What are market trends in a business plan?

Table of Contents

What are market trends?

Why do i need market trends in my business plan, how to keep up with market trends, what market trends to monitor frequently, customer behaviours, technological advances, industry regulations, how to write the market trends in your business plan, using countingup to streamline your business.

Market trends in a business plan are key pieces of information that share where your company sits in the wider picture of your industry. Your business plan should prove why your business is viable, show where you fit in the market and what customers you serve. Examining what the market looks like is a smart business move when starting out.

This article on market trends in a business plan will cover:

- What are market trends

- Why market trends are necessary in my business plan

Market trends are the direction changes of a specific industry and can be influenced by customer behaviours or developing technology.

Take the mobile phone industry for example, as technology has improved over the last twenty years consumers have moved from bulky handsets to slimmer smartphones, that can do everything a computer can and more. Consumers have even gone back to the fashion of flip phones now that technology has allowed a bigger screen that can be folded to save space. This is a good example where both technology and customer demand has influenced the direction of the industry,

Acknowledging these trends when running a business ensures that you stay on the same path as the industry itself, moving with customer needs and adapting your business as the sector and technology evolve. Ignoring market trends in the long term could mean you are left behind by customers, as they may move to businesses that meet their needs more.

Your market trend research should be part of wider market analysis in your business plan. Understanding where you fit in a sector and what separates your company from competitors will help you shape everything from your product to pricing and marketing plans.

It’s important to focus on trends in this process so you can understand what appeals to your target audience. By analysing the market landscape and trends, you will be able to serve your customers better. It will also feed into your marketing messaging and content creation strategy later on.

A market and trend analysis should be both quantitative (using numbers and statistics such as projections and financial forecasts) and qualitative (based on experience or observation). Trends will fit into both categories of research and you should be able to find data and non-numerical information to support your examination of trends when writing your business plan.

It’s important to remember that a business plan is not set in stone. It can be a document that you regularly update to reflect changes in your industry and company.

Keeping pace in a fast-changing market is not easy – after all, you’ve got a business to run. Using social media and subscribing to relevant industry emails make it simpler to get the information you need. Doing this will allow you to stay on top of market trends to include in your initial business plan and for more long-term future planning.

Follow influencers in your industry to see what they talk about and how they create content for the audience that you serve. This will give you an idea of what resonates with your target customers when it comes to content and the form of content the influencer tends to use (video, written blogs, imagery etc.).

Read relevant publications in your sector to find out what is making headlines. Magazines or online blogs that share up-to-date opinions and thought leadership (influential content) will help you stay on the pulse of what is currently important to the industry.

Reading detailed reports and research can be time-consuming but will give you a good overview of the industry’s current state and any new developments. You can then update your business plan to follow the trends that arise from any data you’ve seen.

Some common areas will affect the running of your business, the trends in your business plan and the whole market landscape. Keeping on top of the following aspects and regularly checking in on them will ensure your business develops as the market does.

Your customer can make or break your business. If you don’t cater to their needs and wants, your business will not be on the radar of your target audience.

Let’s take an example – if your target customer is under 45, and you primarily do business online, you will need to ensure your website is optimised for mobile. This is because consumer behaviours have changed in recent years, and most searches are now conducted via mobile . If you don’t pick up on this development, your business risks being left behind when competitors optimise for mobile and you don’t.

Like our previous example, customer behaviour often changes with advances in technology. As mobile phones, and then smartphones, have become more able to operate as a computer, consumers have moved to using their phones out of convenience.

Keep on top of developments that are relevant to your business and make sure you can move with, and not against, the technology changes.

Every now and again, there will be a law change or new regulation that rocks many industries – such as GDPR in 2018. Staying up to date with regulations that could affect the way you run and market your business will save you weighty fines (especially in the case of data protection).

There may be more frequent regulation updates if you operate in an industry that requires you to follow safety guidelines or best practices, such as those that an electrician or builder will have to follow.

Ensuring that you are up to date on precautions and rules, as well as renewing any professional certifications you need to operate, will ensure your business plan reflects the changing face of your industry.

Using your research on your target customers and the sector, use the following steps to write up the market trends section of your business plan:

- Current market overview, including which company has the biggest share or most influence

- Where you fit in that market, what gives your business a competitive edge.

- Current trends that impact your business operation

- Any upcoming trends that may impact your business or the products/services you offer

- Outline any plans on how you will keep up with trends

- Upcoming regulatory changes

You can then follow this with your competitor research in your business plan, to give a full picture of your industry and where you fit in.

Now that you have the answers to questions like ‘what are market trends in a business plan’, you will be able to prepare a thorough market analysis to set up your new venture for success.

Countingup can help your new business by making your business accounting simple, too. Countingup is the business account with built-in accounting software. The app is helping thousands of business owners across the UK save time and money by automating the time consuming parts of accounting. Find out more here and get started today.

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

Business insurance from superscript.

We’re partnered with insurance experts, Superscript to provide you with small business insurance.

How to register a company in the UK

There are over five million companies registered in the UK and 500,000 new

How to set up a TikTok shop (2024)

TikTok can be an excellent platform for growing a business, big or small.

Best Side Hustle Ideas To Make Extra Money In 2024 (UK Edition)

Looking to start a new career? Or maybe you’re looking to embrace your

How to throw a launch party for a new business

So your business is all set up, what next? A launch party can

10 key tips to starting a business in the UK

10 things you need to know before starting a business in the UK

How to set up your business: Sole trader or limited company

If you’ve just started a business, you’ll likely be faced with the early

How to register as a sole trader

Running a small business and considering whether to register as a sole trader?

How to open a Barclays business account

When starting a new business, one of the first things you need to

6 examples of objectives for a small business plan

Your new company’s business plan is a crucial part of your success, as

How to start a successful business during a recession

Starting a business during a recession may sound like madness, but some big

What is a mission statement (and how to write one)

When starting a small business, you’ll need a plan to get things up

Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Market Size in a Business Plan

Market Size in a Business Plan

… the market size looks like this …

What is Market Size?

To the investor, the solution in itself has no value unless it can be realized in the market place. Ultimately, it will be the industry market size that decides the value of your business to an investor and, as a rule of thumb, the bigger the available market, the better.

How to Calculate Market Sizes

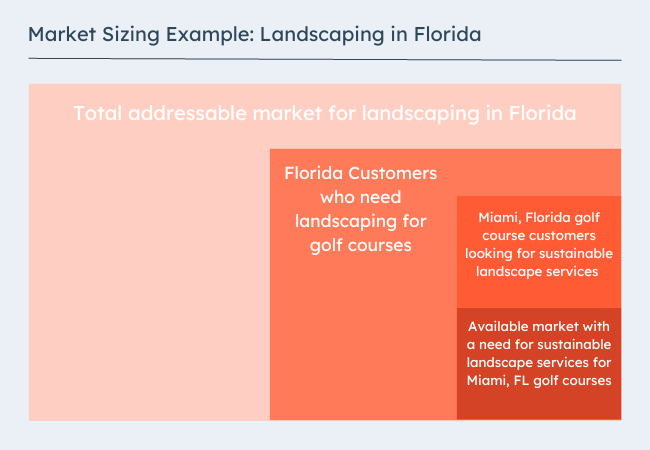

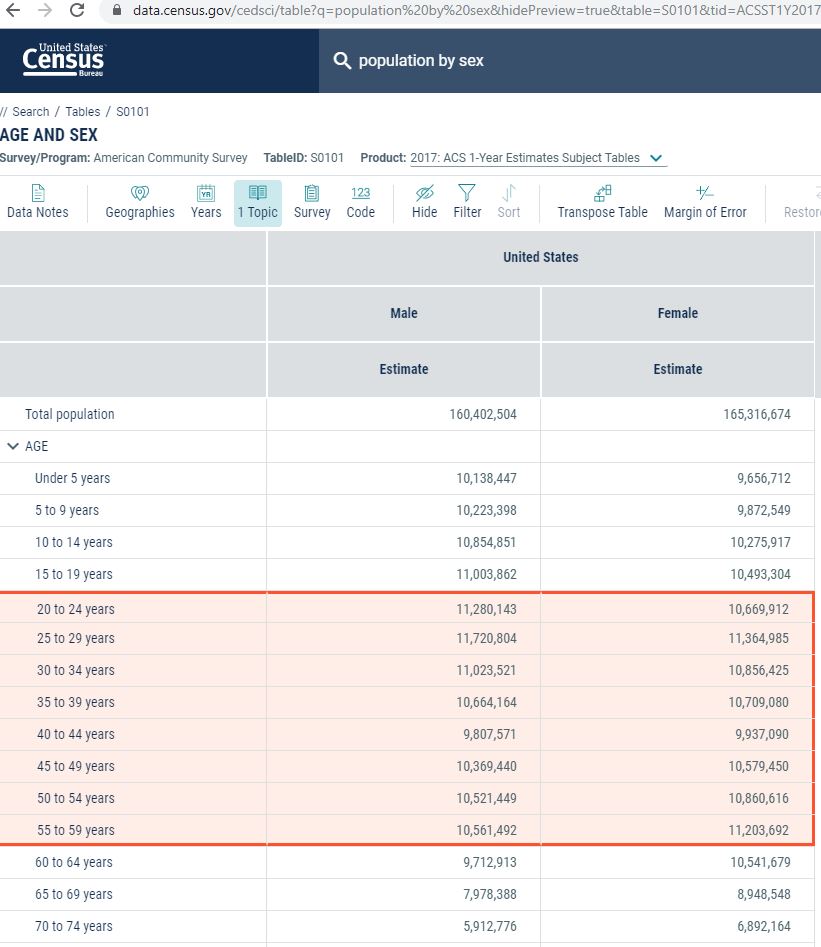

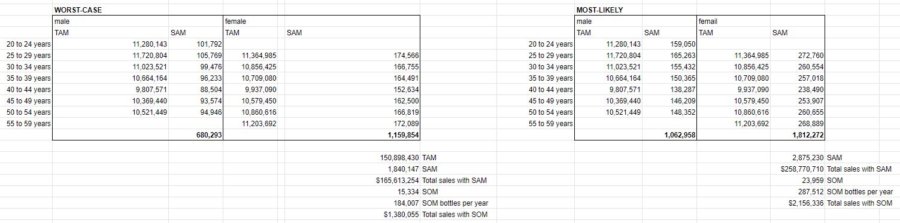

TAM (Total Available Market) is the total market size (people, revenues, units etc.) who have the problem you are seeking to solve today.

SAM (Served Available Market) is the part of the TAM who are able to use your solution to the problem. This is your target market .

Available Market Size Estimation

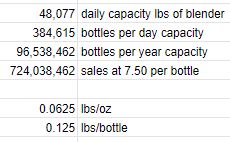

The total available market or TAM is based on the number of properties in the region which use lawn care treatments. Using a top down approach, Government statistics might show that there are six million properties with gardens and industry analysis reveals that 3% of properties use lawn care treatments, and spend an average of 150 per year. The TAM is calculated as follows:

TAM = 6 million x 3% x 150 = 27 million per year

This means that if your business operated throughout the entire region with no competition its revenues would be 27 million per year. TAM defines the maximum size for the market the business operates in.

However, at the moment not all of the TAM are able to use your lawn care service as you only have one lawn care outlet in one town in the region. The market which is able to use your solution is limited to the town, so the serviceable available market or SAM is based on the number of properties with gardens within the town. Again, Government statistics might show that there are one million properties with gardens in the region, so the SAM is given as follows:

SAM = 1 million x 3% x 150 = 4.5 million (16.7% of TAM)

If there was no competition within the town and you had the resources to provide the service , then the revenue from the business would be 4.5 million per year. The SAM represents 16.7% of the TAM.

Market Size and Growth

The investor will also want to know whether this is a growing or declining market. The market size section of the business plan should also give an indication of the potential for growth over the next five years. We might be able to find additional market size data which shows that the number of properties with gardens will grow to 20.5 million, and the number using lawn care treatments is expected to increase to 4%, with an average spend of 165. the TAM is calculated as follows:

TAM = 6.5 million x 4% x 165 = 42.9 million per year in five years time

Like wise for the town the number of properties with gardens might be expected to increase to 1.15 million, and the SAM is given as follows:

SAM = 1.15 million x 4% x 165 = 7.59 million (17.7% of TAM)

Market Estimate Presentation in the Business Plan

The business plan market size section can be presented in a number of formats, but a simple column format setting out the TAM and SAM now and in five years time, will allow the investor to quickly ascertain how big the market for the product could be and it prospects for growth over the duration of the business plan.

Market sizing is an important part of the business plan process. But this is planning not accounting. The market size section is an educated guess at how big the available market for the product is and aims to show that a successful launch and continued growth for the product is possible. It is based on available statistics and trade association data.

A few key points should be remembered when trying to determine market size

- Start from verifiable and accurate base data. In the above example, the starting point was a government statistic based on the number of properties with gardens.

- Double check any information with an alternative source if possible.

- Check the results make sense.

- Check the results using a bottom up calculation. For example, if you know a lawn care business in the region has revenue of 500,000 and estimated 2% of the market, then the TAM should be in the order of 500,000 / 2% = 25 million compared to the 27 million calculated above.

- Keep the industry definition narrow, in this case lawn care treatments.

- Be specific, don’t try and say for example, there are millions of properties in the world with gardens and if we can take a very small percentage of that our plan will work.

- The analysis will differ depending on whether you are dealing with an existing market or a completely new market. For an existing product there will be market and industry data available, for a new product you may need to carry out market size research with potential customers and work upwards from there.

This is part of the financial projections and Contents of a Business Plan Guide , a series of posts on what each section of a simple business plan should include. The next post in this series is about the analysis of the target market for the business plan product.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

The 2 Simple & Straightforward Methods for Market Sizing Your Business

Published: September 21, 2023

When you’re considering a new venture, one of the first things you should do is determine whether there is a valuable market for it.

Discover the methods to calculate your market size and accurately measure your business’ revenue potential .

Keep reading, or jump to the section you’re looking for:

What is market sizing?

Market sizing terms to know, how to calculate market size, market sizing methods.

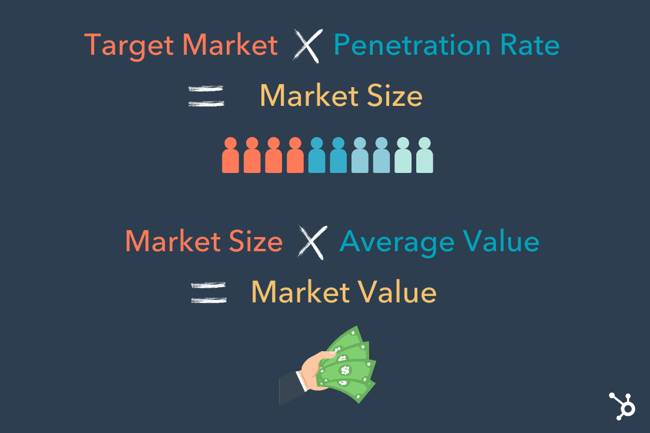

Market sizing is the process of finding how big your product's audience or revenue could be. So, market size is the total number of potential buyers for a product or service and the potential revenue reach based on that population size.

When market sizing, you're calculating customer numbers to measure the growth potential of your business.

.png)

Free Market Research Kit

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

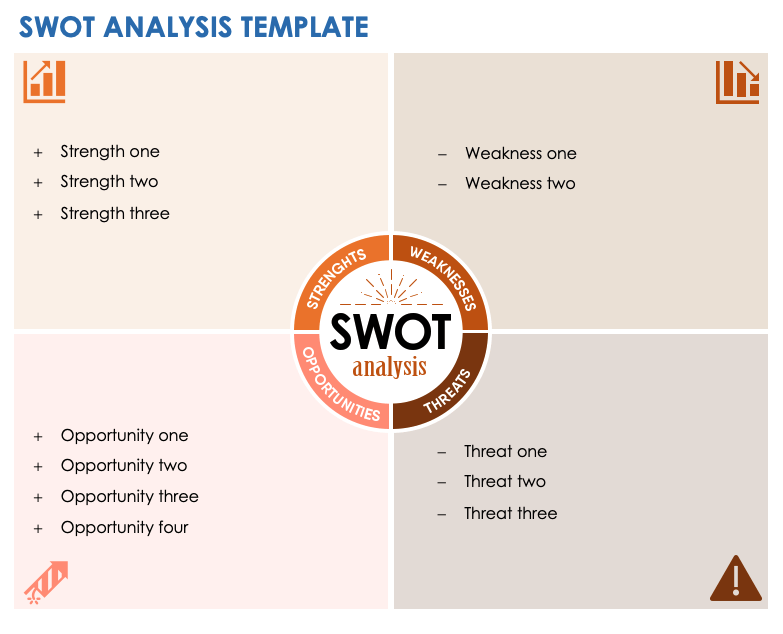

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why is market size important?

There are several reasons why every business should spend time sizing its market:

- Market sizing helps you figure out if your product is a worthy investment. Say you have a great idea for a product but there are only 100 people who would buy it. From there, you can decide if that population size is worth the cost of manufacturing, production, distribution, and more for your product.

- Market sizing helps you estimate profit and potential for growth. If you know how many people your business has the potential to reach, you can estimate how much revenue you can generate. This is valuable for both business owners as well as investors.

- Market size defines who you’re marketing to and what their needs are. No business can succeed without marketing. Knowing your market size is the first step in understanding your target market and their needs.

- Market sizing helps your business make better decisions. Understanding your market landscape, gaps, and opportunities will inform your decision-making. It can also help you set more realistic goals, assign resources, and refine your strategies.

- Market sizing helps your business minimize risk. Starting or expanding a business is inherently risky. Understanding your market can help you anticipate and prepare for challenges.

Market Size vs. Market Value

Market size is the total potential demand for a product or service. This number usually calculates the number of potential customers, units sold, or revenue generated. So, market size is an estimate of the overall market reach.

Market value refers to the financial worth or estimated market capitalization of a company or industry. It’s a measure of perceived value. It can give you an idea of how much a company could sell for in a given market.

In summary, market size focuses on the potential market opportunity, while market value is the financial value of an individual company or an entire market.

Before diving into how to figure out your market size, there are a few helpful terms you should get to know.

TAM stands for Total Addressable Market. This number is the maximum potential revenue or customer base that a company could achieve if it were to capture 100% of market share.

SAM stands for Serviceable Addressable Market. SAM is a part of the TAM that aligns with the company's resources, capabilities, and target customers.

SOM stands for Serviceable Obtainable Market. SOM is the part of the SAM that a company can get at its current scale. This figure may consider marketing and sales strategies, competitive positioning, and product demand.

Check out this post to learn more about TAM, SAM, and SOM and how to calculate them.

Target Market

A target market is a specific group of customers, industries, or segments that a company focuses on. It's the customer segment that's most likely to show interest, purchase, and appreciate a company's products or services.

Penetration Rate

Penetration rate refers to the percentage of a target market that a company has successfully captured. It shows the level of market share reached by a company in a specific market segment or overall market.

If you're a new business, you can calculate penetration rate by dividing your total customers by the number of potential customers in the target market. Then, multiply the result by 100 to get the percentage.

Learn more about market penetration here.

Market Segmentation

Market segmentation is the process of dividing the total market into distinct groups or segments. Usually, the people in these segments have common characteristics, needs, or behaviors.

Segmenting the market can help you better understand your target customers. It can also help you tailor business strategies, like marketing , to meet specific segment needs.

Value Proposition

A value proposition is the unique benefits that a company offers to its target customers. It differentiates a company's product or service from competitors and creates value for customers.

Understanding the value proposition is crucial in market sizing. This is because it can help you find the specific customer segments that will find the most value in your offer.

Try one of these free value proposition templates to draft your value proposition.

- Start with your total addressable market.

- Find a group of customers to focus on within that target market.

- Figure out how many of those customers are likely to buy your product.

- Multiply that customer number by estimated penetration rate.

While calculating market size takes only a few steps, it's a crucial process. The steps below will help you understand the potential demand and revenue opportunities for your business.

1. Start with your total addressable market.

You can calculate your TAM by multiplying the total customers in a market by the annual value per customer. But before calculating, make sure you take a look at the tips below:

- Define your product or service. While developing a product can be quick, growing a business around a product is more complex. It's important to clearly understand your product or service and how it solves a problem or meets a need in the market.

- Find your market category. Some products fall within more than one industry or market category. This is the first step that will narrow your TAM. So, think carefully about what you expect customers to compare your offer to.

- Conduct market research. Gather relevant data and information about your potential users. If you're new to market research, check out this free market research kit , with research and planning templates.

- Analyze the competition. Conduct competitive analysis to figure out the market share and unique value of your top competitors.

- Define your total addressable market. With the research and analysis you've pulled together, create a realistic TAM estimate.

2. Find a group of customers to focus on within that target market.

Dig into the tips below to quantify the top customers in your market:

- Create your ideal buyer persona. Use the Make My Persona tool to outline the characteristics, demographics, and behaviors of your ideal customers.

- Segment your target market. Start dividing your target market into distinct segments. You might base segments on factors like age, location, interests, or buying behavior.

- Continue market research. Continue collecting data and insights about each segment. This will help you understand how big each segment is, as well as their needs, preferences, pain points, and purchasing habits. Your ongoing market research might include surveys, interviews, focus groups, or analyzing existing market research.

- Set pricing for your product or service. For some products, pricing is a deciding purchase factor. So, if you haven't already, set pricing or a price range for your products.

- Assess segments of your market and prioritize . Think about each segment's size, growth potential, and competition. It's also a good idea to think about how each segment aligns with your company's capabilities and resources. In short, don't just focus on segments that offer the most attractive opportunities. Make sure they align with your strengths and needs.

- Refine your buyer personas. With your prioritized segments, take another look at your ideal customer profile. This will give you a more useful buyer persona for your marketing and sales strategies.

- Confirm your SAM with market testing. Test your target segments with a product or service pilot group, measuring their responses and feedback.

3. Figure out how many of those customers are likely to buy your product.

This step will narrow your scope more intensely on the customers who need exactly what you have to offer. These are the people who are looking for you or a clear alternative to your competitors. To quantify this group:

- Create a customer journey map. From awareness to purchase, this process can help you map out the ideal customer path. From how you expect customers to discover your products to the blockers that might keep them from clicking buy, this step is useful for market sizing and beyond. Use these customer journey templates if you're new to this process.

- Estimate conversion rates. Use historical data, industry benchmarks, or industry research to estimate conversion rates. This can help you quantify expected numbers of leads, prospects, and customers in each segment.

- Figure out buyer intent. Create a ranking or score for each segment to measure their likelihood of purchasing your product. This can help you prioritize segments with the highest conversion potential.

- Create a SOM estimate with your data. The research above will add credibility to your market size estimate. It can also help guide your growth strategies.

4. Multiply that customer number by estimated penetration rate.

To calculate penetration rate, divide the SOM you calculated above by your TAM, then multiply by 100.

Once you have a calculation for your market size, you'll want to make sure you can trust that number. Keep your market sizing current with these tips:

- Confirm your data is accurate and reliable. As you complete your research, use reliable sources such as industry reports, market studies, or government databases. Also, check to ensure the data you're referencing is up to date.

- Keep up with market growth, seasonality, industry trends, tech advancements, regulatory changes, and economic conditions. These factors can affect both market size and customer demand.

- Review and update your market size estimates regularly. Market conditions change over time. Plan regular reviews of your market size, then update your calculations with new or relevant data.

There are two simple methods for market sizing your business. These straightforward processes can help you use data to gauge market size.

Top Down Approach

The first is a top-down approach, in which you start by looking at the market as a whole, then refine it to get an accurate market size. That would look like starting from your total addressable market and filtering from there.

Don't forget to share this post!

Related articles.

![market size and trends in business plan sample Solving the Crisis of Disconnection: How to Unite Your Brand Around Growth [Expert Tips & Data]](https://blog.hubspot.com/hubfs/solving-for-company-disconnection_3.webp)

Solving the Crisis of Disconnection: How to Unite Your Brand Around Growth [Expert Tips & Data]

3 Reasons So Many Business Strategies Fail (And How To Succeed), According to the Strategy Hacker

Business Strategy: What It Is & How to Build an Effective One

How to Automate Your Business's Reporting Workflows

7 Challenges for Growing Businesses (& How to Fix Them)

7 Reasons Scale-Ups Earn Investments, According to HubSpot's Founder

A Marketer's Short & Sweet Guide on Diversification

15 Effective Ways to Cut Costs in Business

How to Find Your Business's White Space Opportunities

How These 7 Companies Thrived During the Recession

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

How to Write the Market Analysis Section of a Business Plan

Written by Dave Lavinsky

What is the Market Analysis in a Business Plan?

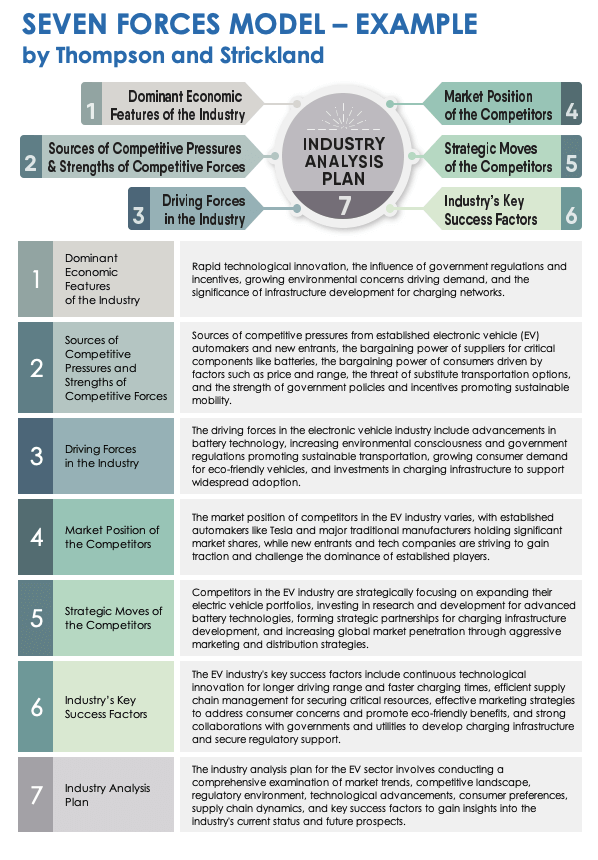

The market analysis section of your business plan is where you discuss the size of the market in which you’re competing and market trends that might affect your future potential such as economic, political, social and/or technological shifts.

This helps you and readers understand if your market is big enough to support your business’ growth, and whether future conditions will help or hurt your business. For example, stating that your market size is $56 billion, has been growing by 10% for the last 10 years, and that trends are expected to further increase the market size bodes well for your company’s success.

Download our Ultimate Business Plan Template here

What Should a Market Analysis Include?

You’ll want to address these issues in your market analysis:

- Size of Industry – How big is the overall industry?

- Projected Growth Rate of Industry – Is the industry growing or shrinking? How fast?

- Target Market – Who are you targeting with this product or service?

- Competition – How many businesses are currently in the same industry?

Learn how to write the full market analysis below.

How to Write a Market Analysis

Here’s how to write the market analysis section of a business plan.

- Describe each industry that you are competing in or will be targeting.

- Identify direct competition, but don’t forget about indirect competition – this may include companies selling different products to the same potential customer segments.

- Highlight strengths and weaknesses for both direct and indirect competitors, along with how your company stacks up against them based on what makes your company uniquely positioned to succeed.

- Include specific data, statistics, graphs, or charts if possible to make the market analysis more convincing to investors or lenders.

Finish Your Business Plan Today!

Industry overview.

In your industry overview, you will define the market in which you are competing (e.g., restaurant, medical devices, etc.).

You will then detail the sub-segment or niche of that market if applicable (e.g., within restaurants there are fast food restaurants, fine dining, etc.).

Next, you will describe the key characteristics of your industry. For example, discuss how big the market is in terms of units and revenues. Let the reader know if the market is growing or declining (and at what rate), and what key industry trends are facing your market.

Use third-party market research as much as possible to validate the discussion of your industry.

Here is a list of additional items you may analyze for a complete industry overview:

- An overview of the current state of the industry . How big is it, how much does it produce or sell? What are its key differentiators from competitors? What is its target customer base like – demographic information and psychographics? How has the industry performed over time (global, domestic)?

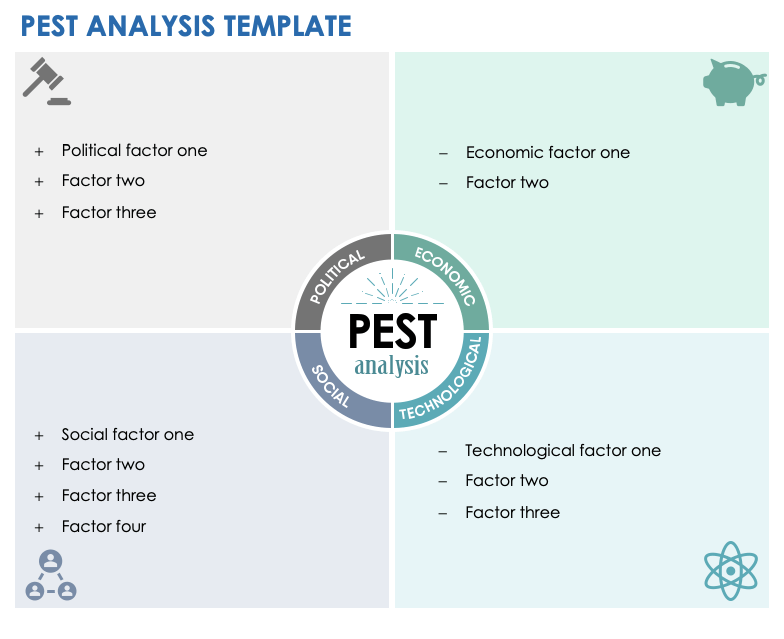

- Analyze the macro-economic factors impacting your industry . This includes items such as economic growth opportunities, inflation, exchange rates, interest rates, labor market trends, and technological improvements. You want to make sure that all of these are trending in a positive direction for you while also being realistic about them. For example, if the economy is in shambles you might want to wait before entering the particular market.

- Analyze the political factors impacting your industry . This is an often-overlooked section of any business plan, but it can be important depending on what type of company you are starting. If you’re in a highly regulated industry (such as medical devices), this is something that you’ll want to include.

- Analyze the social factors impacting your industry . This includes analyzing society’s interest in your product or service, historical trends in buying patterns in your industry, and any effects on the industry due to changes in culture. For example, if there is a growing counter-culture trend against big oil companies you might want to position yourself differently than a company in this industry.

- Analyze the technological factors impacting your industry . This includes analyzing new technologies being developed in software, hardware, or applications that can be used to improve your product or service. It also includes emerging consumer trends and will be highly dependent on your business type. In a technology-related venture, you would analyze how these changes are impacting consumers. For an educational-related venture, you would analyze how these changes are impacting students, teachers, and/or administrators.

For each of these items, you want to provide some detail about them including their current state as well as what external factors have played a role in the recent past. You can also include many other important factors if they apply to your business including demographic trends, legal issues, environmental concerns, and sustainability issues.

When you are done analyzing all of these factors, wrap it up by summing them up in a statement that includes your view on the future of the industry. This should be positive to attract investors, potential customers, and partners.

If you’re having trouble thinking about all of these factors then it might be helpful to first develop a SWOT analysis for your business.

Once you have an understanding of the market, you’ll need to think about how you will position yourself within that potential market.

Picking Your Niche

You want to think about how large your market is for this venture. You also want to consider whether you’d like to pick a niche within the overall industry or launch yourself into the mainstream.

If you have an innovative product it can be easier to enter the mainstream market – but at the same time, you might face some additional competition if there are similar products available.

You can choose to specialize in a niche market where you’ll face less competition – but might be able to sell your services at a higher price point (this could make it easier for you to get potential customers).

Of course, if your product or service is unique then there should be no competition. But, what happens if it isn’t unique? Will you be able to differentiate yourself enough to create a competitive advantage or edge?

If you are planning on entering the mainstream market, think about whether there are different sub-niches within your specific market. For example, within the technology industry, you can choose to specialize in laptops or smartphones or tablets, or other categories. While it will be more difficult to be unique in a mainstream market, you will still be able to focus on one type or category of products.

How Will You Stand Out?

Many companies are able to stand out – whether by offering a product that is unique or by marketing their products in a way that consumers notice. For example, Steve Jobs was able to take a business idea like the iPhone and make it into something that people talked about (while competitors struggled to play catch up).

You want your venture to stand out – whether with an innovative product or service or through marketing strategies. This might include a unique brand, name, or logo. It might also include packaging that stands out from competitors.

Write down how you will achieve this goal of standing out in the marketplace. If it’s a product, then what features do you have that other products don’t? If it’s a service, then what is it about this service that will make people want to use your company rather than your competition?

You also need to think about marketing. How are you going to promote yourself or sell your product or service? You’ll need a marketing plan for this – which might include writing copy, creating an advertisement, setting up a website, and several other activities. This should include a description of each of these strategies.

If you’re struggling with the details of any of these sections, it might be helpful to research what other companies in your market are doing and how they’ve been successful. You can use this business information to inform your own strategies and plans.

Relevant Market Size & Competition

In the second stage of your analysis, you must determine the size and competition in your specific market.

Target Market Section

Your company’s relevant market size is the amount of money it could make each year if it owned a complete market share.

It’s simple.

To begin, estimate how many consumers you expect to be interested in purchasing your products or services each year.

To generate a more precise estimate, enter the monetary amount these potential customers may be ready to spend on your goods or services each year.

The size of your market is the product of these two figures. Calculate this market value here so that your readers can see how big your market opportunity is (particularly if you are seeking debt or equity funding).

You’ll also want to include an analysis of your market conditions. Is this a growing or declining market? How fast is it growing (or declining)? What are the general trends in the market? How has your market shifted over time?

Include all of this information in your own business plan to give your readers a clear understanding of the market landscape you’re competing in.

The Competition

Next, you’ll need to create a comprehensive list of the competitors in your market. This competitive analysis includes:

- Direct Competitors – Companies that offer a similar product or service

- Indirect Competitors – Companies that sell products or services that are complementary to yours but not directly related

To show how large each competitor is, you can use metrics such as revenue, employees, number of locations, etc. If you have limited information about the company on hand then you may want to do some additional research or contact them directly for more information. You should also include their website so readers can learn more if they desire (along with social media profiles).

Once you complete this list, take a step back and try to determine how much market share each competitor has. You can use different methods to do this such as market research, surveys, or conduct focus groups or interviews with target customers.

You should also take into account the barriers to entry that exist in your market. What would it take for a new company to enter the market and start competing with you? This could be anything from capital requirements to licensing and permits.

When you have all of this information, you’ll want to create a table like the one below:

Once you have this data, you can start developing strategies to compete with the other companies which will be used again later to help you develop your marketing strategy and plan.

Writing a Market Analysis Tips

- Include an explanation of how you determined the size of the market and how much share competitors have.

- Include tables like the one above that show competitor size, barriers to entry, etc.

- Decide where you’re going to place this section in your business plan – before or after your SWOT analysis. You can use other sections as well such as your company summary or product/service description. Make sure you consider which information should come first for the reader to make the most sense.

- Brainstorm how you’re going to stand out in this competitive market.

Formatting the Market Analysis Section of Your Business Plan

Now that you understand the different components of the market analysis, let’s take a look at how you should structure this section in your business plan.

Your market analysis should be divided into two sections: the industry overview and market size & competition.

Each section should include detailed information about the topic and supporting evidence to back up your claims.

You’ll also want to make sure that all of your data is up-to-date. Be sure to include the date of the analysis in your business plan so readers know when it was conducted and if there have been any major changes since then.

In addition, you should also provide a short summary of what this section covers at the beginning of each paragraph or page. You can do this by using a title such as “Industry Overview” or another descriptive phrase that is easy to follow.

As with all sections in a business plan, make sure your market analysis is concise and includes only the most relevant information to keep your audience engaged until they reach your conclusion.

A strong market analysis can give your company a competitive edge over other businesses in its industry, which is why it’s essential to include this section in your business plan. By providing detailed information about the market you’re competing in, you can show your readers that you understand the industry and know how to capitalize on current and future trends.

Business Plan Market Analysis Examples

The following are examples of how to write the market analysis section of a business plan:

Business Plan Market Analysis Example #1 – Hosmer Sunglasses, a sunglasses manufacturer based in California

According to the Sunglass Association of America, the retail sales volume of Plano (non-prescription) sunglasses, clip-on sunglasses, and children’s sunglasses (hereinafter collectively referred to as “Sunwear”) totaled $2.9 billion last year. Premium-priced sunglasses are driving the Plano Sunwear market. Plano sunglasses priced at $100 or more accounted for more than 49% of all Sunwear sales among independent retail locations last year.

The Sunglass Association of America has projected that the dollar volume for retail sales of Plano Sunwear will grow 1.7% next year. Plano sunglass vendors are also bullish about sales in this year and beyond as a result of the growth of technology, particularly the growth of laser surgery and e-commerce.

Business Plan Market Analysis Example #2 – Nailed It!, a family-owned restaurant in Omaha, NE

According to the Nebraska Restaurant Association, last year total restaurant sales in Nebraska grew by 4.3%, reaching a record high of $2.8 billion. Sales at full-service restaurants were particularly strong, growing 7% over 2012 figures. This steady increase is being driven by population growth throughout the state. The Average Annual Growth Rate (AGR) since 2009 is 2.89%.

This fast growth has also encouraged the opening of new restaurants, with 3,035 operating statewide as of this year. The restaurant industry employs more than 41,000 workers in Nebraska and contributes nearly $3 billion to the state economy every year.

Nebraska’s population continues to increase – reaching 1.9 million in 2012, a 1.5% growth rate. In addition to population, the state has experienced record low unemployment every year since 2009 – with an average of 4.7% in 2013 and 2014.

Business Plan Market Analysis Example #3 – American Insurance Company (AIC), a chain of insurance agencies in Maine

American Insurance Company (AIC) offers high-quality insurance at low prices through its chain of retail outlets in the state of Maine. Since its inception, AIC has created an extensive network of agents and brokers across the country with expanding online, call center and retail business operations.

AIC is entering a market that will more than double in size over the next 50 years according to some industry forecasts. The insurance industry is enjoying low inflation rates, steady income growth, and improving standards of living for most Americans during what has been a difficult period for much of American business. This makes this a good time to enter the insurance industry as it enjoys higher margins because customers are purchasing more coverage due to increased costs from medical care and higher liability claims.

American Insurance Company provides affordable homeowners, auto, and business insurance through high-quality fulfillment centers across America that have earned a reputation for top-notch customer service.

AIC will face significant competition from both direct and indirect competitors. The indirect competition will come from a variety of businesses, including banks, other insurance companies, and online retailers. The direct competition will come from other well-funded start-ups as well as incumbents in the industry. AIC’s competitive advantages include its low prices, high quality, and excellent customer service.

AIC plans to grow at a rate that is above average for the industry as a whole. The company has identified a market that is expected to grow by more than 100% in the next decade. This growth is due to several factors: the increase in the number of two-income households, the aging population, and the impending retirement of many baby boomers will lead to an increase in the number of people who are purchasing insurance.

AIC projects revenues of $20M in year one, which is equivalent to 100% growth over the previous year. AIC forecasts revenue growth of 40%-60% each year on average for 10 years. After that, revenue growth is expected to slow down significantly due to market saturation.

The following table illustrates these projections:

Competitive Landscape

Direct Competition: P&C Insurance Market Leaders

Indirect Competition: Banks, Other Insurance Companies, Retailers

Market Analysis Conclusion

When writing the market analysis section, it is important to provide specific data and forecasts about the industry that your company operates in. This information can help make your business plan more convincing to potential investors.

If it’s helpful, you should also discuss how your company stacks up against its competitors based on what makes it unique. In addition, you can identify any strengths or weaknesses that your company has compared to its competitors.

Based on this data, provide projections for how much revenue your company expects to generate over the next few years. Providing this information early on in the business plan will help convince investors that you know what you are talking about and your company is well-positioned to succeed.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Resources for Writing Your Business Plan

How to Write a Great Business Plan Executive Summary How to Expertly Write the Company Description in Your Business Plan The Customer Analysis Section of Your Business Plan Completing the Competitive Analysis Section of Your Business Plan The Management Team Section of Your Business Plan Financial Assumptions and Your Business Plan How to Create Financial Projections for Your Business Plan Everything You Need to Know about the Business Plan Appendix Best Business Plan Software Business Plan Conclusion: Summary & Recap

Other Helpful Business Planning Articles & Templates

Business Plan Market Analysis - Your Road Map to Success

Welcome to our comprehensive guide on the business plan market analysis section of a business plan. Market Analysis is a key part of any good business plan, which will help you better assess and understand your market. The business plan market analysis section is the heart and soul of your strategy, impacting everything from marketing to operations to the financial forecast. The market analysis helps you understand your position within the industry, the potential size of your market, the competitive landscape, and most importantly, it assists in identifying your target customers. In this blog post, we'll take you through the essentials of market analysis: what it is, why it's crucial, and the components it comprises.

Table of Contents

Business Plan Market Analysis - What Is It?

- Key Components

- How To Implement

Tips and Best Practices

- Market Analysis Case Study

Wrapping It All Up

Market analysis is a comprehensive examination of the dynamics, trends, and competitive landscape of the business environment within which a company operates. It is a vital component of a business plan as it allows entrepreneurs and business owners to understand their industry and market better, enabling them to make well-informed decisions. The business plan market analysis section has two main benefits. Firstly, it Allows you to Identify key opportunities in the market. By studying the market, a business can identify gaps, trends, or customer needs that aren't currently being met and then plan to cater to them effectively. Secondly, it also allows you to recognise potential threats and competition. By understanding your competitors, their offerings, strategies, strengths, and weaknesses, you can position yourself better against their position in the marketplace. Overall the role of market analysis in a business plan cannot be understated. It serves as the foundation upon which the marketing and sales strategies are built. In the following sections, we will take a deep dive into the key components of market analysis and how to conduct it effectively.

Remember, the opening of your Executive Summary sets the tone for the entire document. Make it memorable and compelling to encourage the reader to continue exploring.

What Are The Key Components of Market Analysis?

Understanding the key components of a market analysis is crucial to conducting one effectively. Each element contributes a unique insight into your market, providing a comprehensive overview of the environment in which your business will operate. Here are the key components:

- Industry Description and Outlook: This involves describing the industry within which your business will operate. Look to identify the key trends influencing it and the outlook of the future of the industry based on reliable industry forecasts.

- Target Market: It's vital to identify and understand your ideal customers. This involves defining the demographics (age, gender, income, etc.), psychographics (interests, values, behaviours, etc.), and geographic location of the customers your business aims to target. Furthermore, it's important to understand their needs, preferences, and buying habits.

- Market Size and Trends: Here, you need to determine the total size of your target market. This involves quantifying the number of potential customers, the total sales volume, or the total market value. Furthermore, it's crucial to identify key market trends, which may include changes in customer behaviour, new technologies, or shifting regulatory environments.

- Market Segmentation: This involves dividing your target market into distinct groups (segments) based on certain characteristics. These might include age, location, buying habits, or customer needs. By taking the time to segment your customers you can develop better targeting strategies for your marketing campaigns.

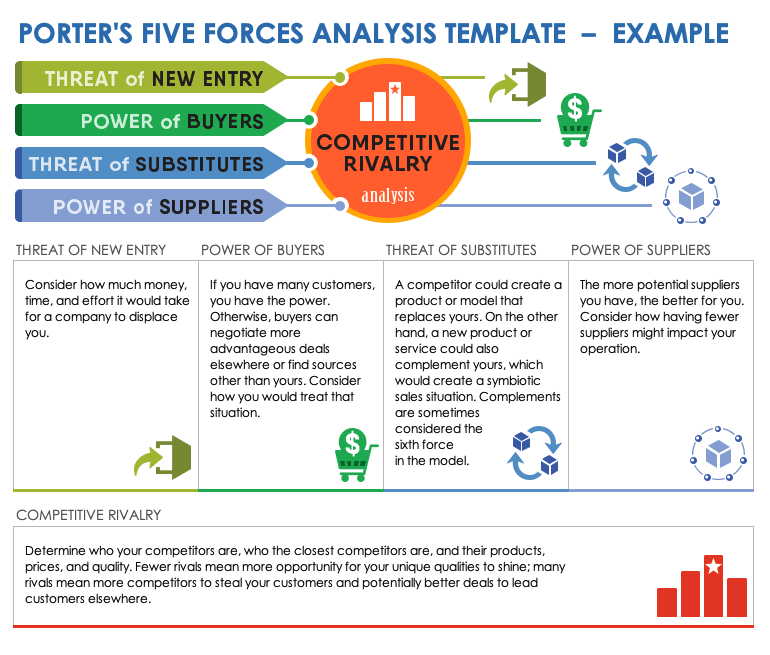

- Competitive Analysis: This component involves identifying your key competitors and analysing their products, sales strategies, market share, strengths, and weaknesses. A competitive analysis will help your business identify its unique selling proposition (USP) and differentiate itself from competitors.

- SWOT Analysis: Finally, conducting a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis will allow your business to identify its internal strengths and weaknesses, as well as external opportunities and threats in the market. This can help your business leverage its strengths, address its weaknesses, capitalise on opportunities, and prepare for potential threats.

Business Plan Market Analysis - How to Implement

Conducting a business plan market analysis might seem like a daunting task, but you can make it more achievable by breaking it down into key tasks.

- Industry Description and Outlook: Start by gathering data on your industry. This can include industry reports, market research data, news articles, and government statistics. Remember to cite your sources to add credibility to your analysis.

- Target Market: Identifying your target market requires an understanding of who is most likely to buy your product or service. You can conduct surveys, interviews, or focus groups to gather data on potential customers. If you already have a customer database, try to delve into this further by conducting post-purchase interviews with customers. Try to identify demographic, geographic, and psychographic characteristics, as well as buying habits and needs. The aim is to create a clear and specific profile of your ideal customer. You will aim to use this data to generate customer segments to target with your marketing campaigns.

- Market Size and Trends: Estimating market size can be challenging but can be done by looking at industry reports, government data, and market research studies. You can also look at the sales of competitors or analogous products. Identify key market trends by examining changes in customer behaviour, technological advances, and regulatory changes.

- Competitive Analysis: Identify your key competitors and analyse their offerings. Look at their products, pricing, marketing strategies, and market share. Try to understand their strengths and weaknesses. You can gather this information from their websites, customer reviews, and industry reports. Use this analysis to identify opportunities for your business to differentiate itself.

- SWOT Analysis: You can consolidate all of your initial research into a SWOT analysis which will help synthesise your learning and make it easier to develop strategies from your research.

Remember, conducting a market analysis isn't a one-time task. Markets are dynamic, with customer preferences, competition, and external factors continually changing. Your aim should be to continually update your business plan market analysis periodically. Here at Action Planr we have a full guide on how to conduct a SWOT Analysis for more detailed information on the full process.

Successfully conducting a market analysis involves more than just understanding its components and knowing where to find the necessary data. Here are some tips and best practices to help make your market analysis more robust, reliable, and useful for decision-making:

- Using Reliable Data Sources for Market Research: The quality of your analysis is directly tied to the quality of your data. Therefore, it's important to use reliable sources such as government databases, industry reports, reputable market research firms, and academic studies. Be wary of data that doesn't come from reliable sources.

- Understanding the Importance of Both Quantitative and Qualitative Research: Quantitative data, like statistics and numerical facts, provides a solid base for your analysis. But don't underestimate the power of qualitative data—opinions, anecdotes, and experiences—which can provide deeper insight into customer behaviours and preferences.

- Keeping the Analysis Current and Updated: Markets change rapidly. What was true last year—or even last month—may not hold today. Regularly updating your market analysis can help you keep up with changes and adjust your business strategies accordingly.

- Ensuring Your Analysis is Relevant to Your Specific Business Model: The insights you need depend on your business model. A B2B company will need a different kind of analysis than a B2C company. Tailor your market analysis to your specific business needs and objectives.

- Importance of Validating Assumptions: In the course of conducting a market analysis, you'll likely make assumptions. Be sure to validate these assumptions with solid data whenever possible.

- Keep your Audience in Mind: If your business plan is read by investors, they'll be interested in market size, growth opportunities, and competitive landscape. Make sure your market analysis addresses these topics and is presented in a clear, easy-to-understand format.

Business Plan Market Analysis - Case Study

To understand how the principles and processes of market analysis work in a real-world context, let's look at a case study of an innovative tech startup, "Techie Toys." Techie Toys is a company that produces educational toys based on augmented reality technology, targeting children aged 6 to 12. Their goal is to make learning fun and interactive.

- Industry Description and Outlook: Techie Toys reviewed multiple industry reports and found that the educational toy market has seen substantial growth over recent years, and this growth is expected to continue due to increasing focus on interactive learning methods. The integration of technology into educational toys, specifically augmented reality, is a significant trend shaping the industry.

- Target Market: Through surveys and focus groups, Techie Toys identified their target customers as parents of children aged 6 to 12 who value educational development and are comfortable with technology integration in toys. These parents have middle to upper-middle income, are mostly city dwellers, and are willing to invest in their children's education.

- Market Size and Trends: By analysing industry reports and sales of similar products, Techie Toys estimated a sizable target market for their augmented reality educational toys. The trend of "edutainment" was identified as a key market trend, with technology-based educational toys gaining popularity.

- Market Segmentation: Techie Toys segmented their market based on age (6-8, 9-12), type of toy preferred (science, math, language arts), and parents' willingness to spend on educational toys. They plan to tailor their products and marketing strategies according to these segments.

- Competitive Analysis: Techie Toys identified several key competitors offering educational toys but found a gap in those providing augmented reality-based learning. They also discovered that their unique selling proposition – interactive learning through augmented reality – is an aspect where they outshine their competitors.

- SWOT Analysis: Strengths identified included a strong development team, unique product offering, and alignment with market trends. Weaknesses involved a higher price point and lack of brand recognition. Opportunities included a growing market and a trend toward edutainment, while threats were potential competitors and rapid technological change.

By conducting this detailed market analysis, Techie Toys was able to effectively position itself within the market, identify its unique selling proposition, and tailor their product development and marketing strategy to their target audience. This comprehensive understanding of their market greatly contributed to their success.

The business plan market analysis section of a business plan is one of its most critical components. Conducting a detailed and accurate market analysis can be a challenging process, but as we've seen in our guide, the benefits are large. Business is all about planning and conducting an in-depth market analysis process, It will allow your business to navigate its environment with knowledge and foresight. The insight gained can help you identify growth opportunities and provide a strong basis for the development of effective marketing and sales strategies. Keep these insights, steps, and tips in mind as you work on your market analysis and remember markets are continually changing so don't make this a one-and-done exercise. If you are looking for help with other sections of the business plan, please check out our Learning Zone homepage.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Market Analysis for a Business Plan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A lot of preparation goes into starting a business before you can open your doors to the public or launch your online store. One of your first steps should be to write a business plan . A business plan will serve as your roadmap when building your business.

Within your business plan, there’s an important section you should pay careful attention to: your market analysis. Your market analysis helps you understand your target market and how you can thrive within it.

Simply put, your market analysis shows that you’ve done your research. It also contributes to your marketing strategy by defining your target customer and researching their buying habits. Overall, a market analysis will yield invaluable data if you have limited knowledge about your market, the market has fierce competition, and if you require a business loan. In this guide, we'll explore how to conduct your own market analysis.

How to conduct a market analysis: A step-by-step guide

In your market analysis, you can expect to cover the following:

Industry outlook

Target market

Market value

Competition

Barriers to entry

Let’s dive into an in-depth look into each section:

Step 1: Define your objective

Before you begin your market analysis, it’s important to define your objective for writing a market analysis. Are you writing it for internal purposes or for external purposes?

If you were doing a market analysis for internal purposes, you might be brainstorming new products to launch or adjusting your marketing tactics. An example of an external purpose might be that you need a market analysis to get approved for a business loan .

The comprehensiveness of your market analysis will depend on your objective. If you’re preparing for a new product launch, you might focus more heavily on researching the competition. A market analysis for a loan approval would require heavy data and research into market size and growth, share potential, and pricing.

Step 2: Provide an industry outlook

An industry outlook is a general direction of where your industry is heading. Lenders want to know whether you’re targeting a growing industry or declining industry. For example, if you’re looking to sell VCRs in 2020, it’s unlikely that your business will succeed.

Starting your market analysis with an industry outlook offers a preliminary view of the market and what to expect in your market analysis. When writing this section, you'll want to include:

Market size

Are you chasing big markets or are you targeting very niche markets? If you’re targeting a niche market, are there enough customers to support your business and buy your product?

Product life cycle

If you develop a product, what will its life cycle look like? Lenders want an overview of how your product will come into fruition after it’s developed and launched. In this section, you can discuss your product’s:

Research and development

Projected growth

How do you see your company performing over time? Calculating your year-over-year growth will help you and lenders see how your business has grown thus far. Calculating your projected growth shows how your business will fare in future projected market conditions.

Step 3: Determine your target market

This section of your market analysis is dedicated to your potential customer. Who is your ideal target customer? How can you cater your product to serve them specifically?

Don’t make the mistake of wanting to sell your product to everybody. Your target customer should be specific. For example, if you’re selling mittens, you wouldn’t want to market to warmer climates like Hawaii. You should target customers who live in colder regions. The more nuanced your target market is, the more information you’ll have to inform your business and marketing strategy.

With that in mind, your target market section should include the following points:

Demographics

This is where you leave nothing to mystery about your ideal customer. You want to know every aspect of your customer so you can best serve them. Dedicate time to researching the following demographics:

Income level

Create a customer persona

Creating a customer persona can help you better understand your customer. It can be easier to market to a person than data on paper. You can give this persona a name, background, and job. Mold this persona into your target customer.

What are your customer’s pain points? How do these pain points influence how they buy products? What matters most to them? Why do they choose one brand over another?

Research and supporting material

Information without data are just claims. To add credibility to your market analysis, you need to include data. Some methods for collecting data include:

Target group surveys

Focus groups

Reading reviews

Feedback surveys

You can also consult resources online. For example, the U.S. Census Bureau can help you find demographics in calculating your market share. The U.S. Department of Commerce and the U.S. Small Business Administration also offer general data that can help you research your target industry.

Step 4: Calculate market value

You can use either top-down analysis or bottom-up analysis to calculate an estimate of your market value.

A top-down analysis tends to be the easier option of the two. It requires for you to calculate the entire market and then estimate how much of a share you expect your business to get. For example, let’s assume your target market consists of 100,000 people. If you’re optimistic and manage to get 1% of that market, you can expect to make 1,000 sales.

A bottom-up analysis is more data-driven and requires more research. You calculate the individual factors of your business and then estimate how high you can scale them to arrive at a projected market share. Some factors to consider when doing a bottom-up analysis include:

Where products are sold

Who your competition is

The price per unit

How many consumers you expect to reach

The average amount a customer would buy over time

While a bottom-up analysis requires more data than a top-down analysis, you can usually arrive at a more accurate calculation.

Step 5: Get to know your competition

Before you start a business, you need to research the level of competition within your market. Are there certain companies getting the lion’s share of the market? How can you position yourself to stand out from the competition?

There are two types of competitors that you should be aware of: direct competitors and indirect competitors.

Direct competitors are other businesses who sell the same product as you. If you and the company across town both sell apples, you are direct competitors.

An indirect competitor sells a different but similar product to yours. If that company across town sells oranges instead, they are an indirect competitor. Apples and oranges are different but they still target a similar market: people who eat fruits.

Also, here are some questions you want to answer when writing this section of your market analysis:

What are your competitor’s strengths?

What are your competitor’s weaknesses?

How can you cover your competitor’s weaknesses in your own business?

How can you solve the same problems better or differently than your competitors?

How can you leverage technology to better serve your customers?

How big of a threat are your competitors if you open your business?

Step 6: Identify your barriers

Writing a market analysis can help you identify some glaring barriers to starting your business. Researching these barriers will help you avoid any costly legal or business mistakes down the line. Some entry barriers to address in your marketing analysis include:

Technology: How rapid is technology advancing and can it render your product obsolete within the next five years?

Branding: You need to establish your brand identity to stand out in a saturated market.

Cost of entry: Startup costs, like renting a space and hiring employees, are expensive. Also, specialty equipment often comes with hefty price tags. (Consider researching equipment financing to help finance these purchases.)

Location: You need to secure a prime location if you’re opening a physical store.

Competition: A market with fierce competition can be a steep uphill battle (like attempting to go toe-to-toe with Apple or Amazon).

Step 7: Know the regulations

When starting a business, it’s your responsibility to research governmental and state business regulations within your market. Some regulations to keep in mind include (but aren’t limited to):

Employment and labor laws

Advertising

Environmental regulations

If you’re a newer entrepreneur and this is your first business, this part can be daunting so you might want to consult with a business attorney. A legal professional will help you identify the legal requirements specific to your business. You can also check online legal help sites like LegalZoom or Rocket Lawyer.

Tips when writing your market analysis

We wouldn’t be surprised if you feel overwhelmed by the sheer volume of information needed in a market analysis. Keep in mind, though, this research is key to launching a successful business. You don’t want to cut corners, but here are a few tips to help you out when writing your market analysis:

Use visual aids

Nobody likes 30 pages of nothing but text. Using visual aids can break up those text blocks, making your market analysis more visually appealing. When discussing statistics and metrics, charts and graphs will help you better communicate your data.

Include a summary

If you’ve ever read an article from an academic journal, you’ll notice that writers include an abstract that offers the reader a preview.

Use this same tactic when writing your market analysis. It will prime the reader of your market highlights before they dive into the hard data.

Get to the point

It’s better to keep your market analysis concise than to stuff it with fluff and repetition. You’ll want to present your data, analyze it, and then tie it back into how your business can thrive within your target market.

Revisit your market analysis regularly

Markets are always changing and it's important that your business changes with your target market. Revisiting your market analysis ensures that your business operations align with changing market conditions. The best businesses are the ones that can adapt.

Why should you write a market analysis?

Your market analysis helps you look at factors within your market to determine if it’s a good fit for your business model. A market analysis will help you:

1. Learn how to analyze the market need

Markets are always shifting and it’s a good idea to identify current and projected market conditions. These trends will help you understand the size of your market and whether there are paying customers waiting for you. Doing a market analysis helps you confirm that your target market is a lucrative market.

2. Learn about your customers

The best way to serve your customer is to understand them. A market analysis will examine your customer’s buying habits, pain points, and desires. This information will aid you in developing a business that addresses those points.

3. Get approved for a business loan

Starting a business, especially if it’s your first one, requires startup funding. A good first step is to apply for a business loan with your bank or other financial institution.

A thorough market analysis shows that you’re professional, prepared, and worth the investment from lenders. This preparation inspires confidence within the lender that you can build a business and repay the loan.

4. Beat the competition

Your research will offer valuable insight and certain advantages that the competition might not have. For example, thoroughly understanding your customer’s pain points and desires will help you develop a superior product or service than your competitors. If your business is already up and running, an updated market analysis can upgrade your marketing strategy or help you launch a new product.

Final thoughts

There is a saying that the first step to cutting down a tree is to sharpen an axe. In other words, preparation is the key to success. In business, preparation increases the chances that your business will succeed, even in a competitive market.

The market analysis section of your business plan separates the entrepreneurs who have done their homework from those who haven’t. Now that you’ve learned how to write a market analysis, it’s time for you to sharpen your axe and grow a successful business. And keep in mind, if you need help crafting your business plan, you can always turn to business plan software or a free template to help you stay organized.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

Target Market Examples

Elon Glucklich

7 min. read

Updated April 24, 2024

Imagine your dream is to own a diner.

You have restaurant experience and a great location in mind – you just need the bank to approve your loan to get started.

But the bank has questions. A big one it wants answered is: who is your target market?

It might be tempting just to say, “hungry diners.” But you’ll need to dig deeper to truly define your target market .

In this article, we’ll use this diner scenario to walk through the market research process and illustrate what the final result could look like.

- Questions about your target market

Before you even set foot in the bank, you should already have asked – and taken steps to answer – several key questions about your target market.

Let’s call our example business the Bplans Diner. Where is that perfect location you’ve found for the diner? Is it in a densely populated urban area, suburban neighborhood, or rural?

What are your hours of operation? Some diners cater to a breakfast crowd, while others might offer 24-hour dining to be a favorite among night owls. When you expect your peak hours could help determine whether you should expect to sell more omelets or hamburgers.

What’s the area’s median income, and what types of businesses or institutions are nearby? This information will help you determine pricing and marketing strategies for your diner. For instance, if your diner is located in a business district, you may want to offer lunch specials. But if it’s near a college or university, you might want to offer student discounts.

This is what a thorough target market analysis looks like, providing key insights and data to pinpoint the specific groups of customers most likely to patronize your diner. Gathering all of this information may sound intimidating, but it’s really just a matter of doing research. If you need help and guidance, check out our complete guide to conducting market research for your business .

Let’s look at an example of a target market analysis for this diner. Then, we’ll break it down and discuss each element in detail.

- Example of a target market analysis

As you can see, the target market analysis follows the basic market segmentation process of splitting out potential customers into their demographic, geographic, psychographic and behavioral traits.

Next, let’s take a look at each in more detail. Afterward, we’ll look at how you can harness your target market analysis into actual business strategies.

- Demographic

You may have noticed that the demographic analysis in our example is very broad – 18 to 65 years old, including students, workers, and some seniors.

Finding your target market isn’t always about identifying a narrow demographic to cater to. In the case of a restaurant, it makes sense to focus on the geographic location and who currently frequents the area (more on that in the next section).

A different approach may be needed for a technology product that’s sold online. In that case, narrowing the demographic focus to specific age ranges or needs would be much more important than where the business is located.

In the case of the diner, we reached our decision by conducting a demographic analysis, examining the age ranges, occupations, and other concrete data points about potential customers near the proposed location (Reminder: we didn’t do this for the Bplans Diner, we’re just providing an example).

There are several ways to go about collecting this information for your business. The most straightforward is to get out in the neighborhood, take a look around and talk to people. Are you mostly seeing students, or families? Are there a lot of office workers in the area?

You can also look up data from the U.S. Census Bureau , which includes population, age, income and other useful information, often down to the neighborhood level.

After conducting this research, one valuable step is to create a detailed customer persona that represents the typical customer you expect for your business (we provide an example of a customer persona for the diner further down in this article).

While the demographic analysis considers the type of people who might frequent your business, the geographic analysis considers the characteristics of the neighborhood itself.

Our target market analysis for Bplans Diner noted that we plan to operate in an urban area near a university with heavy foot traffic and expect a fair amount of late-night diners.

A key reason for examining the geographic makeup of your businesses is to size up your competition. If there’s already a popular diner in the area you plan to target, getting customers could be a major challenge. But if there’s a lack of dining options or no one is serving diner-style food, you’re more likely to be successful. Determining the size of your market will help you create reasonable revenue projections.