Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

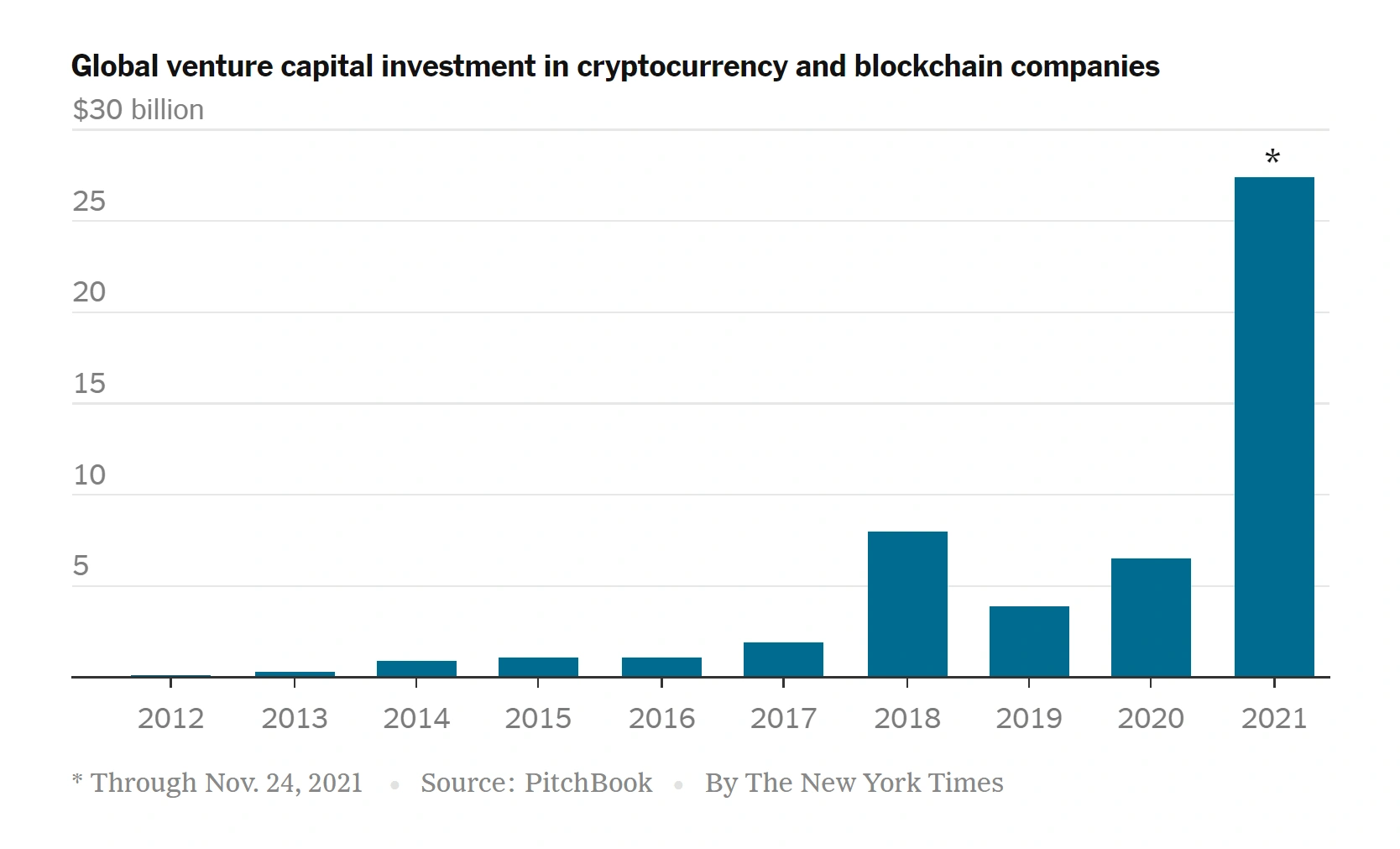

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

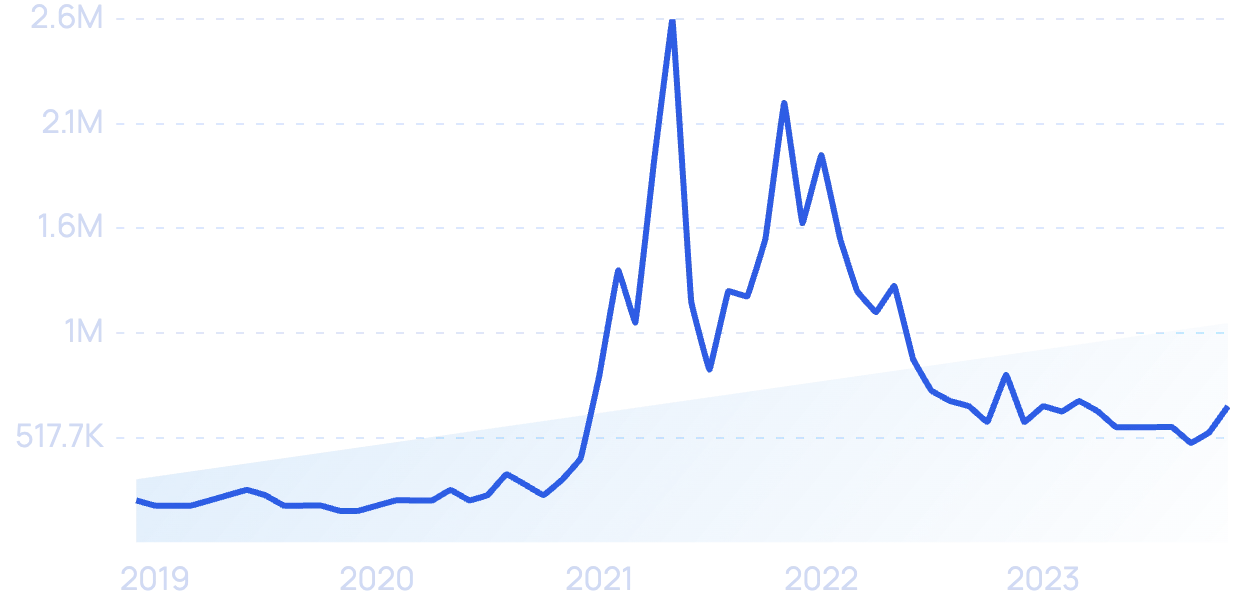

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

RESEARCH REPORT

Top 10 banking trends for 2024

Banking on AI

5-MINUTE READ

January 8, 2024

- Banking stands on the threshold of a new era, similar to the start of the Digital Age.

- Like digital, the Age of AI is likely to have a transformative impact on the industry, affecting roles in virtually every part of the bank.

- Not only is the rapid adoption of gen AI the most important trend for banks in 2024—it’s also shaping the other nine trends.

The age of AI

A quarter of a century ago, banking stood on the verge of the Digital Age. The internet was starting to reveal its potential and most bankers had a strong premonition that far-reaching change was coming. Today we feel a similar sense of awe as we contemplate the potential of gen AI, especially when powered by the cloud and rapidly expanding data capabilities.

We’re confident the age of AI will change banking and many other industries—exactly how, we’ll only know in retrospect. No part of the bank—and few if any roles within it—will remain untouched.

Every year we share our perspective on the trends most likely to shape the future of the industry in the next 12 months and beyond. It should be no surprise the number one trend this year is the rapid adoption of gen AI, nor that it’ll have a transformative impact on the other nine trends bankers will need to confront in the months to come.

We’re now on the threshold of the Age of AI. Banking, like most other industries, will never be the same. The challenge is to ensure it’s a force for good that benefits our organizations, our people and all humankind.

10 trends will change banking in 2024

1. the rise of gen ai.

Banks are likely to benefit more than other industries—our analysis indicates productivity could rise by 20–30% and revenue by 6%. Banks will need to not only utilize cloud and data effectively, but also to rethink work and talent.

2. Capturing the digital dividend

While most banks have mastered digital, it has come at the cost of close customer relationships. Banks will need to focus on finding ways to have meaningful conversations with customers across these channels – AI may hold the key.

3. All the risk we cannot see

In 2024, banks will be confronted by a variety of risks—some familiar, others less obvious. We've identified five that deserve particular attention. Planning for the unplanned will pay dividends.

4. A whole new way of working

Banks are realizing that people are just as important as technology to the success of their human + machine initiatives. They’re putting talent at the center of their strategies as they reimagine the future of work.

5. The power of pricing

Banks have always known optimized pricing can hugely impact their top and bottom lines. Now they’re starting to combine intuition with gen AI and more comprehensive data to turbocharge scenario planning and move closer to personalized pricing.

6. Time to think cloud first

Most banks’ early experiences of cloud were like that of a novice driver put behind the wheel of a Ferrari: they tried to drive it like a family sedan. Lately they're moving up through the gears and discovering what cloud can really do for them.

7. Regulation recalibrated

Bank regulations have ballooned since the 2008/9 Financial Crisis. We expect more collaboration among banks, central banks and regulators to work more effectively together.

8. From technology to engineering

How does the role of technology in banking evolve? A subtle change, with major organizational implications: the shift from a technology management to an engineering mindset.

9. The key to the core

New approaches and technologies—not least of which is gen AI and its ability to swiftly convert outdated code—are combining to finally free banks from the limitations of their aging core systems.

10. Beyond Six Sigma

Banks have historically employed re-engineering and cost-out thinking to optimize operations and experiences—the limitations were clear. Gen AI’s learning ability breaks this barrier and ushers in a new way of thinking that goes beyond Six Sigma.

Gen AI will undoubtedly be disruptive, but we’re confident that most of this will be positive. Our recent Art of AI Maturity survey on the topic—involving 1,600 C-suite executives at many of the world’s largest companies—found that 42% of those leading the way have already achieved a return on their AI investments that exceeds their expectations.

But the secret to these outcomes isn’t AI—it’s how it’s being used. It’s as much about people as it is about technology and as much about strategy as implementation. That’s a lot of balls to keep up in the air. But banks that master this juggling act will look back in years to come and toast to 2024.

As we enter the Age of AI, many bankers feel the same sense of awe that their counterparts did a quarter of a century ago as they stood on the verge of the Digital Age.

Michael Abbott / Global Banking Lead

Michael Abbott discusses how generative AI could reshape financial services in 2024 in this American Banker podcast.

Frequently asked questions

Is gen ai just another technology fad.

The speed at which gen AI is being adopted by most organizations in nearly all industries, and the massive escalation of the power of the technology, are convincing indicators that it is here to stay—and will have a profound impact on banking.

What benefits does gen AI offer banks?

Gen AI will make bank professionals more productive and improve the efficiency of banks’ operating model. However, we believe its biggest impact will be to increase revenue and loyalty by improving banks’ ability to understand and respond to individual customers’ intent and financial goals.

Where in the average bank is AI likely to have the greatest positive impact?

There are few functions and roles that will not be affected; our analysis indicates 73% of banking roles have a high potential to be either automated or augmented. We’ve already identified about 50 promising use cases for banks.

How should banks include talent in their gen AI strategy?

People should be at the very center of every gen AI strategy. New skills are needed to design, build, implement and train gen AI – banks will need to get used to a new way of working.

Related insights

- Top 10 banking trends for 2023

- Art of AI maturity

- Banking Consumer Study

Michael Abbott

Senior Managing Director – Global Banking Lead

Frontier Topics in Banking

Investigating New Trends and Recent Developments in the Financial Industry

- © 2019

- Elisabetta Gualandri 0 ,

- Valeria Venturelli 1 ,

- Alex Sclip 2

Marco Biagi Department of Economics, University of Modena and Reggio Emilia, Modena, Italy

You can also search for this editor in PubMed Google Scholar

- Shines a light on frontier topics in banking while also incorporating the development of “traditional” topics in new contexts

- Investigates new trends and opportunities for the financing of SMEs and new ventures, and the implications for financial inclusion

- Analyzes the combined role of financing of banks with new “social” techniques of communication and the broad field of customer social responsibility

Part of the book series: Palgrave Macmillan Studies in Banking and Financial Institutions (SBFI)

12k Accesses

20 Citations

4 Altmetric

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Table of contents (12 chapters)

Front matter, nobel prize in economic sciences: the role of financial studies.

- Gianfranco Vento, Paola Vezzani

The Financing of SMEs

Risk and pricing on the italian minibond market.

- Alessandro Giovanni Grasso, Francesco Pattarin

Exploring Factors Influencing the Success of Equity Crowdfunding Campaigns: Findings from Italy

- Stefano Cosma, Alessandro Giovanni Grasso, Francesco Pagliacci, Alessia Pedrazzoli

From Seeker Side to Investor Side: Gender Dynamics in UK Equity Crowdfunding Investments

- Valeria Venturelli, Alessia Pedrazzoli, Elisabetta Gualandri

Banks and Their Customers

Financial inclusion: trends and determinants.

- Mais Sha’ban, Claudia Girardone, Anna Sarkisyan

Framing, Overconfidence and Regret in Italian Mortgage Banking Litigations

- Caterina Lucarelli, Francesco James Mazzocchini

‘Share this pic!’: A Picture of the Adoption of Online Social Media by Italian Banks

- Elisa Giaretta, Giusy Chesini

Central Banks’ Commitment to Stakeholders: CSR in the Eurosystem: 2006–2016

- Vincenzo Farina, Giuseppe Galloppo, Daniele A. Previati

Regulation and Bank Management

Bank’s asset quality review using debt service coverage ratio: an empirical investigation across european firms.

- Maurizio Polato, Federico Beltrame

Credit Risk Disclosure Practices in the Annual Financial Reporting of Large Italian Banks

- Enzo Scannella, Salvatore Polizzi

The Impact of Recent Regulatory Reforms on Cross-Border Banking: A Study of the Nordic Markets

- Viktor Elliot, Ted Lindblom, Magnus Willesson

The Effectiveness of the ‘Belt and Road’ Initiative in Tackling China’s Economic Slowdown and Its Financial Implications Within a Policy Trilemma Context

- Piotr Łasak, René W. H. van der Linden

Back Matter

- Crowdfunding

- SMEs financing

- SMEs and new ventures financing

- corporate social responsibility

- financial inclusion

- cross-border banking

- financing of SMEs

- equity crowdfunding

- corporate governance

About this book

Editors and affiliations.

Elisabetta Gualandri, Valeria Venturelli, Alex Sclip

About the editors

Elisabetta Gualandri , MA in Financial Economics at the University College of North Wales, is a Full Professor of Banking and Finance in the Marco Biagi Department of Economics at the University of Modena and Reggio Emilia, Italy, where she is a member of the Center for Studies in Banking and Finance (CEFIN). She is also the Director of the European Association of University Teachers of Banking and Finance – Wolpertinger.

Valeria Venturelli is an Associate Professor of Banking and Finance in the Marco Biagi Department of Economics at the University of Modena and Reggio Emilia, Italy, where she teaches Financial Markets and Institutions at both undergraduate and graduate level. She graduated in Economics from the University of Modena and Reggio Emilia and received a PhD in Financial Markets and Institutions from the Catholic University of Milan, Italy.

Alex Sclip is a Post-doc researcher in the Marco Biagi Department of Economics at the University of Modena and Reggio Emilia, Italy. He earned his PhD in Banking and Finance at the University of Udine, Italy. His research interests are focused on risk management in banking and insurance companies, bank capital structure and financial regulation.

Bibliographic Information

Book Title : Frontier Topics in Banking

Book Subtitle : Investigating New Trends and Recent Developments in the Financial Industry

Editors : Elisabetta Gualandri, Valeria Venturelli, Alex Sclip

Series Title : Palgrave Macmillan Studies in Banking and Financial Institutions

DOI : https://doi.org/10.1007/978-3-030-16295-5

Publisher : Palgrave Macmillan Cham

eBook Packages : Economics and Finance , Economics and Finance (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2019

Hardcover ISBN : 978-3-030-16294-8 Published: 13 June 2019

Softcover ISBN : 978-3-030-16297-9 Published: 14 August 2020

eBook ISBN : 978-3-030-16295-5 Published: 28 May 2019

Series ISSN : 2523-336X

Series E-ISSN : 2523-3378

Edition Number : 1

Number of Pages : XXXI, 373

Number of Illustrations : 30 b/w illustrations

Topics : Banking

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

Finance articles from across Nature Portfolio

Latest research and reviews, esg performance on the value of family firms: international evidence during covid-19.

- Christian Espinosa-Méndez

- Carlos Maquieira

- José Tomás Arias

Nexus between boardroom independence and firm financial performance: evidence from South Asian emerging market

- Majid Jamal Khan

- Faiza Saleem

- Muhammad Yar Khan

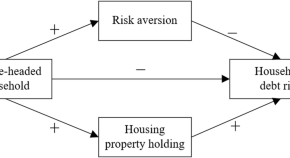

The influence and mechanism of female-headed households on household debt risk: empirical evidence from China

- Yingzhu Guo

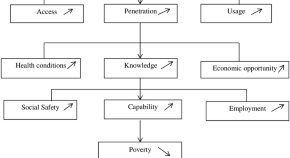

Can financial inclusion enhance human development? Evidence from low- and middle-income countries

- Kais Tissaoui

- Abdelaziz Hakimi

- Taha Zaghdoudi

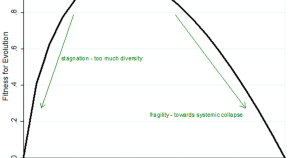

Ecological money and finance—upscaling local complementary currencies

- Thomas Lagoarde-Ségot

- Alban Mathieu

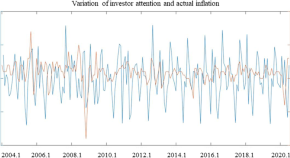

Investor attention and consumer price index inflation rate: Evidence from the United States

- Qingjie Zhou

- Yinpeng Zhang

News and Comment

Hunger, debt and interest rates

Financial imperatives to food system transformation

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial resources while making better use of existing ones. These imperatives are yet to garner greater traction to instigate meaningful change.

- Eugenio Diaz-Bonilla

- Brian McNamara

Central bank digital currencies risk becoming a digital Leviathan

Central bank digital currencies (CBDCs) already exist in several countries, with many more on the way. But although CBDCs can promote financial inclusivity by offering convenience and low transaction costs, their adoption must not lead to the loss of privacy and erosion of civil liberties.

- Andrea Baronchelli

- Hanna Halaburda

- Alexander Teytelboym

ESG performance of ports

An article in Case Studies on Transport Policy quantifies the environmental, social, and governance performances of three ports.

- Laura Zinke

Venture capital accelerates food technology innovation

Start-ups are now the predominant source of innovation in all categories of food technology. Venture capital can accelerate innovation by enabling start-ups to pursue niche areas, iterate more rapidly and take more risks than larger companies, writes Samir Kaul.

Challenges for a climate risk disclosure mandate

The United States and other G7 countries are considering a framework for mandatory climate risk disclosure by companies. However, unless a globally acceptable hybrid corporate governance model can be forged to address the disparities among different countries’ governance systems, the proposed framework may not succeed.

- Paul Griffin

- Amy Myers Jaffe

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

151+ Good Banking And Finance Research Topics For Students [2024 Updated]

Are you curious about Banking and Finance Research Topics? In this blog, we explore various banking and finance-related research topics. What drives the banking sector’s resilience in the face of challenges? How do financial markets influence our economic well-being?

Let’s find the good topics of personal finance, corporate decision-making, risk management, and more. From the fundamental principles of accounting to the latest trends in fintech, this collection of research topics spans various fields, offering a comprehensive view of the ever-evolving finance domain.

Discover the impact of digital currencies, the role of central banks, and the effectiveness of credit scoring models. Explore the importance of real estate finance and know the behavioral aspects influencing investment decisions. We also examine the intersection of finance with emerging technologies and its role in sustainable development.

Whether you are a student researching finance or the banking sector with good research ideas about economic difficulties. These Banking and Finance Research Topics provide a gateway to understanding the pivotal role finance plays in our global society. Let’s know all about them here.

Table of Contents

What Is Banking And Finance Research Topics?

Banking and finance research topics refer to specific questions that researchers investigate related to financial systems and institutions. These topics help explore how banks, investments, financial markets, and economic policies work.

Some examples of banking and finance research topics include:

- How new technologies like mobile apps are changing banking

- What causes stock market prices to rise and fall

- How government regulations impact financial institutions

- Why do people make certain financial decisions?

- Ways to improve risk management for banks

- The future of cryptocurrencies as an investment

- How fintech companies are competing with traditional banks

Researching these topics aims to gain a deeper understanding of the financial world. The knowledge can then be used to inform better policies, practices, and decisions related to banking and finance.

How To Find Banking And Finance Research Topics For Students?

Here are some tips for students on finding good banking and finance research topics:

- Look at current events in the banking and finance industries for inspiration. Pay attention to what’s happening with major banks, new technologies, economic policies, financial crises, and industry trends.

- Review finance publications, academic journals, magazines, and websites to discover recent research studies related to banking and see what knowledge gaps they identify that require further investigation.

- Browse research paper databases for sample banking and finance essays to find potential topics or note areas requiring additional up-to-date research.

- Align topics with your existing interests and course curriculum. If you enjoy technology, explore fintech questions. If macroeconomics fascinates you, investigate the implications of monetary policies.

- Consider meaningful real-life research questions, like how underprivileged groups are financially underserved or how developing nations can gain affordable banking access.

- Brainstorm ideas and get input from professors who will guide you in refining topics based on viability, available data sources, analytical methods, and relevance to the current finance field.

List of Good Banking And Finance Research Topics

Here are the most interesting banking and finance research topics:

Good Banking And Finance Research Topics For Students

- Comparative analysis of traditional banking vs. online banking.

- The impact of mergers and acquisitions on bank performance.

- Assessing the role of central banks in ensuring financial stability.

- Investigating the effectiveness of bank stress tests in predicting financial crises.

- Analyzing the factors influencing customer satisfaction in banking services.

- The role of blockchain technology in enhancing banking security.

- Examining the impact of interest rate fluctuations on bank profitability.

- Evaluating the role of government intervention in preventing bank failures.

- Analyzing the challenges and opportunities of Islamic banking.

- The impact of Basel III regulations on banking risk management.

Best Banking And Finance Sector Research Topics For MBA Students

- The role of the stock market in economic development.

- Examining the factors affecting stock market volatility.

- Impact of high-frequency trading on financial markets.

- Exploring the relationship between corporate governance and stock prices.

- The role of derivatives in managing financial market risks.

- Analyzing the impact of macroeconomic indicators on stock prices.

- The role of insider trading in financial markets.

- Investigating the efficiency of emerging financial markets.

- The impact of market sentiment on stock prices.

- Analyzing the role of financial analysts in shaping market perceptions.

Personal Finance-Related Research Topics

- The impact of financial literacy on personal finance management.

- Evaluating the effectiveness of budgeting tools in personal finance.

- The role of behavioral economics in understanding individual investment decisions.

- Investigating the factors influencing retirement savings decisions.

- The impact of socio-economic factors on household debt levels.

- Assessing the effectiveness of financial planning in achieving financial goals.

- The role of technology in personal financial management.

- Analyzing the impact of tax policies on personal savings.

- The relationship between education and income levels in personal finance.

- Investigating the role of psychological biases in personal investment decisions.

Corporate Banking And Finance Research Topics

- The impact of capital structure on firm profitability.

- Evaluating the role of financial leverage in corporate decision-making.

- Analyzing the factors influencing dividend payout policies.

- The impact of corporate governance on firm performance.

- Investigating the relationship between CEO compensation and firm performance.

- The role of working capital management in corporate finance.

- Analyzing the impact of exchange rate fluctuations on multinational corporations.

- The influence of financial disclosure on investor decisions.

- Evaluating the impact of corporate social responsibility on shareholder value.

- The role of venture capital in financing innovation and startups.

Risk Management Research Topics For College Students

- The impact of credit risk on financial institutions.

- Analyzing the role of derivatives in hedging financial risks.

- Evaluating the effectiveness of value-at-risk (VaR) models in risk management.

- The impact of operational risk on financial institutions.

- Exploring the relationship between risk-taking and financial performance.

- Analyzing the role of insurance in managing financial risks.

- The impact of climate change on financial risk assessment.

- Evaluating the role of stress testing in assessing systemic risk.

- The influence of cyber threats on financial institutions’ risk management.

- The role of artificial intelligence in enhancing risk management practices.

Accounting and Auditing Research Topics

- Analyzing the impact of International Financial Reporting Standards (IFRS) on financial reporting quality.

- Evaluating the role of forensic accounting in fraud detection.

- The impact of audit quality on financial statement reliability.

- Investigating the role of auditor independence in ensuring financial transparency.

- Analyzing the effectiveness of fair value accounting in financial reporting.

- The influence of accounting conservatism on financial decision-making.

- Evaluating the impact of accounting information on investment decisions.

- The role of big data analytics in modern accounting practices.

- Analyzing the challenges and opportunities of sustainability reporting.

- The impact of earnings management on financial statement reliability.

Financial Regulation and Policy Research Topics

- The role of government intervention in preventing financial crises.

- Evaluating the impact of Dodd-Frank Wall Street Reform and Consumer Protection Act.

- Analyzing the effectiveness of Basel III in regulating global banking.

- The role of regulatory bodies in promoting financial market integrity.

- Investigating the impact of tax policies on corporate financial decisions.

- Analyzing the challenges and opportunities of cross-border financial regulation.

- The role of ethics in financial decision-making and regulation.

- Evaluating the impact of monetary policy on inflation and economic growth.

- The influence of political factors on financial regulation.

- The impact of regulatory changes on financial innovation.

Real Estate Finance Related Research Topics

- Analyzing the factors influencing real estate prices and investment.

- The impact of interest rate changes on real estate markets.

- Evaluating the role of mortgage-backed securities in real estate finance.

- The influence of housing policies on real estate market dynamics.

- The role of real estate crowdfunding in property financing.

- Analyzing the impact of urbanization on real estate development.

- The role of sustainability in real estate investment decisions.

- Evaluating the impact of economic downturns on real estate values.

- The influence of demographic trends on real estate market dynamics.

- Analyzing the challenges and opportunities of real estate finance in emerging markets.

Behavioral Finance Research Paper Topics

- Investigating the role of behavioral biases in investment decisions.

- The impact of overconfidence on financial decision-making.

- Analyzing the influence of social networks on investment behavior.

- Evaluating the role of emotions in financial decision-making.

- The impact of financial news and media on investor sentiment.

- Investigating the role of heuristics in shaping financial perceptions.

- Analyzing the impact of market bubbles on investor behavior.

- The influence of framing effects on investment choices.

- Evaluating the role of financial education in mitigating behavioral biases.

- The impact of cultural factors on individual investment decisions.

Financial Technology (Fintech) Research Topics

- Analyzing the impact of robo-advisors on traditional investment advisory services.

- The role of blockchain in reshaping payment systems.

- Evaluating the potential of cryptocurrencies as a mainstream means of exchange.

- The impact of artificial intelligence on credit scoring models.

- Analyzing the challenges and opportunities of regulating fintech startups.

- The role of big data analytics in personalized financial services.

- Evaluating the impact of open banking on financial innovation.

- The influence of cybersecurity threats on fintech adoption.

- Analyzing the role of regulatory sandboxes in fostering fintech innovation.

- The impact of fintech on financial inclusion in developing economies.

Economics and Finance Sector Related Research Topics

- Investigating the relationship between economic indicators and financial markets.

- The impact of trade policies on exchange rates and international finance.

- Analyzing the role of economic sanctions in shaping financial landscapes.

- Evaluating the impact of globalization on financial stability.

- The role of monetary policy in addressing economic inequality.

- Analyzing the impact of economic recessions on financial decision-making.

- The influence of political instability on financial markets.

- The impact of demographic trends on economic and financial dynamics.

- Evaluating the role of economic forecasting in financial decision-making.

- The relationship between economic growth and financial development.

Sustainable Banking And Finance Research Topics

- Analyzing the impact of environmental, social, and governance (ESG) factors on investment decisions.

- The role of green finance in promoting sustainable development.

- Evaluating the impact of carbon pricing on financial markets.

- The influence of sustainable investing on corporate decision-making.

- Analyzing the challenges and opportunities of integrating sustainability into financial reporting.

- The role of impact investing in addressing social and environmental issues.

- Evaluating the impact of climate change on financial risk assessment.

- The influence of corporate sustainability on shareholder value.

- The role of green bonds in financing environmentally friendly projects.

- Analyzing the effectiveness of sustainable finance policies in achieving global goals.

Recent Banking And Finance Research Topics

- Investigating the potential of decentralized finance (DeFi) in traditional banking services.

- The impact of quantum computing on financial modeling and risk management.

- Analyzing the challenges and opportunities of central bank digital currencies (CBDCs).

- The role of augmented reality (AR) and virtual reality (VR) in financial services.

- The impact of 5G technology on financial transactions and services.

- Evaluating the potential of tokenization in transforming financial markets.

- Analyzing the role of artificial intelligence in credit scoring and lending decisions.

- The influence of geopolitical factors on global financial markets.

- The impact of regulatory technology (RegTech) in compliance and risk management.

- The role of smart contracts in streamlining financial transactions.

Cross-Border Finance Research Paper Topics

- Investigating the impact of exchange rate fluctuations on cross-border investments.

- The role of currency unions in promoting cross-border trade and investments.

- Analyzing the challenges and opportunities of cross-border banking operations.

- Evaluating the impact of trade agreements on cross-border financial flows.

- The influence of political and economic integration on cross-border finance.

- Analyzing the role of international financial institutions in cross-border finance.

- The impact of capital controls on cross-border investments.

- The role of cross-border financial services in promoting global economic integration.

- Evaluating the impact of cross-border financial regulations on multinational corporations.

- The influence of cross-border financial crimes on international cooperation.

Financial Education and Literacy Research Topics

- Investigating the impact of financial education programs on students’ financial literacy.

- The role of technology in enhancing financial education and literacy.

- Evaluating the effectiveness of workplace financial wellness programs.

- Analyzing the impact of cultural factors on financial literacy levels.

- The influence of family background on financial literacy.

- The impact of early financial education on long-term financial behavior.

- Analyzing the relationship between financial literacy and retirement planning.

- The role of schools and universities in promoting financial literacy.

- The influence of gender on financial literacy and decision-making.

- Evaluating the impact of online resources on improving financial literacy.

Banking and Finance in Developing Economies

- Analyzing the challenges and opportunities of financial inclusion in developing economies.

- The role of microfinance in poverty alleviation and economic development.

- Evaluating the impact of foreign aid on financial stability in developing countries.

- The influence of corruption on financial development in developing economies.

- Analyzing the role of remittances in shaping economic landscapes in developing countries.

- The impact of informal financial services on rural communities.

- Evaluating the role of government policies in promoting financial development.

- The influence of economic and political instability on financial systems in developing countries.

- The role of international financial institutions in supporting economic growth in developing economies.

- Analyzing the impact of technology adoption on financial inclusion in developing regions.

What Are Some Good Topics In The Area Of Finance And Accounting For A Ph.D. Research?

Here are some current Banking And Finance research topics for students:

Recent Project Topics On Banking And Finance PDF

Here are the most recent project topics on banking and finance pdf:

These Are the best Banking and Finance Research Topics. These topics serve as gateways to understanding the nature of banking, finance, and other research topics. As you find a good research topic, consider your interests and the current trends shaping the financial domain. Whether it’s the impact of technology on banking, the dynamics of stock markets, or the role of sustainable finance.

Engage with your coursework, delve into academic journals, and attend seminars to find the latest understandings and potential research questions. Consulting with professors and advisors offers valuable guidance, helping refine your focus. Keep an eye on industry reports and financial news for inspiration, considering contemporary challenges and emerging trends.

Remember, your research can contribute to understanding financial systems and inform real-world practices. Choose a topic that not only captivates your interest but also addresses relevant issues, and you’ll find yourself good banking and finance research topics. Happy exploring!

Related Posts

100+ Most Qualitative Research Topics For High School Students In 2024

100+ Most Interesting Google Scholar Research Topics For Students [Updated 2024]

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Economic Effects of Tighter Lending by Banks

Download PDF (299 KB)

FRBSF Economic Letter 2024-11 | May 6, 2024

Banks tightened the criteria used to approve loans over the past year. Analysis shows that their tighter lending standards can be partially explained by economic conditions that reduce demand for loans and increase their potential risk, such as policy rate increases and a slowing economy. The unexplained part may reflect a restrained credit supply, specifically related to banks being less willing or able to take on risk. What are the potential economic consequences? Past credit supply shocks have had significant long-lasting effects on unemployment but less impact on inflation.

The first half of 2023 was characterized by credit market turbulence, including the collapse of Silicon Valley Bank, Signature Bank, and others. The increased uncertainty in the banking sector that followed these closures led many banks to tighten their credit standards, becoming stricter about the conditions under which they were willing to lend. According to the Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS), lending standards in 2023 tightened to a degree only seen during the Global Financial Crisis and the COVID-19 pandemic. This leads to questions about the possible effects on the overall economy, particularly whether tighter standards resulted from an unexpected drop in the credit supply or other economic factors, such as higher interest rates or a slowing of the economy.

In this Economic Letter , I analyze supply and demand factors in credit market conditions and their impact on bank lending standards, like Lown and Morgan (2006) and others. A measure based on reports from bank loan officers shows that credit conditions began tightening in mid-2022, well before the bank closures. Since early 2023, about half of the tightening in lending standards has been due to changes in the credit supply specific to the banking sector, such as banks reevaluating their willingness to take on risk, and the remainder in response to other economic conditions. My analysis also estimates that unexpected changes to credit supply conditions—including the March 2023 bank closures—can account for 0.4 percentage point of unemployment by the end of 2023, meaning that unemployment in that quarter would have been 3.3% without the credit supply shock. My estimates suggest that the effects related to these credit supply shocks will be persistent, lasting through 2026. The contribution of these shocks to inflation is likely to be more subdued, pushing core personal consumption expenditures (PCE) inflation down by less than a 0.1 percentage point through 2026.

Bank lending standards and the economy

Bank lending to businesses depends on two key components: the loan interest rate and the lending standards that businesses need to meet to qualify for a loan. When banks are more willing to take on risk, they impose minimal lending standards; by contrast, when banks prefer to take on less risk, they scrutinize borrowers more and impose stricter conditions. The interest rate on loans responds to both credit supply and credit demand conditions. By contrast, lending standards are more directly related to the willingness or ability of banks to tolerate risk. Thus, they can be used as a proxy for credit supply conditions.

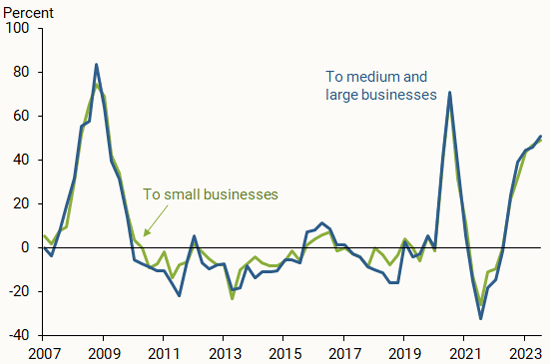

Using SLOOS data, I measure commercial and industrial bank lending conditions as the percentage of responding banks that report tighter lending standards minus the percentage that report easing of lending standards. The resulting measure can range from –100, meaning that all banks are easing standards, to 100, meaning that all banks are tightening standards. A positive (negative) number means that it is harder (easier) for firms to get credit. This method has been used by Lown and Morgan (2006) and other studies to measure credit supply conditions. Figure 1 shows the evolution of this measure from 2007 through 2023 for lending to medium and large businesses (blue line) and to small businesses (green line).

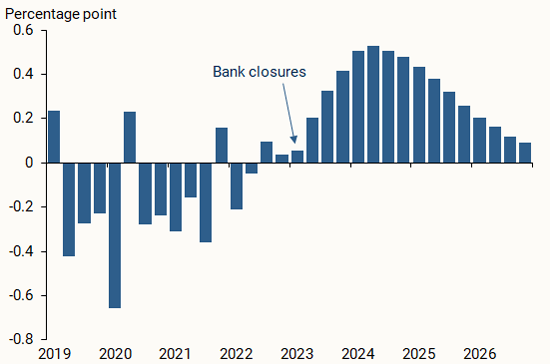

Figure 1 Tightening in commercial and industrial lending standards

The figure shows that lending standards tightened in 2023 to a degree seen only during the Global Financial Crisis in 2008 and the onset of the COVID-19 pandemic in 2020. It also clearly shows that lending standards began tightening in the second half of 2022, well before the bank collapses in early 2023. Finally, the tightening in 2023 lending standards was very similar for all businesses regardless of their size. Therefore, I use the measure for medium and large firms as representative for the economy.

I use this measure in statistical analysis to estimate how credit conditions interact with the rest of the economy, particularly to understand their impact on unemployment and inflation. To measure unemployment, I focus on the unemployment gap, calculated as the difference between the measured unemployment rate and the Congressional Budget Office measure of the potential unemployment rate, and I use the core personal consumption expenditures (PCE) price index to measure inflation.

My approach builds on the work of Lown and Morgan (2006), combining this measure of credit conditions with other measures of financial conditions. These include the effective federal funds rate, the 10-year Treasury constant maturity yield, the 30-year fixed mortgage rate spread relative to the 10-year Treasury yield, the BAA corporate bonds yield spread relative to 10-year Treasury bonds, and bank loans. Finally, to reflect forces that have recently been important in shaping the economy and inflation—namely supply chain pressures and significant changes in energy prices—I also include the West Texas Intermediate spot oil price, and the Federal Reserve Bank of New York’s Global Supply Chain Pressures Index. The analysis uses data from 1998 through the second quarter of 2023.

My statistical model considers interactions between the different variables within the same quarter and over time. The SLOOS lending standards measure is observed early in the quarter and corresponds to bank responses from the previous quarter. Shocks to this measure are thus identified as changes in lending standards that do not respond to other variables within the same quarter. That is, tightening of standards can respond to this identified shock in the same quarter, and to other types of shocks from previous quarters.

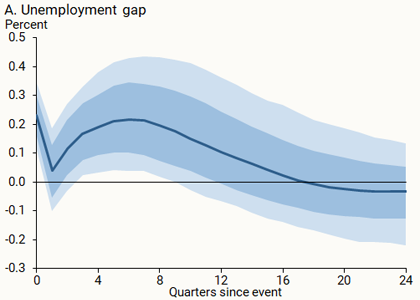

Figure 2 shows how much a 10 percentage point tightening in lending standards affects the unemployment gap and inflation. The horizontal axis shows the number of quarters since the shock took place. The vertical axis shows the increase in percentage points for each variable relative to the absence of tighter lending standards, with zero meaning no change in outcomes. The solid blue line is the median estimate, and the shaded areas represent the 70% (darker) and 90% (lighter) probability ranges of possible estimates.

Figure 2 Response of unemployment and inflation to a 10 percentage point tightening of lending standards

Note: Shading represents 70% (darker) and 90% (lighter) probability estimates around median estimate. Source: Senior Loan Officer Opinion Survey on Bank Lending Practices and author’s calculations.

Overall, the tightening in lending standards induces a persistent increase in the unemployment gap and a small drop in inflation. The impact on unemployment is expected: tighter lending standards imply that firms cannot invest as much, reducing demand for credit in the economy. With weaker demand, firms will hire fewer workers and lay off some of their workforce, leading to higher unemployment.

The impact on inflation is more nuanced. On the one hand, a weaker demand for credit eases price inflation. On the other hand, as documented in Gilchrist and Zakrajsek (2012), tighter lending standards are also associated with higher interest rates, which increase operational costs for firms. Firms will pass some of those higher costs to their customers, leading to price inflation. Model estimates suggest the demand effect is more likely to prevail, and inflation falls slightly on net in response to tighter lending standards.

What led to tight lending standards in 2023?

Was the 2023 tightening in lending standards a pure credit supply shock, or was it a natural response of banks to evolving economic conditions? To address this question, I compare actual data at each point in time with the model’s predictions for that time to extract each component’s response to past shocks. I use the results to determine how much of the actual response of each component is due to shocks of different sources—for example, how much of the changing lending standards comes from responses to supply chain shocks or credit supply shocks.

The analysis suggests that credit supply shocks account for about 23 percentage points of the tighter lending standards in the first half of 2023. The remaining 22 percentage points of the tightening is associated with the response of lending standards to changes in economic conditions due to supply chain pressures and other factors originating outside the credit market.

The measure also shows that lending standards started to tighten before 2023, as early as the second quarter of 2022, as shown in Figure 1. This suggests that inflationary pressures and monetary policy tightening in previous quarters played a role in banking conditions more generally. Therefore, tighter credit standards may be related to the bank collapses in that they shared similar root causes in recent economic and financial conditions. However, credit supply factors in the first half of 2023 that could be associated with bank closures explain only part of the overall tightening of lending standards. Furthermore, my model estimates that the impact of the credit supply shock on tighter lending standards will be relatively short lived, dissipating by the end of 2024.

I next use this methodology to estimate how much credit supply shocks contributed to unemployment and inflation in the recent past and how much they are expected to contribute through 2026. To do this, I combine the estimated size of the shocks with the estimated responses of the economy to those shocks. The bars in Figure 3 show the median estimated contribution to unemployment.

Figure 3 Contribution of credit supply shocks to unemployment

The estimated contribution for the last quarter of 2023 is 0.4 percentage point, which means that unemployment would have been 3.3% without the credit supply shock, rather than the 3.7% reported in the data. My analysis shows that, even though the tightening of lending standards is not expected to last long, the effects on unemployment are estimated to persist through 2026. For inflation, the contribution of the credit supply shock is more subdued but more persistent, pulling inflation down by less than 0.1 percentage point through the entire projection into 2026. A persistent increase in corporate bond yield spreads implied by the credit supply shock may explain why the effects on the rest of the economy last so long.

This analysis has several limitations, including the possibility that underlying economic relations changed with the COVID-19 pandemic. Related to this, the model is proportional, implying that a shock of twice the size would have effects that are also twice the reported size. However, the unusually large shocks in this analysis could trigger more than proportional economic responses—for example, if cascading bank failures induced snowball effects in the economy due to an increasingly fragile banking system. Finally, using different measures to proxy for financial and monetary policy conditions could result in different estimates, although my tests using different data yielded similar results to those reported here.

In the first half of 2023, lending standards tightened substantially. This Letter finds that only about half of the tightening resulted from a credit supply shock that would have caused a slowdown in economic activity, while the remainder corresponds to banks’ normal response to overall economic conditions. While a tightening of lending standards is not expected to persist for very long, this analysis suggests it could add half a percentage point to unemployment through 2024 and push down inflation by a small amount.

Lown, Cara, and Donald P. Morgan. 2006. “The Credit Cycle and the Business Cycle: New Findings Using the Loan Officer Opinion Survey.” Journal of Money Credit and Banking 38(6).

Simon Gilchrist and Egon Zakrajsek. 2012. “Credit Spreads and Business Cycle Fluctuations.” American Economic Review 102(4, June), pp. 1,692–1,720.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to [email protected]

More From Forbes

Navigating the future of technology in banking: insights and innovations.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Josh Scriven, Global VP of Technology at Neudesic : Driving Strategy and Transformation Through Innovative Technologies.

In an era marked by rapid technological advancements and shifting market dynamics, the banking sector stands at a crossroads. I'll share insights from a recent corporate banking modernization panel I had the pleasure of joining, highlighting the pivotal areas where technology not only addresses current challenges but also shows unique opportunities for innovation and efficiency.

The Evolution Of Modern Technology Platforms

Modernizing your technology platform is not merely about updating old systems; it's about reimagining the infrastructure, process and people to thrive in the digital age. Key advancements such as cloud-native architectures, microservices, DevSecOps and the integration of AI have paved the way for platforms that are scalable, resilient and future-proof.

Four areas stand out in their potential to drive significant business outcomes: data mesh architecture, edge computing's expanding horizon, the strategic application of multicloud and hybrid cloud, and the rapid advancements in GenAI.

Data Mesh: A Paradigm Shift In Data Management

The shift toward data mesh architecture represents a radical rethinking of data management. By emphasizing domain-oriented decentralized data ownership, this approach ensures that data is not just an asset but a product—managed with the same rigor and focus as any other product in an organization. For trade banking, this means agile and informed decision-making powered by accessible, high-quality data across the organization.

New FBI Warning As Hackers Strike Email Senders Must Do This 1 Thing

2 obvious signs of ‘workplace gaslighting,’ from a psychologist, wells fargo championship 2024 golf betting preview odds and pga picks, edge computing: bringing processing closer to the source.

"The edge is here" is more than a statement; it's a reality reflecting the move toward edge computing. This evolution brings computing resources closer to data generation and consumption points. In banking, edge computing offers new opportunities for real-time analytics, high-frequency trading enhancements and immediate fraud detection—directly impacting customer satisfaction and operational efficiency.

Multicloud And Hybrid Cloud: Flexibility At Scale

The adoption of multicloud and hybrid cloud strategies offers unprecedented flexibility and resilience. Banks are now leveraging the best-in-class services, optimizing infrastructure costs, and ensuring data sovereignty and regulatory compliance. This strategic flexibility enables rapid deployment of new applications and services, fostering innovation and maintaining competitiveness.

Artificial Intelligence: The Catalyst For Transformation

Artificial intelligence (and now GenAI) is quickly pushing the next technological revolution. From automating tedious processes to enhancing customer service with predictive analytics and personalized advice, AI's role cannot be overstated. In trade banking, AI algorithms play a critical role in fraud detection, risk management and offering tailored financial products, marking a significant leap toward efficient, secure and customer-centric services.

The integration of these technologies extends beyond traditional banking, catalyzing the rise of collaborative finance. This paradigm shift toward technology-enabled shared platforms is not just redefining financial services; it's fostering new business models, expanding markets and facilitating unprecedented levels of collaboration across the tech industry.

A Supply Chain Finance Revolution

As the global trade landscape continually evolves, supply chain finance institutions are at the forefront of embracing cutting-edge technologies to overhaul their operations and services. By integrating the Internet of Things (IoT), AI, data mesh architecture and cloud computing solutions, these institutions are pioneering a revolution that promises to redefine industry standards for efficiency, reliability and financial empowerment.

Revolutionizing Visibility With IoT And AI

At the forefront of this transformation is the application of IoT devices across supply chains. Global leaders like Maersk have set a precedent by using such technologies to gain real-time visibility into container conditions and locations. Additionally, top-performing supply chain organizations are investing in AI and machine learning (AI/ML) to optimize their processes at more than twice the rate of low-performing peers, using productivity rather than efficiency or cost savings as their key focus to sustain business momentum over the next three years.

Decentralizing Data For Agility

Confronted with the data deluge, institutions are adopting a data mesh architecture, championing decentralized data stewardship. Each node, from suppliers to distributors, becomes autonomous in managing and sharing its data, echoing the strategies of innovators like JPMorgan Chase, the Department of Defense ( DoD ) and IBM. This paradigm shift enhances data integrity and access and accelerates responsiveness to market dynamics, equipping stakeholders with critical, actionable intelligence.

Flexibility For Global Operations: A Synergistic Infrastructure

In navigating the complexities of international operations, leaders are opting for a hybrid cloud strategy augmented by edge computing. This dual approach maximizes the utility of expansive public cloud resources while maintaining sensitive data securely within private clouds. Edge computing, as employed by Maersk and DHL, brings computational power closer to data sources , allowing for immediate, informed actions that are essential for scaling and instantaneous decision-making.

A New Era Of Supply Chain Finance

As organizations incorporate these technologies into their supply chain and trade finance systems, they can push a shift toward a more interconnected, streamlined and equitable ecosystem. Suppliers gain access to faster financial support, mitigating the traditional woes of payment delays. Buyers, in turn, enjoy an optimized supply chain that supports superior inventory control and strategic planning, marking the dawn of a new era in supply chain finance.

By weaving together these technological threads, the institution not only anticipates the future of global trade but actively shapes it—ensuring that its network remains resilient, competitive and at the forefront of innovation.

This is just the beginning of modernizing technology platforms in banking. As we look ahead, the ongoing collaboration between technology providers, financial institutions and regulators will be crucial in shaping a banking sector that is agile, secure and ready to meet the challenges of tomorrow.

Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?

- Editorial Standards

- Reprints & Permissions

7 Important Finance Trends (2024-2027)

You may also like:

- Soaring Fintech Startups

- Important Fintech Trends

- Growing Cryptocurrency Trends

From crypto to DeFi, the world of finance is changing faster than ever.

And financial services (like banks, insurance, and money management) are scrambling to keep up.

Many of these new trends come on the back of changing technology. While others are the result of a renewed focus on the customer.

Let’s look at a handful of current and developing finance trends that are set to explode over the coming months.

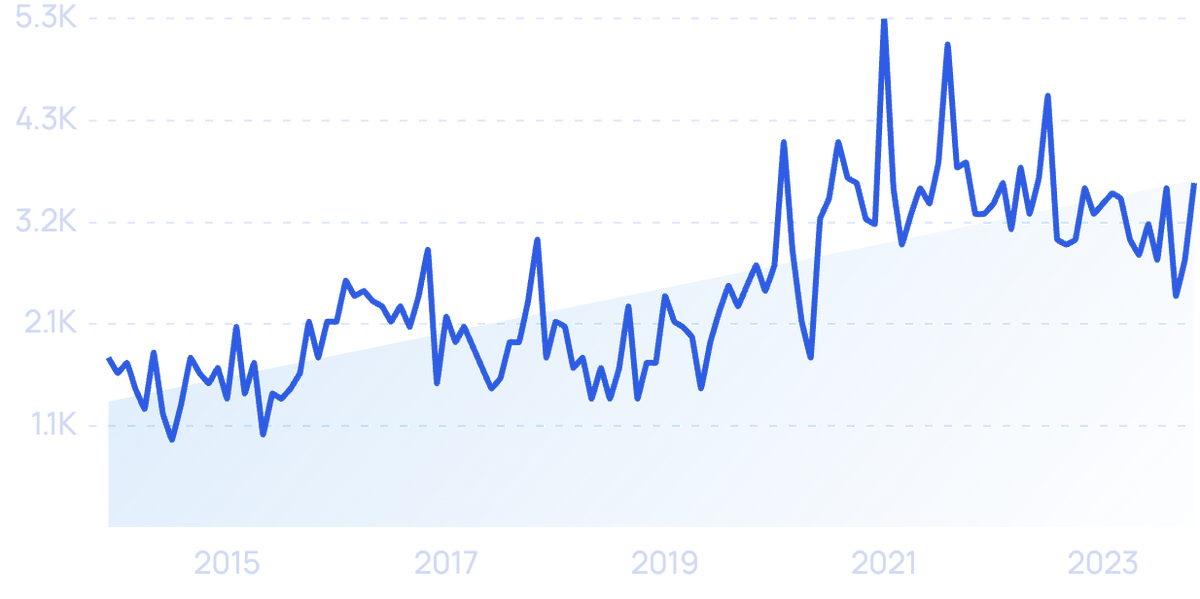

1. The Financial Services Industry Embraces Blockchain

For years, blockchain technology has been synonymous with cryptocurrency. However, experts believe that the technology will now become more integrated with existing financial systems.

For example, using blockchain would allow banks to conduct cheaper, more efficient transactions while maintaining tight security.

It can also be used to handle peer-to-peer lending, an industry that could see a growth of up to $150 billion by 2025.

More banks are transitioning to cloud-based banking in 2024, and blockchain will no doubt play a role in this.

HSBC and Wells Fargo already use blockchain technology to settle forex trades .

Paypal, Mastercard, and JP Morgan all allow users to make payments on their networks using blockchain currencies .

This involves cryptocurrency, of course, but it shows banks’ willingness to embrace blockchain.

It’s not just banks incorporating blockchain, either.

AXA, the French multinational insurance company, uses blockchain technology when insuring clients against flight delays.

An Ethereum blockchain then connects both the insurance contract and air traffic data.

As soon as a flight is over two hours late, the system takes notice and automatically triggers the insurance payout.

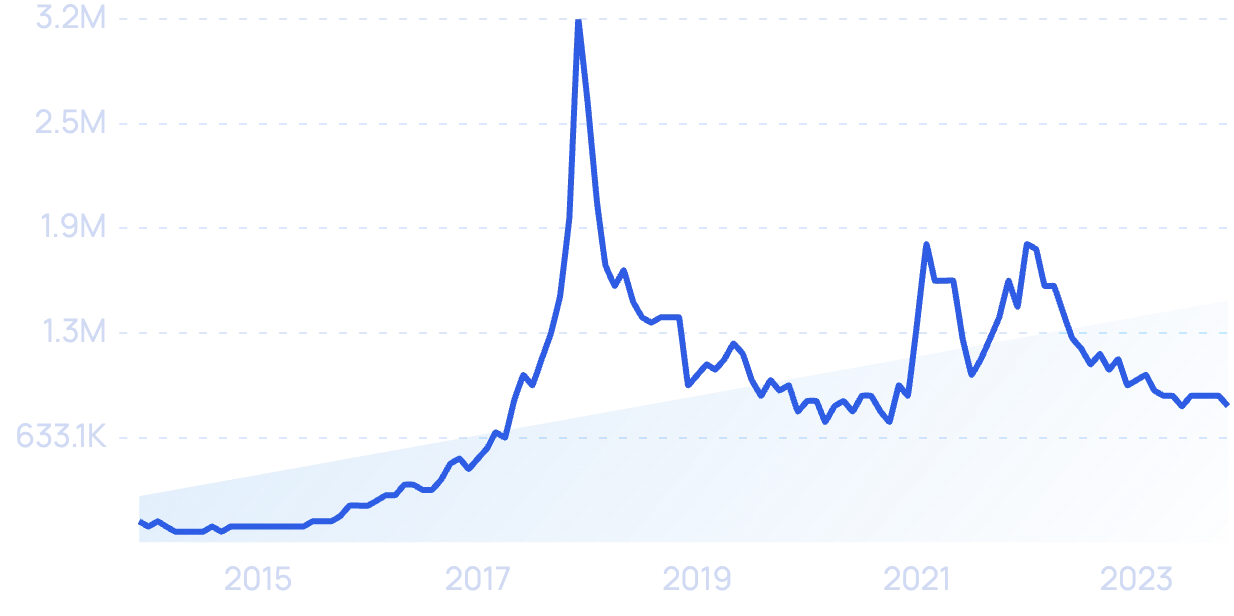

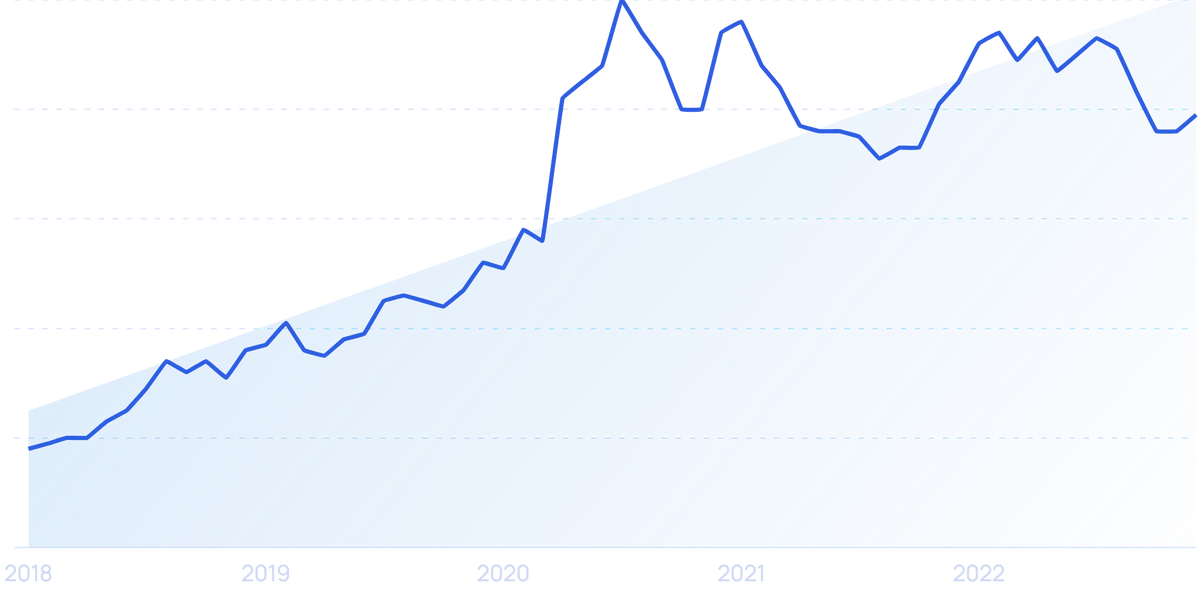

2. More People Download Personal Finance Apps

During the pandemic, downloads of personal finance apps grew roughly 90% .

Finance apps like Mint, Prism, and EveryDollar provided exactly what people were looking for and their popularity went through the roof.

These apps not only help people manage their money , but they offer ways to invest in stocks and crypto.

It’s not just the ability to manage your money remotely that’s attracting people, either. People specifically like having the power to run their financial world (literally) in the palm of their hand.

And as the US adopts open banking , which will make financial apps even safer, this number will likely increase. And skeptical users who harbored security concerns might be persuaded to take a second look.

Square’s Cash App remains the most popular personal finance app available, and among its list of benefits is a rewards system , which ties into what we discussed above about customer loyalty programs.

3. More People Get Their Money Professionally Managed

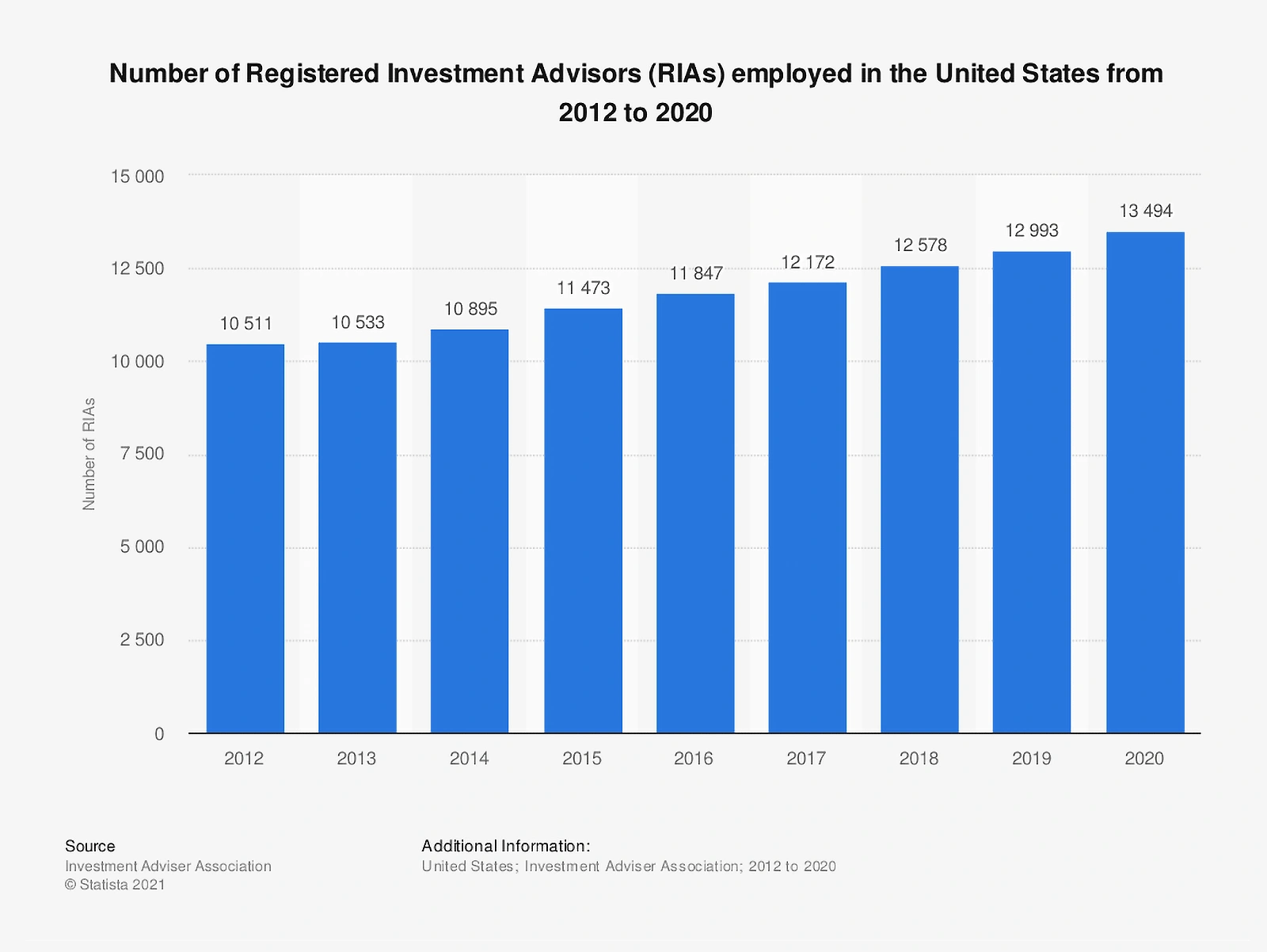

A new kind of wealth manager is quickly becoming the de facto money manager for many consumers: RIA.

A Registered Investment Adviser (RIA) is a firm that is regulated by the Securities and Exchange Commission and specializes in giving financial advice and managing investments.

Compared to typical broker-dealers, RIA’s have what is known as a fiduciary duty to their clients.

This means that they are required to put their client’s interests before their own when making financial decisions.

This kind of high-touch and client-focused model is gaining traction in the US.

At the end of 2020, RIA’s managed a collective $110 trillion supplied by over 60 million clients around the US This is compared to roughly $20 trillion at the beginning of this century.

In addition, there are now just under 14,000 RIAs nationwide, employing close to a million people.

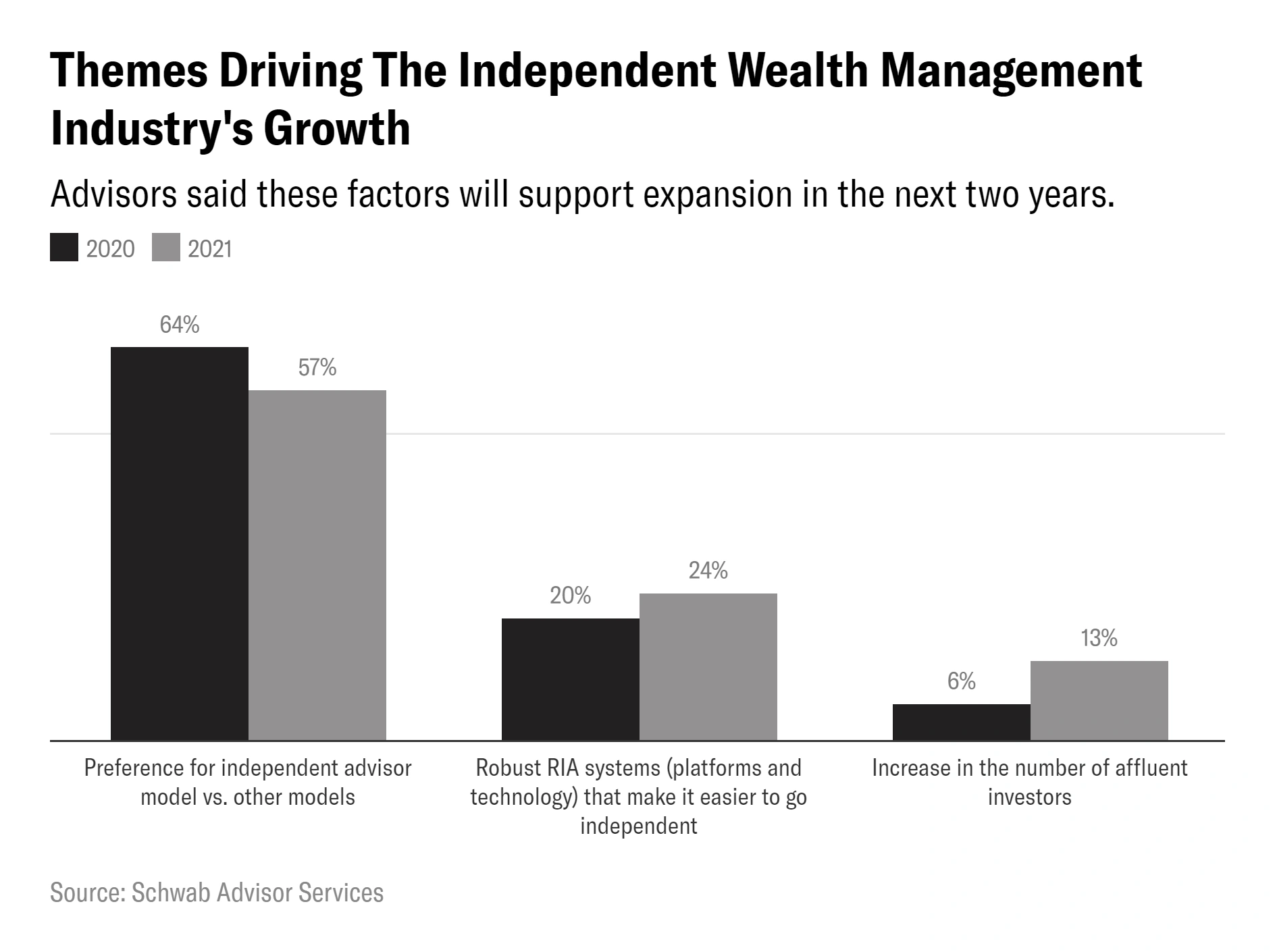

Even at this growth rate, 47% of RIAs still believe that the industry has a lot of room to grow.

A study by Schwab found that over half of investors prefer to have a fiduciary (an RIA) manage their money compared to any other model.

Overall, it seems that the growth of the RIA industry is leading more Americans to consider letting a professional manage their money.

4. Loyalty Programs Drive Repeat Business

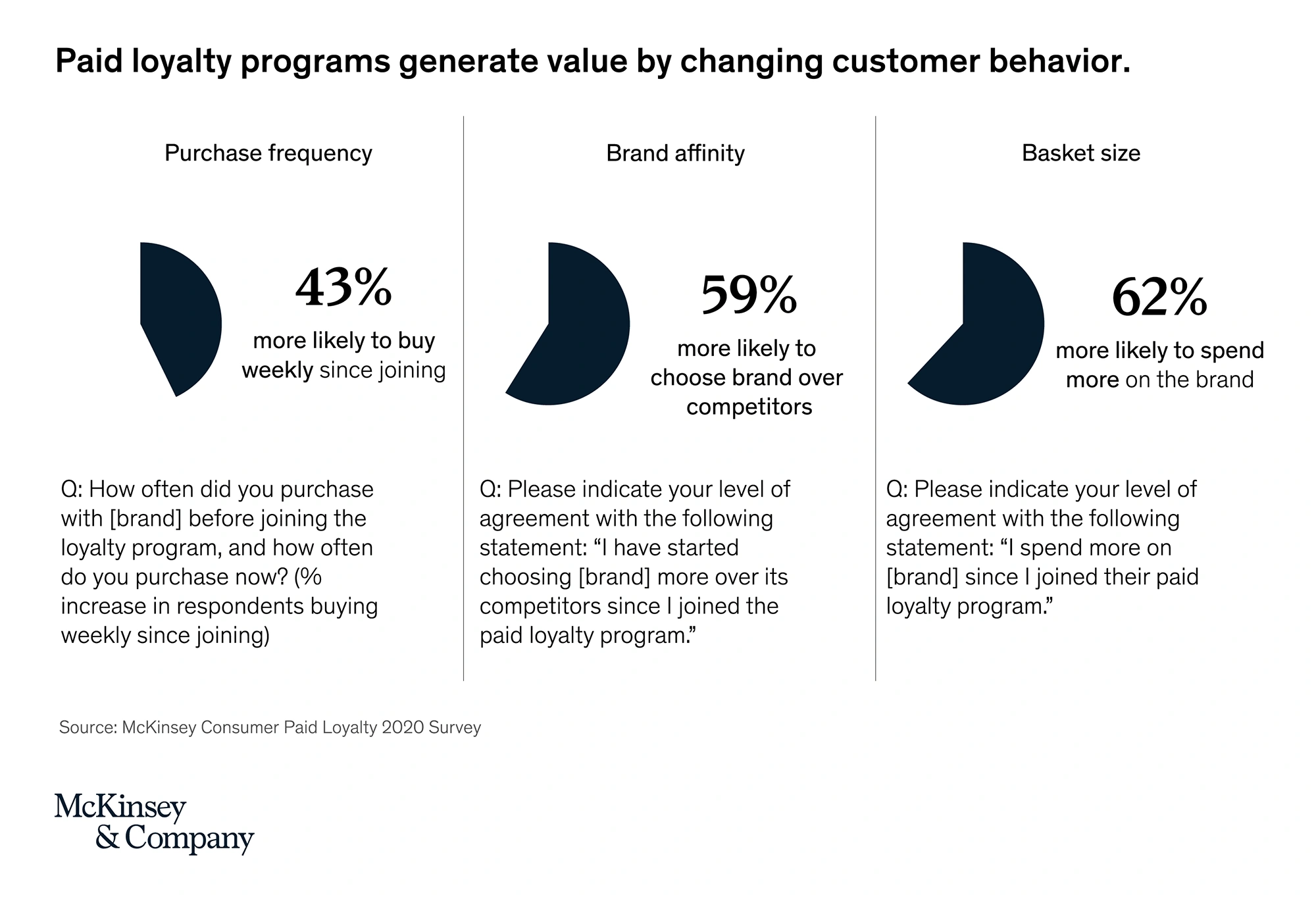

From half-full punch cards sitting in the back of your wallet to website-specific rewards programs, the idea of a loyalty program is nothing new.

However, we’re seeing an uptick in loyalty programs in the finance world.

Loyalty programs have long been a popular way to keep customers coming back, but they’re usually offered in retail and the food industry.

Now, loyalty programs are practically mandatory, even in the financial services industry. Many believe that they’re only going to get bigger, better, and more competitive.

In August of 2021, an American Banker/Monigle Agency survey of banking customers found that, regardless of financial institution or product, “rewards and loyalty remain paramount to the customer experience” .

Most customers, 80% of millennials and 68% of non-millennials would be willing to sign up for a premium loyalty program offered by their favorite brands.

Repeat customers spend at least 33% more than new customers.