Bank Teller Resume Examples [Updated for 2024]

As a bank teller, you’re a trusted individual that handles large sums of cash.

In fact, you’re the face of the bank!

You’ll be faced with many problems during your shifts, but perhaps you didn’t expect to face one so soon...

Your resume!

What does a good bank teller resume look like, anyway?

With so many people competing for the best bank teller positions, you can’t leave any questions unanswered.

But don’t worry, this guide has you covered!

- A job-winning bank teller resume example

- How to create a bank teller resume that hiring managers love

- Specific tips and tricks for the banking industry

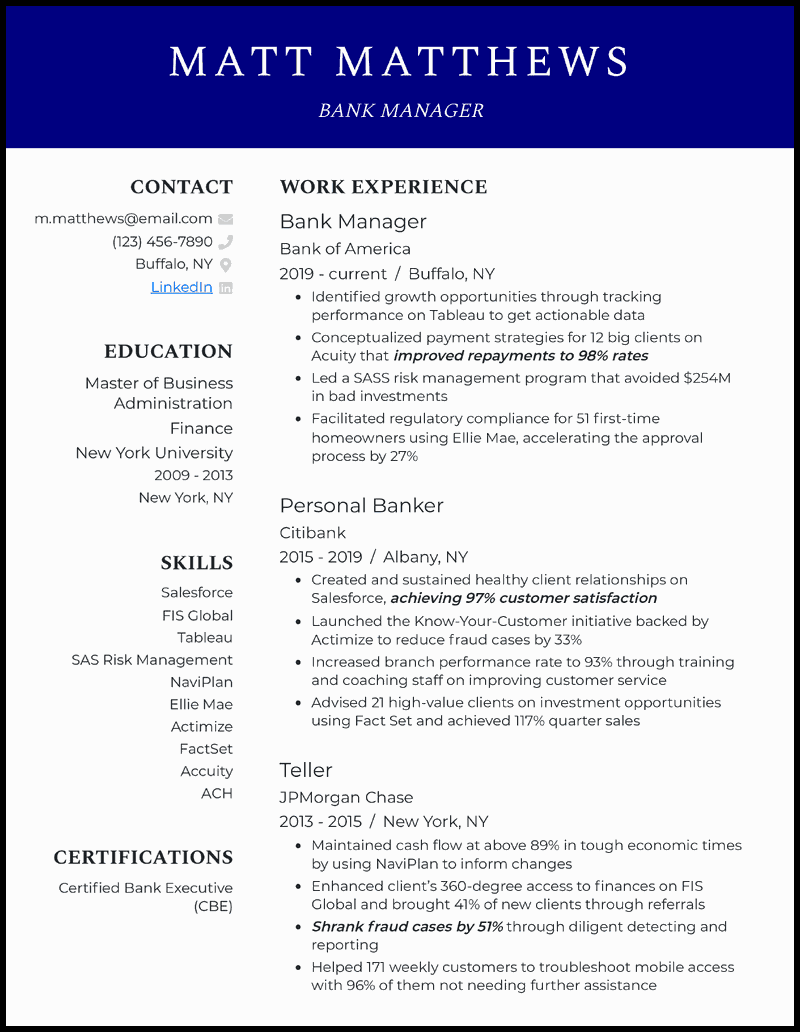

Here’s a bank teller resume example, built with our own resume builder :

Looking for a resume example for a different finance position? We've got more resume examples right here:

- Banking Resume

- Financial Analyst Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

Follow the steps below to create a bank teller resume of your own.

How to Format a Bank Teller Resume

Banking is always going to be a competitive segment of the job market.

However, you may be surprised at just how many apply for the position of bank teller.

Now, we aren’t telling you this to scare you.

Rather, that you must do everything in your power to make your resume stand out .

The first course of action is to choose the correct format.

You see, even those with the richest of bank teller experience won’t be able to impress a hiring manager that is struggling to read the content.

The “ reverse-chronological ” format is the most popular format for bank tellers, and it’s for good reason. It displays your most recent work experience first, and then works backwards through your history and skills.

You could also try the two following formats:

- Functional Resume - This format places a large emphasis on your skills, which makes it the best format for bank tellers that are highly-skilled, but have little in the way of bank teller work experience.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, which means it focuses on both your banking skills AND work experience.

- Try to keep your bank teller resume to one-page. Doing this will show the hiring manager that you present information is a precise way. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins - One-inch margins on all sides

- Font - Pick a font that stands out, but make it professional

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Line Spacing - Use only 1.0 or 1.15 line spacing

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As a bank teller, the recruiter wants to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Bank Teller Resume Template

Ever made a resume?

If so, there’s a good chance that Word was the program of choice.

There’s also a good chance that your resume wasn’t as well-formatted as it could be.

It’s no secret that Word is far from the best tool for the job.

For a professional bank teller resume that has a solid structure, you may want to use a resume template .

What to Include in a Bank Teller Resume

The main sections in a bank teller resume are:

- Contact Information

- Work Experience

For a bank teller resume that stands out from other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

Right, now let’s talk about each of the above sections, and explain how to write each of them.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a bank teller, you should know that not a single digit can be out of place.

And this is exactly the case with your contact information section. One small misspelling of your phone number can render your whole application useless.

For your contact information section, include:

- Title - This should be specific to the exact job you’re applying for, which is “Bank Teller”

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Emily Hembrow - Bank Teller. 101-358-6095. [email protected]

- Emily Hembrow - Banking Admin Angel. 101-358-6095. [email protected]

How to Write a Bank Teller Resume Summary or Objective

Now, you should be aware that making your resume stand out is the #1 goal .

But HOW can you do this?

There’s no use putting your best achievements right at bottom of the resume.

Nope – you need an opening paragraph that you can bank on!

These opening paragraphs are known as either a resume summary or objective .

Both are short, snappy paragraphs that sum up the main points of your resume. They are great for introducing your skills and experiences.

The difference between a summary and objective is that.

A resume summary is a paragraph that summarizes your most notable experiences and achievements. It is the best option for individuals who have multiple years of bank experience.

- Committed bank teller with five years of experience at YZX Bank, where I balanced ledgers, handled cashed, maintained accounts, and more. Maintained a 99.80% customer satisfaction rating during the total period of employment. Seeking a chance to leverage my interpersonal skills and banking knowledge to become a bank teller at Bank XYZ.

On the other hand, a resume objective should give a run-down of your professional goals and aspirations. It is ideal for entry-level bank teller candidates. Although you’re talking about your own goals, it is important to align these goals with the employer’s vision.

- Motivated finance student looking for a bank teller role at Bank XYZ. Two years of experience at a gym reception with heavy traffic. Excellent communication, organization, and problem solving skills. Enthusiastic to support your client-facing staff, where I can use my interpersonal skills to achieve the best quality of service.

So, which one is best for bank tellers?

Well, a summary is suited for bank tellers with work experience, whereas an objective is suited for those who are entering the field for the first time (student, graduate, or switching careers).

How to Make Your Bank Teller Work Experience Stand Out

There’s no easier way to impress the hiring manager than with a rich work experience.

Sure, talking about your education and banking knowledge is super important, but nothing proves your talents like a wealth of bank teller experience.

Follow this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

Bank Teller

01/2018 - 03/2020

- Voted “Teller of the Year” in 2018 and 2019

- Set-up a new database system that accurately secured all transactions

- Processed withdrawals, deposits, transfers, loan payments, and cashier’s checks for 50+ people every day]

To make your experience stand out, you should focus on your most impressive achievements , rather than your daily responsibilities.

Instead of saying:

“Data entry”

“Set-up a new database system that accurately secured all transactions”

So, what exactly are we suggesting here?

Simply put, the first statement isn’t impressive – at all!

On the other hand, the second statement goes into more detail and shows that you’re an excellent asset to the bank.

- Tailor your experience to the job advertisement. Simply look for any required skills that you can demonstrate in your work experience.

What if You Don’t Have Work Experience?

Maybe you’re a finance graduate who hasn’t worked before?

Or maybe you’re transitioning from a different banking position?

Whatever the situation, don’t threat.

You see, it doesn’t matter if you haven’t been a bank teller in the past, as you can still add relevant skills and experiences from previous jobs.

For example, if you’ve worked store manager, you can talk about any crossover skills and experiences. Just like a bank teller, you would have to be friendly, give advice to customers, and help with cashier duties.

For the students read this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Bank Teller Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these same words on nearly all bank teller resumes.

And since you need your bank teller resume stand out, we’d recommend using some of these action words instead:

- Conceptualized

- Spearheaded

How to List Your Education Correctly

The next section in any bank teller resume is the education section.

Now, there isn’t just one correct path to becoming a professional bank teller.

In fact, a high school diploma or GED certificate is usually all that’s required.

So whatever path you have taken, just include the following details:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Boston State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Risk Analysis, Financial Management, Bank Lending and the Legal Environment, Quantitative Methods for Banking, Finance and Economics, and more]

Now, you may have a few questions, so here are the most frequently asked questions:

- What if I haven’t finished studying?

No problem. Regardless of whether you’re still studying or not, you should still mention all of the years that you have studied to date

- Should I include my high school education?

Only if you don’t have any higher education. The bank manager will have little care for your high school education if you have a finance degree

- What is more important for a bank teller, education or experience?

If you’re an experienced bank teller, your work experience should come before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 15 Skills for a Bank Teller Resume

Being a professional bank teller requires having a certain set of skills.

And the hiring manager needs to see that you have them!

Now, you may be the most skilled bank teller in the world, but you need to make these skills clearly displayed on your resume.

You see, the manager can’t see your skills if you hide them away in a bank vault!

Here are some of the skills a hiring manager wants to see from a bank teller...

Hard Skills:

- Balancing Ledgers

- Mortgages and Loans

- Deposits and Withdrawals

- Investments

- Safety Deposit Boxes

- Cash Handling

- Risk Assessment

- Account Maintenance

- Foreign Currency Exchange

Soft Skills:

- Excellent Communicator

- Time Management

- Problem Solving

- Confident & Professional Manner

- Organization

- Although soft skills are important for a bank teller, they’re difficult to prove on your resume. As such, try not to go too overboard with the generic soft skills. You should also think of situations that you have used your soft skills, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have fantastic-looking resume that highlights your array of skills and experiences!

But wait...

Is your resume the absolute best it can be?

Remember, the #1 goal is for your resume to stand out .

And a carbon copy of your competitors resume is not going to do that.

The following sections will set you apart from the other bank teller candidates.

Awards & Certifications

Did you win any recognition awards at your previous work place?

Did you win a competition during your studies?

Have you completed any relevant courses on Coursera?

Whatever the recognition, be sure to add any awards and certifications to your resume.

Awards & Certificates

- “Economics of Money and Banking” - Coursera Certificate

- “Learning How to Learn” - Coursera Certificate

- “Teller of the Year” 2018 and 2019 - XYZ Bank]

Whether or not the bank teller requires knowledge of another language, being able to speak multiple languages is an impressive skill.

If you can speak any other language, even to a basic standard, feel free to add it to your resume, but only if you have space.

Order the languages by proficiency:

- Intermediate

Now, you’re likely wondering, “why does the hiring manager need to know about my book club meeting every Friday?”

Well, they don’t need to know, but it allows the hiring manager to learn more about you as a person.

And this is a good thing, as banks are looking for someone who they’ll get along with.

The best way to do this is by listing your hobbies and interests!

Especially if your hobby involves social interaction, as you’ll be working in a customer-facing role.

If you want some ideas of hobbies & interests to put on your resume , we have a guide for that!

Match Your Cover Letter with Your Resume

According to the U.S. BLS , bank teller jobs will decline by 12% between 2018 and 2028.

And this means there will be a constant increase in competition for the top jobs.

As such, you need to do everything in your power to stand out.

But HOW can you do this?

Well, by writing a convincing cover letter !

You see, a letter is perfect for communicating with more depth and personality.

Even better, you can show the bank’s hiring manager that want THIS position in THIS bank.

As with your resume, your cover letter should also have the correct structure.

Here’s how to do that:

And here’s what to put in each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website (or Behance / Dribble)

Hiring Manager’s Contact Information

Including full name, position, location, email

Opening Paragraph

It’s critical to hook the hiring manager with your opening paragraph, so it needs to be very powerful, otherwise they’re not going to read the rest of your resume. So, mention:

- The specific position you’re applying for – Bank Teller

- A short, punchy summary of your most notable experiences achievements

Once you’ve got the hiring manager hooked with your opener, you can go deeper into the rest of your work history and background. Some of the points you can mention here are:

- Why you want to work for this specific bank

- Anything you know about the bank’s culture

- What are your most notable and how do they relate to this job

- If you’ve worked in other banks or similar positions

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragrpah

- Thank the hiring manager for their time

- Finish with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “Sincerely” or “Best regards”.

Creating a job-winning cover letter can be a challenging craft. But don’t worry, you can rely on our how to write a cover letter for guidance.

Key Takeaways

You now have the knowledge and tools to create a job-winning bank teller resume.

Let’s quickly recap everything we’ve covered:

- Choose the correct format based on your specific circumstances. Prioritize a reverse-chronological format, and follow the best layout practices to keep everything clear and concise

- Use a resume summary or objective to hook the reader

- Talk about your most notable achievements, instead of your daily duties

- Match your bank teller resume with a convincing cover letter

Suggested reading:

- Guide to Green Careers - All You Need to Know

- Why Should We Hire You - 10+ Best Answers

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

Jobscan > Resume Examples > Finance Resume Examples, Skills and Keywords > Bank Teller Resume Examples, Skills, and Keywords

Bank Teller Resume Examples, Skills, and Keywords

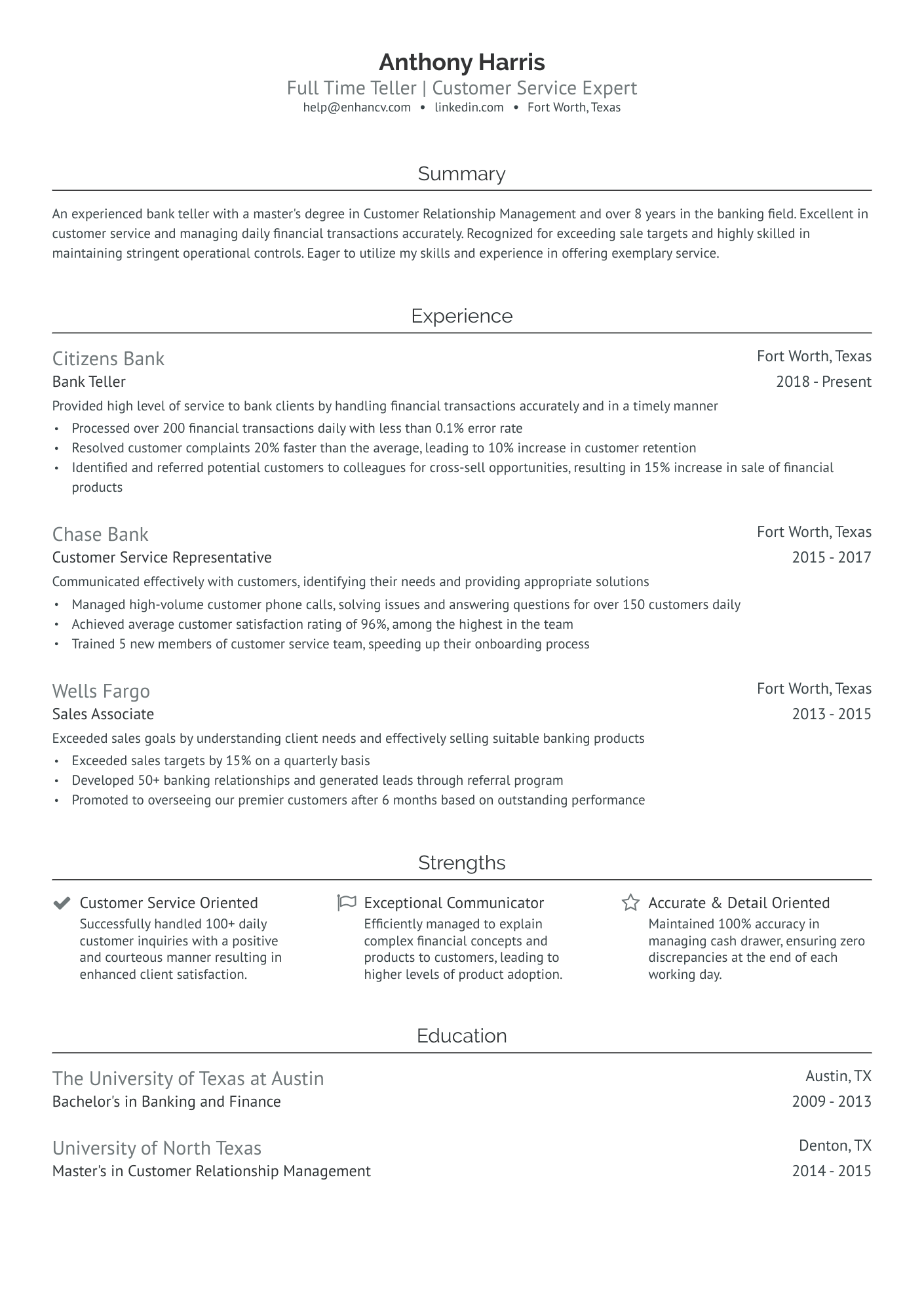

Ever wondered what it would be like to work at a branch of your favorite bank? Whether you're making a career change or applying for your very first job, our bank teller resume samples will give you the tools you need to land that highly anticipated interview.

Jobscan has helped land interviews with

Bank Teller Resume Sample

Bank tellers are the account holder’s first point of contact with their banking institutions. These financial professionals have the power to make or break the whole customer’s banking experience. Becoming a bank teller lets you test the waters in the financial services world, and will help you determine if that’s something you see yourself doing in the long run.

As a bank teller, you’ll be in charge of processing an extensive variety of transactions — even at an entry-level position. You’ll assist customers in opening and closing their accounts and perform other duties like:

- Making deposits

- Cashing checks

- Withdrawing funds

- Processing loan payments

- Making account transfers

To get a shot at this job, you’ll first need to impress your potential employer with your bank teller skills . If you don’t know where to begin, have a look at Jobscan’s recruiter-ready bank teller resume example. After that, take a look at our five pointers for landing an interview at a bank.

Salt Lake City, UT 84111 • (555) 555-1234 • [email protected] • linkedin.com/in/donald-smithers

BANK TELLER

Experienced bank teller passionate about helping customers navigate their finances. Friendly and helpful demeanor and proven success with reaching sales goals as well as the satisfaction of customers. Attention to detail in regards to calculating accurate counts and balances.

Customer service | Business operations | SLA fulfillment | Problem-solving | Written and verbal communication | Organization | Ledger balancing | Tax preparation | Numeracy skills | Strong mathematical ability | Quality assurance management

Demonstrated analytical, accuracy and problem solving skills on a daily basis. Exceeded sales goals and prioritized the needs of customers. Was named Employee of the Month three times and received high customer satisfaction.

- Efficiently performed accurate mathematical calculations

- Exceeded bank sales goals by 50%

- Prioritized multiple tasks while maintaining accuracy and timeliness

- Promoted a culture of teamwork and increased productivity

- Demonstrated positive attitude and a professional image

Executed customer transactions while prioritizing the customer experience and receiving high marks for customer satisfaction.

- Managed cash transactions such as deposits and withdrawals

- Received and accept cash from merchants and customers

- Posted deposit and withdrawal transactions to customers’ accounts via teller terminal

- Disbursed monthly interest checks and accurately transferred funds between accounts

- Ensured compliance with cash can limits

- Sold bank cashier checks to customers

- Answered basic checking and savings questions with professional and friendly demeanor

Why this resume works

Bank Teller Resume Skills and Keywords

The first step in getting an interview is bypassing the applicant tracking system (ATS) . This candidate-filtering software is widely popular among recruiters and hiring managers in all industries. It looks for keywords in every resume and discards the resumes that don’t meet its automated criteria. To make sure that your resume makes it to the top of the pile, you have to include the proper resume keywords .

Top Bank Teller Resume Skills

- Administration

- Retail banking

- Mortgage lending

- Private banking

- U.S. VA loans

- Business loans

- Organization Skills

- Commercial banking

- Cash handling

- Time management

- Communication

- Client-focused

- Reliability

- Accountability

- Microsoft access

- Transactional banking

- Government loans

- Financial analysis

- Financial services

- Public speaking

- Customer service

- Customer experience

- Home equity loans

- Investments

- Risk management

- Multitasking

- Investment banking

- Personal banking

- Teller operations

- Customer satisfaction

- Financial accounting

- Office administration

- Construction loans

5 Resume Writing Tips for Bank Tellers

Now that you’ve got some idea of where to start, it’s time to build your resume . But before you begin to type, check out the resume-writing suggestions our experts put together for you. If you follow them, you’ll get that interview you’ve wanted for so long.

Tip # 1: Showcase your attention to detail by following instructions to the letter

As a bank teller, you’ll be working with people’s money. A single mistake could cost the bank a beloved customer or hundreds of dollars. That’s why your potential employer might test your attention to detail by providing very specific instructions during the application process. Read the job ad thoroughly and look for:

- Special directions

- Particular formatting guidelines

- Distinct keywords

- Separate application forms

Tip # 2: Don’t exaggerate your skills

Anyone who’s ever applied for a job knows how tempting it is to embellish a resume to make it look more impressive. However, rather than making you look more experienced, it might raise some red flags. And if you get quizzed on it during the interview and you can’t come up with an answer, you’re in trouble.

Getting caught in a lie by your potential employer might become an immediate cause for disqualification from the process. What’s more, if the recruiter or hiring manager spreads the word, you might find it hard to land a position somewhere else. Banking is a small world, and, after all, nobody wants a bad liar handling people’s assets.

Tip # 3: Keep your entries concise and clear

Think about all the resumes your prospective employer will read through before finally reaching yours, or how many they see every day across multiple positions. That’s why you want to keep your resume sections as brief and straight to the point as possible. Avoid using passive voice,as it requires more words and doesn’t sound interesting.

Hiring managers might take a hard pass on resumes with walls of text. Use bullet points to present your experience in a skimmable, easy-to-read way. Make your statements more attractive by incorporating action words .

Tip # 4: Add a brief sneak peek of your banking experience and skills

Including a resume introduction at the beginning of your resume just makes sense. It should be about three sentences, and they should cover:

- Your experience, if any, in finance.

- Your career objectives.

- One or two professional achievements that make you extra proud.

It’s a way for an employer to understand you and your goals at a glance, rather than having to sift through your whole resume.

Alternatively, you could add a professional objectives section to explain how you see yourself growing within the organization that you’re applying to. If you’re changing careers, or you just want to get an entry-level job in banking, this is a great place to let them know!

Tip # 5: Space out your skills wisely

We get it. You want to make sure that your future employer knows everything you’re capable of. Adding a skills section is a wonderful idea, and it helps you tailor your resume to the job posting. But you need to be careful and strategic about how you list them.

A long list of skills is tedious to go through, and it doesn’t tell a potential employer what you bring to the table for this specific job. Solve this issue by adding a few job-specific skills to a designated “Skills” section and scatter the rest through the rest of your resume, like tucking them into your work experience.

Build an ATS-friendly resume for free

Many resume builders are advertised as free, but they often charge a fee to download your resume. Jobscan's online resume builder has no hidden costs and it’s ATS-compatible.

Optimize your resume

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Banking Resume Examples That Made the Cut in 2024

Best for professionals eager to make a mark

Looking for one of the best resume templates? Your accomplishments are sure to stand out with these bold lines and distinct resume sections.

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

Banking Resume

- Banking Resume by Experience

- Banking Resumes by Role

- Write Your Banking Resume

Whether you’re an entry-level bank teller or you’ve climbed the ladder to being a manager, working in banking requires that you know your stuff. Thanks to your in-depth knowledge of the financial landscape, interpersonal skills, and keen eye for numbers, your bank’s customers walk away happy after each visit.

With various legal regulations, keeping up to date with the latest banking software, and studying new products, you’ve got your hands full on a daily basis. However, you’ll need to find the time to create an effective resume to advance your career.

That’s where we come in. Our AI cover letter generator , banking resume examples and handy resume tips helped hundreds of banking professionals land their next jobs, and now, it’s your turn!

or download as PDF

Why this resume works

- Show your workplace impact in your banking resume by detailing your numbers in driving customer satisfaction, solving problems, and cutting down process time to optimize profits.

Experienced Banker Resume

- On top of your achievements, including a certification such as a Certified Bank Teller further lends credibility to your application and gets you closer to the door.

Bank Branch Manager Resume

- To do this, display how you’ve streamlined processes, led teams, and boosted customer satisfaction. Now is great time to introduce metrics such as cutting administrative overhead, spearheading staff training, and more.

Personal Banker Resume

- Integrate your measurable achievements such as meeting sales quotas, solving customer problems, driving up profits, and so on in your personal banker resume .

Bank Manager Resume

- Impress potential employers by showing your sales performance, customer service, and business growth metrics in your bank manager resume .

Related resume examples

- Investment Banking

- Bank Teller

- Financial Analyst

Create a Banking Resume that Matches the Job Description Perfectly

The key to crafting an irresistible application is to match the job description as closely as you can.

For instance, if you’re applying for a senior bank teller role, include a good mix of skills that point to your banking proficiency as well as a couple of your interpersonal abilities. That includes things like conflict resolution and cross-selling, but also knowledge of anti-fraudulent measures and Oracle Flexcube.

In any case, try to check some of the most important boxes in the job listing. Keep things specific—instead of a vague “team player,” use more descriptive skills like “relationship building.”

Want some inspiration?

15 popular banking skills

- Fiserv Signature

- Loan Processing

- Banking Regulations

- Credit Analysis

- Oracle Flexcube

- Microsoft Dynamics

- Fraud Detection

- Basic Accounting

- Customer Service

- Sales Strategies

- FIS Horizon

- Crisis Management

- Temenos T24 Transact

Your banking work experience bullet points

You’re no stranger to various kinds of data, be it financial figures or customer satisfaction metrics. Data will be your best friend as you work on this part of your resume and discuss your greatest achievements.

Refrain from simply listing off every single task from your past jobs—instead, frame your work as accomplishments and back it up with metrics.

In banking, money speaks volumes. Talk about the types of client accounts you’ve handled, investments you’ve guided, or branch budgets you’ve handled. There are many equally useful metrics, from reducing customer complaints to lowering the average wait times at your branch.

- Discuss your success in driving profits for the bank and its clients with financial metrics, such as revenue growth, ROI, and cost-to-income ratio.

- Mention any increases in efficiency, such as the branch performance rate, directing customers to other channels to free up more tellers, or optimizing client documentation.

- Take a customer-centric approach and talk about customer satisfaction ratings, retention, and engagement.

- Sales play a big part in banking, so show off metrics related to cross-selling, up-selling, handling loans, credit cards, and investments.

See what we mean?

- Fixed minor jam errors on NCR Selfserv that decreased customer wait time by 67%

- Detected 91% of fraud cases on Verafin and thwarted them without escalation to the supervisor

- Built 101 long-term client relationships, exceeding annual sales quota by 117%

- Conceptualized payment strategies for 12 big clients on Acuity that improved repayments to 98% rates

9 active verbs to start your banking work experience bullet points

- Facilitated

3 Tips for Writing a Banking Resume if You’re Starting Your Career

- You may be new to banking, but as long as you have any experience in working with customers, you’ve got a lot to talk about. Highlight past jobs where you worked with people, such as retail or tech support, but also college projects and internships.

- Banking requires a great deal of attention to detail, so don’t make the mistake of sending out a resume that’s tailored to a different job. Take the time to read the job description and update your work experience and skills accordingly.

- Pick a resume template that lets you add courses or certifications and include them to increase your credibility. The Certified Bank Teller (CBT) certification is great, but so is the Anti-Money Laundering (AML).

3 Tips for Writing a Banking Resume for a Seasoned Financial Expert

- As you advance in your career, leadership becomes a key skill, whether it is training new colleagues or managing an entire branch. Provide examples of times when you were in charge, such as assigning tasks or handling performance appraisals.

- Don’t be afraid to flaunt your financial acumen by talking about your ability to manage budgets, control costs, or drive growth. For instance, discuss the kinds of budgets you managed for your branch or for particular business accounts, making sure to mention ROI to showcase your impact.

- A successful banker is one who leaves a trail of happy customers behind. Underscore this in your resume by including metrics like customer retention, cross-selling, or satisfaction ratings, as well as mentioning how you helped your staff stick to bank policies.

Unless your career spans over 10 years, we recommend sticking to a one-page resume . Much the way customers only skim the contracts they sometimes sign, recruiters only spend a few seconds scanning your resume, so it’s best to keep it short and sweet.

A resume summary or objective can be an effective way to quickly highlight a career-defining achievement or describe why you’re the right fit for this particular banking job. Use it to mention a couple of key skills, such as your risk management, and include the name of the company you’re applying to.

You can, but it’s better to show them through your work experience bullet points. If you do add some, make them relevant to the job—for instance, employee engagement for a bank manager position.

- Career Blog

10 Banking Resume Samples & Banker Objective Templates

In today’s competitive job market, having a strong banking resume is essential in securing a coveted role in the industry. A well-crafted banking resume highlights relevant skills, experience, and achievements that demonstrate an applicant’s fit for the job.

This article provides an overview of ten banking resume samples and banker objective templates to help job seekers create a standout resume. Each of the templates has been carefully selected to showcase various skills, such as customer service, credit analysis, and investment banking.

Throughout this article, we will outline key elements to incorporate into a banking resume and provide tips on how to tailor your resume to different banking roles. Whether you’re a recent graduate or a seasoned professional, this article has valuable insights to help you take your banking resume to the next level.

Resume Writing Basics

As a job seeker in the banking industry, it’s crucial that your resume stands out among the competition. Tailoring your resume to the banking industry can be tough, but it’s important to make yourself a competitive candidate. Here are a few tips to help you tailor your resume to the banking industry:

A. How to tailor your resume to the banking industry

Highlight financial experience: Showcase your experience and skills related to banking and finance. This could include experience working in a bank or financial institution, a degree in finance or accounting or relevant certifications.

Use industry-specific lingo: Use language and terminology specific to the banking industry. This sends a message to potential employers that you are familiar with the industry and have the necessary knowledge to succeed in the field.

Emphasize customer service skills: Customer service is an essential aspect of working in the banking industry. Highlight your customer service skills and experience to show employers that you can handle a variety of customer interactions.

B. Dos and don’ts of resume writing

When it comes to resume writing, there are some things you should do and some things you should avoid. Keep in mind the following dos and don’ts when crafting your banking resume:

- Use keywords relevant to the banking industry

- Keep your resume concise and easy to read

- Use bullet points to make it easier to read

- Proofread your resume for typos and errors

Don’ts:

- Use generic language and phrases

- Include irrelevant work experience

- Use long paragraphs or sentences

- Submit a resume with errors

C. Importance of resume formatting and layout

Resume formatting and layout may seem like insignificant details, but they can make a big difference in how your resume is received. Here are a few tips to keep in mind:

Use a simple and clean design: Your design should be simple but professional. Avoid using too many colors, graphics, or distracting fonts.

Keep it readable: Use a font size between 10pt and 12pt, and use a font that is easy to read such as Arial, Calibri, or Times New Roman.

Use white space effectively: Leave enough white space between sections and use bullet points to break up text.

Make it easy to scan: Recruiters and hiring managers often scan resumes quickly, so make it easy for them to do so by using clear headings and bullet points.

It’s important to tailor your resume to the banking industry and keep in mind the dos and don’ts and resume formatting and layout when crafting your resume. Following these tips can help your resume stand out from the competition and increase your chances of getting hired in the banking industry.

Entry-Level Banking Resume Sample

Entry-level banking positions are highly competitive, and a well-crafted resume is crucial to landing a job in this field. An entry-level banking resume should highlight the candidate’s educational background and any relevant experience, including internships or part-time work in a financial setting.

A. Description of an entry-level banking resume

An entry-level banking resume should begin with a strong objective statement that clearly states the candidate’s career goals and what they can bring to the table. It should also include a summary of their education, with an emphasis on finance-related coursework or degrees.

The candidate should highlight any extracurricular activities that demonstrate their leadership capabilities or financial acumen, such as involvement in a student investment club or a finance-related volunteer organization.

B. Sample resume and analysis

To secure an entry-level position in a banking institution where I can utilize my skills in financial analysis and customer service.

Bachelor of Arts in Economics, XYZ University

- Relevant coursework: Financial Management, Financial Markets & Institutions, Macroeconomic Theory

Experience:

Intern, ABC Bank

- Assisted with financial analyses and reports

- Provided exceptional customer service to clients

- Participated in training sessions focused on banking regulations and financial products

Activities:

Finance Club, XYZ University

- Participated in various finance-related events and competitions

- Organized fundraisers for charity organizations

This sample entry-level banking resume showcases a candidate’s degree in economics and relevant coursework, internship experience in banking, and participation in a finance club. The objective statement highlights the candidate’s skills and career goals, while the experience and activities sections demonstrate their relevant skills and qualifications.

C. Key takeaways and examples

- A strong objective statement is essential to an entry-level banking resume and should clearly state the candidate’s career goals and what they can bring to the table.

- Education should be emphasized, with an emphasis on finance-related coursework or degrees.

- Extracurricular activities that demonstrate financial and leadership skills should be highlighted.

- Internships or part-time work in a financial setting should be included.

- Use action verbs to showcase relevant experience and skills (e.g. “Assisted with financial analyses and reports”).

- Demonstrate exceptional customer service skills, as this is a key aspect of banking jobs.

An entry-level banking resume should showcase a candidate’s relevant skills and qualifications, including education, experience, and extracurricular activities. By crafting a strong objective statement and using action verbs to highlight relevant experience, candidates can stand out in a highly competitive job market.

Experienced Banker Resume Sample

A. Description of an experienced banker resume

An experienced banker resume showcases the individual’s expertise and knowledge in the banking industry. It highlights their ability to create and maintain strong relationships with clients, develop business strategies, and manage complex projects.

Name: John Smith Contact Information: [Insert contact information]

Summary: Highly skilled and experienced banker with over 10 years of experience in managing banking operations, developing business strategies, and driving sales growth. Known for building strong relationships with clients and providing excellent customer service. Proven track record of achieving targets and meeting business objectives.

Professional Experience:

Bank Manager [Insert Bank Name] | [Insert location] [Insert employment dates]

- Managed day-to-day banking operations and oversaw a team of 15 bankers.

- Developed and implemented business strategies to achieve sales targets and increase revenue.

- Built and maintained strong relationships with clients, resulting in an increase in customer satisfaction ratings by 15%.

- Conducted market research and analyzed trends to stay up-to-date on current banking practices and regulations.

Personal Banker [Insert Bank Name] | [Insert location] [Insert employment dates]

- Provided excellent customer service and built relationships with clients to increase sales of banking products and services.

- Achieved sales targets by 25% through effective client acquisition and retention strategies.

- Conducted financial analysis to help clients make informed decisions on banking products and services.

- Trained newly hired bankers on effective sales strategies and best practices in providing customer service.

- Strong communication and interpersonal skills

- Excellent analytical and problem-solving skills

- In-depth knowledge of banking products and services

- Ability to manage complex projects and meet business objectives

- Proficient in Microsoft Office and banking software

- An experienced banker resume emphasizes the individual’s expertise in banking operations, business strategies, and customer service.

- The use of specific examples, such as achieving sales targets and increasing customer satisfaction ratings, demonstrates the individual’s success in these areas.

- Including relevant education and skills highlights the individual’s knowledge and qualifications in the banking industry.

The experienced banker resume sample showcases the individual’s ability to manage operations, develop strategies, and provide excellent customer service, making them an asset to any banking organization.

Investment Banking Resume Sample

A. description of an investment banking resume.

An investment banking resume is a document that showcases an individual’s education, work experience, skills, and achievements in the field of investment banking. It is typically submitted as part of the application process for jobs in this industry.

The investment banking resume should be concise, well-organized, and easy to read. It should highlight the candidate’s relevant skills and experience, and demonstrate their understanding of the industry.

Name: John Doe

Contact Information:

- Address: 123 Main Street, New York, NY 10001

- Phone: (555) 555-5555

- Email: [email protected]

Objective: Experienced investment banker seeking a challenging role in a top-tier investment bank.

- Bachelor of Science in Finance, XYZ University, 2010-2014

- Master of Business Administration, ABC University, 2014-2016

Work Experience:

Investment Banking Analyst, XYZ Bank, 2016-present

- Assisted in preparing pitchbooks, financial models, and presentations for multiple transactions in various sectors

- Conducted market research and competitive analysis to support deal sourcing efforts

- Collaborated with senior bankers to build relationships with clients and execute transactions

Intern, ABC Bank, Summer 2015

- Conducted research on potential investment opportunities

- Assisted in financial analysis and due diligence for initial public offerings and mergers and acquisitions

- Proficient in financial modeling software (e.g., Bloomberg, Excel)

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Ability to work under pressure and meet deadlines

The sample investment banking resume demonstrates several key attributes that are essential for success in this field.

First, the candidate has relevant education and work experience. They have a bachelor’s degree in finance and a master’s degree in business administration, both from reputable universities. Additionally, they have worked as an investment banking analyst for several years, gaining valuable experience in the industry.

Second, the candidate emphasizes their skills, which are crucial for success in investment banking. They highlight their proficiency in financial modeling software, analytical and problem-solving skills, and excellent communication and interpersonal skills. These abilities are highly sought-after in the industry.

Third, the candidate has a clear and concise objective statement that demonstrates their career goals and aspirations. This statement helps to demonstrate their understanding of the industry and their commitment to a career in investment banking.

The sample investment banking resume is well-written and organized, showcasing the candidate’s skills and experience in a clear and concise manner. It provides an excellent example for individuals seeking to create their own investment banking resume.

Private Banking Resume Sample

In the competitive industry of banking, private bankers need to stand out from the crowd to secure lucrative clients for their banks. A well-crafted private banking resume showcases an individual’s skills, experiences, and achievements to attract high-net-worth individuals and manage their wealth.

A. Description of a private banking resume

A private banking resume follows the standard format of a chronological resume. The header should contain the applicant’s name, contact information, and a professional summary that highlights the individual’s expertise in managing wealth, building relationships, and increasing revenue. The professional summary must be concise and engaging, capturing the attention of the recruiter within a few seconds.

The following sections should describe the individual’s work experience, including the name of the bank, their role, and the duration of their tenure. Each job experience must include bullet points that showcase the individual’s accomplishments and quantifiable metrics such as revenue generated, client acquisition, and retention rates.

Additionally, the resume must detail the applicant’s education, including the name of the school, degree, and relevant coursework or certifications. Lastly, the resume must have a section for the individual’s skills, highlighting their proficiency in financial analysis, client relationship management, and sales.

Based on the description above, here is a sample private banking resume:

John Doe 123 Main Street New York, NY 10001 (123) 456-7890 john.doe.

Branch Manager Resume Sample

As a branch manager, your resume should demonstrate your ability to lead a team and achieve sales goals while maintaining excellent customer service. Your resume should reflect your experience in banking, leadership, and communication skills.

A. Description of a Branch Manager Resume

In a branch manager resume, the focus should be on leadership and management skills, as well as experience in the banking industry. Your resume should showcase your ability to handle operations, achieve sales targets, develop and execute business plans, and maintain excellent customer service. Strong communication skills and the ability to work well under pressure are also essential.

B. Sample Resume and Analysis

1234 Main Street, Anytown USA | (555) 555-5555 | [email protected]

Experienced Branch Manager with over 10 years of leadership experience in banking. Achieved consistent sales targets and maintained excellent customer service.

Professional Experience

Branch manager | 2015-present.

- Developed and executed business plans, leading to a 12% increase in sales

- Coached and trained a team of 15 employees, resulting in an increase in customer satisfaction ratings

- Ensured compliance with bank policies and procedures, resulting in zero regulatory issues

Assistant Branch Manager | 2012-2015

- Managed daily operations and achieved sales targets

- Promoted to branch manager position due to successful performance

Bachelor’s degree in Finance | XYZ University

C. Key Takeaways and Examples

- Showcase your leadership and management skills

- Highlight your experience in the banking industry

- Demonstrate your ability to handle operations and achieve sales targets

- Strong communication skills and the ability to work well under pressure are essential

- Use specific examples to demonstrate your achievements, such as coaching a team to increase customer satisfaction ratings or developing and executing successful business plans

A branch manager’s resume should reflect their ability to lead a team, achieve sales goals, and maintain excellent customer service. Use specific examples to showcase your experience and achievements in the banking industry.

Commercial Banking Resume Sample

The commercial banking industry is a highly competitive field that requires individuals with exceptional qualifications and experience. As such, crafting a compelling commercial banking resume is crucial to landing your dream job. This section explores the key components and features of a commercial banking resume.

A. Description of a commercial banking resume

A commercial banking resume should showcase your expertise in areas such as financial modeling, risk management, credit analysis, and business development. Your potential employers are looking for highly skilled individuals who have a proven track record of success in these areas. Therefore, make sure to highlight any relevant experience and achievements in these fields.

In addition, a commercial banking resume should also include a strong summary statement that highlights your unique selling proposition. This statement should be concise, yet compelling, and should entice your potential employer to continue reading your resume.

Here is an example of a commercial banking resume:

Name: Sarah Johnson

Contact information:

- Email: sarahjohnson.

Compliance Officer Resume Sample

As a compliance officer, your primary responsibility is to ensure that all legal and regulatory standards are met within a company or organization. Your resume should reflect your knowledge and experience in this field, as well as your ability to communicate effectively with all levels of management.

A. Description of a compliance officer resume

A compliance officer resume should highlight your:

- Strong understanding of regulatory compliance rules and regulations

- Knowledge of industry-specific compliance standards and policies

- Experience in designing and implementing compliance programs and procedures

- Effective communication and leadership skills

- Ability to conduct compliance audits and investigations

- Understanding of risk management and mitigation strategies

Name: John Smith Contact Information: [email protected] / (123) 456-7890 Objective: Seeking a challenging compliance officer position in a reputable financial institution where my knowledge and expertise can be utilized to ensure compliance with regulatory standards.

Summary: Experienced compliance officer with over 5 years of experience in the banking industry. Proficient in designing and implementing compliance procedures and policies. Proven track record of conducting compliance audits and investigations. Excellent communication and leadership skills.

- Conducted compliance audits and investigations to ensure adherence to regulatory standards

- Designed and implemented compliance training programs for employees

- Collaborated with senior management to identify and mitigate compliance risks

- Conducted regular compliance reviews and recommended corrective actions as necessary

- Maintained knowledge of regulatory changes and updated policies and procedures accordingly

- Bachelor’s degree in Business Administration from XYZ University

- Certified Regulatory Compliance Manager (CRCM)

When creating your compliance officer resume, remember to:

- Highlight your knowledge and experience in regulatory compliance

- Emphasize your ability to design and implement compliance programs and procedures

- Demonstrate your effective communication and leadership skills

- Showcase your experience in conducting compliance audits and investigations

- Include any relevant certifications or education

For example, if you developed and implemented a compliance program that helped reduce risk in a previous job, be sure to include that in your resume. Additionally, if you have a certification in regulatory compliance, such as the CRCM, make sure to mention it.

A well-crafted compliance officer resume can convey your expertise and value to potential employers in the financial industry. By highlighting your skills and experience in regulatory compliance, as well as your ability to communicate and lead effectively, you can increase your chances of landing a rewarding and challenging position in this field.

Treasury Analyst Resume Sample

As a treasury analyst, your role is to manage a company’s financial assets and liabilities to ensure optimal cash flow and liquidity. Your job may involve identifying and mitigating financial risk, developing and implementing financial strategies, and collaborating with other departments to achieve financial objectives.

To land a job as a treasury analyst, it’s important to showcase your relevant skills and experience in your resume. This section will provide an overview of what employers typically look for in a treasury analyst resume.

A. Description of a Treasury Analyst Resume

A treasury analyst resume should ideally highlight your experience in financial analysis, cash management, risk management, and financial modeling. Here are some key elements to include in your resume:

Professional summary: A brief overview of your experience and qualifications.

Skills: A section listing your relevant skills, such as financial analysis, cash management, and risk management.

Professional experience: A detailed summary of your previous jobs and roles, with specific examples of how you have contributed to your previous employer’s financial objectives.

Education: Any relevant academic degrees or certifications.

Achievements: Any notable achievements that demonstrate your financial acumen and expertise.

Here’s an example of a treasury analyst resume:

In this sample resume, the candidate highlights their relevant skills and experience in financial analysis, cash management, and risk management. They also provide specific examples of how they have contributed to their previous employer’s financial objectives.

Loan Officer Resume Sample

A. description of a loan officer resume.

A loan officer resume highlights the candidate’s qualifications and experience in the financial industry. It showcases their ability to communicate and negotiate with clients while adhering to regulations and policies. A loan officer resume also emphasizes a candidate’s expertise in evaluating financial statements and creditworthiness, as well as their knowledge of lending products.

- Phone: (123) 456-7890

Summary: A dedicated and detail-oriented loan officer with 5 years of experience in the banking industry. Proven track record of providing exceptional customer service and exceeding sales goals. Proficient in analyzing financial statements and creditworthiness to evaluate loan applications.

Senior Loan Officer, ABC Bank (2018-Present)

- Evaluate loan applications and provide recommendations for approval or denial based on creditworthiness and financial statements.

- Manage a portfolio of high net worth clients and maintain relationships with key stakeholders.

- Achieved 120% of loan origination goals within the first year of employment.

Loan Officer, XYZ Bank (2015-2018)

- Provide excellent customer service and consult clients on various lending products, including personal loans, mortgages, and business loans.

- Consistently meet sales targets and exceed expectations for loan applications and origination.

- Conduct extensive research to stay informed on industry trends and regulations.

- Bachelor of Science in Finance, XYZ University

When creating a loan officer resume, it is important to highlight experience working with financial statements and evaluating creditworthiness. Use specific examples of how you met or exceeded sales goals and managed client relationships to highlight your skills in customer service and consultation. Additionally, staying up to date with industry trends and regulations can set you apart from other candidates. A strong summary at the beginning of your resume can also help capture the attention of hiring managers and convey your qualifications in a concise manner. A successful loan officer resume should demonstrate your expertise in lending products, ability to communicate effectively, and commitment to providing excellent customer service.

Related Articles

- Warehouse Worker Resume: Samples & Complete Guide 2023

- The Best Outfits for Job Interviews in 2023

- Finance Director Resume: Proven Example for 2023

- 10 CEO Resume Templates & Examples for 2023

- Actor Job Description: Opportunities, Skills, and More

Rate this article

0 / 5. Reviews: 0

More from ResumeHead

- • Processed an average of 50 customer transactions daily, ensuring accuracy and compliance with bank policies.

- • Trained and mentored 5 new tellers, improving team performance and reducing transaction errors by 15%.

- • Managed vault operations, maintaining cash levels and completing audits with zero discrepancies.

- • Resolved customer complaints efficiently, resulting in a 20% increase in customer satisfaction ratings.

- • Identified and prevented fraudulent activities, safeguarding over $100,000 in bank assets.

- • Promoted cross-selling of banking products, contributing to a 10% increase in sales revenue.

- • Conducted customer transactions, including deposits, withdrawals, and check cashing, with a 99.5% accuracy rate.

- • Developed relationships with regular customers, enhancing customer loyalty and retention.

- • Balanced cash drawers daily, ensuring no discrepancies and maintaining accurate records.

- • Assisted in branch operations, including opening and closing procedures, resulting in improved efficiency.

- • Participated in community outreach programs, increasing bank visibility and customer base.

4 Bank Teller Resume Examples & Guide for 2024

Your bank teller resume should clearly display your proficiency in handling transactions. Showcase your ability to manage cash drawers with accuracy and reliability. Demonstrate your strong customer service skills and detail orientation. Highlight any past experience with financial software or banking systems to assert your technical proficiency.

Resume Guide

Resume Format

Resume Experience

Hard and Soft Skills

Education and Certifications

Resume Summary/Objective Tips

Additional Resume Sections

Key Takeaways

By Experience

Senior Bank Teller

Entry-level bank teller, td bank teller.

Crafting a compelling resume as a bank teller can be challenging. After all, you handle sensitive information. The goal’s to show your skills and experiences without breaching confidentiality. Bank tellers often engage in delicate financial discussions and resolve complex issues. These must be conveyed effectively on a resume while respecting privacy protocols.

Banktelling is expected to witness about 29,000 openings each year . This competitive job market means your resume needs to stand out. Our guide provides real-life examples and insightful strategies to help you write each section. Learn how to describe your experience, list your skills effectively, and maintain discretion. This will ensure your resume highlights your value while protecting sensitive information.

You’ll also learn how to:

- Format your resume to reflect your seriousness and professionalism;

- Tailor your experience section to fit a real job description for a bank teller;

- Describe your education and certifications;

- Include an incomplete degree on your resume;

- List your abilities, so that they reflect your technical knowledge and your people skills;

- Craft a well-written bank teller summary;

- Show proactivity and dedication with original additional sections.

Check out these related guides as well:

- Banking resume example

- Loan officer resume example

- Loan processor resume example

- Phone banking resume example

- Credit analyst resume example

- Personal banker resume example

- Bank manager resume example

- Customer service resume example

- Call center representative resume example

- Entry-level customer service resume example

How to format a bank teller resume

The first step in crafting a fascinating bank teller resume is choosing the right layout. Make your resume easy to read, scan, and remember. Choose between the three main resume formats : reverse chronological, functional, and hybrid. Your choice will depend on your goals and needs.

- For those who already have some bank teller experience, a reverse chronological resume is a neat way to present it. It lists your experience in reverse chronological order, starting with the most recent. This ensures a clear outline of your career path.

- A functional resume emphasizes your skills and abilities rather than your experience. That’s why it’s perfect for entry-level positions or those who are switching careers.

- And finally, there’s the hybrid resume. Also called the combination resume , this layout puts equal focus on your experience and skills. If you believe yours are equally strong, opt for this resume format.

Be sure to follow these resume writing guidelines for a stand-out application:

- Design, colors, fonts: Both 1 and 2-column designs work with ATS (Applicant Tracking Systems) , so it’s a matter of preference. A little color on your resume can go a long way. Choose blue, dark green, or gray to stay professional in the banking field. Avoid using too many color variations , though. And as for fonts, go with modern sans-serifs such as Rubik, Lato, or Arial. Your font size should be between 10–12 pt, with headings a little bit bigger.

- Resume length : Most professionals would need a 1-page resume to showcase their experience. However, if you’ve got a lot of it, you can opt for a 2-page resume . Make sure the most important information is placed on the first page, and keep the header on both pages.

- Header and photo: Feature your header at the top of your resume . It should include basic contact information such as full name, e-mail, and phone number. Including a photo and your physical address would depend on the specific job posting requirements.

- Resume format and naming: A PDF format is generally preferred as it keeps your chosen design in place. It’s also readable by ATS. As for naming conventions , use your name, the word “resume”, and the position you’re applying for. Don’t include special symbols, such as :, / or .

Worried about typos on your resume ? Ensure yours is proof-ready with our free ATS resume checker .

Is your resume good enough?

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

So what sections should you include on your resume?

The top sections on a bank teller resume:

- Contact information: This should be included so recruiters can easily reach out for interviews or further clarification.

- Personal summary: Recruiters look at this to quickly figure out if the candidate matches the general qualifications for the job.

- Job experience: Specifically related banking and customer service experiences will show how well-suited the candidate is for the bank teller position.

- Skills: Highlighting relevant skills for a bank teller resume, like cash handling and customer service, can make an applicant stand out amongst others.

- Education: Including educational credentials will give recruiters a full picture of the candidate's background and potential growth within the bank.

Recruiters look for several main components on a bank teller resume. Check them out:

What recruiters want to see on your resume:

- Cash handling experience: This is crucial because bank tellers perform numerous cash transactions daily and accuracy is key.

- Customer service skills: It's about interaction with customers, resolving their issues, and providing first-class service for customer retention.

- Attention to detail: Errors can be costly in banking, so the ability to work with precision is highly valued.

- Numeracy skills: Proficiency in working with numbers is an integral part of the job, so high numeracy skills are a priority.

- Knowledge about banking procedures: Recruiters seek candidates who are familiar with banking processes to lessen training efforts and improve productivity.

Now you know what you need on your resume. Let’s break down the most important section: your experience.

How to write your bank teller resume experience

Think of your experience section as a magnet for recruiters. If you write it well, it’ll attract attention. Include relevant job titles–ideally, all related to banking and finance. That is one way to tailor your resume to the job posting. Your resume should be straightforward and concise, so don’t waste valuable space on experiences you can’t relate to the job you’re applying to. When creating your experience section, remember:

- Each entry should include 4—6 bullets detailing your work expertise.

- Focus on key achievements in your career.

- Start your sentences with action verbs to build a powerful narrative.

Make sure you never lie about career results on your resume. Maintaining trust with potential employers from the start is the right way to go.

Let’s explore a real bank teller job description:

Job title: Bank Teller

Company introduction: Founded in 1904, ABC Bank serves businesses and individuals from our 30 offices located throughout the US. Our team takes pride in providing an unparalleled level of customer service and attention.

Job description: The position of bank teller is responsible for performing routine branch and customer service duties; accepting consumer and commercial checking and savings deposits; processing loan payments; cashing checks and processing withdrawals; promoting business for the Bank by maintaining good customer relations and referring customers to appropriate staff for new services. In addition, the bank teller should follow all compliance regulations as applicable and adhere to discretion in handling sensitive information, ensuring confidentiality and security when dealing with financial data.

Responsibilities:

- Receives consumer and commercial checking and savings deposits by determining that all necessary deposit documents are in proper form, and issuing receipts.

- Cashes checks, processes withdrawals and redeem U.S. Savings Bonds; confirms all necessary documents are properly authorized, are in proper form, and are within authorized limits; processes currency and coin orders; requests assistance when questionable items are presented for cashing.

- Issues official checks, counter checks, etc.

- Assists with night depository duties; logs bags; processes deposits; makes change orders; issues receipts and returns bags to customers.

- Cross-sells the Bank’s other products and services, referring customers to appropriate staff as indicated.

- Provides effective customer service and assists in resolving problems within given authority.

- Records, files, scans documents, and sorts mail as required.

- Answers telephones and directs callers to proper Bank personnel by properly identifying customers and specific requests.

- Types routine letters, reports, and forms. Performs basic account maintenance and requests.

- Treats others with respect; adheres to Bank’s policies and procedures; inspires the trust of others; works ethically and with integrity.

- Positive customer and coworker interactions; shows respect and sensitivity for cultural differences; acknowledges the value of diversity in a work environment; promotes working environment free of harassment of any type.

- Assures compliance with all Bank policies, procedures, and processes, and all applicable state and federal banking laws, rules, and regulations; adheres to Bank Secrecy Act (BSA) responsibilities that are specific to the position.

- Maintains discretion in handling sensitive information, ensuring confidentiality and security when dealing with financial data.

- Performs the position safely, without endangering the health or safety of themselves or others and will be expected to report potentially unsafe conditions.

Location: Bishopville, SC

And now, here are two bank teller experience examples—a bad one, and a good one, tailored to that exact job posting.

Starting with the bad:

- • Helped with general administrative tasks around the branch.

- • Answered phones and directed calls to appropriate staff.

- • Participated in staff meetings and team-building activities.

This one doesn’t work because it’s:

- Lack of specificity: The responsibilities listed (e.g., "helped with general administrative tasks") are too vague and do not demonstrate any specialized skills or knowledge relevant to the bank teller position, such as handling financial transactions or customer service.

- Irrelevant duties: Tasks such as "participated in staff meetings and team-building activities" do not directly relate to the core duties of a bank teller, which are more focused on financial transactions, customer interactions, and confidentiality.

- Absence of compliance and confidentiality: There is no mention of adhering to compliance regulations or handling sensitive information, which are critical aspects of working as a bank teller. This omission suggests a lack of experience in crucial areas for the role.

And here’s a bank teller experience section that’ll win recruiters over:

- • Accurately processed deposits, withdrawals, and check cashing transactions, ensuring compliance with all regulations.

- • Maintained confidentiality and security of sensitive financial information, adhering to bank policies and procedures.

- • Successfully promoted and cross-sold bank products and services, enhancing customer engagement and satisfaction.

Here’s why it’s better:

- Accurate transaction processing: The first bullet point highlights the candidate's ability to perform key teller duties with precision and adherence to regulations, demonstrating reliability and attention to detail.

- Confidentiality and security: "Maintained confidentiality and security of sensitive financial information, adhering to bank policies and procedures" shows that the candidate understands the importance of discretion and can be trusted with sensitive information, which is vital for a teller role.

- Customer engagement: "Successfully promoted and cross-sold bank products and services, enhancing customer engagement and satisfaction" indicates the candidate's proactive approach in contributing to the bank's business growth and providing excellent customer service, both important for a teller's success.

One way to really stand out with your experience is to fill it with quantifiable impact.

How to quantify impact on your resume

We don’t need to tell you numbers speak for themselves. Specific numbers to illustrate your accomplishments will keep potential employers engaged. Measurable outcomes impress easily and are much nicer to look at than mundane job responsibilities. Here are some examples of how to quantify key achievements on your resume :

- Highlight the cash amounts you've handled daily or monthly: This demonstrates your trustworthiness and ability to manage large sums. Both are integral skills for a bank teller resume.

- Include the number of transactions processed each day: It reflects your speed and efficiency. These are crucial in providing timely banking services to customers.

- Note any improvement in transaction speed or transaction error reduction: This could impress recruiters. It signifies your focus on improving the quality of your performance.

- Mention if you've contributed to reducing customer wait times: This directly impacts customer satisfaction, a key measure of success in any client-facing role.

- Mention if you've played a role in accomplishing audit scores: High audit scores highlight your precision and adherence to the bank's policies and procedures.

- Outline if you've contributed to meeting or exceeding sales targets for banking products: This could signify that you're not just a transactional employee but also proactive in contributing to the bank's revenue.

- Include instances where you accurately identified fraudulent transactions: This signifies your vigilance and understanding of banking safeguards. It means you strive to provide a secure environment for customers.

- If you've trained new employees, mention the number of employees trained: This underlines your ability to share knowledge and contribute to team growth. Which can be an asset in a collaborative work environment like a bank.

But what if you’re just starting out? We’ll give you some tips on how to write your resume if you don’t have much experience.

How do I write a bank teller resume with no experience

Worried about having little or no experience in bank telling? Don’t be. Everybody’s got to start somewhere, and we’ll give you some practical tips on how to do just that.

It’s always important to evaluate what transferable skills and experience you have. Maybe you’ve worked in retail or customer service? Or you’re good with numbers and you took Economics in college? Think about what you can list on your resume that’ll relate to the job you’re applying for.

Rather than leaving your entry-level resume sparse, try to include some of these sections:

- Education : Mention any coursework that involves finance, economics, mathematics, or business administration. These courses demonstrate your understanding of financial principles and your ability to work with numbers, which are crucial for a bank teller role.

- Extracurricular activities: Highlight your involvement in any clubs or organizations, especially related to finance, business, or community service.

- Volunteer work : Volunteering experiences, especially those involving customer interaction, cash handling, or organizational tasks, can be very relevant.

- Projects: Detail any projects where you handled financial transactions, conducted data analysis, or managed budgets. You can mention a project where you helped organize a fundraising event, managed its budget, or used financial software to track expenditures and revenue.

- Internships: Whether they’re paid or unpaid, internships offer crucial hands-on experience that’s always appreciated in your future endeavors. Describe what you have learned and how you think this contributes to your fit for the role.

- Hobbies and interests: Underscore any hobbies or interests that prove your aptitude for finance, numbers, or customer service. This could include things like managing a personal budget, reading financial news, or any activities that require precision and accuracy.

All in all, transferable experience is your go-to when applying for an entry-level bank teller position. Don’t forget to include your transferable skills , too. These are usually soft skills such as teamwork and time management. Alter them to the job description in your bank teller resume. Pick the best applicable ones and try to demonstrate them through examples on your resume.

Let’s explore more valuable skills in our next section.

Hard and soft skills on your resume

Your bank teller skills should vary. Hard skills are the role-specific skills you’ve acquired throughout your working career. They help improve your performance in the workplace and allow you to handle a wide set of job duties more effectively. Hard skills include technical skills , which can relate to using specific bank software, for example. When crafting your resume for a bank teller position, dedicate a specific section to "Hard skills" and place it where it's easy to spot—either at the top or right after your work experience. If you've got plenty of skills, sort them into categories to keep things organized and approachable.