- Skip to main content

- Skip to primary sidebar

Business Jargons

A Business Encyclopedia

Definition : Cheque refers to a negotiable instrument that contains an unconditional order to the bank to pay a certain sum mentioned in the instrument, from the drawer’s account, to the person to whom it is issued, or to the order of the specified person or the bearer.

Parties to Cheque

Basically, there are three parties to a cheque:

- Drawer : The person who draws the cheque, i.e. signs and orders the bank to pay the sum.

- Drawee : The bank on which the cheque is drawn or who is directed to pay the specified sum written on the cheque.

- Payee : The beneficiary, i.e. to whom the amount is to be paid.

Apart from these three, there are two more parties to a cheque:

- Endorser : When a party transfers his right to take the payment to another party, he/she is called endorser.

- Endorsee : The party in whose favour, the right is transferred, is called endorsee.

Sometimes, the drawer and payee can be the same person, when the drawer writes a self-cheque.

Types of Cheque

- Open Cheque : Otherwise called as uncrossed cheque, it is one on which cash is payable at the counter of the bank, or it is transferred to the bank account of the person whose name is written on the cheque. It is negotiable, i.e. it is transferable in nature.

- Bearer Cheque : Bearer cheque refers to the cheque which can be encashed by the person whose name is written on the cheque or anyone who presents the cheque before the bank for payment. It is negotiable in nature, which can be transferred by simply delivering it and so endorsement is not needed. No identification of the presenter or holder is required in case of a bearer cheque.

- Order Cheque : As the name suggests, it is the cheque which becomes payable to the person or organization whose name is specified on the cheque or to his order. To convert a bearer cheque into an order cheque, the word ‘or bearer’ is stricken off from the cheque. Endorsement of the cheque to the third party is done by simply signing on the cheque.

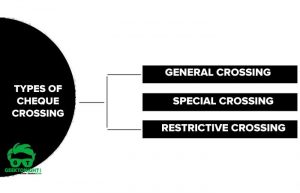

- Crossed Cheque : You might have observed, two transverse parallel lines at the top left corner of some cheques, which may or may not have the words – & Co., A/c payee or Non-Negotiable. Such cheques are regarded as crossed cheques. The amount on such cheques is credited to the account of the payee.

- Self Cheque : When a person wants to withdraw money from his own account, by writing ‘self’ at the name of the payee, is called self-cheque. Do not cross the cheque or cancel the words ‘or bearer’ from the cheque. These cheques should not be crossed, as well as the words ‘or bearer’ should not be stricken off from the cheque, so that any person as your representative can receive the amount on your behalf.

- Blank Cheque : A cheque which is only signed, but the name of the payee and date is not indicated, is called a blank cheque. Such cheques can be made account payee, and the maximum limit of withdrawal can be mentioned.

- Stale Cheque : A cheque bears a date and is valid up to three months of the stated date. If a cheque is presented before the bank, after the expiry of the reasonable period, i.e. three months after the date, then it is called stale cheque.

- Post-Dated Cheque : When a cheque is drawn containing a future date, it is called post-dated cheque. In such cases, money will not be payable by the bank before that date.

- Ante-dated Cheque : A cheque containing a prior date, is called an ante-dated cheque. Bank honours cheques until three months to the date mentioned.

- Banker’s Cheque : Otherwise called a pay order, it is a non-negotiable instrument, which is issued by the bank on behalf of the customer, which is payable in the same city.

- Cancelled Cheque : Due to any kind of mistakes while writing the cheque, it is cancelled, and so it is called cancelled cheque.

- Mutilated Cheque : A cheque which is torn, damaged, crushed or washed, is called a mutilated cheque. Such cheques are honoured only when certain details are visible, after confirming with the drawer.

- Traveler’s Cheque : A cheque issued by a bank for a fee, containing a fixed amount. These cheques are enchased or used to make payment in a foreign country, after endorsement by the signature of the holder.

- Gift Cheque : Cheques that are used for the purpose of gifts and prizes, usually very large in size, are called Gift Cheques. Banks charge a fee for issuing such cheques.

Cheque includes both electronic image of a truncated cheque and a cheque in electronic mode.

Related terms:

- Cheque Truncation System

- Traveler’s Cheque

- Promissory Note

- Bill of Exchange

- Concentration Banking

Reader Interactions

joseph amadu bangura says

February 20, 2020 at 9:01 am

Hey! I appreciate your write-ups, they are really helpful.

Ezeanyagu Praise says

January 19, 2021 at 3:35 am

Yes they are very fantastic

multidioblog says

April 6, 2020 at 2:05 pm

priyanka says

September 15, 2020 at 9:21 am

can i please get the name of the author?

Surbhi S says

September 15, 2020 at 9:44 am

The author of this article is Surbhi S.

Vinod ekhellikar says

January 25, 2021 at 8:22 am

Great knowledge u have, nd in simple language u have explained.

Rabiu Mardyah says

October 12, 2020 at 10:14 pm

I really appreciate your write-up 👊👊

Brimo Meek says

November 10, 2020 at 8:56 pm

Thanks very much It really helpful 👍

Shantel Madamombe says

March 18, 2021 at 1:37 am

Thank you so much….. Really helpful

Dennis says

June 16, 2021 at 11:34 pm

AMULYA says

July 3, 2021 at 10:15 pm

Beautifully explained Ma’am. Thank You

Ayomikun Felix says

July 7, 2021 at 12:34 am

Thank you very much, I really appreciate

Aliyu Dikko says

October 23, 2021 at 11:33 pm

Sincerely the write-up is okay and educative. kudos to both the author and everyone involved in sharing this with the general public. Thanks a lot.

Praise says

May 23, 2023 at 11:59 pm

Wow so amazing

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- CROSS-BORDER PAYMENTS

- CREDIT TRANSFERS

- DIRECT DEBITS

- LIST OF ALL SWIFT MESSAGES TYPES

- PAYMENT COURSES

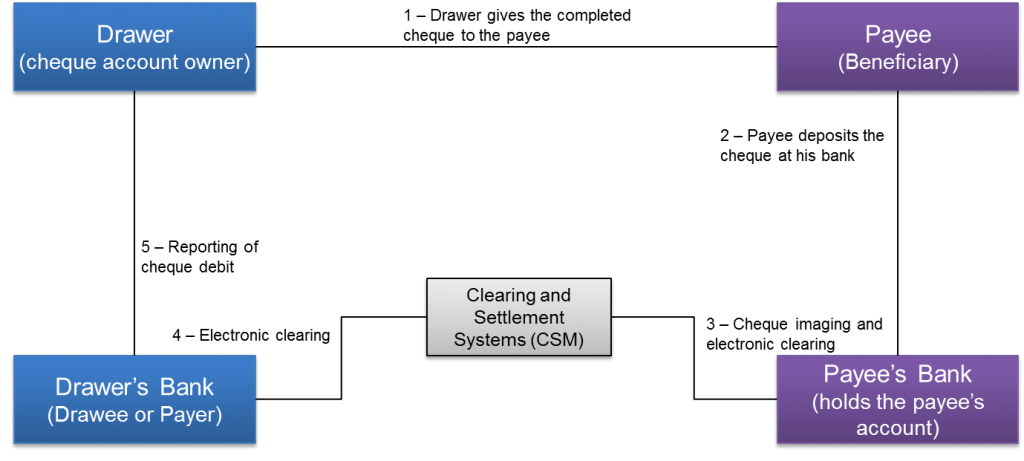

The Four Corner Model for cheque payment

After introducing the cheque (check in US english) in the previous article, the next question to explore is: how does cheque payment work? To answer this question, we will use one of the precious tools to analyze a mean of payment: the Four Corner Model.

The diagram below shows the Four Corner Model for cheque payment. On the left side, you see the drawer and his bank and on the right side, the payee and his bank. One additional actor that was not mentioned in the cheque definition (See previous article) appears: the beneficiary’s bank. It plays a major role in the cheque processing circuit, as we will see below.

Now let’s look at what happens from the time the cheque is issued by the drawer until it is paid to the beneficiary.

1- The drawer fills in the cheque form by writing the name of the payee, the amount, the date and place of issue. Then he signs it and hands it to the payee.

2- The beneficiary endorses the cheque by adding his name, account number and signature on its back and deposits it with his bank for collection. If it is allowed by the country regulation, the beneficiary may create an image of the cheque with a mobile banking app, saving a trip to the branch.

3- The payee’s bank checks, sometimes manually, that the cheque is correctly filled in before processing it. It usually credits the payee’s account the same day or the next day depending on the time when the cheque was received. The payee’s bank then performs the cheque imaging which consists in taking electronic images of cheques and capturing related information electronically for the purpose of presentation to drawee banks and clearing. In some countries (France for example), the captured information is enough for the cheque clearing. In others (Hong Kong for example), both image and captured information are required. In any case, Cheque imaging avoids the need to make physical presentation of cheques to drawee banks thereby making the clearing and settlement process faster and more efficient. The payee’s bank presents the image of the cheque to the drawee (drawer’s Bank) through a national cheque clearing system. Since the payee’s account is credited on the same day or a day later, the payee’s bank clears the cheque to recover of the funds already credited to the beneficiary. Remark: If drawer and payee are customers of the same bank, there is not need to go through a clearing system. An internal book transfer is sufficient.

4- The drawee (drawer’s bank) receives the image of the cheque to be collected, carries out a number of controls including the balance check and debits the drawer’s account for the amount indicated on the cheque if all the controls are OK. The cheque can bounce if there is insufficient balance on the drawer’s account. In that case, the drawee informs the beneficiary bank by sending him a reject message. The payee’s bank then debits the funds initially credited to the beneficiary. A cheque rejection can have drastic consequences in certain countries and even lead to suspension of banking privilege. Remark: Depending on the case, a bank may reject the cheque immediately or waits for many days before initiating a rejection. The deadline for cheque rejection differs per country. The funds are definitely for the payee only when the rejection deadline is passed and the payee’s bank has not received any rejection.

5- The bank informs the drawer that his account has been debited for the payment of the cheque. It can be through e-mail, SMS or account statement. It depends on the agreement between the bank and his customer.

Before ending this article, a few more words on cheque imaging. Cheque imaging has become the standard in many countries because it reduces the cost of cheque processing and clearing significantly. Before image clearing, the physical cheque has to be presented to the drawee bank to collect the funds. This required sending the cheques through the post and could take many days before a cheque is presented. Nowadays a cheque can be issued, presented and clear the same day thanks to cheque imaging.

Now that we know how a cheque payment works, we can look at the different types of cheques that exist. That will be the topic of our next article.

RELATED ARTICLES

The different types of bank cheques, cheque: what is it, direct and indirect participants to clearing and settlement systems.

May I know how does the drawer present the cheque to the drawee, is it normally done by cheque imaging ?

Hi Peter, You are right. it is the beneficiary bank that presents the cheque to the drawee. In many countries, it is not required to present the physical cheque anymore. The beneficiary bank presents just an image of the cheque to collect the funds.

Can we get a real business scenario for cheque and how it’s clearing happen . I have worked in high value and low value payment side .I want to get some insight for cheque processing as well . Also which format file is used for image processing , i believe its x9?

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

MOST POPULAR

Psd2 and the new generation of third-party providers, differences between sepa, swift and uk faster payments, sepa payments schemes, instruments, initiatives and messages standards, how corporations use the swift mt101 request for transfer, swift serial and cover payments.

Phone : +33 6 42 23 96 63 Email : [email protected] Address : 350 Rue Lecourbe , 75015 Paris

Useful Links

- Online courses

- Training calendar

Copyright ©2022 - Paymerix - All rights reserved | Privacy Policy | Terms and Conditions

Privacy Overview

519-787-1162

- Large Print

Large Presentation Cheques – What They Are, When to Use Them and Examples

At AlphaGraphics we design and print large presentation cheques which are an excellent way to show your appreciation to your sponsors, donors, or customers. These cheques come in a large size that is 47″ x 20″.

Large presentation cheques are the perfect way to make an impact on your audience or give to someone in honor of an accomplishment or milestone. These cheques come in all different sizes and can be used for any kind of event or cause – no matter how big or small.

They are great giveaways at conferences, trade shows, gala dinners, fundraisers, charity events and more! A big presentation cheque has the ability to really get your message across as well as making a lasting impression on everyone who receives one (or everyone who sees it being handed out). So what are you waiting for?

What are large presentation cheques?

Big presentation cheques are a great way to kick off an event. A large presentation cheque can be used for business investments or charity fundraisers or even as giveaways at trade shows. Big presentation cheques make a large impression on everyone in attendance of your event. It’s also great as an ice breaker activity if you’re having trouble getting people talking at your event. People will love posing with their new souvenir snapshot!

Why large presentation cheques?

If you’re considering giving away a big presentation cheque for your business, charity or event, you might wonder what value it brings. Large presentation cheques are not often used in general business transactions, but they’re useful for specific types of occasions. As such, there is no one size fits all approach when it comes to deciding whether large presentation cheques are right for your needs or not. However below we have collected some of their most common uses and how businesses can benefit from them.

Big Presentation Cheque Examples

Where to get large presentation cheques?

Sure you can visit your local Staples or contact us who specializes in Big Presentation Cheques and we can help you get your custom large cheque ready and shipped in time for your event anywhere across Canada.

Leave a Replay

Recent Posts

Tear drop flags vs feather flags, are vinyl banners a good option for outdoors, effective sidewalk signage: how to attract more foot traffic, how can we help.

- Select options

Big Cheques

Vehicle Magnets

Trailer Wraps

Sign up for our newsletter.

Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit

Sign up for Newsletter

Signup for our newsletter to get notified about sales and new products. Add any text here or remove it.

- Business Cards

- Leaflets and Flyers

- Booklet & Brochures

- Letterheads

- Compliment Slips

- Presentation Folders

- Folded Flyers

- Restaurant Menus

- Small Posters

- Notepads and Deskpads

- Duplicate & Triplicate Books

- Shelf Wobblers

- Invitations

- Large Posters

- PVC Banners

- Rigid Media

- Canvas Printing

- Self Adhesive Vinyl

- Magnetic Signage

- Forecourt Overbags

- Waterproof Posters

- Backlit Lightbox Posters

- One Way Vision

- Fabric Posters

- Presentation Cheques

- Selfie Frames

- Roller Banners

- Roll Up Banners

- Fabric Media Wall

- Feather Flags

- Counter Displays

- Plotted Sticker Printing

- Shaped Labels on Sheets

- Sticker Printing – Indoor

- Wall Calendars

- Year Planners

- Tent Calendars

- Flip Tent Calendars

- Christmas Cards

- Gift Vouchers

- Invitations and Tickets

- Graphic Design

- Health & Safety Printing – Social Distancing

Kaizen Print Inspire & Support Blog

Shining a light on the presentation cheque.

At the centre of a press conference celebrating a donation is the presentation cheque. The presentation cheque is largely taken for granted. However, it is at the centre of many large marketing campaigns so its importance can’t be understated no matter how symbolic the gesture is.

What Is a Presentation Cheque?

A presentation cheque I a ceremonial presentation, primarily for a press conference and for a photo shoot. The cheque is amplified to an exaggerated size for maximum effect. Above all, the size amplification gives the audience visibility to the presented details. There’s little use or effect when one holds up a regular size cheque from one’s pocketbook. For instance, big charity cheques are often seen at fundraising events, such as Children In Need or Sports Relief. Presentation cheques give legitimacy to charities and their fundraising efforts and activities.

Make a Visual Impact

Incorporating a big presentation cheque into a Public Relations photo makes a massive visual impact. Physically, the sheer size has an impact. In addition, the content of the cheque must be on the same scale if presented in such a form. For instance, you are not going to make a huge cheque out of a minimal donation or prize. Therefore, this presentation cheque demands full attention.

Presentation cheques can be used across all digital marketing channels. In addition, it can be utilised in traditional media including local press or any relevant trade publications. You may also want to include the image in any communications with those that donated to your group.

Presentation Cheque Uses

Charities are mainly associated with the Presentation cheque. However, they do have uses that reach beyond charitable donation announcements. Here are some of the uses of large presentation cheques.

- Charitable Donations

- Employee Bonus

- Tournament or Content Prizes

- Large Sales Promotions

- Business Awards

- Gift Representations

- Presentations to Staff

- Display Purposes

Kaizen Print Will Present a Cheque to You

Kaizen Print is one of the leading suppliers of customisable cheques in Belfast, Omagh and throughout Northern Ireland. Groups and organisations throughout Northern Ireland, the UK and Ireland use Kaizen Print for their promotional campaigns. We specialise in creating bespoke branded presentation cheques for businesses, charitable groups and organisations across the UK and Ireland. Let Kaizen Print hep you highlight your fundraising efforts or however you may need to use a presentation cheque.

Cheque Options

Kaizen Print offers you two options when printing your presentation cheque: Paper or on 3mm Foamex with laminated vinyl onto a rigid board. The option to design your own cheque is available. However, our standard design template is also an option and it is available for free.

We usually send the cheques out blank so you can fill in the details yourself with a marker. However, we also offer to print the information to fill out the presentation cheque.

Cheque Formats

Kaizen Print offer you two different format options to choose from, each with their own unique benefits.

Mounted Vinyl Cheques – These are printed on self-adhesive vinyl, laminated and mounted onto a rigid foam board. These mounted cheques are of the highest quality. In addition, they are durable and will last because of the materials used. They can be used repeatedly if treated with care and in addition, they can be cleaned with a cleaning solution. In addition, these cheques are delivered with special care utilising bubble-wrap, therefore ensuring they are delivered in a condition built to last.

Large Paper Cheques – These are perfect for those working with a limited budget. These cheques are printed on matt coated paper and are generally used for single use. In addition, bespoke sizes are also available, as they can be printed in sizes p to 1.3m tall and by virtually any length.

Ordering Your Presentation Cheque from Kaizen Print

Kaizen Print helps numerous businesses and organisations throughout Belfast, Omagh and throughout Northern Ireland with striking bespoke presentation cheques. We offer practical tips and advice when it comes to your design. We are proven experts when it comes to outstanding print results. Our exacting standards and dedication to only the best quality at the best value make us the ideal supplier for your business printing needs. To find out more about how we can help you with your presentation cheque, please get in touch via our contact form or by calling 028 9002 2474.

Please Note Before Ordering

Our presentation cheques are shipped in allotted time-frames after the artwork approval. In other words, please ensure a prompt reply to the artwork team to ensure you cheques are delivered in a timely manner and dazzle your audience.

Michael Gallagher

Get Help 24/7

77728 77729.

All About Cheques: Types, Usage, and Benefits

In the world of financial transactions, people have used cheques as a fundamental instrument for centuries. The modern form of cheques originated in Middle English during the 17th century. Originally, people used simple paper documents to transfer money from one party to another. Today, cheques have undergone significant transformations and come in various types to cater to different financial needs.

Unveiling Cheques: A Comprehensive Introduction

In the realm of financial transactions, people have long regarded cheques as versatile and trusted instruments. These pieces of paper, often adorned with a person’s or an entity’s name, carry with them the power to transfer money, settle debts, and facilitate commerce. The cheque, a financial artifact with a history spanning centuries, continues to play a crucial role in modern banking, even in an age of rapid digitalization.

A cheque, in its simplest form, is a written order that an account holder issues instructing a financial institution to pay a specified sum of money to a designated individual or entity. This seemingly straightforward piece of paper embodies a multitude of features, functions, and nuances, making it a cornerstone of the financial world.

In this comprehensive exploration of cheques, we will delve into their various types, their common uses, the benefits they offer, as well as the challenges they face in an era of electronic payments and digital currency. We will also consider their historical evolution and the critical role they continue to play in our financial lives. So, let’s embark on a journey to uncover the intricacies of cheques and appreciate their enduring significance in the ever-evolving landscape of finance.

Types of Cheques

1. bearer cheque :.

A bearer cheque is one of the most common types of cheques, and it pays to the person who possesses it. It doesn’t require the issuer to name the recipient in the cheque, making it a convenient form of payment. However, people need to handle bearer cheques with caution, as they can easily cash them if they get lost or stolen.

2. Crossed Cheque :

Cheques have two parallel lines drawn across the face of the cheque, with or without the addition of the words “Account Payee.” This crossing signifies that the issuer does not allow the cheque to be payable in cash at the bank counter but insists that it must be deposited into the payee’s bank account. Crossed cheques are a safer option for making payments, reducing the risk of loss or theft.

3. Post-Dated Cheque :

People can use a post-dated cheque for future payments, loan repayments, or to secure a transaction while ensuring the availability of funds at the specified time. It carries a future date, meaning it cannot be cashed until that specific date arrives.

4. Blank Cheque :

People leave a blank cheque with essential information like the date, payee, and amount left blank. This type of cheque is highly risky and should be used with utmost caution. It can lead to unauthorized withdrawals or fraud if someone mishandles it.

5. Substitute Cheque :

Substitute cheques, also known as image replacement documents, represent digital versions of paper cheques. People commonly use them in cheque truncation systems, which facilitate quicker cheque clearance by eliminating the need for physically transferring paper cheques between banks.

6. Non-CTS Cheques :

Older paper cheques that do not adhere to the standardized format required for electronic processing are known as non-CTS (Cheque Truncation System) cheques. Many banks no longer accept non-CTS cheques due to the time-consuming and error-prone manual processing involved.

Common Usage and Benefits

Cheque payments have various common usages and benefits:

1. Safe and Secure :

Crossed cheques provide a secure way to transfer funds as they require the payee to have a bank account. This reduces the risk of cash theft and fraud.

2. Record Keeping :

Cheques offer a paper trail of transactions, aiding in record-keeping for both individuals and businesses. This documentation can be useful for financial professionals and tax purposes.

3. Flexible Payment Timing :

People use post-dated cheques to agree on payment dates that align with their financial situation, providing flexibility and assurance in transactions.

4. Universal Acceptance :

Cheques are widely accepted as a form of payment, ensuring that people can use them for various financial transactions, from paying bills to buying goods and services.

5. Credit Interest Calculation :

Many savings and chequing accounts offer interest on the account balance. Depositing cheques allows account holders to earn credit interest over a period of time.

Challenges and Decline in Usage

Despite their advantages, cheques face some challenges in the modern era:

1. Cheque Clearing Times :

Paper cheques can take several days to clear, delaying access to funds compared to electronic payment methods like online banking and mobile banking.

2. Risk of Fraud :

Blank cheques and mishandled bearer cheques can lead to fraud or unauthorized withdrawals, making it imperative for people to handle cheques responsibly.

3. Costs and Service Charges :

Some banks impose additional charges for cheque leaves or cheque-related services, which can add to the cost of using cheques.

The Role of Technology

With the rise of online banking, electronic payment methods, and standardized bank transfer orders, people have witnessed a decline in the usage of cheques in recent years. Many financial institutions, including the Reserve Bank of India, Bank of Baroda, ICICI Bank, and IDFC FIRST Bank, have embraced digital alternatives to streamline financial transactions.

The Future of Cheques

While cheques may no longer be the primary method of payment, they continue to serve a valuable role in certain situations. Responsible borrowing and timely repayment remain key factors in ensuring cheques remain a reliable and secure method of financial transaction.

In Conclusion: Cheques’ Enduring Legacy

In conclusion, people have used cheques as a fundamental financial instrument for centuries, and they have evolved to meet modern banking needs. Cheques offer a secure, reliable, and versatile form of payment, but their usage has declined with the emergence of electronic payment methods. As financial professionals advocate for responsible borrowing and timely repayment, cheques will continue to find their place in a world where digital and paper-based financial transactions coexist.

In this comprehensive exploration of cheques, we have journeyed through time, examining the various types, unraveling their common uses, and uncovering the myriad benefits they offer. As we now conclude this journey, it becomes abundantly clear that cheques, despite the relentless march of the digital age, have not lost their relevance or significance in the world of finance.

Cheques: An Evolutionary Tale

Cheques, originally rooted in history, have evolved with the ever-changing financial landscape. From their humble origins in Middle English as mere pieces of paper representing monetary promises, they have transformed into sophisticated financial instruments designed to cater to diverse needs. We have explored how individuals issue bearer cheques, use crossed cheques, employ post-dated cheques, manage blank cheques, engage with substitute cheques, and deal with non-CTS cheques, each fulfilling unique purposes and carrying its set of advantages and precautions.

Common Usage and Enduring Benefits

Despite the proliferation of electronic payment methods, cheque payments continue to offer a plethora of advantages. They provide a secure and universally accepted means of transferring funds, ensuring both safety and convenience. The ability to meticulously record transactions on paper serves the needs of individuals and businesses alike. Parties can flexibly time their transactions with post-dated cheques, promoting financial planning and trust in commercial dealings. Moreover, the interest accrued through credit interest calculation on cheque deposits adds an additional layer of financial benefit to those who utilize this traditional instrument.

Challenges and Adaptation

It is important to acknowledge the challenges cheques face in the contemporary financial landscape. Lengthy cheque clearing times and the risk of fraud, especially when dealing with blank cheques, are valid concerns. Additionally, some financial institutions impose service charges for cheque-related services, which can impact the cost-effectiveness of using this form of payment. These challenges have contributed to a decline in cheque usage, particularly as more efficient electronic payment methods have emerged.

The Role of Technology and the Way Forward

Technology has played a pivotal role in shaping the future of cheque usage. Online banking, electronic payment methods, and standardized bank transfer orders have significantly reduced the reliance on paper cheques. Institutions like the Reserve Bank of India, Bank of Baroda, ICICI Bank, and IDFC FIRST Bank have embraced digital alternatives to streamline financial transactions. While the decline in cheque usage is evident, it is equally important to recognize that cheques have not become obsolete. Instead, they have found a niche role, particularly in legal, commercial, and financial contexts where their unique attributes shine.

The Future of Cheques: A Balancing Act

In conclusion, the cheque, as a financial instrument, represents both the past and the future. Its enduring legacy lies in its adaptability and resilience. While it may no longer be the primary method of payment, it continues to serve a valuable role in specific situations. Responsible borrowing and timely repayment are essential factors in ensuring that cheques remain a reliable and secure method of financial transaction. As financial landscapes continue to evolve and electronic payment methods gain prevalence, cheques will persist, offering a bridge between tradition and innovation in the realm of finance.

So, as we wrap up this exploration, let us appreciate the cheque for what it is—an instrument that has stood the test of time, a tangible representation of trust and financial responsibility, and a testament to the enduring importance of balance and adaptability in our ever-evolving financial world.

1. What is the difference between a crossed cheque and a bearer cheque?

- A crossed cheque has two parallel lines drawn across it, indicating that the payee must deposit it into their bank account rather than cashing it over the counter. In contrast, a bearer cheque is payable to the person who possesses it and can be cashed at the bank counter.

2. What precautions should you take when handling blank cheques?

- When handling blank cheques, ensure you do not leave any section completely blank. Always fill in the date, payee, and amount just before issuing the cheque. Avoid giving blank cheques to anyone, as they can misuse them.

3. Are post-dated cheques legally binding, and how do they function?

- Yes, post-dated cheques are legally binding. They feature a specified future date and cannot be cashed until that date arrives. They are commonly used to secure transactions or ensure the availability of funds at a later specified time.

4. What advantages do cheques offer over electronic payment methods?

- Cheques provide a secure and universally accepted means of transferring funds. They create a tangible record of transactions, aiding individuals and businesses in record-keeping. Additionally, they allow parties to flexibly time their transactions through post-dated cheques.

5. How has technology influenced the use of cheques in recent years?

- Technology has led to a decline in cheque usage, as online banking, electronic payment methods, and standardized bank transfer orders offer quicker and more efficient alternatives. Many financial institutions have transitioned to digital platforms, reducing their reliance on paper cheques.

For a Legal advice regarding Cheques, feel free to contact Legal251 at (+91) 77728-77729.

Table of Contents

Follow us on.

Latest from Us

Stay informed and empowered with our latest updates, your source for navigating the ever-changing legal landscape.

251+ legal services over one platform

Registration

Return Filing

Import Export

License (IEC)

Professional

Tax Registration

Mukesh Tiwari

Founder & CEO Bharatmat.co

Right from the start, the website was user-friendly and intuitive, making it easy to navigate and find the information I needed. The process of submitting my legal request was straightforward, and I appreciated the option to provide relevant documents electronically, saving me the hassle of scanning or mailing physical copies.

Testimonials

Our Clients

Our customers love the convenience of filing with us and appreciate our expertise in getting their Legal work done on time. We value the trust our clients place in us, and we strive to provide them with the best service possible.

Amazing Stories From Our

Amazing things are on the way “What has changed for the better since you moved to

asked our clients. Thousands of people answered; here are some of their comments.

BOOK A FREE

Consultation now.

Ready to take first step ? Let's chat about how we can help.

- [email protected]

- (+91)77728-77729

- Latest News

- How we work

Legal & Policies

- Terms & Condition

- Privacy Policy

- Cookie Policy

- Refund Policy

- Partner Login

- Service Tracking

Subscribe for more info

Follow us on.

© 2023 ISONOMY LEGAL251 PVT. LTD. All Rights Reserved.

Frequently Asked Questions

What is Cheque? Definition, Characteristics, Types, Parties

- Post last modified: 29 May 2023

- Reading time: 13 mins read

- Post category: Business Law

- What is Cheque?

A cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’.

The cheque is always payable on demand. A cheque must contain all the characteristics of a bill of exchange.

Table of Content

- 1 What is Cheque?

- 2.1.1 Drawer

- 2.1.2 Drawee

- 2.1.3 Payee

- 3 Truncated Cheque

- 4 Cheque in electronic form

- 5 Presentment of truncated cheque

- 6 Difference Between Bill of Exchange and Cheque

- 7 Business Law Notes

- 8 Business Law Book References

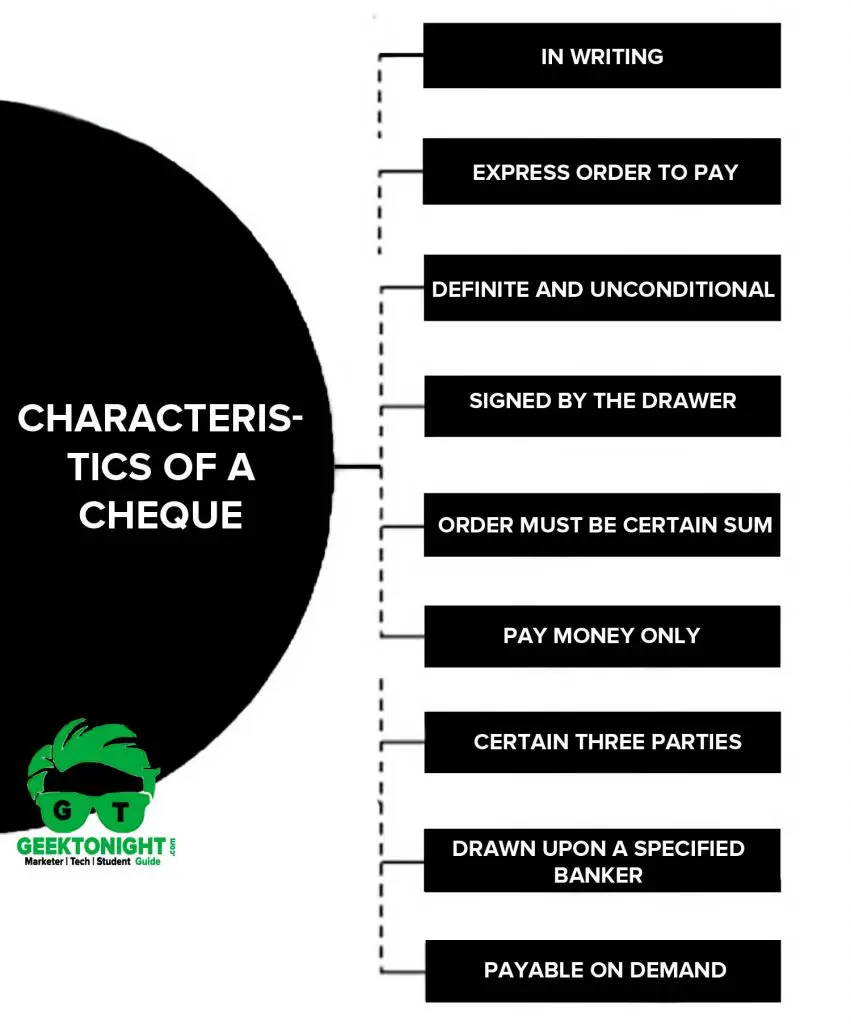

Characteristics of a Cheque

The essentials characteristics of a cheque can be summarized as under:

- It must be in writing .

- It must contain an express order to pay .

- The order to pay must be definite and unconditional .

- It must be signed by the drawer .

- The sum contained in the order must be certain sum .

- The order must be to pay money only .

- Three parties (drawer, drawee and payee) must be certain.

- It is always drawn upon a specified banker .

- It is always payable on demand .

Parties of Cheque

Basically, there are three parties to a cheque:

Drawer is a debtor or borrower. The person who makes the promise to another to pay the debt.

Drawee is a credit or lender. The person on whom the bill is drawn.

Payee The person to whom the money is to be paid or a person receiving payment.

Truncated Cheque

A truncated cheque means a cheque which is truncated during the course of a clearing cycle either by the clearing house or bank whether paying or receiving payment immediately on generation of an electronic image for transmission, substituting the further physical movement of the cheque in writing.

Cheque in electronic form

A cheque in electronic form means a cheque which contains the exact mirror image of paper cheque and is generated, written and signed in secure system, ensuring the minimum safety standards with the use of digital signature (with or without biometric signature) and asymmetric crypto system.

Presentment of truncated cheque

In case of and reasonable suspicion about the genuineness of the electronic image of a truncated cheque (e.g., suspicion as to fraud, forgery, tampering or destruction of the instrument), the paying banker is entitled to demand any further information regarding the truncated cheque. The payee banker can also demand the presentment of truncated cheque itself for verification.

Difference Between Bill of Exchange and Cheque

Business law notes.

( Click on Topic to Read )

- What is Business Law?

- Indian Contract Act 1872

- Types of Contract

- Offer: Types, Elements

- Elements of a Valid Contract

- Performance of a Contract

- Discharge of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

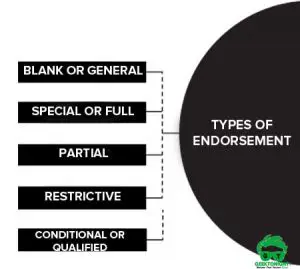

- Types of Endorsement

- Promissory Note

- Bill of Exchange

- Crossing of Cheque

Business Law Book References

- Goel, P. K. (2006). “ Business Law for Managers ” Wiley

- Sheth, T. (2017). “ Business Law ” (2ed.) Pearson.

- Kuchhal. M.C. & Prakash. “ Business Legislation for Management ” (2ed.) Vikas Publishing.

Go On, Share article with Friends

Did we miss something in Business Law Note ? Come on! Tell us what you think about our article on Cheque | Definition, Types, Parties | Business Law in the comments section.

- Essential Elements of a Valid Contract

- What is Discharge of Contract?

- Performance of Contract

- What is Promissory Note?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

- What Is Market Segmentation?

- What Is Marketing Mix?

- Marketing Concept

- Marketing Management Process

- What Is Marketing Environment?

- What Is Consumer Behaviour?

- Business Buyer Behaviour

- Demand Forecasting

- 7 Stages Of New Product Development

- Methods Of Pricing

- What Is Public Relations?

- What Is Marketing Management?

- What Is Sales Promotion?

- Types Of Sales Promotion

- Techniques Of Sales Promotion

- What Is Personal Selling?

- What Is Advertising?

- Market Entry Strategy

- What Is Marketing Planning?

- Segmentation Targeting And Positioning

- Brand Building Process

- Kotler Five Product Level Model

- Classification Of Products

- Types Of Logistics

- What Is Consumer Research?

- What Is DAGMAR?

- Consumer Behaviour Models

- What Is Green Marketing?

- What Is Electronic Commerce?

- Agricultural Cooperative Marketing

- What Is Marketing Control?

- What Is Marketing Communication?

- What Is Pricing?

- Models Of Communication

- What is Sales Management?

- Objectives of Sales Management

- Responsibilities and Skills of Sales Manager

- Theories of Personal Selling

- What is Sales Forecasting?

- Methods of Sales Forecasting

- Purpose of Sales Budgeting

- Methods of Sales Budgeting

- Types of Sales Budgeting

- Sales Budgeting Process

- What is Sales Quotas?

- What is Selling by Objectives (SBO) ?

- What is Sales Organisation?

- Types of Sales Force Structure

- Recruiting and Selecting Sales Personnel

- Training and Development of Salesforce

- Compensating the Sales Force

- Time and Territory Management

- What Is Logistics?

- What Is Logistics System?

- Technologies in Logistics

- What Is Distribution Management?

- What Is Marketing Intermediaries?

- Conventional Distribution System

- Functions of Distribution Channels

- What is Channel Design?

- Types of Wholesalers and Retailers

- What is Vertical Marketing Systems?

- What i s Marketing?

- What i s A BCG Matrix?

- 5 M’S Of Advertising

- What i s Direct Marketing?

- Marketing Mix For Services

- What Market Intelligence System?

- What i s Trade Union?

- What Is International Marketing?

- World Trade Organization (WTO)

- What i s International Marketing Research?

- What is Exporting?

- What is Licensing?

- What is Franchising?

- What is Joint Venture?

- What is Turnkey Projects?

- What is Management Contracts?

- What is Foreign Direct Investment?

- Factors That Influence Entry Mode Choice In Foreign Markets

- What is Price Escalations?

- What is Transfer Pricing?

- Integrated Marketing Communication (IMC)

- What is Promotion Mix?

- Factors Affecting Promotion Mix

- Functions & Role Of Advertising

- What is Database Marketing?

- What is Advertising Budget?

- What is Advertising Agency?

- What is Market Intelligence?

- What is Industrial Marketing?

- What is Customer Value

- What is Business Communication?

- What is Communication?

- Types of Communication

- 7 C of Communication

- Barriers To Business Communication

- Oral Communication

- Types Of Non Verbal Communication

- What is Written Communication?

- What are Soft Skills?

- Interpersonal vs Intrapersonal communication

- Barriers to Communication

- Importance of Communication Skills

- Listening in Communication

- Causes of Miscommunication

- What is Johari Window?

- What is Presentation?

- Communication Styles

- Channels of Communication

- Hofstede’s Dimensions of Cultural Differences and Benett’s Stages of Intercultural Sensitivity

- Organisational Communication

- Horizontal C ommunication

- Grapevine Communication

- Downward Communication

- Verbal Communication Skills

- Upward Communication

- Flow of Communication

- What is Emotional Intelligence?

- What is Public Speaking?

- Upward vs Downward Communication

- Internal vs External Communication

- What is Group Discussion?

- What is Interview?

- What is Negotiation?

- What is Digital Communication?

- What is Letter Writing?

- Resume and Covering Letter

- What is Report Writing?

- What is Business Meeting?

- What is Public Relations?

- What is Consumer Behaviour?

- What Is Personality?

- What Is Perception?

- What Is Learning?

- What Is Attitude?

- What Is Motivation?

- Consumer Imagery

- Consumer Attitude Formation

- What Is Culture?

- Consumer Decision Making Process

- Applications of Consumer Behaviour in Marketing

- Motivational Research

- Theoretical Approaches to Study of Consumer Behaviour

- Consumer Involvement

- Consumer Lifestyle

- Theories of Personality

- Outlet Selection

- Organizational Buying Behaviour

- Reference Groups

- Consumer Protection Act, 1986

- Diffusion of Innovation

- Opinion Leaders

- What is Brand Management?

- 4 Steps of Strategic Brand Management Process

- Customer Based Brand Equity

- What is Brand Equity?

You Might Also Like

Articles of association: definition, example, contents, alteration, indian contract act 1872 | business law.

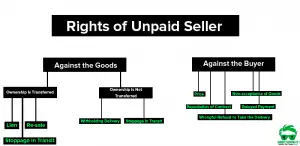

Rights of Unpaid Seller | Sale of Goods Act, 1930

Employee state insurance act 1948 | definition, objectives, applicability, what is business law definition, meaning, books, conditions and warranties | business law.

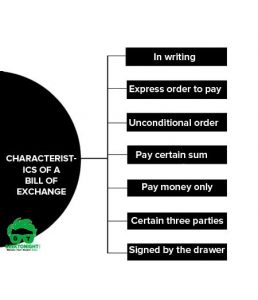

What is Bill of Exchange? Example, Features, Characteristics

What is Discharge of Contract? Modes: Performance, Mutual

Types of Endorsement | Business Law

What is Offer? Types, Elements Lapse & Revocation

What is Crossing of Cheque? Types, Meaning, Dishonoured

Leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal growth.

Development

How to Read a Cheque? A Complete Breakdown

If you’re a beginner and want a better understanding of how cheques work, you’ve come to the right place.

This article will provide you with valuable information on how to read a cheque and correctly interpret each part, and by doing so, you will be one step closer to writing a cheque yourself .

Keep on reading to learn more!

What Are the Parts of a Cheque?

Reading checks might seem confusing at first glance as they don’t come with instructions. But it’s essential to learn to read the check details and correctly translate the different parts. Let’s find out what each part of a Canadian cheque represents!

Personal Information

You’ll find this section in the top left corner. It contains information about the authorized account user who issues the cheque.

On the top line, you’ll need to write your full name as stated on your bank account. Next, the second line requires your home street address, while the bottom line is reserved for the city, province and postal code.

If you have a personalised cheque, this information will already be filled in. On the other hand, starter and temporary cheques oblige the user to write the check info .

Next, we have one of the crucial check lines . The payee line contains the name of the individual, business, or organizations receiving the payment.

Keep in mind that you need to use an individual’s legal name when filling out a check, as some banks have strict policies that don’t allow spelling mistakes or nicknames.

Analogically, cheques issued to businesses require the business’s legal name instead of its DBA name.

Lastly, make sure you use comprehensible writing in this section of a cheque.

Dollar Amount Line

After determining the recipient of the cheque, you’ll need to write the amount you wish to pay on the dollar amount line.

Here, users are required to enter the exact sum in words. This prevents potential misreading of the figure given in numbers in the dollar amount box. Additionally, you can avoid a thief trying to alter the numbers on the cheque.

Dollar Amount Box

Right next to the dollar amount line, you’ll notice the dollar amount box. All you have to do here is enter the total amount in numbers.

Don’t forget to include any cents that need to be paid. If there are none, simply write an even number or enter a decimal followed by two zeros.

While the memo line isn’t among the mandatory check details , it serves as a reminder of the reason behind the payment.

Filling in the memo line is beneficial as it enables you to keep a record of all of your payments and see what you have spent your money on.

The date is supposed to be written on the top right corner of the cheque, including the year, month and day.

On a Canadian cheque, the date should be in the following format: DD.MM.YY.

The date represents the day that the check was written and it’s valid for six months.

Signature Line

You’ll notice the signature line on the bottom right corner of the cheque.

When filling out a check , the endorser must use the same signature used when opening the checking account at their bank .

If the signature is missing or it is incorrect, then the cheque will be considered invalid.

The bank name and address are usually printed on the cheque itself and they represent the bank of the account ’s holder.

Routing Number

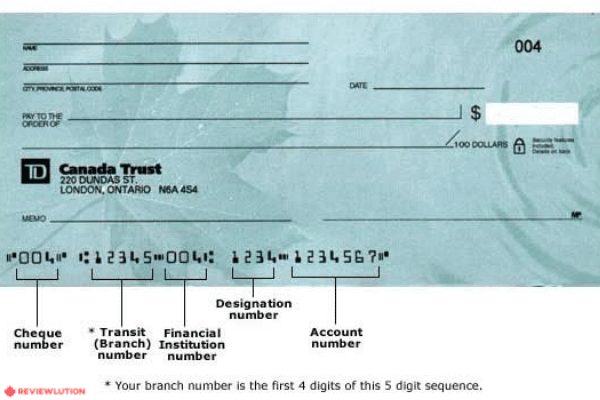

The routing number on a check is an 8- digit number that consists of the transit number and the institution code.

The transit number has five digits and stands for the home branch of the bank, while the institution code consists of three digits and refers to the bank or financial institution’s code.

In simple terms, the routing number is a bank identification number. Each bank has its own routing number that is unique only to them.

Account Number

Many people are confused about the routing vs account number and wonder what is what on a check .

On a Canadian cheque, the account number is the last one on the MICR encoding line and it’s between 7-12 digits long. Some banks might use dashes and spaces between numbers, while some use a format with no spaces in between.

Although it is your bank that decides the format and number arrangement, the MICR design is always the same for all Canadian banks.

Cheque Number

On Canadian cheques, the cheque number is at the top right corner and is the first number of the MICR line at the bottom of the cheque. The check account number is usually a 3- digit or a 6- digit number used for tracking. It helps users identify which checks have been used from the chequebook.

Fractional Bank Number

The fractional number on a cheque is an abbreviated form of the routing number and it’s used to determine the location of the original bank within the banking system.

Now you have a comprehensive breakdown of all 12 parts of a cheque to help you understand them better.

When to Use a Cheque?

While there has been a decline in the usage of paper cheques across the world, they are still widely used as a valuable method of payment. There are several instances where using cheques could be the best way to pay for something or to make a money transfer .

For example, you can use checks to pay small businesses, make bill payments , deposit and move funds between accounts, and make a down payment on a house or car.

Additionally, you can also pay someone for a service. Whether it’s only a one-time or it’s occasional work like a dog walker or if someone is mowing your loan, using a cheque is a convenient way of payment.

Another factor to consider is that many elders in Canada don’t have an access to the internet or don’t know how to make an online payment. So, filling out a check could really come in clutch.

Unlike cash, paper cheques are still considered to be a valid method of payment that can provide a level of safety in your transactions and money transfer . Many businesses still prefer to pay individuals by using paper cheques which are a great way to pay if the employer does not offer direct deposit , or if you are working as a freelancer.

What Are the Benefits and Drawbacks of Cheques?

The value of using cheques is undeniable for sure, but let’s see what are the positive and negative sides of these once so-popular paper slips.

Benefits of a Cheque

- They’re a great option for bill payments.

- They can easily be traced in the event of a loss or theft.

- Payments can be terminated if the check is lost or stolen.

- They serve as proof of a complete payment.

- All cheques are entered into the bank ’s computer system.

- If you get paid by checks, you don’t need a bank account to cash them.

- They enable you to keep a record of all of your spending.

- Carrying a chequebook instead of cash is much safer.

- You can make small business payments.

- You pay a large lump sum without using cash.

- Checks can be gifted.

- You can write a cheque to yourself to either pay yourself or move funds between your bank accounts.

- Cheques are a great option if there is no internet access.

Drawbacks of a Cheque

- Cheque payments aren’t accepted everywhere.

- If you’re in a hurry to make payments or make money transfers , cheques can take longer to be processed than an electronic transaction.

- If you don’t have enough funds in your bank account but still want to write a cheque, then your cheque will bounce and you might be charged fees.

- Depositing a cheque requires physical presence in a bank.

- Cheques expire after six months.

- You’re at risk of cheque fraud.

Ultimately, cheques will remain irreplaceable for some people. For others, the usage of digital tools for payments and money movement will always be the best solution.

What Is the MICR Encoding Line?

After covering all the check details and check numbers , we have left yet to explain the MICR encoding line.

A MICR line on a cheque is located at the bottom of the cheque and is an acronym for Magnetic Image Character Recognition. The MICR Encoding line is printed using magnetic ink and it includes the account and routing number on a check , as well as the check account number .

The MICR line contains valuable check information . This info is being identified and read by special processing machines and scanners. During the scanning process, the numbers are instantly converted into digital data, which is then used by the banks in order to process the Canadian cheques and complete the payments.

Finishing Thoughts

Reading a check is easy once you understand what the check lines mean. It can be daunting at first, but it’s useful to know how to write and read it because it is still a widely acceptable form of payment across Canada and you never know when you might need to use a cheque.

Writing in cursive on a cheque is not mandatory. However, lines written in words should be clear.

Although a written check is valid only six months, chequebooks do not expire.

Depending on the quantity and style of the cheques, the average cost of a chequebook in Canada can range between $25 and $70.

The check number represents the reference number on a check and it usually consists of three digits, although, recently many Canadian banks have started to require as many as six digits in a check number.

Once you learn how to read a check , you’ll know that In Canada, the routing number is a total of 8 digits. It consists of a five- digit transit number and a three- digit institution code.

ABOUT AUTHOR

by Angela Najdenovska

When Angela combined her deep-seated love for linguistics with her growing interest for finance and money management, she struck a gold mine. She’s scoured the internet far and wide for all things related to money and finances, including payments, budgeting and investing. Now she’s eager to share her knowledge and skills with the world, determined to make it a better place. In her free time, she loves to read a good book.

Latest from this author

Related posts.

FHSA: What Is It and How Does It Work?

What Is the Minimum Credit Score for Mortgage Approval in Canada?

How to Purchase GIC for Students in Canada?

Couch Potato Investing Canada: The Ultimate Guide for 2024

How to Increase Your Credit Card Limit

What Percentage of Gamblers Win at Casinos?

How to Invest as a Teenager in Canada?

Conventional vs Collateral Mortgage: What’s the Difference?

Are Credit Card Rewards Taxable: Everything You Need to Know

Average House Prices in Canada – Stats, Trends and Forecasts

Leave a Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Cambridge Dictionary +Plus

Meaning of cheque in English

Your browser doesn't support HTML5 audio

- anti-kickback

- automatic withdrawal

- meal ticket

- microtransaction

- monetization

- ready money

- wave and pay

cheque | Intermediate English

Cheque | business english, examples of cheque, translations of cheque.

Get a quick, free translation!

Word of the Day

doggie day care

a place where owners can leave their dogs when they are at work or away from home in the daytime, or the care the dogs receive when they are there

Dead ringers and peas in pods (Talking about similarities, Part 2)

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- English Noun

- Intermediate Noun

- a cheque bounces/is bounced

- cash a cheque

- a cheque clears/is cleared

- Translations

- All translations

Add cheque to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

- Daily Crossword

- Word Puzzle

- Word Finder

- Word of the Day

- Synonym of the Day

- Word of the Year

- Language stories

- All featured

- Gender and sexuality

- All pop culture

- Grammar Coach ™

- Writing hub

- Grammar essentials

- Commonly confused

- All writing tips

- Pop culture

- Writing tips

Advertisement

- a bill of exchange drawn on a bank by the holder of a current account; payable into a bank account, if crossed, or on demand, if uncrossed

- the total sum of money received for contract work or a crop

Discover More

Word history and origins.

Origin of cheque 1

Example Sentences

Mr. Agnew saw the picture, recognised its merit, and wrote a cheque for the full amount asked.

On our arrival home the cabman, fortunately, was induced to accept a cheque in payment.

Mr. M. Williams informed the writer's brother that at a meeting of several gentlemen in London, a cheque for 8000l.

The next day Mr. Williams said to him, "Why did you not pocket the cheque before you quarrelled with them?"

And now, Monsieur Pujol,” said he impudently, “I am willing to sell you this rubbish for the cheque.

Related Words

How To Read A Cheque In Canada: 9 Sections to Unravel (2024)

Although paper cheque use is declining, Canadians still write over a billion cheques a year collectively.

Since they’re not used as often, though, many have forgotten or aren’t quite sure how to read a cheque in Canada .

Whether you’re looking for a quick brush-up or you’re just learning how to read or write a cheque for the first time, you’re in the right place.

Below, I’ll show you exactly how to read a cheque in Canada (from any bank), so you’ll know how to use one the next time you’re presented with one.

How To Read A Cheque In Canada: The Basics

For the most part, Canadian cheques are the same. Depending on the financial institution that you bank with, cheques from one bank may look a little bit different than cheques from another bank.

However, all cheques should have the same basic lines, including:

- Personal information (your name, address, postal code)

- Payee line (“pay to the order of”)

- Dollar amount line (written)

- Dollar amount box (numerical)

- Signature Line

- Endorsement (on the back of the cheque)

Additionally, the bottom of every Canadian cheque should have a series of numbers known as the MICR encoding line .

For reference, here’s a diagram of a blank cheque from TD bank :

The entire upper-left-hand corner is typically dedicated to information about the account holder.

For instance, if it’s your personal bank account, you should expect to see your full legal name.

This is typically the same name that you have listed on all of your government documents and may include titles, such as Dr., Mr., Mrs., and others.

If you’re using a business bank account, then the top line will be your legal business name that’s registered with the bank. It’s important to note that your DBA (doing business as) name is not listed.

For instance, if your legal business name is “123Alpha LLC” and the DBA name is “John’s Quick-Stop,” the former is what will be listed on your cheque.

If you change your business name , your bank should also be notified to reflect this.

Directly underneath the name of the account holder, you’ll find the address line (which may take up two lines, depending on the type of residence you’re in).

If you’re an individual, then this line will display the primary residence address that your bank has on file for you.

If you’re looking at a business cheque, then the address will be represented by your business’ primary mailing address, which your bank should have on file.

It’s important to make sure that you get the address right. If you ever have a cheque mailed back to you, you’ll want to make sure it ends up in the correct place.

I always recommend updating your chequebook and registered bank address as soon as you move to a new residence.

3. Postal Code

Part of the address should also include the postal code of the Canadian city, town, or region that you live in.

Canada has several cities and towns with the same name, so having the correct postal code ensures that cheques always end up in the right location.

4. “Pay To The Order Of”

The payee line is, by far, one of the most important lines on a Canadian cheque. This is where you’ll find the name of the individual, business, or organization getting paid .

In most cases, the name should directly line up with the individual or business that will be depositing the cheque.

For example, if you intend to write a cheque to your brother Joe (whose legal name is “Joseph”), you should use the individual’s legal name. Some banks are stricter than others on this.

Certain banks will accept the use of nicknames on cheques, while others may deny the cheque for a simple spelling error.

The same principle applies to business cheques. If you’re writing a cheque to a business, you should always write the legal business name, not the DBA name of the business.

To ensure that there’s not any confusion, you should do your best to write the name out in clear handwriting. Try to avoid using “signature script” here.

5. Dollar Amount Line

Once you’ve defined who you’re paying, it’s time to define how much you’re going to pay them. The dollar amount line is where you will write out the fully-spelled and articulated amount.

The purpose of this is to avoid any possible confusion that could result from somebody misreading the numerical value posted in the dollar amount box (see below).

It also prevents thieves from manipulating the number (turning a 63 into an 83, for instance).

The word “sixty-three” is clearly different from “eighty-three.” Even if a would-be clever thief manipulated the numerical value, they wouldn’t be able to manipulate a fully spelled-out word to match it.

Here are some examples of how to write out numerical values:

Additionally, if there is a cent amount included in the value (such as an extra nickel or dime ), you should represent that as a fraction of 100.

For instance, if the amount is $100.20 , you would write out one-hundred dollars and 20/100 . Fifty cents would be represented by 50/100, seventy-five cents would be written as 75/100, and so forth.

Don’t worry about condensing the fraction down like you learned about in math class. Since there are 100 cents in a dollar, you should always write the amount as a fractional part of 100.

6. Dollar Amount Box

To the right of the written dollar amount line, you’ll find a blank box with the “$” symbol on the far left side.

This is the simplest box on the cheque and should include the numerical value of the number that you just wrote out to the left.

Make sure that you also include any cents that are being paid as well. If there are no cents, you can write an even number or include a decimal followed by two zeros (i.e., $55.00) to indicate this.

In my opinion, the more accurate the number is, the better.

This is probably one of the least important lines of a Canadian cheque. This allows you to write a brief memo about what the cheque is for.

It’s more important for personal accounting than it is for the bank. Most banks won’t have a problem if the memo line is blank.

That being said, I always recommend filling it out if you’re writing a cheque to somebody.

If you received a cheque from an individual with a blank memo line, then it’s still a good idea for you to write what it was for, so that you can keep a record of it.

Memos don’t need to be overly descriptive. A good memo is straight and to the point. Some examples of a good cheque memo include:

- “Holiday gift”

- “Payment for invoice #123”

- “Payroll cheque 9-9-2022 for 35 hours”

- “Rent for unit 1A”

- “Babysitting”

If you’re writing a cheque to an individual or business, you should also flip to the back pages of your chequebook and write the same memo.

This will help you with your accounting at the end of the year, so you know exactly who you paid and for what .

8. Signature Line

The signature line, typically located at the bottom right of a cheque, is where the account holder signs to authorize the cheque. It’s crucial for the cheque’s validity as the bank compares this signature with the one on file to prevent fraud.

An unsigned cheque is considered incomplete and won’t be accepted by the bank. Therefore, one should only sign a cheque when all other details are correctly filled out, ensuring the intended payment is authorized accurately. In the case of businesses, digital or printed signatures may be used, often with added security features.

9. Endorsement (Back Of Cheque)

Last but not least, you’ll find the endorsement line on the back of the cheque. It will usually be an empty line that runs perpendicularly to the text on the front of the cheque.

This line is meant to be signed by the individual who is depositing the cheque.

The individual or organization writing the cheque should NOT fill out this line.

The purpose of this line is to prove who the individual is that deposited the cheque.

If there is ever a discrepancy or an instance of fraud, the bank can compare signatures to see the individual responsible for signing the cheque (or if it was forged by a thief).

Most banks will not allow you to deposit a cheque that you, as the receiver, have not endorsed .

Here, you’re encouraged to use your personal signature to endorse the cheque.

This should match the personal signature that the bank has on file for your account and helps to prove that it was really you who deposited the cheque.

How To Read The MICR Encoding Line On A Canadian Cheque

Have you ever looked at a cheque and wondered “ How do you read the bottom of a Canadian cheque? ” Now that you know how to read a cheque in Canada (at least the basic parts), it’s time to take a closer look at the MICR encoding line .

This numerical line, with its futuristic number script, includes important cheque identification data, including:

- The cheque number (in the order of your chequebook)

- The transit/branch number

- The designation/institution number

- The bank account number

To clarify, here’s an example of what an RBC bank cheque looks like:

Now, I’ll give you a brief explanation of each number and why they’re important.

The Cheque Number

Starting on the far left, you’ll find the cheque number. This typically ranges between 1 and 100 and represents the order of the cheque in the chequebook.

For instance, the first cheque of the book would be represented by the number 001 and the last cheque of the book would be represented by 100 .

The Transit Number (Branch Number)

The transit number is a unique five-digit code that’s assigned to the branch where you created the account at.

For as long as you keep your account open with the bank, the transit number will remain the same. This is true even if you move to another city and start visiting another branch of the same bank.

Unless you close the account permanently and reopen another bank account , the branch number will never change.

The Designation Number (Institution Number)

To the right of the transit number, you’ll find the designation number. This three-digit number is unique to every banking institution in Canada.

All TD banks in Canada will have the same three-digit designation, just as all RBC bank branches in Canada will have the same three-digit institution number.

The Account Number

Lastly, on the far right-hand of the MICR number, you’ll find the bank account number. This is unique to every individual bank account.

While multiple individuals may have the same designation and transit numbers on their cheques, your account number is unique to you .

Understanding Cheque Fraud in Canada

Cheque fraud is a serious issue that can have significant financial impacts. In Canada, as in many countries around the world, cheque fraud is a criminal offence. It can occur in several ways:

Counterfeit Cheques

Counterfeit cheques are created by criminals who use sophisticated technology to make the cheques look legitimate. They can be printed with the account and routing numbers of real accounts. The criminals then use these counterfeit cheques to pay for goods or services.

Forged Cheques

Forgery can happen when someone alters a legitimate cheque, changing the name of the payee or the amount of the cheque without the account holder’s knowledge or consent.

Stolen Cheques

Criminals can steal legitimate cheques, often from mailboxes, and then alter them to make them payable to themselves. They can also use the account information on those cheques to create counterfeit cheques.

Fraudulent Endorsement

This happens when someone finds a cheque made out to another person and then forges that person’s signature to cash the cheque or deposit it into their own account.

How to Protect Yourself

The Canadian Anti-Fraud Centre provides several tips to help individuals and businesses protect themselves from cheque fraud:

- Keep your cheques safe : Always store your cheques, both blank and cancelled, in a safe and secure location.

- Examine cheques closely : If you’re accepting a cheque, look at it closely. Make sure the cheque number and bank account number match, the cheque has a legitimate bank name, and the cheque amount and written amount match.

- Monitor your accounts : Keep a close eye on your bank accounts.

Whether you’re writing a cheque to pay a bill, receiving a written cheque from an employer, or just want to know how to find your account number on your cheque, you should have a complete understanding of how to read a cheque in Canada.

If you’re looking for a more detailed guide on how to write a cheque in Canada, keep reading here !

Check Out These Posts:

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Join Our Newsletter

Signup for news and special offers!

You have successfully joined our subscriber list.

Wealth Awesome

Retire Career Credit Banking

Money Invest Guides Tools

Stock Analysis

40 Best Canadian Stocks Best Canadian Dividend Stocks Best Canadian Energy Stocks Banking

ETF Reviews

Best S&P500 ETFs Canada Best AI ETFs Canada Best REIT ETF's Canada

Account Guides

TFSA Limit Calculator TFSA Pros and Cons Ultimate RRSP Guide Banking

Contact About Disclaimer Banking

Disclaimer: The content on Wealthawesome.com is intended for informational and educational purposes only. Consult a licensed financial expert before making any life-changing decisions with your money. No content on this website is intended as financial advice. The publisher of this website does not take any responsibility for possible financial consequences of any persons applying the information in this educational content. As an Amazon Associate I earn from qualifying purchases.

© 2024 Wealthawesome.com. All rights reserved

Privacy Policy | Terms Of Use

An official website of the United States government

Here's how you know

The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

What the New Overtime Rule Means for Workers

One of the basic principles of the American workplace is that a hard day’s work deserves a fair day’s pay. Simply put, every worker’s time has value. A cornerstone of that promise is the Fair Labor Standards Act ’s (FLSA) requirement that when most workers work more than 40 hours in a week, they get paid more. The Department of Labor ’s new overtime regulation is restoring and extending this promise for millions more lower-paid salaried workers in the U.S.

Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid.

Some workers are specifically exempt from the FLSA’s minimum wage and overtime protections, including bona fide executive, administrative or professional employees. This exemption, typically referred to as the “EAP” exemption, applies when:

1. An employee is paid a salary,

2. The salary is not less than a minimum salary threshold amount, and

3. The employee primarily performs executive, administrative or professional duties.

While the department increased the minimum salary required for the EAP exemption from overtime pay every 5 to 9 years between 1938 and 1975, long periods between increases to the salary requirement after 1975 have caused an erosion of the real value of the salary threshold, lessening its effectiveness in helping to identify exempt EAP employees.

The department’s new overtime rule was developed based on almost 30 listening sessions across the country and the final rule was issued after reviewing over 33,000 written comments. We heard from a wide variety of members of the public who shared valuable insights to help us develop this Administration’s overtime rule, including from workers who told us: “I would love the opportunity to...be compensated for time worked beyond 40 hours, or alternately be given a raise,” and “I make around $40,000 a year and most week[s] work well over 40 hours (likely in the 45-50 range). This rule change would benefit me greatly and ensure that my time is paid for!” and “Please, I would love to be paid for the extra hours I work!”

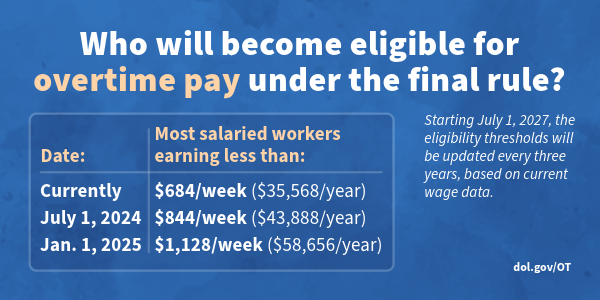

The department’s final rule, which will go into effect on July 1, 2024, will increase the standard salary level that helps define and delimit which salaried workers are entitled to overtime pay protections under the FLSA.

Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most salaried employees.

The rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the FLSA if certain requirements are met) from $107,432 per year to $132,964 per year on July 1, 2024, and then set it equal to $151,164 per year on Jan. 1, 2025.

Starting July 1, 2027, these earnings thresholds will be updated every three years so they keep pace with changes in worker salaries, ensuring that employers can adapt more easily because they’ll know when salary updates will happen and how they’ll be calculated.