BrandMentions Blog

BrandMentions Blog | BrandMentions Blog on Digital Marketing Tactics & Strategies

JOIN 72,558 SUBSCRIBERS

Grow your customer-focused business with our bi-weekly newsletter featuring tips from entrepreneurs and experts in customer service and support.

How to Do a Competitive Analysis | Case Study Included

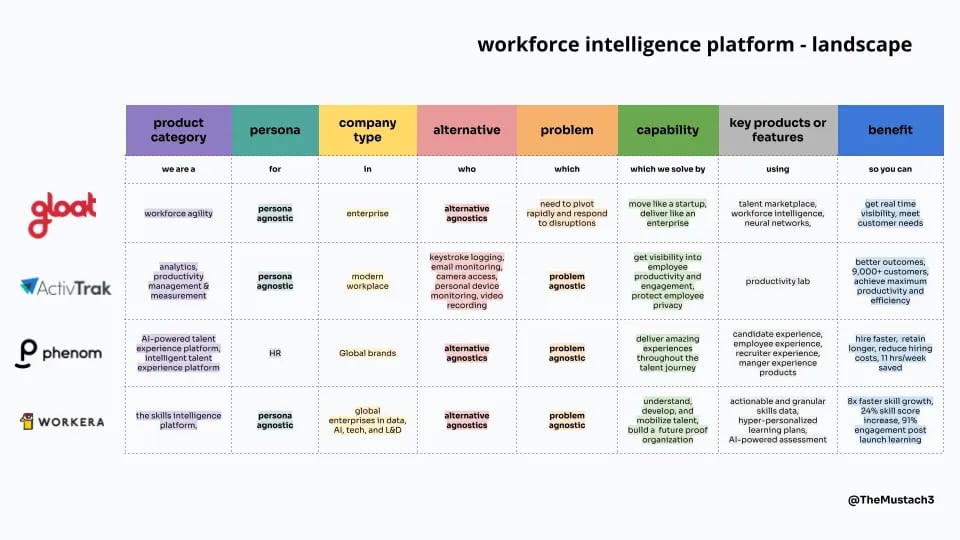

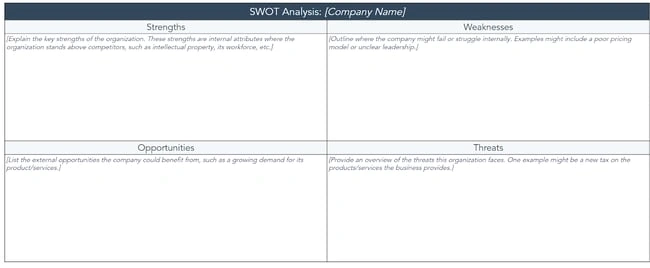

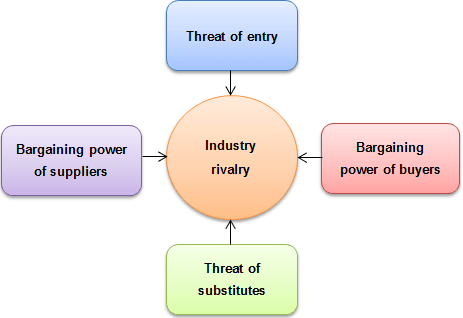

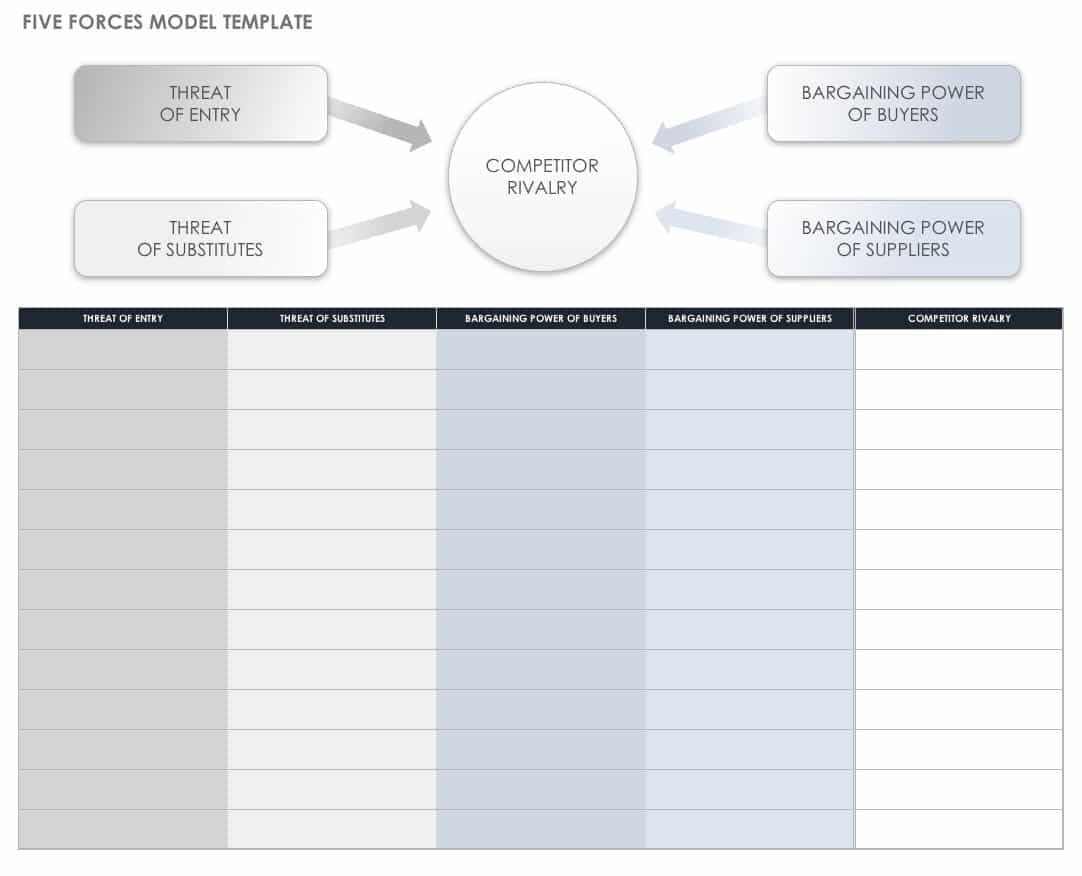

In order to be a leader in your industry, you need to know how to perform a competitive analysis. A competitor analysis is more than a simple SWOT analysis where you find the strength and weaknesses of your market segment. Evaluating your competitors is highly important and must be done through complete market research using an analysis template like the one that we're going to present in this article.

Finding out where your competition excels doesn't have to be a burden if you have the right strategy and necessary tools.

What Is a Competitor Analysis?

Why perform a competitor analysis, how to conduct your competitive analysis, step 1. find your top competitors, step 2. analyze your competitors popularity, step 3. identify the public perception of competitors, step 4. analyze your competitors' social media strategy, step 5. perform an seo competitor analysis.

Competitor analysis in digital marketing is the process of finding strengths and weaknesses of your competitors, relative to those of your own product or service.

There is no exact competitive analysis definition. Yet, you need to know that the strengths within a competitive analysis are the things that make you unique, your key selling point, the ideas around your whole business - which can be about the product or the team. On the opposite side, the weaknesses point out some deficiencies, and things you could improve, when it comes to your brand, or take advantage from, when it comes to the weaknesses of your competitors.

The competitive analysis has the role to make a valid and accurate market positioning and a report on what you are doing best, and where your competitors excel, and learn from that to win more potential customers. A competitive analysis also means picking the right competitors and looking at analytics that include business metrics, digital marketing analysis, social media metrics.

By doing an accurate competitor analysis you'll be able to receive a lot of data and insights for making better business decisions. Similar to an internal research, by evaluating quantitative and qualitative data, if you research your competitors, you will uncover effective strategies and new ideas for increasing your business' performance, be it on social media, on online, or in the physical store.

A well-performed competitor analysis will allow you to:

- Build your unique selling proposition (the statement that describes the benefit of your offer and how you solve your clients' needs).

- Bring business improvements regarding products and services, team management, customer care, delivery and many more.

- Discover new market segments.

- Prioritize goals and future development.

- Create products that are actually required and respond to customer's needs.

For a better understanding of how your competitor analysis framework should look like, we've performed a competitive market research on the cosmetic niche. We've analyzed several metrics on this market segment to conduct a competitive analysis as in-depth as possible, with most of the data being pulled out from brand mention monitoring.

Brand monitoring, when done with the right tools, is more versatile than you'd think. Running an in-depth brand mentions competitive analysis could help you make sure that you are not overlooking any efficient strategies that might be working wonders for your competitors.

They are talking about your company

Get instant access to brand mentions across social, news, blogs, videos and more. Get Free Report

Even though you might be aware of some of your market leaders, there might be a few you're missing.

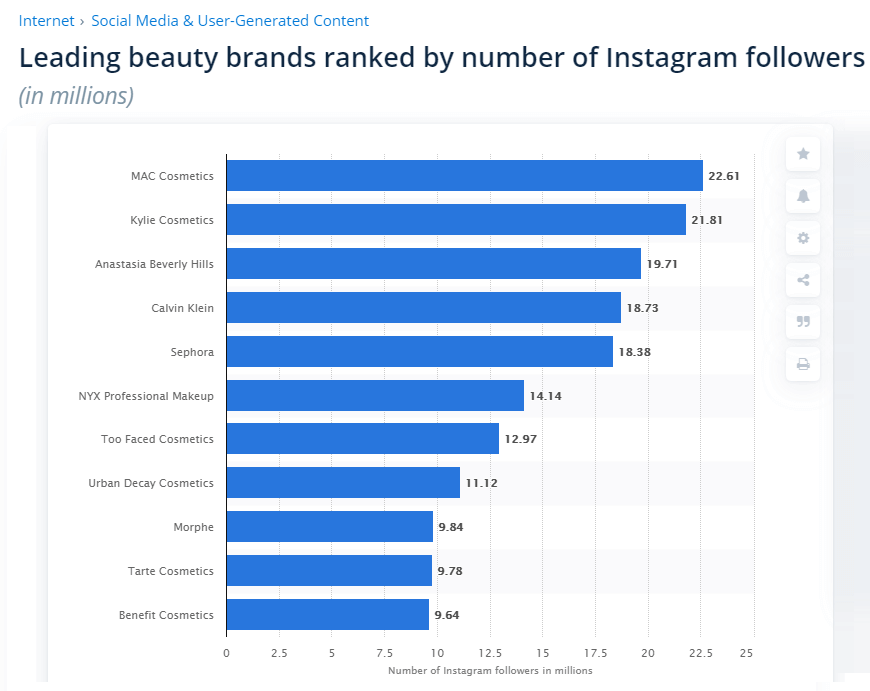

For our case study example, we searched for top leading beauty brands. As social media is a highly important segment within this industry, one of the analyses we've performed was to find the top-performing brands on social media, by the number of followers.

You can also search on Google for the relevant keywords in your business and see the top brands that are ranking for those keywords. And use a spying tool to find out important analytics on every website you want, such as the Mozbar browser extension.

Also, check out Social Media to figure out the businesses that pop out in results in your market. The research we performed helped us understand the niche a little better. Therefore, based on this research performed, we've chosen to continue our competitive analysis on the following brands:

- MAC cosmetics

- Kylie cosmetics

- Anastasia Beverly Hills

- Urban Decay

It’s too complicated and actually impossible to manually track all your competitors’ records and activity, as much manual web scraping you'd be doing.

So, even if you know your competition , the question remains: how do you find who is the most popular brand in your niche?

Most popular = most mentioned

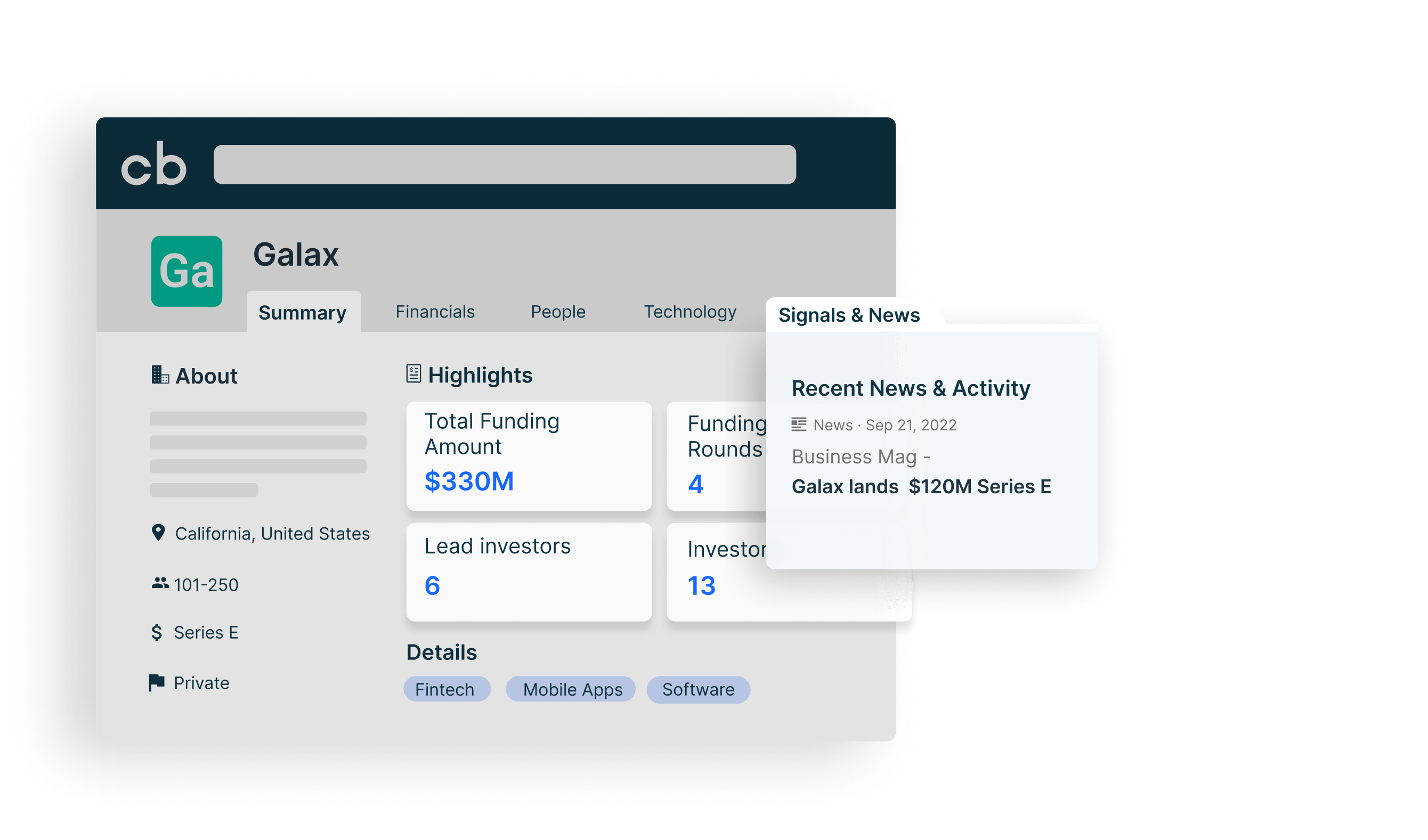

Tools like BrandMentions can make things easier.

Therefore, to answer to our main question, "how to perform a competitive analysis", you need to start performing an in-depth research of your competition. Brand Mentions allows you to track keywords, brands, product names or whatever you need.

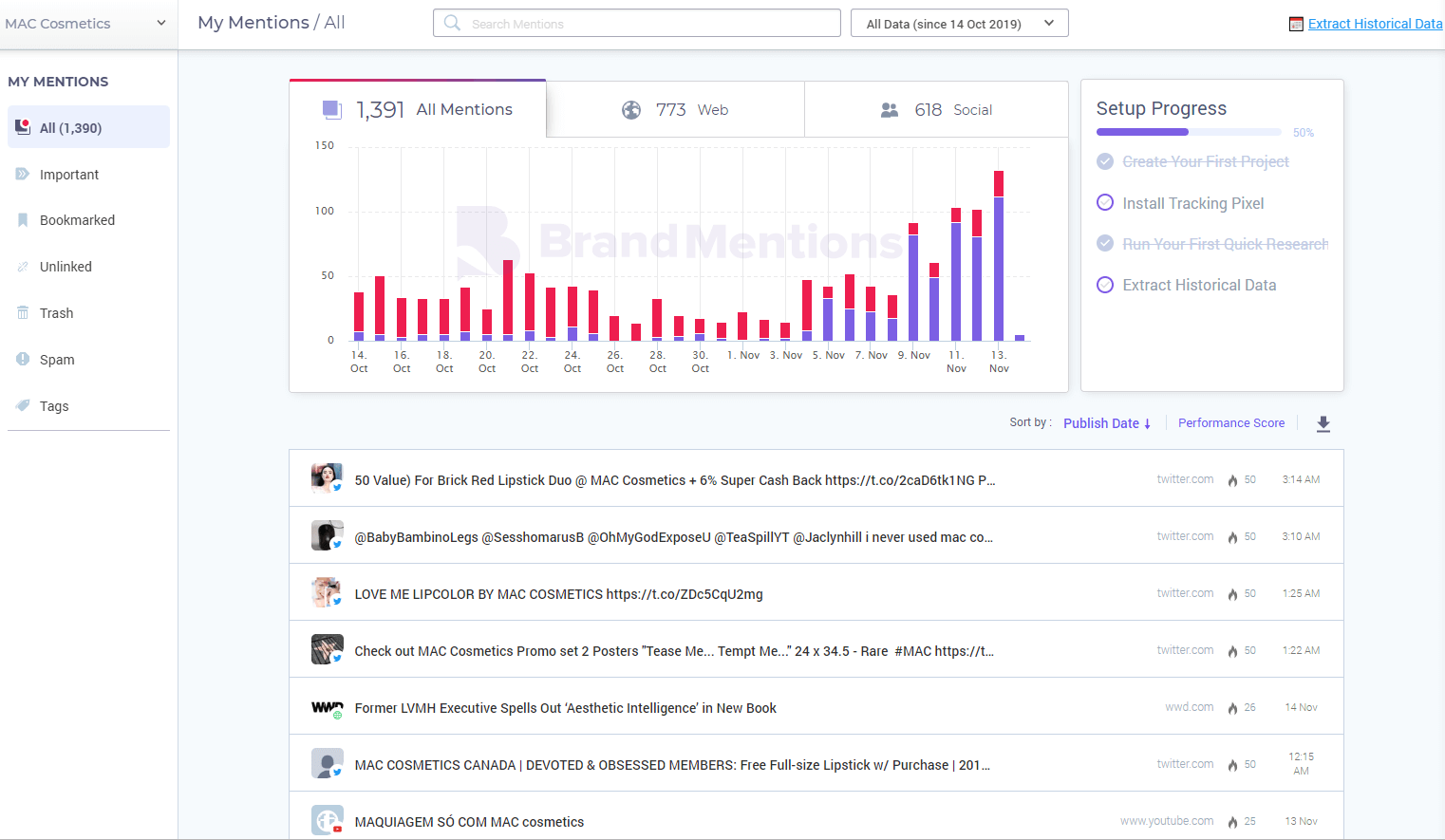

Going back to the beauty niche we are analyzing, let's figure out the most popular brands here. We took BrandMentions for a spin, to find out the most popular beauty brand into a very competitive niche by analyzing and monitoring social media metrics. We analyzed the mentions for these beauty brands for a short period of time, October 14 - November 15 , Worldwide for all languages.

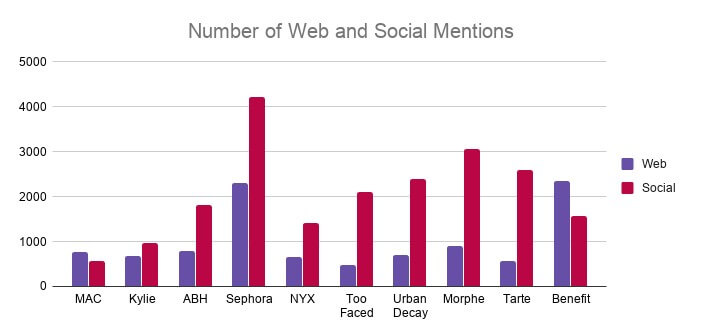

After analyzing the results, we saw that Sephora has some interesting discoveries. Compared to the rest of the beauty sites, Sephora has the highest number of mentions on web and social. In the printscreen below, we can see all mentions for each brand categorized by source (web and social).

By far, Sephora outranks the rest of beauty brands on the total amount of mentions on web and social.

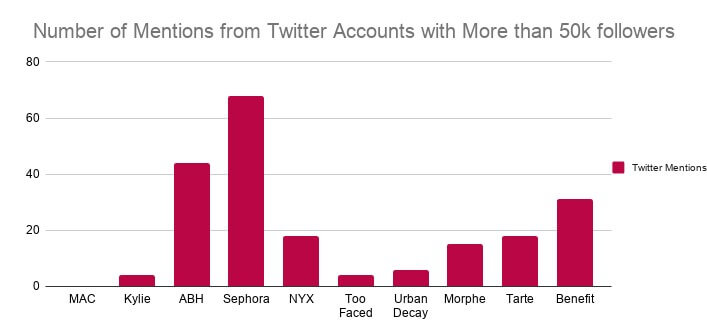

The number of mentions could be explained by the fact that Sephora has more influencers that talk about it on Twitter. Results showed that the brand is mentioned by influencers with over 50k followers on Twitter compared to other beauty brands.

BrandMentions has a filter that allows you to filter mentions to see the Twitter posts from people that have a specific number of followers. The Twitter account for each brand was excluded.

Just by taking a look at your competitors and monitoring their brands, you can get a bunch of data:

- compare how often your competitors versus you post on social media

- what outlets mention them more than you

- how many mentions they have had in the last 24 hours

- how many shares their mentions have

- what languages are their mentions written in

- do they have mostly web or social mentions

And yes, all mentions matter, but some matter more than others.

When looking into your competitor’s yard, look at their best practices and try to figure out what worked best for them.

You must have heard at least once people saying that all publicity is good publicity, as long as they spell your name right. Or that the only thing worse than being talked about is not being talked about. But is it really so? How much does the public perception influence a brand's popularity? Let's find out!

The Sentiment Analysis feature allowed us to have a better understanding on the public perception of the analyzed brands. If we first identified the competitors and looked for the most popular ones, now we can have a look at how they are perceived in the online world.

How did we do that exactly?

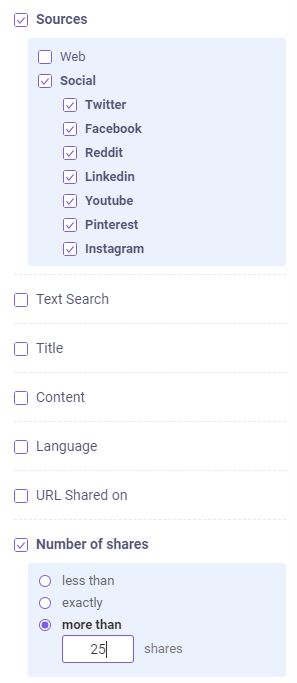

We monitored all brands with BrandMentions as we said before, and from all mentions we started to filter them out. Filters are a blessing in this situation, giving you full control over the segment of mentions that you want to analyze.

Trying to manually find all the negative brand mentions that interest you is like trying to find a needle in a haystack.

After analyzing the sentiment analysis for each individual beauty brand ,we came to realize that most of them share a higher positive experience with the users.

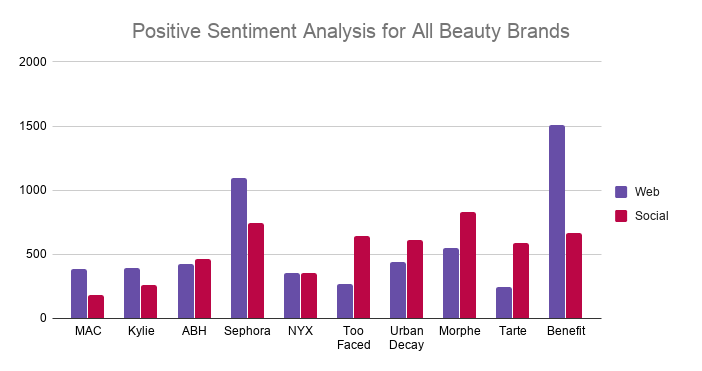

By looking at the data, for all brands or just some of them, we can draw lots of conclusions. For instance, comparing to other brands, Benefit has the highest number of web and social mentions that have a positive sentiment analysis. If we look at the next graph, we can easily see that Benefits stands out:

Another thing we can observe is the fact that Benefit has the highest number of web mentions with a positive sentiment, as well. But the brand that is leading the positive social mentions is Sephora.

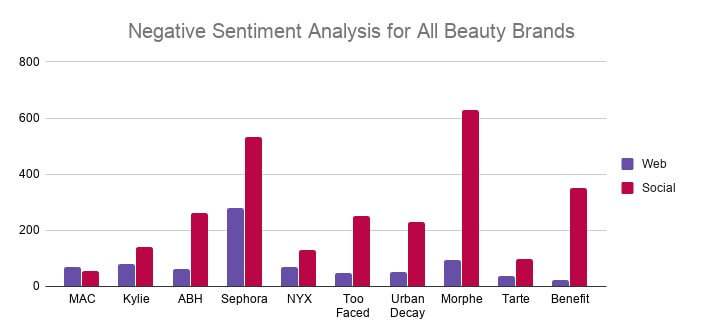

Even though Sephora has the highest number of positive social mentions, overall, compared to the rest of the beauty brands, it has the highest number of negative sentiment. Which might be a downsize for the brand.

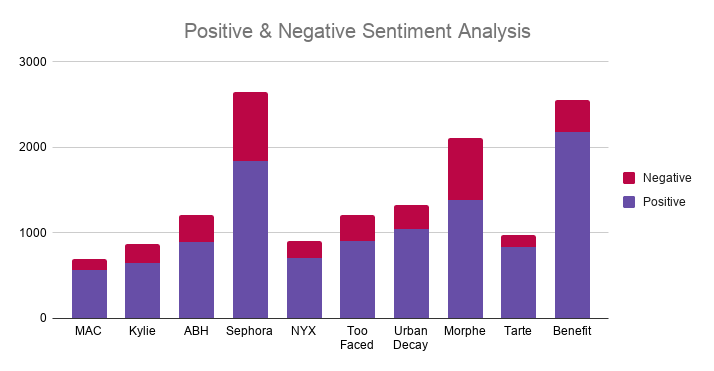

Below you can see a comparison with the other cosmetics brand on positive and negative sentiment analysis.

We can see that most of the mentions are from social media and more specifically, from Twitter. The connection with the previous results might be stronger. Often time it has happened that people are more driven to write online about a negative experience, rather than a positive one.

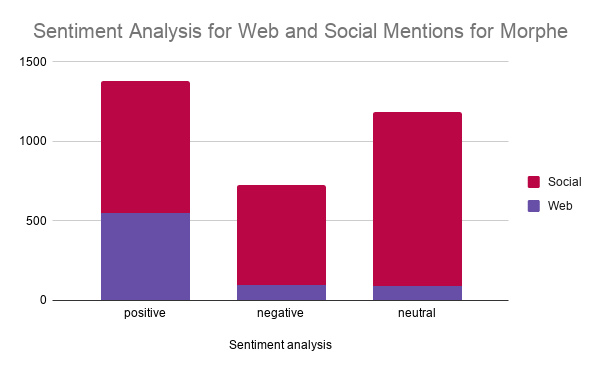

We saw that the negative sentiment had the lowest value compared with the positive and neutral sentiment, with a single exception. Morphe had a higher neutral sentiment than the negative one. Check out the graphic below:

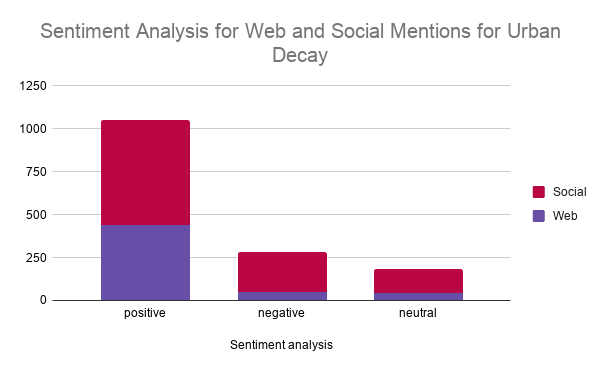

Urban Decay has the most naturally ordered distribution of the sentiment analysis for the mentions analyzed on web and social.

We are not saying that bad publicity couldn't be good publicity for some businesses or individuals. But for most businesses and niches, bad publicity and negative brand mentions are never a reason for joy but an occasion for a crisis communication meeting.

Another interesting thing to observe in the graph above is that Morphe has the highest negative sentiment analysis on social media.

People love it the most, but they also hate is the most, compared to the rest of the brands. If we look particularly at the brand to evaluate the total number of positive vs. negative sentiments, we can see that in the end, a positive experience overcomes the negative one, in terms of absolute numbers.

We've previously talked about Morphe saying that it has a higher number of neutral sentiments, the only brand with this particularity. We can understand that people have mixed feelings when it comes to this brand: You either love it or hate it.

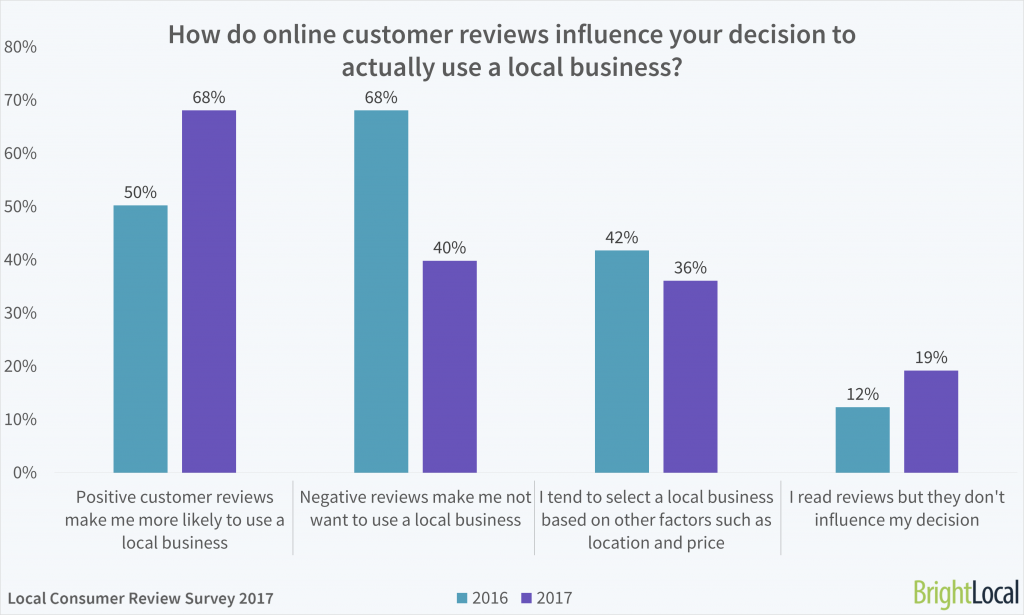

Both positive and negative mentions have a big impact on the purchase decision of a client.

Although it might sound bad to spy on your competition , this marketing technique is a fully transparent, popular, and white-hat one. How else would we all improve ourselves and our brands if we were to not compare our endeavors with the others? And this is where a brand monitoring tool comes to rescue us.

When doing competitor spying, we are actually building PR relationships.

Both directly and indirectly.

Directly by getting to know your common audience better (the one your competition shares with you) through your competitors’ eyes, win ties with important outlets in the industry, etc.

In addition, while keeping “your enemies” closer, you indirectly relate to and establish a relationship with them. By constantly trying to keep up the pace with or outrun the brightest ones in the niche, and struggling not to ever fall in the pitfalls of black-hat marketing techniques other companies deploy in their strategies, you simply get better and better. In other words, you widen your professional circle.

Competitor spying is the more polite version of eavesdropping. There's no harm in doing it as long as you're using the tools to improve yourself and not disrupt the other.

You can easily gain insights on your competitors' performance and dig into their success strategies and use the lessons to your own benefit.

Tracking mentions for your competitor can lead you into discovering social media campaigns, new content ideas, top-performing social channel alongside types of content shared on each platform, plus trending hashtags used and top influencers for each competitor.

For instance, in our case, in the beauty niche, the results might surprise you. If you thought Instagram would be the most used Social Media platform for beauty products, you might be wrong.

According to the analysis performed in BrandMentions, it turned out that Twitter has the highest number of mentions for every beauty brand compared to the other social media marketing platforms.

If you thought that Instagram was the king of the beauty industry, you are wrong.

Of course, Instagram is a powerful Social Media channel, but maybe there's more in that direction. There are some insights related to this social platform, nonetheless. We know that Facebook became stricter about sharing data with third parties, so we can't see private posts. Instagram has shifted the strategy in this direction as well. Instagram started to hide likes in select countries earlier this year, and it will soon do the same in the United States.

This method affects the way we see data, on top of the fact that there are lots of users with private user accounts where even if you have an account you can't see their posts, likes, and stories.

After analyzing all the social mentions for all the beauty brands on all social platforms, here's what we discovered:

- Twitter is the Social Media Platform with the highest number of mentions.

- Twitter is the Social Media Platform with the highest number of mentions with positive sentiment analysis.

It seems that Twitter is a great way to start an influencer marketing strategy; it is also the most popular social media site. Finding all the information will help all marketers, brand managers, and community managers to build the best social media strategies for beauty brands.

When we looked at the distribution of web and social mentions for the beauty brands, we discovered 2 categories:

- more web mentions: MAC and Benefit

- more social mentions: Kylie cosmetics, Anastasia Beverly Hills, Sephora, NYX, Too Faced, Urban Decay, Morphe and Tarte.

It's obvious that social is the king here. We won't bother you with tons of charts and data on all the analysed brands, yet, you need to know that within Brand Mentions you can perform any type of analysis you want when it comes to social mention analysis.

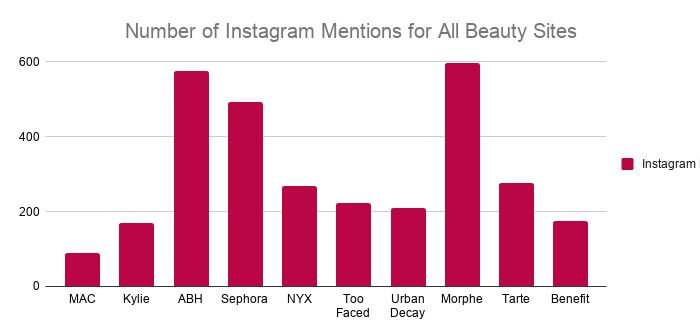

If we analyze one of the competitors, Morphe, we can see that it is more popular on Instagram by the number of mentions. It is seconded by a small number by Anastasia Beverly Hills.

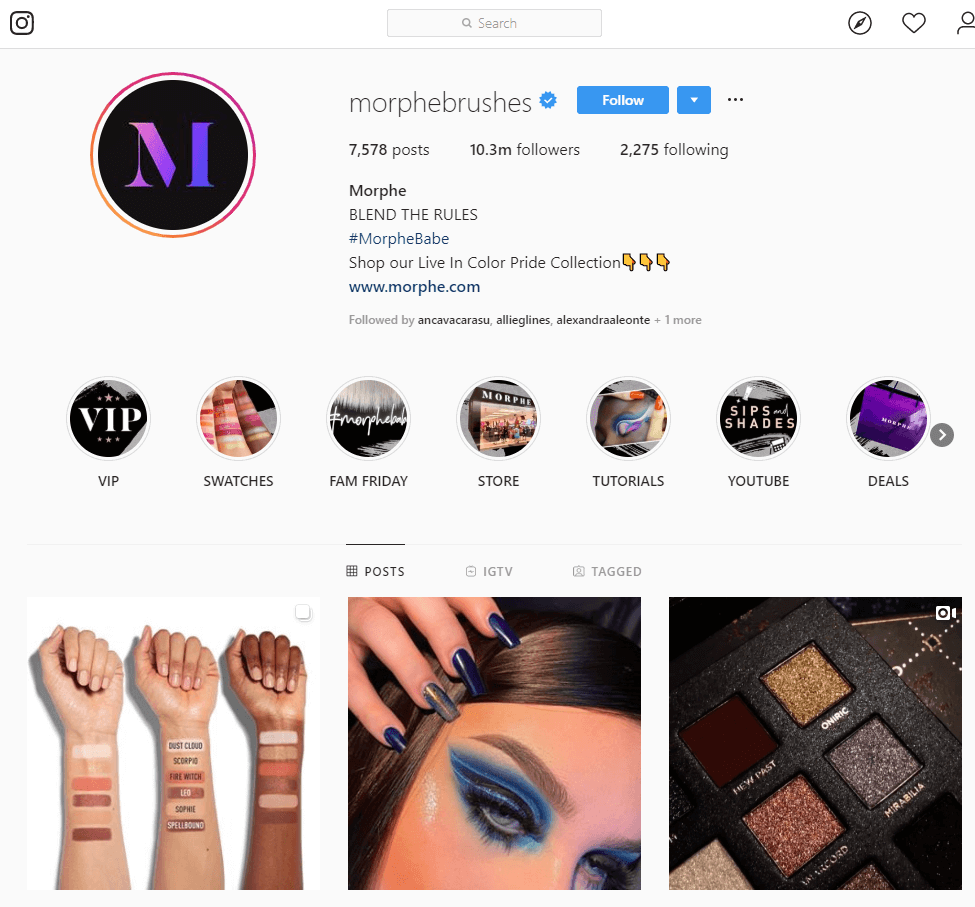

Morphe has lots of mentions on Instagram, but it is on the 8th place when it comes to Instagram followers with 10.3m.

When it comes to answering the question on how to do a competitive analysis we know that what matter most are the insights you get to find out. And here are some great insights we've extracted for the most popular social media beauty sites scrutinized within our competitive analysis:

1. For the MAC Brand:

- MAC has the highest number of influencers on Instagram.

- MAC doesn't have influencers of people with more than 50k followers that mention the brand on Twitter.

- MAC is the least popular on the web and social media judging by the number of mentions.

2. For the Sephora Brand:

- Sephora is one of the most popular beauty brands on social media and the whole web compared to the rest of the brands by the number of mentions.

- Sephora is mentioned by influencers and people with more than 50k followers on Twitter.

3. For the Morhphe Brand:

- Morphe shares a positive experience on social media compared to the rest of the beauty brand. It has the highest number of social mentions with a positive sentiment.

- But it also shares the highest value of negative emotions on social.

- Morphe is the top beauty brand on Instagram by the number of mentions compared to the rest of the brands.

4. For the Benefit Brand:

- Benefit is on the 10th place by the number of followers on Instagram with 9.8m (see printscreen below), the last place compared to the rest of the brands.

- Benefit offers a higher positive experience by analyzing sentiment analysis for the whole web and social mentions.

After analyzing all the mentions for all the beauty brands, there are lots of insights to help you create social media marketing strategies and find out the top competitors in your niche.

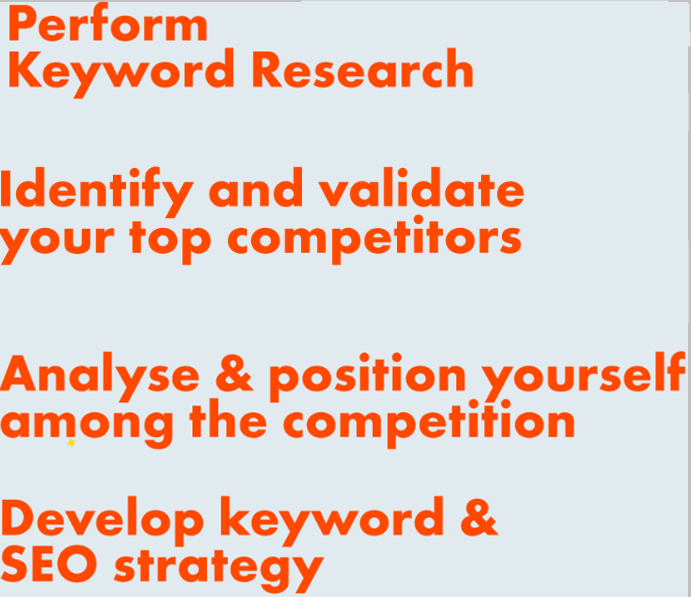

Knowing how to analyze your SEO competition is an important step in determining your overall keyword and SEO strategy. There are many factors involved in the process, and without the correct framework, it can get complicated. Here you can find the steps for the SEO competitor analysis explained, as clear and simple as possible. Within the screenshot below you can see the main steps that you need to take to make sure you perform an SEO competitive analysis at the highest level.

What Tools We Used to Do The Competitive Analysis

We used BrandMentions to analyze the beauty content and all the mentions for each beauty brand : MAC cosmetics, Kylie cosmetics, Anastasia Beverly Hills, Sephora, NYX, Too Faced, Urban Decay, Morphe, Tarte, Benefit.

Each created project had the name of the brand, and we added the keywords, domain URL, Facebook and Twitter account for higher accuracy in finding relevant mentions. We let the tool do its magic and analyze the beauty content on social media and the web.

For the metrics and discoveries made, we used filters and features available in BrandMentions, such as Sentiment Analysis analyzer, web and social sources, mentions from Twitter accounts with a specific number of followers and more. Check out the data for designing your winning social media strategy.

Also, the trigger was when we found a research on Statista with most followed cosmetics brands on Instagram; so we thought of performing a deeper analysis on the topic, and finding the most popular beauty site on Social Media, not only on Instagram. We wanted to see if there more we needed to know. And yes, there was so much more.

For an effective competitive research, there are multiple things that need to be taken into consideration, beside web and social listening. Things like brand awareness , customer experience, target audience, the search engines you are interested in, target market, the service or product features, the competitors sales, etc. This is not a complete guide to obtain competitive advantages that applies for all. But a competitor analysis template that helps you best identify your competitors and your main competitor strengths and weaknesses.

The best time to start finding out information about your competitors is now. So even if you are a content marketer, a small online store owner or a big ecommerce business , an online marketing specialist or you're in the sales teams, you need to start digging into competitive intelligence.

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Marketing How to Create a Competitor Analysis Report (with Examples)

How to Create a Competitor Analysis Report (with Examples)

Written by: Midori Nediger Nov 09, 2023

Your business will always have competition.

And if you don’t know what that competition is up to, you could be missing out on huge opportunities.

That’s why a competitive analysis is so crucial to your success as a business. It gives you the tools to quickly adapt to any changes in the competitive landscape and potentially capitalize on industry trends that your competitors haven’t even noticed.

So let’s get some basics out of the way…

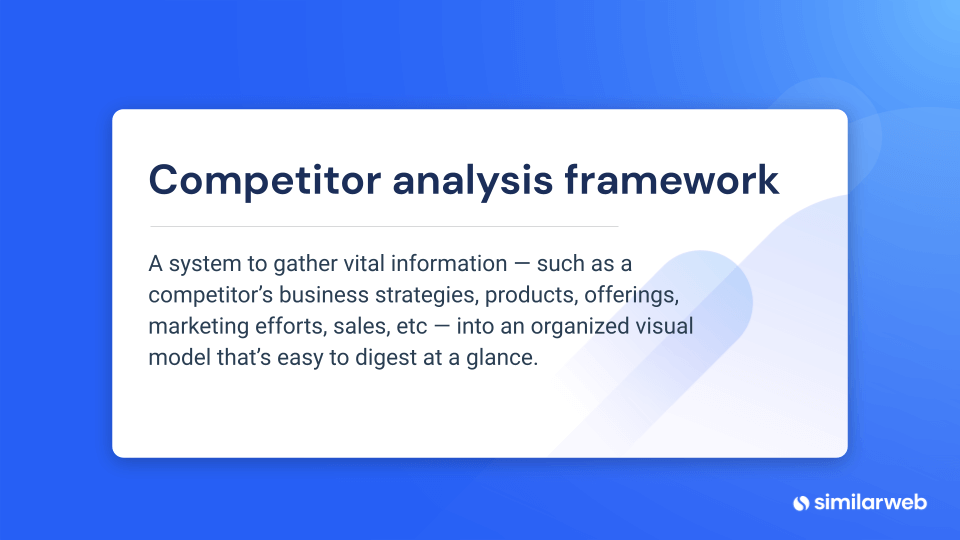

What is a competitive analysis report?

A competitive analysis report outlines the strengths and weaknesses of your competitors compared to those of your own business.

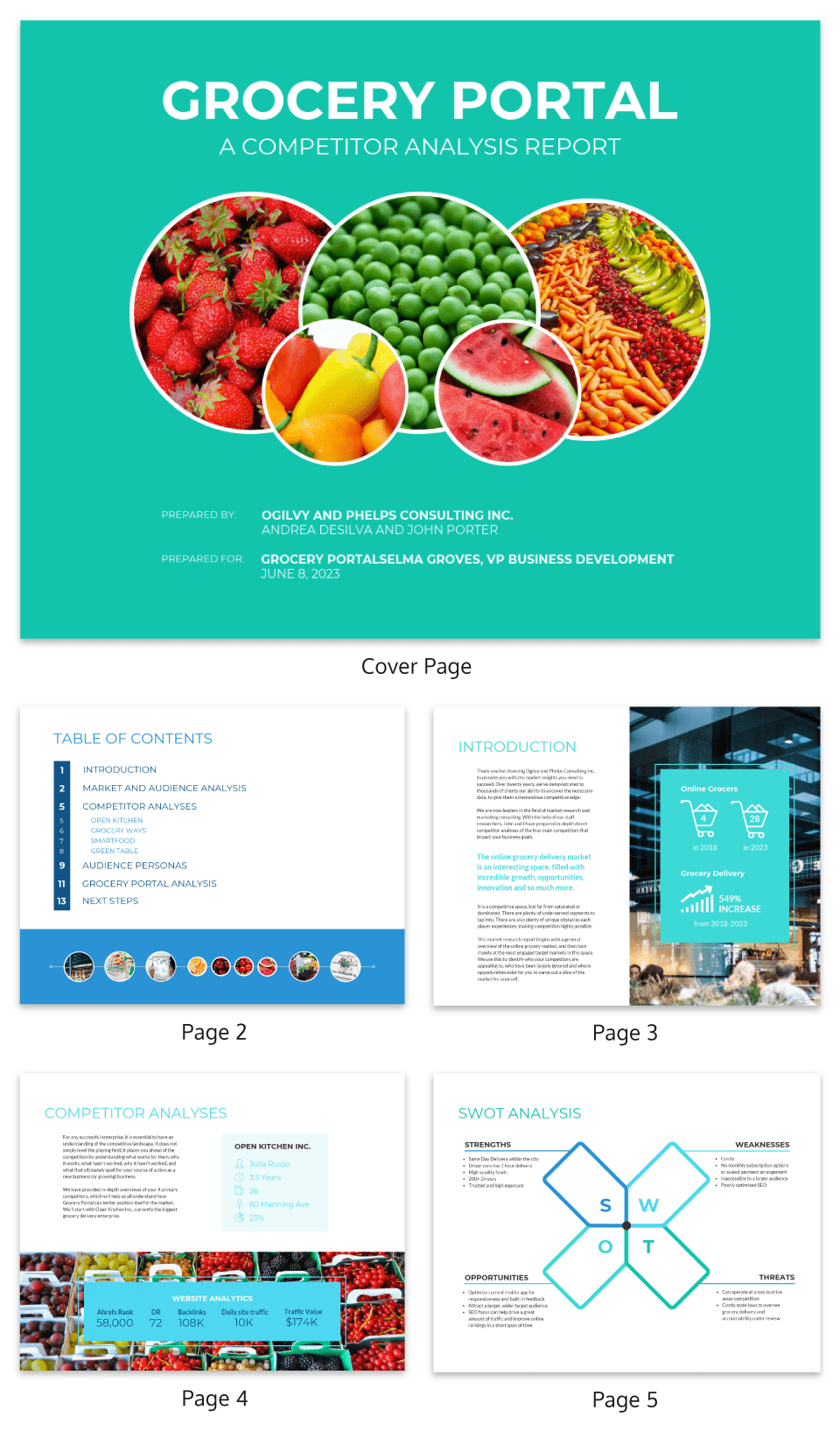

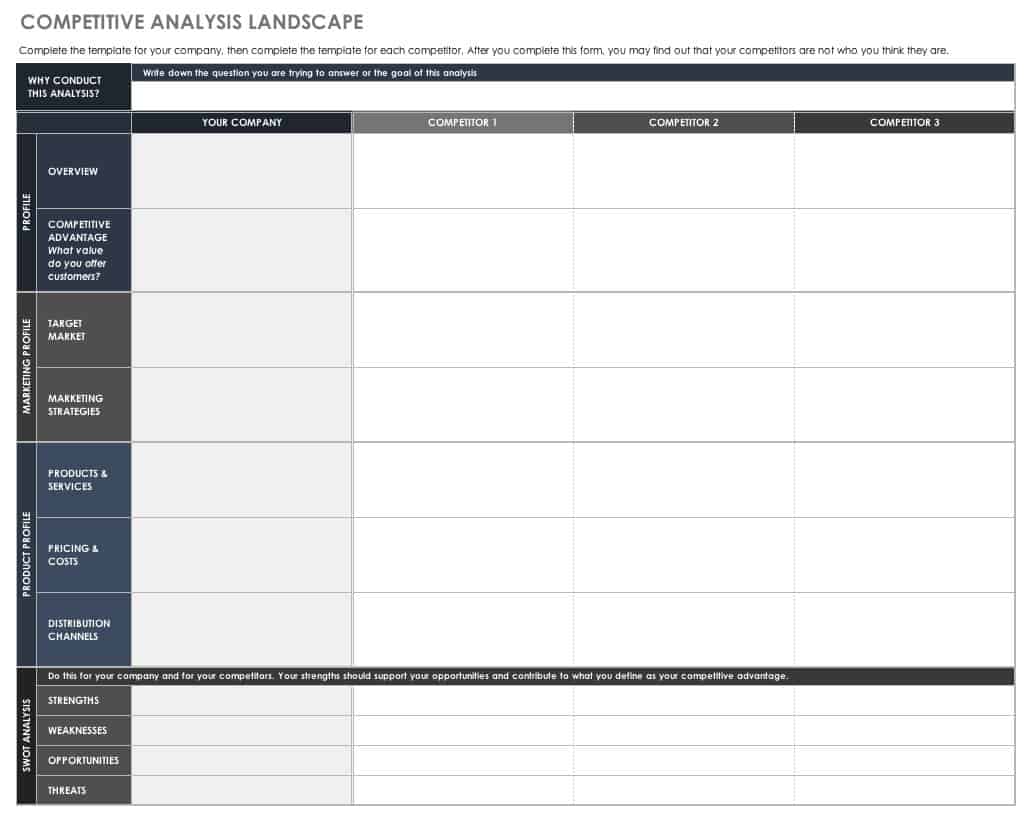

Typically, a competitive analysis report will contain:

- A description of your business’s target market

- Details about the features of your product compared to your competitors’ products

- A breakdown of current and projected market share, sales, and revenues

- Comparisons of pricing models

- An analysis of marketing strategy and social media strategy

- A description of customer ratings of the features of each competitor

Whether you’re a startup trying to break into the marketplace , a consultant trying to get results for your client, or an established company looking to cement your foothold against the competition, a well-researched competitive analysis gives you the tools you need to make strategic decisions.

Your competitive analysis should inform your marketing plan , your business plan , your consultant report and every part of your high-level business strategy.

But how do you actually create a competitive analysis report?

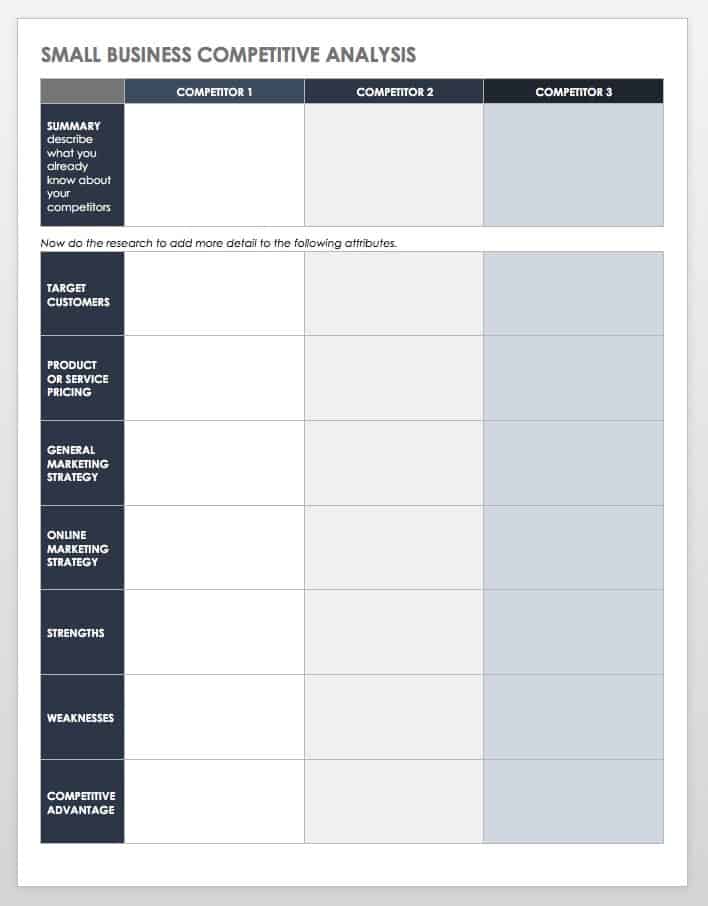

How to make competitor analysis report :

- Start with a competitor overview

- Conduct market research to uncover customer personas and industry trends

- Compare product features in a feature comparison matrix

- Summarize your strengths and weaknesses with a SWOT analysis

- Show where you fit in the competitive landscape

- Use a competitor analysis template for a professional look and feel

The level of detail you include in each section of your competitive analysis report will vary depending on the stage of your business growth and your goals. For example, a startup might create a report that focuses on market research, while an established business might dive into detail on an emerging competitor.

But let’s talk about the parts of a competitive analysis that every report should include.

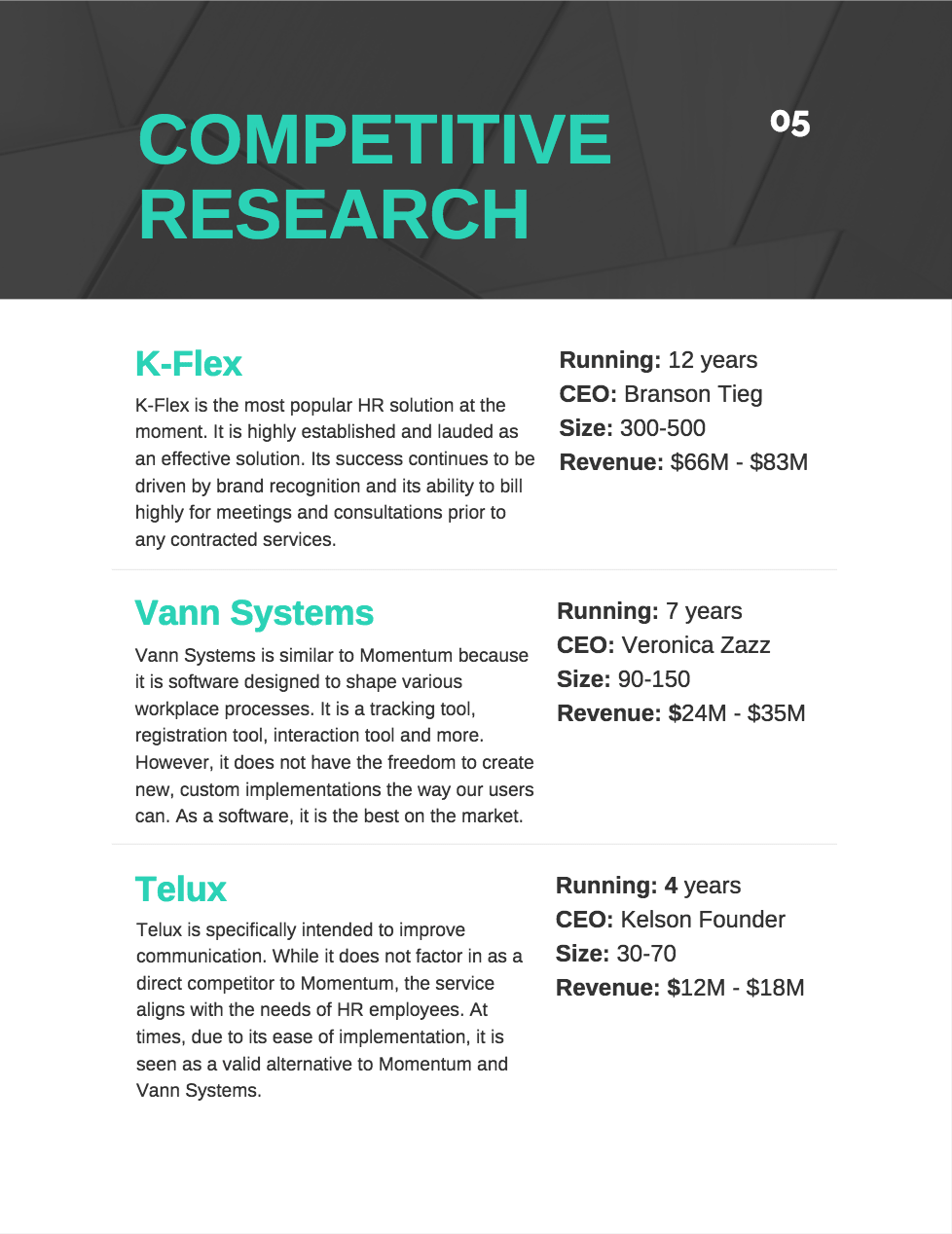

1. Start with a competitor overview

A strong report shows exactly what a company must out-compete to be successful.

Meaning you must audit any product or service that currently solves the problem your business is trying to solve for customers and write a quick profile for each competitor.

Like the template below, each competitor profile might include:

- The company’s revenue and market share

- The company’s size and information about their management team

- A broad description of the company’s strengths and weaknesses

- An overview of how the company is perceived by customers

This overview will help your readers get a big-picture view of the market landscape.

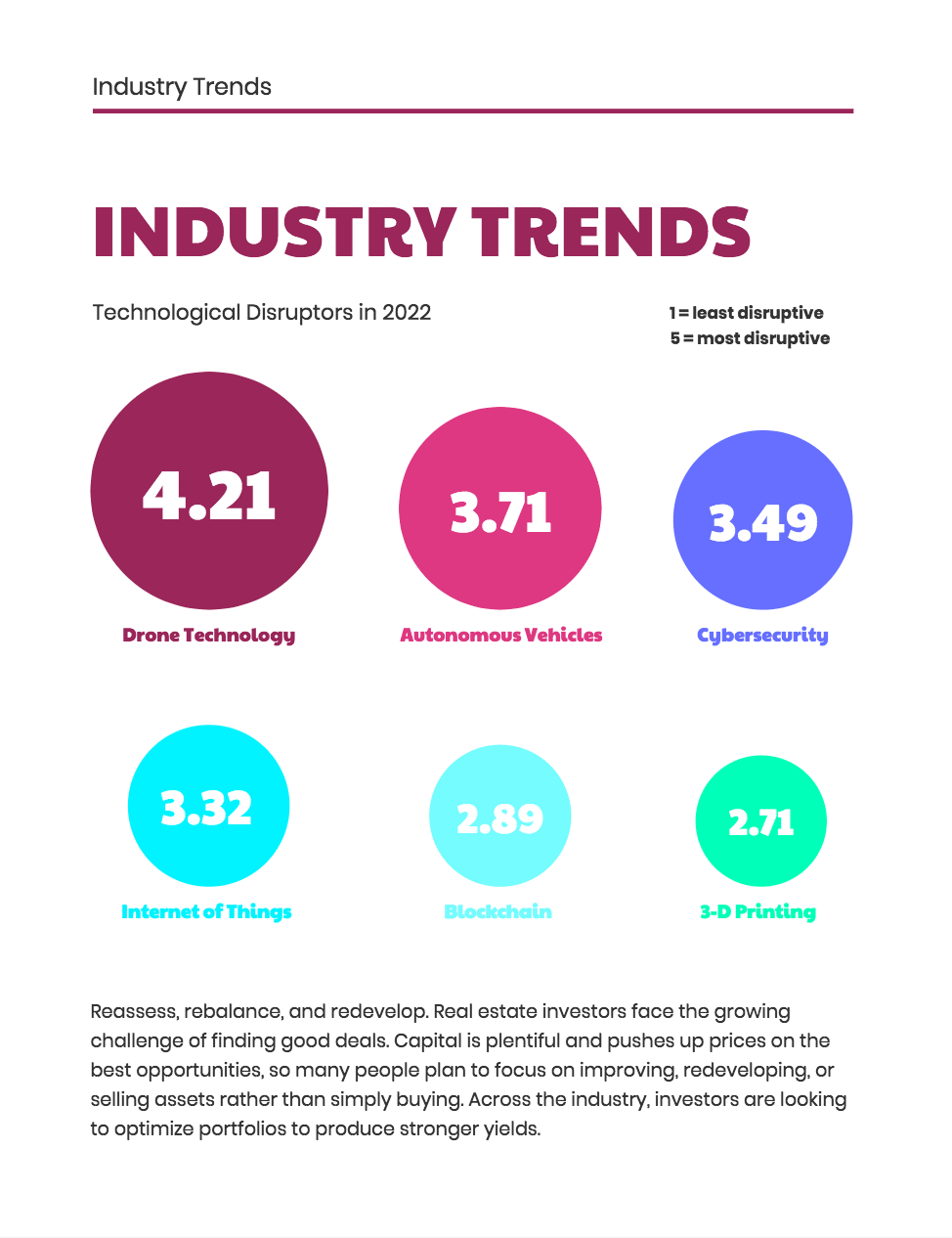

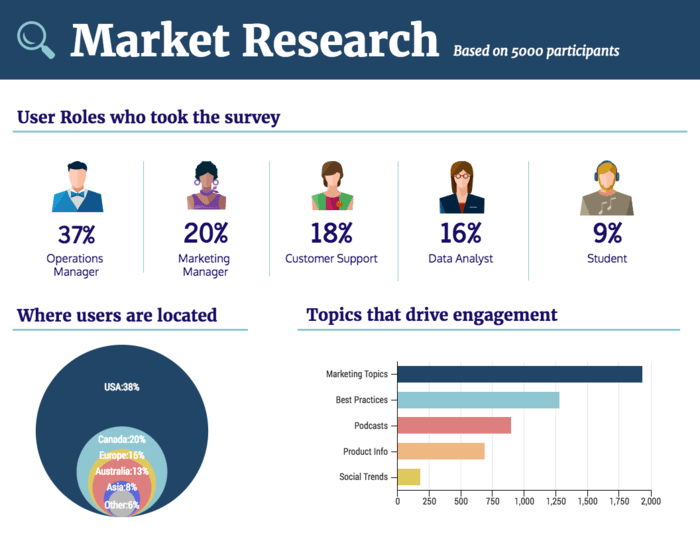

2. Conduct market research to uncover customer personas and industry trends

You can’t create a competitive analysis report without doing extensive market research , which is all about gathering information to understand your customers, identify opportunities to grow, and recognize trends in the industry.

This research can help you put together the customer personas that will guide business and marketing decisions down the line, and allow you to plan for any shifts that might disrupt the marketplace.

You can conduct primary market research, with:

- Customer interviews

- Online surveys or questionnaires

- In-person focus groups

- Purchasing a competitor product to study packaging and delivery experience

Or secondary market research, by:

- Reading company records

- Examining the current economic conditions

- Researching relevant technological developments

When assembling your market research you may just want provide a high-level summary of the industry trends, like this competitor analysis example shows:

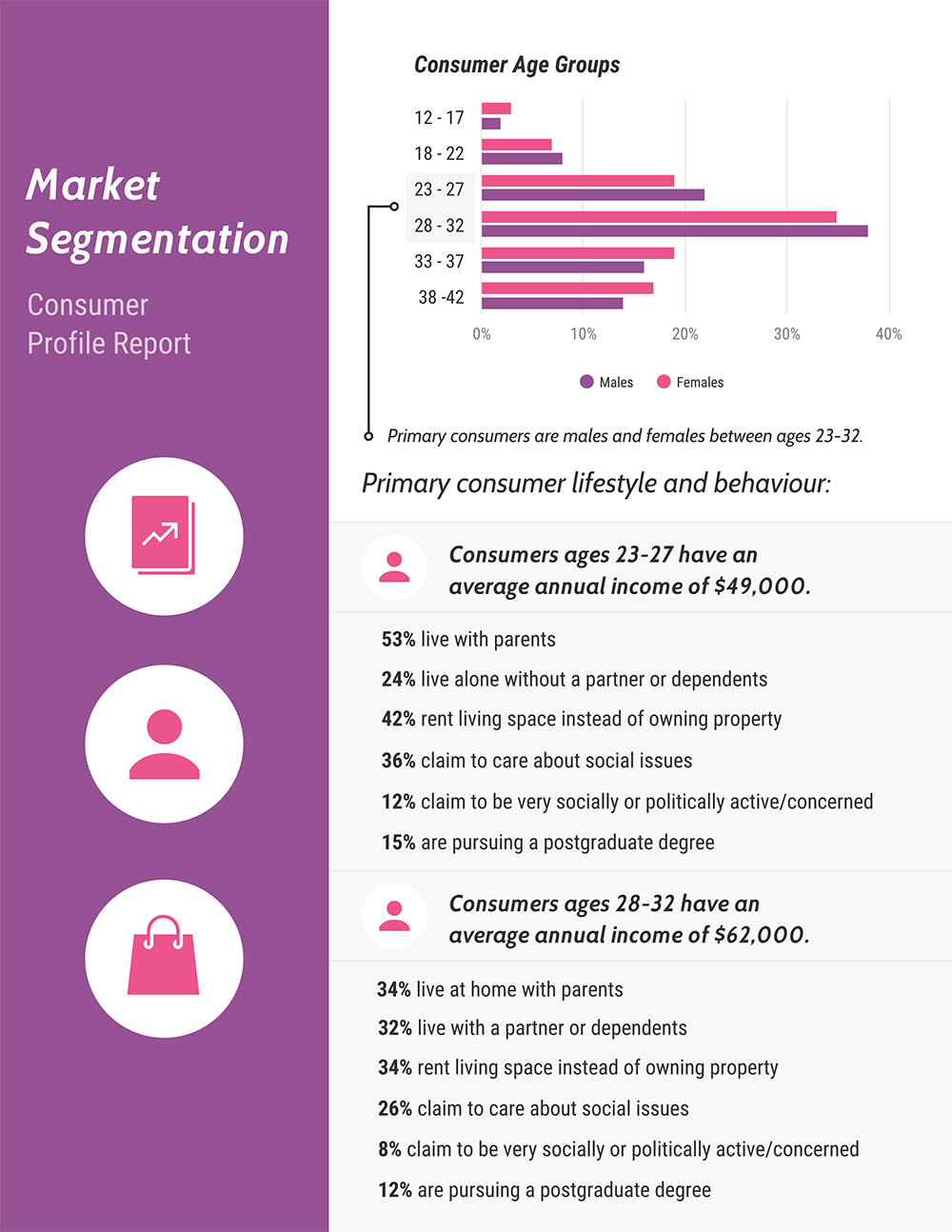

Or you may want to dive into detail on the demographics of a particular consumer segment, like this:

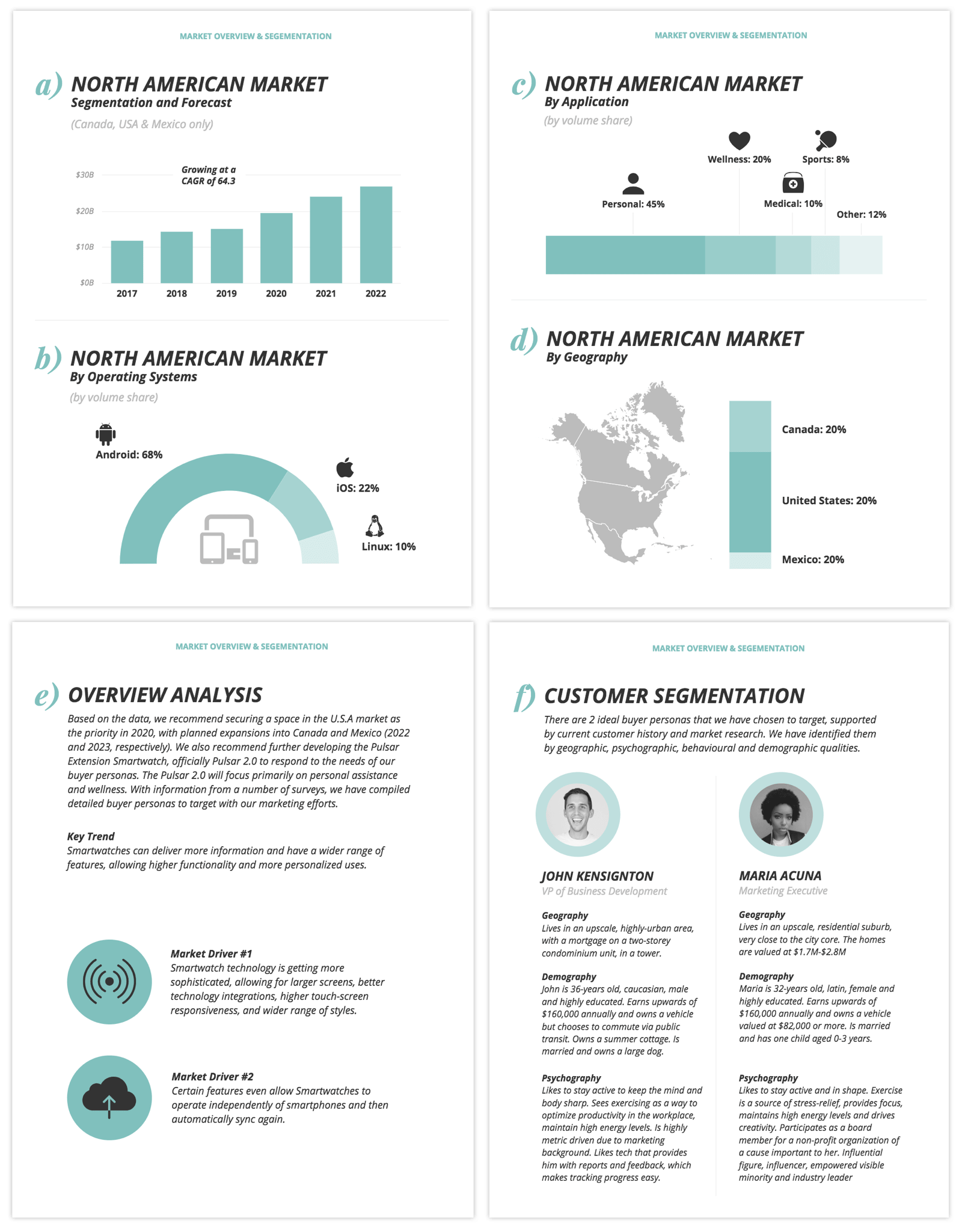

But if you’re a consultant or advisor struggling to get buy-in from skeptical stakeholders, the report below would be ideal. Covering everything from market forecasts to consumer profiles, it can help you get clients and decision-makers on board.

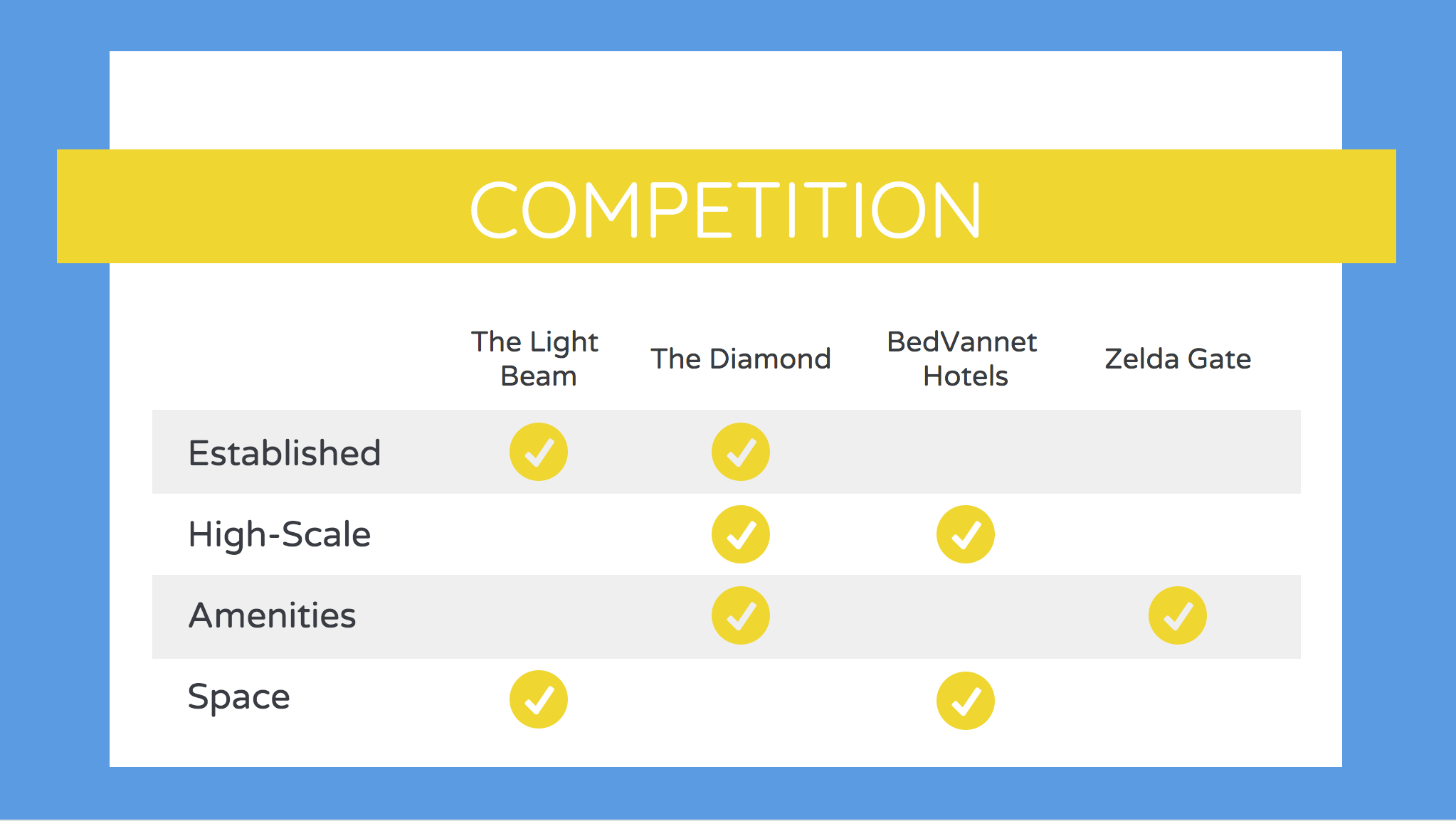

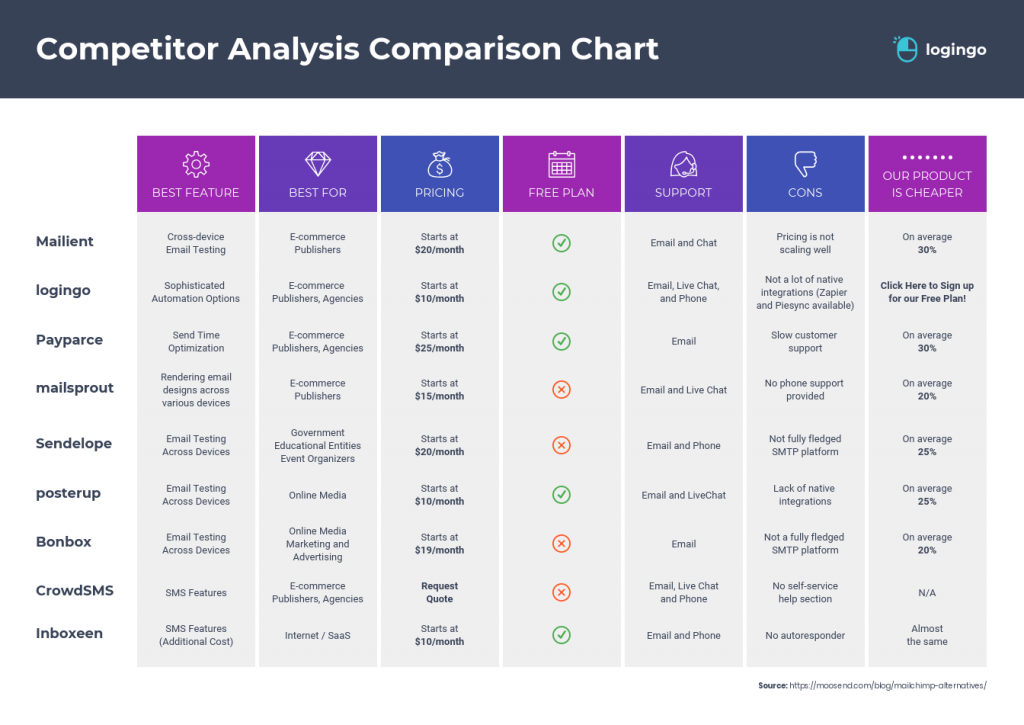

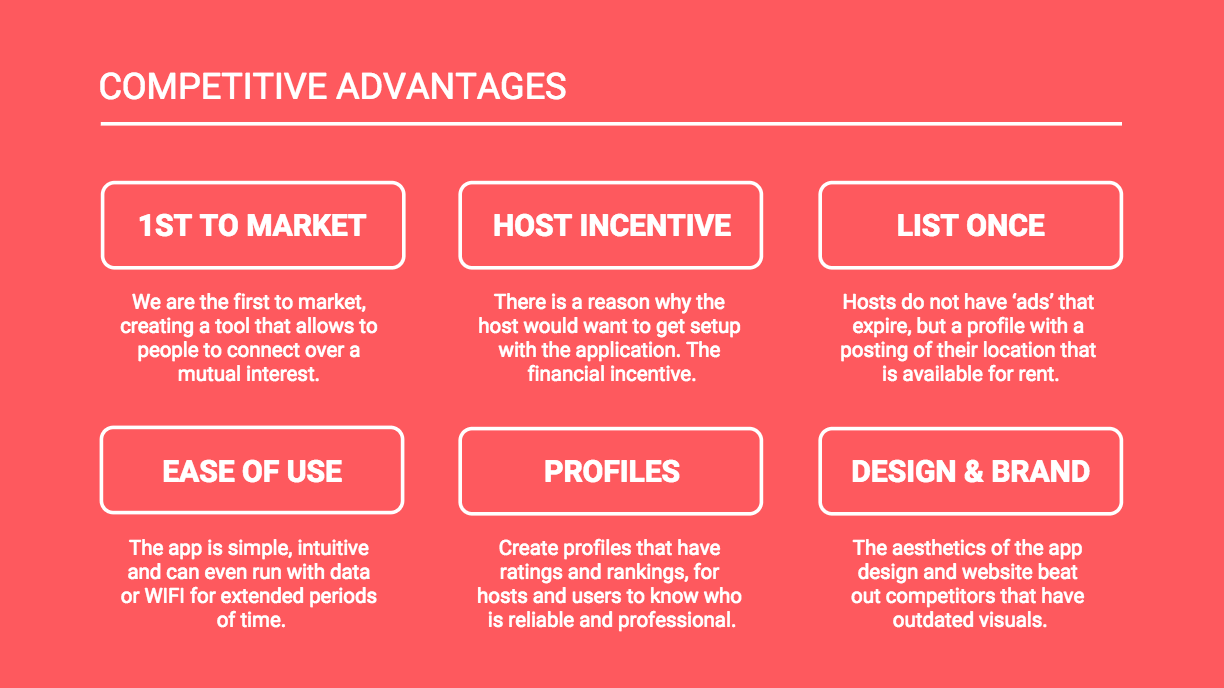

3. Compare product features in a feature comparison matrix

The feature comparison is arguably the most important part of the competitive analysis. Breaking down your product and your competitors’ products feature-by-feature will allow you to see what really sets everyone apart.

In addition to specific product features, here are some attributes that you might include in a feature comparison matrix:

- Product quality

- Number of features

- Ease of use

- Customer support

- Brand/style/image

The most common format for a features analysis is a simple matrix with you and your competitors along one side and all of the relevant features along the other. You can check off or rate how you perform in each area:

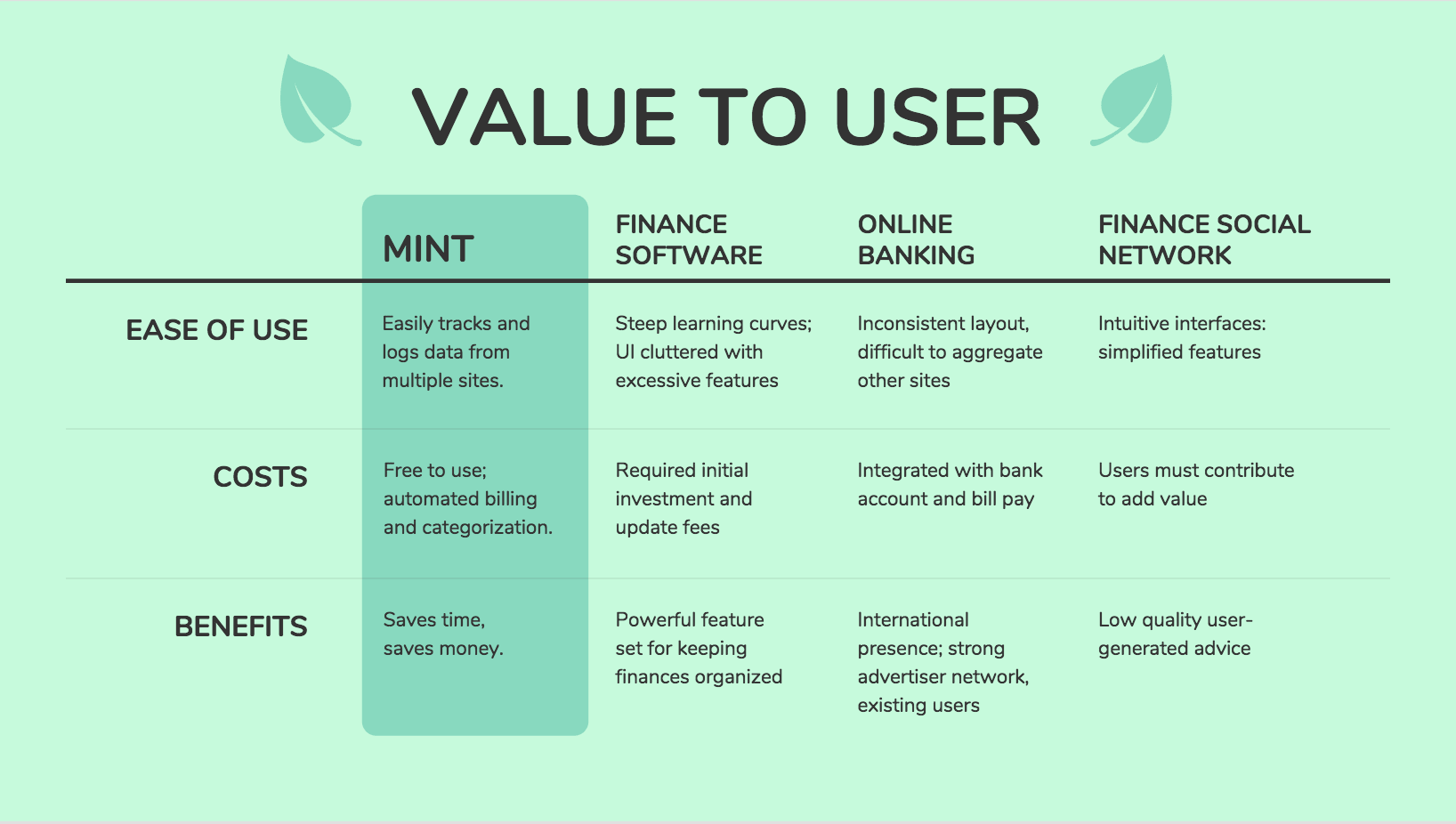

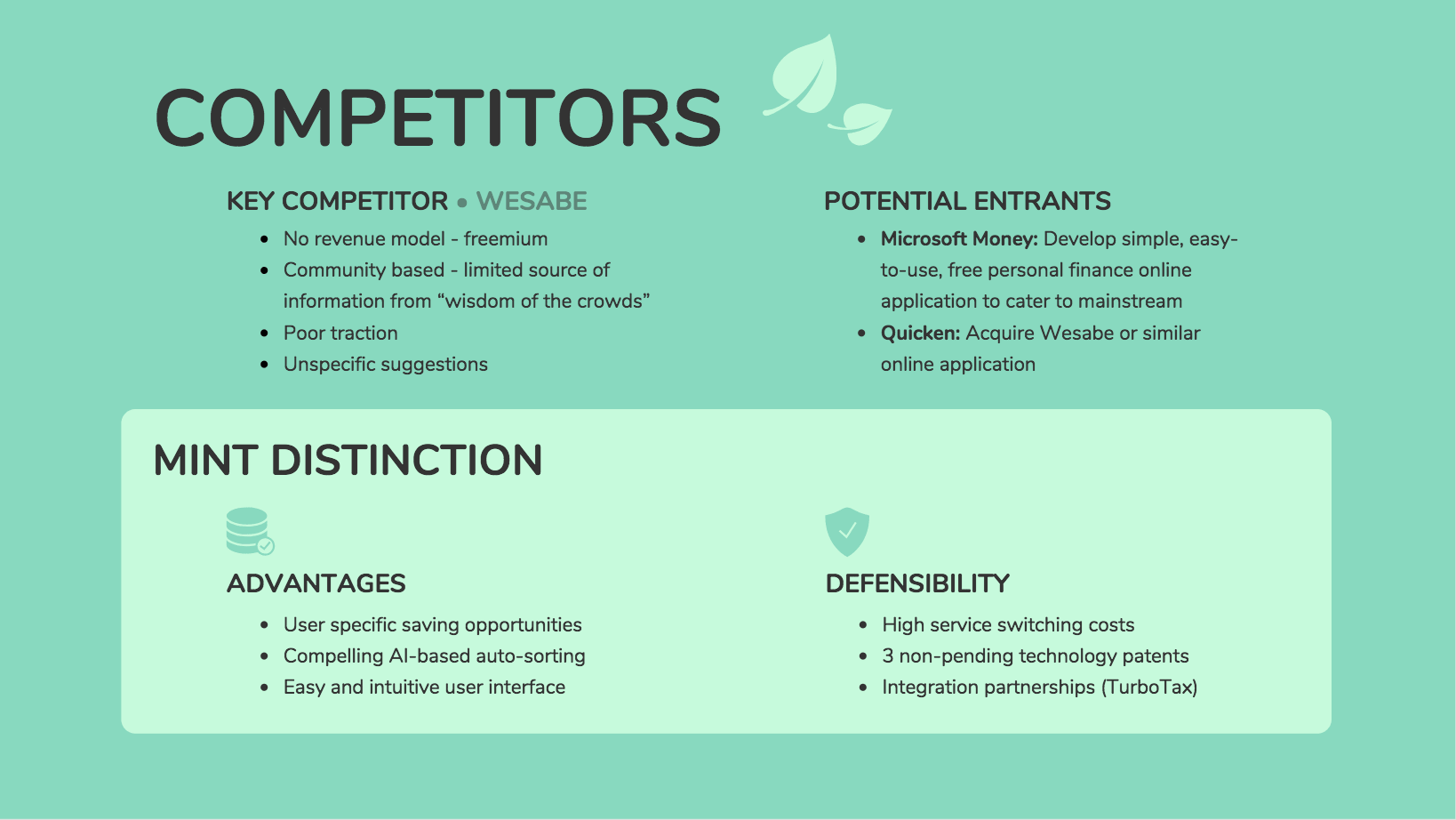

But these tables can get pretty long. Another approach is to focus on the things that provide the most value to the user, like in this competitor analysis example from Mint. It only includes ease of use, costs, and benefits:

If you want to visualize your comparisons in an engaging way, you could use a comparison infographic .

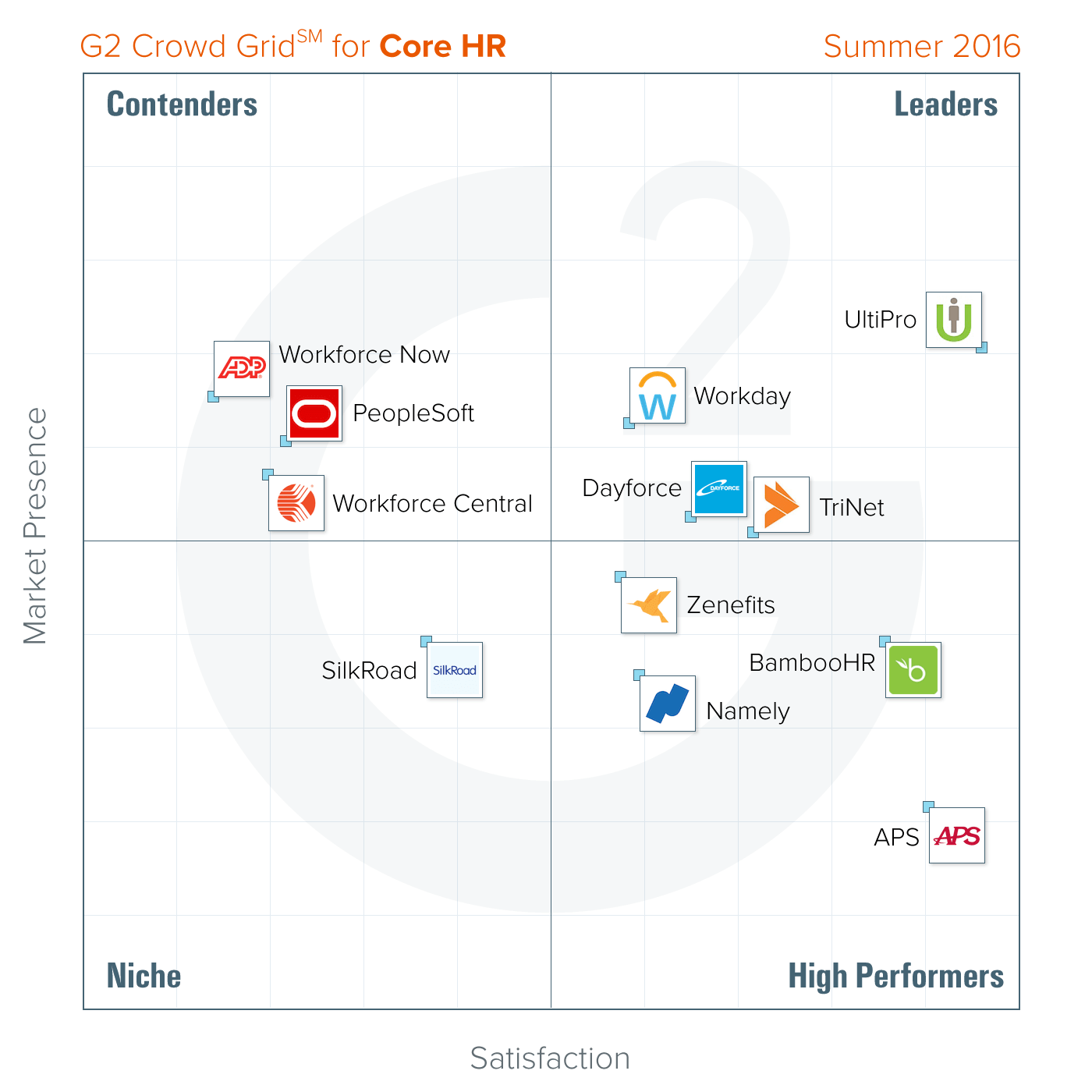

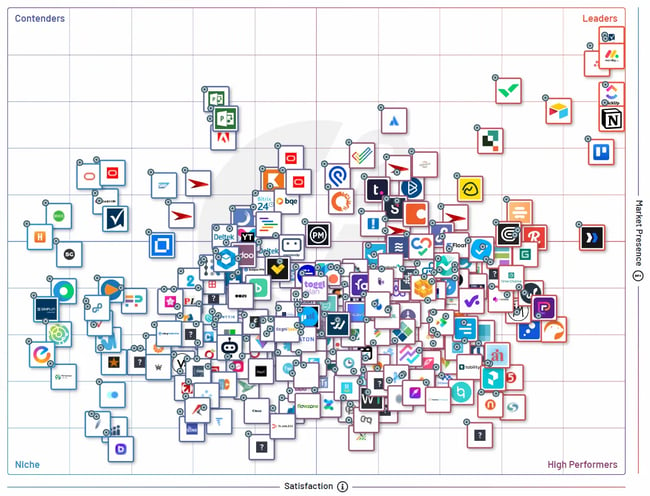

Great resources for this section of your competitive analysis report are product rating sites like Capterra and G2Crowd . They’ll give you an unbiased view of your company and your competitors.

And as with any market research, it’s critical that you speak with real people who use your product and your competitors’ products. That’s the only way to get an accurate picture of how your target customers rate the competition .

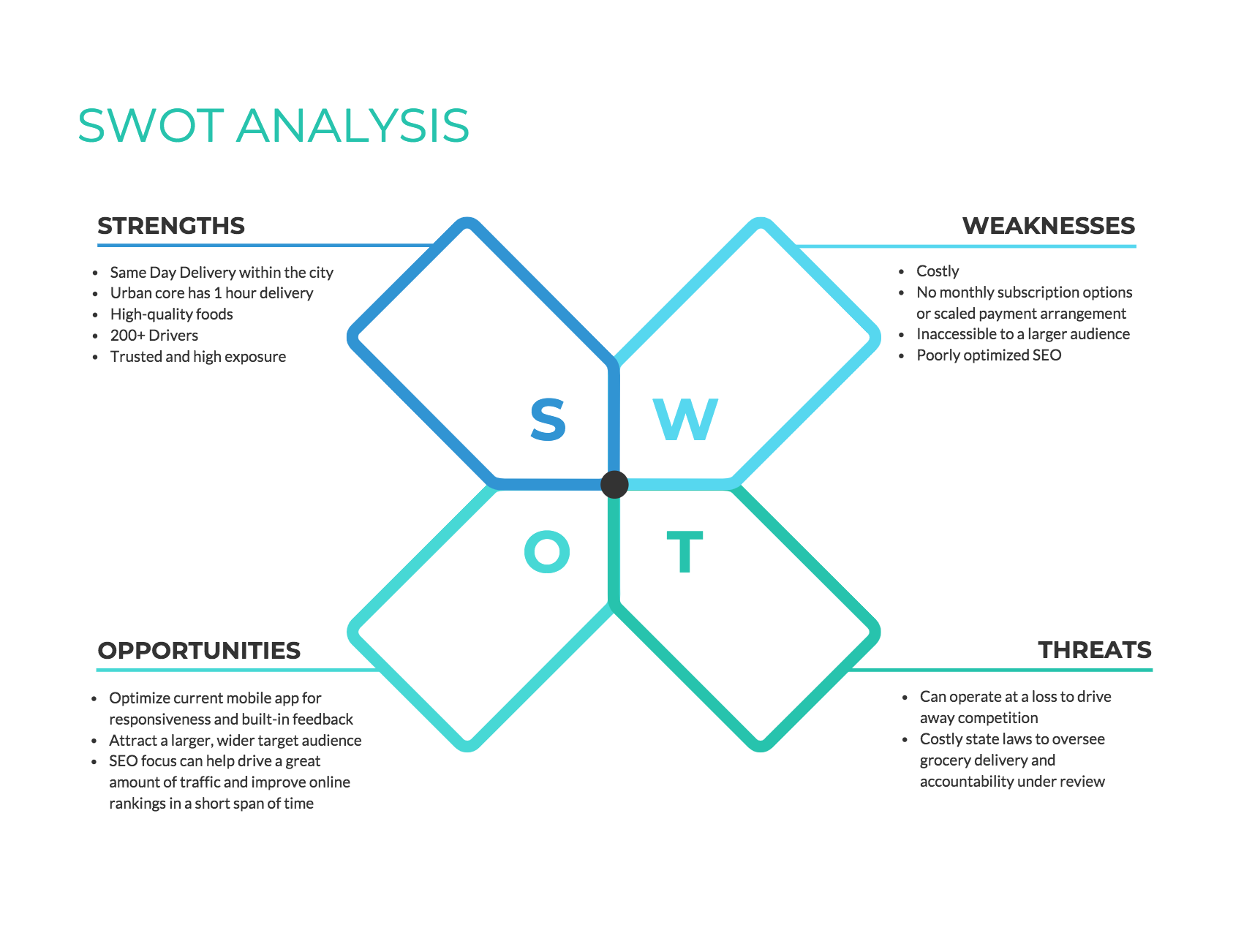

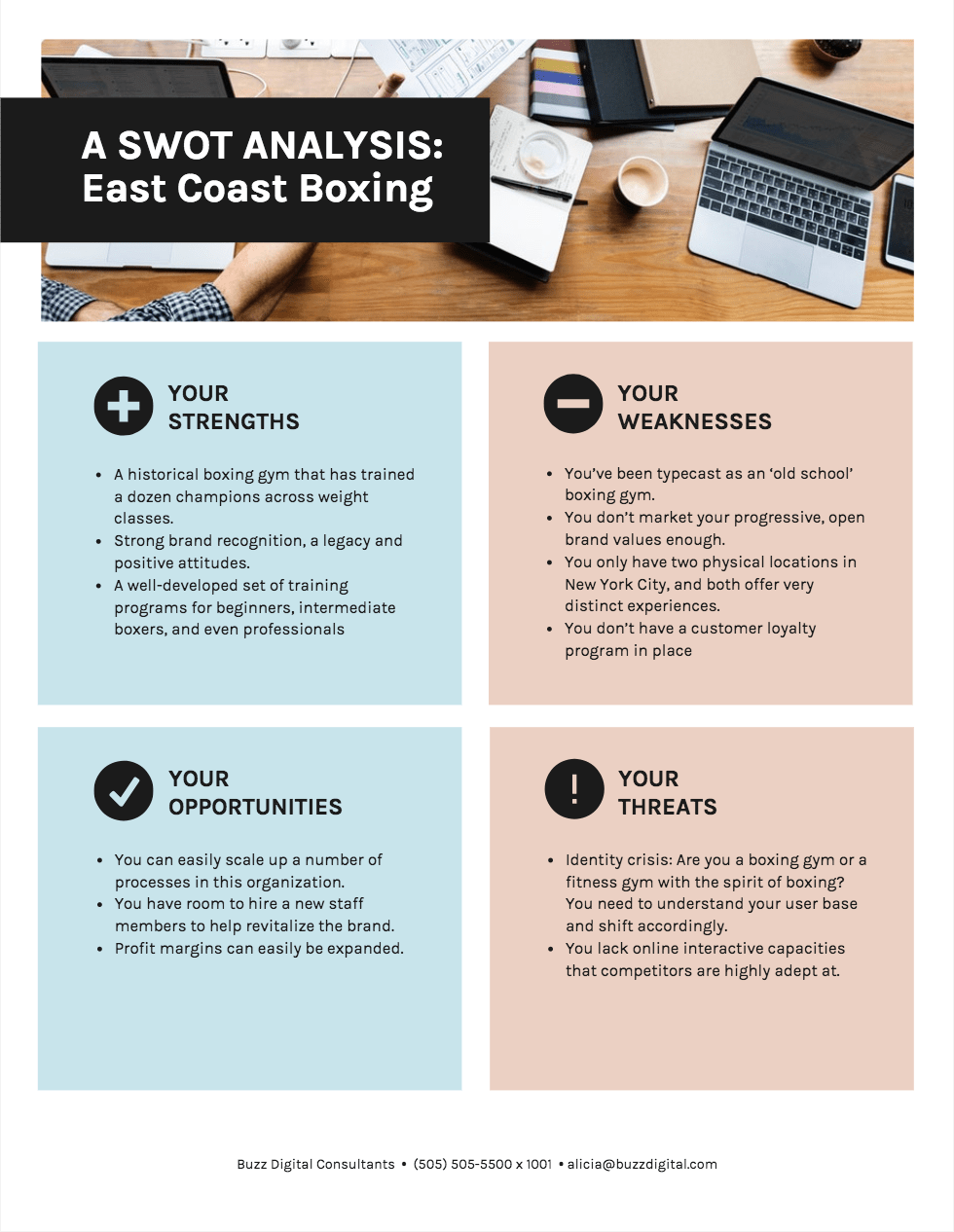

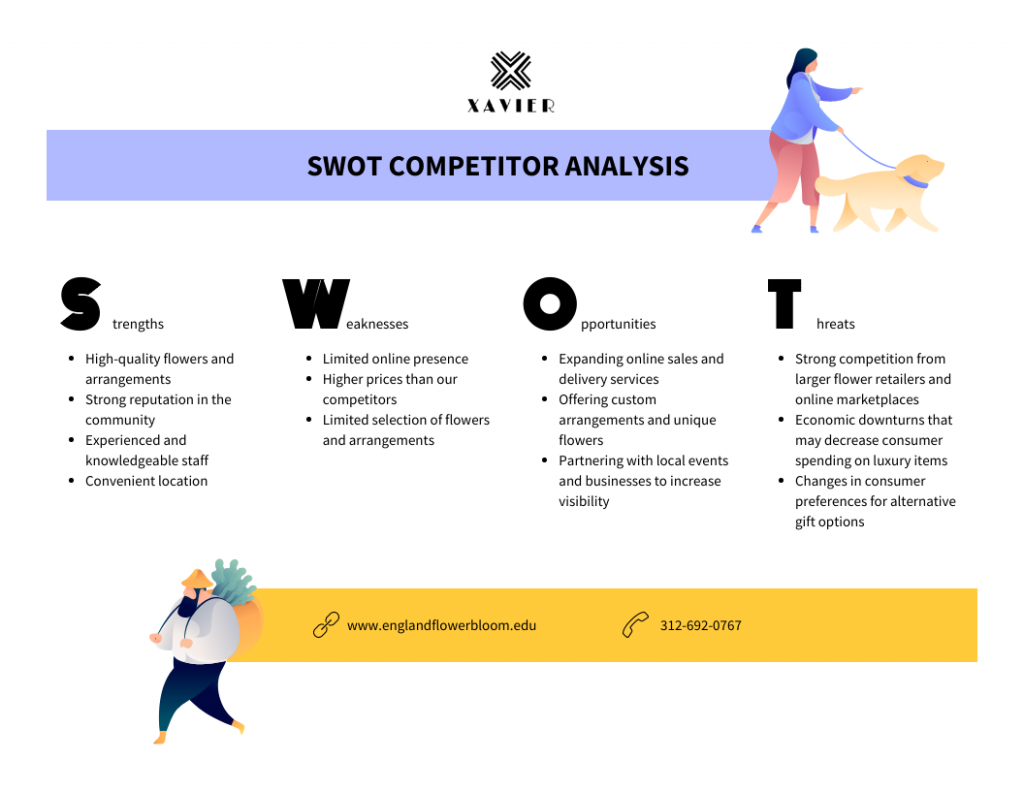

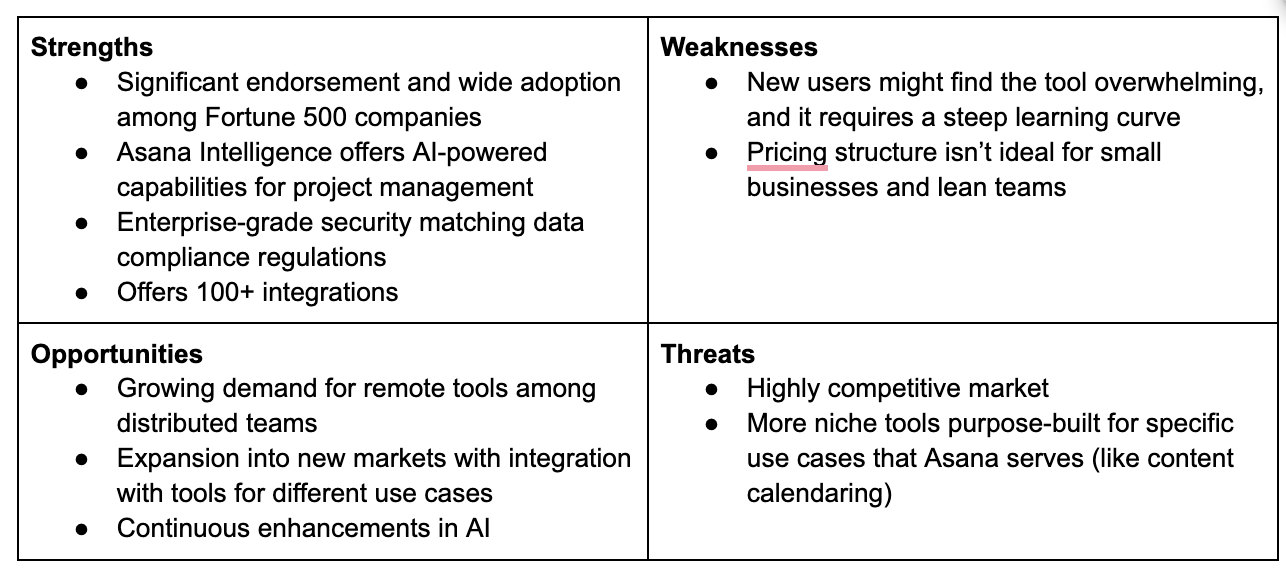

4. Summarize your strengths and weaknesses in a SWOT analysis

When you’re conducting research for your competitive analysis, it’s going to be messy. You’ll have a lot of data and it’ll be hard for an outsider to understand.

That’s what makes the SWOT analysis so essential.

A SWOT analysis is a framework for evaluating your competitive position by listing your key strengths, weaknesses, opportunities, and threats.

It can act like a short summary of the rest of your competitive analysis report for anyone who doesn’t have time to dig into the details.

Click the template above to enter our online SWOT analysis maker tool. Customize the template to your liking–no design no-how required.

Here are some questions to kickstart your SWOT analysis:

- Strengths: What are we doing really well (in terms of marketing, products, sales, branding, technology, etc.)?

- Weaknesses: What are we struggling with? What’s holding us back?

- Opportunities: What’s the weakest area for our biggest competitor? Are there any gaps in the market that aren’t current being addressed? What has recently changed in our business or the market?

- Threats: What is our biggest competitor doing much better than us? What new products/features are they working on? What problems aren’t we currently addressing?

In your report, you could arrange your SWOT analysis in a simple list, but it can be helpful to use color-coded quadrants, like the competitor analysis example below. Note how each quadrant is paired with an icon:

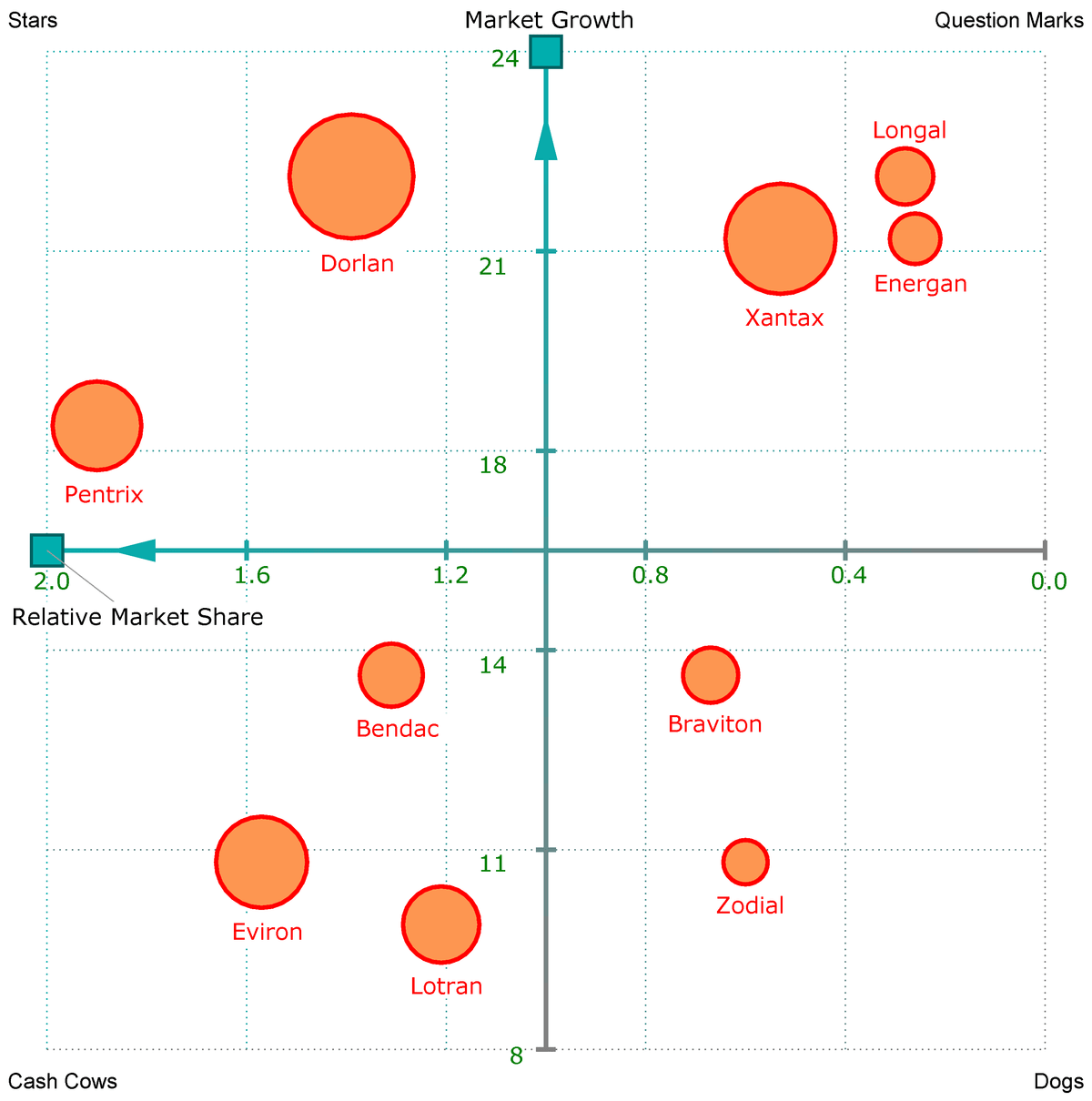

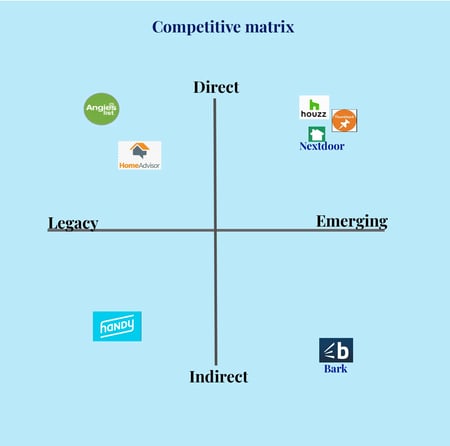

5. Show where you fit in the competitive landscape

After summarizing your strengths, weaknesses, opportunities, and threats, it’s time to look at the bigger picture. It’s time to figure out where every major competitor currently fits into the competitive landscape.

The most popular way of doing this is to identify the two dimensions that are most important for being competitive in your industry and plot them on a matrix, like this one from the Boston Consulting Group:

And this one from G2 Crowd (which looks at market presence and customer satisfaction):

You may want to focus on where you fit in the market landscape based on your own biggest strengths and weaknesses, or the biggest threats and opportunities you identified in the SWOT analysis.

Or, it may be enough just to summarize in words the features and benefits that set your apart from your competitors (which is a great way to end your report on a high note).

Competitor analysis examples for strategic planning

Let’s delve into some competitor analysis examples that can empower your organization to navigate the market effectively.

1. Competitor analysis example for marketing specialists

Imagine this: You are a Marketing Specialist and your goal is to establish a strong online presence and attract a diverse user base. However, you face stiff competition from established players in the market. Here are some things you should look into when doing your competitor analysis:

Competitor analysis focus:

- SEO strategies: Analyze competitors’ websites to understand their SEO strategies. Identify high-ranking keywords, backlink strategies, and content optimization techniques . Alternatively, if you’re running a local business, you might want to analyze and scrape Google Maps listings to better assess how companies are optimizing Google My Business to generate leads.

- Social media engagement: Examine competitors’ social media presence. Evaluate the type of content that garners engagement, the frequency of posts, and audience interactions.

- Online advertising: Investigate competitors’ online advertising campaigns. Are they leveraging Google Ads, social media ads, or other platforms? Assess the messaging, visuals, and targeting criteria.

- Content marketing: Scrutinize competitors’ content marketing efforts. Identify the topics that resonate with their audience, the formats they use (blogs, videos, infographics), and the platforms they prioritize.

Here’s a SWOT analysis template to help you get started:

2. Competitor analysis example for SME business development managers

Imagine this: As the business development manager for a medium sized start up, you are tasked with expanding the client base. The market is crowded with similar service providers, and differentiation is key. When doing your competitor analysis report, look into:

- Client testimonials and case studies: Explore competitors’ websites for client testimonials and case studies. Identify success stories and areas where clients express satisfaction or dissatisfaction.

- Service offerings: Analyze the range of services offered by competitors. Identify gaps in their offerings or areas where you can provide additional value to clients.

- Pricing models: Investigate competitors’ pricing structures. Are they offering packages, subscription models, or customized solutions? Determine whether there’s room for a more competitive pricing strategy .

- Partnerships and collaborations: Explore potential partnerships or collaborations that competitors have formed. This can provide insights into untapped markets or innovative service delivery methods.

Here’s a competitor analysis comparison chart template that you could use:

3. Competitor analysis example for product managers

Imagine this: You are a Product Manager for a consumer electronics company tasked with improving your company’s products and services. The market is buzzing with innovation, and staying ahead requires a deep understanding of competitor products.

- Feature comparison: Conduct a detailed feature-by-feature comparison of your product with competitors. Identify unique features that set your product apart and areas where you can enhance or differentiate.

- User experience (UX): Evaluate the user experience of competitors’ products. Analyze customer reviews, app ratings, and usability feedback to understand pain points and areas for improvement.

- Technological advancements: Investigate the technological capabilities of competitors. Are they integrating AI, IoT, or other cutting-edge technologies? Assess whether there are emerging technologies you can leverage.

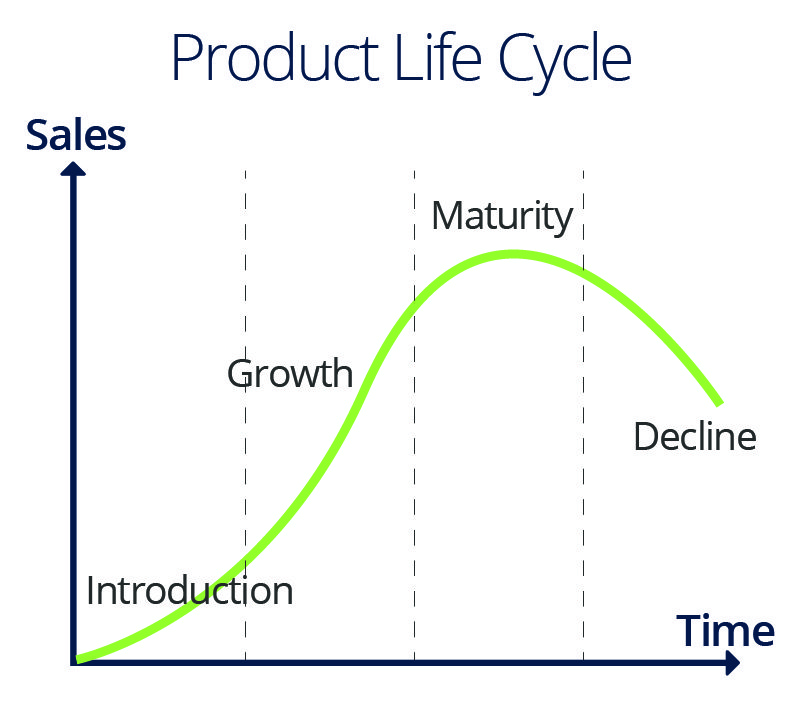

- Product lifecycle management: Examine competitors’ product release cycles. Identify patterns in their product launches and assess whether there are opportunities for strategic timing or gap exploitation.

To help you get started, use this competitive analysis report template to identify the strengths, weaknesses, opportunities and threats of the product or service

How to present a competitor analysis

Presenting a competitor analysis effectively involves organizing and communicating information about your competitors in a clear and concise manner. Here’s a step-by-step guide on how to present a competitor analysis:

- Introduction: Start with a brief introduction to set the stage. Outline the purpose of the competitor analysis and its significance in the current market context.

- Competitor identification: Clearly list and identify the main competitors. Include both direct and indirect competitors. Briefly describe each competitor’s core business and market presence.

- Key metrics and performance: Present key metrics and performance indicators for each competitor. This may include market share, revenue, growth rate, and any other relevant quantitative data.

- SWOT analysis: Conduct a concise SWOT analysis for each competitor. Summarize their strengths, weaknesses, opportunities, and threats. Use a simple visual representation if possible.

- Market positioning: Discuss how each competitor is positioned in the market. This could include their target audience, unique selling propositions, and any specific market niches they occupy. Also, focus on finding keywords , as your competitor’s targeted keywords are the main source of information on their online market performance.

- Strategic moves: Highlight recent strategic moves made by your competitors. This could include product launches, partnerships, mergers, acquisitions, or changes in pricing strategy. Discuss how these moves impact the competitive landscape.

- Recommendations and implications: Based on the analysis, provide recommendations and implications for your company. Identify opportunities to capitalize on competitors’ weaknesses and outline potential threats that need to be addressed. Discuss any adjustments to your own strategy that may be necessary in response to the competitive landscape.

3 tips to improve your competitive analysis report design

How you design your competitive analysis report can have a significant impact on your business success. The right report design can inspire stakeholders to take action based on your findings, while a mediocre design may reflect poorly on your hard work.

Here are a few report design best practices to keep in mind when designing your competitive analysis report:

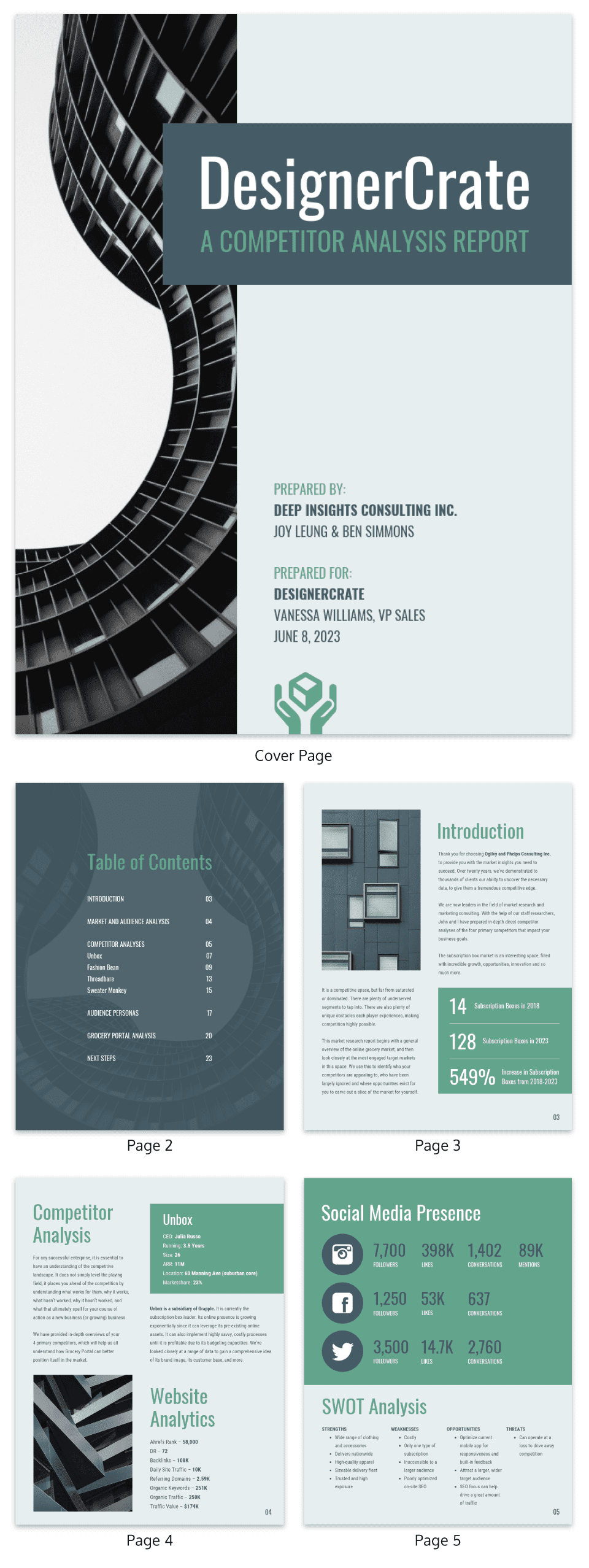

- Start with a competitive analysis report template

- Keep core design elements like colors and fonts consistent

- Use visuals to summarize important information and keep your audience engaged

1. Start with a competitor analysis template

The quickest way to lose the confidence of your stakeholders is to present a messy, amateur report design. Besides distracting from the content of the report, it might even put your credibility at risk.

Starting with a pre-designed competitor analysis template, like the one below, takes almost all of the design work out of the mix so you can focus on the content (while still impressing your stakeholders).

And if you’re a consultant competing for a project, a pre-designed template may just give you the edge you need to land that client.

Click on any of our templates; you’ll enter our online drag and drop report maker tool. No design know-how required.

2. Keep core design elements like colors and fonts consistent

If you take a look at the competitor analysis template below, you might notice that the designer has switched up the layout from page to page, but many of the other design elements are kept consistent.

That consistency helps the report design feel cohesive while making it easier for readers to quickly skim for key pieces of information.

Here are a few quick guidelines for keeping important design elements consistent:

- Use the same color scheme throughout your report (with one highlight color to draw attention to key takeaways and important numbers)

- Use the same font styles for your headers, subheaders, and body text (with no more than 2-3 font styles per report)

- Use the same style of visuals throughout your report (like flat icons or illustrated icons… but not both)

3. Use visuals to summarize important information and keep your audience engaged

The challenge with a competitive analysis report is that you collect heaps of background research, and you have to condense it into a brief report that your client will actually read.

And written summaries will only get you so far.

Visuals like charts and tables are a much better way to communicate a lot of research quickly and concisely, as seen in the market research summary below.

Even lists can be made more engaging and informative by spacing out list items and giving more emphasis to headers:

The more you can replace descriptive paragraphs and long lists with thoughtful visuals, the more your readers will thank you.

A competitive analysis will allow you to think up effective strategies to battle your competition and establish yourself in your target market.

And a report that communicates the findings of your competitive analysis will ensure stakeholders are on board and in the know.

Now that you know how to design a competitive analysis report, you’re ready to get started:

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

Find Keyword Ideas in Seconds

Boost SEO results with powerful keyword research

Competitor Analysis: Core Principles and How to Conduct One

Written by Leigh McKenzie In collaboration with Semrush

In the fast-paced realm of digital marketing, understanding and outperforming your competitors is not just an advantage, it’s a necessity.

Competitor analysis, a critical skill for any marketer, provides insights that can be the difference between leading the market or lagging behind.

This guide, rooted in Backlinko’s expert approach to digital marketing strategies, delves into the nuts and bolts of effective competitor analysis.

From leveraging SEO tactics to understanding audience needs, we unpack the methods that will not only help you understand your rivals but also enable you to outmaneuver them strategically.

Get ready to transform your approach to competition, armed with tools and insights that put you ahead in the digital marketing game.

Let’s dive in.

Key Takeaways

- A competitor analysis involves collecting data about your competitors to identify their strengths and weaknesses and improve your marketing strategy.

- Any type of business can benefit from conducting a competitor analysis.

- Before you begin a competitor analysis, you need to be sure of who your target customer is.

- The next step of a competitor analysis involves identifying your organic and paid search competitors. You also need to determine if they’re classed as direct, indirect, or replacement competitors.

- Once you’ve identified your competitors, you need to analyze their content strategies , backlink profiles, technical SEO , and paid media strategies.

The Importance of Competitor Analysis in Marketing

Before we discuss how to carry out your competitor analysis, let’s take a look at exactly what it is and why it’s so beneficial.

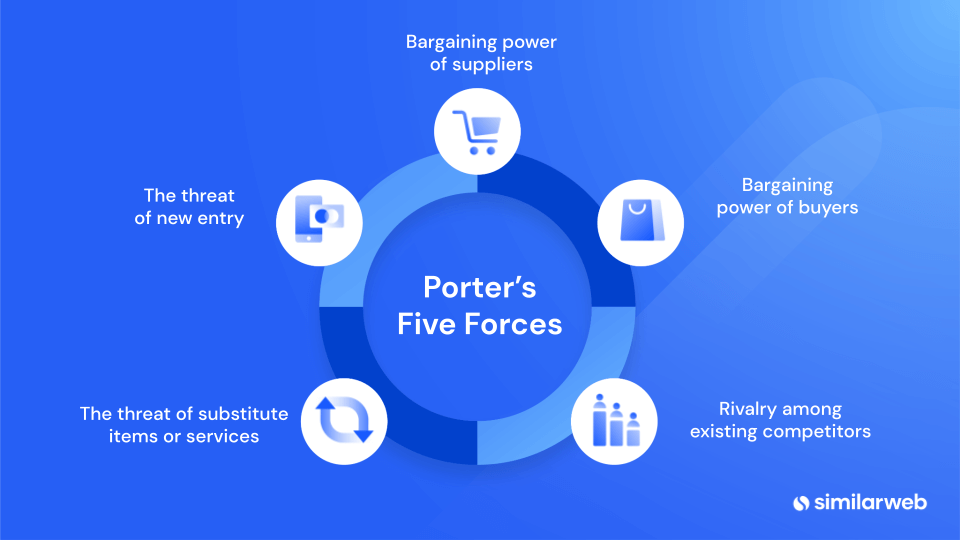

What is Competitor Analysis?

A competitor analysis, commonly referred to as competitive analysis, is a strategic and systematic approach to identifying competitors within your industry and analyzing their strengths and weaknesses.

It involves assessing your competitors’ product offerings, pricing strategies, distribution channels, customer service, innovation, marketing strategies, and overall market positioning.

This in-depth analysis serves as a valuable benchmark. It helps you grasp not just the strategies and tactics your competitors employ but also allows you to pinpoint your own strengths and weaknesses relative to each competitor.

Armed with this well-rounded view, you can strategically position your business for success in the competitive arena.

A competitive analysis can be broad or specific. You can delve into every aspect of your competitors’ business or focus on just one area. For example, you might choose to concentrate solely on analyzing their marketing strategy.

However you decide to go about it, you need to ensure your approach is customized to align with the needs and goals of your business.

Who Can Benefit from an Analysis?

Simply put, anyone who wants to gain a better understanding of a market and the competitive landscape will benefit from a competitor analysis.

Business Owners and Executives

Competitive research helps business owners and executives:

- Identify opportunities and threats posed by competitors

- Make informed decisions

- Optimize resource allocation

- Stay ahead of industry trends

- Proactively respond to competitive challenges

As a result, these actions contribute to business growth and sustained success.

Product Marketing Teams

Conducting market research can greatly benefit product marketing teams by helping them:

- Identify unique features and benefits of their products

- Understand how competitors position and present their products

- Tailor their marketing messages to highlight distinct advantages of their products

- Recognize market gaps for potential product innovation

- Understand customer preferences

- Adapt strategies to differentiate products effectively in the market

Brand Marketing Teams

Gathering market competitor insights will help brand marketing teams:

- Understand how competitors position and present their brands

- Develop strategies to create a distinct and compelling brand image

- Identify unique selling points to differentiate the brand

- Adapt messaging to address customer perceptions and preferences

Content Marketing Teams

Content marketing teams will be able to use the insights gained from conducting competitor research to:

- Tailor content to address customer needs based on competitor insights

- Identify content gaps and opportunities in the market

- Adapt their messaging to differentiate content from competitors

- Learn from competitors’ successful content strategies

- Improve overall content effectiveness and relevance in the market

SEO Professionals

SEOs can use these competitive benchmarks to help them:

- Identify keywords competitors are ranking for

- Uncover link-building opportunities

- Discover content gaps to provide valuable and unique information

- Improving website structure and user experience based on their competitors’ successes

Pay-Per-Click (PPC) Specialists

A competitive analysis can help PPC specialists:

- Identify effective strategies used by competitors in their ads

- Adjust bidding strategies based on competitors’ performance

- Improve ad creatives and messaging to stand out in the market

Social Media Teams

The insights gained from an analysis allows Social media teams to:

- Identify successful strategies used by competitors on social platforms. This includes analyzing content themes and engagement tactics that resonate with the target audience.

- Uncover the various social media platforms their competitors leverage

- Discover opportunities for unique and engaging social content

- Adapt posting schedules and frequency based on their competitors’ performance

Sales Teams

Competitor analysis data will help Sales teams:

- Determine their competitors’ strengths and weaknesses

- Identify their competitors’ unique selling points

- Anticipate customer objections, and stay informed about market trends

This helps them tailor their pitches, address customer concerns effectively, and position their products or services competitively. As a result, it can enhance sales outcomes.

Identifying Your Target Customer

Before delving into a competitor analysis, it’s crucial to clearly understand your target audience. Without this insight, you’re essentially navigating in the dark. To help clear things up, let’s dive into why it’s so important. Plus, we’ll cover the best ways to identify your target audience, but first, let’s discuss the difference between a target market and a target customer.

Target Market vs. Target Customer

A target market is a fairly broad group of customers you hope to sell your products or services to. For example, if you sell gym wear, your target market could be fitness enthusiasts.

A target customer is a more specific segment of your target market. So, your target customer within your target market could be a fitness enthusiast aged 25 to 35, who lives in Los Angeles.

The process begins by identifying your target market and then pinpointing more specific target customers within that market.

To pinpoint your target market, you must assess the key features and benefits of your products or services. Delve into understanding the problems they solve and the value they offer. Next, identify the broad groups of customers who are likely to find these qualities appealing.

By identifying your target customers, you can efficiently allocate resources to analyzing the competitors that engage with your specific audience.

How to Identify Your Target Customer

So, now you know why it’s important to identify your target customer before carrying out a competitor analysis, but how do you do it?

1. Start With Your Existing Customers

If you’re already selling products or services, you should have insights into your existing customer base, which can significantly inform your understanding of your target customer. Analyzing your current customer data, including demographics, preferences, and purchase behavior, provides a foundation for identifying and refining your target customer profile.

Additionally, gathering feedback directly from your current customers proves invaluable in gaining deeper insights.

A highly effective method to achieve this is by initiating surveys with your customer base. You can do this via email, text, or call to ask customers who have purchased to complete a survey. You can also add survey buttons and links to certain pages on your site or read customer reviews.

Furthermore, you should leverage social media platforms as an additional channel to connect with your current customers. You should create posts or direct messages inviting them to participate in surveys or share their thoughts and experiences.

2. Gather Demographics Data With Google Analytics 4 (GA4)

To collect demographic data on your target audience, you can utilize GA4 . This tool offers comprehensive insights, allowing you to get a deeper understanding of your audience.

After you log in, click “Reports”, “User attributes”, and then “Demographic details”. You’ll now see a graph representing the number of users who visited your site from different countries.

Scroll down, and you’ll see the total number of “Users” for each country, as well as the number of “New Users” (users who interacted with your site for the first time).

To view different types of demographic data, click the “Country” button in the table and you’ll get a dropdown.

For example, we chose “Interests”, and this is what the tool gave us.

In this case, the data provided above clearly indicates that a significant portion of our audience is located in the US and Canada, with a keen interest in technology, media, and entertainment.

By applying different filters, we can also see data about the audience’s:

3. Dig Into Your Social Media Analytics

Another way to identify your target customer is to explore your social media analytics. This helps you gain insights into the behaviors, preferences, and demographics of your audience.

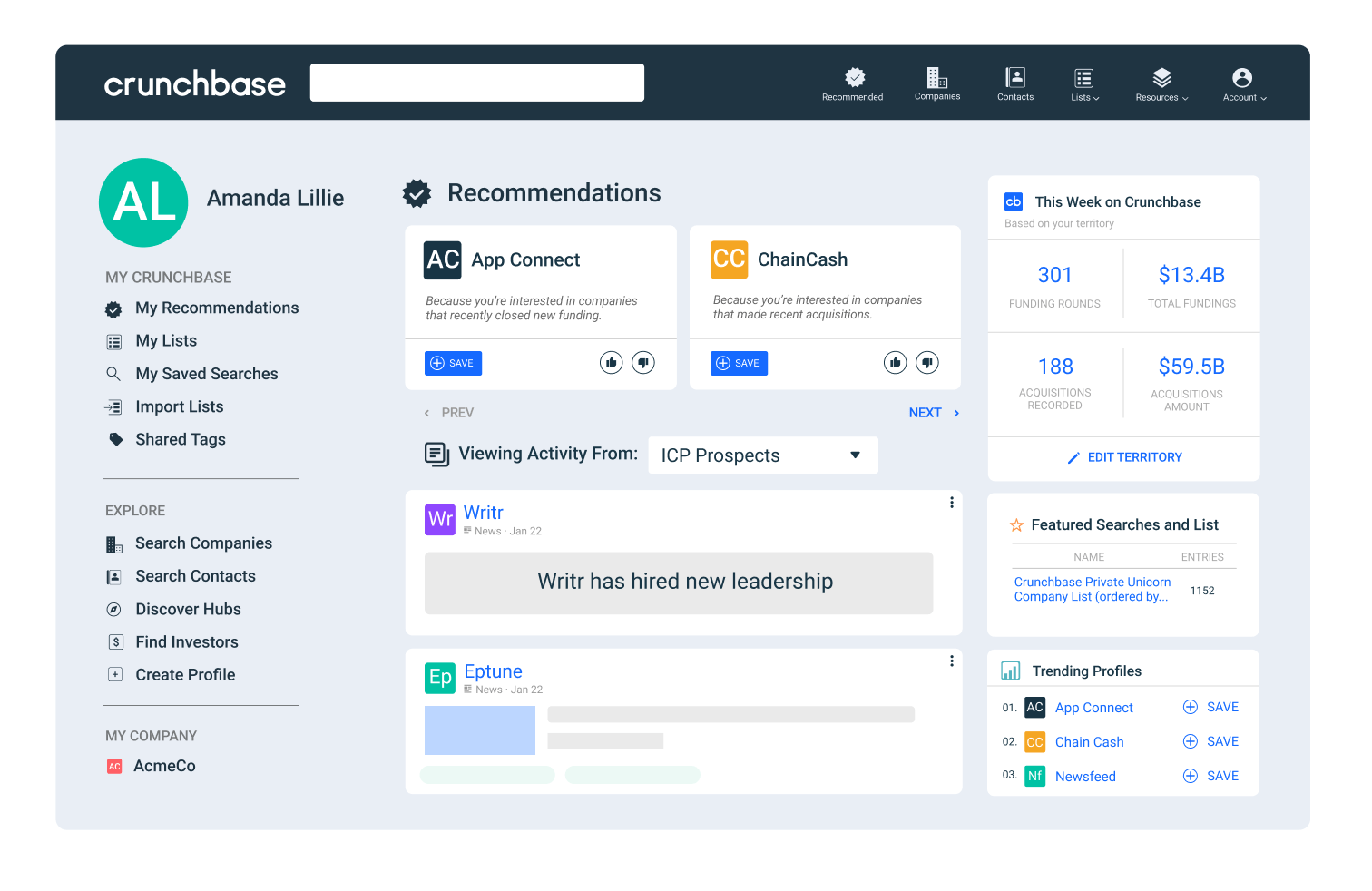

Semrush’s Social Tracker tool allows you to analyze your followers, mentions, and engagement levels on multiple social media platforms.

This helps you identify the type of customer who interacts with your site via social media and also reveals the social media channels that generate the highest engagement and traffic for your site. You can then focus on these channels when analyzing your competitor’s social media strategy .

4. Create a Target Audience Profile

Once you’ve collected the data, it’s time to put it to use by creating a profile of your ideal target customer.

This should include information like:

- Level of education

- Platform usage

It’s essential to recognize that you may have various types of target customers. For example, an e-commerce store could have a distinct target customer for each product or service they offer.

The more data you can collect about your different types of target customers before you start a competitor analysis, the better.

How to Conduct a Competitor Market Analysis

After you identify who your target customer is, it’s time to begin your competitive research.

Before we begin, here’s a bit of advice.

- A competitor analysis can easily become overwhelming if you try to do everything at once.

- It’s always best to start fairly small and break it down into manageable chunks. Instead of analyzing 50 competitors, start with a small number (even one will do) and gradually increase the scope of your analysis over time.

- Identify what your goals are before you start your analysis. Ideally, your main objective should be conducting sufficient research to take actions that positively impact your business.

- Store your competitor insight data in a spreadsheet, which should be a living document that you return to periodically and update with new information.

OK, let’s get into how to conduct a competitor analysis.

1. Identifying Your Main Competitors

First things first, it’s time to figure out who your main competitors are.

When identifying your competitors, you need to break them down into three categories:

Direct Competitors

Direct competitors are businesses in your industry or local area that sell products or services very similar to the ones you offer. They also have the same target audience as you and are of a similar size and scope to your business.

McDonald’s and Burger King are direct competitors in the fast-food market. Both chains offer a range of fast-food items such as burgers, fries, and beverages. They target a similar customer base and compete for market share in the quick-service restaurant industry.

Indirect Competitors

Indirect competitors are businesses that offer different solutions to the same customer needs or cater to the same target audience. Unlike direct competitors, indirect competitors do not provide similar products or services but fulfill a similar customer need or serve the same overall market.

You and your competitor both run travel websites. However, you focus on offering luxurious beach vacations while they specialize in adventure vacations – like hiking trips. Even though you’re both trying to attract people looking for vacations, the key difference is that you provide different kinds of trips.

Replacement Competitors

Replacement competitors offer alternative or substitute products or services to what your business offers.

- Your business: Specializes in selling traditional incandescent lightbulbs.

- Replacement competitor: Specializes in selling energy-efficient LED bulbs.

The replacement competitor is considered as such because, although they offer a different type of product, their offerings serve as a substitute or replacement for the traditional incandescent lightbulbs sold by your business.

Customers looking for a solution to their lighting needs have the option to choose between your traditional bulbs and the energy-efficient LED bulbs offered by the replacement competitor.

The competition arises because both businesses are aiming to satisfy the same fundamental customer need, illumination, albeit through different types of products.

How to Identify Your Competitors

Whenever we need to identify our competitors, we primarily use Semrush, but there are other ways you can get an idea of who your industry competitors are. These include:

- Customer Feedback: Reach out to your existing customers and inquire about the other businesses they considered before choosing yours. Make sure to ask for their opinions on which other businesses they perceive as providing a similar service or product.

- Market research: Consult your sales department to understand the businesses they frequently encounter during research within your target market. Their on-the-ground insights can contribute valuable information.

- Google Search: Conduct a Google Search using your target keyword (e.g., “running shoes”) to identify competitors. Analyze the first page of the search results to pinpoint key players in your industry.

You’ll also want to gain a comprehensive understanding of your organic, paid, and local competitors.

Several features within the Semrush tool can help you.

Identify Your Organic Search Competitors

These are sites that compete with you in the SERPs for non-paid traffic. They use SEO strategies to rank as highly in the SERPs as possible.

The easiest way to identify your organic competitors is to use Semrush’s Organic Research tool .

Type in your domain, hit “Search”, then click “Competitors”.

You’ll see a chart representing your site and your main competitors who rank for the same organic keywords as you. The X-axis shows you how many keywords your competitors are ranking for, and the Y-axis shows you how much monthly traffic they receive.

Scroll down, and you’ll see a long list of competitors with several bits of data like competition level (how closely a site is competing with you for the same keywords) and common keywords (the number of keywords both you and your competitor are ranking for).

Now, just because these sites are competing with you for the same organic keywords doesn’t necessarily mean they’re direct competitors, they could be targeting a different audience to you.

Here’s an example to give you a better grasp:

Imagine there’s a website that writes a blog about advertising. They want to attract people interested in “online marketing strategies.”

Now, let’s say you have a blog about SEO, and you also want to attract people searching for “online marketing strategies.” Even though you’re both targeting the same keyword, you’re not necessarily in direct competition.

Here’s why: The first website is focused on advertising, so their audience is interested in learning about advertising. On the other hand, your blog is about SEO, and your audience is more interested in SEO topics.

So, even though you target the same keyword, the sites serve different interests and are not considered direct competitors.

The best way to determine whether the sites in your list are direct, indirect, or replacement competitors is to visit each site and analyze their offerings. Here, we clicked on “neilpatel.com”.

A brief review of the blog content indicates that it shares similarities with ours and is geared toward the same audience. This categorizes it as a direct competitor.

Find Your Paid Search Competitors

Paid search advertising, or Pay-Per-Click (PPC) advertising, involves businesses bidding on keywords. Ads from the highest bidders are then displayed in the SERPs when users search for these keywords.

To identify your paid search competitors, you can use Semrush’s Advertising Research tool . You’ll see the same graph you get in the Organic Research tool but with paid traffic and keywords instead.

Below, you’ll get a table of your paid competitors.

As with the Organic Traffic table, you can see the number of keywords you have in common with your competitors. This is a good indication of how closely you’ll be competing with them.

Remember, to split your competitors into different types, you’ll need to examine the site content, and their products or services to see what they offer. This may sound like a lot of work, but as we said earlier, you only need to start small.

Identifying Local Competitors

Your local competitors are the businesses in your area that offer a similar product or service. You may already have several local businesses in mind that you consider to be your competition. However, your local competitors might not be exactly what you expected when it comes to SEO.

Local SEO competitors are businesses that rank prominently in the SERPs for keywords related to your products or services within a specific geographical area. These businesses are your direct competition for visibility in local search results and aim to attract local customers searching for relevant products or services.

The most effective method to pinpoint these competitors is through Google. For example, if you operate a law office in Seattle, users searching for such services in your area will likely use long-tail keywords (three or more words) with location modifiers specific to the region, such as “lawyer in Seattle.”

Type this into Google and see which businesses appear in the local search results. One of the most important things to pay attention to is the Map Pack. This is a group of top-ranking local businesses that are displayed prominently in the SERPs.

2. Analyzing Your Competitor’s Content Strategy

Once you’ve identified your competitors, it’s time to analyze their content strategy .

The goal is to identify the components of their strategy that are performing well and those that are not. By doing so, you can replicate the successful elements and take advantage of the opportunities created by the shortcomings in the weaker aspects of their strategy.

The key things to analyze are:

Content Types and Formats

Identify the various kinds of content competitors create, like blog posts , videos , infographics , or podcasts .

Additionally, analyze the formats they employ to present information within these content types. For example, blog post formats may include how-to guides, listicles , or thought leadership articles.

This analysis will help you understand the diversity of their approach and allow you to tailor your content strategy to meet similar or unique audience preferences.

Content Quality and Relevance

Assess the overall quality of their content. Look at factors such as relevance, depth, and level of expertise. Evaluate how well their content meets the users’ search intent and addresses the needs and interests of their target audience.

The insights you gain will allow you to learn from your competitors’ successes or capitalize on their failures. By identifying what works well in their content, you can incorporate similar strategies into your own. Similarly, understanding where their content falls short provides an opportunity to avoid similar pitfalls and tailor your approach for better results.

Content Frequency

Analyze how often they publish new content and the consistency of their posting schedule. This can provide insights into their content production capabilities and audience engagement strategy.

By evaluating your competitors’ content frequency, you can learn from their success in maintaining a consistent posting schedule, potentially improving your own content planning . On the flip side, identifying gaps or irregularities in their posting schedule presents an opportunity to capitalize on potential shortcomings and enhance your own content consistency for better audience engagement.

Content Distribution Channels

This involves recognizing the platforms or mediums competitors use to promote and share their content , which may include social media, email newsletters , or external platforms.

This analysis will help you to learn from their success in reaching audiences through specific platforms. It also provides insights into potential gaps or missed opportunities. This offers you a chance to capitalize on alternative channels for broader content reach and engagement.

Analyzing the keywords your competitors prioritize provides insights into what their audience is actively searching for, allowing you to align your content with similar user intent . Identifying the keywords they are targeting will help you spot industry trends and topics that resonate with your shared audience.

If you create a Semrush project, Copilot AI will automatically check what keywords your competitor ranks for. It will also check where they’re gaining visibility compared to you.

You’ll also be able to identify content gaps that will help you tailor your strategy to address topics that may be underserved in your niche. Additionally, analyzing how your competitors utilize keywords in their meta titles, page headings, and main content can offer valuable insights. This analysis will guide you in optimizing your content effectively or seizing opportunities where your competitors may fall short.

Backlink Profile

By analyzing the quality and quantity of backlinks pointing to their content, you will get insights into the authority and credibility of their content in the eyes of search engines.

3. Assessing Your Competitor’s Backlink Profile

A backlink is a hyperlink from a page on one site to a page on another site. Acquiring backlinks from high-authority sites that align with your niche is a great way of increasing the authority of your site.

When analyzing your competitor’s backlink profile, you need to assess the quality of their links rather than focusing solely on the quantity.

Analyzing your competitors’ backlink profiles is important because sites with robust and diverse link profiles are likely to rank highly in the SERPs. By analyzing their strategies, you can identify backlink opportunities for your site, and boost your rankings and traffic.

If you’d like to learn more about building links, check out our comprehensive guide on link-building strategies .

Here’s how to check up on your competitors’ backlinks.

You can use Semrush’s Backlink Analytics tool .

On the “Overview” page, you will see:

Referring Domains: This is the total number of referring domains pointing to your competitor’s domain.

Backlinks: This is the total number of backlinks your competitor has earned.

As mentioned earlier, the quality of the backlinks is more important than the quantity. You’ll need to assess the quality of referring domains that are linking to your competitor’s pages. To do this, click on “Referring Domains”.

On the “Referring Domains” page, select:

- Set the AS score to 40-100

- Click on “Add filter” and select “Follow”

As you can see in the image above, there are over 3.5k high-authority referring domains linking to this competitor’s domain.

Now, if you want to check the actual backlinks pointing to your competitor’s pages, click on “Backlinks”.

Here you can see the source pages, their AScore, and the pages they are linking to on your competitor’s site.

4. Evaluating Your Competitor’s Technical SEO

Analyzing the technical aspects of your competitor’s site is crucial to understanding how well their site performs. You then compare this data to your site and identify areas where you’re outperforming them and where you need to improve.

Here’s why conducting a technical analysis of your competitors’ sites is essential:

- Identify Strengths and Weaknesses: Analyzing the technical aspects of your competitors’ sites can reveal their strengths and weaknesses in terms of website structure, page speed, mobile optimization, and other technical elements. Understanding these aspects helps you identify areas where you can surpass them.

- User Experience (UX): Technical SEO influences the user experience. By analyzing your competitors’ technical elements, you can gain insights into how user-friendly their websites are. This understanding can guide improvements to your site’s UX.

- Crawling and Indexing: Examining how well your competitors’ websites are crawled and indexed by search engines provides insights into their overall search engine visibility. This can reveal potential issues or opportunities for improvement on your site.

You can use the info you gather to avoid common mistakes, prioritize tasks, and replicate successful strategies. Ultimately, this can lead to better UX, increased traffic, and improved rankings.

5. Exploring Your Competitor’s Paid Media Strategy

Simply put, analyzing your competitor’s paid media strategy helps you:

- Learn what works in your industry

- Stay updated on market trends

- Benchmark your performance

- Discover new advertising channels

- Improve your creativity and messaging

- Adapt to changes

- Enhance your targeting strategies

All of this ensures your advertising efforts remain effective and competitive.

Here’s how to go about analyzing your competitors’ paid media strategies.

Keyword Research

You need to identify the keywords your competitors are bidding on. This will help you uncover gaps in your PPC keyword strategy.

Analyze Historical Performance

You should analyze your competitors’ click-through rates, ad spends, and conversion rates. This will help you determine if their tactics are worth replicating to improve your site’s PPC results.

Ad Placement Analysis

You need to identify where your competitors are placing their ads. Do they tend to favor specific sites, the SERPs, or social media platforms like Facebook? This provides valuable insights into the effectiveness of the different channels they use, their overall market presence, and their strategic focus. Armed with this knowledge you can optimize your advertising approach based on successful practices and focus on platforms that yield better results.

Ad Copy Analysis

A key part of any PPC competitor analysis involves assessing your competitors’ ad copy. You need to analyze the ways they position their product or service and how they promote their unique selling points (USPs).

When analyzing ad copy, it’s useful to ask questions like:

- What types of CTA do they use?

- How do they incorporate keywords into their ad copy?

- Do the color schemes in their ads align with those of their brand?

- Do they use graphics or videos to drive clicks?

Landing Page Analysis

Optimized landing pages are one of the most important elements of a successful PPC campaign. If they contain effective CTAs, enticing content, and are well laid out, they can greatly increase your conversion rates.

So, it’s important to dig into your competitors’ landing pages to identify their strengths and weaknesses. Key things to analyze include:

- Relevance: Does the landing page align with the ad copy that led users to it? To maintain user trust and increase conversions, there must be consistency between the content of a landing page and the ad that leads to it.

- Visuals: How do your competitors use images, graphics, and videos on their landing pages? Are they high-quality and relevant? Do they support the overall message of the page?

- Headline: Pay attention to how clear and compelling the headline on the landing page is, and if it quickly communicates the value proposition of the product or service to the user. The value proposition tells the user the benefits and value of a product or service. For example, “Save time and money with our user-friendly project management software designed for small businesses.”

- Social proof and trust indicators: Keep an eye out for social proof signals like reviews and user ratings, and trust signals like security badges, as these can enhance credibility and user trust.

Track Performance and Return On Investment (ROI)

Keeping tabs on your competitors’ performance and ROI helps you to set goals and KPIs for your site.

Semrush’s Advertising Research tool enables you to effortlessly monitor key performance and ROI metrics, such as CPC and average positions.

Paid Social Media Analysis

Analyzing your competitors’ paid social media strategies will help you identify the ad copy and promotions they use to attract customers within your target audience. The insights you gather will offer ideas that you can integrate into your own paid social media campaigns.

One way of doing this is to use the tools that are built into social media platforms, like Meta Ads Library. This allows you to see all of your competitor’s ads that are currently active on Facebook or Instagram. All you need to do is choose a location and the type of ads you want to see and then type in a keyword or a competitor’s domain.

Then, you’ll be taken to a page with the ads your competitor is running. For each ad, it tells you when it was launched and which Meta platforms it’s running on and you can view the ad itself.

However, this doesn’t provide insight into the success of competitor’s ads. To gauge their effectiveness, we need to uncover metrics such as ad spend, impressions, and share of voice. You can use Semrush’s AdClarity tool to gain these insights. The tool allows you to track your competitors’ ad performance metrics on social media platforms including Facebook, Instagram, TikTok, and X (formerly Twitter).

Real-World Competitor Analysis Example

OK, you now know what information you need to uncover during your competitor analysis and how to conduct one. To make it even clearer, we’re going to walk you through a real-world example where we’ll carry out our own competitor analysis.

For this example, we’re going to identify a single competitor for “Backlinko.com”, and focus on them for the analysis.

As we already went into detail about how to identify your target customer, we’ll be skipping this step. We’ve already used the steps laid out above to determine that our target customer lives in the US, is aged between 18 to 34, and is interested in SEO but isn’t necessarily an SEO professional.

Step 1: Identify Your Competitor

Using Semrush’s Organic Research tool, we can pull up a list of the main competitors (we’ll be focusing on organic competitors in this example).

In the list above, you can see that Backlinko has 7.3K keywords in common with “wordstream.com” and 13% “Competition Level”. By quickly scanning the site, we can also see that we create similar types of content and target the same audience.

This makes “wordstream.com” a great choice for our competitor analysis.

Step 2: Content Analysis

During the next phase of competitor analysis, we’re going to dig into WordStream’s content strategy.

First, identify the types of content they publish. The easiest way to do this is to simply have a look at the WordStream site and make a note of all the different content formats.

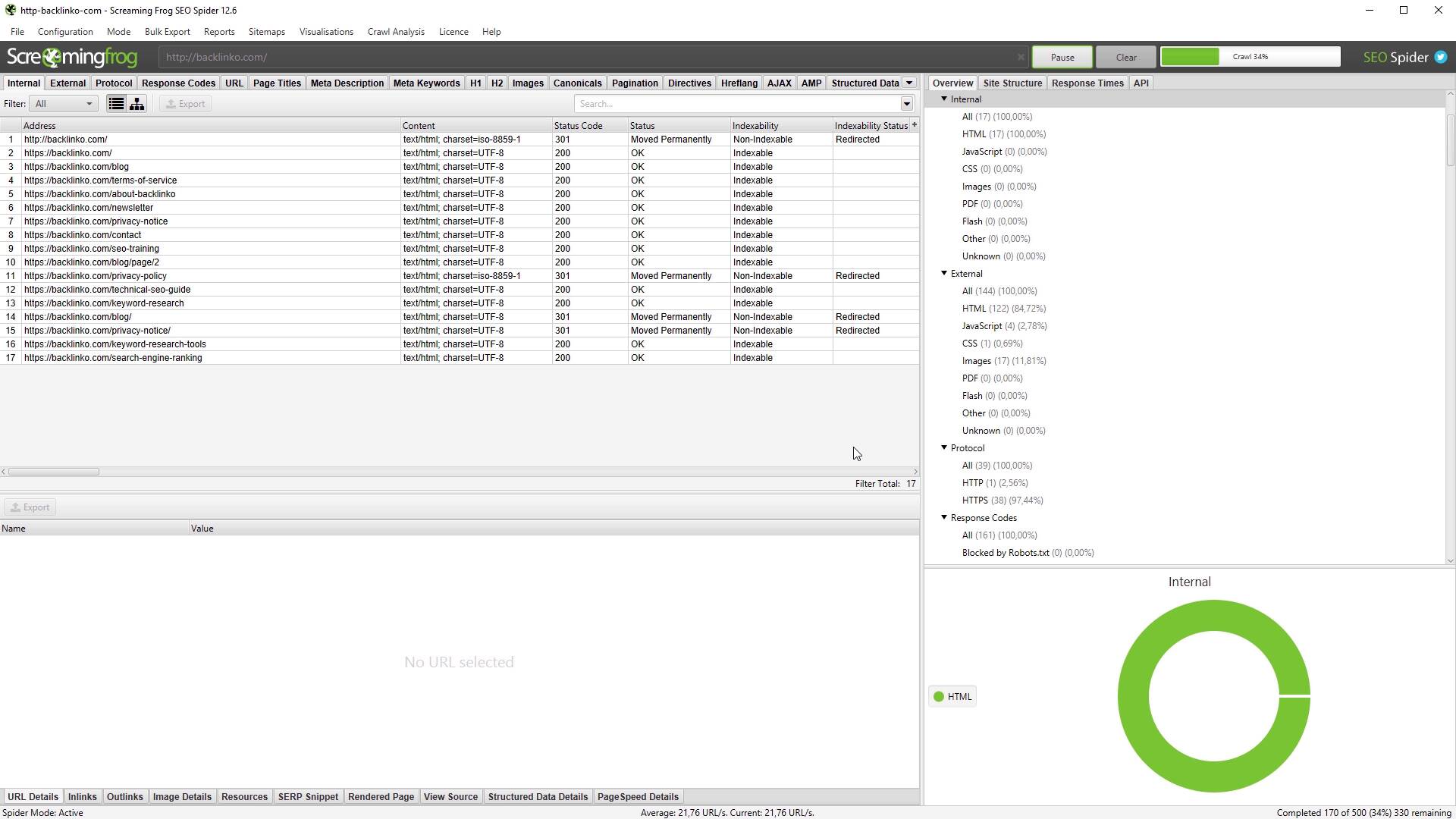

You can also analyze WordStream’s meta titles to get an understanding of the content they create. For this, we’re going to use Screaming Frog SEO Spider.

This is a tool that crawls domains and gives you valuable info about them. The free version allows you to crawl up to 500 URLs, which is perfect for smaller websites.

By analyzing these meta titles, you can start to build a picture of the types of content WordStream is creating. We can see titles include phrases like “How to” and “25 ways”, which indicates WordStream is creating how-to guides and listicles.

When analyzing your competitor’s content strategy, you should identify how frequently they publish content. To do this, type site:your competitor’s domain into Google, click “Tools”, and click “Anytime”.

Next, choose a date range from the dropdown menu. We went with “Past month”.

This will give you an idea of the amount of content your competitor publishes a month.

Next, you should take a look at the pages driving the most traffic to your competitor’s site. To do this, you can use the “Organic Pages” report in Semrush’s Organic Research tool.

There are two things you can learn from this report.

- These insights will provide content ideas. Identify the topics most relevant to your site and start creating content for them.

- If you already have content covering these topics but the pages aren’t getting a lot of traffic, you need to optimize them to start drawing in higher levels of traffic.

Next, you need to assess the quality of the content your competitor is producing. You need to look at the depth of the content and its relevance. Is the information well researched and does the content match search intent?

Next, evaluate the levels of E-E-A-T (Experience, Expertise, Authority, and Trustworthiness) your competitor demonstrates within their content.

For example, do they demonstrate experience by including hands-on videos within their how-to guides?

Or do they communicate their expertise by including info about the authors of their articles?

Here’s a look at an article on Wordstream.

Step 3: Backlink Analysis

Next, we’re going to analyze WordStream’s backlink profile. There are many different elements of this we could analyze, but we’re going to focus on four main things during this competitor analysis:

- Number of backlinks: The total number of backlinks pointing to WordStream’s site.

- Quality of backlinks: The number of high-authority referring domains linking to WordStream.

- Top-linked pages: The number of pages that have the most backlinks pointing to them. This indicates the quality and popularity of their content.

Using Semrush’s Backlink Analytics tool, we can see that WordStream has a total of 10.6M backlinks and 87K referring domains.

Now, let’s check out how many of those links are coming from high authority referring domains.

To do this, click on the number under “Referring Domains”.

You’ll only want to pay attention to the domains with the highest Authority Score (AS), so click “AS” at the top-left of the table to view the list in descending order. You can also view the number of backlinks your competitor receives from each domain.

Underneath the domain name, Semrush tells us what category the site falls into. By looking at this table, we can determine the diversity of sources for WordStream’s backlink profile, too.

Next, we want to analyze the pages receiving the most backlinks. Just click on the “Indexed Pages” to get the report:

If your site has pages covering the same topics as your competitors, you should compare the backlinks you’ve received with those of your competitor’s pages. This comparison provides insights into whether you’re outperforming them or falling short in terms of backlink performance.

If your site lacks pages covering these topics, prioritize the most relevant topics and create superior content.

Then, identify the referring domains linking to your competitor’s pages, and proactively reach out to the webmasters of these domains and ask for a link.

Step 4: Technical SEO Analysis

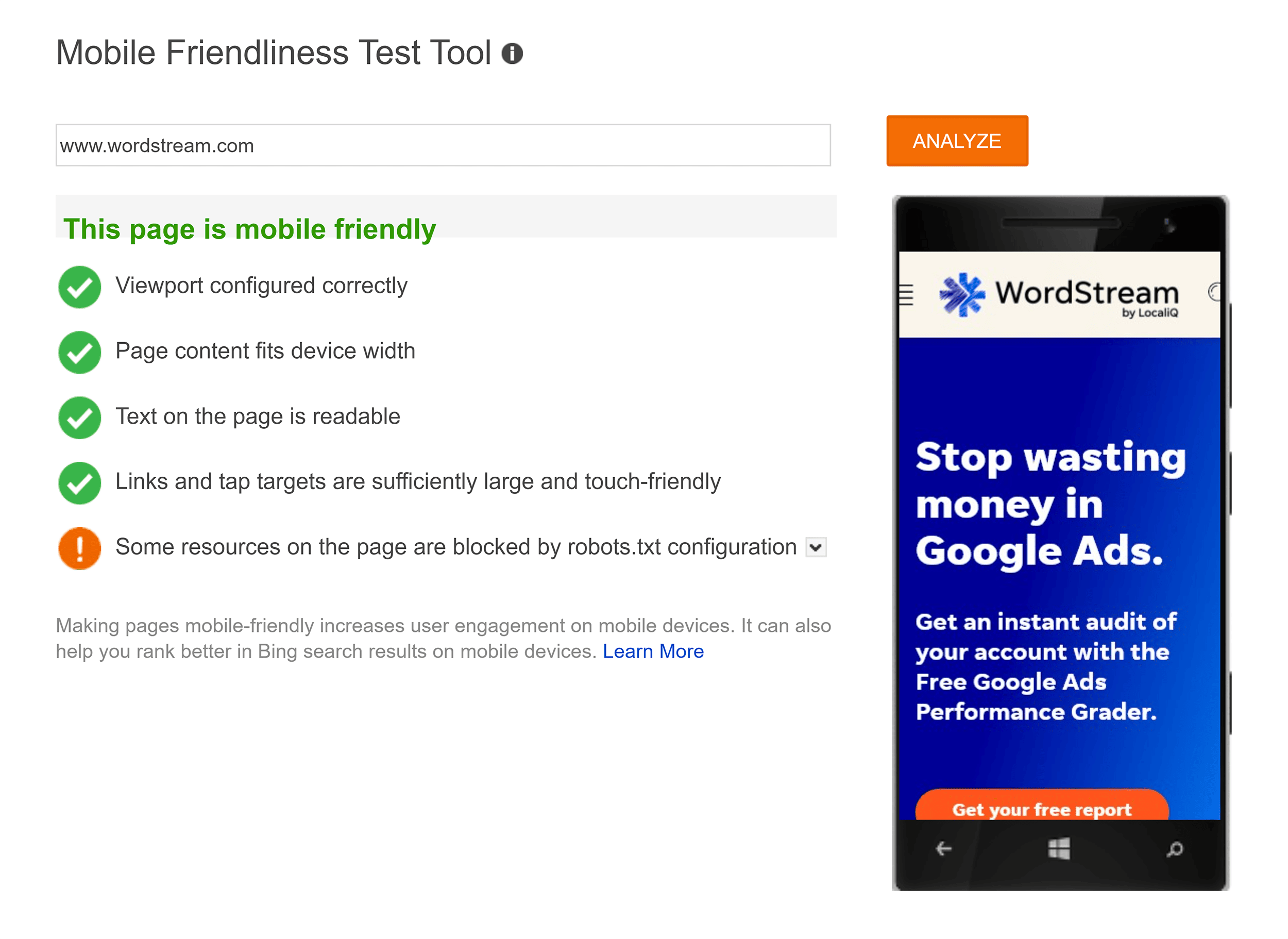

There are a huge number of technical SEO elements you can analyze during a competitor analysis. we’re going to focus on site performance, and analyze Wordstream’s Core Web Vitals, page load speeds, and check if their site is mobile-friendly.

Core Web Vitals

Core Web Vitals are a set of metrics that measure a site’s performance in terms of providing a positive UX. The Core Web Vitals metrics are:

- Cumulative Layout Shift (CLS): Measures how visually stable a page is by analyzing how much the content of the page shifts around as it loads.

- First Input Delay (FID): Measures the time it takes between a user first interacting with a page and the browser starting to process this interaction. FID will be replaced by a new metric called Interaction to Next Paint (INP) in March 2024.

- Largest Contentful Paint (LCP): Measures how long it takes for the largest content element on a page to become visible to the user.

All of these metrics are important for providing a good UX, and they’re also included in Google’s ranking factors , which is why it’s worth analyzing them.

The quickest way to do this is by using Google’s Page Speed Insights .

First, you’ll see your competitor’s Core Web Vitals for the mobile version of their page.

Click on the “Desktop” tab to see the metrics for the desktop version.