- Previous Chapter

The Global Financial Crisis has been a watershed event not only for the United States and many advanced economies but also emerging markets (EM) around the world. The subprime crisis that began in the summer of 2007 was triggered by deteriorating quality of U.S. subprime mortgages. This rapidly propagated across different asset classes and financial markets. Increased delinquencies on subprime mortgages, driven by rising interest rates for refinancing and falling house prices, resulted in uncertainty surrounding the value of a number of structured credit products which had these assets in their underlying portfolios. As a result, rating agencies downgraded many of the related securities and announced changes in their methodologies for rating such products. Meanwhile, structured credit mortgage-backed instruments saw rapid price declines, and the liquidity for initially tradable securities in their respective secondary markets evaporated.

The losses, downgrades, and changes in methodologies shattered investors’ confidence in the rating agencies’ abilities to evaluate risks of complex securities, a result of which, investors pulled back from structured products in general. With interbank markets across various advanced economies becoming dysfunctional in early August 2007, there was clear evidence of a run for “quality” by investors. Financial markets more generally showed signs of stress, as investor preference moved away from complex structured products in a flight to quality and liquidity, and global investors’ risk appetite sharply decreased due to a widespread re- pricing of risk.

It soon became apparent that a wide range of different financial institutions had exposures to many of these mortgage-backed securities, often off-balance sheet entities such as conduits or structured investment vehicles (SIVs). Due to the increasing uncertainty with regard to their exposure to and the value of the underlying mortgage-backed securities, investors became unwilling to roll over the corresponding asset- backed commercial paper. As the problems with SIVs and conduits deepened, banks came under increasing pressure to rescue those that they had sponsored by providing liquidity or by taking their respective assets onto their own balance sheets. As a result, the balance sheets of those financial institutions were particularly strained by this re-absorption, which in addition was amplified by losses due to declining asset values.

Many European banks that had large exposures to US asset-backed securities had difficulties accessing wholesale funding, inducing subsequent market illiquidity in different market segments. The US subprime crisis increasingly became one of insolvency, as banks such as Northern Rock, IKB, and Bear Stearns had to be rescued. Due to the major importance of the interbank money market, central banks in turn intervened by reducing interest rates and providing additional liquidity to the markets in order to reduce pressures.

The Lehman Brothers collapse in September 2008 was the watershed event that unleashed a full-blown systemic crisis with global risk aversion dramatically increasing, asset markets across countries and regions plunging and the unwinding of carry trades that saw high- yielding EM currencies sharply depreciate within a short period of time. The interbank market became even more exposed to counterparty and liquidity risk, leading market participants to globally withdraw from these market segments.

Volatility also spilled over into the foreign currency markets with the carry trades starting to rapidly unwind at the end of September 2008. High-yielding and previous investment currencies saw large depreciations against the U.S. dollar, while funding currencies such as the Japanese yen benefited by a repatriation of funds into Japan. There was a scramble for U.S. dollars.

EM countries were less affected during the initial stages of the subprime crisis than advanced economies, as for example EM equity markets peaked in November 2007. But the persistence of the market dislocations, the deterioration of economic fundamentals in advanced economies and rising global risk aversion significantly affected EM countries by late 2008 after the Lehman Brothers collapse. Even EM countries with sound macroeconomic and financial pre-conditions, built-up over the previous years, have been strongly affected by the financial contagion that in late 2008 spilled over to the real sector with export and GDP growth rates plunging and trade finance sharply contracting across the world.

Against the backdrop of the above short narrative of the beginning of the crisis (see chapter III for more details), the first four chapters of the open access book focus on the origins and early phase of the Global Financial Crisis as well as spillovers and contagion:

Chapter I (published in 2008) with Nathaniel Frank and Brenda Gonzalez-Hermosillo examines the linkages between market and funding liquidity pressures, as well as their interaction with solvency issues surrounding key financial institutions during the 2007 subprime crisis.

Chapter II (published in 2009) with Nathaniel Frank examines the effectiveness of central bank interventions during the early phase of the crisis by focusing on the Federal Reserve (Fed) and the European Central Bank (ECB). It provides evidence that central bank interventions had a statistically significant impact on easing stress in unsecured interbank markets during the first phase of the subprime crisis which began in July 2007. But the economic magnitudes of the central bank interventions have overall not been very large.

Chapters III and IV focus on spillovers and contagion of the Global Financial Crisis. Specifically, chapter III (first published in 2009) with Nathaniel Frank looks at the financial spillovers to EMs by examining potential financial linkages between liquidity and bank solvency measures in advanced economies and EM bond and stock markets. The findings at the time indicate that the notion of possible de-coupling (in the financial markets) had been misplaced. While EM stock markets reached their peak in the last quarter of 2007, interlinkages between funding stress and equity markets in advanced economies and EM financial indicators were highly correlated and have seen sharp increases during specific crisis moments then.

Following that, chapter IV (first published in 2009) with Brenda Gonzalez-Hermosillo examines several key global market conditions, such as a proxy for market uncertainty and measures of interbank funding stress, to assess financial volatility and the likelihood of crisis. Using Markov regime-switching techniques, it shows that the Lehman Brothers failure was a watershed event in the crisis, although signs of heightened systemic risk could be detected as early as February 2007. In addition, the chapter analyzes the role of global market conditions to help determine when governments should begin to exit their extraordinary public support measures.

The next book chapters narrow down on a number of (geographical) case studies during and after the Global Financial Crisis:

Chapter V (first published in 2009) with Tao Sun examines financial stability issues that arise from the increased presence of sovereign wealth funds (SWFs) in global financial markets by assessing whether and how stock markets react to the announcements of investments and divestments to firms by SWFs using an event study approach. Based on 166 publicly traceable events collected on investments and divestments by major SWFs during the period from 1990 to 2009, results show that there was no significant destabilizing effect of SWFs on equity markets, which is consistent with anecdotal evidence.

Chapter VI (first published in 2010) with Adolfo Barajas, Ralph Chami and Raphael Espinoza focuses on the credit stagnation during the Global Financial Crisis in the Middle Eastern and North African (MENA) countries from three analytical angles. First, it finds that, similar to other regions and to its past history, a credit boom preceded the current slowdown, and that a protracted period of sluggish growth was likely going forward. Second, it uncovers a key role played by bank funding (deposit growth and external borrowing slowed considerably) but whose effect was frequently dampened by expansionary monetary policy. Third, bank-level fundamentals–capitalization and loan quality–helped to explain differences in credit growth across banks and countries. The chapter concludes on what policy measures could have been taken to revive credit growth in the MENA region.

Chapter VII (published in 2012) examines the case of Romania, which had been significantly impacted by the Global Financial Crisis. The chapter looks at foreign bank deleveraging and examines how Romania’s asset prices have been impacted from European crisis spillovers.

With European banks at the centre during the Global Financial Crisis, chapter VIII (published in 2013) with Nadege Jassaud looks at the balance sheet repair of European banks and the progress with bank restructuring at that time. The chapter specifically discusses the hurdles that impair restructuring and resolution that were present during the 2012/ 2013 European FSAP.

The next three chapters focus on the important aspect of bank stress testing. The Global Financial Crisis has clearly shown the shortcomings of stress testing but also its importance in examining financial stability and helping form policy recommendations.

Neglecting liquidity risks has come at a substantial price during the Global Financial Crisis. Over the last decade, large banks became increasingly reliant on short-term wholesale funding to finance their rapid asset growth. At the same time, funding from non-deposit sources (such as commercial paper placed with money-market mutual funds) soared. With the unfolding of the Global Financial Crisis, when uncertainties about the solvency of certain banks emerged, various types of wholesale funding market segments froze, resulting in funding or liquidity challenges for many banks. In the light of this experience, there is a widespread consensus that banks’ extensive reliance on deep and broad unsecured money markets is to be avoided. In this regard, chapter IX (published in 2012) with Christian Schmieder, Benjamin Neuendorfer, Claus Puhr and Stefan Schmitz presents a framework to run system-wide, balance sheet data-based liquidity stress tests. The liquidity framework includes a module to simulate the impact of bank-run type scenarios, a module to assess risks arising from maturity transformation and rollover risks, and a framework to link liquidity and solvency risks.

Stress testing has become an essential and very prominent tool in the analysis of financial- sector stability and the development of financial-sector policy, but in itself can have only a limited impact unless it is tied to action. Stress testing and related simulations can serve various functions, such as the calibration of the relative importance of various risk factors, and the assessment of banks’ capital needs when they are already under stress. The publication of stress-test results with enough supporting material (including on the initial condition of banks) can be helpful in reducing uncertainty; even banks that are revealed to be relatively weak may benefit if the market paralysis engendered by great uncertainty is relieved. But stress tests are of value mainly when they are followed up by concrete and swift actions by the authorities (supervisory and others) and by bank managers that improve the condition of banks and of banks’ clients. In this regard, chapter X (published in 2013) with Daniel Hardy discusses the role of European-wide stress tests.

One of the challenges of financial stability analysis and bank stress testing is how to establish scenarios with meaningful macro-financial linkages, i.e., taking into account spillover effects and other forms of contagion. Chapter XI (first published in 2014) with Ferhan Salman and Christian Schmieder presents an analytical approach to simulate the potential impact of spillover effects based on the “traditional” design of macro-economic stress tests. Specifically, the chapter examines spillover effects observed during the financial crisis and simulates their impact on banks’ liquidity and capital positions. The outcome suggests that spillover effects have a highly non-linear impact on bank soundness, both in terms of liquidity and solvency.

The final two chapters XII and XIII examine some aspects of debt sustainability and sovereign debt restructuring, namely the domestic financial stability implications from a face-value preserving maturity extension, so-called reprofiling as well as the role of banks’ home bias for sovereign debt sustainability:

Chapter XII (published in 2014) analyses the experience with past cases of reprofiling to assess whether they had destabilizing effects on the domestic banking system. It examines several past maturity extensions (Cyprus, Jamaica, Pakistan, and Uruguay) and finds that destabilizing effects did not materialize. Several factors contributed to the generally successful outcomes under maturity extensions: financial stability concerns were taken into account in the design of the restructuring and program strategy; banks mainly held their sovereign assets as held-to-maturity (HTM); a reprofiling was not assessed to be an impairment event requiring a write down of these assets (e.g., Cyprus, Jamaica); regulatory incentives for banks were provided (e.g., Jamaica or Uruguay); capital and liquidity support mechanisms were established (e.g., Jamaica) or were present (Cyprus); the amount of bank holdings of sovereign bonds in most cases was not very large; and some forbearance was used. The Jamaican case illustrates how a restructuring was designed to be light in order to ensure a limited impact on the financial system. The chapter also proposes possible measures that could help protect the banking system during a reprofiling and encourage participation by domestic banks in the exchange. Finally, the chapter examines financial stability implications of a creditor bailout. Although a reprofiling may have some disruptive effects, a bailout does not necessarily insulate the domestic financial system, as the Greek experience demonstrates.

Motivated by the recent increase in domestic banks’ holdings of domestic sovereign debt (i.e., home bias) in the European periphery, chapter XIII (published in 2015) with Tamon Asonuma and Said Bakhache analyzes implications of banks’ home bias for the sovereign’s debt sustainability. The main findings, based on a sample of advanced (AM) and EM economies, suggest that home bias generally reduces the cost of borrowing for AMs and EMs when debt levels are moderate to high. A worsening of market sentiments appears to dimish the favorable impact of home bias on cost of borrowing particularly for EMs. In addition, for AMs and EMs, higher home bias is associated with higher debt levels, and less responsive fiscal policy. The findings suggest that home bias indeed matters for debt sustainability: Home bias may provide fiscal breathing space, but delays in fiscal consolidation may actually delay problems until debt reaches dangerously high levels.

Within Same Series

- Introduction

Other IMF Content

Other publishers content, asian development bank.

- ASEAN+3 Bond Market Forum Brief No. 1 - The Professional Bond Market: A Practical Introduction

- Introduction to Small Area Estimation Techniques: A Practical Guide for National Statistics Offices

- Climate Change, Coming Soon to a Court Near You: Report Series Purpose and Introduction to Climate Science

- Asia Bond Monitor: March 2023

- ADB Economics Working Paper Series No. 546: Global Banking Network and Regional Financial Contagion

- Asymmetric Spillovers in ASEAN Bond Markets

- ADB Economics Working Paper Series No. 516: A Contagion through Exposure to Foreign Banks during the Global Financial Crisis

- Financial Integration and Macrofinancial Linkages in Asia: Crises, Responses, and Policy Considerations

- The Impact of Nonperforming Loans on Cross-Border Bank Lending: Implications for Emerging Market Economies

- The Future of Inclusive Finance: 3rd Asia Finance Forum Conference Proceedings

Inter-American Development Bank

- Explaining European Patterns of Taxation: From the Introduction of the Euro to the Euro-Crisis

- Remittances to Latin America and the Caribbean: Introduction (Part 3 of 5)

- Learning in Twenty-First Century Schools: Note 1; Series Introduction

- Breve 11: Value Based Drug Reimbursement; Introduction to the Main Features of the German Pharmaceutical Policy

- Preconditions for a Successful Introduction of Structural Fiscal Balance-based Rules in Latin America and the Caribbean: A Framework Paper

- Developing Clean Energy Solutions in Latin America's Major Cities: An Introduction for Subnational Energy Policy Decision-Makers

- Ex-post Evaluation of Forest Conservation Policies Using Remote Sensing Data: An Introduction and Practical Guide

- Impact Evaluation of the IDB's Liquidity Program for Growth Sustainability

- Multilateral Safety Nets for Financial Crises

- Preventing Crisis and Contagion: Fiscal and Financial Dimensions

International Labour Organization

- Introduction to work study. Fourth revised edition

- Resilience in a downturn: The power of financial cooperatives

The World Bank

- An introduction to the microstructure of emerging markets

- The Economics of Forced Displacement: An Introduction

- Finding a Path to Formalization in Benin: Early Results after the Introduction of the Entreprenant Legal Status.

- Institutional Investment in Infrastructure in Developing Countries: Introduction to Potential Models

- Introduction and summary to the handbook of trade policy and WTO accession for development in Russia and the CIS

- Collateral Registries for Movable Assets: Does Their Introduction Spur Firms' Access to Bank Finance?

- Competency Standards as a Tool for Human Capital Development: Assessment of Their Development and Introduction into TVET and Certification in Indonesia

- The Cultural Trade Index: An Introduction

- External debt management: an introduction

- Accounting for infrastructure regulation: an introduction

Table of Contents

- Front Matter

International Monetary Fund Copyright © 2010-2021. All Rights Reserved.

- [66.249.64.20|109.248.223.228]

- 109.248.223.228

Character limit 500 /500

Essays on the Global Financial Crisis

Author: Mr. Heiko Hesse

MISC PUBS , Misc , , subprime crisis , market , subprime mortgage , market paralysis , Neglecting liquidity risk

Organization

Bookstore Links

- Skip to main content

Advancing social justice, promoting decent work

Ilo is a specialized agency of the united nations, the global crisis. causes, responses and challenges.

This important collection of essays brings together the main findings of ILO research since the start of the global financial and economic crisis in 2008. With contributions from diverse research disciplines, the volume provides new perspectives on employment and income-led growth and the role of regulation, and makes policy recommendations for the future.

Publication

Check your browser settings and network. This website requires JavaScript for some content and functionality.

The Global Financial Crisis

The global financial crisis (GFC) refers to the period of extreme stress in global financial markets and banking systems between mid 2007 and early 2009. During the GFC, a downturn in the US housing market was a catalyst for a financial crisis that spread from the United States to the rest of the world through linkages in the global financial system. Many banks around the world incurred large losses and relied on government support to avoid bankruptcy. Millions of people lost their jobs as the major advanced economies experienced their deepest recessions since the Great Depression in the 1930s. Recovery from the crisis was also much slower than past recessions that were not associated with a financial crisis.

Main Causes of the GFC

As for all financial crises, a range of factors explain the GFC and its severity, and people are still debating the relative importance of each factor. Some of the key aspects include:

1. Excessive risk-taking in a favourable macroeconomic environment

In the years leading up to the GFC, economic conditions in the United States and other countries were favourable. Economic growth was strong and stable, and rates of inflation, unemployment and interest were relatively low. In this environment, house prices grew strongly.

Expectations that house prices would continue to rise led households, in the United States especially, to borrow imprudently to purchase and build houses. A similar expectation on house prices also led property developers and households in European countries (such as Iceland, Ireland, Spain and some countries in Eastern Europe) to borrow excessively. Many of the mortgage loans, especially in the United States, were for amounts close to (or even above) the purchase price of a house. A large share of such risky borrowing was done by investors seeking to make short-term profits by ‘flipping’ houses and by ‘subprime’ borrowers (who have higher default risks, mainly because their income and wealth are relatively low and/or they have missed loan repayments in the past).

Banks and other lenders were willing to make increasingly large volumes of risky loans for a range of reasons:

- Competition increased between individual lenders to extend ever-larger amounts of housing loans that, because of the good economic environment, seemed to be very profitable at the time.

- Many lenders providing housing loans did not closely assess borrowers’ abilities to make loan repayments. This also reflected the widespread presumption that favourable conditions would continue. Additionally, lenders had little incentive to take care in their lending decisions because they did not expect to bear any losses. Instead, they sold large amounts of loans to investors, usually in the form of loan packages called ‘mortgage-backed securities’ (MBS), which consisted of thousands of individual mortgage loans of varying quality. Over time, MBS products became increasingly complex and opaque, but continued to be rated by external agencies as if they were very safe.

- Investors who purchased MBS products mistakenly thought that they were buying a very low risk asset: even if some mortgage loans in the package were not repaid, it was assumed that most loans would continue to be repaid. These investors included large US banks, as well as foreign banks from Europe and other economies that sought higher returns than could be achieved in their local markets.

2. Increased borrowing by banks and investors

In the lead up to the GFC, banks and other investors in the United States and abroad borrowed increasing amounts to expand their lending and purchase MBS products. Borrowing money to purchase an asset (known as an increase in leverage) magnifies potential profits but also magnifies potential losses. [1] As a result, when house prices began to fall, banks and investors incurred large losses because they had borrowed so much.

Additionally, banks and some investors increasingly borrowed money for very short periods, including overnight, to purchase assets that could not be sold quickly. Consequently, they became increasingly reliant on lenders – which included other banks – extending new loans as existing short-term loans were repaid.

3. Regulation and policy errors

Regulation of subprime lending and MBS products was too lax. In particular, there was insufficient regulation of the institutions that created and sold the complex and opaque MBS to investors. Not only were many individual borrowers provided with loans so large that they were unlikely to be able to repay them, but fraud was increasingly common – such as overstating a borrower's income and over-promising investors on the safety of the MBS products they were being sold.

In addition, as the crisis unfolded, many central banks and governments did not fully recognise the extent to which bad loans had been extended during the boom and the many ways in which mortgage losses were spreading through the financial system.

How the GFC Unfolded

Us house prices fell, borrowers missed repayments.

The catalysts for the GFC were falling US house prices and a rising number of borrowers unable to repay their loans. House prices in the United States peaked around mid 2006, coinciding with a rapidly rising supply of newly built houses in some areas. As house prices began to fall, the share of borrowers that failed to make their loan repayments began to rise. Loan repayments were particularly sensitive to house prices in the United States because the proportion of US households (both owner-occupiers and investors) with large debts had risen a lot during the boom and was higher than in other countries.

Stresses in the financial system

Stresses in the financial system first emerged clearly around mid 2007. Some lenders and investors began to incur large losses because many of the houses they repossessed after the borrowers missed repayments could only be sold at prices below the loan balance. Relatedly, investors became less willing to purchase MBS products and were actively trying to sell their holdings. As a result, MBS prices declined, which reduced the value of MBS and thus the net worth of MBS investors. In turn, investors who had purchased MBS with short-term loans found it much more difficult to roll over these loans, which further exacerbated MBS selling and declines in MBS prices.

Spillovers to other countries

As noted above, foreign banks were active participants in the US housing market during the boom, including purchasing MBS (with short-term US dollar funding). US banks also had substantial operations in other countries. These interconnections provided a channel for the problems in the US housing market to spill over to financial systems and economies in other countries.

Failure of financial firms, panic in financial markets

Financial stresses peaked following the failure of the US financial firm Lehman Brothers in September 2008. Together with the failure or near failure of a range of other financial firms around that time, this triggered a panic in financial markets globally. Investors began pulling their money out of banks and investment funds around the world as they did not know who might be next to fail and how exposed each institution was to subprime and other distressed loans. Consequently, financial markets became dysfunctional as everyone tried to sell at the same time and many institutions wanting new financing could not obtain it. Businesses also became much less willing to invest and households less willing to spend as confidence collapsed. As a result, the United States and some other economies fell into their deepest recessions since the Great Depression.

Policy Responses

Until September 2008, the main policy response to the crisis came from central banks that lowered interest rates to stimulate economic activity, which began to slow in late 2007. However, the policy response ramped up following the collapse of Lehman Brothers and the downturn in global growth.

Lower interest rates

Central banks lowered interest rates rapidly to very low levels (often near zero); lent large amounts of money to banks and other institutions with good assets that could not borrow in financial markets; and purchased a substantial amount of financial securities to support dysfunctional markets and to stimulate economic activity once policy interest rates were near zero (known as ‘quantitative easing’).

Increased government spending

Governments increased their spending to stimulate demand and support employment throughout the economy; guaranteed deposits and bank bonds to shore up confidence in financial firms; and purchased ownership stakes in some banks and other financial firms to prevent bankruptcies that could have exacerbated the panic in financial markets.

Although the global economy experienced its sharpest slowdown since the Great Depression, the policy response prevented a global depression. Nevertheless, millions of people lost their jobs, their homes and large amounts of their wealth. Many economies also recovered much more slowly from the GFC than previous recessions that were not associated with financial crises. For example, the US unemployment rate only returned to pre-crisis levels in 2016, about nine years after the onset of the crisis.

Stronger oversight of financial firms

In response to the crisis, regulators strengthened their oversight of banks and other financial institutions. Among many new global regulations, banks must now assess more closely the risk of the loans they are providing and use more resilient funding sources. For example, banks must now operate with lower leverage and can’t use as many short-term loans to fund the loans that they make to their customers. Regulators are also more vigilant about the ways in which risks can spread throughout the financial system, and require actions to prevent the spreading of risks.

Australia and the GFC

Relatively strong economic performance.

Australia did not experience a large economic downturn or a financial crisis during the GFC. However, the pace of economic growth did slow significantly, the unemployment rate rose sharply and there was a period of heightened uncertainty. The relatively strong performance of the Australian economy and financial system during the GFC, compared with other countries, reflected a range of factors, including:

- Australian banks had very small exposures to the US housing market and US banks, partly because domestic lending was very profitable.

- Subprime and other high-risk loans were only a small share of lending in Australia, partly because of the historical focus on lending standards by the Australian banking regulator (the Australian Prudential Regulation Authority (APRA)).

- Australia's economy was buoyed by large resource exports to China, whose economy rebounded quickly after the initial GFC shock (mainly due to expansionary fiscal policy).

Also a large policy response

Despite the Australian financial system being in a much better position before the GFC, given the magnitude of the shock to the global economy and to confidence more broadly, there was also a large policy response in Australia to ensure that the economy did not suffer a major downturn. In particular, the Reserve Bank lowered the cash rate target significantly, and the Australian Government undertook expansionary fiscal policy and provided guarantees on deposits at and bonds issued by Australian banks.

Following the crisis, APRA implemented the stronger global banking regulations in Australia. Together, APRA and the financial market and corporate regulator, the Australian Securities and Investments Commission, have also strengthened lending standards to make the financial and private sectors more resilient.

Imagine that Jane buys an asset for $100,000 using $10,000 of her own money and $90,000 of borrowed money. If the asset price increases to $110,000, then Jane's own money after paying back the loan has doubled to $20,000 (ignoring interest costs). However, if the asset price falls to $90,000, then Jane would have lost all of the money she initially had. And if the asset price were to fall to less than $90,000, then Jane would owe money to her lender. [1]

Home / Essay Samples / Government / Financial Crisis / The Global Financial Crisis

The Global Financial Crisis

- Category: Government

- Topic: Crisis , Financial Crisis

Pages: 1 (582 words)

- Downloads: -->

Introduction

Causes and triggers, lessons learned, global cooperation and recovery.

--> ⚠️ Remember: This essay was written and uploaded by an--> click here.

Found a great essay sample but want a unique one?

are ready to help you with your essay

2011 Theses Doctoral

Essays in International Finance and the Global Financial Crisis

Grad, David

This thesis is a compilation of three separate and distinct papers on topics in international finance and the recent financial crisis. Chapter one links the foreign exchange risk premium to macroeconomic risk by studying the options market around macroeconomic news releases. Using a unique data set of overnight currency option prices, I study the reaction of the entire state price density to both anticipated and recently occurring macroeconomic news releases for both US and foreign announcements. I then use intraday data to compare the behavior of the physical pdf around these news releases over the same tenor as the option. I find significant movements in the implied distribution that can be linked to macroeconomic news both ex-ante and ex-post. The volatility risk premium in the overnight options market is large across all currencies, and a strategy that sells insurance through the form of overnight straddles around US non-farm payroll releases earns significant profits. Nonetheless, a significant portion of the volatility risk premium remains that cannot be explained through macroeconomic news despite the short lifespan of these options. Chapter two studies the evolution of last-resort operations in the recent credit crisis of 2007-2008. The financial crisis that began in 2007 took place in the context of a secular shift from a bank-loan financial system to a capital-markets financial system; that is, from one based on nontradable financial assets, with banks playing the key intermediary role, to one based on tradable securities, with dealers playing the key intermediary role. We argue that the system's response to the crisis can be viewed as moving from a private lender of last resort, through a public lender of last resort, to a dealer of last resort. It was the last that was finally able to stabilize the system, because it is the response suited to a liquidity crisis in the capital-markets financial system where the problem arose. We use a balance-sheet approach to trace out the breakdown of the so-called shadow banking system and the measures taken first in the private money markets and then by the Federal Reserve to restore liquidity to the financial system. Chapter three studies the effect of hedging imbalances in the foreign exchange market as a possible explanation for deviations from Uncovered Interest Parity. Speculators, becoming weary of holding excess demand for forward hedges, hedge their own exposure in the currency options market. The subsequent increase in option prices is a consequence of this market overhang and is reflected in the implied volatility of currency options. Separating out implied from forecast volatility, we construct a measure of hedging imbalances and add this to the standard UIP regression. For some currencies, a partial rehabilitation of UIP is found.

More About This Work

- DOI Copy DOI to clipboard

ESSAY SAUCE

FOR STUDENTS : ALL THE INGREDIENTS OF A GOOD ESSAY

Essay: The global financial crisis

Essay details and download:.

- Subject area(s): Finance essays

- Reading time: 6 minutes

- Price: Free download

- Published: 9 June 2012*

- File format: Text

- Words: 1,550 (approx)

- Number of pages: 7 (approx)

Text preview of this essay:

This page of the essay has 1,550 words. Download the full version above.

The global financial crisis

The Global Financial Crisis has been brewing for quite a while now, but it really started showing its efforts in the early 2007 and into 2008. During this period the world stock markets have fallen, large financial institutions have collapsed or been bought out, and governments of even the developed nations have had to come up with rescue packages to bail out their financial systems.

Many economists believe that the financial institutions or the banks that have been bailed out by the respective government are the ones which have led the world in recession and on the other hand the truth lies with the fact that bailing out is not the solution to the global economic meltdown. This was the deepest recession since World War Two and had the potential to affect the livelihoods of almost all in this largely inter-dependent world.

The financial meltdown has its origin in the U.S. mortgage market since the early 2000’s. At that time the U.S. economy was booming and the government was more intent on making home ownership affordable to more and more people; the financial institutions had a lot of money to dispense and the real estate values were rising at a higher rate than expected. There was a lot of competition among the mortgage lenders and so to over power the other they started getting new terms and simpler ways to lend money; like �no-or-low documentation loans.” This created the market for ‘subprime borrowers’ i.e. people who previously would not have qualified to borrow money from the market. After some time in the year 2006 the housing prices started to taper-off after rising for a long while. As the markets declined lots of borrowers decided to re-finance there already bought properties but because of hike in the interest rates, they figured out that their loan were re-priced to higher monthly payments which they were unable to adjust. Consequently, there was an imbalance as property prices kept on decreasing and the defaulters kept on increasing; this brought a bubble and led to recession.

The other problem which still persists and because of which we are here is the credit crunch. Prior to the recession the bank in the developed countries were on a lending spree. The credit worthiness of the applicants was not inspected thoroughly. It was only when the banks started experiencing bad debts that they stopped lending. Fearing that this would lead to a collapse of the banking system, the government of the developed countries started recapitalizing the banks at the cost of hundreds of billions of Euros and dollars. The state also backed the bank with guarantees on their loans. The state thought that this would bring a restoration in the banking system only with the small set back of low or no growth. But this was not the case. At this point of time banks were more concerned about bringing stability rather than providing credit. The central bank then opted to lower the Libor rate(interbank lending rate)in a hope to overcome the problem of credit availability. But at the year end 2008 it was declining. This created a situation where the Libor rate were falling due to increased liquidity but as per the then existing scenario there was not much of inter bank lending. This meant that the central bank had become more than the lenders of last resort, they were actually the sole lenders.

The financial banking crisis developed from August 2007 through to July 2008 and then exploded into the global real economy: Central Europe and Latin America were devastated in September; South-east Asia and the Middle East in October and China in November. This is a combination of a demand crisis, brought on by a credit crisis linked with a liquidity and solvency crisis in the financial sector related to a housing slump in the US, UK and several other major economies. All these factors have never combined before in such a �perfect storm.”

The crisis became so severe that after the failure and buyouts of major institutions, the Bush Administration offered a $700 billion bailout plan for the US financial system. It was controversial as people believed that the culprits were being bailed out while the common man would be left to suffer. On the other hand in Europe, major financial institutions failed while few other needed bailouts by the government. Starting with Britain, a number of nations decided to nationalize some failing banks to try and restore confidence. This in itself shows how serious the issue of recession as the US initially was never in favour of helping the troubled banks as they always believed in free market ideologies.

In Iceland, where the economy was very dependent on the finance sector, economic problems had hit them hard. The banking system virtually collapsed and the government had to borrow from the IMF and other neighbors to try and rescue the economy. In the end, public dissatisfaction at the way the government was handling the crisis meant the Iceland government fell.

The impact on the banks in European countries was not very different compared to the banks in the US. For example:

1) Defaulters arising due to losses on holdings in the US subprime securities and other subprime assets.

2) The slowdown on the prices of residential properties/ assets arising in their own countries.

3) Because of interdependence between countries on grounds of funding and money markets there arose a situation of significant liquidity problems. Many institutions had to refinance there balance sheets very quarter. During market uncertainties banks were reluctant to finance other institutions and this problem led to the economic crisis become a global phenomenon.

4) In the United Kingdom high profile companies like Woolworths, MFI, Waterford Crystal/Wedgewood went into administrations hands this marked a serious build up in the economic recession or deflation.

Britain’s economy in the third quarter 2009, quashes hopes that the downturn was ending and instead marking the longest recession on record. The Office for National Statistics said British gross domestic product fell by 0.4 percent between July and September, meaning the economy has contracted for six successive quarters. UK may be the only major economy to have contracted in the third quarter. In the UK, the jobless rate is expected to rise from 7.6% to 9.3% – its highest level since the early 1990s. So a lot has to be done on the Governments part to tackle the issue.

Governments have a key role to play in providing a stable economic environment in which people and businesses can plan for the future, and growth can prosper. ACCA (the Association of Chartered Certified Accountants) is the global body for professional accountants. ACCA has played a full part, regarding the causes of the crisis, including the roles of global macro-economic imbalances and financial innovation, failures in regulation, supervision, and corporate governance. This time ACCA has come out with the steps that the government should follow so that the UK does not fall in such a crisis again. The ACCA plans/suggests that the steps they suggest should be implemented in the next ten years.

The first step that they want to take is to separate retail – or at the very least depositors – from other forms of banking will have taken place. This will ensure that the banks return in Private sector in a profitable way and all the ethics and risk training are well dealt with.

According to the ACCA, UK and USA have marked serious issues by showing low levels of saving and high levels of debts. They suggest that the government should build an environment where the credit cards can be rejected for the piggy banks; thereby building the savings culture. . The other important thing is the formulation of tax policies which is often politicized; leaving the country with only short termist approach.

They also suggest that the Small and Medium sized enterprises should be elevated to Cabinet level and continuity in small business policy will be assured. The ‘Think Small First’ principle will not be considered as an exception but as a norm

As the global recession has demonstrated, the financial problems of a globalized world are too big to be tackled by individual countries. The G20 offers a framework for co-ordinated action. And therefore, they suggest that the current rotating secretariat should be replaced by a new and permanent one so that in situations like these action can be taken at the earliest. UK is also ready to be a part of such a global agreement where the developing are also given a chance to participate and learn.

Banking has gone digital. Millions of customer find it convenient and faster to operate their accounts online. Despite a lot of security and passwords, accounts are still hacked and data or private information is leaked, unauthorized and incorrect payments are made online on their name. This issue needs to be resolved soon. The ACCA suggests that the browsers and email systems should become more effective at protecting customers and their information.

In the fourth quarter of 2009, UK has finally managed to come out of recession but still the above mentioned steps need to be followed so that such an issue does not affect the country again.

Referencing:

http://www.globalissues.org/article/768/global-financial-crisis#Thefinancialcrisisandwealthycountries

http://en.wikipedia.org/wiki/Financial_crisis_of_2007-2010

...(download the rest of the essay above)

About this essay:

If you use part of this page in your own work, you need to provide a citation, as follows:

Essay Sauce, The global financial crisis . Available from:<https://www.essaysauce.com/finance-essays/the-global-financial-crisis/> [Accessed 23-04-24].

These Finance essays have been submitted to us by students in order to help you with your studies.

* This essay may have been previously published on Essay.uk.com at an earlier date.

Essay Categories:

- Accounting essays

- Architecture essays

- Business essays

- Computer science essays

- Criminology essays

- Economics essays

- Education essays

- Engineering essays

- English language essays

- Environmental studies essays

- Essay examples

- Finance essays

- Geography essays

- Health essays

- History essays

- Hospitality and tourism essays

- Human rights essays

- Information technology essays

- International relations

- Leadership essays

- Linguistics essays

- Literature essays

- Management essays

- Marketing essays

- Mathematics essays

- Media essays

- Medicine essays

- Military essays

- Miscellaneous essays

- Music Essays

- Nursing essays

- Philosophy essays

- Photography and arts essays

- Politics essays

- Project management essays

- Psychology essays

- Religious studies and theology essays

- Sample essays

- Science essays

- Social work essays

- Sociology essays

- Sports essays

- Types of essay

- Zoology essays

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend Print delivery

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

The global financial crisis of 2008 Essay

The global financial crisis started in the year 2008, and it is set to continue unleashing devastating effects on the global economy. The magnitude and the level of disruption of the global economies have led to speculation of various causes that has contributed to its occurrence. The major factor that explains the occurrence of this crisis are the loose monetary policies (Bean, 2008).

John Taylor argues that interest rates were well below the ones implied by Taylor’s rule. In addition, large current accounts surpluses in emerging economies with underdeveloped financial markets. For instance, China has largely driven the interest rates up (Caballero & Gourinchas, 2008).

The last, but not the least is the loose financial regulation which has led to the increase in risks and investments in poorly understood new financial products (Borio 2008). This paper seeks to describe global economic crisis and its impact on global finance currently and over a couple of years to come.

The global crisis has crucial dimensions which includes buildup of both corporate and household debts (Brunnermeir, 2009). As the main concern, these bad debts have caused confusion to the UK government on how to deal with loan defaulters. These ever increasing bad debts have been threatening the solvency of banks.

Also, the apparent change in bailing out policy from the earlier rescue approach, created a panic in the interbank lending rates, thus worsening the situation further. However, the uncertainty of banks’ future has seen them as ceasing lending causing to stagnate the system as a whole. Moreover, stock market investors’ panic has led bank shares to perform poorly in the stock market.

Nevertheless, bank regulations are pegged on the notion that loans’ forms have a significant percentage of bank capital, and since decline in stocks has reduced capital to a great extent; this has, in turn, led to massive decline in the bank lending. This further threatens the stability of the global financial system (Morris, 2008).

In addition, there has been an abrupt change in policy towards bailing out banks whereby the UK government is buying shares from the banks with intent of restoring the profitability, and then sell its shareholding to investors (Taylor, 2008). The significant effect of recognizing bad debt is that, the idea of recovering large amounts of capital lent as housing loans is no longer worth (Taylor, 2008a).

This has made the financial sector to shift the cost of the crisis to the public to the extent of using taxpayers’ money in order to survive. Banks are rebuilding the profit base by declining to reduce interest rates on funds borrowed which leads to reduction in rate of return to depositors and savers, thus causing a conflict between the government and banks (Morris, 2008).

This has led to serious implications to both current and future pensioners. Furthermore, there has been massive loss of jobs, as various firms succumb to the effects of credit crunch.

To remedy this situation, the government has been encouraging mergers to help in curbing the effects of global economic crisis. However, this bail-out approach has resulted in a considerable ideological cost, both in terms of reputation and increased legitimacy of regulation.

The effects of global economic crisis will continue to have serious effects on many firms around the globe overtime. This is because firms are being forced to downsize their operations, as a result of difficulties in obtaining finances from the banks (Adalid & Detken, 2009). Banks are raising the interest rates as one of the measures to correct the effects of global credit crunch.

Also, debts, owed to the firms, have proved not forthcoming and, instead, firms are writing them off. Therefore, the profits which could otherwise be utilized in expanding the businesses are now utilized in writing off bad debts. However, the problem of declining job opportunities will persist overtime, leading to increased poverty levels amongst the households.

To correct the global economic crisis, governments across the world are taking measures on places that will see the economic growth of their respective countries back to normal, though this is a process that might take quite longer.

Adalid, R., & Detken, C. (2009). Liquidity shocks and asset price boom/bust cycles. Working paper, 732(2), 5-56

Bean, C. (2008). Some Lessons for Monetary Policy from the Recent Financial Turmoil. Remarks given at a conference on Globalisation, Inflation and Monetary. New York: SAGE

Borio, C. (2008). The financial turmoil of 2007-? A preliminary assessment and some policy considerations. Bank of International Settlements Working Paper , 251, 56- 89

Brunnermeir, M. (2009). Deciphering the Liquidity and Credit Crunch 2007-08. Journal of Economic Perspectives , 23, 77-100.

Caballero, R., E. Fahri, H., & Gourinchas, P. (2008). An equilibrium model of global imbalances and low interest rates. American Economic Review , 98, 358-393.

Morris, C. (2008). Trillion Dollar Meltdown: Easy Money, High Rollers, and the Great Credit Crash. London: Public Affairs Books.

Taylor, J. (2008). Monetary Policy and the State of the Economy. Testimony to the US House of Representatives. New York: SAGE

Taylor, J. (2008a). The financial crisis and the policy responses: an empirical analysis of what went wrong. NBER Working Paper, 14631, 56-78

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2019, May 13). The global financial crisis of 2008. https://ivypanda.com/essays/the-global-financial-crisis-of-2008-essay/

"The global financial crisis of 2008." IvyPanda , 13 May 2019, ivypanda.com/essays/the-global-financial-crisis-of-2008-essay/.

IvyPanda . (2019) 'The global financial crisis of 2008'. 13 May.

IvyPanda . 2019. "The global financial crisis of 2008." May 13, 2019. https://ivypanda.com/essays/the-global-financial-crisis-of-2008-essay/.

1. IvyPanda . "The global financial crisis of 2008." May 13, 2019. https://ivypanda.com/essays/the-global-financial-crisis-of-2008-essay/.

Bibliography

IvyPanda . "The global financial crisis of 2008." May 13, 2019. https://ivypanda.com/essays/the-global-financial-crisis-of-2008-essay/.

- Elimination of Bail in America

- American Financial Crisis and Its Prevention

- Ethical Implication of Banking Bailout

- Contribution of the Credit Crunch Towards a Downturn in UK House Prices

- Credit Crunch in the UK Financial Services Industry

- The Credit Crunch in UK Companies

- Bail and Pre-Trial Release Conditions Impact on Court Systems

- Credit Crunch and Its Impact on Hospitality Industry

- Implications of the Credit Crunch on Recruitment and Selection, and Training and Development

- Credit Crunch Impact Analysis

- Rise of Long-Term Prices of Commodities

- How the SME's create jobs in Saudi Arabia

- BRICs and Mega Trends in World Culture

- Combating Commodity Price Volatility in Canada

- Current Credit Crisis in the United States: Understanding the Trigger Factors

Credit: quietword / AdobeStock

Global Economy Remains Resilient Despite Uneven Growth, Challenges Ahead

Despite gloomy predictions, the global economy remains remarkably resilient, with steady growth and inflation slowing almost as quickly as it rose. The journey has been eventful, starting with supply-chain disruptions in the aftermath of the pandemic, an energy and food crisis triggered by Russia’s war on Ukraine, a considerable surge in inflation, followed by a globally synchronized monetary policy tightening.

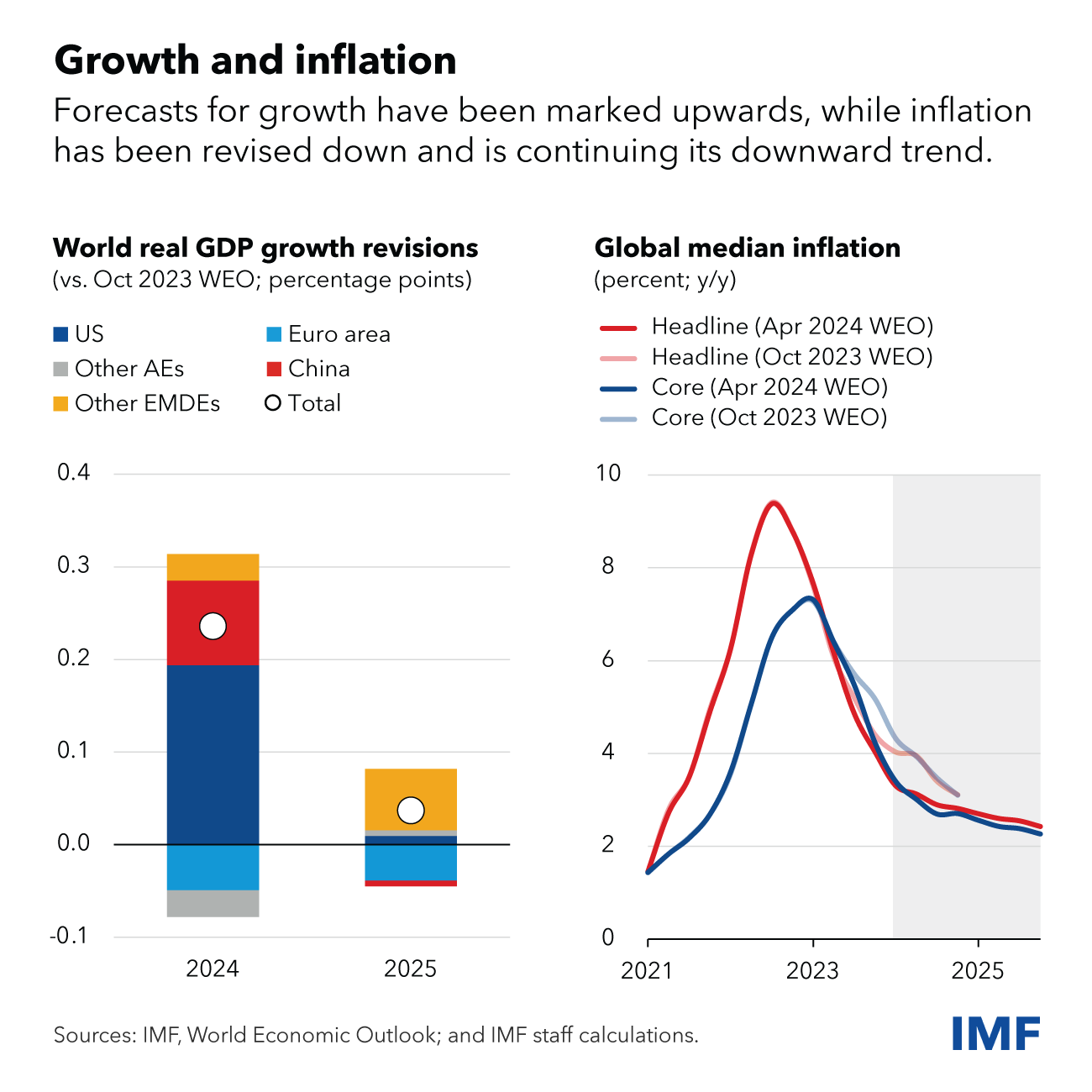

Global growth bottomed out at the end of 2022, at 2.3 percent, shortly after median headline inflation peaked at 9.4 percent. According to our latest World Economic Outlook projections, growth this year and next will hold steady at 3.2 percent, with median headline inflation declining from 2.8 percent at the end of 2024 to 2.4 percent at the end of 2025. Most indicators continue to point to a soft landing.

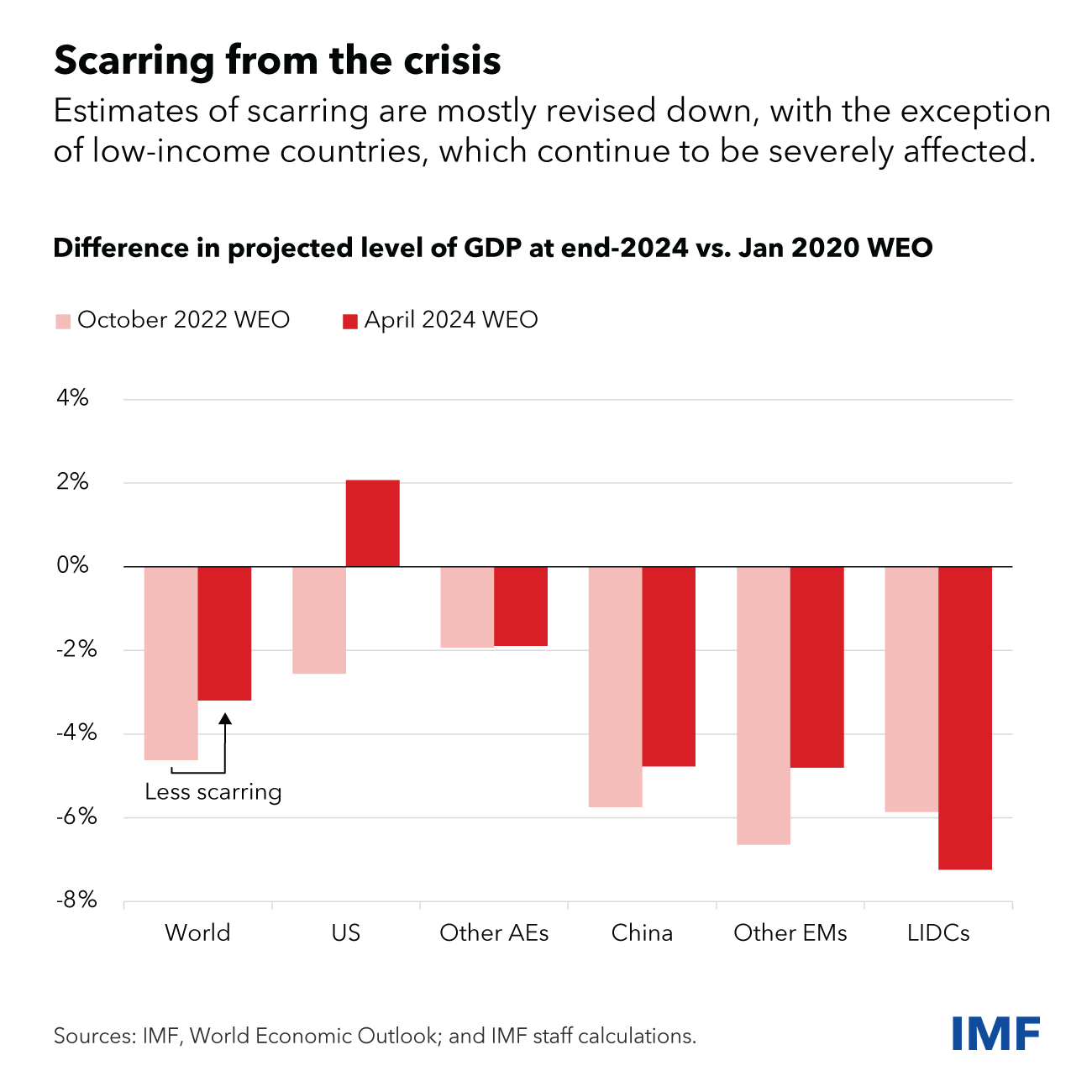

We also project less economic scarring from the crises of the past four years, although estimates vary across countries. The US economy has already surged past its prepandemic trend. But we now estimate that there will be more scarring for low-income developing countries, many of which are still struggling to turn the page from the pandemic and cost-of-living crises.

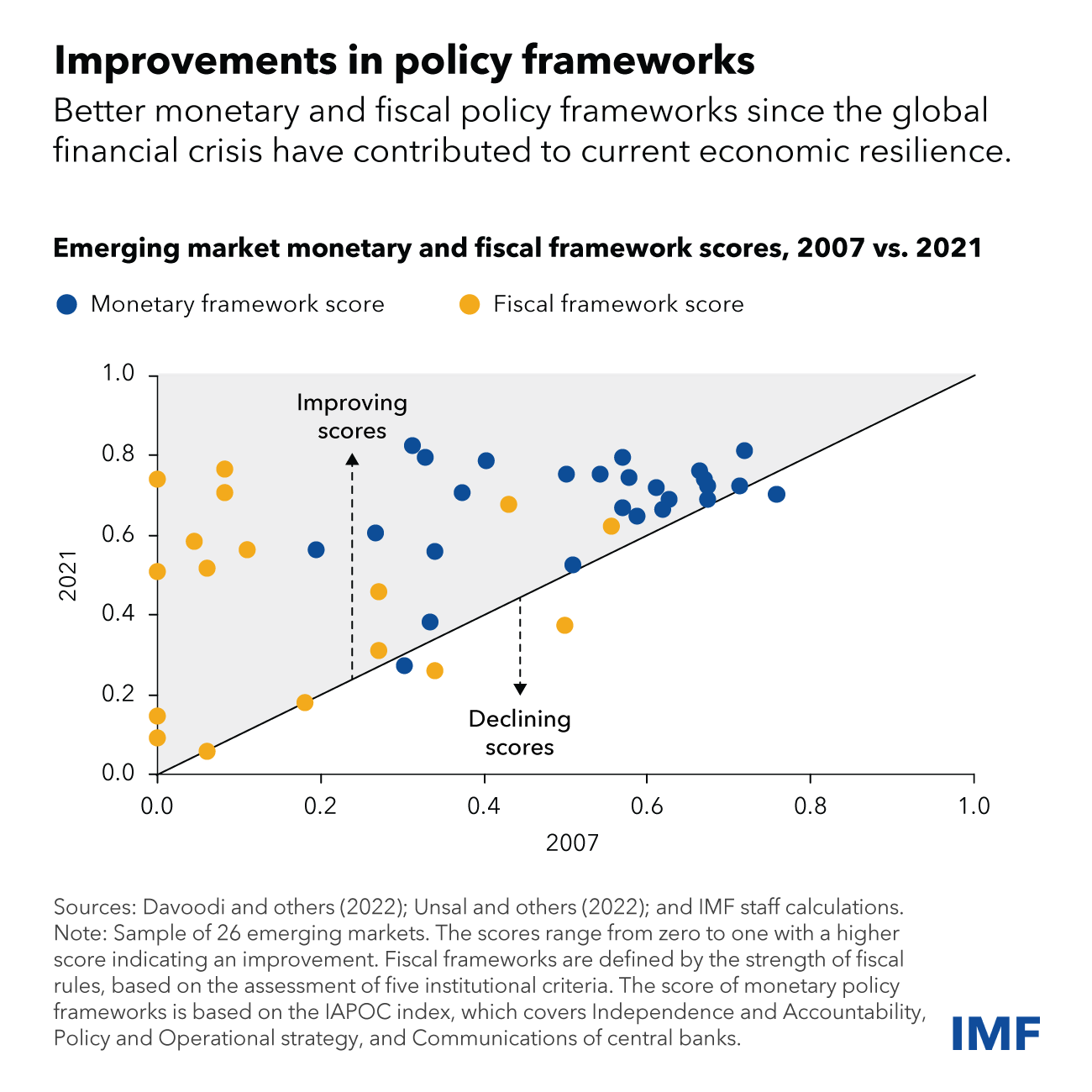

Resilient growth and rapid disinflation point toward favorable supply developments, including the fading of energy price shocks, and a striking rebound in labor supply supported by strong immigration in many advanced economies. Monetary policy actions have helped anchor inflation expectations even if its transmission may have been more muted , as fixed-rate mortgages became more prevalent.

Despite these welcome developments, numerous challenges remain, and decisive actions are needed.

Inflation risks remain

Bringing inflation back to target should remain the priority. While inflation trends are encouraging, we are not there yet. Somewhat worryingly, progress toward inflation targets has somewhat stalled since the beginning of the year. This could be a temporary setback, but there are reasons to remain vigilant. Most of the good news on inflation came from the decline in energy prices and in goods inflation. The latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices. But oil prices have been rising recently in part due to geopolitical tensions and services inflation remains stubbornly high. Further trade restrictions on Chinese exports could also push up goods inflation.

Economic divergences widen

The resilient global economy also masks stark divergence across countries.

The strong recent performance of the United States reflects robust productivity and employment growth, but also strong demand in an economy that remains overheated. This calls for a cautious and gradual approach to easing by the Federal Reserve. The fiscal stance, out of line with long-term fiscal sustainability, is of particular concern. It raises short-term risks to the disinflation process, as well as longer-term fiscal and financial stability risks for the global economy. Something will have to give.

Growth in the euro area will rebound but from very low levels, as past shocks, and tight monetary policy weigh on activity. Continued high wage growth and persistent services inflation could delay the return of inflation to target. However, unlike in the United States, there is little evidence of overheating, and the European Central Bank will need to carefully calibrate the pivot toward monetary easing to avoid an inflation undershoot. While labor markets appear strong, that strength could prove illusory if European firms have been hoarding labor in anticipation of a pickup in activity that does not materialize.

China’s economy remains affected by the downturn in its property sector. Credit booms and busts never resolve themselves quickly, and this one is no exception. Domestic demand will remain lackluster unless strong measures address the root cause. With depressed domestic demand, external surpluses could well rise. The risk is that this will further exacerbate trade tensions in an already fraught geopolitical environment.

Many other large emerging market economies are performing strongly, sometimes benefiting from a reconfiguration of global supply chains and rising trade tensions between China and the US. These countries’ footprint on the global economy is increasing .

Policy path

Going forward, policymakers should prioritize measures that help preserve or even enhance the resilience of the global economy.

The first such priority is to rebuild fiscal buffers. Even as inflation recedes, real interest rates remain high and sovereign debt dynamics have become less favorable . Credible fiscal consolidations can help lower funding costs, improve fiscal headroom and financial stability . Unfortunately, fiscal plans so far are insufficient and could be derailed further given the record number of elections this year.

Fiscal consolidations are never easy but it is best not to wait until markets dictate their conditions. The right approach is to start now, gradually, and credibly. Once inflation is under control, credible multiyear consolidations will help pave the way for further monetary policy easing. The successful 1993 US fiscal consolidation and monetary accommodation episode comes to mind as an example to emulate.

The second priority is to reverse the decline in medium term growth prospects. Some of that decline comes from increased misallocation of capital and labor within sectors and countries. Facilitating faster and more efficient resource allocation will boost growth. For low-income countries, structural reforms to promote domestic and foreign direct investment, and to strengthen domestic resource mobilization, will help lower borrowing costs and reduce funding needs. These countries also must improve the human capital of their large young populations, especially as the rest of the world is aging rapidly.

Artificial intelligence also gives hope for boosting productivity. It may do so, but the potential for serious disruptions in labor and financial markets is high. Harnessing the potential of AI for all will require that countries improve their digital infrastructure, invest in human capital, and coordinate on global rules of the road.

Medium-term growth prospects are also harmed by rising geoeconomic fragmentation and the surge in trade restrictive and industrial policy measures. Trade linkages are already changing as a result, with potential losses in efficiency. The net effect could well be to make the global economy less, not more, resilient. But the broader damage is to global cooperation. It is still time to reverse course.

Third, a great achievement of the past few years has been the strengthening of monetary, fiscal and financial policy frameworks especially for emerging market economies. This has helped make the global financial system more resilient and avoid a permanent resurgence of inflation. Going forward, it is essential to preserve these improvements. That includes protecting the hard-won independence of central banks .

Lastly, the green transition requires major investments. Cutting emissions is compatible with growth and activity has become much less emission-intensive in recent decades. But emissions are still rising. Much more needs to be done and done quickly. Green investment has expanded at a healthy pace in advanced economies and China. The greatest effort must now be made by other emerging market and developing economies, which must massively increase their green investment growth and reduce their fossil fuel investment. This will require technology transfer by other advanced economies and China, as well as substantial private and public financing.

On these questions, as well as on so many others, multilateral frameworks and cooperation remain essential for progress.

—This blog is based on Chapter 1 of the April 2024 World Economic Outlook .

Industrial Policy is Back But the Bar to Get it Right Is High

More data, analysis and dialogue are needed to avoid costly mistakes

World Must Prioritize Productivity Reforms to Revive Medium-Term Growth

Without ambitious steps to enhance productivity, global growth is set to fall far below its historical average

How the G20 Can Build on the World Economy’s Recent Resilience

The G20 has an important opportunity to shift focus from firefighting against successive shocks to a medium-term agenda that supports strong, sustainable, balanced, and inclusive growth.

- Fourth International

- Socialist Equality Party

- About the WSWS

IMF says US debt creating “significant risks” for the global economy

Nick beams 17 april 2024.

- facebook icon

Reports delivered by the International Monetary Fund (IMF) to its annual spring meeting in Washington this week indicate that a major crisis is building up in the global economy and financial system to which the ruling classes will respond with an onslaught against the working class.

It will be far deeper than the attacks on jobs, wages and social conditions that followed the 2008 global financial crisis because of the enormous rise in debt since then. This is the consequence of a speculative binge, fuelled by the supply of ultra-cheap money from the world’s major central banks, as well as the escalation of government debt to historically unprecedented levels.

The developing crisis is centred in the very heart of the global economy, the United States, and was alluded to by the IMF’s chief economist Pierre-Olivier Gourinchas on Tuesday when he said the fiscal position of the US was “of particular concern.”

The huge US debt raised risks to the disinflation process “as well as longer-term fiscal and stability risks for the global economy. Something will have to give.”

The worsening debt situation, not only in the US but in other major economies—the IMF named Italy, the UK and China—was further elaborated in its Fiscal Monitor report published yesterday.

The report said it expected the US to record a fiscal deficit of 7.1 percent of GDP next year, more than three times the 2 percent average for other economies. In 2023, it noted, the US had exhibited “remarkably large fiscal slippages” with the deficit reaching 8.8 percent of GDP, up from 4.1 percent in 2022.

The four countries it named “critically need to take policy action to address fundamental imbalances between spending and revenues.” Unless this were done it could have “profound effects for the global economy and pose significant risks for baseline fiscal projections in other economies.”

The report said loose fiscal policy and tightening monetary policy in the US had “contributed to the increase in long-term government yields [higher interest rates on bonds] and their heightened volatility in the United States, raising risks elsewhere through interest rate spillovers.”

The question posed by the report is where will the money come from to pay down the debt?

Not from expanded growth in the world economy because, as the World Economic Outlook report indicated, growth has been on a steady decline since 2008 and the projection for the next five years is that it will remain well below the historical average.

Policy must be directed to the expenditure side. As stated in the executive summary of the report: “Durable fiscal consolidation efforts are needed to safeguard public finances and rebuild buffers in a context of slowing medium-term growth prospects and high real interest rates.”

The real content of this language, typical of such reports which are always aimed at obscuring rather revealing their social and class content, was, however, alluded to in the body of the report.

“Many advanced economies with aging populations,” it said, “should focus on containing pressures on health and pensions through entitlement reforms and other measures.”

This means that in the US, the long-pursued aim of the evisceration of Social Security will be intensified along with the further rundown of already debilitated health services. The same applies to other countries as well.

In the US, according to the Congressional Budget Office, interest payments to the holders of government debt, banks and other financial institutions, which form an ever-increasing portion of the annual deficit, will rise to more than $1 trillion over the next two years.

The IMF said delaying efforts to strengthen public finances—that is, holding back on attacks on pensions, health and other vital services—“could increase vulnerabilities and limit fiscal space to deal with future crises, potentially leading to more painful fiscal adjustment and adverse financial consequences.”

This means that unless debt is reduced now, governments in the UK, the US and elsewhere may not have enough money on hand when another crisis strikes, as it inevitably will, to bail out corporations and financial institutions as they have in the past.

Governments also need to drive down debt in order to finance rapidly rising military spending.

Another key component of the IMF analysis, but one which has been little reported on, is the growth of private credit as a source of finance for both corporations and finance houses. The Global Financial Stability report devoted a whole chapter to this area of the financial system.

It estimated the size of this sector at $2 trillion, most of it centred in the US. But according to research by JP Morgan, the results of which were published in the Financial Times , it is much larger, coming in at $3.14 trillion.

One of the reasons for the divergence is that this area is “opaque,” meaning that financial authorities have little knowledge about its operations.

The IMF analysis, while discounting any immediate problem, pointed to a number of factors which mean this situation could rapidly change.

It said borrowers’ vulnerabilities could “generate large, unexpected losses in a downturn.” These losses could create significant losses for investors including “insurance and pension funds” which had “significantly expanded their investments in private credit and other illiquid investments.”

An illiquid asset is one which cannot be easily turned into cash during a crisis or even a downturn. “Without better insight into the performance of underlying credits, these firms and their regulators could be caught unaware by a dramatic re-rating of credit risks across the asset classes.”

The IMF also warned that risks to financial stability may also stem from the interconnections of private credit with other parts of the financial system under conditions where “data constraints” made it “challenging” for supervisors to “evaluate exposures across segments of the financial sector and assess potential spillovers.”

What the various IMF reports make clear is that for all the talk of a so-called “soft landing”—a reduction in inflation, continued economic growth albeit at a much slower rate and the prevention of a recession, at least so far—the global capitalist system is heading into a systemic crisis and breakdown.

The response of the ruling classes and their agencies, such as the IMF, is that the workers and their families, the aged, the ill and children needing education must be made to pay for it through an all-out assault their social position.

This objective situation poses the necessity for working class to respond with its own independent systemic solution through the fight for a revolutionary program aimed at the conquest of political power as the first step in the establishment of a socialist economy. Nothing else offers a solution for workers to the crisis of the profit system that is deepening every day.

- IMF warning over growing private credit market 9 April 2024

- “Something will have to give”—IMF warns of build-up of US debt 16 April 2024

IMAGES

VIDEO

COMMENTS

Henry Paulson. financial crisis of 2007-08, severe contraction of liquidity in global financial markets that originated in the United States as a result of the collapse of the U.S. housing market. It threatened to destroy the international financial system; caused the failure (or near-failure) of several major investment and commercial banks ...

Abstract. The present paper is dedicated to the examination of the global financial crisis and its impact on the economy of the USA and other countries of the world. Major attention is drawn to the underlying causes of the crisis, the impact of the US critical situation on the world's financial situation, international trade, and other ...

The Global Financial Crisis Essay. International finance is a study that entails the workings of the global financial system, exchange rates and foreign investment and how they impact international trade. International finance is a vital ingredient in the decision making process of many firms. Every entity is faced with the inevitable reality ...

The Global Financial Crisis has been a watershed event not only for many advanced economies but also emerging markets around the world. This book brings together research and policy work over the last nine years from staff at the IMF. It covers a wide range of issues such as the origins of the financial crisis, the policy response, spillovers ...

Introduction. Global financial crisis is described as the extensive economic disaster that started in the United States in 2007. Starting with the collapse of the American financial system, the economic emergency rapidly spread to other countries in the world. Interrelated markets of the current global trading systems were the major cause of ...

The Global Financial Crisis has been a watershed event not only for the United States and many advanced economies but also emerging markets (EM) around the world. The subprime crisis that began in the summer of 2007 was triggered by deteriorating quality of U.S. subprime mortgages. This rapidly propagated across different asset classes and ...

One of the most puzzling facts in the wake of the Global Financial Crisis (GFC) is that output across advanced and emerging economies recovered at a much slower rate than anticipated by most forecasting agencies. This paper delves into the mechanics behind the observed slow recovery and the associated permanent output losses in the aftermath of the crisis, with a particular focus on the role ...

Essays. The global financial crisis . By Kevin Rudd. ... The agent for this change is what we now call the global financial crisis. In the space of just 18 months, this crisis has become one of the greatest assaults on global economic stability to have occurred in three-quarters of a century. As others have written, it "reflects the greatest ...

Author: Mr. Heiko Hesse. The Global Financial Crisis has been a watershed event not only for many advanced economies but also emerging markets around the world. This book brings together research and policy work over the last nine years from staff at the IMF. It covers a wide range of issues such as the origins of the financial crisis, the ...

As such, the Global Financial Crisis (GFC) provides us with the opportunity to re-examine the interrelationship between change and continuity in areas of public policy. ... Essays constitute a legitimate means for articulating one's thoughts on a given problem, as produced through an exercise of "disciplined imagination" (Weick et al., 1989).

Recessions and banking crises tend to have negative effects on the formation of new connections, and these effects are not the same for all countries or all banks. The Global Financial Crisis of 2008-09 followed this pattern and had a large negative impact on the formation of new relationships in the global banking network.

In this essay, we reflect on difficulties that may constrain the achievement of substantive change in areas of public policy. Our focus is the discipline of finance - as a field of practices and a field of research - in the aftermath of the Global Financial Crisis. Our exploratory analysis indicates difficulties in concretizing substantive change in both fields, although difficulties do ...

The Global Economic Crisis Essay. I could never have thought that the world's economy could be brought down on its knees in such a short while if you would have asked me before the economic crisis hit. Yet again, it's not like there was a war looming in the air to contribute to this or anything. My view is that the great depression of the ...

By the mid-19th century the world was getting used to financial crises. Britain seemed to operate on a one-crash-per-decade rule: the crisis of 1825-26 was followed by panics in 1837 and 1847. To ...

This important collection of essays brings together the main findings of ILO research since the start of the global financial and economic crisis in 2008. With contributions from diverse research disciplines, the volume provides new perspectives on employment and income-led growth and the role of regulation, and makes policy recommendations for the future.

The global financial crisis (GFC) refers to the period of extreme stress in global financial markets and banking systems between mid 2007 and early 2009. During the GFC, a downturn in the US housing market was a catalyst for a financial crisis that spread from the United States to the rest of the world through linkages in the global financial ...

Introduction. The global financial crisis of 2008 stands as one of the most significant economic upheavals in modern history. It was a watershed moment that exposed vulnerabilities within the financial system and sent shockwaves across economies, industries, and societies worldwide.

May 18, 2011. This thesis is a compilation of three separate and distinct papers on topics in international finance and the recent financial crisis. Chapter one links the foreign exchange risk premium to macroeconomic risk by studying the options market around macroeconomic news releases. Using a unique data set of overnight currency option ...

The financial banking crisis developed from August 2007 through to July 2008 and then exploded into the global real economy: Central Europe and Latin America were devastated in September; South-east Asia and the Middle East in October and China in November. This is a combination of a demand crisis, brought on by a credit crisis linked with a ...

This essay introduces the papers presented at a conference held in April 2009 on the global financial crisis. The issue begins with four articles that survey the key events and analyze important issues around the crisis from the context of four asset classes: the equity market, fixed income market, foreign exchange market, and emerging markets.

THE GLOBAL FINANCIAL CRISIS: ESSAY ON THE POSSIBILITY OF. SUBSTANTIVE CHANGE IN THE DISCIPLINE OF FINANCE. by. Yves Gendron, Ph.D. Faculté des sciences de l'administration. Pavillon Palasis-Prince.