You are using an outdated browser. Please upgrade your browser to improve your experience.

Market Research Heavy Industry Market Research Manufacturing & Construction Market Research Construction Market Research

Construction Market Research Reports & Industry Analysis

The construction industry plays a pivotal role in our world, shaping the built environment and driving economic growth. It encompasses a wide range of sectors, from construction equipment and home improvement to HVAC, building materials, plumbing fixtures and supplies, and various services. At MarketResearch.com, we cover all these markets and more. Our reports provide a comprehensive analysis of each sector, empowering you with the knowledge you need to make strategic decisions.

Leading-Edge Construction Market Research

Our construction industry reports go beyond basic market data. They provide detailed information covering market forecasts, market segmentation, industry trends, technology analysis, pricing, competitive assessments, and company profiles. We understand the importance of staying ahead of disruptive trends, which is why our reports also delve into the emerging technologies, market shifts, and regulatory changes that are shaping the construction industry. By leveraging this information, you can anticipate market dynamics and make proactive business decisions.

Get Ahead with MarketResearch.com as Your Partner

When you choose MarketResearch.com, you benefit from our rich experience and industry expertise, enabling you to achieve your research initiatives faster and at the best prices available.

- As a leading company in the field of market research for over 20 years, we have established ourselves as a trusted partner for top construction companies, home improvement retailers, equipment manufacturers, investment banks, consulting firms, and multinational companies.

- What sets us apart is our ability to bring together reports from hundreds of leading firms all in one place. With convenient access to a vast array of research, you can save valuable time and effort.

- Our dedicated team of research specialists is also here to assist you at every step and provide knowledgeable recommendations, so you can quickly zero in on research you can trust.

Construction Industry Research & Market Reports

Refine your search, autonomous construction equipment global market opportunities and strategies to 2033.

May 16, 2024 | Published by: The Business Research Company | USD 4,000

... Construction; Building ConstructionCovering: Caterpillar Inc.; Komatsu Limited; Volvo Group; Hitachi Construction Machinery Co., Ltd.; Kobelco Construction Machinery Co. Ltd Autonomous Construction Equipment Global Market Opportunities And Strategies To 2033 from The Business Research Company provides ... Read More

Hemp Fiber Global Market Opportunities And Strategies To 2033

... Care; Personal CareCovering: Konoplex; Hemp Flax Group B.V.; EnviroTextiles LLC; Fresh Hemp Food Ltd; Canvaloop Fibre Private Limited Hemp Fiber Global Market Opportunities And Strategies To 2033 from The Business Research Company provides the strategists; ... Read More

Natural Fiber Reinforced Composites Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

May 15, 2024 | Published by: Mordor Intelligence Inc | USD 4,750

... expected to reach 6.56 Million tons by 2029, growing at a CAGR of 8.51% during the forecast period (2024-2029). In the medium term, factors such as the increasing demand for bio-based composites and the growth ... Read More

Flexible Insulation Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

... 16.86 billion by 2029, growing at a CAGR of 3.84% during the forecast period (2024-2029). Key Highlights The increasing demand for energy efficiency from the construction industry and the increasing application of flexible piping insulation ... Read More

Liquid-Applied Membrane Market by Type (Elastomeric, Bituminous, Cementitious), Application (Roofing, Walls, Building Structures, Roadways), Usage, End-Use Industry (Residential Construction, Commercial Construction), and Region - Global Forecast to 2029

May 14, 2024 | Published by: MarketsandMarkets | USD 4,950

... is projected to reach USD 32.1 billion by 2029 from USD 24.1 billion in 2024, at a CAGR of 5.9% during the forecast period. The rising demand for waterproofing solutions across residential, commercial, and industrial ... Read More

Roads And Highways Global Market Opportunities And Strategies To 2033

May 13, 2024 | Published by: The Business Research Company | USD 4,000

... Roads.Covering: China Communications Construction Co Ltd; Bouygues SA; Vinci SA; ACS Group; CRH Plc. Roads And Highways Global Market Opportunities And Strategies To 2033 from The Business Research Company provides the strategists; marketers and senior ... Read More

Concrete Floor Coatings Global Market Opportunities And Strategies To 2033

... BASF SE; Nippon Paint Co.; Sika AG; Ardex GmbH; The Sherwin-William Company. Concrete Floor Coatings Global Market Opportunities And Strategies To 2033 from The Business Research Company provides the strategists; marketers and senior management with ... Read More

Asphalt Shingles Global Market Opportunities And Strategies To 2033

... Inc.; IKO Industries Ltd; Certain Teed Corporation; BMI Group; Atlas Roofing Corporation. Asphalt Shingles Global Market Opportunities And Strategies To 2033 from The Business Research Company provides the strategists; marketers and senior management with the ... Read More

Heat Exchanger Market by Type (Shell & Tube, Plate & Frame, Air Cooled), Material (Metal, Alloys, Brazing Clad Materials), End-Use Industry (Chemical, Energy, Hvacr, Food & Beverage, Power, Pulp & Paper), and Region - Global Forecast to 2029

May 13, 2024 | Published by: MarketsandMarkets | USD 4,950

... Global Forecast to 2029 The Heat exchangers market is projected to reach USD 32.3 billion by 2029, at a CAGR of 7.0% from USD 23.0 billion in 2024. Growing awareness about energy efficiency and stringent ... Read More

Office Buildings Global Market Opportunities And Strategies To 2033

May 09, 2024 | Published by: The Business Research Company | USD 4,000

... State Construction Engineering Co. Ltd; Mitsui Fudosan Co. Ltd; Lennar Corporation; CBRE Group Inc.; Bouygues SA. Office Buildings Global Market Opportunities And Strategies To 2033 from The Business Research Company provides the strategists; marketers and ... Read More

Siding Global Market Opportunities And Strategies To 2033

... de Saint-Gobain S.A.; Louisiana-Pacific Corporation; Rockwool International A/S; Etex Group SA Siding Global Market Opportunities And Strategies To 2033 from The Business Research Company provides the strategists; marketers and senior management with the critical information ... Read More

TPF SA - Strategic SWOT Analysis Review

May 09, 2024 | Published by: GlobalData | USD 125

... employees, key competitors and major products and services. This up-to-the-minute company report will help you to formulate strategies to drive your business by enabling you to understand your partners, customers and competitors better. Scope Business ... Read More

Sanitary Ware Global Market Opportunities And Strategies To 2033

... And Isostatic Casting4) By End-Users: Commercial and Residential5) By Sales Channels: Retail; WholesaleCovering: Kohler Co.; LIXIL Corporation; TOTO LTD.; Roca Sanitario S.A.; Masco Corporation Sanitary Ware Global Market Opportunities And Strategies To 2033 from The ... Read More

Gammon Construction Ltd - Strategic SWOT Analysis Review

... key employees, key competitors and major products and services. This up-to-the-minute company report will help you to formulate strategies to drive your business by enabling you to understand your partners, customers and competitors better. Scope ... Read More

KBR Inc (KBR) - Financial and Strategic SWOT Analysis Review

... you a clear and an unbiased view of the company’s key strengths and weaknesses and the potential opportunities and threats. The profile helps you formulate strategies that augment your business by enabling you to understand ... Read More

Bird Construction Inc (BDT) - Financial and Strategic SWOT Analysis Review

... to you a clear and an unbiased view of the company’s key strengths and weaknesses and the potential opportunities and threats. The profile helps you formulate strategies that augment your business by enabling you to ... Read More

Costain Group Plc (COST) - Financial and Strategic SWOT Analysis Review

Stantec inc (stn) - financial and strategic swot analysis review, silicone market by type (elastomers, resins, fluids, gels), end-use industry (industrial process, building & construction, personal care & consumer products, transportation, electronics, medical & healthcare, energy), & region - global forecast to 2029.

May 09, 2024 | Published by: MarketsandMarkets | USD 4,950

... global silicone market size is projected to grow from USD 21.5 billion in 2024 to USD 31.5 billion by 2029, at a CAGR of 8.0% during the forecast period. The silicone market is growing due ... Read More

Road and Bridge Construction in Australia - Industry Market Research Report

May 08, 2024 | Published by: IBISWorld | USD 795

... quarrying of earth, soil or filling, in conjunction with road or bridge construction. This report covers the scope, size, disposition and growth of the industry including the key sensitivities and success factors. Also included are ... Read More

Clay Brick Manufacturing in Australia - Industry Market Research Report

... COVID-19 pandemic and high interest rates, have caused industry revenue to slump. Increasing production costs and weakening demand from downstream markets have led to many manufacturers exiting the industry as profit margins suffered. Manufacturers have ... Read More

Luxury Vinyl Tiles Market by Type (Rigid And Flexible), End-Use Sector (Residential And Commercial), And Region (North America, Europe, Asia Pacific, South America, And Middle East & Africa) - Global Forecast to 2029

May 06, 2024 | Published by: MarketsandMarkets | USD 4,950

... luxury vinyl tiles market is projected to grow from USD 18.8 billion in 2024 to USD 35.9 billion by 2029, at a CAGR of 13.7% during the forecast period. The rising global population, especially the ... Read More

Electrical Services in Australia - Industry Market Research Report

May 06, 2024 | Published by: IBISWorld | USD 795

... and maintain existing electrical equipment and fixtures. This report covers the scope, size, disposition and growth of the industry including the key sensitivities and success factors. Also included are five year industry forecasts, growth rates ... Read More

Global Construction Equipment GPS Tracker Market 2024 by Manufacturers, Regions, Type and Application, Forecast to 2030

May 06, 2024 | Published by: GlobalInfoResearch | USD 3,480

... and cranes to track their location in real-time. These trackers use GPS technology to provide accurate location information, allowing construction companies to monitor the whereabouts of their equipment and prevent theft or misuse. Additionally, GPS ... Read More

2024 New Multisection Manufactured Homes Retail Sales Global Market Size & Growth Report with Updated Recession Risk Impact

May 04, 2024 | Published by: Kentley Insights | USD 295

... market size, revenue, growth, and share across 4 global regions (The Americas, Europe, Asia & Oceania, Africa & Middle East), 22 subregions, and 195 countries. Figures are from 2012 through 2023, with forecasts for 2024 ... Read More

< prev 1 2 3 4 5 6 7 8 9 10 next >

Filter your search

- Bridges & Tunnels (207)

- Commercial (3,375)

- Construction Company Reports (322)

- Construction Equipment (1,096)

- Engineering (415)

- General Construction (5,208)

- Heavy Construction (1,751)

- Highways & Roads (616)

- Home Building & Improvement (2,390)

- HVAC (2,274)

- Materials (6,601)

- Plumbing Fixtures/Supplies (925)

- Services (595)

- Africa (695)

- Asia (1,825)

- Caribbean (28)

- Central America (49)

- Europe (2,425)

- Global (7,432)

- Middle East (703)

- North America (1,885)

- Oceania (476)

- South America (585)

Research Assistance

Join Alert Me Now!

Start new browse.

- Consumer Goods

- Food & Beverage

- Heavy Industry

- Life Sciences

- Marketing & Market Research

- Public Sector

- Service Industries

- Technology & Media

- Company Reports

- Reports by Country

- View all Market Areas

- View all Publishers

Find the right market research agencies, suppliers, platforms, and facilities by exploring the services and solutions that best match your needs

list of top MR Specialties

Browse all specialties

Browse Companies and Platforms

by Specialty

by Location

Browse Focus Group Facilities

Manage your listing

Follow a step-by-step guide with online chat support to create or manage your listing.

About Greenbook Directory

IIEX Conferences

Discover the future of insights at the Insight Innovation Exchange (IIEX) event closest to you

IIEX Virtual Events

Explore important trends, best practices, and innovative use cases without leaving your desk

Insights Tech Showcase

See the latest research tech in action during curated interactive demos from top vendors

Stay updated on what’s new in insights and learn about solutions to the challenges you face

Greenbook Future list

An esteemed awards program that supports and encourages the voices of emerging leaders in the insight community.

Insight Innovation Competition

Submit your innovation that could impact the insights and market research industry for the better.

Find your next position in the world's largest database of market research and data analytics jobs.

For Suppliers

Directory: Renew your listing

Directory: Create a listing

Event sponsorship

Get Recommended Program

Digital Ads

Content marketing

Ads in Reports

Podcasts sponsorship

Run your Webinar

Host a Tech Showcase

Future List Partnership

All services

Dana Stanley

Greenbook’s Chief Revenue Officer

Top Construction Industry Market Research Companies

Featured Experts in Top Construction Industry Market Research Companies

in Experts in Market Research on Construction Industry

Service or Speciality

Acquisitions

Advertising Agencies

Advertising Effectiveness

Advertising Research - General

Advertising Tracking

Africa / Middle East

African-American

Agile Research

Agriculture / Agribusiness

Alcoholic Beverages

Apparel / Clothing / Textiles

Artificial Intelligence / AI-Powered Platforms

Association Membership

Attitude & Usage Research

Audience Research

Australia / Pacific Rim

B2B Research - General

Banking - Commercial

Banking - Retail

Biotechnology

Brand / product / service launch

Brand / product / service repositioning

Brand Equity

Brand Identity

Brand Image Tracking

Brand Loyalty / Satisfaction

Brand Positioning

Bulletin Boards

Business Insights

Business-to-Business

CATI - Computer-Aided Telephone Interviewing

CX - Customer Experience

CX Benchmark Studies

Candy / Confectionery

Cannabis / CBD

Car Clinics

Casinos / Gambling

Central America

Central Location

Chemical Industry

College Students

Communications

Communications Strategy Research

Computer Hardware

Computer Software

Concept Development

Concept Testing

Concept Testing - Advertising

Conjoint Analysis / Trade-off/Choice Modeling

Construction Industry

Consultation

Consumer Durables

Consumer Research - General

Consumer Services

Consumer Trends

Convention / Tradeshow

Copy Testing - Digital Media

Corporate Image/Identity Research

Cosmetics / Beauty Aids

Credit Cards

Customer Loyalty / Value

Customer Satisfaction

DIY Surveys (do-it-yourself)

Data Analysis

Data Processing

Data Tabulation

Defend market share

Digital Media

Doctors / Physicians

East Asia & China

Electronics

Employee Experience & Satisfaction

Entertainment Industry

Environment & Sustainability

Ethnic Groups

Ethnography / Observational Research

Executives / Professionals

Exercise & Fitness

Exit Interviews

Field Services

Financial Industry

Financial Services Professionals

Focus Group Facility

Focus Group Facility - Non-Traditional

Focus Group Recruiting

Focus Groups

Focus Groups - International

Focus Groups - Pop-Up

Foods / Nutrition

Foreign Language

Fragrance Industry

Full Service

Gain new customers

Gaming / Gamers

General - Healthcare

Generation X

Generation Y / Millennials

Generation Z

Global Capabilities

Global, multinational branding

HMOs / Managed Care

High Net Worth

High Technology

Hispanic / Latino

Home Use Tests

Hospital Personnel

Hospital Purchasing Agents

Hospitality / Hotels / Resorts

Hospitals / Nursing Homes

Household Products/Services

Hybrid / Mixed Methodology

IT Professionals

IVR - Interactive Voice Response

Idea Generation

In-Depth (IDI) / One-on-One

In-Depth / One-on-One

Increase awareness

Increase market share

Increase sales, volume

Industrial & Manufacturing

International / Multi-country

International Consumer Market Research

Internet of Things (IoT)

Investment Banking

Lawn & Garden

Legal / Lawyers

Low Incidence

Mail Questionnaires / Surveys

Mall Intercept

Manufacturing / Machinery

Market & Competitive Intelligence

Market Opportunity Evaluation

Market Segmentation

Media Industry

Media Market Research

Medical / Health Care

Medical / Healthcare Professionals

Mock Juries

Moderator Services

Movies / Streaming / TV

Multi-Country Studies

Multicultural

Multivariate Analysis

Music Tests

Mystery Shopping

NPS Measurement

New Products

Non-Profit / Fund Raising

North America

Nurses / Nurse Practitioners

Online - Qualitative

Online - Quantitative

Online Communities - MROC

Online Diaries / Journals / Blogs

Online Panels

Open-End / Verbatim Response Coding

Packaged Goods

Packaging Development

Packaging Testing

Pet Owners / Foods / Supplies

Pharmaceutical - OTC Medicines

Pharmaceutical - Prescription Medicines

Pharmacists

Political Polling

Post-Launch Tracking

Preventive Healthcare

Price / Pricing

Print Media Readership Studies

Print Publishing

Product Development

Product Market Research

Product Optimization

Product Testing

Professionals / Executives

Proprietary Panels

Psychological / Motivational Research

Public Opinion Research

Qualitative

Qualitative Research

Qualitative Services - General

Quantitative Research

Questionnaire / Survey Design

Questionnaire Design

Quick Service Restuarants (QSR)

Recruiting Research

Restaurants / Food Service

Retail Industry

Sample & Recruiting

Sample Fraud Detection & Remediation

Secondary Research / Desk Research

Segmentation

Seniors / Mature

Sensory Research

Sentiment Analysis

Service Industries

Small Business / Startups / Entrepreneurs

Smart Products

Social Listening & Analytics

South America

Southeast Asia & India

Statistical Analysis

Strategic Research

Supermarkets & Grocery Stores

Surgical Products / Medical Devices

Survey Programming

Survey Recruiting

Survey Reporting and Analysis

Survey Translation

Syndicated / Published Reports

Taste Test Facility

Taste Tests / Sensory Tests

Teenagers / Youth

Telecommunications

Test/Commercial Kitchen

Text Chat / SMS / IM Sessions

Tracking Research

Trade Associations

Trade Surveys

Transportation

Upper Income / Affluent

Usability Lab

User Testing

Utilities / Energy

Veterinarians

Video Conferencing

Video Management Platforms

Video Recording

Website Usability / UX

Western Europe

Atlanta (GA)

Charlotte (NC--SC)

Chicago (IL--IN--WI)

Massachusetts

New York (NY--NJ--CT)

South Carolina

Toronto (ON)

United States of America

Vendor type

Data & Analytics

Data Collection

International

Panels / Communities

Qualitative Consultant

Support Services

Business Designation

HIPAA Compliant

Women-Owned Business

Clear filters ( 0 )

Related Specialties

Business-to-Business Research

B2B Research on Manufacturing

Household Products [market sector expertise]

Manufacturing & Machinery [market sector expertise]

Utilities & Energy [market sector expertise]

Compare Experts in Market Research on Construction Industry

White Plains, New York

SOCIAL LINKS

Save to my lists

Featured expert

B2B International

B2B International is a leading global business-to-business market research consultancy providing customized b-to-b research and intelligence studies.

Why choose B2B International

900+ global clients

Conducted 4,000+ studies

Researched 145+ countries

Researched every vertical

13 offices worldwide

Learn more about B2B International

New York, New York

We’re the only B2B research company that solves the challenges of today’s insights leaders by connecting them with verified business expertise.

Why choose NewtonX

100% ID-Verified

1.1 billion reach

140 industries globally

Niche audiences

Custom recruiting

Learn more about NewtonX

Atlanta, Georgia

Geo Strategy Partners

Business-to-Business and Industrial Market Research. The Go-to-Firm for Go-to-Market Strategy. Global scope. Full capabilities.

Why choose Geo Strategy Partners

Exclusively B2B

Industrial Market Experts

Go-to-Market Strategy

Professional M&A Experts

Learn more about Geo Strategy Partners

Spartanburg, South Carolina

Based on 2 ratings

Priority Metrics Group

Leading global B2B market research firm providing customized market analysis, competitive intelligence, and customer insight.

Why choose Priority Metrics Group

25+ Years in Business

Partners Manage Projects

We Deliver Growth

Learn more about Priority Metrics Group

Cedar Rapids, Iowa

Vernon Research Group

Our experienced analysts and business experts help organizations make decisions with confidence thru thoughtfully designed and well-executed research.

Why choose Vernon Research Group

Advanced analysis experts

Senior level team

Business expertise

Tackle difficult projects

98% show rate

Learn more about Vernon Research Group

Based on 1 ratings

IT'S A GREAT DAY FOR DISCOVERING WHY... Researchers find Reliable and Affordable Data from Global Survey Audiences to Significantly Improve Results

Why choose OvationMR

Increase B2B Feasibility

Consultative Client Team

Less Time Cleaning Data

Extend Your Team

Grow with Confidence

Learn more about OvationMR

Knoxville, Tennessee

Shelton Group, an ERM Group Company

We are exclusively focused on sustainability and ESG, helping our clients create a sustainable future through B2B and consumer insights.

Why choose Shelton Group, an ERM Group Company

Sustainability Experts

17 years of trend data

31 years in business

Wayfinding for ESG

Custom research

Learn more about Shelton Group, an ERM Group Company

Des Plaines, Illinois

Irwin Broh Research

Since 1971, minding your customers' mind.

Learn more about Irwin Broh Research

Ridgewood, New Jersey

Provoke Insights

A full service international market research firm that specializes in branding, advertising, & content marketing initiatives in the B2C & B2B space.

Why choose Provoke Insights

Brand & Media Strategists

Researchers + Strategy

Cross-discipline Approach

Nothing Outsourced

Trend Spotters

Learn more about Provoke Insights

Toronto, Ontario, Canada

The Logit Group

The Logit Group specializes in market research execution, delivering quality service on an affordable budget.

Why choose The Logit Group

Methodologically agnostic

Tech driven solutions

Competitive costs

International scope

Value added insights

Learn more about The Logit Group

Chicago, Illinois

Fieldwork Network

Our specialties include local and country-wide recruiting, managing and facilitating Mock Juries, Medical / Medical Device, and Global Research.

Why choose Fieldwork Network

Recruit local & national

Expert On-line Platform

Dedicated Proj Mgmt

50 countries & counting!

Over 40 years experience

Learn more about Fieldwork Network

SIS International Research

SIS International Research, founded in 1984, is a leading full-service Market Research and Market Intelligence firm.

Why choose SIS International Research

Global Coverage

Full Service Capabilities

B2B & Industrial Research

Healthcare Research

Strategy Consulting

Learn more about SIS International Research

Wilmington, Delaware

iMAD Research Inc.

End to end global data collection solutions including online B2B sample, survey programming, and data processing - 8mil+ respondents in 35+ countries.

Why choose iMAD Research Inc.

Experienced

Collaborative

Consultative

Easy to use

Cost effective

Learn more about iMAD Research Inc.

Old Orchard Beach, Maine

Libran Research & Consulting

Libran Research is a boutique consultancy focused on insight generating to support unique or custom business issues.

Why choose Libran Research & Consulting

Consultative approach

Strategic focus

Deep level of experience

Great service

Efficient costing

Learn more about Libran Research & Consulting

Renaissance Research & Consulting, Inc.

Actionable solutions to marketing problems through online panels, innovative statistical tools, thoughtful analysis, and insightful interviewing.

Why choose Renaissance Research & Consulting, Inc.

Best tools and techniques

Flexible approach

One-stop shopping

Your institutional memory

Broad range of categories

Learn more about Renaissance Research & Consulting, Inc.

Precision Research Inc.

Comprehensive facility near O’Hare with a Test Kitchen large rooms for product displays, with space for 4 cars. B2B and consumer recruiting experts.

Why choose Precision Research Inc.

Large Rooms

Commercial Test Kitchen

Auto Show Room

B2B/Consumer Recruiting

Learn more about Precision Research Inc.

Boston, Massachusetts

Zintro, Inc.

The Leading Market Research Expert Network - Custom project recruitment and surveys with B2B, Healthcare, and non-consumer audiences.

Why choose Zintro, Inc.

Flexible engagements

Affordable model

Strong communication

Funny jokes

Learn more about Zintro, Inc.

Glenview, Illinois

Accurate Data Marketing, Inc.

"Top Rated" Data collection specialists: Recruit in-house: consumer, medical, construction, credit cards, usability lab, B2B, ethnos, CLT's, etc.

Why choose Accurate Data Marketing, Inc.

Ultimate service

Quality recruiting

Superb management

Experienced recruiters

On-site recruiting

Learn more about Accurate Data Marketing, Inc.

Sign Up for Updates

We will send you a greatest letters one per week for your happy

I agree to receive emails with insights-related content from Greenbook. I understand that I can manage my email preferences or unsubscribe at any time and that Greenbook protects my privacy under the General Data Protection Regulation.*

Your guide for all things market research and consumer insights

Create a New Listing

Manage My Listing

Find Companies

Find Focus Group Facilities

Tech Showcases

GRIT Report

Expert Channels

Get in touch

Marketing Services

Future List

Publish With Us

Privacy policy

Cookie policy

Terms of use

Copyright © 2024 New York AMA Communication Services, Inc. All rights reserved. 234 5th Avenue, 2nd Floor, New York, NY 10001 | Phone: (212) 849-2752

Construction Research

- Commercial Construction

- Roofing Products

- Facade Gasket

- Wooden Formwork

- Total Infrastructure Construction

- Transport Infrastructure

- Manufactured Homes

- Prefabricated Wood Building

- Residential Construction

- Total Construction

- Senior Living

- Co-Working Spaces

- Coworking Spaces

- Flexible Offices

- Building Inspection Services

- MEP Services

- Condominium and Apartments

- Luxury Residential Real Estate Market

Filter Reports

By Countries

208 Construction Reports

Study Period: 2019 - 2029

Major Players: Clayton Homes, Zekelman Industries, Skyline Champion Corporation, Cavco Industries, Wells Concrete Products Co.

Study Period: 2020 - 2029

Country Covered: Philippines

Major Players: Power Steel Corporation, USG Boral Building Products, Zamil Industrial Investment Co., United Steel Technology Int'l Corporation, iSteel Inc.

Study Period: 2019-2029

Country Covered: Sweden

Major Players: Skanska, NCC, Veidekke, Sweco AB, Ramboll Group

Study Period: 2024-2029

Regions Covered: North America, Latin America, Europe, Asia Pacific, Middle East and Africa

Major Players: Masonite International Corporation, JELD-WEN Holding, Inc., Pella Corporation, Andersen Corporation, VELUX Group

.webp)

Countries Covered: Australia, China, India, Indonesia, Japan, Malaysia, Vietnam, Thailand

Major Players: Nippon Express, Sankyu, DHL, DSV, Goke Hengtai (Beijing) Medical Technology Co., Ltd.

_-_Copy.webp)

Study Period: 2020-2029

Countries Covered: Germany, UK, France, Russia, Spain

Major Players: Saint-Gobain group, Kingspan Group Plc, Cemex, Sherwin-Williams Company, PPG Industries Inc.

Countries Covered: China, India, Japan, South Korea, Australia

Major Players: Saint-Gobain Group, Henkel Balti OÜ, Huitian, Bondzil, Shin-Etsu Chemical Co., Ltd

Country Covered: Saudi Arabia

Major Players: Attieh Steel, Gulf Specialized Works, Station Contracting Ltd, Age Steel, Absal Steel

Country Covered: United Arab Emirates

Major Players: Arabian International Company Ras Al Khaimah, Mabani Steel LLC, IMCC, Standard Steel Fabrication Co LLC, Techno Steel

Regions Covered: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa

Major Players: Granite, Trinity, Hanson, CRH, James Hardie

Country Covered: Finland

Major Players: A-insinoorit Oy (AINS Group), Skanska AB, Destia, Finnish Transport Infrastructure Agency, YIT

_-_Copy.webp)

Country Covered: Spain

Major Players: ACCIONA CONSTRUCCION SA., DRAGADOS SOCIEDAD ANONIMA, FERROVIAL CONSTRUCCION SA., COSENTINO GLOBAL SOCIEDAD LIMITADA, COBRA INSTALACIONES Y SERVICIOS SA

Major Players: ACS Group , VINCI , China State Construction Engineering Corporation Ltd (CSCEC) , Skanska, Larsen & Toubro

Major Players: AE Arma-Electropanc, Aegion Corp., Bechtel, CB&I LLC, Consolidated Contractors Group

Major Players: Al-Futtaim Group, ALEC Engineering & Contracting LLC, Consolidated Contractors Company, khansaheb, National Contracting and Transport CO

Country Covered: Germany

Major Players: ALHO Systembau GmbH, Romakowski GmbH & Co. KG, MCE GmbH Niederlassung Rhein-Main, Deutsche Fertighaus Holding, Fertighaus Weiss GmbH

Major Players: ALUCASA Mobile homes, COFITOR Prefabricated houses, Sismo Building Technology, Custom Home - Casas Modulares Huércal, Construcciones Modulares CUNI

Major Players: TUNSIF, PETRACO, ARTIC, DURRAKA, Albitar Factory Co.

Country Covered: Tanzania

Major Players: Advent Construction Ltd, Estim Construction, Becco Limited, Salem Construction Limited, Mohammedi Builders Ltd

Country Covered: Canada

Major Players: Aecon Group Inc., PCL Construction, Pomerleau, Bird Construction, Bantrel

Major Players: Aegion Corp, Bechtel, AE Arma-Electropanc, CB&I LLC, Fluor Corp

Country Covered: Qatar

Major Players: Al Ali Engineering Co. W.L.L, Al Balagh Trading and Contracting, Arabian Construction Company, Al Darwish Engineering Co., AL Huda Engineering Works

Major Players: Gulf Contracting Co, Aljaber Engineering LLC, Al Bidda Group, ALEC, Arabian Construction Engineering Company

Countries Covered: Saudi Arabia, United Arab Emirates, Iran, South Africa

Major Players: Al Shafar Steel Engineering, Corrugated Sheet Ltd, Palram Industries Ltd, Safintra Rwanda Ltd, Ampa Plastics Group Pvt Ltd

Countries Covered: Germany, United Kingdom, France

Major Players: Alliance Facades, Alucraft Ltd, EOS Framing Limited, POHL-GROUP, Saint-Gobain S.A.

Major Players: Alta-Fab Structures, ATCO, Champion Home Builders, NRB Modular Solution, Stack Modular

Countries Covered: United Arab Emirates, Saudi Arabia, Qatar

Major Players: Alumasc Group plc, Kingspan Group plc, Bauder Limited, Forbo International SA, Interface Inc

Countries Covered: United States, Canada, Mexico

Major Players: Amvic Inc., PPG Industries, Siemens, BASF SE, Bauder Limited

Regions Covered: Asia Pacific, North America, Europe, South America, Middle East and Africa

Major Players: Amvik Systems, Alumasc Group PLC, BASF SE, Binderholz Gmbh, Bauder Limited

- Asia Construction Research

- North America Construction Research

- Argentina Construction Research

- Australia Construction Research

- Brazil Construction Research

- Canada Construction Research

- China Construction Research

- France Construction Research

- Germany Construction Research

- India Construction Research

- Indonesia Construction Research

- Italy Construction Research

- Japan Construction Research

- Mexico Construction Research

- Qatar Construction Research

- Russia Construction Research

- Saudi Arabia Construction Research

- South Africa Construction Research

- South Korea Construction Research

- Spain Construction Research

- UAE Construction Research

- UK Construction Research

- US Construction Research

Related Construction Reports

- Real Estate

Please be sure to check your spam folder too.

Get a free sample of this report

Please enter your name

Business Email

Please enter a valid email

Please enter your phone number

Sorry! Payment Failed. Please check with your bank for further details.

Want to use this image? X

Please copy & paste this embed code onto your site:

Images must be attributed to Mordor Intelligence. Learn more

About The Embed Code X

Mordor Intelligence's images may only be used with attribution back to Mordor Intelligence. Using the Mordor Intelligence's embed code renders the image with an attribution line that satisfies this requirement.

In addition, by using the embed code, you reduce the load on your web server, because the image will be hosted on the same worldwide content delivery network Mordor Intelligence uses instead of your web server.

Intelligent Investment

United States Construction Market Trends

2023 year-end.

February 7, 2024 3 Minute Read

Looking for a PDF of this content?

Executive summary.

The Current Situation

- Labor costs and hourly wages continue to rise. Increasing construction labor costs are a major challenge facing the industry. Companies are competing for a limited pool of skilled workers, which is driving up wages. Sustained demand for skilled construction workers coupled with a lack of qualified candidates to fill the positions has added to the strain. This is due in part to an aging workforce and a lack of interest in trade careers among younger generations.

- The unemployment rate remains low both nationally and for construction as the overall workforce contracts by 2%. According to USBLS, there were 374,000 construction industry job openings in December. This is down 4.1% from this time last year, but still relatively high overall showing continued demand.

Supply Chain & Material Availability

- Fuel costs have plummeted compared with last quarter as freight costs decline from their peak. The cost of No. 2 diesel fuel was -$0.76/gallon or 16.4% lower than last quarter. Diesel remains key to the supply chain as it is the predominant fuel used for shipping and freight distribution.

- There were few changes in material availability this past quarter. Some Electrical equipment continues to have extended lead times and reduced availability.

- The Environmental Protection Agency is imposing new regulations on the HVAC industry on January 1, 2025, to reduce greenhouse gas emissions due to coolants. The implications are yet to be fully seen but will certainly impact the industry.

Contractor Confidence & Construction Volume

- Contractor backlog remains very strong nationally with an average of 8.6 months as reported by Associated Builders and Contractors (ABC) in December.

- According to the AIA Construction Consensus Spending Forecast, the outlook for construction volume is negative for most sectors over the next two years. Volume is also down this quarter for Office, Commercial and Residential construction. According to data from the U.S. Census, private commercial and office construction volume were nearly flat since last quarter and down significantly compared with last year.

- Construction contractor confidence presents a mixed picture, reflecting both positive trends and ongoing challenges. Adaptability, innovation, and collaboration will be key for navigating uncertainty and ensuring a resilient future for the industry.

Cost Escalation

- The Consumer Price Index (CPI) rate reached 3.3% in December 2023, compared with the 40-year high 9.1% in June 2022. This is comparable to the 40-year (1983 – 2023) historical US average of 2.8%.

- The Federal Open Market Committee (FOMC) continues fine-tuning interest rates to return inflation to the targeted 2% range.

- The CBRE Construction Cost Index showed a decline in annual escalation compared to the record high 2022. 2023 concluded at 4.9% (± 2%) . This is still higher than the industry pre-COVID average of 2-5% per year.

Related Services

Global workplace solutions.

Guide transformational outcomes to create tangible value across your portfolio.

Cost Advisory

We empower clients to plan and control spending, estimate project costs, manage risk, eliminate waste, and identify tax and procurement process savings.

Dan Richardson

Cost Consultancy Director

Omar Elsingergy

Minzhi Lian

Associate Cost Manager

- Pollfish School

- Market Research

- Survey Guides

- Get started

Market Research Survey: The Complete Guide

This process involves gathering primary (self-conducted) and secondary (information already researched and made available) sources, to fully assess how a business will fare within a particular market and audience.

A market research survey is typically a source of primary information that businesses can use as part of their market research campaigns. It can also exist as a secondary source, in which case, its studies and results are published online or in a print publication.

This article will take a close look at the market research survey, so that you can use it to the optimum benefit for your business.

What Can you Achieve with Market Research?

A market research survey, as its name entails, is used for research purposes. Before we dive into all the aspects of this survey, it is apt to learn how you can use market research to your full advantage.

Market research is critical for a variety of purposes, including marketing , advertising , and branding campaigns.

Aside from providing data-based support for these macro purposes, market research gains you invaluable insight into particular markets. For example, you may consider running a research campaign for the retail market . Market research will help you gather all the relevant information pertaining to this specific market.

Aside from retail, you can conduct market research in a number of verticals, including ecommerce , technology, real estate and many others.

There are plenty of other applications for market research. Here are some of the ways to use market research to your advantage:

- Observe data to prepare for challenges in advance

- Gauge the demand for your product or service

- Learn key market trends and staples

- Discover how your competitors are winning or losing

- Uncover your target market’s desires, preferences, aversions and thoughts

The final point is remarkably crucial for market research and for generally keeping your business afloat. And so, we’ll now dig deep into the market research survey, as this tool is especially useful for this purpose.

Defining a Market Research Survey

This tool is the most commonly used market research method — and for good reason. A market research survey allows you to gather data on your target market. Moreover, it allows businesses to do so by accessing any insights they need, as long as they form corresponding questions to their investigation.

Surveys have a far-reaching history, as they date back to ancient civilizations such as Greece and Rome. There was a surge in survey use in 1930s America, in which the government sought to understand the economic and social state of the nation.

Surveys have taken up a variety of forms, including analog forms, such as paper and mail-in formats .

Telephone surveys were the medium of choice for survey research during the 1960s-90s. But, as technological advancements would have it, those have declined in usefulness as well.

In the present day, surveys are conducted online, particularly through the use of designated software platforms. This type of software has paved the way for easy access to primary research.

Businesses can use online survey software and tools and to carry out all their survey research (save for creating the screener and questions). Many such tools available both allow you to build surveys along with deploying them.

To reiterate, market research surveys are powerful tools, in that they empower businesses to ask any question they choose to better understand their market and consumer base. They also can offer key insights into competitors.

The Components of a Market Research Survey

This tool contains two major components: the screener and the questionnaire . These form the bulk of the insights your primary research will gather.

There are also two auxiliary components to incorporate to make your survey research successful. These include the call-out (introduction) and the thank you message (conclusion).

Unlike the essential components, the need to use these will vary based on your survey deployment method and campaign. For example, an emailed survey won’t require a call-out, as the email itself serves this purpose.

A web or mobile survey, on the other hand, will need a call-out to get the attention of your respondents.

Here is a break-down of each component, beginning with the essential elements:

- These conditions often deal with demographics, which is incredibly important, as you would need to first and foremost, survey your target market. The screener will ensure it is only your target market that takes part in the survey.

- The screener is often comprised of 2-3 questions.

- The questionnaire should ask all the necessary questions you need for a particular campaign or sub-campaign. Or, if used in a preliminary stage of your market research, they can deal with questions particularly designed to segment your target market.

- If respondents are contacted via email, the call-out is in the email’s body, inviting participants to take it, listing why it’s important, its length and what it’s used for.

- If the survey exists within a website (either as a banner, or button), the call-out is the clickable element itself (the button/banner to the survey). It too should explain the survey to respondents.

- If the survey is on a website/app, the call-out has to be visible and attractive enough for users to notice it and click on it.

- The survey often routes users to another page with a thank you message.

- It’s important, as it lets participants know that their survey has in fact been submitted.

How to Create a Market Research Survey

Here are a few steps to take into consideration when starting on a market research survey project.

Step 1: Find a topic your business needs to learn more about.

This is particularly important if it is a topic that has little to no secondary sources. In this case, opting for a survey is the best way to learn more about it firsthand, from the people who matter most: your target market. Pay attention to any problems your business may experience, as surveys should help resolve them.

Step 2: Consider the topic in regards to your target market

When you’ve narrowed down a problem or two, think about your target market. Do you know who constitutes it? If yes, tailor your survey topic into a subtopic that they’ll be most likely to respond to. For example, if your target market is middle-aged men who watch sports, consider whether your problem/topic will be relevant to them.

If you don’t know your target market, you should conduct some secondary research about it first, then perform market segmentation (surveys can help on this front too).

Step 3: Find the larger application of the survey campaign

Now that you’ve settled on a topic/problem and decided on whether it’s fitting for your target market, consider what the parent campaign of the survey would be. Let’s hypothetically say your topic is related to a product. Would a survey on that topic benefit a branding campaign like finding your next slogan? Would it be better suited to settle on a theme for an advertising campaign?

Once you find the most appropriate application or macro campaign to house the survey, your market research will be organized and your survey will be better set up for success.

Step 4: Calculate your margin of error

A margin of error , in simple terms, is a measurement of how effective your survey will be. Expressed as a percentage, it measures the difference between survey results and the population value.

You need to measure this unit, as surveys represent a large group of people, but are made up of a much smaller group. Therefore, the larger the margin of error, the less accurate the opinions of the survey represent an entire population.

Step 5: Create your survey(s)

Now that you’ve calculated the margin of error, start creating your campaign. Decide on how many surveys you would need, in regard to your margin of error and your market research needs.

Start with a broader topic and get more specific in each question. Or, create multiple surveys focused on different but closely related subtopics to your main topic.

Send out your surveys through a trusted survey platform.

Questions to Ask for Various Campaigns

The steps laid out above are part of a simple procedure in developing a market research survey. However, there is much more to these steps, especially that of creating the survey.

Namely, you would need the correct set of questions, as they are the lifeblood of a survey. With so many different survey research campaigns and purposes, brainstorming questions can seem almost counterintuitive.

To avoid information overload and any confusion that creating a survey may incite, review the below question examples. They are organized per campaign type, so you can discern which questions are most suitable for which corresponding research purpose.

Questions for Branding

Branding campaigns include efforts that build the identity of your business; this includes gathering data-backed ideas on logos, imagery, messaging and core themes surrounding your brand. You can use these when embarking on a new campaign, revamping an existing one or when you’re looking to change your brand’s reputation and style.

- Which of these brands do you know?

- What do you like most/least about this brand?

- Which idea is more important? (Use an idea behind setting up your brand’s image/style)

- Which images do you find the most inspiring? (To compare images you’ll use in your marketing/ definitive to your brand)

- What do you like about [brand]? (Can be open-ended)

Questions for Advertising

Using market research for advertising will help you obtain ideas for new advertising campaigns, testing already established campaign ideas and predicting the success of new ones.

- How would you rate the motivating power of this ad?

- Which of the following ads resonate the most with you?

- Do you remember this ad? (Name and image/video of a popular ad within your industry)

- How do you feel after watching this ad?

- What kind of use do you think this product/service produces?

Questions for Comparing Yourself with Competitors

Studying your competitors is often associated with secondary research, but you can gain intelligence on this topic through your own survey research. The great thing about surveys is that you don’t have to focus on one competitor when managing these surveys.

- How often do you use this product/service?

- Which brand do you use for this product/service? (Include one open-ended answer).

- Which of the following products (same kind, different brand) do you find the most useful?

- What about [competitor product] would you like to see change?

- Which brand has improved your life? (Include one open-ended question).

Questions for Market Segmentation

This application is possibly the most challenging, as it involves understanding who your target market already is, then further segmenting it. We understand coming to terms with your target market first, before narrowing it any further down.

Here is how to segment your target market; you’ll notice that the questions are much more granular than the typical questions associated with each topic. (Ex: demographics typically ask for race, age, gender, income, etc).

- Demographic segmentation: Which of the following groups do you identify with most closely? (It can involve anything from music, to shopping habits, to lifestyle choices)

- Geographic segmentation: Which of the following areas do you typically spend time in to make physical purchases?

- Psychographic segmentation: How do you feel about retailers who test their products on animals?

- Behavioral segmentation: How often do you buy this kind of product?

- Sentimental segmentation: How do the following [practices, images, actions] make you feel?

Securing the Most Benefits Out of Your Market Research Survey

As we can deduce from this guide, the market research survey is a critical tool for market research . There is so much to discover about your industry, competitors and chiefly, your customers. But before making any hasty decisions, it is vital to peruse all your research documents, not just the primary research ones, such as surveys.

When you combine primary and secondary research sources, you’re setting up any business move for greater success.

That’s because market research involves studying more than one source. It may appear daunting, but with the right tools, you can design better products, innovate on existing products, appeal to a wider audience and gain more revenue from your marketing efforts.

Thus, pair your market research survey with other research means for a lucrative market research campaign. Knowledge truly is power.

Frequently asked questions

What is a market research survey.

A market research survey is a survey used for conducting primary market research and is the most commonly used market research method. Market research surveys help you understand your target market, gathering data necessary to make informed decisions on content creation, product development, and more.

What are the components of a market research survey?

There are 4 major components in a market research survey. First, we have the callout to get digital visitors to participate in a survey. Next is the screener which determines who is eligible to take the survey based on their demographics information and answers to screening questions. Then, there is the questionnaire—-- this is the heart of the survey, containing a set of open-ended or closed-ended questions. Lastly, there’s the callout. This introduces the survey to respondents. Next, there’s the thank you message. This acts as the conclusion to the survey.

How can you create a market research survey?

Creating a market research survey starts with identifying the topics your business needs to learn more about. Next, you consider topics within the context of your target market and find the larger application of the survey campaign. Calculate your margin of error and then create your survey using online software.

What types of questions should you ask on your market research survey?

You can ask branding related questions to gather information on how your identity of your business is perceived. You can also ask questions that spark ideas for new advertising campaigns. To supplement your secondary research on competitors, ask questions about your business’s place in the industry. Questions can also be used for market segmentation. These are questions on demographic, geographic, psychographic, behavioral and sentimental topics.

How can you get the most benefits out of your market research survey?

You can get the most out of your market research survey by using the correct online survey platform-- one with specific audience targeting for real consumers, radius targeting and quality screening questions-- you’ll get relevant answers from the right audience.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

Business growth

Marketing tips

How to conduct your own market research survey (with example)

After watching a few of those sketches, you can imagine why real-life focus groups tend to be pretty small. Even without any over-the-top personalities involved, it's easy for these groups to go off the rails.

So what happens when you want to collect market research at a larger scale? That's where the market research survey comes in. Market surveys allow you to get just as much valuable information as an in-person interview, without the burden of herding hundreds of rowdy Eagles fans through a product test.

Table of contents:

What is a market research survey?

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports. Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

A market research survey can collect information on your target customers':

Experiences

Preferences, desires, and needs

Values and motivations

The types of information that can usually be found in a secondary source, and therefore aren't good candidates for a market survey, include your target customers':

Demographic data

Consumer spending data

Household size

Why conduct market research?

Here are some examples of how market research surveys can be used to fill a wide range of knowledge gaps for companies:

A B2B software company asks real users in its industry about Kanban board usage to help prioritize their project view change rollout.

A B2C software company asks its target demographic about their mobile browsing habits to help them find features to incorporate into their forthcoming mobile app.

A printing company asks its target demographic about fabric preferences to gauge interest in a premium material option for their apparel lines.

A wholesale food vendor surveys regional restaurant owners to find ideas for seasonal products to offer.

Primary vs. secondary market research

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports.

Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

If you've exhausted your secondary research options and still have unanswered questions, it's time to start thinking about conducting a market research survey.

6 types of market research survey

Depending on your goal, you'll need different types of market research. Here are six types of market research surveys.

1. Buyer persona research

A buyer persona research survey will help you learn more about things like demographics, household makeup, income and education levels, and lifestyle markers. The more you learn about your existing customers, the more specific you can get in targeting potential customers. You may find that there are more buyer personas within your user base than the ones that you've been targeting.

2. Sales funnel research

With a sales funnel research survey, you can learn about potential customers' main drivers at different stages of the sales funnel. You can also get feedback on how effective different sales strategies are. Use this survey to find out:

How close potential buyers are to making a purchase

What tools and experiences have been most effective in moving prospective customers closer to conversion

3. Customer loyalty research

The demographics of your most loyal customers

What tools are most effective in turning customers into advocates

What you can do to encourage more brand loyalty

4. Branding and marketing research

The Charmin focus group featured in that SNL sketch is an example of branding and marketing research, in which a company looks for feedback on a particular advertising angle to get a sense of whether it will be effective before the company spends money on running the ad at scale. Use this type of survey to find out:

Whether a new advertising angle will do well with existing customers

Whether a campaign will do well with a new customer segment you haven't targeted yet

What types of campaign angles do well with a particular demographic

5. New products or features research

What features they wish your product currently had

What they think of a particular product or feature idea

6. Competitor research

Whether your competitors have found success with a buyer persona you're not targeting

Information about buyers for a product that's similar to one you're thinking about launching

Feedback on what features your competitors' customers wish their version of a product had

How to write and conduct a market research survey

Once you've narrowed down your survey's objectives, you can move forward with designing and running your survey.

Step 1: Write your survey questions

A poorly worded survey, or a survey that uses the wrong question format, can render all of your data moot. If you write a question that results in most respondents answering "none of the above," you haven't learned much.

Categorical questions

Also known as a nominal question, this question type provides numbers and percentages for easy visualization, like "35% said ABC." It works great for bar graphs and pie charts, but you can't take averages or test correlations with nominal-level data.

Multiple choice: Use this type of question if you need more nuance than a Yes/No answer gives. You can add as many answers as you want, and your respondents can pick only one answer to the question.

Checkbox: Checkbox questions add the flexibility to select all the answers that apply. Add as many answers as you want, and respondents aren't limited to just one.

Ordinal questions

This type of question requires survey-takers to pick from options presented in a specific order, like "income of $0-$25K, $26K-$40K, $41K+." Like nominal questions, ordinal questions elicit responses that allow you to analyze counts and percentages, though you can't calculate averages or assess correlations with ordinal-level data.

Dropdown: Responses to ordinal questions can be presented as a dropdown, from which survey-takers can only make one selection. You could use this question type to gather demographic data, like the respondent's country or state of residence.

Ranking: This is a unique question type that allows respondents to arrange a list of answers in their preferred order, providing feedback on each option in the process.

Interval/ratio questions

For precise data and advanced analysis, use interval or ratio questions. These can help you calculate more advanced analytics, like averages, test correlations, and run regression models. Interval questions commonly use scales of 1-5 or 1-7, like "Strongly disagree" to "Strongly agree." Ratio questions have a true zero and often ask for numerical inputs (like "How many cups of coffee do you drink per day? ____").

Ranking scale: A ranking scale presents answer choices along an ordered value-based sequence, either using numbers, a like/love scale, a never/always scale, or some other ratio interval. It gives more insight into people's thoughts than a Yes/No question.

Matrix: Have a lot of interval questions to ask? You can put a number of questions in a list and use the same scale for all of them. It simplifies gathering data about a lot of similar items at once.

Example : How much do you like the following: oranges, apples, grapes? Hate/Dislike/Ok/Like/Love

Textbox: A textbox question is needed for collecting direct feedback or personal data like names. There will be a blank space where the respondent can enter their answer to your question on their own.

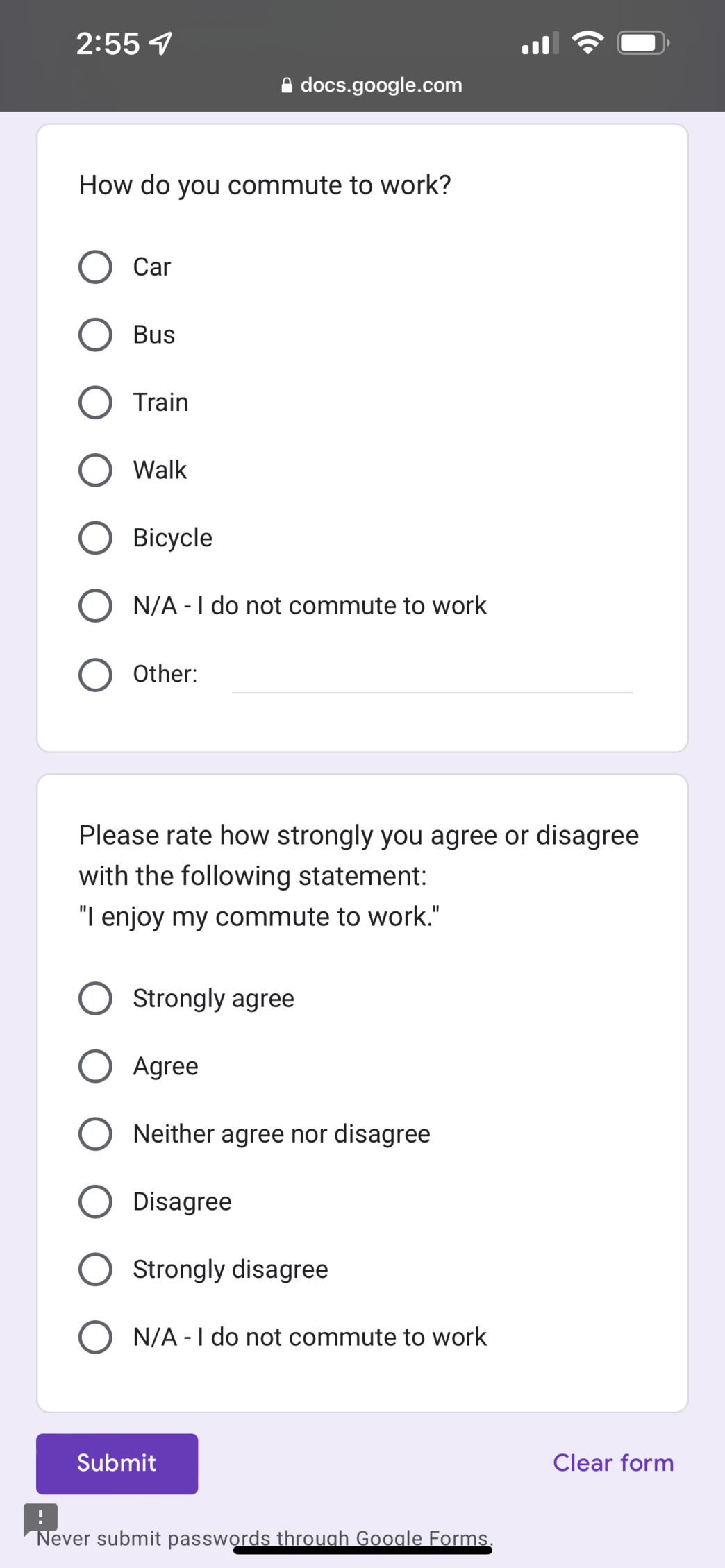

Step 2: Choose a survey platform

Most survey apps today look great on mobile, but be sure to preview your survey on your phone and computer, at least, to make sure it'll look good for all of your users.

If you have the budget, you can also purchase survey services from a larger research agency.

Step 3: Run a test survey

Before you run your full survey, conduct a smaller test on 5%-10% of your target respondent pool size. This will allow you to work out any confusing wording or questions that result in unhelpful responses without spending the full cost of the survey. Look out for:

Survey rejection from the platform for prohibited topics

Joke or nonsense textbox answers that indicate the respondent didn't answer the survey in earnest

Multiple choice questions with an outsized percentage of "none of the above" or "N/A" responses

Step 4: Launch your survey

If your test survey comes back looking good, you're ready to launch the full thing! Make sure that you leave ample time for the survey to run—you'd be surprised at how long it takes to get a few thousand respondents.

Even if you've run similar surveys in the past, leave more time than you need. Some surveys take longer than others for no clear reason, and you also want to build in time to conduct a comprehensive data analysis.

Step 5: Organize and interpret the data

Tips for running a market research survey.

You know the basics of how to conduct a market research survey, but here are some tips to enhance the quality of your data and the reliability of your findings.

Find the right audience: You could have meticulously crafted survey questions, but if you don't target the appropriate demographic or customer segment, it doesn't really matter. You need to collect responses from the people you're trying to understand. Targeted audiences you can send surveys to include your existing customers, current social media followers, newsletter subscribers, attendees at relevant industry events, and community members from online forums, discussion boards, or other online communities that cater to your target audience.

Focus questions on a desired data type: As you conceptualize your survey, consider whether a qualitative or quantitative approach will better suit your research goals. Qualitative methods are best for exploring in-depth insights and underlying motivations, while quantitative methods are better for obtaining statistical data and measurable trends. For an outcome like "optimize our ice cream shop's menu offerings," you may want to find out which flavors of ice cream are most popular with teens. This would require a quantitative approach, for which you would use categorical questions that can help you rank potential flavors numerically.

Establish a timeline: Set a realistic timeline for your survey, from creation to distribution to data collection and analysis. You'll want to balance having your survey out long enough to generate a significant amount of responses but not so long that it loses relevance. That length can vary widely based on factors like type of survey, number of questions, audience size, time sensitivity, question format, and question length.

Market research survey campaign example

Let's say you own a market research company, and you want to use a survey to gain critical insights into your market. You prompt users to fill out your survey before they can access gated premium content.

Survey questions:

1. What size is your business?

<10 employees

11-50 employees

51-100 employees

101-200 employees

>200 employees

2. What industry type best describes your role?

3. On a scale of 1-4, how important would you say access to market data is?

1 - Not important

2 - Somewhat important

3 - Very important

4 - Critically important

4. On a scale of 1 (least important) to 5 (most important), rank how important these market data access factors are.

Accuracy of data

Attractive presentation of data

Cost of data access

Range of data presentation formats

Timeliness of data

5. True or false: your job relies on access to accurate, up-to-date market data.

Survey findings:

63% of respondents represent businesses with over 100 employees, while only 8% represent businesses with under 10.

71% of respondents work in sales, marketing, or operations.

80% of respondents consider access to market data to be either very important or critically important.

"Timeliness of data" (38%) and "Accuracy of data" (32%) were most commonly ranked as the most important market data access factor.

86% of respondents claimed that their jobs rely on accessing accurate, up-to-date market data.

Insights and recommendations: Independent analysis of the survey indicates that a large percentage of users work in the sales, marketing, or operations fields of large companies, and these customers value timeliness and accuracy most. These findings can help you position future report offerings more effectively by highlighting key benefits that are important to customers that fit into related customer profiles.

Market research survey example questions

Your individual questions will vary by your industry, market, and research goals, so don't expect a cut-and-paste survey to suit your needs. To help you get started, here are market research survey example questions to give you a sense of the format.

Yes/No: Have you purchased our product before?

Multiple choice: How many employees work at your company?

<10 / 10-20 / 21-50 / 51-100 / 101-250 / 250+

Checkbox: Which of the following features do you use in our app?

Push notifications / Dashboard / Profile customization / In-app chat

Dropdown: What's your household income?

$0-$10K / $11-$35K / $36-$60K / $61K+

Ranking: Which social media platforms do you use the most? Rank in order, from most to least.

Facebook / Instagram / Twitter / LinkedIn / Reddit

Ranking scale: On a scale of 1-5, how would you rate our customer service?

1 / 2 / 3 / 4 / 5

Textbox: How many apps are installed on your phone? Enter a number:

Market research survey question types

Good survey apps typically offer pre-designed templates as a starting point. But to give you a more visual sense of what these questions might look like, we've put together a document showcasing common market research survey question types.

Use automation to put survey results into action

Related reading:

This article was originally published in June 2015 by Stephanie Briggs. The most recent update, with contributions from Cecilia Gillen, was in September 2023.

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Amanda Pell

Amanda is a writer and content strategist who built her career writing on campaigns for brands like Nature Valley, Disney, and the NFL. When she's not knee-deep in research, you'll likely find her hiking with her dog or with her nose in a good book.

- Forms & surveys

Related articles

12 Linkedin Lead Gen Form examples to inspire your next campaign

12 Linkedin Lead Gen Form examples to...

14 types of email marketing to experiment with

14 types of email marketing to experiment...

8 business anniversary marketing ideas and examples worth celebrating

8 business anniversary marketing ideas and...

A guide to verticalization: What it is, when to try it, and how to get started

A guide to verticalization: What it is, when...

Improve your productivity automatically. Use Zapier to get your apps working together.

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![market research survey construction → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .