- Receivables

- Notes Receivable

- Credit Terms

- Cash Discount on Sales

- Accounting for Bad Debts

- Bad Debts Direct Write-off Method

- Bad Debts Allowance Method

- Bad Debts as % of Sales

- Bad Debts as % of Receivables

- Recovery of Bad Debts

- Accounts Receivable Aging

- Assignment of Accounts Receivable

- Factoring of Accounts Receivable

Assignment of accounts receivable is an agreement in which a business assigns its accounts receivable to a financing company in return for a loan. It is a way to finance cash flows for a business that otherwise finds it difficult to secure a loan, because the assigned receivables serve as collateral for the loan received.

By assignment of accounts receivable, the lender i.e. the financing company has the right to collect the receivables if the borrowing company i.e. actual owner of the receivables, fails to repay the loan in time. The financing company also receives finance charges / interest and service charges.

It is important to note that the receivables are not actually sold under an assignment agreement. If the ownership of the receivables is actually transferred, the agreement would be for sale / factoring of accounts receivable . Usually, the borrowing company would itself collect the assigned receivables and remit the loan amount as per agreement. It is only when the borrower fails to pay as per agreement, that the lender gets a right to collect the assigned receivables on its own.

The assignment of accounts receivable may be general or specific. A general assignment of accounts receivable entitles the lender to proceed to collect any accounts receivable of the borrowing company whereas in case of specific assignment of accounts receivable, the lender is only entitled to collect the accounts receivable specifically assigned to the lender.

The following example shows how to record transactions related to assignment of accounts receivable via journal entries:

On March 1, 20X6, Company A borrowed $50,000 from a bank and signed a 12% one month note payable. The bank charged 1% initial fee. Company A assigned $73,000 of its accounts receivable to the bank as a security. During March 20X6, the company collected $70,000 of the assigned accounts receivable and paid the principle and interest on note payable to the bank on April 1. $3,000 of the sales were returned by the customers.

Record the necessary journal entries by Company A.

Journal Entries on March 1

Initial fee = 0.01 × 50,000 = 500

Cash received = 50,000 – 500 = 49,500

| Cash | 49,500 | |

| Finance Charge | 500 | |

| Notes Payable | 50,000 |

The accounts receivable don't actually change ownership. But they may be to transferred to another account as shown the following journal entry. The impact on the balance sheet is only related to presentation, so this journal entry may not actually be passed. Usually, the fact that accounts receivable have been assigned, is stated in the notes to the financial statements.

| Accounts Receivable Assigned | 73,000 | |

| Accounts Receivable | 73,000 |

Journal Entries on April 1

| Cash | 70,000 | |

| Sales Returns | 3,000 | |

| Accounts Receivable Assigned | 73,000 |

Interest expense = 50,000 × 12%/12 = 500

| Notes Payable | 50,000 | |

| Interest Expense | 500 | |

| Cash | 50,500 |

by Irfanullah Jan, ACCA and last modified on Oct 29, 2020

Related Topics

- Sales Returns

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Classifications

- Cost Accounting Systems

- Cost Behavior

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

The Difference Between Assignment of Receivables & Factoring of Receivables

- Small Business

- Money & Debt

- Business Bank Accounts

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Decrease Bad Debt Expenses to Increase Income

What does "paid on account" in accounting mean, what is a financing receivable.

- What Do Liquidity Ratios Measure?

- What Are Some Examples of Installment & Revolving Accounts?

You can raise cash fast by assigning your business accounts receivables or factoring your receivables. Assigning and factoring accounts receivables are popular because they provide off-balance sheet financing. The transaction normally does not appear in your financial statements and your customers may never know their accounts were assigned or factored. However, the differences between assigning and factoring receivables can impact your future cash flows and profits.

How Receivables Assignment Works

Assigning your accounts receivables means that you use them as collateral for a secured loan. The financial institution, such as a bank or loan company, analyzes the accounts receivable aging report. For each invoice that qualifies, you will likely receive 70 to 90 percent of the outstanding balance in cash, according to All Business . Depending on the lender, you may have to assign all your receivables or specific receivables to secure the loan. Once you have repaid the loan, you can use the accounts as collateral for a new loan.

Assignment Strengths and Weaknesses

Using your receivables as collateral lets you retain ownership of the accounts as long as you make your payments on time, says Accounting Coach. Since the lender deals directly with you, your customers never know that you have borrowed against their outstanding accounts. However, lenders charge high fees and interest on an assignment of accounts receivable loan. A loan made with recourse means that you still are responsible for repaying the loan if your customer defaults on their payments. You will lose ownership of your accounts if you do not repay the loan per the agreement terms.

How Factoring Receivables Works

When you factor your accounts receivable, you sell them to a financial institution or a company that specializes in purchasing accounts receivables. The factor analyzes your accounts receivable aging report to see which accounts meet their purchase criteria. Some factors will not purchase receivables that are delinquent 45 days or longer. Factors pay anywhere from 65 percent to 90 percent of an invoice’s value. Once you factor an account, the factor takes ownership of the invoices.

Factoring Strengths and Weaknesses

Factoring your accounts receivables gives you instant cash and puts the burden of collecting payment from slow or non-paying customers on the factor. If you sell the accounts without recourse, the factor cannot look to you for payment should your former customers default on the payments. On the other hand, factoring your receivables could result in your losing customers if they assume you sold their accounts because of financial problems. In addition, factoring receivables is expensive. Factors charge high fees and may retain recourse rights while paying you a fraction of your receivables' full value.

- All Business: The Difference Between Factoring and Accounts Receivable Financing

Related Articles

The advantages of selling accounts receivable, buying accounts receivable, difference between payables and receivables in accounting, the role of factoring in modern business finance, the prevention of dilution of ownership, how to remove an empty mailbox in outlook, the importance of factoring in business, how to factor inventory, setting up webmail on mail for the imac, most popular.

- 1 The Advantages of Selling Accounts Receivable

- 2 Buying Accounts Receivable

- 3 Difference Between Payables and Receivables in Accounting

- 4 The Role of Factoring in Modern Business Finance

Accounts Receivable Assignment: Key Concepts and Business Impact

Explore the essential concepts and business impact of accounts receivable assignment, including cash flow effects and advanced techniques.

Efficient management of accounts receivable is crucial for maintaining a healthy cash flow in any business. Assigning these receivables can be an effective strategy to optimize liquidity and reduce financial risk.

Understanding the implications of this practice helps businesses make informed decisions that align with their financial goals.

Key Concepts of Accounts Receivable Assignment

Accounts receivable assignment involves transferring the rights to collect receivables from a business to a third party, often a financial institution. This practice is typically used to secure immediate cash flow, allowing businesses to meet short-term obligations without waiting for customer payments. The third party, known as the assignee, then assumes the responsibility of collecting the receivables.

One of the primary concepts in accounts receivable assignment is the distinction between recourse and non-recourse agreements. In a recourse agreement, the business retains some liability if the receivables are not collected, meaning they may need to compensate the assignee for any uncollected amounts. Conversely, a non-recourse agreement transfers the full risk of non-payment to the assignee, providing the business with greater financial security but often at a higher cost.

Another important aspect is the discount rate applied by the assignee. This rate reflects the cost of the service and the perceived risk associated with the receivables. Factors influencing the discount rate include the creditworthiness of the customers, the average collection period, and the overall economic environment. Businesses must carefully evaluate these rates to ensure that the benefits of immediate cash flow outweigh the costs.

Impact on Cash Flow

The assignment of accounts receivable can significantly influence a company’s cash flow dynamics. By converting receivables into immediate cash, businesses can bridge the gap between sales and actual cash inflows. This immediate liquidity can be particularly beneficial for companies facing seasonal fluctuations or those in industries with extended payment terms. For instance, a manufacturing firm might use receivable assignment to ensure it has the necessary funds to purchase raw materials, even if its customers take months to pay their invoices.

Moreover, the infusion of cash from receivable assignments can enable businesses to capitalize on growth opportunities. With more liquid assets on hand, companies can invest in new projects, expand operations, or take advantage of bulk purchasing discounts. This proactive approach to cash management can lead to increased profitability and a stronger market position. For example, a retail business might use the funds from assigned receivables to open new store locations, thereby increasing its market reach and revenue potential.

However, it’s important to recognize that while receivable assignment can provide immediate financial relief, it also comes with costs. The discount rate applied by the assignee reduces the total amount of cash received compared to the face value of the receivables. This reduction must be carefully weighed against the benefits of improved cash flow. Additionally, businesses must consider the potential impact on customer relationships, as the assignee will now be responsible for collections. Ensuring that the assignee maintains a professional and courteous approach is essential to preserving customer goodwill.

Accounting Treatment and Reporting

When it comes to the accounting treatment and reporting of accounts receivable assignments, businesses must adhere to specific guidelines to ensure accurate financial statements. The first step involves recognizing the assignment transaction in the accounting records. This typically requires debiting a cash account to reflect the immediate influx of funds and crediting the accounts receivable account to remove the assigned receivables from the company’s books. The difference between the receivables’ face value and the cash received, often due to the discount rate, is recorded as a financing expense or loss.

Proper disclosure is another critical aspect of accounting for receivable assignments. Financial statements must clearly indicate the nature and extent of the receivables assigned, including any recourse obligations if applicable. This transparency helps stakeholders understand the company’s financial position and the potential risks associated with the assigned receivables. For instance, notes to the financial statements should detail the terms of the assignment agreement, the discount rate applied, and any contingent liabilities that may arise from recourse provisions.

Additionally, businesses must consider the impact of receivable assignments on their financial ratios. Metrics such as the current ratio, quick ratio, and accounts receivable turnover can be significantly affected by the removal of receivables from the balance sheet. Analysts and investors often scrutinize these ratios to assess a company’s liquidity and operational efficiency. Therefore, it is essential to provide context and explanations for any substantial changes in these metrics due to receivable assignments.

Advanced Techniques in Receivable Assignment

Advanced techniques in receivable assignment can offer businesses more sophisticated ways to manage their cash flow and financial risk. One such technique is the use of securitization, where receivables are pooled together and sold as securities to investors. This method not only provides immediate liquidity but also diversifies the risk among multiple investors, making it an attractive option for companies with large volumes of receivables. Securitization can be particularly beneficial for industries like telecommunications or utilities, where customer bases are extensive and receivables are substantial.

Another advanced approach is dynamic discounting, which allows businesses to offer early payment discounts to their customers in exchange for quicker cash inflows. Unlike traditional discounting, dynamic discounting uses a flexible rate that can change based on the timing of the payment. This technique leverages technology platforms to automate and optimize the discounting process, ensuring that businesses can maximize their cash flow without sacrificing too much revenue. For example, a software company might use dynamic discounting to encourage its clients to pay invoices within 10 days instead of the standard 30, thereby improving its liquidity.

Relevance in Accounting: Concepts and Practical Applications

Modern accounting statements: techniques, technology, global standards, you may also be interested in..., calculating cost of goods manufactured for financial clarity, types of accounting and their unique roles explained, affiliated companies: types, reporting, and strategic benefits, debt extinguishment accounting explained.

What is the purpose of assigning accounts receivable?

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

Read more →

Author: Harold Averkamp, CPA, MBA

The purpose of assigning accounts receivable is to provide collateral in order to obtain a loan.

To illustrate, let’s assume that a corporation receives a special order from a new customer whose credit rating is superb. However, the customer pays for its purchases 90 days after it receives the goods. The corporation does not have sufficient money to purchase the raw materials, pay for the labor, and then wait 90 days to collect the receivable. The corporation’s bank or a finance company may lend 80% of the receivable but insists that the receivable be assigned to them as collateral for the loan.

Assigning a specific account receivable usually results in recording the receivable in a separate general ledger account such as Accounts Receivable Assigned. Some lenders require that the corporation’s customer be notified of the assignment and that the customer must remit the receivable amount directly to the bank.

Instead of assigning a specific receivable, the lender may require the corporation to assign all of its receivable as collateral for a loan.

Advance Your Accounting and Bookkeeping Career

- Perform better at your job

- Get hired for a new position

- Understand your small business

- Pass your accounting class

- What is the accounts receivable turnover ratio?

- What is the accounts receivable collection period?

- How do you estimate the amount of uncollectible accounts receivable?

- What is the days' sales in accounts receivable ratio?

- What is a general ledger account?

- How does the aging of accounts receivable determine bad debts expense?

- Accounts Receivable and Bad Debts Expense

Featured Review

"I became a PRO user of AccountingCoach to enhance my knowledge of accounting procedures, as I am self-taught, and knew from the first time I logged on that this site would be beneficial for me. I like the AccountingCoach website because of the detailed explanations of procedures and the self-testing to show where my weaknesses and strengths are, and because it is an extremely useful reference program. The benefit of using AccountingCoach for me is the easy access to specific subject matters and the assistance it provides me to learn, grow, and take on added responsibilities with confidence in my role as Accounting Manager. I would highly recommend this site for anyone who is responsible for accounting, bookkeeping, and financial reporting. It has helped me personally to gain confidence in providing accurate financial information to the owner of our company." - Darlene H.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

About the Author

Certificates of Achievement

We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping:

- Debits and Credits

- Adjusting Entries

- Financial Statements

- Balance Sheet

- Income Statement

- Cash Flow Statement

- Working Capital and Liquidity

- Financial Ratios

- Bank Reconciliation

- Payroll Accounting

Badges and Points

- Work towards and earn 30 badges

- Earn points as you work towards completing our course

- 01. Accounting Basics 0%

- 02. Debits and Credits 0%

- 03. Chart of Accounts 0%

- 04. Bookkeeping 0%

- 05. Accounting Equation 0%

- 06. Accounting Principles 0%

- 07. Financial Accounting 0%

- 08. Adjusting Entries 0%

- 09. Financial Statements 0%

- 10. Balance Sheet 0%

- 11. Working Capital and Liquidity 0%

- 12. Income Statement 0%

- 13. Cash Flow Statement 0%

- 14. Financial Ratios 0%

- 15. Bank Reconciliation 0%

- 16. Accounts Receivable and Bad Debts Expense 0%

- 17. Accounts Payable 0%

- 18. Inventory and Cost of Goods Sold 0%

- 19. Depreciation 0%

- 20. Payroll Accounting 0%

- 21. Bonds Payable 0%

- 22. Stockholders' Equity 0%

- 23. Present Value of a Single Amount 0%

- 24. Present Value of an Ordinary Annuity 0%

- 25. Future Value of a Single Amount 0%

- 26. Nonprofit Accounting 0%

- 27. Break-even Point 0%

- 28. Improving Profits 0%

- 29. Evaluating Business Investments 0%

- 30. Manufacturing Overhead 0%

- 31. Nonmanufacturing Overhead 0%

- 32. Activity Based Costing 0%

- 33. Standard Costing 0%

Assignment of Accounts Receivable: Definition, Benefits, and Emerging Trends

Last updated 03/28/2024 by

Fact checked by

Compare Business Loans

What is assignment of accounts receivable, how does assignment of accounts receivable work, what are some special considerations for assignment of accounts receivable, emerging trends in assignment of accounts receivable, fintech solutions.

- Access to immediate cash flow

- Allows businesses to leverage their accounts receivable

- May be available to companies with limited credit history or poor credit

- Provides an alternative financing option when traditional loans are not available

- Helps businesses manage cash flow fluctuations

- Higher cost compared to traditional financing options

- Interest rates and service charges can be substantial

- May indicate financial distress to stakeholders

- Loss of control over customer relationships and collections process

- Defaulting on the loan can result in loss of assets

Frequently asked questions

How does assignment of accounts receivable differ from factoring, can any business use assignment of accounts receivable, what happens if a customer defaults on payment, is assignment of accounts receivable a sign of financial distress, what are the eligibility criteria for assignment of accounts receivable, how does assignment of accounts receivable affect financial statements, are there any alternatives to assignment of accounts receivable, how can businesses mitigate the risks associated with assignment of accounts receivable, key takeaways.

- Assignment of accounts receivable allows businesses to access immediate cash flow by leveraging their outstanding invoices.

- While it provides an alternative financing option, it can be costly compared to traditional loans.

- Fintech companies are transforming the accounts receivable financing market with innovative digital solutions.

- Businesses should carefully evaluate the terms and implications of assigning their accounts receivable before entering into agreements with lenders.

Show Article Sources

You might also like.

- Trade Finance

- Letters of Credit

- Trade Insurance & Risk

- Shipping & Logistics

- Sustainable Trade Finance

- Incoterms® Rules 2020

- Research & Data

- Conferences

- Purchase Order Finance

- Stock Finance

- Structured Commodity Finance

- Receivables Finance

- Supply Chain Finance

- Bonds and Guarantees

- Find Finance Products

- Get Trade Finance

- Incoterms® 2020

- Letters of Credit (LCs)

Receivables Finance And The Assignment Of Receivables

Tfg legal trade finance hub, receivables finance and the assignment of receivables.

A receivable represents money that is owed to a company and is expected to be paid in the future. Receivables finance, also known as accounts receivable financing, is a form of asset-based financing where a company leverages its outstanding receivables as collateral to secure short-term loans and obtain financing.

In case of default, the lender has a right to collect associated receivables from the company’s debtors. In brief, it is the process by which a company raises cash against its own book’s debts.

The company actually receives an amount equal to a reduced value of the pledged receivables, the age of the receivables impacting the amount of financing received. The company can get up to 90% of the amount of its receivables advanced.

This form of financing assists companies in unlocking funds that would otherwise remain tied up in accounts receivable, providing them with access to capital that is not immediately realised from outstanding debts.

FIG. 1: Accounts receivable financing operates by leveraging a company’s receivables to obtain financing. Source: https://fhcadvisory.com/images/account-receivable-financing.jpg

Restrictions on the assignment of receivables – New legislation

Invoice discounting products under which a company assigns its receivables have been used by small and medium enterprises (SMEs) to raise capital. However, such products depend on the related receivables to be assignable at first.

Businesses have faced provisions that ban or restrict the assignment of receivables in commercial contracts by imposing a condition or other restrictions, which prevents them from being able to use their receivables to raise funds.

In 2015, the UK Government enacted the Small Business, Enterprise and Employment Act (SBEEA) by which raising finance on receivables is facilitated. Pursuant to this Act, regulations can be made to invalidate restrictions on the assignment of receivables in certain types of contract.

In other words, in certain circumstances, clauses which prevent assignment of a receivable in a contract between businesses is unenforceable. Especially, in its section 1(1), the Act provides that the authorised authority can, by regulations “make provision for the purpose of securing that any non-assignment of receivables term of a relevant contract:

- has no effect;

- has no effect in relation to persons of a prescribed description;

- has effect in relation to persons of a prescribed description only for such purposes as may be prescribed.”

The underlying aim is to enable SMEs to use their receivables as financing to raise capital, through the possibility of assigning such receivables to another entity.

The aforementioned regulations, which allow invalidations of such restrictions on the assignment of receivables, are contained in the Business Contract Terms (Assignment of Receivables) Regulations 2018, which will apply to any term in a contract entered into force on or after 31 December 2018.

By virtue of its section 2(1) “Subject to regulations 3 and 4, a term in a contract has no effect to the extent that it prohibits or imposes a condition, or other restriction, on the assignment of a receivable arising under that contract or any other contract between the same parties.”

Such regulations apply to contracts for the supply of goods, services or intangible assets under which the supplier is entitled to be paid money. However, there are several exclusions to this rule.

In section 3, an exception exists where the supplier is a large enterprise or a special purpose vehicle (SPV). In section 4, there are listed exclusions for various contracts such as “for, or entered into in connection with, prescribed financial services”, contracts “where one or more of the parties to the contract is acting for purposes which are outside a trade, business or profession” or contracts “where none of the parties to the contract has entered into it in the course of carrying on a business in the United Kingdom”. Also, specific exclusions relate to contracts in energy, land, share purchase and business purchase.

Effects of the 2018 Regulations

As mentioned above, any contract terms that prevent, set conditions for, or place restrictions on transferring a receivable are considered invalid and cannot be legally enforced.

In light of this, the assignment of the right to be paid under a contract for the supply of goods (receivables) cannot be restricted or prohibited. However, parties are not prevented from restricting other contracts rights.

Non-assignment clauses can have varying forms. Such clauses are covered by the regulations when terms prevent the assignee from determining the validity or value of the receivable or their ability to enforce it.

Overall, these legislations have had an important impact for businesses involved in the financing of receivables, by facilitating such processes for SMEs.

Digital platforms and fintech solutions: The assignment of receivables has been significantly impacted by the digitisation of financial services. Fintech platforms and online marketplaces have been developed to make the financing and assignment of receivables easier.

These platforms employ tech to assess debtor creditworthiness and provide efficient investor and seller matching, including data analytics and artificial intelligence. They provide businesses more autonomy, transparency, and access to a wider range of possible investors.

Securitisation is an essential part of receivables financing. Asset-backed securities (ABS), a type of financial instrument made up of receivables, are then sold to investors.

Businesses are able to turn their receivables into fast cash by transferring the credit risk and cash flow rights to investors. Investors gain from diversification and potentially greater yields through securitisation, while businesses profit from increased liquidity and risk-reduction capabilities.

References:

https://www.tradefinanceglobal.com/finance-products/accounts-receivables-finance/ – 28/10/2018

https://www.legislation.gov.uk/ukpga/2015/26/section/1/enacted – 28/10/2018

https://www.legislation.gov.uk/ukdsi/2018/9780111171080 – 28/10/2018

https://www.bis.org/publ/bppdf/bispap117.pdf – Accessed 14/06/2023

https://www.investopedia.com/terms/a/asset-backedsecurity.asp – Accessed 14/06/2023

https://www.imf.org/external/pubs/ft/fandd/2008/09/pdf/basics.pdf – Accessed 14/06/2023

International Trade Law

1 | Introduction to International Trade Law 2 | Legal Trade Finance 3 | Standard Legal Charges 4 | Borrowing Base Facilities 5 | Governing law in trade finance transactions 6 | SPV Financing 7 | Guarantees and Indemnities 8 | Taking security over assets 9 | Receivables finance and the assignment of receivables 10 | Force Majeure 11 | Arbitration 12 | Master Participation Agreements 13 | Digital Negotiable Instruments 14 | Generative AI in Trade Law

Access trade, receivables and supply chain finance

Contact the trade team, speak to our trade finance team, want to learn more about trade finance download our free guides.

Learn more about Legal Structures in Trade Finance

Digital Negotiable Instruments

Electronic Signatures

Force Majeure

Master Risk Participation Agreements In Trade Finance

What is a Creditor?

What is a debtor (debitor).

About the Author

Trade Finance Global (TFG) assists companies with raising debt finance. While we can access many traditional forms of finance, we specialise in alternative finance and complex funding solutions related to international trade. We help companies to raise finance in ways that is sometimes out of reach for mainstream lenders.

Our Insights

Assignment of Accounts Receivable – Trap for the Unwary

By Steven A. Jacobson

Most businesses are familiar with the mechanics of an assignment of accounts receivable. A party seeking capital assigns its accounts receivable to a financing or factoring company that advances that party a stipulated percentage of the face amount of the receivables.

The factoring company, in turn, sends a notice of assignment of accounts receivable to the party obligated to pay the factoring company’s assignee, i.e. the account debtor. While fairly straightforward, this three-party arrangement has one potential trap for account debtors.

Most account debtors know that once they receive a notice of assignment of accounts receivable, they are obligated to commence payments to the factoring company. Continued payments to the assignee do not relieve the account debtor from its obligation to pay the factoring company.

It is not uncommon for a notice of assignment of accounts receivable to contain seemingly innocuous and boilerplate language along the following lines:

Please make the proper notations on your ledger and acknowledge this letter and that invoices are not subject to any claims or defenses you may have against the assignee.

Typically, the notice of assignment of accounts receivable is directed to an accounting department and is signed, acknowledged and returned to the factoring company without consideration of the waiver of defenses languages.

Even though a party may have a valid defense to payment to its assignee, it still must pay the face amount of the receivable to the factoring company if it has signed a waiver. In many cases, this will result in a party paying twice – once to the factoring company and once to have, for example, shoddy workmanship repaired or defective goods replaced. Despite the harsh result caused by an oftentimes inadvertent waiver agreement, the Uniform Commercial Code validates these provisions with limited exceptions. Accordingly, some procedures should be put in place to require a review of any notice of assignment of accounts receivable to make sure that an account debtor preserves its rights and defenses.

- Announcement

Assignment of Accounts Receivable

The financial accounting term assignment of accounts receivable refers to the process whereby a company borrows cash from a lender, and uses the receivable as collateral on the loan. When accounts receivable is assigned, the terms of the agreement should be noted in the company's financial statements.

Explanation

In the normal course of business, customers are constantly making purchases on credit and remitting payments. Transferring receivables to another party allows companies to reduce the sales to cash revenue cycle time. Also known as pledging, assignment of accounts receivable is one of two ways companies dispose of receivables, the other being factoring.

The assignment process involves an agreement with a lending institution, and the creation of a promissory note that pledges a portion of the company's accounts receivable as collateral on the loan. If the company does not fulfill its obligation under the agreement, the lender has a right to collect the receivables. There are two ways this can be accomplished:

General Assignment : a portion of, or all, receivables owned by the company are pledged as collateral. The only transaction recorded by the company is a credit to cash and a debit to notes payable. If material, the terms of the agreement should also appear in the notes to the company's financial statements.

Specific Assignment : the lender and borrower enter into an agreement that identifies specific accounts to be used as collateral. The two parties will also outline who will attempt to collect the receivable, and whether or not the debtor will be notified.

In the case of specific assignment, if the company and lender agree the lending institution will collect the receivables, the debtor will be instructed to remit payment directly to the lender.

The journal entries for general assignments are fairly straightforward. In the example below, Company A records the receipt of a $100,000 loan collateralized using accounts receivable, and the creation of notes payable for $100,000.

|

| |

Cash | $100,000 | |

Notes Payable | $100,000 |

In specific assignments, the entries are more complex since the receivable includes accounts that are explicitly identified. In this case, Company A has pledged $200,000 of accounts in exchange for a loan of $100,000.

|

| |

Cash | $100,000 | |

Assigned Accounts Receivable | $200,000 | |

Notes Payable | $100,000 | |

Accounts Receivable | $200,000 |

Related Terms

Contributors

Moneyzine Editor

Double Entry Bookkeeping

learn bookkeeping online for free

Home > Accounts Receivable > Assignment of Accounts Receivable Journal Entries

Assignment of Accounts Receivable Journal Entries

The assignment of accounts receivable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable assignment.

The assignment of accounts receivable journal entries are based on the following information:

- Accounts receivable 50,000 on 45 days terms

- Assignment fee of 1% (500)

- Initial advance of 80% (40,000)

- Cash received from customers 6,000

- Interest on advances at 9%, outstanding on average for 40 days (40,000 x 9% x 40 / 365 = 395)

| Account | Debit | Credit |

|---|---|---|

| Accounts receivable | 50,000 | |

| Revenue | 50,000 |

| Account | Debit | Credit |

|---|---|---|

| Assigned accounts receivable | 50,000 | |

| Accounts receivable | 50,000 |

| Account | Debit | Credit |

|---|---|---|

| Cash (advance) | 39,500 | |

| Assignment fees | 500 | |

| Loan or Note Payable | 40,000 |

| Account | Debit | Credit |

|---|---|---|

| Cash | 6,000 | |

| Assigned accounts receivable | 6,000 |

| Account | Debit | Credit |

|---|---|---|

| Interest expense | 395 | |

| Loan or Note payable | 395 |

| Account | Debit | Credit |

|---|---|---|

| Cash | 6,395 | |

| Loan or Note payable | 6,395 |

About the Author

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

Accounts Receivable (AR)

What Is Accounts Receivable?

Accounts receivable (AR) are the amounts owed by customers for goods or services purchased on credit. The money owed to the company is called 'accounts receivable' and is tracked as an account in the general ledger , and then reported as a line on the balance sheet.

Where Do You Find Accounts Receivable?

Look for accounts receivable on the company’s balance sheet under the current assets category . Because accounts receivable converts to a cash payment at some time in the future, it will be listed as a current asset. Current assets are those that are expected to be paid within 12 months.

Who Uses Accounts Receivable?

Most businesses use accounts receivable to extend payment terms to their customers.

Businesses also examine their accounts receivable and the A/R turnover rate (described below) to understand how quickly and how well they are collecting payments due to them.

How to Calculate Accounts Receivable

To calculate accounts receivable, add up all of the company’s sales on net credit terms. Net terms may be represented as net 15, net 30, net 60, and so on. The number refers to the amount of time extended to the customer to pay the invoice. For example, “net 15” would mean that the customer must pay in full within 15 days.

Accounts Receivable Example

Let’s assume that an office supply company receives an order from a New York consulting firm for $1,000 in office supplies. The office supply company ships the order and extends net 60 credit terms to their customer.

Once the office supply company receives the order and sends the invoice, it decreases its inventory account by $1,000 and increases its accounts receivable by $1,000.

The consulting firm pays their invoice within 60 days. The office supply company now increases their cash by $1,000 and reduces its accounts receivable by $1,000.

What Is the Accounts Receivable Turnover Ratio?

The accounts receivable turnover ratio is used to assess how well a company collects payment from its customers.

Collecting accounts receivable on time is important because companies need cash to pay for their own operations. A high accounts receivable balance can lead to cash flow shortages for a company until it is able to collect on its debt. It may indicate that the company has a problem collecting its debts.

A/R turnover ratio is calculated as:

Where: Net credit sales = the total number of sales minus returns for a given period. Average accounts receivable = starting balance of A/R + ending balance of A/R for the period divided by 2.

Example of Accounts Receivable Turnover Ratio

Using the previous example of an office supply firm, let’s look at their A/R turnover ratio.

If the total number of sales for the office supply company for the quarter is $20,000 (with no returns), the net credit sales is $20,000. Assuming the starting A/R balance is $3,000 and the ending balance is $1,000, we get $4,000/2 = $2,000.

$20,000 = 10 $2,000

The A/R turnover ratio means that the company has collected its A/R 10 times that quarter. Comparing that figure to the A/R turnover ratio from other quarters can help management assess whether the company is improving its ability to collect on A/R – or whether it is having difficulty collecting.

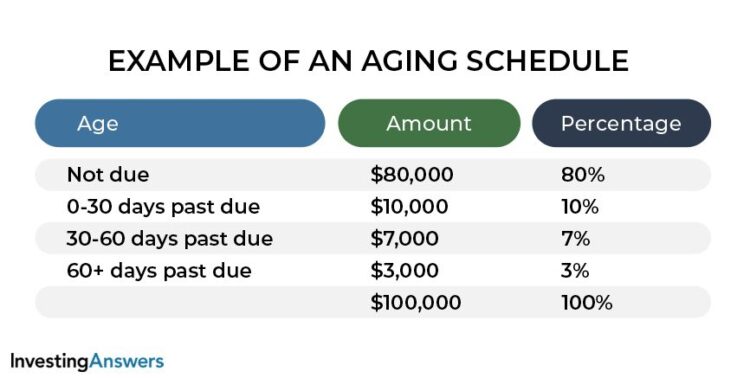

Aging Schedule for Accounts Receivable

An aging schedule for accounts receivable displays the amount of A/R owed by time period. It can help a company estimate how much A/R remains outstanding and predict cash flow. It can also be used to project “doubtful debt”, which is any debt that might be completely uncollectible in the future.

Companies can use past aging schedules to assess how much aging debt may need to be written off. They can review their history of collecting on debts at each stage of the aging schedule and then make an informed guess as to how much might become “bad” debt.

The Advantages and Disadvantages of Accounts Receivable

Using accounts receivable has several advantages:

- Using payment terms and invoicing customers is a standard business practice and is thus favorably received.

- It allows customers to receive goods and services on credit and pay according to terms.

- Businesses can sell more through payment terms.

It has some disadvantages, however:

- Companies may find it challenging to collect on open balances. They may need to send multiple reminders – or even send collection agencies – to collect on the debts owed to them.

- Cash flow may be tight during times when the company has many outstanding receivables.

Accounts Receivable vs. Accounts Payable

Accounts receivable is the money owed to a company. Accounts payable is money the company owes to others. An easy way to remember the difference: A/R is for “received” payment and A/P is for “paying others.” Receivables are classified as short-term assets, while payables are short term liabilities.

Accounts Receivable vs. Revenue

When looking at accounts receivable vs. revenue, it can help to consider how they fit into the whole accounting picture:

- A/R refers to the amount of money that customers owe to a company for the sale of goods or services. It appears as a line item under current assets on a company’s balance sheet.

- Revenue refers to all of the sales of a company. The revenue figure may include accounts receivable, but it will also include paid invoices, too. Revenue appears on the income statement.

Cash Basis Accounting vs. Accounts Receivable

Cash basis accounting does not recognize accounts receivable or payable. Instead, sales are recognized when they are made and paid, and the business pays for supplies immediately upon purchase and receipt.

Consider a small business owner who sells crafts at fairs and flea markets. He may pay in cash for his materials (e.g. paint, glue) and insists on cash payments. Cash basis accounting offers the simplest method for such a business owner to track sales and expenses.

Bad Debt vs. Accounts Receivable

Bad debt refers to accounts receivable that are unlikely to be collected. These occur when companies deliver goods on credit (net terms) and fail to collect payment.

Bad debt is expensed as a cost of doing business. It is frequently categorized under SG & A (sales and general administrative expenses) and leads to an offsetting reduction against accounts receivable on the balance sheet.

Related Articles

How Did Warren Buffett Get Rich? 4 Key Stocks to Follow

5 Money Moves That Made Warren Buffett Rich Warren Buffett is perhaps the most famous investor in the world, amassing a fortune of over $80 billion during his lifetime. His ...

How Sean Quinn Went from Billionaire to Bankruptcy

Sean Quinn was once the richest man in Ireland. In 2008, Forbes estimated Quinn's riches reached $6 billion. Today, however, he owes Anglo Irish Bank $2.7 billion and in ...

After A Huge Sell-Off, Here's Where The Market's Heading

A nearly 2% pullback for the S&P 500 shouldn’t be of much concern. The fact that index had risen for five straight months prior to the pullback suggests a bit of ...

- How to Profit from Real Estate Without Becoming a Landlord

- Robo Advisors - Here's Why 15+ Million People Have Already Opened Up Accounts

- Fundrise - 23% Returns Last Year from Real Estate - Get Started with Just $10

- Personal Capital - Our #1 Choice for Free Financial Planning Tools

- CrowdStreet - 18.5% Average IRR from Real Estate (Accredited Investors Only)

- Search Search Please fill out this field.

- What is AR Financing?

- Understanding AR Financing

Structuring

Underwriting, advantages and disadvantages.

- Corporate Finance

What Is Accounts Receivable Financing? Definition and Structuring

Investopedia / Candra Huff

What Is Accounts Receivable Financing?

Accounts receivable (AR) financing is a type of financing arrangement in which a company receives financing capital related to a portion of its accounts receivable. Accounts receivable financing agreements can be structured in multiple ways usually with the basis as either an asset sale or a loan.

Understanding Accounts Receivable Financing

Accounts receivable financing is an agreement that involves capital principal in relation to a company’s accounts receivables. Accounts receivable are assets equal to the outstanding balances of invoices billed to customers but not yet paid. Accounts receivables are reported on a company’s balance sheet as an asset, usually a current asset with invoice payment required within one year.

Accounts receivable are one type of liquid asset considered when identifying and calculating a company’s quick ratio which analyzes its most liquid assets:

Quick Ratio = (Cash Equivalents + Marketable Securities + Accounts Receivable Due within One Year) / Current Liabilities

As such, both internally and externally, accounts receivable are considered highly liquid assets which translate to theoretical value for lenders and financiers. Many companies may see accounts receivable as a burden since the assets are expected to be paid but require collections and can’t be converted to cash immediately. As such, the business of accounts receivable financing is rapidly evolving because of these liquidity and business issues. Moreover, external financiers have stepped in to meet this need.

The process of accounts receivable financing is often known as factoring and the companies that focus on it may be called factoring companies. The best factoring companies will usually focus substantially on the business of accounts receivable financing but factoring in general may be a product of any financier. Financiers may be willing to structure accounts receivable financing agreements in different ways with a variety of different potential provisions.

Key Takeaways

- Accounts receivable financing provides financing capital in relation to a portion of a company’s accounts receivable.

- Accounts receivable financing deals are usually structured as either asset sales or loans.

- Many accounts receivable financing companies link directly with a company’s accounts receivable records to provide fast and easy capital for accounts receivable balances.

Accounts receivable financing is becoming more common with the development and integrations of new technologies that help to link business accounts receivable records to accounts receivable financing platforms. In general, accounts receivable financing may be slightly easier for a business to obtain than other types of capital financing. This can be especially true for small businesses that easily meet accounts receivable financing criteria or for large businesses that can easily integrate technology solutions.

Overall, there are a few broad types of accounts receivable financing structures.

Asset Sales

Accounts receivable financing is typically structured as an asset sale. In this type of agreement, a company sells accounts receivable to a financier. This method can be similar to selling off portions of loans often done by banks.

A business receives capital as a cash asset replacing the value of the accounts receivable on the balance sheet. A business may also need to take a write-off for any unfinanced balances which would vary depending on the principal to value ratio agreed on in the deal.

Depending on the terms, a financier may pay up to 90% of the value of outstanding invoices. This type of financing may also be done by linking accounts receivable records with an accounts receivable financier. Most factoring company platforms are compatible with popular small business bookkeeping systems such as Quickbooks. Linking through technology helps to create convenience for a business, allowing them to potentially sell individual invoices as they are booked, receiving immediate capital from a factoring platform.

With asset sales, the financier takes over the accounts receivable invoices and takes responsibility for collections. In some cases, the financier may also provide cash debits retroactively if invoices are fully collected.

Most factoring companies will not be looking to buy defaulted receivables, rather focusing on short-term receivables. Overall, buying the assets from a company transfers the default risk associated with the accounts receivables to the financing company, which factoring companies seek to minimize.

In asset sale structuring, factoring companies make money on the principal to value spread. Factoring companies also charge fees which make factoring more profitable to the financier.

BlueVine is one of the leading factoring companies in the accounts receivable financing business. They offer several financing options related to accounts receivable including asset sales. The company can connect to multiple accounting software programs including QuickBooks, Xero, and Freshbooks. For asset sales, they pay approximately 90% of a receivables value and will pay the rest minus fees once an invoice has been paid in full.

Accounts receivable financing can also be structured as a loan agreement. Loans can be structured in various ways based on the financier. One of the biggest advantages of a loan is that accounts receivable are not sold. A company just gets an advance based on accounts receivable balances. Loans may be unsecured or secured with invoices as collateral. With an accounts receivable loan , a business must repay.

Companies like Fundbox , offer accounts receivable loans and lines of credit based on accounts receivable balances. If approved, Fundbox can advance 100% of an accounts receivable balance. A business must then repay the balance over time, usually with some interest and fees.

Accounts receivable lending companies also benefit from the advantage of system linking. Linking to a companies accounts receivable records through systems such as QuickBooks, Xero, and Freshbooks, can allow for immediate advances against individual invoices or management of line of credit limits overall.

Factoring companies take several elements into consideration when determining whether to onboard a company onto its factoring platform. Furthermore, the terms of each deal and how much is offered in relation to accounts receivable balances will vary.

Accounts receivables owed by large companies or corporations may be more valuable than invoices owed by small companies or individuals. Similarly, newer invoices are usually preferred over older invoices. Typically, the age of receivables will heavily influence the terms of a financing agreement with shorter term receivables leading to better terms and longer term or delinquent receivables potentially leading to lower financing amounts and lower principal to value ratios.

Accounts receivable financing allows companies to get instant access to cash without jumping through hoops or dealing with long waits associated with getting a business loan . When a company uses its accounts receivables for asset sales it does not have to worry about repayment schedules. When a company sells its accounts receivables it also does not have to worry about accounts receivable collections. When a company receives a factoring loan, it may be able to obtain 100% of the value immediately.

Although accounts receivable financing offers a number of diverse advantages, it also can carry a negative connotation. In particular, accounts receivable financing can cost more than financing through traditional lenders, especially for companies perceived to have poor credit. Businesses may lose money from the spread paid for accounts receivables in an asset sale. With a loan structure, the interest expense may be high or may be much more than discounts or default write-offs would amount to.

:max_bytes(150000):strip_icc():format(webp)/Investopedia_Factor_Final_Blue-1eaca17d9ba34c62a2dcc84521fd1597.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

In the realm of trade credit security, factoring, forfaiting, and assignment of receivables share a common thread – they all revolve around the utilization of receivables as financial instruments. However, it is crucial to recognize that while they may seem similar due to their reliance on receivables, they differ fundamentally in their use and application. Let's explore how these financial strategies, though linked by receivables, serve distinct purposes in the world of trade credit security.

Factoring and Forfaiting:

Factoring involves the sale of a business's accounts receivable to a specialized financial entity, known as a factor, at a discounted rate. The factor takes on the responsibility of collecting customer payments, offering rapid access to cash flow and bolstering liquidity.

Principal Difference: Transfer of Ownership

The fundamental distinction lies in the transfer of ownership. In factoring, the trade creditor relinquishes ownership of the accounts receivable to the factor. This means the factor or forfaiter becomes the new legal owner of the receivables and directly manages the collection process. The trade creditor essentially converts future payments into immediate capital.

Assignment of Receivables:

Assignment of receivables, on the other hand, is a process where the rights and benefits of a receivable are transferred from one party (assignor) to another (assignee). It serves as a tool for credit risk management, allowing businesses to transfer the risk of non-payment or default to the assignee while stabilizing cash flow.

Principal Difference: Retention of Ownership

In contrast to factoring, in the assignment of receivables, ownership of the receivables remains with the assignor. The assignee, while assuming responsibility for collecting payments, does not become the new legal owner of the receivables. Instead, they act on behalf of the assignor to ensure payment collection.

In essence, while both factoring and assignment of receivables offer solutions for managing credit risk and enhancing cash flow, their fundamental difference lies in the ownership structure. Factoring involves the sale and transfer of ownership of accounts receivable to a factor, while assignment of receivables retains ownership with the assignor, with the assignee acting as a collector.

Businesses evaluating these trade credit security options should carefully consider their preferences, goals, and impact on customer relationships to determine which approach best aligns with their financial strategies.

#credit #creditmanagement #creditrisk #creditworthiness #creditengineering

Law of Assignment of Receivables

– Vinod Kothari

– With edits/updates by Richa Saraf

[Updated as on 08th April, 2020]

Assignment of receivables out of transactions is growing astronomically; though without any numerical evidence, but one can say that the total volume of sale of loans and sale of receivables might be exceeding global trades in goods and services put together. Assignment or transfer of receivables is taking place for variety of purposes – securitisation, loan sales, originate-to-transfer transactions, security interest, transfer of servicing or collection function, sale of distressed loans to loan resolution companies, and so on.

While the global usage of assignment of receivables has become so common, the body of law that defines what can be assigned, what is the impact of restrictions on assignment, what happens upon assignment, etc., is still anchored in 19 th Century principles, and in most countries, there may not be a specific law dealing with assignments. This is a pity, given such clear laws dealing with sale of goods.

Before getting into the subject, just a bit of clarity on the jargon. Assignment of debt, assignment receivables, assignment of actionable claims, assignment of choses in action, assignment of things in action, transfer of receivables, sale of receivables, loan sales, etc are all terms that point to the same thing. This article is relevant for each of these. Assignment may lead to securitisation –this article does not deal with the law of securitisation.

Commercial risks in originate-to-transfer model:

This article is on the legal issues of assignment; however, as most assignments take place in context of loan trading or receivables acquisition business, it is important to mention some significant commercial risks of the originate-to-transfer model.

The subprime crisis of 2007-8 brought to focus the risks of what came to be known as the originate-to-distribute model. The word “distribute” pertains to securitisation transactions – a more generic word is “transfer”. There are plenty of commercial transactions today which are originated and sold by the originators to others. Banks/brokers originate loans and sell them; vendors originate leases and sell them; within the world of financial institutions, trading in loans takes place very commonly. Hence, it may sound highly anachronistic to talk of the risks of originate-to-distribute model, but then, some significant risks are as follows:

- The originator extracts the whole or substantially the whole of his equity in the transaction; therefore, originator does not have significant skin-in-the-game. In most cases, originators may also be putting the assets off the balance sheet – hence, originators may not have sufficient stakes, to be vigilant about the transaction.

- The originator’s business model may be non-compliant with several applicable laws. Hence, the assignee’s rights would be subjected to all such counterclaims that the originator would have faced.

- Since originator extracts equity upfront, originator may have business policies aimed at the short-term, compromising the long term.

- After all, the assignee acquires such rights as the originator has, in the originating agreement. Assignee would not have drafted/approved the origination agreement. Hence, if there are any deficiencies, gray areas or weaknesses in the origination agreement, the same will be inherited by the assignee as well.

- If the originator has made any promises, representations or other averments, at the time of doing the transaction, the assignee will be affected thereby. Sometimes, there may be correspondence, mail trails etc which may not have been disclosed to the assignee.

All this highlights the need for the assignee to be extra vigilant.

Meaning of assignment:

While the current level of commercial use of assignment has never been seen in the past, assignment of debt or contractual benefits has been there ever since law of contract has existed, and has almost been the same over the ages.

The word assignment is used in context of incorporeal, that it, intangible assets. Corporeal assets are transferred; incorporeal assets are assigned, as the physical dimension of transfer, meaning change of hands, is not applicable in case of intangible assets. As physical assets may be transferred either for sale, or security, or exchange, or gift, likewise, assignment of incorporeal assets may be done either for sale, or exchange, or gift, or pledge or creation of security interest. If it is a sale, gift or exchange, the assignment will be absolute; if it is merely by way of a security interest, it may be conditional or specific.

Assignment of contract or assignment of benefits under contract:

Users are quite often confused as to whether a contract is being assigned, or benefits under a contract are being assigned. A contract is a bunch of mutual rights and obligations. Assignment of a contract would mean assignee steps in the shoes of the assignor and assumes all the rights and obligations of the assignor. For example:

- X enters into a contract of sale with Y where X is the seller. The contract would obviously provides for rights and obligations of either party. X will have the obligation to deliver what he promised to sell, and to ensure that the subject matter adheres to such specifications, conditions and fitness as is either explicitly agreed upon or implied. X has the right to receive the price. Y has the obligation to pay the price, and the right to receive goods.

o Assignment of the benefits under the contract by X would mean the receivables under the contract, that is, the price for the goods, may be assigned to P.

o Assignment of the contract by X would mean P becomes the counterparty to the contract of sale, which is now a contract between P and Y.

- This is true for most contracts, as any contract would imply a bunch of mutual rights and obligations.

The general position in law is that a contract is assignable only with the consent of the counterparty. This is most logical, because holding otherwise would expose the counterparty to obligations of a party with whom it never dealt. Holding otherwise would land up Y in contract with P, who Y had never selected.

On the contrary, assignment of the benefit of contract, that is, rights arising out of contract, does not at all impact the counterparty, as the counterparty can still enforce his rights, that is, the assignor’s obligations, against the assignor. All assignor transfers is his rights. In the example above, if X transfers the receivable to P, there is no adverse implication for Y.

In Khardah Company Ltd v. Raymon & Co (India) Private Ltd. AIR 1962 SC 1810 [1] , the Constitution Bench laid out the principle as follows:

“An assignment of a contract might result by transfer either of the rights or of the obligations thereunder. But there is a well-recognised distinction between these two classes of assignments. As a rule obligations under a contract cannot be assigned except with the consent of the promisee, and when such consent is given, it is really a novation resulting in substitution of liabilities. On the other hand, rights under a contract are assignable unless the contract is personal in its nature or the rights are incapable of assignment either under the law or under an agreement between the parties.”

Similarly, in Indu Kakkar v. Haryana State Industrial Development Corporation Ltd. and Another (1999) 2 SCC 37 [2] , a two-judge Bench of the Apex Court held, in reliance upon Khardah Company (supra), that:

“Assignment by act of parties may cause assignment of rights or of liabilities under a contract. As a rule a party to a contract cannot transfer his liabilities under the contract without consent of the other party. This rule applies both at the Common Law and in Equity (vide para 337 of Halsbury’s Laws of England, Fourth Edition, Part 9). Where a contract involves mutual rights and obligations an assignee of a right cannot enforce that right without fulfilling the co- relative obligations.”

Even in a case of assignment of rights simpliciter , an assignment would necessarily require the consent of the other party to the contract if it is of a ‘personal nature’. This is elucidated by learned authors Pollock and Mulla in their commentary on The Indian Contract and Specific Relief Acts (R. Yashod Vardhan, and Chitra Narayan eds., 15 th edn., Vol. I) at page 730:

“A contract which is such that the promisor must perform it in person, viz. involving personal considerations or personal skill or qualifications (such as his credit), are by their nature not assignable. The benefit of contract is assignable in ‘cases where it can make no difference to the person on whom the obligation lies to which of two persons he is to discharge it.’ The contractual rights for the payment of money or to building work, for e.g., do not involve personal considerations.”

In Kapilaben vs Ashok Kumar Jayantilal Sheth (2019) [3] , the Supreme Court observed as follows:

“10. It is important to note that in the modern context where parties frequently enter into complex commercial transactions, it is perhaps not so convenient to pigeonhole contracts as being either ‘general’ or of ‘personal nature’ or as involving the assignment of purely ‘rights’ or ‘obligations’. It is possible that a contract may involve a bundle of mutual rights and obligations which are intertwined with each other. However, as this Court has held in Indu Kakkar (supra), the same rule as laid down in Khardah Company (supra) and as stated in Section 15(b) of the Specific Relief Act, may be applied to such contracts as well. Where the conferment of a right or benefit is contingent upon, or coupled with, the discharge of a burden or liability, such right or benefit cannot be transferred without the consent of the person to whom the co-extensive burden or liability is owed.

It further has to be seen whether conferment of benefits under a contract is based upon the specific assurance that the co- extensive obligations will be performed only by the parties to the contract and no other persons. It would be inequitable for a promisor to contract out his responsibility to a stranger if it is apparent that the promisee would not have accepted performance of the contract had it been offered by a third party. This is especially important in business relationships where the pre-existing goodwill between parties is often a significant factor influencing their decision to contract with each other. This principle is already enshrined in Section 40 of the Contract Act:

“40. Person by whom promise is to be performed.- If it appears from the nature of the case that it was the intention of the parties to any contract that any promise contained in it should be performed by the promisor himself, such promise must be performed by the promisor. In other cases, the promisor or his representative may employ a competent person to perform it.” It is clear from the above that the promisor ‘may employ a competent person’, or assign the contract to a third party as the case may be, to perform the promise only if the parties did not intend that the promisor himself must perform it. Hence in a case where the contract is of personal nature, the promisor must necessarily show that the promisee was agreeable to performance of the contract by a third person/assignee, so as to claim exemption from the condition specified in Section 40 of the Contract Act. If the promisee’s consent is not obtained, the assignee cannot seek specific performance of the contract. B. Application of the above principles to the present case.”

General rule on assignment of benefits under contract:

The general rule on assignment is:

- Assignment of a contract is permissible only with the consent of the counterparty;

- Assignment of rights of benefits under a contract is permissible without the consent of the counterparty.

If the assignment of the contract is done with the consent of the counterparty, that amounts to a novation- that is, partial re-writing of the terms of the original contract.

Exceptions to the assignability of benefits under a contract:

The rule that the benefits under a contract are assignable, is subject to some important exceptions:

- Contracts involving the credit, skill or personality of the assignor cannot be assigned. For example, a bank agrees to give a loan to X. X cannot assign the right to receive the loan to P, as the loan was based on the credit of X. Likewise, if a tailor agrees to stitch a suit for X, X cannot assign the right to have a suit stitched to Y.

- Contracts of personal service cannot be assigned. For example, if Y agrees to serve the office of X, X cannot assign the service contract to P.

- If the contract expressly prohibits the right of a party to assign his receivables or benefit under a contract, then such receivables/benefit are not assignable, or not assignable without the consent of the counterparty. There have been several rulings on the impact of prohibition under contract on assignability of benefits under, particularly, something a like a debt. More than a century ago, in Re Turcan (1888) 40 Ch.D.5 , it was held that if a life insurance policy was not assignable, it did not prevent the insured from declaring himself as a trustee for the assignee. In Barbados Trust Company Ltd Bank of Zambia and Anr [2007] EWCA Civ 148 [4] , the House of Lords held that a prohibition on assignment operates only between the assignor and the counterparty to the contract, and not between the assignor and assignee- hence, the contract to assign would still operate as equitable assignment.

Whether receivables can be assigned?

Section 3 of the Transfer of Property Act, 1882 (“ TP Act ”) defines ‘actionable claim’ as follows:

““actionable claim” means a claim to any debt, other than a debt secured by mortgage of immoveable property or by hypothecation or pledge of moveable property, or to any beneficial interest in moveable property not in the possession, either actual or constructive, of the claimant, which the Civil Courts recognise as affording grounds for relief, whether such debt or beneficial interest be existent, accruing, conditional or contingent”

Sections 130-137 of the TP Act contains provisions with regard to assignment of actionable claims and lays down the procedure for assignment of receivables. Section 130 of the TP Act states that:

“(1) The transfer of an actionable claim whether with or without consideration shall be effected only by the execution of an instrument in writing signed by the transferor or his duly authorised agent, shall be complete and effectual upon the execution of such instruments, and thereupon all the rights and remedies of the transferor, whether by way of damages or otherwise, shall vest in the transferee, whether such notice of the transfer as is hereinafter provided be given or not:

PROVIDED that every dealing with the debtor other actionable claim by the debtor or other person from or against whom the transferor would, but for such instrument of transfer as aforesaid, have been entitled to recover or enforce such debt or other actionable claim, shall (save where the debtor or other person is a party to the transfer or has received express notice thereof as hereinafter provided) be valid as against such transfer.

(2) The transferee of an actionable claim may, upon the execution of such instrument of transfer as aforesaid, sue or institute proceedings for the same in his own name without obtaining the transferor’s consent to such suit or proceeding and without making him a party thereto.”

So, the assignment of receivables shall be effected upon execution of an instrument and the transferee shall, on the strength of the instrument, attain lawful rights to recover the claims from the debtor in his own name without any reference to the transferor.

In the case Mulraj Khatau v. Vishwanath Vaidya (1913) 15 BOM LR 9 [5] , the Bombay High Court held that an assignment by a debtor when effectuated by a written instrument is governed by Section 130(1) of the TP Act and only thereafter all the rights and remedies are vested in the transferee [6] .

Therefore, it appears from the above, the receivables are assignable in accordance with the provisions of the TP Act.

Principles for assignment of receivables:

For a valid transfer of receivables, the following principles are generally accepted:a) The receivables must exists at the time of assignment;b) Receivables must be identifiable;c) Assignment of rights and not obligations;d) No contractual restriction on transfer;e) There must not be a right of set-off or claims against the assignor. As held by the Apex Court, in ICICI Bank Limited v. Official Liquidator of APS Star Industries Ltd. & Others [7] , “ rights under a contract are always assignable unless the contract is personal in its nature or unless the rights are incapable of assignment, either under the law or under an agreement between the parties. A benefit under the contract can always be assigned. That, there is, in law, a clear distinction between assignment of rights under a contract by a party who has performed his obligation thereunder and an assignment of a claim for compensation which one party has against the other for breach of contract.”

The benefits arising out of a contract are assignable from the assignor to the assignee, and in this context, the relevant case is Mulkerrins (formerly Woodward (FC)) v. Pricewaterhouse Coopers [2003] UKHL 41 [8] . The House of Lords held that, “ The general rule is that the benefit of a contract may be assigned to a third party without the consent of the other contracting party. If this is not desired, it is open to the parties to agree that the benefit of the contract shall not be assignable by one or either of them, either at all or without the consent of the other party.”

Assignment of future benefits under contract vs. assignment of benefits under future contracts:

A contract may give rise to benefits in future- for example, a contract of sale on credit creates a right to receive the sale price at the appointed time. This is an existing debt, though payable in future. There is no doubt as to the assignability of such debt.

A contract may also create future receivables, which either do not exist now, or are contingent, conditional or uncertain right now. For example, if a landlord has let out property to a tenant, the tenant will have rentals to pay in future, but as these rentals are based on continuing performance, they have not become unconditional or non-contingent right now. The rule on assignability of future debt is that future debt is also assignable, though such an assignment would operate when the receivable comes into existence. There is elaborate discussion on assignment of future debt in Vinod Kothari: Securitization: Financial Instrument of the Future .

However, as regards assignability of contracts in future, that is, contracts not yet entered into, it is highly speculative and contingent, and other than as a promise on the part of the assignor to assign benefits of such contracts as may be entered into in future, such an assignment has no relevance.

Assignment of receivables in case of pending litigation: Whether disputed receivables can be assigned?

Another major question that arises is that whether future debt or receivables is assignable. This question must be answered in affirmative keeping in mind the case law of Tailby v. Official Receiver [1888] 13 A.C. 523, in which it has been held that all future debts, properties and expectancies are assignable. In the case of Mc Dowell and Co. Ltd. v. District Registrar 2000 (3) ALD 199 [9] , the Andhra Pradesh High Court held that “the definition of actionable claim has been extended so as to include such equitable choses in action as debts or beneficial interest in moveable property whether existent, accruing, conditional or contingent.”

Rights of the assignee:

Rights of assignee are no better than those of the assignor, as the assignee steps into the shoes of the assignor. A very old text [ Alfred W. Bays American Commercial Law Series, 1920, sec 122] puts it as follows: “ The theory of contract being that it is a personal relationship between two or more persons who have chosen each other, assignment of rights thereunder, without the other party’s consent, is permitted, as we have seen, upon the theory that the contractual arrangement is not thereby disturbed. It follows from this, that such assignment cannot be permitted to increase the obligations of the other party thereunder. Therefore, the assignee will take the right as it actually exists, not as it may seem to be; and will take it subject to all adjustments and defenses to which the assignor would have been subject had there been no assignment ”. That is to say, the counterparty to the contract cannot be put to a disadvantage by virtue of an assignment, as assignment is merely a transfer of rights that the assignor had.

Assignment of receivables vs. sale of the asset:

Practitioners are sometimes not clear about assignment of receivables, versus sale of the asset from which receivables arise. Take, for instance, the case of a lease of an asset. Assignment of receivables would mean sale of the lease rentals, not the asset. In that case, the leased asset still remains the property of the assignor – that is, the assignor has retained the residual interest in the asset. However, it would be different if the lessor sells the asset that has been leased out.