Essay on Family Financial Problem

Students are often asked to write an essay on Family Financial Problem in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Family Financial Problem

Understanding family financial problems.

Money issues in a family can lead to stress. When there isn’t enough money, paying for basic things like food, house, and clothes becomes hard. Parents may work long hours or multiple jobs, which can be tiring and leave less time for family.

Causes of Money Troubles

Money problems can come from losing a job, having a lot of debt, or not planning how to spend money wisely. Sometimes, unexpected events like illness can also cause financial strain.

Effects on the Family

When a family faces money issues, it can cause arguments and worry. Kids might not be able to join sports or go on trips, which can make them feel left out.

Finding Solutions

Families can overcome money problems by creating a budget, cutting unnecessary spending, and saving money. Talking openly about money and making plans together can also help.

250 Words Essay on Family Financial Problem

Money issues within a family can be tough. When a family does not have enough money, it causes stress. This stress can come from not being able to pay bills, buy food, or afford a place to live. Sometimes, parents might lose their jobs or have unexpected expenses like a car breaking down. When this happens, it can be hard for the family to manage their money.

Effects on Daily Life

Financial problems can change how a family lives every day. Parents might have to work more hours or find extra jobs. This means they have less time to spend with their children. Kids might not be able to join sports or do fun activities because they cost money. Also, families might have to move to a cheaper home or cut back on buying new things.

Working Together to Solve Problems

Families can work together to fix their money problems. This could mean making a plan for how to spend their money wisely. Parents can teach their children about saving money and not wasting it. They can also look for ways to reduce costs, like using coupons or buying things on sale.

Getting Help

It’s okay to ask for help when dealing with money issues. Families can talk to friends, relatives, or professionals who know about finances. There are also programs that help families with food and other needs. By reaching out, families can find support and advice to get through tough times.

In conclusion, family financial problems are challenging, but with careful planning and help from others, families can overcome these issues. It’s important to talk about money worries and work together to find solutions.

500 Words Essay on Family Financial Problem

Money issues within a family can be a big source of stress. When a family does not have enough money to cover all its needs, it is facing a financial problem. This can mean not being able to pay for important things like food, a home, or medical care. Sometimes, these problems come up because a family member loses a job, gets sick, or has to deal with an unexpected expense like a car repair.

There are many reasons why a family might have money problems. One common reason is not earning enough money. This can happen if jobs in the area don’t pay very well or if there aren’t enough jobs for everyone who needs one. Another reason is high costs. Sometimes, the price of things like rent, groceries, and gas goes up, but the money people make does not. Also, if someone in the family gets sick and the medical bills are high, this can lead to financial stress.

Effects on Family Life

When a family struggles with money, it can affect everyone in the house. Parents might argue more about money, which can make the home feel stressful. Kids might notice these problems and feel worried or sad. They might not be able to do fun activities or have certain things that their friends do. This can make them feel left out or different.

Managing Money Wisely

One way to help with financial problems is to manage money wisely. This means making a plan for how to spend money, which is called a budget. A budget helps a family see where their money is going and find ways to spend less. For example, they might decide to eat at home instead of going out or to walk instead of taking the bus to save on transportation costs.

Sometimes, families need help to get through tough financial times. There are places that offer help, like food banks, where families can get food for free. There are also groups that can help pay for things like heating in the winter. Schools sometimes offer programs for kids, like free lunch, to make sure they have enough to eat.

Moving Forward

Working through financial problems can be hard, but it’s not impossible. Families can come together to make a plan and support each other. Talking openly about money issues can help everyone understand the situation and think of ways to improve it. By being careful with spending and looking for help when needed, families can overcome these challenges.

In conclusion, family financial problems are tough but common. They can happen for many reasons, like low income or high costs. These problems can make family life hard, but there are ways to deal with them. Making a budget, using community resources, and supporting each other can help families get through these hard times. With patience and effort, families can work towards a more stable financial future.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Family Gathering

- Essay on Fiscal Federalism

- Essay on Fire Station

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

How to write a financial need statement for your scholarship application (with examples!)

So you’re applying for a scholarship that asks you about your financial need. What do you say? How honest or specific should you be? What is TMI? In this article, we break down how to pen an awesome financial need scholarship essay or statement.

What to include in a financial need scholarship essay

Template to structure your financial need scholarship essay, introduction: your basic profile, body: your financial situation and hardships, conclusion: how you would benefit from this scholarship, was this financial need essay for a college financial aid application , now, reuse that same essay to apply for more scholarships, additional resources to help you write your financial need scholarship essay.

Many scholarships and college financial aid awards are “need-based,” given to students whose financial situation requires additional support. That’s why one of the most common college scholarship essays is a statement of financial need. This might be very explicit (“Explain your financial need”), somewhat explicit (“Describe your financial situation”), or quite open-ended (“Explain why you need this scholarship”).

In all cases, scholarship providers want to get a sense of your family’s financial picture: what your family income is, if you personally contribute to it (do you have a job?), and how much additional money you need to attend your target college (your “financial gap”).

If the essay prompt is a bit more open-ended (“Explain how this scholarship would help you”), your essay should probably be a combination of a financial need statement and a career goals / academic goals essay. That’s because you want to show how the award will help you financially and in your academic or career goals.

Usually this statement of financial need is a pretty short scholarship essay (150-300 words), so unlike a college essay or personal statement where you have ample word count to tell anecdotes, you’ll likely need to get right to the point.

Be sure to include:

- If you are an underrepresented group at college, for instance, part of an ethnic minority or the first in your family to go to college

- Any relevant family circumstances, like if your parents are immigrants or refugees, as well as your parents’ occupation and how many children/family members they support financially

- How you are currently paying for college, including what you personally are doing to contribute financially (like working student jobs)

- What financial challenges/difficulties your family is facing, for instance, if a parent recently lost their job

- How you would benefit from the scholarship–including your academic and career goals (if word count allows)

Also remember to write in an optimistic tone. Writing about your financial situation or hardships might not be the most positive thing to share. But you can turn it around with an optimistic tone by writing about how these challenges have taught you resiliency and grit.

Give a short introduction to who you are, highlighting any family characteristics that might make you part of an underrepresented group at college.

“I am a first-generation American and the first in my family to go to college. My family moved from El Salvador to New York when I was seven years old, to escape the violence there.”

Example 2:

“I am from a working-class family in Minnesota. My family never had a lot, but we pooled our efforts together to make ends meet. My parents both worked full-time (my father as a mechanic, my mother as a receptionist at the local gym), while my siblings and I all worked weekend jobs to contribute to the family income.”

Dive into the details. How are you currently planning to pay for college? The idea here is to show that you and your family have made a good-faith effort to earn enough money to pay your tuition, but that it has simply not been enough.

Make sure you describe your parents’ occupation, any savings (like a 529 College Savings Account), and any student jobs. You might also discuss any sudden changes in fortune (e.g. parent fell ill or lost their job) that have ruined your original financial plans.

Example

As immigrants with limited English, my parents have had to accept low-paying jobs. My father is an Uber driver, and my mother is a housekeeper. They earn just enough to pay our rent and put food on the table, so I’ve always known they could not help me pay for college. So I’ve been proactive about earning and saving my own money. Since age 11, I’ve worked odd jobs (like mowing my neighbors’ lawns). At age 16, I started working at the mall after school and on weekends. Through all these jobs, I’ve saved about $3000. But even with my financial aid grants, I need to pay $8000 more per year to go to college.

Bring it home by wrapping up your story. Explain how you plan to use the financial aid if you’re awarded this scholarship. How will you benefit from this award? What will you put the money toward, and how will it help you achieve your academic and/or career goals?

Scholarship review boards want to know that their money will be put to good use, supporting a student who has clear plans for the future, and the motivation and determination to make those plans a reality. This is like a shortened, one-paragraph version of the “Why do you deserve this scholarship?” essay .

Winning $5000 would help me close the financial gap and take less in student loans. This is particularly important for me because I plan to study social work and eventually work in a role to support my community. However, since these jobs are not well paid, repaying significant student loans would be difficult. Your scholarship would allow me to continue down this path, to eventually support my community, without incurring debt I can’t afford.

My plan is to study human biology at UC San Diego, where I have been admitted, and eventually pursue a career as a Nurse-Practitioner. I know that being pre-med will be a real academic challenge, and this scholarship would help me focus on those tough classes, rather than worrying about how to pay for them. The $2000 award would be equivalent to about 150 hours of working at a student job. That’s 150 hours I can instead focus on studying, graduating, and achieving my goals.

Sometimes this financial need statement isn’t for an external scholarship. Instead, it’s for your college financial aid office.

In that case, you’re usually writing this statement for one of two reasons:

- You’re writing an appeal letter , to request additional financial aid, after your original financial aid offer wasn’t enough. In this case, you’ll want to make sure you’re being extra specific about your finances.

- You’re applying for a specific endowed scholarship that considers financial need. In this case, your financial need essay can be quite similar to what we’ve outlined above.

Now that you’ve written a killer financial need scholarship essay, you have one of the most common scholarship essays ready on hand, to submit to other scholarships too.

You can sign up for a free Going Merry account today to get a personalized list of hundreds of scholarships matched to your profile. You can even save essays (like this one!) to reuse in more than one application.

You might also be interested in these other blog posts related to essay writing:

- What’s the right scholarship essay format and structure?

- How to write a winning scholarship essay about your academic goals

- How to write an awesome essay about your career goals

- Recent Posts

- Scholarships for Students in Pennsylvania for 2021 - November 11, 2020

- Counselor Starter Guide: How to Use Going Merry’s Scholarship Platform - September 9, 2020

- How to write a financial need statement for your scholarship application (with examples!) - August 13, 2020

Ready to find scholarships that are a match for you?

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

The Impact of Financial Hardship on Single Parents: An Exploration of the Journey From Social Distress to Seeking Help

Rebecca jayne stack.

Department of Psychology, School of Social Sciences, Nottingham Trent University, Nottingham, UK

Alex Meredith

Single parent families are at high risk of financial hardship which may impact on psychological wellbeing. This study explored the impact of financial hardship on wellbeing on 15 single parents. Semi-structured interviews were conducted and analysed using constructivist thematic analysis. Participants described food and fuel poverty, and the need to make sacrifices to ensure that children’s basic needs were met. In some cases, participants went without food and struggled to pay bills. Isolation, anxiety, depression, paranoia, and suicidal thoughts were described. However, participants reported that psychological services not able to take the needs of single parents in to account. Support for single parents must acknowledge the impact of social circumstances and give more consideration economic drivers of distress.

In the United Kingdom, approximately one in four children live in single parent families (also known as lone parent families). In 2016 there were 2.9 million single parents in the United Kingdom, representing an 18.6% increase in single parents since 1996, (Great Britain. Office for National Statistics 2016 ). Women account for 86% of single parents with dependent children, the average age of a single parent is 38 years of age, with approximately 60% of single parents caring for one dependent child. Single parent families are one representation of the range and diversity of family units in modern society (Golombok 2000 ; Golombok et al. 2016 ) and can be created through circumstances, including divorce, separation, death of a partner, donor insemination or an unplanned pregnancy.

Societal perceptions often construct single parents as young, female, unemployed parents with multiple children (Garner and Paterson 2014 ; Zartler 2014 ). Single parents are a stigmatised group in that they are in possession of a set of characteristics that conveys a social identity that is often devalued within society (Crocker et al. 1998 ). However, in Britain, employment among female single parents is higher than that of married or co-habiting women (Chambaz 2001 ). Despite high employment levels single parents are more likely to experience fuel poverty than other family structures (Liddell 2008 ). In addition, single parent families are still nearly twice as likely to be in poverty as those in couple parent families, with 67% of single parents reporting that they struggle with finances (Gingerbread 2015 ). Single parents therefore must manage a number of stressors including stigma, work and poverty.

The link between financial hardship poor health and poor mental health has been demonstrated in multiple populations. A study across 27 European countries found that single parents (in comparison to cohabiting parents and married parents) had poorer health, with the United Kingdom being substantially worse in this regard (Campbell et al. 2015 ; Van de Velde et al. 2014 ). In addition, studies have shown that single parents also experience lower levels of mental health and low psychological wellbeing (Ifcher and Zarghamee 2014 ), with more extensive use of the mental health services (Cairney and Wade 2002 ). Brown and Morgan ( 1997 ) examined marital status, poverty and depression in female parents over a 2-year period and found that single parents were twice as likely as their married counterparts to be in financial hardship (Brown and Moran 1997 ), despite being twice as likely to be in full-time employment. Single parents have been shown to experience higher levels of chronic stress (Cairney et al. 2003 ), loneliness (Baranowska-Rataj et al. 2014 ) and depression (Jackson et al. 2000 ). Elevated distress levels were also identified in German single parents compared to married mothers (Franz et al. 2003 ). Tein et al. ( 2000 ) conducted a prospective longitudinal study of the relationships among life stress, psychological distress, coping, and parenting behaviours in single mothers in the United States. The findings showed that both major and minor events had a significant impact on distress levels, with daily negative events having the largest impact on distress levels. Theoretically, high levels of distress, low economic resources and a lack of stress buffering resources may lead to poor psychological coping strategies amongst single parents (Folkman and Lazarus 1980 ), however, this must be explored though the in-depth examination of single parent experience.

It is clear from existing research that single parents are likely to experience higher levels of depression, anxiety, and general stress, despite making extensive efforts to meet their financial obligations. However, there is little research exploring help-seeking and how distress relating to financial hardship is addressed. The aims of this study were to explore the impact of financial hardship on personal health and wellbeing on single parents, and their attempts to seek help to cope with the impact of financial hardship.

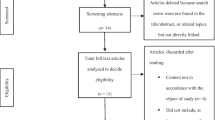

Participants

Participants were recruited from single parent networks and charities in England, such as Gingerbread (a British charity offering advice, support and networking opportunities to single parents), with the recruitment being enabled through posters, flyers, and social media announcements. Eligible participants were parents who were currently raising at least one dependent child in a household consisting of one adult. In addition, the participants of this study self-identified with the terms lone parent or single parent. Demographic details and the parenting responsibilities of participants are presented in Table 1 .

Characteristics of participants

Ethical approval for this procedure was granted by a University Ethics committee. The first author conducted 15 one-to-one semi-structured interviews which were guided by an interview schedule. The interview schedule was developed through consultation with single parent charities and a literature review on financial hardship, wellbeing and parenting. Following the first two interviews, the schedule was adapted to reflect the emerging topics and themes discussed by interviewees, with existing questions also being adjusted as appropriate. This inductive adaption of the interview schedule was undertaken again after a further four interviews had been conducted. Interviews lasted between 30 to 90 min, were audio-recorded using a digital voice recorder and transcribed verbatim prior to analysis.

The data were analysed using thematic analysis (Braun and Clarke 2006 ), with a constructivist epistemology being applied to the interpretation of the emerging themes. The initial stage of analysis was line-by-line coding where labels were attached to descriptions, events, perceptions and topic of discussion featured in the interview transcript. The first five interview transcripts were independently coded by the first and second authors. Coding categories that lacked concordance were discussed and absorbed into the coding framework. The initial codes were then grouped into the most noteworthy and frequently occurring global themes. The quotations within each theme were arranged into organising themes with constructivist descriptions of quotations developed by the first author, the constructivist descriptions were drawn from a combination of the quotations content, the line-by-line codes, and the relationship between the quotations within the organising themes. In addition, relationships between the organising themes were considered, and their overall contribution towards their global theme were outlined.

All participants were female between 18 and 55 years of age. The findings are organised in to core themes, related to the impact of financial hardship, debt on psychological wellbeing and health (Table 2 ).

Table of organising and sub-themes

The Stress of Being a Single Provider

Lone financial responsibility.

The parent who took the primary custodial responsibility for the child(ren) was construed to be the parent with the primary financial burden; a scenario which was described by one participant as big trouble . Not having enough financial resources to support their children and needing to rely on other people were described as stressful and worrying. Participants represented themselves as trapped and helpless, and constructed their position as one where there was a persistent battle with finances; with the need to fight for everything . Participants described a range of feelings in response to the constant worry about providing for a child a single person, including feeling miserable and stressed. These feelings and stressors did not dissipate with time, and were worsened by unanticipated life events.

I’m miserable really. It’s, it’s stress. It’s the stress of it. It’s, it’s worrying every single day how, how you’re gonna give your child the best…I’m in this position with a child I feel completely helpless. I can’t support my own family and I have to rely on what I’m given and you have to fight everything nowadays. (Emily, a 28 year old mother of one young child)

Participants viewed money worries as being a central part of everyday life, and was a repeated stressor which could not be avoided. The stress and the worry about food was constructed as being constant and life-consuming, and was therefore something that regularly occupied their thoughts. It was this sense of rumination about being unable to provide necessities that lead to feelings of sickness, with some single parents describing the bleakness of their current circumstances, with feelings of hopelessness and depression. Often at the centre of this worry were concerns about providing food, which were constructed as part of an ongoing daily struggle. These food related worries were linked by participants to sleeplessness, and feelings of physical sickness (described in more detail in Theme 2).

I really need to do some food shopping but I’ve got £4…I’ve had sleepless nights and nights full of tears, where I’ve just thought I literally don’t know how I’m going to get through the next few days. I’ve got no food, no money…So yeah, definitely times where I’ve felt very, very depressed about the situation and can’t see a way out of it almost. (Sandra, a 23 year old mother of one young child)

Making Sacrifices

Participants constructed their personal responsibility for feeding children as vital, and unquestionable. Participants described doing whatever it took to ensure that their children had food, so that their children would not go hungry. In doing so, however, participants would reduce their own food intake or go hungry , arguably leading to the detriment of their own physical and mental health. Similarly, meals would be skipped to pay utility bills, or to ensure that debt associated with bills was not accumulated.

I don’t eat sometimes; I just have my online shopping and it’s all for my daughter, so I’ll be having toast for dinner. That’s, that’s kind of life really. (Alisha, a 29 year old mother of one infant child) Um, there are cases where I will skip meals. Um, you know, there was a few weeks where it was literally like “Right, I’ve got £5 at the end of the week or whatever, this has either got to go on electric or, or something else” and I will skip meals. (Sarah, a 33 year old mother of one young child)

Financial hardship was associated with household fuel poverty, with some participants specifically speaking about the difficulties they faced in providing heat in their homes (as opposed to other forms of fuel consumption). Participants discussed making decisions not to heat their homes to save money, or lowering the temperature of heaters to reduce financial outgoings. Fuel costs were presented as an acceptable necessity to sacrifice, where as providing food was never questioned. In a similar way to identifying funds for food and heating, finding the money for children’s clothing was a source of worry. School clothing was suggested to be a particular burden, which could not be avoided, requiring participants to worry about finding the money .

But there were times when I thought you know, I’m not going to put my gas on. And I’m not going to do that extra load of washing, just because I don’t know if I can afford it, and I need to make sure I’ve got money in my purse to go and do food shopping. (Sandra, a 23 year old mother of one younger child) He’s starting secondary school in September and I’m going to have to find the money for all his school uniform and blazers and that’s gonna run in to hundreds I dare say. So I’m already thinking “oh my goodness, how am I gonna find the money for that?” (Sarah, a 33 year old mother of one young child)

Single parent participants also suggested that financial hardship had a negative impact on their social interactions. Social isolation, loneliness and withdrawal were suggested to corrode their psychological wellbeing and mental health. Not having enough money to participate in social activities was suggested to be a physical barrier, however, the embarrassment of having little money was a social and psychological barrier which was suggested to underlie their tendency to withdraw socially. This meant that social withdrawal and social isolation were often associated with financial stress and financial hardship.

And I think I’d love to be able to take him to a Soft Play, or do something else that normal parents would be able to do, but I can’t because I haven’t got any money. (Martha, a 40 year old mother of two young children) But it’s just little things, like if we decide to go to the park with a friend, they might get a treat or go for a coffee. And I just thought I don’t have three pounds to do that, so we’ll just stay at home and do things ourselves. (Sabrina, a 47 year old mother of a teenager)

The Impact of Financial Hardship

Physical health.

Participants often questioned their ability to cope . In some cases participants described feeling so ill that they were unable to eat, with the stress related to work and the need to bring in extra money leading to exhaustion. A large proportion of physical symptoms were related to strain, stress, and feeling run down which were described in ways that directly related these physical symptoms to psychological wellbeing. For example, the accumulative effect of stress related to money worries and sole responsibility were suggested to interrupt sleep and lead to sleeplessness. The psychological impact of night-time excessive rumination experienced by single parents was inescapable, but in some cases participants forced themselves to get physical rest. However, despite forcing physical rest, some participants described feeling run down . The stress of doing everything was linked to more susceptible to illness, particularly colds and flu.

Yeah, oh I felt so ill, I couldn’t eat, it would just come over in waves, it was awful…I was doing a bit of cleaning as well to bring in some money to pay the food and I think the body just, said I can’t cope. (Charlotte, a 55 year old mother of a teenager) I didn’t really cope very well, I just, I used to have sleepless nights, if I woke up I would often go and I would, things would go round and round and round in my head all the time, erm, so at night I would maybe get 3 h sleep…You’re doing everything, so yes it does, it puts that extra strain on you. So I would definitely say yes, and you’re picking up more, because you’re run down all the time, I think you’re more likely to pick up bugs and things as well. (Laura, a 45 year old mother of one young child and one teenager)

Participants described how they would cope with illnesses such as chest infections and back pain that caused them to seek medical attention, but highlighted that they were unable to rest and recover. Regardless of one’s health status or the presence of an illness the need to do everything remained. Some participants, such as Zainab, also suffered from long-term illnesses, which presented an extra physical challenge. Here the need for rest was particularly pertinent, and a range of strategies designed to juggle illness alongside their parenting responsibilities were described. Often, normal sick role activities (such as rest and seeking help) were inhibited by the responsibilities of parenting alone.

I just have to sleep and rest when I can, when I haven’t got him or when he’s at school. Um, I have to try and pace myself in terms of trying to get the housework done. (Zainab, a 34 year old mother of one young child) If you’re ill, there was no way I would get to lie in. So I did find that I was ill quite a lot and I found myself going to the Doctors for chest infections or my back being out because I do suffer with back pain. (Laura, a 45 year old mother of one young child and one teenager)

Mental Health

Sleepless nights, frustration and distress were common. Participants described feeling anxious about everything , suggesting that single parents were on high alert. Some single parent participants described feeling judged by others and had feelings of paranoia. Similar to physical health, descriptions of mental health were underlined by stress, rumination, and the turmoil of circumstances. Descriptions of feeling overwhelmed constructed the enormity of the situation, and placed the experience of distress as paramount in their existence. Claire also described the exhaustion she felt, and collapsing once the children had gone to bed. All of her energy had been devoted to caring for her children, and once they were asleep, she would spend the time alone in a state of distress which involved exhaustion, crying, feeling overwhelmed, and sleeplessness.

I was so anxious about everything…I felt so judged by everybody. Yeah, VERY anxious… there was a spell when basically the boys went to bed about 7:15, 7:30, and then I just collapsed sobbing on the sofa and then went to bed. And I couldn’t sleep because my head was just in turmoil about all the things that had happened. It just can feel really overwhelming sometimes. (Claire, a 37 year old mother to two young children) So my situation escalated really quickly…And I just found that with the pressure of looking after two such young children and their care needs, plus the pressures both financially and, you know, sorting out all the bills, having to get things like tax credits which I’ve never had before in my life. Having to look after the house and do all that, and the garden, and the car, and everything by myself, I just kind of imploded. (Sara, a 25 year old mother of an infant child)

The distress and anxiety experienced were linked by participants to parenting responsibilities and financial hardship. In some cases participants were very specific in outlining the source of their distress, for example sorting out bills, tax-credits, taking care of the house and caring for the children. Feelings of entrapment, desperation and being unable to get out of the current situation led to suicidal thoughts. In addition, it was felt that there was not help out there for the mental health problems being faced, with Charlotte (a 55 year old mother of a teenager) saying that there was no help to empower people to steer out of it . This would indicate that a therapeutic paradigm with more direction would be of benefit. Conversely the presence of their children was protective for their mental health.

I would have killed myself, I know, because I thought about it many times, so that is…it’s desperate, when you’re in a mess, it’s desperate…but I think so much more needs to be done in educating ordinary people in how to manage finance. (Charlotte, a 55 year old mother of a teenager) He [the child] is the best thing that has ever happened to me in my life. I honestly would have been dead by now if it weren’t for him because I would have just killed myself, like literally. (Alexandria, a 36 year old mother of a young child)

Seeking Help and Support

Seeking help: food banks.

Food banks were used as support in times of crisis when they were unable to provide adequate levels of food. Some participants were not aware of the help available at food banks, and were not sure if they were entitled to support. In some cases participant were advised by workers at a SureStart centre (a government run local/community based centre to advice and support to families with young children) that they were entitled, highlighting the vital role of community support in signposting support. Participants presented that this type of identification of needs and signposting was necessary for them to access support, as Martha (a 40 year old mother of two younger children) sated that she “wouldn't have dreamt of asking for it.”

There’s a difference between knowing it exists. It’s probably one of these things, like a lot of people say about benefits, oh I’m not entitled to it, there’s probably a lot of people what think. (Rosemary, a 32 year old mother of one young child and one teenager) I was at one of the SureStart Centres one day helping at something, and one of the staff who knew my situation came up and asked how was I getting on…And I said I’m starting to struggle again, and she said well, you do know you can use food bank. I wouldn’t have dreamt of asking for it. I didn’t know that… I knew all about it in a sense, but I didn’t know I was entitled to have it. (Martha, a 40 year old mother of two young children)

For others, the issue was in getting access to the food bank. One single parent described a desperate situation where she was unable to provide food for her daughter, but did not have the money or resources to get to the food bank. In these circumstances the impact of not being able to afford transport, prevented access to services designed for those unable to afford food; with one form of hardship, impacting upon another form of hardship, constructing a cycle of deprivation.

My daughter was eating peanuts and I thought…there’s no way she’s gonna have just peanuts today, and I’d called the council to say, you know, could you help me with the food bank…please, there must be something you can do to help me. I can’t, I’ve got no money to get there. And the lady said “well, sorry, you know, if you can’t get there you can’t have the food.” So even simple things like that, you know, you, you can’t get to a food bank and they’re refusing to kind of help you, you’d think they might be able to bring it to you if you’re, you know, in a really dire situation. (Emily, a 28 year old mother of one young child)

Seeking Help: Mental Health Support

Professional help was often sought when participants described themselves as having hit a crisis point. This was usually characterised by the accumulated stress of being a single parent (described in Themes 1 and 2) become overwhelming, and the ability to continue with parenting duties were questioned. The feeling of crisis was constructed as extreme, and at a point where the only option was to seek help. The was an underlying sentiment that help for single parents was not typical or expected, therefore, seeking help was an extraordinary act born out of crisis. Typically, general practitioners (GPs also known as family practitioners) acted as the first line of support in such cases. GPs were constructed as highly responsive, supportive and caring. They often offered antidepressants as intervention, but it appeared that their initial response (of caring and taking the situation seriously) were well received and helpful.

And my GP was brilliant, and he was very supportive. He straight away went down the route of yes, if at a later date we feel the need for anti-depressants and things, but at this precise minute I want to see you every week. Let’s just, you know, keep things talking. (Martha, a 40 year old mother of two young children) And I went to see my GP, and she was lovely. And I’ve never had any sort of mental health difficulties ever in the past and she just said I think you need some chemical help. (Claire, a 37 year old mother of two young children)

Drug therapies were not always seen as being a viable treatment or as an alternative to psychotherapy. Similarly, participants believed that their distress was caused by social stressors, and that a chemical solution acting on the brain would not address the cause of their distress. The causal beliefs about the origins of their distress (e.g., financial and social), were preventing single parent participants from accepting the feasibility of an intervention. There was a resistance to being medicated or reduced to a fluffy state, and that pharmacotherapy would just mask the issue, and that the underlying issues would remain, and would continue to be unaddressed and perhaps worsen. Additionally, one participant was worried that taking antidepressant would make her susceptible to being taken advantage of, or not being fully coherent enough to manage the multiple tasks she was required to undertake. However, there was a suggestion that feelings of anger, depression and sadness were normal and justified, and that interventions attempted to remove these justified feelings, and that help should have an alternative focus which allows single parents to work with these feelings and address the social consequences of their psychological distress.

I didn’t actually take any anti-depressants because my philosophy was, I know what’s causing my depression, erm, and if I could resolve those issues, then my depression would go away, so I didn’t feel that I wanted to mask things. (Laura, a 45 year old mother of one younger child) If I did take medication, I would become like even more relaxed and maybe even a bit more compliant but you know, I don’t know, I just didn’t want any of my sense to be reduced, I wanted to feel that anger, I had a right to that anger. (Sara, a 25 year old mother of one younger child)

There was a general scepticism to psychological interventions from some participants. One parent described that she felt as though she were just going over things. Whereas others suggested that they felt that their psychological state was not the result of disorder thinking, or other traditional causes of mental health difficulties. Instead participants saw themselves as under extreme stress, therefore, their thoughts and feelings were legitimate and did not need to be changed through psychological intervention. There was a desire for more solutions to emerge from the counselling process.

I had six sessions with a counsellor. I’m not sure the counselling helped, to be truthful. It kind of felt like just going over the same stuff, and the counsellor didn’t kind of suggest anything, or say anything. It was just kind of you oh gosh, that’s difficult, but didn’t kind of have any solutions. (Claire, a 37 year old mother of two young children)

Low mood, anxiety and depression were thought by participants to be the result of their social circumstances, therefore, attempts made to change their way of thinking would not address the underlying social, financial and stress origins of their psychological morbidity. Participants described how services were not designed to deal with their complex social needs. Instead services were set up for psychological disorders, but not for psychological disorders where the stressors were external (e.g., parenting responsibility, financial or poverty related). Therefore, participants held scepticism about how effective traditional psychological therapies would be in helping to alleviate their anxiety, depression, distress or suicidal thoughts.

He (GP) then referred me to, what I was told was counselling, but ended up being CBT, cognitive behavioural therapy. And it was a complete waste of time. Because to me, CBT is good if you want to change habits and things. However the stresses and things I was feeling, was not due to any habits that needed changing. It was due to, you know, my life being completely turned upside down. (Martha, a 40 year old mother of two young children) If you kind of turned up to a healthcare professional and started talking about some of the issues you go through, they don’t actually have services designed to actually help single parents cope or even just a basic understanding of some of the things you’ve been through. So when you kind of rock up to CBT, they’ve got no idea or conceptualisation of what you’ve been through but if you have an eating disorder… (Sheryl, a 36 year old mother of one young child)

This exploration of financial hardship in single parents identified multiple aspects of poverty. Single parents in this study described making difficult compromises to afford food, heating, and clothing and often focused their resources on their children. Participants described attempting to shield their children from poverty through missing their own meals, and taking on extra work which meant that the experiential impact of financial stressors were contained by the parent. Many poverty theories conceptualise negative traits in poverty related decision making including impertinence and impulsivity which are thought to perpetuate poverty cycles, this research highlights that parents make decisions which minimise the impact of the on their children, however, such decision make increase the impact on them as individuals. Psychological research has identified that parental self-sacrifice is a negative core belief, which is associated with negative outcomes and often accompany feelings of shame and a lack of control (Shah and Waller 2000 ). The impact and consequences of self-sacrifice styles of decisions making on factors such as wellbeing and long-term financial hardship should play a role on poverty related decision-making models. Similarly, Bahr and Bahr ( 2001 ) noted that self-sacrifice is a concept neglected in family theory, yet self-sacrifice plays a clear role in family dynamics.

Single parents in our sample described high levels of stress, psychological distress and anxiety, which were related to their position of sole responsibility and concerns about finances. Some levels of distress were particularly concerning, including rumination, sleeplessness, and suicidal thoughts. A particular concern, and one which should be addressed by healthcare professionals and policy makers, was that single parents in this study suggested that mental health distress was normal, and that psychological difficulties were a natural consequence of their social circumstances. This finding is concerning as it indicates that single parents are less likely to seek help or support for mental health difficulties. Furthermore, when help was sought the causal beliefs associated with their mental distress affected their ability to engage with psychological interventions. In addition, stress related health concerns were also described, however, many parents the option to rest and recover was removed due to parental duties.

Self-regulation models of help-seeking behaviour examine the role of beliefs in determining whether help is sought for physical or mental health condition (Bishop and Converse 1986 ). This theory suggests that we hold prototypical beliefs about what it is like to experience an illness, and when we experience symptoms comparisons are made between the expected experience and the actual experience (Jones 1990 ). Beliefs where comparisons are made between expectations and experience include the cause of an illness, the timeline associated with an illness (how long with it last), the consequences, identity (symptoms associated with the illness) and the ability for the illness to be controlled (Stack et al. 2013 ). This study identified a range that single parents held prototypical beliefs about mental health conditions, but did not always recognise the legitimacy of their distress, instead suggesting that the cause of their symptoms was normal for people in their social circumstances. This causal belief was a barrier to help-being sought. Further exploration of the prototypical beliefs held by single parents experiencing mental health difficulties is required to understand the role negative self-beliefs and self-stigma on single parents’ willingness to access mental health services. Previous research has explored the role of social interactions in the development of prototypical beliefs (Tiwana et al. 2015 ), however, this study highlights that other factors such as self-stigma, social stigma and family dynamics can play an important role in the development of prototypical beliefs, and may prevent help-seeking. Developments of self-regulation prototypical models may consider the role of social factors in belief development, and ways that health services may help potential service users to understand that their illness is deserving of treatment.

The occurrence of psychological distress, stress, health concerns originated from stressors were also found in other studies (Campbell et al. 2015 ; Van de Velde et al. 2014 ). However, the current study identified the barriers and facilitators of seeking help, particularly, medical attention for the impact of distress, stressors, financial hardship and isolation. Meyer ( 2003 ) offered a conceptual framework to describe the impact of stigma, prejudice and discrimination faced by selected social groups. These social factors mean that some social groups face a negative social environment which contributes towards poor mental health. Meyer’s model considered the impact of hostile social environments for Lesbian, gay and bisexual people, but considered how other minority groups are exposed to excess social stressors which increased the prevalence of poor mental health for stigmatised social groups. Single parents are another group potentially effected by minority social stress, as single parents in this study discussed social isolation, social withdrawal and poor mental health. Further research, should explore the impact of stressors within negative social environments and the impact these factors have on mental health, and the ability of stigmatised minority groups in seeking support for mental health conditions in hostile social environments.

Previous research has identified that healthcare professionals routinely identify fuel poverty as a causal factor for numerous health problems, including asthma, and cardiovascular diseases (Atsalis et al. 2016 ). However, our study highlights that the impact of fuel and food poverty go beyond physical health manifestations and it is essential for healthcare professionals to address the social and psychological consequences of financial concerns and the social stressors associated with being a single parent. This study identified that initial contact with GPs were on the whole useful and positive. However, the further support in the form of counselling, psychotherapy and pharmacotherapy was suggested to be unhelpful. In this study, single parents reported being offered anti-depressants, cognitive behaviour therapy and more traditional forms of counselling. However, approaches which place the experience of social and financial hardship at the forefront of intervention are required. We identified that single parents believed their distress originated in social circumstances, therefore, therapies directed towards addressing cognitions and emotions were rejected. Therapeutic approaches to therapy which considers the social processes relevant to single parents must be promoted and made more readily available. Indeed, in the recent past, approaches to counselling designed to address the needs of single parents have been developed which could prove promising (Atwood and Genovese 2014 ; Morawetz and Walker 2014 ). Further research is needed to explore whether access to these therapies can be broadened, and whether more consideration can be given to social processes in healthcare.

This paper highlights a number of number of issues affecting single parents which are important for policy makers and healthcare professionals to consider. Despite financial hardship single parents were unwilling to compromise on food, with this being one area where some single parents, when signposted, sought help. One parent in particular was assisted by staff at a SureStart centre [providers of advice and support for families, covering a range of issues including job opportunities, support with health, social support and child welfare (Glass 1999 )]. While some have questioned whether SureStart centres are accessed by disadvantaged and hard-to-reach communities (Hutchings et al. 2007 ), our study suggests that these centres may be utilised by single parents for advice and signposting. However, recently, funding to these centres has been significantly reduced in 2015, 156 SureStart centres closed, up from the 85 centres closed in 2014 (leaving a total of 3259 centres remaining in 2016 according to the Department of Education). Therefore, this potential source of support is being diminished, and may have an impact upon the welfare and wellbeing of single parent families experiencing poverty (Melhuish et al. 2008 ).

This qualitative study has explored a number of important issues in a small sample of single parents and this paper is limited in its generalisability to wider single parent populations, however, the findings have formulated the basis for research which will aim to quantify and identify predictive patterns between financial hardship, mental health, and help-seeking in single parents. Follow on studies exploring the issues raised by this paper in other contexts should also consider variables such as the income level of single parents and whether single parents with higher income are less impacted by psychological distress. Furthermore, more consideration needs to be given to the geographical location of single parents, for example, studies have highlighted the difficulties faced by parents in rural locations verses inner city locations (Simmons et al. 2007 ). Due to the qualitative nature of the present study these factors were not taken in to account, but our future quantitative research will give include an analysis of these variables. A further limitation of this study was that recruitment was based on a self-selecting opportunity based approach. However, this resulted in a sample dominated by female participants. This was not unexpected as 90% of single parents are female (Great Britain. Office for National Statistics 2016 ). Furthermore, single mothers have been found to have significantly less income than single fathers (Hilton and Kopera-Frye 2006 ), therefore, may experience the stressors associated with financial hardship and parenting to a greater extent. However, we acknowledge that some of the emerging themes may be constructed with differing narratives if the experiences of single fathers were explored.

Past research has identified that single parents in the United Kingdom face significant financial hardships. This study has highlighted that the stresses of parenting alone appear to heighten feelings of stress, uncertainty, and depression associated with finances. Therefore, it is vital that health and mental health services recognise this distress, and understand the impact that financial difficulties have upon single parents. It is important to consider the sources of help available to single parents particularly help related to mental health and help focused on helping long parents cope with financial hardship. A focus on mental health support for single parents in need may have an additional impact upon the adjustment and wellbeing of children growing up in single parent households.

Biographies

is a Senior Lecturer in Psychology at Nottingham Trent University in the United Kingdom. Dr. Stack is a Chartered Psychologist registered with the British Psychological Society, and is a member of the Division of Health Psychologists and the Division of Teachers and Academics. She received a PhD from the University of Manchester in Pharmacy Practice, and has conducted research in a number of health-related areas including adherence to medicines and help-seeking behaviour. Dr Stack has received research funding from several charitable organisations including The Dunhill Medical Trust, The Swedish Foundation for Humanities and The Queen Elizabeth Medical Trust and has received awards for research from Arthritis Research UK and the British Society for Rheumatology.

is a Senior Lecturer in Psychology at Nottingham Trent University, and course leader of the MSc in Psychological Wellbeing and Mental Health. Dr Meredith received his PhD from Nottingham Trent University and he has conducted research on a number of topics, including conceptions of identity, and online lying, with ongoing research examining issues relating to youth empowerment regarding sustainable behaviours.

Compliance with Ethical Standards

The authors declare no conflict of interest.

Ethical Approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki declaration and its later amendments or comparable ethical standards. Ethical approval was obtained from the Business, Law and Social Science Research Ethics Committee at Nottingham Trent University.

Informed Consent

All participants provided informed written consent.

- Atsalis A, Mirasgedis S, Tourkolias C, Diakoulaki D. Fuel poverty in greece: Quantitative analysis and implications for policy. Energy and Buildings. 2016; 131 :87–98. doi: 10.1016/j.enbuild.2016.09.025. [ CrossRef ] [ Google Scholar ]

- Atwood JD, Genovese F. Therapy with single parents: A social constructionist approach. London: Routledge; 2014. [ Google Scholar ]

- Bahr HM, Bahr KS. Families and self-sacrifice: Alternative models and meanings for family theory. Social Forces. 2001; 79 (4):1231–1258. doi: 10.1353/sof.2001.0030. [ CrossRef ] [ Google Scholar ]

- Baranowska-Rataj A, Matysiak A, Mynarska M. Does lone motherhood decrease women’s happiness? Evidence from qualitative and quantitative research. Journal of Happiness Studies. 2014; 15 (6):1457–1477. doi: 10.1007/s10902-013-9486-z. [ CrossRef ] [ Google Scholar ]

- Bishop GD, Converse SA. Illness representations: A prototype approach. Health Psychology. 1986; 5 (2):95. doi: 10.1037/0278-6133.5.2.95. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Braun V, Clarke V. Using thematic analysis in psychology. Qualitative Research in Psychology. 2006; 3 (2):77–101. doi: 10.1191/1478088706qp063oa. [ CrossRef ] [ Google Scholar ]

- Brown GW, Moran PM. Single mothers, poverty and depression. Psychological Medicine. 1997; 27 (01):21–33. doi: 10.1017/S0033291796004060. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Cairney J, Boyle M, Offord DR, Racine Y. Stress, social support and depression in single and married mothers. Social Psychiatry and Psychiatric Epidemiology. 2003; 38 (8):442–449. doi: 10.1007/s00127-003-0661-0. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Cairney J, Wade TJ. Single parent mothers and mental health care service use. Social Psychiatry and Psychiatric Epidemiology. 2002; 37 (5):236–242. doi: 10.1007/s00127-002-0539-6. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Campbell M, Thomson H, Fenton C, Gibson M. Health and wellbeing of lone parents in welfare to work: A systematic review of qualitative studies. Lancet. 2015; 386 :S27. doi: 10.1016/S0140-6736(15)00865-X. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Chambaz C. Lone-parent families in europe: A variety of economic and social circumstances. Social Policy and Administration. 2001; 35 (6):658–671. doi: 10.1111/1467-9515.00259. [ CrossRef ] [ Google Scholar ]

- Crocker J, Major B, Steele C. Social stigma. In: Gilbert D, Fiske S, Lindzey G, editors. Handbook of social psychology. 4. New York: McGraw-Hill.; 1998. pp. 504–553. [ Google Scholar ]

- Folkman, S., & Lazarus, R. S. (1980). An analysis of coping in a middle-aged community sample. Journal of health and social behavior , 219–239. doi:10.2307/2136617. [ PubMed ]

- Franz M, Lensche H, Schmitz N. Psychological distress and socioeconomic status in single mothers and their children in a german city. Social Psychiatry and Psychiatric Epidemiology. 2003; 38 (2):59–68. doi: 10.1007/s00127-003-0605-8. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Garner JD, Paterson WA. Unbroken homes: Single-parent mothers tell their stories. London: Routledge; 2014. [ Google Scholar ]

- Gingerbread. (2015). Paying the price: The impact of the summer budget on single parent familie s. Retrieved from https://gingerbread.org.uk/file_download.aspx?id=9519 Gingerbread .

- Glass N. Sure start: The development of an early intervention programme for young children in the united kingdom. Children and Society. 1999; 1 (4):257–264. doi: 10.1002/CHI569. [ CrossRef ] [ Google Scholar ]

- Golombok S. Parenting: What really counts? London: Routledge; 2000. [ Google Scholar ]

- Golombok S, Zadeh S, Imrie S, Smith V, Freeman T. Single mothers by choice: Mother-child relationships and children’s psychological adjustment. Journal of Family Psychology: JFP: Journal of the Division of Family Psychology of the American Psychological Association (Division 43) 2016; 3 (4):409–418. doi: 10.1037/fam0000188. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Hilton JM, Kopera-Frye K. Loss and depression in cohabiting and noncohabiting custodial single parents. The Family Journal. 2006; 1 (1):28–40. doi: 10.1177/1066480705282053. [ CrossRef ] [ Google Scholar ]

- Hutchings J, Gardner F, Bywater T, Daley D, Whitaker C, Jones K, et al. Parenting intervention in sure start services for children at risk of developing conduct disorder: Pragmatic randomised controlled trial. BMJ (Clinical Research. Ed.) 2007; 334 (7595):678. doi: 10.1136/bmj.39126.620799.55. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Ifcher J, Zarghamee H. The happiness of single mothers: Evidence from the general social survey. Journal of Happiness Studies. 2014; 1 (5):1219–1238. doi: 10.1007/s10902-013-9472-5. [ CrossRef ] [ Google Scholar ]

- Jackson AP, Brooks-Gunn J, Huang C, Glassman M. Single mothers in Low-Wage jobs: Financial strain, parenting, and preschoolers’ outcomes . Child Development. 2000; 7 (5):1409–1423. doi: 10.1111/1467-8624.00236. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Jones RA. Expectations and delay in seeking medical care. Journal of Social Issues. 1990; 46 (2):81–95. doi: 10.1111/j.1540-4560.1990.tb01924.x. [ CrossRef ] [ Google Scholar ]

- Liddell, C. (2008). The impact of fuel poverty on children. Save the Children, Belfast . Retrieved from https://www.savethechildren.org.uk/sites/default/files/docs/The_Impact_of_Fuel_Poverty_on_Children_Dec_08(1)_1.pdf .

- Melhuish E, Belsky J, Leyland AH, Barnes J, National Evaluation of Sure Start Research Team Effects of fully-established sure start local programmes on 3-year-old children and their families living in england: A quasi-experimental observational study. The Lancet. 2008; 372 (9650):1641–1647. doi: 10.1016/S0140-6736(08)61687-6. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Meyer IH. Prejudice, social stress, and mental health in lesbian, gay, and bisexual populations: Conceptual issues and research evidence. Psychological Bulletin. 2003; 129 (5):674. doi: 10.1037/0033-2909.129.5.674. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Morawetz A, Walker G. Brief therapy with single-parent families. London: Routledge; 2014. [ Google Scholar ]

- Office for National Statistics. (2016). Families and Households in the UK . London: ONS.

- Shah R, Waller G. Parental style and vulnerability to depression: The role of core beliefs. The Journal of Nervous and Mental Disease. 2000; 188 (1):19–25. doi: 10.1097/00005053-200001000-00004. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Simmons LA, Dolan EM, Braun B. Rhetoric and reality of economic self-sufficiency among rural, low-income mothers: A longitudinal study. Journal of Family and Economic Issues. 2007; 28 (3):489–505. doi: 10.1007/s10834-007-9071-x. [ CrossRef ] [ Google Scholar ]

- Stack RJ, Simons G, Kumar K, Mallen CD, Raza K. Patient delays in seeking help at the onset of rheumatoid arthritis: The problem, its causes and potential solutions. Aging Health. 2013; 9 (4):425–435. doi: 10.2217/ahe.13.42. [ CrossRef ] [ Google Scholar ]

- Tein J, Sandler IN, Zautra AJ. Stressful life events, psychological distress, coping, and parenting of divorced mothers: A longitudinal study. Journal of Family Psychology. 2000; 1 (1):27. doi: 10.1037/0893-3200.14.1.27. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Tiwana R, Rowland J, Fincher M, Raza K, Stack RJ. Social interactions at the onset of rheumatoid arthritis and their influence on help-seeking behaviour: A qualitative exploration. British journal of health psychology. 2015; 20 (3):648–661. doi: 10.1111/bjhp.12134. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Van de Velde S, Bambra C, Van der Bracht K, Eikemo TA, Bracke P. Keeping it in the family: The self-rated health of lone mothers in different european welfare regimes. Sociology of Health & Illness. 2014; 3 (8):1220–1242. doi: 10.1111/1467-9566.12162. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Zartler U. How to deal with moral tales: Constructions and strategies of single-parent families. Journal of Marriage and Family. 2014; 7 (3):604–619. doi: 10.1111/jomf.12116. [ CrossRef ] [ Google Scholar ]

Important Values of Family, the Financial Question Essay

The family is the smallest unit in a human society, which is built as a result of a man and a woman uniting through marriage and the raising up of children. The formation of the family is bound by many problems; whereby financial problems are the most serious ones. Without money the construction of a marriage is nearly impossible; which is at all phases started at courtship to the raising of the family (Guillermo 20-320).

There are many necessities in the raising of a marriage which range from moral support, love, and trust to financial support. Financial support is actually the stable element in the raising of families in any society. All societies, both from the developed countries and undeveloped countries find money an essential element in building a family. In nearly all societies the men are responsible for providing for the family, whereby the wife is only provided for; or bound to assist the man where necessary (Guillermo 20-32).

.Financial constraints are strong such that they stop many poor people from marrying or sometimes lead to late marriages. Ladies from all spheres; both civilized and uncivilized expect gifts from men during courtship; which may cause poor men to forego the courtship phase and remain single. On the other hand, most ladies don’t like to be associated with poor men; thus posing a big challenge to the formation of families by the men of the poor class (Jay 80-120).

Further, delayed marriages are very evident in poor societies. This is because men would prefer to look for money first before they marry thus leading to late marriages. Most relationships also break up even before marriage, due to the financial constraints involved in the preparation of a family. As an effort to avoid this, people courting may on the other side extend their courtship to stabilize their finances before marriage. This explains the difference seen in the marriages carried out within poor societies, and those in well-up societies whereby men from financially stable families tend to marry early than those from poor families (Guillermo 20-32).

Financial problems during courtship are better explained by the many requirements of ladies and the high dowry required. The cultures of nearly all societies are still very strict such that dowry payment should precede marriage; thus posing a threat to the poor. Sometimes the value quoted for dowry is such high that; most of the poor men can’t afford, or can just wait for lengthened periods of time to be able to pay these amounts. As a result, this culture of paying dowry leads to many people foregoing marriage; or delaying marriages to look for money to settle the dowry debt (Joan 34-53).

Financial requirements in marriage further lead to discrimination and social groupings in the society; whereby the rich and poor have minimal interactions. The status quo and social ranks have been difficult to break; where even love has been unable to break the barrier between the rich and the poor. Men from the rich and wealthy classes tend to marry ladies from rich families; thus enhancing financial disparities between the rich and the poor. Most people are driven and guided by the endless financial requirements in marriage, thus a person from a rich family feels uneasy to marry a poor lady since he views it as increasing his financial burden (Joan 34-53).

Finical support is really the stable element in marriage; where this is due to the endless needs of both the husband and wife not to mention those of the children. The satisfaction of basic needs to the family is not an easy task, especially to the poor. Without perseverance and understanding between the members of the family, financial constraints can lead to wrangles in the family, especially in poor societies where unemployment and little income is the order of the day; thus building up a family becomes a demanding issue. In cases where the wife does not contribute anything to the family, meeting the family’s needs becomes a real problem; which is usually evident within poor societies where family planning is not practiced thus increasing the family needs to be met (Joan 34-53).

Financial problems in the family have also led to many wrangles in the family. First, the evil of unfaithfulness among married women is evident in families with financial problems, as they at times opt to offer themselves to gain financial gains. This is the case because women may enter into this evil in order to support their children and also get money to meet other family needs. Further, the issue of children developing bad habits like stealing is also caused by the pressing financial problems within their families. The men, who are in most cases the breadwinners within the family, are also forced to get into crime so as to provide for their families; as they may have no other source of income to support their families. All these evils are not socially acceptable, but due to the endless financial needs of a family, they will remain to be rampant (Joan 34-53).

The breaking of many married couples is also common in recent days; where this scenario is best explained by the financial demands of raising a family. In the case the income of a family comes to an end; for instance, the breadwinner is sacked from a job or family business fails; a couple may divorce. This is because a family which had in the past enjoyed a steady income may find it hard to cope with the new challenges due to the endless financial needs of the family (Guillermo 20-32).

After keenly following the lives of married couples and that of a family, in particular, we find it hard for a family to live comfortably without adequate financial support. Money is really stable support to the family and thus for any family to succeed; there must be a stable source to meet the family’s endless financial requirements.

Works cited

Guillermo, Otalora. “Work-family conflict”.Madagascar: Vdm Verlag. (2008): 20-32.

Jay, Adams. “Solving marriage problems”. Michigan: Zondervan. (1986): 80-120.

Joan, Williams. “Why family and work conflict & what to do about it.” Oxford: Oxford University Press. (2001): 34-53.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2021, December 23). Important Values of Family, the Financial Question. https://ivypanda.com/essays/important-values-of-family-the-financial-question/

"Important Values of Family, the Financial Question." IvyPanda , 23 Dec. 2021, ivypanda.com/essays/important-values-of-family-the-financial-question/.

IvyPanda . (2021) 'Important Values of Family, the Financial Question'. 23 December.

IvyPanda . 2021. "Important Values of Family, the Financial Question." December 23, 2021. https://ivypanda.com/essays/important-values-of-family-the-financial-question/.

1. IvyPanda . "Important Values of Family, the Financial Question." December 23, 2021. https://ivypanda.com/essays/important-values-of-family-the-financial-question/.

Bibliography

IvyPanda . "Important Values of Family, the Financial Question." December 23, 2021. https://ivypanda.com/essays/important-values-of-family-the-financial-question/.

- Women's Nonverbal Communication During Courtship

- Male Mating Success and Courtship Modalities

- Christopher Buckley’s “Supreme Courtship”

- Courting Practices Between African Americans and Caucasian Americans

- High Marriage Costs in the United Arab Emirates

- Socio Economic Conditions Role in Courtship and Dating Violence

- On one hand people regard women as devi (goddess), on the other hand they burn them alive

- Relationships of History and Literature: “I Stood Here Ironing”, “The Courtship of Mr. Lyon”, "A Rose for Emily"

- James MacKillop's Discussion of "The Quiet Man"

- Sharjah International Airport: Cultural Case

- How Families Have Changed

- Adoption Available as a For-Profit Service

- Significance of Family in Self-Development

- The American Family: Current Problems

- The Book “The Second Shift” by Arlie Hochschild and Anne Machung

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

The 10 Biggest Financial Struggles Families Face

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology .

20 Years Helping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

Many American families were struggling to pay the bills before COVID-19, and the pandemic certainly didn’t make things easier. Financial hardships like layoffs and pay cuts made an already tough situation even trickier to navigate .

Among U.S. adults who say their financial situation has gotten worse since the start of the pandemic, 44% expect it will take them at least three years to get back to where they were a year ago, according to a 2021 survey conducted by the Pew Research Center. This includes 1 in 10 who don’t think they will ever financially recover from the pandemic .

Even families who made it through the past year with little-to-no financial consequences directly tied to the pandemic still face a myriad of financial issues. Despite doing their best to stay afloat financially, many are finding it hard to keep up with standard expenses.

If this sounds familiar, you’re not alone. Here’s a look at the 10 biggest financial concerns faced by U.S. families in 2021 .

Last updated: June 21, 2021

Healthcare Costs

Having health insurance is a crucial way to keep the cost of care down, but 28.9 million non-elderly Americans were uninsured as of 2019, according to the Kaiser Family Foundation. This is problematic, considering Healthcare.gov cites the cost of fixing a broken leg as up to $7,500, while the average cost of a three-day hospital stay is $30,000.

In total, U.S. healthcare spending was $11,582 per person in 2019, according to the Centers for Medicare & Medicaid Services. Health insurance makes a massive difference in overall spending, but having coverage can still come with hefty bills.

Insured workers contributed an average of $5,588 for family coverage in 2020, according to the KFF. This is a serious amount of cash — especially for those already stretching their budgets to pay the bills.

Total outstanding consumer debt reached a new high of just under $14.9 trillion in 2020, according to Experian. This includes a variety of different types of debt, including mortgage loans, auto loans, student loans, credit card debt, home equity lines of credit, personal loans and retail credit card debt.

In total, the average American has a debt balance of $92,727, according to Experian. Some of the debt averages included in this total are credit cards — $5,315 — HELOC — $41,954 — and personal loans — $16,458.

Once in debt, it can be hard for families to get out. Being forced to pay high interest rates, combined with a lack of extra money to put aside in savings, can make it difficult to pay debt down at all — much less entirely.

High Cost of Living

Different parts of the country have vastly different costs of living. Families residing in states like Hawaii, Washington, D.C., New York, California and Massachusetts face much higher living expenses on average than those in states like Mississippi, Kansas, Oklahoma, Alabama and Tennessee, according to the Missouri Economic Research and Information Center.

For example, the median income homeowners needed to live comfortably in Washington, D.C. is $142,230 per year, dropping to $122,934 annually for renters, according to a GOBankingRates study. Conversely, the median income to live comfortably as homeowner in Memphis, Tennessee is just $63,595 per year, rising to $69,331 for renters.

Loss of Job

More than four-in-10 American adults or someone in their household have lost their job or had their wages cut since the beginning of the pandemic, according to the Pew Research Center. Considering May 2021 Bureau of Labor Statistics data revealed it takes an average of 19.3 weeks — five months — to find a new job, this can easily cause financial hardship.

The unemployment rate reached record highs last year, peaking at 14.8% in April 2020. Thankfully, it has steadily declined to 5.8% in May 2021, but that’s still a long way from the 3.7% realized at the same time in 2019.

More than one-quarter — 27% — of people who lost their job or experienced an income disruption in 2020 had to seek help from a food bank, according to the Prudential Wellness Census Special Report. Another 10% received assistance from a charitable organization.

Having a job doesn’t necessarily make it easy to pay the bills. More than half — 61% — of employed people are having an increasingly difficult time keeping up with their financial obligations, according to Prudential.

As of 2019, the average American worker earned $51,916 per year, according to the Social Security Administration. While half the population earned more, the other half earned less.

Specifically, 247,000 American workers earned the federal minimum wage of $7.25 per hour in 2020, according to the BLS. Approximately another 865,000 workers earned wages that fell below the federal minimum.

When paid even minimum wage, a 40-hour workweek amounts to gross earnings of $290 — or $1,160 per month. This can make it impossible for families to keep up with basic living expenses.

Lack of Savings

As of 2019, the average American family has just $5,300 in savings, according to the Federal Reserve. In addition to making it hard to reach future savings goals — i.e., putting money aside for a down payment on a home — this can make it hard to stay financially afloat in emergency situations.