- Scroll to top

- Get Started

Money Lending Business Plan (Example and How to Create One)

- Author Content Team

- Published February 21, 2024

A money lending business plan serves as an invaluable strategic guide for establishing and operating a successful lending operation.

Crafting a comprehensive plan walks you through critical thinking on all facets of your envisioned lending business, including:

- Products/services to offer

- Operational processes and resource needs

- Foundational financial analysis

- Marketing and growth strategies

- Technology requirements

- Risk factors and contingency plans

Essentially, it encompasses detailed blueprint of your planned venture at launch and for years to come.

Having this documented plan helps drive focus when mobilizing resources and executing on priorities. It also communicates vision to prospective investors/partners seeking thorough understanding of you lending concept.

Used as a living document, a lending business plan guides continual improvement over time as market conditions and borrower needs evolve.

While requiring effort upfront, a well-constructed plan pays dividends through providing clarity, direction, and a benchmark for progress as you build out your money lending operation.

How good is money lending business?

The money lending business can be both good and bad, depending on several factors. Here’s a breakdown:

Potential Benefits

- High Potential Returns: Money lending can be profitable due to interest rates charged on loans. The higher the risk, the higher the interest rate is likely to be, leading to potential for significant income.

- Passive Income: Once you’ve established your business, it can generate a relatively passive income stream from interest payments.

- Demand: There’s always a demand for loans, whether from individuals needing help with expenses or businesses looking for funding.

- Flexibility: You can potentially set your own terms and conditions depending on your risk appetite and the lending structure.

Challenges & Risks

- Regulation: The lending industry is often heavily regulated, requiring licenses and compliance with various laws. This can be complex and costly.

- Risk of Default: There’s always a risk that borrowers won’t repay their loans, resulting in losses for you. Careful credit risk assessment is crucial.

- Competition: The lending market can be competitive, with banks, other lenders, and peer-to-peer lending platforms providing alternatives. You need to offer something unique or competitive to succeed.

- Capital Requirements: You’ll need a source of funds – either your own capital or investors – to start a lending business.

How to Make Your Money Lending Business More Successful

- Know the Laws: Get well-versed in the regulations and laws governing lending practices in your area.

- Strong Underwriting: Implement thorough processes to assess borrower creditworthiness, reducing your risk of defaults.

- Find a Niche: Specialize in a particular type of loan (e.g., small business loans, mortgages, personal loans) to establish expertise and target your marketing.

- Competitive Rates and Terms: Stay aware of competitor offerings and strike a balance between attractive terms and managing your risk.

- Excellent Customer Service: Building strong relationships with borrowers can encourage on-time payments and increase the chance of repeat business.

The money lending business can be lucrative but it also involves risk and careful management. If you understand the regulations, have processes to minimize defaults, and provide a valuable service to borrowers, it can be a good business venture.

Here’s how to create a business plan for your money lending business.

Conducting Market Research

One key component when developing a money lending business plan involves conducting thorough market research around the demand for lending products and services you aim to provide.

This research should seek to quantify factors like:

- Size of addressable market – The broader base of prospective borrowers meeting basic eligibility criteria regarding location, assets, credit standing, or other attributes. Provides total available market ceiling.

- Target segments – Refine broad market by attributes of subsets most likely to seek/qualify for loans. Assess segment size along with common borrowing needs.

- Competitive analysis – Profile existing lending providers competing for target segments. Detail their offerings, rates, processes strengths/weaknesses.

- Projected market share – Given competitive landscape and your differential advantages, estimate potential portion of business you can capture.

Robust research synthesizes data from sources including:

- Government census/economic data

- Financial trade association projections

- Customer surveys and interviews

- Competitor product literature

Isolate strategic opportunities where significant borrower demand exists, but current lending options are scarce, costly, or cumbersome to access.

Translating research into projections around number of prospective borrowers, conversion rates, and average loan sizes allows for mapping revenues and expenses at various scales.

Revisiting assumptions annually updates understanding of outlooks and opportunities as the basis for adjustments.

Building Financial Forecasts and Projections

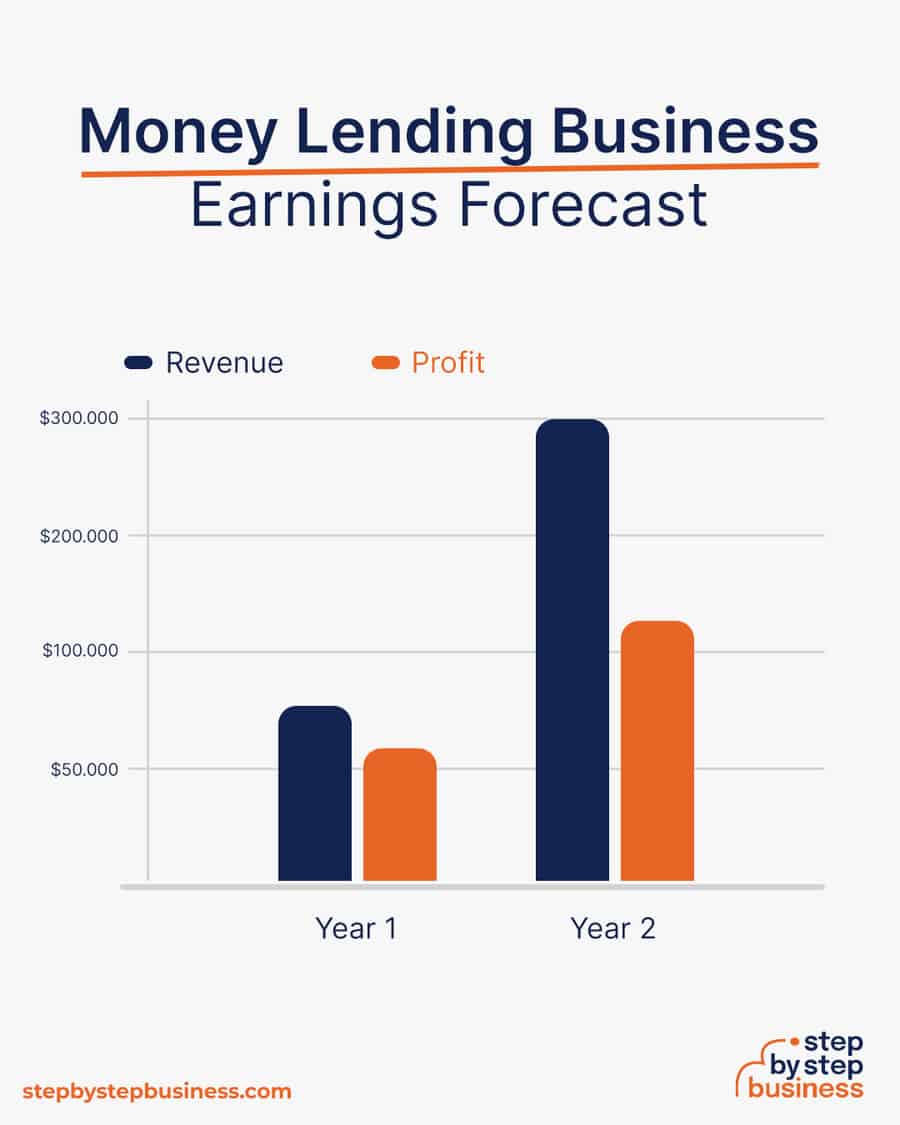

With research providing estimates of market opportunity, a money lending business plan needs to translate projections into expected financial performance.

Crafting projected income statements, balance sheets, and cash flow statements provides clarity on the numbers needed to viably launch while guiding growth.

Income Statement

Shows projected profitability by capturing:

- Interest income

- Loan origination/application fees

- Other revenue

- Less operating expenses

Illuminates expected profit margins at target volumes. Helps set lending rates and fees.

Balance Sheet

Estimates asset and liability positions over time.

Key line items:

- Cash reserves

- Outstanding loan balances

- Debt obligations

- Shareholder equity

Informs capital requirements and funding sources.

Cash Flow Statement

Tracks net cash generated/spent:

- Cash from operations

- Investing cash flows

- Financing cash flows

Ensures liquidity to fund lending and operations.

Building in Contingencies

While projections aim to model realistic outcomes, uncertainties exist when starting any business. A money lending business plan needs to incorporate contingencies that brace operations for unexpected events.

Building contingencies involves stress testing assumptions to account for potential downside scenarios related to:

Lower Than Expected Loan Demand

Triggers may include economic shifts or new competitive entrants. Contingency actions could involve:

- Adding new customer acquisition channels

- Expanding lending footprint geographically

- Adjusting rates/terms to incentivize borrowing

Maintains revenue streams amidst demand swings.

Higher Than Expected Loan Defaults

Contributing factors can range from interest rate hikes to lax underwriting. contingency maneuvers might require:

- Tightening underwriting criteria

- Increasing collections staff/activities

- Securing additional loan loss reserve capital

Keeps credit risks in check.

Insufficient Funding Access

May result from restrictive capital markets or partners backing out. Creates need to pursue options like:

- Providing loan guarantees/collateral

- Exploring alternative private funding sources

- Curtailing lending until funding secured

Prevents overextending beyond capital means.

While not expected, incorporating contingencies for big picture risks allows for agile response if challenges surface. Displays prudence to prospective investors/partners as well.

Defining Operational Infrastructure and Resource Requirements

With projections and contingencies established, the money lending business plan needs to map out key infrastructure elements and resource needs critical for delivery.

This involves detailing essential components like:

Staffing Requirements

- Management/executive roles

- Loan underwriting personnel

- Support staff for documentation, payments, customer service

- Any outsourced provider positions

Outline key responsibilities and ideal background sought.

Core Technology Architecture

- Loan management software

- Risk rating systems

- Customer relationship management (CRM) platforms

- Accounting systems

Itemize critical integration points between systems.

Facilities/Equipment Needs

- Office space requirements

- Furnishings and supplies

- Security measures

- Telecom/internet capabilities

Ensures environment supports target operations.

Startup and Ongoing Budgets

- Initial outlays for configuration expenses

- Salary estimates by role

- Projected overhead costs

Forecasts spending requirements over time.

Defining these key elements provides actionable direction on mobilizing an operating infrastructure aligned to plan projections and target segments. Assesses feasibility.

Detailing Growth Strategies and Execution Tactics

Beyond getting initial operations running, a money lending business plan needs to map out how to drive growth in borrowers, market share, lending portfolio, and ultimately revenues/profits over the long haul.

This typically involves crafting strategy across dimensions like:

Product Strategy

What loan products offer the biggest opportunities now and into the future? Plan helps identify ability to expand into new areas like:

- Personal lending

- Commercial real estate lending

- Specialty asset lending

- Peer-to-peer lending exchanges

Options for responsibly broadening products over time .

Market Penetration Strategy

How deeply do we reach target segments ? Can assess tactically increasing market penetration via:

- Local vs regional vs national lending

- New channel partnerships

- Expanded marketing budgets/reach

- Technology enhancements

Widens borrower access and share.

Innovation Strategy

What new capabilities and offerings improve competitiveness? Can pinpoint areas for innovation like:

- Streamlining application/funding processes

- Customizing risk algorithms

- Offering complementary services

Differentiates borrower experiences.

Painting a strategic vision for prudent, sustained growth gives stakeholders confidence in execution abilities while assuring teams have outlined roadmap for expansion.

Reviewing and evolving outlined tactics keeps growth trajectory headed in the right direction.

Money Lending Business Plan Template

1. executive summary.

- Brief overview of key details

- Mission statement

- Company description

- Products and services offered

- Target customer profiles

- Ownership structure and management team

- Startup funding requirements

- Financial projections

- Keys to success

2. Company Analysis

- Industry trends and outlook

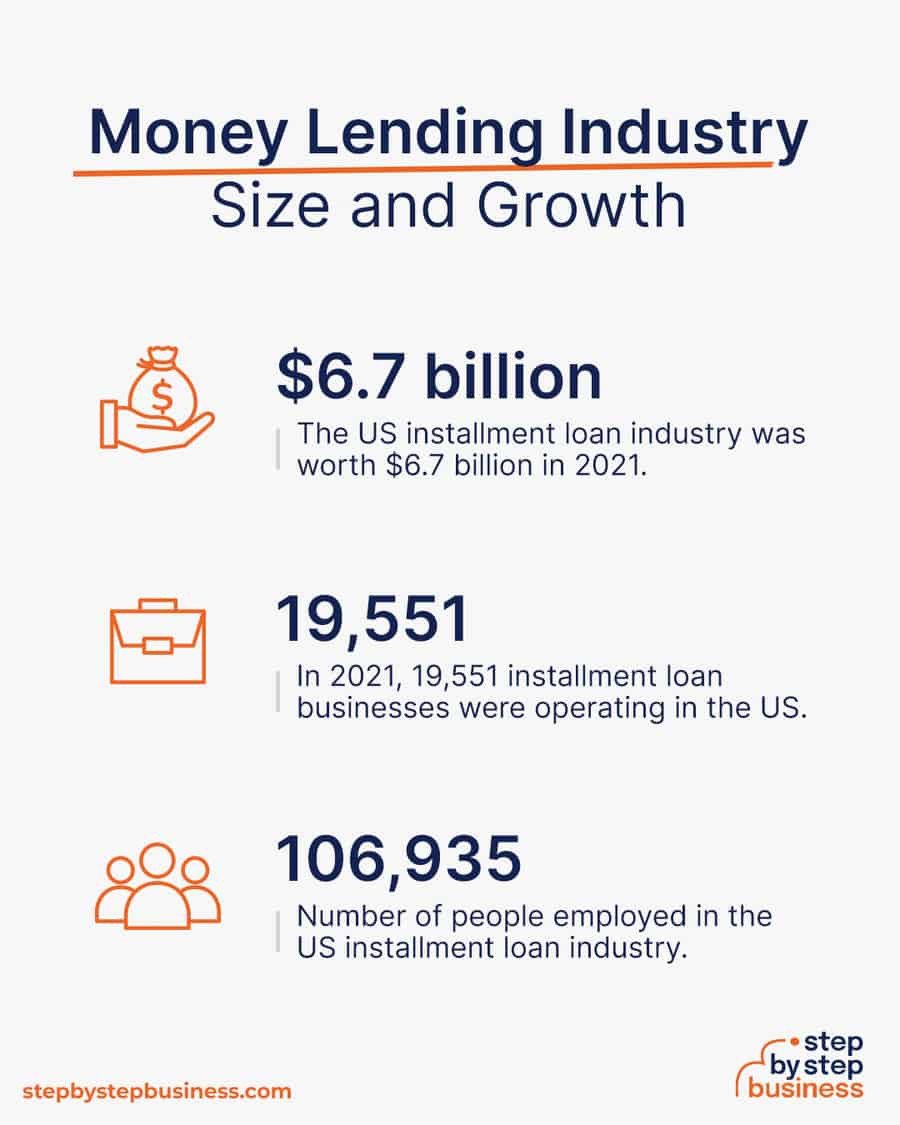

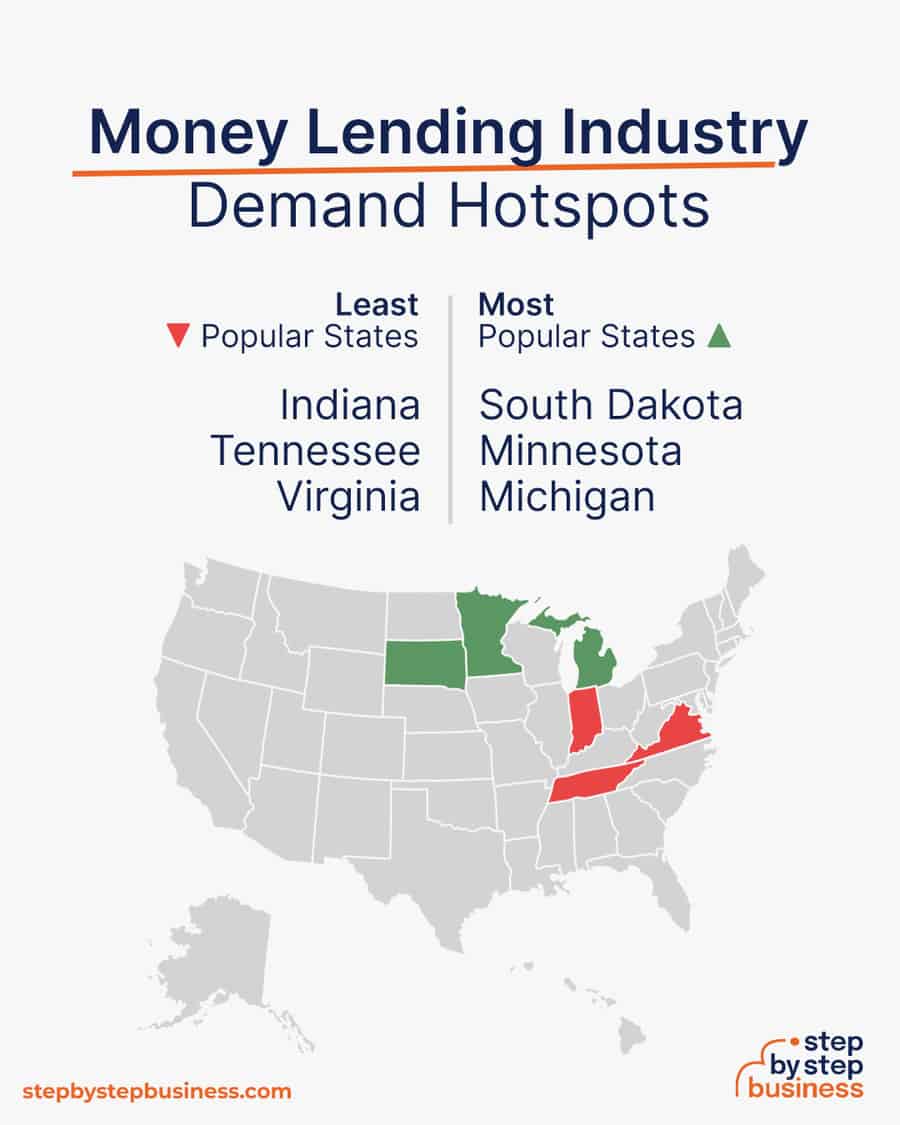

- Market size and growth forecasts

- Customer personas

- Purchasing factors

- Direct and indirect competitors

- Their strengths and weaknesses

- Internal strengths and weaknesses

- External opportunities and threats

- Company differentiators

3. Services

- Personal loans

- Payday loans

- Business loans

- Debt consolidation loans

- Interest rates

- Payment schedules

- Loan amounts

- Collateral policies

- Compliance policies and licensing

- Application and approval process

4. Marketing Plan

- Branding strategy

- Search, Display, and Social Media Ads

- Print, Radio, Direct Mail

- Partnerships and referrals

- Sales process and pipeline

- Retention programs for existing clients

5. Operations Plan

- Office space and equipment

- Policies and procedures

- Management team

- Loan officers

- Support staff

- Vendor relationships

- Daily workflow

6. Financial Plan

- Investments

- 3-5 year profit and loss projections

- Break-even analysis

- Cash flow forecasts

- Balance sheet

- Worst/Best case scenarios

- Key financial metrics and benchmarks

Key Takeaways

- Conduct extensive market research to size opportunities and refine target segments

- Build projected financial statements modeling performance

- Stress test assumptions through contingency planning

- Map out staffing, tech, facilities, and equipment needs

- Define strategies and tactics for driving growth in products, market penetration and innovation over time

- Money Lending Business Strategy Example + Ideas

- Top #7 Loan Management Software for Small Lenders

- What is Jisort – Meet your finance app

Recent Posts

- Posted by Content Team

Microfinance Mastery: Crafting a Winning Business Plan in India

Microfinance Bank Business Model Explained

How Create A Strategic Blueprint for Microfinance Success

This website stores cookies on your computer. Cookie Policy

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Successful Business Plan for a Loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does a loan business plan include?

What lenders look for in a business plan, business plan for loan examples, resources for writing a business plan.

A comprehensive and well-written business plan can be used to persuade lenders that your business is worth investing in and hopefully, improve your chances of getting approved for a small-business loan . Many lenders will ask that you include a business plan along with other documents as part of your loan application.

When writing a business plan for a loan, you’ll want to highlight your abilities, justify your need for capital and prove your ability to repay the debt.

Here’s everything you need to know to get started.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

A successful business plan for a loan describes your financial goals and how you’ll achieve them. Although business plan components can vary from company to company, there are a few sections that are typically included in most plans.

These sections will help provide lenders with an overview of your business and explain why they should approve you for a loan.

Executive summary

The executive summary is used to spark interest in your business. It may include high-level information about you, your products and services, your management team, employees, business location and financial details. Your mission statement can be added here as well.

To help build a lender’s confidence in your business, you can also include a concise overview of your growth plans in this section.

Company overview

The company overview is an area to describe the strengths of your business. If you didn’t explain what problems your business will solve in the executive summary, do it here.

Highlight any experts on your team and what gives you a competitive advantage. You can also include specific details about your business such as when it was founded, your business entity type and history.

Products and services

Use this section to demonstrate the need for what you’re offering. Describe your products and services and explain how customers will benefit from having them.

Detail any equipment or materials that you need to provide your goods and services — this may be particularly helpful if you’re looking for equipment or inventory financing . You’ll also want to disclose any patents or copyrights in this section.

Market analysis

Here you can demonstrate that you’ve done your homework and showcase your understanding of your industry, current outlook, trends, target market and competitors.

You can add details about your target market that include where you’ll find customers, ways you plan to market to them and how your products and services will be delivered to them.

» MORE: How to write a market analysis for a business plan

Marketing and sales plan

Your marketing and sales plan provides details on how you intend to attract your customers and build a client base. You can also explain the steps involved in the sale and delivery of your product or service.

At a high level, this section should identify your sales goals and how you plan to achieve them — showing a lender how you’re going to make money to repay potential debt.

Operational plan

The operational plan section covers the physical requirements of operating your business on a day-to-day basis. Depending on your type of business, this may include location, facility requirements, equipment, vehicles, inventory needs and supplies. Production goals, timelines, quality control and customer service details may also be included.

Management team

This section illustrates how your business will be organized. You can list the management team, owners, board of directors and consultants with details about their experience and the role they will play at your company. This is also a good place to include an organizational chart .

From this section, a lender should understand why you and your team are qualified to run a business and why they should feel confident lending you money — even if you’re a startup.

Funding request

In this section, you’ll explain the amount of money you’re requesting from the lender and why you need it. You’ll describe how the funds will be used and how you intend to repay the loan.

You may also discuss any funding requirements you anticipate over the next five years and your strategic financial plans for the future.

» Need help writing? Learn about the best business plan software .

Financial statements

When you’re writing a business plan for a loan, this is one of the most important sections. The goal is to use your financial statements to prove to a lender that your business is stable and will be able to repay any potential debt.

In this section, you’ll want to include three to five years of income statements, cash flow statements and balance sheets. It can also be helpful to include an expense analysis, break-even analysis, capital expenditure budgets, projected income statements and projected cash flow statements. If you have collateral that you could put up to secure a loan, you should list it in this section as well.

If you’re a startup that doesn’t have much historical data to provide, you’ll want to include estimated costs, revenue and any other future projections you may have. Graphs and charts can be useful visual aids here.

In general, the more data you can use to show a lender your financial security, the better.

Finally, if necessary, supporting information and documents can be added in an appendix section. This may include credit histories, resumes, letters of reference, product pictures, licenses, permits, contracts and other legal documents.

Lenders will typically evaluate your loan application based on the five C’s — or characteristics — of credit : character, capacity, capital, conditions and collateral. Although your business plan won't contain everything a lender needs to complete its assessment, the document can highlight your strengths in each of these areas.

A lender will assess your character by reviewing your education, business experience and credit history. This assessment may also be extended to board members and your management team. Highlights of your strengths can be worked into the following sections of your business plan:

Executive summary.

Company overview.

Management team.

Capacity centers on your ability to repay the loan. Lenders will be looking at the revenue you plan to generate, your expenses, cash flow and your loan payment plan. This information can be included in the following sections:

Funding request.

Financial statements.

Capital is the amount of money you have invested in your business. Lenders can use it to judge your financial commitment to the business. You can use any of the following sections to highlight your financial commitment:

Operational plan.

Conditions refers to the purpose and market for your products and services. Lenders will be looking for information such as product demand, competition and industry trends. Information for this can be included in the following sections:

Market analysis.

Products and services.

Marketing and sales plan.

Collateral is an asset pledged to a lender to guarantee the repayment of a loan. This can be equipment, inventory, vehicles or something else of value. Use the following sections to include information on assets:

» MORE: How to get a business loan

Writing a business plan for a loan application can be intimidating, especially when you’re just getting started. It may be helpful to use a business plan template or refer to an existing sample as you’re going through the draft process.

Here are a few examples that you may find useful:

Business Plan Outline — Colorado Small Business Development Center

Business Plan Template — Iowa Small Business Development Center

Writing a Business Plan — Maine Small Business Development Center

Business Plan Workbook — Capital One

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on Nerdwallet's secure site

U.S. Small Business Administration. The SBA offers a free self-paced course on writing a business plan. The course includes several videos, objectives for you to accomplish, as well as worksheets you can complete.

SCORE. SCORE, a nonprofit organization and resource partner of the SBA, offers free assistance that includes a step-by-step downloadable template to help startups create a business plan, and mentors who can review and refine your plan virtually or in person.

Small Business Development Centers. Similarly, your local SBDC can provide assistance with business planning and finding access to capital. These organizations also have virtual and in-person training courses, as well as opportunities to consult with business experts.

Business plan software. Although many business plan software platforms require a subscription, these tools can be useful if you want a templated approach that can break the process down for you step-by-step. Many of these services include a range of examples and templates, instruction videos and guides, and financial dashboards, among other features. You may also be able to use a free trial before committing to one of these software options.

A loan business plan outlines your business’s objectives, products or services, funding needs and finances. The goal of this document is to convince lenders that they should approve you for a business loan.

Not all lenders will require a business plan, but you’ll likely need one for bank and SBA loans. Even if it isn’t required, however, a lean business plan can be used to bolster your loan application.

Lenders ask for a business plan because they want to know that your business is and will continue to be financially stable. They want to know how you make money, spend money and plan to achieve your financial goals. All of this information allows them to assess whether you’ll be able to repay a loan and decide if they should approve your application.

On a similar note...

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Stratrgic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

How to Write a Professional Business Plan for a Loan

- March 27, 2024

11 Min Read

So, are you thinking of getting a loan or funding to start an exciting business journey?

That’s great! But before you go any further, it’s very important to have a solid business plan in place.

Well, we understand that creating a successful plan for a loan can be a daunting task. That’s why we’re here to help you!

This investment-ready business plan template for loans will help you include all the essential elements in your plan, from summarizing your business concept to projecting the financial data. It not only impresses business loan lenders but also sets the stage for success.

Ready to get started? Let’s first understand how business plans will help you with loan proposals.

How business plans help in loan applications?

A business plan is a professional document that serves as a written loan proposal if you want to secure a loan for capital investment. It details every aspect of your business, including its concept, goals, market opportunity, and financial data.

Whether you’re a new entrepreneur or a small business owner, you’ll need a well-prepared business plan. It helps you persuade potential investors or lenders of its viability and potential for success.

Here are a few primary reasons why business plans are necessary in loan applications:

It helps you showcase your vision

A well-written business plan communicates your business vision effectively and allows you to demonstrate your clarity of purpose and strategic direction. It offers lenders a compelling narrative of what your business is aimed for and how it will achieve its goals.

It helps you prove your financial feasibility

Well, lenders need assurance that they’re making a wise investment. A detailed business plan presents them with realistic financial projections, along with how your business will earn money and repay the loan. This infuses confidence in lenders and convinces them that your business is a safe bet.

It helps you mitigate potential risks

Once you start your business, it naturally involves fair enough risks. However, a good business plan clarifies that you’re aware of those challenges and have backup plans or strategies to mitigate them. This shows lenders that you’ve considered different situations and keep contingency plans in place.

It helps you demonstrate your preparedness

A business plan shows lenders that you’ve carefully outlined every aspect of your business—from conducting market analysis to predicting finances. It assures that you’re serious about your business and well-prepared to manage the ups and downs of starting a business.

In short, having a solid business plan can be the cornerstone of a successful loan application that explains your business idea and how you plan to utilize the loan money to get started.

Now that you know how business plans help in a loan application, it’s time to check out and understand the key elements of a business plan for a loan template.

Say goodbye to boring templates

Build your business plan faster and easier with AI assistant

Plans starting from $7/month

Key components of a successful business plan for a loan

1. executive summary.

An executive summary is the first section of the plan, providing a concise overview of the entire business plan.

Generally, it is written in the last, as it summarizes the most important components you mentioned in your plan.

Since the potential investors or lenders would read this section first, make sure that you keep it simple, crisp, and compelling to build their confidence in your business. Also, it should not be more than 1 or 2 pages.

You may write your executive summary with a precise explanation of your business concept, the type of business you operate, and its status.

Here are a few primary elements you must add to your summary:

- Your company’s mission statement

- The product or service you intend to offer

- Market Opportunity

- Management team’s background and experience

- Growth plans or long-term objectives

- Financial projections and funding needs

2. Company Overview

As you’ll give a brief introduction in the executive summary, this chapter will expand on it, providing an in-depth understanding of your business.

Company description includes all the business-related facts, such as the startup concept, vision-mission statements, company location, etc. Also, it explains the problems or challenges you aim to solve.

In addition to that, consider answering a few questions that would help lenders to grasp the significance of your business:

- What is the legal structure of your business?

- Who is the business owner?

- Do you have any business partners?

- Why did you start this business, and when it was founded?

- What are your business accomplishments to date?

- Who will get benefits from your company’s product or service?

Note that the company overview section can be regarded as your extended elevator pitch.

So, it’s a good opportunity to present your business’s specific details and structural aspects that the financing partner needs to know.

3. Market Analysis

The market analysis section provides readers with a deep understanding of the specific industry or market in which you plan to serve.

This seems unnecessary but serves different purposes. Those who are looking to fund a franchise business should do some serious work for this section, as lenders will review it very closely.

To carefully draft this section, you should conduct thorough market research and industry analysis to define your target customers, industry trends, market demand, and competitors.

This will demonstrate that you understand the market dynamics and validate the demand for your products or services.

Here are a few elements you should include in your market analysis section:

- Ideal target market

- Market size and growth potential

- Customer segments

- Competitive analysis

- Emerging trends

- Applicable government regulations

4. Product or Service Offerings

In this section, you may provide a detailed description of your products and service offerings, along with their features, benefits, and pricing structure.

It helps you highlight what your business offers to its ideal customers, how your offerings will satisfy their needs and explains the value proposition of your products or services.

You may consider including these points in the product or service section:

- A brief description of your product & service

- Pricing details

- Intellectual property, copyright, and patent filings

- Quality measures

- Any additional offerings

5. Sales and Marketing Strategies

Your marketing and sales plan elucidates how you intend to market your products or services in greater detail. It helps you outline the marketing and sales strategies you’ll use to attract and retain potential customers.

The primary goal is to give a flexible and practical marketing and sales strategy that persuades the lenders you know how to advertise or develop a public relations campaign to reach the company’s revenue goals.

For a well-crafted marketing plan, you might consider adding the following details in your plan:

- Your target audience and brand positioning

- Detailed marketing strategy

- Sales and marketing goals and KPIs

- Sales and marketing budgets

- Customer retention plan

While reviewing your loan application, lenders would like to know how you plan to make money and how you overcome marketing and sales challenges, so ensure that this strategy is always relevant.

6. Operations Plan

The operations plan section provides a clear picture of your company’s day-to-day operations and activities. It is a detailed-oriented section that outlines how you’ll manage to run your business smoothly.

Also, operational excellence is necessary to achieve your goals, satisfy client commitments, and maximize results. So, try to mention your operational intricacies and showcase efficient systems and processes.

Here are a list of details you must include in your operations plan:

- Staffing & training

- Operational processes

- Inventory needs and supplies

- facilities & technology

- Regulatory compliance

By offering insights into these operational aspects, this section helps you instill confidence in lenders about your ability to effectively handle and grow your company.

7. Management Team

Your management team section introduces the key individuals who are responsible for driving your business ahead.

It helps lenders easily understand your team’s roles & responsibilities, educational qualifications, industry experience, and how you plan to compensate your leadership team.

Even this will assure lenders that your team is capable enough to navigate challenges, make informed decisions, and reach strategic objectives. Also, they feel confident giving you a loan—even if it’s your startup.

So, you may consider including the below information:

- Company owner profile

- Resume-styled summary of key executives

- Organizational chart

- Compensation plan

- Details of advisory board members(if any)

8. Financial Plan

A well-written and comprehensive financial plan is one of the most crucial sections of your plan, as it helps you prove to lenders your business’s financial health, growth potential, and ability to repay the business loan.

So, your financial analysis must include the projected financial statements for three years or more. The following are the key financial projections that you should add:

- Income statements

- Cash flow statements

- Capital expenditure budgets

- Balance sheet

- Break-even analysis

- Funding requirements

As well as you should also list hard or soft collateral if you possess it so that you can put it up to get a loan. Even lenders may request to add more granular data(such as cost of sales or cost per product/service).

Note that if you’re a startup and don’t carry enough data to highlight, consider including estimated costs, revenue streams, and other strategic future projections you may have.

9. Appendix

The appendix is the last section of a professional business plan that typically provides supplementary information and other supporting documents the lender may need for better understanding.

You may include the following details in an appendix:

- Business licenses and permits

- Contractual agreements or other legal documents

- Letters of reference

- Credit histories and tax returns

- Key managers’ resumes and certificates

- Product photos

By adding these details, you offer more detailed explanations or validation for your business plan, strengthening your discussions and claims.

What factors do lenders look for in a business plan

When you submit a business plan to secure funding, lenders will analyze it to evaluate the viability and creditworthiness of your loan application. Here are several key factors they look for:

Character of your management team

Lenders will assess a business’ character that includes subjective or intangible qualities like whether its owners or key executives are perceived as honest, competent, or committed. Also, they consider educational background, industry experience, skills, leadership capabilities, and credit histories. This can be critical for evaluating prospects as most lenders don’t wish to lend to whom they don’t feel trustworthy.

Your capability to repay loans

Loan officers also spend a lot of time analyzing the borrower’s ability to repay the loan. They will thoroughly examine the financial statements such as projected revenue, expenses, cash flows, growth plans, and loan payments. Further, lenders analyze the financial history to see how much revenue you have generated or how much profit you have made in the past.

The capital amount you’re seeking

While reviewing loan applications, lenders will go through your financial information that highlights how much funding you’re seeking, how much cash you carry on hand, and how much debt you have. Also, they assess your personal financial investments as a sign of commitment and seriousness. So, make sure your business plan clearly outlines your investment amount and funding needs.

Collateral or personal guarantees

In some cases, lenders may request collateral or personal guarantees to secure the loan. Thus, you should document any assets or valuable items you can offer as collateral or additional security. Even lenders may still approve your loan without collateral if you have a good credit history and a reliable business plan.

By understanding these key considerations, you can prepare a business plan that resonates with the lender’s interests and concerns. Now, let’s move to a few business plan examples for a loan.

Business plan examples for a loan

When you’re just venturing into your entrepreneurship journey, crafting a comprehensive business plan for a loan application can be overwhelming.

So, try to consider some sample business plan templates or resources to get started on the first draft of your plan. Here are a few business plan examples that you may find helpful:

- Sample business plan outline

- Small business plan template

- Comprehensive business plan writing

- Business Plan Workbook for Loan Applications

Start preparing your business plan

Finally, you understand the importance and key elements of drafting a business plan for securing a loan or funding. But it requires some extra effort to find success down the road.

If you’re still confused about where to start, Upmetrics could be a great choice. It’s a modern business plan app that helps entrepreneurs or small business owners create an actionable plan quickly.

With Upmetrics, you’ll get easy-to-follow guides, a library of business plan templates , AI support, a financial forecasting tool, and other valuable resources to streamline your entire business planning approach.

So, don’t wait and start preparing your business plan for a loan!

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

Do i need a business plan to get a loan.

Of course, most lenders or financial institutes require a solid business plan, even if you are a well-established business. A well-crafted business plan helps you highlight every essential information about your business and demonstrate to lenders that you have a realistic plan in place to generate income and repay the loan.

Can I write a business plan myself?

Definitely, you can write a business plan by yourself. Also, you can get help from various resources available, including business plan templates and guides, to create a comprehensive plan. But, if you’re unsure or need assistance, you may consider having a business plan software or hiring a professional writer.

How long should my business plan be?

The length of your business plan should be concise and focused, typically depending on its purpose. A one-page business plan is a single-page document, a lean or mini business plan comprises 1–10 pages, while a comprehensive business plan can range from 15 to 35 pages and beyond.

What's the most important element of a loan-seeking business plan?

The financial plan is the most crucial element of a loan-seeking business plan, as lenders want to check realistic and well-structured financial forecasts that present your ability to repay the loan. Also, this section can make or break a lender’s confidence and willingness to raise capital.

What format should I use?

It’s essential to select a format that can effectively convey your business idea, strategy, and financial projections to the lenders. Following are a few common options to consider:

- Traditional text-based document

- PowerPoint or Keynote presentation deck

- Executive summary or a pitch deck

So, whatever format you choose, it should align with your preferences, the lender requirements, and the complexity of your business.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

- Search Search Please fill out this field.

Why Do I Need a Business Plan?

Sections of a business plan, the bottom line.

- Small Business

How to Write a Business Plan for a Loan

How to secure business financing

Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture.

:max_bytes(150000):strip_icc():format(webp)/smda1_crop-f0c167dd2b2144f68f352c63d17f7db5.jpg)

A business plan is a document that explains what a company’s objectives are and how it will achieve them. It contains a road map for the company from a marketing, financial, and operational standpoint. Some business plans are more detailed than others, but they are used by all types of businesses, from large, established companies to small startups.

If you are applying for a business loan , your lender may want to see your business plan. Your plan can prove that you understand your market and your business model and that you are realistic about your goals. Even if you don’t need a business plan to apply for a loan, writing one can improve your chances of securing finance.

Key Takeaways

- Many lenders will require you to write a business plan to support your loan application.

- Though every business plan is different, there are a number of sections that appear in every business plan.

- A good business plan will define your company’s strategic priorities for the coming years and explain how you will try to achieve growth.

- Lenders will assess your plan against the “five Cs”: character, capacity, capital, conditions, and collateral.

There are many reasons why all businesses should have a business plan . A business plan can improve the way that your company operates, but a well-written plan is also invaluable for attracting investment.

On an operational level, a well-written business plan has several advantages. A good plan will explain how a company is going to develop over time and will lay out the risks and contingencies that it may encounter along the way.

A business plan can act as a valuable strategic guide, reminding executives of their long-term goals amid the chaos of day-to-day business. It also allows businesses to measure their own success—without a plan, it can be difficult to determine whether a business is moving in the right direction.

A business plan is also valuable when it comes to dealing with external organizations. Indeed, banks and venture capital firms often require a viable business plan before considering whether they’ll provide capital to new businesses.

Even if a business is well-established, lenders may want to see a solid business plan before providing financing. Lenders want to reduce their risk, so they want to see that a business has a serious and realistic plan in place to generate income and repay the loan.

Every business is different, and so is every business plan. Nevertheless, most business plans contain a number of generic sections. Common sections are: executive summary, company overview, products and services, market analysis, marketing and sales plan, operational plan, and management team. If you are applying for a loan, you should also include a funding request and financial statements.

Let’s look at each section in more detail.

Executive Summary

The executive summary is a summary of the information in the rest of your business plan, but it’s also where you can create interest in your business.

You should include basic information about your business, including what you do, where you are based, your products, and how long you’ve been in business. You can also mention what inspired you to start your business, your key successes so far, and your growth plans.

Company Overview

In this section, focus on the core strengths of your business, the problem you want to solve, and how you plan to address it.

Here, you should also mention any key advantages that your business has over your competitors, whether this is operating in a new market or a unique approach to an existing one. You should also include key statistics in this section, such as your annual turnover and number of employees.

Products and Services

In this section, provide some details of what you sell. A lender doesn’t need to know all the technical details of your products but will want to see that they are desirable.

You can also include information on how you make your products, or how you provide your services. This information will be useful to a lender if you are looking for financing to grow your business.

Market Analysis

A market analysis is a core section of your business plan. Here, you need to demonstrate that you understand the market you are operating in, and how you are different from your competitors. If you can find statistics on your market, and particularly on how it is projected to grow over the next few years, put them in this section.

Marketing and Sales Plan

Your marketing and sales plan gives details on what kind of new customers you are looking to attract, and how you are going to connect with them. This section should contain your sales goals and link these to marketing or advertising that you are planning.

If you are looking to expand into a new market, or to reach customers that you haven’t before, you should explain the risks and opportunities of doing so.

Operational Plan

This section explains the basic requirements of running your business on a day-to-day basis. Your exact requirements will vary depending on the type of business you run, but be as specific as possible.

If you need to rent office space, for example, you should include the cost in your operational plan. You should also include the cost of staff, equipment, and any raw materials required to run your business.

Management Team

The management team section is one of the most important sections in your business plan if you are applying for a loan. Your lender will want reassurance that you have a skilled, experienced, competent, and reliable senior management team in place.

Even if you have a small team, you should explain what makes each person qualified for their position. If you have a large team, you should include an organizational chart to explain how your team is structured.

Funding Request

If you are applying for a loan, you should add a funding request. This is where you explain how much money you are looking to borrow, and explain in detail how you are going to use it.

The most important part of the funding-request section is to explain how the loan you are asking for would improve the profitability of your business, and therefore allow you to repay your loan.

Financial Statements

Most lenders will also ask you to provide evidence of your business finances as part of your application. Graphs and charts are often a useful addition to this section, because they allow your lender to understand your finances at a glance.

The overall goal of providing financial statements is to show that your business is profitable and stable. Include three to five years of income statements, cash flow statements, and balance sheets. It can also be useful to provide further analysis, as well as projections of how your business will grow in the coming years.

What Do Lenders Look for in a Business Plan?

Lenders want to see that your business is stable, that you understand the market you are operating in, and that you have realistic plans for growth.

Your lender will base their decision on what are known as the “five Cs.” These are:

- Character : You can stress your good character in your executive summary, company overview, and your management team section.

- Capacity : This is, essentially, your ability to repay the loan. Your lender will look at your growth plans, your funding request, and your financial statements in order to assess this.

- Capital : This is the amount of money you already have in your business. The larger and more established your business is, the more likely you are to be approved for finance, so highlight your capital throughout your business plan.

- Conditions : Conditions refer to market conditions. In your market analysis, you should be able to prove that your business is well-positioned in relation to your target market and competitors.

- Collateral : Depending on your loan, you may be asked to provide collateral , so you should provide information on the assets you own in your operational plan.

How Long Does It Take to Write a Business Plan?

The length of time it takes to write a business plan depends on your business, but you should take your time to ensure it is thorough and correct. A business plan has advantages beyond applying for a loan, providing a strategic focus for your business.

What Should You Avoid When Writing a Business Plan?

The most common mistake that business owners make when writing a business plan is to be unrealistic about their growth potential. Your lender is likely to spot overly optimistic growth projections, so try to keep it reasonable.

Should I Hire Someone to Write a Business Plan for My Business?

You can hire someone to write a business plan for your business, but it can often be better to write it yourself. You are likely to understand your business better than an external consultant.

Writing a business plan can benefit your business, whether you are applying for a loan or not. A good business plan can help you develop strategic priorities and stick to them. It describes how you are going to grow your business, which can be valuable to lenders, who will want to see that you are able to repay a loan that you are applying for.

U.S. Small Business Administration. “ Write Your Business Plan .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

U.S. Small Business Administration. “ Fund Your Business .”

Navy Federal Credit Union. “ The 5 Cs of Credit .”

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Mar 30, 2023

The Ultimate Guide to Writing a Business Plan for a Loan: A Step-by-Step Walk-Through

The Ultimate Guide to Writing a Business Plan for a Loan: A Step-by-Step Walkthrough

As a business plan specialist and expert business planner, I'm here to guide you through the process of writing a comprehensive business plan for securing a loan. Whether you're a start-up or an established business looking to expand, a well-crafted business plan is essential for impressing potential lenders and securing the funding you need.

In this extensive, 5,000-word article, I'll cover everything you need to know about creating a top-notch business plan that will boost your chances of loan approval. We'll go through each section in detail, providing you with practical examples and tips to optimize your plan for success. So, let's get started!

Executive Summary

The executive summary is the first and most critical section of your business plan. It's a brief overview of your entire plan, highlighting the key points and giving readers an insight into your business.

Key elements to include in your executive summary:

Business concept: Briefly explain your business idea, the products or services you plan to offer, and the target market.

Company overview: Provide essential information about your company, including its legal structure, location, and mission statement.

Management team: Showcase the expertise and experience of your management team, emphasizing their ability to lead the business.

Market opportunity: Describe the market demand, trends, and target audience, highlighting the opportunity for your business to succeed.

Financial highlights: Summarize your financial projections, including sales, profits, and cash flow.

Loan purpose: Clearly state the purpose of the loan and the amount you're seeking.

Remember, the executive summary is often the first thing lenders read, so make it engaging and informative to grab their attention.

Company Description

The company description section is where you provide a more in-depth look at your business. It should give readers a clear understanding of your company's purpose, goals, and competitive advantages.

Key elements to include in your company description:

Business history: If your company has an existing history, briefly describe its origins and milestones achieved.

Mission statement: Articulate the purpose of your company and the value you aim to provide to customers.

Objectives: Outline the specific goals you want to achieve with your business, both short-term and long-term.

Products and services: Provide a detailed description of the products or services you plan to offer, emphasizing the benefits they provide to customers.

Target market: Identify your target audience, specifying their demographics, psychographics, and buying habits.

Competitive advantage: Explain what sets your business apart from the competition and how you plan to maintain this edge.

Market Analysis

The market analysis section demonstrates your understanding of the industry, market, and competition. It's crucial to show lenders that you've done your homework and have a comprehensive understanding of the market landscape.

Key elements to include in your market analysis:

Industry overview: Provide a high-level view of your industry, including its size, growth trends, and key players.

Market segmentation: Break down your target market into smaller segments, identifying their unique needs and preferences.

Target market characteristics: Describe the specific characteristics of your target market, such as demographics, psychographics, and geographic location.

Market demand: Present evidence of market demand, using data on customer needs, market trends, and buying behaviors.

Competitor analysis: Evaluate your main competitors, analyzing their strengths, weaknesses, and market share.

SWOT analysis: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) to assess your business's position in the market.

Marketing and Sales Strategy

In this section, outline your marketing and sales strategy to show lenders how you plan to attract and retain customers, as well as generate revenue. A well-defined marketing and sales strategy is crucial to demonstrate that you have a clear plan for growth and profitability.

Key elements to include in your marketing and sales strategy:

Marketing objectives: Define your marketing goals, such as brand awareness, lead generation, or customer retention.

Target audience: Reiterate your target market, emphasizing their needs and preferences.

Unique selling proposition (USP): Highlight your USP, the main reason customers should choose your products or services over the competition.

Marketing channels: Identify the marketing channels you plan to use, such as social media, email, content marketing, or paid advertising. Explain the rationale behind your choice of channels and how they align with your target audience.

Sales process: Describe your sales process, from lead generation to closing deals. Include details on your sales team structure, training, and compensation plans.

Key performance indicators (KPIs): List the KPIs you'll use to measure the success of your marketing and sales efforts, such as conversion rates, average deal size, or customer lifetime value.

Operations Plan

The operations plan section details the day-to-day activities required to run your business. It shows lenders that you have a clear understanding of the operational aspects of your company and the resources needed to support your growth.

Key elements to include in your operations plan:

Facilities: Describe your business's physical location, including its size, layout, and any equipment or machinery required.

Production process: If applicable, detail your production process, including the steps involved, quality control measures, and production capacity.

Supply chain: Outline your supply chain, identifying key suppliers, procurement processes, and inventory management practices.

Staffing: Explain your staffing requirements, including the roles, responsibilities, and qualifications of each team member.

Management structure: Provide an organizational chart, showcasing your company's management structure and reporting lines.

Legal and regulatory requirements: Identify any relevant legal or regulatory requirements, such as licenses, permits, or certifications needed to operate your business.

Financial Plan

The financial plan is arguably the most crucial section of your business plan when applying for a loan. It demonstrates your ability to manage finances, make informed decisions, and, ultimately, repay the loan.

Key elements to include in your financial plan:

Revenue projections: Estimate your future sales, breaking them down by product or service category and showing growth rates over time.

Expense projections: Forecast your expenses, including fixed costs (e.g., rent, utilities) and variable costs (e.g., marketing, salaries).

Cash flow statement: Provide a detailed cash flow statement, showing how cash will flow in and out of your business over a specified period (typically 12 months).

Profit and loss statement: Create a profit and loss statement that projects your business's profitability over time.

Balance sheet: Prepare a balance sheet that showcases your business's assets, liabilities, and equity.

Break-even analysis: Calculate the point at which your business will break even, meaning your revenues equal your expenses.

Loan repayment schedule: Detail your proposed loan repayment schedule, including the loan amount, interest rate, repayment terms, and projected date of full repayment.

The appendices section is where you can include any additional documents or supporting materials that are relevant to your business plan. These documents may provide further evidence of your company's viability and help strengthen your case for securing a loan.

Examples of items to include in the appendices:

Resumes of key team members

Product samples or prototypes

Market research data or surveys

Letters of intent or contracts with suppliers, partners, or customers

Intellectual property documentation, such as patents, trademarks, or copyrights

Relevant licenses, permits, or certifications

Writing a comprehensive business plan for a loan can seem like a daunting task, but with the right approach and guidance, it's an achievable goal. By following the step-by-step instructions outlined in this article, you can create a well-structured, persuasive business plan that will greatly improve your chances of securing the funding you need. Remember to:

Pay close attention to your executive summary, as it sets the tone for the entire plan.

Be thorough and detailed in your market analysis, showing a deep understanding of your industry and target audience.

Develop a solid marketing and sales strategy to demonstrate your ability to attract and retain customers.

Address the operational aspects of your business, including staffing, facilities, and supply chain management.

Present a robust financial plan, complete with projections and a loan repayment schedule.

By doing so, you'll showcase your expertise, commitment, and preparedness to potential lenders, significantly increasing the likelihood of obtaining the loan your business needs to grow and succeed.

In addition to following the steps outlined in this guide, consider seeking professional assistance from a business plan consultant or specialist to review and refine your plan. Their expertise can help you identify any areas that may need improvement and ensure that your business plan is optimized for success.

Finally, remember to continuously update your business plan as your business evolves. Regular updates will ensure that your plan remains relevant and accurate, providing you with a valuable roadmap for your business's future growth and development.

With dedication, persistence, and a well-crafted business plan, you can secure the funding you need to bring your business vision to life. Good luck, and here's to your success!

- Writing Your Business Plan

- Funding Your Business

Recent Posts

The Five Most Frequently Asked Questions About Business Loans

The Five Most Frequently Asked Questions About Startup Funding

The Ultimate Cheat Sheet: Business Plan Writing Tips & Tricks

Micro Lending Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry » Lending & Loan Brokerage Business

Are you about starting a micro lending business? If YES, here is a complete sample micro lending business plan template & feasibility report you can use for FREE .

Okay, so we have considered all the requirements for starting a micro lending business . We also took it further by analyzing and drafting a sample micro lending company marketing plan template backed up by actionable guerrilla marketing ideas for micro lending businesses.

What Does It Take to Start a Micro Lending Business?

Building a micro lending and mortgage business is not different from building a normal brokerage or loan business. Micro lenders may actually broker loans to small businesses without collateral, but they are different from brokers because they have the license and right to lend money to people seeking home financing.

Building your own Micro lending and mortgage business might seem or sound easier and the joy of creating your own hours and keeping your commissions may be very attractive. You may also avoid office drama and politics and plan your own advancement opportunities.

But bear in mind that handling some logistics properly will be very crucial to getting your micro loan business running successfully. This is why it is very important that you learn all the ropes of the business before you look at starting yours. There are many grey areas of the micro lending business that needs to be mastered.

One of the ways to get really conversant with the micro lending business is to carry out your own feasibility research. Also you may want to use a business plan template to learn all that the business involves. The cost of starting, how many employees you will need amongst many others. Here is a sample micro lending business plan;

A Sample Micro lending Business Plan Template

1. industry overview.

Even in hard economic conditions, people and enterprises go for loans to be able to pay for the purchase of real estate and other transactions, which in turn make the lending business a recession-proof business. But before going into the micro lending and mortgage business, you need to know the contours and crannies of this large industry.

The Micro lending and mortgage business is actually coming back from a drastic crash in the housing market, economic recession and also riding with the swelling competition from commercial banks within the five years to 2016. The Micro lending and mortgage industry revenue doubled prior to the recession because of the unequivocal consumer demand for credit and the popular use of a wide variety of micro options for previously unqualified borrowers.

Due to the steady and good improvements in the housing sector in the past few years, the micro lending and mortgage industry has moved its focus toward earning back its reputation. In the approaching years to 2022, the micro lending and mortgage industry it is believed to continue recovery due to raising economy, and the housing market will favourably help the industry’s growth.

The Micro lending and mortgage industry may also venture into a declining stage of its economic life cycle because of the competition they face from commercial banks which is becoming imminent. The industry value added (IVA), which actually decides the industry’s contribution to the overall economy, is expected to grow at an annual rate of 1.5% within the 5 years to 2022.

Earnestly, the US GDP is believed will grow at a yearly rate of 2.2% during the same period. All these figures explain that the industry’s share of the US economy is quietly declining. A

lso during the past 10 years, the immediate introduction of brand new products, including subprime mortgages, Alt-A mortgages and NINJA loans, and reduced lending standards supported demand for home loans, has explicitly injected a positive pressure on the need for micro lenders and brokers that have actually enjoy unlimited access to these products and to a enjoy variety of interest rates.

2. Executive Summary

Vanguard lenders LLC is an outstanding micro lending and mortgage firm that will be attending to the enormous needs of small businesses, real estate professionals, builders and individual home buyers. We have access to a full range of microfinance and we offer the right loan–with the best rates, terms and costs–to meet our prospective customer’s enormous needs.

Vanguard lenders LLC offers high-quality micro lending and mortgage services to residential and business customers. Our major aim is to provide our customers with substantial microloans at reasonable prices and rates, while also keeping our customers Informed and active throughout the process.

Vanguard lenders LLC will also strive to become friends and advisers to our customers as well as quality service providers. Vanguard lenders LLC is a good firm to work, a professional work environment that is challenging, rewarding, innovative, and respectful of our customers and employees ideas and plans.

Vanguard lenders LLC will unanimously provide excellent value to our customers and fair reward to its owners and employees. Vanguard lenders LLC is also a legally registered micro lending and mortgage firm which will be located in the City of Alexandria, Virginia.

We will be occupying a standard office facility in the business district of the city, giving us the suitable traffic to attract customers. We plan to mould Vanguard lenders LLC into the very best of Micro lending and mortgage firm and actually compete favourably in the industry.

Our business goal which is to take over the market completely may seem outrageous, but we are very positive that it will be realized because we have done an extensive research and feasibility studies and we believe we have dotted all our i’s and made all reasonable judgements to position Vanguard lenders LLC for the war to take over Virginia entirely.

Vanguard lenders LLC are capitalized by two principal investors, Mr John Taylor and Mr Alfred Garth. Both are well renowned in the lending industry with a combined experience of over 30 years in the industry.

3. Our Products and Services

We’re going to be offering a varieties of services within the parameters of the micro lending and mortgage services industry in the united states of America and of course on the global stage. We are well place to maximise profits in the industry and we plan to do all within the proximity of the law in the United States to achieve these goals, aim and ambition. Our business offering are listed below;

- Offer loans to small businesses

- Providing residential mortgages

- Providing commercial and industrial mortgages

- Providing home equity loans

- Providing equipment loans

- Providing vehicle loans

- Providing residential mortgages loans online

- Providing mortgage financing online

- Providing home equity loans online

- Providing an online mortgage marketplace

- Providing other related loan cum mortgage consulting and advisory services

4. Our Mission and Vision Statement

- Our vision is to build loan services brand which will become the lead choice for individuals, smaller businesses and corporate clients in the whole of Virginia.

- Our vision shows our zeal, values, integrity, security, service, excellence and teamwork.

- Our mission is to provide professional, reliable and trusted microloan services that assist individuals, start – ups, corporate organization, and non-profit organizations in achieving their goals with little or no stress .

- We will build our business to become one of the leading firms in the micro loan services line of business in the whole of America, starting with Alexandria Virginia.

Our Business Structure

Vanguard lenders LLC is a micro loan service firm that we hope to grow big in order to compete favourably with leading microloan service firms in the industry both in the United States and on a global stage. We understand the need to create a solid business structure and hire capable hands that will aid in making Vanguard lenders LLC the best among the best.

The sort of loan services we hope to build and the great goals we want to achieve is what moved us to choose the list of offices and individuals we need to hire. We believe that these portfolios will be filled with well experienced and learned individuals, who understand the do and don’ts of the lending market.

We also hope to hire people that are qualified, hardworking, and creative, result driven, customer centric and are ready to work to help us build a prosperous business that will benefit all the stake holders (the owners, workforce, and customers).

Chief Executive Officer

- Business consultant

Human Resource and Admin Manager

- Sales and Marketing director

- Company accountant

Receptionist

5. Job Roles and Responsibilities

- The Chief Executive Officer will be responsible for providing work direction for the business

- He will be responsible for building, communicating, and implementing the vision, mission, and direction of Vanguard lenders LLC – which also includes leading the achievement and implementation of all strategies.

- The Chief Executive Officer is also in charge of fixing prices and signing business deals for the business

- He is also responsible for employment

- He also pays workers salary

- He signs checks and documents for and on behalf of the agency

- The Chief Executive Officer also Evaluates the success of the organization

Business Consultant

- Will be in charge of providing residential microloans

- Responsible for providing commercial and industrial microloans

- Will be obligated to provide home equity loans

- Also provides equipment loans

- Charged with providing vehicle loans

- Is also in charge of fixing micro and mortgage financing online

- The business consultant is also charged with fixing home equity loans online

- Provides an online micro and mortgage marketplace for the company

- Also responsible for providing mortgage related loan cum lending consultancy

- Oversees the running of HR and administrative tasks for Vanguard lenders LLC

- In charge of Monitoring office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Makes sure of the operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Is tasked with staying updated on job knowledge by participating in educational opportunities; reading professional publications; maintaining personal networks; participating in professional organizations.

- Builds the reputation of the firm by accepting ownership for accomplishing new and different requests; exploring opportunities to add value to job accomplishments.

- Tasked with stating job positions for recruitment and managing interviewing process

- Responsible for organising staff induction for new team members

- Tasked with organising trainings, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Tasked with overseeing the smooth running of the daily office activities.

Sales and Marketing Director

- Responsible for organising external research and coordinating all the internal sources of information to retain the organizations’ best customers and attract new ones

- Responsible for creating demographic information and analysing the volumes of transactional data generated by customer purchases

- Expected to understand, prioritizes, and reaches out to new partners, and business opportunities et al

- Tasked with understanding development opportunities; follows up on development leads and contacts; participates in the structuring and financing of projects; assures the completion of development projects.

- It’s the job of the director to supervise implementation, advocate for the customer’s needs, and communicate with clients

- The sales and marketing director is also charged with creating, executing and evaluating new plans for expanding increase sales

- Keep all customer contact and information

- Represents the company in strategic meetings

- Aid to increase sales and growth for the business

Company Accountant

- The company accountant is responsible for preparing financial reports, budgets, and financial statements.

- Also provides the managements with financial analyses, development budgets, and accounting reports; analyses financial feasibility for the most complex proposed projects; conducts market research to forecast trends and business conditions.

- The company accountant is also tasked with the company’s financial forecasting and risks analysis.