Property Development Business Plan Template

Written by Dave Lavinsky

Property Development Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their property development companies.

If you’re unfamiliar with creating a business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a property development business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Property Development Business Plan?

A business plan provides a snapshot of your property development business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Property Development Company

If you’re looking to start a property development business or grow your existing property development company, you need a business plan. A proper property development business plan will help you raise funding, if needed, and plan out the growth of your business to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Property Development Companies

With regards to funding, the main sources of funding for a property development company are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for property development companies.

Finish Your Business Plan Today!

How to write a business plan for a property development company.

If you want to start a property development company or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your property development business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of property development business you are running and the status. For example, are you a startup, do you have a business that you would like to grow, or are you operating property development businesses in multiple markets?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the property development and real estate industry.

- Discuss the type of property development business you are operating.

- Detail your direct competitors. Give an overview of your target market.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of business you are operating.

For example, you might specialize in one of the following types of property development businesses:

- Single-family detached housing : these types of property developers build free-standing residential buildings for sale.

- Multifamily housing: these types of property developers build apartment buildings, condos, and mixed-use developments.

- Developing and Subdividing Lots: these types of property developers purchase property, either developed or undeveloped, and clear it and prepare it for sale to builders.

- Commercial buildings: these types of property developers build and manage commercial buildings such as shopping centers or offices.

In addition to explaining the type of property development company you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the property business?

- What milestones have you achieved to date? Milestones could include the number of properties developed, reaching X percentage of vacancy/occupancy, reaching X amount of revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the property development industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the property development industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your property development business plan:

- How big is the property development industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your property development company? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your property development business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, families, and small businesses.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of property development business you operate. Clearly, families would respond to different marketing promotions than businesses, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Property Development Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other property development businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes realtors, foreclosure markets, rental housing, or companies purchasing and remodeling their own building. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of property development company are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide finance packages?

- Will you offer amenities or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a property development company, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of property development company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you specialize in single-family detached housing, mixed use developments, or shopping centers?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the project types and/or services you offer and their prices.

Place : Place refers to the site of your property development company. Document where your company is situated and mention how the site will impact your success. For example, is your property development business located in a business or industrial district, or is it a standalone office surrounded by models? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your property development marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday Short-Term Processes

In this section, include all of the tasks involved in running your property development business, including answering calls, meeting with potential customers, performing construction, showing properties, etc.

Long-Term Goals

Your long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sell your Xth home, or when you hope to reach $X in revenue. It could also be when you expect to expand your business to a new city.

Management Team

To demonstrate your property development business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing property development businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your management team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a property development business or successfully running a construction project management firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you develop 5 or 25 properties per quarter, and/or offer property management services? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your property development business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a property development business:

- Cost of construction equipment and supplies

- Cost of contract labor

- Cost of office space and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your model properties’ blueprints or a breakdown of development types you offer.

Writing a business plan for your property development company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the property development industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful property development business.

Property Development Company Business Plan Template FAQs

What is the easiest way to complete my property development business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your business plan.

How Do You Start a Property Development Business?

Starting a property development business is easy with these 14 steps:

- Choose the Name for Your Property Development Company

- Create Your Property Development Business Plan

- Choose the Legal Structure for Your Property Development Company

- Secure Startup Funding for Your Property Development Business (If Needed)

- Secure a Location for Your Business

- Register Your Property Development Company with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Property Development Company

- Buy or Lease the Right Property Development Equipment

- Develop Your Property Development Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Property Development business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to hire someone to write a business plan for you from Growthink’s team.

Other Helpful Business Plan Articles & Templates

Property Development Business Plan Template

Written by Dave Lavinsky

Property Development Business Plan

You’ve come to the right place to create your Property Development business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their property development companies.

Below is a template to help you create each section of your Property Development business plan.

Executive Summary

Business overview.

Redstone Development is a new property development company located in Salt Lake City, Utah. We focus on residential property development for single-family and multi-family homes. We handle all steps of the process, from sourcing the land to selling the finished property. Redstone Development aims to be the most trusted source of affordable housing in the Salt Lake City metro area.

Redstone Development is owned and operated by Jack Grant, a real estate development industry veteran who is well-versed in the entire property development process. Jack has over 30 years of experience developing residential properties and holds a Master’s in Real Estate Development. His education, experience, and industry connections will ensure that Redstone Development becomes one of the area’s most successful property development businesses.

Product Offering

Redstone Development will handle the entire development process, including sourcing land, securing all necessary approvals and permits, construction, and sale of the finished property.

The company focuses on building single-family homes and multi-family apartment complexes in the heart of Salt Lake City. All projects are designed to make these homes aesthetically appealing and luxurious. However, they will also be affordable to ensure that anyone in the Salt Lake City area can afford to live in our properties.

Customer Focus

Redstone Development will serve home buyers and real estate investors who live and work in Salt Lake City, Utah, or the surrounding area. Salt Lake City is a growing city in need of additional housing. More people come to this beautiful city every year, which reduces the number of available homes and apartment units. Therefore, we will target buyers who are struggling to find affordable housing.

Furthermore, there are thousands of first-time home buyers in the area. These buyers are an ideal target market for the company.

Management Team

Redstone Development will be owned and operated by Jack Grant. He recruited his former administrative assistant, Sheila Johnson, to be his Office Manager and help manage the office and operations.

Jack has over 30 years of experience developing residential properties and worked for several of our competitors. He also holds a Master’s in Real Estate Development from the University of Utah. His education, experience, and industry connections will ensure that Redstone Development becomes one of the area’s most successful real estate development businesses.

Sheila Johnson has been Jack Grant’s loyal administrative assistant for over ten years at a former property development firm. Jack relies strongly on Sheila’s diligence, attention to detail, and focus when organizing his clients, schedule, and files. Sheila has worked in the property development industry for so long that she understands all aspects required to run a successful property development company.

Jack will also employ several other full-time and part-time staff to assist with all aspects of running a real estate development business.

Success Factors

Redstone Development will be able to achieve success by offering the following competitive advantages:

- Location: Redstone Development’s office is near the center of town, in the shopping district of the city. It is visible from the street, where many residents shop for both day-to-day and luxury items.

- Client-oriented service: Redstone Development will have a full-time assistant with property development experience to keep in contact with clients and answer their everyday questions. Jack realizes the importance of accessibility and will further keep in touch with his clients through monthly newsletters.

- Management: Jack has been highly successful working in the property development sector. His unique qualifications will serve customers in a much more sophisticated manner than many of Redstone Development’s competitors.

- Relationships: Having worked and lived in the community his whole life, Jack knows many local leaders, real estate agents, and other influencers in the local property development industry.

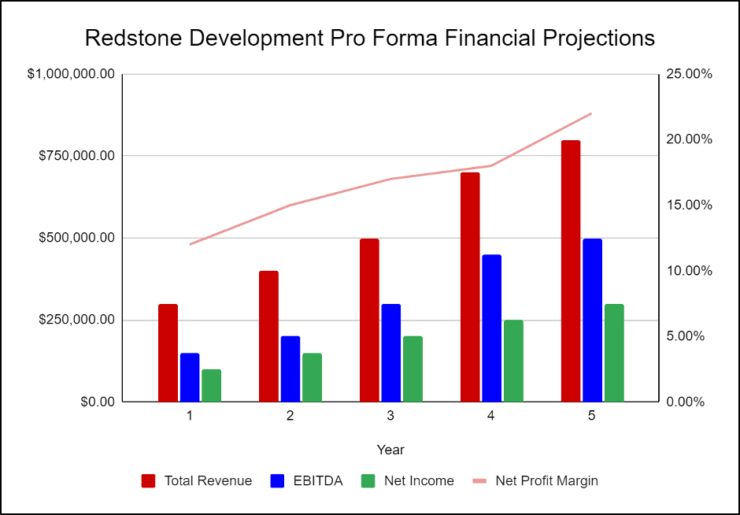

Financial Highlights

Redstone Development is seeking $1,000,000 in debt financing to launch its property development business. The funding will be dedicated to purchasing our first property, construction costs, securing the office space, and purchasing office equipment and supplies. Funding will also be dedicated toward six months of overhead costs, including payroll, rent, and marketing costs. The breakout of the funding is below:

- Office space build-out: $50,000

- Office equipment, supplies, and materials: $20,000

- Land purchase and construction expenses: $530,000

- Six months of overhead expenses (payroll, rent, utilities): $250,000

- Marketing costs: $50,000

- Working capital: $100,000

The following graph below outlines the pro forma financial projections for Redstone Development.

Company Overview

Who is redstone development.

Redstone Development is a new property development company located in Salt Lake City, Utah. We focus on residential property development for single-family and multi-family homes. We handle all steps of the property development process, from sourcing the land to selling the finished property. Redstone Development aims to be the most trusted source of affordable housing in the Salt Lake City metro area.

Redstone Development is owned and operated by Jack Grant, who is a real estate development industry veteran and well-versed in the entire property development process. Jack has over 30 years of experience developing residential properties and holds a Master’s in Real Estate Development. His education, experience, and industry connections will ensure that Redstone Development becomes one of the area’s most successful property development businesses.

Redstone Development’s History

After 30 years of working in the property development industry, Jack Grant began researching what it would take to create his own property development company. This included a thorough analysis of the costs, market, demographics, and competition. Jack has compiled enough information to develop his business plan and approach investors.

Once his market analysis was complete, Jack began surveying the local office spaces available and located an ideal location for the property development headquarters. Jack incorporated Redstone Development as a Limited Liability Corporation on October 1st, 2022.

Once the lease is finalized on the office space, renovations can be completed to make the office a welcoming environment to meet with clients.

Since incorporation, Redstone Development has achieved the following milestones:

- Located available office space for rent that is ideal for meeting with clients

- Identified the first property to develop

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

Redstone Development’s Services

Redstone Development will handle the entire property development process, including sourcing land, securing all necessary approvals and permits, construction, and sale of the finished property.

Industry Analysis

The real estate and property development industries have been strong over the past few years. As of 2021, the real estate industry was valued at $3.69 trillion and is expected to grow at a compound annual growth rate of 5.2% from now until 2030.

This growth will be driven by increasing demand for personal housing. Millennials and Gen-Z are beginning to rent their first apartments or buy their first homes. After years of living with family or roommates, they are ready to have a space to call their own. This trend is leading to a substantial demand for housing that many cities are struggling to supply.

The main challenge to the property development industry is the decrease in market size in the land development industry. Over the past five years, the industry saw an average annual decline of 0.7%. However, we believe that the pandemic was a considerable factor in this decline. Currently, the land development market is valued at $12 billion USD, and we expect it to grow substantially due to the growth of similar industries and the increasing demand for housing, as mentioned above.

Customer Analysis

Demographic profile of target market.

Redstone Development will serve home buyers and real estate investors in Salt Lake City, Utah, and its surrounding areas.

The community of Salt Lake City has thousands of first-time home buyers, residential real estate investment firms, and people looking for affordable housing options in the area. The company will also target millennials specifically since the majority of first-time home buyers are in this age group.

The precise demographics for Salt Lake City, Utah are:

Customer Segmentation

Redstone Development will primarily target the following customer profiles:

- Home buyers

- Real estate investors

- Millennials

- Apartment/Condominium management companies

Competitive Analysis

Direct and indirect competitors.

Redstone Development will face competition from other companies with similar business profiles. A description of each competitor company is below.

Upscale Property Developers, Inc.

Upscale Property Developers, Inc. is a property development company in Salt Lake City. In business for over 40 years, Upscale Property Developers, Inc. provides oversight for the entire property development process for new single-family and multi-family residences, commercial offices, and government buildings across the area. Upscale Property Developers, Inc also offers a variety of property renovation, demolition, and revitalization services for existing buildings.

Although Upscale Property Developers, Inc. provides homes with a luxury aesthetic, they are also the most expensive property developments on the market, thus resulting in many first-time home buyers being priced out of the market.

Premium Property Development Solutions

Established in 1990, Premium Property Development Solutions is a property developer of new commercial and residential properties in Salt Lake City. The company specializes in eco-friendly building materials and upscale design options for individual and corporate clients. Clients can customize their building design or choose from a variety of standard design options. The company employs experienced property developers and designers who are well-versed in green building design.

Premium Property Development Solutions is more affordable than Upscale Property Developers Inc. but is still out of most first-time home buyers’ price ranges.

Salt Lake Residential

Salt Lake Residential is also a local property development company that manages the complete property development process from sourcing and permitting to construction and sale. They are mostly known for their unique apartment complex designs but are equipped to take on a variety of different builds. The company has been in business for about ten years and has developed a reputation for building quality homes for affordable prices.

Although Salt Lake Residential has a similar value proposition of luxury homes at affordable prices, this company lacks the green building and eco-efficiency component to their business model, thus losing out on business from eco-conscious home buyers.

Competitive Advantage

Redstone Development enjoys several advantages over its competitors. Those advantages include:

- Location: Redstone Development’s office is near the center of town, in the city’s shopping district. It is visible from the street, where many residents shop for both day-to-day and luxury items.

Marketing Plan

Brand & value proposition.

Redstone Development will offer the following unique value proposition to its clientele:

- Service built on long-term relationships and personal attention

- Big-firm expertise in a small-firm environment

- Client-focused property development, where the company’s interests are aligned with the client

- Effective project management

- Affordable pricing

Promotions Strategy

The promotions strategy for Redstone Development is as follows:

Website/SEO

Redstone Development will invest heavily in developing a professional website that displays all of the features and benefits of the property development company. It will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

Redstone Development will invest heavily in a social media advertising campaign. The marketing manager will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Print Advertising

The company will invest in professionally designed advertisements to be printed in real estate publications. Redstone Development will also list its properties for sale in key local publications, including newspapers, area magazines, and its own newsletter.

Community Events/Organizations

The company will promote itself by distributing marketing materials and participating in local community events, such as local festivals, business networking, or sporting events.

Redstone Development’s pricing will be moderate so consumers feel they receive great value when purchasing properties from the company.

Operations Plan

The following will be the operations plan for Redstone Development.

Operation Functions:

- Jack Grant will be the Owner and President of the company. He will oversee all staff and manage client relations. He will also oversee all major aspects of the development projects. Jack has spent the past year recruiting the following staff:

- Sheila Johnson – Office Manager who will manage the office administration, client files, and accounts payable.

- Kenneth Bohannon – Staff Accountant will provide all client accounting, tax payments, and monthly financial reporting.

- Beth Martinez – Marketing Manager who will provide all marketing for Redstone Development and each property it manages.

- Jack will also hire a team of architects, engineers, interior designers, and contractors to design and build the properties.

Milestones:

The following are a series of steps that lead to our vision of long-term success. Redstone Development expects to achieve the following milestones in the following six months:

1/1/202X Finalize lease agreement

2/1/202X Design and build out Redstone Development

3/1/202X Hire and train initial staff

4/1/202X Purchase first property for development

5/1/202X Kickoff of promotional campaign

6/1/202X Find second property for development

Jack has over 30 years of experience developing residential properties and worked for several of our competitors. He also holds a Master’s in Real Estate Development from the University of Utah. His education, experience, and industry connections will ensure that Redstone Development becomes one of the area’s most successful property development businesses.

Jack will also employ several other full-time and part-time staff to assist with all aspects of running a real estate development business as outlined in the Operations Plan.

Financial Plan

Key revenue & costs.

Redstone Development’s revenues will come primarily from the sale of completed properties. The company will sell new single-family homes, multi-family townhomes, and apartment complexes/condominium properties to individual buyers and investors.

The cost drivers will be the overhead costs required to staff a property development office. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Average monthly payroll expenses: $50,000

- Office lease per year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, property development business plan faqs, what is a property development business plan.

A property development business plan is a plan to start and/or grow your property development business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Property Development business plan using our Property Development Business Plan Template here .

What are the Main Types of Property Development Businesses?

There are a number of different kinds of property development businesses , some examples include: Single-family detached housing, Multifamily housing, Developing and Subdividing Lots, and Commercial buildings.

How Do You Get Funding for Your Real Estate Development Business Plan?

Property Development businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding. This is true for a real estate developer business plan and a real estate investment business plan template.

What are the Steps To Start a Property Development Business?

Starting a property development business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Write A Property Development Business Plan - The first step in starting a business is to create a detailed real estate development company business plan that outlines all aspects of the venture. This should include market research on the real estate market and potential target market size, information the services you will offer, marketing strategies, pricing details and a solid financial plan.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your property development business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your property development business is in compliance with local laws.

3. Register Your Property Development Business - Once you have chosen a legal structure, the next step is to register your property development business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your property development business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Property Development Equipment & Supplies - In order to start your property development business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your property development business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Home » Real Estate

A Sample Property Development Business Plan Template

A property development company is a company that is involved in buying land, financing real estate, building, or having builders build and develop projects for commercial purposes. Property development companies renovate and re-lease existing buildings, purchase raw land, and sell developed land or parcels to others. They are involved in developing a property from beginning to end.

A report released by the National Association of REALTORS® shows that over 5.64 million existing homes were sold in 2020. Also, according to data from the U.S. Census Bureau, 822,000 newly constructed homes were sold in the same year. In 2019, 64.9 percent of families owned their primary residence, according to the Federal Reserve’s Survey of Consumer Finances.

Steps on How to Write a Property Development Business Plan

1. executive summary.

Vintage Group© Property Development Company, Inc. is an American-based and licensed real estate cum property development company. Our head office will be located in a standard and centrally located facility in the heart of New York City, New York.

We will engage in property development projects for a wide range of clients. We will work towards becoming one of the largest property development companies in New York and the whole of the United States of America. Jason Theodora is the founder and CEO of Vintage Group© Property Development Company, Inc.

Company Profile

A. our products and services.

Vintage Group© Property Development Company, Inc. will be involved in;

- Houses and housing estate developments

- Apartments and other residential developments

- Commercial developments

- Industrial developments

- Other developments (Investment Properties)

- Real estate consultancy and advisory services

b. Nature of the Business

Our property development company will operate the partnership business model. We will work with investors who are willing to partner with us to grow their investment portfolios in the real estate market.

c. The Industry

Vintage Group© Property Development Company, Inc. will operate under the real estate sales and brokerage industry.

d. Mission Statement

Our mission is to be at the forefront of buying property and partnering with landowners, then develop a plan for what to build or rebuild on that property. We will bring in investors and predict how much money the new homes or businesses will bring in.

e. Vision Statement

Our vision of to be listed among the top three property development companies in the whole of New York.

f. Our Tagline (Slogan)

Vintage Group© Property Development Company, Inc. – The Genius of Property Development!

g. Legal Structure of the Business (LLC, C Corp, S Corp, LLP)

Vintage Group© Property Development Company, Inc. will be formed as a Limited Liability Partnership (LLP).

h. Our Organizational Structure

- Chief Executive Officer

- Project Manager

- Company’s Lawyer/Secretary

- Admin and HR Manager

- Head of Construction and Renovation

- Business Developer/Sales and Marketing

- Customer Service Executive/Front Desk Officer

i. Ownership/Shareholder Structure and Board Members

- Jason Theodora (Owner and Chairman/Chief Executive Officer) 51 Percent Shares

- Hilary Kings (Board Member) 14 Percent Shares

- Harrison Williams (Board Member) 10 Percent Shares

- Rachael Abraham (Board Member) 10 Percent Shares

- Stella Norman (Board Member and Sectary) 10 Percent Shares.

SWOT Analysis

A. strength.

- Ideal location for property development (thriving real estate market)

- Highly experienced and qualified employees and management

- Access to finance from business partners

- Robust relations with property owners and properties investment moguls

- Good returns on investment for investors.

b. Weakness

- Financial Constraints

- Our business will be competing with well-established property developers and other home remodeling companies

- Inability to retain highly experienced and qualified employees longer than we want

c. Opportunities

- New York is a thriving market for property development companies and the real estate industry.

- Good support structure for property development companies.

i. How Big is the Industry?

The market size, measured by revenue of the real estate sales and brokerage industry is put at $156.2 billion in 2023 hence it will be safe to safe the industry is amongst the biggest industries in the United States of America.

ii. Is the Industry Growing or Declining?

All available data points to the fact that the real estate and brokerage industry is growing. The market size of the industry is expected to increase 0.4 percent in 2023.

iii. What are the Future Trends in the Industry

The real estate sales and brokerage industry is changing, and players in the industry are improvising. No doubt, technology and climate change (the go green initiative) will change the landscape of the industry going forward.

iv. Are There Existing Niches in the Industry?

No, there are no existing niche ideas when it comes to the property development business. This is because the property development line of business is a subset of the real estate and brokerage industry.

v. Can You Sell a Franchise of your Business in the Future?

Vintage Group© Property Development Company, Inc. has plans to sell franchises in the nearest future and we will target major cities with thriving real estate markets in the United States of America.

- The arrival of new property development companies within our market space

- Unfavorable government policy and regulations.

- Community resistance

- Liability problems

- Continuously changing consumer demands especially as it relates to style and design of properties et al.

i. Who are the Major Competitors?

- New World Development Co. Ltd

- Wheelock and Company

- AvalonBay Communities

- Greystar Real Estate Partners

- Wood Partners

- Mill Creek Residential

- Continental Properties Company, Inc.

- Trammell Crow Company

- The JBG Companies

- Lowe Enterprises

- Simon Property Group

- General Growth Properties

- SITE Centers

- Kimco Realty Corp

- Brixmor Property Group

- Panattoni Development Co.

- McDonald Development Co.

- USAA Real Estate Co.

- LaSalle Investment Management

- Gibraltar Syndication & Development Company

ii. Is There a Franchise for Property Development Business?

Well, for now, there are no known franchise opportunities in the property development business.

iii. Are There Policies, Regulations, or Zoning Laws Affecting Property Development Business?

Yes, there are county or state regulations and zoning laws for the business. Zoning laws are found in virtually every municipality in the United States, affecting land use, lot size, building heights, density, setbacks, and other aspects of property use.

In addition to that, it is important to state that in the United States, government agencies and departments routinely grant variances to rules and regulations. Often, you only have to fill out a short form. In other cases, your request may have to be publicly heard before your city council, zoning board, or other body. Please check with your zoning or planning department to find out what options are available to you.

Marketing Plan

A. who is your target audience.

i. Age Range

Our target market comprises adults above 18 years old who have the finance to do business with us.

ii. Level of Educational

We don’t have any restriction on the level of education of those we are ready to work with as investors or buyers of the properties we develop.

iii. Income Level

The income level of those we are looking to do business with will be between $70,000 and above $124,000.

iv. Ethnicity

There is no restriction when it comes to the ethnicity of the people we are looking to partner with.

v. Language

There is no restriction when it comes to the language spoken by the people we will partner with.

vi. Geographical Location

Anybody from any geographical location will be welcome to partner with us or do business with our company.

vii. Lifestyle

Vintage Group© Property Development Company, Inc. will not restrict any investor or client from partnering with us or doing business with us based on their lifestyle, culture, or race.

b. Advertising and Promotion Strategies

- Host Themed Events That Catch Attention.

- Tap Into Text Marketing.

- Make Use of Bill Boards.

- Share Your Events in Local Groups and Pages.

- Turn Your Social Media Channels into a Resource

- Develop Your Business Directory Profiles

- Build Relationships with players in the real estate and brokerage industry.

i. Traditional Marketing Strategies

- Marketing through Direct Mail.

- Print Media Marketing – Newspapers & Magazines.

- Broadcast Marketing -Television & Radio Channels.

- OOH Marketing – Public Transits like Buses and Trains, Billboards, Street shows, and Cabs.

- Leverage direct sales, direct mail (postcards, brochures, letters, fliers), tradeshows, print advertising (magazines, newspapers, coupon books, billboards), referral (also known as word-of-mouth marketing), radio, and television.

ii. Digital Marketing Strategies

- Social Media Marketing Platforms.

- Influencer Marketing.

- Email Marketing.

- Content Marketing.

- Search Engine Optimization (SEO) Marketing.

- Affiliate Marketing

- Mobile Marketing.

iii. Social Media Marketing Plan

- Start using chatbots.

- Create a personalized experience for our customers.

- Create an efficient content marketing strategy.

- Create a community for our target market and potential target market.

- Gear up our profiles with a diverse content strategy.

- Use brand advocates.

- Create profiles on the relevant social media channels.

- Run cross-channel campaigns.

c. Pricing Strategy

When working out our pricing strategy, Vintage Group© Property Development Company, Inc. will make sure it covers profits, insurance, premium, license, and economy or value and full package for each property,

In all our pricing strategy will reflect;

- Cost-Based Pricing

- Value-Based Pricing

- Competition-Based Pricing.

Sales and Distribution Plan

A. sales channels.

Our channel sales strategy will involve using partners and third parties—such as referral partners, affiliate partners, strategic alliances in the real estate and brokerage industry, and freelancers to help refer clients to us.

Vintage Group© Property Development Company, Inc. will also leverage the 4 Ps of marketing which are place, price, product, and promotion. By carefully integrating all these marketing strategies into a marketing mix, we can have a visible, in-demand service that is competitively priced and promoted to our customers.

b. Inventory Strategy

The fact that we will need the required building materials means that Vintage Group© Property Development Company, Inc. will operate an inventory strategy that is based on a day-to-day methodology for ordering, maintaining, and processing items in our warehouse. We will develop our strategy with the same thoroughness and attention to detail as we would if we were creating an overall strategy for the business.

c. Payment Options for Customers

Here are the payment options that Vintage Group© Property Development Company, Inc. will make available to her clients;

- Payment via bank transfer

- Payment via credit cards

- Payment via online bank transfer

- Payment via check

- Payment via mobile money transfer

- Payment via bank draft

d. Return Policy, Incentives, and Guarantees

At Vintage Group© Property Development Company, Inc., we develop properties and the nature of products (properties) we offer does not accommodate return policy, but we will guarantee our investors of good returns on their investment (ROI). Our Operating Margin targets for housebuilders across the economic cycle will be placed at 15-20 percent on Gross Development Value (GDV).

e. Customer Support Strategy

Our customer support strategy will involve seeking customers’ feedback. This will help us provide excellent properties, return on investment (ROI) and customer service to all our clients and investors, it will help us understand their needs, experiences, and pain points. We will work with effective CRM software to be able to achieve this.

Operational Plan

Our operational plan will cover capacity planning, location planning, layout planning, quality planning, and methods planning.

Overall, we plan to expand our revenue by 50 percent in the second year and the plan will include a marketing, sales, and operations component. The operations component of the plan would include attracting grants and fundraising strategies that will enable us to boost our properties and service offerings.

a. What Happens During a Typical Day at a Property Development Business?

- The office is open for the day

- Documentation and other administrative works are conducted throughout the day

- Marketers go out in the field to market our properties and services

- If there is an ongoing property development project, the required team and machinery are sent to the field to carry out the project.

- The team and machinery return to base (office) after the day’s job

- Report for the day is written and submitted to the required authority

- The office is closed for the day.

b. Production Process (If Any)

There is no production process when it comes to the property development business.

c. Service Procedure (If Any)

No, there are no defined service procedures for a property development business.

d. The Supply Chain

Vintage Group© Property Development Company, Inc. will rely on key players in the real estate and brokerage industry to refer business deals to us. So also, we have been able to establish business relationships with wholesale supplies of building materials.

e. Sources of Income

Vintage Group© Property Development Company, Inc. make money from;

Financial Plan

A. amount needed to start your property development company.

Vintage Group© Property Development Company, Inc. would need an estimate of $4.5 million to successfully set up a property development company in the United States of America. Please note that this amount includes the salaries of all our staff for the first month of operation.

b. What are the Cost Involved?

- Business Registration Fees – $750.

- Legal expenses for obtaining licenses and permits – $7,300.

- Marketing, Branding and Promotions – $5,000.

- Business Consultant Fee – $2,500.

- Insurance – $5,400.

- Rent/Lease – $200,000.

- Other start-up expenses including, commercial satellite TV subscriptions, stationery ($500), and phone and utility deposits ($2,800).

- Operational Cost (salaries of employees, payments of bills et al) – $100,000

- Start-up Inventory – $15,000

- Store Equipment (cash register, security, ventilation, signage) – $4,750

- Furnishing and Equipping – $80,000

- Liquid Cash for Execution of Projects: $3.5 million

- Website: $600

- Miscellaneous: $2,000

c. Do You Need to Build a Facility? If YES, How Much will it cost?

Vintage Group© Property Development Company, Inc. will not build a new facility; we intend to start with a long-term lease and after 5 years, we will start the process of acquiring our facility.

d. What are the Ongoing Expenses for Running a Property Development Company?

- Transportation cost

- Cost of building materials and supplies

- Utility bills (internet, phone bills, signage and sewage et al)

- Salaries of employees

e. What is the Average Salary of your Staff? List the Job Position and their proposed salary based on industry rate and your startup capital

- Chief Executive Officer – $85,000 Per Year

- Project Manager – $72,000 Per Year

- Head of Construction and Renovation – $70,000 Per Year

- Company’s Lawyer/Secretary – $68,000 Per Year

- Admin and HR Manager – $45,000 Per Year

- Business Developer/Sales and Marketing – $42,000 Per Year

- Accountant – $40,000 Per Year

- Customer Service Executive/Front Desk Officer – $30,000 Per Year.

f. How Do You Get Funding to Start a Property Development Company

- Raising money from personal savings and sale of personal stocks and properties

- Raising money from investors and business partners

- Sell shares to interested investors

- Applying for a loan from your bank/banks

- Pitching your business idea and applying for business grants and seed funding from, government, donor organizations, and angel investors

- Source for soft loans from your family members and your friends.

Financial Projection

A. how much should you charge for your service.

At Vintage Group© Property Development Company, Inc. our fee will be based on the location and type of property we want to develop.

b. Sales Forecast?

- First Fiscal Year (FY1): $3.5 million

- Second Fiscal Year (FY2): $5 million

- Third Fiscal Year (FY3): $9 million

c. Estimated Profit You Will Make a Year?

The ideal profit margin we hope to make at Vintage Group© Property Development Company, Inc. will be between 16 and 20 percent on development costs.

d. Profit Margin of a Property Development Company

Vintage Group© Property Development Company, Inc. will collect developer fees that will range from 5 to 10 percent aside from making profits off every property sold.

Please note in planning our property development project, we will make sure that the bottom line shows a suitable return for the money and effort we put into it.

Growth Plan

A. how do you intend to grow and expand .

Vintage Group© Property Development Company, Inc. will grow our property development company by first opening other offices in key cities in the United States of America within the first five years of establishing the business and then will start selling franchises from the sixth year.

b. Where do you intend to expand to and why? (Geographical locations)

Vintage Group© Property Development Company, Inc. plans to expand first to Los Angeles – California, San Francisco – California, Chicago – Illinois, Washington, D.C., Boston – Massachusetts, Miami – Florida, Seattle – Washington, Dallas – Texas, and Philadelphia – Pennsylvania.

The reason we intend to expand to these geographic locations is the fact that available statistics show that the cities listed above have the highest real estate market in the United States. New York has the highest real estate value in the country at $2.8 trillion.

The founder of Vintage Group© Property Development Company, Inc. plans to exit the business via family succession. We have placed structure and processes in place that will help us achieve our plan of successfully transferring the business from one family member to another and from one generation to another.

More on Real Estate

ZenBusinessPlans

Home » Sample Business Plans » Real Estate

A Sample Property Development Business Plan Template

Are you about starting a real estate development company? If YES, here is a complete sample property development business plan template you can use for FREE. Okay, so we have considered all the requirements for starting a property development business.

We also took it further by analyzing and drafting a sample property marketing plan template backed up by actionable guerrilla marketing ideas for property development businesses. So let’s proceed to the business planning section.

Why Start a Property Development?

It is therefore no doubt that housing is one very essential ingredient to life. The moment one is able to find a place of abode, there comes a form of huge relief. It is for that reason that the need for the government of different parts of the world to provide basic shelter for its citizens cannot be over flogged.

Every day there are an avalanche of people who dive into the property development business because they know how lucrative this trade is and how money spinning it becomes when one is able to get a hang of it. This is why those who have scaled through the teething stage of the business know that adequate planning is one of the hurdles that just must be scaled so as to get things right.

1. Industry Overview

The property development industry falls into the real estate category and it is indeed a very large industry that has the potential to make entrepreneurs millionaire within a short period of time. Property development industry is a many-sided business that covers all aspect of activities, ranging from acquiring raw lands, to selling or renting or leasing of fully finished and furnished properties.

In essence, developers are responsible for turning ideas into real properties; i.e. they acquire lands, they finance real estate deals, they engage in building projects and they sell, rent, lease and even manage properties on behalf of their clients.

Beyond every reasonable doubt, one of the most profitable, creative and interesting aspect of the real estate industry is property development. As a matter of fact, developers are major players when it comes to determining the prices of properties. Although this type of business venture can be risky, but in order to make it big in the trade as a property developer, you have got to just take calculated risks.

Just like all other investment vehicles, there are potential down sides that you need to look out for as a property developer. One of the major risks in property development is a sudden down turn in the economy. Property development could take a period of two to three years from conception to completion, depending on the size of the project and the cash flow.

As a matter of fact, some projects could even take much longer than that. Because of the time frame involved in developing properties from start to finish, loads of unanticipated things could crop up and it falls in the thick of property cum economy downturn which is not good for the business considering the investment that has gone into the project.

Another factor that is of major concerns and a threat to property development business generally could be cost increase as a result of inflation, currency devaluation as well as economic challenges.

Unforeseen delays from the part of government agencies, litigation and also delays from contractors could lead to substantial cost increase especially if the project is heavily dependent on bank loans. If perhaps during this period there is a change in the supply and demand dynamics of the property sector, the project could as well be affected negatively.

As a property developer, it is very important to be creative, to be able to use your ideas to meet the rapidly changing needs of the society when it comes to properties; you should be able to convert a slum into a beautiful city, if indeed you want to become a major player in the real estate industry.

Over and above, the property development sector is known to be a major contributor in the economy of many nations of the world and the industry is notable for producing some of the richest men in the world.

2. Executive Summary

Solorio’s® Property Development Company is a property development company that will be based in 530 Madison Avenue New York, NY 10033, USA. Our aim of starting this business is to work in tandem with the government of the united states of America to deliver affordable homes and properties for all classes of people in the United States of America.

Our Head Office will be located in New York City, but we will have our branch offices in major cities in all regions of the United States of America. During the first two years of operation we would have set up our offices in the following locations; Las Vegas, Washington, DC, Dallas, Texas and Boston.

Solorio’s® Property Development Company is going to be a self-administered and a self-managed real estate investment trust (REIT). We will work towards becoming one of the largest owners, managers, and developers of first-class properties (accommodations, public buildings and office properties) in the United States of America.

We are quite aware that property development business requires a huge capital base, which is why we have perfect plans for steady flow of cash from private investors who are interested in working with us. We can confidently say that we have a robust financial standing and we are ready to take on any property development deal that comes our way.

As part of our plans to make our customers our number one priority and to become the leading property development company in New York City, we have perfected plans to work with our clients to deliver projects that can favorably compete with the best in the industry, at an affordable and reasonable price within the stipulated completion date barring any unforeseen circumstance and also to generate great value from any property that we manage (both for our clients and for the company).

Solorio’s® Property Development Company will become a specialist in turning slums into beautiful cities and turning a run –down and dilapidated building into a master piece. And that hopefully will be our brand and signature.

Solorio’s® Property Development Company will be owned majorly by Shannon McKenzie and family. Shannon McKenzie is a property guru that has worked with top Real Estate Companies in the United States of America for many years; prior to starting his own business. Other investors with same investment ideology whose name cannot be mentioned here for obvious reasons are also part owners of the business.

3. Our Products and Services

Solorio’s® Property Development Company will be involved in the core real estate business and because we aspire to become one of the leading property development company in New York City, we have decided to explore every available means of generating money from Property Development. Our business offering can are listed below;

- Developing Properties for our Clients

- Leasing of Properties

- Renting of Properties

- Selling of Fully Furnished Properties

- Selling of Landed Properties

- Leasing of Bare Land

- Manage Properties and Facility for Clients

- Property Makeover Services

- Real Estate Consultancy and Advisory Services

4. Our Mission and Vision Statement

- To deliver affordable and quality properties to all classes of people in the United States of America.

- At Solorio’s® Property Development Company, our mission and values is to help people and businesses in the United States of America and throughout the world realize their dreams of owning properties.

Our Business Structure

Solorio’s® Property Development Company is aiming to be amongst the leading property development companies in New York City, and the only way for us to attain this position is to structure the business for growth and to hire the best hands we can get in the industry.

We want to build a team that will work together towards achieving the company’s goal and also a business with standard structure and processes; a business that runs on auto pilot. In view of the above, we have made provisions for the following positions in our organization;

- Chief Executive Officer

Project Manager

Civil Engineer

- Structural Engineer

- Quantity Surveyor

Land Surveyor

Company’s Lawyer/Secretary

Admin and HR Manager

Business Developer

- Front Desk Officer

5. Job Roles and Responsibilities

Chief Executive Officer – CEO:

- Responsible for providing direction for the business

- Creating, communicating, and implementing the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for the day to day running of the business

- Responsible for handling high profile clients and deals

- Responsible for fixing prices and signing business deals

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

- Reports to the board

- Responsible for the planning, management and coordinating all projects on behalf of the company

- Supervise projects

- Ensures compliance during project executions

- Provides advice on the management of projects

- Responsible for carrying out risk assessment

- Using IT systems and software to keep track of people and progress of ongoing projects

- Responsible for overseeing the accounting, costing and billing of every project

- Represents the organization’s interest at various stakeholders meetings

- Ensures that project desired result is achieved, the most efficient resources are utilized and different interests involved are satisfied.

- Responsible for preparing bids for tenders, and reporting to clients, public agencies and planning bodies

- Ensures that sites meet legal guidelines, and health and safety requirements

- Assesses the environment impact and risks connected to projects

- Responsible for judging whether projects are workable by assessing materials, costs and time requirements

- Draws up blueprints, using Computer Aided Design (CAD) packages

- Discusses requirements with the client and other professionals (e.g. architects and project managers et al)

- Responsible for managing, directing and monitoring progress during each phase of a project

- Responsible for creating building designs and highly detailed drawings both by using the hands and by using specialist computer – aided design (CAD) software

- Working around constraining factors such as town planning legislation, environmental impact and project budget

- Writes and presents reports, proposals, applications and contracts

- Adapts plans according to circumstances and resolving any problems that may arise during construction

- Works with project team and management to achieve a common goal

- Responsible for applying for planning permission and advice from governmental new building and legal department.

- Responsible for undertaking land surveys/measurements using a variety of specialist technical equipment such as theodolites, laser alignment devices and satellite positioning systems et al.

- Responsible for presenting data to clients

- Responsible for producing and advising about construction plans and drawings

- Responsible for advising about technical matters and whether the construction plans are viable

- Responsible for drawing up contracts and other legal documents for the company

- Consults and handles all corporate legal processes (e.g. intellectual property, mergers & acquisitions, financial/securities offerings, compliance issues, transactions, agreements, lawsuits and patents et al)

- Develops company policy and position on legal issues

- Researches, anticipates and guards company against legal risks

- Represents company in legal proceedings (administrative boards, court trials et al)

- Plays a part in business deals negotiation and take minutes of meetings

- Responsible for analyzing legal documents on behalf of the company

- Prepares annual reports for the company

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Defines job positions for recruitment and managing interviewing process

- Carries out staff induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

- Identifies, prioritizes, and reaches out to new partners, and business opportunities et al

- Responsible for supervising implementation, advocate for the customer’s need s, and communicate with clients

- Develops, executes and evaluates new plans for expanding increase sales

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps increase sales and growth for the company

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Responsible for financial forecasting and risks analysis.

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the company

- Serves as internal auditor for the company

Front Desk/Customer’s Service Officer

- Receives Visitors/clients on behalf of the organization

- Receives parcels/documents for the company

- Handles enquiries via e-mail and phone calls for the organization

- Distributes mails in the organization

- Handles any other duties as assigned my the line manager

6. SWOT Analysis

In as much as property development business is a very lucrative business, there are loads of investors and entrepreneurs who are interested in owning a business portfolio in the industry, so as such the competition for available business deals will be much.

This is why we invested time and resources to prepare a killer property development marketing plan. Prior to setting up Solorio’s® Property Development Company we employed the services of tested and trusted business and HR consultants to help us conduct critical SWOT analysis for us.

We did this so as to know how to maximize our strength and opportunities and also to look for ways to properly manage our weakness and the threat that we may likely face in the property development industry as a newbie. Here is a summary from the result of the SWOT analysis that was conducted on behalf of Solorio’s® Property Development Company;

Solorio’s® Property Development Company prides itself in the fact that the management team are core professionals and experts in their own chosen fields and they are some of the best in New York City. Despite the fact that we a new property development company, we can confidently say that we have a strong financial strength to handle most of the deals that we will have to handle.

Our weakness could not be farfetched; we are a new property development company, and there is the possibility of clients to think twice before awarding us contracts. Most people would prefer to deal with companies that have been in existence for a long period of time , as against dealing with a new company that they are not sure will deliver as planned.

- Opportunities:

Our business concepts and our mission and vision put us at an advantage in the industry. We are set to not only work with big money bags but also to work with smaller clients whose wish is just to have a roof over their head. Furthermore, we are certain that the location of our business is going to bring multiple business opportunities to us.

Some of the threats that we are likely going to face as a property development company are unfavorable government policies, global economic downturn and other big money bags that are major players in the property development industry. There is hardly anything we could do as it concerns this threats, other than to be optimistic that things will continue to work for our good.

7. MARKET ANALYSIS

- Market Trends

It is no longer news that property development involves various stakeholders with various contributions and responsibilities. In property development you have a synergy involving the property owner, the financier, the property developer and a team of technical experts. The property owner may be an individual or a group and could also be a corporate body.

Before now, the interest of most owners is to sell the property to any willing buyer and move on with their life. However, because of the profitability of the business, there are land owners now who are willing to use their property as a leverage to have an equity stake in the project.

This is a win-win for all the parties since the developer too will use the extra cash savings to accelerate the completion of the project and also to handle other projects. It is obvious that loads of investors are now very much interested in property development business, because it is one of the quickest means of becoming a millionaire and as a matter of fact, it is rare to see a multi – millionaire who does not have a business portfolio in the real estate industry.

One good thing about the property development industry is that it has room wide enough to accommodate as many investors that wants to dive into the industry. We know that we can achieve our business goals and targets in the property development industry in New York City and the United States, which is why we have mapped out our own marketing and sales strategies.

8. Our Target Market

Our target market cuts across people of different classes and people from all walks of life. We are coming into the industry with a business concept that will enable us work with the highly placed people in the country and at the same with the lowly placed people who are only interested in putting a roof under their head.

We are in business to make profits at the same we in business to give our customers the opportunities to own their own properties at an affordable price.

Solorio’s® Property Development Company wants to be known as a company that has the interest of the rich, the middle class and the poor in the United States of America. Below is a list of the people and organizations that we have specifically design our products and services for;

- Families who are interested in renting/leasing or acquiring a property

- Corporate organizations who are interested in renting/leasing or acquiring their own property/properties

- Land Owners

- Properties Owners

- University Campuses (Private Hostels)

- Foreign investors who are interested in owning properties in the United States of America

- The government of the United States of America (Government contracts)

- Managers of public facilities

Our Competitive Advantage

There are major players who have gotten a grip of the property development business in New York, but that does not deter us from entering the trade to build our business to become one of the top property development businesses in New York City. Solorio’s® Property Development Company has a management team members that are considered experts in their own chosen area of specialization.

Our CEO has a robust experience in the real estate industry and he is bringing the experience to help build Solorio’s® Property Development Company to become a top brand as far as property development business is concern. Of course, we are a new company, but we have been able to build our capital base to be able to handle most of the projects that we will bid for and also to acquire properties for the organization.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Solorio’s® Property Development Company is established with the aim of maximizing the profits in the real estate industry via delivering quality and affordable property to our highly esteemed clients. The property business is wide in scope and there are several means of generating income for the company. Below are the sources we intend exploring to generate income for Solorio’s® Property Development Company;

10. Sales Forecast

Prior to launching Solorio’s® Property Development Company we have serious interest in the industry and we have been able to secure some properties that is still under construction. We are optimistic that the projects / properties will be completed within the next two months and we have concluded plans to put the property for lease.