Top 111+ Project Topics for Accounting Students In 2024

Are you a budding accounting enthusiast eager to embark on an exciting academic journey? Accounting, the language of business, is all about deciphering the stories hidden within numbers. As a student, you have the unique opportunity to delve into this dynamic field and choose a project topic that not only ignites your curiosity but also highlights your expertise.

In this captivating blog, we’ll guide you through a treasure trove of top-notch project topics for accounting students that promise to captivate your interest and impress your professors. These topics aren’t just academically stimulating; they are also highly relevant in the ever-evolving world of finance and business. So, let’s set sail on a voyage of discovery as we explore the most compelling project topics for accounting students.

Table of Contents

Meaning of Accounting

Accounting is the systematic process of recording, summarizing, analyzing, and reporting financial transactions within an organization. It serves as the language of business, providing a structured framework for businesses and individuals to track their financial activities.

However, the primary purpose of accounting is to ensure the accuracy of financial information, enabling stakeholders to make informed decisions about investments, budgeting, taxation, and overall financial health. It involves creating financial statements, such as balance sheets, income statements, and cash flow statements, to present a clear picture of an entity’s financial performance. Accounting is a vital tool for measuring and managing economic activities, ensuring transparency, and promoting financial accountability.

Benefits of Project Topics for Accounting Students

Here are the benefits of project topics for accounting students in a bullet point format:

- Application of Knowledge: Projects help students apply theoretical accounting concepts to real-world situations, deepening their understanding.

- Enhanced Research Skills: Researching for projects improves analytical and investigative skills, which are valuable in the field of accounting.

- Problem-Solving Abilities: Projects challenge students to solve complex accounting problems, honing their critical thinking skills.

- Teamwork and Communication: Collaborative projects promote effective communication and teamwork, essential in the workplace.

- Time Management: Meeting project deadlines teaches time management, a crucial skill in the fast-paced accounting profession.

- Portfolio Enhancement: Well-executed projects serve as impressive portfolio pieces, boosting career prospects.

- Practical Experience: Projects provide practical experience, preparing students for the challenges of accounting careers.

- Networking Opportunities: Projects often involve interactions with professors and professionals, expanding students’ networks.

- Career Advancement: Successful projects can lead to job offers and career opportunities in the financial and accounting sectors.

Also Read: Digital Techniques Micro Project Topics

List of Project Topics for Accounting Students

Here is a complete list of project topics for accounting students in 2024:

Financial Accounting

- Analysis of Financial Statements

- Earnings Management and Its Implications

- Revenue Recognition Methods

- Effects of IFRS on Financial Reporting

- Accounting for Goodwill and Intangible Assets

- Cash Flow Statement Analysis

- Accounting for Leases

- Audit Quality and Financial Reporting

- Accounting for Income Taxes

- Financial Reporting for Non-Profit Organizations

- Accounting for Business Combinations

Managerial Accounting

- Cost-Volume-Profit Analysis

- Activity-Based Costing (ABC)

- Budgeting and Variance Analysis

- Transfer Pricing in Multinational Corporations

- Performance Measurement and Management

- Decision-Making Using Relevant Costs

- Environmental Accounting and Sustainability

- Target Costing in Manufacturing

- Responsibility Accounting

- Balanced Scorecard Implementation

- Audit Risk and Materiality

- Internal Audit Effectiveness

- Forensic Accounting and Fraud Detection

- Role of Technology in Auditing

- Audit Committee Effectiveness

- Auditor Independence and Ethics

- Auditor Liability and Legal Liability

- Continuous Auditing and Monitoring

- Audit Sampling Techniques

- Emerging Trends in Audit

- Tax Planning for Individuals

- Corporate Taxation and Tax Credits

- International Taxation and Transfer Pricing

- Tax Evasion and Avoidance

- Value Added Tax (VAT) Compliance

- Taxation of E-Commerce Transactions

- Taxation of Cryptocurrencies

- Taxation in Developing Countries

- Estate and Gift Tax Planning

- Taxation Implications of Mergers and Acquisitions

Forensic Accounting

- Money Laundering and Asset Tracing

- Investigating Financial Frauds

- Whistleblower Programs

- Digital Forensics in Accounting

- Expert Witness in Litigation Support

- Data Analytics in Forensic Accounting

- Ethical Issues in Forensic Accounting

- Bankruptcy Fraud Investigations

- Insurance Claims Investigations

- Ponzi Schemes and Investment Fraud

Accounting Information Systems

- Enterprise Resource Planning (ERP) Systems

- Cybersecurity in AIS

- Blockchain in Accounting

- Cloud Computing and Accounting Systems

- Big Data Analytics in Accounting

- XBRL (eXtensible Business Reporting Language)

- Mobile Accounting Applications

- Accounting System Implementation Challenges

- Data Privacy and Accounting Information Systems

- Electronic Invoicing and E-Accounting

Corporate Governance

- Role of Board of Directors

- Shareholder Activism and Corporate Governance

- CEO Compensation and Performance

- Corporate Social Responsibility (CSR) Reporting

- Governance Mechanisms and Firm Performance

- Insider Trading and Corporate Governance

- Stakeholder Theory in Corporate Governance

- Women on Boards and Gender Diversity

- Corporate Governance in Family Businesses

- Sarbanes-Oxley Act and Corporate Governance

Ethics in Accounting

- Ethical Dilemmas in Financial Reporting

- Professional Codes of Ethics for Accountants

- Whistleblowing and Ethical Responsibility

- Accounting Ethics Education

- Ethical Decision-Making in Taxation

- Ethical Implications of Creative Accounting

- Sustainability Reporting and Ethical Considerations

- Conflicts of Interest in Accounting

- Social Responsibility of Accountants

- Ethical Leadership in Accounting

Sustainability Accounting

- Environmental, Social, and Governance (ESG) Reporting

- Carbon Accounting and Reporting

- Sustainable Development Goals (SDGs) and Accounting

- Triple Bottom Line Reporting

- Green Accounting and Eco-Efficiency

- Corporate Sustainability Performance Metrics

- Sustainability Reporting Assurance

- Socially Responsible Investing (SRI) and Accounting

- Sustainable Supply Chain Accounting

- Impact Measurement and Reporting

International Accounting

- Harmonization of International Accounting Standards

- Cross-Border Mergers and Acquisitions

- Foreign Currency Translation and Accounting

- International Taxation Challenges

- IFRS vs. GAAP: A Comparative Study

- International Financial Reporting for Multinational Corporations

- Cultural Impacts on Accounting Practices

- International Financial Reporting Standards (IFRS) Adoption

- Accounting for Foreign Subsidiaries

- Transfer Pricing in Global Business

Emerging Accounting Issues

- Accounting for Cryptocurrencies and Digital Assets

- NFTs (Non-Fungible Tokens) and Accounting Treatment

- Accounting for COVID-19 Pandemic Impacts

- Artificial Intelligence in Accounting

- The Future of Accounting Education

- Accounting Implications of Remote Work

- Accounting for Cybersecurity Breaches

- ESG Disclosures in the Post-Pandemic Era

- Financial Reporting for Special Purpose Acquisition Companies (SPACs)

- Accounting for Artificial Intelligence Startups

- DeFi (Decentralized Finance) and Accounting Considerations

- Environmental, Social, and Governance (ESG) Metrics and Financial Reporting

These project topics for accounting students cover a wide range of accounting-related areas, allowing students to explore various aspects of the field and engage in meaningful research and analysis.

How do I Start a Project for Accounting Students?

Starting a project topics for accounting students involves several essential steps to ensure its success:

- Topic Selection: Choose a relevant and interesting accounting topic that aligns with your interests and the project guidelines.

- Research: Gather information and resources related to your chosen topic. Books, academic journals, and online databases can be valuable sources.

- Project Outline: Create a project plan or outline, including key objectives, methodologies, and a timeline to stay organized.

- Data Collection: Collect necessary financial data or information related to your project. Ensure data accuracy and reliability.

- Analysis: Analyze the collected data using appropriate accounting techniques and tools to draw meaningful conclusions.

- Documentation: Prepare a well-structured report or presentation, including an introduction, methodology, findings, and a conclusion.

- Review and Edit: Proofread your work for errors and clarity, and consider seeking feedback from peers or professors.

- Presentation: If required, prepare a presentation and practice delivering it effectively to your audience.

- Submission: Submit your project according to the provided guidelines, meeting all deadlines.

- Reflect: After completion, reflect on the project’s learnings and areas for improvement to enhance future projects.

Following these steps will help you initiate and complete a successful accounting project.

Tips for Successful Accounting Project

Here are some concise tips for a successful accounting project:

- Choose a relevant and engaging topic.

- Plan and organize your work.

- Ensure data accuracy and reliability.

- Use appropriate accounting tools and methods.

- Communicate findings clearly in your report or presentation.

- Review and edit your work meticulously.

- Seek feedback from peers or professors.

- Meet all project deadlines.

When selecting a project topic, consider your interests, career goals, and the resources available to you. Your project should not only be a requirement for your degree but also an opportunity to learn and contribute to the field of accounting. Don’t hesitate to consult with your professors and peers for guidance and ideas. With the right project topic, you can demonstrate your skills and passion in the exciting world of accounting.

We hope these project topics for accounting students help you embark on a rewarding and educational journey. Good luck with your project!

1. How do I select the right accounting project topic?

To choose the right topic, consider your interests, the project guidelines, and its relevance to the accounting field. Research current trends and areas of interest in accounting to make an informed decision.

2. What are the key elements of a well-structured accounting project report?

A well-structured report should include an introduction, clear methodology, detailed findings, and a well-supported conclusion. It should also have proper citations, data sources, and a bibliography to show the research’s credibility.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Best 120 Research Topics For Accounting Students

Hey there, curious minds in the world of numbers and balance sheets! Are you ready to dive into the exciting realm of accounting research? Whether you’re an aspiring bean counter or a number enthusiast, we’ve got a treasure trove of 90 research topics for accounting students. Imagine unlocking the secrets behind financial reporting, discovering the magic of tax strategies, and exploring the ethics that guide the accounting world. From financial fairy tales to auditing adventures, this blog is your gateway to research topics that are as clear as crystal. So grab your pens, put on your thinking caps, and get ready to embark on a journey through the fascinating landscape of accounting ideas. Let’s explore together!

120 Research Topics For Accounting Students

Financial accounting topics.

- The impact of financial reporting on investor decisions.

- Analyzing the effectiveness of International Financial Reporting Standards (IFRS).

- Earnings management and its implications on financial statements.

- The role of auditors in ensuring financial statement accuracy.

- Evaluating the effects of fair value accounting on financial reporting.

- Accounting for goodwill and its significance in company valuation.

- The relationship between corporate social responsibility and financial performance.

- Investigating the use of financial ratios in assessing company health.

- The challenges of implementing accounting standards in small businesses.

- Detecting financial fraud through forensic accounting techniques.

Management Accounting Topics

- Cost-volume-profit analysis and its role in decision-making.

- Budgeting techniques and their impact on organizational performance.

- Activity-based costing vs. traditional costing methods.

- Environmental accounting: Measuring and managing sustainability costs.

- Performance measurement in nonprofit organizations.

- Analyzing the relevance of balanced scorecards in strategic management.

- The role of management accountants in driving organizational change.

- Evaluating the use of variance analysis in controlling costs.

- The impact of technology on management accounting practices.

- Target costing and its role in pricing strategies.

Auditing Topics

- The evolution of auditing standards over the years.

- The importance of independence in auditor-client relationships.

- Auditing implications of the digital economy.

- Assessing the effectiveness of internal control systems.

- The role of auditors in detecting money laundering.

- Auditor liability and the legal framework.

- The use of data analytics in modern auditing practices.

- Ethical considerations in auditing: A case study approach.

- Audit committee oversight and its impact on financial reporting.

- The future of auditing: Trends and challenges.

Taxation Topics

- Comparative analysis of different tax systems worldwide.

- Tax planning strategies for small businesses.

- The effects of tax policy changes on individual behavior.

- Transfer pricing: Challenges and solutions.

- International tax evasion and methods of detection.

- Tax incentives and their impact on economic growth.

- The role of tax havens in global finance.

- Estate planning and its tax implications.

- Tax compliance issues in the gig economy.

- Environmental taxes and their contribution to sustainability.

Ethics and Social Responsibility Topics

- Corporate governance practices and their impact on ethics.

- The role of accountants in promoting ethical behavior.

- Whistleblowing and its effect on organizational culture.

- Social accounting and its role in measuring societal impact.

- Corporate fraud and the need for ethical leadership.

- Conflicts of interest in accounting: Prevention and resolution.

- Ethical considerations in financial reporting for nonprofit organizations.

- Professional ethics in the digital age of accounting.

- The impact of cultural differences on ethical decision-making.

- Sustainability reporting and its role in stakeholder engagement.

Emerging Trends in Accounting Topics

- Blockchain technology and its impact on accounting processes.

- Artificial intelligence in financial statement analysis.

- The rise of sustainable accounting practices in business.

- Robotic process automation and its implications for accountants.

- Cloud-based accounting systems: Benefits and challenges.

- Big data analytics and its role in auditing practices.

- Cybersecurity risks in accounting and preventive measures.

- The integration of ESG factors into financial reporting.

- Digital currencies and their accounting treatment.

- The future role of accountants in a tech-driven world.

Public Sector Accounting Topics

- Governmental accounting standards and their implications.

- Performance measurement in public sector organizations.

- Public finance management and accountability.

- The challenges of budgeting in government agencies.

- Financial transparency and accountability in the public sector.

- Evaluating the impact of public-private partnerships on financial reporting.

- The role of accounting in disaster response and recovery.

- Social welfare accounting and its role in policy evaluation.

- Environmental accounting in government initiatives.

- Healthcare financial management and its unique challenges.

International Accounting Topics

- Comparative analysis of accounting practices across different countries.

- Harmonization vs. diversity in international accounting standards.

- The challenges of translating financial statements in multinational companies.

- Cultural influences on financial reporting practices.

- International taxation and its impact on cross-border business.

- Exchange rate fluctuations and their effects on financial reporting.

- The role of international accounting bodies in standard-setting.

- Case study: Accounting challenges in global supply chains.

- The impact of globalization on accounting education.

- The role of accountants in promoting cross-border investment.

Accounting Education Topics

- The effectiveness of online accounting education.

- Integrating practical experience into accounting curricula.

- Assessing the impact of technology on accounting education.

- The role of internships in shaping future accountants.

- Teaching ethics and professional responsibility in accounting programs.

- Diversity and inclusion in accounting education.

- Curriculum development for evolving accounting industry needs.

- The use of case studies in accounting classrooms.

- Lifelong learning and professional development for accountants.

- Enhancing critical thinking skills in accounting students.

10 Intriguing Research Topics in Accounting and Finance for Undergraduates

- The Impact of Technology on Modern Accounting Practices.

- Exploring Ethical Dilemmas in Financial Decision-Making.

- Analyzing the Role of Financial Ratios in Assessing Company Performance.

- The Link between Corporate Social Responsibility and Financial success

- Investigating the Influence of Economic Factors on Stock Market Trends.

- Financial Planning Strategies for Young Professionals: A Comparative Study.

- The Role of Microfinance in Empowering Local Entrepreneurs.

- The Dynamics of Personal Budgeting and its Long-Term Financial Benefits.

- Assessing the Implications of Cryptocurrencies on Traditional Financial Systems.

- Analyzing the Effects of Global Economic Events on International Trade.

10 Research Topics in Accounting and Finance for Postgraduate

- Unraveling the Complexities of Derivative Market Strategies in Risk Management.

- The Role of Artificial Intelligence in Enhancing Financial Analysis and Decision-Making.

- Exploring the Nexus Between Financial Instruments and Macroeconomic Stability.

- Green Finance: Assessing the Integration of Sustainability into Investment Practices.

- Cryptocurrency Regulations: Balancing Innovation and Financial Integrity.

- Behavioral Biases in Investment Decision-Making: Implications for Portfolio Management.

- The Dynamics of Mergers and Acquisitions: A Study of Value Creation and Integration Challenges.

- Quantitative Easing’s Ripple Effect: Analyzing its Impact on Interest Rates and Inflation.

- Innovations in Fintech and their Disruptive Influence on Traditional Banking Models.

- Islamic Finance: Analyzing its Principles and Their Application in Contemporary Financial Systems.

10 Research Title for Accounting Students

- “Navigating Financial Reporting Challenges in the Era of Digital Transformation”

- “Ethical Dilemmas in Corporate Financial Decision-Making: A Comprehensive Analysis”

- “Unlocking the Potential of Data Analytics in Auditing Processes”

- “The Role of Sustainability Reporting in Shaping Corporate Social Responsibility”

- “Cryptocurrencies and the Evolution of Financial Transactions: Opportunities and Challenges”

- “Impact of International Financial Reporting Standards (IFRS) Adoption on Cross-Border Business”

- “Behavioral Biases in Investment Decision-Making: Implications for Personal Finance”

- “Financial Fraud Detection: Integrating Machine Learning and Forensic Techniques”

- “Examining the Relationship Between Tax Policies and Economic Growth”

- “Mergers and Acquisitions: Evaluating Financial Performance and Value Creation”

As we draw the curtain on this exploration of 120 compelling research topics for accounting students, we hope you’re feeling as inspired as we are by the vast possibilities that await your inquisitive minds. The world of accounting is a dynamic landscape, evolving with every technological stride and ethical challenge that comes its way. These research topics for accounting students serve as invitations to delve deeper, question assumptions, and contribute to the ever-growing body of knowledge.

Remember, each research topic represents a gateway to discovery, innovation, and the chance to make a meaningful impact in the realm of accounting. Whether you choose to unravel the intricacies of financial technology, dissect ethical quandaries, or scrutinize the shifting paradigms of financial reporting, your journey promises to be both enlightening and rewarding.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

250+ Exciting Accounting and Finance Project Topics: Explore All

When you’re studying accounting and finance, one big choice stands out: what project topic should you pick? This decision is super important. It affects how your research goes, how well you do in school, and even what jobs you can get later. In this blog post, we’re going to help you figure out the best accounting and finance project topics.

The Significance of Choosing the Right Topic

Table of Contents

Before we dive into specific project topics, it’s essential to understand why selecting the right topic is crucial. The choice of your project topic can impact several aspects of your academic and professional journey.

- Firstly, a well-chosen topic aligns with your interests and passions. It allows you to delve into a subject matter that genuinely excites you. When you’re passionate about your research, you’re more likely to invest the time and effort required to excel.

- Secondly, the right topic contributes to the quality of your research. It’s essential that your project is relevant and meaningful, not just to you, but also to the broader academic and professional community. A well-selected topic has the potential to generate new insights, solutions to real-world problems, or advancements in the field.

- Lastly, your choice of topic can have career implications. It can help you build expertise in a specific area of accounting and finance, making you a sought-after candidate in the job market. Employers value individuals who have conducted in-depth research and possess specialized knowledge.

Now that we understand the importance of choosing wisely, let’s explore 10 categories of accounting and finance project topics that offer a wide range of possibilities for your research endeavors.

250+ Accounting and Finance Project Topics

25 financial analysis and reporting project topics.

- Comparative Financial Analysis: Analyzing the financial performance of two or more companies in the same industry.

- Ratio Analysis: Evaluating a company’s financial health using various financial ratios like liquidity, profitability, and solvency ratios.

- Trend Analysis: Examining the historical financial data of a company to identify trends and patterns.

- DuPont Analysis: Applying the DuPont formula to dissect a company’s return on equity (ROE) into its components.

- Earnings Quality: Investigating the quality of reported earnings and potential earnings management practices.

- Cash Flow Analysis: Assessing a company’s cash flow statement to understand its liquidity and cash management.

- Financial Statement Forecasting: Developing models to forecast future financial statements of a company.

- Credit Risk Analysis: Evaluating the creditworthiness of borrowers or companies.

- Valuation of Companies: Applying various valuation methods (e.g., DCF, comparables) to determine the intrinsic value of a company’s stock.

- Financial Distress Prediction: Building models to predict the likelihood of a company facing financial distress.

- Impacts of Accounting Standards: Investigating how changes in accounting standards affect financial reporting and analysis.

- Mergers and Acquisitions (M&A) Analysis: Analyzing the financial aspects of M&A transactions, including post-merger performance.

- Analysis of Financial Scandals: Studying high-profile financial scandals and their impact on financial reporting.

- Working Capital Management: Evaluating a company’s management of its current assets and liabilities.

- Economic Value Added (EVA) Analysis: Assessing a company’s performance based on its economic value added.

- Dividend Policy Analysis: Investigating a company’s dividend decisions and their impact on shareholder value.

- Cash Conversion Cycle Analysis: Analyzing the efficiency of a company’s cash flow cycle.

- Earnings Per Share (EPS) Analysis: Studying factors affecting EPS and its implications for investors.

- Corporate Governance and Financial Reporting: Exploring the relationship between corporate governance practices and financial reporting quality.

- Risk-Return Analysis: Assessing the trade-off between risk and return in investment portfolios.

- Environmental, Social, and Governance (ESG) Reporting Impact: Examining the influence of ESG factors on financial performance and reporting.

- IFRS vs. GAAP Comparison: Comparing financial statements prepared under International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP).

- Impact of Taxation on Financial Reporting: Analyzing how tax regulations affect financial statements and reporting.

- Financial Statement Restatements: Investigating reasons for financial statement restatements and their consequences.

- Impact of Technology on Financial Reporting: Exploring the role of technology, such as AI and blockchain, in improving financial reporting accuracy and efficiency.

25 Risk Management Project Topics

- Evaluation of Risk Management Strategies in the Banking Sector

- Analysis of Credit Risk Assessment Models in Financial Institutions

- Assessing the Impact of Economic Factors on Financial Risk

- Comparative Study of Risk Management Practices in Insurance Companies

- Risk Management in the Context of Climate Change and Environmental Risks

- The Role of Cybersecurity in Risk Management for Financial Institutions

- Operational Risk Management in the Healthcare Industry

- Quantitative vs. Qualitative Approaches to Risk Assessment: A Comparative Analysis

- The Effectiveness of Enterprise Risk Management (ERM) in Multinational Corporations

- Stress Testing and Scenario Analysis in Risk Management

- Risk Management in Supply Chain and Logistics

- Assessing Market Risk in Investment Portfolios

- The Role of Risk Culture in Effective Risk Management

- Measuring and Managing Liquidity Risk in Banks

- The Impact of Regulatory Changes on Risk Management in the Financial Industry

- Credit Default Swap (CDS) and its Role in Mitigating Credit Risk

- Operational Risk Assessment in the Hospitality Industry

- Risk Management in Project Management: A Case Study Approach

- Assessing the Effectiveness of Risk Management in Start-up Businesses

- The Role of Risk Management in Healthcare Quality Improvement

- Risk Management Strategies in the Oil and Gas Industry

- The Relationship between Risk Management and Corporate Governance

- Risk Management in Information Technology Projects

- Implementing Risk Management in Non-profit Organizations

- The Impact of Geopolitical Risk on International Business Operations

25 Investment and Portfolio Management Project Topics

- Portfolio Optimization Using Modern Portfolio Theory: Analyzing the allocation of assets to maximize returns while minimizing risk.

- Performance Evaluation of Mutual Funds: Assessing the historical performance of different mutual funds and their suitability for investors.

- Factor-Based Investing Strategies: Investigating the effectiveness of factors like value, growth, and momentum in portfolio construction.

- Asset Allocation Strategies for Retirement Planning: Developing investment strategies tailored to retirement goals and risk tolerance.

- Hedging Strategies for Risk Management: Evaluating the use of derivatives and other tools to hedge against market risks.

- Real Estate Investment Analysis: Analyzing the feasibility and potential returns of real estate investments.

- Behavioral Biases in Investment Decision-Making: Studying how psychological factors influence investment choices.

- Evaluating the Impact of Economic Indicators on Stock Prices: Assessing the relationship between economic data and stock market movements.

- Impact of Dividend Policy on Stock Prices: Analyzing how a company’s dividend decisions affect its stock price.

- Value vs. Growth Investing: Comparing the performance of value and growth investment strategies over time.

- Risk-Adjusted Performance Metrics: Developing and comparing various risk-adjusted performance measures for investment portfolios.

- Impact of Interest Rate Changes on Bond Portfolios: Evaluating how interest rate fluctuations affect bond investments.

- Sustainable and ESG Investing: Analyzing the performance and impact of environmental, social, and governance (ESG) criteria in portfolio management.

- Factor Investing in Fixed Income: Exploring the application of factors in bond and fixed income portfolio strategies.

- Portfolio Diversification Across Asset Classes: Examining the benefits of diversifying across stocks, bonds, real estate, and other asset classes.

- Algorithmic Trading Strategies: Developing and backtesting algorithmic trading strategies for equities or other financial instruments.

- Impact of News and Social Media on Stock Prices: Investigating the relationship between news sentiment and stock market movements.

- Volatility Forecasting Models: Developing models to predict market volatility and its impact on portfolio risk.

- Global Portfolio Diversification: Analyzing the benefits and challenges of diversifying a portfolio internationally.

- Peer-to-Peer Lending and Investment Returns: Studying the returns and risks associated with peer-to-peer lending investments.

- Currency Risk Management for International Portfolios: Strategies to hedge currency risk in global investment portfolios.

- Alternative Investments and Portfolio Diversification: Examining the role of alternative assets like hedge funds, private equity, and cryptocurrencies in portfolio diversification.

- Risk Parity Strategies: Analyzing the risk parity approach to portfolio construction and its advantages.

- Robo-Advisors and Automated Portfolio Management: Evaluating the performance and adoption of robo-advisory services.

- Portfolio Rebalancing Strategies: Developing and testing strategies for maintaining the desired asset allocation in a portfolio.

25 Corporate Finance Project Topics

- Optimal Capital Structure Analysis: Investigate the ideal mix of debt and equity for a specific company or industry.

- Valuation of Private Companies: Explore methods for valuing privately-held businesses.

- IPO Pricing Strategies: Analyze the factors influencing initial public offering (IPO) pricing decisions.

- Dividend Policy and Shareholder Value: Examine how a company’s dividend policy affects shareholder wealth.

- Mergers and Acquisitions (M&A) Impact: Investigate the financial consequences of mergers and acquisitions on involved companies.

- Corporate Restructuring Strategies: Evaluate different strategies for corporate restructuring, such as spin-offs and divestitures.

- Capital Budgeting and Investment Analysis: Analyze the process of evaluating potential investments and capital expenditure decisions.

- Financial Risk Management: Explore methods to mitigate financial risks, such as interest rate risk or currency risk.

- Corporate Governance and Firm Performance: Investigate the relationship between corporate governance practices and financial performance.

- Financial Distress Prediction: Develop models to predict financial distress or bankruptcy for companies.

- Working Capital Management: Study strategies for optimizing a company’s working capital to improve liquidity and profitability.

- Real Options Analysis: Apply real options theory to assess strategic investment decisions in uncertain environments.

- Behavioral Finance in Corporate Finance: Explore how behavioral biases affect financial decision-making within corporations.

- Corporate Tax Planning: Investigate strategies for minimizing corporate taxes legally.

- Financial Fraud Detection: Analyze methods and tools for detecting financial fraud within organizations.

- Initial Public Offerings (IPO) Performance: Evaluate the long-term performance of companies after going public.

- Corporate Debt Issuance Strategies: Study the timing and structure of corporate bond issuances.

- Corporate Ethics and Financial Performance: Examine the impact of ethical corporate behavior on financial performance.

- Leveraged Buyouts (LBOs): Analyze the mechanics and financial implications of leveraged buyout transactions.

- Corporate Social Responsibility (CSR) Reporting: Evaluate the financial consequences of CSR initiatives and reporting.

- Credit Risk Assessment: Develop models for assessing the creditworthiness of corporate borrowers.

- Share Repurchase Programs: Study the effects of share repurchase programs on a company’s stock price and financials.

- Financial Distress and Restructuring: Analyze the financial strategies used by distressed companies for recovery.

- Corporate Debt Restructuring: Investigate the methods and implications of corporate debt restructuring.

- Environmental, Social, and Governance (ESG) Integration: Explore how ESG factors are incorporated into corporate finance decisions.

25 Financial Markets and Instruments Project Topics

1. Analysis of Stock Market Volatility

– Investigate the causes and implications of stock market volatility.

2. The Role of Derivatives in Hedging Financial Risk

– Explore how derivatives, like options and futures, are used to manage financial risk.

3. Impact of High-Frequency Trading on Financial Markets

– Study the effects of high-frequency trading on market efficiency and stability.

4. Asset Pricing Models: A Comparative Analysis

– Compare and contrast different asset pricing models, such as CAPM and APT.

5. Initial Public Offerings (IPOs) and Market Performance

– Analyze the performance of stocks after their initial public offerings.

6. Behavioral Biases in Investment Decision-Making

– Investigate how psychological biases influence investment choices.

7. The Role of Exchange-Traded Funds (ETFs) in Diversification

– Explore the benefits and drawbacks of using ETFs for portfolio diversification.

8. Cryptocurrency Market Dynamics and Investment Strategies

– Study the behavior of cryptocurrencies and develop investment strategies.

9. Impact of News and Social Media on Financial Markets

– Analyze how news and social media affect market sentiment and trading decisions.

10. Credit Default Swaps (CDS) and Credit Risk Assessment

– Examine the use of CDS in assessing and managing credit risk.

11. Role of Central Banks in Monetary Policy and Financial Stability

– Investigate the influence of central banks on financial markets and economic stability.

12. Algorithmic Trading Strategies and Their Impact

– Study various algorithmic trading strategies and their effects on market dynamics.

13. Real Estate Investment Trusts (REITs) Performance Analysis

– Analyze the performance of REITs in different economic environments.

14. Risk-Return Tradeoff in Bond Investments

– Explore the relationship between risk and return in bond investments.

15. Analysis of Commodity Markets and Investment Opportunities

– Investigate the behavior of commodity markets and potential investment strategies.

16. Role of Options in Hedging Strategies

– Study the use of options as tools for hedging against market risk.

17. Foreign Exchange Market Dynamics and Currency Forecasting

– Analyze factors influencing exchange rates and develop currency forecasting models.

18. Mutual Fund Performance Evaluation

– Evaluate the performance of mutual funds using various metrics and benchmarks.

19. Impact of Regulatory Changes on Financial Markets

– Investigate how regulatory changes affect market behavior and investor sentiment.

20. Sovereign Debt Crisis Analysis

– Study historical sovereign debt crises and their implications for financial markets.

21. Private Equity Investment Strategies and Returns

– Analyze private equity investment strategies and their potential returns.

22. Market Microstructure and Order Flow Analysis

– Explore the structure of financial markets and analyze order flow data.

23. Role of Credit Rating Agencies in Financial Markets

– Investigate the influence of credit rating agencies on investor decisions.

24. Impact of Earnings Announcements on Stock Prices

– Analyze how corporate earnings announcements affect stock prices and trading volume.

25. Financial Market Efficiency and Anomalies

– Study market efficiency theories and anomalies like the January effect or the small-cap effect.

25 Auditing and Internal Controls Project Topics

1. The Effectiveness of Internal Controls in Fraud Prevention

– Investigate how well internal controls can prevent fraudulent activities within organizations.

2. Auditing the Cybersecurity Measures in Financial Institutions

– Analyze the cybersecurity measures in financial institutions and assess their adequacy from an audit perspective.

3. Internal Audit’s Role in Corporate Governance

– Explore the contribution of internal audit in maintaining and improving corporate governance.

4. Evaluating the Impact of Data Analytics in Auditing

– Investigate how data analytics tools and techniques are transforming the audit process.

5. Assessing the Internal Control Systems of Small and Medium-sized Enterprises (SMEs)

– Study the effectiveness of internal controls in SMEs compared to larger organizations.

6. Auditing the Supply Chain: Risks and Controls

– Examine the risks associated with supply chain management and the controls needed to mitigate them.

7. The Role of Forensic Accounting in Detecting Financial Fraud

– Explore the techniques and methodologies of forensic accounting in fraud detection.

8. Compliance Audit: A Case Study on a Specific Industry

– Choose a particular industry and conduct a compliance audit to assess adherence to relevant regulations.

9. The Impact of Internal Audit on Organizational Performance

– Investigate how internal audit activities contribute to the overall performance of organizations.

10. Audit of Non-profit Organizations: Challenges and Best Practices

– Analyze the unique challenges faced by auditors when dealing with non-profit organizations.

11. Auditing Environmental, Social, and Governance (ESG) Practices

– Evaluate the integration of ESG factors in auditing and assess their impact on financial reporting.

12. IT Audit and Information Security

– Explore the intersection of IT audit and information security to ensure data protection and privacy.

13. Auditing in the Healthcare Industry

– Investigate the specific challenges and requirements of auditing in the healthcare sector.

14. Whistleblower Programs and Their Role in Enhancing Internal Controls

– Analyze the effectiveness of whistleblower programs in identifying internal control weaknesses.

15. Auditing in the Public Sector

– Examine the unique aspects of auditing in government agencies and public-sector organizations.

16. Auditing the Procurement Process: A Case Study Approach

– Choose a specific organization and audit its procurement process to identify vulnerabilities.

17. The Role of Audit Committees in Strengthening Internal Controls

– Investigate how audit committees contribute to enhancing internal controls within organizations.

18. Auditing Ethical Practices and Corporate Social Responsibility (CSR)

– Assess how ethical practices and CSR initiatives are audited and reported.

19. The Use of Artificial Intelligence (AI) in Auditing

– Explore the applications and challenges of AI in the audit process.

20. Auditor Independence and Objectivity

– Investigate the importance of auditor independence in maintaining objectivity during audits.

21. Auditing in a Global Context: International Standards and Challenges

– Analyze the challenges and opportunities of auditing in a globalized business environment.

22. Auditing Tax Compliance

– Explore the role of auditors in ensuring compliance with tax regulations.

23. Internal Controls in Financial Institutions: A Comparative Study

– Compare and contrast the internal control systems of different financial institutions.

24. Fraudulent Financial Reporting: Detection and Prevention

– Investigate the methods and tools for detecting and preventing fraudulent financial reporting.

25. Auditor Liability and Legal Issues

– Examine the legal implications and liabilities associated with auditing practices.

25 Taxation Project Topics

- The Impact of Recent Tax Reforms on Small Businesses.

- Analyzing the Effectiveness of Tax Incentives for Foreign Direct Investment.

- Tax Evasion and Its Economic Consequences: A Case Study.

- The Role of Transfer Pricing in International Taxation.

- Tax Compliance Behavior: A Behavioral Economics Approach.

- Evaluating the Impact of Tax Credits on Renewable Energy Adoption.

- Taxation and Income Inequality: A Cross-Country Analysis.

- The Effect of the Digital Economy on Taxation: Challenges and Solutions.

- Taxation of Cryptocurrency Transactions: Emerging Issues.

- Comparative Analysis of Value Added Tax (VAT) Systems Worldwide.

- Taxation of E-commerce Transactions: Jurisdictional Challenges.

- The Role of Tax Policy in Promoting Sustainable Business Practices.

- Taxation and Foreign Investment: Case Study of a Developing Economy.

- Taxation and Wealth Redistribution: Pros and Cons.

- Taxation of Multinational Corporations: Transfer Pricing Strategies.

- Taxation of Real Estate Transactions: Impact on Property Markets.

- Taxation and Economic Growth: A Longitudinal Analysis.

- Taxation of the Gig Economy: Implications for Tax Collection.

- Taxation of High-Income Earners: Progressive vs. Flat Tax Systems.

- Tax Compliance Costs for Small Businesses: An Empirical Study.

- Taxation and Charitable Giving: Incentives and Behavior.

- Tax Havens and Their Impact on Global Taxation Systems.

- Environmental Taxes and Their Role in Promoting Sustainability.

- Taxation of Cross-Border Investments: Double Taxation Agreements.

- Taxation and Innovation: Incentives for Research and Development.

25 Sustainability and Corporate Social Responsibility (CSR) Project Topics

- Assessing the Impact of Sustainable Practices on Profitability: Analyze how adopting sustainable initiatives affects a company’s bottom line.

- Measuring the Effectiveness of CSR Programs: Evaluate the outcomes and benefits of various CSR programs implemented by companies.

- Environmental Reporting and Disclosure: Investigate the transparency of companies in disclosing their environmental performance in annual reports.

- Stakeholder Engagement in CSR: Study how companies engage with stakeholders in developing and implementing CSR strategies.

- Sustainable Supply Chain Management: Assess the integration of sustainability practices in supply chain management and its impact on overall sustainability.

- Sustainability Reporting Frameworks: Compare and contrast different sustainability reporting frameworks like GRI, SASB, and IIRC.

- Impact of Sustainable Investing on Financial Markets: Analyze how sustainable investing and ESG criteria influence stock market performance.

- Sustainable Procurement Strategies: Examine how organizations can promote sustainability by implementing eco-friendly procurement practices.

- CSR in the Pharmaceutical Industry: Investigate CSR initiatives in the pharmaceutical sector, especially related to drug pricing and access to medicines.

- Renewable Energy Investment and CSR: Analyze how companies’ investments in renewable energy sources contribute to CSR and sustainability goals.

- Employee Engagement and Sustainability: Study the role of employees in driving sustainability initiatives within organizations.

- CSR and Consumer Behavior: Explore how consumers’ purchasing decisions are influenced by a company’s CSR efforts.

- Sustainable Tourism and its Economic Impact: Investigate the economic effects of sustainable tourism practices in a specific region.

- Sustainability in the Fashion Industry: Analyze the efforts of fashion brands to adopt sustainable practices in manufacturing and sourcing.

- CSR in Emerging Markets: Examine CSR practices in emerging economies and their unique challenges and opportunities.

- Sustainable Agriculture and Food Security: Study the relationship between sustainable agriculture practices and food security in a given area.

- Circular Economy Strategies: Evaluate how companies are implementing circular economy principles to reduce waste and enhance sustainability.

- CSR and Ethical Leadership: Investigate the role of ethical leadership in promoting CSR within organizations.

- Carbon Footprint Reduction Strategies: Analyze different strategies employed by companies to reduce their carbon footprint.

- CSR and Disaster Relief: Study the CSR initiatives of companies involved in disaster relief efforts and humanitarian aid.

- Social Impact Assessment of CSR Projects: Evaluate the social impact of specific CSR projects, such as community development programs or education initiatives.

- Sustainability and Green Building Practices: Examine the adoption of green building practices in the construction industry.

- CSR and Gender Equality: Investigate how companies are promoting gender equality through CSR programs and policies.

- Water Resource Management and CSR: Analyze the role of companies in sustainable water resource management and conservation.

- CSR and Small-to-Medium Enterprises (SMEs): Study the challenges and benefits of CSR adoption for SMEs and its impact on their competitiveness.

25 Financial Technology (FinTech) Project Topics

- Blockchain Technology and Its Impact on Financial Transactions

- The Rise of Cryptocurrencies: Analyzing Market Trends and Investment Strategies

- Exploring the Role of Artificial Intelligence in FinTech Applications

- Evaluating the Regulatory Challenges of Peer-to-Peer Lending Platforms

- Robo-Advisors: Revolutionizing Financial Advisory Services

- Cryptocurrency Adoption in Developing Economies: Opportunities and Challenges

- The Use of Big Data Analytics in Credit Scoring and Risk Assessment

- Security and Privacy Concerns in Mobile Payment Systems

- The Evolution of Digital Banking and Its Effects on Traditional Banking

- Decentralized Finance (DeFi): A Comprehensive Analysis

- Smart Contracts in FinTech: Applications and Implications

- FinTech and Financial Inclusion: Bridging the Gap for the Unbanked

- The Role of FinTech Startups in Shaping the Financial Services Industry

- Digital Wallets and Their Impact on Payment Ecosystems

- Tokenization of Assets: Transforming Traditional Investments

- The Future of Central Bank Digital Currencies (CBDCs)

- Cross-Border Payments and the Role of FinTech in Reducing Transaction Costs

- RegTech (Regulatory Technology): Enhancing Compliance in Financial Institutions

- Biometrics and Identity Verification in FinTech Applications

- Cybersecurity Challenges in the FinTech Sector: Threats and Mitigation Strategies

- The Gig Economy and FinTech: Financial Services for Freelancers

- FinTech and Sustainable Finance: Promoting ESG Investments

- NFTs (Non-Fungible Tokens) and Their Use Cases in FinTech

- Open Banking and API Integration: Facilitating Innovation in Financial Services

- FinTech and InsurTech: Innovations in the Insurance Industry

25 International Finance Project Topics

- Exchange Rate Volatility and Its Impact on International Trade

- Determinants of Exchange Rates: A Comparative Study

- Currency Hedging Strategies in Multinational Corporations

- The Role of Central Banks in Exchange Rate Management

- Effects of Brexit on International Financial Markets

- Global Financial Crisis: Causes, Consequences, and Lessons Learned

- International Investment and Capital Flows

- The Eurozone Crisis : Causes and Implications

- Impact of Trade Wars on Global Financial Markets

- Emerging Markets and Foreign Direct Investment (FDI)

- Sovereign Debt Crises: Case Studies and Analysis

- Exchange Rate Regimes: Fixed vs. Floating

- The Role of International Financial Institutions (IMF, World Bank)

- Globalization and Financial Integration

- The Asian Financial Crisis: Causes and Recovery

- Foreign Exchange Market Manipulation: Scandals and Regulatory Responses

- Comparative Analysis of International Banking Regulations

- The Influence of Political Risk on International Investments

- International Portfolio Diversification Strategies

- The Impact of Global Economic Trends on International Finance

- Cross-Border Mergers and Acquisitions: Challenges and Opportunities

- Financial Contagion: Spillover Effects in Global Markets

- The Role of Multinational Corporations in Global Finance

- Global Capital Markets and Access to Financing for Developing Countries

- Environmental, Social, and Governance (ESG) Factors in International Investment Decisions

How to Craft the Perfect Accounting and Finance Project

| Step | Action | Description |

| 1 | Choose a Relevant Topic | Select a topic aligned with your interests and objectives. |

| 2 | Define Clear Objectives | Clearly state what you aim to achieve with your project. |

| 3 | Conduct Literature Review | Research existing studies to build on prior knowledge. |

| 4 | Formulate Research Questions | Develop specific questions your project will answer. |

| 5 | Gather Data | Collect relevant data from reputable sources. |

| 6 | Analyze Data | Apply appropriate statistical or analytical techniques. |

| 7 | Interpret Findings | Explain the implications of your data analysis. |

| 8 | Write a Clear Proposal | Detail your project plan, methodology, and timeline. |

| 9 | Seek Feedback | Share your proposal with mentors or advisors for input. |

| 10 | Refine and Finalize | Make necessary adjustments based on feedback. |

| 11 | Execute the Project | Collect and analyze data according to your plan. |

| 12 | Document Your Work | Keep thorough records of your research process. |

| 13 | Draw Conclusions | Summarize the findings and how they answer your questions. |

| 14 | Create Visuals | Prepare charts, graphs, and tables to illustrate results. |

| 15 | Write a Clear Report | Structure your report logically with proper citations. |

| 16 | Proofread and Edit | Ensure your report is free from errors and inconsistencies. |

| 17 | Seek Peer Review | Have colleagues review your work for constructive feedback. |

| 18 | Prepare a Presentation | Create a compelling presentation to communicate your findings. |

| 19 | Practice Presentation | Rehearse to convey your research effectively. |

| 20 | Present Your Project | Deliver a confident and engaging presentation. |

| 21 | Respond to Questions | Address queries from the audience with clarity. |

| 22 | Reflect and Learn | Evaluate your project experience for future improvements. |

To wrap things up, let’s talk about why picking the right project topic in accounting and finance is super important. It’s like choosing the right path for a big adventure. Your project topic sets the direction for your research journey, affecting everything you do.

A good topic isn’t just something you like; it makes your research better. It gives your work meaning, not just for you but also for others who care about accounting and finance.

Plus, your project can boost your career. It makes you an expert in a specific area, which employers love. Having deep knowledge from your project can open doors to exciting job opportunities.

Related Posts

Online gambling is becoming popular with college students.

Best Ever Topic for Accounting Research Paper

189+ Best Accounting Project Topics And Materials For Students

Are you wondering about cool projects to explore in the world of numbers and money? Well, buckle up because we’re about to dive into an awesome list of Accounting Project Topics And Materials designed just for you!

You might be thinking, ‘What’s so exciting about accounting?’ Trust me, it’s not just about counting coins. These topics are like treasure chests filled with fascinating ideas. From learning how businesses handle their cash to uncovering the secrets behind financial statements, taxation, and even catching financial fraudsters—there’s a whole bunch of interesting stuff waiting for you.

Think of these topics as your ticket to understanding how money moves in the business world. Ever wondered how companies figure out what to spend and where to save? Or how do they make sure everything adds up correctly? Well, these projects will give you a sneak peek into those secrets.

So, get ready to explore, learn, and become the next financially proficient youth with these awesome Accounting Project Topics And Materials! Let’s get started on this money-making adventure together!

Must Know: Insurance Project Ideas

Table of Contents

What Are The Best Accounting Project Topics?

Selecting the finest Accounting Project Topics involves thoughtful consideration of subjects that open doors to comprehensive learning experiences. These topics are carefully curated to offer students engaging insights into the intricate world of finance and accounting. Ranging from dissecting financial statements and understanding taxation principles to exploring the nuances of cost accounting and auditing practices, these topics serve as pathways to comprehend essential financial management concepts.

They aim not only to broaden students’ horizons but also to instill practical skills and analytical thinking crucial for navigating the complexities of the accounting domain. The best Accounting Project Topics and materials are those that serve as bridges between theoretical knowledge and practical application. They act as catalysts for deeper understanding by immersing students in topics such as ethics in accounting, international standards, risk management strategies, and the integration of technology in modern accounting systems.

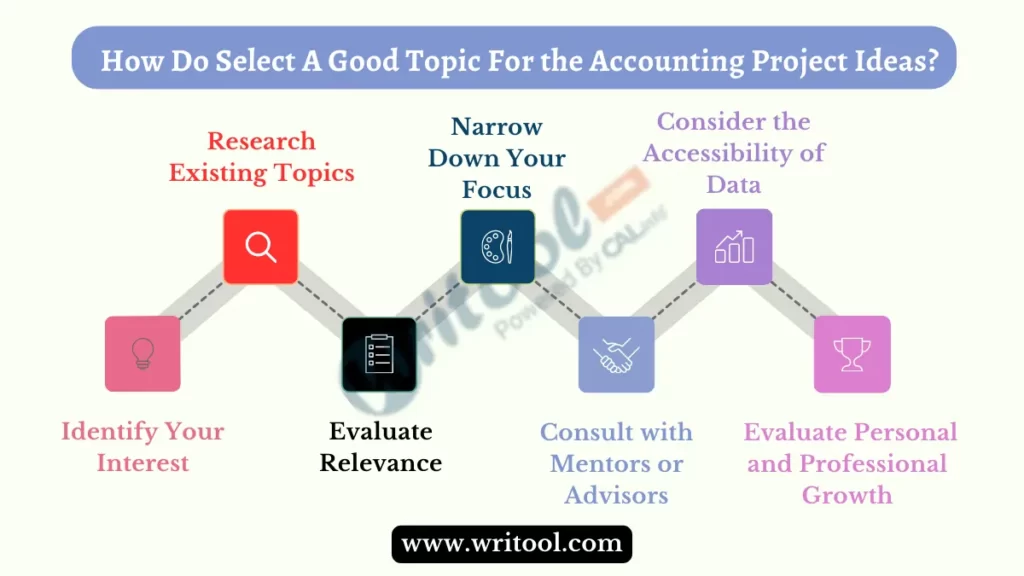

How Do You Select A Very Good Topic For Your Graduation Project In The Accounting Section?

Here are 7 easy steps to help you choose an excellent topic for your graduation project in the accounting section:

1. Identify Your Interests

Start by listing areas of accounting that captivate your attention. Whether it’s auditing, taxation, financial analysis, or cost accounting, understanding your interests will guide you toward a topic that keeps you engaged throughout your project.

2. Research Existing Topics

Explore various resources like textbooks, journals, online databases, and academic websites to discover existing topics in accounting. This can inspire new ideas or help you refine existing ones by understanding what has been previously studied.

3. Evaluate Relevance

Consider the relevance and significance of potential topics. Ensure the chosen subject aligns with current trends, addresses practical issues, or offers solutions to existing problems in the accounting field.

4. Narrow Down Your Focus

Once you have a list of potential topics, narrow it down based on feasibility, resources available, and the scope of your project. Aim for a specific aspect within a broader topic to maintain focus and depth.

5. Consult with Mentors or Advisors

Seek guidance from professors, mentors, or advisors. Discuss your ideas with them to receive valuable insights, suggestions, and feedback. Their expertise can help you refine your topic and ensure its academic viability.

6. Consider the Accessibility of Data

Ensure that you can access the necessary data and resources to support your research. A feasible project topic should have readily available information for analysis and study.

7. Evaluate Personal and Professional Growth

Lastly, reflect on how the chosen topic aligns with your academic and career goals. Consider how researching this topic might contribute to your knowledge, skills, and future aspirations in the field of accounting.

List of 189+ Best Accounting Project Topics And Materials For Students

These topics cover various areas within accounting and can be further developed into project proposals or research papers:

Good Financial Accounting Project Topics And Materials

- Impact of Financial Reporting Quality on Investment Decisions

- Evaluation of Accounting Conservatism in Financial Statements

- Adoption and Implementation of International Accounting Standards in Developing Countries

- Assessing the Effectiveness of Accounting Information in Stock Market Predictions

- Corporate Disclosure Practices and Investor Confidence

- Financial Statement Analysis of Multinational Corporations

- Accounting for Leases under IFRS 16 vs. ASC 842: A Comparative Analysis

- Accounting for Intangible Assets: Valuation and Reporting Issues

- Financial Reporting and Corporate Social Responsibility (CSR) Disclosures

- The Role of Accounting in Mergers and Acquisitions

Recent Managerial Accounting Project Topics And Materials

- Throughput Accounting: Theory and Practical Application in Manufacturing

- Target Costing in New Product Development: Case Studies in Different Industries

- Performance Measurement Systems in Service Industries

- Cost Management Techniques in Healthcare Organizations

- Transfer Pricing Strategies and Their Impact on Multinational Corporations

- Strategic Cost Analysis for Decision-Making in Competitive Markets

- Environmental Management Accounting Practices in Sustainable Businesses

- Activity-Based Budgeting: Implementation Challenges and Benefits

- Cost Allocation Methods and Their Effect on Profitability Analysis

- Management Accounting Techniques for Non-Profit Organizations

Auditing and Assurance

- Audit Committee Effectiveness and its Impact on Financial Reporting Quality

- Role of Big Data Analytics in Auditing Procedures

- Auditor Liability: Legal and Ethical Implications

- The Impact of Corporate Governance on External Audit Quality

- Auditing in the Era of Industry 4.0: IoT, AI, and Automation

- Forensic Audit Techniques in Fraud Detection and Prevention

- Internal vs. External Audits: Comparative Analysis and Advantages

- The Evolution of Audit Reports: Past, Present, and Future Trends

- Assessing Audit Risk in Complex Business Environments

- Continuous Auditing and its Application in Contemporary Businesses

Taxation And Accounting Project Topics And Materials

- Tax Compliance and Ethics: A Comparative Study Across Countries

- Taxation Policies and Economic Development: Lessons from Emerging Markets

- Tax Incentives and Investment Decisions in Developing Economies

- Taxation of E-commerce Transactions: Challenges and Opportunities

- Tax Implications of Cryptocurrency Transactions

- Environmental Taxation and its Role in Sustainable Development

- Tax Planning Strategies for High-Net-Worth Individuals

- Tax Reform Proposals and Their Socioeconomic Impact

- Taxation of Multinational Corporations: Transfer Pricing Issues

- Tax Treaties and their Influence on International Business Transactions

Forensic Accounting

- Corporate Governance and Fraudulent Financial Reporting

- Cybersecurity Risks in Financial Systems and Forensic Countermeasures

- Whistleblowing Policies and Their Role in Fraud Detection

- Digital Forensics and Investigation Techniques in Financial Crimes

- The Use of Artificial Intelligence in Forensic Accounting

- Investigating Embezzlement and Financial Misconduct in Organizations

- The Role of Forensic Accountants in Dispute Resolution

- Money Laundering: Detection and Prevention Strategies

- Forensic Accounting Techniques in Bankruptcy Cases

- Ethical Dilemmas and Challenges in Forensic Accounting Investigations

Accounting Information Systems

- ERP Systems Implementation and its Impact on Accounting Processes

- Cloud Computing in Accounting Information Systems

- Data Analytics in AIS: Enhancing Decision-Making Processes

- Information Security in Accounting Information Systems

- Blockchain Technology in Financial Reporting and Auditing

- AIS and Corporate Governance: Ensuring Data Integrity and Security

- AI-Powered Predictive Analytics in Financial Reporting

- The Evolution of AIS and its Future Trends

- AIS in Small and Medium-sized Enterprises (SMEs): Challenges and Opportunities

- Mobile Accounting Applications: Advantages and Risks

Easy Ethics in Accounting Project Topics And Materials

- Professional Ethics in Accounting: Codes and Practices

- Ethical Leadership and its Impact on Financial Reporting Integrity

- Conflicts of Interest in Accounting: Analysis and Mitigation Strategies

- Corporate Social Responsibility (CSR) and Ethical Accounting Practices

- Ethical Decision-Making in Accounting: Case Studies

- The Role of Ethics in Accounting Education and Professional Development

- Whistleblowing and Ethical Dilemmas in Accounting Firms

- Ethical Challenges in Tax Planning and Compliance

- Gender Diversity in Accounting and Ethical Implications

- Ethical Issues Surrounding Creative Accounting Practices

Accounting for Specific Industries

- Hospitality Industry Accounting Practices and Challenges

- Accounting in the Pharmaceutical Industry: Regulations and Reporting Standards

- Accounting for Government and Non-Governmental Organizations (NGOs)

- Agricultural Accounting: Challenges and Solutions

- Financial Reporting in the Entertainment Industry

- Real Estate Accounting and Property Management

- Healthcare Accounting: Revenue Recognition and Cost Control

- Accounting Practices in the Fashion and Retail Industry

- Aviation Industry Accounting: Revenue Management and Cost Analysis

- Accounting for the Energy Sector: Challenges and Environmental Reporting

Financial Regulation and Compliance

- Dodd-Frank Act and its Impact on Financial Reporting

- Basel Accords and their Influence on Banking Regulations

- Financial Regulatory Reforms post-Global Financial Crisis

- Compliance with Anti-Money Laundering (AML) Regulations in Financial Institutions

- Role of Central Banks in Ensuring Financial Stability

- Regulatory Challenges in Fintech and Digital Banking

- Insider Trading Regulations: Case Studies and Implications

- Credit Risk Management and Regulatory Compliance

- Corporate Governance Regulations and Financial Performance

- Regulatory Changes and Their Effects on Financial Markets

International Accounting Project Topics And Materials

- International Tax Planning Strategies for Multinational Corporations

- Cross-Border Mergers and Acquisitions: Accounting and Reporting Challenges

- Harmonization of Accounting Standards: Achievements and Challenges

- The Impact of Globalization on Accounting Practices

- International Financial Reporting Standards (IFRS) and US GAAP Convergence

- Comparative Analysis of Accounting Systems in Different Countries

- Challenges of Foreign Currency Translation in International Accounting

- International Accounting and Reporting in Developing Economies

- Accounting Harmonization in the European Union

- Cultural Influences on Accounting Practices in Global Businesses

Accounting Education and Profession

- Pedagogical Techniques in Teaching Accounting to Students

- The Role of Technology in Accounting Education

- Accounting Skills and Competencies for Future Professionals

- Continuous Professional Development in Accounting: Challenges and Solutions

- The Influence of Internships on Accounting Students’ Career Choices

- Gender Disparity in the Accounting Profession

- Accounting Accreditation and its Impact on Education Quality

- Ethics Education in Accounting Programs: Curricular Design and Effectiveness

- The Future of Accounting: Emerging Roles and Career Prospects

- Professional Certifications in Accounting: Benefits and Challenges

Financial Management and Analysis

- Working Capital Management Strategies and Firm Performance

- Capital Budgeting Techniques in Investment Decision-Making

- Financial Risk Management in Global Corporations

- Corporate Restructuring and Financial Performance

- Merger and Acquisition Valuation Methods

- Dividend Policy and its Impact on Shareholder Wealth

- Initial Public Offerings (IPOs) and Stock Market Performance

- Corporate Cash Holdings and Firm Value

- Behavioral Finance: Biases in Investment Decision-Making

- Corporate Governance and Financial Distress Prediction Models

Accounting for Non-Profit Organizations

- Financial Sustainability of Non-Profit Organizations

- Donor Stewardship and Financial Accountability in NGOs

- Fund Accounting and Grant Management in Non-Profit Entities

- Performance Measurement in Non-Profit Organizations

- Budgeting and Financial Planning in Non-Profit Sector

- Reporting Requirements for Non-Profit Entities

- Fundraising Strategies and Financial Reporting for Non-Profits

- Volunteer Services and their Valuation in Non-Profit Accounting

- Compliance and Governance Challenges for Non-Profit Organizations

- Impact Assessment and Reporting in Non-Profit Sector

Accounting for Small Businesses and Startups

- Accounting Practices for Small Business Sustainability

- Financial Reporting Challenges for Small Businesses

- Start-up Financing Options and Accounting Implications

- Cash Flow Management in Small Businesses

- Tax Planning Strategies for Small and Medium-sized Enterprises (SMEs)

- Accounting Software for Small Business: Selection and Implementation

- Financial Decision-Making in Startup Ventures

- Accounting for Intellectual Property in Startups

- Challenges of Financial Management in Growing Small Businesses

- Cost Accounting for Small-Scale Manufacturing Units

Accounting in Developing Economies

- Accounting Infrastructure in Developing Countries

- Challenges of Implementing International Accounting Standards in Developing Economies

- Corporate Governance in Emerging Markets

- Accounting for Microfinance Institutions in Developing Nations

- Public Sector Accounting Reforms in Developing Economies

- Financial Reporting Challenges in Less-Developed Countries

- Role of Informal Economies in Accounting Practices

- Accounting for Poverty Alleviation Programs

- Challenges of Taxation in Developing Nations

- Accounting Education in Developing Economies

Environmental Accounting Project Topics And Materials

- Environmental Accounting Standards and Reporting Frameworks

- Carbon Accounting and Emission Trading

- Environmental Cost Accounting: Measurement and Reporting

- Social and Environmental Responsibility Reporting by Corporations

- Ecological Footprint Accounting in Organizations

- Sustainability Reporting and Triple Bottom Line Accounting

- Environmental Management Accounting for Business Decision-Making

- Green Accounting: Benefits and Implementation Challenges

- Renewable Energy Accounting and Financial Reporting

- Environmental Auditing and Compliance Reporting

Accounting and Technology

- Accounting Automation and its Effects on Employment

- Robotic Process Automation in Accounting and Finance

- Accounting Information Systems Integration with AI and Machine Learning

- Cybersecurity Measures in Accounting Information Systems

- Cloud-Based Accounting Solutions: Advantages and Risks

- Big Data Analytics in Accounting: Applications and Limitations

- Role of Blockchain in Accounting and Financial Transactions

- Mobile Applications for Personal Financial Management

- AI-powered Financial Planning and Analysis Tools

- Digital Transformation in Accounting Firms

Accounting and Social Issues

- Impact Investing and Social Accounting

- Gender Pay Gap Reporting and its Financial Implications

- Diversity and Inclusion Reporting in Corporate Financial Statements

- Corporate Philanthropy Reporting and its Effect on Stakeholders

- Income Inequality and its Reflection in Financial Reporting

- Human Rights and Corporate Accountability Reporting

- Social Impact Measurement in Financial Reporting

- Corporate Ethics and Social Responsibility Reporting

- Accounting for Sustainable Development Goals (SDGs)

- Fair Trade Accounting and Reporting

Accounting in Specific Geographic Regions

- Accounting Practices in Asia-Pacific Countries

- Accounting Standards and Regulations in Latin America

- Accounting Challenges in African Nations

- European Union Accounting Harmonization and its Implications

- North American Accounting Regulations and Practices

- Accounting Differences in Middle Eastern Countries

- Accounting Reforms and Practices in BRICS Nations

- Accounting Challenges in Post-Soviet Bloc Countries

- Accounting Practices in Pacific Island Nations

- Comparative Analysis of Accounting Systems in Developed vs. Developing Nations

Accounting and Governance

- Corporate Governance Mechanisms and Financial Reporting Quality

- Board Diversity and Financial Performance of Companies

- Shareholder Activism and Corporate Governance

- Corporate Social Responsibility and Board Oversight

- Governance Mechanisms in Family-Owned Businesses

- Executive Compensation and Corporate Governance

- Role of Auditors in Corporate Governance

- Governmental Influence on Corporate Governance Practices

- Whistleblowing Policies and Corporate Governance

- Stakeholder Theory and Corporate Governance

Best Accounting Project Materials For Students

Here, we give various types of educational, professional, and other materials commonly used in the field of accounting, including some examples and potential categories.

1. Educational Materials

Textbooks play a crucial role in accounting education, covering fundamental concepts to specialized areas. Here’s a table showcasing some popular accounting textbooks:

| Textbook Title | Author(s) | Description |

|---|---|---|

| “Financial Accounting: Tools for Business Decision Making” | Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso | Covers basic principles of financial accounting with real-world examples. |

| “Cost Accounting: A Managerial Emphasis” | Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan | Focuses on cost management, cost analysis, and decision-making for managers. |

| “Auditing and Assurance Services” | Alvin A. Arens, Randal J. Elder, Mark S. Beasley | Covers auditing concepts, standards, and practices in assurance services. |

Online Courses

Online platforms offer a variety of accounting courses. Here are examples from different levels:

| Platform | Course Title | Description |

|---|---|---|

| Coursera | “Financial Accounting Fundamentals” | A beginner-level course covering basic accounting principles. |

| Udemy | “Intermediate Accounting: Advanced Topics” | An intermediate course focusing on complex accounting topics. |

| LinkedIn Learning | “ “ | Advanced-level course to prepare for the Certified Public Accountant (CPA) exam. |

Lecture Notes and Slides

Universities and colleges often provide lecture materials online. Here’s how a table might categorize these:

| Institution | Course Title | Description |

|---|---|---|

| Harvard University | “Financial Reporting” | Lecture slides and notes covering financial reporting standards and practices. |

| Stanford University | “Taxation Law” | Lecture materials discussing tax laws, regulations, and case studies in taxation. |

| MIT OpenCourseWare | “Managerial Accounting” | Lecture notes on managerial accounting, budgeting, and cost management. |

2. Professional Materials

Accounting standards and pronouncements.

Accounting standards issued by various bodies are crucial for professionals. Here’s a potential table layout:

| Standard Issuer | Standard Name | Description |

|---|---|---|

| International Accounting Standards Board (IASB) | IFRS 15: Revenue from Contracts with Customers | Provides guidelines on recognizing revenue from contracts with customers. |

| Financial Accounting Standards Board (FASB) | FASB ASC 606: Revenue Recognition | Guidance on revenue recognition principles across various industries. |

| Governmental Accounting Standards Board (GASB) | GASB Statement No. 34: Basic Financial Statements | Prescribes reporting standards for state and local governments. |

Journal Articles and Research Papers

Research papers and articles contribute to accounting knowledge. Here’s an example table structure:

| Title | Authors | Publication | Description |

|---|---|---|---|

| “The Impact of IFRS Adoption on Financial Reporting Quality” | John Smith, Emily Johnson | Journal of Accounting Research | Investigates the effects of IFRS adoption on financial reporting. |

| “Fraud Risk Factors and Auditors’ Response” | David Brown, Sarah Clark | Accounting Review | Analyzes fraud risk factors and auditor actions in response. |

Accounting software aids in managing financial tasks. A table could display different software options:

| Software Name | Developer | Description |

|---|---|---|

| QuickBooks | Intuit | Small business accounting software for bookkeeping and invoicing. |

| Xero | Xero Limited | Cloud-based accounting software for businesses of all sizes. |

| SAP ERP | SAP SE | Enterprise resource planning software integrating accounting modules. |

3. Other Materials

Calculators.

Financial calculators are essential tools in accounting. A simple table might look like this:

| Calculator Model | Manufacturer | Description |

|---|---|---|

| HP 12C Financial | HP | Popular financial calculator for time value of money calculations. |

| Texas Instruments BA II Plus | Texas Instruments | Common calculator for financial and statistical calculations. |