach it. Students in a financial accounting graduate class demonstrate their master of GAAP research skills by creating research assignments using the FASB Accounting Standards Codification.

- Forming Groups in the Age of YouTube This resource uses a variation of speed dating as a means for forming groups in an introductory accounting class. By learning more about their classmates prior to self-selecting a group this method allows students to choose better groups.

- Getting Started in the Throughbred Horse Business: A Review of Some Basic Accounting Principles This resource provides reinforcement of common accrual accounting concepts centered on the breeding and racing operations of a small thoroughbred horse business. This curriculum is appropriate to use after students have been exposed to fixed assets, inventory, profit and loss and cash flow reporting.

- IFRS Immersion This resource provides instructions for teaching an IFRS course from the standpoint of foreign companies that have already dealt with the problems and issues associated with converting from local GAAP to international GAAP.

- IFRS Projects Using Dual Reporting of IFRS and U.S. GAAP This resource illustrates integrating IFRS learning into financial accounting curricula by incorporating valuable contrasting information from the dual reporting.

- Integrated Accounting Principles: A New Approach to Traditional Accounting Principles Courses This resource describes an integrated accounting principles course that combines traditional financial and managerial accounting courses into a single six hour course.

- Introducing Freshmen Students in the Accounting/Finance Course to the Library This resource describes a series of online, interactive tutorials and quizzes to help students learn fundamental concepts and skills of company and industry related research.

- Introduction to Financial Accounting Case Project: Arctic Blast Ice Cream Store This case provides an opportunity for students to apply accounting concepts to a simple business venture. The project lasts 4-6 weeks and covers three distinct phases of the management process: business decision making, performance and evaluation.

- Let's Go to the Movies: Using Movies as an Ethics Assignment This project involves students watching a series of predetermined movies and noting the ethical dilemma. At the end of the semester each student must defend one of the movies as a nominee for "A Must See Ethics Movie" for accounting/business students.

- Mini-responsibility Centers: A Strategy for Learning by Leading This resource explains the concept of using mini-responsibility centers (MRCs) to decentralize large financial, managerial and cost accounting courses. In return the students are more focused and engaged.

- Modeling Uncertainty in C-V-P Assignments: Going Beyond the Basics! This resource provides an outline for using the Monte Carlo Simulation to offer graduate students an opportunity to rapidly come to insights about probabilistic model building and interpretation. The simulation combines quantitative skills and qualitative skills along with reports and presentations.

- Northwind Data Query Exercise This project encourages students to consider the evolution of data sources for financial reporting and evaluate how to acquire and manipulate information in this emerging business reality; by actually practicing queries and exporting information to worksheets.

- Reinventing Student Engagement and Collaboration within Introductory Accounting Courses This resource provides ideas for increasing engagement and collaboration in the introductory accounting class. Examples include student projects, flipped classroom applications and in-class problems.

- Responsibilities and Choices: An Active Engagement Exercise for Introductory Accounting Courses This exercise provides students with an opportunity to perform a basic due diligence task, complete a relatively simple working paper to document their work and make a decision. The exercise has embedded moral temptation and ethical issues and examines ethical choices that students make in the presence of time pressure and reward structures that encourage aggressive performance.

- TeachingIFRS.com This document provides information on TeachingIFRS.com which was created in response to the rapid growth of IFRS and lack of high quality and effective teaching resources. The site consolidates and provides links to numerous freely available IFRS pedagogical materials.

- Testing Critical Thinking Skills in Accounting Principles This resource describes a method for testing critical thinking skills in an accounting principles course. Using this method, each testing period is divided into two parts. First, students complete an individual traditional test. The second part is a critical thinking exercise called "the challenge problem".

- The Accounting Profession Post Sarbanes-Oxley: An Approach to Impart Knowledge About the Conceptual Framework and Attract Students to the Accounting Major This document provides the description of a program entitled "The Accounting Profession Post Sarbanes-Oxley". The program provides students with an opportunity to better understand important elements of the conceptual framework. It also provides an overview of the career opportunities in accounting.

- The Accounting Tournament - March Madness in Financial Accounting This resource describes implementation of an end of year comprehensive review using brackets as a model. Students are randomly placed in the bracket and compete against each other for extra credit points.

- The Amazing Accounting Race: An Introductory Accounting Semester Project This project engages students with an exciting internet race around the professional world of accounting. Students obtain clues to complete tasks, encounter detours, road blocks and fast forwards. The assignments utilize students' synthesis skills and computer application skills as they collect facts about accounting careers from the internet and assemble data in an organized format.

- The College to Professional Experience This resource outlines a program that serves to better prepare students for the "real world" by changing the perception of education from "learning by doing" to "doing and making to learn with technology". The project aims to move beyond traditional models of education to leverage technology to facilitate new methods of delivery and understanding.

- The Farming Game and the Introductory Financial Accounting Course: An Accounting Simulation The Farming Game enables students to develop many of the skill-based competencies needed by students entering the accounting profession, regardless of career path. The Game provides experiential learning of various accounting principles. It is a learning opportunity that offers students a degree of reality and a larger view of the system.

- Understand FX Risk by Playing Monopoly This resource uses a short version of Monopoly to understand the FX risk impact on net income.

- Back to the Future: Using Accounting History to Explore Professional Opportunities In this project students read an article about a period of time in accounting history and present their findings to the class in a video format. Students then tie what they have learned in the presentations to the field of accounting today as well as the future.

- From Pacioli to Picasso: Using Art to Enhance Critical Thinking in Accounting Capstone Courses This resource outlines using name cards, picture drawings and classic artwork to help students enhance their critical thinking skills. The exercise sets the tone for a course that requires them to think about more than rules and regulations and instead delve into the "why" and "what could be."

- Digging Deep: Using Forensic Analytics as a Context to Teach Microsoft Excel and Access This resource describes a graduate level case that focuses on the development of technology skills through the lens of forensic analysis.

- Who Moved My Classroom? Community Linked Learning and Assessment This resource describes three exercises that expand learning beyond the classroom. The first exercise allows students to discover the linkage between classroom studies and what practitioners do in the "real world". The second allows students to apply the COSO model to internal controls. The third requires students to interpret financial statements for a friend.

Additional Materials

Here are additional materials we reviewed and think are useful to incorporate into the classroom.

- IIRC Database of Research on Integrated Reporting The International Integrated Reporting Council (IIRC) launched the <IR> Academic Database, a searchable collection of more than 200 articles, books, chapters, dissertations, and other pieces of scholarly research on the advancement, adoption, and practice of integrated reporting.

- A destination is only as good as its compass. The new My 360 is here to help you create a free plan personalized to your financial needs by helping guide you through all the resources 360 Degrees of Financial Literacy has to offer.

We are the American Institute of CPAs, the world’s largest member association representing the accounting profession. Our history of serving the public interest stretches back to 1887. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education and consulting.

About AICPA

- Mission and History

- Annual Reports

- AICPA Media Center

- AICPA Research

- Jobs at AICPA

- Order questions

- Forgot Password

- Store policies

Association of International Certified Professional Accountants. All rights reserved.

- Terms & Conditions

Select a product below:

- Connect Math Hosted by ALEKS C

- My Bookshelf (eBook Access) C

Sign in to Shop:

- Professional

- International

- Sign In

- There are currently no items in your shopping cart.

- News & Insights

- Diversity, Equity & Inclusion

- Social Responsibility

- About

- Get Support

Get Support

- My Account Details

Products by Course

- Accounting Information Systems (2)

- Advanced Accounting (5)

- Auditing (5)

- Computerized Accounting (5)

- Cost Accounting (4)

- Financial Accounting (15)

- Financial and Managerial Accounting (Two Semesters) (3)

- Governmental/Non-Profit (3)

- International Accounting (2)

- MBA Financial (5)

- Managerial Accounting (11)

- Payroll Accounting (7)

- Taxation (28)

- Accounting Principles (3)

- Assurance Services (4)

- College Accounting (9)

- Corporate Financial Reporting (1)

- Data Analytics for Accounting (3)

- Financial Statement Analysis (5)

- Forensics Accounting (1)

- Intermediate Accounting (3)

- Introduction to Data Analytics for Accounting (2)

- MBA Managerial (3)

- Other Accounting (2)

- Survey of Accounting (6)

Accounting Ledger blog

Make course prep easier with the Connect Get Started Kit and much more.

Stop being tech-support for students and use these resources to start a new term hassle free.

Stay on your path to success with tools to manage your reports, due dates, and more.

Resources for Administrators – We are Here to Support Your Staff, Faculty, and Students

We offer a variety of flexible solutions and services to help your faculty and staff maintain academic integrity, increase educational equity, and improve student engagement.

Managerial Accounting

18th edition.

Financial Accounting: Information for Decisions

11th edition.

Financial Accounting

6th edition.

Intermediate Accounting

Mcgraw hill business program: supercharge your students’ readiness.

McGraw Hill’s Business Program exists to supercharge your students’ readiness, through their college experience and for their careers. As the market leader, McGraw Hill will help your students stay engaged and motivated while acquiring the quantitative and soft skills they need to succeed—from analytics to communication.

Multiple Choice

Answers will vary but should include factors such as starting salaries, value of fringe benefits, cost of living, and other monetary factors.

Answers will vary but should include considerations such as price, convenience, features, ease of purchase, availability, and other decision-making factors.

Responses should comment on the growth Netflix has experienced. Although this may have been due to subscription price increases, the biggest driver of these increases is the number of subscriptions. While this is only a few data points, it does appear likely that Netflix will continue to grow sales in the next year or so. Factors influencing this prediction would be competition, changes in the streaming market, and economic considerations.

Answers will vary, but responses should state, in a sentence or two, the primary purpose of the entity. The goal of this exercise is to have students clearly communicate why the entity exists, the stakeholders served by the entity, and the role accounting plays in the organization.

Answers will vary but should highlight aspects of each model: Brick-and-mortar : higher investment in physical storefront, interior, etc., to attain visual appeal; insurance and regulatory requirements; space/storage considerations; lower delivery costs; no delivery time. Online : less overhead costs, higher delivery costs, higher website and technology costs, competition.

Manufacturer: movies; service: hotels, restaurants, waste removal, entertainment; retail: shopDisney, clothes and apparel.

Answers will vary but should include the key services of the SEC related to regulation and enforcement. You may be particularly interested to explore the SEC’s whistle-blowing initiatives. Responses regarding required filings for publicly traded companies should include a discussion about the relationship between transparency and protecting the public interest. The significant amount of invested capital by the investing public is also relevant to the discussion.

Answers will vary but should include the increase in popularity of energy drinks and Monster’s partnership with the Coca-Cola Company (which now owns close to a 17% stake in Monster). Considerations as to whether or not to purchase Monster shares today would include the estimated future performance of the company, the energy drink market, purchasing at a high point, etc.

Answers will vary but should include a discussion of the importance for accountants to provide information that is unbiased. Accountants have an obligation to protect the public interest by reporting information that is useful for decision-making but does not sway the user in a particular way. Accountants are in a unique position where they serve many stakeholders, including their employer, clients, and the public. The interests of all stakeholders must be considered while maintaining the highest level of integrity.

Answers will vary and may include certifications/licensing in nursing, information technology, engineering, human resources management, counseling, medicine, and many other occupations.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 1: Financial Accounting

- Publication date: Apr 11, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-financial-accounting/pages/chapter-1

© Dec 13, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

The Edu Partner

How to Prepare an Accounting Assignment

Preparing an accounting assignment requires thorough and proactive thinking and a planned discipline. Accounting assignments are one of the most important evaluation tools to understand your knowledge of financial concepts. Additionally, the complexities demand strategic accounting assignment help.

In this guide, we will study effective preparation strategies by providing step-by-step guidelines for success. Students and professionals can easily understand accounting assignments by reading the requirements, researching thoroughly, and using an organised outline structure to write and read through. Follow us as we delve into the core components, such as literature review and methods, to ensure your accounting project thoroughly comprehends financial ideas that have practical implications for our discipline.

Table of Contents

Importance of Accounting Assignments

Accounting assignments play a significant role among students as they mediate between theory and practice. These tasks enable students to put accounting principles into practice in real-life situations and develop analytical problem-solving skills. Most students hire a professional accounting assignment helper to ace their projects.

Furthermore, these papers better comprehend financial concepts and equip students for professional issues. Analysing data, researching, and presenting findings improve critical thinking skills and increase communication abilities. To sum up, successful completion and mastering of accounting assignments allow the students to gain the necessary skills and confidence in working out the complexities of financial reality that play a crucial role when embarking on professional careers.

Steps to Prepare Your Assignments

These Papers require proper planning and detailed steps. Students have to give undivided attention to their papers, no matter what. With the increasing challenges of accounting, students are bound to seek accounting assignment help . Check the steps below to understand the steps needed to prepare an impactful assignment.

Understand the Assignment Requirements

Comprehending assignment requirements is paramount. Read guidelines carefully, paying attention to the important points such as topic, scope and format. Determine special instructions, word count limit and submission dates. This first step gives you a clear plan ahead, keeps away any deviations and ensures that your accounting assignment fits the requirements set by your instructor to a T. Moreover, with a proper understanding of the requirements, you are set to work in the right direction.

Research and Gather Information

Study your accounting assignment with thoroughness. Seek the guidance of a reliable accounting assignment helper and use reliable sources such as textbooks, academic journals and web materials. Make sure the information is recent and relevant to your subject. Record every little detail meticulously and arrange them systematically. This step aims to create an informed and complete assignment framework, offering appropriate information and insights to support your analysis and discussions effectively.

Create an Outline

Develop a structured plan for your accounting assignment. Break it down into the relevant portions, including the introduction section, literature review part, methodology chapter, findings discussion portion and finally, conclusion. Additionally, hire accounting assignments help to ensure a smooth flow of ideas, with each section coherently connected to the next one. This necessary step maximises the cohesion and readability of your assignment, as it helps you through this activity while helping you effectively convey insights from a relevant perspective.

Introduction and Background

Start your accounting assignment with an engaging introduction that briefly summarises how and why you will accomplish the purpose of this work. Write out the clear objectives and questions that your assignment aims to answer. This establishes the tone and creates interest in your assignment, detailing financial principles and concepts. Moreover, you can hire a professional accounting assignment helper for better results. Furthermore, your introduction briefly summarises your paper and summarises your knowledge and findings.

Literature Review

Perform a thorough literature review that demonstrates your knowledge of recent research and theories in the accounting field. Embed key findings from reliable sources, focusing on their relation to your assignment’s purpose. Your literature review draws from current knowledge to show your expertise. It reveals gaps that open up a way for you to make unique contributions to this assignment on accounting discourse. Additionally, you can hire a service offering online assignment help Australia for reliable sources and materials.

Methodology and Analysis

Demonstrate the methodology utilised in your account assignment by tracing data collection measures and evidence instruments. Use tables and graphs where appropriate to present findings. This section illustrates how you have approached this task, pointing out that your methodology is systematic and rigorous, allowing the reader to understand clearly your capacity for accurate data interpretation and aiding in giving substance and credibility to the accounting assignment. Besides, make sure your methodology answers all the possible questions.

Discuss your findings in the accounting assignment comprehensively. Demonstrate critical thinking by relating the results to existing literature and theoretical frameworks. Seek a professional accounting assignment help to define the limitations of your study and suggest areas for future research. This part enhances the assignment by identifying links between your analysis and better financial ideas, promoting further insight and demonstrating how you can critically assess.

Conclusion and Reference

The conclusion of your assignment summarises key points, reaffirming the importance of the findings. Do not present new information and summarise the main arguments briefly. Make sure to cite all the sources correctly according to a particular referencing style (APA, MLA, etc. A careful approach to referencing makes your accounting assignment more plagiarism-free, gives it credibility and enhances overall professionalism. Additionally, hire an accounting assignment helper if you are unsure of the citation and referencing styles.

Proofreading and Editing

Ensure that your accounting assignment is properly proofread and edited before submission. Look for advice from other peers or teachers to gain useful insights and increase clarity. This careful review provides a neat and faultless document, bringing the overall quality of your assignment higher. A well-edited submission suggests professionalism and attention to detail, meaning those who evaluate your work will see you in a positive light. Additionally, seek online assignment help in Australia for reliable editors.

In The End,

A successful accounting assignment is an elaborate process, from understanding requirements to presenting well-researched findings. By following a well-structured plan, comprehensive research, and adequate methodologies, students and professionals can address the intricacy of financial concepts. Accounting assignments are significant because they teach how to combine theoretical knowledge with practical application while increasing critical thinking and communication skills. As a result of this process, an assignment that has been correctly proofread and referenced makes genuine contributions to academia. Besides, students can always seek professional accounting assignment help to smoothen their process.

LANGKAHCURANG2024 SLOTGACOR2024 SLOTGACOR2024 agen89 agen89 bantengjp WDKAN138 WDKAN138 GASKAN138 1win patriot globet88 globet88 maxwin77 macantogel bimagacor mamen4d mamen123 bantengjp bantengjp bantengjp 1win 1win 1win patriot88 patriot88 patriot88 mamen4d mamen4d mamen4d mamen4d mamen4d bantengjp 1win patriot globet88 globet88 maxwin77 macantogel bimagacor mamen4d luna805 luna805 luna805 mamen4d

You might also like

6 Essential Guidelines To Make Writing Programming Assignments Easy

Top Tips for Choosing a Reliable Management Assignment Help Service inside the UK

15 Effective Tips For Writing A Great Assignment

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Assignment on Accounting

Accounting forms the backbone of all business operations and refers to the analysis and reporting of all financial transactions. Despite being a speciality subject, the field makes use of concepts from other domains as well. Writing a good accounting assignment is therefore a difficult task which requires stringent research. In order to meet these research needs, Researchomatic has provided a section dedicated to accounting assignments.

- Click to Read More

Getting Started On Risk Management

Accounting assignment, solyndra solar, financial accounting, worldcom - case study, accounting - modules 2, case assignment and session long project, conservation easement, generate free bibliography in all citation styles.

Researchomatic helps you cite your academic research in multiple formats, such as APA, MLA, Harvard, Chicago & Many more. Try it for Free!

Boost Your Grade with Our Top-Tier Online Accounting Assignment Help

Struggling with pending accounting assignments that keep you up at night? Look no further! Our online accounting assignment help service is here to rescue you. Whether it's cost accounting, managerial accounting, business accounting, or auditing, our team of expert accounting assignment helpers covers it all. We dedicate 100% effort to deliver comprehensive accounting assignments that not only meet your professor's expectations but also help you outshine your peers. The best part is our affordability, offering top-notch accounting assignment solutions at a budget-friendly price

GET ACCOUNTING ASSIGNMENT HELP INSTANTLY

Send your accounting assignment now and get a free quote.

Access an Array of Accounting Assignment Help Services Online Under One Roof

Our team's expertise spans a wide range of accounting subjects, reflecting our commitment to providing comprehensive accounting assignment help services to students aiming to excel in their academic coursework and assignments. We understand that the field of accounting is diverse and multifaceted, and our experts are well-equipped to tackle the intricacies of each area. No matter the accounting subject or the level of difficulty, our goal is to be a trusted academic partner for students, helping them achieve academic success, gain a deeper understanding of accounting concepts, and ultimately, build a strong foundation for their careers in accounting and finance. Browse through some of the accounting topics our experts specialize:

This area involves calculating and assessing the costs associated with business activities. It helps in determining the cost of goods sold and setting appropriate selling prices. Our cost accounting assignment helpers excel in solving assignments related to cost allocation, budgeting, and cost control methods, providing detailed and accurate solutions that reflect practical cost accounting scenarios.

Managerial accounting focuses on providing financial information to managers for decision-making. This includes budget preparation, performance analysis, and cost management. Our managerial accounting assignment writing service caters to tasks dealing with these aspects, offering detailed analyses and strategic insights that help students understand the application of managerial accounting in real-world scenarios.

This field involves the preparation of financial statements for external use, adhering to standardized accounting principles. It covers income statements, balance sheets, and cash flow statements. Procure our help with financial accounting assignments if you are struggling with solving tasks that require creating these financial statements and interpreting financial data, ensuring compliance with accounting standards.

International accounting deals with accounting standards and practices on a global scale, including dealing with foreign currencies and international financial reporting standards (IFRS). Our team of international accounting assignment doers is adept at solving assignments that require an understanding of international accounting norms, providing solutions that are globally applicable and compliant.

This topic encompasses the accounting methods focused on taxes, including tax return preparation and understanding tax laws. Our tax accounting assignment writers excel in solving complex taxation accounting assignments, ensuring they reflect current tax regulations and practices, providing comprehensive and up-to-date solutions.

A branch of accounting that involves the integration of accounting, auditing, and investigative skills to examine financial statements for legal purposes, forensic accounting is complex. Students who choose our help with forensic accounting assignments can expect specialized solutions for assignments in this area, providing detailed analysis and investigative insights into financial discrepancies and frauds.

This area focuses on financial management in the public sector, including budgeting and expenditure tracking according to government policies. Accountingassignmenthelp.com is associated with skilled government accounting assignment helpers who excel in solving assignments, offering solutions that reflect an understanding of public sector financial processes and regulations.

Auditing involves examining financial records for accuracy and compliance. Our audit assignment help service offers expert solutions to assignments involving various types of audits, ensuring that they reflect the principles and practices of effective auditing, including compliance and operational auditing.

Covering the fundamentals of accounting in a business context, this includes ledger management and financial statement analysis. Our business accounting assignment experts provide comprehensive solutions to assignments in business accounting, ensuring a thorough understanding of basic accounting practices and their application in a business setting.

Hire Us to Do Your Accounting Assignments For You at an Affordable Rate

We take great pride in offering high-quality accounting assignment assistance at prices designed to be within reach for students. We recognize the financial challenges that students often face during their academic journey and are committed to making our services affordable without compromising on the excellence of our work. Our pricing structure is both transparent and straightforward, allowing you to easily understand the factors that influence the cost of your assignment help. We understand that students have diverse financial circumstances, and our mission is to provide top-notch assistance that doesn't strain your budget. Our pricing is carefully crafted to cater to the needs of students, ensuring that you receive exceptional support while maintaining affordability. We firmly believe that access to high-quality academic assistance should not be a burden on your finances. To provide you with a clear understanding of our pricing, here is a sample table of our prices:

Take Advantage of Our Exclusive Discounts & Seasonal Offers

Our exclusive offers and discounts are a testament to our deep appreciation for our clients. We understand the financial challenges that students often face and are dedicated to making our accounting assignment help services as affordable as possible. Our commitment goes beyond delivering high-quality academic assistance; it extends to ensuring that you have access to cost-effective solutions that empower your academic success. At Accountingassignmenthelp.com, we stand firmly by our commitment to your academic success and your financial well-being. These exclusive offers and discounts are just one aspect of our dedication to providing value, support, and affordability to every student we serve:

We understand the importance of building a lasting partnership with our clients, and that's why we offer a Second Order Discount. It's our way of showing appreciation for your continued trust and loyalty. After your initial order with us, you can enjoy a special discount on your second order and all subsequent orders. This discount reflects our commitment to providing ongoing support and cost-effective solutions as you progress in your academic journey. It's our way of saying thank you for choosing us as your academic assistance provider and coming back for more exceptional assistance.

Throughout the year, we run Seasonal Promotions and holiday discounts to help you save money on your assignments during specific times. Whether it's back-to-school season, the holiday season, or any other special occasion, we offer discounts that align with the spirit of the season. These promotions provide an opportunity for both new and returning clients to access our services at reduced prices. It's our way of spreading the joy and making academic support more affordable during these times.

We value the trust and loyalty of our clients, and our Bulk Order Discount is a token of our appreciation. When you place multiple accounting assignments at once, you become eligible for this special discount. It's our way of recognizing your commitment to our expertise and your confidence in our ability to deliver outstanding results consistently. This discount not only helps you save on each assignment but also acknowledges your long-term partnership with us.

Sharing the positive experiences, you've had with our platform is highly appreciated, and we want to reward you for it. Through our Referral Rewards program, when you refer a friend to our platform, both you and your friend will receive a discount on your next assignments. It's a win-win situation - you get to save on your future orders, and your friend benefits from our high-quality assistance as well. This program is our way of saying thank you for spreading the word about our services and helping us grow.

Avail Our Help with Accounting Assignments Through A Simple & Bureaucracy-Free Process

At Accountingassignmenthelp.com, we've streamlined our ordering process to make it as simple and secure as possible, ensuring that you can access our accounting assignment assistance with ease, even without the need to create an account. With this straightforward and secure ordering process, you can access top-quality accounting assignment assistance with ease and confidence, allowing you to focus on your academic success and future in the field of accounting. Here's a step-by-step guide on how to place an order:

To initiate the order process, simply complete our user-friendly form by providing key assignment details. Start by selecting the type of assignment you need assistance with. Indicate your academic level (undergraduate or graduate) to align with your educational expectations. Specify the accounting subject or topic, share detailed instructions from your instructor, and note the required word count or page length. Additionally, choose your preferred turnaround time and upload any pertinent files.

After providing all the necessary assignment details, simply click the "Get a Quote" or "Calculate Price" button. With this action, you'll receive an instant and transparent price quote for the service. The quote is generated based on the complexity of your assignment, the selected turnaround time, and any additional requirements you've specified.

Take a moment to review the provided quote to ensure it aligns with your budget and meets your requirements. We believe in complete transparency, and there are no hidden fees or unexpected charges. If you're satisfied with the quote and it suits your needs, proceed with confidence to confirm your order.

To finalize and confirm your order, make a secure payment using the available payment options. We accept a variety of payment methods for your convenience, and you can trust that your transaction will be handled securely and efficiently.

Once your payment is processed, you'll promptly receive an order confirmation that includes a unique order ID. This confirmation assures you that your assignment request is now in our system and being processed by our team of accounting experts.

Throughout the assignment process, our integrated messaging system allows you to maintain direct and hassle-free communication with your assigned expert. This feature empowers you to ask questions, provide additional instructions, seek clarifications, or request updates on the progress of your assignment. We prioritize open and effective communication to ensure your satisfaction.

Before your specified deadline, your completed accounting assignment will be delivered to your account on our platform. You will receive a notification as soon as it's ready for download. Your completed assignment will be thoroughly checked for quality, accuracy, and adherence to your instructions, ensuring that it meets the highest standards of excellence.

Incredible Features & Perks that Make Paying for Our Services Worthwhile

At AccountingAssignmentHelp.com, we take pride in offering a comprehensive range of exceptional features that distinguish our accounting assignment help service. These exceptional features collectively define our commitment to providing reliable accounting assignment help , making us your trusted partner for academic success in the field of accounting. Our unwavering commitment to delivering top-quality assistance is reflected in the following key attributes:

- Expert Accounting Professionals: Our team comprises highly qualified and experienced accountants who bring in-depth knowledge and practical expertise to every assignment.

- Customized Solutions: We understand that every student's needs are unique. That's why we tailor each assignment to your specific requirements.

- Plagiarism-Free Work: We uphold the highest standards of academic integrity. Every assignment we deliver is meticulously crafted from scratch, guaranteeing originality and authenticity.

- Timely Delivery: Whether your assignment has a tight timeframe or a more extended delivery window, our commitment to punctuality ensures that you receive your work promptly.

- 24/7 Customer Support: Our dedicated customer support team is available round the clock to assist you.

- Confidentiality: Your privacy is paramount to us. We have robust measures in place to safeguard your personal information and assignment details.

- Multiple Revisions: We are committed to your satisfaction. If you have feedback or require revisions, our team is readily available to make the necessary adjustments.

- Flexibility: Whether you need urgent accounting assignment help , require support at different academic levels, or have specific formatting requirements, we offer flexibility to accommodate your unique needs.

A One-Stop-Shop for the Best Accounting Assignment Help

Our commitment to quality is the cornerstone of our service. We understand that delivering high-quality assignments is not just a goal but an absolute necessity for your academic success. Therefore, we adhere to unwavering standards and implement stringent quality assurance processes to ensure that every assignment we deliver meets the highest benchmarks. Here's a closer look at our commitment to maintaining exceptional quality:

- Expert Team of Writers:

- Customization and Originality:

- Thorough Research:

- Adherence to Guidelines:

- Multiple Quality Checks:

Our Experts Strive to Deliver Plagiarism-Free Accounting Assignment Solutions

We take the issue of plagiarism very seriously. We understand the importance of academic integrity, and our commitment to providing plagiarism-free work is unwavering. Our approach to ensuring plagiarism-free work reflects our dedication to academic integrity and the quality of our services. When you choose AccountingAssignmentHelp.com, you can trust that your assignments are in the hands of a team that places the highest value on originality, integrity, and ethical conduct. Your academic success and reputation are our top priorities, and we take every measure to safeguard them. Here's an overview of our approach to upholding originality and integrity in every assignment:

Our foremost principle is to create assignments from the ground up. We never recycle or repurpose existing content. When you procure our writing service, our experts begin by conducting in-depth research on the topic. This research serves as the foundation for creating entirely unique and customized solutions tailored to your specific requirements.

We are well-versed in various citation styles, including APA, MLA, Harvard, Chicago, and more. Our writers are meticulous about citing sources correctly and referencing all external materials used in your assignment. This ensures that we give proper credit to the original authors and sources, and it helps to strengthen the credibility of your work.

We employ advanced plagiarism detection tools to verify the originality of every assignment. Before delivering the final work to you, we run it through these tools to identify any potential instances of plagiarism. This step provides an additional layer of assurance that the content is entirely free from any form of plagiarism.

Our dedicated quality assurance team conducts thorough checks on each assignment before it is sent to you. They review the content to ensure it adheres to our stringent standards of originality and integrity. This includes confirming that all citations and references are accurate and properly formatted.

We encourage collaboration with our clients throughout the assignment process. If you have specific sources, materials, or ideas you'd like us to incorporate, we take your input into account while crafting the assignment. This ensures that the final work reflects your unique perspective and requirements.

For your peace of mind, we can provide plagiarism reports upon request. These reports detail the results of the plagiarism checks conducted on your assignment, confirming its originality and authenticity. This transparency underscores our commitment to delivering work that is entirely free from plagiarism.

Our writers are well-informed about the ethical guidelines and principles surrounding academic integrity. They are dedicated to upholding these principles in every assignment they complete. This includes avoiding any form of cheating, copying, or using unauthorized materials.

In the rare event that any issues related to plagiarism arise, we are ready to address them promptly. If you have concerns or require revisions, our team is committed to making necessary adjustments to ensure that the assignment is entirely original and aligned with your expectations.

We Excel in Completing College Accounting Assignments without Compromising Quality

Through Accountingassignmenthelp.com, students from prestigious universities can receive specialized and targeted help with college accounting courses, ensuring their assignments are not only completed accurately but also demonstrate a deep understanding of the course content. Here are some of the courses we excel:

- RSM321H1 - Advanced Financial Accounting Topics: This course at the University of Toronto explores advanced aspects of financial accounting, including issues like consolidated financial statements and foreign currency transactions. We specialize in assisting students with complex assignments from this course, providing detailed solutions that cover these intricate financial accounting principles, ensuring students understand and excel in these advanced topics.

- ACCT 362 - Cost Accounting: This course focuses on the principles and practices of cost accounting, including cost allocation, budgeting, and variance analysis. Our service aids students from institutions like McGill University in tackling assignments related to these concepts, offering expert solutions that emphasize practical applications of cost accounting methodologies.

- ACCT 1010 - Accounting and Financial Reporting: This introductory course from the University of Pennsylvania covers the fundamentals of accounting and financial reporting. At Accountingassignmenthelp.com, we help students from the University of Pennsylvania with assignments that demand an understanding of the basic principles of financial accounting, assisting them in creating and interpreting financial statements accurately.

- ACCN08007 Accountancy 1A: As an essential course at the University of Edinburgh, it lays the foundation in both financial and management accounting. Our expertise at Accountingassignmenthelp.com is particularly beneficial for students from the University of Edinburgh, offering assistance in assignments that require a solid understanding of the core concepts of accountancy, ensuring a comprehensive grasp of the subject.

Quality Accounting Assignment Help Online Tailored to the Needs of International Students

At AccountingAssignmentHelp.com, our commitment to supporting international students pursuing accounting degrees in the USA, Australia, the UK, and Canada goes beyond providing mere assistance; it encompasses a deep understanding of the unique challenges they encounter. We recognize that these students often grapple with adjusting to a new educational system, language barriers, and varying accounting standards and practices in their host countries. Our tailored assistance is designed to bridge these gaps effectively. We have a dedicated team of experts well-versed in the specific accounting standards of each country, ensuring that assignments align perfectly with local requirements.

Native Accounting Assignment Helpers in the USA

International students studying accounting in the USA often encounter challenges related to adapting to a new academic system, cultural differences, and language barriers. Our dedicated team of expert writers is well-versed in the U.S. accounting standards and can provide customized assistance to help international students excel in their coursework. We offer comprehensive support with accounting assignments, ensuring that you meet the rigorous academic requirements of American institutions.

Customized Accounting Assignment Help in Australia

For international students studying accounting in Australia, understanding the country's unique accounting principles and regulations can be daunting. Our specialized services cater to these needs by providing assignment help that aligns with Australian accounting standards. We assist in clarifying complex concepts, ensuring accurate compliance, and delivering assignments that reflect a deep understanding of the Australian accounting landscape.

Personalized Accounting Assignment Help for UK Students

The United Kingdom has its own set of accounting principles and practices, which can pose challenges for international students. Our tailored assistance for UK accounting students includes guidance on British accounting standards and regulations. We help international students in the UK grasp these nuances and excel in their assignments, ensuring that they meet the academic expectations of their institutions.

Reliable Accounting Assignment Help in Canada

International students pursuing accounting studies in Canada may encounter challenges related to adapting to a new educational environment and the Canadian accounting framework. Our specialized support addresses these concerns by providing assignment help that adheres to Canadian accounting standards. We assist students in understanding the intricacies of Canadian accounting, enabling them to excel in their coursework.

Well-Researched Blogs Prepared by Certified Accounting Assignment Solvers

Explore our blog section for insightful articles, tips, and resources related to accounting studies and assignments. Our blog is a valuable resource for international students seeking to enhance their understanding of accounting concepts, stay updated on industry trends, and improve their academic skills. Our experts regularly contribute to the blog, sharing their knowledge and expertise to help you succeed in your accounting coursework.

Embarking on the study of accounting involves unraveling a intricate language of numbers and ledgers. As you strive to successfully complete your accounting assignment, a robust understanding of foundational concepts becomes imperative. These principles serve as your compass, navigating the com... Read More

In the intricate world of accounting, students often find themselves at a crossroads when it comes to mastering the concepts and completing assignments. The decision between seeking accounting assignment help through tutors and embarking on a self-study journey is a pivotal one. Both avenues co... Read More

Embarking on the journey to write your accounting assignment can be a daunting task, especially if you're grappling with complex financial concepts and intricate calculations. However, fear not, as mastering the art of accounting assignment writing is within your reach. In this comprehensive gu... Read More

Are you grappling with the intricacies of accounting assignments, desperately searching for a lifeline to help you navigate the challenging terrain of balance sheets, income statements, and ledgers? Fear not! In this digital age, where technology reigns supreme, accounting software emerges as t... Read More

In the intricate and dynamic world of accounting, students often find themselves facing various challenges, particularly when dealing with assignments. It's not uncommon for learners to make critical errors that can impact their grades and hinder their understanding of this vital subject. In ... Read More

Embarking on the journey to take your accounting test can be a daunting task, but fear not! With the right strategies and expert guidance, you can not only navigate the complexities of accounting exams but also excel in them. In this comprehensive guide, we'll delve into a detailed exploratio... Read More

In the dynamic world of business, where financial transactions and reporting play a pivotal role, ethics in accounting emerge as a cornerstone for sustained success and professional integrity. Aspiring accountants and seasoned professionals alike must navigate a complex web of rules and regulat... Read More

Are you struggling to solve your accounting assignment? Tackling accounting assignments can be a daunting task, especially when faced with complex concepts and intricate calculations. To shed light on the intricacies of accounting assignments and provide valuable insights for students, we sat... Read More

In the dynamic world of accounting, staying updated on the latest accounting standards is crucial for students aiming to excel in their academic pursuits and future professional careers. As students navigate through their accounting courses, they often encounter the challenge of adapting to eve... Read More

In the realm of finance and accounting, understanding financial statements is a fundamental skill for students aspiring to navigate the complexities of the business world. Whether you are a budding accountant, finance major, or simply trying to decode the financial language, this step-by-step... Read More

In a world driven by data and analytics, the role of numbers has become more crucial than ever before. The field of accounting, once confined to traditional bookkeeping and financial statements, is now evolving rapidly to meet the demands of a dynamic business landscape. As we step into the fut... Read More

Embarking on an internship in the field of accounting is not just a stepping stone but a vital experience that can shape your future career. In today's competitive job market, gaining practical knowledge and honing your skills during an internship can set you apart from the crowd, offering help... Read More

Embarking on the challenging terrain of tax season is a rite of passage for accounting students, marking a crucial juncture in their academic journey. Navigating the intricacies of tax concepts is not only essential for meeting academic requirements but is also instrumental in preparing student... Read More

In the dynamic landscape of global business, accounting serves as the universal language that enables companies to communicate their financial health and performance. Whether you're a business owner, investor, or student looking to conquer the challenges of accounting assignments, understanding... Read More