Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

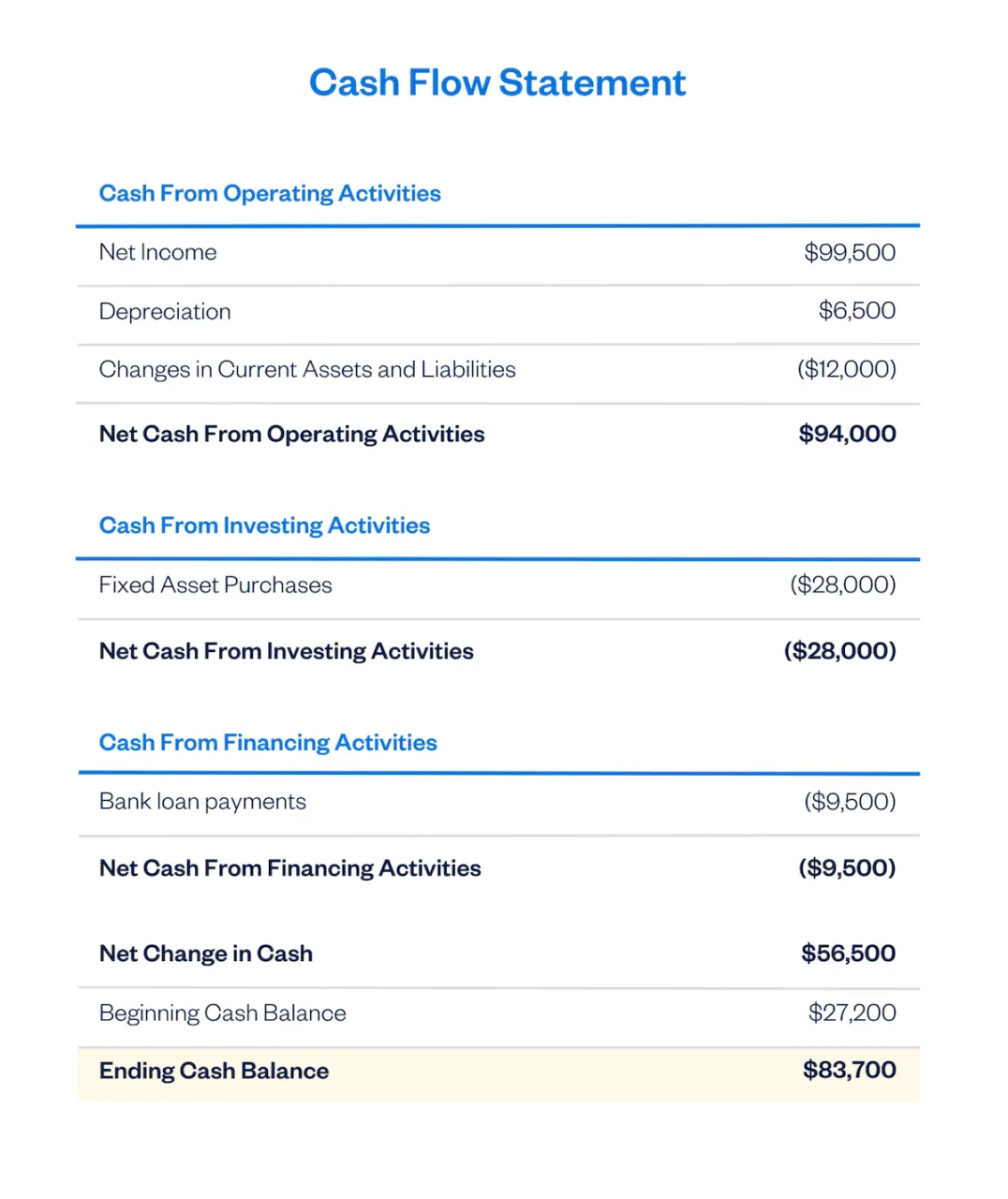

Cash flow statement

A cash flow statement shows the exact amount of money coming into your business (inflow) and going out of it (outflow). Each cost incurred or amount earned should be documented on its own line, and categorized into one of the following three categories: operating activities, investment activities and financing activities. These three categories can all have inflow and outflow activities.

Operating activities involve any ongoing expenses necessary for day-to-day operations; these are likely to make up the majority of your cash flow statement. Investment activities, on the other hand, cover any long-term payments that are needed to start and run your business. Finally, financing activities include the money you’ve used to fund your business venture, including transactions with creditors or funders.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today .

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Apply for the CO—100!

The CO—100 is an exclusive list of the 100 best and brightest small and mid-sized businesses in America. Enter today to share your story and get recognized.

Get recognized. Get rewarded. Get $25K.

Is your small business one of the best in America? Apply for our premier awards program for small businesses, the CO—100, today to get recognized and rewarded. One hundred businesses will be honored and one business will be awarded $25,000.

More tips for your startup

How to choose a business name, a small business guide to setting up an e-commerce business, 5 time-consuming entrepreneurial tasks you can outsource.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to Write a Small Business Financial Plan

Noah Parsons

4 min. read

Updated April 22, 2024

Creating a financial plan is often the most intimidating part of writing a business plan.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Set and Use Milestones in Your Business Plan

How to Write a Competitive Analysis for Your Business Plan

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

4 Key Financial Statements For Your Startup Business Plan

- September 12, 2022

- Fundraising

If you’re preparing a business plan for your startup, chances are that investors (or a bank) have also asked you to produce financial projections for your business. That’s absolutely normal: any startup business plan should at least include forecasts of the 3 financial statements.

The financial projections need to be presented clearly with charts and tables so potential investors understand where you are going, and how much money you need to get there .

In this article we explain you what are the 4 financial statements you should include in the business plan for your startup. Let’s dive in!

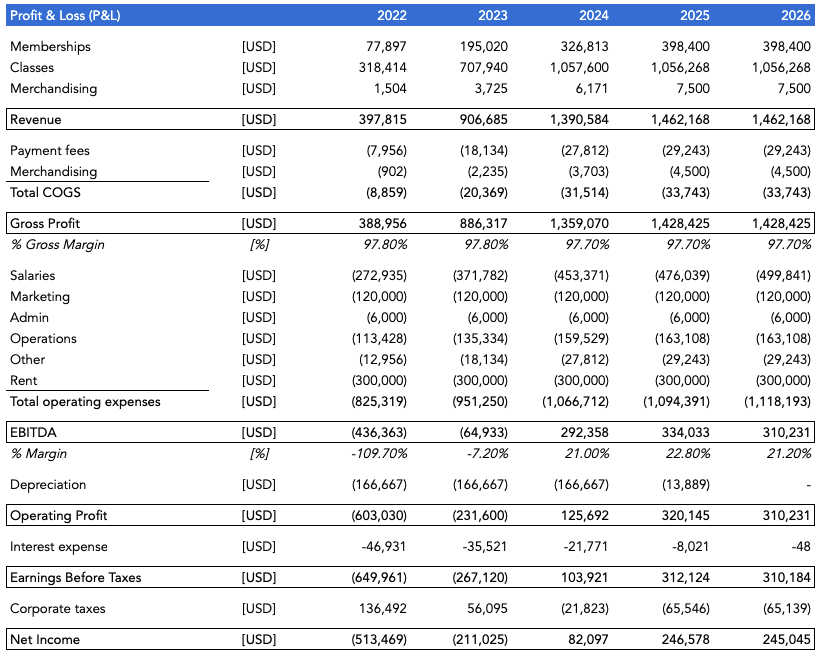

Financial Statement #1: Profit & Loss

The profit and loss (P&L) , also referred to as “income statement”, is a summary of all your revenues and expenses over a given time period .

By subtracting expenses from revenues, it gives a clear picture of whether your business is profitable, or loss-making. With the balance sheet and the cash flow statement, it is one of the 3 consolidated financial statements every startup must produce every fiscal year .

Most small businesses produce a P&L on a yearly basis with the help of their accountant. Yet it is good practice to keep track of all revenues and expenses on a monthly or quarterly basis as part of your budget instead.

When projecting your financials as part of your business plan, you must do so on a monthly basis. Usually, most startups project 3 years hence 36 months. If you have some historical performance (for instance you started your business 2 years ago), project 5 years instead.

Expert-built financial model templates for tech startups

Financial Statement #2: Cash Flow

Whilst your P&L includes all your business’ revenues and expenses in a given period, the cash flow statement records all cash inflows and outflows over that same period.

Some expenses are not necessarily recorded in your P&L but should be included in your cash flow statement instead. Why is that? There are 2 main reasons:

- Your P&L shows a picture of all the revenues you generated over a given period as well as the expenses you incurred to generate these revenues . If you sell $100 worth of products in July 2021 and incurred $50 cost to source them from your supplier, your P&L shows $100 revenues minus $50 expenses for that month. But what about if you bought a $15,000 car to deliver these products to your customers? The $15,000 should not be recorded as an expense in your P&L, but a cash outflow instead. Indeed, the car will help you generate revenues, say over the next 5 years, not just in July 2021

- Some expenses in your P&L are not necessarily cash outflows. Think depreciation and amortization expenses for instance: they are pure artificial expenses and aren’t really “spent”. As such, whilst your P&L might include a $100 depreciation expense, your cash flow remains the same.

Financial Statement #3: Balance Sheet

Whilst the P&L and cash flow statement are a summary of your financial performance over a given time period, the balance sheet is a picture of your financials at a given time.

The balance sheet lists all your business’ assets and liabilities at a given time (at end of year for instance). As such, it includes things such as:

- Assets: patents, buildings, equipments, customer receivables, tax credits etc. Assets can be either tangible (e.g. buildings) or intangible (e.g. customer receivables ).

- Liabilities: debt, suppliers payables, etc.

- Equity : the paid-in capital invested to date in the company (from you and any other potential investors). Equity also includes the cumulative result of your P&L: the sum of your profits and losses to date

Whilst P&L and cash flow statement are fairly simple to build when preparing your business plan, you might need help for your balance sheet.

Financial Statement #4: Use of Funds

The use of funds is not a mandatory financial statement your accountant will need to prepare every year. Instead, you shall include it in your startup business plan, along with the 3 key financial statements.

Indeed, the use of funds tells investors where you will spend your money over a given time frame. For instance, if you are raising $500k to open a retail shop, you might need $250k for the first year lease and another $250k for the inventory.

Use of funds should not be an invention from you: instead it is the direct result of your cash flow statement . If you are raising for your first year of business, and your projected cash flow statement result in a $500k loss (including all revenues and expenses), you will need to raise $500k.

For instance, using the example above, if you need $500k over the next 12 months, raise $600k or so instead. Indeed, better be on the safe side in case things do not go as expected!

Related Posts

Pro One Janitorial Franchise Costs $9K – $76K (2024 Fees & Profits)

- July 5, 2024

Dance Studio Business Plan PDF Example

- June 17, 2024

- Business Plan

Carpet and Upholstery Cleaning Business Plan PDF Example

Privacy overview.

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

Hot Summer Savings ☀️ 60% Off for 4 Months. Buy Now & Save

60% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make financial statements for small businesses.

Information is power. As long as you can make sense of that information. As a business owner, you’ll want to track your financial progress to make informed business decisions about your future. And that involves understanding cash flows, operating expenses, and net profit, all found in your financial statements.

Even if you delegate the bookkeeping to a professional, and don’t prepare financial statements yourself, you’ll need to know what your CPA is talking about when they walk you through your balance sheet.

In this article, you’ll learn about the 3 principal financial statements—income statements, balance sheets, and cash flow statements—and how to interpret them.

Here’s what we’ll cover: Income Statement (Profit and Loss Statement) Balance Sheet Difference Between an Income Statement and a Balance Sheet Cash Flow Statement Financial Statements Are Fundamental

Income Statement (Profit and Loss Statement)

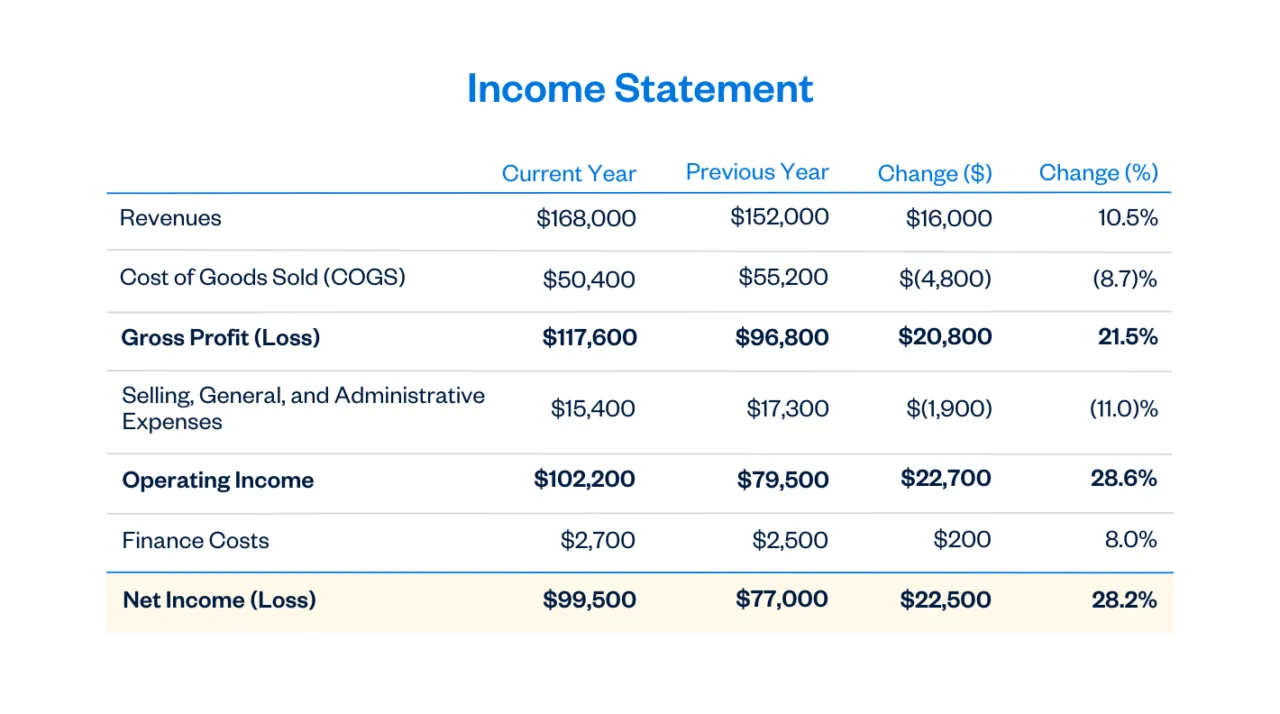

An income statement shows a company’s financial performance by revealing whether it’s made a profit or a loss.

Without an income statement, you’d be in the dark about the profitability of your business. An income statement is also known as a profit and loss statement, profit and loss account, or P&L.

The reporting period for an income statement is typically one fiscal year.

What Goes on an Income Statement?

Let’s now jump to the format of an income statement.

In most cases, it will look something like this:

Now, let’s dig into what an income statement covers.

Revenues (or Sales)

This is the top line on your income statement. It’s the total amount for the year of all the things or services you sold. But if you’ve given any discounts, you’ll reduce your sales by the discount amount.

For example, if you sold $100 in t-shirts but offered a 10% discount as a Black Friday incentive, you would record $90 as your net sales amount .

Cost of Goods Sold (or Cost of Sales)

These are the expenses directly related to the sales you’ve made. Suppose you’re selling electronics. The cost of goods sold is the cost of the electronics you sell within a financial year. And this is important. It’s not the cost of the electronics you bought in the year.

In a service-related business, a consultancy, for example, the cost of sales is often termed direct costs. Hence, you’ll include costs directly related to your service.

Gross Profit

Gross profit is the profit that results directly and specifically from the trading activity of buying and selling. You calculate the gross profit by subtracting the cost of goods sold from revenues.

Selling, General, and Administrative Expenses

All other expenses like salaries, rent, or travel merely facilitate the main trading activity of your business and are often categorized under selling, general, or administrative (SG&A) expenses.

You can have as many categories of SG&A expense as is necessary and helpful for running your business. Some of the common ones are:

- Office supplies

- Salaries and wages

- Marketing and advertising

Operating Income

Next is operating income. As the name implies, it’s the profit your business has earned from its operations when considering all the revenue and expenses necessary to run your business.

Finance Costs

Finance costs represent the costs of financing arrangements, such as interest on bank loans. You’ll want to strip financing costs away from SG&A expenses because they don’t represent the costs necessary for producing the goods or services you sell.

Net Income

After factoring in finance costs, you’re left with net income (or net loss). This is the much-talked-about bottom line. Your net income is how much your company has earned throughout the year.

What About Income Taxes?

You may ask yourself, why didn’t we include taxes? A small business isn’t burdened with income tax unless it’s structured as a C-corporation (which few small businesses are due to their complexity and maintenance costs). Instead, the business profits pass through to the owner and get taxed on the individual Form 1040.

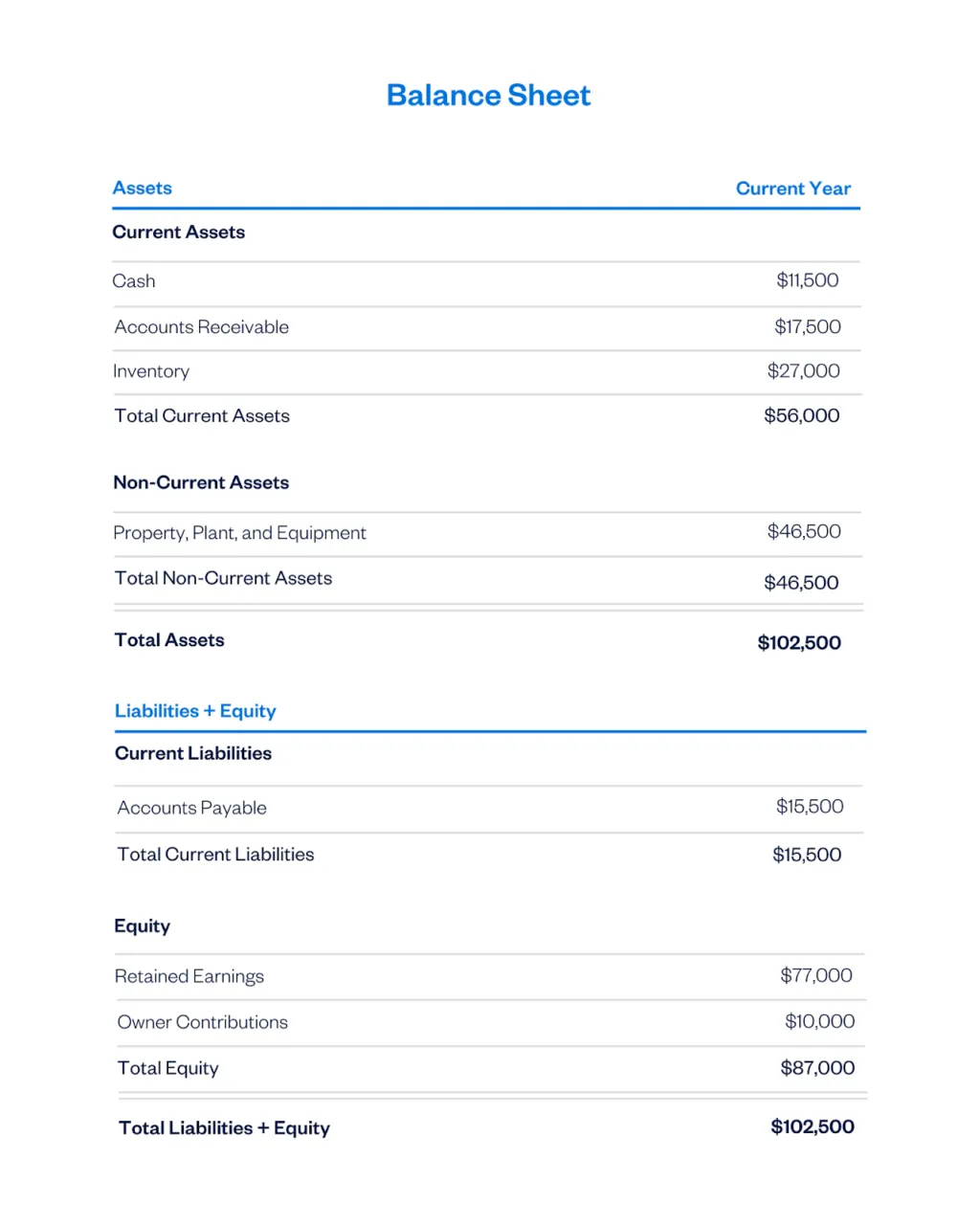

Balance Sheet

Also known as the statement of financial position, the balance is an organization’s most important financial report because it shows the company’s financial health.

A balance sheet reports data for a specific point in time, often the last day of a fiscal year.

What Goes on a Balance Sheet?

Balance sheets contain 3 sections: assets, liabilities, and equity.

These are the resources your company owns that have a current or future economic value. These include cash, equipment (such as computers), and vehicles.

Assets can be broken down into:

- Current assets: This is anything you own that can be converted to cash within one year (e.g., accounts receivable and inventory). Also called short-term assets.

- Non-current assets: These are assets that can’t be quickly converted into cash, like computers, equipment, and vehicles, or intangible assets, like trademarks and copyrights. Also called fixed assets or long-term assets.

2. Business Liabilities

These are amounts your business owes other entities such as banks, employees, and suppliers.

- Current liabilities: Amounts you owe that are due within one year (e.g., accounts payable and payroll liabilities)

- Non-current (long-term) liabilities: Debts that will be repaid in more than one year

3. Owner Equity or Shareholder Equity

This is the value of the owner’s or shareholders’ investment in the business after liabilities are subtracted from assets. It may also be called owner’s or shareholders’ capital.

Purpose of a Balance Sheet

The balance sheet shows anyone what your business is worth. Lenders, investors, partners, and potential buyers will want to review your balance sheet.

The overall worth of your business can be measured or estimated by the total value of its assets, which are recorded and presented on the balance sheet.

But even more important, your balance sheet shows your business’s net worth , which is the owner’s equity (or shareholder’s equity). This is a business’s residual value after removing its liabilities . It’s what ultimately belongs to the business owner.

Format of a Balance Sheet

Balance sheets are prepared based on the accounting equation, which is:

Traditionally, before accounting software was developed and bookkeeping was done with pencil and paper, assets were put on the left side of the balance sheet, while equity and liabilities went to the right side.

Today, however, a balance sheet will almost always look like this:

Now here’s something to remember.

The net income (your income statement bottom line) is annually transferred to your balance sheet, where it will appear as retained earnings. So retained earnings are a running total of your company’s profitability from day 1.

Difference Between an Income Statement and a Balance Sheet

If you want to know how your business has performed over a span of time (a year, month, or quarter), you’ll want to refer to your income statement.

On the flip side, if you want to know your business’s financial health, to know its value or worth at a particular point since it was established, the balance sheet is the report you’ll want to refer to.

Cash Flow Statement

A cash flow statement shows the movement of cash, the cash inflows and outflows within the business, based on 3 cash sources and cash expenditure categories: operations, investing, and financing.

This is an extremely important financial statement because, ultimately, cash is the best indicator of the financial health of an enterprise.

The reporting period for a cash flow statement is often one fiscal year but could be a quarter, month, or any reporting period that makes sense for your business.

Why Do You Need a Cash Flow Statement?

You already have an income statement that shows you the profits you’ve made. Why do you still need a cash flow statement?

An income statement is prepared based on the accrual method of accounting . This means your sales are recorded when you earn them, not when your business receives the actual cash.

This creates a timing difference. A sales amount of $10,000 on your income statement, for example, doesn’t always mean this amount is in your bank account. It may be an invoice you sent to your customer, and you’re still awaiting payment.

The same goes for expenses. In accrual-basis accounting, expenses are recorded when your business incurs them and not when you pay out the cash.

But what about the cash figure on the balance sheet? While the balance sheet captures the cash balance, which can be meaningful, this balance sheet figure doesn’t tell us the source of the cash.

The cash could be from a windfall, like an insurance claim, which is a one-time event and unsustainable. Or it could be from normal day-to-day business operations, which are more sustainable.

Sections of a Cash Flow Statement

A cash flow statement has 3 sections:

- Cash from operations (or from operating activities)

- Cash from investing activities

- Cash from financing activities

And this is what a typical cash flow statement looks like:

Cash From Operating Activities

Cash from operations is the first section of a cash flow statement, revealing its relative importance in the cash flow statement hierarchy. Cash from operating activities is the most meaningful because this is cash from your day-to-day trading activities.

These include cash received from sales, set off against cash expenses like the cost of goods sold, utility expenses, and rent.

It also takes into account non-cash items, like depreciation , that are included in net income but don’t involve any actual cash movement. And it considers any changes in your assets and liabilities during the time period, like an increase in accounts receivable .

Since operating activities are the mainstay of a business, a company with positive cash flow from operating activities will be more sustainable.

Cash From Investing Activities

The main source and use of cash from investing activities are purchasing and selling fixed assets. Common examples of fixed asset items are things like buildings, vehicles, computer equipment, or machinery.

But other investment items can appear in the investing activity section, such as buying stocks and bonds for investment purposes.

Cash From Financing Activities

All cash inflows and outflows from financing activities will be captured in this last section of cash flow statements.

If you’ve taken out a bank loan to purchase equipment, the cash the bank provided you will show up in this section. And when you begin making loan payments, these will be included here. To learn more about this follow our guide on Loan Repayment Entry , which provide you with the right steps.

Financial Statements Are Fundamental

In Sam Walton’s autobiography Made In America , here’s what Al Johnson, the CEO of Walmart at one time, revealed about Walmart’s owner and founder:

“Every Friday morning for six years, I would take my columnar pad with all the numbers on it into Sam’s office for him to review. Sam would jot them down on his own pad and work through the calculations himself. I always knew I could not just go in there and lay a sheet of numbers in front of him and expect him to just accept it.”

As a small business owner, you should be able to make sense of your financial statements. It will ensure you ask the right questions and follow important clues and cues.

You can make financial statements manually in a spreadsheet, but accounting software automates everything, so it’s faster and easier and leaves less room for error. With all your financial information in one place, you can immediately access your financial data whenever you or your accountant needs it.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

Inc. Power Partner Awards Application Deadline This Friday, July 12 Apply Now

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

- How to Write a Great Business Plan: Financial Analysis

The last article in a comprehensive series to help you craft the perfect business plan for your startup.

This article is part of a series on how to write a great business plan .

Numbers tell the story. Bottom line results indicate the success or failure of any business.

Financial projections and estimates help entrepreneurs, lenders, and investors or lenders objectively evaluate a company's potential for success. If a business seeks outside funding, providing comprehensive financial reports and analysis is critical.

But most importantly, financial projections tell you whether your business has a chance of being viable--and if not let you know you have more work to do.

Most business plans include at least five basic reports or projections:

- Balance Sheet: Describes the company cash position including assets, liabilities, shareholders, and earnings retained to fund future operations or to serve as funding for expansion and growth. It indicates the financial health of a business.

- Income Statement: Also called a Profit and Loss statement, this report lists projected revenue and expenses. It shows whether a company will be profitable during a given time period.

- Cash Flow Statement: A projection of cash receipts and expense payments. It shows how and when cash will flow through the business; without cash, payments (including salaries) cannot be made.

- Operating Budget: A detailed breakdown of income and expenses; provides a guide for how the company will operate from a "dollars" point of view.

- Break-Even Analysis: A projection of the revenue required to cover all fixed and variable expenses. Shows when, under specific conditions, a business can expect to become profitable.

It's easy to find examples of all of the above. Even the most basic accounting software packages include templates and samples. You can also find templates in Excel and Google Docs. (A quick search like "google docs profit and loss statement" yields plenty of examples.)

Or you can work with an accountant to create the necessary financial projections and documents. Certainly feel free to do so... but I'd first recommend playing around with the reports yourself. While you don't need to be an accountant to run a business, you do need to understand your numbers... and the best way to understand your numbers is usually to actually work with your numbers.

But ultimately the tools you use to develop your numbers are not as important as whether those numbers are as accurate as possible--and whether those numbers help you decide whether to take the next step and put your business plan into action.

Then Financial Analysis can help you answer the most important business question: "Can we make a profit?"

Some business plans include less essential but potentially important information in an Appendix section. You may decide to include, as backup or additional information:

- Resumes of key leaders

- Additional descriptions of products and services

- Legal agreements

- Organizational charts

- Examples of marketing and advertising collateral

- Photographs of potential facilities, products, etc

- Backup for market research or competitive analysis

- Additional financial documents or projections

Keep in mind creating an Appendix is usually only necessary if you're seeking financing or hoping to bring in partners or investors. Initially the people reading your business plan don't wish to plow through reams and reams of charts, numbers, and backup information. If one does want to dig deeper, fine--he or she can check out the documents in the Appendix.

That way your business plan can share your story clearly and concisely.

Otherwise, since you created your business plan... you should already have the backup.

And one last thing: always remember the goal of your business plan is to convince you that your idea makes sense--because it's your time, your money, and your effort on the line.

More in this series:

- How to Write a Great Business Plan: Key Concepts

- How to Write a Great Business Plan: the Executive Summary

- How to Write a Great Business Plan: Overview and Objectives

- How to Write a Great Business Plan: Products and Services

- How to Write a Great Business Plan: Market Opportunities

- How to Write a Great Business Plan: Sales and Marketing

- How to Write a Great Business Plan: Competitive Analysis

- How to Write a Great Business Plan: Operations

- How to Write a Great Business Plan: Management Team

The Daily Digest for Entrepreneurs and Business Leaders

Privacy Policy

Call Us (877) 968-7147 Login

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.

Coming up with your financial projections may be a bit trickier if you are a startup. After all, you have nothing to go off of. Come up with a reasonable monthly goal based on things like your industry, competitors, and the market. Hint : Look at your market analysis section of the business plan for guidance.

A financial statement details your business’s finances. The three main types of financial statements are income statements, cash flow statements, and balance sheets.

Income statements summarize your business’s income and expenses during a period of time (e.g., a month). This document shows whether your business had a net profit or loss during that time period.

Cash flow statements break down your business’s incoming and outgoing money. This document details whether your company has enough cash on hand to cover expenses.

The balance sheet summarizes your business’s assets, liabilities, and equity. Balance sheets help with debt management and business growth decisions.

If you run a startup, you can create “pro forma financial statements,” which are statements based on projections.

If you’ve been in business for a bit, you should have financial statements in your records. You can include these in your business plan. And, include forecasted financial statements.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business , to learn more about the different types of financial statements for your business.

Potential investors want to know when your business will reach its break-even point. The break-even point is when your business’s sales equal its expenses.

Estimate when your company will reach its break-even point and detail it in the financial section of business plan.

If you’re looking for financing, detail your funding request here. Include how much you are looking for, list ideal terms (e.g., 10-year loan or 15% equity), and how long your request will cover.

Remember to discuss why you are requesting money and what you plan on using the money for (e.g., equipment).

Back up your funding request by emphasizing your financial projections.

Last but not least, your financial section should also discuss your business’s exit strategy. An exit strategy is a plan that outlines what you’ll do if you need to sell or close your business, retire, etc.

Investors and lenders want to know how their investment or loan is protected if your business doesn’t make it. The exit strategy does just that. It explains how your business will make ends meet even if it doesn’t make it.

When you’re working on the financial section of business plan, take advantage of your accounting records to make things easier on yourself. For organized books, try Patriot’s online accounting software . Get your free trial now!

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Business Plan Executive Summary Example & Template

Updated: Jun 3, 2024, 1:03pm

Table of Contents

Components of an executive summary, how to write an executive summary, example of an executive summary, frequently asked questions.

A business plan is a document that you create that outlines your company’s objectives and how you plan to meet those objectives. Every business plan has key sections such as management and marketing. It should also have an executive summary, which is a synopsis of each of the plan sections in a one- to two-page overview. This guide will help you create an executive summary for your business plan that is comprehensive while being concise.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

$0 + State Fee

On Formations' Website

The executive summary should mimic the sections found in the business plan . It is just a more concise way of stating what’s in the plan so that a reader can get a broad overview of what to expect.

State the company’s mission statement and provide a few sentences on what the company’s purpose is.

Company History and Management

This section describes the basics of where the company is located, how long it has been in operation, who is running it and what their level of experience is. Remember that this is a summary and that you’ll expand on management experience within the business plan itself. But the reader should know the basics of the company structure and who is running the company from this section.

Products or Services

This section tells the reader what the product or service of the company is. Every company does something. This is where you outline exactly what you do and how you solve a problem for the consumer.

This is an important section that summarizes how large the market is for the product or service. In the business plan, you’ll do a complete market analysis. Here, you will write the key takeaways that show that you have the potential to grow the business because there are consumers in the market for it.

Competitive Advantages

This is where you will summarize what makes you better than the competitors. Identify key strengths that will be reasons why consumers will choose you over another company.

Financial Projections

This is where you estimate the sales projections for the first years in business. At a minimum, you should have at least one year’s projections, but it may be better to have three to five years if you can project that far ahead.

Startup Financing Requirements

This states what it will cost to get the company launched and running. You may tackle this as a first-year requirement or if you have made further projections, look at two to three years of cost needs.

The executive summary is found at the start of the business plan, even though it is a summary of the plan. However, you should write the executive summary last. Writing the summary once you have done the work and written the business plan will be easier. After all, it is a summary of what is in the plan. Keep the executive summary limited to two pages so that it doesn’t take someone a long time to peruse what the summary says.

Start A Limited Liability Company Online Today with ZenBusiness

Click to get started.

It might be easier to write an executive summary if you know what to expect. Here is an example of an executive summary that you can use as a template.

Bottom Line

Writing an executive summary doesn’t need to be difficult if you’ve already done the work of writing the business plan itself. Take the elements from the plan and summarize each section. Point out key details that will make the reader want to learn more about the company and its financing needs.

How long is an executive summary?

An executive summary should be one to two pages and no more. This is just enough information to help the reader determine their overall interest in the company.

Does an executive summary have keywords?

The executive summary uses keywords to help sell the idea of the business. As such, there may be enumeration, causation and contrasting words.

How do I write a business plan?

If you have business partners, make sure to collaborate with them to ensure that the plan accurately reflects the goals of all parties involved. You can use our simple business plan template to get started.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best LLC Services

- Best Registered Agent Services

- Best Trademark Registration Services

- Top LegalZoom Competitors

- Best Business Loans

- Best Business Plan Software

- ZenBusiness Review

- LegalZoom LLC Review

- Northwest Registered Agent Review

- Rocket Lawyer Review

- Inc. Authority Review

- Rocket Lawyer vs. LegalZoom

- Bizee Review (Formerly Incfile)

- Swyft Filings Review

- Harbor Compliance Review

- Sole Proprietorship vs. LLC

- LLC vs. Corporation

- LLC vs. S Corp

- LLP vs. LLC

- DBA vs. LLC

- LegalZoom vs. Incfile

- LegalZoom vs. ZenBusiness

- LegalZoom vs. Rocket Lawyer

- ZenBusiness vs. Incfile

- How To Start A Business

- How to Set Up an LLC

- How to Get a Business License

- LLC Operating Agreement Template

- 501(c)(3) Application Guide

- What is a Business License?

- What is an LLC?

- What is an S Corp?

- What is a C Corp?

- What is a DBA?

- What is a Sole Proprietorship?

- What is a Registered Agent?

- How to Dissolve an LLC

- How to File a DBA

- What Are Articles Of Incorporation?

- Types Of Business Ownership

Next Up In Business

- Best Online Legal Services

- How To Write A Business Plan

- Member-Managed LLC Vs. Manager-Managed LLC

- Starting An S-Corp

- LLC Vs. C Corp

- How Much Does It Cost To Start An LLC?

Best West Virginia Registered Agent Services Of 2024

Best Vermont Registered Agent Services Of 2024

Best Rhode Island Registered Agent Services Of 2024

Best Wisconsin Registered Agent Services Of 2024

Best South Dakota Registered Agent Services Of 2024

B2B Marketing In 2024: The Ultimate Guide

Kimberlee Leonard has 22 years of experience as a freelance writer. Her work has been featured on US News and World Report, Business.com and Fit Small Business. She brings practical experience as a business owner and insurance agent to her role as a small business writer.

Cassie is a deputy editor collaborating with teams around the world while living in the beautiful hills of Kentucky. Focusing on bringing growth to small businesses, she is passionate about economic development and has held positions on the boards of directors of two non-profit organizations seeking to revitalize her former railroad town. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write a Financial Analysis

Know what to include in important section of business plan

Alyssa Gregory is an entrepreneur, writer, and marketer with 20 years of experience in the business world. She is the founder of the Small Business Bonfire, a community for entrepreneurs, and has authored more than 2,500 articles for The Balance and other popular small business websites.

:max_bytes(150000):strip_icc():format(webp)/alyssa-headshot-2018-5b73ee0046e0fb002531cb50.png)

Financial Analysis of a Business Plan

Assumptions, know the ground rules, use visuals, check your math.

The financial analysis section of a business plan should contain the data for financing your business for the present, what will be needed for future growth, and an estimation of your operating expenses.

The financial analysis section of your business plan may be the most challenging for you to complete on your own, but it also could be the deal-maker or deal-breaker when you are searching for funding.

Because of the structured, in-depth financial data required for this section, you should consult your accountant or other trusted and qualified financial professional before writing this section .

The financial analysis section should be based on estimates for new businesses or recent data for established businesses. It should include these elements:

- Balance sheet : Your assumed and anticipated business financials, including assets , liabilities, and equity.

- Cash-flow analysis : An overview of the cash you anticipate will be coming into your business based on sales forecasts, minus the anticipated cash expenses of running the business.

- Profit-and-loss analysis : Your income statement that subtracts the costs of the business from the earnings over a specific period of time, typically a quarter or a year.

- Break-even analysis : Demonstrates the point when the cost of doing business is fully covered by sales.

- Personnel-expense forecast : The expenses of your team, as outlined in a management summary section .

Completing a financial analysis section for a business that hasn't been started yet requires some assumptions. However, these aren't guesses. What you expect from the business needs to be based on detailed research and data.

Go back to the other sections of your business plan and write down any financial assumptions you made while drafting those sections. You then can use those assumptions in your financial analysis section. The most important factor is ensuring that the data in the financial analysis section is consistent with the assumptions made in other sections of your business plan.

There may be no section of your business plan where you need help as much as you do with your financial analysis section. The assumptions, forecasting, and specific numbers can be complicated and generally difficult to wrap your head around, especially if you don’t have a financial background. This financial information, though, is exactly the data your audience will be looking for.

You can avoid the stress and uncertainty by getting help from a qualified financial professional early in the process.

When it comes to the financial analysis of your business plan, have a basic idea of what each element should include, where the data comes from, and what the numbers mean. This stands even if you have help developing the financial analysis section because you will be the one left to explain and expand on the financial data in face-to-face situations.

GAAP (generally accepted accounting principles ), a collection of rules, procedures, and conventions that define accepted accounting practices should be followed throughout this section.

Use graphs and charts in the financial analysis section to illustrate the financial data , just as you should in other sections of your business plan that include extensive data, numbers, statistics, and trends. Put the most important visuals in the financial analysis, with the supporting graphics included in the Appendix.

A quick way to lose the attention of a potential investor is by having flawed calculations or numbers that are not backed up. Double and triple check all of your calculations and figures, and have a third-party do the same to ensure everything adds up.

You also should avoid including any figures that are not explained, backed up and otherwise researched extensively, especially when it comes to assumptions you've made. Use data from current and past markets and financial situations to substantiate your numbers.

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .