Need help? Talk to an expert [email protected]

Easing restrictions on net operating loss carry-over due to effects of COVID-19 measure

Published On - 28 October, 2020

The Philippine government is still implementing quarantine protocols across various regions, including the most significant business district, Metro Manila. In response to the business communities’ prayer for government help from the difficulty of their business operations due to the Covid 19 Pandemic, the government has passed the Republic Act No. 11494, also known as the “Bayanihan to Recover as One Act”.

One of the features to help the businesses’ growing uncertainties and losses is a provision relative to Net Operating Loss Carry-Over (NOLCO) Under Section 34 (D) (3) of the National Internal Revenue Code (NIRC), as Amended and the Bureau of Internal Revenue (BIR) has already issued the Revenue Regulations No. 25-2020 dated September 30, 2020, to put the amendment into effect.

Notwithstanding the provision of existing laws to the contrary, the net operating loss of the business or enterprise for taxable years 2020 and 2021 shall be carried over as a deduction from gross income for the next five (5) consecutive taxable years immediately following the year of such loss; Provided, that this subsection shall remain in effect even after the expiration of this Act.”

Prior to the issuance of RR No. 25-2020, Section 34 (D) (3) of the NIRC, the NOLCO can only be carried over to the next three (3) consecutive taxable years immediately following the year of such loss.

Under the present law RA 11494, this is now extended to the next five (5) consecutive taxable years following the year of such loss. However, this is only applicable to the registered Corporation and taxable partnerships and not including the businesses operating under a “Sole Proprietor” set up.

NET OPERATING LOSS as defined in Section 3 (3.3) in RR 25-2020, means the excess of the allowable deductions over gross income of the business in a taxable year.

In reporting the NOLCO to the income tax return and Notes to Financial Statements, the taxpayer corporation must be careful to comply with the requirement so as not to disqualify them from claiming the NOLCO.

Presentation of NOLCO in Tax Return and Unused NOLCO in the Income Statement. – The NOLCO shall be separately shown in the taxpayer’s income tax return (also shown in the Reconciliation Section of the Tax Return) while the unused NOLCO shall be presented in the Notes to the Financial Statements showing, in detail, the taxable year in which the net operating loss was sustained or incurred, and any amount thereof claimed as NOLCO deduction within five (5) consecutive years immediately following the year of such loss. The NOLCO for taxable years 2020 and 2021 shall be presented in the Notes to Financial Statements separately from the NOLCO of the other taxable years. Failure to comply with this requirement will disqualify the taxpayer from claiming the NOLCO.

With this, the NOLCO incurred in the taxable year 2020, can be carried over to the next five (5) consecutive taxable years from 2021 to 2025 while the NOLCO incurred in the taxable year 2021 can be carried over to the next five (5) consecutive taxable years 2022 to 2026.

If you have any questions regarding the above, please do not hesitate to leave your inquiry at [email protected] and a member of our team of experts will get back to you shortly.

2020 and 2021 Carry-over of Net Operating Losses Extended

- November 1st, 2020

Keeping in mind the general welfare of the people in response to the COVID-19 pandemic, the government has set forth quarantine measures in major areas of the country. Not only the movement of the people became limited, it also halted the operations of many businesses thus resulting to a net loss especially to those who are not engaged in providing essential goods or services.

To provide the taxpayers time to recover from the losses incidentally being carried by the pandemic, the Bureau of Internal Revenue (BIR) has extended the period to claim Net Operating Loss Carry-Over (NOLCO) as tax deduction to five (5) years from the previous three (3) years. This is for the losses incurred for taxable years 2020 and 2021.The NOLCO is the excess of deductible expenses over gross income of the business. This extension is in conformance with Section 4 (bbbb) of Republic Act No. 11494 otherwise known as “Bayanihan to Recover As One Act”, which states that:

“Notwithstanding the provision of existing laws to the contrary, the net operating loss of the business or enterprise for taxable years 2020 and 2021 shall be carried over as a deduction from gross income for the next five (5) consecutive taxable years immediately following the year of such loss; Provided, That this subsection shall remain in effect even after the expiration of this Act;”

As to presentation requirement for government reporting, the NOLCO should be separately shown in the income tax return of the taxpayer. In the reconciliation section of the same tax return, it must also be shown independently. The NOLCO for taxable years of 2020 and 2021 should appear separate from the NOLCO of the other taxable years in the Notes to the Financial Statements. These presentation requirements must be observed as failure to do so will disqualify the taxpayer from claiming the NOLCO as a deduction.

At this time when most are having financial difficulty, businessmen are looking for ways on how to recuperate and pivot their businesses. This regulation will not only help taxpayers to maximize tax benefits but most importantly, this will help them in getting back on track.

Unit 301, West Insula Building, 135 West Avenue, Quezon City 1105

5th floor Clark Center 07 Berthaphil 3, Jose Abad Santos Ave Clark Freeport Zone Pampanga

0917 168 1059 / 0925 895 1059

Monday to Friday 8:30 AM to 5:30 PM

02 7500 3533

2024 © MP Camaso & Associates. All rights reserved | Privacy Policy .

Designed and Developed by Sunday Elephant

What Is Meant By Net Operating Loss Carry-Over or NOLCO In Taxation?

You may like these posts

36 comments.

Good day! if I may ask, can we not claim the NOLCO following the year of its incurrence? or can we opt not to claim it at all during the 3 years period? Thank you po.

Hi good day po sa inyo, bakit po naman ayaw ninyong e-claim ang NOLCO? Sayang naman. NOLCO is a benefit or a privilege to offset the previous year's loss. Hanggang three (3) years lang ang pwede, pag di pa rin naubos o na-offset at umabot sa fourth year, forfeited na po ito. So its beneficial to the business owner. Claim po ninyo, sayang naman.

Tungkol sa tanong na kung pwede ba or can we opt not to claim, syempre pwede naman, bakit hindi..

Good evening po, what if ang taxable income ay lower kaysa sa personal exemption, mayron po bang tax due?

Good Evening Sir, what if mas lower pa po yung net income kaysa sa personal exemption, maaapply po ba ang NOLCO?

obviously no more income tax due... :)

Good day sir, kung may NOLCO ako last year ma-claim ko po ba sya sa 1701q or sa 1701 na, sa end pa ng taon? thanks po.

Hi po, good day din po sa inyo. Pwede po tayong maka-claim ng NOLCO sa 1701Q and then annual final adjustment income tax returns sa 1701. Pwede po yan ma-claim as deduction in Item 33 sa 1701Q at Item 59 sa 1701. Ito po sinabi sa RR No. 14-2001 Section 6.4 "Quarterly and Annual Availment of NOLCO. NOLCO shall be allowed as deduction in computing the taxpayers' income taxes per quarter and annual final adjustment income tax returns: Provided, however, that if per the taxpayers' final adjustment annual income tax return, the entire operations for the year resulted to a net operating loss, such net operating loss may be claimed as NOLCO deduction in the immediately succeeding taxable year. Provided further, that NOLCO may be claimed as deduction only within a period of three (3) consecutive taxable years immediately following the year the net operating loss was sustained or incurred....." Yun po.... :)

Hi Sir, Good Day! Ang Tanong ko po ay hindi connected sa NOLCO.Ito po ay tungkol sa INPUT TAX on ZERO RATED SALES. Dalawang uri po kasi ang sales, REGULAR SALES and ZERO SALES. Ang tanong ko po, kailangan pa po ba ng TAX CREDIT CERTIFICATE before maededuct ang INPUT TAX ng ZERO RATED SALES against OUT PUT TAX ng REGULAR SALES? mayron dn po kasing ng sasabi n for TAX REFUND lng po dw talaga ang INPUT TAX ng ZERO RATED SALES. THANK YOU.

My answer is YES. Here's the result of my research, please do validate this one. Thanks. Section 112(A) of the 1997 Tax Code, as amended, provides for the remedy of a taxpayer to recover the unapplied accumulated input VAT arising from zero-rated transactions: Excess Output or Input Tax. - If at the end of any taxable quarter the output tax exceeds the input tax, the excess shall be paid by the VAT-registered person. If the input tax exceeds the output tax, the excess shall be carried over to the succeeding quarter or quarters. Any input tax attributable to the purchase of capital goods or to zero-rated sales by a VAT-registered person may at his option be refunded or credited against other internal revenue taxes, subject to the provisions of Section 112. Zero-Rated or Effectively Zero-Rated Sales. - Any VATregistered person, whose sales are zero-rated or effectively zerorated may, within two (2) years after the close of the taxable quarter when the sales were made, apply for the issuance of a tax credit certificate or refund of creditable input tax due or paid attributable to such sales, except transitional input tax, to the extent that such input tax has not been applied against output tax:

Sir, follow up question po.since kailangan po ang TCC ano po b ang mga requirements n kailangan para mkakuha ng TAX CREDIT CERFTIFICATE (TCC).Thank you.

I think you need to fill in the BIR Form 1914 Application for Tax Credits/Refunds and please see BIR Revenue Memorandum Circular Number 54-2014 "Clarifying Issues Relative to the Application for Value Added Tax (VAT) Refund/Credit under Section 112 of the Tax Code, as amended" for additional information. Please do validate for any updates as well. Thanks.

Hello Sir, Good Day! Tanong ko lang po, with in 3 years ma e treat din po ba us Deferred TAX ASSET ang NOLCO? Thank you.

When you apply the tax rate to the actual current loss, the tax equivalent of that NOLCO can be treated as Deferred Tax Asset. In IAS 12, deferred tax asset is defined as the amount of income taxes recoverable in future periods in respect of deductible temporary differences, carryforwards of unused tax losses, and carryforwards of unused tax credits. While, deferred tax liability is the amounts of income taxes payable in future periods in respect of taxable temporary differences. Under IAS 12, a deferred tax asset is recognised for an unused tax loss carryforward or unused tax credit if, and only if, it is considered probable that there will be sufficient future taxable profit against which the loss or credit carryforward can be utilised. [IAS 12.34]

Hi Sir, What is the journal entry when treating NOLCO as Deferred Tax Asset? Thanks.

Hi Sir, What would be the corresponding entry to record the NOLCO in the book?

Hi Sir, I would like to ask what would be the entry to record NOLCO in the book and the entry to apply NOLCO a certain period? Many Thanks..

Hi po, ask ko lng po Sir pano inaapply ung NOLCO sa preferential rate (ROHQ, filing 1702MX) sa income tax returns (eBIR form) sa regular income column (30%) kasi lumalabas ung NOLCO pag inapply, imbis na sa 10% (preferential). Thanks.

how to compute the nolco po? if P100,000 po yung loss, 100k din po ba ang nolco o hindi po?

ask lng po for purposes of computing earnings per share which nt income should i use, income after the effect of nolco or income before the effect of nolco. tnx po

Hi Sir, Good day! Can I claim Nolco on my second year of operation even if I opted for OSD on my second year of operation? Thank you.

Hi Sir, we are applying for sec accreditation and we were questioned with our computation of income tax. Our company deducted NOLCO and in the process have zero taxable income so we computed for MCIT. The reviewer's argument citing 14-2001... "that you cannot enjoy NOLCO if you are paying MCIT". after explaining our side, her reply was our reply on that matter is not meritorious... is our computation correct. we applied NOLCO first then computed for MCIT.

Am i right in understanding, that in case there is net operating loss, PERSONAL EXEMPTION IS NOT INCLUDED? (amount to carry forward for the next year should not include personal exemption?)

Hindi na po maclaim ang personal exemption kung ang result ng business ay loss? Ang maari maclaim next year ay ang net operating loss?

Hi sir, I have a question po. In computing the DTA from NOLCO sa sole prop. Graduated income tax rate po ba gagamitin? or 30% Regular Income Tax Rate? ty

hi, would like to ask if may income tax benefit/ deferred tax asset din ba if an individual taxpayer is in net loss? should i consider personal and additional exemptions or ignore it kasi loss na? if for example i'm at net loss of 2M with 2 qualified dependents. how much po net loss should reflect sa balance sheet ko? thank you

hi, how to compute for deferred tax asset if the taxpayer is individual. net loss is (2,485,535.62), with 2 dependents (below 21yo). thank you

Let us say, i have been operating for 2 years and laging may taxable income ako. then on the 3rd year, i incurred a net loss. can i claim my net loss as deduction on the forth year?

Good day po. thanks po sa illustrations. Sir pwede po ba sabay na iclaim yung NOLCO at MCIT carry over?

Sir additional din po. Yung NOLCO po ba na pwedeng i-carry over ay yung Loss from Operations? kasi sa isang blog po yung NOLCO niya is 30% of Loss from Operations. Tapos sa following years, binawas pa nya yung Tax paid quarterly & creditable withholding tax which is parang ang liit na ng inapply na NOLCO nya. Link: https://taxandaccountingconsultancy.wordpress.com/2014/03/26/net-operating-loss-carry-over-rr-14-2001/

good day po sir, ano po effect ng NOLCO sa financial statements? like Balance sheet? If may NOLCO po, let say, Net loss of 100,000. ano po effect niya as a whole?

Good day everyone! Ill just want to confirm if I have three business on my name as a sole proprietorship, can i just consolidate it and report in 1701q every quarter and 1701 every year under bir tin number 000? please confirm. Is it understandable with the BIR that I consolidate it or have to inform them, its for three business. thanks.

Hello Sir: Income Tax (1701Q/1701) for a sole proprietorship business is consolidated and reported through the TIN of the main/head office -000. It is not necessary for the branch -001 and -002 to file any 1701Q/1701. The filing of the head office -000 is sufficient. To verify this, please check the Certificate of Registration (COR, Form 2303) of the head office and branches. From there, you will see that the head office has the only TAX TYPE - Income Tax while the branches do not have that kind of tax type. It is the tax types in the COR that are the official tax obligations of the registered head office and/or branches. So please check your TAX TYPES in the Form 2303, that would be your official basis for the tax obligations of that registered head office/branches.

Hi Sir, ask ko lang po how to claim NOLCO in quarterly income tax return (1702Q). Thank you po.

Hi for Individual - what if total NOLCO is 500k. Reflected ba to as DTA - 500k and the credit is provision for IT - deferred na 500k din?

Popular Posts

Resetting BIR Alphalist Data Entry and RELIEF Usernames and Passwords

Commentaries on the First Epistle of John the Beloved

- Accounting Issues

- Biblical Advice

- Business Laws

- Business Practices

- Business Tips

- Financial Literacy

- Foreign Business

- Opportunities

- Start A Business

- Success Principles

- Tax Updates

Contact form

best law firms in the philippines | law firms in makati

Best lawyers in the philippines, tax lawyer philippines, labor lawyer philippines, immigration attorney philippines, corporate attorney, legal services philippines, special power of attorney philippines.

- Practice Areas

Publications

- MTF Tax Journal

- MTF Articles

- MTF References

- Legal Journals

Availment of Nolco Deduction

Written on October 22, 2021 . Posted in MTF Articles .

By Euney Marie Mata-Perez on October 21, 2021

First of two-part

Having incurred losses during the Covid-19 pandemic, companies can avail of the net operating loss carry-over deduction (Nolco) pursuant to the National Internal Revenue Code (Tax Code), as amended, as well as certain special laws.

Section 34(D)(3) of the Tax Code provides that the net operating loss of a business or enterprise for any taxable year immediately preceding the current taxable year and not previously offset as a deduction from gross income can be carried over as a deduction from gross income for the next three consecutive taxable years immediately following the year of the loss. However, any net loss incurred in a taxable year during which the taxpayer was exempt from income tax will not be allowed as a Nolco deduction.

“Net operating loss” means the excess of allowable deductions over the gross income of the business in a taxable year.

Republic Act (RA) 11494 or the Bayanihan to Recover as One Act extended the allowable Nolco period to the next five consecutive taxable years following the years of the loss for losses incurred during taxable years 2020 and 2021. The Nolco for such can be carried over as a deduction even after the expiration of the Bayanihan Act, provided that the same are claimed within the next five consecutive taxable years immediately following the year of the loss.

For this purpose, “taxable year” means the calendar year or fiscal year (FY) ending during such calendar year, on the basis of which net income is computed under the Tax Code, and includes, in the case of a return made for a fractional part of a year, the period for which such return is made. For Nolco purposes, the term taxable year 2020 and 2021 includes all corporations with fiscal years ending on or before June 30, 2021 and June 30, 2022, respectively. (Revenue Regulations 25-20, September 30, 2020).

Under existing revenue issuances, an FY will fall on a particular taxable year depending on the number of months it has in the two years involved. Thus, an FY ending on March 31, 2020 will fall in taxable year 2019 since it has nine months in 2019 and only three months in 2020. In the case of an FY ending on June 30, 2021 and the beginning of which is July 1, 2020, it is considered as taxable year 2020 since it has more days in 2020 (184) than in 2021 (181). (Revenue Memorandum Circular 138-20).

The Corporate Recovery and Tax Incentives for Enterprises Act (Create) or RA 11534, meanwhile, amended Section 294(C)(8) of the Tax Code to provide that the net operating loss of the registered project or activity during the first three years from the start of commercial operation, which has not been previously offset as a deduction from the gross income, can be carried over as a deduction from gross income within the next five consecutive taxable years immediately following the year of the loss.

Nolco is also available under several special laws:

The Financial Institutions Strategic Transfer Act (Fist) or RA 11523, passed early this year, provides that a loss incurred by a financial institution as a result of the transfer of non-performing loans and real and other properties acquired within the two-year period from Fist’s effectivity will be treated as ordinary loss and may be carried over for a period of five consecutive taxable years immediately following the year of the loss. However, any accrued interest and penalties will not be included as a loss on said loss carry-over from operations. (Fist Act, Section 17[a]).

The Renewable Energy (RE) Act of 2008 or RA 9513 also provides that the net operating losses of a renewable energy developer during the first three years from the start of commercial operation, which have not been previously offset as a deduction from gross income, will be carried over as a Nolco deduction from gross income for the next seven consecutive taxable years immediately following the year of the loss.

Further, the Philippine Mining Act of 1995 (RA 7942) provides that net operating loss without the benefit of incentives incurred in any of the first 10 years of operations can be carried over as a deduction from taxable income for the next five years immediately following the year of such loss. (RA 7942, Sec. 92).

There are conditions imposed in the availment of Nolco. Under Section 34(D)(3) of the Tax Code, Nolco will be allowed only if there has been no substantial change in the ownership of the business or enterprise. There is deemed no substantial change if not less than seventy-five percent (75 percent) in the nominal value of a corporation’s outstanding issued shares is held by or on behalf of the same persons or (ii) not less than seventy-five percent (75 percent) of the corporation’s paid-up capital is held by or on behalf of the same persons. We will discuss these conditions in part two of this article.

#nolco #netoperatinglosscarryover #netoperatingloss #taxcarryover #tax #taxcode #philippinetaxlaw #taxlawphilippines

Euney Marie J. Mata-Perez is a CPA-lawyer and the managing partner of Mata-Perez, Tamayo & Francisco (MTF Counsel). She is a corporate, M&A, and tax lawyer and has been ranked as one of the top 100 lawyers of the Philippines by Asia Business Law Journal. This article is for general information only and is not a substitute for professional advice where the facts and circumstances warrant. If you have any question or comment regarding this article, you can email the author at [email protected] or visit the MTF website at www.mtfcounsel.com.

https://www.manilatimes.net/2021/10/21/business/top-business/availment-of-nolco-deduction/1819138

- Form 1601-FQ

- Form 1604-E

- Form 1604-F

- Form 1601-EQ

- Form 1601-C

- Form 1604-C

- Form 1702-RT

- Form 2000-OT

- Form 0619-E

- Form 0619-F

- Help Center

RMC No. 138-2020: Availment of NOLCO for Taxpayers

- BIR News & Updates

- RMC No. 138-2020: Availment of…

Clarifying Revenue Regulation No. 25-2020 on the Availment of NOLCO for Taxpayers Adopting Fiscal Year

Headline 1: Clarification of RR No. 25-2020 relative to NOLCO incurred by businesses Headline 2: Availment of NOLCO for Taxpayers Under Fiscal Year

- Businesses or enterprises which incurred net operating loss for taxable year 2020 and 2021 will be allowed to carry over the same as a deduction from its gross income for the next 5 consecutive taxable years

- Companies with fiscal years ending BEFORE July 31,2020 and AFTER June 30,2022 which incurred net operating loss are only allowed to carry-over the loss as a deduction from its gross income for the next 3 taxable years

- FY taxable year table

The Bureau of Internal Revenue (BIR) as of December 22, 2020 released Revenue Memorandum No. 138-2020 (RMC No. 138-2020) which is effective immediately to clarify the previously released Revenue Regulation No. 25-2020 on the Availment of NOLCO for Taxpayers Adopting Fiscal Year.

Businesses or enterprises which incurred net operating loss for taxable year 2020 and 2021 will be allowed to carry over the same as a deduction from its gross income for the next five (5) consecutive taxable years immediately following the year of such loss. The term taxable year and fiscal year are defined in Sec. 3 of the Regulations as follows:

“3.5 Taxable Year- means that calendar year, or the fiscal year ending during such calendar year, upon basis of which the net income is computed under Title II of Tax Code of 1997, as amended. TAxable year includes, in the case of a return made for a fractional part of a year, the period for which such return is made.

3.6 Fiscal Year- means an accounting period of twelve (12) months ending on the last day of any month other than December. Taxable year 2020 and 2021 shall include all those corporations with fiscal years ending on or before June 30, 2021 and June 30, 2022, respectively.”

Under existing revenue issuances, a fiscal year (FY) will fall on a particular taxable year depending on the number of months it has on the two (2) years involved. Therefore, FY ending on March 31,2020 will fall on taxable yer 2019 since it has nine (9) months in 2019 and only three (3) months in 202. In the case of FY ending on June 30, 2021, the beginning of which is July 1, 2020, it shall be considered as taxable year 2020 since it has more days in 2020 (184 days) than 2021 (181 days).

Based on the information given above, the following FY ending on the stated months are counted as:

Companies with fiscal years ending BEFORE July 31,2020 and AFTER June 30,2022 which incurred net operating loss are only allowed to carry-over the loss as a deduction from its gross income for the next three (3) consecutive taxable years under Sec. 34 (D)(3) of the Tax Code. Companies cannot vail of the extended period to carry-over the loss for another two (2) years.

Related Posts

- Privacy Policy

- Terms of Use

ASC 740 Net Operating Losses and Credit Carryforward Rules

RELATED ARTICLES

When to Recognize a Valuation Allowance for a Deferred Tax Asset

Example: How is a Valuation Allowance Recorded for a Deferred Tax Asset

Browse all provision articles

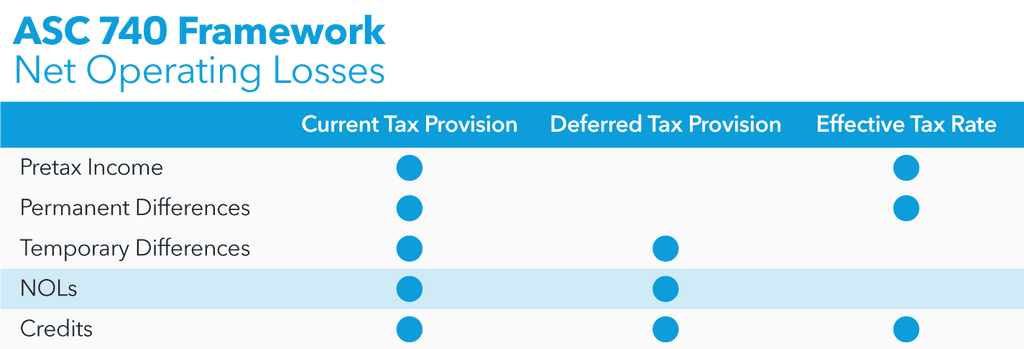

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP.

Net operating losses (NOLs) and tax credits impact the ASC 740 provision for income tax . If a company’s deductions exceed its income in a given year, it reports a net operating loss for federal income tax purposes. NOL and credit carryforwards create deferred tax assets subject to valuation allowances .

How do NOL carrybacks and carryforwards affect the ASC 740 income tax provision?

When utilized, carrybacks and carryforwards affect the current-year ASC 740 tax provision – subject to certain exceptions.

Current-year net operating losses reduce the ASC 740 deferred tax provision by the amount of the NOL tax benefit that the company will more likely than not realize. Create a valuation allowance for any portion of the NOL that fails the more-likely-than-not standard.

NOLs do not impact the ASC 740 effective tax rate calculation.

NOL formula

For federal income tax purposes, the NOL for a given year is:

NOL = Allowable deductions – Gross income

When calculating the NOL, ignore any NOLs from other years and any taxable income limitation on the dividends-received deduction.

NOL carryforward rules

To correctly calculate valuation allowances and carry NOLs to other years, companies must separately track NOLs each year a net operating loss occurs. Different carryback and carryforward rules apply to federal NOLs generated in different tax years:

- NOLs created in tax years ending before Jan. 1, 2018: Carry back to two prior years and carry forward for up to 20 subsequent years.

- NOLs created in tax years ending between Dec. 31, 2017, and Jan. 1, 2021: Carry back five years and carry forward indefinitely until used.

- NOLs created in tax years ending after Dec. 31, 2020: Can’t be carried back but can instead be carried forward indefinitely until used. Can be used only to offset up to 80% of taxable income.

ASC 740 requires companies to disclose the amounts and expiration dates of all NOL carryforwards.

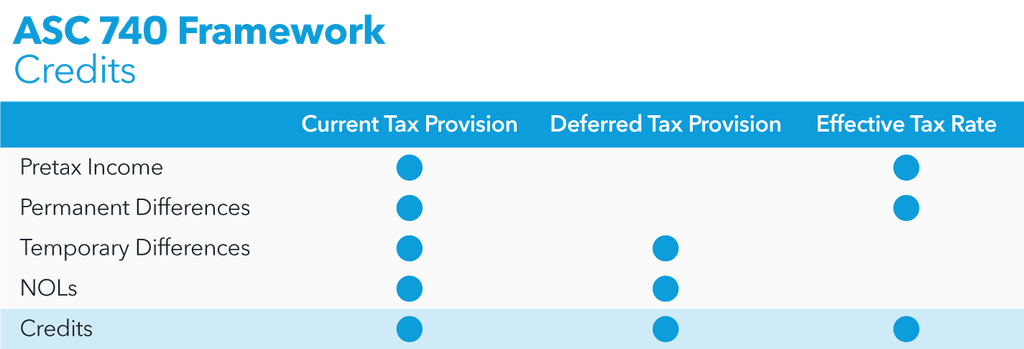

How are tax credit carrybacks and carryforwards accounted for under ASC 740?

Tax credits reduce the current ASC 740 income tax provision to the extent they offset the current year’s tax liability. Credits grant a dollar-for-dollar reduction in tax liability, so the tax benefit equals the amount of the credit.

Current federal tax law generally doesn’t offer refundable income tax credits to corporations. Any excess tax credit over current-year liability generates a deferred tax asset and reduces the ASC 740 deferred tax provision. A valuation allowance applies to the deferred tax asset for any portion that fails to meet the more-likely-than-not standard for recognition.

Unused tax credits generally carry back one year and carry forward 20 years, though certain small businesses can carry general business credits back five years and forward 25 years. Foreign tax credits have a 10-year carryforward.

ASC 740 doesn’t specifically address how to account for the tax benefit of a tax credit carryforward or carryback. Some practitioners apply the rules for NOLs and recognize the tax benefit of a credit in the year in which the activity that gives rise to the credit occurs. The amount used is recognized as a current benefit and the carryforward amount is recognized as a deferred benefit.

Unlike NOLs, the ASC 740 effective tax rate is affected by tax credits generated by current-year activity regardless of carryback or carryforward. Credits reduce the effective tax rate for companies with taxable income. However, credits increase the effective tax rate for companies reporting an NOL – the credit increases the benefit associated with current year income.

Like NOLs, under ASC 740 companies must disclose the amounts and expiration dates of all tax credit carryforwards.

Simplify your ASC 740 process with Bloomberg Tax Provision

Like most ASC 740 tax provision subjects, handling net operating losses and tax credits correctly requires both tax and accounting expertise. Manually tracking NOL and credit carryforwards, expiration dates, and valuation allowances for deferred tax assets can consume considerable time and lead to errors. The frequent carryforward and carryback period changes for NOLs can prove particularly burdensome. Find answers to the technical and process challenges that arise when calculating your ASC 740 income tax provision with this comprehensive Essential Guide to ASC 740 .

Thankfully, practitioners no longer need to maintain cumbersome spreadsheets. Bloomberg Tax Provision offers a complete ASC 740 tax provision solution, allowing companies to handle NOL and credit carryforwards with ease. Request a demo to learn more about how Bloomberg Tax Provision software can help you calculate your ASC 740 tax provision accurately and efficiently.

By clicking submit, I agree to the privacy policy .

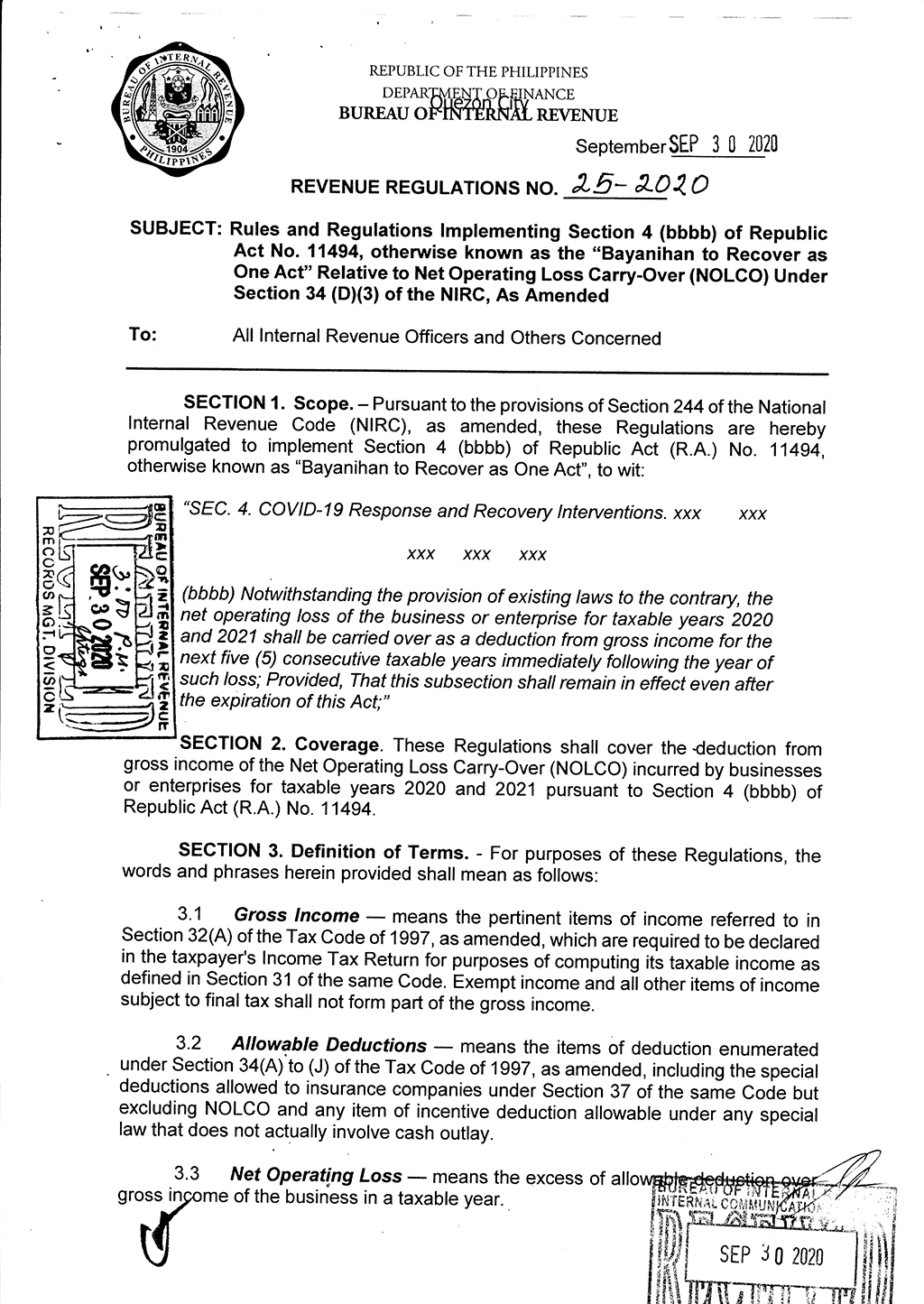

BIR Revenue Regulations No.25-2020

August 10, 2021 By Management

REVENUE REGULATIONS NO. 25-2020 issued on September 30, 2020 prescribes the Rules and Regulations to implement Section 4 (bbbb) of Republic Act (RA) No. 11494 (Bayanihan to Recover as One Act) relative to Net Operating Loss Carry-Over (NOLCO) under Section 34 (D)(3) of the National Internal Revenue Code (NIRC) of 1997, as amended. Unless otherwise disqualified from claiming the deduction, the business or enterprise which incurred net operating loss for taxable years 2020 and 2021 shall be allowed to carry over the same as a deduction from its gross income for the next five (5) consecutive taxable years immediately following the year of such loss. The net operating loss for said taxable years may be carried over as a deduction even after the expiration of RA No. 11494 provided the same are claimed within the next five (5) consecutive taxable years immediately following the year of such loss. The NOLCO shall be separately shown in the taxpayer’s Income Tax Return (also shown in the Reconciliation Section of the Tax Return) while the unused NOLCO shall be presented in the Notes to the Financial Statements showing, in detail, the taxable year in which the net operating loss was sustained or incurred, and any amount thereof claimed as NOLCO deduction within five (5) consecutive years immediately following the year of such loss. The NOLCO for taxable years 2020 and 2021 shall be presented in the Notes to the Financial Statements separately from the NOLCO for other taxable years. Failure to comply with this requirement will disqualify the taxpayer from claiming the NOLCO.

Everything you need to know about NOLCO and how to apply it to your Annual ITR.

When filing for your Annual Income Tax for Corporations and Partnerships (1702RT), you may have noticed being asked if you have any Net Operating Loss Carry Over (NOLCO).

Net Operation Loss Carry Over (NOLCO) is the total of your excess allowable deductions over business gross income per taxable year. You can carry over your NOLCO for the next three (3) consecutive taxable years. This will only be applicable for corporations not under MCIT rate in the current taxable year.

You can view the computation of your NOLCO in Schedule III of your 1702RT form:

If you are filing this form in Taxumo, here's how you can compute for your NOLCO:

To declare and compute for your NOLCO, answer "Yes" in this screen.

This will trigger the pre-submission screen below.

You can only only declare excess allowable deductions for a maximum of three (3) taxable years, which is why there are only three (3) rows of fields where you can input data. The last row shows the current taxable year's excess allowable deduction computed from the data you inputted in Taxumo, which is why it is not an editable field.

You don't have to fill up all three (3) rows i.e. if you only have excess allowable deductions for two (2) years, then you can just fill up two rows.

Year Incurred - Input the taxable year where you had an excess allowable deduction.

Amount - Input the amount of your excess allowable deduction.

NOLCO Applied (Previous) - Input here the NOLCO amount you used (if any) from the previous years for your previous 1702RT filings. This should always be less than or equal to the Amount column of that respective year. If none, then you can just input "0".

NOLCO Expired - Input here the NOLCO amount that has expired (if any) from the previous years for your previous 1702RT filings. If none, then you can just input "0".

NOLCO Applied (Current) - Input here the NOLCO amount that you want to apply for your current taxable year.

From your inputted data in this screen, we will be able to compute for your NOLCO and apply it as excess allowable deduction for your current 1702RT filing.

Please note that the 1702RT form is a newly released form on Taxumo. As you continue to file this form on our platform for the next coming taxable years, we will be able to automate the next years for your NOLCO as well. 😉

If you have any questions or need clarifications, you can reach out to us at [email protected] or through our live chat agents.

10 Tax mistakes on financial statements and income tax returns Philippines

By: Garry S. Pagaspas, CPA

Comes 2014 calendar year filing season, taxpayers, accountants, and tax agents in the Philippines are on their respective schedules for the filing of the annual income tax returns with attached audited financial statements not later than April 15, 2015. During tax seasons in the Philippines, the following tax mistakes on the audited financial statements (AFS) and annual income tax returns (ITR) in the Philippines should be avoided:

1. Excessive Retained earnings subject to 10% IAET

Improper accumulation of earnings after tax is subject to 10% and an indicator of the same on the face of the audited financial statements is the glaring free retained earnings more than the paid-up capitalization. Under Section 43 of the Corporation Code of the Philippines, as amended, domestic corporations are not allowed to maintain free retained earnings more than 100%. In Section 29 of the Tax Code, as amended, a 10% improperly accumulated earnings tax is being imposed. This 10% tax could be avoided with proper tax planning. In case caught up with such scenario, consult with your tax consultant on how to do about it as their could be a number of remedies.

2. Improper claim of creditable withholding tax credits in the Philippines

Taxes withheld by your suppliers evidenced by BIR Form No. 2307 are tax credits or deductions from income tax liability. As such, it is treated as an asset on books. In some instance, financial statements would show such material asset amount that should have been used. However, in some instances, such asset reflected in the financial statements are without proper BIR Form 2307 documentations, or if there is, the same would pertain to prior years. For large taxpayers, please note the new 2307 requirements under Revenue Regulations No. 2-2015 for attachments.

3. Claim of deductible expenses without withholding applicable taxes

Under Section 34(k) of the Tax Code, as amended, if an expense is subject to withholding tax, the same shall not be deductible until after the applicable withholding taxes has been made. To ensure that you only deduct expenses properly withheld, double checking is made with alphalists of payees and employees duly filed with the BIR and seeing to it that justifications are available to those expenses not withheld taxes.

4. Failure to consider tax deductible NOLCO

Net operating loss carry-over (NOLCO) is another tax asset some simply disregards. To avail NOLCO deduction for taxpayers claiming itemized deductions, it must have been properly stated on the prior year financial statements, and income tax returns. Note that it could be claimed within three (3) taxable years from the year of loss on a first-in, first-out basis.

5. Failure to consider MCIT credits

Minimum corporate income tax (MCIT) of prior year or years is another tax credit some would fail to consider. Like NOLCO, could be claimed within three (3) taxable years from the year of MCIT during the year when the corporation becomes liable to the 30% normal corporate income tax. During the year of MCIT payment, please ensure that the MCIT is indicated in the annual income tax return and on the audited financial statements in the Philippines.

6. Taxing the non-taxable income

As you will note on books of accounts and on the financial income, other income is one line item. Please do not be mislead to conclude that the same is automatically subject to 30% corporate income tax or includible in the 2% MCIT computations. Verify and check each item in such other income account is indeed, taxable ordinary income to avoid misapplication if the same is not such as those capital gains subjected to capital gains tax, unrealized gains, and the likes.

7. Incomplete BIR mandated notes to financial statements

Notes to financial statements is not the sole mandate of the rules and regulations of the Securities and Exchange Commission (SEC) Philippines. BIR has also requires some items and details on taxes to be indicated in the financial statements such as those in Revenue Regulations No. 15-2010 and Revenue Memorandum No. 19-2011. See to it that those notes appears in the Notes to the Audited Financial Statements.

8. Failure to account year-end DST on debt agreements

If you are on a group of companies, a cash cow company like the holding company is very common and intercompany mobility of funds are evident on year end balances appearing on the financial statements. See to it t hat you properly account for the documentary stamp tax (DST) on debt instruments imposed under Section 179 of the Tax Code, as amended.

9. Failure to account withholding tax on accruals

Under the accrual basis of accounting, expenses incurred during the year are deductible expenses, though, unpaid as of year-end cut-off. When making accruals of expenses, please ensure that you properly account withholding taxes so as to fully comply with tax rules on deductibility of expenses. Example of this is accruals for audit fees, legal fees, management bonus, and the likes.

10. Failure to consider limitations on some expenses

Please not also on the three (3) expenses subject to limitations – interest expense with respect to the reduction of 33% of interest income subjected to final tax under “tax arbitrage”, the 1% (services) or 0.5% (goods) on representation expenses, and 5% (corporation) or 10% (individual) on charitable contributions.

While each one of us would want to beat the tax filing timeline, we are likewise bound to ensure that we do it in a manner in accord with the rules and regulations to avoid tax risks during tax examinations.

Disclaimer : This article is for general conceptual guidance only and is not a substitute for an expert opinion. Please consult your preferred tax and/or legal consultant for the specific details applicable to your circumstances. For comments, you may please send mail at in**@ta************.org .)

See how we can help you with our professional services…

See our quality seminars, workshops, and trainings…

Read More Articles…

7 New VAT Rules under Ease of Paying Taxes Act RA 11976 Philippines

Revenue Memorandum Circular No. 39-2024

Revenue Memorandum Circular 29-2024

Revenue Memorandum Circular No. 22-2024

SEC MC No. 02, series of 2024

Revenue Memorandum Circular No. 16-2024

Revenue Memorandum Circular No. 3-2024

Apr 10 - Apr 11, 2024

Live Webinar: Winning BIR Tax Assessments Series: Process, Remedies & Writing Effective Protest

Apr 17 - Apr 18, 2024

Live Webinar on Ph Payroll Computations and Taxation

Live Webinar: Value Added Tax: In and Out

Apr 23 - Apr 24, 2024

Live Webinar: Basic Bookkeeping for Non-Accountants

Apr 24, 2024

Live Webinar: Returns and Reports Preparation under eBIR Forms and Online Submissions

Apr 25, 2024

Live Webinar: Input VAT Refund

Apr 26, 2024

Live Webinar: Ease of Paying Taxes Act: Understanding the Latest Implementing Rules and Regulations

May 03, 2024

Onsite Training: PEZA Registered Entities: Taxation and Basic Reports

May 07, 2024

Live Webinar: SEC Dividend Declarations

May 07 - May 08, 2024

How to analyze Financial Statements Accounting for Correct Business Decision Making?

Consultant Inquiry Form

Search our website:.

Phone : (02) 5310-2239

Email : info(@)taxacctgcenter.ph

Government Links

- Bureau of Internal Revenue (BIR)

- Securities and Exchange Commission(SEC)

- Philippine Economic Zone Authority(PEZA)

- Bases Conv. & Dev't. Authority (BCDA)

- Cagayan Economic Zone Authority (CEZA)

- Subic Bay Metropolitan Authority (SBMA)

- Board of Investments (BOI)

- Bureau of Customs (BoC)

- Department of Finance (DOF)

- Department of Trade and Industry(DTI)

- Food and Drugs Administration Phils. (FDA)

- Bureau of Immigration(BI)

Newsletter Sign Up

© Tax and Accounting Center 2024. All Rights Reserved

Privacy Overview

An official website of the United States government

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Take action

- Report an antitrust violation

- File adjudicative documents

- Find banned debt collectors

- View competition guidance

- Competition Matters Blog

New HSR thresholds and filing fees for 2024

View all Competition Matters Blog posts

We work to advance government policies that protect consumers and promote competition.

View Policy

Search or browse the Legal Library

Find legal resources and guidance to understand your business responsibilities and comply with the law.

Browse legal resources

- Find policy statements

- Submit a public comment

Vision and Priorities

Memo from Chair Lina M. Khan to commission staff and commissioners regarding the vision and priorities for the FTC.

Technology Blog

Consumer facing applications: a quote book from the tech summit on ai.

View all Technology Blog posts

Advice and Guidance

Learn more about your rights as a consumer and how to spot and avoid scams. Find the resources you need to understand how consumer protection law impacts your business.

- Report fraud

- Report identity theft

- Register for Do Not Call

- Sign up for consumer alerts

- Get Business Blog updates

- Get your free credit report

- Find refund cases

- Order bulk publications

- Consumer Advice

- Shopping and Donating

- Credit, Loans, and Debt

- Jobs and Making Money

- Unwanted Calls, Emails, and Texts

- Identity Theft and Online Security

- Business Guidance

- Advertising and Marketing

- Credit and Finance

- Privacy and Security

- By Industry

- For Small Businesses

- Browse Business Guidance Resources

- Business Blog

Servicemembers: Your tool for financial readiness

Visit militaryconsumer.gov

Get consumer protection basics, plain and simple

Visit consumer.gov

Learn how the FTC protects free enterprise and consumers

Visit Competition Counts

Looking for competition guidance?

- Competition Guidance

News and Events

Latest news, ftc, doj, and hhs extend comment period on cross-government inquiry on impact of corporate greed in health care.

View News and Events

Upcoming Event

Older adults and fraud: what you need to know.

View more Events

Sign up for the latest news

Follow us on social media

--> --> --> --> -->

Playing it Safe: Explore the FTC's Top Video Game Cases

Learn about the FTC's notable video game cases and what our agency is doing to keep the public safe.

Latest Data Visualization

FTC Refunds to Consumers

Explore refund statistics including where refunds were sent and the dollar amounts refunded with this visualization.

About the FTC

Our mission is protecting the public from deceptive or unfair business practices and from unfair methods of competition through law enforcement, advocacy, research, and education.

Learn more about the FTC

Meet the Chair

Lina M. Khan was sworn in as Chair of the Federal Trade Commission on June 15, 2021.

Chair Lina M. Khan

Looking for legal documents or records? Search the Legal Library instead.

- Cases and Proceedings

- Premerger Notification Program

- Merger Review

- Anticompetitive Practices

- Competition and Consumer Protection Guidance Documents

- Warning Letters

- Consumer Sentinel Network

- Criminal Liaison Unit

- FTC Refund Programs

- Notices of Penalty Offenses

- Advocacy and Research

- Advisory Opinions

- Cooperation Agreements

- Federal Register Notices

- Public Comments

- Policy Statements

- International

- Office of Technology Blog

- Military Consumer

- Consumer.gov

- Bulk Publications

- Data and Visualizations

- Stay Connected

- Commissioners and Staff

- Bureaus and Offices

- Budget and Strategy

- Office of Inspector General

- Careers at the FTC

Fact Sheet on FTC’s Proposed Final Noncompete Rule

- Competition

- Office of Policy Planning

- Bureau of Competition

The following outline provides a high-level overview of the FTC’s proposed final rule :

- Specifically, the final rule provides that it is an unfair method of competition—and therefore a violation of Section 5 of the FTC Act—for employers to enter into noncompetes with workers after the effective date.

- Fewer than 1% of workers are estimated to be senior executives under the final rule.

- Specifically, the final rule defines the term “senior executive” to refer to workers earning more than $151,164 annually who are in a “policy-making position.”

- Reduced health care costs: $74-$194 billion in reduced spending on physician services over the next decade.

- New business formation: 2.7% increase in the rate of new firm formation, resulting in over 8,500 additional new businesses created each year.

- This reflects an estimated increase of about 3,000 to 5,000 new patents in the first year noncompetes are banned, rising to about 30,000-53,000 in the tenth year.

- This represents an estimated increase of 11-19% annually over a ten-year period.

- The average worker’s earnings will rise an estimated extra $524 per year.

The Federal Trade Commission develops policy initiatives on issues that affect competition, consumers, and the U.S. economy. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Follow the FTC on social media , read consumer alerts and the business blog , and sign up to get the latest FTC news and alerts .

Press Release Reference

Contact information, media contact.

Victoria Graham Office of Public Affairs 415-848-5121

IMAGES

VIDEO

COMMENTS

Learn how to comply with the requirements for claiming NOLCO deduction from gross income for taxable years 2020 and 2021. NOLCO shall be separately shown in the tax return and the Notes to the Financial Statements.

Learn how to claim and report Nolco from taxable years 2020 and 2021 for the next five consecutive years under RR 25-2020. See the requirements, exceptions and presentation of Nolco in financial statements for corporate taxpayers.

When NOLCO is applied or claimed as a deduction for tax purposes, it is recorded as a credit to the DTA (if previously recognized) and as a debit entry to income tax expense. That said, the amount of NOLCO in the income tax return can never be reflected in the income statement as required by the RR.

Net operating Loss Carry Over (NOLCO) is a special deduction for business income. The video teaches you the fundamental concept of applying NOLCO in computin...

Presentation of NOLCO in Tax Return and Unused NOLCO in the Income Statement. - The NOLCO shall be separately shown in the taxpayer's income tax return (also shown in the Reconciliation Section of the Tax Return) while the unused NOLCO shall be presented in the Notes to the Financial Statements showing, in detail, the taxable year in which ...

Learn how to present Net Operating Loss Carry-Over (NOLCO) in financial statements for taxable years 2020 and 2021. The BIR has extended the NOLCO period to five years and requires separate disclosure in the income tax return and notes.

According to Section 34-D.3 of the National Internal Revenue Code (NIRC), net operating loss carry-over (NOLCO) shall mean the excess of allowable deductions over business gross income in a taxable year. Accordingly, the net operating loss of the business or enterprise for any taxable year immediately preceding the current taxable year, which ...

financial statements have been approved and authorized for issuance by the Board of Directors PH.4on [DATE]. ... The details of the Company's NOLCO and MCIT which can be claimed as deductions from regular corporate taxable income at ... The presentation shall be made in columnar format according to the above categories and disclosure items.

Specific guidance on materiality and its application to the financial statements is included in paragraphs 29-31 of IAS 1 Presentation of Financial Statements. Preparers may also consider Practice Statement 2 Making Materiality Judgements, which provides guidance and examples on applying materiality in the preparation of financial statements.

The BIR has issued RR 25-2020 to extend the Nolco period for taxable years 2020 and 2021 to five years. The Nolco shall be separately shown in the taxpayer's income tax return and in the notes to financial statements in detail.

Nolco is also available under several special laws: The Financial Institutions Strategic Transfer Act (Fist) or RA 11523, passed early this year, provides that a loss incurred by a financial institution as a result of the transfer of non-performing loans and real and other properties acquired within the two-year period from Fist's effectivity ...

The Bureau of Internal Revenue (BIR) as of December 22, 2020 released Revenue Memorandum No. 138-2020 (RMC No. 138-2020) which is effective immediately to clarify the previously released Revenue Regulation No. 25-2020 on the Availment of NOLCO for Taxpayers Adopting Fiscal Year. Businesses or enterprises which incurred net operating loss for ...

NOLCO must be presented in the Notes to the Financial Statements showing, in detail, the taxable year in which the net operating loss was sustained or incurred, and any amount thereof claimed as NOLCO deduction within five consecutive years immediately following the year of such loss. Further, the NOLCO for taxable years 2020 and 2021 must be

958-205-50-1 The financial statements shall provide a description of the nature of the not-for-profit entity's (NFP's) activities, including a description of each of its major classes of programs. If not provided in the notes to financial statements, the description can be presented on the statement of activities (for example, using column ...

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. Net operating losses (NOLs) and tax credits impact the ASC 740 provision for income tax.If a company's deductions exceed its income in a given year, it reports a net operating loss for federal income tax purposes.

The NOLCO shall be separately shown in the taxpayer's Income Tax Return (also shown in the Reconciliation Section of the Tax Return) while the unused NOLCO shall be presented in the Notes to the Financial Statements showing, in detail, the taxable year in which the net operating loss was sustained or incurred, and any amount thereof claimed ...

Updated over a week ago. When filing for your Annual Income Tax for Corporations and Partnerships (1702RT), you may have noticed being asked if you have any Net Operating Loss Carry Over (NOLCO). Net Operation Loss Carry Over (NOLCO) is the total of your excess allowable deductions over business gross income per taxable year. You can carry over ...

S-X 4-01(a)(1) requires financial statements filed with the SEC to be presented in accordance with US GAAP, unless the SEC has indicated otherwise (e.g., foreign private issuers are permitted to use IFRS as issued by the IASB). Regulation S-K Item 10(e) prohibits the inclusion of non-GAAP information in financial statements filed with the SEC.

NOLCO refers to a net operating loss carry-over that allows taxpayers to deduct operating losses from gross income over the next 3 years. It results when allowable deductions exceed gross income in a year. A company's NOLCO of P100,000 in 2010 can be deducted until 2013, and its P100,000 loss in 2011 until 2014. The substantial ownership of a business must remain 75% the same for the acquiring ...

FSP 6.2 was updated to include a summary of recently-issued FASB guidance that affects the statement of cash flows.; FSP 6.5.2 was updated to clarify guidance on the definition of cash equivalents.; FSP 6.5.3 was updated to clarify guidance on the presentation and disclosure of amounts generally described as restricted cash or restricted cash equivalents.

4. Failure to consider tax deductible NOLCO. Net operating loss carry-over (NOLCO) is another tax asset some simply disregards. To avail NOLCO deduction for taxpayers claiming itemized deductions, it must have been properly stated on the prior year financial statements, and income tax returns.

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion. In our opinion, the consolidated financial statements presents fairly, in all material respects, the financial

Approval by the Board of Classification of Liabilities as Current or Non-current—Deferral of Effective Date issued in July 2020. Classification of Liabilities as Current or Non-current—Deferral of Effective Date, which amended IAS 1, was approved for issue by all 14 members of the International Accounting Standards Board. Hans Hoogervorst.

Overview. IAS 1 Presentation of Financial Statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such as going concern, the accrual basis of accounting and the current/non-current distinction. The standard requires a complete set of financial statements to comprise a ...

Presentation of Financial Statements with effect from accounting periods beginning on or after 1 January 2027. The requirements in IAS 1 that are unchanged have been transferred to IFRS 18 and other Standards. Companies will be required to apply the new requirements in interim financial statements in the initial year of application, and to restate

Management is responsible for the preparation and the fair presentation of these financial statements in accordance with Philippine Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from

Presentation and Disclosure in Financial Statements. IFRS 18 replaces IAS 1 Presentation of Financial Statements with effect from accounting periods beginning on or after 1 January 2027. The requirements in IAS 1 that are unchanged have been transferred to IFRS 18 and other Standards. Companies will be required to apply the new

The following outline provides a high-level overview of the FTC's proposed final rule:. The final rule bans new noncompetes with all workers, including senior executives after the effective date.