- Personal Budgeting Game

- Stock Market Game

- Our Platform

- Real-Time Stock Game

- Financial Literacy Resources

- Financial Literacy Certifications

- Market Insight Widgets

- Career Readiness

- Homeschool Resources

- K12 Schools

- School Districts

- Corporate Financial Literacy Program

- Employee Financial Education & Wellness

- Sponsor a School

- White Label Financial Education Solutions

- Teacher Test Drive

- Schedule a Demo

- Request a Quote

- Login Login -->

What Is A Stock Presentation

This presentation accompanies our lesson on Stocks, which is available as a class Assignment with a built-in assessment. Click Here to view the main lesson !

Copy this presentation to Google Slides

Download this presentation as a PowerPoint

Read These Next

Comments are closed.

- Search Search

From Our Blog

- Feature Highlight – Student Stock Comparison Tool

- Feature Highlight – Weekend Choices

- Feature Highlight – Trailing Stop Orders

- Feature Highlight – Economic Concepts Presentation Templates

- January 2024 Content Update

Personal Finance Lab

Stock Pitch

A guide on how to approach one of Wall Street’s most ubiquitous assignments: the stock pitch.

What is a Stock Pitch?

Whether you’re involved in a finance club at your university or applying for a position at a hedge fund, individuals pursuing a career in finance have all more than likely come across the illustrious stock pitch.

A stock pitch, simply put, is a presentation or paper documenting your thesis as to whether a company is overvalued or undervalued. Supporting evidence is used to tell a narrative and ultimately guide the audience towards your investment recommendation to buy or short a stock.

Let’s look into the steps of building a successful stock pitch.

Before Putting Pen to Paper: Building a Credible Investment Thesis

Generate ideas through research.

An important first step in the process is doing the underlying research. Find an industry you are interested in or one that you think has structural tailwinds, and narrow in by screening for certain criteria (i.e. geography, revenue, market cap, etc.).

Once you have a more targeted list, look through industry primers, news publications, research reports, company reports, and other available resources on the main companies in the industry.

What to look for:

- Competitors with an angle of differentiation.

- Catalysts that seem to be overlooked.

- Strong underlying business fundamentals that make for a clear and compelling argument.

Unless you have a strong background in the space, try to avoid companies in industries like Oil & Gas or Financial Institutions that have unique approaches to valuation, as this will create unnecessary complications in building out your analysis.

Determine an Investment Thesis

Once you have a target company in mind, it's important to lay the foundation behind your ideas. One thing to remember is that equities, in theory, are supposed to have all publicly available information priced into the stock. This simply means that the market has traded on the stock to reflect a price that captures what is known about the respective company.

Your investment thesis, then, is to set the stage for why you are convinced that the market is dislocated. What evidence is there to suggest that the institutional investors may have gotten it wrong?

While not exhaustive, here are a few areas around which your investment thesis may be driven:

- Strategic Shifts – A company’s decision to make systemic changes to its organization or operations creates uncertainty as to the credibility and confidence of change.

- Misinterpreted Growth Levers – Company developments (organic or inorganic) or its strategic positioning may be discounted in the market or viewed over-optimistically.

- Susceptibility to Macro Factors – Trends in the macroenvironment and/or the industry landscape may create opportunities for disruption or create unanticipated barriers to development and competitive differentiation.

As an example, when I worked on a stock pitch a few years ago for the company Sony , my pitch started off with the following overarching observation that helped to organize my thoughts and structure the presentation:

Sony’s reorientation of its business in 2012 reflected a monumental shift in the company’s vision towards key investment areas and product innovation. Innovations like the PS5 (set to be released in the following years) were not properly accounted for in future projections despite historical precedent for similar key mark product launches, as the company’s stock remained overshadowed by its legacy inability to adapt to technological advances.

How to Structure a Stock Pitch

The general structure of a stock pitch is relatively consistent across the board, broken down into the following sections:

- Investment Summary

- Industry & Company Overview

- Risks & Mitigants

- Final Recommendation

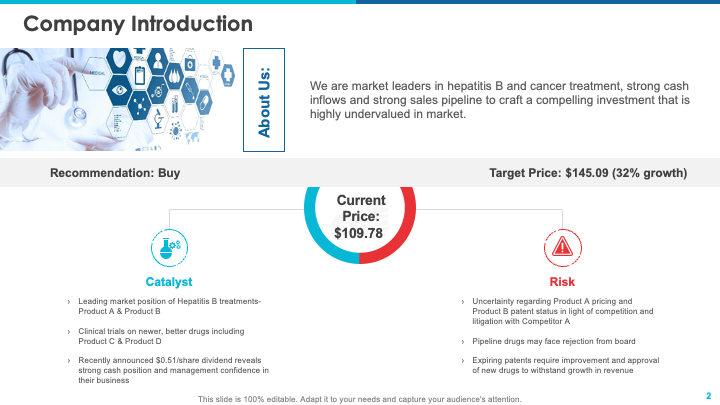

Section 1: Investment Summary

The investment summary serves to bring your ideas up front in a concise, punchy manner. Often covered over a single slide, include things like:

- Recommendation – The position you hold (buy or short), the target price of the stock, and the time horizon expected to achieve this price.

- Catalysts – The 3-4 drivers behind your belief that the stock price will change (analyzed more closely in the following slides).

- Valuation – The football field summary or median implied share derived from your valuation analyses and what this implies based on the current market price.

- Risks – The items that may pose a threat to your investment case so that the audience knows you’ve analyzed both sides of the story.

Section 2: Industry and Company Overview

In a movie, the industry and company overview would be the plot. The goal with these slides isn’t itself to sell your viewpoint, but more so to give context around the dynamics which help lend themselves to your recommendation.

Industry Overview Guidance Questions

- What are the trends today that you see?

- What does the competitive landscape look like?

- Where is there an opportunity for growth?

Company Overview Guidance Questions

- What is the history of the company (visuals like an annotated stock price chart can help to tell this story)?

- How is the company positioned in its market?

- What are the company's competitive advantages?

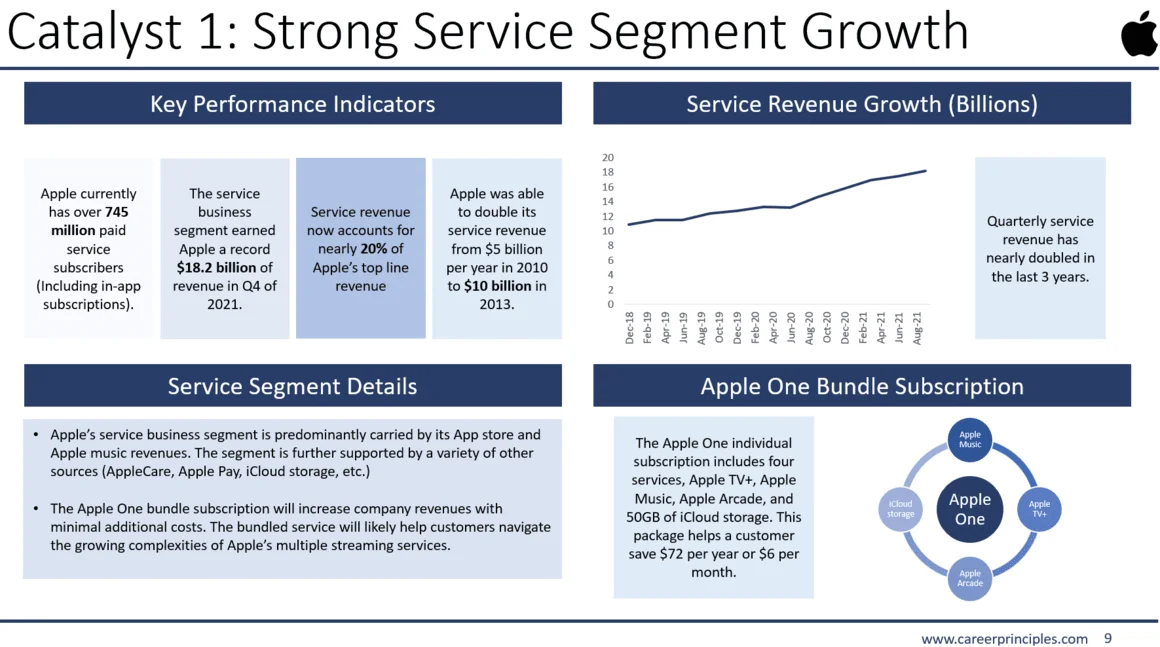

Section 3: Catalysts

If the investment thesis is the floor of a building, catalysts are the pillars. Here, you want to detail the near-term initiatives that the company plans to take which will support its capital appreciation. This may include:

- Product Launches

- Geographic Expansion

- Cost Optimization

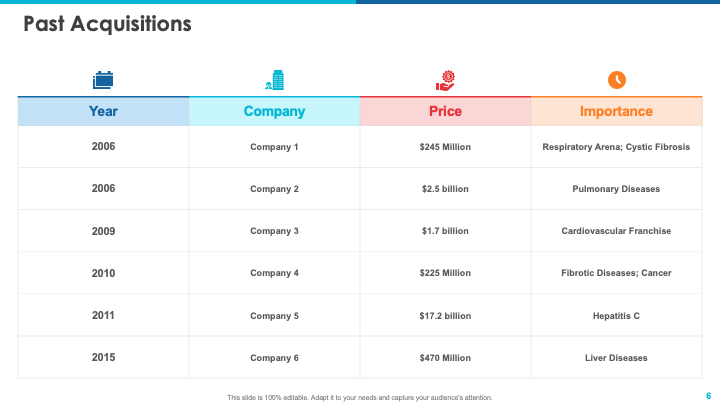

- Acquisitions / Divestitures

- Leadership Change

Each catalyst should have its own dedicated page to fully explain how you see this as tangible evidence for business growth. This is the meat of your argument, so the key lies in the details of your observations.

Section 4: Risks & Mitigants

As an investor, it’s important to consider all cases, particularly those where things don’t turn out so rosy. With the risks and mitigants section, you are trying to show that you’ve considered there is a probability for downside, but after thoughtful consideration, the potential benefits outweigh the likelihood of these concerns manifesting.

Risks and mitigants are typically laid out on a single page, structured by noting the most relevant potential impediments to the business. This is followed with a few bullets per risk noting what the business is doing, in its strategy and day-to-day business operations, that help to alleviate the threat of this risk.

Example - Luxury Goods Company

Risk: Luxury goods revenue is dependent on a relatively small sales volume at high prices, which leaves its financial performance subject to broader economic conditions that may influence discretionary spending.

Mitigant: The company has relatively high pricing power to counteract potential decreases in sales. In addition, its end market of high-net-worth clients is insulated from recessionary periods that may influence the average consumer.

Section 5: Valuation

Likely the most direct part of the presentation, this section is where you lay out the outputs from your valuation exercises. For individual pages on comparable companies, precedent transactions, DCF, etc., you may want to include a few bullets on the assumptions underpinning your thought process. For example, the rationale as to why certain comps were selected.

Ultimately, however, you will want to create a football field to show what implied share price you derived across your valuation methodologies to determine where there is overlap and where your target share price shakes out.

To learn how to produce DCF, comparable companies, and precedent transaction models, check out our Complete Finance & Valuation Course .

Section 6: Final Recommendation

Similar to the Investment Summary, you want to iterate the main arguments of your pitch in your Final Recommendation. One difference is that you will want to place slightly more emphasis on what your analysis, both quantitative and qualitative, tells you. Synthesize what the market is missing and why your target price is justified.

Stock Pitch Tips

While there is no right or wrong view, there are a few general recommendations we think are important to consider when building out a stock pitch:

- Avoid Starting with a Name – Instead of starting off with a specific company in mind, use what you learn from your research to make an informed decision on your company selection and recommendation. This will avoid you falling into the problem of looking for justifications (as opposed to having compelling catalysts to begin with and working backward to select the company).

- Make Your Recommendation Differentiated – Try to avoid obvious choices for pitches, such as FAANG stocks. Not only will this more likely ensure that your views are seen as unique, but also helps to highlight your diligence in stock selection.

- Do the Work Behind the Scenes – In many cases, stock pitches will include a post-presentation Q&A, which will help to showcase who has done the bare minimum and who has gotten in the weeds of knowing the company beyond what is put on PowerPoint.

- Support Your Assumptions – For any projections included in analyses like a DCF, make sure you have an argument for assumptions.

- Stay True to Your Conviction – The last thing you want to do is finish your work and feel like you don’t have a strong case. Using the steps and tools mentioned in this article will help to steer you in the right direction.

Additional Resources

For full case study coverage on the stock pitch, check out our Complete Finance & Valuation Course and PowerPoint for Business & Finance Course which gives more light on the content and structure for a successful presentation.

Other Articles You May Find Helpful

- WACC Calculator

- How to Become an Investment Banker

- My Goldman Sachs Investment Banking Resume

- Cash Flow Statement

Introduction

Building a cash flow statement from scratch using a company income statement and balance sheet is one of the most fundamental finance exercises commonly used to test interns and full-time professionals at elite level finance firms.

Test hyperlink

Dolor enim eu tortor urna sed duis nulla. Aliquam vestibulum, nulla odio nisl vitae. In aliquet pellentesque aenean hac vestibulum turpis mi bibendum diam. Tempor integer aliquam in vitae malesuada fringilla.

Elit nisi in eleifend sed nisi. Pulvinar at orci, proin imperdiet commodo consectetur convallis risus. Sed condimentum enim dignissim adipiscing faucibus consequat, urna. Viverra purus et erat auctor aliquam. Risus, volutpat vulputate posuere purus sit congue convallis aliquet. Arcu id augue ut feugiat donec porttitor neque. Mauris, neque ultricies eu vestibulum, bibendum quam lorem id. Dolor lacus, eget nunc lectus in tellus, pharetra, porttitor.

- Test Bullet List 1

- Test Bullet List 2

- Test Bullet List 3

"Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus."

Tristique odio senectus nam posuere ornare leo metus, ultricies. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Aliquam tellus lorem sed ac. Montes, sed mattis pellentesque suscipit accumsan. Cursus viverra aenean magna risus elementum faucibus molestie pellentesque. Arcu ultricies sed mauris vestibulum.

Morbi sed imperdiet in ipsum, adipiscing elit dui lectus. Tellus id scelerisque est ultricies ultricies. Duis est sit sed leo nisl, blandit elit sagittis. Quisque tristique consequat quam sed. Nisl at scelerisque amet nulla purus habitasse.

Nunc sed faucibus bibendum feugiat sed interdum. Ipsum egestas condimentum mi massa. In tincidunt pharetra consectetur sed duis facilisis metus. Etiam egestas in nec sed et. Quis lobortis at sit dictum eget nibh tortor commodo cursus.

Odio felis sagittis, morbi feugiat tortor vitae feugiat fusce aliquet. Nam elementum urna nisi aliquet erat dolor enim. Ornare id morbi eget ipsum. Aliquam senectus neque ut id eget consectetur dictum. Donec posuere pharetra odio consequat scelerisque et, nunc tortor. Nulla adipiscing erat a erat. Condimentum lorem posuere gravida enim posuere cursus diam.

Ready to Level Up Your Career?

Learn the practical skills used at Fortune 500 companies across the globe.

Stock pitch guide: Basics, insights, and practical tips

In this guide, we discuss the intricacies of stock pitches. You will discover the crucial elements of a stock pitch, such as the investment thesis, DCF model, and risk mitigation options. You will also learn how to prepare a successful presentation and pitch a stock to any potential investor.

What is a stock pitch?

A stock pitch is a multipurpose tool that helps capital markets professionals identify and evaluate each other as well as promising opportunities. When presented correctly, a pitch stock can increase your credibility within the field and put a start to limitless profitable ventures.

Stock pitch definition

A stock pitch is a verbal or written presentation that analyzes the potential of investing in a public company. Stock pitches can both advise pro and against the share and are often used to measure the presenter’s market analysis skills.

As you will see from the sample stock pitch template below, stock pitches consist of several crucial elements, including company research, market share, investment thesis, investment risks, and stock’s key drivers.

But while the quality and quantity of the necessary information call for an extensive period of time, in some cases, you will need to put a stock pitch together on short notice.

Typical stock pitch scenarios

To know how to do a stock pitch correctly, you need to have a clear objective in mind. This means building your stock pitch according to the target audience’s expectations. Below are the most common applications of stock pitches in modern deal-making.

Stock pitches are powerful tools for connecting with hedge funds and investment banks. You can include an investment opportunity summary in the form of a stock pitch in your introductory email to showcase expertise or offer services.

Your priority, in this case, is to keep the delivery concise but valuable.

Pitching a stock has become a crucial part of business schools’ curricula in the past few years. Students can enroll in a stock pitch competition, join investment clubs, or even pitch an investment thesis to existing hedge funds in the prospect of landing an internship.

Primary research is typically sufficient for educational purposes since the main goal is evaluating students’ skills rather than the practical implementation of their idea.

Interviewing for a job

Hiring managers of private equity (PE), hedge funds, and personal investing firms include stock pitches in the interview process. Your stock pitch will help the decision makers evaluate how much conviction you have in your analytical methods, where you source investment ideas, and how your delivery style aligns with their organizational values.

Just as at any other job interview, the key elements here are thorough research and confidence.

Fulfilling job duties

Consequently, if you had to create two to three pitches during the hiring process, stock pitch development will be a part of your job description. Most hedge funds, or any other established financial institution, expect associates to monitor the industry trends and sometimes initiate internal stock pitch competitions to brainstorm ideas and explore new territories.

Investment banking and hedge fund professionals must have the deepest understanding of stock mechanics. In such scenarios, you can spend several weeks on a single stock pitch.

Building a personal portfolio

Once you master stock pitches, you can use them as a research formula for expanding your own portfolio. While you might not need to convince yourself with an eloquent investment thesis, it is still a good idea to take a deep dig into the company’s background, financials, and key risks.

While a personal investment pitch is less demanding, stock pitch mistakes will cost you. Therefore, research the public company you want to invest in with the same scrutiny as if you were doing it for a client.

Note: To learn what happens to stock when a company is bought explore our dedicated article.

Stock pitch structure

Let’s review the basic structure of putting your investment ideas into a stock pitch.

Recommendation statement

The first part of your stock pitch is always a brief summary of your investment idea. You must mention whether you suggest longing or shorting on a specific company and offer a strong reason why. Keep this section concise, as you will have the opportunity to go into more detail in the investment thesis.

When pitching stocks to a hedge fund or any other investor, make sure you are familiar with the target’s portfolio and market outlook.

Company overview

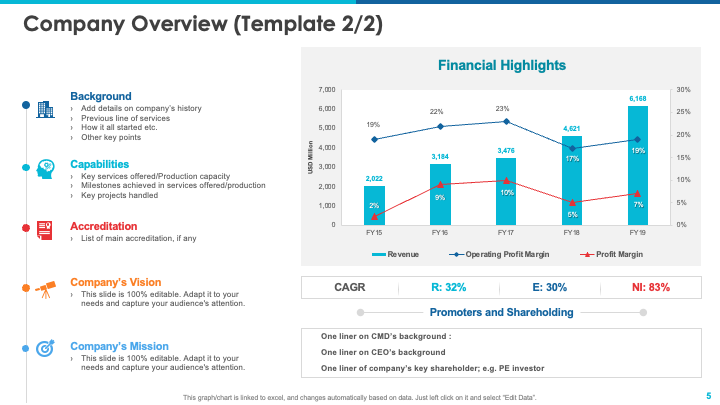

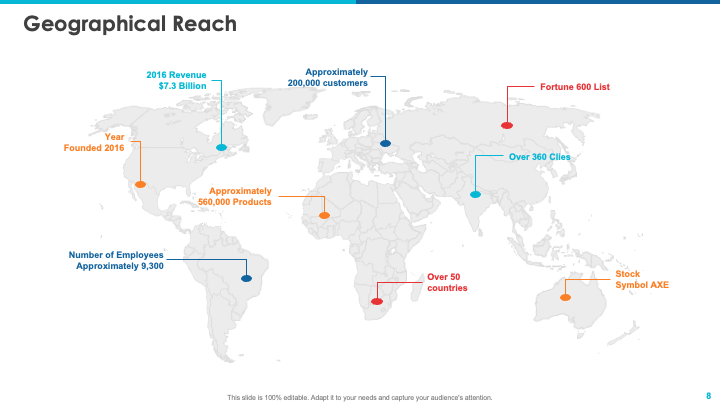

The next step of your stock pitch is the overview of the company background, including the market share and major industry trends. You can also include the stock price and trading volumes data for the company’s entire existence or recent years.

Create a comparable company analysis template when selecting a pitch candidate from several similar companies. For example, when comparing biotech startups, line up their recent innovations and patents to distinguish the most promising venture.

Investment thesis

The general idea behind an investment thesis is to state why the market is wrong about the current stock price by evaluating market cap, equity research, PE, market sentiment, and other factors.

The thesis is the quintessence of your investment ideas that essentially define the value of the stock pitch. To ensure you sound convincing, draft several investment thesis examples before picking the final one.

Price correction catalysts

Back up your investment thesis by mentioning the upcoming events that will affect the stock price and push the market to fulfill the asset’s intrinsic value. These include product launches, acquisitions, cash flow fluctuations, and competitor tactics, among others.

Quarterly reports and press releases are great sources of typical catalysts for stock pitches. For example, Apple and Samsung presentations are famous for briefly but noticeably influencing the market with new product announcements.

Stock pitch valuation depends on whether you are making a long or a short recommendation. This way, if you suggest longing, you need to prove that the present value is too low. Similarly, argue that the price is too high if you want investors to short.

There are two general valuation metrics used in stock pitches – DCF and NAV. DCF calculates the profitability of investment ideas based on expected cash flows. And NAV divides the value of the cash flow and securities minus liabilities by the number of outstanding shares.

Risks and risk mitigation options

Finally, describe all the key risks associated with your suggested investment strategy and the options to alleviate them. Rely on the combination of fundamental and technical analysis, the company’s market cap, and primary strategies.

Make sure you only consider risk factors specific to the company. For example, the global recession applies to the entire market, and you don’t necessarily need to feature it in the stock pitch.

Stock pitch template and examples

Below is a generalized stock pitch example you can use as a template. Please note that any information listed below is presented for illustrative purposes and does not serve as a functional trading signal source.

Stock pitch elements

1. recommendation statement.

Content: The main reason to consider the stock.

What to include:

- Whether you suggest to long or short

- Expected value spike or drop

Example quotes: “I recommend longing the ABC stock because it is undervalued by 25% and could increase in value over the next 12-18 months.”

2. Company overview

Content: The background of the company you are pitching.

- Geographies

- LTM financials

- Base projections

- FY prices and volumes

Example quotes: “LTM financials: $2 billion in revenue; $1.5 billion EBITDA; $1.3 billion FFO.”

3. Investment thesis

Content: Why is the market currently wrong about the stock’s value?

- Factors that contributed to imperfect pricing

- Reasons why the market hasn’t yet corrected

- Recommendation

Example quotes: “Historically low P E ratios despite positive earnings and optimistic fundamentals. The market has not yet realized the potential of expanding demographics. It is strategically wise to long this stock within the next month.”

4. Price correction catalysts

Content: What factors will affect the price in the suggested time frame?

- Product launches

- Expansions

- Positive FY earnings

Example quotes: “ABC is to finalize three additional acquisitions within the next 6 months, adding to the enterprise of seven previously acquired companies.”

5. Valuation

Content: Whether the current value is too low or too high.

- Model(s) you used to calculate the value

Example quotes: “According to the DCF valuation method presented above, the ABC equity value per share is $120.5.”

6. Risk factors and mitigation options

Content: Risks your investors might face and how to reduce them.

- Risks specific to the company, such as constant innovations in the field, political uncertainties, growing offer

- Mitigation strategies

Example quotes: “Just like ABC, its competitors often announce innovations. This can be alleviated through contact R&D investments.”

How to make a good stock pitch?

Now that you know how to structure a stock pitch, it’s time to take this skill to the next level. Next, we will discuss how to pitch a stock successfully to appeal to even the most meticulous investment competition decision-makers and hedge fund chairs.

1. Believe in your investment ideas

The investment idea at the base of your stock pitch has to be well-researched and backed up by relevant data. But by the end of the day, the best screening tool is your judgment. Below are some tips for getting on the right track when pitching a stock.

Know your investor

Whom are you going to pitch to? Perform the equity research of the hedge fund or private investor you are targeting to understand what companies they usually go for and what their target price could be.

Also, pay attention to the type of transactions they typically finalize. For example, a long-only fund is less likely to be interested in a short recommendation.

Focus on the industries you are familiar with

An industry overview is much faster and easier if you are familiar with the field. Additionally, you can leverage your Capital IQ access or private equity connections to locate a promising investment opportunity for a stock pitch.

Choose a company with minimum key drivers

Stock pitches are more effective when they are straightforward. Pick a stock price with clear technical analysis patterns and only three or four key business lines. Any more would clutter your stock pitch and might substantially reduce valuation accuracy.

Stay alert for confusing financials

Cash flows and balance sheets must be transparent. No matter how good your investment idea is in theory, messy financials add risk factors and reduce your credibility. What’s more, an established hedge fund would never consider a stock pitch based on unclear numbers.

Look for clear catalysts

Look for direct catalysts such as acquisitions, innovative patterns, and product launches, as they usually have an evident impact on the market and often result in higher revenue growth. To ensure you make the right choice, analyze average sales associated with similar events in the past and note how they affected the stock price.

2. Invest time in research and valuation

The research process is arguably the most time-consuming part of your stock pitch. You must sound confident and knowledgeable to convince a private equity firm or a hedge fund to follow your recommendation.

Explore the company and its industry

There are numerous ways to backup your investment idea with data. Start by exploiting free resources, such as the company’s press releases, annual reports, and stock charts. Take your time to understand the company’s business model and reach out to their representative if something isn’t clear.

You can also set up a personal trading account to apply your theory on a smaller scale. There are two approaches to take, depending on how much time you have.

Get your relative valuation from public-access tools, such as Yahoo finance. In case your stock pitch is for presentation purposes only, basic data will usually be enough.

- In-depth way

Consult investment professionals to get a deeper insight into your stock pitch. Use professional social networking channels to connect with partners, major clients, suppliers, etc.

Build a DCF valuation model

DCF or Discounted Cash Flow model is a very common approach to evaluating investment potential. The formula takes into account the cash flow period, interest rate, and the number of years before the future cash flows get realized.

DCF is an extremely popular form of valuation metrics, so it is virtually compulsory in stock pitch competitions. Organize your calculations in a spreadsheet and ensure to keep it below 300 rows to save investors’ time.

3. Present your stock pitch well

The delivery style for your pitch varies based on the audience. But there are a few universal suggestions that will help you present stock pitches to professional investor firms, private equity experts, and anyone else.

- Lead a conversation instead of making a speech

Your stock pitch presentation should open the floor for additional ideas, concerns, and questions. Once you express your investment idea and deliver the investment thesis, address any queries before moving on.

- Get ready for some Q&A

Extend the conversation at the end of the stock pitch. Be ready to answer any questions regarding the stock’s current price, the company’s quality, and the risks associated with this public company’s stock. Thorough research will be a great asset at this stage.

- Admit the gaps in your knowledge

Even the deepest investment research will not cover the whole picture. When stock pitching, prepare for questions you won’t have answers to. Acknowledge the inquirer and get back to them with the response after the stock pitch. This is significantly easier during written pitches, as you can research as you go.

What to avoid when making a stock pitch

So far, we’ve covered most of the stock pitch do’s. Now, it is only fair to mention the don’ts as well. Avoid the next three approaches to investment idea sourcing, whether you are participating in an undergraduate stock pitch competition or applying for an investment banking or hedge fund position.

Quantitative screening

Quantitative screening is one of the rudimentary forms of volume analysis that relies on mathematical principles alone. Unlike relative valuation, this approach does not consider factors beyond the dry data, which results in substantial valuation inaccuracies.

Moreover, predictions and trailing in technical analysis follow patterns that are too impractical compared to fundamentals.

Hedge funds might consider elements of quantitative screening in your stock pitch only if you back it up with substantial catalysts.

Sell-side ideas

Sell-side analysts are too involved to deliver relevant data. What’s more, once the stock pitch idea is out, it quickly loses its P E value with the drop in originality. Take pitches from brokers with a pinch of salt and rely on your own research instead.

Hedge funds’ public disclosures and hedge fund word-of-mouth

A hedge fund might also not be a very reliable idea source. For one, it is practically impossible to evaluate the actual state of every company’s quality and overall portfolio. Misinformation and generic ideas are the worst enemies of your stock pitch, so it is better to steer clear of them.

Stock pitch interview questions to research

As already mentioned, you must be ready to protect your investment opportunity pitch with information. Below are the examples of questions a hedge fund or any other buy-side interviewer can ask during or after your stock pitch.

- What techniques did you use to form your investment thesis?

- Why is this a good investment right now?

- What are the primary revenue drivers?

- What is the company’s market share?

- How does the company stand out from the competition?

- Who manages the company, and who serves on the board?

- What is the customers’ feedback about the company in general and on its recent products in particular?

- Is it possible that the company is undervalued due to the discounted value of its cash flows?

- Do you have any other stock pitches in the same or a different field?

- Why are you pitching this idea to me/our hedge fund?

Stock pitch: Final takeaways

The quality and consistency of stock pitches play a crucial role in forming market key drivers. To successfully pitch a stock, it is essential to cover all the contributing factors, from valuation metrics to potential return presentation.

The foundation of every effective pitch is a deep understanding of the investor and sufficient research. While it is virtually impossible to get ready for every question and concern, the more you know about the company background and performance, the higher chances your pitch has.

Finally, it is best to continuously explore the market and draft pitches on any interesting instrument. This will allow you to build confidence and credibility for any future presentations.

Other insights

Middle market mergers and acquisitions: Opportunities, challenges, and best practices

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Numi Advisory is an expert in hedge fund and equity research recruiting , having advised over 600 clients by providing career coaching, mock interviews, and resume reviews for people seeking jobs in equity research, private equity, investment management, and hedge funds (full bio at the bottom of this article).

If you want to know how to pitch a stock , it would be great to have a full stock pitch guide in one article… right?

Well, you’re in luck: in this article, we give you real stock pitch examples and templates that you can use in hedge fund, asset management, and other buy-side interviews.

The stock pitch matters a lot in these types of interviews because it is literally what you do on the job, and it’s the best way to set yourself apart.

Also, interviewers will ask you to pitch a stock, often multiple times, if you want to get a job at a hedge fund .

Step 6: Favor Companies with Clear Catalysts

Focus on the following key points, investment thesis examples, stock pitch templates & examples.

Let’s start with the most important part: stock pitch examples for real companies. I’ll share two below from our financial modeling courses :

- Jazz Pharmaceuticals [JAZZ] – [SHORT] – Word | PowerPoint

- AvalonBay [AVB] – [LONG] – Word | PowerPoint

The Jazz stock pitch turned out to be incorrect over a 12-month time frame, but it was correct over a ~6-month time frame when the stock price fell.

The AvalonBay stock pitch turned out to be correct , with the company returning over 25% (including dividends) compared with an overall S&P gain of ~10% in that time frame.

I’m not going to share the full financial models, but you can get a sense of the AVB valuation by looking at our tutorials on REIT NAV Models and REIT Valuation .

For the Jazz model, there’s a whole treasure trove of DCF modeling tutorials on our YouTube channel.

What is a Stock Pitch?

Definition: A stock pitch is a short write-up or presentation that argues for or against investing in a public company’s stock, and which is backed by a strong investment thesis, data, valuation metrics, catalysts, and an assessment of the risk factors.

You use a stock pitch in the following ways:

- Networking: For example, you could look up contact information for hedge fund professionals and include your pitch in your introductory email to them.

- Interviews: You’ll be asked to pitch a stock all the time in hedge fund and asset management interviews.

- Investment Clubs and Competitions: You’ll have to present your views, argue why a security is mis-priced, and then convince others that you’re right.

- Personal Investing: If you have a personal trading account and you invest in individual stocks, you can use stock pitches to hone your reasoning and make better picks.

- On the Job: Finally, if you’re working at a hedge fund or other investment firm, you’ll research and pitch stocks on the job regularly. That is the job!

The bottom line: if you want a hedge fund career , or a career in closely related fields, you’ll need some solid stock pitches to interview successfully for Hedge Fund Analyst roles .

And if you want to start a hedge fund , you’ll need to generate a steady stream of stock pitches.

Usually, interviewers, firms, and competition judges won’t give you a specific company to pitch; it’s up to you to do the research and find one.

If they do give you a specific company, then it’s probably a time-pressured case study where you have 2, 3, or 4 hours to skim the company’s filings, build a simple model, and make a quick pitch based on that.

This article is geared toward longer, “take-home” stock pitches where you have a few days up to a week to finish the pitch, but the basic structure applies to time-pressured pitches as well.

If the firm you’re interviewing with does not give you an explicit time limit, ask for it , along with the formatting requirements and anything else they want to see.

Finally, note that we are only covering stock pitches here – not credit pitches or distressed debt pitches or global macro pitches involving FX, commodities, or sovereign bonds.

You can use the same structure for those, but specific elements of the pitch, such as the valuation, catalysts, and risk factors, will differ.

The Ideal Stock Pitch Structure

We recommend the following structure for all stock pitches:

- Recommendation – State whether it’s a Long or Short (i.e., whether you think its stock price will increase or decrease) and what the company should be worth. Do not give a “neutral” recommendation unless they assigned the company to you.

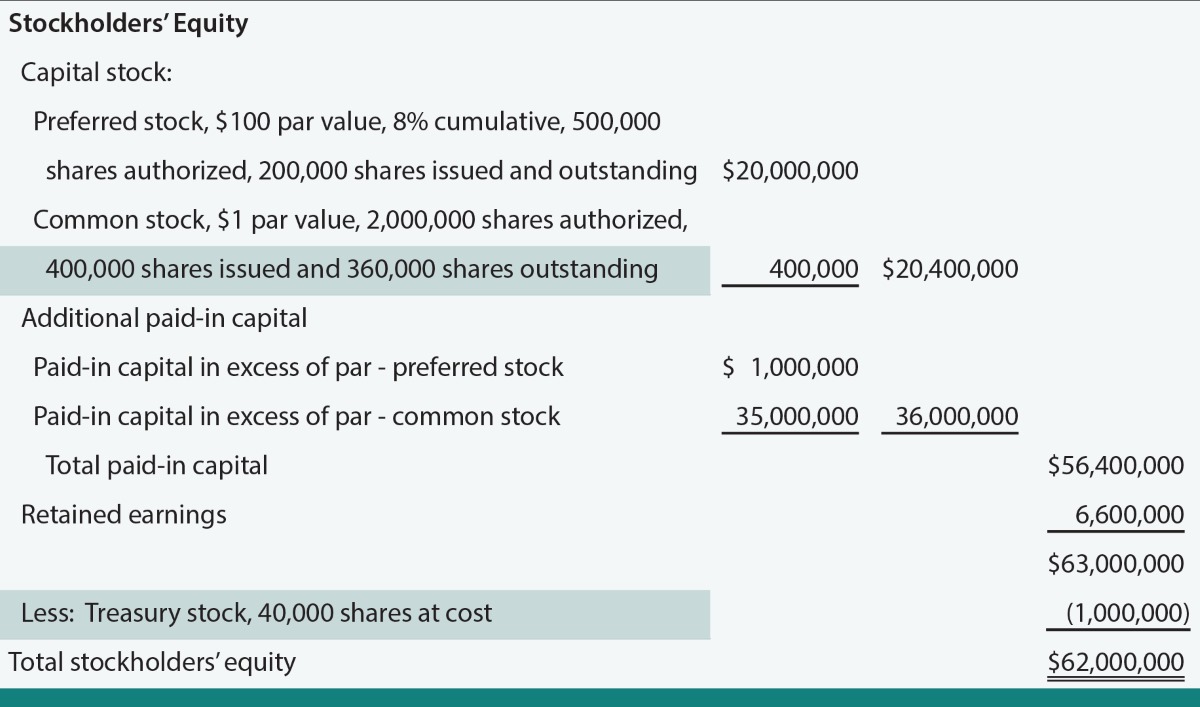

- Company Background – What are the company’s products/services, how much revenue/EBITDA does it generate, what is its market cap, and what are its current valuation multiples? Bonus points for a price/volume graph.

- Investment Thesis – The stock is priced imperfectly because of these 2-3 key factors. The market has not factored them in because of reasons X and Y. The market is wrong, and there’s a chance to gain significantly by longing/shorting this stock.

- Catalysts – Certain key events in the next 6-12 months will cause the market to “realize” this pricing imperfection, resulting in a price correction and the potential to make money. Key events might include new product launches, acquisitions, earnings announcements, divestitures, clinical trial results, and financing activities.

- Valuation – For a Long recommendation, you need to show that the stock is undervalued (e.g., right now it’s trading at $25, but there’s a reasonable chance it’s worth $35-$40); for a Short recommendation, you show why the stock is overvalued .

- Risk Factors and How to Mitigate Them – You lay out the top 2-3 market and company-specific reasons why your investment thesis might be wrong, and then explain what you can do to mitigate these risks. Even if you’re wrong, could you limit your losses?

If this is an initial pitch for networking or interviews, keep it short.

“Short” means “2-3 pages at the most,” as in our examples above.

Make it longer only if you have a lot of time to present, you’ve been asked to create a slide presentation, or you’ve been asked for a certain number of pages.

Building an Investment Thesis: Stock Pitch Idea Generation

“OK,” you say, “that structure sounds nice. But where am I supposed to get ideas in the first place? And how do I complete the research process and build a valuation in only a few days?”

The blunt truth is that you need to be following industries or companies already to have a good shot of finishing a stock pitch, even a 2-3-page one, in only a few days.

If not, then you should reevaluate whether or not you want a career in investing or hedge funds.

The best investors do it because they’re passionate about the process itself ; pitching stocks is their hobby.

So, ideally, you already have in mind companies that are undervalued or overvalued and whose stock prices could change significantly in the next 6-12 months.

How to Find a Company to Pitch, Step-By-Step

But let’s say you just found out about an interview in 4-5 days, you have nothing prepared, and you don’t follow specific companies.

Here’s the process I’d recommend in that case:

Step 1: Research the Fund’s Strategy

Before you even open Excel or Word, you need to make sure you’re searching for a company that is a relative match for the fund’s strategy. For example:

- Good Idea: Short for a recently public tech startup.

- OK-But-Not-As-Good Idea: Long for an undervalued, mature tech company.

- Bad Idea: Merger arbitrage pitch for a life insurance company spin-off.

- Good Idea: Long for an undervalued industrial tools manufacturer.

- OK-But-Not-As-Good Idea: Long for a misunderstood consumer/retail company amid a turnaround.

- Bad Idea: Short for an overpriced biotech startup.

It’s more important to match the strategy than it is to match the industry.

That’s why the “bad ideas” above are strategy mismatches.

Step 2: Start with an Industry You Know Something About, or That Lends Itself to the Fund’s Strategy

For example, if you’re an engineer, pick the technology , telecom, or media industries.

If you’ve done internships at retail companies, pick consumer/retail .

If you like whiskey even more than I do, pick the food & beverage industry.

Avoid industries that are highly technical or that have specific accounting/valuation methodologies (e.g., oil & gas or commercial banks ) – unless the fund specializes in them.

Also, keep in mind that certain industries will match the fund’s strategy more easily than others.

You can easily find over-priced and over-hyped tech and biotech startups that are ideal “Short” candidates, but in an industry like chemicals or industrials, it’s easier to find mature, undervalued companies that might be long-term investments.

Step 3: Screen for Mid-Sized Companies in the Industry

If you don’t have Capital IQ access, the best screening tool is https://finviz.com/ .

Here’s an example healthcare screen , which you can sort by sector, industry, country, market cap, and other criteria.

If the biggest companies in your industry have market caps of $100 billion and the smallest have market caps of $50 million, you should pick something in the middle: maybe the $1 – $10 billion range.

If you can screen by revenue, aim for companies with revenue in the hundreds of millions to low billions USD.

Step 4: Find Companies with 3-4 Key Drivers, At Most, and Relatively Pure-Play Businesses

Do not pick a company with 20 different business lines where each segment depends on different assumptions.

Consumer/retail companies are great because revenue depends on the number of stores and the average sales per store, and the projections are straightforward.

On the other hand, the maritime/shipping industry is not ideal because you need to make granular assumptions for different types of ships in the fleet.

In our example stock pitches here, I picked Jazz Pharmaceuticals partially because it had a manageable number of products – the main one, two smaller ones, and several even smaller ones that we consolidated:

Step 5: Eliminate Companies with Messy Financial Statements

If the company’s Cash Flow Statement is four pages long, or its Income Statement has 13 non-recurring charges, or its Balance Sheet has 30+ items on each side, drop it.

Yes, you can simplify and consolidate the statements, but that takes up precious time that you don’t have.

If you’re down to 2-3 companies by this point and you can’t decide, pick the one with the most concrete, impactful catalysts .

A company that just announced an acquisition or divestiture, a major product or clinical trial results, or a major strategic pivot is a good bet.

Product launches and expansion strategies are good catalysts because it’s easy to argue that future growth will be higher or lower than expected.

If you’ve done everything above but still can’t decide, pick a company randomly and move on.

One final note: do not rely on equity research reports to find companies or investment theses.

Equity research is useful for gaining background knowledge and finding market data, but you should not use it for building your investment thesis.

Stock Pitch Research and Valuation Process

You will not be able to read thousands of pages if you have only a few days or a week, so we recommend the following steps:

- Research the Company and Industry – Get the company’s latest annual and interim reports and its most recent investor presentation. You can also search for press releases about the company’s products/services.

- Build a Simple DCF-Based Valuation – You should go beyond percentage growth rate assumptions for revenue and expenses, but you don’t need a 5,000-row spreadsheet, either. Aim to project revenue with Units Sold * Average Selling Price in the main segments, and link the key expenses to Units Sold or the Employee Count. That might result in a DCF model that’s around 100-300 rows; a 3-statement model is unnecessary. You’ll need a sense of the Public Comps as well, but you should not spend time scrubbing the data. Use Capital IQ or FactSet if you have them, or Finviz and Google Finance if not. See our tutorial on comparable company analysis for examples.

- Time Permitting, Do Real-Life Research – If you have the time to do so, spend a few hours speaking with people in real life to find out more about the overall prospects of the company and industry. For example, you could use LinkedIn to look up suppliers, partners, and employees, contact them via email, and ask if they’re willing to speak with you for a few minutes. In exchange, you can explain how investors view their industry.

This process is known as a “channel check,” and it’s a great way to set yourself apart with modest effort. A direct quote from a manager at the company’s key supplier is far better than a more complex financial model.

- Your Angle: How do you see this company differently from the rest of the market? Will it grow more quickly/slowly than expected? Will it be more/less profitable than expected? Will its new products and services perform better/worse than expected?

- Valuation Inputs: How do these points translate into model assumptions in Excel? Research means nothing unless you can reflect it in your revenue, expense, and cash flow assumptions.

- Implied Value: What does the output of your valuation look like? Is the company overvalued, undervalued, or valued appropriately right now? How does that change in different cases, such as Base, Upside, and Downside?

- Catalysts: Which 2-3 events or potential events over the next 6-12 months could cause this company’s stock price to change in the direction you predict? Companies can stay mispriced forever if the market doesn’t realize it. Catalysts are particularly important for “Short” recommendations because they are so dependent on timing.

- Risk Factors: Why might your recommendation be wrong? What are the top 2-3 factors that could result in the company’s stock price moving in the other direction? And how could you mitigate these risks?

Once you’ve done this, you should be able to create a short, 2-page outline based on your findings.

Here are the outlines we created for AvalonBay and Jazz Pharmaceuticals:

- Jazz Pharmaceuticals [JAZZ] – SHORT – Stock Pitch Outline

- AvalonBay [AVB] – LONG – Stock Pitch Outline

After you have this outline, you’ll expand it to create the full stock pitch.

You can understand the research and valuation process in-depth and financial modeling in Excel by completing our courses.

The “Core” course linked to above has a simple example of a valuation, DCF, and stock pitch, while the Advanced Financial Modeling course has a detailed example backed by outside research and industry data:

Advanced Financial Modeling

Learn more complex "on the job" investment banking models and complete private equity, hedge fund, and credit case studies to win buy-side job offers.

Stock Pitch Section 1: Recommendation

In this section, you present the most convincing arguments for your pick. We recommend the following structure:

- Long or short, current share price, the percentage by which it’s mispriced, and the top 2-3 reasons why the stock price will change in the next 6-12 months.

- Two or three potential catalysts that will cause the stock price to change in the next 6-12 months.

- Two or three investment risks (company-specific or market-specific) and how you might mitigate those risks through other investments, call or put options, etc.

Here’s our Recommendation slide for Jazz Pharmaceuticals:

If you want a better visual style for this one, see the summary slide at the end instead:

It is not a great idea to give specific probabilities here (e.g., “75% chance of gaining 30% and a 25% chance of losing 15%”) because the first question in any interview will be, “So, how did you come up with those probabilities?”

Instead of giving probabilities, focus on best-case and worst-case outcomes:

- Longs: Aim to show that the company is modestly undervalued in the Base Case (e.g., 20-30%), dramatically undervalued in the Upside Case (50%+), and only slightly overvalued in the Downside Case (5-10%).

- Shorts: Show the company is modestly overvalued in the Base Case, only slightly undervalued in the Upside Case, and dramatically overvalued in the Downside Case.

You are demonstrating that there’s an asymmetric risk profile , i.e., higher potential gains than potential losses.

Stock Pitch Section 2: Company Background

Here, you list the company’s key financial stats (revenue, EBITDA, market cap, and current multiples) and a quick overview of its business segments and products/services.

Don’t just copy in the descriptions from the filings or annual reports – summarize the most important points and leave out the corporate speak.

In the PowerPoint version of the Jazz stock pitch, we added a price-volume chart because of the extra space available:

In the Word version, we left out the chart and wrote the bullets in sentences instead.

Stock Pitch Section 3: Investment Thesis

In the investment thesis section, you must point out something that everyone else is missing or misunderstanding about the company.

In the Jazz stock pitch, we make very simple arguments: generics that threaten the company’s key product are likely to arrive sooner than expected, the company’s pricing power is lower than expected, and its new drugs have lower-than-expected market sizes :

We link each factor to a specific per-share impact on the company’s stock price to show how the misplaced mainstream view is more than theoretical.

Besides arguments about pricing and market size, there are many other ways to build an investment thesis.

For example, here’s what we use for AvalonBay in the apartment REIT sector:

This is a Long recommendation, and the company is in a sector that’s highly sensitive to macroeconomic conditions, so the main idea is:

“Even if economic conditions worsen, the company won’t be affected too badly, and it might even benefit in some ways; also, the company’s development pipeline is stronger than expected and will deliver higher growth when the first deliveries arrive.”

Other investment thesis examples include:

- Misunderstood Acquisition or Divestiture: The company’s true upside from a deal will be far higher or lower than expected, and the rest of the market hasn’t yet factored it in because they don’t understand the cost synergies or integration plan.

- Lipstick-on-a-Pig Company: The company presents itself as a “SaaS” or “AI” play, but in reality, it’s an overhyped services business that should trade at far lower multiples.

- Misunderstood Threats: The market expects the competition to beat the company in Areas X and Y, or it expects the company to fail to execute Initiative Z, but it’s wrong for the following reasons.

- Financial Statement Shenanigans: The company is recognizing revenue too aggressively, exaggerating its reserves, or playing games with capitalized vs. expensed costs, all of which affect its cash flows and, therefore, its valuation.

Stock Pitch Section 4: Catalysts

Catalysts should be events or potential events that might occur within the next 6-12 months.

Most hedge funds operate on relatively short time frames, so if specific events will not change the company’s stock price for another 3-5 years, the company is a bad pick (for more on this, see our hedge fund overview article ).

Also, it’s much more difficult to predict the impact of events that far into the future.

“Hard Catalysts” are events that are definitely going to happen and will produce a specific result : earnings reports, the announced outcome of clinical trials, or the announced acquisition of a smaller company.

“Soft Catalysts” are potential events that may or may not happen and where the time frame is less certain, such as a planned international expansion, a change in market share, or the launch of a future competitive product with an unknown release date.

You should prioritize “Hard Catalysts,” but it’s OK to use a mix of both – as we do for Jazz and AvalonBay:

Catalysts are most important for Short recommendations because overvalued companies tend to stay overvalued until a specific event, such as an earnings report far below expectations, suddenly makes everyone come to their senses.

If a company is high-quality, appropriately valued or undervalued, and has solid growth potential, its share price might increase gradually over time, and specific events are not as essential to your investment thesis.

Stock Pitch Section 5: Valuation

In this section, you must resist the urge to paste in 538 sensitivity analysis tables and instead summarize the output, with a focus on the implied share price in different cases.

For Jazz Pharmaceuticals, we used the traditional valuation football field , but we summarized the long-term projections on the next slide and showed sensitivities after that:

Focus on the DCF (or DDM, or NAV Model depending on the industry) because it demonstrates your differentiated, long-term views of the company more effectively than the other methodologies.

You can support the intrinsic analyses with valuation multiples, but you can’t base your entire argument on them.

Valuation multiples fluctuate for so many different reasons that you can’t just say, “Aha! Company X trades at multiples that are 20% lower than Company Y, despite similar growth rates and margins – therefore, it’s undervalued by 20%!”

It’s quite important to include different scenarios, such as Base, Upside, and Downside cases linked to the company’s revenue and expense drivers.

If you’ve only looked at a single case in which the company grows by 10% per year, it will be very difficult to answer questions about the risk factors, the worst-case scenario, or the potential losses if your thesis is wrong.

The valuation must tie in directly to the asymmetric risk profile , and your audience must read it and think, “OK, it seems like there’s more to gain than to lose here.”

Stock Pitch Section 6: Risk Factors and Mitigating Factors

In this section, you cross-examine your investment thesis and point out all the flaws and reasons why it might be wrong.

The easiest method is to reverse the catalysts: for example, what if the company can raise prices by more/less than expected? Or, what if its new drugs turn into a giant success/failure? What if its clinical trial results are unexpectedly positive/negative?

Risk factors must be specific to the company to be effective.

So, don’t list “There could be a global recession!” or “Oil prices might plummet!” or “The company might get displaced by robots and AI!” as risk factors.

Yes, those are all risks, but they’re general risks that will impact a wide range of companies – not yours alone.

We followed the “reverse the catalysts” approach in the Jazz stock pitch, but one of the risk factors relates to early-stage drugs not mentioned in the catalysts section:

You should also write something about how to mitigate these risks.

The obvious approach for a Long/Short Equity pitch is to use call or put options, or stop-loss or stop-limit orders to cap your losses at a certain percentage.

But you could also recommend longing or shorting other companies’ stocks that might move in the opposite direction, or using other investments to reduce the risk in some way.

The worst-case scenario is worth mentioning as well, especially in Long pitches: if the company completely crashes, what might its Balance Sheet be worth in a liquidation scenario?

Could it sell non-core assets or other divisions if something catastrophic happens?

For Short pitches, what happens if the company’s stock price jumps 200%? How high could it realistically go, based on your valuation, and where would you cap your losses?

Presenting the Stock Pitch

The presentation of your pitch varies, but if you’re doing it live, expect an extended Q&A session or “healthy debate” after you finish.

The investment professionals will dig into your assumptions, question specific numbers, ask about your primary research, and assess how much conviction you have.

I wouldn’t recommend taking public speaking classes or joining Toastmasters or anything like that because your pitch is more of a conversation than a “speech.”

However, you should make notes about the key numbers, what your different sources said, and the industry stats.

And if you don’t know something, you should admit it upfront.

Then, offer to look it up and follow up with them after the interview… and make sure you follow through and do that.

Even simple valuations have a lot of numbers and assumptions, so there’s a decent chance you won’t be able to remember the source for one specific number.

Stock Pitches: Anything Else?

Some books, guides, and articles about stock pitches recommend that you include other factors in your pitch as well:

- The existing shareholders and how they’ve changed over time.

- How “crowded” the trade is, i.e., whether or not many other funds have also invested, and the short interest.

- The stock’s performance over the past few years.

- The liquidity and average daily trading volume of the stock.

- How you’ll enter and exit the position without affecting the stock price.

If you have the time and resources, and you’re allowed to make a longer pitch, sure, you can include these points.

But one problem is that you’ll need Bloomberg access to research these points in-depth, which may not be realistic if you’re a student or not yet in the finance industry.

Also, some of these issues are on-the-job considerations – critical when you’re making the trade in real life, but not as essential if you’re presenting the initial idea to generate interest.

The Top Stock Pitch Mistakes To Avoid

I’ve reviewed hundreds of case studies, models, stock pitches, and investment recommendations over the years.

Here are the top mistakes I’ve seen:

- Unnecessarily Detailed Model – Some candidates spend all their time worrying about minutiae on the financial statements rather than the key drivers. You should create a moderately detailed model (100-300 rows for the DCF) and spend the bulk of your time researching the company, speaking with real people, and honing your investment thesis.

- Inability to Support the Main Assumptions – Why are you assuming higher revenue growth or margins in a certain year? What historical performance, research, or channel checks support that assumption?

- Poor or Non-Existent Catalysts – Your catalysts should be short-term (6-12 months), they should represent specific per-share impacts, and 1-2 of them should be “hard” rather than “soft.” Macro catalysts can work, but only if you explain how they will affect your company specifically .

- Poor or Non-Existent Risk Factors and Mitigants – The most common mistake is to leave out the risk factors altogether, or to give risk factors that are too vague. Many candidates also fail to explain how to mitigate the risks.

- Lack of Conviction – Many candidates walk in expecting to take the SAT or GMAT and coast through the process, but stock pitches are very, very different. If you are not passionately convinced that your idea is great, it will be very obvious to everyone, and you won’t win the offer.

Stock Pitches: What Next?

“Practice makes perfect” is a cliché, but it’s also 100% true with stock pitches.

To create high-quality stock pitches, you’ll need to practice with at least 2-3 companies before you get a feel for it.

And if you don’t yet have a good understanding of accounting and valuation, add on several months to learn those.

For interview purposes, you should prepare 2-3 ideas – at least 1 Long and 1 Short – and you can adapt them to different funds as necessary (e.g., you could recommend underweighting your Short pick if you interview at a long-only fund).

If you follow this guide, you should have a good start on those first 2-3 pitches.

And if you want personalized assistance with your stock pitches, I highly recommend the services of Numi:

Numi Advisory has provided career coaching, mock interviews, and resume reviews to over 600 clients seeking careers in equity research, private equity, investment management, and hedge funds. With extensive firsthand experience in these fields, Numi offers unparalleled insights on how to ace your interviews, excel on the job, and create and present great stock pitches.

Numi customizes solutions to each client’s unique background and career aspirations and helps them find the path of least resistance toward securing their dream careers. He has helped place over 150 candidates in leading buy-side and sell-side jobs. For more information on career services and client testimonials, please contact numi.advisory@gmail. com , or visit Numi’s LinkedIn page .

If you liked this article, you might be interested in Investment Banking Pitch Books: Design, Examples & Templates .

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

20 thoughts on “ Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers ”

Thank you so much for this. I have an interview/case study coming up and I really needed this.

Thanks! Glad to hear it.

Hey – thank you for this! I was wondering whether it is possible to pitch a long for a firm that has just announced that it is going private? Is this alright or would this impact the quality of the pitch?

I would probably not do this unless it’s something like a merger arbitrage fund or some other event-driven fund where you’re making an argument that the firm will definitely be acquired, and the market is underpricing the odds with a spread that’s far too wide (or something like that). Otherwise, long pitches for firms that are set to be acquired usually aren’t compelling because the potential upside is too low once the deal announcement has been made.

Great article. Thanks for publishing. I suggest adding some caveat regarding sending the stock pitch to professionals in introductory emails. In my experience most professionals cannot accept external pitches without going through compliance first, so sending it proactively might oftentimes be unwelcome.

I agree that you have to be careful with these sorts of things, but in most ER/HF/AM interviews and even in networking interactions, they will ask you for some type of stock pitch as part of the process. So I’m not sure if there’s a huge difference if they’re going to ask for it later anyway. One option might be to send a short outline but not a full “pitch” in the intro email, or to simply state that you’ve prepared 1-2 pitches and ask if they want to see them. My experience is that most finance professionals take stock pitches as seriously as they take Seeking Alpha articles, and they use pitches mostly to evaluate who knows at least something vs. who is completely clueless.

Hello Brain, very fantastic investing lesson. Can I use this article and your two attachment as template to teach high school students write stock analysis report? They only have template with buy recommendation but not for Sell and Hold recommendation. Thus, I think students need two more example to wirte their analysis report.

Best Regards, Kim

Sure, but please link to the URL of this original article on this site.

I am a doing a stock pitch and part of my pitch they said i should do Competitive dynamics and Regulatory framework. Do you know what it means?

They want you to summarize the company’s main competitors in the industry, how much overall competition there is (think in terms of market share), and any special regulatory burdens or rules the company has to follow.

You mentioned that we should prioritize “hard catalyst”. But I wonder if the hard catalyst, in most cases, has already been priced in the stock price?

In addition, how to know what’s the market view of this stock? For instance, if I think the company’s revenue growth rate is 8% in the future, how do I know the market view of the revenue growth rate?

You would have to research the company and its stock price history to see if various catalysts are priced in. There’s no way to tell universally, as some companies are repeatedly misunderstood by the market and others are not. The easiest way to tell is to look at how many times the company has had “surprise” earnings reports in the past.

For the current market view of the stock, find consensus estimates on Capital IQ or if you don’t have Capital IQ, look on sites like Yahoo Finance or FinViz for estimates.

Thank you for recommending the stock pitch coaching service at the end of the post. I wonder if there is any stock pitch coaching service with a website that gives more transparent information, or any widely-used stock pitch coaching service?

There are other stock pitch coaching services out there, but I have no firsthand experience with them and cannot speak to their quality. The individual running this service is employed as a PM within the industry, so he doesn’t want to give his identity (but I know him in real life and can vouch for the services). But if you want a service that gives the person’s name and full employment information, you might be able to find that somewhere.

I hope you are having a nice day. I’m currently in a stock pitch competition. I need a presentation, a written report and also a 8-10 minutes long script. Is there anything that I should watch out for or do extra that will put me apart from the other contestants?

Also, any suggestions on what kind of company is best to pitch for in this kind of competitions?

Would really appreciate your help.

We have many examples of stock pitches on this site, so I would suggest reviewing those for ideas. We unfortunately cannot comment or help with homework assignments or competition projects. My advice is to pick a lesser-known company that you have followed and know much better than the judges.

Hi, Brian. I am currently interviewing for an AM company. If they asked me to give some opinions on their current positions, does it mean that I am asked to do a pitch? I think my interviewers mush have very solid opinions about the stocks the company is holding… Or if they just would like to know my brief opinions? And in either way, how long should my answer be? within 1 minute?

Not necessarily a formal stock pitch, but you should have a basic view on what they hold and whether you recommend buying, holding, or selling some of the stake. Maybe 30 seconds for an initial opinion.

Hi Brian, I have a final round interview with a BB bank (non-US branch office) for the ER analyst role in 2 weeks. I’m a target school but have never done a stock pitch or valuations before. Do you have advice for me given the large amount of work required to do stock pitch? Should I just admit that I’m new to finance but is willing to learn more based on my past experience with transferrable skills? Or should I learn as much possible from now and build from scratch and put up one? But I don’t think I would be confident if they ask me detailed challenging questions though. Thank you!!

Do some research and build a very simple valuation, or just use simple multiples, and explain that you are new to finance but did the most you could in ~2 weeks. Keep your analysis very simple and rely more on the qualitative factors than the quantitative/valuation ones.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Master Private Equity & Hedge Fund Modeling

Complete advanced M&A, valuation, and LBO models with 8+ global case studies and get stock pitches and investment recommendations.

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Stock Pitch Deck Templates with Examples and Samples

Deepika Dhaka

“Success in the stock market doesn't come from guessing the future, but rather from understanding the present," these words from renowned investor Peter Lynch encapsulate the essence of sound investment strategies.

In this blog post, we will explore the art of stock pitching using a Stock Pitch Deck Template.

Why Stock Pitch Deck Templates?

The art of stock pitching lies in understanding the present, backed by comprehensive data and compelling examples. Using Stock Pitch Deck Templates, investors can harness the power of structure, visual appeal, time efficiency, and consistency to deliver persuasive investment presentations. These templates empower presenters to communicate their investment ideas effectively and leave a lasting impression on potential stakeholders.

Best Stock Pitch Deck Template to Pitch Your Stock

Introducing SlideTeam's Stock Pitch Deck template — a powerful tool to captivate investors and present your business vision with precision. This expert-curated sleek template ensures a professional and polished presentation. Impress your audience with compelling data visualizations, strategic market insights, and persuasive narratives, all seamlessly integrated into this comprehensive template. You can download it from the given link.

Download this Stock Pitch Deck

Now, let's explore key PPT slides of this presentation individually, guiding you through the immense value on offer. Gain a comprehensive understanding of each slide's significance as we take you on a journey to unlock the potential it holds for you.

The 100% customizable nature of the templates provides you with the desired flexibility to edit your presentations. The content-ready slides give you the much-needed structure.

Template 1: Company Introduction PPT Slide for Stock Pitch

Elevate your company introduction with our impressive PPT Slide, highlighting recommendations, target stock prices, and growth percentages. Effectively showcase catalysts and risks, empowering investors to analyze information and make informed decisions. Download now and unlock the power of presenting essential data with confidence and clarity.

Download this Stock Pitch Deck

Template 2: Industry Outlook PPT Template for Stock Pitch

Introducing Industry Outlook PPT Template — an essential tool to seize opportunities in today's dynamic stock markets. Stay ahead with compelling industry trends and market share insights that command attention and instill confidence in investors. This template empowers you to comprehensively analyze your target industry, showcasing your expertise and strategic vision. Get it now!

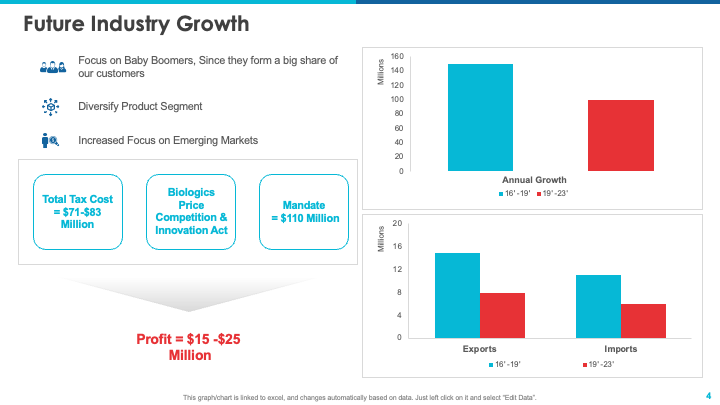

Template 3: Future Industry Growth PPT Slide

Use this PPT Template to illustrate emerging opportunities and growth prospects to captivate investors seamlessly. Leverage appealing charts and data-driven insights to demonstrate your understanding of the market landscape, making a compelling investment case. Use the power of this Future Industry Growth PPT Slide to showcase your profit, tax costs, biological price competition, and innovation act. Download today!

Template 4: Company Overview Template for Stock Pitch Deck

Showcase your company's background, capabilities, accreditations, vision, and mission in a concise, easily understandable manner. With this slide, you can establish credibility, inspire confidence, and highlight key differentiators, effectively positioning your company as an attractive investment opportunity. Download now!

Template 5: Past Acquisition PPT Template for Stock Pitch Deck

This well-structured format of this template allows you to highlight details such as the year, company name, price, and importance of each acquisition. Its foolproof design lets you confidently present your acquisition history simply and organized.

Template 6: Organizational Structure Template for Stock Pitch

Use this professional and captivating flow chart to visualize your company's hierarchy and team dynamics. Showcase clear reporting lines, roles, and responsibilities, providing investors with a comprehensive understanding of your organizational setup. Download it now to streamline your company's structure and operational efficiency.

Template 7: Geographical Reach PPT Slide for Stock Pitch

Highlight your company's extensive reach, demonstrating a diversified presence across multiple regions and markets. This slide provides a visually engaging presentation of your geographical expansion strategy, instilling confidence in potential investors. Showcase the number of products, revenue, employees, and clients in this Geographical Reach PPT Slide to emphasize your global competitive advantage and unlock new growth opportunities.

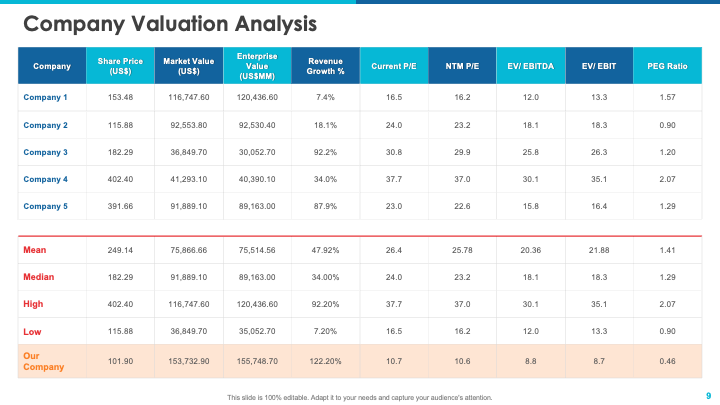

Template 8: Company Valuation Analysis Template for Stock Pitch

This template empowers you to comprehensively analyze your company's valuation, showcasing critical financial metrics and growth projections. Present a compelling narrative backed by robust valuation methodologies, impressing investors with your thorough analysis and strategic insights. Demonstrate the real value of your company by downloading this PPT Template.

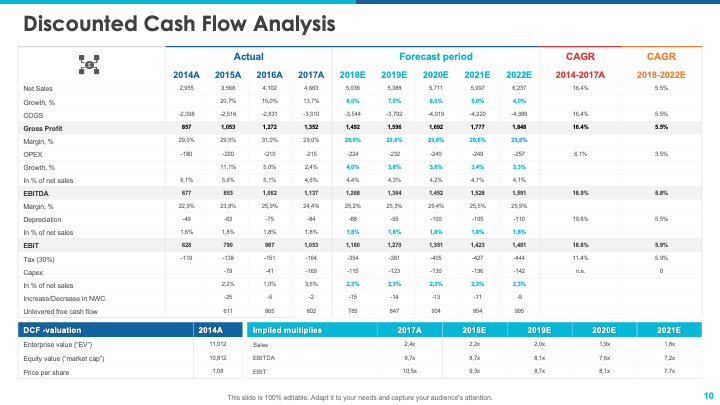

Template 9: Discounted Cash Flow Analysis Template

Calculate and present the intrinsic value of your investment opportunity using this comprehensive template. Use discounted cash flow models to project cash flows, assess risk factors, and determine the fair value of your stock. Impress investors with a data-driven approach and make a perfect case for investment success with our Discounted Cash Flow Analysis Template for the stock Pitch Deck.

Template 10: Price Target PPT Slide

This slide empowers you to present a compelling price target for your stock based on thorough analysis and market insights. Showcase your expertise in forecasting and provide a clear and persuasive target price. This ensures investors queue up for a piece of the stock action. Elevate your stock pitch with our Price Target PPT Slide and unlock the potential for significant returns on investment. Download now!

Powerful persuasion for investors

Now that you have seen how using a template is always a good idea to pitch your stock, downloading this presentation is time to bring this knowledge into action. You will not regret this investment, as it equips you with the tools to deliver a powerful and persuasive pitch that captivates investors and drives success. Get ready to make a lasting impression and seize opportunities with confidence.

PS. If you are looking for Fundraising Pitch Decks, here’s a handy guide with the most popular templates, samples, and examples.

FAQs on Stock Pitch Deck

What is a stock pitch deck.

A stock pitch deck is a presentation or a set of slides that investors use to pitch a particular stock or investment opportunity to potential stakeholders. It includes key information about the company, industry analysis, financial data, growth prospects, competitive advantages, and a persuasive argument for investing in the stock.

How to build a stock pitch deck?

To build a stock pitch deck, start by conducting thorough research on the company and the industry it operates in. Gather relevant financial data, market trends, and competitive analysis. Create compelling slides that cover the company overview, investment thesis, growth prospects, risks, valuation analysis, and potential catalysts. Ensure a clear and persuasive narrative flow supported by visual aids and data-driven insights.

How do you pick a stock to pitch?

When picking a stock to pitch, it is crucial to do your homework. Conduct fundamental analysis by assessing the company's financial health, industry trends, competitive positioning, and growth prospects. Look for stocks with solid fundamentals, a sustainable business model, and a compelling investment thesis. Consider market conditions, potential catalysts, and the stock's risk-reward profile.

How long is a stock pitch?

The length of a stock pitch can vary depending on specific requirements and time constraints. Generally, a stock pitch ranges between 10 and o 20 minutes for oral presentations. However, the pitch deck can be more extensive, with 15-30 slides covering all essential aspects of the investment opportunity. It's important to balance providing comprehensive information and keeping the presentation concise and engaging.

How do stock pitches work?