What’s happening in Sri Lanka and how did the economic crisis start?

Professor of Economics, Tata Institute of Social Sciences

Disclosure statement

R. Ramakumar does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

View all partners

The island nation of Sri Lanka is in the midst of one of the worst economic crises it’s ever seen. It has just defaulted on its foreign debts for the first time since its independence, and the country’s 22 million people are facing crippling 12-hour power cuts , and an extreme scarcity of food, fuel and other essential items such as medicines .

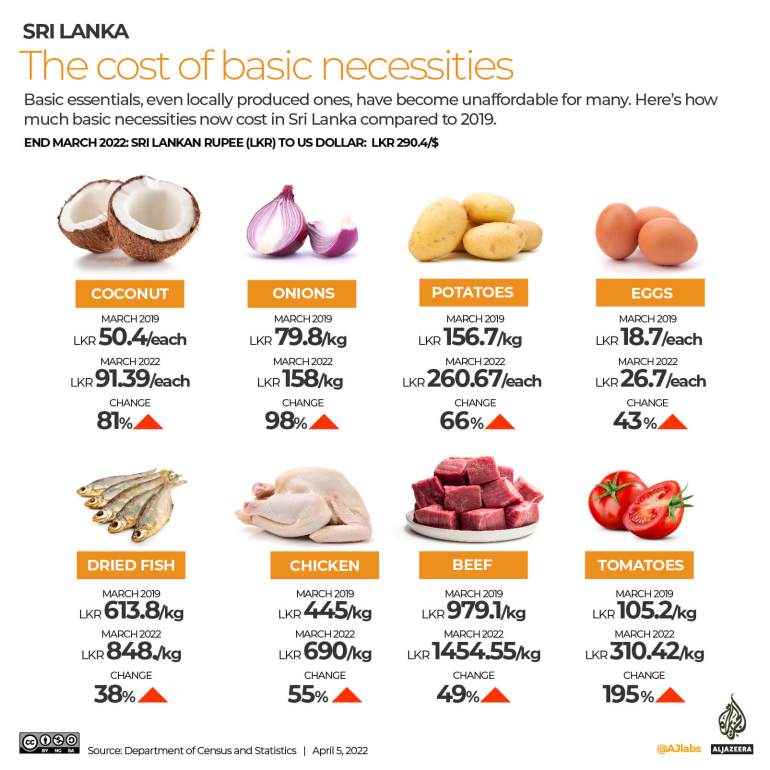

Inflation is at an all-time high of 17.5%, with prices of food items such as a kilogram of rice soaring to 500 Sri Lankan rupees (A$2.10) when it would normally cost around 80 rupees (A$0.34). Amid shortages, one 400g packet of milk powder is reported to cost over 250 rupees (A$1.05), when it usually costs around 60 rupees (A$0.25).

On April 1, President Gotabaya Rajpaksha declared a state of emergency. In less than a week, he withdrew it following massive protests by angry citizens over the government’s handling of the crisis.

The country relies on the import of many essential items including petrol, food items and medicines. Most countries will keep foreign currencies on hand in order to trade for these items, but a shortage of foreign exchange in Sri Lanka is being blamed for the sky-high prices.

Read more: Sri Lanka teeters on economic edge, from pandemic-fueled financial crisis and Ukraine war spillovers

Why are some people blaming China?

Many believe Sri Lanka’s economic relations with China are a main driver behind the crisis. The United States has called this phenomenon “debt-trap diplomacy”. This is where a creditor country or institution extends debt to a borrowing nation to increase the lender’s political leverage – if the borrower extends itself and cannot pay the money back, they are at the creditor’s mercy.

However, loans from China accounted for only about 10% of Sri Lanka’s total foreign debt in 2020. The largest portion – about 30% – can be attributed to international sovereign bonds. Japan actually accounts for a higher proportion of their foreign debt, at 11%.

Defaults over China’s infrastructure-related loans to Sri Lanka, especially the financing of the Hambantota port , are being cited as factors contributing to the crisis.

But these facts don’t add up. The construction of the Hambantota port was financed by the Chinese Exim Bank. The port was running losses, so Sri Lanka leased out the port for 99 years to the Chinese Merchant’s Group, which paid Sri Lanka US$1.12 billion.

So the Hambantota port fiasco did not lead to a balance of payments crisis (where more money or exports are going out than coming in), it actually bolstered Sri Lanka’s foreign exchange reserves by US$1.12 billion.

So what are the real reasons for the crisis?

Post-independence from the British in 1948, Sri Lanka’s agriculture was dominated by export-oriented crops such as tea, coffee, rubber and spices. A large share of its gross domestic product came from the foreign exchange earned from exporting these crops. That money was used to import essential food items.

Over the years, the country also began exporting garments, and earning foreign exchange from tourism and remittances (money sent into Sri Lanka from abroad, perhaps by family members). Any decline in exports would come as an economic shock, and put foreign exchange reserves under strain.

For this reason, Sri Lanka frequently encountered balance of payments crises . From 1965 onwards, it obtained 16 loans from the International Monetary Fund (IMF). Each of these loans came with conditions including that once Sri Lanka received the loan they had to reduce their budget deficit, maintain a tight monetary policy, cut government subsidies for food for the people of Sri Lanka, and depreciate the currency (so exports would become more viable).

But usually in periods of economic downturns, good fiscal policy dictates governments should spend more to inject stimulus into the economy. This becomes impossible with the IMF conditions. Despite this situation, the IMF loans kept coming, and a beleaguered economy soaked up more and more debt.

The last IMF loan to Sri Lanka was in 2016. The country received US$1.5 billion for three years from 2016 to 2019. The conditions were familiar, and the economy’s health nosedived over this period. Growth, investments, savings and revenues fell, while the debt burden rose.

A bad situation turned worse with two economic shocks in 2019. First, there was a series of bomb blasts in churches and luxury hotels in Colombo in April 2019. The blasts led to a steep decline in tourist arrivals – with some reports stating up to an 80% drop – and drained foreign exchange reserves. Second, the new government under President Gotabaya Rajapaksa irrationally cut taxes .

Value-added tax rates (akin to some nations’ goods and services taxes) were cut from 15% to 8%. Other indirect taxes such as the nation building tax, the pay-as-you-earn tax and economic service charges were abolished. Corporate tax rates were reduced from 28% to 24%. About 2% of the gross domestic product was lost in revenues because of these tax cuts.

In March 2020, the COVID-19 pandemic struck. In April 2021, the Rajapaksa government made another fatal mistake. To prevent the drain of foreign exchange reserves, all fertiliser imports were completely banned . Sri Lanka was declared a 100% organic farming nation. This policy, which was withdrawn in November 2021, led to a drastic fall in agricultural production and more imports became necessary.

But foreign exchange reserves remained under strain. A fall in the productivity of tea and rubber due to the ban on fertiliser also led to lower export incomes. Due to lower export incomes, there was less money available to import food and food shortages arose.

Because there is less food and other items to buy, but no decrease in demand, the prices for these goods rise. In February 2022, inflation rose to 17.5%.

What will happen now?

In all probability, Sri Lanka will now obtain a 17th IMF loan to tide over the present crisis, which will come with fresh conditions.

A deflationary fiscal policy will be followed, which will further limit the prospects of economic revival and exacerbate the sufferings of the Sri Lankan people.

- International Monetary Fund (IMF)

- Sri Lanka economic crisis

Scheduling Analyst

Assistant Editor - 1 year cadetship

Executive Dean, Faculty of Health

Lecturer/Senior Lecturer, Earth System Science (School of Science)

Sydney Horizon Educators (Identified)

- A-Z of Sri Lankan English

- Banyan News Reporters

- Longing and Belonging

- LLRC Archive

- End of war | 5 years on

- 30 Years Ago

- Mediated | Art

- Moving Images

- Remember the Riots

- Site Guidelines

Sri Lanka’s Economic Crisis: Causes, Consequences and Cure

on 05/24/2023 05/24/2023

Photo courtesy of Bloomberg

The principal problem faced by people due to the economic crisis is of rising prices while incomes for many remain unchanged. As a result, the poverty rate has doubled from 2021 from 13% to 25%, according to the World Bank.

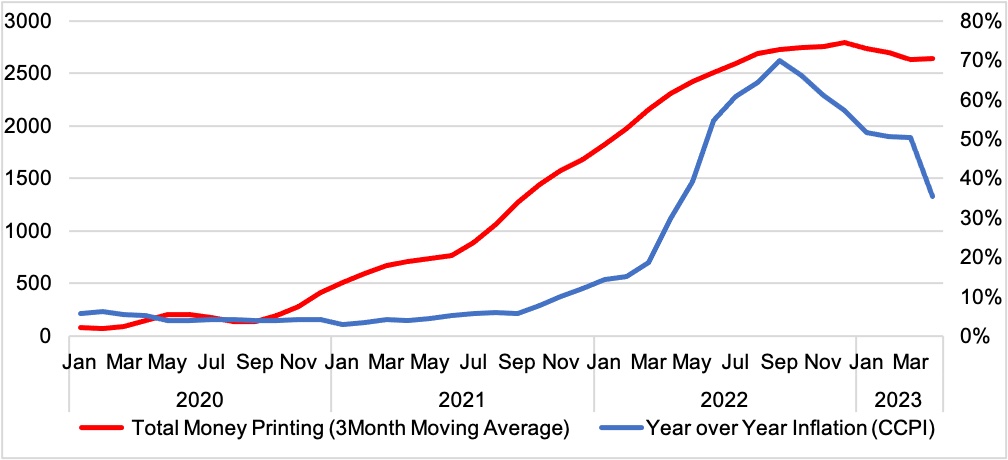

Inflation is a problem worldwide but global inflation in 2022 averaged only 10.1% while Sri Lanka’s inflation was 57.2%, according to the IMF. Global problems have certainly added to Sri Lanka’s woes but external factors cannot explain the dramatic rise in local prices. Local supply chain disruptions did impact prices in 2020/21 but this is no longer a major factor although some effects still linger. What then, were the causes?

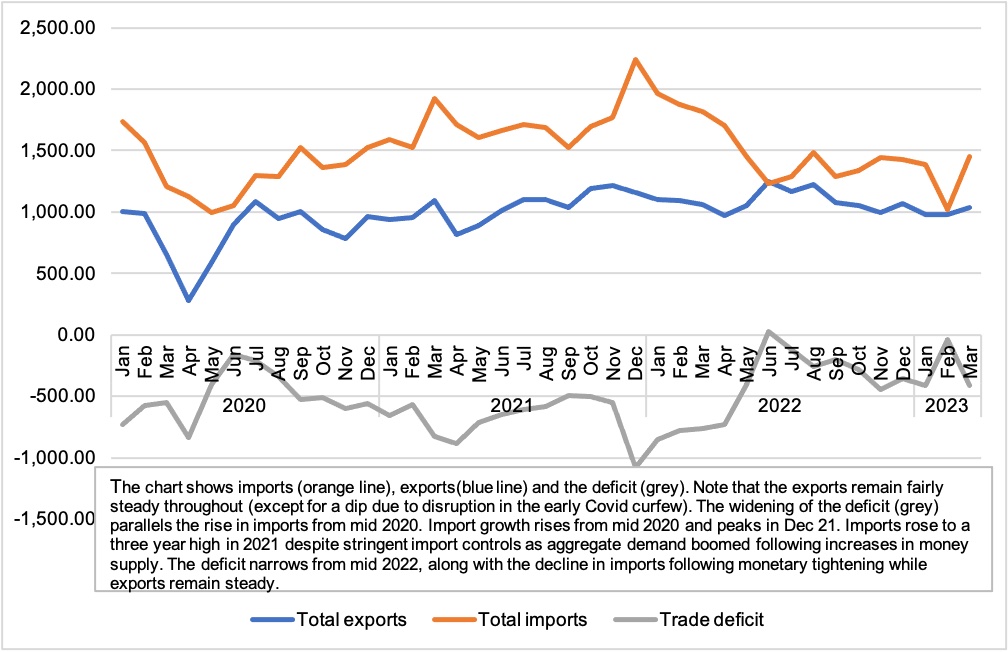

Import restrictions, foreign exchange shortages and currency depreciation have contributed. All of these are connected to the balance of payments therefore understanding the cause of the balance of payments problem is one key to the puzzle. The other key is to identify the cause of demand-pull inflation, which arises from rapid growth in aggregate demand.

These are interconnected and the root of the problem lies the debasement of the currency. This article attempts to explain how the Central Bank’s funding of the government fuels both inflation and the balance of payments problem. Debasing the currency also results in distributional consequences, the painful effects of which are now being experienced.

Balance of payments

The trade flows – imports and exports that appear in the balance of payments statistics – do not exist in isolation; they are a function of the overall demand and supply within the economy. Trade flows are directly affected by decisions of consumption and savings that are made by citizens and the government. Spending by individual or businesses is limited by their income or what they can borrow. If they chose to borrow, the funds they use represent the savings of others. The financial sector mediates between savers and borrowers but what is borrowed is limited to what is saved so no imbalance can occur.

The actions of government, because of sheer size, have a major impact on overall demand and savings; this is the rationale for stimulus spending but it can also create imbalances. If the government is spending less than it collects it is a net saver and no imbalance arises. If it spends more than it collects it is a net dis-saver (or borrower). If the dis-saving is financed by the Central Bank it causes an imbalance that affects the balance of payments and inflation.

Public finances: taxes, debt and money printing

The government has three avenues to finance its expenditure: taxes, debt and credit from the Central Bank (money printing). If government revenues cover its expenditure public finances are sustainable. When a government runs a deficit it can cover this by borrowing. As long as the borrowing is from the market it does not cause an imbalance but the problem is that it tends to bid up the rates of interest in the market. However if the borrowing is from the Central Bank there is no pressure on interest rates which makes it an attractive option.

Money printing, inflation and the balance of payments

Unlike commercial banks the Central Bank does not accept deposits or raise funds from the market yet somehow finances government. This sleight-of-hand is accomplished through accounting entries in the banking system. When the Central Bank buys government securities instead of paying for these by a transfer of funds it simply passes an accounting entry crediting the account of the Treasury and debiting the Central Bank’s holding of government securities. This is new money created out of thin air with no underlying economic activity. This is the source of the imbalance; if the quantum small then the effects can pass unnoticed but if it is large problems are inevitable.

The account of the Treasury is used to make cashless interbank payments for government salaries, pensions, interest and for various goods and services. The money thus spent is received in the hands of people who then use it for their own expenses. The new money starts to circulate in the economy but a problem exists – the quantity of goods and services has not changed.

Greater quantities of money are being spent on the same quantity of goods and services. Depending on the quantities printed, over time this leads to rising prices but critically the changes that take places in prices are not uniform. This has important distributional effects. It also causes the balance of payments problem.

When people spend the new money they do not spend money solely on domestic goods; they also buy imported goods. Moreover many domestic goods use imported inputs. Therefore even if people spend newly created money on purely domestic goods it will create demand for the imported inputs. For example domestically produced rice will use imported fertiliser, pesticides and other inputs so an increase in demand for domestic rice will eventually lead an increase in demand for the imported inputs. Therefore not only does the money printing drive inflation it also drives imports directly when people consume imported goods and indirectly via the demand for imported inputs by local producers.

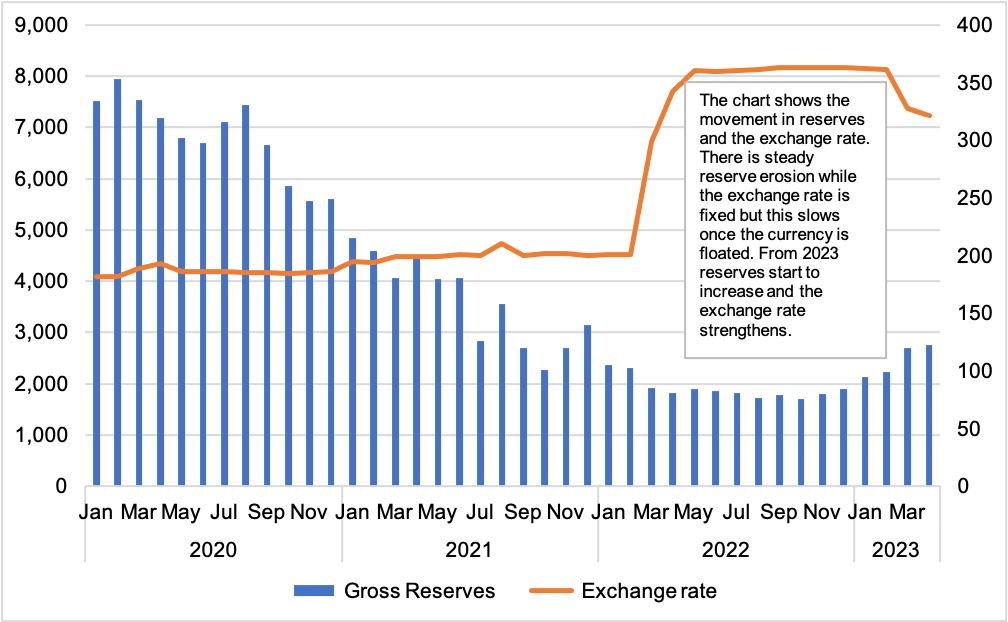

If the demand for imports starts to increase and the increase is persistent, then the demand for foreign exchange will grow. This brings pressure on the currency to depreciate. If the currency depreciates then this brings foreign exchange market back into balance. Imports become more expensive, people consume less and the demand for imports eases and the pressure on the currency disappears.

However if the government tries to control or fix the rate of exchange artificially, then the demand for imports continues unabated and foreign exchange starts to become scarce. A balance of payments problem is born [1] .

This, in a nutshell, is the problem. To understand how this has affected people we need to understand the nature of the economy and the role that prices play.

What is the economy?

The economy is made up of the sum of the millions and millions of transactions made every day by people, wherever money is involved. What consumers buy in turn leads to a multitude of decisions taken by thousands of people responsible for producing goods and services: businesspeople, manufacturers, farmers, merchants and hoteliers and all others. They erect buildings, buy machinery, hire workers, develop marketing campaigns based on the prices for which they can sell their goods or services and the costs of obtaining the labour and inputs used in production.

It is a vast and multi-layered entity made up of an extremely delicate and complex web of relationships that are coordinated and held together by prices. It also very dynamic, constantly changing with people’s behaviour which makes it very hard to predict or control.

How did Sri Lanka stumble into this crisis?

Starting in December 2019 and continuing until mid 2022 the government increased spending . For example some 100,000 new jobs were created. It also cut taxes. With increased expenditure and reduced income the budget deficit grew rapidly. It financed much of this spending and even the rollover of its domestic debt through credit from the Central Bank. The Central Bank simply kept bidding at low rates and buying government securities. Interest rates fell to record lows and for a while the economy boomed. The monetary base expanded by 49% between 2020 to 2022 creating a massive shock to the economy.

Distributional effects of an injection of new money into the economy

The monetary shock does not create an immediate or uniform change in prices. Instead the shock percolates through the economy, affecting some prices first, others later while some may remain unaffected. Prices of consumer items will change faster although again not all are affected equally as it depends on spending patterns but the prices of commercial goods, where the demand is derived from consumer goods, will rise more slowly. Among commercial goods, prices of raw materials and components to production process may rise faster than that of factors of production – land, capital assets and labour. Prices of anything on fixed contracts such as wages and rents will change much more slowly. For prices of the factors of production to change the production processes themselves need to change but this changes only in the long term.

Gradually, the new money ripples through the economy, raising demand and prices as it goes. Income and wealth are redistributed to those who receive the new money early in the process (i.e. before prices rise) at the expense of those who receive the new money late in the day (when prices have risen) and of those on fixed incomes who receive no new money at all.

Two types of shifts in relative prices occur as the result of this increase in money: the redistribution from late receivers to early receivers that occurs during the inflation process and the permanent shifts in wealth and income that continue even after the effects of the increase in the money supply have worked themselves out. When a new equilibrium eventually emerges it will reflect a changed pattern of wealth, income and demand resulting from the changes during the intervening inflationary process. For example, the fixed income groups permanently lose in relative wealth and income.

The alternate reality: developments between 2020 to 2022

Between 2020 to 2022 while the purchasing power of money fell, the government disguised the obvious symptoms through price controls (to fix rising prices), exchange rate and import controls (to fix the currency and foreign exchange shortages) and a multitude of others.

These controls did not ultimately work; the problem continued but the restrictions kept the economy tied in knots and masked the most obvious symptoms. A divergence emerged between official prices and reality. As the volumes of money creation grew the divergence widened and the economy entered a phantom state where prices were fixed but goods were not available.

The shortages and queues simply reflected the divergence between the real and nominal buying power of the rupee. The prices of gas and fuel are officially fixed but not enough is available at that price. The same is true for electricity; power cuts indicate the gap between demand and supply. It is the government that was supplying energy but since it depended on imported inputs it could no longer buy sufficient quantities because the rupees it collects from customers bought fewer dollars. The same is true of foreign exchange where the official rate was Rs. 200 but little or nothing was available.

Although the reserves were running out currency swaps and bailouts from friendly countries kept the illusion going for a while longer. Life continued in this twilight zone but reality eventually dawned when no further imports were possible.

Waking up to reality: addressing the imbalances

The government had suppressed many of the visible symptoms of the problem; the controls and regulations that did so hindered some of the normal adjustment that would take place over time in response to increased money creation.

Addressing the problem meant that the huge imbalances that had built up had to be unwound. Fundamentally what had happened is that the currency has been debased, its real purchasing power has diminished greatly. The first step to adjust to the grim reality is to devalue the currency to reflect its real value in the foreign exchange market. Then all prices within the economy needed to adjust to the realistic value of the rupee. As the adjustments needed are huge they deliver a massive, dislocating shock. This is the pain that people are experiencing.

All economic relations within the economy are governed and coordinated by prices. Prices are expressed in money. As long as the value of money remains stable prices will coordinate this complex set of interactions.

A sudden change in the value of the rupee, especially when that change is large, disorders all economic relations. The very foundation of the economy is lost; the entire economy must now adjust to the new value of the rupee that is what is taking place now.

Returning to reality

The measures put in place since 2022 are designed to address the root causes. The imbalances become visible in the foreign exchange market but the causes lie elsewhere in the public finances and monetary policy. In short, the government needs to balance its budget, stop using Central Bank credit and use other sources of funding. Therefore it must raise taxes, cut expenditure and borrow from the market instead of the Central Bank.

How is the problem to be fixed?

The starting point is to restore the currency to a realistic value. The devaluation of the currency is needed to readjust its value to account for all the new money that has been created over the cycle of the boom.

The government then needs to borrow in the market instead of printing, which is why interest rates on treasury bills are hovering around 30% from 6% to 7% in 2021 and taxes have been raised.

It can also reduce expenditure but since much of it is spent on salaries and pensions it will seek other avenues. Fuel and energy were being sold below cost, more so once the currency depreciated so electricity, fuel, gas and water prices have been raised. Costs include the costs of waste, corruption and inefficiency that take place within those entities which is why the government needs to restructure these so costs can be reduced then the savings can be passed on to consumers. Debt is being restructured to reduce interest payments. Losses in state enterprises that add to government expenditure need to be reduced, hence the need for State Owned Enterprise restructuring.

Over the last year as these measures have been implemented shortages have reduced, the balance of trade in goods and services is in surplus, the Central Bank is now acquiring foreign reserves, the rupee has started to strengthen and the rate of inflation has started to fall.

The importance growth

Putting public finances in order brings macroeconomic stability such as stable exchange rates, lower inflation and restores the balance of payments. These have slowed the speed of decline, people are not getting poorer as fast. It has stopped things from getting much worse but cannot address the distributional consequences of the fall in the value of money.

To restore lost wealth requires restoring sustained economic growth, not a temporary boom based on an artificial stimulus. Since 2004 successive governments have tried to increase growth through stimulus such as state spending and capital expenditure, which achieved short term improvements in GDP. The current state of public finances renders this impossible as the government cannot spend or borrow more.

Sustainable growth must be based on improved productivity. Growth comes about when activity increases in in sectors with higher productivity at the expense of sectors with lower productivity in the economy. As a result of the changes in relative prices some businesses will no longer be viable, they may need to downsize or close down; meanwhile new opportunities can emerge based on new patterns of consumption.

Therefore the processes of production must also change. The structure of the economy is changing and the government needs to facilitate this. Investment is needed to create jobs; the government cannot function as employer of last resort and keep recruiting people and borrowing or printing to pay them. Resources in the economy need to be reallocated from lower productivity to higher productivity activities so laws and regulations that hinder the reallocation of resources must be reformed.

Bankruptcy procedures must be streamlined to allow firms to exit and for debts to be recovered. Prudential regulation needs to be strengthened to prevent a wave of bad debt destabilising the banks. For firms that are not unviable but need to downsize or restructure, labour regulations need to be reformed to speed this process. To create new jobs regulations and licenses that hinder new investment need to be reviewed including restrictions on land ownership and use to allow different crops or activities to take place on former agricultural land.

The danger ahead

People may have expected immediate relief with reforms but unfortunately the higher taxes, higher energy prices and currency depreciation paradoxically increased the burden on people, sparking popular anger. Unfortunately the bitter medicine is necessary and can only deliver benefits in the long term.

There is a clear lack of understanding of the fundamentals of the problem both among politicians and the public. Various political parties are attempting to capitalise on public anger; there is a search for scapegoats and conspiracy theories are in circulation. Populist policies – simplistic solutions to complex problems – are on offer from various quarters. Unfortunately there are no quick or easy solutions; there is only a long and rocky path that must be traversed to put the country back on a path of growth.

The danger is that an angry population could vote in parties that abandon the reforms and the pursue the various short term unorthodox policies. This would be a grave mistake since the problems of today are the result of harebrained unorthodox, homegrown alternative solutions. The economy is stabilising slowly but the recovery is far from secure. A few missteps is all it will take for things to quickly become much worse.

The problems of Sri Lanka are self-inflicted, people are paying a heavy price for past errors and while things still bad, with the right reforms incomes can grow again. The public, policymakers and would-be policymakers need to learn from the mistakes of the past and avoid the temptation of further quick fixes.

[1] Note: It is possible to maintain a fixed exchange rate without balance of payments problems provided it is consistent with the monetary policy, if money is being printed continuously then a fixed exchange rate cannot be maintained.

Related Articles

Dr a.t. ariyaratne: a visionary community leader, is sri lanka capitalizing on economic disaster, empowering women in the digital economy, mannar island: a paradise at the crossroads, if the economy has stabilised, why do so many feel poor, a governance diagnostic by the sri lankan public, can sri lanka’s economic revival weather the storm of a 2024 election, re-inventing the idea of university: response to professor jayadeva uyangoda part 2, re-inventing the idea of university: response to professor jayadeva uyangoda part 1, imf: strengthening the social safety net is critical.

No Sri Lankan, rich or poor, spared as economic crisis worsens

Savings evaporate, businesses face closure and the poor struggle to eat as value of the Sri Lankan rupee plummets.

Colombo, Sri Lanka – Sri Lankans, both rich and poor alike, are fed up.

Hit by a deepening economic crisis , people in the informal settlements of the capital, Colombo, say they are eating half of what they used to as food prices have doubled in less than a year. In middle-class neighbourhoods, meanwhile, owners of cafés, bakeries and salons have had to let go of staff and are facing the prospect of closing shop altogether, with hours-long power cuts and reduced earnings keeping customers away.

Keep reading

Infographic: sri lanka’s economic crisis and political turmoil, sri lanka president rajapaksa ‘will not resign’, says minister, sri lanka’s poor queue for hours to buy kerosene amid crisis, crisis-hit sri lanka is hosting thousands of stranded ukrainians.

“The whole country is destroyed,” said one woman in Colombo’s Nugegoda district. “Even stray dogs live better than us.”

“Everything is expensive,” said another. “We cannot manage.”

Sparked by a foreign exchange crisis , Sri Lanka – an island nation of 22 million people – is grappling with its worst economic downturn in decades.

The foreign currency crunch has left President Gotabaya Rajapaksa’s government unable to pay for fuel imports and other essentials. This has resulted in fuel shortages that have caused rolling electricity blackouts of up to 13 hours and brought ground transport in parts of the country to a halt.

Queues for diesel, cooking gas and kerosene are a common sight , with people reporting having to wait in line for days on end to get their rations. Police say at least two people have died while waiting in the scorching heat.

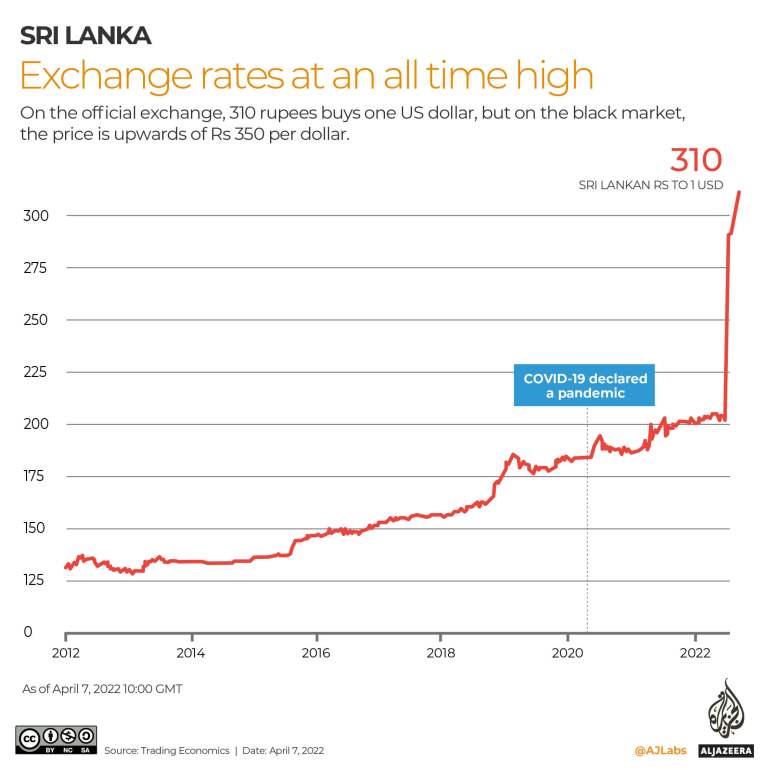

Prices of medicines have also skyrocketed, while the value of the Sri Lankan rupee has plummeted by 30 percent against the United States dollar this year, making it the worst-performing currency in the world.

The Rajapaksa government has turned to the International Monetary Fund for a bailout and is also seeking financial assistance from India, which provided a $500m credit line for fuel imports in February and approved a second $1bn credit line to help ease shortages of essentials in March.

But that has done little to end the crisis, and protests calling for the president’s resignation have broken out across the country since early March, two years after the COVID-19 pandemic decimated one of Sri Lanka’s key economic sectors: tourism. Protesters chanting “Go home, Gota”, a reference to the president’s nickname, have been taking to streets across cities and towns at different times throughout the day.

In Colombo, a city that has endured bombings, riots, curfews and rationings – mostly during Sri Lanka’s 26-year civil war against Tamil separatists, which ended in 2009 – many residents said these were the hardest times they could remember.

In Nugegoda, along a row of low-slung houses perched on the edges of a railway track, residents said they were barely making ends meet. Chandra Madhumage, who has struggled to find work as a domestic servant since the start of the pandemic, was worried she might soon run out of money to pay for medication for her diabetes and high cholesterol.

“This is a disaster,” said the mother of three. “How can we survive?”

Across the road from Madhumage’s house, DW Nimal, who was clearing weeds at the roadside with his hands, said he too was finding it hard to manage on his meagre earnings. Most of his monthly salary of 30,000 Sri Lankan rupees ($100) went to food.

“I am fed up with this life,” he said.

Up the road, Gayan Kanchana, a 42-year-old tuk-tuk driver said, “This is the hardest it’s ever been.”

The father of two said he was getting fewer and fewer calls for hires, as the cost of a ride has increased due to the doubling of the price of petrol. His family can no longer afford meat, bread, milk powder or eggs.

“We used to eat chicken two to three times a week,” he said. “Now, it’s just dried fish and rice.”

Figures from the Sri Lankan Central bank show that inflation in the country rose by 18.7 percent in March, compared with the same period last year. Food prices have jumped by 30.2 percent, with onions, dhal and rice costing double what they used to. The price of tomatoes has tripled, while that of turmeric, which is imported, has quadrupled.

Vendors at a fruit and vegetable market in Narahenpita, in the southeast of Colombo, said they had enough supplies but that people no longer had the money to buy their goods. At a stall that was well-stocked with carrots, beans, spring onions and chillis, PKP Sampath said “no one comes to buy food any more”.

Pointing at a customer holding a plastic bag that was only half full, Sampath said, “He’s been coming here for the past 13 years, and he used to buy several bags full of vegetables. Now, he’s had to cut down.”

The vendor said “people used to buy what they want” in the past, but now, “they only buy what they need to survive.”

At the adjacent fruit stall, Shriyani Jayasuriya, who was stocking up on watermelon, said she might have to close her food business because of the high cost of produce. The owner of Kindred Foods said she used to get at least 50 customers a day, but now, it was only 10 or 12.

“These are terrible times,” she said. “We cannot live in Sri Lanka.”

Many business owners said the crisis has hit the middle class the hardest.

Shiranshi Jayalath, who owns a salon in Ethulkotte, said she may also have to close shop due to power cuts lasting at least four hours during the day. Speaking from a protest outside the parliament, the 43-year-old said she has already had to let go of three of her workers.

“The middle class itself is disappearing,” she said. “This government needs to go.”

The construction sector has also been hit hard.

“Prices of cement and reinforced steel have tripled and the bank loans people have taken out for home construction are no longer sufficient,” said Dilina Hettiarachchi, a 37-year-old structural engineer. “They have no hope of completing their homes.”

Bigger projects were continuing, however, he said, as the industry’s strongest players had stocks of material as well as the foreign currency reserves to buy what they need. But even they were not taking on any new projects, he said, demonstrating just how widespread the impact of the crisis is.

One resident said the well-to-do in Sri Lanka have typically been insulated from the multiple crises that have roiled the country. But now, they are watching the situation unfold with a “new horror” as the value of their savings drop by the day.

In March, many rushed to get rid of their rupees by buying up gold, only to send up gold prices to a record high at the end of that month.

As the crisis worsens, anyone who can leave Sri Lanka is planning to do so.

Antoinette Prabalini Benjamin George, a 30-year-old lawyer, is one of them. But the dropping value of the currency has complicated her plans.

George applied for a bank loan of 2.2 million Sri Lankan rupees to go study abroad two months ago. At the time, 200 rupees could buy one US dollar. But by early March, the pegged value of the rupee dropped to 230 to a dollar, and by the first week of April, it was hovering at 300 rupees to the dollar.

George said the loan she had applied for was no longer enough, and it was also unclear if any Sri Lankan bank would issue her the foreign currency she needed to pay for her tuition fees.

One official at the Commercial Bank told Al Jazeera the bank was not issuing any foreign currency to new students seeking to leave the country, while those who were already abroad are facing “inordinate delays” in getting their payments approved.

But George said she is determined to leave.

“I think the value of the rupee will only decrease,” she said.

“When I was first making my plans, the country was already in a bad state. And then things only got worse. I’m going to find a way to leave.”

The ArmChair Journal

What led to the Sri Lankan economic crisis?

Share this:.

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

Dimple Baruah is currently pursuing her master's degree in International Studies from Christ (Deemed to be University) and is a Political Science graduate from Delhi University. She loves sketching and animals. She is an International Relations and Global Politics enthusiast. Her field of interest lies in the geopolitics of South Asia and the theories of International Relations.

Sri Lanka is in the midst of its worst economic crisis since its 1948 independence. This can be traced back to several fundamental problems that worsened financial situations. Inflation has reached a new high. The tourism industry has been hit severely after the covid-19 pandemic. The country’s debt profile is deteriorating, and a lack of foreign money has made it impossible to purchase imports. The sole cause of this crisis would be ill-timed, ineffective economic measures and a lack of foreign exchange reserves. The economic mismanagement of successive governments created and maintained a twin deficit – a budget shortfall and a current account deficit.

On the 1 st of April 2022, the President of Sri Lanka, Gotabaya Rajapaksa declared a national emergency after the protests were being held in front of his residence, raising fears of a crackdown on protests. The military has used emergency powers to arrest and hold suspects without warrants, but the scope of the current authorities remains unclear.

1. EVENTS LEADING TO THE CRISIS

To understand what led to the Sri Lankan economic crisis, we have to analyze the preceding events or factors before the final blow to the economy by the pandemic. This rich and wonderful country became a tragedy for reasons that were not recognized. The explanation became clear quickly: a proud and innovative country had devolved into the private domain of a single-family, the Rajapaksas.

The country’s tourism economy suffered from terrorist suicide bombings during Easter in April 2019. Sri Lanka’s tourist sector accounts for 12.6 percent of the country’s GDP (as of 2019). It is heavily reliant on the travel and tourism sector to manage the economy. Nearly 270 people were killed in Columbo after three churches, and luxury hotels were assaulted. As a result, the amount of foreign currency coming into the country from international tourists has decreased.

In December 2019, the newly elected President made a wrong economic decision by cutting down the VAT rates by half. The rates dropped from 15% to 8%, leading to a decline in the country’s income. Faced with a survival dilemma, the Sri Lankan central bank created more currency notes than was prudent. They increased by 1.2 lakh crore (about 26,000 crore rupees in Indian currency), causing significant inflation.

In May 2021, again, a political decision of the President, i.e., turning Sri Lanka into 100% organic agriculture, led to economic turbulence. The government banned the imports of chemical products and fertilizers. This further resulted in crop failure, high food prices, and a degrading agrarian economy.

As the country’s foreign reserves shrink, Sri Lanka is essentially depreciating its currency, potentially increasing Asia’s greatest inflation surge as the government tries to service its debt and pay for imports.

2. CURRENT SCENARIO OF SRI LANKA

2.1. Economic Situation

The current crisis was deeply affected by the cut down on taxes in 2019. The covid hit the tourism industry of Sri Lanka, credit rating agencies, thus shutting it out of international financial markets. In just two years, foreign exchange reserves have plunged by over 70%. The country had only $2.31 billion in reserves as of February, although it faces debt repayments of $7 billion in 2022. The decision by the Rajapaksa government to ban all chemical fertilizers in 2021, which was later reversed, harmed the country’s farm economy and resulted in a decline in the crucial rice yield.

The debt profile of Sri Lanka goes back to the year 2007; market borrowings account for 47 percent of the debt in Colombo, followed by the Asian Development Bank with 13 percent, China and Japan with 10 percent each, the World Bank with 9 percent, and India with 2 percent of the total debt (10 percent account for others; non-residential treasury bills/bond holdings and state-owned enterprises are excluded from this calculation). Analysts believe the government needs to restructure its debt or seek rescue from the International Monetary Fund.

The public faces 10-12 hours of a power cut, examinations have been called off due to the lack of printing papers, fuel and food prices, and touching skies. Cooking is impossible due to a lack of energy. A thousand bakeries have shuttered their doors. Several power facilities have shut down, resulting in widespread power outages. A month’s supply of gas cylinders used to be around 50,000. It’s now down to 2,000, so you can understand the impact on homes. The island’s diesel deficit has hampered public transportation and goods transit.

2.2. Political Situation

Economic woes fuel widespread resentment of the Rajapaksa family, which controls the government. There is a palpable sense of outrage in its core audience of farmers and nationalists. The lack of proper government policies also adds up to economic chaos. If the situation is not addressed, it may result in a change of power. Former President Maithripala Sirisena’s Freedom Party has asked President Rajapaksa to form an all-party administration to allow the country to get through the crisis. He has threatened to exit the coalition if his request is disregarded.

The declaration of emergency grants security forces the authority to arrest and detain people immediately. This was witnessed after hundreds of protesters gathered in the capital, with many attempting to attack the President’s mansion in protest of the government’s “poor handling of economic policy, which has resulted in a state of chaos in the country.” The military has been deployed in the gas stations to ensure efficient distribution. Tear gas and water cannons were reportedly used to control the protests. Night curfews have been imposed in several locations in Sri Lanka.

3. GLOBAL REACTIONS TO THE CRISIS

India, the closest neighbor of Sri Lanka, also has to face repercussions. Refugees influx into the territories of Tamil Nadu. The number is expected to be around 2000-4000. India also has extended help by giving a $1 billion line of credit to stabilize fuel and food prices. Also, a $400 million credit swap arrangement has been sanctioned. So far, essentials such as medicine and rice have been provided under this arrangement. Lanka has been pressed to refinance its loans by China. If the circumstances warrants, India may provide more humanitarian assistance.

The International Monetary Fund (IMF) has suggested increasing the income taxes and VAT rates to control the affected challenging economy. In the next coming days, the International Monetary Fund will begin talks with Sri Lankan authorities on a prospective loan package, according to IMF spokesman Gerry Rice.

Sri Lanka’s geopolitical location can be witnessed in the power struggle for influence in the Indian Ocean between India and China. The country is situated on the vital sea route which connects the east and the west. Therefore it is essential for China for its “Belt and Road” initiative. The government previously rejected a plan to give China outright ownership of land in the port city of Colombo instead of granting Beijing a 99-year lease on 62 hectares.

4. CONCLUSION

Some experts suggest Sri Lanka’s debt should be restructured and repaid over three years. This will save money and ease the burden on Sri Lankans experiencing shortages of imported items like milk powder, pharmaceuticals, gas, and fuel. Along with the government debt of $4.5 billion, Sri Lanka needs to accumulate $2.4 billion for the state-owned and private companies to meet their debt due in 2022.

In the face of mounting economic troubles, most international economists expect things to worsen in the future, with some even predicting disaster as a matter of time. In the short term, the government may be able to alleviate the current crisis with international aid and loans. Still, the situation necessitates rigorous planning and management for long-term economic stability and the state’s welfare in the long run.

Review Corner

Leave a reply cancel reply.

You must be logged in to review articles.

Similar Posts

Ram ke naam: through the lens of publics and counter publics.

Ram Ke Naam illustrates how the others are excluded from the public discourse, and they became a part of ‘counter public.’

Hitler: The fiend that did not die

What would happen if Hitler had not died and had somehow managed to escape to the 21st century via time travel? Would he be able to rise back to power? How would people react? How would he respond to the people? Perhaps the musings over this possibility are what led to Timur Vermes to write…

Atmanirbharta – Is this achievable?

There will be no decentralization of power even though the Prime Minister is aiming for a Swadeshi economics model propagated by Rashtriya Swayamsevak Sangh.

My experience with relief work during lockdown

Relief work is a lot more of an emotional cauldron, and being a social worker, it is very important to understand and channelize your own emotions while you go out to support families. It is also important for us to understand that we are not the centre of the work.

Farm Reform Bills 2020: A Democratic Legislation?

The idea of the bills is to liberalize farm markets hoping it will make the system more efficient and allow for better price realizations.

The politics of fashion

What is ‘fashion’? Who gets to decide what is ‘fashion’? How does politics play out in choosing one over the other?

Causes of the Sri Lanka Economic Crisis

The World Economic Forum ranked Sri Lanka 52nd in global competitiveness out of 142 countries surveyed in its 2011 Global Competitiveness Report. Note that country also ranked 45th in health and primary education, 32nd in business sophistication, 42nd in innovation, and 41st in goods market efficiency. The same report described the Sri Lanka economy as transitioning from the factor-driven stage to the efficiency-driven stage.

A 2016 Systematic Country Diagnostic by The World Bank further described Sri Lanka as a development success story. Its economy grew on an average of 6 percent during the previous years and it successfully met one of the Millennium Development Goals of the United Nations when it reduced poverty from 22.7 percent in 2002 to 6.1 percent between 2012 and 2013 while on track to meet other goals and outperforming other South Asian countries.

However, its debt soared to USD 64.9 billion in 2016. The government had been borrowing from foreign creditors since the term of former President Mahinda Rajapaksa to ramp up its infrastructure projects to the point of near bankruptcy. The International Monetary Fund had bailed out the country while The World Bank warned that its positive gross domestic product driven by non-tradable sectors was both unsustainable and inequitable.

Other economists had also raised concerns over numerous risks that could endanger its economic outlook. Nonetheless, after its per capita gross national product dropped from 3968 dollars in 2018 to 3741 dollars in 2019 while its per capita gross domestic capital dropped from 4079 dollars to 3852 during the same period, the World Bank downgraded Sri Lanka to a lower middle-income country from its previous upper middle-income status.

The Sri Lankan government declared in April 2021 that the country is in its worst economic crisis in 73 years. It has experienced an unprecedented level of inflation and an increase in prices of basic commodities, devaluation of its currency, near-depletion of its foreign exchange reserves, supply shortages in certain food items, and life-saving medicines and medical equipment, shortages in oil and gas, and sociopolitical unrest.

What exactly happened? How did Sri Lanka transition from one of the most promising economies in Asia to one of the worst performing economies in the world? Economists have pinned down the problem to numerous factors ranging from economic mismanagement, precarious policies, and unfavorable political climate to major global events such as the coronavirus pandemic and the Russia-Ukraine conflict.

Identifying and Explaining the Causes of the Sri Lanka Economic Crisis

1. excessive and unsustainable borrowing and spending to finance large-scale infrastructure projects.

Former President Mahinda Rajapaksa ramped up government investments in large-scale infrastructure beginning his term in 2009. His administration has been credited for projects such as the Colombo Lotus Tower, Magampura Mahinda Rajapaksa Port, the Colombo Harbour South Container Terminal, the Mattala Rajapaksa International Airport, the Colombo–Katunayake Expressway, and the Mahinda Rajapaksa International Cricket Stadium.

Some of the projects have helped Sri Lanka to develop its economy further as evident from improvements in its Human Development Index. These include rural infrastructure development and the building of roads and highways to improve. However, critics have noted that the other infrastructure projects such as the Colombo Lotus Tower and Mahinda Rajapaksa International Cricket Stadium which costs hundreds of millions of dollars were uneconomical.

Investments in big-ticket infrastructure projects persisted in the succeeding administrations of former presidents Maithripala Sirisena and Gotabaya Rajapaksa. Of course, to finance these projects, the government had borrowed excessively from foreign creditors including the International Monetary Fund and Chinese banks and lenders. Note that Sri Lanka was nearing bankruptcy until the IMF intervened with a bailout.

The Asian Development Bank published a report in March 2019 that provided a narrative of the history of the twin deficit in Sri Lanka. It explained that the national expenditure of the country has exceeded its national income while its production of tradeable goods and services has dropped. The twin deficit in Sri Lanka has manifested in frequent balance-of-payment crisis that has been observed since 2017 and high macroeconomic volatility.

Nevertheless, the foreign debt of Sri Lanka increased from USD 11.3 billion in 2005 to USD 56.3 billion in 2020. The foreign debt accounted for 42 percent of the GDP in 2019 and rose further to 119 percent of the GDP in 2021. The country eventually declared a pre-emptive negotiated default in April 2022 because of its inability to pay most of its foreign debt. This marked the beginning of the 2022 Sri Lankan Sovereign Debt Crisis.

2. Allegations of Corruption and Misplaced Political Motivation as Factor of the Sri Lanka Economic Crisis

Individuals and groups vocal against the government have put forward numerous allegations of corruption , mismanagement of funds, and inappropriate political motivation. Government opposition and several economists and analysts have argued that one of the major causes of the Sri Lanka economic crisis can be attributed to the unfavorable political climate characterized by anomalies, incompetence, crony capitalism, and protectionism.

The elite Rajapaksa political family has been specifically accused of being responsible for decimating the economy. For example, the construction of the Hambantota Harbour and Colombo Port City was alleged to be politically motivated because their chosen locations are known strongholds of the Rajapaksa family. Several critics previously raised concerns about the capacity of these projects to generate revenues for the government.

Sri Lanka eventually leased 80 percent of Hambantota Harbour to China Merchants Port Holdings Company for 99 years for USD 1.12 billion. Reports suggested that this money was not used to pay off debts associated with its construction but was instead added to the foreign reserves and used to repay unrelated foreign debts. The Colombo Port City failed to meet its vision of becoming a hub similar to ports in Dubai and Singapore.

Writing for Foreign Policy, Sri Lankan political analyst Amita Arudpragasam explained that the Sri Lanka economy began to unravel in 2005 when Mahinda Rajapaksa was elected president. The country experienced spectacular economic growth but it was driven by infrastructure projects that were tainted with corruption and lined the pockets of the so-called parasitic class of businesspeople while providing unfavorable returns.

Maithripala Sirisena succeeded Mahinda Rajapaksa when he became president from 2015 to 2019. He was the common candidate of the opposition coalition and his administration saw Sri Lanka achieving its first major primary budget surplus in 60 years in 2017 and another one in 2018. He planned to make reforms needed to make Sri Lankan exports more competitive but political instability ensued and derailed relevant plans.

Mahinda Rajapaksa asserted his political right to be the prime minister. Sirisena sacked then Prime Minister Ranil Wickremesinghe and replaced him with Mahinda Rajapaksa. Critics noted that the Rajapaksa family orchestrated this crisis and upon regaining political capital, they were instrumental in opposing numerous economic reforms needed to stabilize the economy. Gotabaya Rajapaksa, brother of Mahinda, was elected president in 2019.

3. Fiscal Policy Through Tax Cuts and the Subsequent Monetary Policy Through Overprinting of Money

The fiscal policy and monetary policy of the government under the administration of former President Gotabaya Rajapaksa have also been considered the two major causes of the Sri Lanka economic crisis. To be specific, the fiscal policy of his administration prevented the government from generating enough internal revenues needed to repay its foreign debts while its monetary policy has been attributed to be one of the causes of high inflation.

Gotabaya Rajapaksa ran for the presidency in the 2019 national elections under the promises of large tax cuts. Remember that the Rajapaksa family had been opposing several economic reforms such as tax hikes proposed under the Sirisena administration. Nevertheless, during his bid for the presidency, he appealed to the voting public using populist tax reforms that promised significant tax reductions. He won and served as the 8th President of Sri Lanka.

His administration fulfilled its promise. Gotabaya Rajapaksa introduced massive tax cuts in late 2019. These included lowering taxes for wealthy individuals and increasing tax holidays for corporations. His administration also slashed value-added tax from 15 percent to 8 percent while also abolishing seven other taxes. A report published by the International Centre for Tax and Development noted that Sri Lanka had been experiencing declining tax revenues.

The same report contained an explanation from political economist Mick Moore. He said that both the tax cuts in 2019 and the failure to restructure its debt were key contributors to the sovereign debt crisis and the overall economic crisis in Sri Lanka because they compelled creditors to raise their interest rates. The government continued accumulating debts to finance its ongoing and future projects amidst increasing interest rates.

Nevertheless, the populist tax reforms have far-reaching consequences. Data from PublicFinance.lk of the independent think tank Verité Research showed that registered individual and corporate taxpayers declined to 33.5 percent from 2019 to 2020 due to the increase in thresholds for VAT and abolition of Pay As You Earn tax. Additional data showed that the country lost more than half-a-million taxpayers each in 2020 and 2021.

The government was essentially not generating enough revenues from taxes to pay off its debts. To cover its spending, the Central Bank of Sri Lanka started printing money in record amounts against warnings from the International Monetary Fund. By the end of 2022, the central bank added a total of 432.76 billion Sri Lankan rupees in circulation. The excess money supply is a key contributor to the rising inflation rates in the country.

Increasing the money supply erodes the value of the local currency while raising the prices of essential goods and services. Simply put, when there is more money in circulation, the law of supply and demand dictates that more people have the means to chase a limited number of goods and services. This phenomenon has also been observed in Venezuela and Zimbabwe which have experienced record-breaking hyperinflation due to overprinting.

4. Rushed Transition to Organic Farming and the Resulting Collapse of the Agriculture Sector

Another major blunder committed under the administration of Gotabaya Rajapaksa was the ill-conceived reforms in agriculture. Note that Sri Lanka had a productive and stable agriculture sector. It had been self-sufficient in rice production. Furthermore, it is one of the major sources of important agricultural products in the global market such as tea, rubber, and coconut. These three exports are a critical source of foreign exchange reserves.

However, in April 2021, the government announced that it would ban the importation of inorganic fertilizers and other chemicals used in farming in its attempt to shift to organic farming and become the first country in the world to promote and implement the use of organic and natural chemicals in food production. Some analysts noted that this was motivated in part by the need to preserve foreign exchange reserves by reducing dependence on imports.

Members of the scientific and farming communities earlier warned that the ban on inorganic fertilizers and other chemicals can lead to a possible collapse of the agriculture sector. True enough, rice production dropped by 20 percent within the first six months while reversing rice self-sufficiency and forcing the country to import rice for USD 450 million. Tea production also dropped and resulted in economic losses of around USD 425 million.

The abrupt transition to organic farming was disastrous. Prices of food products increased and food shortages ensued. The foreign exchange reserves depleted further as the government tried to import food products to address the shortages. Farmers were left with no income to buy necessities. The government abandoned its shift to organic farming in November 2021 but the damage to the agriculture sector was already done.

5. Impacts of the Global COVID-19 Pandemic and Russia-Ukraine Conflict on the Sri Lanka Economic Crisis

Major global events such as the global COVID-19 pandemic that began in the first quarter of 2021 and the conflict between Russia and Ukraine that escalated in February 2022 have also been considered important factors in understanding and explaining the causes of the economic crisis in Sri Lanka. Note that these two events have also affected several economies across the world, including the economics of developed countries.

It is important to reiterate the fact that Sri Lanka was already in its fragile state as early as 2019. However, the emergence of the novel coronavirus in China and its subsequent spread in different parts of the globe further decimated its weakened economy. For starters, its tourism sector, which was set to recover from the impacts of the 2019 Easter Bombings, declined further due to the suspension of international flights that barred foreign tourists.

Major financial markets were also affected. The Colombo Stock Exchange experienced an eight-year low in March 2020 and trading was halted for at least 30 minutes on 13 March 2020. Findings from a before-and-after study by A. M. A. Jayawardena, P. A. S. Madhubhashini, and U. H. S. L Bandara showed that the Sri Lankan stock market became more inefficient after the first wave of the pandemic spanning from the first quarter of 2020.

Other macroeconomic indicators were also unfavorable. The Sri Lankan rupee depreciated against the United States dollar to 191.99 on 27 March 2020 and depreciated further to 200.47 on April 8 of the same year. The contribution of the tourism sector to the GDP dropped from 5.6 percent in 2018 to 0.8 percent in 2020. The unemployment rate increased by 0.7 percent and the economy contracted by 3.6 percent during the same year.

The global economy eventually reopened in the second quarter of 2021 after vaccines became available and as communities acclimatized to living amidst the pandemic. Several economies experienced a considerable level of rebound. However, in Sri Lanka, hopes for a possible recovery of its economy dampened when the Russia-Ukraine conflict escalated to a full-blown invasion of Ukraine by the Russian Armed Forces in February 2022.

Russia is the second largest market of Sri Lankan tea exports and the tourism sector is heavily dependent on tourist arrivals from both Russia and Ukraine. The economic sanctions in Russia have fueled global energy and food crises. The prices of oil and gas in the global market have increased alongside shortages and price hikes in food imports. Major industries and sectors from food production to manufacturing in Sri Lanka are dependent on oil and gas.

A Rundown and Note on the Causes of the Sri Lanka Economic Crisis

Sri Lanka is undergoing its worst economic crisis since gaining independence in 1948 and the government has declared a major economic crisis in September 2021. Inflation hit a record high of 54.6 percent in July 2022 while the prices of food rose to 81 percent. There is a shortage in supply of essential goods and services including life-saving medicines and medical equipment, oil and gas for transportation, and electricity.

The worsening economic crisis has compelled citizens to launch a series of protests beginning in March 2022. Protesters took to the streets to call down the resignation of Gotabaya Rajapaksa and other government officials. They stormed down the official residence of the President of Sri Lanka on 9 July and also broke into the private residence of Prime Minister Ranil Wickremesinghe on 13 July and set it on fire.

Rajapaksa resigned from office on 14 July 2022. The Rajapaksa family has been considered responsible for the economic crisis in Sri Lanka. The economic mismanagement and leadership incompetence that began in 2005 during the term of former President Mahinda Rajapaksa and persisted throughout the succeeding presidencies of Maithripala Sirisena and Gotabaya Rajapaksa have alleged far-reaching consequences.

Of course, the cause of the Sri Lanka economic crisis is a mixed bag of different factors. Major global events such as the COVID-19 pandemic and the Russia-Ukraine conflict, as well as the related 2021-2022 Supply Chain Crisis and 2021-2023 Global Inflation Surge , have indeed worsened the situation. However, remember that the country has been at risk of a probable collapse prior to 2019 due to its mounting debt and ill-conceived socioeconomic agenda.

The accumulation of debt worth billions of dollars has played a central role in the economic crisis. Debt can bring forth substantial economic gains when done right but the approach of the Sri Lankan government proved that excess borrowing and unsustainable spending on projects with little to zero economic value, coupled with policies that do not promote the growth of tradable goods and services, can have disastrous consequences.

FURTHER READINGS AND REFERENCES

- Arudpragasam, A. 2022. “How the Rajapaksas Destroyed Sri Lanka’s Economy.” Foreign Policy . Available online

- International Centre for Tax and Development. 2022. “The Tax Story Behind the Sri Lankan Crisis.” International Centre for Tax and Development . Available online .

- Jayawardena, A. M. A., Madhubhashini, P. A. S., and Bandara, U. H. S. L. 2022. “Efficiency of the Sri Lankan Stock Market During the COVID 19 Period.” International Journal of Trend in Scientific Research and Development . 6(3)

- lk. 2022. “Erosion of the Tax Base: A 33.5% Decline in Registered Taxpayers from 2019 to 2020.” PublicFinace.lk . Verité Research. Available online

- Schwab, K. ed. 2011. The Global Competitiveness Report 2011-2012 . World Economic Forum. ISBN: 978-92-95044-74-6. Available via PDF

- The World Bank. 2016 “Sri Lanka: A Systematic Country Diagnostic.” The World Bank . Available online

- Weerakoon, D., Kumar, U., and Dime, R. 2019. Sri Lanka’s Macroeconomic Challenges: A Tale of Two Deficits . Asian Development Bank. DOI: 22617/WPS190024-2

Worsening economic crisis in Sri Lanka: impacts on health

Affiliations.

- 1 Department of Medicine, University of Sri Jayewardenepura, Nugegoda 10250, Sri Lanka. Electronic address: [email protected].

- 2 University of Colombo, Colombo, Sri Lanka; Department of Medicine, Sabaragamuwa University of Sri Lanka, Belihuloya, Sri Lanka.

- PMID: 35569487

- PMCID: PMC9098208

- DOI: 10.1016/S2214-109X(22)00234-0

Publication types

- Economic Recession*

- Socioeconomic Factors

- Sri Lanka / epidemiology

- TRP for UPSC Personality Test

- Interview Mentorship Programme – 2023

- Daily News & Analysis

- Daily Current Affairs Quiz

- Baba’s Explainer

- Dedicated TLP Portal

- 60 Day – Rapid Revision (RaRe) Series – 2024

- English Magazines

- Hindi Magazines

- Yojana & Kurukshetra Gist

- PT20 – Prelims Test Series

- Gurukul Foundation

- Gurukul Advanced – Launching Soon

- Prelims Exclusive Programme (PEP)

- Prelims Test Series (AIPTS)

- Integrated Learning Program (ILP) – 2025

- Connect to Conquer(C2C) 2024

- TLP Plus – 2024

- TLP Connect – 2024

- Public Administration FC – 2024

- Anthropology Foundation Course

- Anthropology Optional Test Series

- Sociology Foundation Course – 2024

- Sociology Test Series – 2023

- Geography Optional Foundation Course

- Geography Optional Test Series – Coming Soon!

- PSIR Foundation Course

- PSIR Test Series – Coming Soon

- ‘Mission ಸಂಕಲ್ಪ’ – Prelims Crash Course

- CTI (COMMERCIAL TAX INSPECTOR) Test Series & Video Classes

- Monthly Magazine

Srilankan Economic Crisis

- September 6, 2021

UPSC Articles

INTERNATIONAL/ ECONOMY

- GS-2: India and its neighbourhood.

- GS-3: Economic Challenges

Context: Sri Lanka’s government declared an economic emergency amid rising food prices, a depreciating currency, and rapidly depleting forex reserves.

- President Gotabaya Rajapaksa has called in the army to manage the crisis by rationing the supply of various essential goods.

Why is Sri Lanka’s economy in trouble?

A number of factors have led to the current economic crisis in Sri Lanka.

- The tourism industry, which represents over 10% of the country’s GDP and brings in foreign exchange, has been hit hard by the coronavirus pandemic.

- As a result, forex reserves have dropped from over $7.5 billion in 2019 to around $2.8 billion in July 2021.

- With the supply of foreign exchange reducing, the amount of money that Sri Lankans have had to shell out to purchase the foreign exchange necessary to import goods has risen. So the value of the Sri Lankan rupee has depreciated by around 8% so far this year.

- Sri Lanka depends heavily on imports to meet even its basic food supplies. So the price of food items has risen in tandem with the depreciating Sri Lankan rupee.

- The government’s ban on the use of chemical fertilisers in farming (to make the country 100% organic) has further aggravated the crisis by reducing agricultural production

- It is predicted that the forced push towards organic farming could halve the production of tea and other crops and lead to a food crisis that is even worse than the current one

What has been the government’s response to the crisis?

- The Sri Lankan government has blamed speculators for causing the rise in food prices by hoarding essential supplies and has declared an economic emergency under the Public Security Ordinance.

- The army has been tasked with the duty of seizing food supplies from traders and supplying them to consumers at fair prices.

- It has also been given the powers to ensure that forex reserves are used only for the purchase of essential goods.

- The government has refused to end its aggressive push for complete organic farming claiming that the short-term pain of going organic will be compensated by its long-term benefits. It has also promised to supply farmers with organic fertilisers as an alternative.

- Further, Sri Lanka’s central bank in early 2021 prohibited traders from exchanging more than 200 Sri Lankan rupees for an American dollar and stopped traders from entering into forward currency contracts.

Will the government’s response help the economy?

- The President’s drive to make Sri Lankan agriculture fully organic is likely to lead to a significant drop in domestic food production and cause a further rise in prices.

- Also, the various steps taken by the government to tackle the crisis may actually make things worse.

- The capping of food prices, for instance, can lead to severe shortages as demand exceeds supply at the price fixed by the government.

- People have already had to queue up to buy essential goods due to rising shortages.

- The strong-arm tactics of the army can also have unintended consequences. When supplies are seized from traders, there is lesser incentive for them to bring in fresh supplies to the market. This can lead to a further drop in supplies and even higher prices for essential goods.

Government has to take necessary remedial measures so as to prevent the economic crisis turning into socio-political crisis.

Connecting the dots:

- India-Sri Lanka Ties

- Sri Lanka’s India First Policy

- Colombo Security Conclave

For a dedicated peer group, Motivation & Quick updates, Join our official telegram channel – https://t.me/IASbabaOfficialAccount

Subscribe to our YouTube Channel HERE to watch Explainer Videos, Strategy Sessions, Toppers Talks & many more…

Related Posts :

The key to revitalising india’s reservation system, karbi anglong peace accord.

- DAILY CURRENT AFFAIRS IAS | UPSC Prelims and Mains Exam –7th May 2024

- [DAY 56] 60 DAY RAPID REVISION (RaRe) SERIES for UPSC Prelims 2024 – GEOGRAPHY, CURRENT AFFAIRS & CSAT TEST SERIES!

- UPSC Quiz – 2024 : IASbaba’s Daily Current Affairs Quiz 7th May 2024

- 210+ Ranks UPSC CSE 2023 Topper’s from IASbaba – Yet another Year of Outstanding Results!

- UPSC Quiz – 2024 : IASbaba’s Daily Current Affairs Quiz 6th May 2024

- [DAY 55] 60 DAY RAPID REVISION (RaRe) SERIES for UPSC Prelims 2024 – GEOGRAPHY, CURRENT AFFAIRS & CSAT TEST SERIES!

- [Earn 100% Scholarship] Baba’s GURUKUL FOUNDATION Classroom Programme for Freshers’ – UPSC/IAS 2025 – Limited to 75 Students in a Batch – OFFLINE in Delhi. Starts 10th June

- DAILY CURRENT AFFAIRS IAS | UPSC Prelims and Mains Exam –4th May 2024

- [DAY 54] 60 DAY RAPID REVISION (RaRe) SERIES for UPSC Prelims 2024 – ENVIRONMENT, CURRENT AFFAIRS & CSAT TEST SERIES!

- UPSC Quiz – 2024 : IASbaba’s Daily Current Affairs Quiz 4th May 2024

Don’t lose out on any important Post and Update. Learn everyday with Experts!!

Email Address

Search now.....

Sign up to receive regular updates.

Sign Up Now !

- Create new account

- Reset your password

- Translation

- Alternative Standpoint

- HT Parekh Finance Column

- Law and Society

- Strategic Affairs

- Perspectives

- Special Articles

- The Economic Weekly (1949–1965)

- Economic and Political Weekly

- Open Access

- Notes for contributors

- Style Sheet

- Track Your Submission

- Debate Kits

- Discussion Maps

- Interventions

- Research Radio

Advanced Search

A + | A | A -

Sri Lanka’s Debt-restructuring Challenge

The recently proposed domestic debt-restructuring programme in Sri Lanka passes most of the burden of adjustment on to the salary owners and ordinary people while sparing the banking sector and treating international creditors and individual domestic creditors very generously. It provides a fertile ground for public resentment and discontent against stabilisation and structural adjustment reforms.

The author gratefully acknowledges incisive comments and suggestion made on the draft article by Sisira Jayasuriya who is a professor at Monash University.

Sri Lanka’s attempt to come out of its worst economic crisis since independence with reforms under the four-year Extended Fund Faculty (EFF) programme has entered a new phase with the announcement of the domestic debt-restricting plan on 29 June 2023.

Dear Reader,

To continue reading, become a subscriber.

Explore our attractive subscription offers.

To gain instant access to this article (download).

(Readers in India)

(Readers outside India)

Your Support will ensure EPW’s financial viability and sustainability.

The EPW produces independent and public-spirited scholarship and analyses of contemporary affairs every week. EPW is one of the few publications that keep alive the spirit of intellectual inquiry in the Indian media.

Often described as a publication with a “social conscience,” EPW has never shied away from taking strong editorial positions. Our publication is free from political pressure, or commercial interests. Our editorial independence is our pride.

We rely on your support to continue the endeavour of highlighting the challenges faced by the disadvantaged, writings from the margins, and scholarship on the most pertinent issues that concern contemporary Indian society.

Every contribution is valuable for our future.

- About Engage

- For Contributors

- About Open Access

- Opportunities

Term & Policy

- Terms and Conditions

- Privacy Policy

Circulation

- Refund and Cancellation

- User Registration

- Delivery Policy

Advertisement

- Why Advertise in EPW?

- Advertisement Tariffs

Connect with us

320-322, A to Z Industrial Estate, Ganpatrao Kadam Marg, Lower Parel, Mumbai, India 400 013

Phone: +91-22-40638282 | Email: Editorial - [email protected] | Subscription - [email protected] | Advertisement - [email protected]

Designed, developed and maintained by Yodasoft Technologies Pvt. Ltd.

Wednesday May 08, 2024

Group News Sites

Dailymirror

Sunday Times

Tamil Mirror

Middleast Lankadeepa

Life Online

Home delivery

Advertise with us

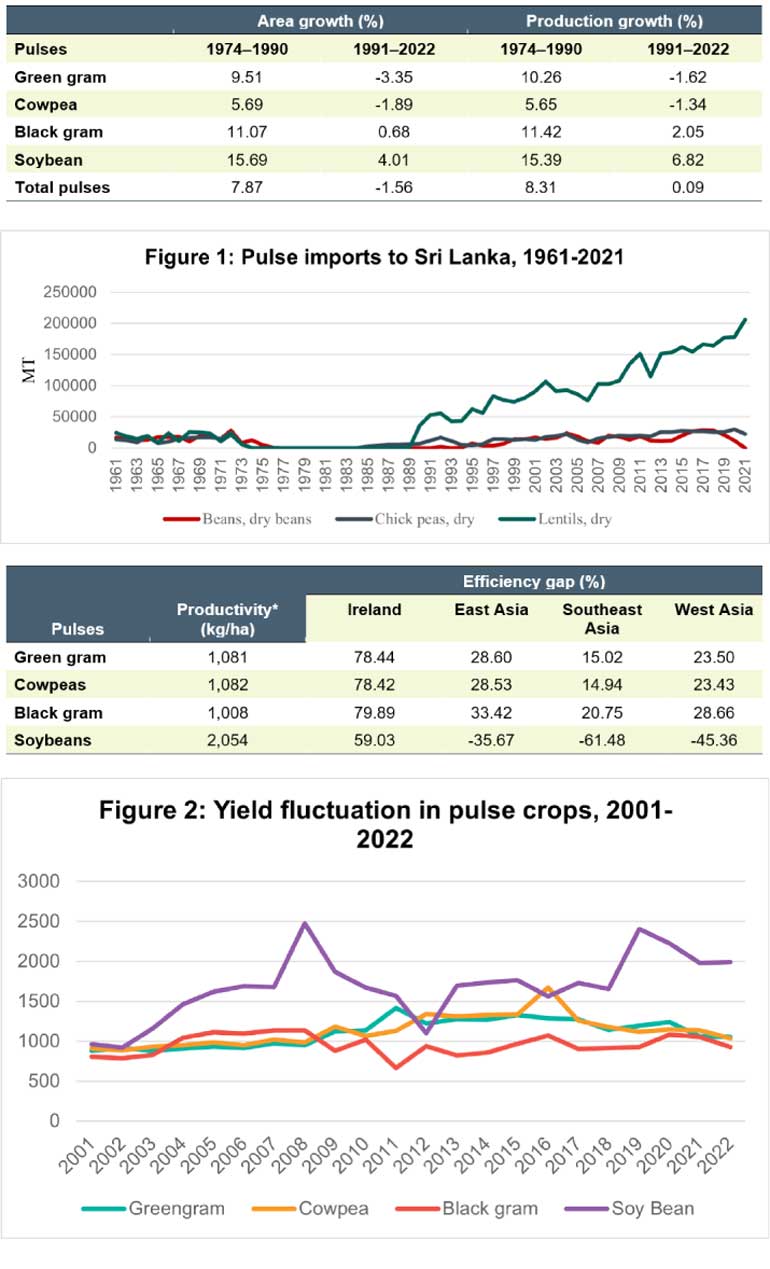

Measuring the pulse of pulses: Improving food security in Sri Lanka

Wednesday, 8 May 2024 00:18 - - {{hitsCtrl.values.hits}}

- the Sri Lankans who are recovering from the economic crisis has been severely affected by their food coping strategies

- Pulses, which are high in the quality and quantity of protein, make up only 8% of the nation’s protein intake

- Sri Lanka depends significantly on pulse imports, yet there is a sizeable gap in the total pulse supply to meet the dietary needs of the population

- Given the current level of pulse production in Sri Lanka, the immediate goal should be to improve local production gradually while filling gaps in supply to achieve dietary requirements through imports

- Long-term strategies must focus on coordinated efforts involving policy support, research and extension, and market and demand considerations

(Dr. Kiruthika Natarajan is an Assistant Professor at the Tamil Nadu Agricultural University in Coimbatore, India and a Visiting Researcher at the International Food Policy and Research Institute (IFPRI), Washington, DC, USA. Her research interests and expertise include Rural Development, Agricultural Development, Food Security, Climate Change, and Impact Assessment. She has a PhD from the Tamil Nadu Agricultural University in Coimbatore, India.)

Dr. Manoj Thibbotuwawa is a Research Fellow at IPS with research interests in agriculture, agribusiness value chains, food security, and environmental and natural resource economics. He holds a BSc (Agriculture) with Honours from the University of Peradeniya, an MSc (Agricultural Economics) from the Post-Graduate Institute of Agriculture at the University of Peradeniya, and a PhD from the University of Western Australia.) (Dr. Suresh Babu is a Senior Research Fellow and the Head of Learning and Capacity Strengthening at the International Food Policy Research Institute (IFPRI) in Washington DC, USA. His research includes human and organisational strengthening of food policy systems, policy processes, and agricultural extension in developing countries. Over the past 23 years at IFPRI, Dr. Babu has been involved in institutional and human capacity strengthening for higher education and research in many countries in South Asia and sub-Saharan Africa. He earned both his master’s degree and PhD in Economics from Iowa State University, Ames, Iowa.)

Sri Lanka's Economic Crisis: A Brief Overview

- A.S. Hovan George Masters IT Solutions, Chennai, Tamil Nadu, India

- A. Shaji George Director, Masters IT Solutions, Chennai, Tamil Nadu, India

- T. Baskar Professor, Department of Physics, Shree Sathyam College of Engineering and Technology, Sankari Taluk, Tamil Nadu, India

Sri Lanka's economic crisis, which began three years ago, has resulted in great hardship for the people and has posed the greatest challenge to the government. Lanka is currently experiencing an economic and political crisis, which continues with high inflation and sporadic demonstrations throughout the country. The government of Sri Lanka requests citizens abroad to send home cash 13 Lankan banks have been placed on rating watch negative Sri Lanka defaults on $51 billion in external debt. Trouble is brewing on the island paradise. There is no food available. Sri Lankans have fallen into poverty by at least 500,000 in the last few months. There is no fuel, no medicines, and critical surgeries are being cancelled. According to doctors, the economic crisis may cause more deaths in Sri Lanka than COVID did. There are daily power outages and large-scale protests in the streets. The absence of power and the inability to obtain safe drinking water has resulted in significant difficulties in the provision of emergency health services. The safety net programmes have been interrupted. The situation in Sri Lanka is much more than just an economic crisis. Clearly, this is a humanitarian crisis. The question is, how did it occur, and how did the government of Lanka lose all of its money? The purpose of this research paper is to answer these questions. In addition, the author of the paper outlines a comprehensive analysis of the issue as well as the causes of the economic crisis.

How to Cite

- Endnote/Zotero/Mendeley (RIS)

Current Issue

Make submission, publication information.

ISSN : 2583-5602

Publisher: PU Publications

Publication Format: ONLINE

Language: English

Publication Establishment Year: January, 2022

Frequency of Publication: Quarterly

eMail: [email protected]

© Copyright 2022 - 2023 PUIRJ | PU Publications . ALL RIGHTS RESERVED. WEB PARTNER: AUSOM DIGITAL

Tuesday, 22 Jan 2019 --> Last Updated : 2024-05-08 00:01:00

Group News Sites

Sunday Times

Tamil Mirror

Middleast Lankadeepa

Life Online

Home delivery

Advertise with us

Mobile Apps

Wed, 08 May 2024 Today's Paper

LRT Project : Sri Lanka keen but Japan not

6 May 2024 08:10 am - 0 - {{hitsCtrl.values.hits}}

Gotabaya Rajapaksa government cancelled the project

- Gotabaya Govt. scrapped the $1.5 billion LRT project for Colombo citing the high cost

- Any LRT project with Japan will depend on future debt sustainability of Sri Lanka

- As a result scrapped project will not resume after debt restructuring