Book Reviews

Money at 30: “the psychology of money” book review.

One of the things I love most about the book reviews I’ve been doing for the past several months now is that, despite writing about finance for five years or so now, I’m consistently introduced to new insights, ideas, and perhaps even some “hot takes” about money. My latest bit of consumption is no exception and, in fact, may be the most paradigm-shifting read I’ve experienced yet. Released earlier this month, The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel may already rank among my favorite personal finance books — partially because it’s so much different from the financial books I typically encounter.

With a title like “The Psychology of Money,” you might expect the material within to be dense and heady. On the contrary, the book is extremely approachable and digestible. That’s thanks in part to its structure that breaks the contents down into 20 relatively short chapters (plus an intro and a postscript). Each of these chapters finds Housel tackling a different topic, with the majority of these chapters feeling like their own isolated essays. That said, lest you lose the thread along the way, the author ties it all up in a bow by in the penultimate numbered chapter.

The book starts out with an extremely relevant and insightful look at how our experiences influence our world views — particularly when it comes to money. Titled “No One’s Crazy,” this chapter does a tremendous job of explaining how two people can come to different conclusions but neither actually be wrong. In just a dozen pages, Housel completely sold me on the premise of the rest of the book and had me hooked. Now is also a good time to mention that, while there is definitely financial advice to be found in Housel’s prose, it’s rare for the author to harp on many specifics seeing as the book’s thesis revolves around us all being different. Nevertheless, in the interest of transparency, he does recount his personal money experiences, beliefs, and strategies in chapter 20.

Throughout the book, Housel also draws distinctions between terms that might not seem so different on the surface. Riches vs. wealth, rational vs. reasonable, fee vs. fine — all are explored and explained to great effect. In every case, the author makes a solid case for the nuance in these expressions, while also detailing how each can impact your relationship with finances. On a similar note, I also appreciated the assessments of what people really mean when they say certain things about money. Easily my favorite example of this is when Housel writes, “When most people say they want to be a millionaire, what they might actually mean is ‘I’d like to spend a million dollars.’ And this is literally the opposite of being a millionaire.” This revelation may sound obvious to some but, for me, really highlights an irony that exists in personal finance.

Another one of my favorite chapters looked at the nature of optimism and why the opposite mentality typically gets the most attention. As I consider myself an optimist, I loved that this highlighted some important truths that are often overlooked. If I may say, the chapter also served as a nice pallet cleanser from the daily news grind these days.

Speaking of these unique days we find ourselves in, I was surprised to see Housel mention the coronavirus ever-so-briefly in his book. Given the lead time I expect most publications have, I really wasn’t expecting anything so up to date. That said, in a later chapter, he notes that the United States currently has record low unemployment, so not everything is up to the minute. Personally, I’m actually thankful that the crisis was mostly excluded as 2020 readers will certainly be able to insert such references on their own where appropriate.

For all the strengths of The Psychology of Money , I did have a couple of minor criticisms. One is that, at times, I felt like the subject strayed a bit from the concept of “psychology” and more toward general “do this, not that” advice. It’s not that these chapters weren’t interesting or lacked impact, but it is something that stuck out to me. The other nitpick I had is that there are a couple of moments that feel redundant or find Housel hammering home his point perhaps a tad too hard — namely in chapter 16, where I felt as though I kept reading the same refrain (although the chapter was still strong overall). Again, these are only small critiques that hardly took away from my enjoyment of the book on the whole.

When I pre-ordered my copy of The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness , I really had no idea what to expect. What I found was a deeply intriguing book that not only helped change the way I thought about money but I predict will also influence the way I write about money in the future. Needless to say, if you’re looking for a different kind of personal finance book — and one that will surely open your mind regardless of who you are — I highly recommend The Psychology of Money by Morgan Housel.

Kyle Burbank

Other articles by kyle burbank.

Alibaba Launches Co-Branded Business Credit Card with Cardless

AI-Powered Compliance Platform Sedric Raises $18.5 Million

Lessons From a First-Time Home Buyer: How New Realtor Rules Could Impact Buyers

2024 SoFi Checking and Savings Review

A Guide to Building Credit and Increasing Your Credit Scores

2024 Pay with GasBuddy Review: Yes, You Can Legitimately Save Money Every Time You Fill

Brim Financial Raises $85 Million as It Eyes Global Expansion

Chase Reveals Q2 2024 Freedom 5%(+) Bonus Categories

About | Essays | Notes | Newsletter | Book Lists

- Scholarships

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel

Reading Time: 8 minutes

In the Psychology of Money, Morgan Housel teaches you how to have a better relationship with money and to make smarter financial decisions. Instead of pretending that humans are ROI-optimizing machines, he shows you how your psychology can work for and against you.

Get book on Amazon

👋 If you enjoy this summary and want to get access to a growing and searchable digital collection of 100+ book summaries like this, check out Foundations .

Key Takeaways

Theory isn’t reality.

“The challenge for us is that no amount of studying or open-mindedness can genuinely recreate the power of fear and uncertainty.” Resurfaced using Readwise

We are not spreadsheets. As much as reading can inform us about what has happened in the past, like stock market crashes or how stocks have trended up and to the right over time, learning about something in a book is very different from actually experiencing the event. So be careful. You may think that you can hold your stocks during a 30% market downturn because you know that only suckers sell at the bottom, but it’s only when you experience that type of downturn that you’ll learn what you’ll do.

Luck and risk

It’s easy to convince yourself that your financial outcomes are determined entirely by the quality of your decisions and actions, but that’s not always the case. You can make good decisions that lead to poor financial outcomes. And you can make bad decisions that lead to good financial outcomes. You have to account for the role of luck and risk.

To mitigate the risk of overweighting the role of individual effort in determining outcomes:

- Be cautious about the people who you admire and look down upon. Those at the top may have been the benefactors of luck while those at the bottom may have been the victims of risk.

- Focus less on individuals, and turn your mind to broader patterns. It’s difficult to replicate the outcomes of successful individuals, but you may be able to participate in broader patterns.

“But more important is that as much as we recognize the role of luck in success, the role of risk means we should forgive ourselves and leave room for understanding when judging failures.”

Be kind to yourself when you make a mistake or end up on the wrong side of risk. The world is uncertain, and it may not be your fault if something goes wrong.

Lessons from Buffet

“There is no reason to risk what you have and need for what you don’t have and don’t need. – Warren Buffet Resurfaced using Readwise

It’s easy to have a goalpost that keeps moving. Once you achieve your goals, you look toward the next goal. And the cycle never ends. This is often driven by comparing yourself to others, and you’re often comparing yourself to someone who is above you in the ladder that you benchmark yourself against.

When it comes to money, someone will always have more of it than you. That’s okay. It’s fine to pursue more money, but don’t start making risky bets that put what you have at risk for something that you don’t need.

“As I write this Warren Buffet’s net worth is $84.5 billion. Of that, $84.2 billion was accumulated after his 50th birthday. $81.5 billion came after he qualified for Social Security, in his mid-60s.”

Compounding is deceptively powerful.

Getting money vs. keeping money

“Getting money requires taking risks, being optimistic, and putting yourself out there. But keeping money requires the opposite of taking risk. It requires humility, and fear that what you’ve made can be taken away from you just as fast. It requires frugality and an acceptance that at least some of what you’ve made is attributable to luck, so past success can’t be relied upon to repeat indefinitely.” Resurfaced using Readwise

Getting money and keeping money are two distinct skills. While getting money necessitates risk taking, hard word, and an optimistic disposition, keeping money is a different skill. It requires you to mitigate risk, avoid getting greedy, and to remember that things can be taken from you at any moment.

Cash is not the enemy

“A plan is only useful if it can survive reality. And a future filled with unknowns is everyone’s reality” Resurfaced using Readwise

If you’re relatively young and earn more than you spend, the best way to optimize your long-term investment returns is to invest the majority of your money into a diversified portfolio of low-cost index funds. Holding more than a few percentage points of your net worth in cash is silly because the value of cash erodes with inflation, and that cash can otherwise be put into assets like stocks that historically have compounded at a rate of 6-7%.

While it’s an alluring prospect to invest in ways that maximize your returns, these theories often don’t account for you psychology. Imagine you’re 95% invested in stocks and have 5% in cash. The market declines 20-25%. Depending on how that crash affects your psychology, having such a small percentage in cash may make you more likely to panic sell some of your stocks during that downturn. And that panic sell may lead to you missing out on far more returns than if you had held a larger percentage of your portfolio in cash and didn’t sell because you felt more secure.

This actually happened to me during the March 2020 downturn. Being too invested with low cash reserves led me to panic sell some of my portfolio, and it was a financially and psychologically costly mistake as we saw one of the fastest market reversals in history. And it led me to re-evaluate my theory of investing .

Humans are not spreadsheets!0 So even if the models say that you maximize returns by being only 1-5% in cash, you might actually hold 10-20% in cash to protect yourself from your psychology when things go poorly. And if this larger cash reserve saves you from one making one big financial mistake, it might be the best move for your portfolio.

“Long tails – the farthest ends of a distribution of outcomes – have tremendous influence in finance, where a small number of events can account for the majority of outcomes.” Resurfaced using Readwise

The investment decisions you make on 99% of days don’t matter. It’s the decisions you make on a small number of days when something big is happening – a massive downturn, a frothy market, a speculative bubble, etc. – that make all the difference. Warren Buffet has owned 400 to 500 stocks during his life. He’s made the majority of his money on 10 of them.

Highest form of wealth

“The ability to do what you want, when you want, with who you want, for as long as you want, is priceless. It is the highest dividend money pays.” Resurfaced using Readwise

Having more flexibility and control over your time is far more valuable than getting another 2% on your returns by working all-nighters or making speculative bets that impact your sleep.

Ferraris don’t generate respect

People buy mansions and fancy cars because they want respect and admiration from others. What they don’t realize is that people don’t admire the person with the fancy house or car ; they admire the object and think of themselves having that object. So buying impressive items to gain admiration and respect from others is a fool’s pursuit – these things can not be bought.

Being rich vs. wealthy

If you’re rich, you have a high current income. But being wealthy is something different – wealth is not visible. It’s the money that you have that’s not spent. It’s the optionality to buy or do something at a future time. Being rich offers you opportunities in the short-term, but being wealthy provides you the flexibility of having more of the items you want – freedom, time, possessions – in the future.

What’s the optimal portfolio?

The optimal portfolio is one that allows you to sleep at night. It allows you to generate reasonable returns, while also maximizing your quality of life and control over your life. It will stand the test of tough recessions and other blips in the road. Most academic understandings of the ideal portfolio ignore the very real human factors that come into play and that may cause you to deviate from the strategy.

Leave room for error

If you want to be in the game for the long run, you need to leave room for error. “Room for error lets you endure a range of potential outcomes, and endurance lets you stick around long enough to let the odds of benefiting from a low-probability outcome fall in your favor.”

A big gap in most people’s understanding of room for error is accepting that there is a difference between what you can technically endure vs. what you can emotionally endure.

For example, maybe you have enough money saved up to last you two years. So maybe you quit your job to pursue your dreams, assuming that you can always get a job when you get closer to $0 in savings. Technically, you can do this, and you won’t even be in debt. But perhaps emotionally, you start getting nervous after you’ve burned 30% of your savings, and all of a sudden you’re depleted psychologically. If that’s the case, you may ditch your dreams and go back to a day job even if you had another year+ in financial runway.

So if you don’t account for your emotions in your models, you may end up in suboptimal situations.

The difficulty of long-term financial planning

As humans, we tend to underestimate how much our personality and goals will change with time. This makes long-term financial planning hard. We may think we’ll never have kids or a big house when we’re young, so we plan as if that’s the case, but then we find ourselves with a house and kids that the plan didn’t account for. So when thinking about your investment strategy, try to account for the unknown.

The price of investing

“Like everything else worthwhile, successful investing demands a price. But its currency is not dollars and cents. It’s volatility, fear, doubt, uncertainty, and regret – all of which are easy to overlook until you’re dealing with them in real time.” Resurfaced using Readwise

If you choose to invest and try to compound your wealth, there is a price. And that price is often hidden – it’s the ups and downs of Mr. Market that take you on a ride. It’s the uncertainty and fear that pop into your mind from time to time, as market conditions and your personal conditions change. You have to be willing to pay that price if you want to invest, especially if you’re very active with your strategy. The only way to deal with this market fee is to accept that it exists and to be willing to pay the price. You need to be prepared to deal with the volatility and uncertainty. It’s a part of the game you’re playing.

What game are you playing?

“Few things matter more with money than understanding your own time horizon and not being persuaded by the actions and behaviors of people playing different games than you are.” Resurfaced using Readwise

If you have a buddy who’s making lots of money trading short-term options and you start getting FOMO and want to play that game, you really need to consider if that aligns with your goals. If you have a 20-year time horizon and like the simple nature of passive investing, it would be stupid for you to start playing your buddy’s game. You may be able to profit, but at what cost? Know the game you’re playing, and know the game others around you are playing as they tell you about their latest tactics.

Pessimism is persuasive

Pessimism often sounds smarter and more persuasive than optimism. If something is not going well, it’s easy to think that it will continue not going well. And that sounds very plausible. But what this line of thinking misses is that problems often create demand for change and solutions. And this leads to ingenuity that creates changes that only the optimist might believe in.

The problem with hindsight

When we look back at the past, we create stories about why certain things happened. And those stories make us think that the world is understandable and makes sense in some way.

The problem is that these stories may be complete nonsense. What happened may have been completely random, yet our stories delude us into thinking that there is some lesson we can learn to better predict the future.

Avoid the illusion that you have full control in the uncertain world in which we live.

Investment results

- If you evaluate how well you’ve done by focusing on your individual investments, versus your entire portfolio, you’ll overestimate the brilliance of your winners and feel too much regret about your losers.

- Good decisions are not always rational. Sometimes, you have to consider that you’re an emotional creature that may have different needs than an ROI-optimizing model may suggest.

- If you can do everything you want without trying to outperform the market, then why try to outperform the market and endure the price tag that this pursuit requires?

If you want to discover more great books...

- Explore the best books for expanding your mind, the best self-help books, the best philosophy books for beginners, books for people who don't enjoy reading, and more great books .

- Check out Foundations. Foundations is a searchable digital notebook built for curious, lifelong learners. It will help you accelerate your learning, solve hard problems, and save time by giving you access to a growing digital collection of insights from timeless books.

You might also enjoy these books...

- Same as Ever: A Guide to What Never Changes by Morgan Housel

- How to Get Rich by Felix Dennis

- The Body Keeps the Score: Brain, Mind, and Body in the Healing of Trauma by Bessel Van Der Kolk

- Rich Dad Poor Dad by Robert Kiyosaki

- Wanting: The Power of Mimetic Desire in Everyday Life by Luke Burgis

- How to Stop Worrying and Start Living by Dale Carnegie

- Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets by Nassim Taleb

- Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts by Annie Duke

- The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution

- Radical Acceptance: Embracing Your Life With the Heart of a Buddha by Tara Brach

If you want the latest book notes in your inbox...

Book Review: “The Psychology of Money” by Morgan Housel

by Jon Sevenker | Sep 23, 2020 | Book Reviews , P&A Articles |

In my opinion, Morgan Housel is the best behavioral financial writer today. I learn something from every article of his that I read. So when I found out he was releasing a book, I preordered a copy. The Psychology of Money includes some of Housel’s existing blog posts, plus new insights and information about people’s relationship with money. Here are 10 of my favorite passages from the book:

- Happiness is just results minus expectations.

- (On the power of compounding) $81.5 billion of Warren Buffett’s $84.5 billion net worth came after his 65th birthday.

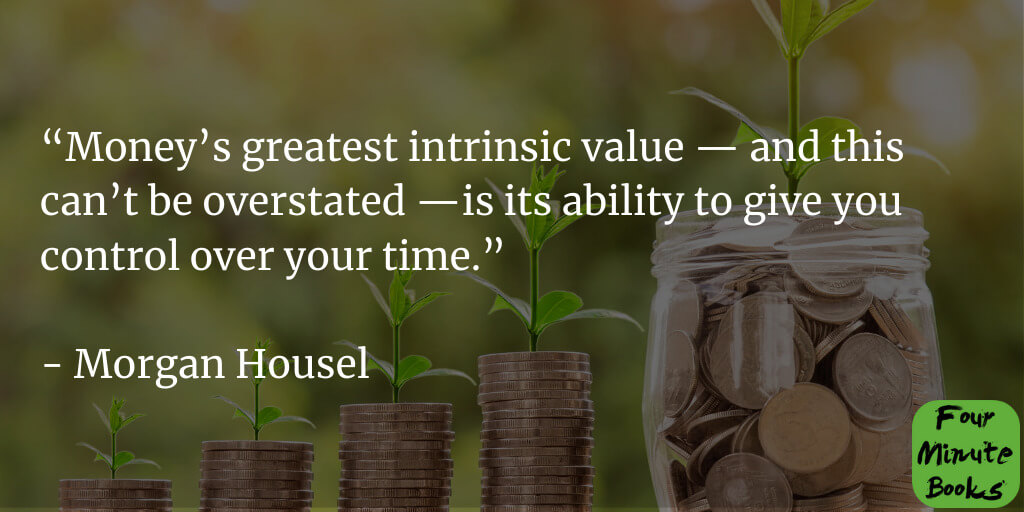

- Money’s greatest intrinsic value is its ability to give you control over your time.

- Wealth is what you don’t see.

- Building wealth has little to do with your income or investment returns, and lots to do with your savings rate.

- Saving is a hedge against life’s inevitable ability to surprise the hell out of you at the worst possible moment.

- The odds are in your favor when playing Russian roulette. But the downside is not worth the potential upside.

- Beware taking financial cues from people playing a different game than you are.

- Optimism sounds like a sales pitch. Pessimism sounds like someone trying to help you. Tell someone that everything will be great, and they’re likely to either shrug you off or offer a skeptical eye. Tell someone they’re in danger, and you have their undivided attention.

- The illusion of control is more persuasive than the reality of uncertainty.

Back in March 2018, I wrote about my “ 5 all-time favorite money books .” If I were to rewrite that post today, I would take out The Behavior Gap and replace it with The Psychology of Money . This book is that good. If you are interested in personal finance, investing, or understanding the forces at work as you make money decisions, I’d highly recommend The Psychology of Money .

If you want to check out more of Morgan Housel’s writings, start with these five blog posts:

- Save Like a Pessimist, Invest Like an Optimist

- The Laws of Investing

- Common Plots of Economic History

- Financial Advice for My New Daughter

- Short Money Rules

We’ve also written about “ 7 investment biases to watch out for ” and “ 7 investment rules it pays to remember ,” the latter of which is a shortened version of a Morgan Housel blog post.

Clicking on the links above may result in you leaving the Pittenger & Anderson, Inc. website. The opinions and ideas expressed on these external websites are those of third-party vendors and Pittenger & Anderson, Inc. has not approved or endorsed any of this third-party content. For the full Terms & Conditions of using the Pittenger & Anderson, Inc. website, click on this link .

Pittenger & Anderson, Inc. does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Additionally, the information presented here is not intended to be a recommendation to buy or sell any specific security. To learn more about our firm and investment approach, check out our Form ADV .

Click here to download the PDF version of this article.

Was this post helpful?

Recent posts.

- P&A Behind the Scenes – Compliance

- The Pets of P&A – Macy

IRAs for Children and Grandchildren

- July 2024 Market Recap

- The Rule of 72

Related Posts

P&a behind the scenes - compliance.

Aug 29, 2024

The Pets of P&A - Macy

Aug 22, 2024

Aug 16, 2024

Since 1995, Pittenger & Anderson has guided individuals and families going through money-in-motion events. We are a fee-only Registered Investment Advisor and a full-time fiduciary providing i nvestment management , financial planning , and complimentary services to 800+ clients in over 30 U.S. states.

Quick Links

Home Retirement Business Sale Inheritance Seeking a New Advisor Fees About FAQs

Address 5533 South 27th St., Suite 201 Lincoln, NE 68512

Phone & Email Phone: (402) 328-8800 Toll Free: (800) 897-1588 [email protected]

Pittenger & Anderson, Inc. ("P&A) is an SEC registered investment advisor located in Lincoln, Nebraska. Registration with the SEC does not constitute an endorsement of the firm by the Commission, nor does it indicate that P&A has attained a particular level of skill or ability. P&A may only transact business in states where it is properly registered, or is excluded or exempted from registration from requirements. This website is limited to the dissemination of general information pertaining to P&A's investment advisory services. The information contained herein is not intended to be personal investment advice or a solicitation to engage in a particular investment strategy. All investments involve risk.

Copyright 2018. Pittenger & Anderson, Inc. All Rights Reserved.

Get P&A in your inbox!

Our once-a-month email is designed to cover topics that impact your financial life, whether you’re just starting out, mid-career, or enjoying retirement. Learn about planning opportunities, our thoughts on the markets, and many other empowering topics. We will never sell or give away your email address, nor will we spam you. We embrace the Golden Rule.

You have Successfully Subscribed!

The confidence your money is looking for.

Please enter your name and email below.

Strategy Boffins

Book reviews, adapting financial strategies for an unpredictable world, embracing change, understanding compounding, questioning historical data, adopting flexible investment strategies, and preparing for economic unpredictability for financial success., subjects: investing.

When it comes to financial planning, the complexities often boil down to two fundamental aspects: setting your goals and figuring out the steps to achieve them. Morgan Housel’s “ The Psychology of Money ” offers a unique lens through which to view this process, focusing less on the ‘how-to’ and more on the ‘why.’

Housel’s book is not your typical financial guide filled with investment tips or budgeting tricks. Instead, it delves into the behavioral aspects of dealing with money. The central premise is that succeeding financially isn’t necessarily a function of how smart you are but is deeply tied to your behavior, which can be incredibly hard to manage or change.

Key Takeaways

– Long-term Thinking: Housel emphasizes the importance of a long-term perspective. He argues that time is the most potent force in investing, allowing small gains to accumulate into significant wealth and making big mistakes less impactful over the long run.

– Behavior Over Intelligence: The Psychology of Money stresses that your behavior—how you manage risk, how you save, how you approach your financial goals—is far more crucial than your financial acumen.

– Common-Sense Management: Housel advocates for a common-sense approach to money management. He suggests that you should manage your finances in a way that lets you sleep peacefully at night. This involves saving not just for specific goals like a car or a house but also for the unpredictable, undefined future events that are bound to occur.

– The Importance of Saving: One of the most straightforward yet powerful pieces of advice Housel offers is to “Save, just save.” He argues that saving for things that are impossible to predict or define is one of the best reasons to save.

Important sections

Sunk costs and change.

The book starts by discussing the concept of “sunk costs,” which are past efforts that can’t be refunded. It argues that clinging to sunk costs can make our future selves prisoners to our past decisions. The key takeaway is to embrace change and adapt your financial goals as you evolve as a person.

Compounding and Its Price

The book then moves on to the concept of compounding, emphasizing that everything has a price, including financial success. It suggests that the price of many things is not obvious until you’ve experienced them firsthand. The idea is to understand the price you’re willing to pay for financial growth and to be prepared for the unexpected.

The Role of Experience and History

The book also delves into the limitations of relying on past experiences and historical data for making future financial decisions. It argues that the most impactful economic events are often unprecedented and therefore unpredictable. The book warns against the “historians as prophets” fallacy, which is an overreliance on past data as a guide to future conditions.

Personal Finance and Investment Strategy

The book shares personal finance strategies, such as investing in low-cost index funds and saving for unexpected expenses. It argues that for most people, dollar-cost averaging into a low-cost index fund will provide the highest odds of long-term success.

The Unpredictability of Economic Events

Finally, the book emphasizes that the world is full of surprises, especially in economics and investing. It suggests that the most important economic events of the future will be things that are unprecedented and therefore not prepared for, making them highly impactful.

Why It Matters

Housel’s book serves as a cautionary tale against self-sabotage. It’s easy to get caught up in the complexities of financial instruments, investment strategies, and economic forecasts. However, Housel reminds us that the most significant financial pitfalls are often behavioral, not informational. He advises that you don’t have to be a genius to succeed financially; you just have to be reasonable and disciplined.

In summary, “ The Psychology of Money ” doesn’t offer a step-by-step guide to riches but provides something potentially more valuable: a fundamental understanding of how to avoid the behavioral traps that can divert you from your financial goals. It’s a book that complements any financial strategy by focusing on the often overlooked but crucial aspect of financial planning—your behavior.

Book Review: Deep Work by Cal Newport

Book review: seeking wisdom: from darwin to munger by peter bevelin, book review: the power of habit, book review: boston consulting group on strategy, book review: trading against the crowd, book review: design thinking toolbox, book review: 13 things mentally strong people don’t do, book review: i’m ok–you’re ok, book review: the strategist’s toolkit, book review: strategy beyond the hockey stick, book review: competitive strategy by michael e. porter, book review: reinvent your business model, book review: freakonomics by steven d. levitt, book review: happy money ken honda, book review: emotional intellience daniel goleman, book review: an ugly truth -facebook, book review: the little book of hygge, book review: how the world really works, book review: average is over – artificial intelligence, book review: mastering the market cycle.

Collections

Captivating.

- Fundamentals

- Derivatives

- Personal Finance

- Mutual Funds

- Fixed Income

- Videos & Podcasts

- Book Reviews

- Contributors

The Psychology of Money

Book review.

Morgan Housel’s 2020 book, The Psychology of Money, looks beyond the spreadsheets and finance textbooks and into how emotions and intuition influence the way people interact with money. Unlike highly theoretical fields like physics or medicine, human psychology plays an inherent role in the world of investing, and this book explores how biases have tangible effects on both the global markets and one’s personal finances.

Through a mix of anecdotes, research, examples, and advice, Housel presents 19 chapters that each explore a different aspect of how people think about money. These chapters blend to present one fundamental idea to investors: “Financial success is not science-based, but a soft skill. How you behave is more important than what you know.”

The book focuses on demonstrating how wealth is not created through the study of theoretical concepts such as interest rates, but instead, by understanding what drives people to do what in different financial market conditions.

The Psychology of Money starts by introducing the stories of Ronald James Read and Richard Fuscone. Read spent 25 years working at a gas station and 17 years as a janitor. With his modest earnings, he saved and invested in the stocks of blue-chip companies. Upon his death, he left behind $8 million for his kids as well as the local hospital and library. In contrast, Fuscone was a top executive at Merrill Lynch who retired early to invest on his own and pursue charitable causes. He ended up going bankrupt in 2000 and losing almost everything. This story, and many others throughout the book, have a common theme: Time is the greatest force in investing and compounding is deceptively powerful.

While every chapter has its own stories and lessons, the concept of time as being the most powerful investing tool is emphasized throughout. After all, time allows small investment wins to grow exponentially, and big losses to fade over time. Read understood his time horizon and invested accordingly, eventually amassing significant wealth. Fuscone, on the other hand, made money through his successful career, but failed to keep it. He lacked the humility and fear that is required to understand that the money you make can be lost far more quickly than most can make it back. The Psychology of Money is a great read that will help anyone deepen their understanding of how humans interact with money and, more importantly, inspire self-reflection into their own investing habits and views on the financial markets.

Related Book Reviews

Review of “Capital in the Twenty-First Century”

“This Time Is Different: Eight Centuries of Financial Folly”

“Against the Gods: The Remarkable Story of Risk”

Review of Thinking, Fast and Slow

Input your search keywords and press Enter.

Join our mailing list

The Psychology of Money Summary

1-Sentence-Summary: The Psychology of Money explores how money moves around in an economy and how personal biases and the emotional factor play an important role in our financial decisions, as well as how to think more rationally and make better decisions when it comes to money.

Favorite quote from the author:

Table of Contents

Video Summary

The psychology of money review, who would i recommend the psychology of money summary to.

Our finances play a huge role in our lives. Yet, people rarely discuss them or educate themselves on this topic. For this reason, many presumptions and false ideas about money have emerged over the years. People think having money is a result of luck, or that rich people are all inheritors, or, worse, that wealth belongs only to those who disrupt — or even exploit — the world.

All of this is wrong. Money is a universal asset circulating in the world. And you too can become financially independent, if you change your current mindset and choose to adopt a few wealth-growing practices. At first, you’ll have to acknowledge your financial situation. Biased financial decisions are what stand in the way between your current life and the life you desire.

Seeking status, envy, and other emotions controlling you all play a significant role when it comes to your financial decisions. The Psychology of Money by Morgan Housel will teach you what you can do, starting today , to improve your finances.

Here are my 3 favorite lessons from the book:

- Being greedy can turn out to be the biggest financial mistake you’ll ever make.

- Envy has no place in the money market, as it can blur your thinking.

- Our early experiences with money determine our financial decisions later on.

Now, let’s discuss these lessons in detail, and see how we can benefit from them!

If you want to save this summary for later, download the free PDF and read it whenever you want.

Lesson 1: When it comes to managing your money, it’s better to leave greed out of it.

Are you a greedy person? Of course not! Or at least, that’s what you tell yourself. We all like to think highly of ourselves and blame our misfortune on bad odds. This is the case of Jesse Livermore, a stock market trader born in 1877.

Prior to the notorious market crash that occurred in 1929 , he took a short position, betting on the decline of the market. He made over $100 million, the equivalent of $1.6 billion today!

Instead of enjoying his riches for life, however, the winning trade made Livermore feel invincible. Naturally, it wasn’t long until he lost everything he had earned by placing all the wrong trades. The sudden downfall pushed him to the edge, and he eventually, sadly, ended his life one night.

The problem was that his success made him want even a bigger slice of the cake, although he already had more than anyone could wish for. The lesson here is: Don’t be greedy, and learn to be humble.

When you already have what you wished for or accomplished significant goals in your life, learn to be grateful, maintain your status, and enjoy the present, instead of always seeking more and more. When you’re scared of losing everything you have, you won’t be happy to risk it all for potential gains.

Lesson 2: Strong emotions such as envy can push you towards making sloppy decisions.

Most people know that investing takes time. They even want to stick to their investments through good and bad, but then the fear of missing out or envy get in the way — sometimes both at the same time!

Managing your emotions is one of the most important things you can work on if you want to become financially independent. Always remember that your journey will be different from any other person you know, so there’s no need to compare yourself to them or be jealous of anyone’s greater assets.

Just take the example of Rajat Gupta, the former CEO of McKinsey. Although he came from a modest background and made it to $100 million in net worth, he still was envious of Warren Buffett for being a billionaire. As such, he committed insider trading, which is one of the most common yet dangerous financial crimes for investors, and got charged with a substantial prison sentence for it.

In other words, he let envy get the best out of him and paid for it a thousandfold. Was it worth it? Definitely not. However, his misfortune serves as a valuable lesson for anyone looking to make better financial decisions. Be rational, and think twice when it comes to money. Always filter out your emotions.

Lesson 3: The experiences we have early on in our life determine our financial decisions.

We all grow up differently. Was your childhood similar to someone born in 1800? 1900? Of course not!

Some people grow up in times of financial crisis. Others know nothing but bull markets until they are in their 30s! As such, those two types would have very different opinions about what a good investment strategy consists of, whether a portfolio should be stock-based or bond-based, or how much risk is worth taking.

We may think that we have no hidden biases, but a study conducted by Ulrike Malmendier and Stefan Nagel proves that people invest according to how the economy looked like when they were young adults. As such, someone who’s experienced high inflation may not see bonds as a good investment, while someone who’s been through turbulent times may think the opposite.

It is of utmost importance that we acknowledge our hidden biases, so as to be able to diminish them and make better choices. In general, any financial decision should always be backed up by sound analysis, reliable facts, and a mind open to new perspectives and constructive criticism.

Moreover, you should work on your ability to adapt to trends and destroy your phobia of new ones, even if it contradicts your inner beliefs. The money market leaves no room for subjectivity, biases, or impulsive decisions. Rushed investments can wipe off years of savings, while valuable ones can speed up your journey to financial freedom .

If you feel like you’ve made all the wrong financial decisions, or that wealth is just not one of the things you’ll ever be able to achieve, The Psychology of Money is the book for you. Reading it will open your mind towards new perspectives and have you conduct an introspection to realize how biased you were all along. This book will give you little steps to take to see instant changes in your financial life.

The 28-year-old person who feels like they’re behind with their finances and want to get out of that situation, the 40-year-old life coach who wants to deepen their knowledge to better help their clients or the 22-year-old economics student who wants to expand on their study materials.

Last Updated on October 27, 2023

While working with my friend Ovi's company SocialBee, I had the good fortune of Maria writing over 200 summaries for us over the course of 18 months. Maria is a professional SEO copywriter, content writer, and social media marketing specialist. When she's not writing or learning more about marketing, she loves to dance and travel all over the world.

*Four Minute Books participates in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising commissions by linking to Amazon. We also participate in other affiliate programs, such as Blinkist, MindValley, Audible, Audiobooks, Reading.FM, and others. Our referral links allow us to earn commissions (at no extra cost to you) and keep the site running. Thank you for your support.

Need some inspiration? 👀 Here are... The 365 Most Famous Quotes of All Time »

Share on mastodon.

Genymoney.ca: Make the Most of your Money

The Psychology of Money Book Review

Although The Psychology of Money wasn’t on my list of books to read as part of my personal finance resolutions for 2021 , I have heard so many great things about this book that I thought I would give it a read. Here’s my Psychology of Money book review.

genymoney.ca is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com

I follow Morgan Housel on Twitter and it is natural progression to read his book, of course. As of November 2021, he has sold over 1 million copies worldwide (this is a very impressive accomplisment).

Psychology of MOney Book Review

Ps ychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel is a book about the gap between our knowledge about money and our behaviour. It is just fascinating. This book is a collection of 20 lessons on money, investing, and human behaviour. Each chapter is an easy short read but like a thriller novel, the last paragraph prompts you to want to read the next chapter.

The premise of Psychology of Money is that behaviour is hard to teach, even to smart people.

Finance is math-based and there are spreadsheets and formulas to tell us what to do and how to optimize things, but most people don’t make financial decisions based on a spreadsheet.

Our worldview and personal history is embedded in our decision making and naturally colours how we view the world. Thus if affects how we make our financial decisions.

We change our behaviour based on stories, based on what we read, and based on being influenced by others (and as I’ve learned over the years, you can’t change others behaviours, they have to do it for themselves). Some of the lessons he shares in his book might make you want to change your behaviour.

Who is MOrgan Housel?

Morgan Housel is a partner at the Collaborative Fund (it is an investment firm based on growing creativity and the collaborative economy). He used to be a columnist at The Wall Street Journal and The Motley Fool and is considered an expert on behavioural finance.

Behavioural finance is an ‘up and coming’ field which combines psychology and money. Another author on behavioural finance is Daniel Kahnehman, who wrote Thinking Fast and Slow . Yet another researcher on behavioural finance is Dan Ariely.

What I Liked About Psychology of Money

I can see why everyone is raving about this book. The first few chapters in, I was a converted fan.

First off, he shares some of the events that have occurred throughout history and how they may have influenced some of the investing behaviours of people who have gone through those experiences. I hadn’t thought of that to this extent.

When I think of this, I think of the differences between boomers and millennials and how our own unique experiences have shaped how we behave today with money. These behaviours are so etched from our upbringing and experiences that it’s difficult to change (or even be aware of how it influences our behaviours).

In another chapter, he talks about having a survival mindset. Personal finance math tells us that staying invested 100% is the optimal way to invest. Staying invested means, that when you have cash, invest it. Don’t leave a cash stockpile. You’ll come out of the other end with more money if you stay invested instead of earning 1% on your cash.

People criticize Warren Buffett for having such a large cash stockpile in Berkshire Hathaway, they say “he’s lost his touch” or he doesn’t have to aim for high returns anymore, or that he’s just coasting.

However, if that cash prevents you from having to sell your investments during the bear market, then you’ve come out ahead.

During the March 2020 blip in the markets and the circuit breaker days, I remember thinking how lucky I was to have cash on hand. Even if the math shows that I would have been better with the money invested 100%, I don’t think I could stomach that volatility.

I choose the option that lets me sleep at night.

Another lesson he shares is about “Tails”. When we think of successful businesses we only see the success. We don’t see the failures (or don’t remember them).

Did you remember the Amazon Fire Phone? Morgan Housel writes that it’s okay for Amazon to lose a ton of money on something like the Fire Phone because that loss was offset by the major success of something like Amazon Web Services (a tail).

In the last chapter “the culmination chapter” he reveals how he invests his own money .

Instead of trying to beat the market, he practises what he preaches and dollar cost averages (yes that’s right he invests money regularly and doesn’t try to time the market) into a low cost (I think Vanguard) index fund.

Also, he paid off his mortgage in a low interest rate environment even though he could have used that money to invest instead.

The rational investor would do otherwise, but as he mentions, human beings are not always rational .

What I Didn’t Like About Psychology of Money

What did I not like about Psychology of Money ? Maybe that it was too short, or the chapters were a bit too short and I would have liked the examples and stories to go into more detail. That’s not much of a ‘complaint’ though. I just loved the examples he gave and the stories he shared.

I highly highly recommend this book if you are interested in learning more about money and why there’s a divide between what we KNOW we should do and what LOGIC tells us to do (for example, use money to invest instead of paying down your mortgage) and what we actually do because we are humans and not actually robots, and are wired a certain way.

This book has influenced me to increase my cash stockpile to at least 20% just like he has, once I reach my investment portfolio goal.

I’ll end with a great quote from the book that really resonated with me:

“Doing something you love on a schedule you can’t control can feel like you’re doing something you hate” — Morgan Housel

Ultimately building wealth is about building freedom to do what you wish with your time and having the control of how you want to spend your time.

Are you spending your time accordingly?

Have you read Psychology of Money?

What’s Your Psychology of Money Book Review?

You may also be interested in:

- Margin of Safety book review

Free Dividend Yield Spreadsheet Tracker Download and Blog Updates

GYM is a 40 something millennial writing about personal finance since 2009 and interested in achieving financial freedom through disciplined saving, dividend and ETF investing, and living a minimalist lifestyle. Before you go, check out my recommendations page of financial tools I use to save and invest money. Don’t forget to subscribe for a free dividend yield spreadsheet and the free Young Money Bootcamp PDF.

You might also be interested in:

2 thoughts on “the psychology of money book review”.

Sounds like a good book, and I’m going to add it to my reading list.

A friend of mine from university has released a couple of CDs (we were in a music program) and one of my favourite songs of hers is called “Time Is How You Spend Your Love”. She didn’t pen the original quote, but that notion really resonates with me, and I try to think of this quote / song whenever I feel like my wheels are spinning.

I also saw the Twitter dividend drama and was not overly impressed with some of the participants.

@James R- Thanks for sharing, I like that title. Time is how you spend your love, very true especially when we all have the same amount of time per day as everyone else. Yeah the Twitter drama was a bit trollish, IMO.

Leave a Comment Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Filter by Keywords

Book Summaries

The psychology of money summary: key takeaways & review.

Senior Content Marketing Manager

January 15, 2024

Start using ClickUp today

- Manage all your work in one place

- Collaborate with your team

- Use ClickUp for FREE—forever

Have you ever wondered why your wallet sometimes seems to have a mind of its own?

That is precisely what Morgan Housel explores in his book The Psychology of Money . He establishes that how you handle your finances is linked to your psychological quirks and experiences.

Housel’s book isn’t just another finance book; it helps you understand why you make certain money decisions.

It provides valuable insights into the psychology of long-term investments and the very real human factors influencing investment decisions and money management approaches.

The book reveals the connection between money, emotions, biases, and uncertain long-term strategies.

Let’s look closer at Housel’s book and explore how managing finances isn’t just about numbers.

The Psychology of Money Book Summary at a Glance

1. you’re not crazy when it comes to money—no one is, 2. it’s not about who earns more; it’s about who saves more, 3. compounding is your secret weapon, 4. luck and risk are more important than your hard work and skills, 5. you’re getting money, but are you keeping it, 6. failures and errors are inevitable, 7. plan your finances according to your identity, 8. remember that goals and desires evolve, 9. the end goal is freedom, popular the psychology of money quotes, applying the psychology of money principles with clickup, keep your finances in check with clickup.

The Psychology of Money stands out from the crowd of personal finance books. Unlike books that claim to offer a universal path to wealth, this one takes a different approach.

Morgan Housel, a behavioral finance and investment history expert, is a renowned financial writer and analyst. In this book, he unveils a simple truth: financial success isn’t about raw intelligence but behavioral skills.

He emphasizes that your connection with money isn’t rooted in science or math but in emotions like fear and greed, pride and envy, and the social comparisons that shape your psychological relationship with money. Getting carried away by such emotions may make you less wealthy and keep you unsatisfied for life.

The book explores how our backgrounds and experiences make all the difference to our risk tolerance. For example, those who’ve seen the stock market rise in their formative years are likelier to invest money in stocks than those who have seen the market crash.

In the financial world, the concept of a “batting average” acknowledges that occasional losses are acceptable if overall gains outweigh them. When analyzing the Russell 3000 index, the author found that 40% of the companies on the index had failed.

However, 7% had performed well enough to offset this. These few companies contributed largely to the 73-fold increase that the Russell Index has seen since 1980. This highlights the importance of outliers.

In this book, Housel underscores the role of luck and risk in outcomes, the power of compounding, how you pay the price to make financial gains, and the tremendous influence of optimism and pessimism on decision-making.

The book challenges the conventional narrative, highlighting the importance of contentment in building wealth and having a happy and fulfilling life. It offers the valuable insight that true wealth lies in unseen financial assets.

The Psychology of Money provides a unique perspective in the crowded personal finance genre. Housel’s unconventional wisdom makes this read a standout, validating its widespread popularity.

Key Takeaways from The Psychology of Money by Morgan Housel

Housel’s book is a short 20-chapter read that imparts enough wisdom for you to adopt a productive financial mindset . Some of its key takeaways include:

Housel believes that no matter how irrational your financial decisions may seem, you aren’t crazy. Your money habits come from your unique life experiences.

Your background and lived experiences influence how you manage money—your saving, investing, and spending habits.

In Western economies, people’s backgrounds changed as they shifted from hands-on jobs to more knowledge work. It changed how people approach finances, making old investment rules outdated. Different backgrounds lead to different money outlooks and risk preferences.

So, even if your financial choices seem weird to others, they make perfect sense to you. Your decision-making, including investment decisions, is based on what you know (and think) about the world.

You can build wealth even with a modest income, with the right financial decision-making. But without a high savings rate, it’s nearly impossible.

In his book, Housel stresses the link between good investing, saving a substantial portion of income, and adopting a humble, frugal lifestyle. You can increase your savings by resisting the urge to keep up with others.

Plus, the best thing about saving money is that it brings you options, flexibility, and the chance to wait for opportunities. It gives you time to think and the freedom to change your path on your terms.

Compound interest, or compounding, is the powerful force behind building your savings. Essentially, it’s the interest you earn on the interest over time.

In good investing, the key isn’t chasing the highest returns but earning consistently good investment returns over the longest time—a formula where compounding works its magic.

For example, Warren Buffett, an American businessman, investor, and philanthropist, is renowned for his investment prowess, financial knowledge, and immense wealth. What’s most remarkable about his journey is not that he had a net worth of $1 million by age 30, but that he accumulated $81.5 billion after age 60 .

Buffett’s disciplined approach to consistent, long-term investing allowed him to unlock the power of compounding.

The message: opt for sustained, reasonable returns over big future risks.

Success and poverty are not solely the result of hard work or laziness; luck and risk play substantial roles.

When it comes to long-term financial planning, some factors are outside your control.

Using Bill Gates as an example, Housel illustrates the impact of luck. Gates’ success was influenced by luck, such as attending a high school with a computer (yes, these were a rarity back then), and risk, like his friend Evans dying in a mountaineering accident.

Recognizing the role of luck in success and risk in failure cultivates humility and compassion.

To achieve financial success, balancing risk-taking and optimism with humility, fear, and frugality is important. Recognize that your hard-earned money can disappear quickly and attribute some of your success to luck.

Survival, the ability to endure, is the cornerstone of financial strategy . Being financially unbreakable, allowing compounding to work wonders over time, becomes the goal.

A well-defined plan is essential, but it is equally important to plan for things not working out as planned. You should balance optimism with caution to achieve realistic optimism and pursue long-term goals.

Unknown risks are inevitable, and preparing for the unforeseen is challenging. Housel suggests avoiding single points of failure, like relying solely on a paycheck.

The biggest financial risk is neglecting savings, creating a gap between current and future expenses. Estimating future returns requires a margin of safety; for instance, the author assumes a one-third lower return than historical averages.

Prepare for the unpredictable nature of the economy. Ensure financial security by building sufficient savings to rely on.

Before you plan your finances, know if you’re a long-term or short-term investor. Your time horizon and goals shape your perspective, influencing what prices seem reasonable.

Financial advice is not one-size-fits-all; commentators on the TV don’t know your priorities. Adopt a financial plan that aligns with your values and withstands short-term volatility. Aim for positive returns.

Build a portfolio that ensures good investment returns, quality of life, and resilience during economic challenges by acknowledging the human aspects overlooked by academic ideals.

Long-term planning of finances for both personal and business needs is challenging as your personal financial goals evolve with time. Your desires shift, and what matters today may not in a decade.

Accepting personal evolution is crucial in any investment strategy. Housel recommends keeping your financial plan flexible to adapt to your changing needs and priorities in life. Aim for moderation and invest wisely.

Housel reminds us that the final objective of financial planning and investing is to free up our time and give us the freedom to do what we want. By making wise financial decisions that build wealth, we gain control over our time and our lives. After all, success is just the ability to choose the life we want.

There’s no doubt that The Psychology of Money is filled with impactful insights about managing money, but some quotes stand out:

“Things that have never happened before happen all the time

This quote highlights the unpredictability of the future. In the world of finance and investments, market dynamics evolve constantly, leading to impactful occurrences. Remember the financial crisis of 2008? In situations like these, adaptability and long-term perspective help.

“Planning is important, but the most important part of every plan is to plan on the plan not going according to plan.”

While planning is crucial in financial decision-making, it’s also important to acknowledge and prepare for unforeseen events. Successful investing demands that you prepare to adjust the course when necessary. The most important part of planning is anticipating deviations to manage expectations and mitigate risks.

“Spending money to show people how much money you have is the fastest way to have less money.”

Spending money solely to display wealth for others’ validation is a waste of money. Instead, you can invest the money spent on such displays to gain genuine wealth.

“Luck and risk are both the reality that every outcome in life is guided by forces other than individual effort.”

Your life experiences may not always result from your actions alone. Luck and unpredictable risks also play a big role in shaping outcomes. So, it’s essential to stay humble, be adaptable, and make decisions with the understanding that not everything is within our control. Life’s a mix of effort, luck, and uncertainty.

“Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.”

Our personal experiences with money, which are just a tiny fraction of global financial happenings, heavily shape how we see the world. It greatly influences how we make financial decisions and think about the world.

If Housel’s book has inspired you to start planning your finances better, trust ClickUp to simplify the game for you. This versatile project management and collaboration tool has many features to help you with finance planning and budgeting.

A cloud-based business management software, ClickUp can simplify your financial processes . Handle multiple accounts, generate easily shareable reports , and use ClickUp AI as your virtual personal assistant while you focus on the bigger picture.

Create custom Dashboards within ClickUp and build a digital map of your financial journey. Craft high-level proposals and reports showcasing budget allocations , actual spending, and profits, and get a comprehensive view of where, when, and how your money is flowing.

If you don’t enjoy number-crunching, use ClickUp AI , which is powered by natural language processing. It can turn numerical data into actionable insights for more thoughtful decisions.

Meanwhile, deadlines are easier to handle with ClickUp Tasks . It’s like setting personal financial reminders; invest and mark it done. It helps you build an effortless cycle that mirrors Housel’s idea of small, consistent actions for financial success.

But is that all? Nope.

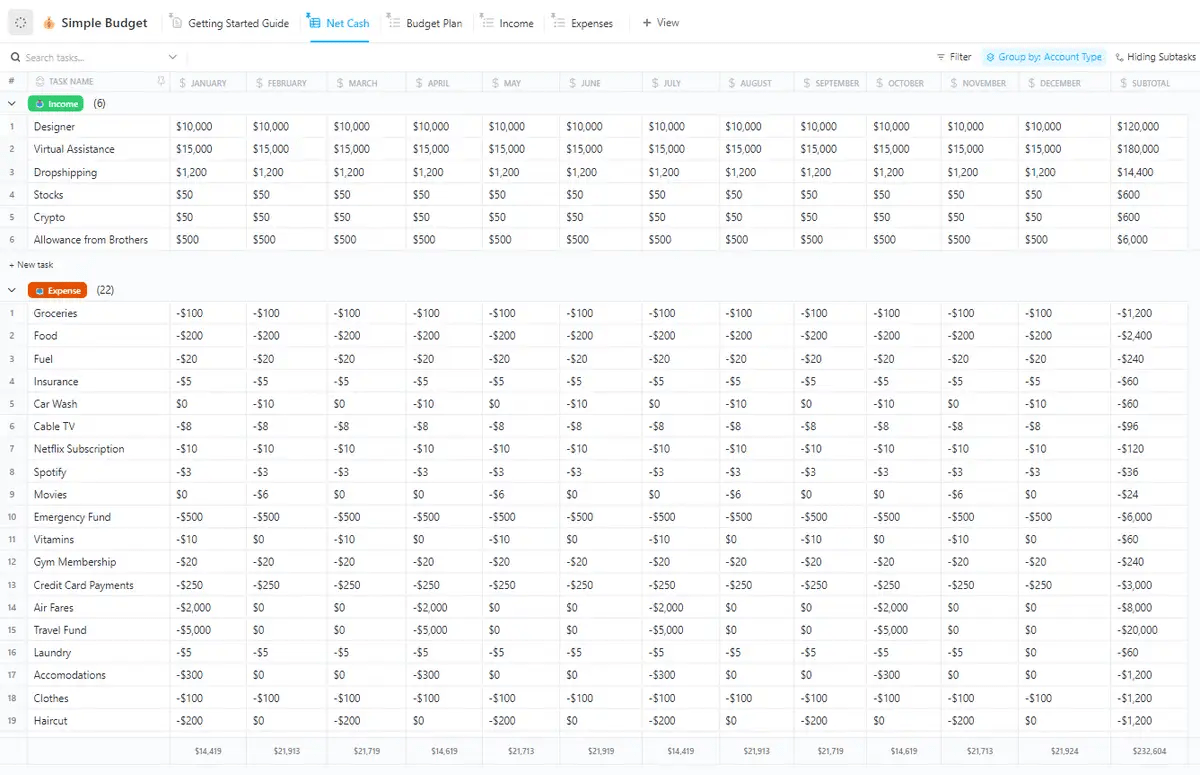

ClickUp comes with many templates designed just for budgeting and financial planning. For example, ClickUp’s Simple Budget template lets you track your monthly income and expenses.

With 16 custom fields and 5 views, including Budget Plan and Net Cash, this template helps you monitor and visualize your budget progress . It also boasts customizable statuses and project management features like time tracking, priority labels, dependency warnings, and emails.

ClickUp helps you take the grunt work out of managing money.

With bite-sized chapters, charts, and personal stories, The Psychology of Money introduces you to the power of healthy money habits like saving money and making smarter financial decisions. .

Take your financial planning up a notch with ClickUp. Organize and visualize your budgets and finances with the help of dashboards, recurring tasks, custom statuses, views, and more.

Make smart decisions, set your money-saving goals, and track your financial outcomes with ClickUp.

Sign up for ClickUp today for free and begin your journey to being wealthy.

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

- Preferences

Psychology of Money - PowerPoint PPT Presentation

Psychology of Money

1. 1. based on personal financial planning by gitman and joehnk, thompson, ... opposites attract. hoarders and spenders. worrier and avoider. monk and amasser ... – powerpoint ppt presentation.

- Money Harmony Resolving Money Conflicts in Your Life and Relationships

- Olivia Mellan

- What is your money personality?

- Take the money personality test

- See Class Materials

- Can you describe your attitude toward money?

- Enjoys holding money so it is difficult for him to spend money on himself or loved ones

- Spending is painful

- Worried about future security

- Enjoys spending money so it is difficult to save money for long-term goals

- Different types of spenders.

- Feels guilty about having money

- Gives money away

- Tries not to think about money

- Meets basic needs

- Feels anxious about performing financial tasks

- Cannot plan

- Afraid of decisions

- Likes to keep large amounts of money at easy access

- Focuses on long-term future

- Thinks frequently about how to increase money

- He who dies with the most toys wins!

- Do you believe in the money myths?

- Money Happiness

- Money Power

- Money Freedom

- Money Self-worth

- Money Security

- Top 2 topics of arguments

- Opposites attract

- Hoarders and spenders

- Worrier and avoider

- Monk and amasser

- Guidance for cooperation see book

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics , the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.

COMMENTS

The Psychology of Money provides new insight into how and why consumers interact with money. Morgan Housel shares a series of short stories that allow you to consider the world's interactions with money more closely. Throughout the book, you'll approach the concept and consequences of money in terms of behavior.

With a title like "The Psychology of Money," you might expect the material within to be dense and heady. On the contrary, the book is extremely approachable and digestible. That's thanks in part to its structure that breaks the contents down into 20 relatively short chapters (plus an intro and a postscript). Each of these chapters finds ...

A book summary and notes by Calvin Rosser on The Psychology of Money by Morgan Housel, a book that teaches you how to have a better relationship with money and to make smarter financial decisions. Learn about the role of luck, risk, compounding, and psychology in wealth, greed, and happiness.

In my opinion, Morgan Housel is the best behavioral financial writer today. I learn something from every article of his that I read. So when I found out he was releasing a book, I preordered a copy. The Psychology of Money includes some of Housel's existing blog posts, plus new insights and information about people's relationship with money.

Morgan Housel's "The Psychology of Money" offers a unique lens through which to view this process, focusing less on the 'how-to' and more on the 'why.' Housel's book is not your typical financial guide filled with investment tips or budgeting tricks. Instead, it delves into the behavioral aspects of dealing with money.

The book uses the stories of Ronald James Read and Richard Fuscone to illustrate how time and compounding are the most powerful investing tools. Read invested wisely and became wealthy, while Fuscone invested recklessly and lost everything.

Learn how money moves in an economy and how personal biases and emotions affect your financial decisions. The Psychology of Money by Morgan Housel teaches you how to think rationally and make better choices when it comes to money.

Download the PDF of The Psychology of Money, a book that reveals how behavior is the key to financial success or failure. Learn from stories of geniuses, janitors, and philanthropists who made or lost millions.

While most of us know this, few of us really practice it. Morgan Housel's new book, The Psychology of Money: Timeless Lessons on Wealth, Greed and Happiness, is an informative, fun, and reader-friendly reminder of how to build wealth over time. He cleverly describes what he sees as the biggest issues affecting investment success - our own ...

A book review and rating site for The Psychology of Money, a nonfiction book by Morgan Housel that explores how people think and behave about money. The book is based on 19 short stories and covers topics such as investing, personal finance, and business decisions.

It is just fascinating. This book is a collection of 20 lessons on money, investing, and human behaviour. Each chapter is an easy short read but like a thriller novel, the last paragraph prompts you to want to read the next chapter. The premise of Psychology of Money is that behaviour is hard to teach, even to smart people.

23. The Pyschology of Money Book Reveiew. T he book " The Psychology of Money " is a masterpiece that highlights the most common mistakes people tend to make with money. Even though we came ...

The best things in life are free. Money makes the man or woman. Money is a good servant but a bad master. Penny wise and pound foolish. Expenditures rise along with income. Empty pockets never held anyone back. Only empty heads and empty hearts can do that. A fool and his/her money are soon parted. A penny is a lot of money if you haven't a ...

Neat and crisply written - this book offers a lot of wisdom and high-quality content. In this book, Morgan Housel shares 19 stories exploring the strange ways people think about money. It covers observations on our relationship with money and tells us how our thinking towards finances drives the critical decisions of our life.

Learn how your emotions, experiences, and biases influence your financial decisions and outcomes. This book review covers the main themes and insights from Morgan Housel's The Psychology of Money, a personal finance book that challenges conventional wisdom.

The Psychology of Money - ABSLMF. Description: The study of the psychology of money is known as "neuroeconomics". Studies show very intriguing facts about how our brains process money matters. Let's see the areas that influence and execute our financial decisions in the Brain. Read to know more. - PowerPoint PPT presentation. Number of ...

World's Best PowerPoint Templates - CrystalGraphics offers more PowerPoint templates than anyone else in the world, with over 4 million to choose from. Winner of the Standing Ovation Award for "Best PowerPoint Templates" from Presentations Magazine. They'll give your presentations a professional, memorable appearance - the kind of sophisticated look that today's audiences expect.