BrandMentions Blog

BrandMentions Blog | BrandMentions Blog on Digital Marketing Tactics & Strategies

JOIN 72,558 SUBSCRIBERS

Grow your customer-focused business with our bi-weekly newsletter featuring tips from entrepreneurs and experts in customer service and support.

How to Do a Competitive Analysis | Case Study Included

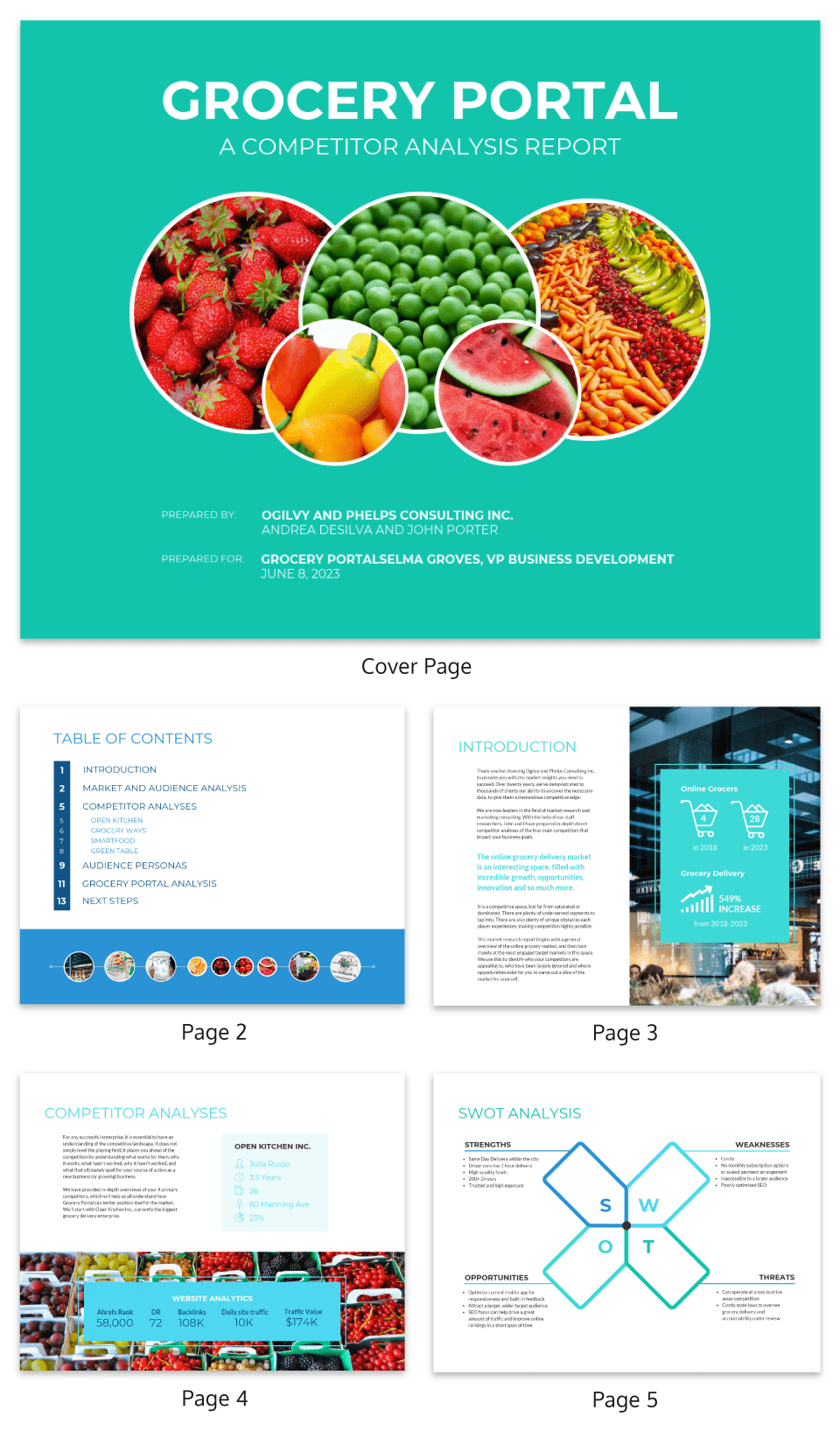

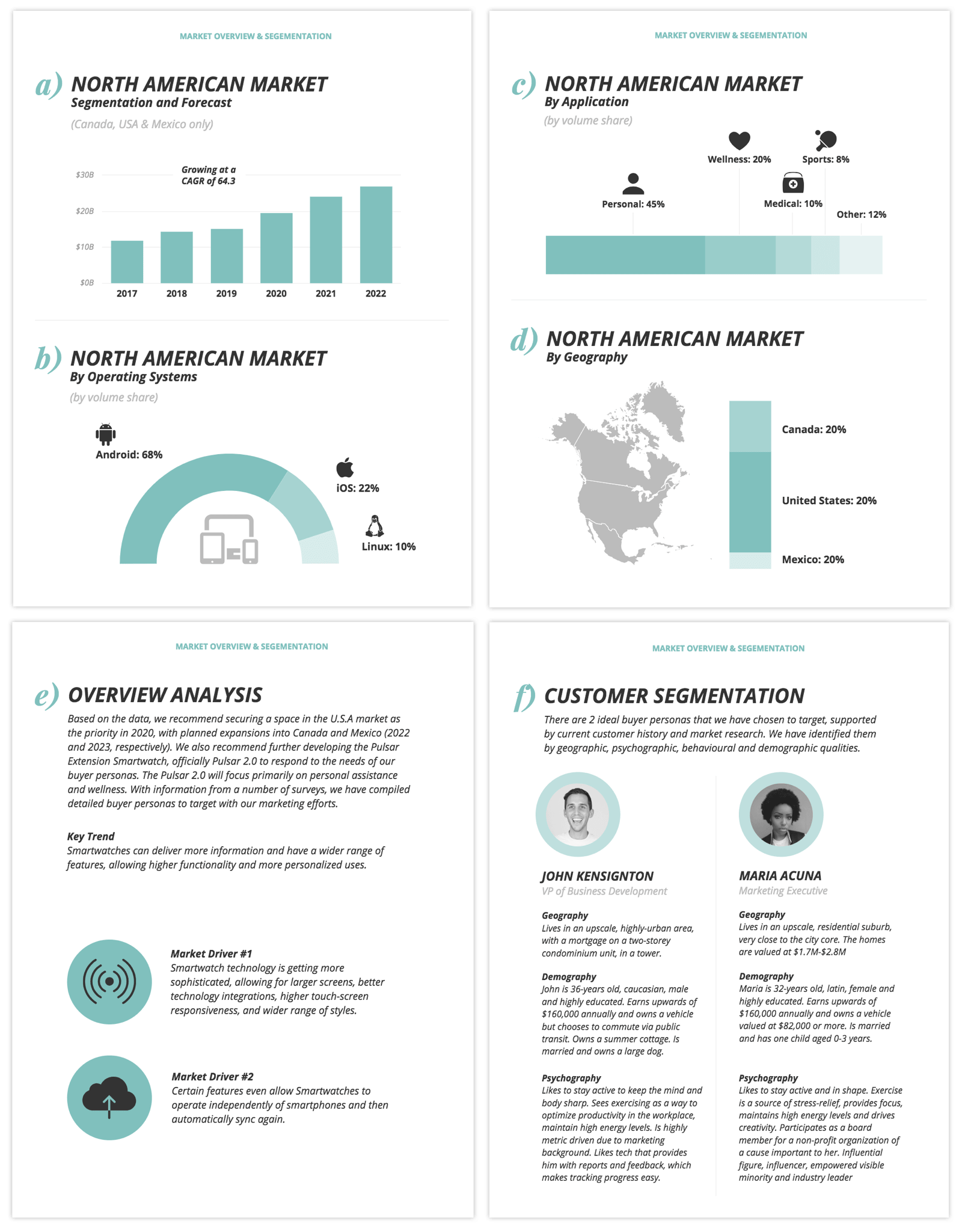

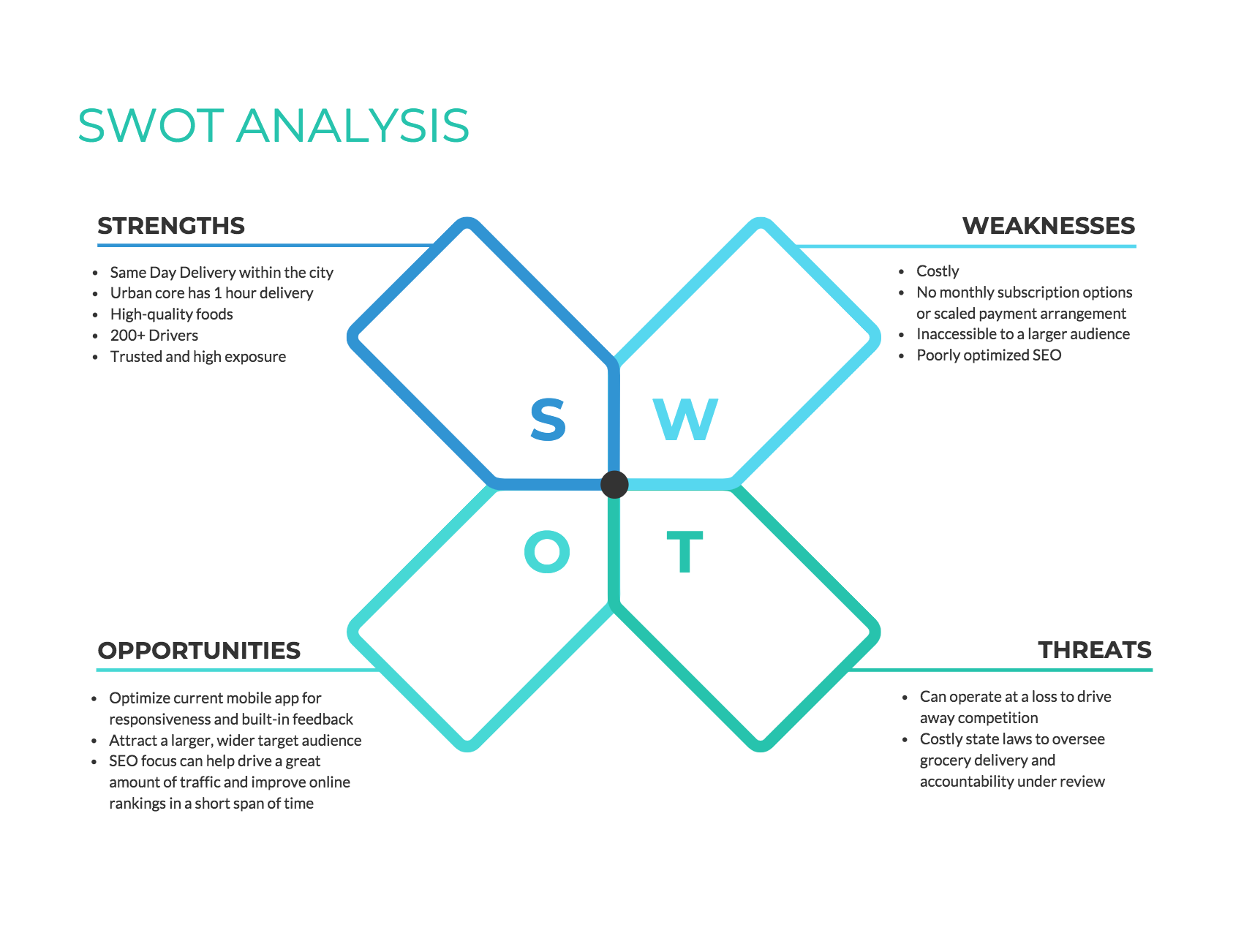

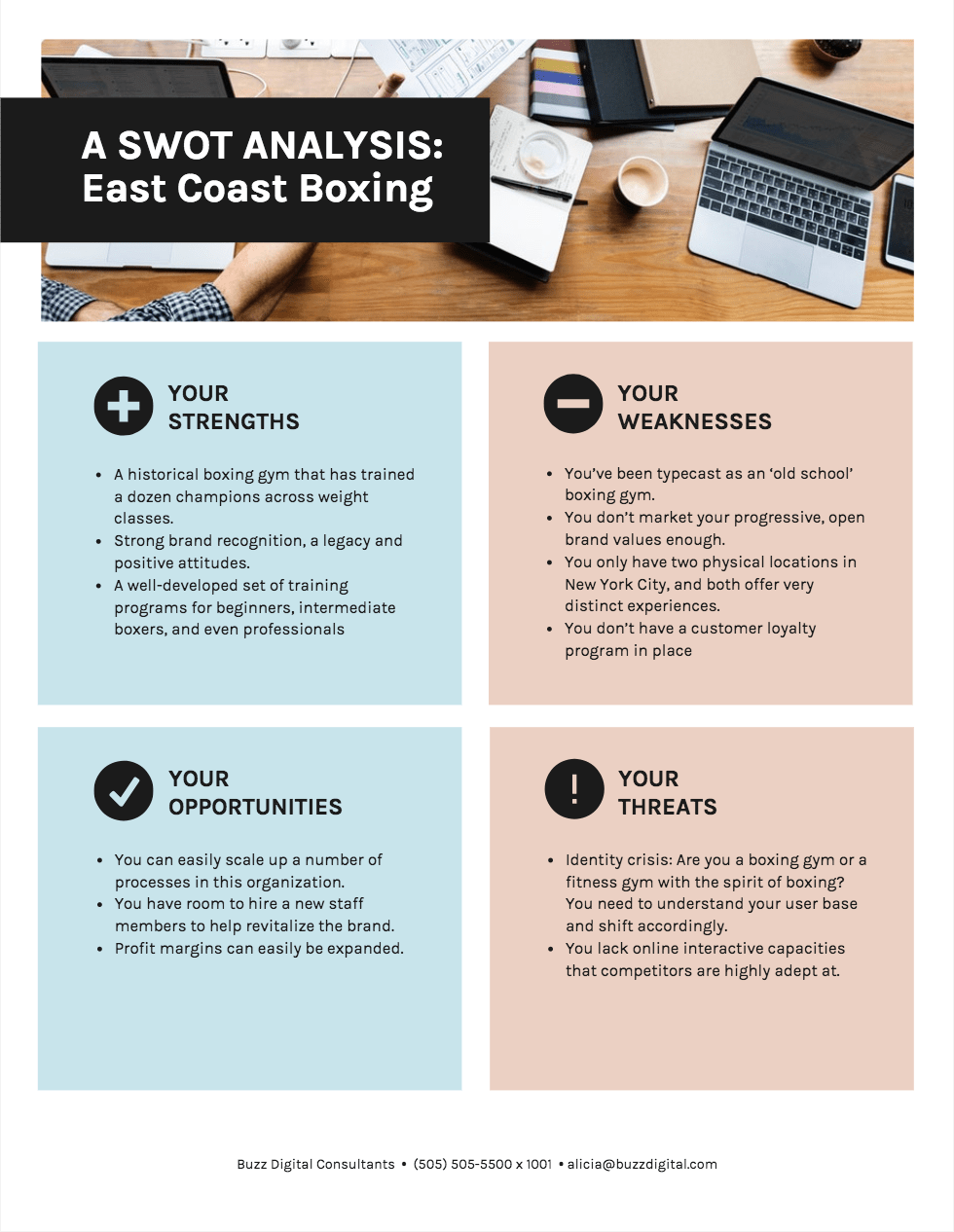

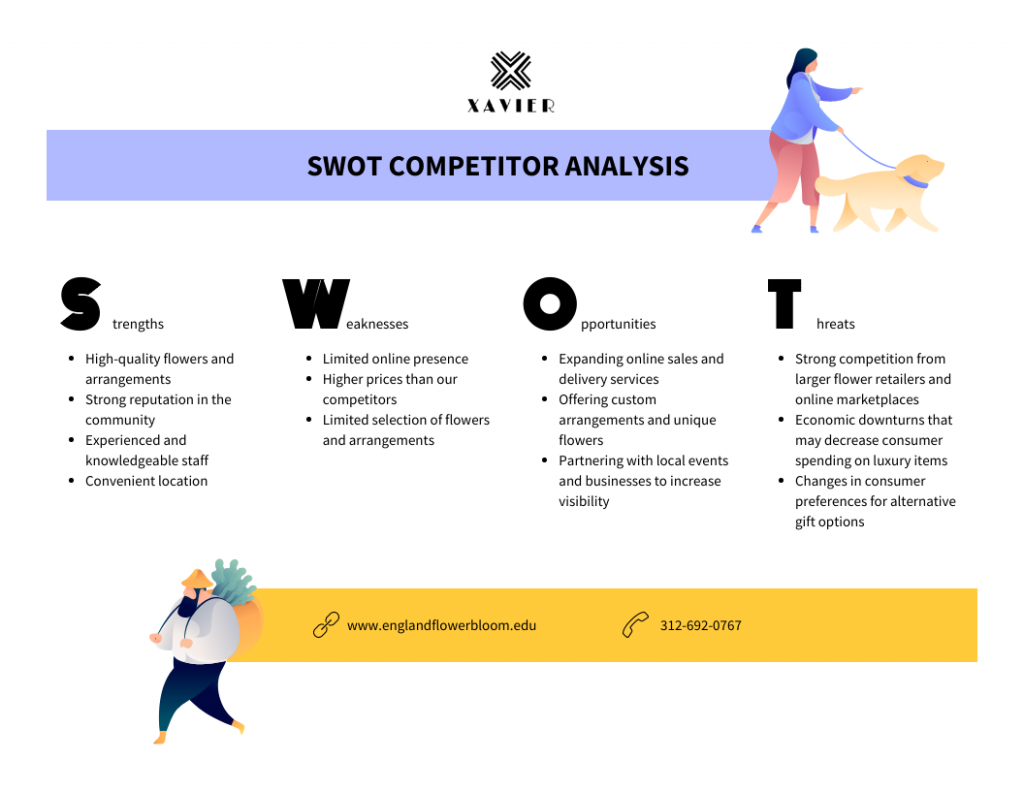

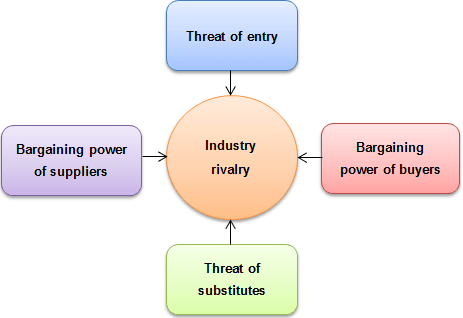

In order to be a leader in your industry, you need to know how to perform a competitive analysis. A competitor analysis is more than a simple SWOT analysis where you find the strength and weaknesses of your market segment. Evaluating your competitors is highly important and must be done through complete market research using an analysis template like the one that we're going to present in this article.

Finding out where your competition excels doesn't have to be a burden if you have the right strategy and necessary tools.

What Is a Competitor Analysis?

Why perform a competitor analysis, how to conduct your competitive analysis, step 1. find your top competitors, step 2. analyze your competitors popularity, step 3. identify the public perception of competitors, step 4. analyze your competitors' social media strategy, step 5. perform an seo competitor analysis.

Competitor analysis in digital marketing is the process of finding strengths and weaknesses of your competitors, relative to those of your own product or service.

There is no exact competitive analysis definition. Yet, you need to know that the strengths within a competitive analysis are the things that make you unique, your key selling point, the ideas around your whole business - which can be about the product or the team. On the opposite side, the weaknesses point out some deficiencies, and things you could improve, when it comes to your brand, or take advantage from, when it comes to the weaknesses of your competitors.

The competitive analysis has the role to make a valid and accurate market positioning and a report on what you are doing best, and where your competitors excel, and learn from that to win more potential customers. A competitive analysis also means picking the right competitors and looking at analytics that include business metrics, digital marketing analysis, social media metrics.

By doing an accurate competitor analysis you'll be able to receive a lot of data and insights for making better business decisions. Similar to an internal research, by evaluating quantitative and qualitative data, if you research your competitors, you will uncover effective strategies and new ideas for increasing your business' performance, be it on social media, on online, or in the physical store.

A well-performed competitor analysis will allow you to:

- Build your unique selling proposition (the statement that describes the benefit of your offer and how you solve your clients' needs).

- Bring business improvements regarding products and services, team management, customer care, delivery and many more.

- Discover new market segments.

- Prioritize goals and future development.

- Create products that are actually required and respond to customer's needs.

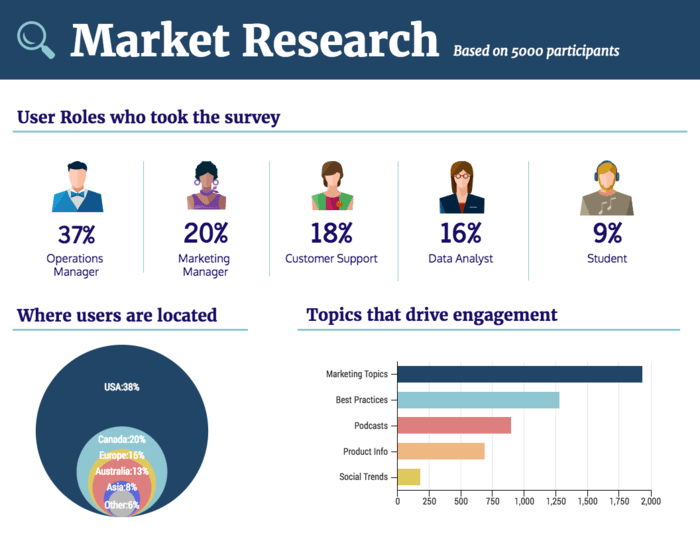

For a better understanding of how your competitor analysis framework should look like, we've performed a competitive market research on the cosmetic niche. We've analyzed several metrics on this market segment to conduct a competitive analysis as in-depth as possible, with most of the data being pulled out from brand mention monitoring.

Brand monitoring, when done with the right tools, is more versatile than you'd think. Running an in-depth brand mentions competitive analysis could help you make sure that you are not overlooking any efficient strategies that might be working wonders for your competitors.

They are talking about your company

Get instant access to brand mentions across social, news, blogs, videos and more. Get Free Report

Even though you might be aware of some of your market leaders, there might be a few you're missing.

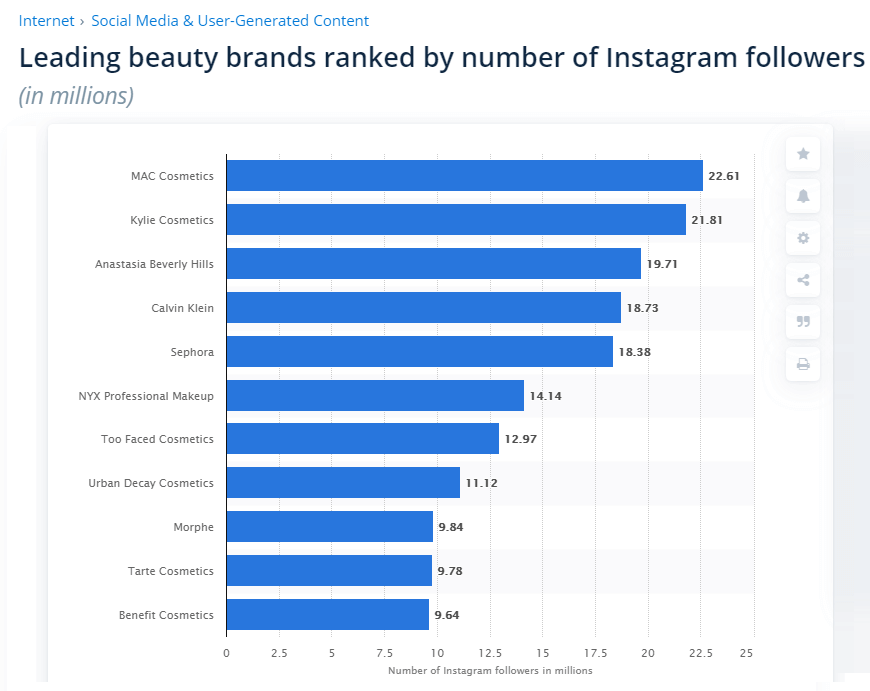

For our case study example, we searched for top leading beauty brands. As social media is a highly important segment within this industry, one of the analyses we've performed was to find the top-performing brands on social media, by the number of followers.

You can also search on Google for the relevant keywords in your business and see the top brands that are ranking for those keywords. And use a spying tool to find out important analytics on every website you want, such as the Mozbar browser extension.

Also, check out Social Media to figure out the businesses that pop out in results in your market. The research we performed helped us understand the niche a little better. Therefore, based on this research performed, we've chosen to continue our competitive analysis on the following brands:

- MAC cosmetics

- Kylie cosmetics

- Anastasia Beverly Hills

- Urban Decay

It’s too complicated and actually impossible to manually track all your competitors’ records and activity, as much manual web scraping you'd be doing.

So, even if you know your competition , the question remains: how do you find who is the most popular brand in your niche?

Most popular = most mentioned

Tools like BrandMentions can make things easier.

Therefore, to answer to our main question, "how to perform a competitive analysis", you need to start performing an in-depth research of your competition. Brand Mentions allows you to track keywords, brands, product names or whatever you need.

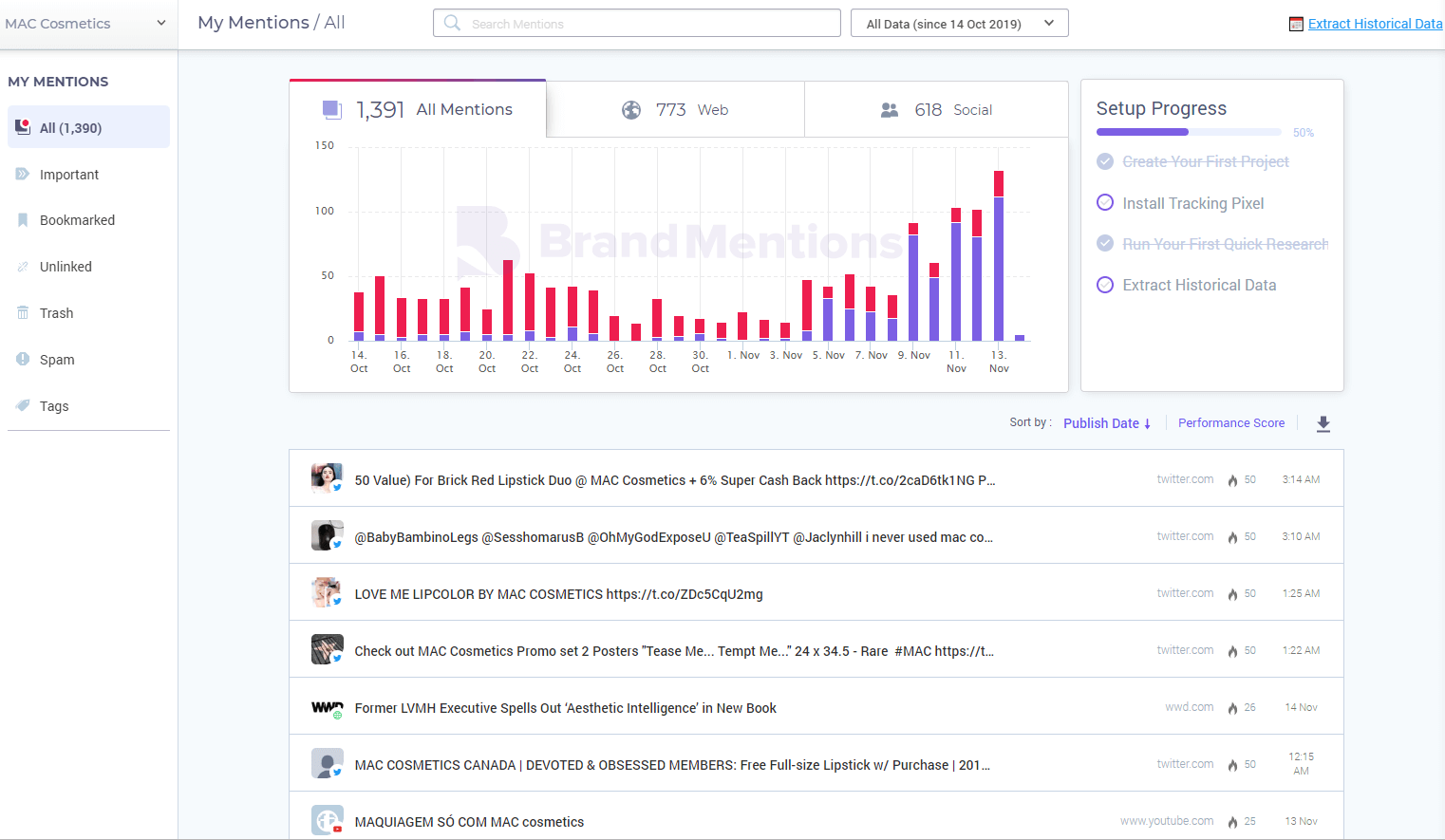

Going back to the beauty niche we are analyzing, let's figure out the most popular brands here. We took BrandMentions for a spin, to find out the most popular beauty brand into a very competitive niche by analyzing and monitoring social media metrics. We analyzed the mentions for these beauty brands for a short period of time, October 14 - November 15 , Worldwide for all languages.

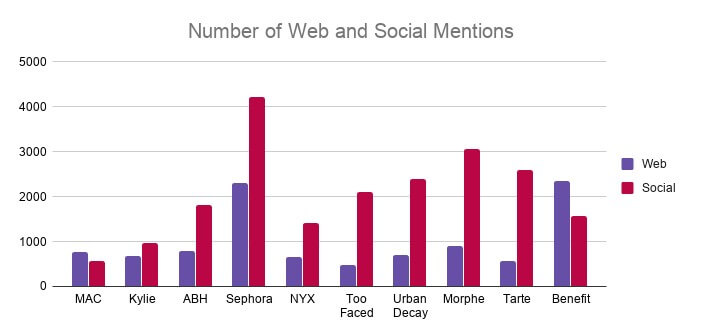

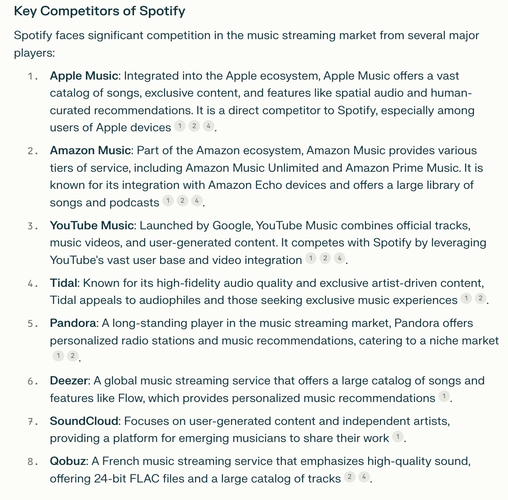

After analyzing the results, we saw that Sephora has some interesting discoveries. Compared to the rest of the beauty sites, Sephora has the highest number of mentions on web and social. In the printscreen below, we can see all mentions for each brand categorized by source (web and social).

By far, Sephora outranks the rest of beauty brands on the total amount of mentions on web and social.

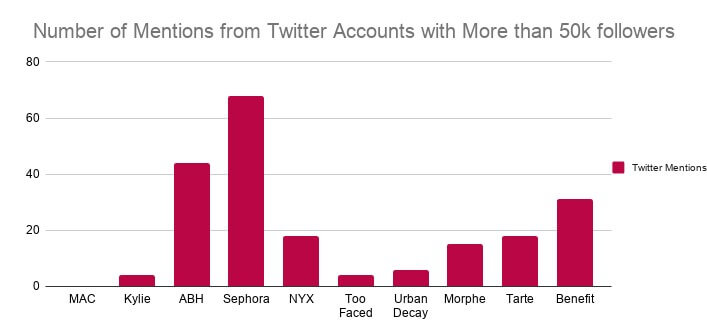

The number of mentions could be explained by the fact that Sephora has more influencers that talk about it on Twitter. Results showed that the brand is mentioned by influencers with over 50k followers on Twitter compared to other beauty brands.

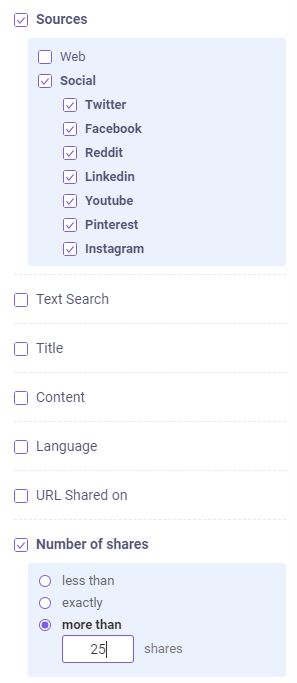

BrandMentions has a filter that allows you to filter mentions to see the Twitter posts from people that have a specific number of followers. The Twitter account for each brand was excluded.

Just by taking a look at your competitors and monitoring their brands, you can get a bunch of data:

- compare how often your competitors versus you post on social media

- what outlets mention them more than you

- how many mentions they have had in the last 24 hours

- how many shares their mentions have

- what languages are their mentions written in

- do they have mostly web or social mentions

And yes, all mentions matter, but some matter more than others.

When looking into your competitor’s yard, look at their best practices and try to figure out what worked best for them.

You must have heard at least once people saying that all publicity is good publicity, as long as they spell your name right. Or that the only thing worse than being talked about is not being talked about. But is it really so? How much does the public perception influence a brand's popularity? Let's find out!

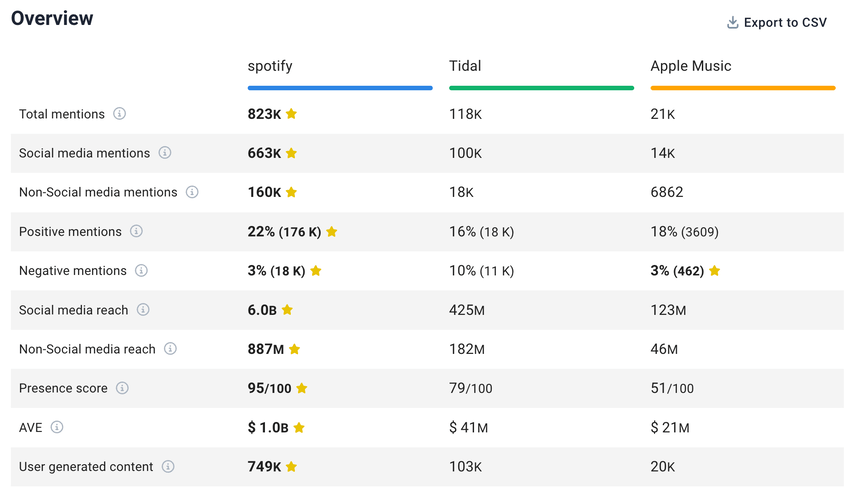

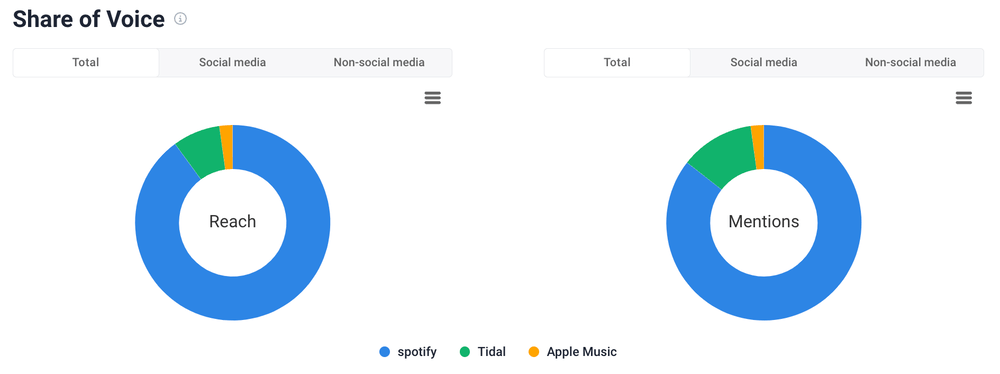

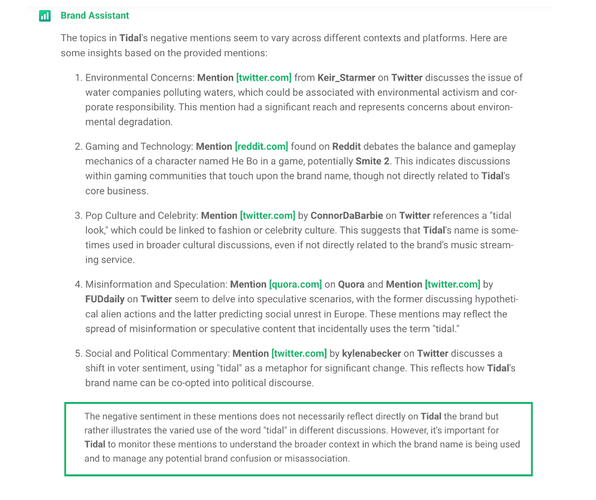

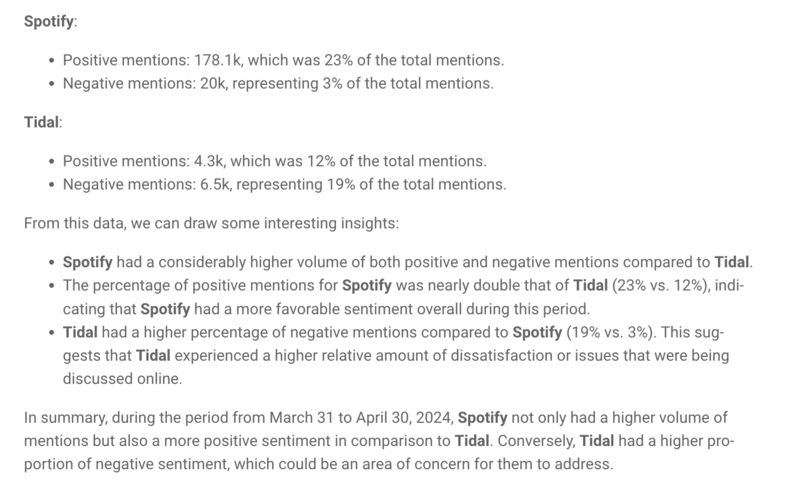

The Sentiment Analysis feature allowed us to have a better understanding on the public perception of the analyzed brands. If we first identified the competitors and looked for the most popular ones, now we can have a look at how they are perceived in the online world.

How did we do that exactly?

We monitored all brands with BrandMentions as we said before, and from all mentions we started to filter them out. Filters are a blessing in this situation, giving you full control over the segment of mentions that you want to analyze.

Trying to manually find all the negative brand mentions that interest you is like trying to find a needle in a haystack.

After analyzing the sentiment analysis for each individual beauty brand ,we came to realize that most of them share a higher positive experience with the users.

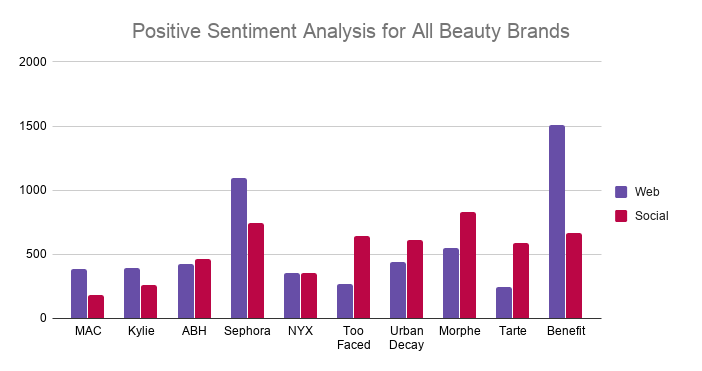

By looking at the data, for all brands or just some of them, we can draw lots of conclusions. For instance, comparing to other brands, Benefit has the highest number of web and social mentions that have a positive sentiment analysis. If we look at the next graph, we can easily see that Benefits stands out:

Another thing we can observe is the fact that Benefit has the highest number of web mentions with a positive sentiment, as well. But the brand that is leading the positive social mentions is Sephora.

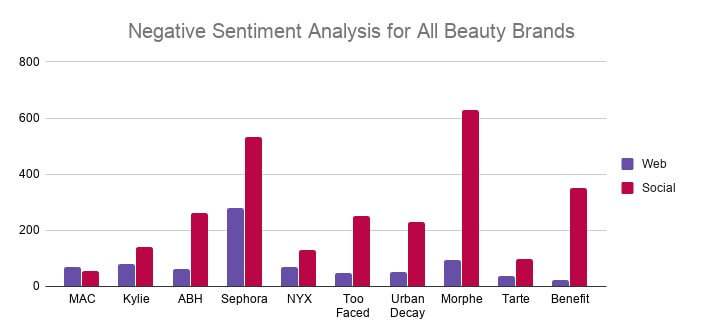

Even though Sephora has the highest number of positive social mentions, overall, compared to the rest of the beauty brands, it has the highest number of negative sentiment. Which might be a downsize for the brand.

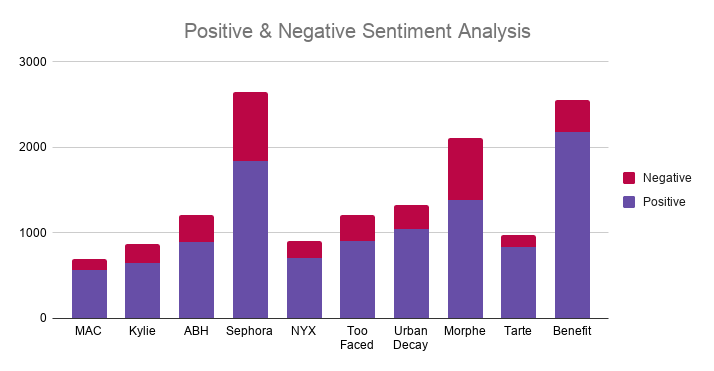

Below you can see a comparison with the other cosmetics brand on positive and negative sentiment analysis.

We can see that most of the mentions are from social media and more specifically, from Twitter. The connection with the previous results might be stronger. Often time it has happened that people are more driven to write online about a negative experience, rather than a positive one.

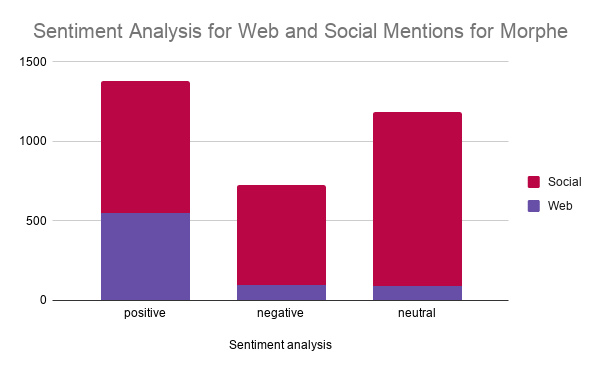

We saw that the negative sentiment had the lowest value compared with the positive and neutral sentiment, with a single exception. Morphe had a higher neutral sentiment than the negative one. Check out the graphic below:

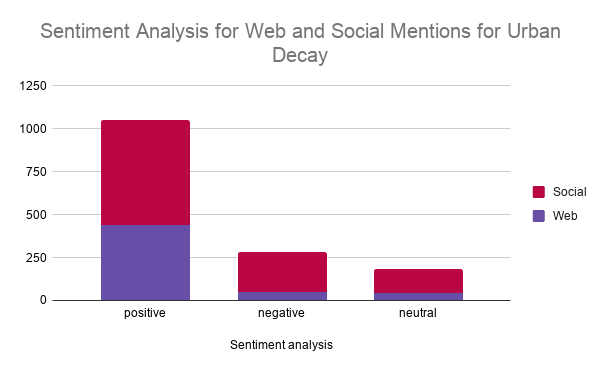

Urban Decay has the most naturally ordered distribution of the sentiment analysis for the mentions analyzed on web and social.

We are not saying that bad publicity couldn't be good publicity for some businesses or individuals. But for most businesses and niches, bad publicity and negative brand mentions are never a reason for joy but an occasion for a crisis communication meeting.

Another interesting thing to observe in the graph above is that Morphe has the highest negative sentiment analysis on social media.

People love it the most, but they also hate is the most, compared to the rest of the brands. If we look particularly at the brand to evaluate the total number of positive vs. negative sentiments, we can see that in the end, a positive experience overcomes the negative one, in terms of absolute numbers.

We've previously talked about Morphe saying that it has a higher number of neutral sentiments, the only brand with this particularity. We can understand that people have mixed feelings when it comes to this brand: You either love it or hate it.

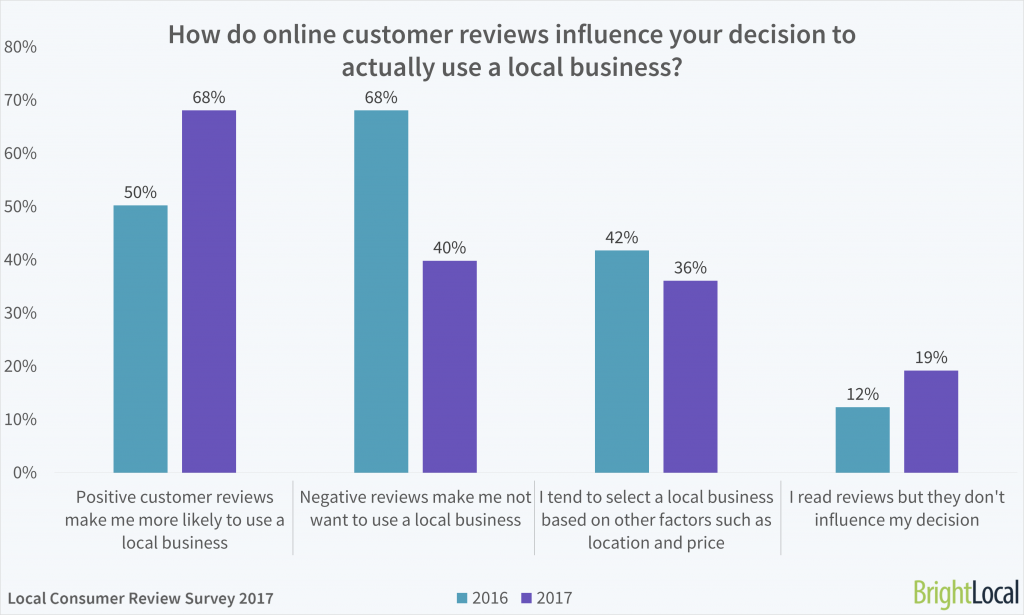

Both positive and negative mentions have a big impact on the purchase decision of a client.

Although it might sound bad to spy on your competition , this marketing technique is a fully transparent, popular, and white-hat one. How else would we all improve ourselves and our brands if we were to not compare our endeavors with the others? And this is where a brand monitoring tool comes to rescue us.

When doing competitor spying, we are actually building PR relationships.

Both directly and indirectly.

Directly by getting to know your common audience better (the one your competition shares with you) through your competitors’ eyes, win ties with important outlets in the industry, etc.

In addition, while keeping “your enemies” closer, you indirectly relate to and establish a relationship with them. By constantly trying to keep up the pace with or outrun the brightest ones in the niche, and struggling not to ever fall in the pitfalls of black-hat marketing techniques other companies deploy in their strategies, you simply get better and better. In other words, you widen your professional circle.

Competitor spying is the more polite version of eavesdropping. There's no harm in doing it as long as you're using the tools to improve yourself and not disrupt the other.

You can easily gain insights on your competitors' performance and dig into their success strategies and use the lessons to your own benefit.

Tracking mentions for your competitor can lead you into discovering social media campaigns, new content ideas, top-performing social channel alongside types of content shared on each platform, plus trending hashtags used and top influencers for each competitor.

For instance, in our case, in the beauty niche, the results might surprise you. If you thought Instagram would be the most used Social Media platform for beauty products, you might be wrong.

According to the analysis performed in BrandMentions, it turned out that Twitter has the highest number of mentions for every beauty brand compared to the other social media marketing platforms.

If you thought that Instagram was the king of the beauty industry, you are wrong.

Of course, Instagram is a powerful Social Media channel, but maybe there's more in that direction. There are some insights related to this social platform, nonetheless. We know that Facebook became stricter about sharing data with third parties, so we can't see private posts. Instagram has shifted the strategy in this direction as well. Instagram started to hide likes in select countries earlier this year, and it will soon do the same in the United States.

This method affects the way we see data, on top of the fact that there are lots of users with private user accounts where even if you have an account you can't see their posts, likes, and stories.

After analyzing all the social mentions for all the beauty brands on all social platforms, here's what we discovered:

- Twitter is the Social Media Platform with the highest number of mentions.

- Twitter is the Social Media Platform with the highest number of mentions with positive sentiment analysis.

It seems that Twitter is a great way to start an influencer marketing strategy; it is also the most popular social media site. Finding all the information will help all marketers, brand managers, and community managers to build the best social media strategies for beauty brands.

When we looked at the distribution of web and social mentions for the beauty brands, we discovered 2 categories:

- more web mentions: MAC and Benefit

- more social mentions: Kylie cosmetics, Anastasia Beverly Hills, Sephora, NYX, Too Faced, Urban Decay, Morphe and Tarte.

It's obvious that social is the king here. We won't bother you with tons of charts and data on all the analysed brands, yet, you need to know that within Brand Mentions you can perform any type of analysis you want when it comes to social mention analysis.

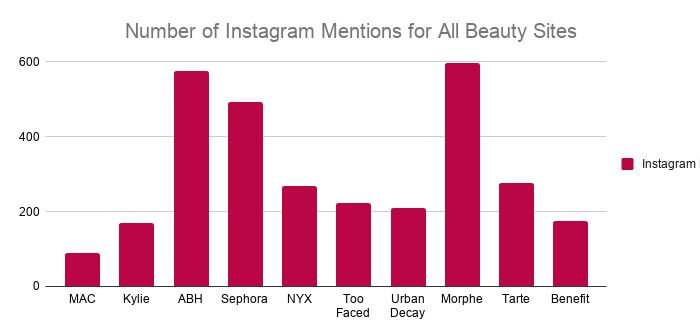

If we analyze one of the competitors, Morphe, we can see that it is more popular on Instagram by the number of mentions. It is seconded by a small number by Anastasia Beverly Hills.

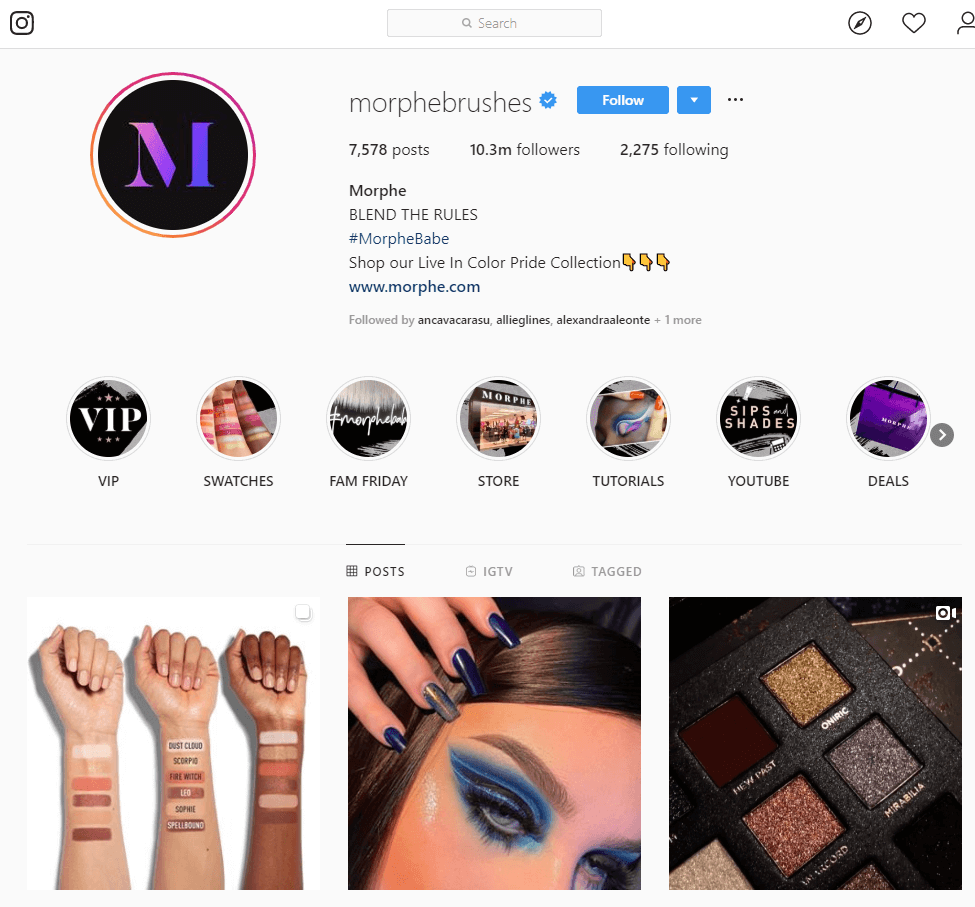

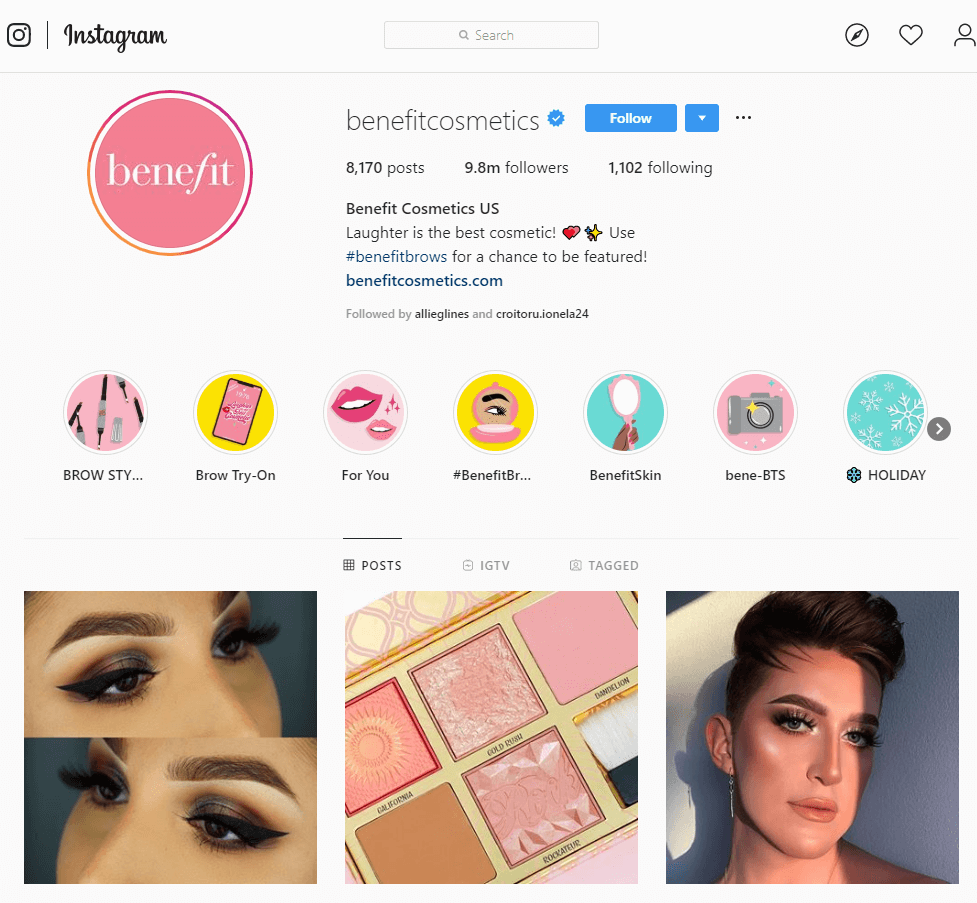

Morphe has lots of mentions on Instagram, but it is on the 8th place when it comes to Instagram followers with 10.3m.

When it comes to answering the question on how to do a competitive analysis we know that what matter most are the insights you get to find out. And here are some great insights we've extracted for the most popular social media beauty sites scrutinized within our competitive analysis:

1. For the MAC Brand:

- MAC has the highest number of influencers on Instagram.

- MAC doesn't have influencers of people with more than 50k followers that mention the brand on Twitter.

- MAC is the least popular on the web and social media judging by the number of mentions.

2. For the Sephora Brand:

- Sephora is one of the most popular beauty brands on social media and the whole web compared to the rest of the brands by the number of mentions.

- Sephora is mentioned by influencers and people with more than 50k followers on Twitter.

3. For the Morhphe Brand:

- Morphe shares a positive experience on social media compared to the rest of the beauty brand. It has the highest number of social mentions with a positive sentiment.

- But it also shares the highest value of negative emotions on social.

- Morphe is the top beauty brand on Instagram by the number of mentions compared to the rest of the brands.

4. For the Benefit Brand:

- Benefit is on the 10th place by the number of followers on Instagram with 9.8m (see printscreen below), the last place compared to the rest of the brands.

- Benefit offers a higher positive experience by analyzing sentiment analysis for the whole web and social mentions.

After analyzing all the mentions for all the beauty brands, there are lots of insights to help you create social media marketing strategies and find out the top competitors in your niche.

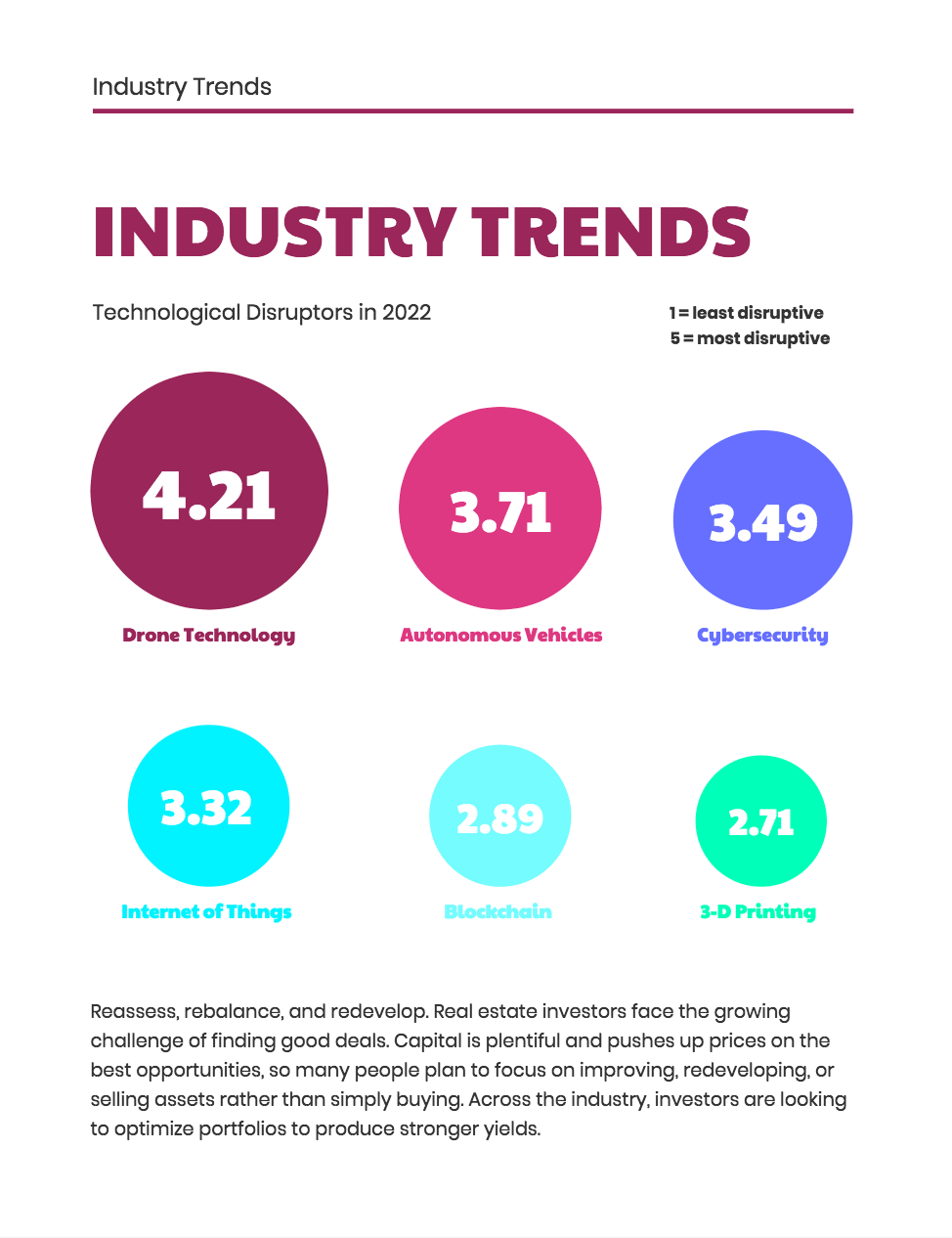

Knowing how to analyze your SEO competition is an important step in determining your overall keyword and SEO strategy. There are many factors involved in the process, and without the correct framework, it can get complicated. Here you can find the steps for the SEO competitor analysis explained, as clear and simple as possible. Within the screenshot below you can see the main steps that you need to take to make sure you perform an SEO competitive analysis at the highest level.

What Tools We Used to Do The Competitive Analysis

We used BrandMentions to analyze the beauty content and all the mentions for each beauty brand : MAC cosmetics, Kylie cosmetics, Anastasia Beverly Hills, Sephora, NYX, Too Faced, Urban Decay, Morphe, Tarte, Benefit.

Each created project had the name of the brand, and we added the keywords, domain URL, Facebook and Twitter account for higher accuracy in finding relevant mentions. We let the tool do its magic and analyze the beauty content on social media and the web.

For the metrics and discoveries made, we used filters and features available in BrandMentions, such as Sentiment Analysis analyzer, web and social sources, mentions from Twitter accounts with a specific number of followers and more. Check out the data for designing your winning social media strategy.

Also, the trigger was when we found a research on Statista with most followed cosmetics brands on Instagram; so we thought of performing a deeper analysis on the topic, and finding the most popular beauty site on Social Media, not only on Instagram. We wanted to see if there more we needed to know. And yes, there was so much more.

For an effective competitive research, there are multiple things that need to be taken into consideration, beside web and social listening. Things like brand awareness , customer experience, target audience, the search engines you are interested in, target market, the service or product features, the competitors sales, etc. This is not a complete guide to obtain competitive advantages that applies for all. But a competitor analysis template that helps you best identify your competitors and your main competitor strengths and weaknesses.

The best time to start finding out information about your competitors is now. So even if you are a content marketer, a small online store owner or a big ecommerce business , an online marketing specialist or you're in the sales teams, you need to start digging into competitive intelligence.

5 Famous Business Competitor Case Studies Of All Time

Look at any good or famous business competitor case study examples, and one thing immediately becomes clear:

Done well, this approach to competitive analysis can help you identify your competitor’s strengths and weaknesses and your own, all while determining those crucial gaps in the market that represent a golden opportunity for your brand.

However, doing not so well and a competitor case study can soon balloon into an overwhelming waste of time which may provide you with a tonne of data on your competition yet offers no real insight on how to use that data to gain a competitive advantage.

To help ensure yours is done well, I’ve put together this comprehensive guide to doing competitive analysis the right way, outlining not only what to look for when analyzing your competition but how to take what you find and put it to work for your business.

What is a Business Competitor Case Study and Why Do You Need One?

Typically, when we think of a business case study, we think of the traditional “Here’s how a business came with a solution to a particular problem.”

For example, there’s a famous case study focusing on the multi-national coffee supply chain Starbucks . After “hitting a wall” in their sales and revenue, the brand found a solution by closing down a significant number of their stores and “reinvigorating” their branding, essentially focussing on quality over quantity.

Other businesses can learn from the Starbucks case study and those like them and, where appropriate, apply what worked to their own brand.

A business competitor case study operates similarly, albeit with some notable differences. In this case, the problem doesn’t belong to another business but your own.

That problem or challenge could be:

- How do we increase our revenues and/or revenue streams?

- How do we re-engage with lapsed/former customers?

- How do we increase our ROI in social media or digital marketing?

- How do we increase our market share?

Or it could be any number of other challenges.

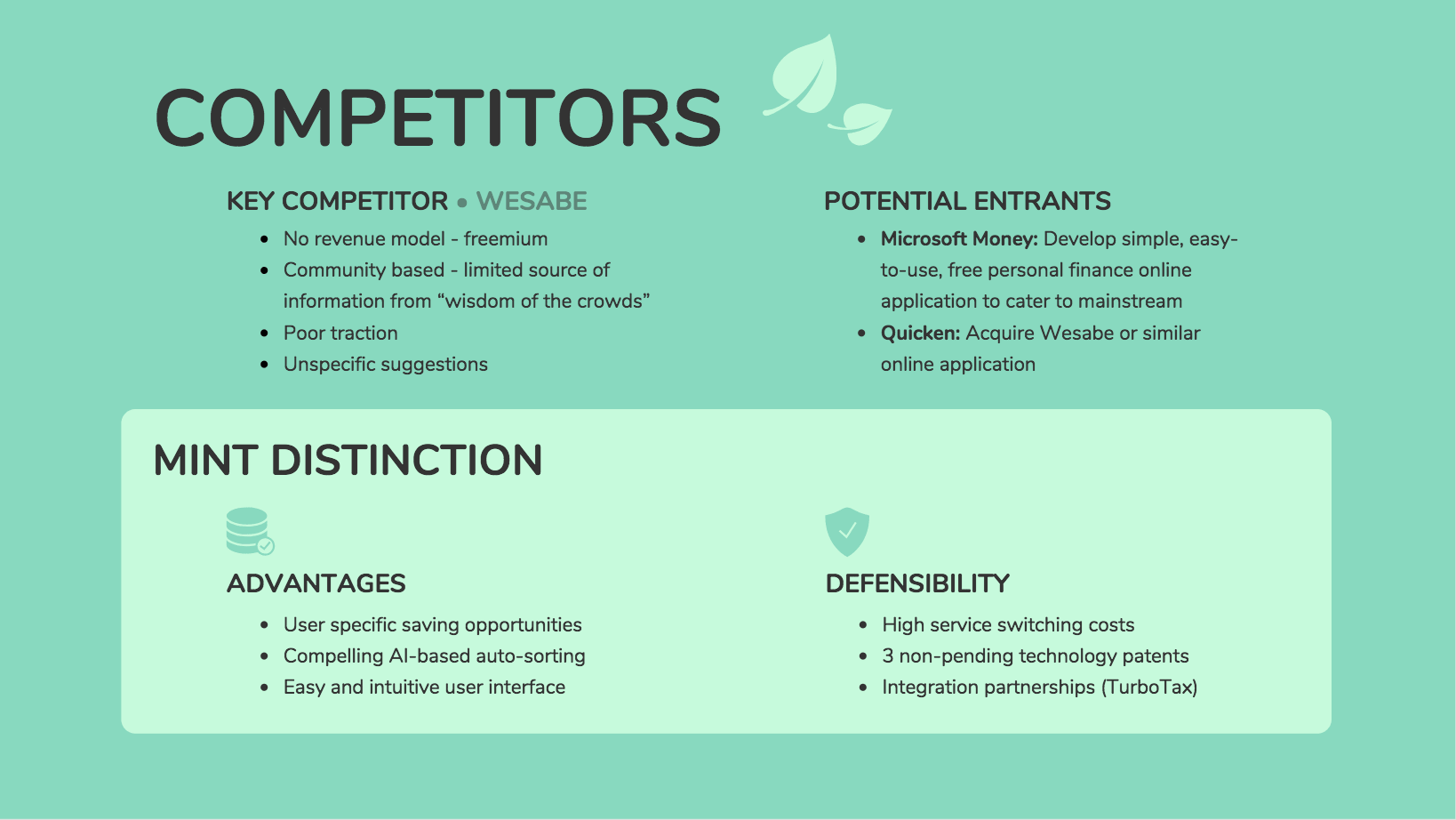

Whatever the case may be, carrying out this kind of competitive analysis helps you find the solution by looking at your main competition. If growing your market share is your main priority, identifying a weakness that your competitor has can help you develop new ideas on how you can offer customers something they’re simply not getting from that competitor.

If your digital marketing is leaving a lot to be desired, surveying the landscape to see where you’re falling behind can help you pinpoint precisely where you’re going wrong.

What’s more, making effective use of this competitive intelligence can help you to identify changes in both your audience and the industry as a whole, highlighting trends you can capitalize on, new audiences you could potentially target, or simply new ways to reach and engage with your existing target audience.

5 Famous Business Competitor Case Study Examples

1. the army crew team.

The Army Crew Team is an all-time classic business competitor case study that has a lot to teach us about how we work as a team. The coach of West Point’s varsity Army Crew team took his eight top individual rowers and placed them together in one boat. In a second boat, he placed his eight second-tier rowers.

The team in the second boat consistently beat the team in the first boat, despite the first boat consisting of better performing individual rowers. The case study shows that, collectively, a team can be more than the sum of its individual parts and that there’s more to getting great work out of a team than simply gathering together your star performers.

For businesses looking at the best ways to get the most out of their teams, this is an essential case study to look at.

See also: Twitter Competitors Analysis

2. Malden Mills

Two weeks before Christmas 1995, the Malden Mills factory burned to the ground.

Employees feared and assumed that they’d be unemployed until the factory was rebuilt, but the company’s CEO, Aaron Feuerstein, invested $25 million of company money to ensure those employees would still have a wage and benefits while the factory was rebuilt.

In one regard, this worked out well. When the factory reopened, the employees who had been well taken care of worked harder than ever. Productivity was at an all-time high and business boomed. In another regard, the cost of paying for the factory rebuild as well as taking care of employees landed Malden Mills in bankruptcy court three times.

This famous case study is used time and time again to present an argument for the pros and cons of philanthropy and making difficult decisions regarding employee satisfaction.

3. Apple Inc.

For the longest time, Apple was known as “Apple Computers” a name that perfectly summed up their focus on the personal computer market. In 2007, however, they dropped the “computers” part and simply became “Apple Inc.” This was more than just a name change for the company, it was part of an entire rebranding a shift in focus from personal computers to iPods, iPhones, iPads, and the like.

It was a strategy that paid off for them. Apple was already a well-known company beforehand, but after their “rebirth” in 2007, they truly became not only a household name but one of the most successful and profitable businesses of all time.

This famous case study is used a lot to demonstrate the benefits of taking the company in an entirely different direction rather than trying to compete in an already overcrowded market.

The ‘ Cadbury Ethical Dilema ‘ is a popular case study that is frequently presented to MBA students taking part in business case study competitions. Chocolate manufacturers Cadbury had prided themselves on their strong values and fair ethical practices. So it came as a huge blow to the brand when it was discovered that child labor was being used to produce cocoa on Côte d’Ivoire cocoa farms.

The House of Representatives passed legislation in the US which meant that companies who could prove their chocolate was produced without forced labor could print “slave-labor free” labels on their chocolate.

Naturally, this would paint companies who couldn’t prove that in a bad light, so the industry as a whole asked for time to essentially clean up its act. When the agreed deadline for doing so came to an end, Cadbury were left with a dilemma – did they continue to stall for time or did they find another way to ensure ethical management of their supply chain?

This case study remains famous for pointing out the difficulties in managing ethical practices and is well worth looking at for considering the impact that the practices of others in your supply chain can have on your business.

5. Coffee 2016

Another well-known case study that should be familiar to anyone who ever competed in a business case study competition in the last few years. Student teams were asked to come up with ideas for improving the returns generated by everyone involved in the production and consumption of coffee from the grower right through to the consumer.

The case was famous as it has so much to teach businesses and business students alike about marketing practices and supply chain logistics.

How to Create a Business Competitor Case Study

So, that takes care of the what and the why, but what about the how? Below, you’ll find a simple nine-step process to help you get the ball rolling with your own competitor analysis.

1. Determine Which Products/Services to Evaluate

If your business offers more than one product or service, you may find that analyzing your competitors becomes much less of a headache when you focus on just one of them or at least one type. For example, if you make sports clothing, you may choose to focus on your competition in the running gear market or concentrate on developing a strategy to increase revenues from your line of sports shoes.

If you’re a digital marketing agency, you might want to narrow down your competitive research to just Search Engine Optimization or how you can improve the service you offer to a web design client.

That’s not to say that you can’t research more than one aspect of your business, but doing so may mean that you end up producing data that isn’t always relevant and doesn’t help you to make the kind of strategic decisions you really need to make.

2. Determining Your Competitors for a Business Competitor Case Study

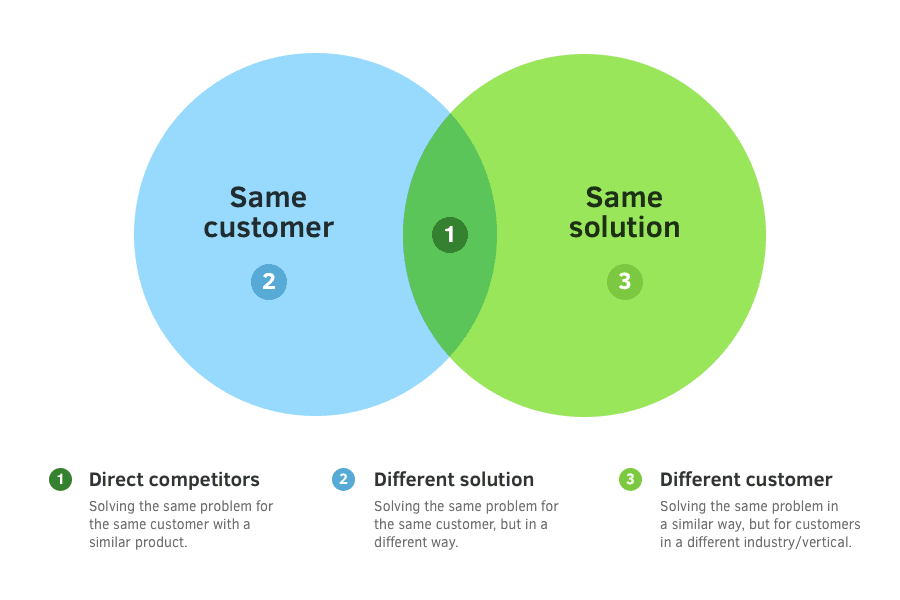

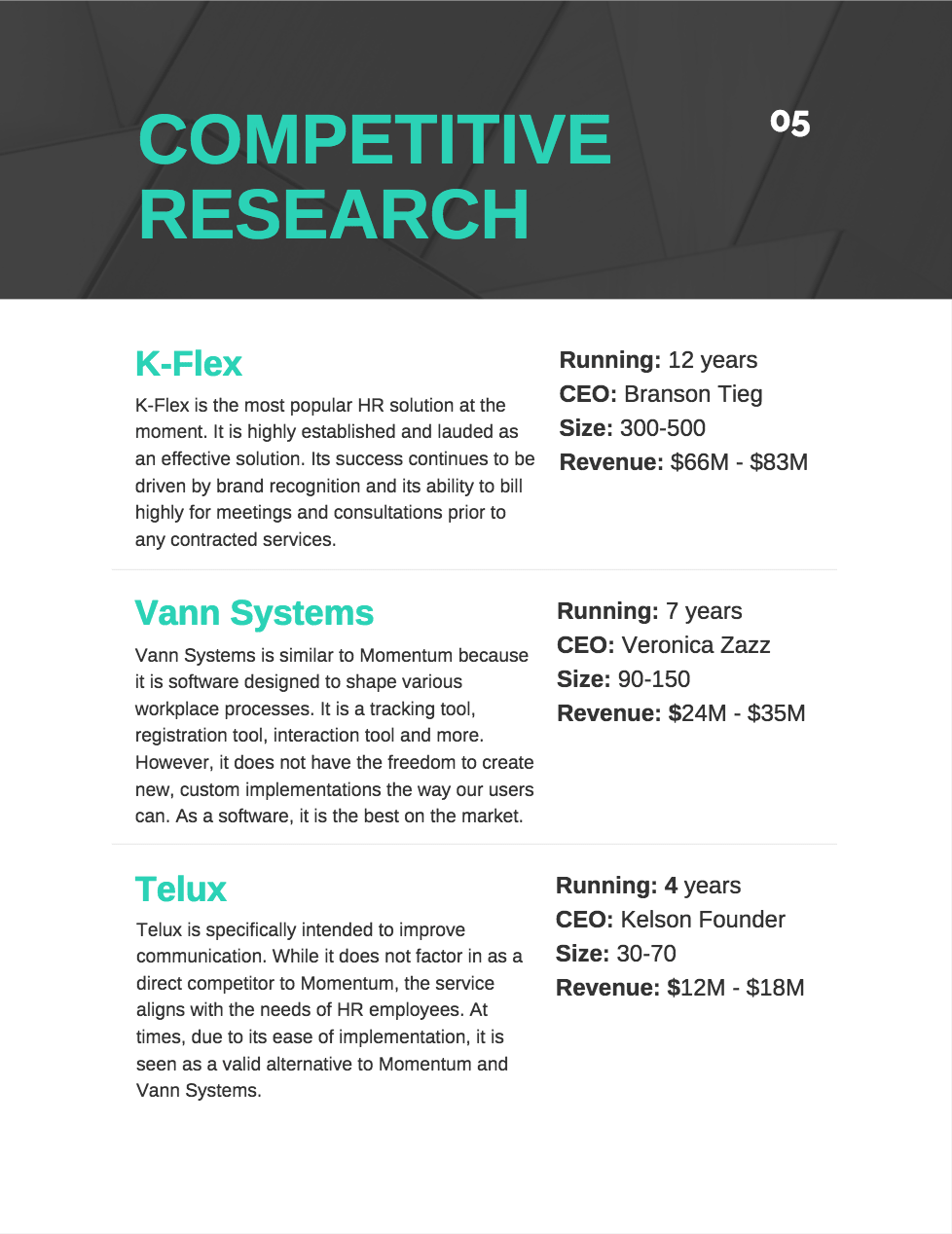

On the whole, your business is likely to have three types of competitors.

Direct Competitor

A direct competitor is any business that sells the same product or service in the same category to meet the same need for the same audience. Your biggest competitor, the one people most closely compare your business to, is more than likely going to fall in this category, as are any others that are actively competing for your share of the market.

If you sell sports shoes to female marathon runners, another company that sells sports shoes to female marathon runners would be your direct competitor. If you run a local car washing service and another business three blocks over also offer a local car washing service, they’re in direct competition with you.

Indirect Competitor

An indirect competitor is a business that sells a different product or service to meet the same need of the same audience. A common example is fast food restaurants.

McDonald’s and Burger King both sell fast food burgers (products) to hungry people (audience) so that those people can fulfill that hunger (need). If I’m hungry and want the convenience of fast food and the delicious taste of a burger, I could spend my money at either restaurant, which makes them direct competitors.

However, if I’m just hungry and want something convenient, whether it’s a burger or not, I might choose to go to McDonald’s or head next door to Pizza Hut or Subway. All three brands are in the same category (fast food), all three brands meet my need for a convenient way to satisfy hunger, but all three do so with different types of products, making them indirect competitors.

Replacement Competitor

A replacement competitor meets the same needs for the same audience but using different products or services in a different category. For example, I could choose to go to McDonald’s to fill my hunger, but I might also choose to go to Target and buy ingredients to make a homemade dinner.

To go back to the car wash example I used earlier – If you run a local car wash and the auto repair shop next door sells car cleaning supplies, that would make them a replacement competition. Your customer could choose to substitute using your service to buy some cleaning supplies and do the job himself.

Potential and Future Competitors

When determining your competition, it’s worth noting that just because a business isn’t currently in your market segment doesn’t mean they won’t eventually. This is why it’s worth noting your potential and future competitors too.

Potential competitors are those who may sell the same products, even with the same category but haven’t yet entered your market. For example, a company that operates exclusively in the next town, city, or state over to you may not be a direct competitor yet, but they have the potential to be if they chose to move into your town/city/state.

Likewise, if you run a limousine hire service focusing exclusively on corporate clients and another company across town focuses exclusively on limousine hire for weddings, they too have the potential to be a competitor. A future competitor is much more likely to become direct competitors, such as an expanding national chain.

To really get the most value out of your eventual competitive analysis report, it pays to consider all of these types of clients and their impact on your business.

How to Find Your Competitors for a Competitive Analysis

There are some competitors that you don’t have to look very hard to find. You know they’re there. They are the businesses and brand names that are hard to ignore, the ones everyone compares you to do.

Still, don’t just limit your research there.

Head to Google.

Search for the kind of keywords you’d expect people to use for your business.

Who else comes up beside you?

Search for your business name.

What are other businesses paying for Google ads around your business?

What about social media? Who are people talking about?

You can also use tools such as the Audience Overlap tool provided by Alexa , which helps you to not only track down your competition but develop and deliver on your entire competitive intelligence project. Don’t discount offline methods either. Magazines, trade publications, and even asking your target audience directly via focus groups, surveys, and so on can all prove helpful.

3. Start Your Research

Although Google can be a very powerful tool for finding out about your competitors, don’t just limit yourself to a quick search or browse their website. Yes, that’s important, especially if you’re both predominantly online brands. If your competitors have a physical presence, it’s important to check that out too.

You may want to treat this the same way you would a typical market research project and get a group of people to experience your competitor’s business, their customer service, sales experience, products, and so on. That way, you get a much wider range of opinions and can look for trends and common themes that can influence the strategic decisions you need to make to gain a competitive advantage.

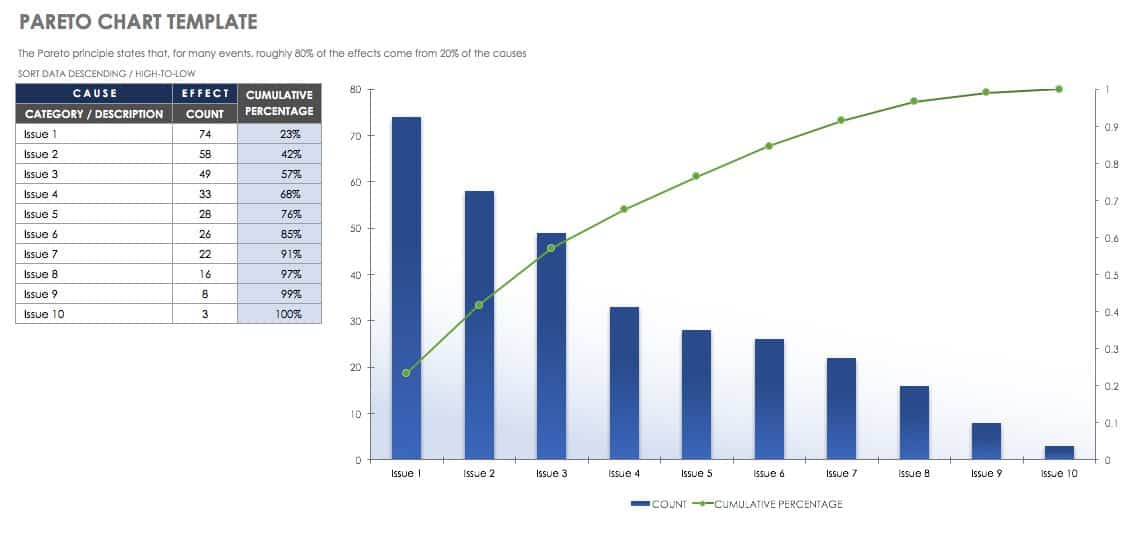

4. Analyze Your Findings

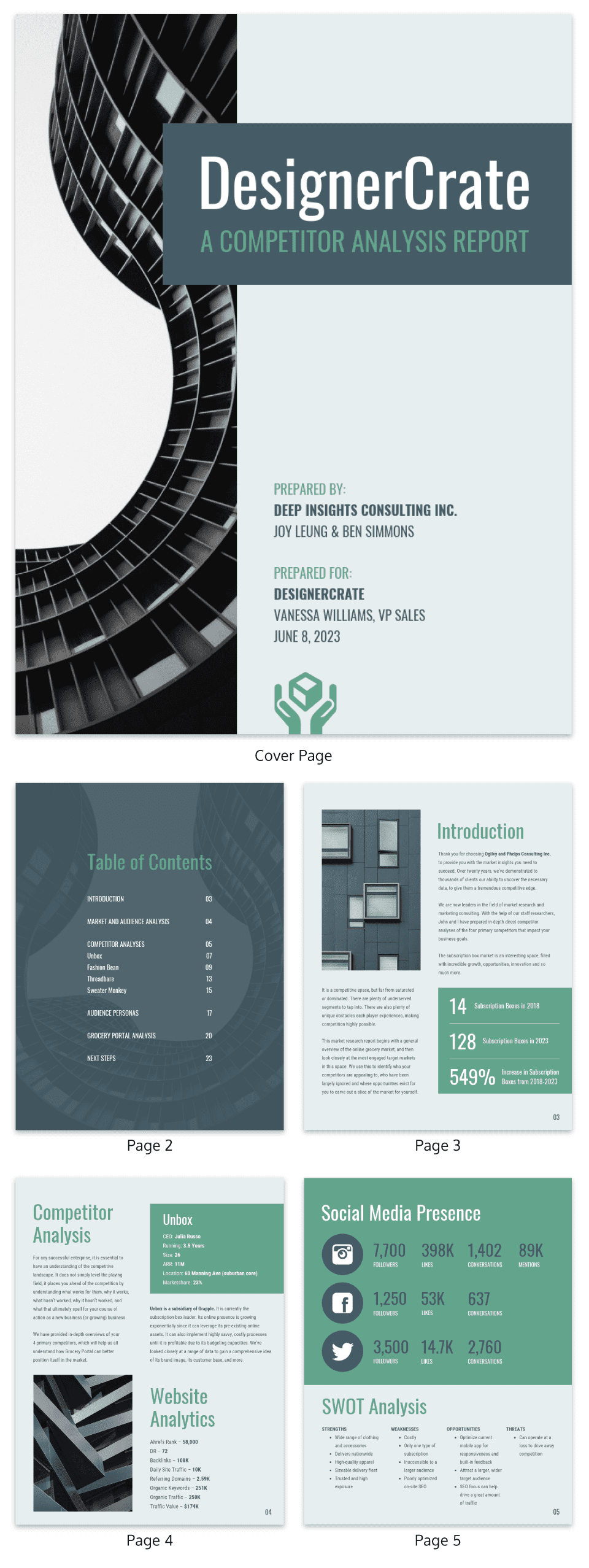

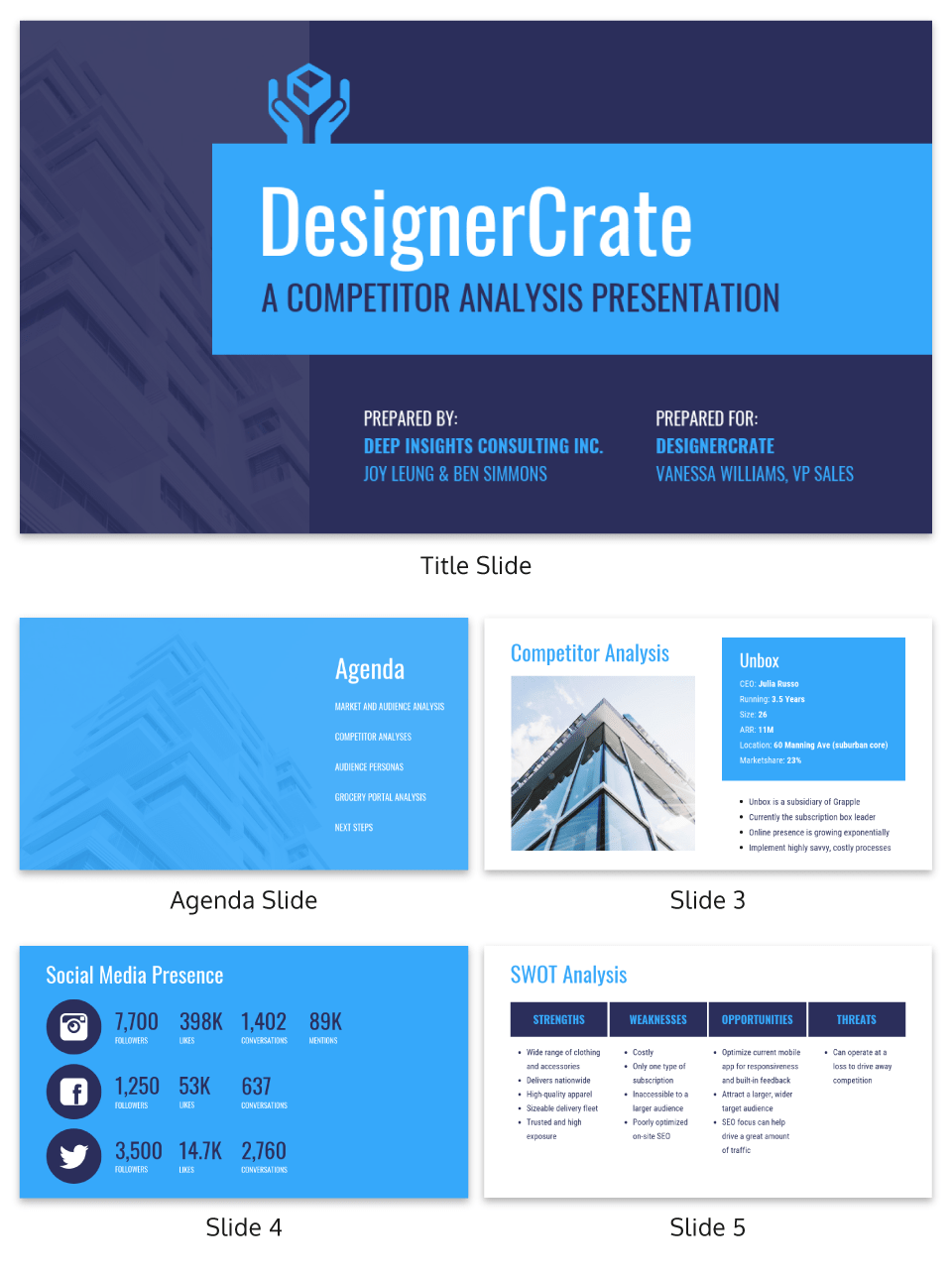

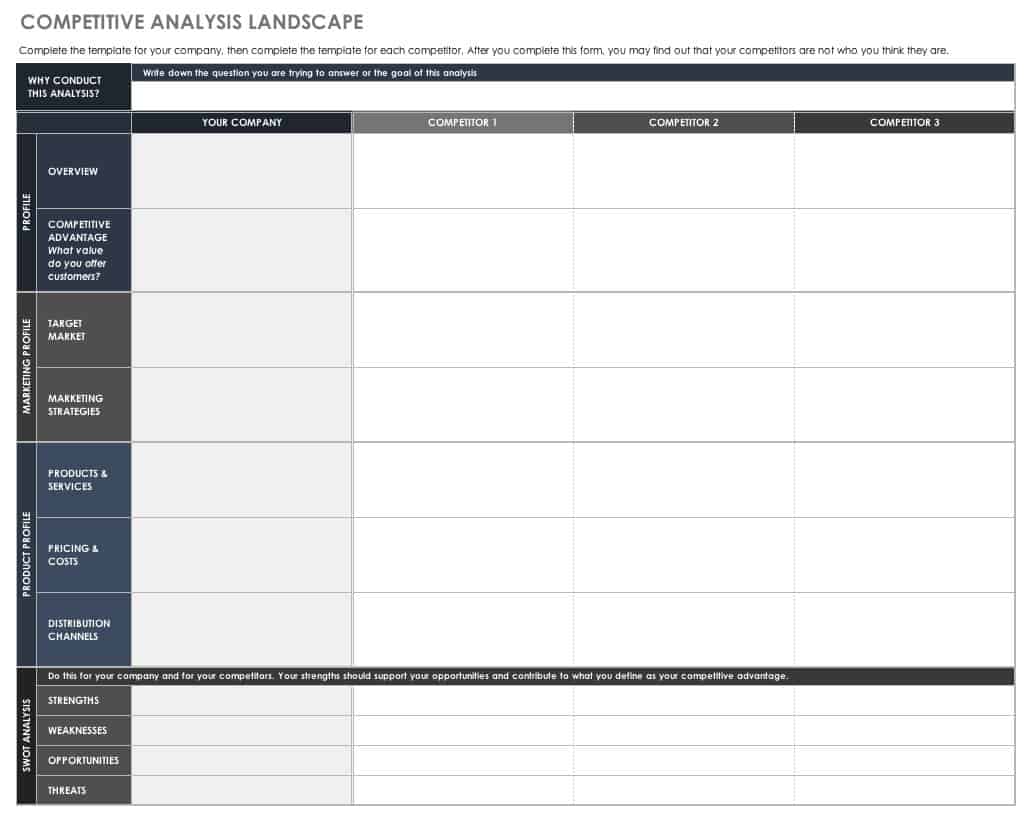

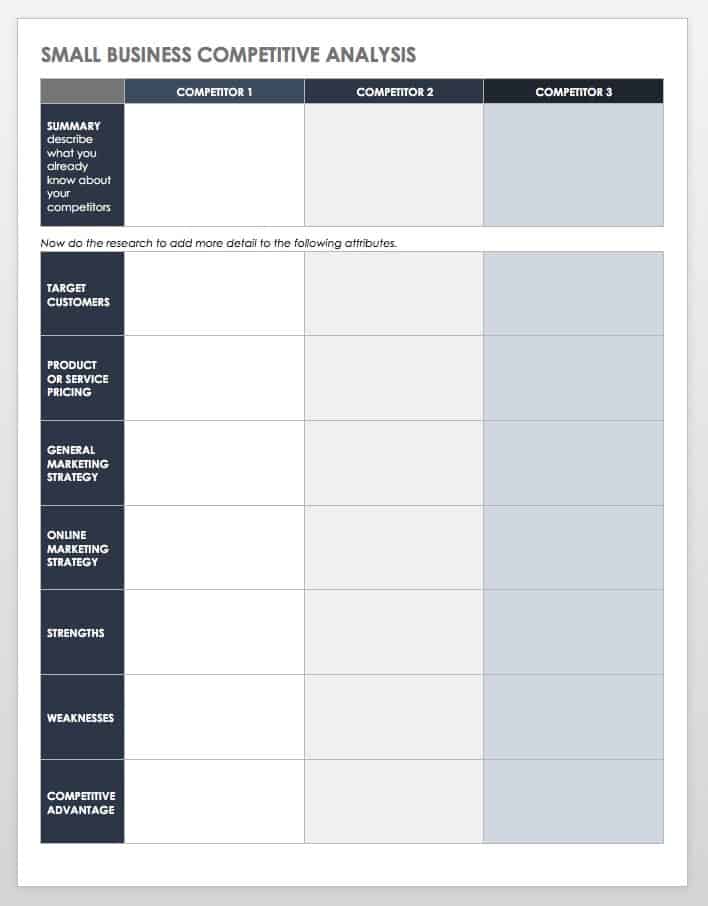

With the research done, it’s time to collate what you’ve found into your competitive analysis report. This may take the form of graphs, charts, written insights, anything that can help you present a compelling business case as to why your brand needs to be made.

5. Identify Action Points

Speaking of which, the point of analyzing your competition isn’t to pay attention to how many social media followers they have or how they compare to you in terms of brand recognition; it’s to provide you with actionable steps that you can take to achieve your business goals.

So with that in mind, figure out what you’re actually going to do due to your competitor research. Will you be rethinking your price points? Revamping your customer service? Starting again with a completely different digital marketing strategy?

6. Take a Snapshot of Your Business Pre-Changes

Before you implement those steps, be sure to look at how your business is currently performing.

Consider your main KPIs and any data relating to how you’re currently doing. After all, it’s going to make it much easier to determine if the steps you’ve taken have been effective when you’ve got some real, measurable statistics to play with.

7. Implement the actions

This next step may sound simple, but it’s where the real work comes in. Whatever actionable steps you decide to take, whether it’s coming up with a brand new social media plan, establishing yourself as a market leader, or simply ensuring that every client receives first-class customer service, now’s the time to make that happen.

8. Measure the Results

When you’ve made your changes, measure your results.

Compare where you are now to where you were when you took that snapshot in step six.

9. Repeat as necessary

Last but not least, it’s important not to fall into the habit of thinking that competitive analysis is a one-and-done affair.

If there’s one universal truth about the business landscape, it’s that things change constantly. New trends emerge, new customers arrive on the scene, once loyal customers become former customers. As such, it’s important to analyze your competition as a regular component of your overall competitive strategy.

What to Include in a Business Competitor Case Study

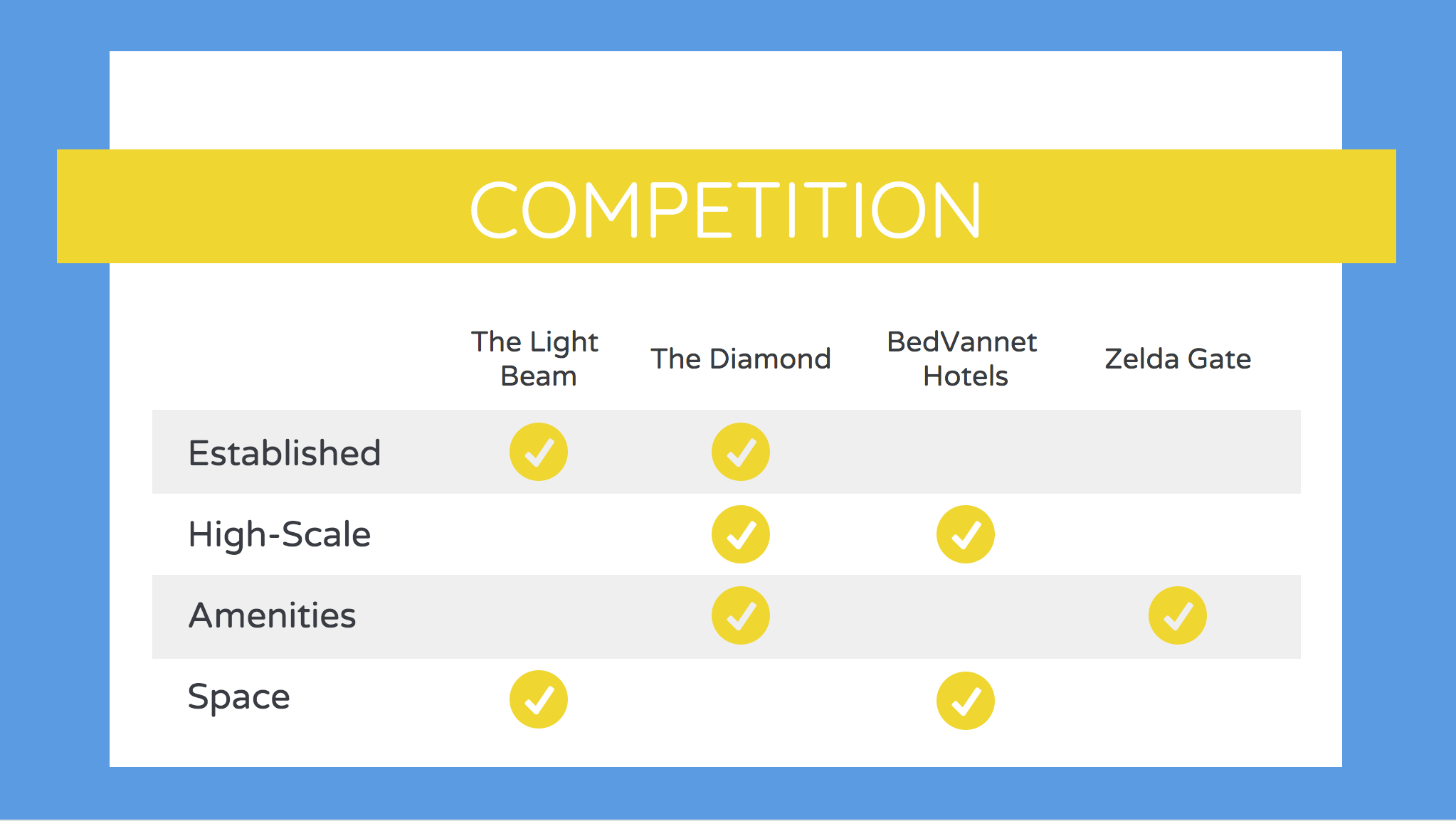

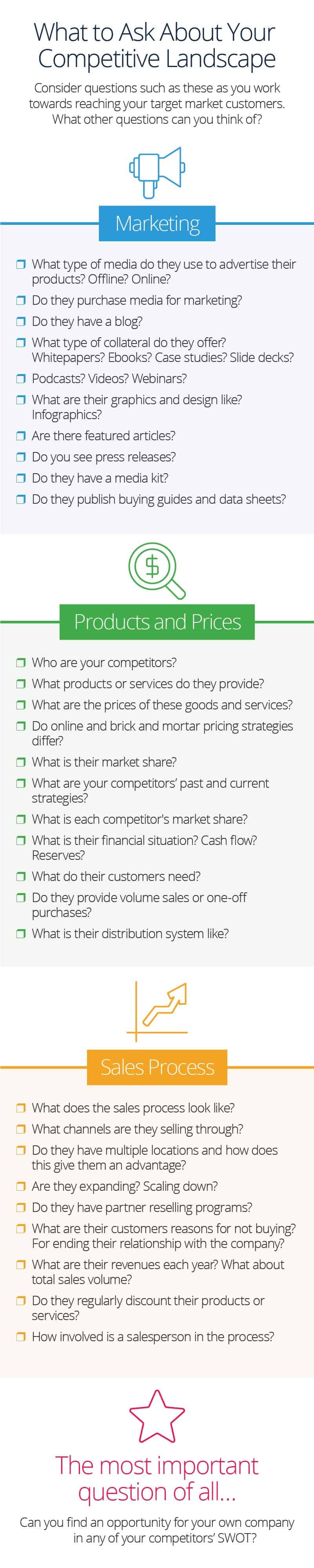

You’ve now got a complete strategy to put your competitive analysis report together, but what exactly should you include in that report, and what aspects of your competitor’s business should you research?

The following are essential aspects that will help you to put together the most effective competitor case study.

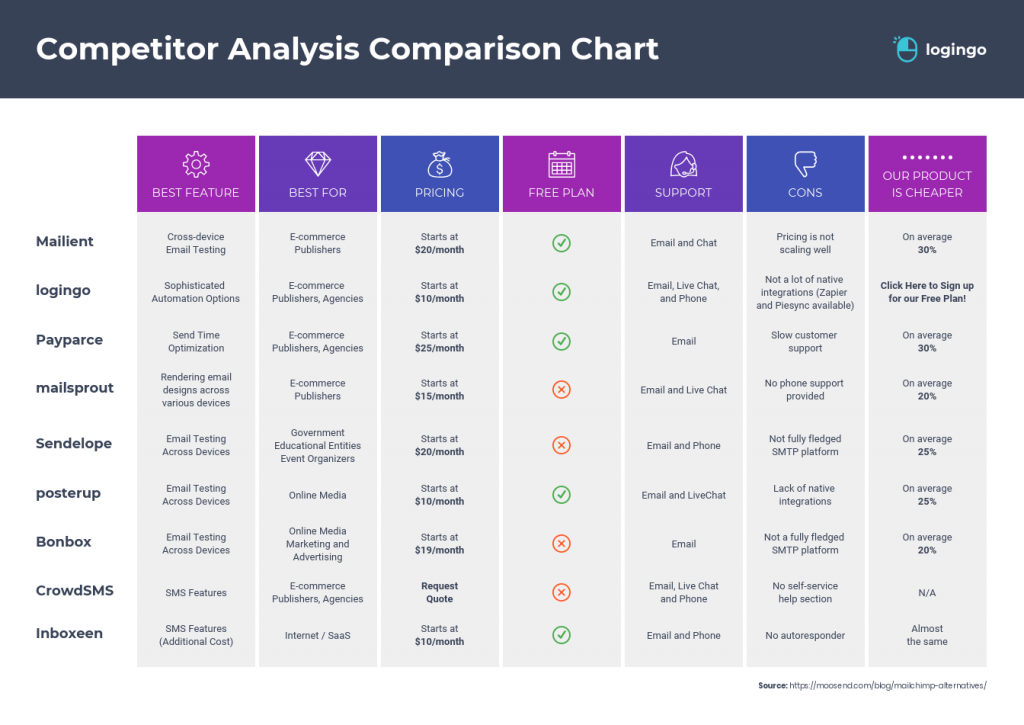

1. Features

Starting with the basics, look at your customers’ product or service, which competes with yours, and note all of its features. For the best results, do this for each competitor and add your findings to a spreadsheet. This will make it easy to compare products and see what you’re missing.

It may even show you what your competitors are missing, highlighting a hidden advantage that you may not have previously capitalized on.

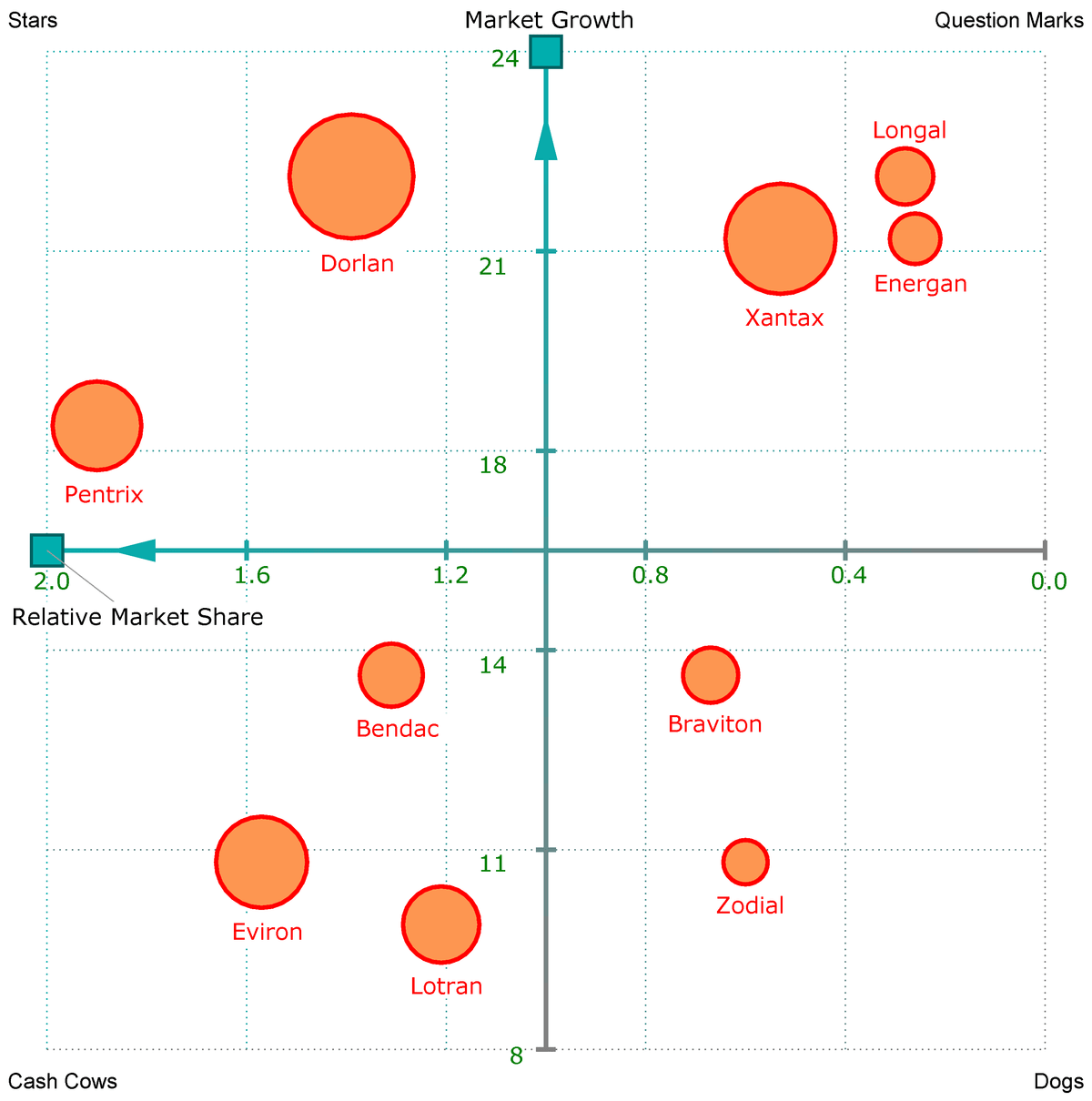

2. Market Share

Determining their market share will help you identify who your main competitor is and who you and who you may need to focus your attention on.

3. Price points

Pay attention to what the competition charges and consider what insights you can gain about your own pricing.

4. Marketing types

Your competition’s SEO marketing strategy, where they invest their ad spend, the kind of social media marketing tools they use are all important.

What keywords are they using to draw traffic?

How do your competitor’s websites compare to yours?

What are their PPC campaigns like?

All of these questions will help you determine their strengths and weaknesses from a digital standpoint.

Don’t forget about other forms of media, either.

Do they advertise in print publications? If so, which ones?

What about TV, radio, and other advertising platforms?

5. Online popularity

How do they fare in terms of social media engagement and website traffic? How does that compare to your own online presence?

Here, you’re looking more at quantifiable numbers. Likes, follows, mentions, page views, etc., should all be taken into consideration. They may not be the most important factor for some aspects of your business, but if you’re looking to up the game with your marketing and communication strategy or your SEO strategy, these numbers are worth considering.

6. Public perception and reputation

Here, we’re focusing on quality over quantity. One company may have more social media mentions than you, but if all those mentions are negative, it’s a different story. Social listening tools can be a big help in discovering what people are saying about your competitor’s brand online and can prove to be a valuable way to discover the perception of your competitors from a client perspective.

Away from social media, you might also want to consider news releases, blogs, and news articles as a means of discovering what kind of reputation your competitors have in the wider media.

7. Search Engine Optimization

An SEO marketing strategy is vital for just about any business in the digital age, but how do the strategies of competing businesses compare to yours, and what can that teach you. Here’s where keyword research and looking at their inbound marketing strategy, their approach to content marketing, and technical SEO aspects will all be important.

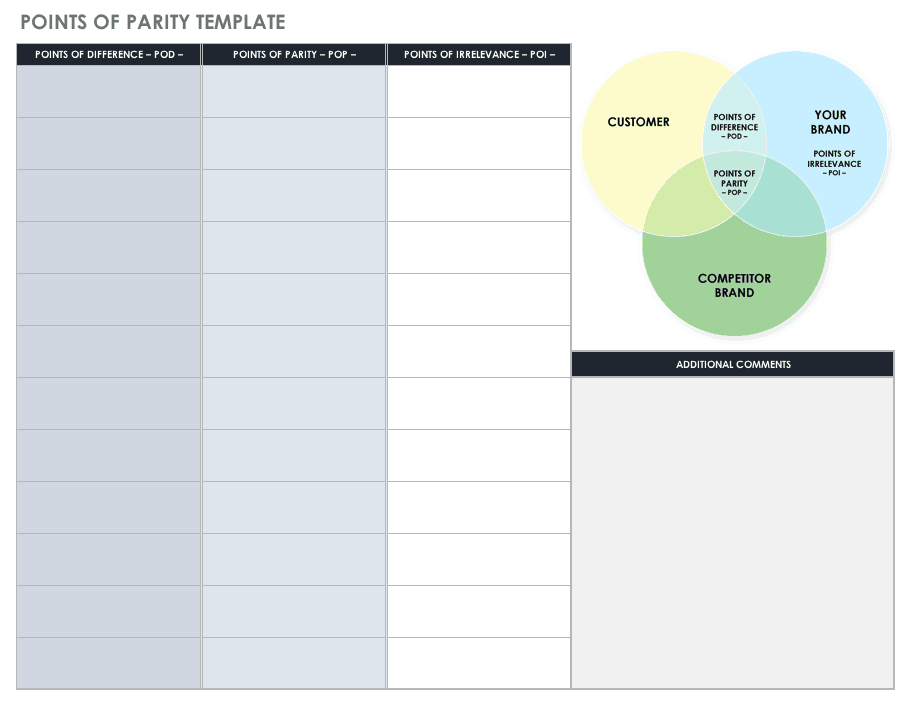

What makes other businesses in your market unique? What do they promote as being their reason for standing out from the crowd? Along with any sales literature, you might want to look at their mission and values statements and the kind of language they use in social media bios to get a good idea of their USPs.

9. Strengths and Weaknesses

Any good business competitor case study will feature a list of competitors’ strengths and weaknesses and insight into what opportunities this presents for your business.

Just as you might do a SWOT analysis for your business, a similar approach may help you analyze what other brands do well, how that influences the things you need to improve on, and what they don’t do so well, and how you do can capitalize on that.

10. Geography

In this regard, when we talk about geography, we’re not just talking about the town, city, or region your competitors operate in. Although that’s important, it’s just as important to note whether they have physical bricks-and-mortar venues in those towns or whether they’re a strictly eCommerce or digital-only operation.

What are the Advantages of Conducting a Competitor Analysis?

Identify your own weak spots

Competitor analysis doesn’t just identify your competitors’ weaknesses and gaps in the market. It may also highlight gaps in any areas for improvement in your own company. By comparing your brand to others, you get a different perspective than you’d get from standard SWOT analysis, and this can pay dividends when it comes to driving your company forward.

Improve your marketing and SEO efforts

Competitive strategy analysis isn’t just about products, services, and customers. It can also identify the SEO techniques used by competitors and come up with appropriate keywords to help you improve your organic search results.

Define your Benchmarks and Fine-Tune Your KPIs

Input your findings into a competitive analysis template, and it will soon become apparent what areas your business needs to be focusing on. This can prove invaluable when it comes time to determine your Key Performance Indicators (KPIs) and decide what -and how- it measures.

Identify gaps in your talent pool

A competitor case study really influences every aspect of your business beyond the direct products or services you sell. Your HR team can use the information to help identify gaps in your talent pool. If there’s a newly emerging market trend that you lack the talent to capitalize upon, your team can use this information to help with the recruitment needed to fill that gap.

What are the Disadvantages of Competitive Analysis?

Too much data, not enough analysis.

It’s easy to get so overwhelmed with the sheer amount of data you can unearth on your competitors that you forget that it’s the analysis of that data that really makes all the difference. It’s important to think about what meaningful conclusions you can draw and what actionable steps you can take as a result.

The impact is lessened if not kept up to date

The landscape of business is constantly changing. It’s not enough to assess the competition when you first start out and then never update it. Industries change, new trends emerge, new competitors arrive on the scene, all of which demand that market research on your competitors remains a key part of your competitive strategy.

Benchmarking performance based on competitors is not always the solution

Comparing your own performance against your competitors may not work so well if your competitors do things wrong or badly. Sure, it’s great to be an industry leader, but if the overall performance of that industry lacks compared to what the market actually demands, you may need to come up with a brand new strategy.

Frequently Asked Questions About Business Competitor Case Study

Question: what is a business case study competition.

Answer: A business case study competition is an event in which student teams compete to develop the best solution to a particular business case study. Though such events aren’t always exclusively for MBA students, most of them are as case study competitions can be a great way to inspire creative thinking and develop skills.

Question: How often should I do a competitive analysis?

Answer: Ideally, competitive analysis should be performed monthly, but if that seems like overkill for your industry, commit to at least once per quarter.

Question: What should be included in a competitive analysis?

Answer: Every competitive analysis report will be different depending on the nature of your business and your industry. However, as a general rule, it should identify who your competitors are, your competitor’s weaknesses, strengths, and overall strategies. Above all, it should provide insight into how you use their strengths and weaknesses to your advantage, whether that’s making improvements where you’re lacking or highlighting to customers what your brand does better than a rival’s.

The Final Word on Creating a Business Competitor Case Study

Whether you call it competitive intelligence gathering, competitive analysis reporting, or compiling a business competitor case study, there are three key points that I want you to take away from this guide:

- Competitive analysis is about identifying your own strengths and weaknesses as much if not more than your competitors.

- All the research and data in the world is unhelpful if it doesn’t provide you with insights into what you’re doing right and what you could be doing better.

- This isn’t a one-and-done project. Analyzing the competition is something you should be doing regularly to keep up with the ever-changing landscape of your industry.

- Latest Posts

- OpenAI Competitors Analysis - April 11, 2023

- How Does Chime Make Money? - March 20, 2023

- Insurance Value Chain Explained - January 31, 2023

Need a hand creating engaging content? Try Buffer for free →

How to Perform a Best-in-Class Competitor Analysis (w/ Template)

Get a full competitive analysis framework that's been real-world tested, and learn the tips and tricks for capturing competitor data and conducting research

You will learn

- The value of running a competitor analysis and how to get your stakeholders on board

- Clear and actionable steps for figuring out who your competitors are

- An easy-to-follow playbook for creating a competitor analysis steeped in research and data

Competitor analysis can be hard .

It’s particularly hard (and confusing and incredibly time-consuming) if you’re relatively new in business . Most of the data is ridiculously difficult to get. Even if you manage to dig something up, you always seem to be left with more questions than answers.

How did they manage to get $10M in funding?

Did that absurdly expensive ad campaign pay off?

Did their CEO leave because things aren’t going well at the company?

What does it all mean?

At least that’s what I felt when I was just getting started with competitive analysis. Whether you’re facing a similar struggle or just aren’t sure where to start, I hope this article will help you navigate through every step of the process.

In this article, I will share the competitive analysis framework my team and I have developed (through weeks of research and dozens of iterations), and give you some tips on where to look for data that isn’t publicly available so you can have a competitive advantage .

But before we start…

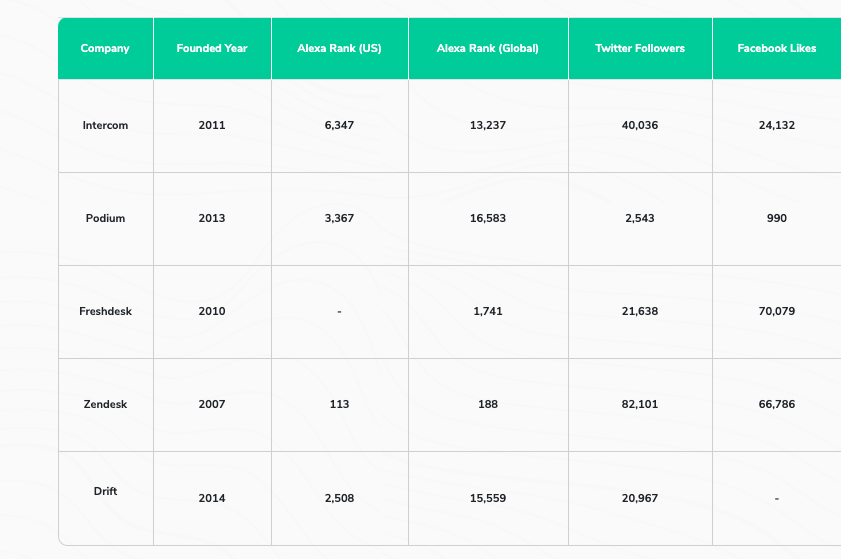

What is competitor analysis?

Competitor analysis is the process of evaluating your direct competitors’ companies, products, and marketing strategies.

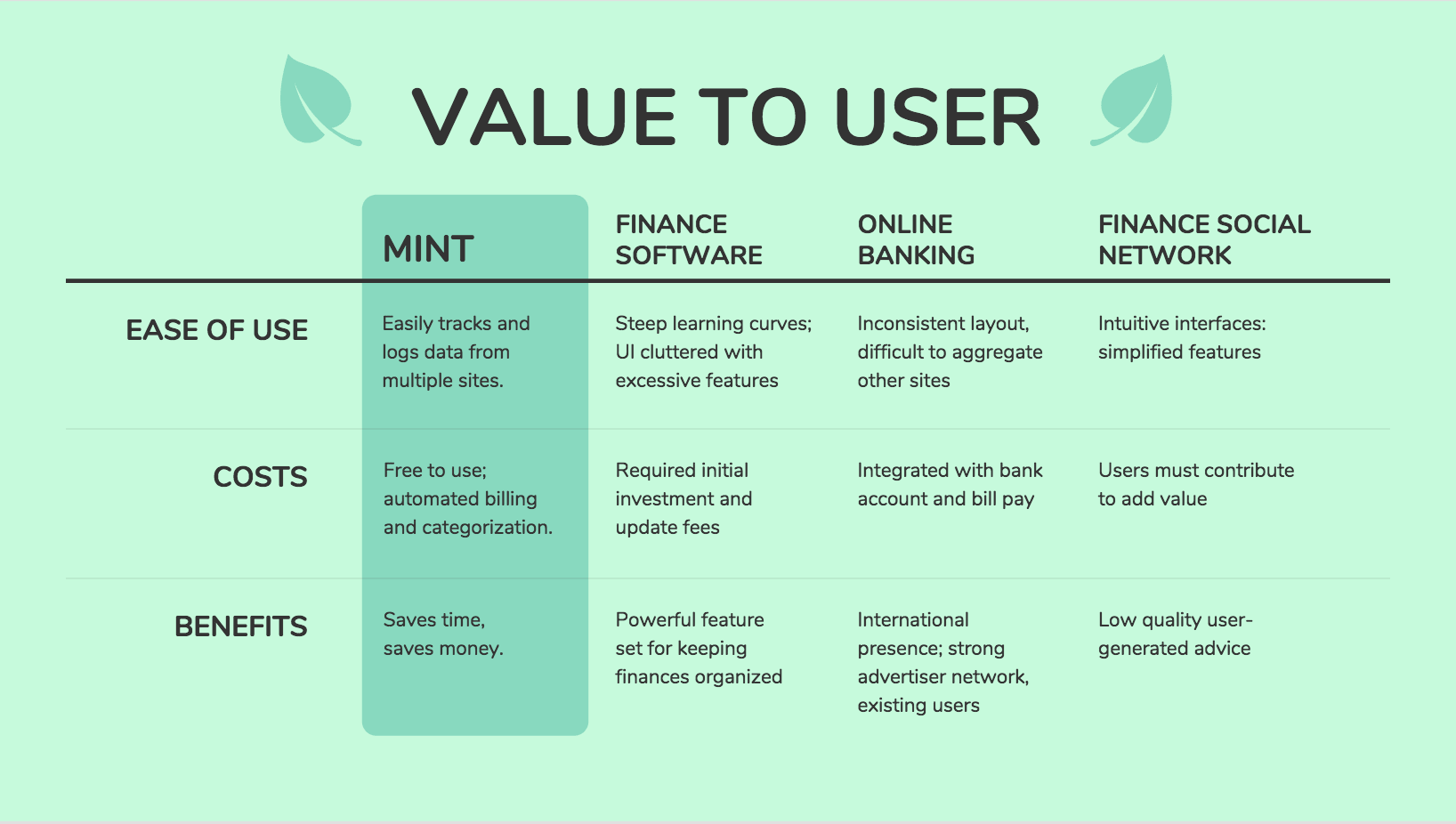

To make your analysis truly useful, it’s important to:

- Pick the right competitors to analyze

- Know which aspects of your competitors’ business are worth analyzing

- Know where to look for the data

- Understand how you can use the insights to improve your own business.

Which brings us to why competitor analysis is worth doing in the first place.

Who can benefit from an analysis framework?

This framework will work well for entrepreneurs , business owners , startup founders , product managers , creators , and marketers .

It covers business metrics, a product analysis, and a marketing assessment, with the marketing bit being a little more in-depth. Feel free to skip certain parts if you’re only interested in one aspect, or better yet, delegate some steps to respective teams if you can.

It doesn’t matter much what kind of product you’re selling or how mature your business is. To use this framework, you may already have a fully functional product, an MVP, or even just a product idea. I’ll be using certain analysis tools to facilitate and automate certain bits of the process. Most of them are either freemium or have a free trial available, so all that you’ll need to invest into the analysis is your own time.

Done properly, competitive analysis will give you plenty of quantitative and qualitative data to back your own business decisions and business strategy (and no, I’m not talking about cloning your competitors’ strategies to come up with a second best product, although this can sometimes work ).

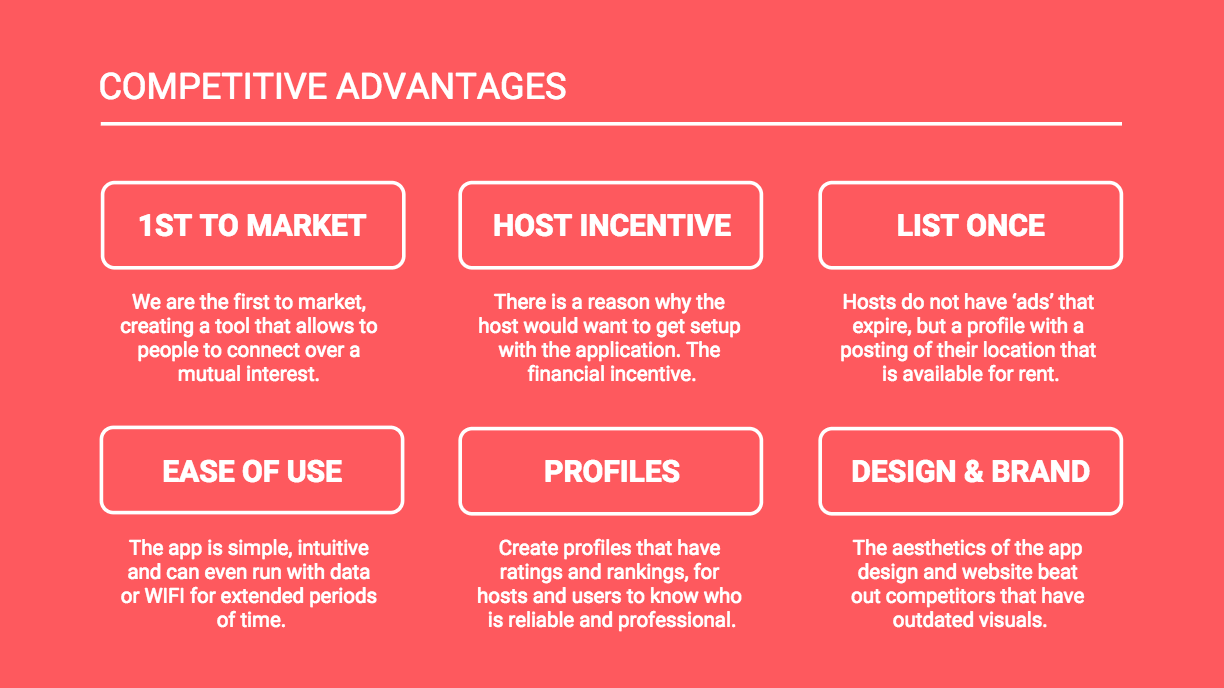

Namely, it can help you:

- Develop (or validate) your Unique Value Proposition

- Prioritize your product development by focusing on the aspects of competitors’ products customers value the most

- Improve your product by capitalizing on competitors’ weaknesses customers complain about

- Find your competitors' strengths to get benchmarks to measure your growth against

- Uncover market segments that aren’t fully served by competitors

- Create a new product category by identifying gaps between what your competitors offer and what the customers need

Who even are your competitors?

I can sense you rolling your eyes at me, but hear me out.

If you’re serious about competitive analysis, it’s not enough to just evaluate the two Industry Leaders everyone’s talking about (that kind of analysis will likely get you depressed real quick).

The competitors you pick for the analysis determine the insights you’ll get at the end, and the decisions you’ll make, based in part on those insights. That’s why including different kinds of competitors (big and small, direct and indirect) into the analysis is critical if you want the results to be comprehensive.

Here’s a handy way to think about your competition that’s based off of Myk Pono’s classification :

It’s best to include at least one competitor from each category into your analysis to make it truly comprehensive.

Whether you can instantly think of over a dozen competitors or can barely recall five, it’s a good idea to turn to Google or a different a search engine ( DuckDuckGo , anyone?) and look up your product category. Examine the products within the top 50 results, along with the ads that are displayed in response to your query — more likely than not, you’ll come across companies you’ve forgotten about, or maybe even learn about a few newcomers.

To give you an example, I’m going to imagine I’m launching a vacation rental website — an alternative to AirBnB. Here’s what my list of competitors may look like broken down by categories:

Now that you have a comprehensive list of your competitors with similar products, it’s time to start the actual analysis.

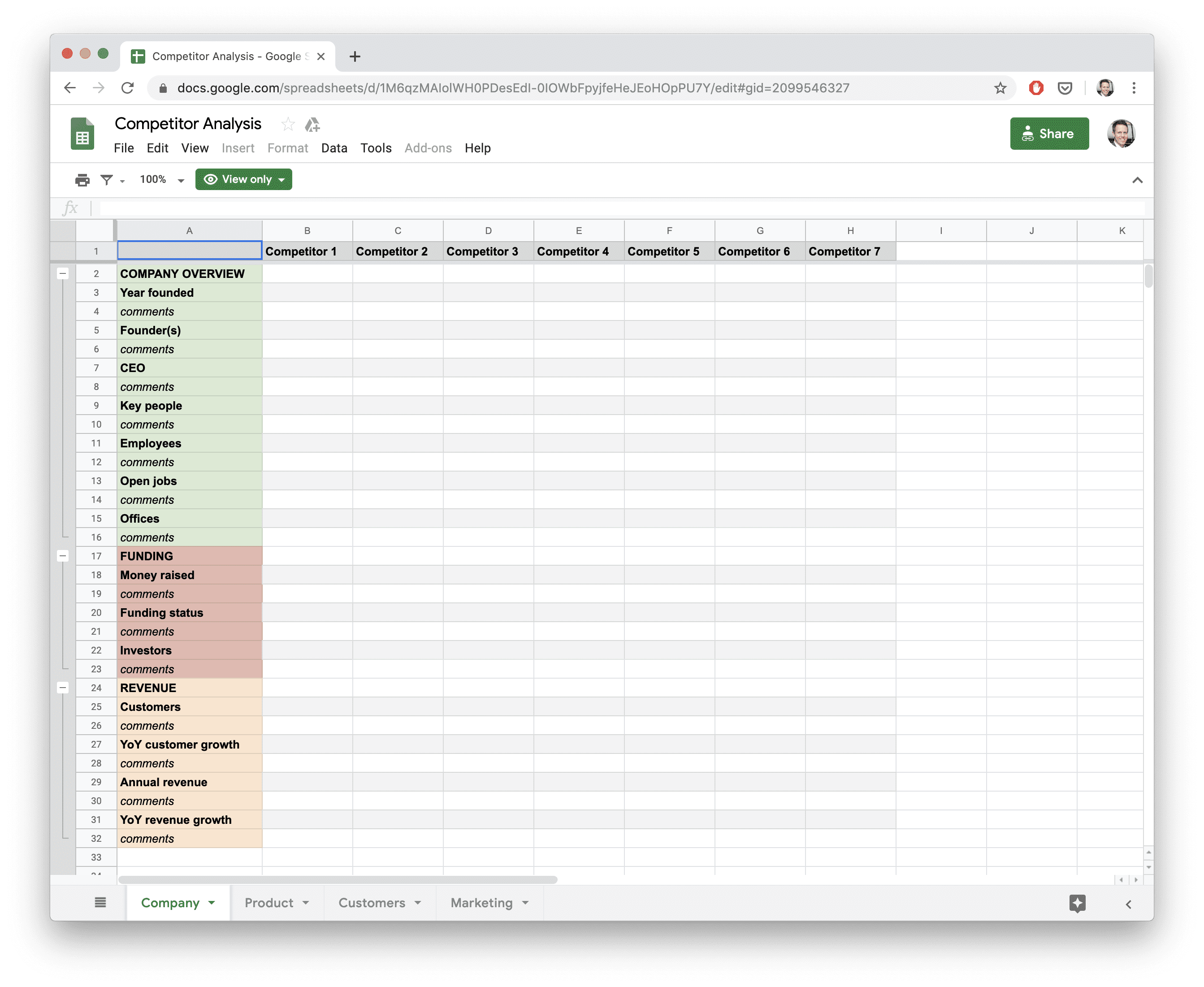

As you go through the process, feel free to use this Google Sheets template I’ve created.

In the spreadsheet, I like to divide the factors into collapsable sections (yes, these do get pretty lengthy). I also tend to add comments under each aspect with details or links that provide more info. Depending on the stage you’re at with your business, you can also add in a column for your own product to quickly see how it compares to competitors.

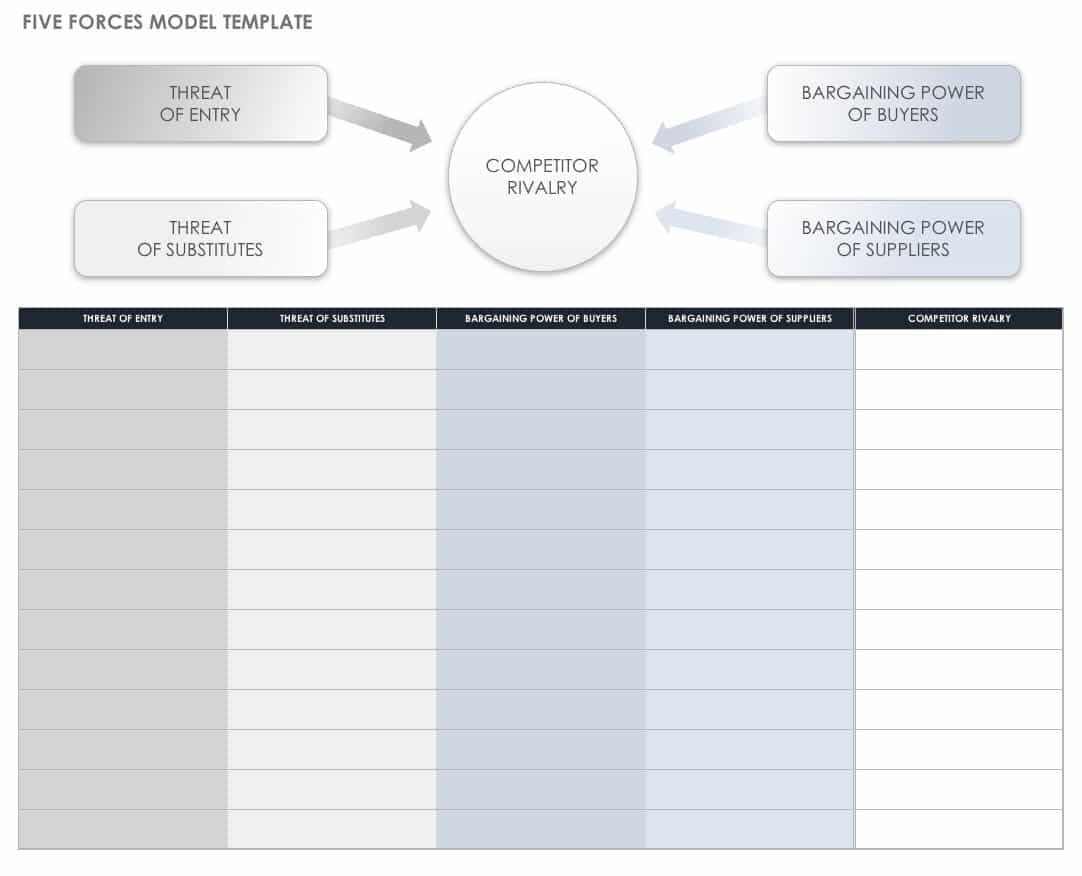

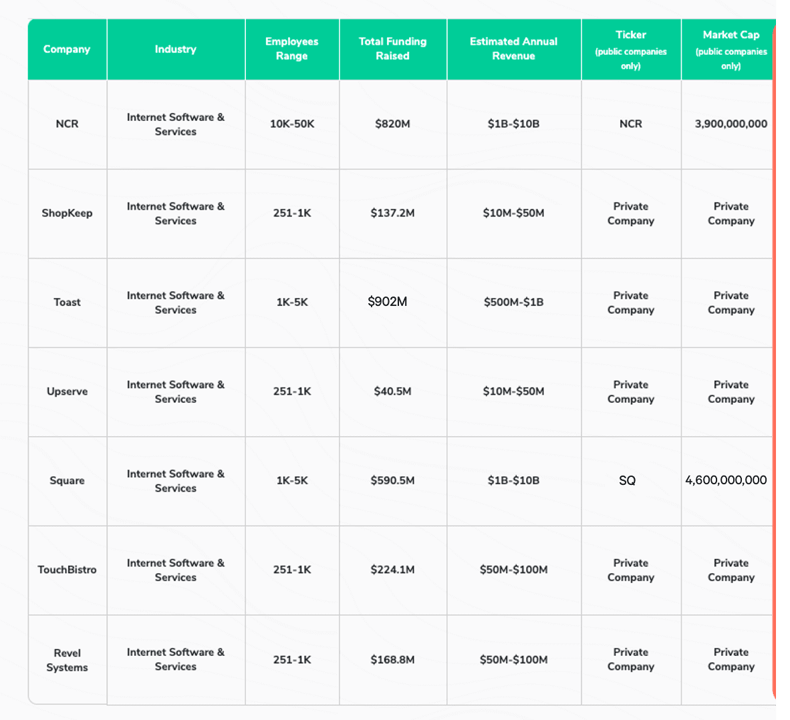

What’s included in a competitor analysis framework

- Business & Company metrics 1.1. Company overview 1.2. Funding 1.3. Revenue & customers

- Product 2.1. Product features 2.2. Pricing 2.3. Perks 2.4. Technology

- Customers & awareness 3.1. Share of Voice 3.2. Sentiment 3.3. Key topics 3.4. Geography 3.5. Social media platforms

- Marketing 4.1. SEO 4.2. Social media 4.3. Advertising 4.4. Influencers and other partners 4.5. Content Marketing 4.6. Customer acquisition 4.7. Sales 4.8. Customer service 4.9. Unique strengths

I’ll go into depth about each section below, and again feel free to grab this competitor analysis template to follow along .

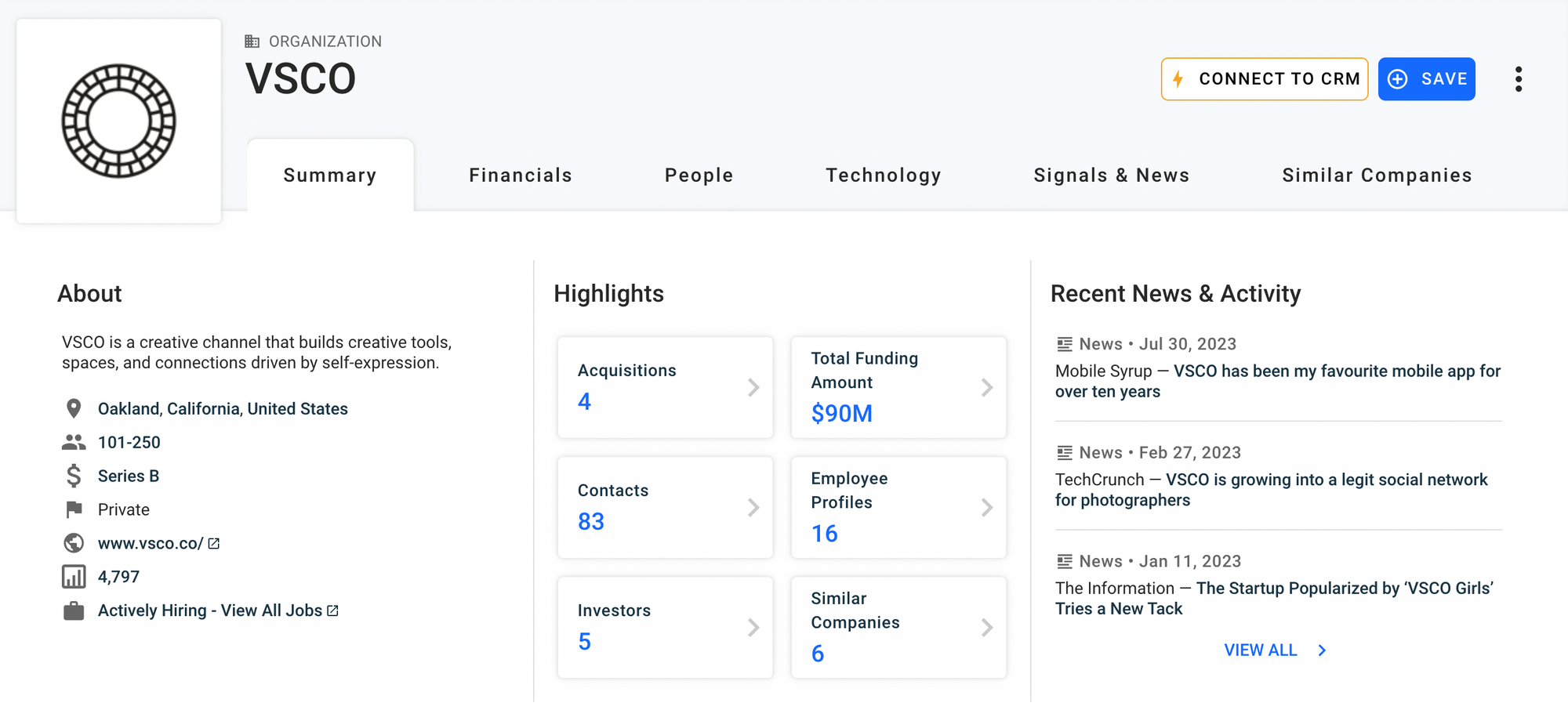

1. Business & Company metrics

1.1. company overview.

Your analysis should start with digging up the basic info about your competitors: things like the company’s founding year, the names of the CEO and other key people, locations of the company’s offices, how many employees work there, etc.

You’ll usually find bits of this information on competitors’ websites.

The company’s LinkedIn profile is often useful, particularly for employee counts.

And for info on key people, offices, and founding date, CrunchBase is a great resource.

Your competitors’ job openings can also be found on their websites, LinkedIn, and job search sites like Glassdoor and Indeed . Knowing who they are hiring and which teams they are expanding will give you an idea of what steps they’re about to take, both product- and marketing-wise. Are they about to hire their first sales rep or content marketer? Are they looking for a developer with a specific skill set? Combined with what you know about your industry, your competition’s job openings will tell you a lot about where they are going with their business.

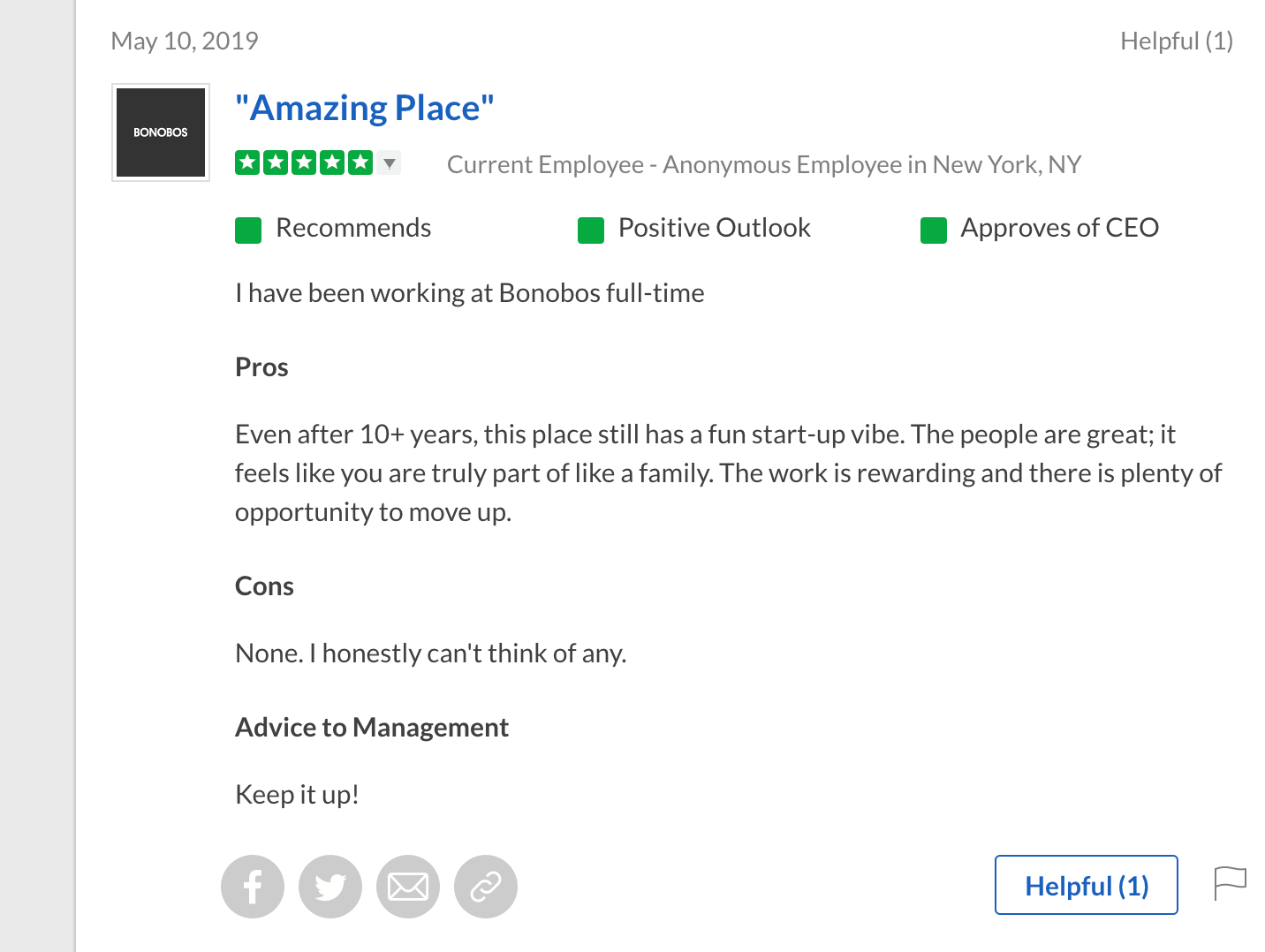

You could also take things one step further and see if you can get an understanding of competitors’ corporate culture. The best place to dig through employee reviews is Glassdoor . There, you can find out what employees think about the culture, the team, the pay, the management – and those are often honest opinions because a lot of the feedback is anonymous.

1.2. Funding

Knowing when, how much, and from whom your competitors received funding can also be important, particularly if you plan on raising capital yourself. It will give you a solid idea on how much funding you can expect to get.

On top of that, venture capitalists (VCs) tend to invest in only one company in a given category so as not to cannibalize their own investments. If an VCs’ name is missing from your competitors’ funding history, they might be a good candidate for you: they missed out on the chance to work with a successful competitor, but now they have the opportunity to invest into a promising startup in the industry (you!).

1.3. Revenue & customers

Your competitors’ revenue and number of customers deserve a separate section in your spreadsheet. For some companies, you’ll be able to find estimates on Owler , but those will often be very rough. A Google search for the name of your competitor combined with the words “revenue,” “customers,” etc. might lead you to interviews or press releases where the companies share this information (because, well, everyone likes to brag).

That said, I bet you won’t be able to find every competitor’s revenue figures this way. To help you dig deeper, I have two hacks to share that go beyond a simple Google search:

Hack #1: Set up alerts for competitors’ interviews and conference presentations.

This one requires some time, but it’s very effective in the long run: you’ll be surprised at just how much your competitors give away at event presentations and in interviews, without being aware of you listening. All you need to do is sign up for Awario (there’s a free 14-day trial available), create an alert for the names of your competitors’ CEOs or other key figures (don’t forget to put the names in double quotes to search for an exact match), and select YouTube as the source for the search. And that’s it! You can now binge-watch those videos right in Awario, without having to leave the tool for a minute, noting your findings along the way.

Hack #2: Use this revenue formula

Jason Lemkin of SaaStr offers a simple formula you can use to calculate a competitor’s revenue estimate, provided you know how many people work there. Take the number of employees the company has listed on its LinkedIn profile and multiply that by $150,000 if well-funded ($200,000 if modestly funded). This should give you an estimate you can work with.

Employee count * $150,000 = Revenue estimate

These details, combined with company info like founding year and employee counts, are important so you can use them as a benchmark against your own growth. How much time did it take each of your competitors to get to the revenue figures they have today? Are you doing as well as a current market leader back when it was an early-stage business?

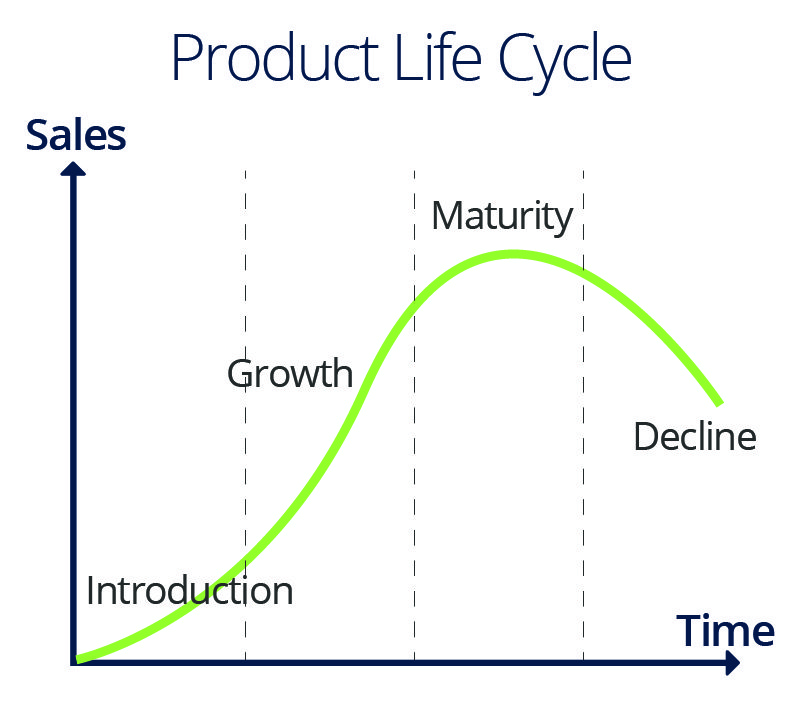

It’s time to evaluate your competitors’ products or services, the actual things they’re selling. What kind of technology are they using to build it? What is their core selling point? Are there any perks that come with the product: a freemium version, complementary free tools, or services?

2.1. Product features

Let’s get down to the core of your competitors’ business – their product and its key features. A word of caution: this will likely be the longest bit of your spreadsheet.

It’s a good idea to divide the features into groups of related ones to keep things organized.

2.2. Pricing

Assessing competitors’ pricing pages is another crucial step in your analysis (if pricing isn’t available on their website, try reaching out to their sales team).

Here are some questions to consider:

- Can you uncover a segment of the market that doesn’t seem to be fully served by competitors’ plans?

- Say, do they have an affordable plan for startups or small businesses? Discounts for students or non-profits?

- Are there data-heavy options available for agencies and big brands, with Enterprise features like an API or white-label options?

Another thing you can draw from competitors’ pricing strategies is great ideas for A/B testing . Do they offer monthly or annual plans? (If it’s both, what is the default option?) How many packages have they got? Identify the opportunities for your experiments, and prioritize the ones that are common for several competitors.

Dig through your competitors’ websites to see if they offer something complimentary with their product. Do they have a free trial or a freemium version? Are there any “free” tools their customers get access to, or perhaps a perks program in partnership with other tools?

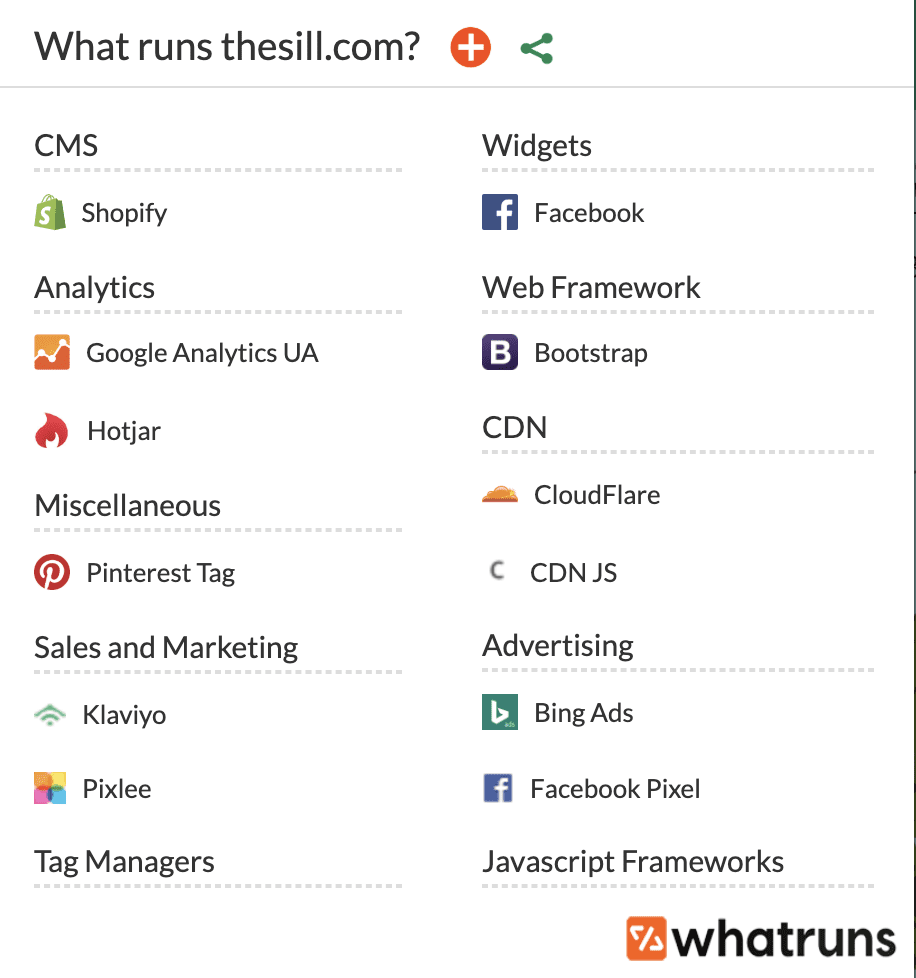

2.4. Technology

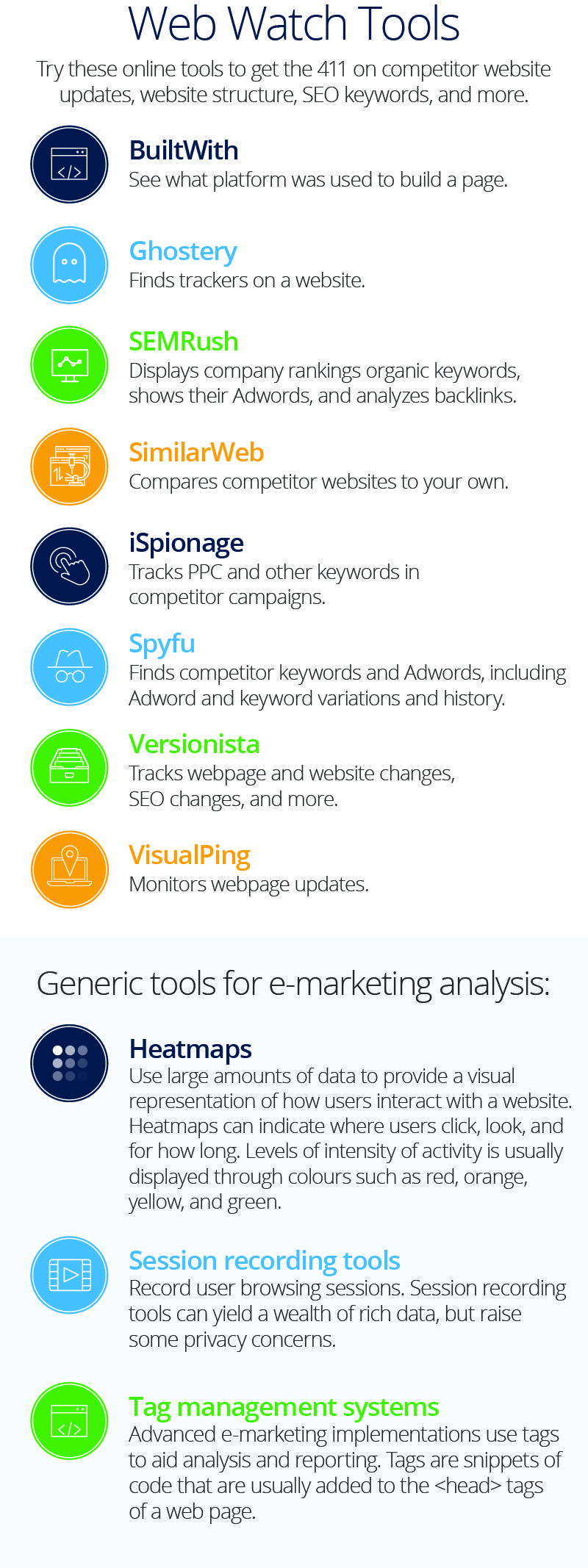

Competitors’ technology is an important aspect to assess for tech companies. BuiltWith is a great (and free) tool to figure out the tech stack that a competitor uses. Just type in the URL, and you’ll be able to see what technology the website runs on, along with any third-party scripts and plugins it uses, everything from analytics systems, email marketing services, to A/B testing tools, and CRMs.

A lean alternative to BuiltWith is What Runs , which is a browser extension that analyzes any webpage you’re on.

On top of that, looking at competitors’ job postings (yes, again) is a great way to see what kind of technology stack they’re using by analyzing the skills they require from candidates. To look for job openings, check your competitors’ websites and job search sites like Glassdoor and Indeed .

3. Customers & awareness

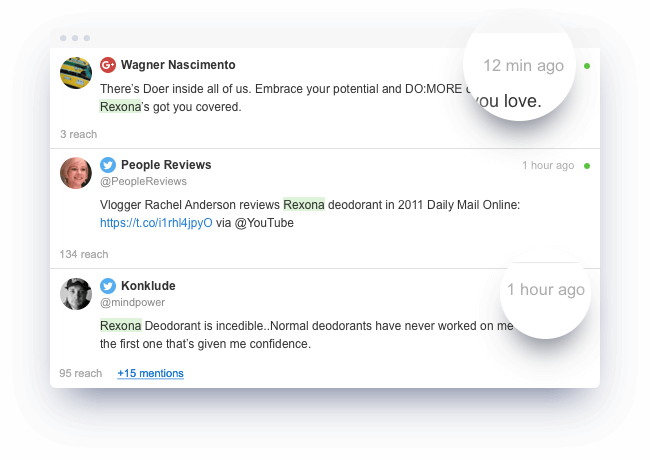

Your next big step in analyzing the competition is looking at what their customers have to say about them. In this section, you’ll look at each brand’s Share of Voice, the sentiment behind their mentions, the key topics customers bring up when they talk about your competitors, and more. To measure these, you’ll need a social listening tool like Awario or Mention .

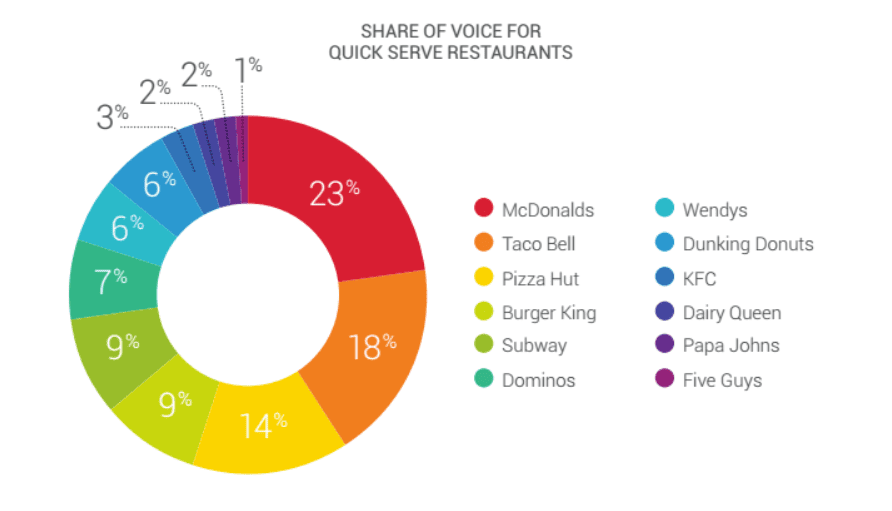

3.1. Share of Voice

Ideally, you’d want to measure the market share for each of your competitors. But alas, it’s nearly impossible. One substitute metric you could use is Share of Voice – the volume of mentions your competitors get on social media and the web compared to each other.

To measure share of voice , create an alert for each competitor’s brand in Awario, give the tool some time to collect the mentions, and jump to the Alert Comparison report to see how much each competitor is talked about on social and the web.

It’s a good idea to keep these alerts running for the long-term (as opposed to just looking at Share of Voice once). This way, you’ll be able to see spikes in their volume of mentions, track what their customers are saying, and see how their (and your own) Share of Voice evolves over time.

3.2. Sentiment

The caveat of measuring the level of awareness a competitor has is that awareness isn’t always a good thing. What if there’s been a data scandal one of the competitors is involved in? What if their customer service is horrible, causing an influx of negative mentions?

That’s not the only reason why measuring the sentiment behind the mentions of your competitors is important. It will also help you understand what these companies’ customers love and hate about their product the most.

On top of that, it can also serve as a benchmark when you analyze the sentiment behind the mentions of your own brand and product. Let’s say, 40% of your mentions are positive, 20% are negative, and the rest are neutral. How do you know if that’s a good thing or a bad thing without a benchmark?

3.3. Key topics

What do your customers focus on when they mention your competitors’ products or write customer reviews?

What do they love and hate the most?

Identifying the key topics within your competitors’ mentions will give quick answers to these questions so you don’t have to dig through mentions by hand. You can find these topic clouds in a social listening dashboard. From there, you can click on any topic to explore the mentions in-depth.

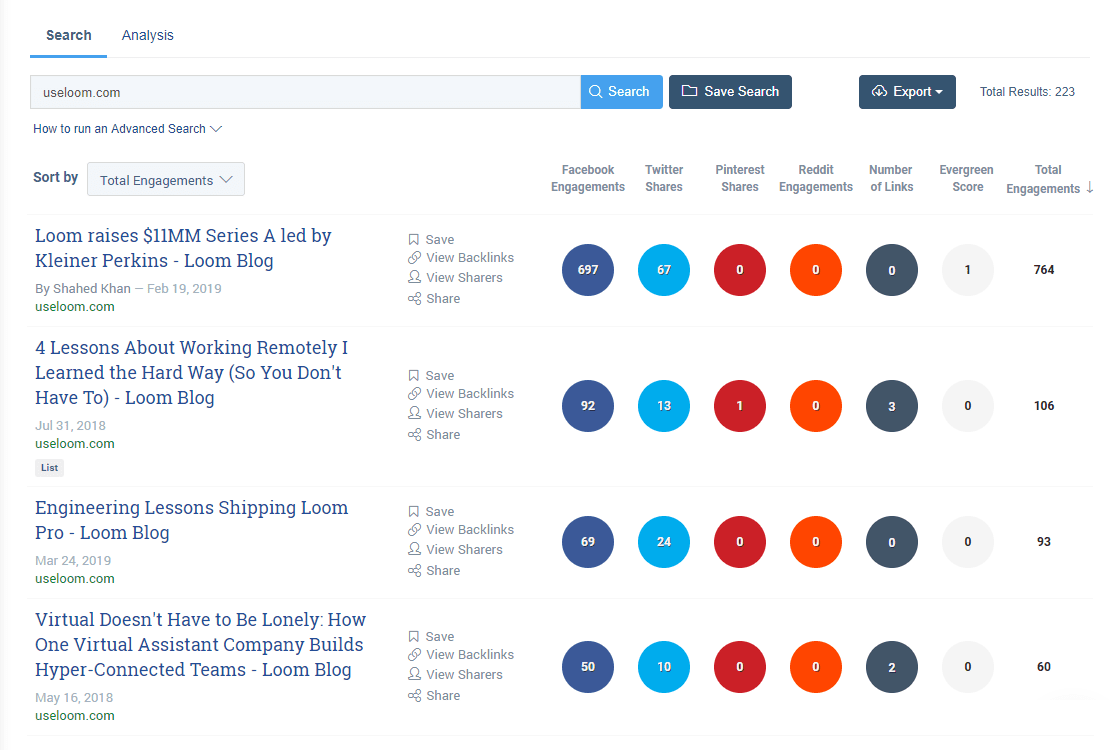

Interestingly, these topic clouds can also offer insight into various aspects of your competitors’ business – and they may help you fill the gaps in other sections in your competitor analysis spreadsheet. Here’s one example: those are the key topics for Loom, a screen recording app, from which you can learn a few useful things if you look closely.

Looks like the company a) has just raised some money, b) offers remote jobs, and c) has just announced a new feature they’re building. And you discovered all that at a glance! Of course, you can further explore any topic by clicking on it to see all the mentions that contain the word/phrase.

3.4. Geography

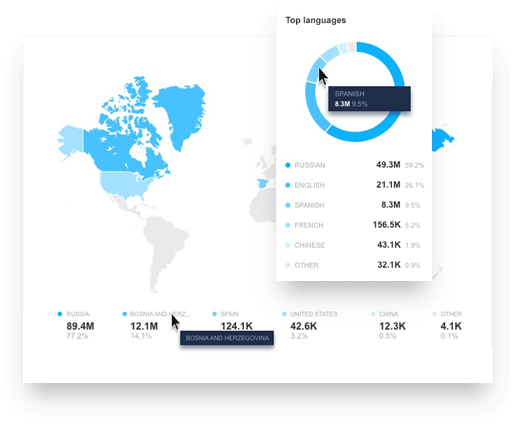

Looking at the geography and demographics of your competitors’ mentions will let you figure out which markets they are focusing on the most (and, with any luck, find an area that isn’t too saturated yet). You’ll find a map of each brand’s mentions in Awario’s dashboard and reports, along with the breakdown of mentions by language.

Try adjusting the date range in the report to see if there’s been any changes in languages/countries recently. This could mean that your competitors are focusing on a new emerging market – an opportunity you might be interested to explore.

3.5. Social media platforms

Just like with geography, this one will give you an idea on where your competitors’ audience hangs out so you can use these findings in your own marketing strategy and social media strategy. On top of that, if you see platforms that appear to be heavily underused (but do look relevant), those may also be worth experimenting with. Just like with the previous factors, you can compare the platforms side-by-side using Awario’s Alert Comparison report.

4. Marketing

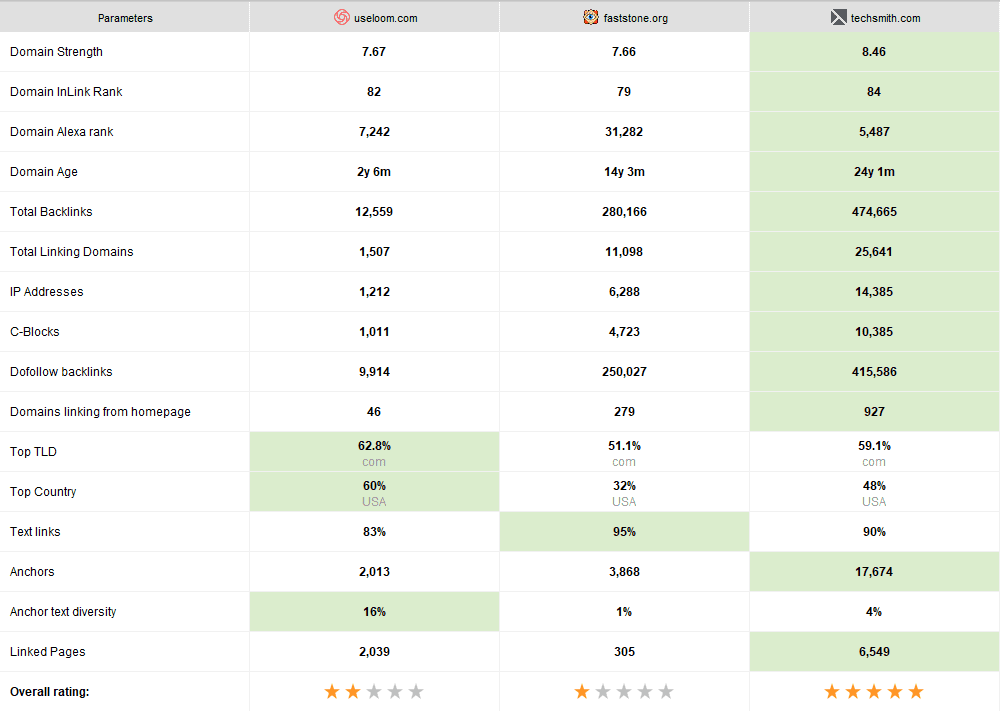

From the SEO perspective, there are two most important things about competition you should focus on: the keywords they rank for and the backlinks they’ve got. The former will give you a solid idea on what type of search terms bring them traffic and sales (so you can shape your own keyword strategy), and the latter will show what authoritative websites in your niche link to them (those will likely be relevant to your website too).

For both tasks, you can use SEO PowerSuite (you can get the free version here ). The toolkit includes 4 apps for different aspects of SEO, but we’ll only need 2 of those to analyze competitors.

Rank Tracker will help you with the keywords. Navigate to the tool’s Ranking Keywords module and type in a competitor’s URL. You’ll see a list of terms they rank for, along with the search volume for each term in your country of choice. It’s a good idea to move the most popular terms to Target Keywords right away so you can keep them for your records. Repeat the process for every competitor, noting their estimated search traffic and top keywords they rank for.

For backlink analysis, you’ll need SEO SpyGlass. Launch the tool and create a project for one of your competitors. Next, jump to Domain Comparison . One by one, specify your competitors’ websites and take a look at how they compare.

Next, jump to Link Intersection – a module that shows you the domains that link to more than one of your competitors. You can sort them by InLink Rank to see the most authoritative websites on your list. Those are likely relevant industry websites that will make a great addition to your backlink profile – make sure to save them so you can reach out and see if you can get a backlink from there.

4.2. Social media

The next step is analyzing what, when, and how your competitors are doing on social media. Rival IQ is a useful tool for this task, and they have a 14-day free trial available. Once you’ve signed up for the tool, specify your competitors’ websites, and the platform will automatically pull their social media profiles.

From there, you’ll be able to see which social networks they’re active on, how many followers they have, how much engagement their posts get, etc. Those insights will be handy to benchmark your own strategy against. The tool will also show you the best times and days of the week to post, based on the engagement competitors’ posts get.

On top of that, it may be a good idea to research if your competitors have a community on social media – a Facebook group or a subreddit dedicated to their product. How big is the community? Are the users engaged?

4.3. Advertising

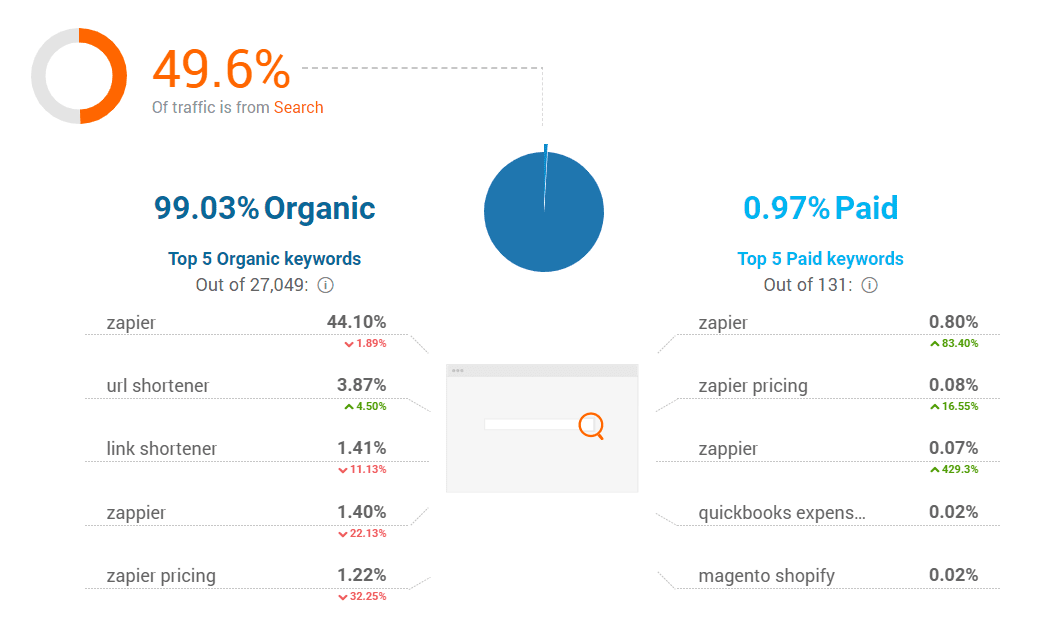

To get an idea of your competitors’ ad strategy, SimilarWeb is a great (and free) starting point. Enter the URL of a competitor’s website and navigate to the Search section – it will show you if your competitors have any search ads running, and, if they do, what their target keywords are.

The Display section below will show you whether a competitor is running any display ads, and, if they are, which platforms bring them the most traffic.

For Facebook ads, simply open a competitor’s Facebook page and click on Info and ads .

Alternatively, you can use Facebook’s Ad Library to search for your competitors’ ads. Unfortunately, these tools won’t reveal targeting rules your competitors use, but you’ll still get a solid idea of how many ads they’re running, and perhaps get inspiration for your own advertising efforts.

If native ads or other kinds of paid content are a thing in your niche, you can also try searching for “sponsored by [competitor]”, “author” “[competitor]”, etc. in a search engine of your choice (the quotes will make sure you’re looking for an exact match, and all of the words in the query are taken into account). Take note of authoritative platforms you come across and try reaching out to them to inquire about sponsored posts.

4.4. Influencers and other partners

At this point, we’re interested in exploring the partnerships your competitors have that help spread the word about their products. We’ll look at influencers endorsing your competition, publishers they work with, and media platforms they guest blog on, if any.

For the analysis, you’ll need the same social media monitoring alerts for your competitors’ brand you’ve already created in Awario. In your feed, make sure to group the mentions by Authors and sort them by Reach to see the most influential posts first (Reach is calculated based on the number of followers and engagements on social media, and based on the site’s estimated traffic for results from news, blogs, and the web).

This will let you see the most influential posts that mention your competition, including social media posts and blog articles from around the web. Take note of the influencers or publishers they work with – chances are they will be happy to work with you as well.

On top of that, you can also turn to SimilarWeb to see what referral sources are bringing the most visits to your competitors’ websites. Chances are you’ll also find a bunch of blogs and media platforms that generate substantial traffic to their sites.

4.5. Content Marketing

If content is part of your competitors’ strategy, it’s important that you analyze their blog and what they tend to write about. Are the readers engaged? Do the posts get shared around social media a lot? Does the competitor accept guest posts?

BuzzSumo is a great tool to help you out. It will show you the most shared posts on any blog within the past year, so you can get inspiration for your own posts and a better idea of what kind of content resonates with your target audience the best.

4.6. Customer acquisition

I know, a lot of the points above were actually customer acquisition techniques; but this section is reserved for the ones that weren’t outlined before. Do your competitors have a referral strategy? Do they have an affiliate program? Do they sponsor or exhibit at industry conferences? Do they acquire customers in any other creative way?

If applicable, it’s also important to analyze your competitors’ sales strategy. Do they do product demos? What does contacting a rep look like? Is there a phone number you can call?

The best thing to do is try and book a demo (or a call) with every company yourself, taking careful note of every step. Do they require filling out dozens of fields for you to talk to sales? Will they refuse to hold a demo just because your company is “too small”? Is their time zone convenient? How long does it take them to reply?

All of this will help you spot strengths and weaknesses in your competitors’ sales strategy to help you shape your own.

4.8. Customer service

Does every competitor offer Customer Support for all customers, or does it start with a particular plan? What channels do they provide support on: is it email, live chat, phone, social media, or all of the above? What is their response time? Do they offer Account Management for Enterprise customers?

Analyzing your competitors’ customer service will help you improve your own. The truth is, in large companies, customer care is often almost non-existent; for a new business in the industry, that’s a great area to capitalize on. If that’s true in your case, make sure to highlight the quality of your customer service on your website.

4.9. Unique strengths

Is there anything else that gives a competitor on your list an unfair advantage over everyone else? For example, is their CEO or somebody else on the team an industry influencer? Does the company publish amazing books that are also free? Have the founders launched successful products before? Make note of each competitor’s unique strengths that are hard to emulate.

What’s next?

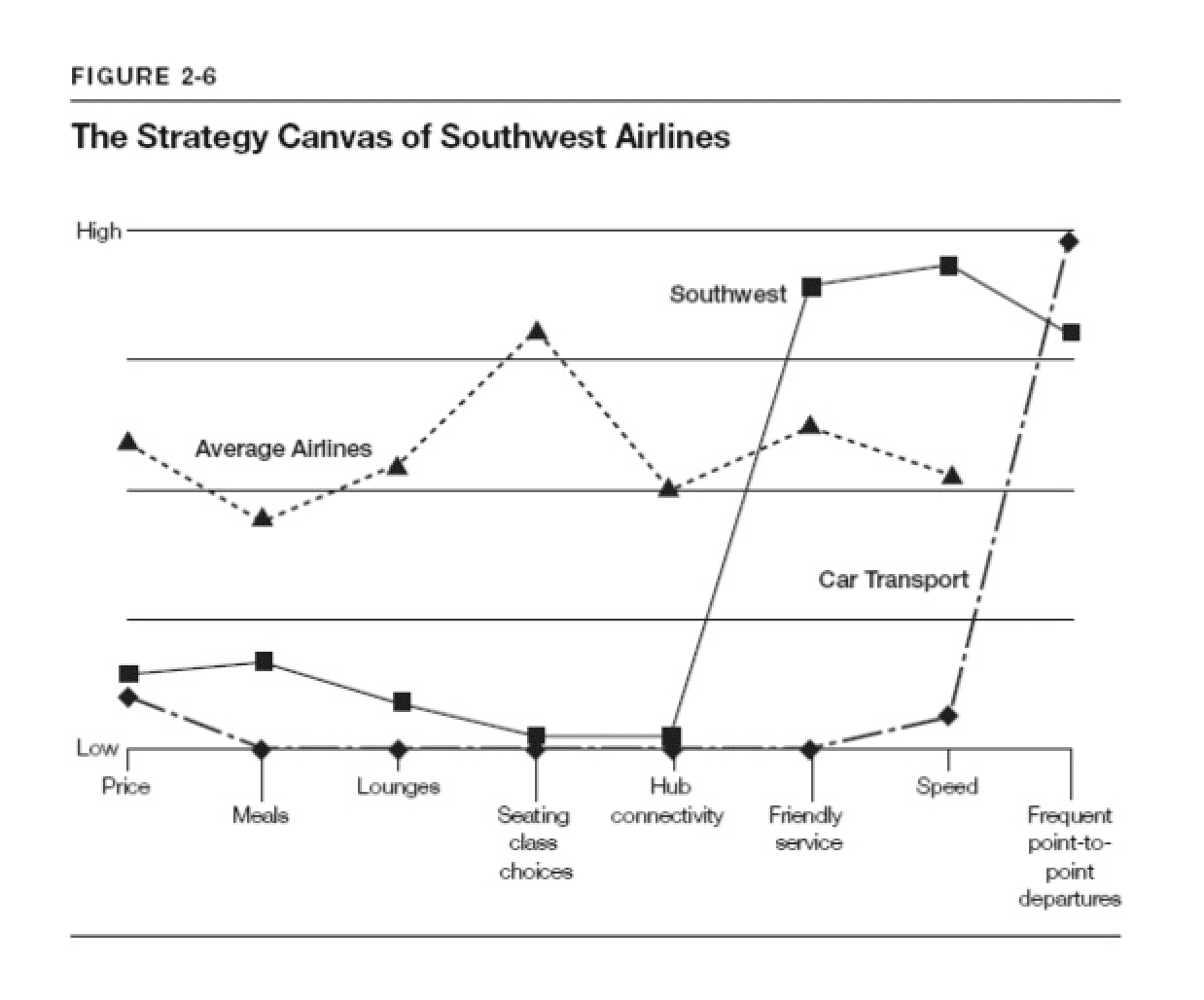

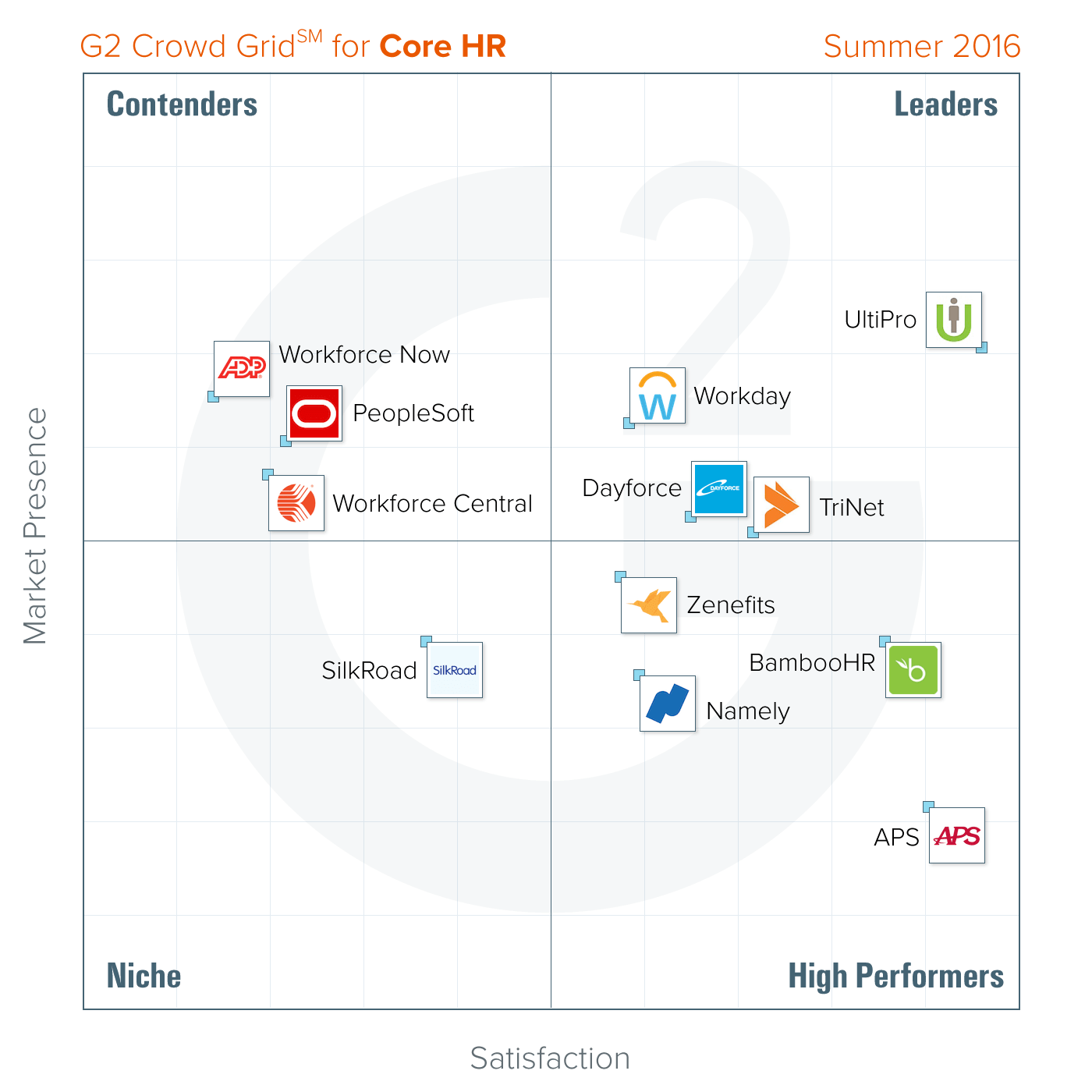

Once you’re done with every step of competitive analysis, I’m sure you’ve got a clear understanding of the market and more than a handful of ideas on how to improve your own product. While the research is still fresh in your mind, one bonus step I’d highly recommend to everyone performing the analysis is to map your competitors on a Strategy Canvas (from the book Blue Ocean Strategy ).

A Strategy Canvas is a chart that breaks down your competitors by various aspects of their businesses and products (the pricing and other aspects specific to your product category).

The easiest way to plot this is a line chart, with each factor assigned a score depending on how well it is executed.

Here’s an example from the book: a Strategy Canvas for Southwest, one of the first low-cost airlines in the US, compared to the 2 categories that could be considered its competitors: air travel at the time and car travel.

Source: Blue Ocean Strategy

Depending on the kind of competitors you’ve analyzed, you’ll likely see that most of them follow one or two distinct patterns: those will be the major categories you’re competing with (though they may not be as different as cars and airplanes). It’s time to plot your own product on the canvas and see how it compares to the competitors.

Finally, think of ways to make your product stand out. From your research, recall the things your audience needs more and less of. Blue Ocean Strategy offers a nice way to think about the factors on the canvas in terms of applying them to your own product, called the Eliminate-Reduce-Raise-Create Grid.

- Think of features you could eliminate to lower the cost of your solution : the ones that seem superfluous, are rarely mentioned by customers, and are particularly costly. For Southwest vs. traditional airlines, those were seating class choices and hub connectivity.

- Think of the factors you can reduce way below the industry standard : the ones that need to be there, but can be leveled down significantly. It’s great if price is going to be one of them! For Southwest, those were the prices, meals, and lounges.

- Time to think about the aspects you’ll raise well above the industry standard , especially if they won’t cost you a fortune. What do customers wish they’d get more of? For Southwest, that was the friendliness of the service and the speed of travel.

- Lastly, try and create new features that your closest competitors don’t offer (or borrow them from another product category). With Southwest, it was the frequent departures that traditional airlines didn’t have – but car travel did.

Remember: the idea of a competitive analysis isn’t to steal what they’re doing, it is to understand where your business falls in the market and find new opportunities to make your product stand out.

Eventually, focusing on your customers and gaps between supply and demand will serve you much better than focusing on the competition. And that’s what competitor analysis is for – finding ways to serve the customer better.

Did you find this article helpful? You might also like our all-you-need social media toolkit.

The all-you-need social media toolkit

Publish Flawlessly. Analyze Effortlessly. Engage Authentically.

Buffer is the all-you-need social media toolkit that lets you focus on doing what you love for your business.

Related Articles:

21+ Free Image Sites to Help You Find Photos You Would Actually Use in Your Marketing

Must-bookmark sites and tools to help you find free, high-quality images for your marketing content...

How to Make Money on TikTok in 2024

TikTok is a great tool for discovery that also has the potential to create a new source of revenue or income. Here’s how you or your business can make money on TikTok....

Power Words: 150+ Words to Drive More Clicks and Conversions on Social Media

Power words can change the trajectory of your social media posts. Here’s why they work and a list of 150+ words you can start to use immediately....

How to Create Your Own Social Media Calendar in 7 Simple Steps

A step-by-step guide to creating your own social media content calendar, expert guidance on why you need a social media calendar, plus the system we use in our marketing team at Buffer....

140,000+ small businesses like yours use Buffer to build their brand on social media every month

- No credit card required

- Cancel anytime

May we suggest

Picked for you.

- Product overview

- All features

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana AI

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Content calendars

- Marketing strategic planning

- Resource planning

- Project intake

- Product launches

- Employee onboarding

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- What's new Learn about the latest and greatest from Asana

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Support Need help? Contact the Asana support team

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Project planning |

- How to create a competitive analysis (w ...

How to create a competitive analysis (with examples)

Competitive analysis involves identifying your direct and indirect competitors using research to reveal their strengths and weaknesses in relation to your own. In this guide, we’ll outline how to do a competitive analysis and explain how you can use this marketing strategy to improve your business.

Whether you’re running a business or playing in a football game, understanding your competition is crucial for success. While you may not be scoring touchdowns in the office, your goal is to score business deals with clients or win customers with your products. The method of preparation for athletes and business owners is similar—once you understand your strengths and weaknesses versus your competitors’, you can level up.

What is a competitive analysis?

Competitive analysis involves identifying your direct and indirect competitors using research to reveal their strengths and weaknesses in relation to your own.

![case study competitor analysis [inline illustration] What is a competitive analysis (infographic)](https://assets.asana.biz/transform/c1a37dfd-53a8-44c4-b57b-10fc6a332ba1/inline-project-planning-competitive-analysis-example-1-2x?io=transform:fill,width:2560&format=webp)

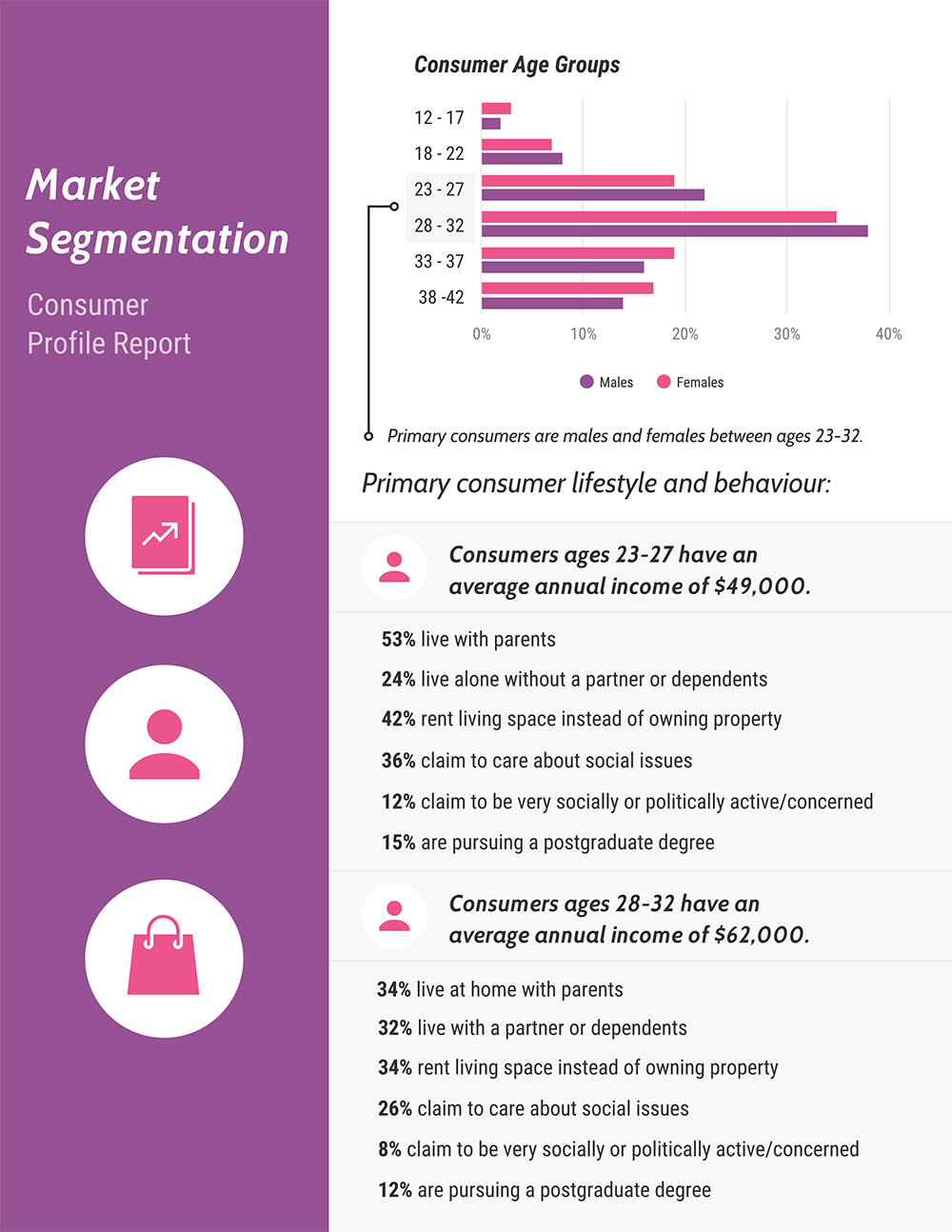

Direct competitors market the same product to the same audience as you, while indirect competitors market the same product to a different audience. After identifying your competitors, you can use the information you gather to see where you stand in the market landscape.

What to include in a competitive analysis

The purpose of this type of analysis is to get a competitive advantage in the market and improve your business strategy. Without a competitive analysis, it’s difficult to know what others are doing to win clients or customers in your target market. A competitive analysis report may include:

A description of your company’s target market

Details about your product or service versus the competitors’

Current and projected market share, sales, and revenues

Pricing comparison

Marketing and social media strategy analysis

Differences in customer ratings