India Medical Devices Research

- Veterinary Equipment

- Animal Drugs

- Animal Vaccines

- Purified Proteins

- Bioservices

- Biotechnology Research Equipment

- Protein Engineering

- Electro Therapy

- Nuclear Medicine

- Cardiovascular

- Dental Care

- Diabetes Care

- Ophthalmology

- Pulmonology

- Drug Filled Devices With Needle

- Clinical IT

- Healthcare Analytics

- Aesthetic Devices

- Clinical Diagnostic Instrument

- Immune System Diagnostics

- Infectious Disease Testing

- Handheld Monitoring Devices

- Single time Monitoring Devices

- Molecular Diagnostic Devices

- Medical Optical Imaging

- Nuclear Medicine Imaging

- Fluoroscopy

- Mammography

- Surgical Imaging

- Joint Reconstruction

- Drug Delivery Products

- Personal Protective Equipment

- Dental Medical Instruments

- Hospital and Clinical Use

- Ablation Devices

- General Surgical Devices

- Minimally Invasive Surgery Devices

- Bariatric Surgery Devices

- Surgical Access Devices

- Wound Care Devices

- Contraceptive Devices

- Anesthesia Equipment

- Insulin Pumps

- Hyperglycemics

- Behavioural Disorder Drugs

- Diabetes Care Drugs

- Oncology Drugs

- Developmental Anomalities

- External Condition Drugs

- Immune System Drugs

- Infectious Disease Drugs

- OB/GYN Drugs

Filter Reports

1091 India Medical Devices Reports

Country Covered: India

Study Period: 2019 - 2029

Major Players: Abbott Laboratories Inc, Koninklinje Philips NV, GE Healthcare (General Electric Company), Johnson & Johnson, Medtronic PLC

Study Period: 2021 - 2029

Major Players: Cardinal Health, 3M, Baxter International, Medtronic PLC, B. Braun SE

Major Players: 3M Company, B. Braun Melsungen AG, Medtronic PLC, Smith & Nephew, Coloplast A/S

Major Players: Abbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-La Roche AG, Transasia Bio-Medicals Ltd, Thermo Fisher Scientific

Major Players: Boston Scientific Corporation, Fresenius SE & Co. KGaA, Nestlé, Abbott, B. Braun SE

Study Period: 2018 - 2029

Major Players: Abbott Diabetes Care Inc., Dexcom Inc., Medtronic PLC, Eversense, Ascensia

Major Players: Olympus Corporation, GE Healthcare, Medtronic PLC, Siemens AG, Smith & Nephew PLC

Major Players: Roche Diabetes Care, Abbott Diabetes Care, Ascensia Diabetes Care, LifeScan, Dr. Morepen

Major Players: Allergan Inc., Cutera Healthcare, Lumenis, Alma Lasers, Bausch Health Companies Inc.

Major Players: Boston Scientific Corporation, Ossur, Medtronic , Baxter, Abiomed

Major Players: Atom Medical Corporation, Becton, Dickinson and Company, Dragerwerk AG & Co. KGaA, GE Healthcare, Koninklijke Philips NV

Major Players: Beckton, Dickinson and Company, Medion Healthcare Pvt. Ltd, Ontex Medical Devices Manufacturing Pvt. Ltd, B. Braun Melsungen AG, GE Healthcare

Major Players: Cadence Inc., Conmed Corporation, B. Braun Melsungen, Boston Scientific Corporation, Johnson & Johnson

Major Players: Medtronic PLC, Johnson & Johnson (Ethicon Inc), Teleflex Incorporated, B. Braun SE, CONMED Corporation

Major Players: CooperSurgical, Inc., Reckitt Benckiser Group plc, Mayer Laboratories, Inc., Bayer AG, Abbvie (Allergan)

Major Players: Medtronic PLC, Olympus Corporation, Stryker Corporation, Karl Storz SE & Co. KG, Boston Scientific Corporation

Major Players: Siemens AG, Planmed OY, Hologic Inc., Fujifilm Holdings Corporation, GE Healthcare

Major Players: Siemens Healthineers AG, Koninklijke Philips N.V., GE Healthcare, Canon Medical Systems Corporation, Fujifilm Holdings Corporation

Major Players: Siemens AG, Canon Medial Systems, GE Healthcare, Fujifilm Holdings Corporation, Koninklijke Philips N.V.

Major Players: Fujifilm Holdings Corporation, GE Healthcare, Koninklijke Philips NV, Siemens Healthineers AG, Mindray Medical International Limited

Major Players: Fujifilm Holdings Corporation, GE Healthcare, Koninklijke Philips NV, Siemens Healthineers AG, Carestream Health

Major Players: Cook Medical , Boston Scientific Corporation, Olympus Corporation, Stryker Corporation, Medtronic plc

Major Players: Fujifilm Holdings Corporation, Siemens Healthineers AG, Koninklijke Philips N.V., GE Healthcare, Bayer AG

Study Period: 2020 - 2029

Major Players: Fujifilm Holdings Corporation, GE Healthcare, Koninklijke Philips N.V., Canon, Siemens Healthcare GmBH

Major Players: Globus Medical Inc., Matrix Meditec Pvt Ltd, Medtronic PLC, Zimmer Biomet Holdings Inc., Johnson and Johnson

Major Players: BPL Group, Koninklijke Philips N.V., GE Healthcare, Nihon Kohden Corporation, Mindray Medical International Limited

Major Players: Johnson and Johnson, Apollo Endosurgery Inc, Medtronic PLC, Conmed Corporation, B. Braun SE

Major Players: Zimmer Biomet, Smith & Nephew PLC, Globus Medical Inc, Styker Corporation, Medtronic PLC

Major Players: Medtronic, Ascensia Diabetes Care, Insulet Corporation, Tandem Diabetes Care, Ypsomed

Major Players: Cook Medical, Boston scientific corporation, Olympus Corporation, Stryker Corporation, Medtronic plc

Please be sure to check your spam folder too.

Get a free sample of this report

Please enter your name

Business Email

Please enter a valid email

Please enter your phone number

Sorry! Payment Failed. Please check with your bank for further details.

Want to use this image? X

Please copy & paste this embed code onto your site:

Images must be attributed to Mordor Intelligence. Learn more

About The Embed Code X

Mordor Intelligence's images may only be used with attribution back to Mordor Intelligence. Using the Mordor Intelligence's embed code renders the image with an attribution line that satisfies this requirement.

In addition, by using the embed code, you reduce the load on your web server, because the image will be hosted on the same worldwide content delivery network Mordor Intelligence uses instead of your web server.

- Healthcare /

- Medical Devices

Medical Devices Market in India 2023

- February 2023

- Region: India

- Netscribes (India) Pvt Ltd

- ID: 5774591

- Description

Table of Contents

Companies mentioned, methodology, related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

Impact of COVID-19:

Market influencers:, market drivers:, key challenges of the market:.

- Country-wise

- Company information

- Business description

- Products/Services

- Financial snapshot

- Key financial performance indicators

- Key business segments

- Key geographic segments

- Centenial Surgical Suture Limited

- Johari Digital Healthcare Limited

- Opto Circuits (India) Limited

- Philips India Limited

- Poly Medicure Limited

- B. Braun Medical (India) Private Limited

- Becton Dickinson Private Limited

- Medtronic, Inc.

- Siemens Healthineers, Inc.

- Wipro GE Healthcare Private Limited

The Global Market for Medical Devices, 13th Edition

- Report

- November 2023

Asia-Pacific (APAC) Medical Devices Industry Outlook 2023

- Asia Pacific

Medical Device Technologies Global Market Report 2024

Medical Technology Market in India 2023-2028

Global Biopsy Devices Market - A Global and Regional Analysis: Focus on Product Type, Biopsy Type, Anatomy, Disease Type, Guidance Technique, Region, and Competitive Insights and Company Profiles - Analysis and Forecast, 2023-2027

- October 2023

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

DOWNLOAD SAMPLE

Please fill in the information below to download the requested sample.

Connect with us

Ask the analyst for, india medical devices market (2024-2030) | analysis, outlook, share, size, forecast, trends, value, revenue, industry, growth & companies.

- Report Description

- Table of Content

- Related Topics

India Medical Devices Market Shipment Analysis

India Medical Devices Market registered a growth of 2.89% in value shipments in 2022 as compared to 2021 and an increase of 6.35% CAGR in 2022 over a period of 2017. In Medical Devices Market India is becoming more competitive as the HHI index in 2022 was 1036 while in 2017 it was 1256. Herfindahl Index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means less numbers of players or countries exporting in the market. India has reportedly relied more on imports to meet its growing demand in Medical Devices Market.

India Medical Devices Market Competition 2023

India export potential assessment for medical devices market (values in thousand), india medical devices market synopsis.

The India medical device market comprises of a wide range of products, ranging from surgical and advanced medical technologies to diagnostics and therapeutic products. The sector has been growing rapidly over the past few years on account of increasing demand for healthcare services due to mounting population, rising prevalence of chronic diseases, technological advancements in the field of medical devices and favourable government policies. India`s Medical Device market is expected to reach US$ 16.1 billion by 2020 with a CAGR 18.1% between 2015-2020 owing to rapid growth in the private healthcare segment as well as increasing public expenditure in health care infrastructure across both urban and rural areas.

Drivers of the Market:

? Increasing Healthcare Expenditure: The Government?s increased focus towards improving overall healthcare infrastructure has led to an increase in spending on medical devices. The total expenditure incurred by government including capital expenditure was Rs 88129 cr (US$ 14 billion) during FY20 which is around 6% up compared with previous year levels

? Growing Private Healthcare Sector: There is an increase in number of private players offering high quality services across hospitals & clinics that have boosted demand for sophisticated medical equipment such as imaging systems, X-rays & other diagnostic kits etc., resulting into significant growth opportunities for domestic manufacturers.

? Technological Advancements: Companies are investing heavily towards R&D activities aimed at developing innovative products with enhanced features leading to improved patient outcomes along with cost efficiencies thereby broadening its customer base & creating potential opportunities for expansion into newer markets.

Trends of the Market:

Increased Demand For Wearable Medical Devices: Due to factors such as convenience & accuracy offered by these devices there is an augmented demand from patients who prefer using them while monitoring their health conditions without needing frequent visits or tests at hospitals or clinics thus driving overall industry growth prospects significantly over next few years.

Challenges of the Market:

High Cost Of Imported Equipment : Despite gradual improvement witnessed in last couple of years regarding availability & affordability factor due to introduction customs duty exemptions/reductions; imported equipment still remains expensive when compared against domestically manufactured ones thus exerting considerable pressure on industry?s profit margins.

Key Players of the Market:

Apollo Hospitals Enterprise Ltd., Fortis Healthcare Ltd., Narayana Hrudayalaya Ltd., Max Healthcare Institute Limited etc..

Key Highlights of the Report:

- India Medical Devices Market Outlook

- Market Size of India Medical Devices Market, 2023

- Forecast of India Medical Devices Market, 2030

- Historical Data and Forecast of India Medical Devices Revenues & Volume for the Period 2020-2030

- India Medical Devices Market Trend Evolution

- India Medical Devices Market Drivers and Challenges

- India Medical Devices Price Trends

- India Medical Devices Porter's Five Forces

- India Medical Devices Industry Life Cycle

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Types for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Orthopedic Devices for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Cardiovascular Devices for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Diagnostic Devices for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By IVD for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By MIS for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Wound Management for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Diabetes Care for the Period 2020-2030

- Historical Data and Forecast of India Orthopedic Devices Medical Devices Market Revenues & Volume By Others for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Applications for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Hospitals & Ambulatory Surgical Centers for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Clinics for the Period 2020-2030

- Historical Data and Forecast of India Medical Devices Market Revenues & Volume By Others for the Period 2020-2030

- India Medical Devices Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Applications

- India Medical Devices Top Companies Market Share

- India Medical Devices Competitive Benchmarking By Technical and Operational Parameters

- India Medical Devices Company Profiles

- India Medical Devices Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

Do you also provide customisation in the market study.

Indonesia Medical Devices Market (2020-2026)

Malaysia Medical Devices Market (2020-2026)

Brazil Medical Devices Market (2020-2026)

Colombia Medical Devices Market (2020-2026)

Peru Medical Devices Market (2020-2026)

Venezuela Medical Devices Market (2020-2026)

Chile Medical Devices Market (2020-2026)

Russia Medical Devices Market (2020-2026)

Poland Medical Devices Market (2020-2026)

Czech Republic Medical Devices Market (2020-2026)

Related Report Available

- Single User License $ 1,995

- Department License $ 2,400

- Site License $ 3,120

- Global License $ 3,795

Related Reports

- Middle East Diesel Genset Market (2024-2030) | Share, Analysis, COVID-19 IMPACT, Outlook, Size, Growth, Industry, Forecast, Revenue, Companies, Value & Trends

- Europe Diesel Genset Market (2024-2030) | Forecast, Share, Outlook, Size, Revenue, Companies, Value, Analysis, Growth, Trends & Industry

- Bangladesh Variable Speed Generator Market (2024-2030) | Trends, Share, Outlook, Size, Analysis, Value, Growth, Companies, Revenue, Forecast & Industry

- Europe, North America, and Latin America Portable Fans Market (2022-2028) | Revenue, Growth, Trends, Forecast, Value, Industry, Size, Share, Analysis & Companies

- India Solid Wood Market (2024-2030) | Revenue, Growth, Trends, Forecast, Value, Industry, Size, Share, Analysis & Companies

- Southeast Asia Elevator And Escalator Market (2023-2029) | Industry, Value, Revenue, Size, Growth, Forecast, Trends, Analysis, COVID-19 IMPACT, Companies & Share

- Global Luxury Fibers Market (2024-2030) | Revenue, Growth, Trends, Forecast, Value, Industry, Size, Share, Analysis & Companies

- Saudi Arabia Conductors Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Australia Fire Doors Market (2023-2029) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- UAE Online Gifting Market (2023-2029) | Size, industry, Revenue, Growth, Size, Share, Value, Outlook & COVID-19 IMPACT

Industry Events and Analyst Meet

Cyber First Kuwait Conference

Bio Fuel Expo 2024

EV INDIA EXPO 2023

3rd Cyber Security for Energy and Utility

The Big 5 Saudi

Our clients.

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines

Request Sample For:

6Wresearch is the premier, one stop market intelligence and advisory center, known for its best in class business research and consulting activity. We provide industry research reports and consulting service across different industries and geographies which provide industry players an in-depth coverage and help them in decision making before investing or enter into a particular geography. Read more

Privacy Policy

Terms & conditions, advisory & consulting, feasibility studies & business plan, competitors intelligence, channel & distribution strategy, procurement intelligence, customer behavior analysis, business models & key management practices, critical success factors analysis, aerospace and defense, chemicals and materials, semiconductor and electronics, power, utility and oil & gas, heavy industry, telecom, information & communication technology, consumer staples, banking, financial and legal services, metals and minerals, media and entertainment, miscellaneous, ©2024 6wresearch , all right reserved.

- Consumer Durables

- Medical Devices

- Biotechnology

- Pharmaceuticals

- Consumer Healthcare

- Animal Healthcare

- Healthcare IT

- Roads & Highways

- Ports, Aviation and Railways

- Real Estate

- Construction Materials

- Specialty Chemicals

- Bulk Chemicals and Inorganics

- Agrochemicals

- Polymer and Plastics

- Adhesives and Sealants

- Advanced Materials

- Paints and Coatings

- Green Chemicals

- Auto Components

- Automobile Service

- Automobile Tires

- Automotive Technologies

- IT & Telecom

- Semiconductor

- Automation and Process control

- Power Generation, Transmission & Distribution

- Energy Storage Solutions

- Print & Outdoor

- TV & Radio

- Commercial Aviation

- Airport Management

- Investment Management

- Agri Commodities

- Agri Machinery and Equipments

- Fertilizers

- Feed and Animal Nutrition

- Alternative Farming

- Digital Agriculture

- Performance Strategy

- Customer/Consumer Strategy

- Product Development Strategies

- On Demand Services">On Demand Services

- Dedicated Analyst Support – On-Site or Off-Site

- Brand Track

- Campaign Assessment Surveys

- Audience Analytics Surveys

- Customer Universe Study

- Digital Mention Study

- Advance Analytics

- Retail Audits

- Mystery Shopping Audits

- Net Promoter Score

- Customer Satisfaction Surveys

- Ad-Hoc Surveys

Press Release

- Knowledgeshare

- Infographics

- Key opinion leader(kol) interviews

- Industry News

India Medical Devices Market Industry Size, Share, Trends, Opportunity, and Forecast, 2019-2029 Segmented By Type (Cardiovascular Devices, Diagnostic Imaging Equipment, In-vitro Diagnostic Devices, Ophthalmic Devices, Diabetes Care Devices, Dental Care Devices, Surgical Equipment, Patient Monitoring Devices, Orthopedic Devices, Nephrology & Urology Devices, ENT Devices, Anesthesia & Respiratory Devices, Neurology Devices, Mobility-Aid Devices, Others), By End User (Hospitals & Clinics, Diagnostic Centers, Others), by region, and Competition

- Industry : Healthcare

- Published Date : NA

Single User Licence

Multi-User Licence

Custom Research Licence

Report Description

Table of content, frequently asked questions, related reports.

Market Overview

India Medical Devices Market has valued at USD 15.35 billion in 2023 and is anticipated to witness an impressive growth in the forecast period with a CAGR of 5.35% through 2029. Medical devices are instruments, machines, apparatuses, implants, or similar items that are designed to diagnose, monitor, treat, or prevent diseases, injuries, or other medical conditions. They play a vital role in the field of healthcare, aiding healthcare professionals in the diagnosis and treatment of patients, as well as assisting individuals in managing their health. Medical devices can vary greatly in complexity, purpose, and application. India's rising healthcare expenditure, both by the government and private sector, has been a major driver. The government's initiatives, such as the Ayushman Bharat program, have significantly increased healthcare funding, leading to greater demand for medical devices. India has become a preferred destination for medical tourism due to the availability of high-quality healthcare services at a lower cost. Medical tourists require advanced medical devices and treatments, boosting market growth. Expanding healthcare services in rural areas is a priority, and this requires equipping healthcare facilities with medical devices suitable for remote and underserved regions. Advances in medical technology, including point-of-care testing, minimally invasive surgery, and wearable devices, have driven the adoption of innovative medical devices in the Indian market. Increasing patient awareness about healthcare options and the benefits of early diagnosis has driven demand for diagnostic and monitoring devices. The presence of multinational medical device companies in India has not only increased competition but also brought advanced technologies and products to the market.

Key Market Drivers

Innovations in Technology

Many medical devices, such as ultrasound machines, ECG monitors, and even some surgical instruments, have become smaller and more portable. This allows for greater flexibility in healthcare delivery and enables point-of-care testing and treatment. Wearable technology has given rise to devices like fitness trackers, smartwatches, and health monitoring wearables. These devices can track various health parameters, such as heart rate, sleep patterns, and physical activity, empowering individuals to monitor and manage their health in real-time. Telemedicine platforms and remote monitoring devices have become more sophisticated. Patients can consult with healthcare providers and share vital health data from the comfort of their homes, leading to improved access to healthcare services and timely intervention. Innovations in medical imaging technology have led to more precise and less invasive diagnostic procedures. This includes 3D and 4D imaging, functional MRI, and PET-CT scans, enabling better visualization and earlier disease detection. AI and machine learning are being used to analyze vast amounts of medical data. This technology can assist in diagnosis, predict disease progression, and optimize treatment plans, resulting in more personalized and efficient healthcare. Robotic-assisted surgery has become increasingly common. These systems provide surgeons with enhanced precision, dexterity, and the ability to perform minimally invasive procedures, reducing patient recovery time.

Nanotechnology is enabling the development of miniature sensors and drug delivery systems. Nanoscale devices can target specific cells or tissues for diagnostics and therapies, potentially reducing side effects and improving treatment outcomes. 3D bioprinting allows the creation of tissues, organs, and even medical devices using biological materials. This technology has the potential to revolutionize transplantation and tissue engineering. Implantable medical devices, such as pacemakers and cochlear implants, have become smarter and more connected. They can transmit real-time data to healthcare providers and offer patients more control over their devices through mobile apps. Point-of-Care Testing (POCT) devices enable rapid, on-site diagnostic testing for a wide range of medical conditions. These devices are particularly valuable in resource-constrained settings and for emergency care.

These tiny robotic devices can be used for targeted drug delivery, tissue repair, and minimally invasive surgery. They hold promise for precise and non-invasive medical interventions. Advances in materials science and robotics have led to the development of more natural and functional prosthetic limbs and exoskeletons for mobility assistance. Implantable sensors can continuously monitor various physiological parameters, making them valuable for long-term disease management and research. CRISPR and other gene editing technologies are opening new possibilities for treating genetic diseases and developing personalized medicine. Blockchain technology is being used to secure and manage health data, ensuring patient privacy and data integrity. This factor will help in the development of the India Medical Devices Market.

Rural Healthcare Expansion

Rural healthcare expansion aims to improve healthcare access for underserved populations. This includes providing medical devices that can be used in remote and rural settings to ensure equity in healthcare delivery. Rural areas often face unique healthcare challenges, including a high burden of communicable and non-communicable diseases. Medical devices for diagnostics, monitoring, and treatment are essential for effective disease management in these regions. Rural healthcare expansion emphasizes preventive healthcare and early disease detection. This drives the demand for medical devices used in screening, vaccination, and health promotion programs. Telemedicine and mobile health solutions are used to connect rural patients with healthcare providers. These solutions often involve the use of remote monitoring devices and telehealth platforms, creating a demand for such devices. Ensuring the well-being of mothers and children in rural areas is a priority. This requires medical devices for maternal care, neonatal care, and child health, including ultrasound machines, incubators, and monitoring equipment.

Access to emergency and trauma care is vital in rural areas, where timely medical intervention can be challenging. Medical devices such as portable defibrillators, mobile X-ray machines, and telemedicine for emergency consultations are essential. The prevalence of chronic diseases is not limited to urban areas. Rural populations also require medical devices for managing conditions like diabetes, hypertension, and respiratory diseases. Rural healthcare expansion includes the setup of diagnostic centers in remote areas. This entails the procurement of diagnostic devices like X-ray machines, ultrasound scanners, and laboratory equipment. Point-of-Care Testing (POCT) devices are particularly valuable in rural settings because they enable rapid, on-site diagnostic testing. These devices are user-friendly and can be used in resource-constrained areas.

Rural healthcare encompasses dental and ophthalmic care, which often requires specialized devices such as dental chairs, dental X-ray machines, and ophthalmic examination equipment. Medical devices are used for monitoring the health of rural populations, including tracking nutritional status and growth in children and monitoring chronic disease parameters. Many rural healthcare programs involve community health workers who use mobile devices and handheld diagnostic tools for community-level health assessments. Government initiatives to strengthen rural healthcare, such as the National Rural Health Mission (NRHM) in India, play a significant role in driving the demand for medical devices in rural areas. This factor will pace up the demand of the India Medical Devices Market.

Increasing Patient Awareness

Informed patients are more likely to engage in preventive healthcare measures. They may seek regular check-ups and screenings, leading to increased utilization of diagnostic and monitoring devices. Patients who are aware of the importance of early disease detection are more likely to request and undergo diagnostic tests. This drives the demand for various diagnostic devices and imaging equipment. Patients with awareness of the benefits of health monitoring may actively use wearable devices and home health monitoring equipment to track their vital signs, manage chronic conditions, and seek timely medical intervention when needed. Informed patients are often better equipped to engage in self-care and disease management. This may involve the use of medical devices such as glucometers for diabetes management or inhalers for respiratory conditions. Patients who understand the importance of adhering to prescribed treatments are more likely to use medical devices as part of their therapy. For example, inhalers, insulin pumps, and continuous positive airway pressure (CPAP) machines.

Informed patients often engage in shared decision-making with healthcare providers. They may express their preferences for certain medical devices and treatment options, influencing the choice of devices used in their care. Patients who are aware of telemedicine and its benefits may actively seek virtual consultations and remote monitoring, leading to increased demand for telehealth technology and connected medical devices. Patients who are aware of clinical trials and research studies may participate in these initiatives, where they are often provided with advanced medical devices for monitoring and treatment. Their participation contributes to the development and evaluation of new medical devices.

Patients who are tech-savvy and health-conscious often invest in consumer health technology, such as fitness trackers, smart scales, and mobile health apps, contributing to the growth of the consumer medical device market. Informed and engaged patients can advocate for better healthcare services and demand access to specific medical devices and treatments, prompting healthcare systems to respond to their needs. Patients who understand the benefits of medical devices may seek improved access to healthcare services, including the availability of advanced devices and technologies in their local healthcare facilities. Some informed patients are willing to share their health data with healthcare providers, which can be used for personalized medicine and the adjustment of treatment plans, potentially involving specific medical devices. This factor will accelerate the demand of the India Medical Devices Market.

Download Free Sample Report

Key Market Challenges

Price Sensitivity

Many patients in India are price-conscious and seek cost-effective healthcare solutions. This has a direct impact on the adoption and utilization of medical devices, as patients may opt for more affordable alternatives. Healthcare expenses, including medical devices, can be a significant financial burden for many individuals and families in India. Affordability is a critical factor when patients and healthcare providers choose medical devices. The Indian government has implemented price controls on certain medical devices to ensure affordability and accessibility for a larger section of the population. These regulations can impact the pricing and profit margins of medical device manufacturers and distributors. While health insurance coverage is expanding in India, policies often come with limitations and coverage caps. Patients and healthcare providers may opt for lower-cost devices to maximize insurance benefits. In some cases, there may be a preference for generic or non-branded medical devices, which are often more affordable than their branded counterparts. Hospitals, particularly government-funded and public healthcare facilities, may have budget constraints that lead to price-sensitive procurement decisions when acquiring medical devices.

Quality Control and Counterfeit Products

Substandard or counterfeit medical devices can pose serious risks to patient safety. The use of such products can lead to incorrect diagnoses, treatment complications, and adverse health outcomes. In the past, the regulatory environment in India for medical devices was less stringent, allowing for substandard and counterfeit products to enter the market. While efforts have been made to strengthen regulations, challenges in enforcement persist. The monitoring and surveillance of medical devices post-market can be inadequate. This means that substandard or counterfeit products may go undetected until adverse events occur. India relies on imported medical devices, which can be susceptible to counterfeit products, especially when imported from regions with less stringent quality control standards. The Indian government's push for local manufacturing, as part of the "Make in India" and "Atmanirbhar Bharat" initiatives, aims to reduce dependence on imports. However, this also necessitates a focus on maintaining quality standards in locally manufactured devices.

Key Market Trends

Adoption of Digital Health Solutions

Telemedicine platforms and telehealth services have seen substantial growth in India, especially in the wake of the COVID-19 pandemic. These services enable remote consultations with healthcare providers, reducing the need for in-person visits and enhancing access to healthcare services. Digital health solutions support remote monitoring of patients' vital signs, chronic conditions, and post-operative recovery. This technology allows healthcare providers to track patients' progress and intervene when necessary, improving patient care. Wearable devices, such as fitness trackers, smartwatches, and health monitoring wearables, have gained popularity. These devices track various health parameters and enable individuals to monitor their health in real-time. The adoption of electronic health records has improved the management of patient data, leading to more accurate and coordinated care. EHRs enhance patient safety and enable data-driven decision-making. Mobile applications that focus on health and wellness have become prevalent. These apps offer features for symptom tracking, medication reminders, fitness routines, and mental health support. Artificial intelligence (AI) and machine learning technologies are used for medical image analysis, disease prediction, and personalized treatment planning. These advanced tools are contributing to more accurate diagnoses and treatment recommendations. Health information exchange platforms facilitate the secure sharing of patient data between healthcare providers, improving care coordination and reducing duplication of tests and procedures.

Segmental Insights

Type Insights

In 2023, the India Medical Devices Market largest share was held by Diagnostic Imaging Equipment segment and is predicted to continue expanding over the coming years. The prevalence of various diseases, including cardiovascular diseases, cancer, and orthopaedic conditions, has been on the rise in India. Diagnostic imaging equipment plays a critical role in the early detection and diagnosis of these diseases, driving demand for these devices. Diagnostic imaging equipment, such as MRI machines, CT scanners, and X-ray machines, are essential for providing advanced healthcare services. Major hospitals and diagnostic centres rely on these devices for accurate and timely diagnoses, making them a central component of the healthcare infrastructure. India has been investing in expanding its healthcare infrastructure, including the establishment of new hospitals, diagnostic centres, and clinics. These facilities often prioritize equipping themselves with modern diagnostic imaging equipment to offer comprehensive services. Increasing health insurance coverage in India has made advanced diagnostic procedures more accessible to a larger portion of the population. This has led to an increased utilization of diagnostic imaging equipment in healthcare facilities. Advances in diagnostic imaging technology have made these devices more precise and accessible. Innovations in equipment design, imaging software, and data analysis have improved the accuracy of diagnoses. There is a growing awareness of preventive healthcare in India. Screening and early detection of diseases have become a focal point for both healthcare providers and patients, leading to greater demand for diagnostic imaging equipment.

End-User Insights

In 2023, the India Medical Devices Market largest share was held by Hospitals & Clinics segment in the forecast period and is predicted to continue expanding over the coming years. Hospitals and clinics in India cater to a significant portion of the population, and they typically handle a large volume of patients daily. This high patient footfall necessitates a wide range of medical devices for diagnostic, therapeutic, and monitoring purposes. Hospitals and clinics offer a comprehensive range of medical services, from routine check-ups to specialized surgeries. This diversity in healthcare services requires an extensive array of medical devices, including imaging equipment, surgical instruments, diagnostic devices, and more. Many advanced medical procedures and specialized care are provided in hospitals and larger clinics. These specialized treatments often require highly sophisticated medical devices, which contribute to a significant portion of the market share. The rising burden of chronic diseases in India, such as diabetes, cardiovascular diseases, and cancer, has led to a higher demand for medical devices for disease management and long-term care. Hospitals and clinics are central to managing chronic conditions. Hospitals play a critical role in providing emergency and critical care services. They require a range of life-saving medical devices, including ventilators, defibrillators, and monitoring equipment, to support patients in emergency situations.

Regional Insights

The North India region dominates the India Medical Devices Market in 2023. North India, especially Delhi and its surrounding areas, houses many prestigious healthcare institutions, hospitals, and medical research centers. These institutions are often early adopters of advanced medical technologies and devices, creating a robust demand for medical devices in the region. North India has a high population density, particularly in urban areas. With a larger population, there is a greater demand for healthcare services and medical devices. The North India region, including the NCR, has experienced significant economic development. As people's income levels rise, they are more likely to access and afford advanced medical treatments, which drives the demand for medical devices. The government of Delhi and the central government have initiated various healthcare programs and policies, including the promotion of advanced medical devices. This support has fostered the growth of the medical device market in the region. Delhi and nearby areas have become a hub for medical tourism. International patients travel to the region for medical treatments, including surgeries and advanced diagnostics. This has further increased the demand for state-of-the-art medical devices.

Recent Developments

- In May 2023, Omron, a Japanese company (6645.T), is set to invest 1.28 billion Indian rupees ($15.5 million) in its inaugural medical device manufacturing facility in India, situated in the southern state of Tamil Nadu, according to the state government. This move marks the latest foreign manufacturer's decision to establish operations in this region, and Omron's contribution is expected to significantly contribute to the enhancement of Tamil Nadu's medical infrastructure by commencing the production of medical devices within the state.

- In April 2022, Wipro GE Healthcare, a prominent global innovator in medical technology and digital solutions, has recently unveiled its next-generation Revolution Aspire CT scanner. This advanced imaging solution is proudly crafted from start to finish within India, aligning with the 'Atmanirbhar Bharat' initiative. The Revolution Aspire CT system incorporates enhanced imaging intelligence, boosting clinical confidence in disease and anomaly diagnoses. Notably, this scanner offers clinicians an up to 50% increase in operational efficiency, thanks to a 20% reduction in rotation time. This improvement allows for speedier diagnoses, coupled with a significantly enhanced cooling rate, enabling continuous scanning at a higher rate and accommodating more patients daily.

Key Market Players

- Wipro GE Healthcare Pvt. Ltd.

- Mindray Medical India Pvt Ltd

- Siemens India

- Philips India Ltd

- Hitachi Medical Systems India

- Shimadzu India

- Fujifilm India Pvt. Ltd, India

- Medtronic Pvt Ltd

- Johnson & Johnson Medical India Limited

- Abbott India Limited

- Becton, Dickinson Private Limited

- Roche Diagnostics India limited.

- Alcon Laboratories (India) Private Limited

- Carl Zeiss India Private Limited

- Canon Medical India

Report Scope:

In this report, the India Medical Devices Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- Medical Devices Market , By Type:

o Cardiovascular Devices

o Diagnostic Imaging Equipment

o In-vitro Diagnostic Devices

o Ophthalmic Devices

o Diabetes Care Devices

o Dental Care Devices

o Surgical Equipment

o Patient Monitoring Devices

o Orthopedic Devices

o Nephrology & Urology Devices

o ENT Devices

o Anesthesia & Respiratory Devices

o Neurology Devices

o Mobility-Aid Devices

o Others

- Medical Devices Market , By End-User:

o Hospitals & Clinics

o Diagnostic Centers

- Medical Devices Market, By region:

o North India

o South India

o East India

o West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the India Medical Devices Market.

Available Customizations:

India Medical Devices Market report with the given market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

India Medical Devices Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]

1. Product Overview

1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.2.3. Key Market Segmentations

2. Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Types

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

3. Executive Summary

3.1. Overview of the Market

3.2. Overview of Key Market Segmentations

3.3. Overview of Key Market Players

3.4. Overview of Key Regions/Countries

3.5. Overview of Market Drivers, Challenges, and Trends

4. Voice of Customer

5. India Medical Devices Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Type (Cardiovascular Devices, Diagnostic Imaging Equipment, In-vitro Diagnostic Devices, Ophthalmic Devices, Diabetes Care Devices, Dental Care Devices, Surgical Equipment, Patient Monitoring Devices, Orthopedic Devices, Nephrology & Urology Devices, ENT Devices, Anesthesia & Respiratory Devices, Neurology Devices, Mobility-Aid Devices, Others)

5.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

5.2.3. By Region (North India, South India, East India, West India)

5.2.4. By Company

5.3. Product Market Map

6. India Cardiovascular Devices Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Type (Diagnostic & Monitoring Devices v/s Surgical Devices)

6.2.1.1. By Diagnostic & Monitoring Devices (ECG, Holter Monitors, Implantable Loop Recorders, Event Monitors)

6.2.1.2. By Surgical Devices (Pacemakers, Stents, Valves, Other)

6.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

7. India Diagnostic Imaging Equipment Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Type (X-Ray Systems, Ultrasound Systems, CT Scanner, MRI, others)

7.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

8. India In-vitro Diagnostic Devices Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Type (Point-of-Care Diagnostic Devices, Immunochemistry Diagnostic Devices, Clinic Chemistry Diagnostics Devices, Others)

8.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

9. India Ophthalmic Devices Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Type (Vision Care Devices, Cataract Surgery Devices, Diagnostic & Monitoring Devices, Others)

9.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

10. India Diabetes Care Devices Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Type (Self-Blood Glucose Monitoring Devices, Continuous Blood Glucose Monitoring Devices)

10.2.1.1. By Self-Blood Glucose Monitoring Devices (Test Strips, Lancets, Glucometer)

10.2.1.2. By Continuous Glucose Monitoring Devices (Sensors, Transmitters & Receivers, Integrated Insulin Pumps)

10.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

11. India Dental Care Devices Market Outlook

11.1. Market Size & Forecast

11.1.1. By Value

11.2. Market Share & Forecast

11.2.1. By Type

11.2.2. By Type (General Dental Devices, Dental Surgical Devices, Others)

11.2.3. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

12. India Surgical Equipment Market Outlook

12.1. Market Size & Forecast

12.1.1. By Value

12.2. Market Share & Forecast

12.2.1. By Type (Surgical Sutures & Staplers, Handheld Surgical Devices, Electrosurgical Devices)

12.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

13. India Patient Monitoring Devices Market Outlook

13.1. Market Size & Forecast

13.1.1. By Value

13.2. Market Share & Forecast

13.2.1. By Type (Vital Signs Monitoring Devices, Fetal & Neonatal Monitoring Devices, Weight Monitoring and Body Temperature Monitoring Devices, Others)

13.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

14. India Orthopedic Devices Market Outlook

14.1. Market Size & Forecast

14.1.1. By Value

14.2. Market Share & Forecast

14.2.1. By Type (Joint Reconstruction Devices, Spinal Surgery Devices, Trauma Fixation Devices, Orthopedic Braces and Support Devices, Others)

14.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

15. India Nephrology & Urology Devices Market Outlook

15.1. Market Size & Forecast

15.1.1. By Value

15.2. Market Share & Forecast

15.2.1. By Type Endoscopy Devices, Dialysis Devices, Urinary Stone Treatment Devices, Others)

15.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

16. India ENT Devices Market Outlook

16.1. Market Size & Forecast

16.1.1. By Value

16.2. Market Share & Forecast

16.2.1. By Type (Hearing Aid Devices, Nasal Splints, ENT Surgical Devices, Others)

16.2.2. End User (Hospitals & Clinics, Diagnostic Centers, Others)

17. India Anesthesia & Respiratory Devices Market Outlook

17.1. Market Size & Forecast

17.1.1. By Value

17.2. Market Share & Forecast

17.2.1. By Type (Respiratory Devices, Anesthesia Machines, Others)

17.2.2. End User (Hospitals & Clinics, Diagnostic Centers, Others)

18. India Neurology Devices Market Outlook

18.1. Market Size & Forecast

18.1.1. By Value

18.2. Market Share & Forecast

18.2.1. Type (Neurostimulation Devices, Neurology Devices, Interventional Neurology Devices, Others)

18.2.2. By End User (Hospitals & Clinics, Diagnostic Centers, Others)

19. India Mobility-Aid Devices Market Outlook

19.1. Market Size & Forecast

19.1.1. By Value

19.2. Market Share & Forecast

19.2.1. By Type (Wheelchairs, Walking Aids, Mobility Lifts, Slings, Others)

19.2.2. End User (Hospitals & Clinics, Diagnostic Centers, Others)

19.2.3.

20. Market Dynamics

20.1. Drivers

20.2. Challenges

21. Market Trends & Developments

21.1. Merger & Acquisition

21.2. Product Development

21.3. Recent Developments

22. Policy & Regulatory Landscape

23. Porters Five Forces Analysis

23.1. Competition in the Industry

23.2. Potential of New Entrants

23.3. Power of Suppliers

23.4. Power of Customers

23.5. Threat of Substitute Products

24. India Economic Profile

25. Pricing Analysis

26. Competitive Landscape

26.1. Wipro GE Healthcare Pvt. Ltd.

26.2. Mindray Medical India Pvt Ltd

26.3. Siemens India

26.4. Philips India Ltd

26.5. Hitachi Medical Systems India

26.6. Shimadzu India

26.7. Fujifilm India Pvt. Ltd, India

26.8. Medtronic Pvt Ltd

26.9. Johnson & Johnson Medical India Limited

26.10. Abbott India Limited

26.11. Becton, Dickinson Private Limited

26.12. Roche Diagnostics India limited.

26.13. Alcon Laboratories (India) Private Limited

26.14. Carl Zeiss India Private Limited

26.15. Canon Medical India

27. Strategic Recommendations

28. About Us & Disclaimer

Figures and Tables

What was the market size of the india medical devices market in 2023.

The market size of the Medical Devices Market was estimated to be USD 15.35 billion in 2023.

Who are the top players operating in the India Medical Devices Market in 2023?

Wipro GE Healthcare Pvt. Ltd., Mindray Medical India Pvt Ltd are some of the key players operating in the Medical Devices Market.

What are the challenges faced by the India Medical Devices Market in the upcoming years?

The Indian medical device industry has historically faced challenges related to regulatory clarity and consistency.

What is the trend in India Medical Devices Market?

Indian healthcare providers and patients were increasingly embracing digital health solutions, such as mobile health apps and wearable health devices.

- Life Sciences Analytics Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product Type (Descriptive Analytics, Predictive Analytics, Prescriptive Analytics), By Application (Research and Development, Supply Chain Analytics, Sales and Marketing, Other Applications), By Component (Services, Software) , By End User (Clinical Research Institutions, Pharmaceutical and Biotechnology Companies, Medical Device Companies, Other End Users) By Region and Competition 2019-2029F

- Breast Biopsy Devices Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Biopsy Needles, Guidance Systems, Biopsy Tables, Localization Wires, Assay Kits, Liquid Biopsy Instruments, Others), By Procedure (Needle Breast Biopsy, Open Surgical Breast Biopsy, Liquid Breast Biopsy), By Application (Early Cancer Screening, Therapy Selection, Treatment Monitoring, Recurrence Monitoring), By End User (Hospitals & Surgical Centers, Breast Care Centers, Imaging Clinics & Diagnostic Centers), By Region, By Competition, 2019-2029F

- Anti-Vascular Endothelial Growth Factor Therapeutics Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product (Eylea, Lucentis, Beovu), By Disease (Macular Edema, Diabetic Retinopathy, Retinal Vein Occlusion, Age-related Macular Degeneration), By End Users (Hospitals & Clinics, Ambulatory Care centers, Others), By Region and Competition 2019-2029F

- E-Prescribing Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product (Solutions (Integrated Solutions, Standalone Solutions), Services(Support, Implementation, Training, Network), By Specialties (Oncology, Sports Medicine, Neurology, Cardiology, Others), By Delivery Mode (Web/Cloud Based, On Premise), By Substances (Controlled Substances, Non-controlled Substances), By Region and Competition, 2019-2029F

- UAE Genetic Testing Market Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Carrier Testing, Diagnostic Testing, New-born Screening, Predictive & Presymptomatic Testing, Prenatal Testing, Others), By Disease (Sickle Cell Anemia, Thalassemia, Huntington's Disease, Cancer, Others), By Technology (Cytogenetic Testing, Biochemical Testing, Molecular Testing), By Service Providers (Clinical & Metabolic Specialists, Genetic Counsellors, Diagnostic Laboratories, Hospitals), By Region and Competition, 2019-2029F

- North America Medical Oxygen Market Segmented By Form (Liquid Oxygen, Compressed Oxygen, Oxygen Gas Mixture), By Delivery Mode (Tanks/Pipeline, Cylinder, Others), By Application (Therapeutic, Diagnostic), By End-User (Hospitals & Clinics, Ambulatory Care Centers, Homecare, Others), By Region, Competition, Forecast and Opportunities, 2019-209F

- Antiviral Combination Therapy Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Branded, Generic), By Drug Combination (DNA Polymerase Inhibitors, Reverse Transcriptase Inhibitors, Protease Inhibitors, Neuraminidase Inhibitors, Others), By Route of Administration (Oral, Intravenous), By Distribution Channel (Hospital Pharmacies; Retail Pharmacies; Other Distribution Channels), By Indications (Human Immunodeficiency Virus, Hepatitis, Others), By Region and Competition, 2019-2029F

- Platysmaplasty Treatment Market – Global Industry Size, Share, Trends, Opportunity, & Forecast, Segmented By Gender (Male, Female), By End-User (Cosmetic Surgery Clinics, Hospitals), By Region, Competition 2019-2029F

- Electrophoresis Reagents Market- Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product (Gels, Dyes, Buffers, and Other Products), By Technique (Gel Electrophoresis and Capillary Electrophoresis), By End User (Academic and Research Institutions, Pharmaceutical and Biotechnology Companies, Laboratories, and Other End Users), By Region, By Competition, 2019-2029F

- Breath Analyzers Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Technology (Fuel Cell Technology, Semiconductor Sensor, Infrared (IR) Spectroscopy, Others), By Application (Drug Abuse Detection, Alcohol Detection, Medical Applications, Others), By Region and Competition, 2019-2029F

Sakshi Bajaal

Business consultant.

India Medical Devices Market To Establish Growth With Impressive CAGR Until FY2027

India Medical Devices Market is expected to show robust growth due to increasing demand for early diagnosis in the forecast period, FY2017-FY2027.

Why Choose Us

- Post-Sales Support

- 4000+ Reports Repository

- 10% Free Customization

- Large Network Of Industry Experts

- Deep Sector Specific Intelligence

- Unique Mix Of Global, Regional And Country Specific Reports

- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

India Medical Devices Market Research Report Information By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, IVD, MIS, Wound Management, Diabetes Care, Opthalmic Devices, Dental, Nephrology, General Surgery, and Others), By End User (Hospitals and ASCs, Clinics, and Others) –Market Forecast Till 2032

- Table of Content

- Download PDF

India Medical Devices Market Overview

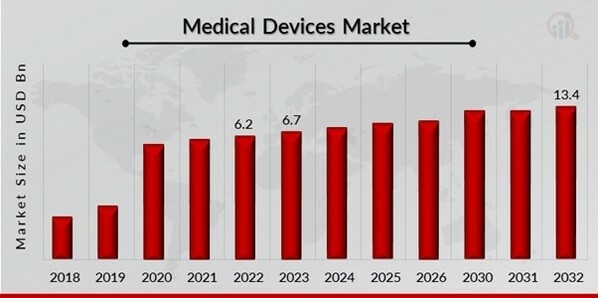

India Medical Devices Market Size was valued at USD 6.2 Billion in 2022. The medical devices market industry is projected to grow from USD 6.7 Billion in 2023 to USD 13.4 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.00% during the forecast period (2023 - 2032). Increasing demand for healthcare services and infrastructure, growing middle class with higher disposable incomes, and rising prevalence of chronic diseases are the main market drivers anticipated to propel the medical devices market in India.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Medical Devices Market Trends

- Increasing demand for healthcare services and infrastructure is driving the market growth

India has a large and rapidly growing population, which is expected to reach 1.4 billion by 2025. This means that there will be an increasing demand for healthcare services to cater to the needs of the growing population. With advances in medical technology and healthcare services, life expectancy in India has been steadily increasing. This means that there will be a larger elderly population that will require more healthcare services and medical devices. Additionally, the Indian government has been increasing its spending on healthcare services, with a focus on providing universal health coverage to its citizens. This has led to an increase in the number of hospitals, clinics, and healthcare facilities across the country. There is an increasing awareness among the Indian population about the importance of maintaining good health and seeking medical attention when required. This has led to a higher demand for healthcare services and medical devices. Overall, the increasing demand for healthcare services and infrastructure in India is driving the growth of the medical devices market in the country, as more medical devices are required to meet the growing healthcare needs of the population.

Furthermore, the rising prevalence of chronic diseases in India is another major factor driving the growth of the medical devices market in the country. Chronic diseases are long-term health conditions that require ongoing medical attention and management. Some of the most common chronic diseases in India include diabetes, cardiovascular disease, respiratory diseases, and cancer. Rapid urbanization and changing lifestyles have led to a rise in sedentary lifestyles, unhealthy diets, and increasing stress levels. These factors have contributed to the increasing prevalence of chronic diseases in India. Moreover, the Indian population is aging, with a larger elderly population that is more susceptible to chronic diseases. According to the World Health Organization (WHO), the proportion of elderly people in India is expected to increase from 7.5% in 2010 to 19% by 2050. The rising prevalence of chronic diseases in India is driving the demand for medical devices that can help in the prevention, diagnosis, and management of these conditions. For example, medical devices such as glucose meters, blood pressure monitors, and respiratory devices are increasingly being used to monitor and manage chronic diseases. Overall, the increasing prevalence of chronic diseases in India is a major growth driver for the medical devices market in the country.

Medical Devices Market Segment Insights

Medical devices type insights.

The India Medical Devices market segmentation, based on type includes Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, IVD, MIS, Wound Management, Diabetes Care, Opthalmic Devices, Dental, Nephrology, General Surgery, and Others. The diagnostic imaging segment dominated the market mostly. This segment includes devices such as X-ray machines, ultrasound systems, MRI machines, CT scanners, and nuclear imaging systems. Diagnostic imaging devices are widely used in various medical fields for diagnosing and monitoring diseases, making it a crucial segment in the medical devices market in India.

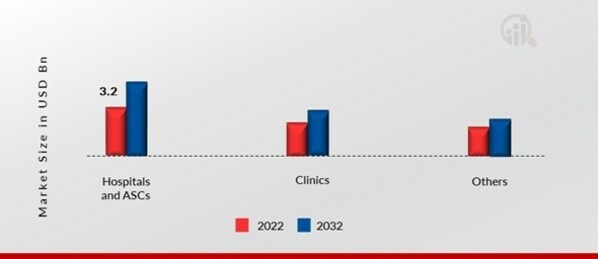

Medical Devices End User Insights

The India Medical Devices market segmentation, based on end user, includes Hospitals and ASCs, Clinics, and Others. The Hospitals and ASCs (Ambulatory Surgical Centers) category generated the most income. Hospitals and ASCs are the primary healthcare facilities where a wide range of medical devices are used for diagnosis, treatment, and patient care. These facilities have a higher demand for medical devices due to the large number of patients they handle and the variety of medical procedures they perform.

Figure 1: India Medical Devices Market, by End User, 2022 & 2032 (USD Billion)

Medical Devices Country Insights

The Indian government has implemented several initiatives to promote the domestic manufacturing of medical devices. The "Make in India" campaign and the National Medical Devices Promotion Council (NMDPC) are aimed at encouraging local production and reducing dependence on imports. India's healthcare expenditure has been rising steadily, driven by increasing awareness, improved access to healthcare facilities, and the implementation of government-sponsored health insurance schemes. This has led to increased demand for medical devices in the country. Moreover, India has emerged as a popular destination for medical tourism due to its affordable healthcare services. This has contributed to the demand for advanced medical devices and technology in the country. In addition, the medical devices sector in India is regulated by the Central Drugs Standard Control Organization (CDSCO) under the purview of the Ministry of Health and Family Welfare. The government has been taking steps to streamline the regulatory framework to ensure safety, efficacy, and quality of medical devices.

Medical Devices Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the medical devices market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, medical devices industry must offer cost-effective items.

Major players in the medical devices market are attempting to increase market demand by investing in research and development operations includes Medtronic, STRYKER, Johnson & Johnson Services, Inc., FRESENIUS SE & CO. KGAA, Koninklijke Philips N.V., Abbott, GENERAL ELECTRIC COMPANY, SIEMENS HEALTHINEERS AG.

Key Companies in the medical devices market include

- Johnson & Johnson Services, Inc.

- FRESENIUS SE & CO. KGAA

- Koninklijke Philips N.V.

- GENERAL ELECTRIC COMPANY

- SIEMENS HEALTHINEERS AG

Medical Devices Industry Developments

2019: Johnson & Johnson launched ACUVUE Oasys with Transitions, a first-of-its-kind contact lens that adapts to changing light conditions.

2020: Medtronic launched the MiniMed 780G system, an advanced insulin pump system for diabetes management.

Medical Devices Market Segmentation

Medical devices type outlook.

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- Wound Management

- Diabetes Care

- Opthalmic Devices

- General Surgery

Medical Devices End User Outlook

- Hospitals and ASCs

Frequently Asked Questions (FAQ) :

The India medical devices market size was valued at USD 6.2 Billion in 2022.

The market is projected to grow at a CAGR of 9.00% during the forecast period, 2023-2032.

The key players in the market are Medtronic; STRYKER; Johnson & Johnson Services, Inc.; FRESENIUS SE & CO. KGAA; Koninklijke Philips N.V.; Abbott; GENERAL ELECTRIC COMPANY; SIEMENS HEALTHINEERS AG.

The diagnostic imaging category dominated the market in 2022.

The hospitals and ASCs category had the largest share in the market.

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

We do not share your information with anyone. However, we may send you emails based on your report interest from time to time. You may contact us at any time to opt-out.

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.

Get Free Sample

Rahul Gotadki

Assistant Manager He holds an experience of about 7+ years in market research and business consulting, working under the spectrum of life sciences and healthcare domains. rahul conceptualizes and implements a scalable business strategy and provides strategic leadership to the clients. his expertise lies in market estimation, competitive intelligence, pipeline analysis, customer assessment, etc. in addition to the above, his other responsibility includes strategic tracking of high growth markets & advising clients on the potential areas of focus they could direct their business initiatives

Free Sample Request

Leading companies partner with us for data-driven Insights.

© 2024 Market Research Future ® (Part of WantStats Reasearch And Media Pvt. Ltd.)

We use cookies for a better user experience. Read our Privacy Policy I Agree X

India Medical Devices Market

SPECIAL OFFER : 25% Super Discount For All !

India Medical Devices Market, By Device Type (Respiratory Care Devices, Diagnostic Imaging Systems, Orthopedic Devices, Ventilators, Anesthesia Monitoring Devices, Endoscopy Devices, Cardiac Monitoring & Cardiac Rhythm Management Devices, Interventional Cardiology Devices, Diabetes Care Devices, Ophthalmic Devices, Respiratory Care Devices, Dialysis Devices), By End-User (Hospitals, Clinics, Home-Care), By Region (North India, South India, East India, West India) Trend Analysis, Competitive Market Share & Forecast, 2018-2028

- Published Date: April 2022

- Report ID: BWC22118

- Available Format: PDF

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Request a Sample Copy --> Request a Sample Copy