Yahoo! The story of strategic mistakes

Jerry Yang and David Filo founded Yahoo in January 1994 . Both of them were Stanford graduates. At first, they developed a website named “Jerry and David’s Guide to the World Wide Web”. It was simply a directory of other websites, organized in a hierarchy as a searchable index of pages.

By April 1994, Jerry and David’s Guide to the World Wide Web was renamed “Yahoo! “. The word “YAHOO” is an acronym for “ Yet Another Hierarchically Organized Oracle “.

Yahoo witnessed an enormous and rapid growth throughout the ’90s and diversified its business. It was poised to become a giant and a high profile company.

Yahoo provided a search engine and a directory for other websites in a time when people could only log into a website if they knew the website address. Else there was no way to search a website.

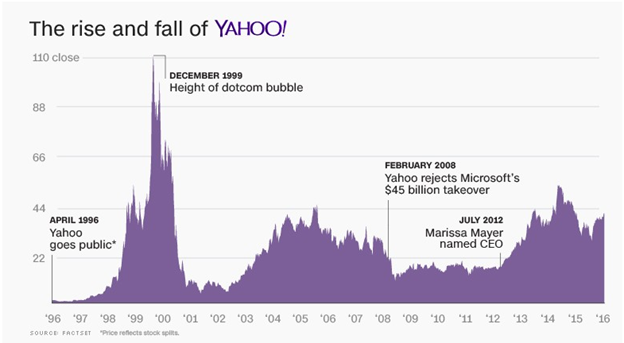

The company started making money from the advertising banners which was the first of its kind and started to grow rapidly. Yahoo went public in April 1996 and its stock price rose by 600 percent within two years and by 1998, Yahoo was the most popular starting point for web users receiving 95 million page views per day.

Yahoo came up with a series of funny advertisements to popularize its search engine. Check this one out!!

Yahoo’s stock became investor’s darling during the dot.com bubble and once closed at an all-time high of $118.75 in 2000. Just after the dot.com bubble crash the stuck plunged to all time lowest (literrally) at $8.11.

Despite the tremendous performance of Yahoo at its early stages, the company started bleeding in the late 2000s due to multiple factors. Here are the top 6 reasons which resulted in Yahoo’s downfall:

Wrong decisions: Yahoo refused to buy Google for 1 million dollars:

Back in 1998, two individuals, Larry Page and Sergei Brin (Google founders), offered to sell their little startup algorithm to Yahoo for $1 million. The algorithm was supposed to help the Yahoo search engine perform faster and enhance the experience of web search.

Yahoo turned down the offer mainly because it wanted its users to spend more time on Yahoo’s own platform and the other Yahoo content so that it can make more money from the advertising banners on the website.

Again, in 2002 Yahoo rejected an offer to buy Google for $5 billion when the CEO Terry Semel refused the deal after months of negotiation. Yahoo offered to buy Google at $3 billion but Google was keen on getting $5 billion. So the deal could never happened. (Thank God!!)

Failing to buy Facebook :

As if saying no to Google was not enough for Yahoo . According to the book called The Facebook Effect by David Kirkpatrick, Yahoo initially offered $1 billion to Facebook but later lowered it to $850 million. David writes that Facebook made its mind in 10 minutes to decline the offer. Although, some stories say that if the offer was submitted at $1.1 billion instead of $1 billion, the board of directors would’ve put pressure on Mark Zuckerberg to sell.

Unsuccessful acquisitions :

Even the successful acquisitions could not bring value to the organization. Yahoo acquired two companies in 1999 that are now ranked by Forbes as some of the worst internet acquisitions of all-time.

The first was a $4.58 billion deal for Geocities, a site that enabled users to build their own personal websites. While Geocities was a pioneer in this regard, it eventually was shut down in 2009 after failing to deliver any value to Yahoo shareholders.

The second was the famous $5.7 billion deal for Broadcast.com, an online television site that was founded by Mark Cuban. Perhaps the idea was way ahead of its time and internet connections were too slow in 1999 to run this type of video content off the web..

Yahoo also bought Tumblr for $1.1 billion in 2013. Many Tumblr users were unhappy with this acquisition and started an online petition which got 170,000 signatures. Yahoo had to write down more than half of Tumblr by 2016 and ultimately sold it to Verizon.

Hiring wrong CEOs :

As experts say, Yahoo has repeatedly hired the wrong CEOs. None of the CEOs at Yahoo including Marissa Mayer had a “strategic vision” that could match what Eric Schmidt at Google brought. Some even blame Marissa Mayer entirely for the wrong decisions.

Lack of clear vision and a string of poor leaders :

It’s very clear from the strategic mistakes of Yahoo that its leadership lacked a clear vision and the overall purpose of the company. Meanwhile, Google and Microsoft were very clear about their strategic direction.

Yahoo was all over the place. During the research, people were asked to identify Yahoo with what first comes to their mind. Some said Mail , Some Media. Some said search. Clearly, Yahoo failed to create a niche for itself that its competitors successfully did.

Some former employees actually saw the slow demise of the company many years before it actually happened as they could see the bureaucratic culture with too much focus on advertising.

It became very difficult to get both investment and alignment. If you built a new product and the home page didn’t want to feature it, you were hosed. Greg Cohn, a former senior product director at Yahoo to Reuters

Declining Microsoft’s acquisition :

This was the final nail in the coffin. In 2008, Microsoft had shown its interest to buy Yahoo for $44.6 billion but Yahoo declined that too (I really don’t know what they were thinking). Since then, the company market value has never reached such numbers. In 2016 Verizon bought Yahoo in a deal worth $4.8 billion.

Yahoo is still not dead though. It is still among the world’s top 10 websites with more than 3.5 billion visits per month . Nevertheless, its place does not augur well for a bright future. Unless Yahoo comes up with any innovation that can change the future of technology, Yahoo! may die gradually in the coming years. It’s a perfect story to learn where the company despite having the right technology and right resources at disposal, failed miserably due to its strategic mistakes.

Interested in reading our Advanced Strategy Stories . Check out our collection.

Also check out our most loved stories below

IKEA- The new master of Glocalization in India?

IKEA is a global giant. But for India the brand modified its business strategies. The adaptation strategy by a global brand is called Glocalization

How Bata became India’s household name despite being a classy international brand?

Bata is not an Indian brand. It is as international as it can be. But what strategies made it India’s highest selling footwear brand?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

How traditional banks in India are dealing with cryptocurrency?

Adaption of cryptocurrency like Bitcoin is rising in India. Despite the removal of the RBI ban by the Supreme Court, banks in India still hesitate to deal with cryptocurrency.

Microsoft – How to Be Cool by Making Others Cool

Microsoft CEO Satya Nadella said, “You join here, not to be cool, but to make others cool.” We decode the strategy powered by this statement.

I'm a Finance professional with passion for economics and stories of the companies. A commercial driven finance person with more than 12 years of experience in the FMCG industry working with some of the biggest brand in the world.

Related Posts

Revolutionizing Supply Chain Planning with AI: The Future Unleashed

Is AI the death knell for traditional supply chain management?

Merchant-focused Business & Growth Strategy of Shopify

Business, Growth & Acquisition Strategy of Salesforce

Hybrid Business Strategy of IBM

Strategy Ingredients that make Natural Ice Cream a King

Investing in Consumer Staples: Profiting from Caution

Storytelling: The best strategy for brands

How Acquisitions Drive the Business Strategy of New York Times

Rely on Annual Planning at Your Peril

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

How does DoorDash make money | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

The Decline of Yahoo in Its Own Words

- Walter Frick

It was 2012 before they really started talking about mobile, according to their earnings calls.

On Google’s earnings call for the first quarter of 2006 – more than a year before the iPhone was released and more than two years before the release of the first Android-operated smartphone – CEO Eric Schmidt went out of his way to talk about mobile.

- Walter Frick is a contributing editor at Harvard Business Review , where he was formerly a senior editor and deputy editor of HBR.org. He is the founder of Nonrival , a newsletter where readers make crowdsourced predictions about economics and business. He has been an executive editor at Quartz as well as a Knight Visiting Fellow at Harvard’s Nieman Foundation for Journalism and an Assembly Fellow at Harvard’s Berkman Klein Center for Internet & Society. He has also written for The Atlantic , MIT Technology Review , The Boston Globe , and the BBC, among other publications.

Partner Center

- Success stories

Business Insights

Artículos, noticias, casos de estudio y documentación sobre negocios. Únete a la comunidad de +50.000 suscriptores de todo el mundo.

Áreas y funciones

Casos de estudio, tags destacados, key concepts.

Personas . Procesos . Tecnología .

Creemos que los procesos claros, con el apoyo de la tecnología adecuada, generan un entorno donde las personas trabajan más felices, y en consecuencia vuelve a tu empresa más productiva.

World class technology. Soluciones de primer nivel para tu empresa.

Yahoo! case: the fall

In the early days of Internet search engines and email pages, Yahoo! was one of the giants. From the beginning, it was outlined to achieve a great future, but due to bad decisions made throughout its history, the company, today, does not have much weight on the Internet and has been sold for much fewer dollars than in a time had been offered.

In this case study, we are going to talk about the history of Yahoo! and what were the key decisions that led this company to its decline instead of leading it to the success that it seemed it was going to have.

<<< Case study Blockbuster: Why is it necessary to innovate? >>>

What is the history of Yahoo!?

The company was born in 1994 , like most companies in the United States, in a small office or shed of some university, from the idea of university classmates. In this case, it was in a small office at Stanford University that Jerry Yang and David Filo created a directory of Internet pages to facilitate the search for information and websites. We must bear in mind that we are talking about the first half of the 90s when the Internet was not yet so installed in our lives and a few years ago web pages began to emerge.

In 1995, the yahoo.com domain was created , having exceeded 100,000 daily visits in 1994 . In this way, its founders managed to get a venture capital company to invest a million dollars in them and from there venture into novelties that were not yet so exploited in the virtual world. In 1996 Yahoo went public.

From that moment, the company began to grow abysmally . Incorporated Yahoo! mail, games, pagers, and yahoo messenger, among other actions that led it to position itself as one of the companies of the moment. For a long period, Yahoo! was growing, increasing its numbers and employees. It was part of the boom of internet pages that occurred between 1997 and 2001.

<<< Netflix case: disruptive business model >>>

When did their mistakes start?

In 1998 Google emerged , the company that years later would be one of the main nightmares of Yahoo!. In its beginnings, today's giant Google asked for financing from Yahoo! and it refused to give it. We could say that this was one of the first mistakes.

During the first years of development, both companies coexisted, but as Google gained ground, Yahoo! went from being a provider of services on the web to being an advertising portal that was increasingly relegated to what the competition allowed it to access.

In 2007 , one of the most serious mistakes of the company Yahoo! is committed. The owners of Google do not rule out selling their company, and Yahoo! offered 3,000 million dollars, but unfortunately, they could not acquire it because the amount that Page and Brin asked for was 5,000 million. Yahoo! did not make any other offer and lost one of the great opportunities that it would have had to gain much more ground in virtuality.

Another of the mistakes that condemned this company was the missed opportunity to buy Doubleclick , an online advertising company, which was later bought by Google and through which it was able to take a big step in terms of online advertising. What also unseated Yahoo! in this area of development.

Later, Yahoo! also had the opportunity to buy Facebook. In 2006 , the social media company did not have the weight it has today, but its imminent growth could be seen coming. Zuckerberg was asking for something like $1 billion, but Yahoo! decided to offer 850 million and did not agree to buy it.

Microsoft , another technology giant, in 2008, offered the owners of Yahoo! to buy the company for more than 44,000 million dollars, much more money than it was worth at the time. But, again, Yahoo! made the wrong decision and turned down the offer. Even more incredible is that years later, Microsoft asked them for permission to use their search engine (Bing), and Yahoo! allowed it. Let's say it gave them something for free that, years before, they had offered billions of dollars for.

<<< Spotify case: The importance of user experience >>>

Other problems faced by the company

Cybersecurity today is one of the main issues that every technology company must guarantee, but in the case of Yahoo!, this has failed . Numerous times the company has acknowledged having suffered cyberattacks that generated data loss and leaks that involved user accounts. This took away the credibility of its security and, of course, caused many users to migrate to other offers. It has even admitted to creating software at the request of the US intelligence service, to obtain information from users' emails.

In addition to security problems, the company has suffered from organizational problems . In its years of history, it has had 7 different executive directors and almost none of them deviates from having made a significant mistake for the company. One of them even admitted having lied about the information on his CV.

In 2012 Marisa Mayer joined, who had previously worked at Google and came to Yahoo! hoping to revitalize the company but she didn't make it. It was she who in 2016 announced the sale of it to Verizon , for an amount of just over 4,000 million dollars , something that a few years before could have been much more.

<<< Zappos case: the best customer service >>>

As we see, the company Yahoo! has been successful in its first years , due to not having too much competition in the market, but as soon as a company of the same weight arrived, it was completely overshadowed by it and did not have enough maturity to make strategic decisions correctly, which led to its decline. The role of executive directors is very important when making decisions and also organizing the company itself, but this is something that could not be achieved. Their high turnover is a point that did not contribute at all to their growth.

Drew's editorial team

¿nos dejas un comentario.

- Utility Menu

Jonathan Xu

Harvard university.

Analyses of Yahoo Inc's challenges + strategic recommendations [Presentation] [Harvard coursework]

Why did Yahoo gradually disappear into oblivion? Why did it try, but fail, to reinvent itself?

We explore the underlying reasons for Yahoo's business failures. We also present some strategic recommendations for the firm going forward.

Jonathan Xu's Recent Publications

Potential circular economy strategies for the tokyo 2020 olympics [whitepaper] [harvard & world economic forum research project].

This was a joint project between by the World Economic Forum and the Harvard University faculty aide program.

In this report, we offer recommendations to the Japanese government on how the upcoming Tokyo 2020 Olympics can be designed to maximize sustainability while minimizing expenses. The recommendations are based on in-depth research and global best practices in event management. The recommendations cover the following areas:

- construction and design of Olympic facilities

- event transportation

- energy, food, and waste management

Rethinking the luxury auto business model [Article] [Harvard research project]

Published in Harvard Business Review (in France) and by the World Economic Forum

This paper proposes 3 strategies for luxury automakers to significantly raise profit margins while reducing resource utilization:

Strategy 1: Engage in more closed-loop recycling: establish vehicle collection programs, be more stringent in raw material selection

Strategy 2: ‘Rent instead of sell’ business model: providing vehicles as a service

Strategy 3: Lengthen product usability: using recyclable materials, improving engine recyclability, leveraging 3D printing

Market research study conducted for a small business facing growth challenges [Presentation] [Harvard coursework]

A small but fast-growing business was facing numerous challenges, including a high percentage of unsatisfied customers as well as difficulties in cross-selling their services.

We conducted a comprehensive market research study for business, comprised of 101 in-depth customer surveys, 2 focus groups, and 4 one-hour customer interviews.

As a result, we identified the key factors driving customer dissatisfaction, and devised more effective methods for reaching new customers and upselling old ones.

(All identifying information pertaining to this business have been removed/modified for this presentation.)

Strategies for effective marketing on Facebook [Presentation] [Harvard coursework]

How do you effectively market your business on Facebook? What are some of the best practices in maximizing impact while minimizing advertising costs? In this presentation, we go through the 5 steps to effective marketing on Facebook.

Entrepreneurial venture seeking to revolutionize the fitness industry [Presentation] [Harvard coursework]

How do you get fit without paying $70/hour for a personal trainer (U.S. urban average)?

We developed an idea for a mobile application that cuts fitness training costs by 40-70% while helping people improve their fitness levels. This can be a profitable business addressing unmet needs in a huge potential market.

Pricing strategy for a new cancer drug [Presentation] [Harvard-MIT 2016 Consulting Case Competition]

How do you price a new cancer drug?

An American pharmaceutical company has developed a new cancer-treating drug (“AB-123”), especially effective at treating colorectal cancer. It is seeking to develop a pricing strategy for the first three years of this drug, with a projected launch date of 2025. Our team presented at the competition in July 2016. (Client and drug names have been changed.) This competition was sponsored by 11 consulting firms, including McKinsey, BCG, Bain, L.E.K., among others.

Trending News

Related Practices & Jurisdictions

- Communications, Media & Internet

- Securities & SEC

- Criminal Law / Business Crimes

- All Federal

The fallout from the Yahoo data breaches continues to illustrate how cyberattacks thrust companies into the competing roles of crime victim, regulatory enforcement target and civil litigant.

Yahoo, which is now known as Altaba, recently became the first public company to be fined ($35 million) by the Securities and Exchange Commission for filing statements that failed to disclose known data breaches. This is on top of the $80 million federal securities class action settlement that Yahoo reached in March 2018—the first of its kind based on a cyberattack. Shareholder derivative actions remain pending in state courts, and consumer data breach class actions have survived initial motions to dismiss and remain consolidated in California for pre-trial proceedings. At the other end of the spectrum, a federal judge has balked at the U.S. Department of Justice's (DOJ) request that a hacker-for-hire indicted in the Yahoo attacks be sentenced to eight years in prison for a digital crime spree that dates back to 2010.

The Yahoo Data Breaches

In December 2014, Yahoo's security team discovered that Russian hackers had obtained its "crown jewels"—the usernames, email addresses, phone numbers, birthdates, passwords and security questions/answers for at least 500 million Yahoo accounts. Within days of the discovery, according to the SEC, "members of Yahoo's senior management and legal teams received various internal reports from Yahoo's Chief Information Security Officer (CISO) stating that the theft of hundreds of millions of Yahoo users’ personal data had occurred." Yahoo's internal security team thereafter was aware that the same hackers were continuously targeting Yahoo's user database throughout 2015 and early 2016, and also received reports that Yahoo user credentials were for sale on the dark web.

In the summer of 2016, Yahoo was in negotiations with Verizon to sell its operating business. In response to due diligence questions about its history of data breaches, Yahoo gave Verizon a spreadsheet falsely representing that it was aware of only four minor breaches involving users’ personal information. In June 2016, a new Yahoo CISO (hired in October 2015) concluded that Yahoo's entire database, including the personal data of its users, had likely been stolen by nation-state hackers and could be exposed on the dark web in the immediate future. At least one member of Yahoo's senior management was informed of this conclusion. Yahoo nonetheless failed to disclose this information to Verizon or the investing public. It instead filed the Verizon stock purchase agreement—containing an affirmative misrepresentation as to the non-existence of such breaches—as an exhibit to a July 25, 2016, Form 8-K, announcing the transaction.

On September 22, 2016, Yahoo finally disclosed the 2014 data breach to Verizon and in a press release attached to a Form 8-K. Yahoo's disclosure pegged the number of affected Yahoo users at 500 million.

The following day, Yahoo's stock price dropped by 3%, and it lost $1.3 billion in market capitalization. After Verizon declared the disclosure and data breach a "material adverse event" under the Stock Purchase Agreement, Yahoo agreed to reduce the purchase price by $350 million (a 7.25% reduction in price) and agreed to share liabilities and expenses relating to the breaches going forward.

Since September 2016, Yahoo has twice revised its data breach disclosure. In December 2016, Yahoo disclosed that hackers had stolen data from 1 billion Yahoo users in August 2013, and had also forged cookies that would allow an intruder to access user accounts without supplying a valid password in 2015 and 2016. On March 1, 2017, Yahoo filed its 2016 Form 10-K, describing the 2014 hacking incident as having been committed by a "state-sponsored actor," and the August 2013 hacking incident by an "unauthorized third party." As to the August 2013 incident, Yahoo stated that "we have not been able to identify the intrusion associated with this theft." Yahoo disclosed security incident expenses of $16 million ($5 million for forensics and $11 million for lawyers), and flatly stated: "The Company does not have cybersecurity liability insurance."

The same day, Yahoo's general counsel resigned as an independent committee of the Yahoo Board received an internal investigation report concluding that "[t]he 2014 Security Incident was not properly investigated and analyzed at the time, and the Company was not adequately advised with respect to the legal and business risks associated with the 2014 Security Incident." The internal investigation found that "senior executives and relevant legal staff were aware [in late 2014] that a state-sponsored actor had accessed certain user accounts by exploiting the Company's account management tool."

The report concluded that "failures in communication, management, inquiry and internal reporting contributed to the lack of proper comprehension and handling of the 2014 Security Incident." Yahoo's CEO, Marissa Mayer, also forfeited her annual bonus as a result of the report's findings.

On September 1, 2017, a California federal judge partially denied Yahoo's motion to dismiss the data breach class actions. Then, on October 3, 2017, Yahoo disclosed that all of its users (3 billion accounts) had likely been affected by the hacking activity that traces back to August 2013. During a subsequent hearing held in the consumer data breach class action, a Yahoo lawyer stated that the company had confirmed the new totals on October 2, 2017, based on further forensic investigation conducted in September 2017. That forensic investigation was prompted, Yahoo's counsel said, by recent information obtained from a third party about the scope of the August 2013 breach. As a result of the new disclosures, the federal judge granted the plaintiffs’ request to amend their complaint to add new allegations and causes of action, potentially including fraud claims and requests for punitive damages.

The SEC Breaks New Cybersecurity Ground

Just a month after issuing new interpretive guidance about public company disclosures of cyberattacks (see our Post and Alert ), the SEC has now issued its first cease-and-desist order and penalty against a public company for failing to disclose known cyber incidents in its public filings. The SEC's administrative order alleges that Yahoo violated Sections 17(a)(2) & (3) of the Securities Act of 1933 and Section 13(a) of the Securities Exchange Act of 1934 and related rules when its senior executives discovered a massive data breach in December 2014, but failed to disclose it until after its July 2016 merger announcement with Verizon.

During that two-year window, Yahoo filed a number of reports and statements with the SEC that misled investors about Yahoo's cybersecurity history. For instance, in its 2014-2016 annual and quarterly reports, the SEC found that Yahoo included risk factor disclosures stating that the company "faced the risk" of potential future data breaches, “without disclosing that a massive data breach had in fact already occurred.”

Yahoo management's discussion and analysis of financial condition and results of operation (MD&A) was also misleading, because it "omitted known trends and uncertainties with regard to liquidity or net revenue presented by the 2014 breach." Knowing full well of the massive breach, Yahoo nonetheless filed a July 2016 proxy statement relating to its proposed sale to Verizon that falsely denied knowledge of any such massive breach. It also filed a stock purchase agreement that it knew contained a material misrepresentation as to the non-existence of the data breaches.

Despite being informed of the data breach within days of its discovery, Yahoo's legal and management team failed to properly investigate the breach and made no effort to disclose it to investors. As the SEC described the deficiency, "Yahoo senior management and relevant legal staff did not properly assess the scope, business impact, or legal implications of the breach, including how and where the breach should have been disclosed in Yahoo's public filings or whether the fact of the breach rendered, or would render, any statements made by Yahoo in its public filings to be misleading." Yahoo's in-house lawyers and management also did not share information with its auditors or outside counsel to assess disclosure obligations in public filings.

In announcing the penalty, SEC officials noted that Yahoo left "its investors totally in the dark about a massive data breach" for two years, and that "public companies should have controls and procedures in place to properly evaluate cyber incidents and disclose material information to investors." The SEC also noted that Yahoo must cooperate fully with its ongoing investigation, which may lead to penalties against individuals.

The First Hacker Faces Sentencing

Coincidentally, on the same day that the SEC announced its administrative order and penalty against Yahoo, one of the four hackers indicted for the Yahoo cyberattacks (and the only one in U.S. custody) appeared for sentencing before a U.S. District Judge in San Francisco. Karim Baratov, a 23-year-old hacker-for-hire, had been indicted in March 2017 for various computer hacking, economic espionage, and other offenses relating to the 2014 Yahoo intrusion.

His co-defendants, who remain in Russia, are two officers of the Russian Federal Security Service (FSB) and a Russian hacker who has been on the FBI's Cyber Most Wanted list since November 2013. The indictment alleges that the Russian intelligence officers used criminal hackers to execute the hacks on Yahoo's systems, and then to exploit some of that stolen information to hack into other accounts held by targeted individuals.

Baratov is the small fish in the group. His role in the hacking conspiracy focused on gaining unauthorized access to non-Yahoo email accounts of individuals of interest identified through the Yahoo data harvest. Unbeknownst to Baratov, he was doing the bidding of Russian intelligence officers, who did not disclose their identities to the hacker-for-hire. Baratov asked no questions in return for commissions paid on each account he compromised.

In November 2017, Baratov pled guilty to conspiracy to commit computer fraud and aggravated identity theft. He admitted that, between 2010 and 2017, he hacked into the webmail accounts of more than 11,000 victims, stole and sold the information contained in their email accounts, and provided his customers with ongoing access to those accounts. Baratov was indiscriminate in his hacking for hire, even hacking for a customer who appeared to engage in violence against targeted individuals for money. Between 2014 and 2016, he was paid by one of the Russian intelligence officers to hack into at least 80 webmail accounts of individuals of interest to Russian intelligence identified through the 2014 Yahoo incident. Baratov provided his handler with the contents of each account, plus ongoing access to the account.

The government is seeking eight years of imprisonment, arguing that Baratov "stole and provided his customers the keys to break into the private lives of targeted victims." In particular, the government cites the need to deter Baratov and other hackers from engaging in cybercrime-for-hire operations. The length of the sentence alone suggests that Baratov is not cooperating against other individuals. Baratov's lawyers have requested a sentence of no more than 45 months, stressing Baratov's unwitting involvement in the Yahoo attack as a proxy for Russian intelligence officers.

In a somewhat unusual move, the sentencing judge delayed sentencing and asked both parties to submit additional briefing discussing other hacking sentences. The judge expressed concern that the government's sentencing request was severe and that an eight-year term could create an "unwarranted sentencing disparity" with sentences imposed on other hackers.

The government is going to the mat for Baratov's victims. On May 8, 2018, the government fired back in a supplemental sentencing memorandum that reaffirms its recommended sentence of 8 years of imprisonment. The memorandum contains an insightful summary of federal hacking sentences imposed on defendants, with similar records who engaged in similar conduct, between 2008 and 2018. The government surveys various types of hacking cases, from payment card breaches to botnets, banking Trojans and theft and exploitation of intimate images of victims.

The government points to U.S. Sentencing Guidelines Commission data showing that federal courts almost always have imposed sentences within the advisory Guidelines range on hackers who steal personal information and do not earn a government-sponsored sentence reduction (generally due to lack of cooperation in the government's investigation). The government also expands on the distinctions between different types of hacking conduct and how each should be viewed at sentencing. It focuses on Baratov's role as an indiscriminate hacker-for-hire, who targeted individuals chosen by his customers for comprehensive data theft and continuous surveillance. Considering all of the available data, the government presents a very persuasive argument that its recommended sentence of eight years of imprisonment is appropriate. Baratov's lawyers may now respond in writing, and sentencing is scheduled for May 29, 2018.

Lessons from the Yahoo Hacking Incidents and Responses

There are many lessons to be learned from Yahoo's cyber incident odyssey. Here are some of them:

The Criminal Conduct

Cybercrime as a service is growing substantially.

Nation-state cyber actors are using criminal hackers as proxies to attack private entities and individuals. In fact, the Yahoo fact pattern shows that the Russian intelligence services have been doing so since at least 2014.

Cyber threat actors—from nation-states to lone wolves – are targeting enormous populations of individuals for cyber intrusions, with goals ranging from espionage to data theft/sale, to extortion.

User credentials remain hacker gold, providing continued, unauthorized access to online accounts for virtually any targeted victim.

Compromises of one online account (such as a Yahoo account) often lead to compromises of other accounts tied to targeted individuals. Credential sharing between accounts and the failure to employ multi-factor authentication makes these compromises very easy to execute.

The Incident Responses

It's not so much about the breach, as it is about the cover up. Yahoo ran into trouble with the SEC, other regulators and civil litigants because it failed to disclose its data breaches in a reasonable amount of time. Yahoo's post-breach injuries were self-inflicted and could have been largely avoided if it had properly investigated, responded to, and disclosed the breaches in real time.

SEC disclosures in particular must account for known incidents that could be viewed as material for securities law purposes. Speaking in the future tense about potential incidents will no longer be sufficient when a company has actual knowledge of significant cyber incidents.

Regulators are laying the foundation for ramped-up enforcement actions with real penalties. Like Uber with its recent FTC settlement, Yahoo received some leniency for being first in terms of the SEC's administrative order and penalty. The stage is now set and everyone is on notice of the type of conduct that will trigger an enforcement action.

Yahoo was roundly applauded for its outstanding cooperation with law enforcement agencies investigating the attacks. These investigations go nowhere without extensive victim involvement. Yahoo stepped up in that regard, and that seems to have helped with the SEC, at least.

Lawyers must play a key role in the investigation and response to cyber incidents, and their jobs may depend on it. Cyber incident investigations are among the most complex types of investigations that exist. This is not an area for dabblers and rookies. Organizations need to hire in-house lawyers with actual experience and expertise in cybersecurity and cyber incident investigations.

Senior executives need to become competent in handling the crisis of cyber incident response. Yahoo's senior executives knew of the breaches well before they were disclosed. Why the delay? And who made the decision not to disclose in a timely fashion?

The failures of Yahoo's senior executives illustrate precisely why the board of directors now must play a critical role not just in proactive cybersecurity, but in overseeing the response to any major cyber incident. The board must check senior management when it makes the wrong call on incident disclosure.

The Litigation

Securities fraud class actions may fare much better than consumer data breach class actions. The significant stock drop coupled with the clear misrepresentations about the material fact of a massive data breach created a strong securities class action that led to an $80 million settlement. The lack of financial harm to consumers whose accounts were breached is not a problem for securities fraud plaintiffs.

Consumer data breach class actions are more routinely going to reach the discovery phase. The days of early dismissals for lack of standing are disappearing quickly. This change will make the proper internal investigation into incidents and each step of the response process much more critical.

Although the jury is still out on how any particular federal judge will sentence a particular hacker, the data is trending in a very positive direction for victims. At least at the federal level, hacks focused on the exploitation of personal information are being met with stiff sentences in many cases. A hacker’s best hope is to earn government-sponsored sentencing reductions due to extensive cooperation. This trend should encourage hacking victims (organizations and individuals alike) to report these crimes to federal law enforcement and to cooperate in the investigation and prosecution of the cybercriminals who attack them.

Even if a particular judge ultimately goes south on a government-requested hacking sentence, the DOJ's willingness to fight hard for a substantial sentence in cases such as this one sends a strong signal to the private sector that victims will be taken seriously and protected if they work with the law enforcement community to combat significant cybercrime activity.

Current Legal Analysis

More from ballard spahr llp, upcoming legal education events.

Sign Up for e-NewsBulletins

Science and tech

Your cart is currently empty!

The Surprising Downfall of Yahoo: A Case Study in Corporate Rise and Fall

Once synonymous with the dawn of the internet age, Yahoo was once a digital trailblazer, shaping the landscape of the World Wide Web. However, the journey of Yahoo is not just a narrative of triumphs; it is also a case study in the surprising downfall of a company that stood at the forefront of the tech revolution. In this blog, we explore the rise, zenith, and unexpected decline of Yahoo, dissecting the critical factors that led to its fall from grace.

1. Early Success and Dominance:

Founded in 1994 by Jerry Yang and David Filo, Yahoo began as a directory of websites. Its simple and intuitive interface quickly gained popularity, and by the late 1990s, Yahoo had become a dominant force in the emerging online world. Acquiring companies like Geocities and launching successful services like Yahoo Mail and Yahoo Finance, the company expanded rapidly, solidifying its position as an internet giant.

2. Missed Opportunities:

Despite its early success, Yahoo missed crucial opportunities that would later contribute to its downfall. One of the most significant lapses was its failure to acquire Google in 2002. Yahoo’s decision to turn down the chance to purchase Google for a mere $3 billion proved to be a monumental mistake, as Google went on to become the unrivaled powerhouse in the search engine market.

3. Leadership Instability:

Yahoo faced a series of leadership changes that introduced a sense of instability within the company. A revolving door of CEOs, each with their own strategies and visions, led to a lack of cohesive direction. The lack of a consistent and effective leadership structure hindered Yahoo’s ability to adapt to the rapidly changing tech landscape.

4. Decline in Advertising Revenue:

Yahoo’s business model heavily relied on advertising revenue, and its inability to keep pace with innovations in online advertising contributed significantly to its downfall. As Google and later Facebook rose to prominence with more effective targeted advertising platforms, Yahoo struggled to compete, leading to a decline in market share and revenue.

5. Cybersecurity Breaches:

In 2013 and 2014, Yahoo suffered two massive cybersecurity breaches that compromised the personal information of over one billion user accounts. The revelations of these breaches not only eroded user trust but also had severe financial implications. The incidents further tarnished Yahoo’s reputation and undermined its credibility in the eyes of both users and potential investors.

6. Failed Acquisitions and Restructuring Attempts:

Yahoo’s attempt to diversify and stay relevant through acquisitions faced numerous challenges. High-profile acquisitions, such as Tumblr and Flickr, failed to yield the expected results. Additionally, attempts at restructuring and rebranding were insufficient to reverse the company’s declining fortunes.

Conclusion:

The downfall of Yahoo is a cautionary tale in the fast-paced, ever-evolving tech industry. From missed opportunities and leadership instability to cybersecurity breaches and a failure to innovate, the company faced a perfect storm of challenges that ultimately led to its surprising decline. Yahoo’s legacy serves as a reminder for companies to stay agile, embrace innovation, and adapt to the evolving demands of the digital era. The rise and fall of Yahoo underscore the volatile nature of the tech landscape and the imperative for companies to remain vigilant, resilient, and attuned to the needs of their users in an ever-changing digital landscape.

Share this:

Discover more from science and tech.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

A business journal from the Wharton School of the University of Pennsylvania

A Tale of Two Brands: Yahoo’s Mistakes vs. Google’s Mastery

February 23, 2016 • 9 min read.

While many theories have been offered to explain Yahoo's downfall in light of Google's ascent, the difference in the companies' brand approaches may be the most illuminating.

The latest upswing for Alphabet, parent company of Google, comes as fellow tech giant Yahoo is mired in increasing challenges to stay afloat. In this opinion piece, author and branding expert Denise Lee Yohn discusses the stark differences in, and impact of, each company’s approach to branding. Yohn is author of the book, What Great Brands Do: The Seven Brand-Building Principles that Separate the Best from the Rest . She is also the former vice president/general manager of brand and strategy for Sony Electronics’ brand office and former marketing leader and analyst for Jack in the Box restaurants and Spiegel catalogs.

Less than two weeks after Google’s parent company, Alphabet, became the world’s most valuable public company, Yahoo put its core business up for sale . The contrast between the two companies couldn’t be sharper.

While many theories have been offered to explain Yahoo’s downfall in light of Google’s ascent, I would like to suggest that the difference in the companies’ brand approaches may be the most illuminating. While Google has mastered brand strategy and management, Yahoo has lacked a definitive brand purpose and future-oriented brand vision — and these deficits have led to key brand missteps including introducing an impotent visual identity.

Yahoo’s Confusion vs. Google’s Clarity

Google’s brand mission is well-known and well-established: to organize the world’s information and make it universally accessible and useful. Founders Larry Page and Sergey Brin crafted the mission in the company’s early years and, ever since, the organization has stayed committed to it. The statement is displayed front and center on Google’s “About” page and regularly appears in company communication. It has been used by many as a robust descriptor for the company and by employees as the driving force behind practically everything they do.

Yahoo’s brand mission isn’t so clear — actually it isn’t to be found. An official mission statement doesn’t exist on its site, and the statements I did uncover elsewhere were varied and often conflicting. The company lacks both a definitive, compelling description of what it does and why it does it.

According to one researcher who tracked Yahoo’s boilerplate for press releases, the company’s self-description changed 24 times in 24 years.

When Marissa Mayer took the reins at Yahoo, she was hailed as a visionary leader who would rescue the floundering company. But she failed her most important task: explaining — to investors, customers, employees and the world, really — why Yahoo should continue to exist.

To be fair, the company was started with a somewhat problematic mission. Two electrical engineering students at Stanford, David Filo and Jerry Yang, created it as a guide to keep track of their personal interests on the Internet. But over time the world outgrew the need for a single place to find useful websites, and one after another, Yahoo’s leaders failed to articulate an alternate enduring reason for the company’s being.

Mayer eventually tried. Late last fall, she commissioned a book to be distributed to Yahoo employees. It contains stories, images, quotes and messages about Yahoo’s past and its future, along with a new statement of the company’s mission, “To be an indispensable guide to digital information, yours and the world’s.” But it’s not a pithy point and it’s probably too late — and given the company’s track record, I wouldn’t be surprised to see it change again.

“While Google has mastered brand strategy and management, Yahoo has lacked a definitive brand purpose and future-oriented brand vision.”

Of course, mission statements, in and of themselves, are not really all that important. But organizations do need a clear and compelling sense of purpose. Leaders of great brands use brand purpose as a compass and engine for their organizations — driving, aligning and guiding everything they do. Without the long-term commitment to a definitive purpose, Yahoo has been rudderless.

Reacting at Yahoo vs. Anticipating at Google

Yahoo has also been vision-less. While many credit Mayer with leading the company’s transition to mobile, the shift was born out of necessity to catch up with the world, not out of opportunity to change it. In fact, Yahoo has been operating in reactive mode for the last decade. Even the new homepage design it recently introduced is merely an incremental evolution of its past designs and its latest attempt to mimic the popular features of other sites.

Yahoo doesn’t have a brand vision that would propel it forward, leapfrogging over existing realities and pushing the limits of what is possible. Mayer once described her vision for the company’s future saying, “As digital content becomes richer, as search and mail become richer, we need to change what the format of that guide is, as we move to mobile, wearables, TVs, cars, and all the other formats in the future. So, we’re focused on search, communications and digital content, all of which we think are incredibly important parts of that role as a guide, and those are the products that we’re investing in and building on.” Her statement merely reflects the company’s reactive stance to changes that it must address — not new growth opportunities it is creating for itself.

Compare this to the way Larry Page described his vision for the future when he introduced Alphabet as the holding company for Google and other entities: “We’ve long believed that over time companies tend to get comfortable doing the same thing, just making incremental changes. But in the technology industry, where revolutionary ideas drive the next big growth areas, you need to be a bit uncomfortable to stay relevant.” Alphabet, he went on to explain, is intended to give more support to businesses “far afield” from Google’s main Internet products, including glucose-sensing contact lenses, drone delivery and driverless cars.

“Mission statements, in and of themselves, are not really all that important. But organizations do need a clear and compelling sense of purpose.”

The introduction of Alphabet itself embodies the company’s future orientation and brand vision. Separating the Google brand from the organization’s more far-reaching efforts allows Google to remain aligned and focused on its brand mission and “un-hinders” from efforts that should have their own missions, such as Jigsaw, the new brand for the organization’s innovation lab. Having ditched the former name, Google Ideas, Jigsaw can freely pursue its mission — “to use technology to tackle the toughest geopolitical challenges, from countering violent extremism to thwarting online censorship to mitigating the threats associated with digital attacks” — without diluting or derailing the Google brand.

This kind of brand separation would have been useful for Yahoo to have established before the dire situation it now finds itself in. A separate brand might have protected Yahoo from the doubts involved with its decision to spin off its stake in ecommerce giant Alibaba, as well as the embarrassment when it reversed itself and shelved the plan. And now, the move to put the core business up for sale calls into question the future of the Yahoo brand as a whole and therefore the viability and vitality of any of the units that would remain after such a sale.

Again, it’s too late. Yahoo finds itself behind the brand eight-ball because it hasn’t created a future-oriented brand vision.

Yahoo Style vs. Google Substance

Without a powerful brand purpose to ground the company and a visionary brand ambition to advance it forward, it’s no surprise that Yahoo missed a critical opportunity when it changed its logo back in 2013.

Not only was the new logo design a mere update of the old version, but it also failed to communicate anything of substance. In her announcement of the new logo, Mayer said, “We knew we wanted a logo that reflected Yahoo — whimsical, yet sophisticated. Modern and fresh, with a nod to our history. Having a human touch, personal. Proud.” She went on to describe the design details of the new logo, explaining, for example why it didn’t incorporate straight lines, but she said nothing about how the change achieved any strategic objective or reflected any substantive change in the brand experience. Kathy Savitt, the company’s chief marketing officer at the time, explained that the new logo was intended to reflect the company’s “reimagined design and new experiences.” But I couldn’t figure out what she was referring to since no new experiences were incorporated into the logo or vice versa.

“When a company knows what it stands for and where it is going, it can focus its people and resources and have clarity in a range of decisions.”

While Yahoo’s identity refresh was simply about design and brand personality, Google’s new logo sent a clear message about the brand’s updated functionality. When Google introduced a sleeker, brighter, animated logo last year, it explained, “Once upon a time, Google was one destination that you reached from one device: a desktop PC. These days, people interact with Google products across many different platforms, apps and devices. Today we’re introducing a new logo and identity family that reflects this reality and shows you when the Google magic is working for you, even on the tiniest screens.” Moreover, Yahoo’s change seems self-serving whereas Google’s customer-orientation is clear.

The contrast between Yahoo and Google’s new visual identities illuminates the impact of brand purpose and vision. With them, visual identity changes are imbued with meaning and value; without them, they’re merely cosmetic exercises.

When a company knows what it stands for and where it is going, it can focus its people and resources and have clarity in a range of decisions. Not all of Yahoo’s problems originate from its brand failings, but if Google provides a fair comparison, it’s clear that more attention to Yahoo’s brand purpose and vision could have helped.

More From Knowledge at Wharton

What Is the Role of Customers in the Gig Economy?

What does the labor side of manufacturing need over the next decade.

Can Intrapreneurship Help Close the Racial Wealth Gap?

Looking for more insights.

Sign up to stay informed about our latest article releases.

- Personal Finance

- Policy & Politics

Yahoo : Case of strategic failure

Kiran Kumar , August 5, 2016, 0 Comments

Moral: Never underestimate others and overvalue yourself. You lose your value in the process. (Source: A forwarded WhatsApp Message) .

While this is not completely expressive of the loss of wealth of shareholders, one can’t ignore the fact that the brand Yahoo! that had the potential to be a high value adding company to shareholders’ pocket, has failed in achieving precisely that. Yahoo! continues to be operating with its remaining assets, close to $ 50 Bn (including the payment from Verizon) in the form of holdings in China’s Alibaba and Japan’s Yahoo! Japan. Famously described as the demise of Yahoo! , the Verizon’s acquisition of Yahoo for $4.83 billion is presenting an interesting case for evaluating a multibagger and lessons for emerging new-age companies.

The Emergence

Yahoo, started as an in-campus search engine by two college students in 1994, within two years, went public with its IPO. Between 1997 to the mid of 2010s, the dot-com company has operated in almost all hot areas of the business – search engine, e-mailing, audio streaming. Mostly lead by expansion-through-acquisition strategy, Yahoo! acquired a number of companies from different domains ranging from communications, mailing services, messenger services, online games, web hosting and reached its peak performance state just before the IT bubble burst of 2000. Yahoo! was also one of the very few companies who could survive the dot-com bubble burst. Yahoo! had introduced paid search engine listing much before Google had introduced.

Google played an important role in Yahoo!’s slow death. From being a search engine partner for Yahoo! initially, Google went onto become one of the largest used search engine service provider and continued its foray into every other web & IT-based field that Yahoo! had its presence.

The Slow Death

Yahoo!’s downward journey can be traced back to mid-2000s and to various merger options overlooked by Yahoo!’s management. Be it the rejection of Microsoft’s offer to buy-out Yahoo! for nearly $45 Bn, or the failed merger attempt with the then fastest growing Google or another failed attempt to merge with News Corp. There were also discussions in the lines of buying out Facebook that was then still an emerging business.

Yahoo! did enter social-networking and blogging space through an all cash deal, popularly perceived to be a costly buy (approx. $ 1 Bn), of Tumblr, but, in 2013, by when Facebook had created enough entry barriers. Throughout these deals, there have been legal battles on patent issues, employee layoff issues and also issues relating to acquisition terms and conditions. Ironically, to highlight how Yahoo! took most wrong decisions when it came to its acquisitions, it let go of options of M&A with companies like Microsoft, Google, Facebook etc., whereas it bought companies like Geocities by paying $4.5 Bn and Broadcast.com by paying $5.7 Bn that too at the peak of the dot-com bubble. The only decision that worked in case of Yahoo! can be the entry into China’s e-commerce space through a 40% stake in Alibaba.com, which is still a face savior for the Yahoo!’s top brass.

Officials at Yahoo! claim it not a mega failure as its being projected by analysts. That is only partially true. Because the core business of Yahoo!, that’s in the hands of Verizon will be clubbed with another (recently acquired) fallen star subsidiary of Verizon – AOL and this is expected to create that much required synergy for the ex-brand Yahoo!. When we take a stakeholder perspective, the death is not that of the stake per se, rather the brand Yahoo!, that is more concerning. As Forbes magazine put it – “ the transaction ends the independence of one of Silicon Valley’s most iconic pioneering companies ”.

What does it mean?

There are certain perspectives we can form taking the curious case of Yahoo!. The corporation was formed at the right time in the right field. Has been there, did all that was required to be the mainstream new-age player (web, mail, mobile, streaming, and all); so much to the envy of traditional product-driven businesses. Yet, it could not optimize its position in the market, as against the giants of the likes of Microsoft, Google or Facebook. How does one explain such failure?

Should we say the lack of innovation? – Yahoo! had access to all the resources across the world. There are other companies, which just imitated a working business model and succeeded. Social Networking was not a fresh idea of Facebook. Search Engine was originally a Yahoo’s idea.

Should we say access to capital? – Despite continued wrong calls, Yahoo was always on the watch list of investors. Yahoo! has consistently been considered a strong buy, if not for company fundamentals, but, for the kind of growth phase the industry was sailing through. Yahoo! derived its goodwill more from the goodwill of the industry, it operated in. And capital was never dearth.

Or should we say killed by competition? – Google, which could be described as one of the major competitor for Yahoo!’s search engine and mailing services, was not the only one on the pie chart. There was also Microsoft’s Bing and Hotmail, and other regional players as well. And it would be inanity to say Yahoo! did not have a competitive strategy in place. Competition was always expected, was always present and was always going to be present.

Or was it due to macro-economic crisis? – As mentioned earlier, Yahoo! was one of the successful survivors of dot-com bubble burst of 2000. The global financial crisis of 2008 did not create the kind of damage to web-based businesses like it damaged the financial services or realty and auto sector.

Yahoo! was operating in an industry that had only one direction – upwards – in the last two decades. Economic conditions were congenial – new economic orders, global integration, opened up market places and embracing customers. There was an abundant supply of capital resources and human talent and also easier access to both. Notwithstanding all this, if a pioneering company of the shining industry fails, after two decades of its operations, to sustain and grow, the fingers can only be pointed towards the management . Managerial decision-making, ( as given by the Value Octagon framework of Dr. Chandra ) especially at the top level, starts with devising corporate strategy and business model, percolates into capital allocation decisions, financing decisions, creating organizational architecture, strategically driving the costs, managing the corporate risks, corporate restructuring decisions and extends up until the governance mechanism. Yahoo!’s failure can be assigned to most of the above parameters, specifically, to the corporate strategy, risk management and corporate restructuring.

One of the mind-mapping exercises at an off-site event of Yahoo! employees, asked the delegates from different countries to utter the first word that comes to their mind with different brands. For most brands like Apple, Microsoft, Google, the responses were almost unison as Smartphone, Windows or Search Engine. But, with the brand word Yahoo!, there were multiple responses, some said search engine, some said email, some said messenger and so on. What this proves is the lack of focus on corporate strategy for Yahoo! (As suggested by Michael Porter’s Generic Strategies)

Operating in the business where every moment is so dynamic and the diffusion of innovation is the fastest, it was imperative that Yahoo! had to have identified the risks, measured the risks and had in place a risk response strategy – mitigate, transfer or accept the risk. Going by the turn of events in the last few years, it’s anybody’s guess that, Yahoo! chose to accept the risk, while failing to do a cost vs benefit analysis between retaining and transferring the risk.

Yahoo!, when it came to its corporate restructuring decisions failed to view itself as part of the business ecosystem . An ecosystem is a broader and an inclusive concept, which suggests businesses operate in a system where every player/stakeholder is not just related to each other, but also influencing each other. Each element is entangled with each other. Co-evolution is the best strategy to win in such a system. (As suggested by James Moore). Firms must pose competitive yet co-operative challenges to the other elements in the ecosystem. Somewhere, it feels Yahoo! missed out on this aspect. It chose to adopt a combating strategy with the potential big players.

Yahoo! rejected Microsoft’s buy-out offer in 2008 claiming the latter is undervaluing Yahoo!. The truth is that it was always Yahoo! that undervalued itself and every other player’s ability in its ecosystem.

Tags: AOL , Business ecosystem , Focus , Google , management , microsoft , Risk response , Strategy , Verizon , Yahoo

Become a contributing writer

Me interview series: west’s idea of globalization, developing countries, and their relevance.

ME Interview Series on Globalization, West & Developing Countries with Hervé Azouloy, President of ATHES Finance and Participation & Ezilarsan PKP, founder...

VE Idea Accelerator Series: MSME Clusters in the State of Gujarat – An Introduction

Skills & Work: Reskilling Employability Needs for Post-Covid World

Women Entrepreneurs Breaking Gender Biases

2021 of Change Management – What we did differently?

Analysis of Electric Vehicle (EV) in India

Health Prime Rider: Here’s Why You Must Get a Rider that Covers Your Doctor Consultation Fee

Health is one of the things most important things in your life. Without health, all the wealth you ever earn will...

Mosambi (sweet lemon) & Weight loss: 6 Benefits of Mosambi Juice

Women, Mobility & Shakti Scheme –Opportunities And Challenges

My maid came early this morning and told me she wouldn’t be coming for the next three days. I was astonished...

Short Stories: Japan & Rising Sun -‘Wow’! It’s a dream that came true

Eduexpress.in | Design thinking, kids & how to create a nurturing environment?

Judging others is often based on our own ignorance!

A Literature Review on Opportunities and Challenges in the AI Era

The success of a research process hinges on the literature review. A literature review (LR) is an academic work that examines...

Indian students studying abroad, India & Recession

Aggressive vs. Discrete Marketing: What Works Best for Generation Z

Connect with us on Facebook

Information is key but not equal to expertise possessed or the ability to do things in a professional way

Co-founders ( required ), Equity with no Monthly Pay…

Multimillion dollar idea & cofounder pay package

- Mobile & Apps

- About MarketExpress

- Advertise with us

- Terms and Conditions

- MarketExpress Sitemap

- Deutsche Welle

- Capital Cube

MarketExpress Media & Education

MarketExpress © 2024 All Rights Reserved

Powered by J Simple Solutions Made in Mumbai

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Yahoo case study

Related Papers

Frederik Hendrickx

Acta Crystallographica Section D Biological Crystallography

David Stuart

abimael nascimento

O judaismo e conhecido como uma religiao, uma matriz de onde sairam duas outras grandes religioes: cristianismo e islamismo. Mas ele tambem pode ser compreendido como uma etica. Isto coloca o judaismo numa perspectiva universal, nao como profissao de fe, e sim dentro do ambiente filosofico. Assim, o pensamento de Cohen, Rosenzweig, Buber e Levinas entenderam o judaismo como uma sabedoria que pode contribuir com o mundo contemporâneo. Tirando-o de uma ontologia do poder para colocar no mundo onde ha o reconhecimento da singularidade de cada pessoa (Rosenzweig), vivendo um dialogo que reconhece no outro um tu nao coisificado (Buber) e assumindo, diante do rosto a minha frente, uma responsabilidade etica (Levinas).

Kristen Biddle

This literature review observes and synthesizes research conducted on the affects, severity and results of Tungiasis in the health of impoverish countries and travelers. Tungiasis has recently become more prevalent due to an increase in travel both internationally and locally, which has brought more research on the female sand flea (or Tunga Penetran). Tungiasis is prevalent in areas of South America, the Caribbean and Sub-Saharan Africa1. Belaz et. Al. and Hakeem et. Al. studied case reports on travelers affected by Tungiasis returning from Madagascar, Asia and South America2,7. In all cases, people returned with painful lesions, mostly on the feet, but also on the hands and other areas. In Brazil and Nigeria, ten different villages were used in a rapid assessment conducted by L. Ariza et. Al. on the prevalence of Tungiasis in endemic communities2. It was found that prevalence of lesions ranged from 21.1% to 54.4% where some of the subjects had up to 200 sand flea infestations. Les...

Revista Mexicana de Mastozoologia

José Moncada

En Ecuador, el oso andino está en peligro de extinción debido a la reducción de su hábitat por el cambio de áreas naturales a zonas agropecuarias. En la parroquia San Francisco de Sigsipamba, provincia de Imbabura, se reportan casos de depredación de ganado vacuno y daños a cultivos por el oso andino. El objetivo fue analizar el conflicto humano-oso andino en esta zona, mediante el contraste de dos fuentes de información: entrevistas aplicadas a los pobladores afectados en dicha zona y un análisis multitemporal de uso del suelo y cobertura vegetal de los años 1991, 2007 y 2017. Con estos insumos, se elaboró un mapa de zonificación del conflicto. La interacción humano–oso andino en la zona estudiada se consideró de alta intensidad debido a las pérdidas económicas generadas por la muerte de 89 cabezas de ganado vacuno durante el período 2014-2017. La comunidad local priorizó cuatro estrategias para evitar que el conflicto se intensifique y contribuir a conservar al oso andino.

Kiran Vargaonkar

The two sided solar still makes distilled water from salty/brackish water, yielding approx. 0.8 to 1 liter of water per day. The design is a self-supporting, stackable unit made by transparent, thermo-formable polycarbonate material also knows Acrylic. Based on the evaporation rate of 8.8 liters per square meter, the salty/brackish water evaporates and forms droplets on the cone's inner wall. This simple, utilitarian solution will improve the lives of the world's population and is a powerful example basic problem solving. With that, attaching simple circuit can give us automatic irrigation system which opens and closes the flow of water automatically depending on soil water content.

Química Nova

Edson Manoel dos Santos

Korean Institute of Chemical Engineers / 한국화학공학회

Vedant Jain

Sedimentary Geology

Marco Stefani

RELATED PAPERS

Virology Journal

Arnaldo Caruso

Namuna Khand

Planta medica

Shah Hussain

Ricardo Burg Ceccim

Numerische Mathematik

Jose Luis Morales

Mariusz Miedziński

Samuel Rivera

Astronomy & Astrophysics

Marek Skarka

A Contracorriente: Revista de Historia Social y Literatura en América Latina

Fabiana Serviddio

Prof. Roberto Coelho

Lecture Notes in Computer Science

jhkghjf hfdgedfg

RAM. Revista de Administração Mackenzie

kassia salazar

Arabian Journal for Science and Engineering

roslina_i staff

Revista Psicologia, Organizações e Trabalho

Marilda Lipp

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

IMAGES

VIDEO

COMMENTS

Timeline: FAILURE (2011 -2016) 20122012 2013 2014 Scott Thompson appointed as CEO following dismissal of Carol Bartz Acquires Tumblr for $1.1Bn, Summly, and others Acquires Polyvore ... HBR case study, Strategy and Governance at Yahoo! Inc , October 31st 2011 Tony Hannidies, 12 Yahoo Services That Will Shut Down by September ,Lazy Tech Guyz ...

This paper aims at analyzing. critically the issues of Yahoo's ruin. The findings suggest that the causes include having no. superior product, lack of focus, poor leadership, and no clear vision ...

The story of strategic mistakes. Jerry Yang and David Filo founded Yahoo in January 1994. Both of them were Stanford graduates. At first, they developed a website named "Jerry and David's Guide to the World Wide Web". It was simply a directory of other websites, organized in a hierarchy as a searchable index of pages.

The Decline of Yahoo in Its Own Words. On Google's earnings call for the first quarter of 2006 - more than a year before the iPhone was released and more than two years before the release of ...

In 2007, one of the most serious mistakes of the company Yahoo! is committed. The owners of Google do not rule out selling their company, and Yahoo! offered 3,000 million dollars, but unfortunately, they could not acquire it because the amount that Page and Brin asked for was 5,000 million. Yahoo! did not make any other offer and lost one of ...

A Case Study of Yahoo Microsoft offered to acquire Yahoo for $40.8 billion. Microsoft attempted acquisition of Yahoo was through hostile takeover or through outright purchase (Asay 2008; Pimental, 2008). According to Pimental (2008), Microsoft has more money than most countries; the company has an excessive cash of over $19 billion.

It can be taught in one hour and twenty minutes. The amount of outside work to prepare for the case is expected to be at least four hours. The case outlines the history of the Silicon Valley titan, Google, Inc., and how it will navigate in one of the worst economic environments since the Great Depression. The case describes the current economic ...

We conducted a comprehensive market research study for business, comprised of 101 in-depth customer surveys, 2 focus groups, and 4 one-hour customer interviews. As a result, we identified the key factors driving customer dissatisfaction, and devised more effective methods for reaching new customers and upselling old ones.

The announcement that Yahoo's brand and remaining businesses will be sold to Verizon for $5 billion comes as no surprise. The company had been trying to sell itself for almost a year. It will now join another faded Internet giant, AOL, in Verizon's stable of misfits hoping to stave off the massive digital disruption currently playing out in ...

our study uses a multiple case study appro ach based on three recent data breaches - Target, Anthem, and. Yahoo. We adopt the approach of Breznik et al. (2019) in focusing on how six key firm ...

Yahoo's failure to keep pace with the innovation of its rivals, particularly in the area of search technology, was a major factor in its decline. ... The Rise and Fall of Kodak: A Case Study in ...

On September 22, 2016, Yahoo finally disclosed the 2014 data breach to Verizon and in a press release attached to a Form 8-K. Yahoo's disclosure pegged the number of affected Yahoo users at 500 ...

Conclusion: The downfall of Yahoo is a cautionary tale in the fast-paced, ever-evolving tech industry. From missed opportunities and leadership instability to cybersecurity breaches and a failure to innovate, the company faced a perfect storm of challenges that ultimately led to its surprising decline.

February 23, 2016 • 9 min read. While many theories have been offered to explain Yahoo's downfall in light of Google's ascent, the difference in the companies' brand approaches may be the most ...

There are three major reasons for M&A failure — flawed strategy, misguided valuation and ineffective integration. And Yahoo is a classic case study in how these three factors can destroy company value. The first reason for failure is flawed or unclear strategy. The strategic rationale for acquisitions must be soundly based on a company's ...

Yahoo : Case of strategic failure. In 1998, yahoo had the chance to buy Google for $1-2 Mn in its nascent years. They said Google's PageRank ain't worth the pennies. In 2002, Yahoo had the might to buy Google for $5 bn. They said Google is overvalued. In 2008, Microsoft proposed to acquire Yahoo for $45 bn. They said they are undervalued.

With the new management, Yahoo! was easily able to gain additional funding from Reuters Ltd. and Softbank in the fall of 1995. Just a few months later on April 12th, 1996, Yahoo! - then made up of just 49 employees - launched a successful IPO, selling 2.6 million shares at $13 each (raising a total of $33.8 million).

Yahoo Case Study ", Çukurova Üniversitesi Sosy al Bilimler Enstitüsü Dergisi, cilt 29, say ı 4, s.423-442. Ç.Ü. Sosyal Bilimler Enstitüsü Dergisi, Cilt 29, Sayı 4, 2020, Sayfa 423 ...

Yahoo's will failed to survive in the market. Business. 1 of 15. Download now. Why Yahoo's failure in compitation. 1. Yahoo's out of Compitation market Reasons (failure) Strategic Management ALLPPT.com _ Free PowerPoint Templates, Diagrams and Charts Submitted By : Harshavardhana T R. 2.

2. 2 | P a g e Organizational Chart: Current situation: Now, Yahoo is the second leading global Internet brand and one of the most trafficked Internet destinations worldwide. At present, Yahoo has offices in more than 25 countries, provinces, or territories. In 2008 Yahoo's revenues increased by 3.4 percent to $7.2 billion which was $6.9 billion in 2007.

This case study analysis is on Yahoo! (referred to also as "Yahoo"). Yahoo (Nasdaq: YHOO) is a global internet services company that operates the Yahoo! Internet portal. It provides varied products and content, from email and search to media streaming and downloads. As of February 2010, it is the third-most popular Internet site in the ...

Yahoo has much revenue generating source such as search engine, email, display content, selected ads, and premium services. By analysis I/O average Yahoo Company's ratio was 2.54. Weaknesses Yahoo net income lowers down from 35.7% to $424 million. In 2009 advertising revenue decreased 13%.

This chapter provides a wisdom-oriented reading of one of the most spectacular business failures of recent times: the collapse of Nokia mobile phones between 2007 and 2015.