Credit Repair Business Plan Template

Written by Dave Lavinsky

Credit Repair Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their credit repair companies.

If you’re unfamiliar with creating a credit repair business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a credit repair business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Credit Repair Business Plan?

A business plan provides a snapshot of your credit repair business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Credit Repair Company

If you’re looking to start a credit repair business or grow your existing credit repair company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your credit repair business to improve your chances of success. Your credit repair business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Credit Repair Businesses

With regards to funding, the main sources of funding for a credit repair business are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for credit repair companies.

Finish Your Business Plan Today!

How to write a business plan for a credit repair business.

If you want to start a credit repair business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your credit repair company business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of credit repair business you are running and the status. For example, are you a startup, do you have a credit repair business that you would like to grow, or are you operating an established credit repair business that you would like to sell?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the credit repair industry.

- Discuss the type of credit repair business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of credit repair business you are operating.

For example, you might specialize in one of the following types of credit repair businesses:

- Credit bureau disputes: This type of credit repair business involves reviewing the customer’s credit report and filing credit bureau disputes on their behalf to get errors such as inaccurate late payments, bankruptcies, and foreclosures removed.

- Legal services: This type of credit repair business is operated by lawyers or paralegals who help customers if their credit has been impacted by incidents such as identity theft, medical bills, and student debt.

- Full services credit repair: This type of business provides customers with a full suite of credit repair services from consultation to cease-and-desist letters, and identity theft protection.

- DIY Credit Repair: This type of business provides software to help customers navigate the credit repair process themselves.

In addition to explaining the type of credit repair business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of cases with positive outcomes, reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the credit repair industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the credit repair industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your credit repair company business plan:

- How big is the credit repair industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your credit repair business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your credit repair business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of credit repair business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Credit Repair Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other credit repair businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes credit consultants, other types of credit advisors, and free credit service providers. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of credit repair business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for your customers to acquire your product or service?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a credit repair business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of credit repair company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide goodwill letters to creditors, credit monitoring, or paralegal services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your credit repair company. Document where your company is situated and mention how the site will impact your success. For example, is your credit repair business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your credit repair marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your credit repair business, including answering calls, meeting with clients, corresponding with creditors, billing and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your credit repair business to a new city.

Management Team

To demonstrate your credit repair business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing credit repair businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a credit repair business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you work with 5 clients per day, and/or offer discounts for referrals? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your credit repair business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a credit repair business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of relevant professional certifications you possess.

Writing a business plan for your credit repair business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will have an expert credit repair business plan; download it to PDF to show banks and investors. You will understand the credit repair industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful credit repair business.

Credit Repair Business Plan Template FAQs

What is the easiest way to complete my credit repair business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your credit repair business plan.

How Do You Start a Credit Repair Business?

Starting a credit repair business is easy with these 14 steps:

- Choose the Name for Your Credit Repair Business

- Create Your Credit Repair Business Plan

- Choose the Legal Structure for Your Credit Repair Business

- Secure Startup Funding for Your Credit Repair Business (If Needed)

- Secure a Location for Your Business

- Register Your Credit Repair Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Credit Repair Business

- Buy or Lease the Right Credit Repair Business Equipment

- Develop Your Credit Repair Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Credit Repair Business

- Open for Business

Learn more about how to start your own credit repair business .

Don’t you wish there was a faster, easier way to finish your Credit Repair business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan writers can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

- Sample Business Plans

Credit Repair Business Plan

If you have all the knowledge about credit scores, and people often take your advice to repair their credit scores, then this business can be rewarding. So, are you planning to start your credit repair business? If yes, then this business plan template will guide you in writing yours.

Need help writing a business plan for your credit repair business? You’re at the right place. Our credit repair business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Credit Repair Business Plan?

Writing a credit repair business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your business:

- This section may include the name of your credit repairing business, its location, when it was founded, the type of credit repairing business (E.g., credit repair services, credit counseling services, credit repair affiliate), etc.

Market opportunity:

Product and services:.

- For instance, you may include credit counseling, credit repair, etc as your services.

Marketing & sales strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business description:

- Credit Repair Services: These services could involve negotiating with creditors, challenging mistakes on credit reports, and giving guidance on raising credit ratings.

- Credit Counselling Services: A credit counseling business offers advice to clients on how to better manage their money and credit scores.

- Credit Education Services: A credit education service gives customers knowledge and tools on how to raise their credit scores and take control of their money.

- Describe the legal structure of your credit repair business, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission statement:

Business history:.

- Additionally, If you have received any awards or recognition for excellent work, describe them.

Future goal:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

- For instance, individuals with poor credit, business owners, etc, would be an ideal target audience for a credit repair business.

Market size and growth potential:

Competitive analysis:, market trends:.

- For instance, alternative credit scoring models are getting popular; explain how you plan on dealing with this potential growth opportunity.

Regulatory environment:

Here are a few tips for writing the market analysis section of your credit repair business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your credit repairing services:

Mention the credit repair services your business will offer. This list may include services like,

- Credit report analysis

- Dispute resolution

- Debt management

- Credit counseling

Describe each service:

Additional services:.

In short, this section of your credit repair company business plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique selling proposition (USP):

- For example, fast results, customized services, or transparent pricing could be some of the great USPs for a credit repair company.

Pricing strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your credit repair service business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your credit repair business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & training:

Operational process:, technology:.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your credit repair business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founder/CEO:

Key managers:.

- It should include, key executives(e.g. COO, CMO.), senior management, and other department managers (e.g. customer support manager.) involved in the credit repair business operations, including their education, professional background, and any relevant experience in the industry.

Organizational structure:

Compensation plan:, advisors/consultants:.

- So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your credit repair services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

- This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

Financing needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your credit repair business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample credit repair business plan will provide an idea for writing a successful credit repair plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our credit repair business plan pdf .

Related Posts

Atm Business Plan

Hedge Fund Business Plan

Business Plan Template with Example

Successful Business Plans Writing Guide

Top 10 AI Business Plan Generators

Key Elements of a Business Plan

Frequently asked questions, why do you need a credit repair business plan.

A business plan is an essential tool for anyone looking to start or run a successful credit repair business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your credit repair company.

How to get funding for your credit repair business?

There are several ways to get funding for your credit repair business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your credit repair business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your credit repair business plan and outline your vision as you have in your mind.

What is the easiest way to write your credit repair business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any credit repair business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Credit Repair Business Plan Template

Written by Dave Lavinsky

Credit Repair Business Plan

You’ve come to the right place to create your Credit Repair business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Credit Repair businesses.

Below is a template to help you create each section of your Credit Repair business plan.

Executive Summary

Business overview.

Lincoln Credit Repair is a new credit repair company located in Lincoln, Nebraska. We offer a full suite of credit repair services to the residents of Lincoln who are struggling financially and need to turn their credit around. Some of the services we offer include a free consultation, identity theft protection, credit disputes, and legal representation. At Lincoln Credit Repair, we know that many of our clients feel overwhelmed by their financial and credit troubles. Our mission is to help in any way possible to repair their credit and turn their life around.

Lincoln Credit Repair is founded by Gary Smith, who has been a credit repair attorney for two decades. As such, he has extensive experience helping hundreds of clients repair their credit and turn their life around. After decades of work, he was tired of working for large firms that didn’t care about their clients nor offer personalized, client-oriented service. His mission with Lincoln Credit Repair is to make the client the central focus, so we can provide the exact services they need to repair their credit.

Product Offering

Lincoln Credit Repair offers a full suite of credit repair services to restore our clients’ credit. These services include sending cease and desist letters, providing legal representation, disputing credit reports, providing identity theft protection, and more. The exact services we provide will depend on each client’s needs as well as what they are willing to pay for. Every potential client gets a free 30-minute consultation that will help us determine what services they need.

Customer Focus

Lincoln Credit Repair will serve the residents of Lincoln, Nebraska. We expect that most of our clients will have a very low credit score (below 600) and earn less than the local median income. Traditionally, most people seek credit repair services in the 35-55 age range, as this is the age range when many significant life and financial changes occur.

Management Team

Lincoln Credit Repair is run by Gary Smith. Gary is an experienced credit repair attorney with over two decades of experience. He has helped hundreds of clients repair their credit and turn their life around. However, Gary has spent his career working for large firms that focus on profits over people. As such, they charge high prices and don’t cater their services to each client’s needs. Gary is establishing Lincoln Credit Repair as a small firm that caters to the needs of the client and offers the best credit repair services in the local market.

Success Factors

Lincoln Credit Repair will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and qualified team of credit repair professionals

- Wide range of credit repair services that are personalized to each client

- High-quality services for an unbeatable price

Financial Highlights

Lincoln Credit Repair is seeking $235,000 in debt financing to launch its credit repair company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs, marketing costs, and working capital. The breakout of the funding is below:

- Office space build-out: $25,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $25,000

- Working capital: $25,000

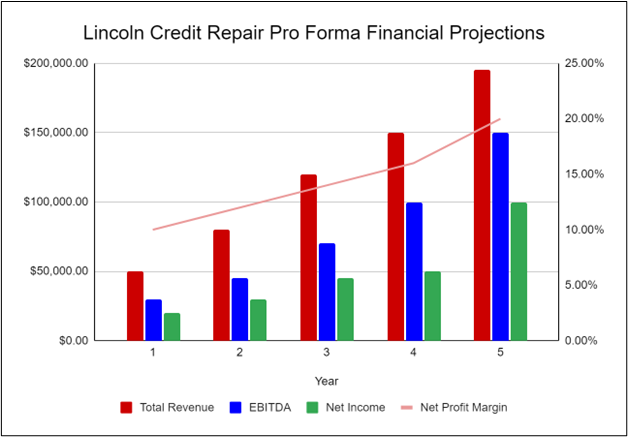

The following graph below outlines the financial projections for Lincoln Credit Repair.

Company Overview

Who is lincoln credit repair.

Lincoln Credit Repair is a new credit repair company located in Lincoln, Nebraska. We know that many people in the Lincoln area have lived through significant financial challenges that have destroyed their credit. Our mission is to help these individuals repair their credit and get their lives back on track.

To do this, we offer several services. Individuals can hire us to dispute errors in credit reports, provide identity theft protection, write cease and desist letters, and provide other legal representation. All potential new clients are offered a free 30-minute consultation so we can determine exactly which services will help them the most.

Lincoln Credit Repair’s History

Gary incorporated Lincoln Credit Repair as an S Corporation on July 1st, 2023. Since incorporation, the company has achieved the following milestones:

- Found a studio space and signed a Letter of Intent to lease it

- Developed the company’s name, logo, social media accounts, and website

- Determined equipment and fixture requirements

Lincoln Credit Repair’s Services

Lincoln Credit Repair will offer a full suite of credit repair services to its clients. Each client can choose which services they want to pay for based on their needs and budget. Some of the services we offer include:

- Identity theft protection

- Credit report disputes

- Legal representation

All new clients get a free 30-minute consultation to help us determine which services they need. All services are charged monthly.

Industry Analysis

Revenue for the credit repair industry is expected to grow over the next several years. According to MarketWatch, the global credit repair industry was worth $6.6 billion in 2021 and is expected to exceed $7.4 billion in 2027. Credit repair services are in high demand as many challenges can lead to a person’s credit getting ruined. Divorce, identity theft, job loss, and credit report errors are all common reasons why thousands of credit scores tank yearly.

There are several factors influencing the industry’s growth. First of all, rising interest rates affect consumers’ ability to service their debt quickly. The interest can easily become overwhelming, and many people seek credit repair and other financial services for help. Similarly, the rise in mortgage rates will lead to a higher rate of mortgage defaults, which means many homeowners will need credit repair services. Finally, the rise in cybersecurity attacks and identity theft/fraud has led to many people needing to dispute errors in their credit reports and restore their credit history. Since identity thefts have been increasing over the past several decades, we expect this to become a significant issue for the industry in the near future.

Customer Analysis

Demographic profile of target market, customer segmentation.

Lincoln Credit Repair will primarily target the following customer profiles:

- Individuals with poor credit (score under 600)

- Middle age residents and couples

- Individuals and families earning less than the local median income

Competitive Analysis

Direct and indirect competitors.

Lincoln Credit Repair will face competition from other companies with similar business profiles. A description of each competitor company is below.

The Credit People

The Credit People is a popular credit repair company that specializes in helping individuals improve their credit scores and overall credit health. They offer personalized solutions, including credit report analysis, dispute resolution, and guidance on building a positive credit history. The Credit People has three subscription plans, including a standard plan, a premium plan, and a premium flat rate plan. The premium plans offer a full suite of services, while the standard plan offers only basic credit dispute services. With a commitment to transparency and customer satisfaction, the Credit People maintain open communication throughout the process and offer satisfaction guarantees.

Lexington Law

Lexington Law is a prominent credit repair company known for its expertise in helping individuals improve their credit profiles. They offer comprehensive services, including credit report analysis, identification and dispute of inaccuracies, and personalized strategies for credit improvement. They also offer a free consultation and credit assessment to help clients see which services are best for them. Lexington Law is one of the most popular and prominent credit repair firms in the industry. As such, we expect them to be our biggest competitor.

The Credit Pros

The Credit Pros is a reputable credit repair company that offers a full suite of credit repair services as well as other financial and wealth management services. They have three membership plans: money management, prosperity, and success. Customers who get the most basic plan are given standard services, such as a budgeting system, dark web monitoring, and TransUnion alerts. Customers who get the more premium plans will have access to several bureau reports, creditor interventions, cease and desist letters, and letters of reference. The Credit Pros is also popular for its free consultation services as well as its low and transparent pricing. Since they are the most affordable competitor, we expect to compete with Credit Pros heavily for customers looking for affordable credit repair services.

Competitive Advantage

Lincoln Credit Repair will be able to offer the following advantages over the competition:

- Client-oriented service : Lincoln Credit Repair is committed to providing client-oriented service that offers personalized services for every client.

- Management : Gary Smith has been extremely successful working in the credit repair sector and will be able to use his previous experience to grant his clients extensive credit repair services. His unique qualifications will serve customers in a much more sophisticated manner than Lincoln Credit Repair’s competitors.

- Affordability : Many people who hire credit repair services do not have much disposable income to spend on these services. Many competitors are too expensive for our target market, so they end up struggling with their poor credit alone. Lincoln Credit Repair will provide its services at a much more affordable rate than the competition in order to help as many local residents as possible.

Marketing Plan

Brand & value proposition.

Lincoln Credit Repair will offer a unique value proposition to its clientele:

- Qualified and compassionate team that is committed to helping our clients.

- Unbeatable pricing for essential, life-changing services.

- Large firm experience in a small firm environment.

Promotions Strategy

The promotions strategy for Lincoln Credit Repair is as follows:

Word of Mouth/Referrals

Gary Smith has built up an extensive list of contacts over the years by providing exceptional service and expertise to his clients. Several clients have already agreed to switch to Lincoln Credit Repair once the company launches. The continued level of great service and expertise will lead to Gary’s clients spreading the word about our company. Lincoln Credit Repair will also offer discounts and other incentives for every successful referral.

Gary will invest in several billboard ads strategically located at busy intersections that receive thousands of traffic daily. The Marketing Manager will develop the print for the billboard design.

Social Media Marketing

Lincoln Credit Repair will invest in advertising on social media platforms such as Facebook and Instagram. By using targeted social media marketing, Lincoln Credit Repair will be able to reach the appropriate target audience in Lincoln. Before opening, Gary will hire a marketing manager to develop the branding and photography needed to create captivating social media posts.

Website/SEO Marketing

Lincoln Credit Repair will invest in a strong SEO presence so that when someone enters “Lincoln credit repair” or “local credit repair services near me” in their Google or Bing search bar, Lincoln Credit Repair will show up at the top of the list.

The pricing of Lincoln Credit Repair will be moderate so customers feel they receive excellent value when purchasing our credit repair services.

Operations Plan

The following will be the operations plan for Lincoln Credit Repair. Operation Functions:

- Gary Smith will be the sole owner of Lincoln Credit Repair. He will oversee the general operations of the company. In the early months, he will be the only credit repair attorney and the sole employee providing credit repair services. Gary will spend the next several months hiring the following:

- An Administrative Assistant who will oversee all administrative aspects of running the business. This will include bookkeeping, tax payments, and payroll of the staff. They will also help with scheduling appointments and answering client questions.

- A Marketing Manager who will provide all sales, marketing, and PR campaigns.

- Once the company becomes profitable and has a long list of clients, Gary will hire other credit repair specialists and attorneys to provide the company’s services.

Milestones:

Lincoln Credit Repair will have the following milestones completed in the next three months.

- 8/1/2023 – Finalize contract to lease office space

- 8/15/2023 – Begin office build-out

- 9/1/2023 – Start hiring key employees

- 9/15/2023 – Begin networking at industry events

- 10/1/2023 – Begin marketing campaigns

- 10/15/2023 – Lincoln Credit Repair opens its office for business

Though Gary has never run a company of his own, he has considerable experience in the industry and knows how to run the general operations of a credit repair company. He is in the process of hiring staff who will help him manage the marketing, accounting, and administrative aspects of the business.

Financial Plan

Key revenue & costs.

The revenue drivers for Lincoln Credit Repair will be the fees we charge for our credit repair services.

The cost drivers will primarily include the overhead costs required to run Lincoln Credit Repair. The expenses will include payroll, rent, utilities, office supplies, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Number of clients per year: 100

- Office lease per year: $30,000

- Average monthly fee charged for our services: $100/month

Financial Projections

Income statement, balance sheet, cash flow statement, credit repair business plan faqs, what is a credit repair business plan.

A credit repair business plan is a plan to start and/or grow your credit repair business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Credit Repair business plan using our Credit Repair Business Plan Template here .

What are the Main Types of Credit Repair Businesses?

There are a number of different kinds of credit repair businesses , some examples include: Credit bureau disputes, Legal services, Full services credit repair, and DIY Credit Repair.

How Do You Get Funding for Your Credit Repair Business Plan?

Credit Repair businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Credit Repair Business?

Starting a credit repair business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Credit Repair Business Plan - The first step in starting a business is to create a detailed credit repair business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your credit repair business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your credit repair business is in compliance with local laws.

3. Register Your Credit Repair Business - Once you have chosen a legal structure, the next step is to register your credit repair business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your credit repair business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Credit Repair Equipment & Supplies - In order to start your credit repair business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your credit repair business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful credit repair business:

- How to Start a Credit Repair Business

We earn commissions if you shop through the links below. Read more

Credit Repair Business

Back to All Business Ideas

How to Start a Credit Repair Business

Written by: Esther Strauss

Esther is a business strategist with over 20 years of experience as an entrepreneur, executive, educator, and management advisor.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on May 24, 2021 Updated on May 7, 2024

Investment range

$8,550 - $27,100

Revenue potential

$24,000 - $120,000 p.a.

Time to build

1 - 3 months

Profit potential

$10,000 - $30,000 p.a.

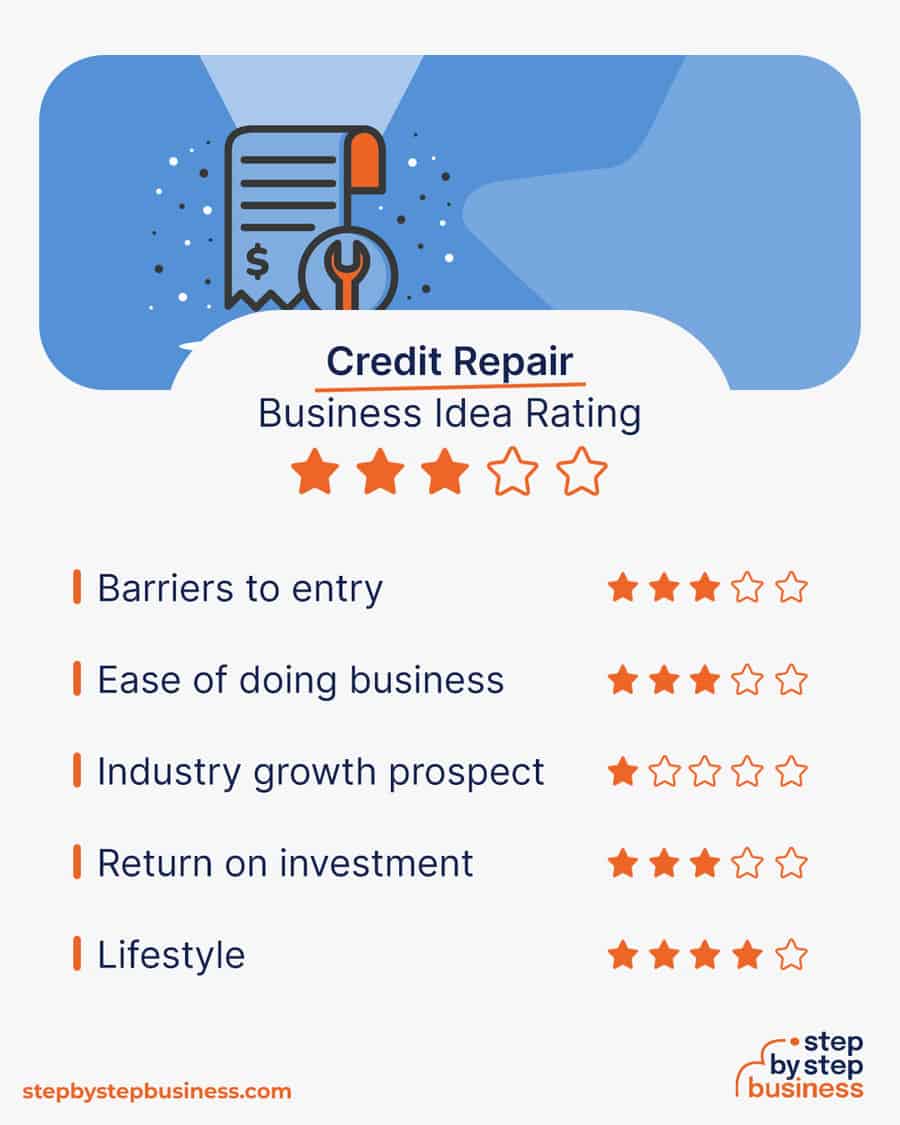

Industry trend

If you enjoy helping people stabilize their lives and financial future, a credit repair business could be a great fit for you. The credit repair industry, which helps people boost their credit scores, took a major hit during the covid-19 pandemic, losing a quarter of its revenue in 2020. But analysts expect the industry to recover with slow but steady growth through 2026, which means the opportunity is there for the taking.

Of course, starting any business requires hard work and patience. Thankfully, you’ve come to the right place, as this article lays out every step you’ll need to take to develop a strong plan and get your credit repair business up and running and giving people greater financial opportunity!

Looking to register your business? A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple.

Form your business immediately using ZenBusiness LLC formation service or hire one of the Best LLC Services .

Step 1: Decide if the Business Is Right for You

Before you dive into starting your business, let’s take a step back and observe what’s happening in the industry.

Pros and cons

The credit repair industry comes with both pros and cons. Let’s take a look at some of them.

- Easy to scale, thanks to software tools

- Everybody needs good credit

- Low startup costs

- Some clients are wary of fraud

- Highly competitive due to few barriers to entry

Credit repair industry trends

Economic growth in the post-pandemic recovery could lead to increased demand for credit repair services. As consumers become more confident, they tend to spend more, which results in greater debt and more need for credit repair.

Industry size and growth

- Industry size and past growth – The US credit repair industry is worth $3.4 billion, after contracting an average of 6% per year since 2017, according to market analyst IBISWorld.(( https://www.ibisworld.com/industry-statistics/market-size/credit-repair-services-united-states/ ))

- Growth forecast – IBISWorld expects to see a turn-around through 2026, as the industry begins to recover from the pandemic slump.

- Number of businesses – More than 40,000 credit repair businesses operate in the US. The number has steadily declined since 2012.(( https://www.ibisworld.com/industry-statistics/number-of-businesses/credit-repair-services-united-states/ ))

- Number of people employed – The industry employs more than 46,000 people.(( https://www.ibisworld.com/industry-statistics/employment/credit-repair-services-united-states/ ))

Trends and challenges

Here are some of the trends shaping the industry:

- Debt-ridden Americans are filing for bankruptcy instead of seeking credit repair services

- Increasing use of online credit repair services

Some of the challenges faced by operators are:

- High level of competition in the industry

- Distrust in credit repair companies

How much does it cost to start a credit repair business?

If you start from home and negotiate monthly payments for your surety bonds and software, you could launch a credit repair business for as little as $5,000. But if you want to invest more in your business and have a large office with staff, you could spend $50,000 or more to cover startup costs and your first month in business.

On average, though, most credit repair startups need around $20,000 to open their doors.

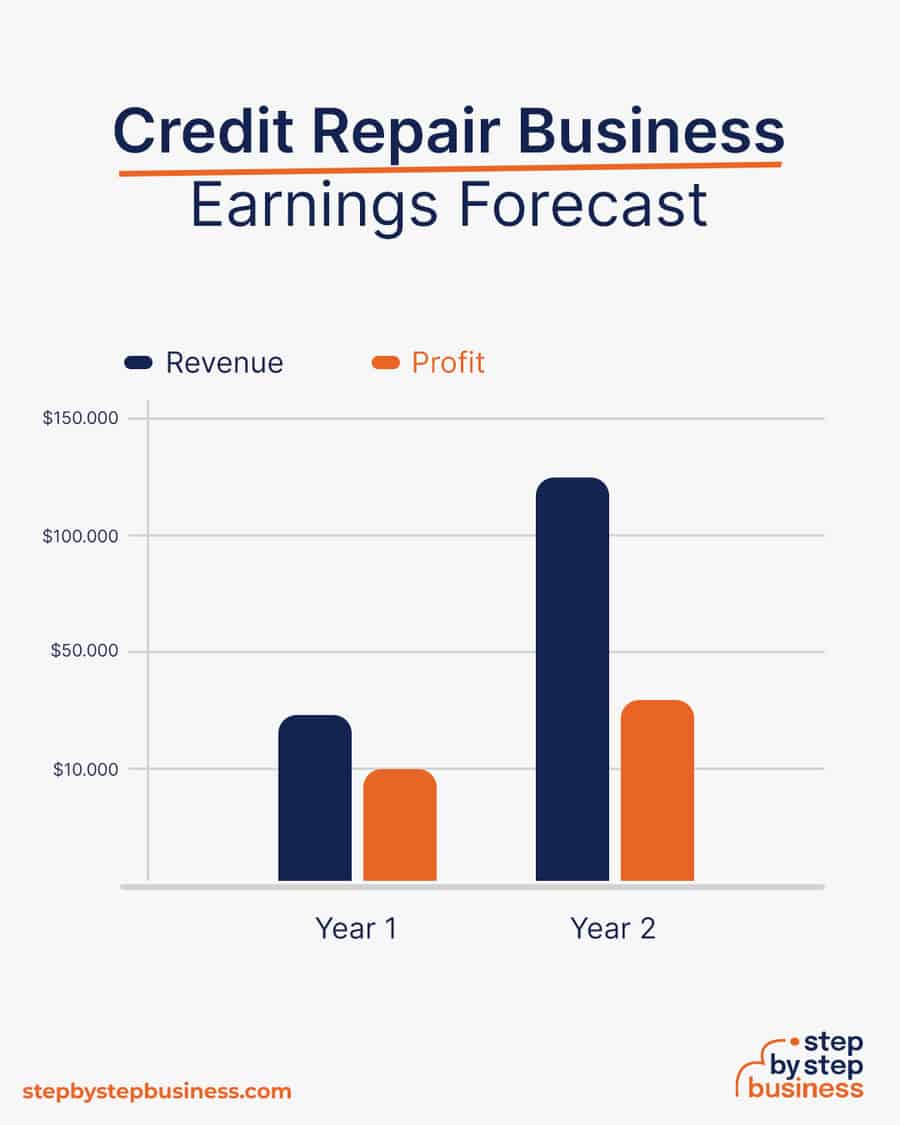

How much can you earn from a credit repair business?

The main factors affecting your revenue are the number of clients you have and the primary services they purchase. Naturally, if you get great results for your clients, the more customers you’ll have in the future.

Your clients will usually pay a flat fee or a recurring payment for your services. But it’s up to you to find what structure works best.

Credit repair businesses enjoy profit margins of 25% to 40%, and most charge $79-$129 per month for their services. So if you start out with 20 customers paying $100 a month in your first year or two, you’ll do $24,000 in annual revenue and almost $10,000 in profit, assuming a 40% margin.

If you’re able to push your customer numbers up to 100, you’ll be generating annual revenue of $120,000. At this stage, you’d hire more staff, reducing your profit margin to 25%. You’ll be making $30,000 in annual profit.

What barriers to entry are there?

There are a few barriers to entry in the credit repair business. The main one is the high level of competition, because it’s easy to start a credit repair business. On the flip side, many of these businesses fail relatively quickly. So if you’re able to stick it out and build a track record as a credit repair specialist , success may knock on your door.

Related Business Ideas

How to Start a Check Cashing Business

How to Start a Financial Coaching Business

How to Start a Money Lending Business

Step 2: hone your idea.

Now it’s time to hone your idea so that your credit repair service can begin taking shape. First, let’s find out how to identify your target market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Your competition will be credit repair firms targeting the same market. While large companies that target broad demographics will still compete with you, you’ll have an edge in your market due to targeted branding.

Once you’ve got a list of competitors, here are some questions to examine:

- What are my competitors’ value propositions?

- How much do they charge for their services?

- What’s included in their services?

- What do customer reviews say about these companies?

- What can I do to differentiate myself from these businesses?

What? Determine your services

Running a credit repair business requires a varied schedule. Here are a few everyday tasks:

- Onboard new clients: New customers are the key to growing your business, so you need to make sure that your clients are informed about the credit repair process. You’ll also need to secure the new client’s credit report as part of this process.

- Disputing claims: This includes creating and sending dispute letters and communicating with the required credit bureau or lender. Some claims you will dispute include late payments from debt collectors (also known as a debt collection agency ).

- Communicating with existing clients: You’ll need to regularly check in with clients to maintain their trust as well as update them on their credit score.

- Marketing: To get new customers, you’ll need to run marketing campaigns.

How much should you charge for your services?

Most credit repair services charge a monthly fee between $79 and $129. While this is the average, to find your ideal rates, you’ll need to consider your costs and the time and effort it takes to complete your service.

Some credit repair services also charge a setup fee for initial document processing and administration. But, this is a grey area as the Credit Repair Organizations Act prohibits credit repair companies from charging upfront service fees. So, as a budding credit repair professional, you likely want to steer clear of upfront fees.

You’ll need to determine an acceptable price for your local market and then tweak it based on expenses. Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Identifying your target market is vital for maximizing your marketing dollars and the effort you spend on your business. You’ll first need to determine who would benefit from your services. An answer to your target market could be “people with bad credit.” While this is valid, it’s also too broad. You could narrow your market down by factors like age, gender, and earnings.

For example, you could target millennials who need help improving their credit for first home purchases, or in regards to student loan debt. To market your services to this demographic you might use social media platforms like Instagram and TikTok.

Where? Choose your business premises

Credit repair businesses can be run from home thanks to technology, but it may be worthwhile to an office, as face-to-face meetings are better for building trust than Zoom calls.

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in your area on sites such as Craigslist , Crexi , and Instant Offices .

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a Credit Repair Business Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- The name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “credit”, boosts SEO

- Choose a name that allows for expansion: “Credit Care Services” over “Student Loan Relief Services”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Discover over 250 unique credit repair business name ideas here . If you want your business name to include specific keywords, you can also use our credit repair business name generator. Just type in a few keywords and hit “generate” and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that set your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Credit Repair Business Plan

Here are the key components of a business plan:

- Executive Summary: A concise overview of your credit repair business, summarizing its mission, goals, and key points to grab the reader’s attention.

- Business Overview: Detailed information about your credit repair business, including its mission, vision, structure, and legal status.

- Product and Services: Explanation of the specific credit repair services you offer, such as credit report analysis, dispute resolution, and financial counseling.

- Market Analysis: Examination of the credit repair industry, target market demographics, and trends to justify the demand for your services.

- Competitive Analysis: Evaluation of competitors in the credit repair market, highlighting your unique selling points and strategies to gain a competitive edge.

- Sales and Marketing: Outline of your sales and marketing strategies, including customer acquisition channels, advertising, and promotional efforts.

- Management Team: Introduction to key individuals responsible for running the credit repair business, emphasizing their skills and experience.

- Operations Plan: Details on day-to-day operations, including the credit repair process, technology requirements, and partnerships essential for smooth functioning.

- Financial Plan: Financial projections, including startup costs, revenue forecasts, and break-even analysis, providing a clear picture of the business’s financial viability.

- Appendix: Additional documents or information supporting the credit repair business plan, such as resumes of key team members, market research data, and any legal documents.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you are planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to credit repair.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your credit repair business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC , which just needs to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization , and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number , or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you are completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans : This is the most common method, but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans : The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants : A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Venture capital : Offer potential investors an ownership stake in exchange for funds, keeping in mind that you would be sacrificing some control over your business.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank and SBA loans are probably the best options, other than friends and family, for funding a credit repair business.

Step 8: Apply for Licenses/Permits

Starting a credit repair business requires obtaining a number of licenses and permits from local, state, and federal governments.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account .

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your credit repair business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of any of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

Strong credit repair software options include DisputeBee , TurboDispute , and Credit Repair Cloud .

DisputeBee streamlines the entire dispute process by automating it from start to finish. It allows you to import a client’s credit report to automatically generate dispute letters and track client progress. TurboDispute’s cloud-based software can help you manage everything business-related. From managing your team and clients to your affiliates and leads, they’ve got you covered. CRC provides a robust CRM, automated disputing, and even a recurring billing solution. Their all-in-one platform even helps you scale your credit repair business.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future business:

- Professional Branding — Ensure your branding communicates trust, professionalism, and financial expertise through your logo, business cards, website design, and overall online presence.

- Website & SEO — Create an informative website that details your services, the credit repair process, and showcases client testimonials, optimized for keywords related to credit repair, debt management, and financial counseling.

- Direct Outreach — Network with local financial advisors, realtors, and lenders to establish a referral base that can direct clients needing credit repair services to your business.

- Social Media Engagement — Utilize LinkedIn for professional networking, and platforms like Facebook and Twitter to share credit tips, client success stories, and relevant financial news.

- Content Marketing — Maintain a financial education blog offering advice on credit repair and improving financial habits, supported by webinars and online workshops that educate on credit management and financial wellness.

- Professional Collaborations — Partner with financial institutions like banks and credit unions to reach clients who could benefit from credit repair services, and collaborate with local businesses to include your services in their employee wellness programs.

- Client Loyalty Programs — Implement a referral program that incentivizes clients to refer others to your services, and offer ongoing credit monitoring or follow-up consultations to help clients maintain their credit improvements.

- Targeted Advertising — Employ targeted digital advertising on platforms like Google Ads and social media to reach individuals actively searching for credit repair services.

- Email Marketing — Build an email marketing campaign to nurture leads, share client success stories, and continuously provide valuable financial tips and updates.

- Customized Financial Services — Offer tailored credit counseling and repair services that meet the specific needs of your clients, ensuring effective and personalized credit solutions.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that set it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your credit repair business meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your credit repair business could be:

- Fastest credit repair in your area

- Better credit guaranteed!

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a credit repair business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in the credit industry for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in credit repair. You’ll probably generate new customers or find companies with which you could establish a partnership. Online businesses might also consider affiliate marketing as a way to build relationships with potential partners and boost business.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a credit repair business would include:

- Credit Repair Specialist – analyze the financial situation of prospective clients

- Administrative Assistant – handles clerical tasks

- Marketing Lead – generates new leads

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Credit Repair Business – Start Making Money!

You’re now ready to start repairing credit and improving lives. Now, how will you find your first client? There are many different ways. You can find business through extensive networking, an efficient referral system, or social media. Remember, having a strong social media presence could spell the difference for you.

On behalf of your clients, you will work with credit bureaus and creditors to remove errors from your client’s credit report. Some examples of creditors include banks and credit card issuers. It’s wise to touch base and establish rapport with these companies first. With these preparations, you should be well on your way to success!