How to master the seven-step problem-solving process

In this episode of the McKinsey Podcast , Simon London speaks with Charles Conn, CEO of venture-capital firm Oxford Sciences Innovation, and McKinsey senior partner Hugo Sarrazin about the complexities of different problem-solving strategies.

Podcast transcript

Simon London: Hello, and welcome to this episode of the McKinsey Podcast , with me, Simon London. What’s the number-one skill you need to succeed professionally? Salesmanship, perhaps? Or a facility with statistics? Or maybe the ability to communicate crisply and clearly? Many would argue that at the very top of the list comes problem solving: that is, the ability to think through and come up with an optimal course of action to address any complex challenge—in business, in public policy, or indeed in life.

Looked at this way, it’s no surprise that McKinsey takes problem solving very seriously, testing for it during the recruiting process and then honing it, in McKinsey consultants, through immersion in a structured seven-step method. To discuss the art of problem solving, I sat down in California with McKinsey senior partner Hugo Sarrazin and also with Charles Conn. Charles is a former McKinsey partner, entrepreneur, executive, and coauthor of the book Bulletproof Problem Solving: The One Skill That Changes Everything [John Wiley & Sons, 2018].

Charles and Hugo, welcome to the podcast. Thank you for being here.

Hugo Sarrazin: Our pleasure.

Charles Conn: It’s terrific to be here.

Simon London: Problem solving is a really interesting piece of terminology. It could mean so many different things. I have a son who’s a teenage climber. They talk about solving problems. Climbing is problem solving. Charles, when you talk about problem solving, what are you talking about?

Charles Conn: For me, problem solving is the answer to the question “What should I do?” It’s interesting when there’s uncertainty and complexity, and when it’s meaningful because there are consequences. Your son’s climbing is a perfect example. There are consequences, and it’s complicated, and there’s uncertainty—can he make that grab? I think we can apply that same frame almost at any level. You can think about questions like “What town would I like to live in?” or “Should I put solar panels on my roof?”

You might think that’s a funny thing to apply problem solving to, but in my mind it’s not fundamentally different from business problem solving, which answers the question “What should my strategy be?” Or problem solving at the policy level: “How do we combat climate change?” “Should I support the local school bond?” I think these are all part and parcel of the same type of question, “What should I do?”

I’m a big fan of structured problem solving. By following steps, we can more clearly understand what problem it is we’re solving, what are the components of the problem that we’re solving, which components are the most important ones for us to pay attention to, which analytic techniques we should apply to those, and how we can synthesize what we’ve learned back into a compelling story. That’s all it is, at its heart.

I think sometimes when people think about seven steps, they assume that there’s a rigidity to this. That’s not it at all. It’s actually to give you the scope for creativity, which often doesn’t exist when your problem solving is muddled.

Simon London: You were just talking about the seven-step process. That’s what’s written down in the book, but it’s a very McKinsey process as well. Without getting too deep into the weeds, let’s go through the steps, one by one. You were just talking about problem definition as being a particularly important thing to get right first. That’s the first step. Hugo, tell us about that.

Hugo Sarrazin: It is surprising how often people jump past this step and make a bunch of assumptions. The most powerful thing is to step back and ask the basic questions—“What are we trying to solve? What are the constraints that exist? What are the dependencies?” Let’s make those explicit and really push the thinking and defining. At McKinsey, we spend an enormous amount of time in writing that little statement, and the statement, if you’re a logic purist, is great. You debate. “Is it an ‘or’? Is it an ‘and’? What’s the action verb?” Because all these specific words help you get to the heart of what matters.

Want to subscribe to The McKinsey Podcast ?

Simon London: So this is a concise problem statement.

Hugo Sarrazin: Yeah. It’s not like “Can we grow in Japan?” That’s interesting, but it is “What, specifically, are we trying to uncover in the growth of a product in Japan? Or a segment in Japan? Or a channel in Japan?” When you spend an enormous amount of time, in the first meeting of the different stakeholders, debating this and having different people put forward what they think the problem definition is, you realize that people have completely different views of why they’re here. That, to me, is the most important step.

Charles Conn: I would agree with that. For me, the problem context is critical. When we understand “What are the forces acting upon your decision maker? How quickly is the answer needed? With what precision is the answer needed? Are there areas that are off limits or areas where we would particularly like to find our solution? Is the decision maker open to exploring other areas?” then you not only become more efficient, and move toward what we call the critical path in problem solving, but you also make it so much more likely that you’re not going to waste your time or your decision maker’s time.

How often do especially bright young people run off with half of the idea about what the problem is and start collecting data and start building models—only to discover that they’ve really gone off half-cocked.

Hugo Sarrazin: Yeah.

Charles Conn: And in the wrong direction.

Simon London: OK. So step one—and there is a real art and a structure to it—is define the problem. Step two, Charles?

Charles Conn: My favorite step is step two, which is to use logic trees to disaggregate the problem. Every problem we’re solving has some complexity and some uncertainty in it. The only way that we can really get our team working on the problem is to take the problem apart into logical pieces.

What we find, of course, is that the way to disaggregate the problem often gives you an insight into the answer to the problem quite quickly. I love to do two or three different cuts at it, each one giving a bit of a different insight into what might be going wrong. By doing sensible disaggregations, using logic trees, we can figure out which parts of the problem we should be looking at, and we can assign those different parts to team members.

Simon London: What’s a good example of a logic tree on a sort of ratable problem?

Charles Conn: Maybe the easiest one is the classic profit tree. Almost in every business that I would take a look at, I would start with a profit or return-on-assets tree. In its simplest form, you have the components of revenue, which are price and quantity, and the components of cost, which are cost and quantity. Each of those can be broken out. Cost can be broken into variable cost and fixed cost. The components of price can be broken into what your pricing scheme is. That simple tree often provides insight into what’s going on in a business or what the difference is between that business and the competitors.

If we add the leg, which is “What’s the asset base or investment element?”—so profit divided by assets—then we can ask the question “Is the business using its investments sensibly?” whether that’s in stores or in manufacturing or in transportation assets. I hope we can see just how simple this is, even though we’re describing it in words.

When I went to work with Gordon Moore at the Moore Foundation, the problem that he asked us to look at was “How can we save Pacific salmon?” Now, that sounds like an impossible question, but it was amenable to precisely the same type of disaggregation and allowed us to organize what became a 15-year effort to improve the likelihood of good outcomes for Pacific salmon.

Simon London: Now, is there a danger that your logic tree can be impossibly large? This, I think, brings us onto the third step in the process, which is that you have to prioritize.

Charles Conn: Absolutely. The third step, which we also emphasize, along with good problem definition, is rigorous prioritization—we ask the questions “How important is this lever or this branch of the tree in the overall outcome that we seek to achieve? How much can I move that lever?” Obviously, we try and focus our efforts on ones that have a big impact on the problem and the ones that we have the ability to change. With salmon, ocean conditions turned out to be a big lever, but not one that we could adjust. We focused our attention on fish habitats and fish-harvesting practices, which were big levers that we could affect.

People spend a lot of time arguing about branches that are either not important or that none of us can change. We see it in the public square. When we deal with questions at the policy level—“Should you support the death penalty?” “How do we affect climate change?” “How can we uncover the causes and address homelessness?”—it’s even more important that we’re focusing on levers that are big and movable.

Would you like to learn more about our Strategy & Corporate Finance Practice ?

Simon London: Let’s move swiftly on to step four. You’ve defined your problem, you disaggregate it, you prioritize where you want to analyze—what you want to really look at hard. Then you got to the work plan. Now, what does that mean in practice?

Hugo Sarrazin: Depending on what you’ve prioritized, there are many things you could do. It could be breaking the work among the team members so that people have a clear piece of the work to do. It could be defining the specific analyses that need to get done and executed, and being clear on time lines. There’s always a level-one answer, there’s a level-two answer, there’s a level-three answer. Without being too flippant, I can solve any problem during a good dinner with wine. It won’t have a whole lot of backing.

Simon London: Not going to have a lot of depth to it.

Hugo Sarrazin: No, but it may be useful as a starting point. If the stakes are not that high, that could be OK. If it’s really high stakes, you may need level three and have the whole model validated in three different ways. You need to find a work plan that reflects the level of precision, the time frame you have, and the stakeholders you need to bring along in the exercise.

Charles Conn: I love the way you’ve described that, because, again, some people think of problem solving as a linear thing, but of course what’s critical is that it’s iterative. As you say, you can solve the problem in one day or even one hour.

Charles Conn: We encourage our teams everywhere to do that. We call it the one-day answer or the one-hour answer. In work planning, we’re always iterating. Every time you see a 50-page work plan that stretches out to three months, you know it’s wrong. It will be outmoded very quickly by that learning process that you described. Iterative problem solving is a critical part of this. Sometimes, people think work planning sounds dull, but it isn’t. It’s how we know what’s expected of us and when we need to deliver it and how we’re progressing toward the answer. It’s also the place where we can deal with biases. Bias is a feature of every human decision-making process. If we design our team interactions intelligently, we can avoid the worst sort of biases.

Simon London: Here we’re talking about cognitive biases primarily, right? It’s not that I’m biased against you because of your accent or something. These are the cognitive biases that behavioral sciences have shown we all carry around, things like anchoring, overoptimism—these kinds of things.

Both: Yeah.

Charles Conn: Availability bias is the one that I’m always alert to. You think you’ve seen the problem before, and therefore what’s available is your previous conception of it—and we have to be most careful about that. In any human setting, we also have to be careful about biases that are based on hierarchies, sometimes called sunflower bias. I’m sure, Hugo, with your teams, you make sure that the youngest team members speak first. Not the oldest team members, because it’s easy for people to look at who’s senior and alter their own creative approaches.

Hugo Sarrazin: It’s helpful, at that moment—if someone is asserting a point of view—to ask the question “This was true in what context?” You’re trying to apply something that worked in one context to a different one. That can be deadly if the context has changed, and that’s why organizations struggle to change. You promote all these people because they did something that worked well in the past, and then there’s a disruption in the industry, and they keep doing what got them promoted even though the context has changed.

Simon London: Right. Right.

Hugo Sarrazin: So it’s the same thing in problem solving.

Charles Conn: And it’s why diversity in our teams is so important. It’s one of the best things about the world that we’re in now. We’re likely to have people from different socioeconomic, ethnic, and national backgrounds, each of whom sees problems from a slightly different perspective. It is therefore much more likely that the team will uncover a truly creative and clever approach to problem solving.

Simon London: Let’s move on to step five. You’ve done your work plan. Now you’ve actually got to do the analysis. The thing that strikes me here is that the range of tools that we have at our disposal now, of course, is just huge, particularly with advances in computation, advanced analytics. There’s so many things that you can apply here. Just talk about the analysis stage. How do you pick the right tools?

Charles Conn: For me, the most important thing is that we start with simple heuristics and explanatory statistics before we go off and use the big-gun tools. We need to understand the shape and scope of our problem before we start applying these massive and complex analytical approaches.

Simon London: Would you agree with that?

Hugo Sarrazin: I agree. I think there are so many wonderful heuristics. You need to start there before you go deep into the modeling exercise. There’s an interesting dynamic that’s happening, though. In some cases, for some types of problems, it is even better to set yourself up to maximize your learning. Your problem-solving methodology is test and learn, test and learn, test and learn, and iterate. That is a heuristic in itself, the A/B testing that is used in many parts of the world. So that’s a problem-solving methodology. It’s nothing different. It just uses technology and feedback loops in a fast way. The other one is exploratory data analysis. When you’re dealing with a large-scale problem, and there’s so much data, I can get to the heuristics that Charles was talking about through very clever visualization of data.

You test with your data. You need to set up an environment to do so, but don’t get caught up in neural-network modeling immediately. You’re testing, you’re checking—“Is the data right? Is it sound? Does it make sense?”—before you launch too far.

Simon London: You do hear these ideas—that if you have a big enough data set and enough algorithms, they’re going to find things that you just wouldn’t have spotted, find solutions that maybe you wouldn’t have thought of. Does machine learning sort of revolutionize the problem-solving process? Or are these actually just other tools in the toolbox for structured problem solving?

Charles Conn: It can be revolutionary. There are some areas in which the pattern recognition of large data sets and good algorithms can help us see things that we otherwise couldn’t see. But I do think it’s terribly important we don’t think that this particular technique is a substitute for superb problem solving, starting with good problem definition. Many people use machine learning without understanding algorithms that themselves can have biases built into them. Just as 20 years ago, when we were doing statistical analysis, we knew that we needed good model definition, we still need a good understanding of our algorithms and really good problem definition before we launch off into big data sets and unknown algorithms.

Simon London: Step six. You’ve done your analysis.

Charles Conn: I take six and seven together, and this is the place where young problem solvers often make a mistake. They’ve got their analysis, and they assume that’s the answer, and of course it isn’t the answer. The ability to synthesize the pieces that came out of the analysis and begin to weave those into a story that helps people answer the question “What should I do?” This is back to where we started. If we can’t synthesize, and we can’t tell a story, then our decision maker can’t find the answer to “What should I do?”

Simon London: But, again, these final steps are about motivating people to action, right?

Charles Conn: Yeah.

Simon London: I am slightly torn about the nomenclature of problem solving because it’s on paper, right? Until you motivate people to action, you actually haven’t solved anything.

Charles Conn: I love this question because I think decision-making theory, without a bias to action, is a waste of time. Everything in how I approach this is to help people take action that makes the world better.

Simon London: Hence, these are absolutely critical steps. If you don’t do this well, you’ve just got a bunch of analysis.

Charles Conn: We end up in exactly the same place where we started, which is people speaking across each other, past each other in the public square, rather than actually working together, shoulder to shoulder, to crack these important problems.

Simon London: In the real world, we have a lot of uncertainty—arguably, increasing uncertainty. How do good problem solvers deal with that?

Hugo Sarrazin: At every step of the process. In the problem definition, when you’re defining the context, you need to understand those sources of uncertainty and whether they’re important or not important. It becomes important in the definition of the tree.

You need to think carefully about the branches of the tree that are more certain and less certain as you define them. They don’t have equal weight just because they’ve got equal space on the page. Then, when you’re prioritizing, your prioritization approach may put more emphasis on things that have low probability but huge impact—or, vice versa, may put a lot of priority on things that are very likely and, hopefully, have a reasonable impact. You can introduce that along the way. When you come back to the synthesis, you just need to be nuanced about what you’re understanding, the likelihood.

Often, people lack humility in the way they make their recommendations: “This is the answer.” They’re very precise, and I think we would all be well-served to say, “This is a likely answer under the following sets of conditions” and then make the level of uncertainty clearer, if that is appropriate. It doesn’t mean you’re always in the gray zone; it doesn’t mean you don’t have a point of view. It just means that you can be explicit about the certainty of your answer when you make that recommendation.

Simon London: So it sounds like there is an underlying principle: “Acknowledge and embrace the uncertainty. Don’t pretend that it isn’t there. Be very clear about what the uncertainties are up front, and then build that into every step of the process.”

Hugo Sarrazin: Every step of the process.

Simon London: Yeah. We have just walked through a particular structured methodology for problem solving. But, of course, this is not the only structured methodology for problem solving. One that is also very well-known is design thinking, which comes at things very differently. So, Hugo, I know you have worked with a lot of designers. Just give us a very quick summary. Design thinking—what is it, and how does it relate?

Hugo Sarrazin: It starts with an incredible amount of empathy for the user and uses that to define the problem. It does pause and go out in the wild and spend an enormous amount of time seeing how people interact with objects, seeing the experience they’re getting, seeing the pain points or joy—and uses that to infer and define the problem.

Simon London: Problem definition, but out in the world.

Hugo Sarrazin: With an enormous amount of empathy. There’s a huge emphasis on empathy. Traditional, more classic problem solving is you define the problem based on an understanding of the situation. This one almost presupposes that we don’t know the problem until we go see it. The second thing is you need to come up with multiple scenarios or answers or ideas or concepts, and there’s a lot of divergent thinking initially. That’s slightly different, versus the prioritization, but not for long. Eventually, you need to kind of say, “OK, I’m going to converge again.” Then you go and you bring things back to the customer and get feedback and iterate. Then you rinse and repeat, rinse and repeat. There’s a lot of tactile building, along the way, of prototypes and things like that. It’s very iterative.

Simon London: So, Charles, are these complements or are these alternatives?

Charles Conn: I think they’re entirely complementary, and I think Hugo’s description is perfect. When we do problem definition well in classic problem solving, we are demonstrating the kind of empathy, at the very beginning of our problem, that design thinking asks us to approach. When we ideate—and that’s very similar to the disaggregation, prioritization, and work-planning steps—we do precisely the same thing, and often we use contrasting teams, so that we do have divergent thinking. The best teams allow divergent thinking to bump them off whatever their initial biases in problem solving are. For me, design thinking gives us a constant reminder of creativity, empathy, and the tactile nature of problem solving, but it’s absolutely complementary, not alternative.

Simon London: I think, in a world of cross-functional teams, an interesting question is do people with design-thinking backgrounds really work well together with classical problem solvers? How do you make that chemistry happen?

Hugo Sarrazin: Yeah, it is not easy when people have spent an enormous amount of time seeped in design thinking or user-centric design, whichever word you want to use. If the person who’s applying classic problem-solving methodology is very rigid and mechanical in the way they’re doing it, there could be an enormous amount of tension. If there’s not clarity in the role and not clarity in the process, I think having the two together can be, sometimes, problematic.

The second thing that happens often is that the artifacts the two methodologies try to gravitate toward can be different. Classic problem solving often gravitates toward a model; design thinking migrates toward a prototype. Rather than writing a big deck with all my supporting evidence, they’ll bring an example, a thing, and that feels different. Then you spend your time differently to achieve those two end products, so that’s another source of friction.

Now, I still think it can be an incredibly powerful thing to have the two—if there are the right people with the right mind-set, if there is a team that is explicit about the roles, if we’re clear about the kind of outcomes we are attempting to bring forward. There’s an enormous amount of collaborativeness and respect.

Simon London: But they have to respect each other’s methodology and be prepared to flex, maybe, a little bit, in how this process is going to work.

Hugo Sarrazin: Absolutely.

Simon London: The other area where, it strikes me, there could be a little bit of a different sort of friction is this whole concept of the day-one answer, which is what we were just talking about in classical problem solving. Now, you know that this is probably not going to be your final answer, but that’s how you begin to structure the problem. Whereas I would imagine your design thinkers—no, they’re going off to do their ethnographic research and get out into the field, potentially for a long time, before they come back with at least an initial hypothesis.

Want better strategies? Become a bulletproof problem solver

Hugo Sarrazin: That is a great callout, and that’s another difference. Designers typically will like to soak into the situation and avoid converging too quickly. There’s optionality and exploring different options. There’s a strong belief that keeps the solution space wide enough that you can come up with more radical ideas. If there’s a large design team or many designers on the team, and you come on Friday and say, “What’s our week-one answer?” they’re going to struggle. They’re not going to be comfortable, naturally, to give that answer. It doesn’t mean they don’t have an answer; it’s just not where they are in their thinking process.

Simon London: I think we are, sadly, out of time for today. But Charles and Hugo, thank you so much.

Charles Conn: It was a pleasure to be here, Simon.

Hugo Sarrazin: It was a pleasure. Thank you.

Simon London: And thanks, as always, to you, our listeners, for tuning into this episode of the McKinsey Podcast . If you want to learn more about problem solving, you can find the book, Bulletproof Problem Solving: The One Skill That Changes Everything , online or order it through your local bookstore. To learn more about McKinsey, you can of course find us at McKinsey.com.

Charles Conn is CEO of Oxford Sciences Innovation and an alumnus of McKinsey’s Sydney office. Hugo Sarrazin is a senior partner in the Silicon Valley office, where Simon London, a member of McKinsey Publishing, is also based.

Explore a career with us

Related articles.

Strategy to beat the odds

Five routes to more innovative problem solving

This site uses cookies, including third-party cookies, to improve your experience and deliver personalized content.

By continuing to use this website, you agree to our use of all cookies. For more information visit IMA's Cookie Policy .

Change username?

Create a new account, forgot password, sign in to myima.

Multiple Categories

Accountants as Problem Solvers

August 01, 2020

By: Linda McCann , DBA, CMA, CPA ; David Horn , CPA ; Jennifer Dosch , CMA

Managers often complain that accounting graduates aren’t prepared for today’s business environment. The complexity of our global economy and the increasing influence of, and reliance on, technology leads to practitioners and instructors questioning if undergraduate accounting programs focus on the right curriculum to prepare students for careers.

One soft skill that can help prepare accounting students for their careers is problem solving. Management accountants need to be able to work cross-functionally to solve problems and provide meaningful analyses. Many colleges, universities, and accrediting bodies in academia incorporate strategic goals requiring curriculum that facilitates problem-solving skills.

As instructors, we teach technical accounting skills by demonstrating and providing practice with accounting concepts and structured problems, which we assess via homework and exams. Teaching soft skills, such as unstructured problem solving, poses greater challenges that are more difficult to incorporate into the curriculum. How can students learn and approach unstructured problem solving?

A SLOW-THINKING APPROACH

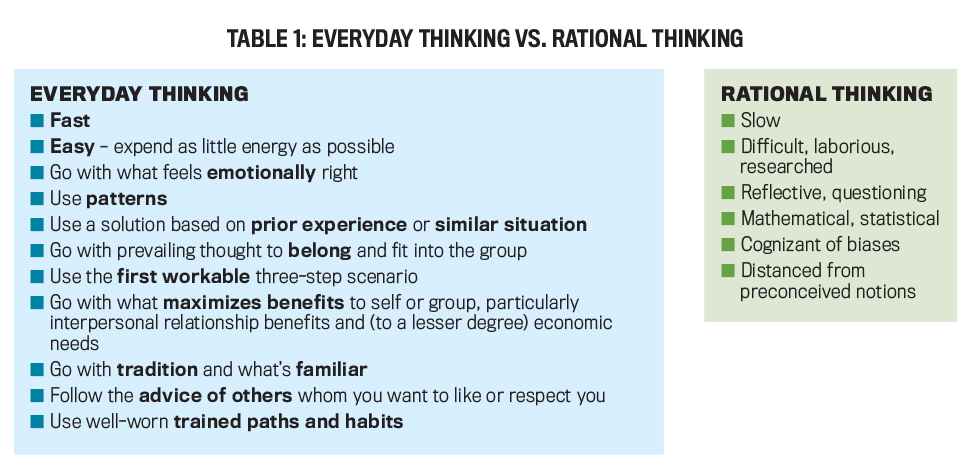

Recent scientific discoveries into the brain reveal that humans employ fast and slow thinking to solve problems. The brain especially prefers making decisions and solving problems quickly based on recognized patterns, visual and verbal cues, prior knowledge, routines, familiar preferences, prejudices, and emotions.

In contrast, decision making and problem solving often require slow thinking to digest new information, hypothesize alternatives, employ quantitative mathematical and statistical analysis, overtly recognize and break free from cognitive biases, challenge preconceived notions, synthesize ideas, and create new knowledge. To support this kind of slow, rational thinking, accountants can learn a methodical process for problem solving (see Table 1).

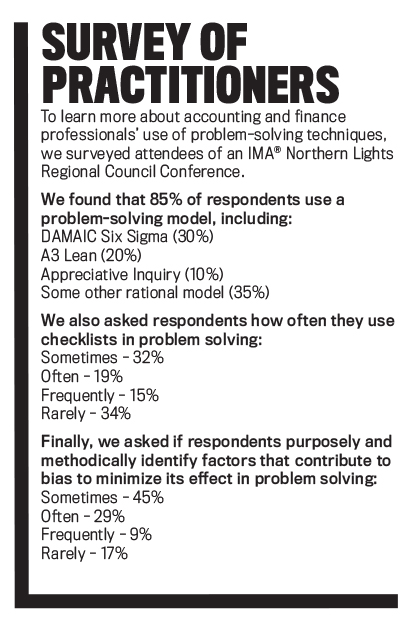

Many common business models—such as Six Sigma, A3 Lean, and Appreciative Inquiry—and the Association of American Colleges and Universities value problem solving, and critical-thinking grading rubrics describe specific steps for rational (i.e., slow thinking) problem solving. Business students, however, learn and apply these models in various courses, typically with no thread that ties them specifically to the accounting profession. Students learn bits and pieces of rational thinking throughout their undergraduate coursework, but instructors often don’t teach a common framework to apply these skills in a relevant and value-added way (see “Survey of Practitioners”).

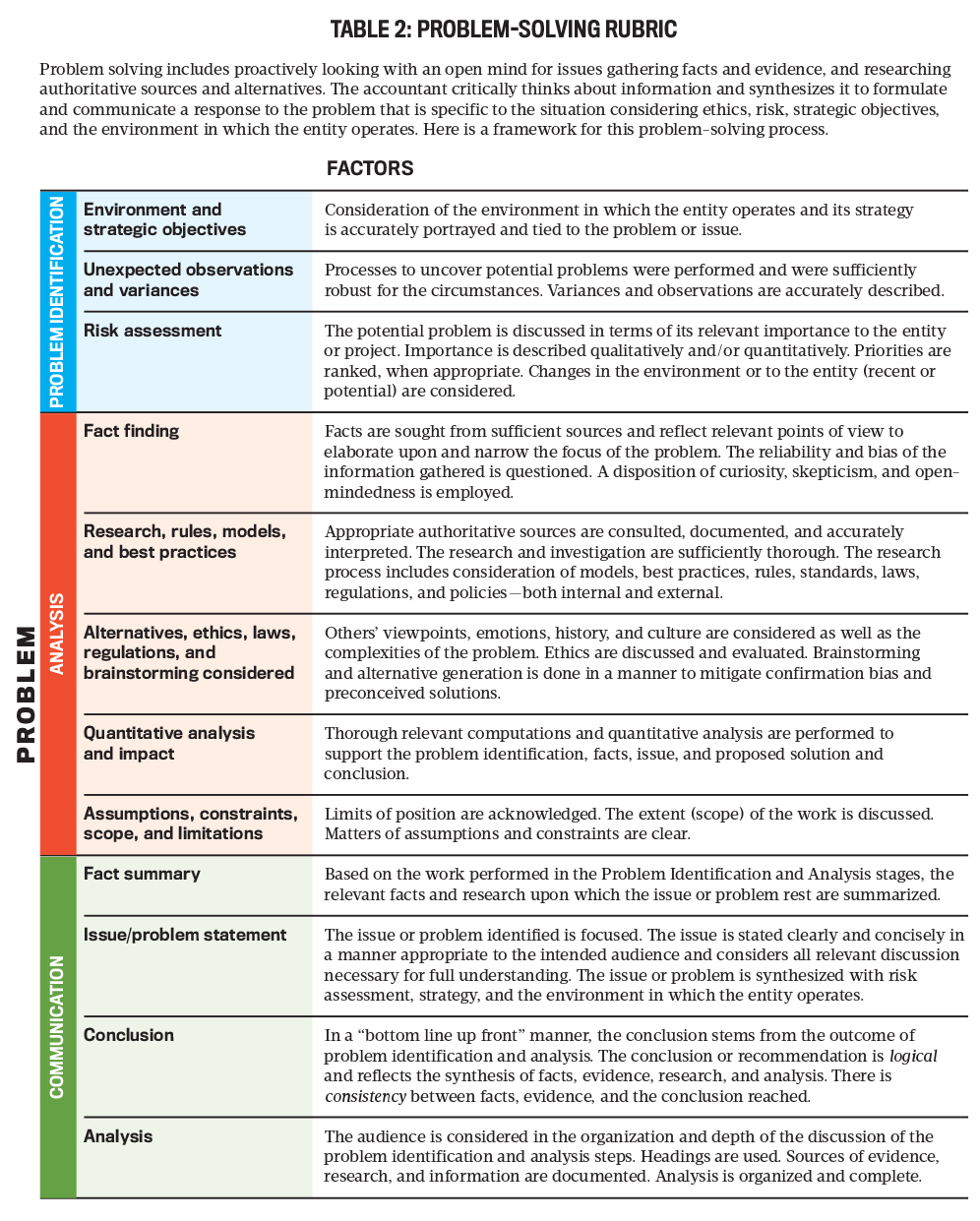

To help address this issue, we developed a problem-solving rubric for accounting students (see Table 2). The three of us are faculty members from Metropolitan State University in Minneapolis/St. Paul, Minn., and represent three different parts of the curriculum (auditing, business taxation, and management accounting), so it was important that it could be used across the entire accounting program.

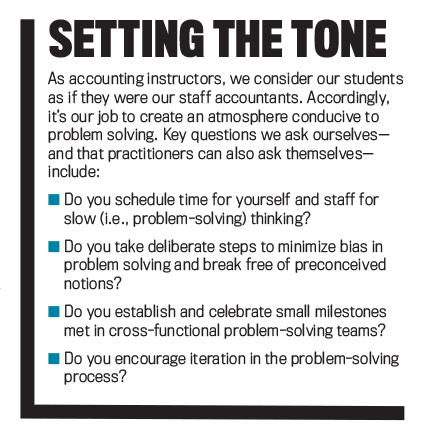

The rubric assesses learning in an organized way, providing a common framework (criteria) for students to consistently approach problem solving. The criteria include problem identification, analysis, and communication of results. It guides students through a series of problem-solving steps using terms and vocabulary specific to the accounting profession. The rubric also reminds us, as instructors, to create a learning environment where problem solving can occur (see “Setting the Tone”).

STEP 1: PROBLEM IDENTIFICATION

The iterative and looping nature of problem solving confounds inexperienced accountants. Where does one begin? Students tell us using a rubric provides a starting point.

To implement the rubric, we assign students projects with unclear goals, incomplete information, and more than one possible solution. Assignment topics vary. It could have students develop a cost-benefit analysis between adding employees or adopting Lean manufacturing techniques, analyze tax outcomes of business decisions, create a risk assessment and audit response for a fictitious client, or some other accounting-related issue.

Students begin by developing one or several hypotheses as to the nature of the problem. To generate ideas, we assist students in their brainstorming discussions. The rubric leads students to consider the environment, strategy, unexpected observations, overall importance, and risk assessment. At this stage, the identified problem may change, but the original hypothesized problem gives direction for next steps. Upon completing the assignment, we assess students on how they identified the problem.

Metropolitan State University’s business taxation course used the rubric in a case study that involves assessing the implication of the Wayfair v. South Dakota U.S. Supreme Court decision on a company’s sales tax collection. Prior to Wayfair , companies operated under a physical presence nexus established in Quill v. North Dakota . The Quill decision required companies to have a physical presence in a taxing jurisdiction in order to require collection and remittance of sales taxes on transactions.

In Wayfair , the U.S. Supreme Court overturned Quill in favor of an economic nexus standard, where companies only needed to have a certain level of economic activity. For example, in South Dakota, the threshold economic activity is 200 transactions or $100,000 in sales. The change from Quill to Wayfair was a major development in how companies operate and collect sales tax. It required companies to assess all jurisdictions in which they operate and evaluate how the change in the nexus standards impact its operations.

To apply this rubric to the change, students learn about a fictitious company that sells inventory to multiple states and collects and remits sales tax under the Quill physical presence nexus standard. We give students a subledger with all sales data for the given year. The rubric leads students to ask about implications of the Wayfair decision on the company, how the ruling impacts the company’s strategic objectives, and risks to the company because of the change in the law. Using the rubric, students are guided to discover the issue at hand, which is whether the company will have a significant number of new sales tax jurisdictions requiring collections and remittance from its customers.

Students tell us that without the rubric, they often feel like they have no road map at the beginning of a project or case study; identifying the problem seems too big and undefined to tackle. Many students initially resist engaging with unstructured problem-solving assignments because they differ from past assignments. Similar to what one might find in cross-functional teams opposed to change, students show their displeasure with crossed arms and distant body language.

Many college courses still rely on testing facts and use formulas and calculations, an approach that doesn’t put the student in the decision-making role but is familiar to them. With a rubric, students see smaller doable steps, where the assignment is heading, and how they can move forward and loop backward, when necessary. The rubric breaks down the initial intimidation students feel with unstructured problems.

STEP 2: ANALYSIS

Next, the rubric guides students through analyzing the problem using accounting-specific skills they’ve acquired in each course. For example, students consider tax laws, financial reporting and audit principles, or cost accounting techniques.

Continuing the sales and use tax example, at this stage, students apply the rubric to perform a complete analysis, enabling them to form a conclusion to communicate. What are the relevant facts to determine Wayfair ’s impact? What facts are irrelevant? What primary and secondary tax authority is needed to conduct research? Are there alternatives and exceptions to applying Wayfair ? Have all states adopted an economic nexus standard? Have all states adopted South Dakota’s transactional thresholds? What’s the quantitative impact to the company? Are there financial accounting implications to the Wayfair decision? What’s the scope of the necessary research, and are there limitations, constraints, and so on? Through the rubric, students formulate and answer questions and perform analysis to solve the problem at hand.

We assess students on their ability to gather and identify relevant facts, research any applicable rules and laws, assess alternatives, and perform any needed qualitative and quantitative analyses. At this stage, students apply theories and best practices learned in specific course fields, such as management accounting, taxation, and auditing.

To encourage elaboration, the rubric uses words such as curious, skeptical, model, assumption, authoritative, best practices, relevant, and sufficient sources. Like many accountants, students want to get their work done quickly, but problem solving takes time and slow thinking. Thanks to the rubric, more students turned in papers with greater depth, less “cut and paste,” and more relevant supporting details.

As in the real world, students often discover their original hypothesis or identified problem is incorrect, incomplete, or irrelevant. They confront the iterative nature of problem solving as they work through the analysis stage and build evidence to support their hypothesis. When evidence doesn’t support an identified problem, students go back and redefine their problem, gather new evidence, explore new alternative solutions, and build a case for their conclusion.

STEP 3: COMMUNICATION

Finally, students present their results in a memorandum to a hypothetical manager or audit partner. The memorandum mirrors common styles, such as IFRAC (issues, facts, rules, analysis, and conclusion) and BLUF (bottom line up front). Students state the problem and include the conclusion (i.e., solution) up front along with a summary of relevant facts and assumptions. Supporting documentation presents additional in-depth analysis.

This format familiarizes students with a presentation style that allows management to quickly understand conclusions while also providing more depth to support the up-front conclusion. We expect students to write and present findings in a clear and concise manner as if in a professional accounting setting. The rubric grading criteria helps students solve problems using rational thinking and delivering a memorandum that directly supports management decision making.

In the Wayfair case study, students draft a memorandum to management addressing the implications of the sales tax nexus precedence change. The facts section should discuss the company’s current sales and use tax policies. Students identify the issue as the change from physical presence nexus to economic nexus. The up-front conclusion should identify new jurisdictions from which the company needs to register and collect sales tax and quantify the volume of sales tax it expects to collect. Finally, the analysis provides an in-depth discussion of the change from Quill to Wayfair . Students should discuss how they determined new jurisdictions, limitations, and further required resources for the company.

PREPARING STUDENTS FOR THEIR CAREERS

We use the rubric format for projects or cases at different stages throughout the accounting curriculum. The problem-solving rubric measures student learning and reinforces rational thinking with each assignment. The projects that use the rubric vary in length, depth, and complexity as students move from management accounting to tax and then finally to audit. We find the rubric flexible enough to adapt to an instructor’s needs, yet it provides consistent core steps—identify the problem, analyze, and communicate—to solve problems.

The rubric helps students organize their communication through the memorandum. Setting up a memorandum so the problem and solution appear “up front” highlights mismatches between the problem, evidence, and conclusion. Further, it encourages students to decide—rather than ramble and include information that isn’t relevant. We find students often get to the communication stage and realize that their analysis doesn’t support their conclusion or identified problem. Fortunately, the rubric allows them to loop back and redefine and reanalyze.

By using the same grading criteria in multiple courses, we provide students with a familiar approach to problem solving that turns fast thinking to slow, rational thinking. The process and steps become routine and less daunting for the student. While each step still requires arduous thinking, the approach itself is a recognized pattern for students.

From our point of view as accounting instructors, the rubric helps provide consistent and fair grading. We provide separate points for milestones in problem identification, analysis, and communication, which further encourages students to go through each step of the process. Metropolitan State University plans to expand the use of this rubric in the accounting curriculum. This common framework provides students with a process to identify problems, research and investigate facts, conduct analyses, and communicate results across all accounting disciplines.

This process reinforces the problem-solving skills that students will need in their professional careers. These capabilities will help them perform their roles in today’s strategic, fast-paced business environment. Solving problems is critical for today’s management accountant. Through implementing the rubric, instructors can help students systematically apply a problem-solving process that they can take with them as they move from student to management accountant.

About the Authors

August 2020

- Strategy, Planning & Performance

- Decision Analysis

- Negotiation

- Metropolitan State University

Publication Highlights

Call for Ethics Papers: Sept. 1 Deadline

Explore more.

Copyright Footer Message

Lorem ipsum dolor sit amet

Top 10 soft skills you need to work in finance

10 soft skills to help you prove your value in the workplace

On this page:

Stay up to date with the latest employer insights & events.

By submitting this completed form to us, you agree to Reed contacting you about our products and services, and content that may be of interest to you. You can unsubscribe from these communications at any time. For more information, please see our privacy policy .

By clicking submit below, you consent to allow Reed to store and process the personal information submitted above.

When searching for a role in finance, it's often not what you know, but what you can offer. Job hunters have long been told to list, and give prominence to, technical skills on their CVs, but finance sector employers are increasingly looking for candidates with interpersonal abilities known as ‘soft skills'. Demonstrating these 10 characteristics will help candidates with finance skills prove their value in the workplace.

1. Communication skills needed in finance

Earlier this year, analysis by LinkedIn showed that 57.9% of new hires who changed jobs in 2014-15 listed communication as one of their strong suits. Good communicators are in demand across a range of industries, and they're vital in fields that require employees to explain their specialist knowledge to others. Whatever your finance skills, an aptitude for number crunching won't get you far in finance if you can't justify and explain your calculations.

2. Negotiation skills needed in finance

Whether you're closing a deal or managing expectations, it's important to know how to fight your corner without ruffling any feathers. An aptitude for negotiation will allow finance professionals to reach an agreement that benefits all parties. Failure to compromise effectively can create frustration and damage interpersonal relationships or, at worst, result in loss of revenue for a business. Having a demonstrable knack for negotiation will put you ahead in any financial enterprise.

3. Influencing skills for finance jobs

Finance professionals must be prepared to explain how their objectives are mutually beneficial and anticipate objections. If, as a financial skills example, an investment banker wants to sell off a stake in a joint venture, he or she must be able to show how this will benefit the bank – even if some colleagues disagree.

4. Critical thinking

A critical thinker objectively analyses or conceptualises a situation from a balanced perspective. Often, customers and clients will look to financial professionals to rationally evaluate a scenario – be it a ledger or the performance of a stock. In fast-paced business environments, a poorly thought-out decision can cost a company time and money. So the ability to make critically-informed choices is crucial for modern finance professionals.

5. Flexibility

Flexible employees are capable of weathering change and staying productive in high-pressure situations. Good stockbrokers provide the most dramatic example of this: their day-to-day work revolves around coping with constant fluctuation and determining the best course of action. However, cultivating a flexible mindset also means being able to see through the eyes of others and understand their motivations. A flexible finance professional will always ask: "Why might someone think this way?"

6. Resilience

Resilience refers to one's ability to bounce back after facing adversity. While this is an important skill in any workplace, it's especially important in high-pressure situations. Being able to cope with changing circumstances, having confidence in your ability to deliver and thinking carefully about what you're trying to achieve can prove valuable – particularly in financial roles.

7. Collaboration

It's no secret that top-level financiers are on the lookout for team players. A recent survey by Adaptive Insights showed that 70% of chief financial officers considered collaboration to be their top priority for 2016. In the financial sector, it has become increasingly common to work across multiple teams and geographies to achieve a shared goal. Someone who approaches group-working scenarios with an open mind and a willingness to listen will benefit any team.

8. Problem solving skills for finance jobs

Effective problem solvers identify the issue at hand, weigh up their options quickly and make a firm decision about the best course of action. Those who excel at problem solving can really drive an organisation forward and will earn the respect of their colleagues by offering meaningful input in even the toughest situations.

It's a common misconception that roles focused on data and numbers require a detached approach – empathy should never be undervalued in finance. Clients often seek financial advice during stressful life events, and dealing with someone who has suffered a loss requires a different approach from a couple seeking their first mortgage.

An empathetic person shows that he or she cares. In displaying understanding, finance professionals will also build trust in their relationships with co-workers and clients.

It's not enough to simply tell an employer you have the soft skills they're looking for. Instead, strive to demonstrate your skillset by offering up examples from previous job roles and highlighting talents you've developed outside of the workplace. Remember, employers are always seeking the right personality for the job – not just a list of positions and qualifications.

10. Interpersonal skills

Interpersonal skills are vital in this sector, in order to communicate effectively with colleagues, clients and stakeholders on a regular basis. It may be necessary to speak to people overseas and understand how different cultures prefer to interact too. Some people are naturally good at this, while others may find it takes practice, perhaps through a training course or taking the initiative to steadily improve their communication skills and confidence, until it becomes second nature.

How to identify your own soft skills for finance:

Reflect on your reactions to tense situations at work and compare them to those of managers and co-workers you admire.

Prepare answers to interview questions that screen for soft skills, such as those about workplace experience in problem solving and collaboration.

Ask current or past colleagues to evaluate your strengths and weaknesses. They may be able to offer insights you hadn't previously considered.

Consider your strengths in relation to the job you want to apply for so you can be confident about the criteria you already fulfil and areas that you can develop on the job.

How to acquire new soft skills for finance jobs:

Make a conscious effort to improve your soft skills every day – remember, they're attributes to develop, not innate qualities.

Take up skill-building hobbies in your leisure time. Something as simple as a cooking class might prepare you to prioritise tasks and work under pressure.

Ask for help and feedback from colleagues and senior staff in your workplace.

Enrol in a course designed to build soft skills, such as those offered by Reed.

You may also be interested in...

Reed’s UK salary guides 2024

Use our salary guides to compare the UK average salary by sector - a resource for both employers and employees. Download the 2024 salary guides here.

CV tips for teaching roles: how to present your best self

Join Andrea Raven-Hill, Reed's Executive Regional Manager and Ben Raven-Hill, Tuition Manager at Reed, who explored how teachers and teaching assistants can tailor their CVs and navigate application processes when applying for their dream teaching position.

Looking to 2024: the challenges facing the education sector in the year ahead

In this article, Gavin Beart, Divisional Managing Director of Reed's education division, discusses the challenges faced by UK schools in 2024 and how the profession needs to tackle the issues head on in order to make a sharp U-turn and bring education standards in the UK to the level they should be at.

Starting a career in finance FAQs

Soft skills are non-technical skills that are an asset in a workplace. They include how you communicate, how you solve problems, and how you manage your workload.

Soft skills are often taken for granted, but it is more than having general ‘people skills’. Listening skills, time management, and empathy are essential to the overall smooth day-to-day operation at work. As such, they are a key element in the recruiter’s search for talent.

An awareness of market forces and desire to keep abreast of the latest market movements. Having a genuine interest in your subject and learning all you can about the business and sector can reap rewards.

It’s helpful to have an analytical mind that enjoys pulling apart the stats to see the raw data – and having the courage of your convictions to draw conclusions from your analysis. See our financial blogs for related information and insight:

Finance CV Template | Reed

Accountant CV template | Example Accountancy CV | Reed

Artificial intelligence is revolutionising accountancy | Reed

An aptitude for numbers certainly helps! Some employers may ask for a relevant degree in a subject like finance, accounting or business studies. You might also work your way into the sector with a college course, an apprenticeship, or having steered a course through other work experience into finance.

To start out on the career ladder, you may need:

2 or more GCSEs at grades 9 to 3 (A* to D), or equivalent, for a level 2 course

4 or 5 GCSEs at grades 9 to 4 (A* to C), or equivalent, for a level 3 course

4 or 5 GCSEs at grades 9 to 4 (A* to C), or equivalent, including English and maths for a T level.

See our financial blogs for related information and insight:

Seven in-demand accountancy and finance roles | Reed

An internship or work experience can teach you a lot about the sector – and crucially will allow you to network, increasing your chances of finding a salaried role in the company or elsewhere. Be prepared to learn as much as you can, be enthusiastic, and if possible, familiarise yourself with the tools and technology that is increasingly changing the face of the sector.

New digital skill sets will help maximise the potential business benefits of tech innovation in automation, risk assessment, and problem solving. Knowledge of coding and programming development will become increasingly important for finance professionals as technology expedites the process away from outdated manual techniques.

Financial reporting refers to an organisation’s financial results that are released to stakeholders and the public for a specific period. It typically comprises balance sheets, income, cash flow and shareholders’ equity statements to show the entry and exit of monies through a company. These crucial documents are essential tools for potential investors in a business.

Financial reporting involves sale forecasting, creating a budget for expenses, creating a cash flow statement, estimating net profit, and an estimate of assets and liabilities.

Find a Reed office

Our national coverage allows us to offer a recruitment service tailored to your needs, with accurate local market intelligence on salaries, competitors and the best professionals who can help your business thrive.

- Contractors

- Junior Professional

How to develop critical thinking skills in finance & accounting

Stephen Moir

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to email a link to a friend (Opens in new window)

When it comes to finance and accounting roles, employers are increasingly looking for problem solvers, not a number-crunchers. Over recent years, we have seen an increasing demand for people who can analyse and interpret data and think critically.

What is critical thinking.

A critical thinker is a problem solver. They are able to evaluate complex situations, weigh-up different options and reach logical (and often quite creative) conclusions.

Critical thinkers are highly-valued by employers as they innovate and make improvements, without taking unnecessary risks. Chartered Accountants Australia and New Zealand recently identified that it was in the top 10 attributes that will help you get noticed in the job market.

Why are critical thinking skills important?

Once you have learnt how to develop critical thinking skills you will be better able to add value to data, interpret trends within the business, understand how people and performance intersect and take-on broader commercial outlook that benefits the business.

How to develop critical thinking skills

Critical thinking comes naturally to some people, but it is also a skill than can be practiced. Here are some tips for how to develop your own critical thinking skills :

- Examine: Self-awareness is the foundation of critical thinking. It allows you to play to your strengths and address your weaknesses. Question how and why you do things the way you do.

- Analyse: Look for opportunities to grow and improve. Consider alternative solutions to the problems you encounter in your work.

- Explain: Clear communication is key. Get into the habit of talking through your reasoning and conclusions with colleagues.

- Innovate: Develop an independent mind-set. Find ways to think outside the box and challenge the status quo. Make sure your decisions are well-thought out. A critical thinker is logical as well as creative.

- Learn: Keep an open and well-oiled mind. Brush-up on your problem-solving skills by doing brain-teasers or trying to solve problems backwards. Keep up-to-date with professional learning opportunities . You may also need to unlearn past mindsets in order to grow and move forward.

How to apply critical thinking skills in your current role

Could you implement a new process or procedure that enhances performance or profitability? You might also consider volunteering for a new project or responsibility that gives you the opportunity to innovate and take on a new challenge. It’s a great way to broaden your skillset and gain exposure to other parts of the business.

Surround yourself with other critical thinkers in the organisation and work together towards achieving a problem-solving culture. Ask questions, and always look for opportunities for continual learning.

Changing roles to develop critical thinking skills

At Moir Group, we are passionate about finding the right cultural fit between people and the organisations they work with. If you are a critical thinker, it’s worth looking for a stimulating work environment that encourages innovation and non-conformist thinking when considering your next role.

How to demonstrate critical thinking skills at an interview

During an interview, use examples from your past experiences to demonstrate your problem-solving abilities. Show that you can be analytical, weigh-up pros and cons, consider other view points and be creative in your solutions. Clearly articulating your thought process is key.

Sometimes an interviewer will ask you to simplify the complex as a way of determining your clarity of thought. For example: “How would you explain the state of the economy to a kindergarten child?” In instances like these, the focus will be on how you explain your reasoning, rather than achieving a ‘right’ answer. Learn more here.

If you’re looking to take that next step in your career, we can help. Get in touch with us here .

2 Responses to “How to develop critical thinking skills in finance & accounting”

Hi Stephen,

The above is very useful and very valuable for employers. However my understanding of critical thinking is slightly different from above. I recently listened to a course in critical thinking by Professor Steven Novella of Yale School of Medicine. To keep it simple it is to do with assessing the veracity of views and statements made by oneself, others and media being constantly aware of the many biases, the flaws and fabrications of memory, half truths, unspoken truths, and even lies. So it becomes key to adopt an inquisitive mindset, to look for external evidence that supports argument and not just wishful or hopeful thinking.

Just wanting to add to the debate as this is a really important area.

Hi Richard,

We are pleased that found this article useful. Thanks for your sharing your thoughts about critical thinking.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Moir Group acknowledges Traditional Owners of Country throughout Australia and recognises the continuing connection to lands, waters and communities. We pay our respect to Aboriginal and Torres Strait Islander cultures; and to Elders past and present and encourage applications from Aboriginal and Torres Strait Islander people and people of all cultures, abilities, sex, and genders.

How to Conduct a Problem-Solving Session with Finance?

In the fast-paced and dynamic world of finance, problem-solving skills are invaluable. Whether you are a financial manager, a business owner, or an aspiring finance professional, being able to effectively address and solve financial issues is crucial for success. In this article, we will explore the importance of problem-solving in finance and provide a step-by-step guide on how to conduct a problem-solving session with finance.

Understanding the Importance of Problem-Solving in Finance

Problem-solving is a fundamental skill in financial management. It involves identifying, analyzing, and resolving financial issues that may arise in a business or organizational setting. Successful problem-solving not only helps in mitigating risks but also contributes to the overall growth and profitability of a company.

When it comes to financial management, problem-solving plays a pivotal role in ensuring the smooth operation and sustainability of a business. Financial managers are responsible for making strategic decisions that can impact the organization’s financial performance. By effectively addressing problems and finding innovative solutions, financial managers can enhance financial stability, optimize resource allocation, and foster growth.

Effective problem-solving in finance offers numerous benefits. Firstly, it helps in identifying and rectifying financial inefficiencies, thus improving cost-effectiveness. For example, if a company is experiencing cash flow issues, a financial manager can analyze the problem and implement strategies to improve cash flow, such as negotiating better payment terms with suppliers or implementing more efficient billing processes.

Secondly, effective problem-solving in finance aids in identifying potential opportunities and enhancing revenue generation. Financial managers who are skilled problem solvers can identify market trends, analyze customer needs, and develop innovative financial strategies to capitalize on emerging opportunities. This could involve launching new products or services, entering new markets, or implementing cost-saving measures.

Moreover, successful problem-solving fosters teamwork, promotes critical thinking, and strengthens decision-making abilities within the finance department. When financial managers and their teams work together to solve complex financial problems, it encourages collaboration and knowledge sharing. This not only leads to better problem-solving outcomes but also cultivates a culture of continuous improvement and learning within the organization.

Preparing for a Problem-Solving Session

Before conducting a problem-solving session, thorough preparation is essential to ensure its effectiveness. Here are the key steps involved:

Identifying the Financial Issues at Hand

The first step is to clearly identify the financial issues that need to be addressed. This could include problems with cash flow, budgeting, financial reporting, investment decisions, or any other challenge affecting the financial performance of the organization.

For example, if the organization is experiencing cash flow problems, it is important to determine the root cause of the issue. Is it due to slow-paying customers, high expenses, or ineffective collection procedures? By identifying the specific financial issues, the problem-solving session can be focused and targeted.

Gathering Relevant Financial Data

Once the issues have been identified, gather all the relevant financial data that is necessary for analysis and decision-making. This may include financial statements, sales reports, budget details, and any other financial information related to the problem at hand.

For instance, if the problem is related to budgeting, it is crucial to gather information on the organization’s current budget, actual expenses, and projected revenue. This data will provide a comprehensive understanding of the financial situation and enable the team to make informed decisions during the problem-solving session.

Assembling the Right Team for the Session

Next, assemble a team of individuals who possess the required expertise and knowledge to contribute to problem-solving. This could include financial analysts, accountants, business strategists, and other relevant stakeholders. Ensure that the team members have diverse perspectives and can bring fresh insights to the table.

For example, having a financial analyst on the team can provide valuable insights into financial data analysis and forecasting. An accountant can offer expertise in identifying financial discrepancies and suggesting corrective measures. By assembling a diverse team, the problem-solving session can benefit from a wide range of perspectives and expertise.

Additionally, it is important to consider the dynamics of the team. Are the members able to collaborate effectively? Do they have good communication skills? These factors can significantly impact the success of the problem-solving session.

Conducting the Problem-Solving Session

Once the preparation phase is complete, it’s time to conduct the problem-solving session. Follow these steps to ensure a productive and efficient session:

Before diving into the problem-solving session, it is important to understand the significance of this phase. This is where the real work happens, where ideas are shared, and solutions are generated. It is a collaborative effort that requires effective communication and critical thinking.

Setting the Agenda for the Meeting

Start by setting a clear agenda for the problem-solving session. Outline the goals, objectives, and topics that need to be discussed during the meeting. This ensures that everyone is aware of the purpose of the session and can come prepared with relevant information and ideas.

When setting the agenda, consider the time constraints and prioritize the most pressing issues. This will help keep the session focused and ensure that valuable time is not wasted on less important matters.

Facilitating Open and Constructive Dialogue

During the session, encourage open and constructive dialogue among the team members. Create a safe and non-judgmental environment where everyone feels comfortable expressing their opinions and challenging existing beliefs. This fosters creativity and innovation, leading to better problem-solving outcomes.

As the facilitator, it is important to actively listen to each team member and ensure that their voices are heard. Encourage active participation and discourage any form of dominance or bias. This will help create a collaborative atmosphere where diverse perspectives can be explored.

Utilizing Problem-Solving Techniques in Finance

There are several problem-solving techniques that can be applied in a finance context. These include brainstorming, SWOT analysis, financial modeling, cost-benefit analysis, and root cause analysis, among others. Apply the appropriate techniques to systematically analyze the financial issues and generate potential solutions.

Brainstorming is a valuable technique that allows team members to freely share their ideas and thoughts without any judgment. This can lead to innovative solutions that may not have been considered otherwise. SWOT analysis helps identify the strengths, weaknesses, opportunities, and threats associated with the problem at hand. Financial modeling allows for a quantitative analysis of different scenarios, helping to evaluate the potential outcomes of each solution.

Cost-benefit analysis helps weigh the financial costs and benefits of each solution, enabling decision-makers to make informed choices. Root cause analysis helps identify the underlying causes of the problem, allowing for targeted solutions that address the core issues.

By utilizing these problem-solving techniques, the team can approach the financial issues from different angles, ensuring a comprehensive analysis and a wider range of potential solutions.

Remember, the problem-solving session is not just about finding a quick fix. It is about understanding the problem, exploring various options, and making informed decisions that will have a positive impact on the financial health of the organization.

Post-Session Actions and Follow-ups

Once the problem-solving session is over, there are critical steps to take to ensure the proposed solutions are implemented effectively:

Analyzing the Results of the Session

Review and analyze the outcomes of the problem-solving session. This step is crucial as it allows for a comprehensive understanding of the proposed solutions and their potential impact on the organization. By carefully evaluating the feasibility, potential impact, and alignment with the organization’s goals, finance professionals can make informed decisions on which solutions to prioritize.

During the analysis, it is essential to consider various factors, such as the resources required for implementation, the potential risks involved, and the expected timeline for achieving the desired outcomes. By conducting a thorough evaluation, finance professionals can identify the most viable options and prioritize them based on their urgency and significance.

Implementing the Proposed Solutions

Once the proposed solutions have been analyzed and prioritized, the next step is to develop an actionable plan for their implementation. This plan should outline the specific steps required to execute each solution effectively.

Assigning responsibilities is a critical aspect of the implementation process. By clearly defining who is accountable for each task, finance professionals can ensure that everyone involved understands their role and can contribute to the successful execution of the solutions. Additionally, setting deadlines is crucial to keep the implementation process on track and avoid unnecessary delays.

Furthermore, allocating the necessary resources is essential for the successful implementation of the proposed solutions. This includes financial resources, human resources, and any other required assets. By ensuring that the necessary resources are available, finance professionals can increase the likelihood of achieving the desired outcomes.

Effective implementation also requires clear communication and coordination among all stakeholders. Regular updates and progress reports should be shared to keep everyone informed and aligned. Additionally, monitoring the progress of the implementation is vital to identify any potential issues or roadblocks early on and take corrective actions as needed.

Monitoring the Impact of Implemented Solutions

Implementing the proposed solutions is not the end of the problem-solving process. It is crucial to regularly monitor the impact of the implemented solutions on the financial performance of the organization. This step allows finance professionals to assess the effectiveness of the solutions and make any necessary adjustments to optimize the outcomes.

Tracking relevant key performance indicators (KPIs) is an effective way to measure the impact of the implemented solutions. These KPIs can include financial metrics, such as revenue growth, cost savings, and profitability, as well as non-financial metrics, such as customer satisfaction and employee productivity. By monitoring these indicators, finance professionals can gain valuable insights into the success of the implemented solutions and identify areas for improvement.

Continuous feedback gathering is also essential in monitoring the impact of the implemented solutions. By seeking input from various stakeholders, including employees, customers, and partners, finance professionals can gain a holistic understanding of the outcomes and identify any potential issues or areas of improvement.

Based on the feedback and performance data gathered, finance professionals can make necessary adjustments to optimize the outcomes of the implemented solutions. This iterative approach ensures that the organization remains agile and responsive to changing circumstances.

In conclusion, conducting a problem-solving session with finance is an essential process for mitigating financial risks and driving organizational growth. By understanding the importance of problem-solving in finance, adequately preparing for the session, conducting it effectively, and taking post-session actions and follow-ups, finance professionals can effectively address financial challenges and steer their organizations toward success.

Check out Avado, the UK’s most trusted CIPD course provider today for HR and L&D courses:

CIPD Level 3 HR Courses : The CIPD Level 3 Certificate in people practice is ideal for anyone looking to start a career in either HR or Learning and Development. CIPD Level 5 HR Course : The CIPD Level 5 Associate Diploma in People Management will help you build on your existing HR knowledge. CIPD Level 5 L&D Course : The CIPD Level 5 Diploma in Organisational Learning and Development is the most comprehensive course available for L&D professionals, ideal for you if you want to formalise your existing experience, skills and knowledge. CIPD Level 7 HR Course : The CIPD Level 7 Advanced Diploma is aimed at expanding learners’ autonomy so they can strategically direct organisations and their people.

If you aspire to become a digital marketing manager or explore the senior level of your career have a look at the squared digital marketing programme .

Related Articles

Navigating the ever-evolving landscape of employee benefits in the UK can be a daunting task. With the workforce’s expectations shifting and the economic climate in constant flux, I’ve found it’s more crucial than ever to stay ahead of the curve. That’s why I’m diving deep into the latest trends that are reshaping the way companies […]

Discover the secrets to conducting a successful problem-solving session with finance in this comprehensive guide.

Discover the secrets to conducting a successful decision-making meeting with finance.

- Get started with computers

- Learn Microsoft Office

- Apply for a job

- Improve my work skills

- Design nice-looking docs

- Getting Started

- Smartphones & Tablets

- Typing Tutorial

- Online Learning

- Basic Internet Skills

- Online Safety

- Social Media

- Zoom Basics

- Google Docs

- Google Sheets

- Career Planning

- Resume Writing

- Cover Letters

- Job Search and Networking

- Business Communication

- Entrepreneurship 101

- Careers without College

- Job Hunt for Today

- 3D Printing

- Freelancing 101

- Personal Finance

- Sharing Economy

- Decision-Making

- Graphic Design

- Photography

- Image Editing

- Learning WordPress

- Language Learning

- Critical Thinking

- For Educators

- Translations

- Staff Picks

- English expand_more expand_less

Money Basics - Financial Problem Solving Strategies

Money basics -, financial problem solving strategies, money basics financial problem solving strategies.

Money Basics: Financial Problem Solving Strategies

Lesson 2: financial problem solving strategies.

/en/moneybasics/why-financial-literacy/content/

Financial problem-solving strategies

Have you ever experienced a financial problem? Do you feel like finances are holding you back from reaching your goals? This lesson will give a brief overview of the general problem-solving process and how to apply it to the most common financial problems.

The problem-solving process

First, let's take a look at a general problem-solving process that you can apply to any situation, not just a financial one.

- Identify the problem . The first step in solving a problem is to identify it. What exactly do you need to overcome?

- Make a plan. What are the steps you need to take in order to overcome the problem?

- Implement the plan . This step actually puts the plan you created in place. While it sounds fairly straightforward, this is usually the most difficult step.

- Evaluate the plan . Although this is listed last, this step might actually occur simultaneously with implementing the plan. Things happen and circumstances change, so you may need to re-evaluate your plan as it is happening.

Identifying the problem

The first step in the problem-solving process is to get to the root of the problem and understand what you need to overcome. Here is a list of the most common financial problems people may face:

- Lack of income/job loss

- Unexpected expenses

- Too much debt

- Need for financial independence

- Overspending or lack of budget

- Lack of savings

When thinking about these common problems, each one falls into one of three areas: You need more money, you need to reduce your debt, or you need to change how you spend.

Making a plan

After identifying the problem you need to overcome, it's time to make a plan. Not sure where to start? No worries! We have you covered with some tips and places to begin.

Problem 1: You need more money . Whether you've lost your job, met an unexpected expense, or are working on becoming more financially independent, a form of income is necessary.

If you are a looking for additional work or maybe just a better-paying job, take some time to update your resume and cover letter. Make sure they are neat, up to date with your most current information, and free of spelling and grammar errors.

Be wary of any advertisements or jobs that offer fast, easy money. A lot of quick-cash methods come with unintended consequences. More often than not, if something sounds too good to be true, it probably is.

Problem 2: You need to reduce your debt . With high interest rates or the need to live paycheck to paycheck, high debt can be debilitating. Sometimes it feels like climbing a neverending mountain with an invisible peak. However, by prioritizing and negotiating your debt, you can make it more manageable.

Try listing all of your debt and the interest rates associated with each. Focus on paying off the ones with the highest interest rates first. If you're having trouble making payments, call the loan company and see if it can offer any solutions for you. The company may be able to lower your interest rate or offer a temporary forbearance to help you get back on your feet. If you need more help tackling your debt, you may want to contact a professional debt counselor like Consolidated Credit.

Problem 3: You need to change how you spend . Going from financial problems to a healthy financial status often requires organization and a shift in thinking. Avoiding overspending, building your savings, and gaining financial independence can often be accomplished with good spending habits.

The first thing you may want to try is creating a budget. There are many templates and resources available to help you create one. Sticking to one can be challenging, but simply having a budget laid out can help you see where you need to start spending less.

In addition to your budget, create a savings plan. Start out small. Even stowing away an extra dollar or two here and there can make a big difference. Also, try placing your savings in a place you cannot easily access. For example, create a savings account at a bank you don't usually use. The more difficult it is to access your money, the less likely you are to spend it.

Implementing the plan

Although the explanation of this part is the simplest, this is often the most difficult part to actually execute. It requires self-discipline and perseverance. The most important part of this step is to know that if your plan doesn't work or if you have a difficult time sticking to it, all is not lost. If it happens, move on to the next step, evaluate your plan, then repeat the process.

Overcoming financial obstacles can require changing your lifestyle, and this does not happen overnight. However, just having a plan itself can help to give you confidence and reassurance that you can eventually overcome whatever is in your way.

Evaluating your plan

As you implement your plan, you'll need to continually evaluate it. Maybe something happens and your original plan needs to change. Perhaps you've learned more along the way and realize that your original plan was incomplete. Or maybe your first plan went as planned and was a success. No matter the circumstances, it is always a good idea to look back and re-evaluate. Try answering these questions:

- Was your problem solved? Did a new problem arise?

- What went right?

- What went wrong?

- What circumstances changed?