Corporate tax risk: a literature review and future research directions

- Published: 02 December 2021

- Volume 73 , pages 527–577, ( 2023 )

Cite this article

- Arfah Habib Saragih ORCID: orcid.org/0000-0003-4190-3196 1 , 2 &

- Syaiful Ali ORCID: orcid.org/0000-0002-0563-4980 1

2759 Accesses

10 Citations

Explore all metrics

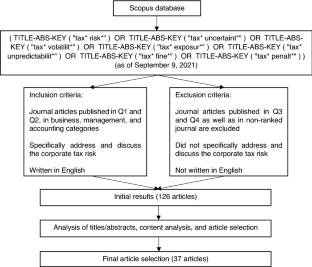

Our study aims to analyze the current state of, and avenues for, future studies into the tax risk literature. The construct of the corporate tax risk (tax uncertainty) has increasingly begun to attract significant interest from both academics and practitioners. Most previous studies discussing corporate tax behavior have also focused on tax planning, tax avoidance, and tax evasion. Studies investigating the tax risk are still very limited and it is an underexplored subject. Examining the tax risk is crucial because it relates to the tax outcomes arising from a firm’s taxation activities. Furthermore, analyzing the tax risk simultaneously with other tax behavior constructs may provide a deeper understanding. Despite the importance of the tax risk construct, there is no published literature review regarding the tax risk. Using a systematic review process, this study selected 37 articles published in 21 highly reputable journals listed in the Scopus database. The findings of this study are provided in two sections: (1) A discussion of the current studies of tax risk, including the theories, methods, and measurements of tax risk, its determinants and consequences; and (2) Recommendations for future research agendas. From the review, we find that tax risk research still tends to be limited and understudied; many relevant research gaps can be identified. Finally, we suggest several research directions into 12 themes: corporate governance, executive personal characteristics, executive compensation plans, ownership structure, firm-level characteristics, the external market, institutional factor, accounting and auditing, operating environment, regulators and regulation, reputational costs, and others.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Mandatory CSR and sustainability reporting: economic analysis and literature review

Carroll’s pyramid of csr: taking another look.

Meta-analyses on Corporate Social Responsibility (CSR): a literature review

Data availability.

All articles included in this review are accessible through the Scopus database.

Abernathy JL, Finley AR, Rapley ET, Stekelberg J (2021) External auditor responses to tax risk. J Accounting, Audit Financ 36:489–516. https://doi.org/10.1177/0148558X19867821

Article Google Scholar

Alsadoun N, Naiker V, Navissi F, Sharma DS (2018) Auditor-provided tax nonaudit services and the implied cost of equity capital. Audit A J Pract Theory 37:1–24. https://doi.org/10.2308/ajpt-51866

Arlinghaus BP (1998) Goal setting and performance measures. Tax Exec 50:434–441

Google Scholar

Armstrong CS, Blouin JL, Jagolinzer AD, Larcker DF (2015) Corporate governance, incentives, and tax avoidance. J Account Econ 60:1–17. https://doi.org/10.1016/j.jacceco.2015.02.003

Atwood TJ, Lewellen C (2019) The Complementarity between tax avoidance and manager diversion: evidence from tax haven firms. Contemp Account Res 36:259–294. https://doi.org/10.1111/1911-3846.12421

Atwood TJ, Drake MS, Myers JN, Myers LA (2012) Home country tax system characteristics and corporate tax avoidance: International evidence. Account Rev 87:1831–1860. https://doi.org/10.2308/accr-50222

Austin CR, Wilson RJ (2017) An examination of reputational costs and tax avoidance: evidence from firms with valuable consumer brands. J Am Tax Assoc 39:67–93. https://doi.org/10.2308/atax-51634

Beasley MS, Goldman NC, Lewellen CM, McAllister M (2021) Board risk oversight and corporate tax-planning practices. J Manag Account Res 33:7–32. https://doi.org/10.2308/JMAR-19-056

Beck PJ, Lisowsky P (2014) Tax uncertainty and voluntary real-time tax audits. Account Rev 89:867–901. https://doi.org/10.2308/accr-50677

Beer S, de Mooij RA, Liu Li (2019) International corporate tax avoidance: a review of the channels, magnitudes, and blind spots. J Econ Surv. https://doi.org/10.1111/joes.12305

Blouin J (2014) Defining and measuring tax planning aggressiveness. Natl Tax J 67:875–899. https://doi.org/10.17310/ntj.2014.4.06

Borthick AF, Smeal LN (2020) Data analytics in tax research: analyzing worker agreements and compensation data to distinguish between independent contractors and employees using irs factors. Issues Account Educ 35:1–23. https://doi.org/10.2308/issues-18-061

Brown JL, Drake KD, Martin MA (2016) Compensation in the post-FIN 48 period: the case of contracting on tax performance and uncertainty. Contemp Account Res 33:121–151. https://doi.org/10.1111/1911-3846.12152

Campbell JL, Cecchini M, Cianci AM (2019) Tax-related mandatory risk factor disclosures, future profitability, and stock returns. Rev Account Stud 24:264–308. https://doi.org/10.1007/s11142-018-9474-y

Campbell JL, Goldman NC, Li B (2021) Do financing constraints lead to incremental tax planning? evidence from the pension protection act of 2006. Contemp Account Res 38:1961–1999. https://doi.org/10.1111/1911-3846.12679

Casino F, Dasaklis TK, Patsakis C (2019) A systematic literature review of blockchain-based applications: current status, classification and open issues. Telemat Informatics 36:55–81. https://doi.org/10.1016/j.tele.2018.11.006

Chang H, Dai X, He Y, Wang M (2020) How internal control protects shareholders’ welfare: evidence from tax avoidance in China. J Int Account Res 19:19–39. https://doi.org/10.2308/jiar-19-046

Chen W (2020) Tax risks control and sustainable development: evidence from China. Meditari Account Res. https://doi.org/10.1108/MEDAR-05-2020-0884

Chen W (2021) Too far east is west: tax risk, tax reform and investment timing. Int J Manag Financ 17:303–326. https://doi.org/10.1108/IJMF-03-2020-0132

Chen S, Chen X, Cheng Q, Shevlin T (2010) Are family firms more tax aggressive than non-family firms? J Financ Econ 95:41–61. https://doi.org/10.1016/j.jfineco.2009.02.003

Chen H, Yang D, Zhang X, Zhou N (2020) The moderating role of internal control in tax avoidance: evidence from a COSO-Based internal control index in China. J Am Tax Assoc 42:23–55. https://doi.org/10.2308/atax-52408

Chen JZ, Hong HA, Kim J-B, Ryou JW (2021a) Information processing costs and corporate tax avoidance: evidence from the SEC’s XBRL mandate. J Account Public Policy 40:49. https://doi.org/10.1016/j.jaccpubpol.2021.106822

Chen TY, Chen Z, Li Y (2021b) Restrictions on managerial outside job opportunities and corporate tax policy: evidence from a natural experiment. J Account Public Policy. https://doi.org/10.1016/j.jaccpubpol.2021.106879

Chen X, Cheng Q, Chow T, Liu Y (2021c) Corporate in-house tax departments. Contemp Account Res 38:443–482. https://doi.org/10.1111/1911-3846.12637

Chyz JA, Gaertner FB (2018) Can paying “too much” or “too little” tax contribute to forced CEO turnover? Account Rev 93:103–130. https://doi.org/10.2308/accr-51767

Clark WR, Clark LA, Raffo DM, Williams RI (2021) Extending Fisch and Block’s (2018) tips for a systematic review in management and business literature. Manag Rev Q 71:215–231. https://doi.org/10.1007/s11301-020-00184-8

Cooper M, Nguyen QTK (2020) Multinational enterprises and corporate tax planning: a review of literature and suggestions for a future research agenda. Int Bus Rev 29:101692. https://doi.org/10.1016/j.ibusrev.2020.101692

De Simone L, Nickerson J, Seidman J, Stomberg B (2020) How reliably do empirical tests identify tax avoidance? Contemp Account Res 37:1536–1561. https://doi.org/10.1111/1911-3846.12573

Demeré P, Donohoe MP, Lisowsky P (2020) The economic effects of special purpose entities on corporate tax avoidance. Contemp Account Res 37:1562–1597. https://doi.org/10.1111/1911-3846.12580

Dhawan A, Ma L, Kim MH (2020) Effect of corporate tax avoidance activities on firm bankruptcy risk. J Contemp Account Econ 16:100187. https://doi.org/10.1016/j.jcae.2020.100187

Donelson DC, Glenn JL, Yust CG (2021) Is tax aggressiveness associated with tax litigation risk? evidence from D&O insurance. Rev Account Stud. https://doi.org/10.1007/s11142-021-09612-w

Downes JF, Kang T, Kim S, Lee C (2019) Does the mandatory adoption of IFRS improve the association between accruals and cash flows? Evidence from accounting estimates. Account Horizons 33:39–59. https://doi.org/10.2308/acch-52262

Drake KD, Lusch SJ, Stekelberg J (2017) Does tax risk affect investor valuation of tax avoidance? J Accounting, Audit Financ 34:151–176. https://doi.org/10.1177/0148558X17692674

Dwivedi A, Dwivedi P, Bobek S, Sternad Zabukovšek S (2019) Factors affecting students’ engagement with online content in blended learning. Kybernetes 48:1500–1515. https://doi.org/10.1108/K-10-2018-0559

Dyreng SD, Hanlon M, Maydew EL (2010) The effects of executives on corporate tax avoidance. Account Rev 85:1163–1189. https://doi.org/10.2308/accr.2010.85.4.1163

Dyreng SD, Hanlon M, Maydew EL (2019) When does tax avoidance result in tax uncertainty? Account Rev 94:179–203. https://doi.org/10.2308/accr-52198

Faúndez-Ugalde A, Mellado-Silva R, Aldunate-Lizana E (2020) Use of artificial intelligence by tax administrations: an analysis regarding taxpayers’ rights in Latin American countries. Comput Law Secur Rev 38:105441. https://doi.org/10.1016/j.clsr.2020.105441

Federico C, Thompson T (2019) Do IRS computers dream about tax cheats? artificial intelligence and big data in tax enforcement and compliance. J Tax Pract Proced 21:35–39

Fisch C, Block J (2018) Six tips for your (systematic) literature review in business and management research. Manag Rev Q 68:103–106. https://doi.org/10.1007/s11301-018-0142-x

Frank MM, Lynch LJ, Rego SO (2009) Tax reporting aggressiveness and its relation to aggressive financial reporting. Account Rev 84:467–496. https://doi.org/10.2308/accr.2009.84.2.467

Ftouhi K, Ghardallou W (2020) International tax planning techniques: a review of the literature. J Appl Account Res 21:329–343. https://doi.org/10.1108/JAAR-05-2019-0080

Gallemore J, Labro E (2015) The importance of the internal information environment for tax avoidance. J Account Econ 60:149–167. https://doi.org/10.1016/j.jacceco.2014.09.005

Gallemore J, Maydew EL, Thornock JR (2014) The reputational costs of tax avoidance. Contemp Account Res 31:1103–1133. https://doi.org/10.1111/1911-3846.12055

Görlitz A, Dobler M (2021) Financial accounting for deferred taxes: a systematic review of empirical evidence. Manag Rev Q. https://doi.org/10.1007/s11301-021-00233-w

Guenther DA, Matsunaga SR, Williams BM (2017) Is tax avoidance related to firm risk? Account Rev 92:115–136. https://doi.org/10.2308/accr-51408

Guenther DA, Wilson RJ, Wu K (2019) Tax uncertainty and incremental tax avoidance. Account Rev 94:229–247. https://doi.org/10.2308/accr-52194

Guggenmos RD, Van der Stede WA (2020) The effects of creative culture on real earnings management. Contemp Account Res 37:2319–2356. https://doi.org/10.1111/1911-3846.12586

Hamann PM (2017) Towards a contingency theory of corporate planning: a systematic literature review. Manag Rev Q 67:227–289. https://doi.org/10.1007/s11301-017-0132-4

Hamilton R, Stekelberg J (2017) The effect of high-quality information technology on corporate tax avoidance and tax risk. J Inf Syst 31:83–106. https://doi.org/10.2308/isys-51482

Hanlon M, Heitzman S (2010) A review of tax research. J Account Econ 50:127–178. https://doi.org/10.1016/j.jacceco.2010.09.002

Hanlon M, Maydew EL, Saavedra D (2017) The taxman cometh: does tax uncertainty affect corporate cash holdings? Rev Account Stud 22:1198–1228. https://doi.org/10.1007/s11142-017-9398-y

Hardeck I, Harden JW, Upton DR (2019) Consumer reactions to tax avoidance: evidence from the United States and Germany. J Bus Ethics 170:75–96. https://doi.org/10.1007/s10551-019-04292-8

He G, Ren HM, Taffler R (2019) The impact of corporate tax avoidance on analyst coverage and forecasts. Rev Quant Financ Account 54:447–477. https://doi.org/10.1007/s11156-019-00795-7

Herron R, Nahata R (2020) Corporate tax avoidance and firm value discount. Q J Financ. https://doi.org/10.1142/S2010139220500081

Higgins D, Omer TC, Phillips JD (2015) The influence of a firm’s business strategy on its tax aggressiveness. Contemp Account Res 32:674–702. https://doi.org/10.1111/1911-3846.12087

Hoopes JL, Mescall D, Pittman JA (2012) Do IRS audits deter corporate tax avoidance? Account Rev 87:1603–1639. https://doi.org/10.2308/accr-50187

Inger KK, Vansant B (2019) Market valuation consequences of avoiding taxes while also being socially responsible. J Manag Account Res 31:75–94. https://doi.org/10.2308/jmar-52169

Jackson M (2015) Book-tax differences and future earnings changes. J Am Tax Assoc 37:49–73. https://doi.org/10.2308/atax-51164

Jacob M, Schütt HH (2020) Firm valuation and the uncertainty of future tax avoidance. Eur Account Rev 29:409–435. https://doi.org/10.1080/09638180.2019.1642775

Joshi P, Outslay E, Persson A et al (2020) Does public country-by-country reporting deter tax avoidance and income shifting? evidence from the European banking industry. Contemp Account Res 37:2357–2397. https://doi.org/10.1111/1911-3846.12601

Kanagaretnam K, Lee J, Lim CY, Lobo GJ (2016) Relation between auditor quality and tax aggressiveness: implications of cross-country institutional differences. Audit A J Pract Theory 35:105–135. https://doi.org/10.2308/ajpt-51417

Karjalainen J, Kasanen E, Kinnunen J, Niskanen J (2020) Dividends and tax avoidance as drivers of earnings management: evidence from dividend-paying private SMEs in Finland. J Small Bus Manag. https://doi.org/10.1080/00472778.2020.1824526

Keding C (2021) Understanding the interplay of artificial intelligence and strategic management: four decades of research in review. Manag Rev Q 71:91–134. https://doi.org/10.1007/s11301-020-00181-x

Khan M, Srinivasan S, Tan L (2017) Institutional ownership and corporate tax avoidance: new evidence. Account Rev 92:101–122. https://doi.org/10.2308/accr-51529

Khurana IK, Moser WJ (2013) Institutional shareholders’ investment horizons and tax avoidance. J Am Tax Assoc 35:111–134. https://doi.org/10.2308/atax-50315

Kim J, McGuire ST, Savoy S et al (2019) How quickly do firms adjust to optimal levels of tax avoidance? Contemp Account Res 36:1824–1860. https://doi.org/10.1111/1911-3846.12481

Koester A, Shevlin T, Wangerin D (2016) The role of managerial ability in corporate tax avoidance. Manage Sci 63:3285–3310. https://doi.org/10.1287/mnsc.2016.2510

Kovermann JH (2018) Tax avoidance, tax risk and the cost of debt in a bank-dominated economy. Manag Audit J 33:683–699. https://doi.org/10.1108/MAJ-12-2017-1734

Kovermann J, Velte P (2019) The impact of corporate governance on corporate tax avoidance—A literature review. J Int Accounting, Audit Tax 36:100270. https://doi.org/10.1016/j.intaccaudtax.2019.100270

Kubick TR, Lockhart GB (2016) Do external labor market incentives motivate CEOs to adopt more aggressive corporate tax reporting preferences? J Corp Financ 36:255–277. https://doi.org/10.1016/j.jcorpfin.2015.12.003

Kubick TR, Masli ANS (2016) Firm-level tournament incentives and corporate tax aggressiveness. J Account Public Policy 35:66–83. https://doi.org/10.1016/j.jaccpubpol.2015.08.002

Law KKF, Mills LF (2017) Military experience and corporate tax avoidance. Rev Account Stud 22:141–184. https://doi.org/10.1007/s11142-016-9373-z

Lennox C, Lisowsky P, Pittman J (2013) Tax aggressiveness and accounting fraud. J Account Res 51:739–778. https://doi.org/10.1111/joar.12002

Lin X, Liu M, So S, Yuen D (2019) Corporate social responsibility, firm performance and tax risk. Manag Audit J 34:1101–1130. https://doi.org/10.1108/MAJ-04-2018-1868

Moore RD (2021) The concave association between tax reserves and equity value. J Am Tax Assoc 43:107–124. https://doi.org/10.2308/JATA-17-109

Neubig T, Sangha B (2004) Tax risk and strong corporate governance. Tax Exec 56:114–119

Neuman SS, Omer TC, Schmidt AP (2020) Assessing tax risk: practitioner perspectives. Contemp Account Res 37:1788–1827. https://doi.org/10.1111/1911-3846.12556

Nguyen JH (2020) Tax avoidance and financial statement readability. Eur Account Rev 30:1043–1066. https://doi.org/10.1080/09638180.2020.1811745

Nobes C (2020) On theoretical engorgement and the myth of fair value accounting in China. Accounting, Audit Account J 33:59–76. https://doi.org/10.1108/AAAJ-11-2018-3743

Olsen KJ, Stekelberg J (2016) CEO narcissism and corporate tax sheltering. J Am Tax Assoc 38:1–22. https://doi.org/10.2308/atax-51251

Overesch M, Wolff H (2021) Financial transparency to the rescue: effects of public country-by-country reporting in the European Union banking sector on tax avoidance. Contemp Account Res 38:1616–1642. https://doi.org/10.1111/1911-3846.12669

Plečnik JM, Wang S (2021) Top management team intrapersonal functional diversity and tax avoidance. J Manag Account Res 33:103–128. https://doi.org/10.2308/jmar-19-058

Powers K, Robinson JR, Stomberg B (2016) How do CEO incentives affect corporate tax planning and financial reporting of income taxes? Rev Account Stud 21:672–710. https://doi.org/10.1007/s11142-016-9350-6

Rasel MA, Win S (2020) Microfinance governance: a systematic review and future research directions. J Econ Stud 47:1811–1847. https://doi.org/10.1108/JES-03-2019-0109

Rego SO, Wilson R (2012) Equity risk incentives and corporate tax aggressiveness. J Account Res 50:775–810. https://doi.org/10.1111/j.1475-679X.2012.00438.x

Saavedra D (2019) Is tax volatility priced by lenders in the syndicated loan market? Eur Account Rev 28:767–789. https://doi.org/10.1080/09638180.2018.1520641

Schweikl S, Obermaier R (2020) Lessons from three decades of IT productivity research: towards a better understanding of IT-induced productivity effects. Manag Rev Q 70:461–507. https://doi.org/10.1007/s11301-019-00173-6

Taylor G, Richardson G (2013) The determinants of thinly capitalized tax avoidance structures: evidence from Australian firms. J Int Accounting, Audit Tax 22:12–25. https://doi.org/10.1016/j.intaccaudtax.2013.02.005

Taylor G, Richardson G (2014) Incentives for corporate tax planning and reporting: empirical evidence from Australia. J Contemp Account Econ 10:1–15. https://doi.org/10.1016/j.jcae.2013.11.003

Taylor G, Richardson G, Al-Hadi A (2018) Income-shifting arrangements, audit specialization and uncertain tax benefits, international tax risk, and audit specialization: evidence from US multinational firms. Int J Audit 22:1–19. https://doi.org/10.1111/ijau.12117

Towery EM (2017) Unintended consequences of linking tax return disclosures to financial reporting for income taxes: Evidence from schedule UTP. Account Rev 92:201–226. https://doi.org/10.2308/accr-51660

Tranfield D, Denyer D, Smart P (2003) Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag 14:207–222. https://doi.org/10.1111/1467-8551.00375

Wang F, Xu S, Sun J, Cullinan CP (2020) Corporate tax avoidance: a literature review and research agenda. J Econ Surv 34:793–811. https://doi.org/10.1111/joes.12347

Watrin C, Burggraef S, Weiss F (2019) Auditor-provided tax services and accounting for tax uncertainty. Int J Account. https://doi.org/10.1142/S1094406019500112

Wilde JH, Wilson RJ (2018) Perspectives on corporate tax planning: observations from the past decade. J Am Tax Assoc 40:63–81. https://doi.org/10.2308/ATAX-51993

Wunder HF (2009) Tax risk management and the multinational enterprise. J Int Accounting, Audit Tax 18:14–28. https://doi.org/10.1016/j.intaccaudtax.2008.12.003

Ying T, Wright B, Huang W (2017) Ownership structure and tax aggressiveness of Chinese listed companies. Int J Account Inf Manag 25:313–332. https://doi.org/10.1108/IJAIM-07-2016-0070

Download references

Acknowledgments

We would like to thank the editor and the anonymous reviewer for their helpful and valuable comments and recommendations. The authors would like to thank the Department of Accounting Faculty of Economics and Business Universitas Gadjah Mada and the Department of Fiscal Administration Faculty of Administrative Sciences Universitas Indonesia for supporting this study.

There is no funding for the research project.

Author information

Authors and affiliations.

Department of Accounting, Faculty of Economics and Business, Universitas Gadjah Mada, Jl. Sosio Humaniora 1, Yogyakarta, Indonesia

Arfah Habib Saragih & Syaiful Ali

Department of Fiscal Administration, Faculty of Administrative Sciences, Universitas Indonesia, Jl. Prof. Dr. Selo Soemardjan, Pondok Cina, Kecamatan Beji, Kota Depok, 16424, Jawa Barat, Indonesia

Arfah Habib Saragih

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Arfah Habib Saragih .

Ethics declarations

Conflict of interest.

We reported no potential conflict of interest.

Ethics Approval

We declared that the principles of ethical and professional conduct have been followed.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Saragih, A.H., Ali, S. Corporate tax risk: a literature review and future research directions. Manag Rev Q 73 , 527–577 (2023). https://doi.org/10.1007/s11301-021-00251-8

Download citation

Received : 15 September 2021

Accepted : 19 November 2021

Published : 02 December 2021

Issue Date : June 2023

DOI : https://doi.org/10.1007/s11301-021-00251-8

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Corporate tax risk

- Tax uncertainty

- Tax volatility

- Literature review

JEL Classification

- Find a journal

- Publish with us

- Track your research

- Browse All Articles

- Newsletter Sign-Up

- 15 Dec 2020

- Working Paper Summaries

Designing, Not Checking, for Policy Robustness: An Example with Optimal Taxation

The approach used by most economists to check academic research results is flawed for policymaking and evaluation. The authors propose an alternative method for designing economic policy analyses that might be applied to a wide range of economic policies.

- 31 Aug 2020

- Research & Ideas

State and Local Governments Peer Into the Pandemic Abyss

State and local governments that rely heavily on sales tax revenue face an increasing financial burden absent federal aid, says Daniel Green. Open for comment; 0 Comments.

- 12 May 2020

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 01 Apr 2019

- What Do You Think?

Does Our Bias Against Federal Deficits Need Rethinking?

SUMMING UP. Readers lined up to comment on James Heskett's question on whether federal deficit spending as supported by Modern Monetary Theory is good or evil. Open for comment; 0 Comments.

- 20 Mar 2019

In the Shadows? Informal Enterprise in Non-Democracies

With the informal economy representing a third of the GDP in an average Middle East and North African country, why do chronically indebted regimes tolerate such a large and untaxed shadow economy? Among this study’s findings, higher rates of public sector employment correlate with greater permissibility of firm informality.

- 30 Jan 2019

Understanding Different Approaches to Benefit-Based Taxation

Benefit-based taxation—where taxes align with benefits from state activities—enjoys popular support and an illustrious history, but scholars are confused over how it should work, and confusion breeds neglect. To clear up this confusion and demonstrate its appeal, we provide novel graphical explanations of the main approaches to it and show its general applicability.

- 02 Jul 2018

Corporate Tax Cuts Don't Increase Middle Class Incomes

New research by Ethan Rouen and colleagues suggests that corporate tax cuts contribute to income inequality. Open for comment; 0 Comments.

- 13 May 2018

Corporate Tax Cuts Increase Income Inequality

This paper examines corporate tax reform by estimating the causal effect of state corporate tax cuts on top income inequality. Results suggest that, while corporate tax cuts increase investment, the gains from this investment are concentrated on top earners, who may also exploit additional strategies to increase the share of total income that accrues to the top 1 percent.

- 08 Feb 2018

What’s Missing From the Debate About Trump’s Tax Plan

At the end of the day, tax policy is more about values than dollars. And it's still not too late to have a real discussion over the Trump tax plan, says Matthew Weinzierl. Open for comment; 0 Comments.

- 24 Oct 2017

Tax Reform is on the Front Burner Again. Here’s Why You Should Care

As debate begins around the Republican tax reform proposal, Mihir Desai and Matt Weinzierl discuss the first significant tax legislation in 30 years. Open for comment; 0 Comments.

- 08 Aug 2017

The Role of Taxes in the Disconnect Between Corporate Performance and Economic Growth

This paper offers evidence of potential issues with the current United States system of taxation on foreign corporate profits. A reduction in the US tax rate and the move to a territorial tax system from a worldwide system could better align economic growth with growth in corporate profits by encouraging firms to invest domestically and repatriate foreign earnings.

- 07 Nov 2016

Corporate Tax Strategies Mirror Personal Returns of Top Execs

Top executives who are inclined to reduce personal taxes might also benefit shareholders in their companies, concludes research by Gerardo Pérez Cavazos and Andreya M. Silva. Open for comment; 0 Comments.

- 18 Apr 2016

Popular Acceptance of Morally Arbitrary Luck and Widespread Support for Classical Benefit-Based Taxation

This paper presents survey evidence that the normative views of most Americans appear to include ambivalence toward the egalitarianism that has been so influential in contemporary political philosophy and implicitly adopted by modern optimal tax theory. Insofar as this finding is valid, optimal tax theorists ought to consider capturing this ambivalence in their work, as well.

- 20 Nov 2015

Impact Evaluation Methods in Public Economics: A Brief Introduction to Randomized Evaluations and Comparison with Other Methods

Dina Pomeranz examines the use by public agencies of rigorous impact evaluations to test the effectiveness of citizen efforts.

- 07 May 2014

How Should Wealth Be Redistributed?

SUMMING UP James Heskett's readers weigh in on Thomas Piketty and how wealth disparity is burdening society. Closed for comment; 0 Comments.

- 08 Sep 2009

The Height Tax, and Other New Ways to Think about Taxation

The notion of levying higher taxes on tall people—an idea offered largely tongue in cheek—presents an ideal way to highlight the shortcomings of current tax policy and how to make it better. Harvard Business School professor Matthew C. Weinzierl looks at modern trends in taxation. Key concepts include: Studies show that each inch of height is associated with about a 2 percent higher wage among white males in the United States. If we as a society are uncomfortable taxing height, maybe we should reconsider our comfort level for taxing ability (as currently happens with the progressive income tax). For Weinzierl, the key to explaining the apparent disconnect between theory and intuition starts with the particular goal for tax policy assumed in the standard framework. That goal is to minimize the total sacrifice borne by those who pay taxes. Behind the scenes, important trends are evolving in tax policy. Value-added taxes, for example, are generally seen as efficient by tax economists, but such taxes can bear heavily on the poor if not balanced with other changes to the system. Closed for comment; 0 Comments.

- 02 Mar 2007

What Is the Government’s Role in US Health Care?

Healthcare will grab ever more headlines in the U.S. in the coming months, says Jim Heskett. Any service that is on track to consume 40 percent of the gross national product of the world's largest economy by the year 2050 will be hard to ignore. But are we addressing healthcare cost issues with the creativity they deserve? What do you think? Closed for comment; 0 Comments.

Who Bears the Corporate Tax? A review of What We Know

This paper reviews what we know from economic theory and evidence about who bears the burden of the corporate income tax. Among the lessons from the recent literature are: 1. For a variety of reasons, shareholders may bear a certain portion of the corporate tax burden. In the short run, they may be unable to shift taxes on corporate capital. Even in the long run, they may be unable to shift taxes attributable to a discount on "old" capital, taxes on rents, or taxes that simply reduce the advantages of corporate ownership. Thus, the distribution of share ownership remains empirically quite relevant to corporate tax incidence analysis, though attributing ownership is itself a challenging exercise. 2. One-dimensional incidence analysis -- distributing the corporate tax burden over a representative cross-section of the population -- can be relatively uninformative about who bears the corporate tax burden, because it misses the element timing. 3. It is more meaningful to analyze the incidence of corporate tax changes than of the corporate tax in its entirety, because different components of the tax have different incidence and incidence relates to the path of the economy over time, not just in a single year.

- Acknowledgements and Disclosures

MARC RIS BibTeΧ

Download Citation Data

Published Versions

Who Bears the Corporate Tax? A Review of What We Know , Alan J. Auerbach. in Tax Policy and the Economy, Volume 20 , Poterba. 2006

More from NBER

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

The Official Journal of the Pan-Pacific Association of Input-Output Studies (PAPAIOS)

- Open access

- Published: 09 May 2020

Tax structure and economic growth: a study of selected Indian states

- Yadawananda Neog ORCID: orcid.org/0000-0002-3578-0460 1 &

- Achal Kumar Gaur 1

Journal of Economic Structures volume 9 , Article number: 38 ( 2020 ) Cite this article

49k Accesses

27 Citations

3 Altmetric

Metrics details

The present study examines the long-run and short-run relationship between tax structure and state-level growth performance in India for the period 1991–2016. The analysis in this paper is based on the model of Acosta-Ormaechea and Yoo ( 2012 ), and for the verification of the relationship between taxation and economic growth the panel regression method is used. With the use of 14 Indian states data, Panel Pool mean group estimation indicates that income tax and commodity–service tax have negative effects whilst property and capital transaction tax have a significant positive effect on state economic growth. This study finds ‘U’ shape relationship between tax structure and growth performance. Based on the analysis, we conclude that for faster growth of Indian states, policymakers should give more focus on property taxes along with the reduction in income taxes.

1 Introduction

The study on the potential association between tax structure and growth performance has gathered a great deal of attention from policymakers, academicians and regulatory circles for several reasons. First, the developing and emerging economies require a large volume of tax revenues for the smooth and efficient functioning of the state at both the national and sub-national levels. Globalization has laid down the foundation for Goods and Service Tax (GST) in many developing countries (Mcnabb 2018 ). Due to competition, developing countries are also facing the difficulties to maintain existing tax revenues (Bird and Zolt 2011 ). Second, tax collection and structure of it create distortionary impacts in the economy through tax burden. Thus, the positive and negative impact of tax made the ‘tax–growth’ relationship more complex and the structure of taxation has a definite role in the development process of an economy.

In a budget constraint economy like India, investigation of tax–growth relationship enables us to formulate the suitable policy measure for the more inclusive and equitable growth process. The budget crisis is usually resolved through the cut-down of public spending or/and an increase in tax revenues (Macek 2014 ). Rapid reduction in spending or increase in taxes is harmful to long-run growth performance. Thus, the concern of the government lies with the problem of fiscal consolidation with sustainable growth performance where tax policies are vital.

Empirical evidence on the impact of tax structure on growth performance is not conclusive. India has adopted the Goods and Service Tax (GST) policy in 2017 intending to raise indirect tax collections and transform the indirect tax structure into a single market to avoid tax evasions and double taxation. GST is regarded as one of the major tax policy changes in independent India and economists are an optimist about its impact on revenue generations and growth performance. But this policy is not the only policy that shaped in independent India; other major policy changes also take place after independence. Footnote 1 Tax Reform Committee (TRC) report of 1991 regarded one of the productive and structured policy recommendations in the recent decade. At the state level, sales tax reform in the form of Value Added Tax (VAT) in 2005 becomes a fruitful policy initiative. However, the tax collections in both national and sub-national level are still low as compared to the international standards. Changes in tax policy also change in the tax structure in the economy and India witnessed these changes at both levels of governments. Recent studies proved that the changes in tax structure have decisive implication in the growth performance through work–leisure behaviour, investment decisions and overall productivity (Arnold et al. 2011 ; Gemmell et al. 2011 ; Macek 2014 ; Mdanat et al. 2018 ; Durusu-Ciftci 2018 ). In India, very few empirical studies are available which analyse the impact of these changes in tax structure on growth performance and this study will be first to investigate tax–growth nexus in India with the use of state-level data.

This analysis primarily concerned with tax structure rather than to tax levels (usually measured as a tax–GDP ratio). The main advantage of tax structure analysis is that it provides revenue-neutral tax policy changes which remove the difficulties related with the question of how aggregate tax revenue changes relates with expenditure changes (Arnold et al. 2011 ). The empirical results from linear panel regression suggest us that property and capital transection tax are positively affecting the state’s growth performance, where commodity and service tax effect negatively. However, the non-linear panel regression indicates that the positive effect is only visible for property taxes at a higher level where the negative effect of commodity and service taxes becomes positive after a threshold point. The effect of income tax is not significant in long run irrespective of panel regression models.

The structure of the paper is as follows: Sect. 2 deals with the theoretical framework and empirical literature, followed by a brief description of data and methodology in Sect. 3 . Empirical results and discussion are presented in Sect. 4 and our last Sect. 5 is for conclusions and recommendations.

2 Theoretical framework and empirical literature

Growth literature very recently acknowledges the role of taxation in the growth process of an economy. Until recently, growth models are more concerned with the steady-state process and exogenous changes. On the theoretical ground, taxation does not have any impact on growth (Myles 2000 ). Development of endogenous growth models creates the space for fiscal policy especially tax policy in determining the growth performance. Barro ( 1990 ), King and Rebello ( 1990 ) and Jones et al. ( 1993 ) were the pioneer in this regard. Tax level and tax structure have an impact on the saving behaviour of the household and investment in human capital. On the other hand, the firm also changes its investment decisions and innovations following tax policies (Johansson et al. 2008 ). These decisions and incentives in the accumulation of physical and human capital create the ‘Growth’ disparities amongst the countries and state economies.

A large body of literature available on “Tax-Growth” relationship is mostly dedicated to cross-country settings (Martin and Fardmanesh 1990 ; Karras 1999 ; Myles 2000 ; Tosun and Abizadeh 2005 ; Johansson et al. 2008 ; Vartia et al. 2008 ; Arnold 2011 ; Szarowska 2013; Macek 2014 ; Stoilova 2017 ; Safi et al. 2017 ; Durusu-Ciftci 2018 ) that investigates the effect of tax policy on economic performance. Income and corporation taxes are the major tax instruments for the governments irrespective of the level of developments of a country. The formation of tax structure with these two taxes has many implications in the growth performance. The study made by Arnold et al. ( 2011 ), Macek ( 2014 ) and Dackehag and Hansson ( 2012 ) has explored the negative relation of income and corporation tax with growth performance. Vartia et al. ( 2008 ) find the negative impact of corporation tax for OECD countries. If we consider the average and marginal tax rate, marginal tax is very influential than to average tax rate in investment decisions and labour supply. Empirical studies prove that marginal tax has a negative relation with growth, which indicate raising of marginal tax rate is associated with compromises with growth performance (Padovano and Galli 2001 ; Lee and Gordon 2005 ; Poulson and Kaplani 2008 ). Studies also established that other type of taxes also has a significant impact on growth performance, like consumption tax (Johansson et al. 2008 ; Durusu-Ciftci 2018 ), GST and Payroll (Tosun and Abizadeh 2005 ), property tax (Xing 2011 ), labour tax (Szarowska 2014 ), sales tax (Ojede and Yamarik 2012 ), excise (Reynolds 2006 ), etc.

However, looking at the single country’s perspective, we find very little evidence on the same. Stockey and Rebelo ( 1995 ) with the use of the endogenous growth model study the role of tax reforms on U.S. growth performance. They have found that tax reforms have very minor implication with economic outcomes. There are several studies exist for US economy where they empirically try to establish the link between tax and growth. Atems ( 2015 ) finds the spatial spillover effect of income taxes on the growth of 48 contiguous states. On the other hand, Ojede and Yamarik ( 2012 ) have not found any kind of impact of income taxes on growth in these states. Their panel pool mean group estimation indicates that property and sales tax has detrimental consequences in development. With the use of data for the U.S. covering the period of 1912–2006, Barro and Redlick ( 2009 ) find that average marginal income taxes were halting the economic growth. However, they have provided an interesting argument that in wartime, the tax does not have any kind of relation with growth. In search of an answer to the question that whether corporate tax rise destroys jobs in the U.S., Ljungqvist and Smolyansky ( 2016 ) use firm-level data for the period 1970–2010. The main conclusion of the paper is that a rise in corporate tax is not good for employment and income and has very little impact on economic activity. Using the error correction model, Mdanat et al. ( 2018 ) find for Jordan that income tax, corporation tax and personal tax negatively impact the growth. They suggest that irrespective of tax collection, the prime focus of the government should be social justice of the people. Dladla and Khobai ( 2018 ) also find similar results for South Africa where income taxes are coming out to be negative. For the case of Italy, Federici and Parisi ( 2015 ) used the 880 firms’ data and results show that corporation tax is bad for investments with the consideration of both effective average and marginal taxes rates.

Looking at the literature, the empirical relationship of tax structure with growth performance is still unclear for India. This study attempts to fill the gap by examining the effect of tax policy on economic performance in an emerging economy such as India at the state level. Second, with the use of panel Pool Mean Group (PMG) estimator which assumes slope homogeneity in the long run and heterogeneity in the short run, we can incorporate the dynamic behaviour of the variables which will be new to tax structure–growth study in India. Third, the tax–growth nexus may show a non-linear relationship due to the threshold effect. We consider this non-linearity in our panel regression model which will be a contribution to the existing literature.

3 Data and methodology

To study the effect of tax policy on economic performance in India, we employed three models and included each tax instruments in the models separately to avoid the problem of Multicollinearity. Following the works of Arnold et al. ( 2011 ) and Acosta-Ormaechea and Yoo ( 2012 ), the tax structure is measured by the share of individual tax to the total state tax revenues. We investigate the tax–growth relationship with the following equation.

Here, Y it is the growth rate of Per capita net state domestic product (NSDP), SGI is the state gross investment as a percentage of state domestic product, TAX is one of the tax shares (Property, Commodity & Services and Income), Tax Burden Footnote 2 is the ratio of total tax revenues to state domestic product and ϵ is the error term. Per the work of Acosta-Ormaechea and Yoo ( 2012 ), this study is more concerned with the impact of tax structure on growth rate rather than level effect. In model 1, we include property tax share, and in model 2 and model 3, we incorporate commodity & service tax and income tax, respectively. By following the approach of Arnold et al. ( 2011 ), we include total tax burden as a control variable which will reduce the biases that may occur from correlation in between tax mix and tax burden. We also included Secondary Enrollment Rate as a proxy variable for human capital in our model, but the inconsistent and insignificant results make us drop the variable from the final estimation model.

In search of a possible non-linear relationship, we introduce a separate panel regression by introducing the square of each tax share into the models.

If the coefficient of α 3 significant and carries an opposite sign to α 2 , then we can conclude that there is a non-linear relationship exist.

In this study, we included 14 Indian states for the period 1991 to 2016 and excluded North-Eastern states due to their relatively small tax revenue collections. Data have been taken from the Centre for Monitoring Indian Economy (CMIE) and Handbook of Statistics on the Indian States, published by Reserve Bank of India. The states that are included in this study are Andhra Pradesh (undivided), Footnote 3 Assam, Gujarat, Haryana, Himachal Pradesh, Jammu & Kashmir, Karnataka, Kerala, Maharashtra, Punjab, Tamil Nadu, Orissa, Rajasthan and West Bengal. All the states are included in model 1 and model 2. For model 3, due to the data availability, we include only seven states Footnote 4 namely Andhra Pradesh, Assam, Gujarat, Karnataka, Kerala, Maharashtra, and West Bengal.

The selection of the study period is primarily driven by the argument provided by Rao and Rao ( 2006 ) that after the market-oriented economic reform of 1991, more systematic and long-term goal-oriented tax reforms were initiated in state level for India. The economic reform also brings rapid growth in India and it becomes very interesting to look at the tax–growth nexus after the economic reform. The second restriction related to the use of long data span is the availability of data for each tax head for each of the states under this study.

3.1 Unit root

Pool Mean Group (PMG) specification is very fruitful and widely used model to capture the dynamic behaviour of policy variables. This model is very powerful as it can investigate both I (0) and I (1) variables in a single autoregressive distributive lag (ARDL) model setup. A necessary condition in the ARDL model is that the model cannot deal with the I(2) variables. Thus, the investigation of stationarity becomes a compulsion. We used popular panel unit root tests like LLC (Levin et al. 2002 ), the IPS (Im et al. 2003 ), the ADF-Fisher Chi square (Maddala and Wu 1999 ) and PP-Fisher Chi square (Choi 2001 ) in this study.

3.2 Panel PMG model

The Mean Group (MG) estimator was developed by Pesaran and Smith ( 1995 ) to solve the issue of bias related to heterogeneous slopes in dynamic panels. Traditional panel models like instrumental variables’ estimator of Anderson and Hsiao ( 1981 , 1982 ) and Arellano and Bond ( 1991 ) may produce inconsistent results in a dynamic panel framework (Pesaran et al. 1999 ). MG estimator takes the average value of every cross-section and provides the long-run estimate for ARDL or PMG. On the other hand, Pooled Mean Group (PMG) estimator developed by Pesaran et al. ( 1999 ) assumes slope homogeneity in the long run but heterogeneous slopes in the short run for cross-section units. Dynamic Fixed Effect (DFE) also works like PMG and restricts cointegrating vector to be equal across all panels and restricts the speed of adjustment to be equal.

Under these assumptions, PMG is more efficient estimator than to MG and DFE estimator. The prime requirement for PMG estimator is that T should be sufficiently large to N. Panel ARDL or PMG works through maximum likelihood. Our basic PMG begins with the following equation.

Here, x it is the vector explanatory variables and y i is the lag dependent variable. X it allows the inclusion of both I (0) and I (1) variables. State fixed effect is captured through μ i . Above equation can be re-parameterized to ARDL format.

ɸ i measures the state-specific speed of adjustment and known as Error Correction Term. Β i is the vector of long-run relationships and α ij and θ ij are the vectors of short-run dynamic relationships. Pesaran et al. ( 1999 ) did not provide any statistical test for checking long-run relationship but it can be concluded form sign and magnitude of Error Correction Term (ECT). If it is negative and less than − 2, a long-run relationship can be established.

4 Results and discussion

Panel unit root test results from Table 1 suggest that in the case of Model 1 & 2, the Growth rate of Per Capita Net State Domestic Product (PC-NSDP), Property tax and commodity taxes are stationary at level. Gross investment and total tax revenue share to GDP are stationary at the 1st difference in all models and income tax share is also stationary at the same order.

5 PMG model results

We have reported MG, PMG and DFE estimation in the Tables 2 and 3 . The Hausman test indicates that the PMG model is the best model for our data than to MG model. Negative and significant error correction terms in all the models show the long-run relationship in between variable. One major issue related to the tax–growth equation is the problem of endogeneity of the variables. As growth in per capita GDP is our dependent variables, there is a possibility that tax collections behave along with business cycles. Therefore, we tested the weak/strong exogeneity of the tax variables through the correlation analysis between business cycles and tax shares. Business cycles have been calculated using the Hodrick-Prescott (HP) Filter. We have found that all the tax instruments are very weakly related to the business cycles movement and thus, we conclude that variables are not truly endogenous.

The speed of adjustment in PMG model 1, 2 and 3 are 78.9%, 78.4% and 79.6%, respectively. For the sake of completeness, we have reported MG and DFE Footnote 5 model results also. But we are more concerned with the results of PMG estimator as Hausman test suggested that PMG is a better model than to MG. The sign of the property tax is positive and significant in the long run as well as in the short run. Results are in line with the findings of Acosta-Ormaechea and Yoo ( 2012 ). Property tax generally considered a good revenue source for state and municipal governments for providing economic and social services in the city. This tax is also able to establish cost–benefit linkages and feasible decisions for the citizens. The positive impact of property taxes indicates that the revenue generation and productive utilization of these revenues exceed the distortionary effect in these states. As we expected, the tax burden is negatively associated with growth performance in both long run and short run. The relationship is showing the distortionary effect of the tax collection in the state economy. In all models, gross investment enhancing the growth in per capita SDP in the long run. Signs are readily justified as enlargement of capital formation has a positive impact on output and employment which channelized to the development outcomes (Swan 1956 , Solow 1956 ).

Commodity and service taxes are negatively related to the growth in per-capita SDP in the long run as well as in short run and findings are similar to the work of Ojede and Yamarik ( 2012 ). Footnote 6 This tax now comes under the Goods & Services taxes, but in the pre-GST period, commodity and service taxes are reducing growth in per capita NSDP. Commodity taxes are indirect taxes and state own tax revenues mostly come from indirect taxes. As indirect taxes, it has certain disadvantages like inflationary pressure in the economy and regressive to the poor section of the society. Our results also support the same hypothesis that increased commodity tax share is harmful. In India, commodity and service tax includes central sale tax, state excise duty, vehicle tax, goods & passenger tax, electricity duty and entertainment tax. Central sale tax was imposed on interstate trade of commodities which is now transformed to Inter-State GST (IGST). According to Das ( 2017 ), if the IGST rate is high to the Revenue Neutral Rate, it will harm the aggregate demand in the economy through the reduction of disposable income. Heavy vehicle and passenger tax collections are creating an abysmal environment for industrial activities. The tax burden variable is also carrying a negative sign in both long run and short run and magnitude is very similar to model 1. Income tax share has become insignificant and positive in the long run and negative insignificant in the short run.

After examining the linear relationships, we extended our analysis to the examination of a non-linear relationship with the use of PMG estimation model. The result from Tables 4 and 5 indicates the existence of a non-linear relationship between tax structure and growth performance for Indian states. The linear coefficient for property taxes has now become negative and the square of it turns out to be positive. Thus, the property taxes show a ‘U’-shaped relationship with states’ growth performance which implies that a rise in property taxes is bad for growth initially and after a threshold point, it becomes growth enhancing. The threshold point for property taxes is 1.88 which indicates that more than 80.77% observation is more than to threshold point.

In the case of commodity and service taxes, both the linear and non-linear coefficients are significant with different signs. However, the coefficient magnitudes are abnormally large and this is due to the inclusion of both linear and quadratic terms into the single equation. The small commodity and service taxes are very bad for the state economy, whereas the large amount of it shows a positive relation. The threshold point for this tax is 4.45 which implies that 79.95% observation lies above the threshold. This is a very interesting result as high commodity and service taxes could lead to high inflation in the economy and high inflation regarded as atrocious for growth. Further investigation of these findings is highly recommendable. As like linear panel regression, the income tax shows no relation in our non-linear regression model also. However, the short-run coefficient for income tax is significant and shows a negative relationship. Income tax is considered to be distortionary tax to the economy in the presence of income and substitution effect (Kotlan 2011 ). Income tax mostly impacts the savings of the households and labour supply which is regarded as an engine of growth.

6 Conclusions and recommendations

In this study, we try to find out the long-run and short-run relationship between different tax structure and economic growth in states of India. Empirical evidence from linear regression suggests that the property tax enhancing growth and commodity & service taxes reduce it. The non-linear regression validates these findings for property taxes where high property taxes are good for growth. In the case of commodity & service taxes, the results become opposite after the threshold point and affecting the growth negatively. Interestingly, we do not find any significant impact of income taxes on growth in both linear and non-linear regressions in the long run.

As far as the total tax burden is concerned, negative relation with the growth performance is verified and results are in line with Arnold et al. ( 2011 ). The negative effect of commodity and service taxes in the short run is expected to be neutralized through the implementation of GST in India. Promotion of growth performance at the state level concerning income taxes is also very crucial. Income tax has a direct effect on individuals and their saving and investment behaviour. On the other side, tax revenues should be placed in productive investments. With the spending, the government can promote inclusive growth, equality and efficiency in the economy.

The most promising path emerged through this study for long-run growth performance in Indian states is to lower the total tax burden and shifting from income and commodity taxes to property tax for revenue generations. The conclusion may be debatable on various grounds as the studied variables do not take into account institutional quality, administrative efficiency in tax collection, fiscal balance and condition of the states and existence of informal sectors. Future research can be done to incorporate these issues.

Availability of data and materials

Dataset analysed in this study is available from the corresponding author on reasonable request.

One can see the writings of Rao and Rao ( 2006 ) for brief discussion.

This is the proxy for total tax burden in the economy with certain limitations. It does not include informal economy and expenditure policies.

Telangana state was established in 2014. We merged the data of Andhra Pradesh and Telangana to achieve aggregate data for undivided Andhra Pradesh.

Data for Income tax are available for ten states, but inclusion of these states made the model inconsistent due to huge fluctuations in tax revenue collections.

Most of the coefficients of PMG and DFE are in similar range and smaller than to MG estimator. This is due to MG estimator only takes the information of each state time series to estimate long-run and short-run coefficients.

They use sale tax, where our study takes aggregate revenue for commodity and services. However, inference can be drawn as sale tax and is one of the dominant contributors in total commodity and service tax revenue in India.

Abbreviations

Net state domestic product

Goods and service tax

Foreign direct investments

- Pool mean group

Dynamic fixed effect

Auto-regressive distributed lag

The organization for economic co-operation and development

Anderson TW, Hsiao C (1981) Estimation of dynamic models with error components. J Am Stat Assoc 76(375):598–606

Article Google Scholar

Anderson TW, Hsiao C (1982) Formulation and estimation of dynamic models using panel data. J Econom 18(1):47–82

Arellano M, Bond S (1991) Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arnold JM et al (2011) Tax policy for economic recovery and growth. Econ J 121:59–80. https://doi.org/10.1111/j.1468-0297.2010.02415.x

Atems B (2015) Another look at tax policy and state economic growth: the long and short run of it. Econ Lett 127(1):64–67

Barro RJ (1990) Government spending in a simple model of endogenous growth. J Politic Econ Univ Chicago Press 98(5):103–126

Barro RJ, Redlick CJ (2009) Macroeconomic effects from government purchases and taxes, ADB economics working paper series, No. 232

Bird RM, Zolt EM (2011) Dual income taxation: a promising path to tax reform for developing countries. World Dev 39(10):1691–1703

Choi I (2001) Unit root tests for panel data. J Int Money Fin. 20:249–272

Dackehag M, Hansson A (2012) Taxation of income and economic growth : an empirical analysis of 25 rich OECD countries

Das S (2017) Some concerns regarding the goods and services tax. Econ Polit Wkly 52(9)

Dladla K, Khobai H (2018) The impact of taxation on economic growth in South Africa, MPRA Paper No. 86219, 1–15

Durusu-çiftçi D, Gökmenoğlu KK, Yetkiner H (2018). The heterogeneous impact of taxation on economic development: new insights from a panel cointegration approach. Economic systems. Elsevier BV. https://doi.org/10.1016/j.ecosys.2018.01.001

Federici D, Parisi V (2015) Do corporate taxes reduce investments? Evidence from Italian firm level panel data. Cogent Econ Finance 3:1–14. https://doi.org/10.1080/23322039.2015.1012435

Gemmell N, Kneller R, Sanz I (2011) The timing and persistence of fiscal policy impacts ongrowth: evidence from OECD countries. Econ J 121(550):33–58

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econometrics. 115:53–74

Johansson Å et al (2008) Taxation and economic. Growth. https://doi.org/10.1787/241216205486OECD

Jones L, Manuelli R, Rossi P (1993) Optimal taxation in models of endogenous growth. J Polit Econ 101(3):485–517

Karras G (1999) Taxes and growth: testing the neoclassical and endogenous growth models. Contemporary Econ Policy. 17(2):177–188

King R, Rebelo S (1990) Public policy and economic growth: developing neoclassical implications. J Polit Econ 98(5):S126-50

Kotlán I, Machová Z, Janíčková L (2011) Vliv zdanění na dlouhodobý ekonomický růst. Politická ekonomie. 5:638–658

Lee Y, Gordon RH (2005) Tax structure and economic growth. J Public Econ 89(5–6):1027–1043. https://doi.org/10.1016/j.jpubeco.2004.07.002

Levin A, Lin CF, Chu CS (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econometrics. 108(1):1–24

Ljungqvist A, Smolyansky M (2016). To cut or not to cut? On the impact of corporate taxes on employment and income, Finance and economics discussion series 2016–006. Washington: Board of Governors of the Federal Reserve System, http://dx.doi.org/10.17016/FEDS.2016.006

Macek R (2014) The impact of taxation on economic growth: case study of OECD countries. Rev Econ Perspect. 14(4):309–328. https://doi.org/10.1515/revecp-2015-0002

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxford Bull Econ Stat 61:631–652

Martin R, Fardmanesh M (1990) Fiscal variables and growth: a cross-sectional analysis. Public Choice 64:239–251

Mcnabb K (2018) Tax structures and economic growth: new evidence from the government revenue dataset. J Int Dev 30:173–205. https://doi.org/10.1002/jid.3345

Mdanat MF et al (2018) Tax structure and economic growth in Jordan, 1980–2015. EuroMed J Bus 13(1):102–127. https://doi.org/10.1108/EMJB-11-2016-0030

Myles GD (2000) Taxation and economic growth. Fiscal Studies. 21(1):141–168. https://doi.org/10.1016/0264-9993(93)90021-7

Ojede A, Yamarik S (2012) Tax policy and state economic growth : the long-run and short-run of it, Economics Letters. Elsevier BV, 116, No.2, pp. 161–165. https://doi.org/10.1016/j.econlet.2012.02.023

Ormaechea AS, Yoo J (2012) Tax composition and growth: a broad cross-country perspective. IMF Working Papers. https://doi.org/10.5089/9781616355678.001

Padovano F, Galli E (2001) Tax rates and economic growth in the OECD countries (1950–1990). Econ Inq 39(1):44–57

Pesaran MH, Smith RP (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econometrics. 68:79–113

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc. 94:621–634

Poulson BW, Kaplani JG (2008) State income taxes and economic growth. Cato J 28(1):53–71

Google Scholar

Rao MGR, Rao RK (2006) Trends and issues in tax policy and reform in India. INDIA POLICY FORUM

Reynolds S (2006) The impact of increasing excise duties on the economy. Working Paper Series 58069. PROVIDE Project

Saafi S, Mohamed MBH, Farhat A (2017) Untangling the causal relationship between tax burden distribution and economic growth in 23 OECD countries: fresh evidence from linear and non-linear Granger causality. Eur J Comp Econ. 14(2):265–301

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Stoilova D (2017) Tax structure and economic growth: evidence from the European Union. Contaduría y Administración. 62:1041–1057. https://doi.org/10.1016/j.cya.2017.04.006

Stokey NL, Rebelo S (1995) Growth effects of flat-rate taxes. J Polit Econ 103(3):519–550

Swan TW (1956) Economic growth and capital accumulation. Econ Record 32:334–361. https://doi.org/10.1111/j.1475-4932.1956.tb00F434

Szarowska I (2014) Effects of taxation by economic functions on economic growth in the European Union. MPRA Paper No. 59781

Tosun MS, Abizadeh S (2005) Economic growth and tax components: an analysis of tax changes in OECD. Appl Econ 37:2251–2263. https://doi.org/10.1080/00036840500293813

Vartia L (2008) How do taxes affect investment and productivity ? An industry-level analysis of OECD countries. OECD Economics Department Working Papers 656

Xing J (2011) Does tax structure affect economic growth? Empirical evidence from OECD countries, Centre for Business Taxation, WP 11/20

Download references

Acknowledgements

Authors like to acknowledge the anonymous referee for his/her valuable comments.

Not applicable.

Author information

Authors and affiliations.

Department of Economics, Banaras Hindu University, Varanasi, India

Yadawananda Neog & Achal Kumar Gaur

You can also search for this author in PubMed Google Scholar

Contributions

Both the authors’ handled the data, analysed and contribute their part to write the manuscript. Both authors read and approved the final manuscript.

Corresponding author

Correspondence to Yadawananda Neog .

Ethics declarations

Competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

See Tables 1 , 2 , 3 , 4 and 5 .

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Neog, Y., Gaur, A.K. Tax structure and economic growth: a study of selected Indian states. Economic Structures 9 , 38 (2020). https://doi.org/10.1186/s40008-020-00215-3

Download citation

Received : 26 November 2019

Revised : 16 March 2020

Accepted : 29 April 2020

Published : 09 May 2020

DOI : https://doi.org/10.1186/s40008-020-00215-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Tax structure

A Systems View Across Time and Space

- Open access

- Published: 16 February 2021

Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers

- Erstu Tarko Kassa ORCID: orcid.org/0000-0002-8199-4910 1

Journal of Innovation and Entrepreneurship volume 10 , Article number: 8 ( 2021 ) Cite this article

71k Accesses

15 Citations

6 Altmetric

Metrics details

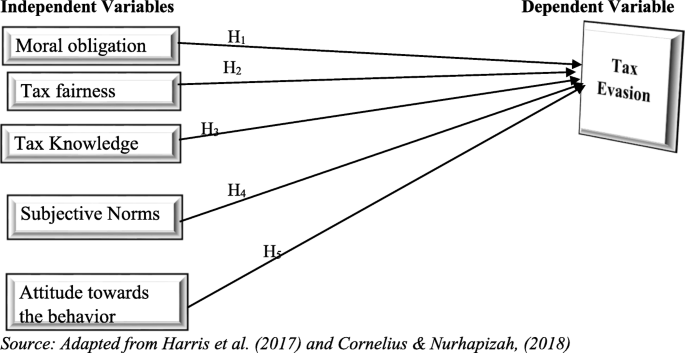

The main purpose of this paper is to investigate factors that influence taxpayers to engage in tax evasion. The researcher used descriptive and explanatory research design and followed a quantitative research approach. To undertake this study, primary and secondary data has been utilized. From the target population of 4979, by using a stratified and simple random sampling technique, 370 respondents were selected. To verify the data quality, the exploratory factor analysis (EFA) was conducted for each variable measurements. After factor analysis has been done, the data were analyzed by using Pearson correlation and multiple regression analysis. The finding of the study revealed that the relationship between the study independent variables with the dependent variable was positive and statistically significant. The regression analysis also indicates that tax fairness, tax knowledge, and moral obligation significantly influence taxpayers to engage in tax evasion, and the remaining moral obligation and subjective norms were not statistically significant to influence taxpayers to engage in tax evasion.

Introduction

In developed and developing countries, business owners, government workers, service providers, and other organizations are forced by the government to pay a tax for a long period in human being history, and no one can escape from the tax of the country. To support this, there is an interesting statement mentioned by Benjamin Franklin “nothing is certain except death and taxes”. This statement confirmed that every citizen should be subjected to the law of tax, and they are obliged to pay the tax from their income. To build large dams, to construct transportation infrastructures, and to provide quality social services for the community, collecting a tax from citizens plays a significant role for the governments (Saxunova and Szarkova, 2018 ).

Tax is the benchmark and turning point of the country’s overall development and changing the livelihoods and enhancing per capital income of the individuals. The gross domestic product of the developed countries and average revenue ratio were 35% in the year 2005, whereas in developing countries the share was 15% and in third world countries also not more than 12% (Mughal, 2012 ).

In the developing world, countries have no system to collect a sufficient amount of tax from their taxpayers. The expected amount of revenue cannot be enhanced due to different reasons. Among the reasons tax operation of the system may not be smooth, tax evasion and lack of awareness creation for the taxpayers are common in the developing world, and citizens are not committed to paying the expected amount of tax for their countries (Fagbemi et al., 2010 ). In today’s world, this remains very much the same as persons now pay taxes to their governments. As the world has evolved, tax compliance has taken a back seat with tax avoidance and tax evasion being at the forefront of the taxpayer’s main objective. Tax avoidance is the use of legal means to reduce one’s tax liability while tax evasion is the use of illegal means to reduce that tax liability (Alleyne & Harris, 2017 ). Tax evasion is a danger to the community; the countries and international organizations have been making an effort to fight undesirable phenomena related to taxation, the tax evasion, or tax fraud (Saxunova and Szarkova, 2018 ).

Tax evasion may brings a devastating loss for the country's GDP at the micro level, and it became a debatable and a special concern for tax collector authorities (Aumeerun et al., 2016 ). The participants in tax evasion activity critized by different individuals and groups by considering the loss that brings to the country economy (Alleyne & Harris, 2017 ).

According to Dalu et al., ( 2012 ) state that in the Zimbabwe tax system there are identical devils tax evasion and tax avoidance that create a problem for the government to collect a tax from taxpayers. Like Zimbabwe, many nations have faced challenges to cover the annual budget and to construct different infrastructures due to the budget deficit created by tax evasion (Alleyne & Harris, 2017 ; Turner, 2010 ).

Scholars especially economists agreed that tax evasion may be considered a technical problem that exists in the tax collection system, whereas psychologists believed that tax evasion is a social problem for the countries (Terzić, 2017 ).

Tax evasion practices are more worsen in developing countries than when we compare against the developed countries. Tax evasion is like a pandemic for the countries because they are unable to control it. Therefore, governments were negatively affected by tax evasion to improve the life standard of its citizens and to allocate a budget for public expenditure, and it became a disease for the country’s economy and estimated to cost 20% of income tax revenue (Ameyaw et al., 2015 ; degl’Innocenti & Rablen, 2019 ; Palil et al., 2016 ).

Several factors may lead taxpayers to engage in tax evasion. Among the factors, tax knowledge, tax morale, tax system, tax fairness, compliance cost, attitudes toward the behavior, subjective norms, perceived behavioral control, and moral obligation are major factors (Alleyne & Harris, 2017 ; Rantelangi & Majid, 2018 ). Other factors have also a significant effect on taxpayers to engage in tax evasion practice such as capital intensity, leverage, fiscal loss, compensation, profitability, contextual tax awareness, interest rate, inflation, average tax rate, gender, and ethical tax awareness on tax evasion (Annan et al., 2014 ; AlAdham et al., 2016 ; Putra et al., 2018 ).

According to Woldia City Administration Revenue Office annual report ( 2019/2020 ) from July 1, 2019, to June 30, 2020, 232,757,512 birr was planned to be collected from taxpayers; however, the office was able to collect only 198,537,785.25 birr; however, the remaining 34,219,726.75 birr have not been collected by the office from the taxpayers. The reason behind this was there might be some factors that lead to taxpayers not to pay the annual tax from their annual income. Based on the review of the previous studies and by diagnosing the tax collection system in the city administration, the researcher identified the gaps. The first gap that motivated the researcher to undertake this study is that the prior studies did not address the factors that influence the tax collection system of Ethiopia, specifically, there is no research result that was able to show which factors influence taxpayers to engage in tax evasion in the Woldia city administration. The other gap is the previous study focused on the demographic, economic, social, and other factors. However, this study mainly focused on the behavioral and other factors that lead taxpayers to engage in tax evasion.

To indicate the benefit of this study, the study specifies on which critical factors the authority will focus on to enhance annual revenue and to aware tax payers of the devastating impact of tax evasion. Moreover, the paper may bring new insights on tax evasion influential non-economic factors that the researchers may give more emphasis on the upcoming researches. This paper will also contribute innovative ways to know the reasons why tax payers engage in tax evasion and inform the authority at which factors they will struggle to reduce their influence and to enhance revenue. The study can be an evidence that the tax authority should launch innovative techniques to control tax evasion practices. Moreover, applying fair tax system in the collectors’ side, the enterprises become innovative and will expand their business.

To sum up, in this study, the researcher examined which factor (tax knowledge, tax fairness, subjective norms, moral obligation, and attitude towards the behavior) influences taxpayers to engage in tax evasion activities. Based on the above discussion, the objective of the study is to examine factors that influence taxpayers to engage in tax evasion in Woldia city administration.

Literature review

Tax and tax evasion.

Tax is charged by the government to the business, governmental organization, and individual without any return forwarded from the authority. Tax can be categorized as direct tax which is collected from the profit of the companies and the incomes of individuals, and the other category of tax is an indirect tax collected from consumers’ payment (James and Nobes, 1999 ).

Tax evasion is a word explaining individuals, groups, and companies rejecting the expected amount of payment for the authority. It is a criminal offense on the view of law (Nangih & Dick, 2018 ). The overall procedure of tax collection faced different challenges especially tax evasion the most important one. Tax evasion is done intentionally by taxpayers by avoiding and hiding different documents that become evidence for the tax collection authorities. It is simply an illegal act to pay the true amount of the tax (Aumeerun et al., 2016 ; Storm, 2013 ). Tax evasion is a crime that is able to distort the overall economic, political, and social system of the country. The economic aspect of tax evasion affects fair distribution of wealth for the citizens. The social aspect also creates different social groups motivated by tax evasion discouraged by these individuals due to unfair competition (AlAdham et al., 2016 ). Tax evasion is a mal-activity that reduces the amount of tax paid by the payers. Perhaps the taxpayers who engaged in evasion activity may be supported by the legislative of the country (Kim, 2008 ; Putra et al., 2018 ; Allingham & Sandmo, 1972 ). According to Al Baaj et al. ( 2018 ) argument, there are two types of tax evasions. The first one is the legal evasion or tax avoidance which is supported by the legislation of the countries and the right is given for the taxpayer, but it is not constitutional (Gallemore & Labro, 2015 ; Zucman, 2014 ).

Theoretical reviews on factors affecting tax evasion

The illegal activity done by taxpayers has many determinants that lead them to engage in tax evasion. Among the factors that trigger taxpayers who participate in this activity are the economic factors. Under the economic factors, business sanctions, business stagnation, and the amount of tax burden are considered as influential factors. On the other hand, legal factors, social factors, demographic factors, mental factors, and moral factors are the most important factors (Saxunova and Szarkova, 2018 ). Many factors determine the taxpayers’ interest to engage in tax evasion. Among the factors, the following are considered under this review.