The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- Presentation and terminology

- Study resources

- Financial Reporting (FR)

- Technical articles and topic explainers

The International Accounting Standards Board (IASB) reissued IAS 1, Presentation of Financial Statements , in September 2007. The main changes are amendments to presentation and terminology.

The reissue of IAS 1 affected all ACCA exam papers which referred to ‘balance sheets’ or ‘cash flow statements’, as the revised standard changed the name of these to ‘statement of financial position’ and ‘statement of cash flows’ respectively.

For ALL international papers* (excluding CAT Papers 6 and 8, and ACCA Qualification Papers F3, F7, F8, P2, and P7): ‘Balance sheet’ became ‘statement of financial position (balance sheet)’ in the June 2008 and December 2008 exams. From the June 2009 exams onwards, ‘balance sheet’ became ‘statement of financial position’.

- ‘Cash flow statement’ became ‘statement of cash flows’ from the June 2008 exam sitting onwards.

Examiners may choose to use a single ‘statement of comprehensive income’ – see Table 1 .

For F3 (INT), F7 (INT), F8 (INT), P2 (INT), and P7 (INT): For exam purposes, the following applies to all companies, partnerships, and sole traders:

- ‘Balance sheet’ became ‘statement of financial position’ from the June 2008 exam sitting onwards.

Another amendment resulting from the reissue of IAS 1 was a requirement to present ‘other comprehensive income’ items (such as revaluation gains and losses, and actuarial gains and losses), as well as the usual income statement items, on the face of the primary financial statements. IAS 1 allows this information to be presented in one ‘statement of comprehensive income’ (see Table 1), or in two separate statements; an ‘income statement’ and a ‘statement of comprehensive income’.

In an exam, whenever a ‘statement of comprehensive income’ is referred to, this always relates to the single statement format (see Table 1). (Please refer to the Study Guides for examinability of line items.)

If ‘income statements’ are referred to, this relates to the statement from ‘revenue’ to ‘profit for the year’ (see Table 1 (part a)).

Exams may also refer to the ‘other comprehensive income section’ of the ‘statement of comprehensive income’ (see Table 1 (part b) (similar to the previous ‘statement of recognised income and expense’ (SORIE)).

Law and tax variant papers Law and tax variant papers continue to use the relevant local terminology. However, Paper F4 (GLO) will adopt the international format, where relevant.

Related Links

- Student Accountant hub page

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

INTRODUCTION TO ACCOUNTING

Nov 12, 2014

17.33k likes | 38.85k Views

INTRODUCTION TO ACCOUNTING. Definition of Accounting. Accounting is a system of dealing with financial information that provides information for decision-making. Accounting vs. Bookkeeping . ACCOUNTING The process of recording, analyzing, and interpreting the economic activities of a business

Share Presentation

- current assets

- current liabilities

- fundamental accounting equation

- total current assets 215

Presentation Transcript

Definition of Accounting • Accounting is a system of dealing with financial information that provides information for decision-making

Accounting vs. Bookkeeping ACCOUNTING • The process of recording, analyzing, and interpreting the economic activities of a business BOOKKEEPING • A method of recording all transactions for a business in a specific format

Why is Accounting Important • Accountability • People who handle cash in the company are responsible for it • Budgeting • This allows businesses to estimate its future sales and expenses • Taxation • Records must be kept in order to pay taxes

Why is Accounting Important • Financial Statements • These are reports that summarize the financial performance of a business • These reports indicate the business’s economic health • Annual Reports • Financial statements are presented to shareholders and potential investors in the form of annual reports

An Information System What financial questions might you have about your business? • Is the business earning profit? • Are selling prices to high/low? • How much does ABC company owe me? • What is the value of my inventory? • How much did John Smith earn last year? • Do we have enough money to pay our bills?

An Information System Who else may want financial information about the business? • Government • Bankers • Lenders • Potential Investor • A Lawyer

OWNING A BUSINESS If you decide to operate your own business you will find yourself facing such accounting tasks as: • Banking • Payroll • Keeping track of amounts owed by and owed to customers • Keeping track of amounts owed to the government • Producing an income statement for income tax purposes

Categories of Accounting Work Routine Daily Activities • Processing Bills • Preparing Cheques • Daily Banking • Recording Transactions • Preparing Business Papers Periodic Accounting Activities (these activities occur at regular intervals) • Paycheques(bi-weekly) • Bank accounts (balanced monthly) • Financial reports (monthly, quarterly, yearly) • Income tax returns (yearly)

Categories of Accounting Work Miscellaneous Activities • Employee resignation • An advertisement is prepared • New capital equipment is purchased • A new loan • A new employee is hired

The Fundamental Accounting Equation • The fundamental accounting equation states that: ASSETS – LIABILITIES = OWNER’S EQUITY OR ASSETS = LIABILITIES + OWNER’S EQUITY

ASSETS • An asset is anything that the business owns that has value • What are some examples of personal assets? • House • Car • Cash • RRSP’s

LIABILITIES • A liability is anything that the business owes; any debts of the business • What are some examples of personal liabilities? • Credit Line • Mortgage • Owed to Parents • Credit cards

OWNER’S EQUITY • Owner’s Equity is also referred to as capital or net worth • It is the difference between the total assets and total liabilities of a business

PERSONAL NET WORTH Here is a list of my assets: • House • Car • Furniture • Cash in Bank • Savings • RRSP’s • Teachers Pension

PERSONAL NET WORTH Here is a list of my liabilities: • Mortgage • Credit card ( paid of every month, but still a potential liability) • Line of credit

PERSONAL NET WORTH • What do I need to do to calculate my net worth? • Take my total assets and subtract them from my total liabilities

PERSONAL NET WORTH • We can see how this looks by examining a Balance Sheet containing my personal assets, liabilities, and net worth

YOUR NET WORTH • Make a list of all of your assets and all of your liabilities • Calculate your total assets and your total liabilities • Now calculate your net worth (remember the fundamental accounting equation) • Make a new net worth statement for yourself for 10 years from now!

The Balance Sheet

BALANCE SHEET = a statement of financial position Liabilities (debts you owe) + Owners Equity (the owner’s share of the assets) Assets (Things owned) =

THE ACCOUNTING EQUATION • ASSETS = LIABILITIES + OWNERS EQUITY A=L+OE

BALANCE SHEET • A “freeze frame” or snapshot of what the business owns, owes and the owners invested interest. • A financial picture of the business at a point in time. • The balance sheet does not indicate whether a business has made a profit, only whether it is financially strong.

Features of the Balance Sheet • The Balance Sheet looks like the Fundamental Accounting Equation • A = L + OE • Assets are on the left side and the liabilities and owner’s equity are on the right side

Features of the Balance Sheet • A Three Line Heading is Used • WHO? – The name of the individual, business or other organization • WHAT? – The name of the financial statement (in this case the balance sheet) • WHEN? – The date on which the financial position is determined

What? WHO? – The name of the individual, business or other organization When?

CASH AND LIQUIDITY • Cash is arguably the MOST valuable asset of a business. • WHY?? • It can easily be exchanged for other assets • Liquidity – how easily an asset can be exchanged for any other asset or converted to cash.

ASSETS • Ownership (title- legal right to use) is separate from financing (source of funds used to purchase asset). • With ASSETS, an owner can: • Use • Sell • Give away • Leave to heirs • Whether bought for cash or on credit, the owner still has “title” to his/her property

CATEGORIZING ASSETS • Current Assets – things a business owns that disappear quickly, usually in less than one year. • Long-term Assets (Capital Assets or Fixed Assets) – assets that a business keeps for a long time.

ASSETS • In order of liquidity, assets include: • cash, bank balances, • accounts receivable (listed in alphabetical order), • inventory and supplies, and • furniture, equipment, fixtures, vehicles, property and buildings (listed in the order in which they will be used up).

ACCOUNTS RECEIVABLE • Customers of the business will often buy goods or services with the understanding that they will be paid for in the future • These debts owed represent a dollar value to the business, so the business has a right to include them among the assets on the balance sheet • Each of these customers that owes money to the business is one of its debtors

CURRENT ASSETS • Current Assets • Cash $ 50,000 • Accounts Receivable $ 30,000 • Inventory $120,000 • Supplies $ 15,000 • Total Current Assets $215,000 ORDER Of LIQUIDITY CLOSEST TO CASH FARTHEST FROM CASH

FIXED ASSETS • Fixed Assets • Land $ 200,000 • Building $ 1,100,000 • Equipment $ 950,000 • Furniture $ 225,000 • Vehicles $ 215,000 • Total Fixed Assets $ 2,690,000 IN ORDER OF REVERSE DEPRECIATION ONE THAT WILL BE AROUND THE LONGEST ONE THAT WILL BE AROUND THE LEAST AMOUNT OF TIME

LIABILITIES • Liabilities are the debts of a business. Businesses acquire debt in two main ways: 1) Accounts Payable – purchasing inventory and supplies on credit. 2) Loans Payable (Notes Payable) – acquired by borrowing money from investors, banks, etc.

CATEGORIZING LIABILITIES • Liabilities are listed in order of priority, or how quickly they need to be paid off. • Current Liabilities – debts such as invoices for merchandise inventory, that are paid off quickly. • Long-term Liabilities – debts such as a mortgage loan, that may not be repaid for decades.

ACCOUNTS PAYABLE • A business often purchases goods and services from its suppliers with the understanding that payment will be made later • These debts to suppliers represent a dollar obligation of the business, the business must include them among its liabilities • Each of the suppliers owed money by the business is one of its creditors

CURRENT LIABILITIES ORDER Of MATURITY* • Current Liabilities • Wages Payable $ 10,000 • Accounts Payable $ 80,000 • Other Liabilities $ 50,000 • Current Portion - Mortgage $ 15,000 • Total Current Liabilities $ 155,000 * Maturity – When a debt is “mature” it’s payment is due FIRST TO BE PAID LAST TO BE PAID

LONG TERM LIABILITIES • Long Term Liabilities • Vehicle Loans $ 150,000 • Equipment Loan $ 900,000 • Mortgage $ 850,000 • Total Long Term Liabilities $1,900,000 ORDER OF MATURITY* SHORTEST TERM LONGEST TERM

OWNER’S EQUITY ORDER SHOWN • Owner’s Equity • Owner’s Capital $ 750,000 • Plus: Net Income $ 150,000 • $ 900,000 • Less: Drawings ($ 50,000) • Total Owner’s Equity $ 850,000 CAPITAL +/(-) INCOME/ (LOSS) THEN SUBTOTAL SUBTRACT DRAWINGS AND THEN TOTAL

MEASURING SUCCESS WITH A BALANCE SHEET Working Capital = Current Assets – Current Liabilities • Working capital indicates a business’s ability to pay its short-term debts. • Working Capital has to be positive Current Ratio = Total Current Assets / Total Current Liabilities • Current Ratio shows how many dollars of liquid assets (cash or near cash) a business has for every dollar of short-term debt. • Current ratio has to be over 1.2

MEASURING SUCCESS WITH A BALANCE SHEET Total Debt to Total Asset Ratio = Short Term Debt + Long Term Debt/Total Assets • A metric used to measure a company's financial risk by determining how much of the company's assets have been financed by debt. Calculated by adding short-term and long-term debt and then dividing by the company's total assets.

Current Assets – Current Liabilities = (1150+2000+1400)-(1350)= 3200 Working Capital Current Ratio Current Assets/Current Liabilities = (1150+2000+1400)/(1350)= 3.37

The Income Statement

WHAT IS AN INCOME STATEMENT? • Remember: a Balance Sheet is a snapshot of a business on one day in time • An Income Statement shows what happens over a period of time in a business, it could be one month, six months, or a year • An Income Statement shows how much money a business made or lost over a period of time

THE INCOME STATEMENT • As a business operates it makes money from daily activities • Through these daily activities the business also accumulates expenses • What are some of the expenses of day to day operations for a business?

THE INCOME STATEMENT RECALL: • What is the difference between a cost and an expense? • Cost • Expense

Order of Entries on an Income Statement • Just like the Balance Sheet, the Income Statement has a three line heading: • Who? (the name of the business/individual) • What? (in this case, an Income Statement) • When? (period of time ending on a certain date)

The Income Statement • The sources of Revenue are listed next • These are listed in alphabetical order • Revenue (Sales or Income) is the money, or the promise of money, received from the sale of goods or services

- More by User

Accounting I: Introduction to University Accounting

Accounting I: Introduction to University Accounting . Susan Moore Accounting & Financial Services General Accounting. A genda. Introductions Course objectives Topics Accounting Concepts Fund Accounting Overview The Chart of Accounts Financial Reporting Questions and Answers.

1.62k views • 107 slides

INTRODUCTION TO ACCOUNTING. UNIT 1: Accounting Principles. TouchText. What IS a business Accounting Principles. Problems and Exercises. Next. Accounting “is for NERDS!”: So Which One Is The Accountant?. Dictionary. Take Notes. Back. Next. Business as “Money Machine”.

827 views • 22 slides

INTRODUCTION TO ACCOUNTING. UNIT 4: Posting to the Ledger. TouchText. Bala nces Accumulate Transactions Get Posted to the Ledger Examples of Postings End-of-Period Balances and Financial Statements. Problems and Exercises. Next. Transactions Amounts vs. Account Balances.

652 views • 24 slides

INTRODUCTION TO ACCOUNTING. UNIT 3: Accounting for Transactions. TouchText. The Journal: Double Entry Bookkeeping Examples: Accounting for Individual Transactions The Ledger: Account Balances Accumulate. Problems and Exercises. Next. Transactions: Starting a Business.

728 views • 28 slides

Introduction to Accounting

Introduction to Accounting. Written by Ruby Ann Sawyer, Brantley County Middle School. What is accounting?. the system of recording and summarizing financial transactions and analyzing, verifying, and reporting the results http://www.merriam-webster.com/dictionary/accounting.

515 views • 9 slides

Introduction to accounting

Introduction to accounting. Miss Savige. Overview. Any thing in RED write down in your books please . Learning Intentions. General understanding of accounting and the language of business Knowledge and understanding of the five types of account classification. Asset Liability Income

1.19k views • 67 slides

Introduction to Accounting. Chapter 1. What is Accounting?. A process or system of dealing with financial information that provides information for decision-making Is the business earning enough profit? Is the selling process appropriate? How much does the business owe to debtors?

700 views • 10 slides

Introduction to Accounting. 8 th grade Mrs. Stovall. What is accounting?. The system of recording and summarizing financial transactions and analyzing, verifying, and reporting the results http://www.merrian-webster.com/dictionary/accounting. Who uses accounting?. Everyone!

1.13k views • 15 slides

Introduction to Accounting . EMBA Summer 2007 ACCT 6322. Introduction to Accounting.

959 views • 57 slides

Introduction to Accounting. Purpose. To teach the basics of accounting to those students entering the MBA program at SSB who do not have any background in accounting.

3.24k views • 159 slides

Introduction to Accounting. Definitions of Accounting.

461 views • 20 slides

Introduction to Accounting. FINAL EXAM REVIEW Chapters 10,11,12, 13, 14, & 15. Standard Cost Card – Variable Production Cost. A standard cost card for one unit of product might look like this:. Standards vs. Budgets. A standard is the expected cost for one unit.

1.08k views • 93 slides

Introduction to Accounting. Chapter 1. Accountant. handles a broad range of responsibilities, makes business decisions, and prepares and interprets financial reports. Operate to earn money for their owners. For-profit business. McDonalds Target Best Buy Belk. Examples:.

755 views • 8 slides

Introduction to Accounting. Topic #1: General Accounting Information. Learning Goals and Success Criteria. Learning Goals: Describe the different parts of the accounting definition Explain why we study accounting Describe the different types of business ownership

573 views • 6 slides

Introduction To Accounting

Introduction To Accounting. MA ECONOMICS EXTERNAL COACHING CLASSES. MICRO ECONOMICS, STATISTICS & MACRO ECONOMICS. GUESS PAPERS AND NOTES ARE AVAILABLE 0322-3385752. JOIN KHALID AZIZ. ECONOMICS OF ICMAP, ICAP, MA-ECONOMICS, B.COM.

956 views • 32 slides

Introduction to Accounting. BAF3M. What is Accounting?. Class Discussion Are there any common misconceptions? What ISN’T Accounting?. What is Accounting?. A system that records the day to day financial activities of a business Summarizes information with Financial Statements

1.05k views • 19 slides

Introduction to Accounting. Activity Based Costing: A Tool to Aid Decision Making Session 10 February 7,2002. ABC is a good supplement to our traditional cost system. Activity Based Costing (ABC).

1.37k views • 71 slides

Introduction to Accounting. Standard Costing Session 31 February 21,2002. Agenda for Today. Discuss problems assigned and other practice problems Outline approaches to future problems. Unit cost standards. Specification of unit cost standards: Direct material sp × sq

429 views • 16 slides

Introduction to Accounting. What is accounting?. the system of recording and summarizing financial transactions and analyzing, verifying, and reporting the results http://www.merriam-webster.com/dictionary/accounting. Who uses accounting?. Everyone !

413 views • 10 slides

Introduction to Accounting. Introduction to Accounting.

860 views • 57 slides

Its related to basic concept of accounting

421 views • 14 slides

Introduction to Accounting. Agenda. Fundamental concepts The Accounting Cycle Financial statements Comprehensive example. Fundamental concepts. What is accounting? The language of business. A means to communicate financial information.

1.48k views • 126 slides

A commonly recognized set of rules and procedures governing corporate accounting and financial reporting

What is GAAP?

GAAP, or G enerally A ccepted A ccounting P rinciples, is a commonly recognized set of rules and procedures designed to govern corporate accounting and financial reporting in the United States (US). The US GAAP is a comprehensive set of accounting practices that were developed jointly by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB), so they are applied to governmental and non-profit accounting as well.

US securities law requires all publicly-traded companies , as well as any company that publicly releases financial statements, to follow the GAAP principles and procedures.

In addition, or as an alternative, are the International Financial Reporting Standards (IFRS) established by the International Accounting Standards Board (IASB). The IFRS rules govern accounting standards in the European Union, as well as in a number of countries in South America and Asia.

The Core GAAP Principles

GAAP is set forth in 10 primary principles, as follows:

- Principle of consistency: This principle ensures that consistent standards are followed in financial reporting from period to period.

- Principle of permanent methods: Closely related to the previous principle is that of consistent procedures and practices being applied in accounting and financial reporting to allow comparison .

- Principle of non- compensation : This principle states that all aspects of an organization’s performance, whether positive or negative, are to be reported. In other words, it should not compensate (offset) a debt with an asset.

- Principle of prudence : All reporting of financial data is to be factual, reasonable, and not speculative.

- Principle of regularity : This principle means that all accountants are to consistently abide by the GAAP.

- Principle of sincerity : Accountants should perform and report with basic honesty and accuracy.

- Principle of good faith : Similar to the previous principle, this principle asserts that anyone involved in financial reporting is expected to be acting honestly and in good faith.

- Principle of materiality : All financial reporting should clearly disclose the organization’s genuine financial position.

- Principle of continuity : This principle states that all asset valuations in financial reporting are based on the assumption that the business or other entity will continue to operate going forward.

- Principle of periodicity : This principle refers to entities abiding by commonly accepted financial reporting periods, such as quarterly or annually.

The Generally Accepted Accounting Principles further set out specific rules and principles governing such things as standardized currency units, cost and revenue recognition , financial statement format and presentation, and required disclosures. For example, it requires precise matching of expenses with revenues for the same accounting period (the matching principle ).

History of GAAP

Generally Accepted Accounting Principles were eventually established primarily as a response to the Stock Market Crash of 1929 and the subsequent Great Depression, which were believed to be at least partially caused by less than forthright financial reporting practices by some publicly-traded companies. The federal government began working with professional accounting groups to establish standards and practices for consistent and accurate financial reporting.

Generally Accepted Accounting Principles began to be established with legislation such as the Securities Act of 1933 and the Securities Exchange Act of 1934.

The GAAP has gradually evolved, based on established concepts and standards, as well as on best practices that have come to be commonly accepted across different industries.

Why is GAAP Important?

Generally Accepted Accounting Principles make financial reporting standardized and transparent, using commonly accepted terms, practices, and procedures. The consistency of presentation of financial reports that results from GAAP makes it easy for investors and other interested parties (such as a board of directors) to more easily comprehend financial statements and compare the financial statements of one company with those of another company.

GAAP also seeks to make non-profit and governmental entities more accountable by requiring them to clearly and honestly report their finances.

In short, GAAP is designed to ensure a consistent presentation of financial statements , making it easier for people to read and comprehend the information contained in the statements.

Applications in Financial Analysis

For financial analysts performing valuation work and financial modeling , it’s important to have a solid understanding of accounting principles. While this is important, financial models focus more on cash flow and economic value, which is not significantly impacted by accounting principles (other than for the calculation of cash taxes).

Alternatives to GAAP

GAAP is the set of standards and practices that are followed in the United States, but what about other countries? Outside the US, the alternative in most countries is the International Financial Reporting Standards (IFRS), which is regulated by the International Accounting Standards Board (IASB). While the two systems have different principles, rules, and guidelines, IFRS and GAAP have been working towards merging the two systems.

Additional Resources

Thank you for reading CFI’s guide to GAAP. To further your education, the following CFI resources will also be helpful:

- Accounting Ethics

- Audited Financial Statements

- Internal Controls

- Types of SEC Filings

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Presentation of Financial Statements (IAS 1)

Last updated: 17 May 2024

IAS 1 serves as the main standard that outlines the general requirements for presenting financial statements. It is applicable to ‘general purpose financial statements’, which are designed to meet the informational needs of users who cannot demand customised reports from an entity. Documents like management commentary or sustainability reports, which are often included in annual reports, fall outside the scope of IFRS, as indicated in IAS 1.13-14. Similarly, financial statements submitted to a court registry are not considered general purpose financial statements (see IAS 1.BC11-13).

The standard primarily focuses on annual financial statements, but its guidelines in IAS 1.15-35 also extend to interim financial reports (IAS 1.4). These guidelines address key elements such as fair presentation, compliance with IFRS, the going concern principle, the accrual basis of accounting, offsetting, materiality, and aggregation. For comprehensive guidance on interim reporting, please refer to IAS 34 .

Note that IAS 1 will be superseded by the upcoming IFRS 18 Presentation and Disclosure in Financial Statements .

Now, let’s explore the general requirements for presenting financial statements in greater detail.

Financial statements

Components of a complete set of financial statements.

Paragraph IAS 1.10 outlines the elements that make up a complete set of financial statements. Companies have the flexibility to use different titles for these documents, but each statement must be presented with equal prominence (IAS 1.11). The terminology used in IAS 1 is tailored for profit-oriented entities. However, not-for-profit organisations or entities without equity (as defined in IAS 32), may use alternative terminology for specific items in their financial statements (IAS 1.5-6).

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and if it turns out not to be right for you, you can unsubscribe with just one click.

Compliance with IFRS

Financial statements must include an explicit and unreserved statement of compliance with IFRS in the accompanying notes. This statement is only valid if the entity adheres to all the requirements of every IFRS standard (IAS 1.16). In many jurisdictions, such as the European Union, laws mandate compliance with a locally adopted version of IFRS.

IAS 1 does consider extremely rare situations where an entity might diverge from a specific IFRS requirement. Such a departure is permissible only if it prevents the presentation of misleading information that would conflict with the objectives of general-purpose financial reporting (IAS 1.20-22). Alternatively, entities can disclose the impact of such a departure in the notes, explaining how the statements would appear if the exception were made (IAS 1.23).

Identification of financial statements

The guidelines for identifying financial statements outlined in IAS 1.49-53 are straightforward and rarely cause issues in practice.

Going concern

The ‘going concern’ principle is a cornerstone of IFRS and other major GAAP. It assumes that an entity will continue to operate for the foreseeable future (at least 12 months). IAS 1 mandates management to assess whether the entity is a ‘going concern’. Should there be any material uncertainties regarding the entity’s future, these must be disclosed (IAS 1.25-26). IFRSs do not provide specific accounting principles for entities that are not going concerns, other than requiring disclosure of the accounting policies used. One of the possible approaches is to measure all assets and liabilities using their liquidation value.

See also this educational material at IFRS.org.

Materiality and aggregation

IAS 1.29-31 emphasise the importance of materiality in preparing user-friendly financial statements. While IFRS mandates numerous disclosures, entities should only include information that is material. This concept should be at the forefront when preparing financial statements, as reminders about materiality are seldom provided in other IFRS standards or publications.

Generally, entities should not offset assets against liabilities or income against expenses unless a specific IFRS standard allows or requires it. IAS 1.32-35 offer guidance on what can and cannot be offset. Offsetting of financial instruments is discussed further in IAS 32 .

Frequency of reporting

Entities are required to present a complete set of financial statements at least annually (IAS 1.36). However, some Public Interest Entities (PIEs) may be obliged to release financial statements more frequently, depending on local regulations. However, these are typically interim financial statements compiled under IAS 34 .

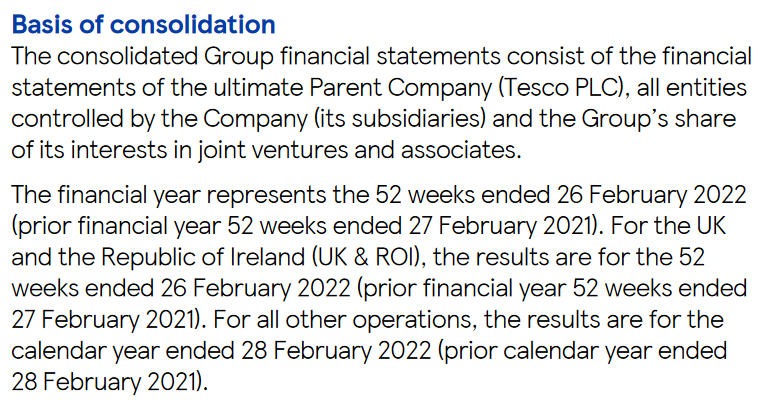

IAS 1 also allows for a 52-week reporting period instead of a calendar year (IAS 1.37). This excerpt from Tesco’s annual report serves to demonstrate this point, showing that the group uses 52-week periods for their financial year, even when some subsidiaries operate on a calendar-year basis:

If an entity changes its reporting period, it must clearly disclose this modification and provide the rationale for the change (IAS 1.36). It is advisable to include an explanatory note with comparative data that aligns with the new reporting period for clarity.

Comparative information

As a general guideline, entities should present comparative data for the prior period alongside all amounts reported for the current period, even when specific guidelines in a given IFRS do not require it. However, there’s no obligation to include narrative or descriptive information about the preceding period if it isn’t pertinent for understanding the current period (IAS 1.38).

If an entity opts to provide comparative data for more than the immediately preceding period, this additional information can be included in selected primary financial statements only. However, these additional comparative periods should also be detailed in the relevant accompanying notes (IAS 1.38C-38D).

IAS 1.40A-46 outlines how to present the statement of financial position when there are changes in accounting policies, retrospective restatements, or reclassifications. This entails producing a ‘third balance sheet’ at the start of the preceding period (which may differ from the earliest comparative period, if more than one is presented). Key points to note are:

- The third balance sheet is required only if there’s a material impact on the opening balance of the preceding period (IAS 1.40A(b)).

- If a third balance sheet is included, there’s no requirement to add a corresponding third column in the notes, although this could be useful where numbers have been altered by the change (IAS 1.40C).

- Interim financial statements do not require a third balance sheet (IAS 1.BC33).

IAS 8 also requires comprehensive disclosures concerning changes in accounting policies and corrections of errors .

Statement of financial position

IAS 1.54 enumerates the line items that must, at a minimum, appear in the statement of financial position. Entities should note that separate lines are not required for immaterial items (IAS 1.31). Additional line items can be added for entity-specific or industry-specific matters. IAS 1 permits the inclusion of subtotals, provided the criteria set out in IAS 1.55A are met.

Additional disclosure requirements are set out in IAS 1.77-80A. Of particular interest are the requirements pertaining to equity (IAS 1.79), which begin with the number of shares and extend to include details such as ‘rights, preferences, and restrictions relating to share capital, including restrictions on the distribution of dividends and the repayment of capital.’ While these kinds of limitations are common across various legal jurisdictions (for example, not all retained earnings can be distributed as dividends), many companies neglect to disclose such limitations in their financial statements.

For guidance on classifying assets and liabilities as either current or non-current, please refer to the separate page dedicated to this topic.

Statement of profit or loss and other comprehensive income

IAS 1 provides two methods for presenting profit or loss (P/L) and other comprehensive income (OCI). Entities can either combine both P/L and OCI into a single statement or present them in separate statements (IAS 1.81A-B). Additionally, the P/L and total comprehensive income for a given period should be allocated between the owners of the parent company and non-controlling interests (IAS 1.81B).

Minimum contents in P/L and OCI

IAS 1.82-82A specifies the minimum items that must appear in the P/L and OCI statements. These items are required only if they materially impact the financial statements (IAS 1.31).

Entities are permitted to add subtotals to the P/L statement if they meet the criteria specified in IAS 1.85A. Operating income is often the most commonly used subtotal in P/L. This practice may be attributed to the 1997 version of IAS 1, which mandated the inclusion of this subtotal—although this is no longer the case. IAS 1.BC56 clarifies that an operating profit subtotal should not exclude items commonly considered operational, such as inventory write-downs, restructuring costs, or depreciation/amortisation expenses.

Profit or loss (P/L)

All items of income and expense must be recognised in P/L (or OCI). This means that no income or expenses should be recognised directly in the statement of changes in equity, unless another IFRS specifically mandates it (IAS 1.88). Direct recognition in equity may also result from intra-group transactions . IAS 1.97-98 require separate disclosure of material items of income and expense, either directly in the income statement or in the notes.

Expenses in P/L can be presented in one of two ways (IAS 1.99-105):

- By their nature (e.g., depreciation, employee benefits); or

- By their function within the entity (e.g., cost of sales, distribution costs, administrative expenses).

When opting for the latter, entities must provide additional details on the nature of the expenses in the accompanying notes (IAS 1.104).

Other comprehensive income (OCI)

OCI encompasses income and expenses that other IFRS specifically exclude from P/L. There is no conceptual basis for deciding which items should appear in OCI rather than in P/L. Most companies present P/L and OCI as separate statements, partly because OCI is generally overlooked by investors and those outside of accounting and financial reporting circles. The concern is that combining the two could reduce net profit to merely a subtotal within total comprehensive income.

All elements that constitute OCI are specifically outlined in IAS 1.7, as part of its definitions.

Reclassification adjustments

A reclassification adjustment refers to the amount reclassified to P/L in the current period that was recognised in OCI in the current or previous periods (IAS 1.7). All items in OCI must be grouped into one of two categories: those that will or will not be subsequently reclassified to P/L (IAS 1.82A). Reclassification adjustments must be disclosed either within the OCI statement or in the accompanying notes (IAS 1.92-96).

To illustrate, foreign exchange differences arising on translation of foreign operations and gains or losses from certain cash flow hedges are examples of items that will be reclassified to P/L. In contrast, remeasurement gains and losses on defined benefit employee plans or revaluation gains on properties will not be reclassified to P/L.

The practice of transferring items from OCI to P/L, commonly known as ‘recycling’, lacks a concrete conceptual basis and the criteria for allowing such transfers in IFRS are often considered arbitrary.

Tax effects

OCI items can be presented either net of tax effects or before tax, with the overall tax impact disclosed separately. In either case, entities must specify the tax amount related to each item in OCI, including any reclassification adjustments (IAS 1.90-91). Interestingly, there is no such requirement to disclose tax effects for individual items in the income statement.

Statement of changes in equity

IAS 1.106 outlines the minimum line items that must be included in the statement of changes in equity. Subsequent paragraphs specify the disclosure requirements, which can be addressed either within the statement itself or in the accompanying notes. It’s crucial to note that changes in equity during a reporting period can arise either from income and expense items or from transactions involving owners acting in their capacity as owners (IAS 1.109). This means that entities cannot adjust equity directly based on changes in assets or liabilities unless these adjustments result from transactions with owners, such as capital contributions or dividend payments, or are otherwise mandated by other IFRSs.

Statement of cash flows

The statement of cash flows is governed by IAS 7 .

- Explanatory notes

Structure of explanatory notes

The structure for explanatory notes is detailed in IAS 1.112-116. In practice, there are several commonly adopted approaches to organising these notes:

Approach #1:

- Primary financial statements (P/L, OCI, etc.)

- Statement of compliance and basis of preparation

- Accounting policies

Approach #1 is logically coherent, as understanding accounting policies is crucial before delving into the financial data. However, in reality, few people read the accounting policies in their entirety. Consequently, users often have to navigate past several pages of accounting policies to reach the explanatory notes.

Approach #2:

- Primary financial statements (P/L, OCI, etc)

In Approach #2, accounting policies are treated as an appendix and positioned at the end of the financial statements. The advantage here is that all numerical data is clustered together, uninterrupted by extensive descriptions of accounting policies.

Approach #3:

- Explanatory notes integrated with relevant accounting policies

Approach #3 pairs accounting policies directly with the associated explanatory notes. For example, accounting policies relating to inventory would appear alongside the explanatory note that breaks down inventory components.

Management of capital

IAS 1.134-136 outline the disclosures related to capital management. These provisions apply to all entities, whether or not they are subject to external capital requirements. An important note here is that entities are not obligated to disclose specific values or ratios concerning capital objectives or requirements.

IAS 1.137 mandates disclosure of dividends proposed or declared before the financial statements were authorised for issue but not recognised as a distribution to owners during the period. Furthermore, entities are required to disclose the amount of any cumulative preference dividends not recognised.

Disclosure of accounting policies

IAS 1 specifies the requirements for disclosing accounting policy information which are discussed here .

Disclosing judgements and sources of estimation uncertainty

IAS 1 mandates disclosing judgements and sources of estimation uncertainty .

Other disclosures

Additional miscellaneous disclosure requirements are detailed in paragraphs IAS 1.138.

IFRS 18 Presentation and Disclosure in Financial Statements

On 9 April 2024, the IASB issued IFRS 18 Presentation and Disclosure in Financial Statements , which replaces IAS 1 and amends IAS 7. This new standard will be effective from 2027 with early application permitted.

Here are the key changes under IFRS 18:

- Two new subtotals have been added to the income statement: ‘Operating Profit’ and ‘Profit Before Financing and Income Taxes’. This change requires companies to categorise income and expenses into operating, investing, and financing activities.

- A new requirement mandates the reconciliation of non-GAAP measures with IFRS-specified subtotals, but this only applies to P/L measures such as adjusted profit. Other metrics like free/organic cash flow or net debt are not included.

- The statement of cash flows will start with operating profit for the indirect method, and the classification of cash flows related to interest and dividends has been standardised. Typically, dividends and interest paid will fall under financing activities, while those received will be recorded under investing activities.

While many IAS 1 provisions remain under IFRS 18, others, including the basis of financial statement preparation and disclosure of accounting policies, have moved to IAS 8, which will be retitled Basis of Preparation of Financial Statements . For further insights, see the IASB Project Summary .

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

Four Steps to Delightful Accounting Presentations

By Charles Hall | Technology

- You are here:

In this article, I provide you with four steps to delightful accounting presentations–even if you are a CPA. Yes, this can be done!

If you’ve read the book Presentation Zen , you know that many speakers –without intending to– hide their message . In watching CPE presentations and board presentations, I have noticed that (we) CPAs unwittingly hide our message. How? We present slide decks that look like intermediate accounting textbooks–chock full of facts, but too much to digest. And do we really believe that those attending will take those slides back to the office and study them?

Probably not.

My experience has been those slides end up in the office dungeon, never to be seen again. We have one chance to communicate–in the session.

It is the presenter’s duty to cause learning . So how can we engage our audience (even those sitting on the back row playing with their cell phones)? Let’s start with the slide deck.

1. Make Simple Slides

Make simple slides.

I try to have no more than two points per slide , and I leave out references to professional standards (at least on the slides).

What happens when you see a slide that looks like it contains the whole of War and Peace ? If you’re like me, you may think, “Are you kidding? You want me to consume all of that in the next three minutes. Forget it. I will not even try.” And then you begin to think about your golf game or your next vacation. So, how much information should you include on a slide?

Nancy Duarte recommends the glance test for each slide . “People should be able to comprehend it in three seconds.”

2. Include a picture related to the topic

Include a picture.

For example, if I am presenting to auditors, I might display a picture of someone being bribed. Verbal information is remembered about ten percent of the time. If a picture is included, the figure goes up to sixty-five percent. Quite a difference.

3. Tell a story (and ask questions)

Tell a story and ask questions.

People love stories. If your presentation is about bribes and you have not audited a bribery situation, Google bribes, and you will find all the stories you need. If you can’t find a story, use a hypothetical. Why? You are trying to draw your audience in–then maybe they will put that cell phone down (your most triumphant moment as a speaker!).

Telling your story at the right pace and volume is also important.

Also engage your audience with questions. Stories get the juices going; questions make them dig. And, if they answer you, there is dialog. And what’s the result? Those talking learn, the audience learns, and, yes, you learn.

Move. Not too much, but at least some.

A statue is not the desired effect. Moving like Michael Jackson is also not what you desire (moonwalking was never in my repertoire anyway). But movement, yes. I walk slowly from side to side (without moonwalking) and will, at times, move toward the audience when I want to make a point. So, am I constantly roaming? No. Balance is important.

Now, let me provide a few thoughts about presentation software and handouts.

Presentation Software and Handouts

Presentation Software

If you have an Apple computer, let me recommend Keynote as your presentation software . I do think PowerPoint (for you Windows users) has improved, but personally, I prefer Keynote.

Another option—though there is a cost—is using Canva to create your slide deck . Your creativity is almost unlimited with this software—pictures, graphics, templates, colors, resizing, and more. Once the slides are created, you can download them as a PDF. Then present the slides (in the PDF) using the full screen option in Adobe Acrobat . I’ve done this a lot lately. Love it.

Here’s a sample Canva slide:

If you need to provide detailed information, give your participants handouts (examples of what you are discussing).

I prefer not to provide copies of slides. Why? Your participants will read ahead. You want to keep your powder dry. If they already know what you’re going to say, they’ll stop listening.

Your Presentation Tips

What do you do to make your presentations sizzle?

About the Author

Charles Hall is a practicing CPA and Certified Fraud Examiner. For the last thirty-five years, he has primarily audited governments, nonprofits, and small businesses. He is the author of The Little Book of Local Government Fraud Prevention, The Why and How of Auditing, Audit Risk Assessment Made Easy, and Preparation of Financial Statements & Compilation Engagements. He frequently speaks at continuing education events. Charles consults with other CPA firms, assisting them with auditing and accounting issues.

Amit, I have seen Prezi on the Internet, but I have not used it myself – though it looks inviting. Have you tried it or have you seen anyone use it?

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Financial Reporting - Fair presentation - Problems with fairness

From a UK perspective, such an overriding requirement for fairness is neither new nor controversial. However, when the 'true and fair view' principle was introduced into the law of other EU member states, it proved problematic: in some states an overriding 'true and fair' requirement conflicts with legal traditions or with accounting rules strongly influenced by tax law. As a result Germany, Austria and Sweden did not implement 'true and fair' as an overriding requirement. Further, 'true and fair view' is not interpreted in the same way in different national environments.

It has been claimed to exist independent from any framework of rules - we cannot determine its meaning from the contents of the Companies Act or EU directives.

To apply it, we have to draw on local customs and notions of 'fairness', on user needs and objectives of financial statements. In Germany, conformity with law and quasi-legal rules is assumed to result in a 'true and fair view', even if these rules permitted, for example, accelerated depreciation not reflecting economic reality.

Controversial issues

In spite of problems with the interpretation and application of 'fairness', the IASB has retained the requirement for 'fair presentation'. But it has given rise to three controversial issues: a framework for the interpretation of 'fair presentation' is now provided; 'fair presentation' and the override have lost in significance; and an escape clause is provided for the override requirement.

This is, arguably, not a bad thing. However, it seems that the IASB has succumbed to US influences. While the Framework refers to 'true and fair view' and 'present fairly',

The US has previously objected to the 'fair presentation' override in

Finally, financial statements claiming to comply with IFRSs must comply with all provisions. While the old

If such differential treatments are permitted with regard to 'fair presentation', this seems to open the door for differential treatment in other areas. Which suggests we may end up with very different interpretations of fairness.

For a fuller discussion of these issues, see Accountancy and Business Research, Volume 33, Number 4, pp 311-325. To subscribe call 0870 2404388.

Rate this article

What’s new for academies for 2024 year ends?

Accounting taxonomy to be updated for ifrs 18 rollout, staff costs hit £49.5m at ifrs foundation, ifrs 18 standard will improve accounting disclosure, frc calls for disclosure improvements in ifrs 17.

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

What Is Accounting? The Basics Of Accounting

Updated: Jun 12, 2024, 8:06pm

Table of Contents

What is accounting, types of accounting, ways to manage your business accounting, effective accounting practices to adopt immediately, frequently asked questions (faqs).

Accounting is the process of keeping track of all financial transactions within a business, such as any money coming in and money going out. It’s not only important for businesses in terms of record keeping and general business management, but also for legal reasons and tax purposes. Though many businesses leave their accounting to the pros, it’s wise to understand the basics of accounting if you’re running a business. To help, we’ll detail everything you need to know about the basics of accounting.

Accounting is the process of recording, classifying and summarizing financial transactions. It provides a clear picture of the financial health of your organization and its performance, which can serve as a catalyst for resource management and strategic growth.

Accounting is like a powerful machine where you input raw data (figures) and get processed information (financial statements). The whole point is to give you an idea of what’s working and what’s not working so that you can fix it.

Featured Partners

Sage Intacct

On Sage's Website

Special Offer: 75% off for 6 months

On Xero's Website

$15 per month (for the first 3-months, then $30 per month)

Expert help, Invoicing, maximize tax deductions, track mileage

On QuickBooks' Website

Why Accounting Is Important

Accounting information exposes your company’s financial performance; it tells whether you’re making a profit or just running into losses at the end of the day.

This information is not just available to you, but also to external users such as investors, stakeholders and creditors who would want to be enlightened about your business, to figure out whether it’ll be a good choice to invest in and what they can expect in returns.

Besides playing a key role in providing transparency for stakeholders, accounting also ensures you make informed decisions backed by data.

Accountant vs. CPA vs. Tax Pro

In accounting, you’ll come across certain titles which appear to bear similar duties but actually have unique job descriptions. In this section, we’ll briefly review the roles of accountants vs. CPAs and tax professionals.

An accountant is a professional with a bachelor’s degree who provides financial advice, tax planning and bookkeeping services. They perform various business functions such as the preparation of financial reports, payroll and cash management.

A certified public accountant (CPA) is a type of professional accountant with more training and experience than a typical accountant. Aspiring CPAs are expected to have a bachelor’s degree, more than two years of public accounting work experience, pass all four parts of the CPA exam and meet additional state-specific qualifications if required. In the U.S., licensed CPAs must have earned their designation from the American Institute of Certified Public Accountants (AICPA).

Tax professionals include CPAs, attorneys, accountants, brokers, financial planners and more. Their primary job is to help clients with their taxes so they can avoid paying too much or too little in federal income or state income taxes.

As a general note, CPAs are considered to be more qualified than tax professionals when it comes to preparing taxes on an individual basis as they are trained to analyze business and personal finances to maximize savings and minimize taxes. It’s also worth noting that while all CPAs are accountants, not all accountants are CPAs.

Accounting can be broken down into several categories ; each category deals with a specific set of information, or documents particular transactions. In this section, we discuss four of the most common branches of accounting:

Financial Accounting

This is the practice of recording and reporting financial transactions and cash flows. This type of accounting is particularly needed to generate financial reports for the sake of external individuals and government agencies. These financial statements report the performance and financial health of a business. For example, the balance sheet reports assets and liabilities while the income statement reports revenues and expenses. Financial accounting is governed by accounting rules and regulations such as U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

Managerial Accounting

This focuses on the use and interpretation of financial information to make sound business decisions. It’s similar to financial accounting, but this time, it’s reserved for internal use, and financial statements are made more frequently to evaluate and interpret financial performance.

Cost Accounting

This is the process of tracking, analyzing and understanding the costs involved in a specific business activity. This includes all direct and indirect expenses associated with your business’s day-to-day operations. Cost accounting is particularly important because it helps you ensure that you are spending money on things that benefit your business’s bottom line.

Tax Accounting

This is the act of tracking and reporting income and expenses related to your company’s taxes. You don’t want to be in a situation where you have to pay more income tax than is normally required by the Internal Revenue Service (IRS).

So far, we’ve seen the types and benefits of accounting. This leads us to the next question of knowing how to carry out accounting efficiently. There are many ways to manage your business accounting. They include:

Outsource to Professionals

You can outsource your accounting work to outside professionals who specialize in bookkeeping and tax preparation. Outsourcing can offer many advantages because it allows you to take advantage of specialized skill sets that may not be available when hiring someone in-house. It’s also flexible and generally costs less.

Using Accounting Software

Accounting software allows you to do basic tasks such as tracking inventory, invoicing and payments, and generating reports on sales and expenses. It’s useful for small businesses and freelancers who don’t have the resources to hire an accountant or bookkeeper. Besides, this frees up time so you can focus on running your business smoothly. Check out our recent piece on the best accounting software for small businesses .

Hiring an In-House Accountant

You can choose to manage your business accounting by hiring an in-house accountant or CPA . This can be a great option if you want to ensure your books are in order, and that your company’s financial information is accurate, but it does come with some drawbacks. For one thing, the cost of hiring someone like this can be a substantial burden on your business’s finances.

There are many ways to do accounting, but there are also certain practices that make it easier to keep track of your finances. Some best practices include:

- Keep your personal finances separate from that of your business to get an accurate view of your company’s financial health. This applies a lot to small businesses just getting started with accounting.

- Pay attention to details. Make sure that all transactions are accounted for and properly totaled to facilitate accurate reporting at year-end.

- Hire an accounting professional if you don’t have the time to learn accounting software. This will save you stress and give you the needed time to focus on other important parts of your business.

- Keep adequate records of all assets, liabilities and cash flows for tax purposes. Pay attention to tax laws and regulations. Stay up to date on current news so you can know what’s happening in the financial world.

Bottom Line

Accounting is popularly regarded as “the language of business” because it doesn’t just help you keep track of your money, but also helps you make informed decisions about your business. To speed up action, you may hire accounting professionals or purchase accounting software to ensure accurate financial audits and reporting.

What is accounting in simple terms?

Accounting is the process of keeping track of your business’s financial transactions. It helps you to understand how money comes in and how it goes out.

Why is accounting important?

Accounting helps a business understand its financial position to be able to make informed decisions and manage risks.

What is the simplest accounting software?

Freshbook is one of the easiest accounting software systems to use. Its interface is very intuitive, making it very easy to learn. Another easy to use option that’s perfect for self-employed entrepreneurs who need an affordable accounting solution is Neat. Learn more about the best accounting software .

Are bookkeeping and accounting different?

Bookkeeping focuses on recording and organizing financial data, including tasks, such as invoicing, billing, payroll and reconciling transactions. Accounting is the interpretation and presentation of that financial data, including aspects such as tax returns, auditing and analyzing performance.

- Best Accounting Software for Small Business

- Best Quickbooks Alternatives

- Best Online Bookkeeping Services

- Best Accounting Software for Mac

- Best Construction Accounting Software

- Best Free Accounting Software

- Best Accounting Software for Nonprofits

- Best Church Accounting Software

- Best Real Estate Accounting Software

- Best Receipt Scanner Apps

- FreshBooks Review

- Xero Review

- QuickBooks Online Review

- Kareo Review

- Zoho Books Review

- Sage Accounting Review

- Neat Review

- Kashoo Review

- QuickBooks Self-Employed Review

- QuickBooks For LLC Review

- FreshBooks vs. Quickbooks

- Quicken vs. Quickbooks

- Xero vs. Quickbooks

- Netsuite vs. Quickbooks

- Sage vs. Quickbooks

- Quickbooks Pro vs. Premier

- Quickbooks Online vs. Desktop

- Wave vs. Quickbooks

- Gusto vs. Quickbooks

- Zoho Books vs. Quickbooks

- How Much Does An Accountant Cost?

- How To Find A Small Business Accountant

- Bookkeeping vs. Accounting

- Small Business Bookkeeping for Beginners

- What is Bookkeeping?

- Accounts Payable vs. Accounts Receivable

- What is a Balance Sheet?

- What is Cost Accounting?

Next Up In Business

- Accounting Methods You Need To Know In 2024

- Best QuickBooks Alternatives

- Quicken Review

- NeatBooks Review

- Gusto vs Quickbooks

- Quickbooks Online Vs. Desktop: What’s The Difference?

What Is SNMP? Simple Network Management Protocol Explained

What Is A Single-Member LLC? Definition, Pros And Cons

What Is Penetration Testing? Definition & Best Practices

What Is Network Access Control (NAC)?

What Is Network Segmentation?

How To Start A Business In Louisiana (2024 Guide)

John Iwuozor is a freelance writer with expertise in the technology field. He has written for a host of top tech companies, the likes of Technologyadvice, Tripwire amongst others. He's an avid chess lover and loves exploring new domains.

Faithful Representation

How much do you know about faithful representation, share this post, related posts, substance over legal form, materiality concept, reliability concept, accounting concept and principles.

- Search Search Please fill out this field.

What Is Financial Accounting?

- How It Works

Financial Statements

Accrual method vs. cash method.

- Why It Matters

- Users of Financial Accounting

- Financial vs. Managerial Accounting

- Professional Designations

- Financial Accounting FAQs

The Bottom Line

- Corporate Finance

Financial Accounting Meaning, Principles, and Why It Matters

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

- Accounting Explained With Brief History and Modern Job Requirements

- Accounting Equation

- Current and Noncurrent Assets

- Accounting Theory

- Accounting Principles

- Accounting Standard

- Accounting Convention

- Accounting Policies

- Principles-Based vs. Rules-Based Accounting

- Accounting Method

- Accrual Accounting

- Cash Accounting

- Accrual Accounting vs. Cash Basis Accounting

- Financial Accounting Standards Board (FASB)

- Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

- IFRS vs. GAAP

- US Accounting vs. International Accounting

- Understanding the Cash Flow Statement

- Breaking Down The Balance Sheet

- Understanding the Income Statement

- Financial Accounting CURRENT ARTICLE

- Financial Accounting and Decision-Making

- Cost Accounting

- Certified Public Accountant (CPA)

- Chartered Accountant (CA)

- Accountant vs. Financial Planner

- Tax Accounting

- Forensic Accounting

- Chart of Accounts (COA)

- Double Entry

- Closing Entry

- Introduction to Accounting Information Systems

- Inventory Accounting

- Last In, First Out (LIFO)

- First In, First Out (FIFO)

- Average Cost Method

Financial accounting is a specific branch of accounting involving a process of recording, summarizing, and reporting the myriad of transactions resulting from business operations over a period of time. These transactions are summarized in the preparation of financial statements—including the balance sheet, income statement, and cash flow statement—that record a company’s operating performance over a specified period.

Work opportunities for a financial accountant can be found in both the public and private sectors. A financial accountant’s duties may differ from those of a self-employed accountant who works for many clients preparing their accounts, tax returns, and possibly auditing other companies.

Key Takeaways

- Financial accounting is the framework that dictates the rules, processes, and standards for financial recordkeeping.

- Nonprofits, corporations, and small businesses use financial accountants to prepare their books and records and generate their financial reports.

- Financial reporting occurs through the use of financial statements, such as the balance sheet, income statement, statement of cash flow, and statement of changes in shareholder equity.

- Financial accounting differs from managerial accounting, as financial reporting is for reporting to external parties, while managerial accounting is for internal strategic planning.

- Financial accounting may be performed under the accrual method (recording expenses for items that have not yet been paid) or the cash method (only cash transactions are recorded).

Investopedia / Laura Porter

How Financial Accounting Works

Financial accounting utilizes a series of established principles. The accounting principles used depend on the business's regulatory and reporting requirements. Companies and organizations often have an accounting manual that details the pertinent accounting rules.

U.S. public companies are required to perform financial accounting in accordance with generally accepted accounting principles (GAAP) . Their purpose is to provide consistent information to investors, creditors, regulators, and tax authorities.

The statements used in financial accounting cover the five main classifications of financial data, which are:

- Revenues – Included here is income from sales of products and services, plus other sources, including dividends and interest.

- Expenses – These are the costs of producing goods and services, from research and development to marketing to payroll.

- Assets – These consist of owned property, both tangible (buildings, computers) and intangible (patents, trademarks).

- Liabilities – These are all outstanding debts, such as loans or rent.

- Equity – If you paid off the company’s debts and liquidated its assets, you would get its equity, which is what a company is worth.

Revenues and expenses are accounted for and reported on the income statement, resulting in the determination of net income at the bottom of the statement. Assets, liabilities, and equity accounts are reported on the balance sheet, which utilizes financial accounting to report ownership of the company’s future economic benefits.

International public companies also frequently report financial statements in accordance with International Financial Reporting Standards (IFRS) .

Balance Sheet

A balance sheet reports a company’s financial position as of a specific date. It lists the company’s assets, liabilities, and equity, and the financial statement rolls over from one period to the next. Financial accounting guidance dictates how a company records cash, values assets, and reports debt.

A balance sheet is used by management, lenders, and investors to assess the liquidity and solvency of a company. Through financial ratio analysis, financial accounting allows these parties to compare one balance sheet account with another. For example, the current ratio compares the amount of current assets with current liabilities to determine how likely a company is going to be able to meet short-term debt obligations.

Income Statement

An income statement , also known as a “profit and loss statement,” reports a company’s operating activity during a specific period of time. Usually issued on a monthly, a quarterly, or an annual basis, the income statement lists revenue , expenses , and net income of a company for a given period. Financial accounting guidance dictates how a company recognizes revenue, records expenses, and classifies types of expenses.

An income statement can be useful to management, but managerial accounting gives a company better insight into production and pricing strategies compared with financial accounting. Financial accounting rules regarding an income statement are more useful for investors seeking to gauge a company’s profitability and external parties looking to assess the risk or consistency of operations.

Cash Flow Statement

A cash flow statement reports how a company used cash during a specific period. It is broken into three sections:

- Operations – These are the costs of a company’s core business activities.

- Financing – This is money the company receives from taking loans or issuing shares, as well as money paid in interest on loans and dividends to investors.

- Investments – This is money that comes from buying and selling the company’s investments, such as securities or fixed assets.

Financial accounting guidance dictates when transactions are to be recorded, though there is often little to no flexibility in the amount of cash to be reported per transaction.

A cash flow statement is used by management to better understand how cash is being spent and received. It extracts only items that impact cash, allowing for the clearest possible picture of how money is being used, which can be somewhat cloudy if the business is using accrual accounting.

Shareholders' Equity Statement

A shareholders' equity statement reports how a company’s equity changes from one period to another, as opposed to a balance sheet, which is a snapshot of equity at a single point in time. It shows how the residual value of a company increases or decreases and why it changed. It gives details about the following components of equity:

- Share Capital – Money raised by selling stock in the company

- Net Income – Any profit after expenses and deductions

- Dividends – The part of profit that is paid to shareholders

- Retained Earnings – Whatever is left after paying dividends

Nonprofit entities and government agencies use similar financial statements; however, their financial statements are more specific to their entity types and will vary from the statements listed above.

There are two primary types of financial accounting: the accrual method and the cash method. The main difference between them is the timing in which transactions are recorded.

Accrual Method

The accrual method of financial accounting records transactions independently of cash usage. Revenue is recorded when it is earned (when a bill is sent), not when it actually arrives (when the bill is paid). Expenses are recorded upon receiving an invoice, not when paying it. Accrual accounting recognizes the impact of a transaction over a period of time.

For example, imagine a company receives a $1,000 payment for a consulting job to be completed next month. Under accrual accounting, the company is not allowed to recognize the $1,000 as revenue, as it has technically not yet performed the work and earned the income. The transaction is recorded as a debit to cash and a credit to unearned revenue, a liability account. When the company earns the revenue next month, it clears the unearned revenue credit and records actual revenue, erasing the debt to cash.

Another example of the accrual method of accounting are expenses that have not yet been paid. Imagine a company received an invoice for $5,000 for July utility usage. Even though the company won’t pay the bill until August, accrual accounting calls for the company to record the transaction in July, debiting utility expense. The company records a credit to accounts payable. When the invoice is paid, the credit is cleared.

Cash Method

The cash method of financial accounting is an easier, less strict method of preparing financial statements: Transactions are recorded only when cash is involved. Revenue and expenses are only recorded when the transaction has been completed via the facilitation of money.

In the example above, the consulting firm would have recorded $1,000 of consulting revenue when it received the payment. Even though it won’t actually perform the work until the next month, the cash method calls for revenue to be recognized when cash is received. When the company does the work in the following month, no journal entry is recorded, because the transaction will have been recorded in full the prior month.

In the other example, the utility expense would have been recorded in August (the period when the invoice was paid). Even though the charges relate to services incurred in July, the cash method of financial accounting requires expenses to be recorded when they are paid, not when they occur.

Financial Accounting

Records transactions when benefit is received or liability is incurred

A more accurate method of accounting that depicts more-realistic business operations

Required for larger, public companies as part of external reporting

Records transactions when cash is received or distributed

An easier method of accounting that simplifies a company down to what has already actually occurred

Primarily used by smaller, private companies with low to no reporting requirements

Principles of Financial Accounting