Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their accounting firms.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an accounting business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is an Accounting Business Plan?

A business plan provides a snapshot of your accounting business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Accounting Firm

If you’re looking to start an accounting firm or grow your existing accounting business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your accounting business to improve your chances of success. Your accounting business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Accounting Firms

With regards to funding, the main sources of funding for an accounting firm are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for accounting firms.

Finish Your Business Plan Today!

How to write a business plan for an accounting firm.

If you want to start an accounting business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your accounting business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of accounting business you are running and the status. For example, are you a startup, do you have an accounting business that you would like to grow, or are you operating an established accounting business you would like to sell?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overv iew of the accounting industry.

- Discuss the type of accounting business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of accounting business you are operating.

For example, you might specialize in one of the following types of accounting firms:

- Full Service Accounting Firm: Offers a wide range of accounting services.

- Bookkeeping Firm: Typically serves small business clients by maintaining their company finances.

- Tax Firm: Offers tax accounting services for businesses and individuals.

- Audit Firm: Offers auditing services for companies, organizations, and individuals.

In addition to explaining the type of accounting business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, or the amount of revenue earned.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the accounting industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the accounting industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your accounting business plan:

- How big is the accounting industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your accounting business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your accounting business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, organizations, government entities, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of accounting business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are othe r accounting firms.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes CPAs, other accounting service providers, or bookkeeping firms. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of accounting business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide options for multiple customer segments?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a accounting business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type o f accounting company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide auditing services, tax accounting, bookkeeping, or risk accounting services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of yo ur plan, yo u are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your accounting company. Document where your company is situated and mention how the site will impact your success. For example, is your accounting business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your accounting marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your accounting business, including answering calls, scheduling meetings with clients, billing and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to book your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your accounting business to a new city.

Management Team

To demonstrate your accounting business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing accounting businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an accounting business or bookkeeping firm.

Financial Plan

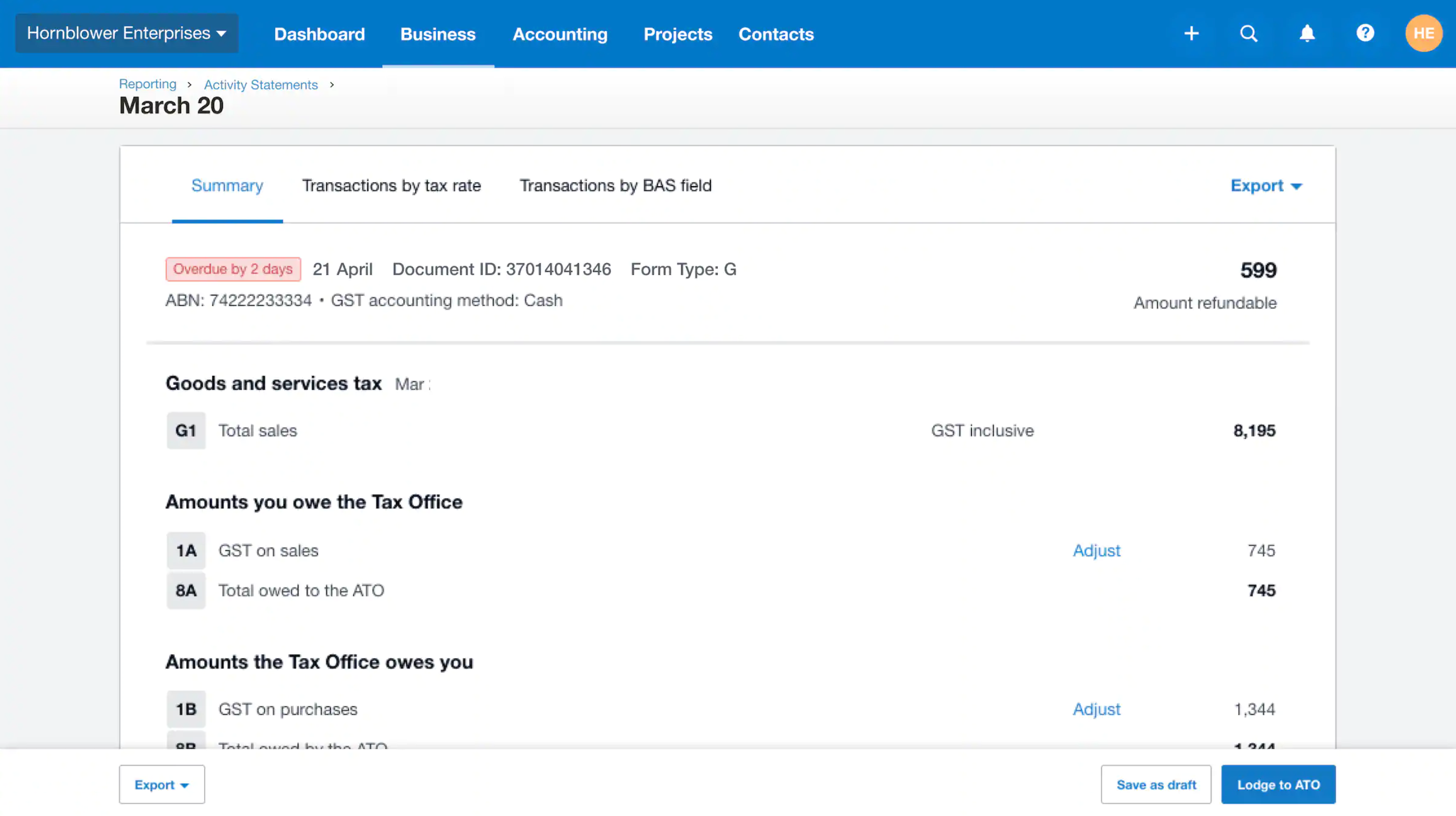

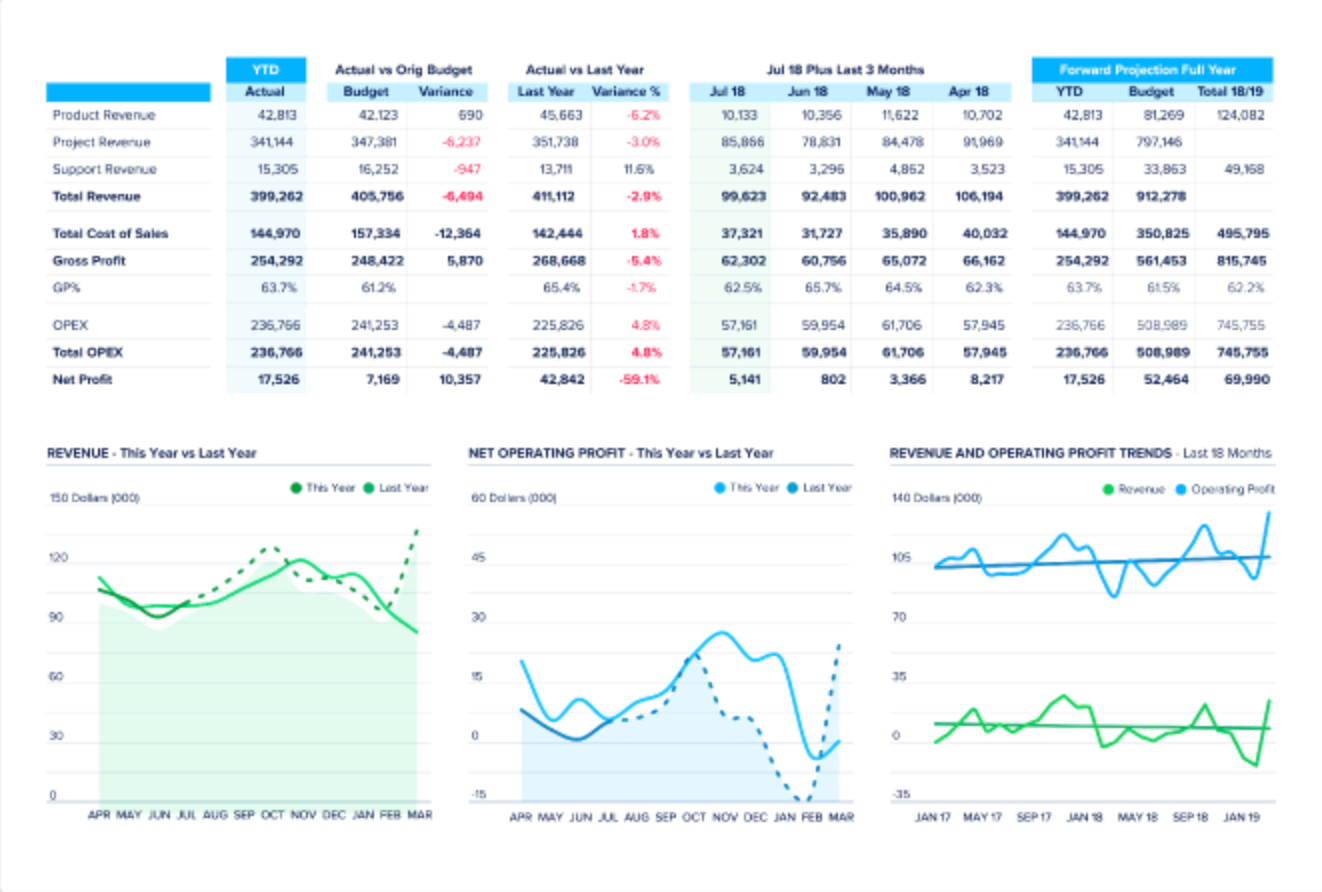

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance s heet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer discounts for referrals ? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your accounting business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a accounting business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of your most prominent clients. Summary Writing a business plan for your accounting business is a worthwhile endeavor. If you follow the accounting business plan example above, by the time you are done, you will truly be an expert. You will understand the accounting industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful accounting business.

Accounting Business Plan Template FAQs

What is the easiest way to complete my accounting business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your accounting business plan.

How Do You Start an Accounting Business?

Starting an accounting business is easy with these 14 steps:

- Choose the Name for Your Accounting Business

- Create Your Accounting Business Plan

- Choose the Legal Structure for Your Accounting Business

- Secure Startup Funding for Your Accounting Business (If Needed)

- Secure a Location for Your Business

- Register Your Accounting Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Accounting Business

- Buy or Lease the Right Accounting Business Equipment

- Develop Your Accounting Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Accounting Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Accounting business plan?

OR, Let Us Develop Your Plan For You Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan writer can create your business plan for you. Other Helpful Business Plan Articles & Templates

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

You’ve come to the right place to create your Accounting business plan.

We have helped over 5,000 entrepreneurs and business owners create business accounting plans and many have used them to start or grow their accounting firms.

Below is a template to help you create each section of your Accounting business plan.

Executive Summary

Business overview.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana. We provide a full suite of accounting services to local businesses, including bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. His expertise, reputation, and loyal clientbase will ensure that our firm is successful.

Product Offering

DeSanta & Co will offer its clients a full suite of accounting services. These services include bookkeeping, accounting, tax services, and auditing. The company will employ a large and diverse staff of professional accountants to ensure we can offer as many services as possible.

Customer Focus

DeSanta & Co will serve small and medium-sized businesses located in the Indianapolis, Indiana area. Most of these businesses will have less than 1000 employees and earn a revenue less than $10 million per year. We will also offer limited services to individuals, such as tax prep and help.

Management Team

DeSanta & Co’s most valuable asset is the expertise and experience of its founder, Michael DeSanta. Michael has been a certified public accountant (CPA) for the past 20 years. Throughout his career, he has developed a loyal client base, and many clients have stated that they will switch to DeSanta & Co once the company is established and running. Michael’s combination of skills, accounting knowledge, and loyal following will ensure that DeSanta & Co is a successful firm.

Success Factors

DeSanta & Co will be able to achieve success by offering the following competitive advantages:

- Michael DeSanta will initially help the clientbase that he has built carefully over the past twenty years.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our accounting services at an affordable rate.

Financial Highlights

DeSanta & Co is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

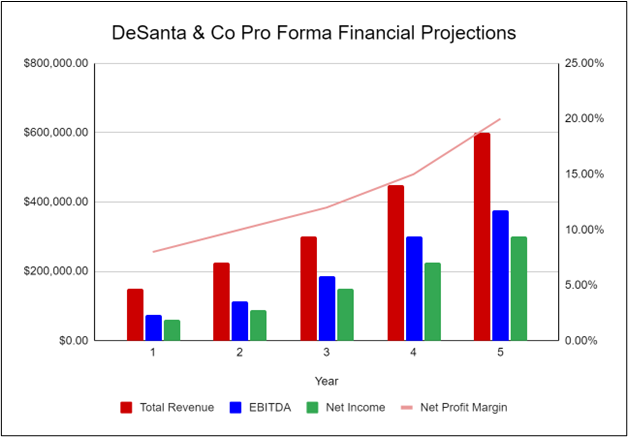

The following graph below outlines the pro forma financial projections for DeSanta & Co.

Company Overview

Who is desanta & co.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana that provides local businesses with a full suite of accounting services. We are a small firm but have considerable experience, so we can offer better quality of services than our competition. We expect that our most popular services will include bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. After working for several accounting firms around town, he surveyed his clientbase to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Michael to finally launch his business.

DeSanta & Co History

Upon surveying his clientbase and finding a potential office, Michael DeSanta incorporated DeSanta & Co as an S-Corporation in April 2023.

The business is currently being run out of Michael’s home office, but once the lease on DeSanta & Co’s office location is finalized, all operations will be run from there.

Since incorporation, DeSanta & Co has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

DeSanta & Co Services

DeSanta & Co will provide the following services to its clients:

- Bookkeeping

- Tax services

- Advisory services

- Investment services

- Management consulting

- Valuation and planning

Industry Analysis

The accounting industry is essential to the success of other businesses and industries. Accountants record and track financial transactions, which helps businesses ensure they are making a profit. As such, accounting services are always in demand and the industry often sees great growth.

There are several essential services that accounting firms can provide to businesses and individuals. The most popular services include bookkeeping, tax services, advisory services, and valuation and planning. Though most businesses employ their own accountants, many businesses are switching to hiring accounting firms to save on costs.

The accounting industry is expected to grow over the next several years. According to The Business Research Company, the accounting industry is expected to grow at a CAGR of 4.2% from now until 2027. This growth is due to the increasing demand for accountants worldwide. This increase in demand and industry growth ensures that DeSanta & Co will achieve success.

Customer Analysis

Demographic profile of target market, customer segmentation.

DeSanta & Co will primarily target the following customer profiles:

- Local small businesses

- Medium-sized businesses

- Individuals

Competitive Analysis

Direct and indirect competitors.

DeSanta & Co will face competition from other companies with similar business profiles. A description of each competitor company is below.

Perkins & Smith

Perkins & Smith is a small accounting firm that has intentionally remained small so that they can have stronger relationships with their clients. Since they opened in 1960, Perkins & Smith has been one of the leading accounting firms in the Four State Region. They offer a wide range of services including accounting, bookkeeping, payroll services, tax prep and planning, and advisory services. They have built up a loyal clientele and maintained a strong, positive reputation since their opening decades ago.

Premiere Accounting

Premiere Accounting is a large accounting firm that specializes in helping large businesses with accounting, taxes, and similar services. Since opening in 1995, they have acquired a loyal client base, including several multi-billion dollar companies. They employ over a hundred professionals who all have diverse backgrounds. This helps serve their diverse clientele and ensures they are meeting the specific needs of every business that works with them.

Jackson Brothers Accounting

Jackson Brothers Accounting is a privately held accountant practice that has been popular in the area since 1985. They offer a wide variety of services including, tax planning and preparation, payroll processing, financial planning, and small business accounting. Though they are open to helping nearly all businesses and sectors, they primarily focus on local small businesses and startups.

Competitive Advantage

DeSanta & Co will be able to offer the following advantages over the competition:

- Client-oriented service : DeSanta & Co will put a focus on customer service and maintaining long-term relationships. We aim to be the best accounting firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management : Michael has been extremely successful working in the accounting sector and will be able to use his previous experience to help his clients better than the competition.

- Relationships : Having lived in the community for 25 years, Michael DeSanta knows many of the local leaders, newspapers and other influences.

Marketing Plan

Brand & value proposition.

DeSanta & Co will offer a unique value proposition to its clientele:

- Client-focused financial services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for DeSanta & Co is as follows:

Targeted Cold Calls

DeSanta & Co will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need accounting services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

DeSanta & Co understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

DeSanta & Co will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

DeSanta & Co will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

The fees and hourly pricing of DeSanta & Co will be moderate and competitive so clients feel they are receiving great value when utilizing our accounting services.

Operations Plan

The following will be the operations plan for DeSanta & Co. Operation Functions:

- Michael DeSanta will be the Owner of DeSanta & Co. In addition to providing accounting services, he will also manage the general operations of the business.

- Michael DeSanta is joined by a full-time administrative assistant, Jessica Baker, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Michael will hire more accounting professionals to provide the company’s services, attract more clients, and grow our business further.

Milestones:

DeSanta & Co will have the following milestones completed in the next six months.

- 6/2023 Finalize lease agreement

- 7/2023 Design and build out DeSanta & Co

- 8/2023 Hire and train initial staff

- 9/2023 Kickoff of promotional campaign

- 10/2023 Launch DeSanta & Co

- 11/2023 Reach break-even

Though he has never run his own business, Michael DeSanta has worked as an accountant long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other accounting firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key revenue & costs.

DeSanta & Co’s revenues will primarily come from charging clients for the accounting services we provide. We will charge our clients an hourly rate that will vary depending on the services they need.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients:

- Year 4: 100

- Year 5: 125

- Annual Rent: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, accounting business plan faqs, what is an accounting business plan.

An accounting business plan is a plan to start and/or grow your accounting business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Accounting business plan using our Accounting Business Plan Template here .

What are the Main Types of Accounting Businesses?

There are a number of different kinds of accounting businesses , some examples include: Full Service Accounting Firm, Bookkeeping Firm, Tax Firm, and Audit Firm.

How Do You Get Funding for Your Accounting Business Plan?

Accounting businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Accounting Business?

Starting an accounting business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Accounting Business Plan - The first step in starting a business is to create a detailed accounting business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your accounting business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your accounting business is in compliance with local laws.

3. Register Your Accounting Business - Once you have chosen a legal structure, the next step is to register your accounting business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your accounting business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Accounting Equipment & Supplies - In order to start your accounting business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your accounting business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful accounting business:

- How to Start an Accounting Business

How To Write a Winning Accountant Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for accountant businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every accountant business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Accountant Business Plan?

An accountant business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Accountant Business Plan?

An accountant business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Accountant Business Plan

The following are the key components of a successful accountant business plan:

Executive Summary

The executive summary of an accountant business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your accountant company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your accountant business , you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your accountant firm, mention this.

Industry Analysis

The industry or market analysis is an important component of an accountant business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the accountant industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an accountant business may include small business owners, individuals with complex financial situations, or other businesses that need accounting assistance.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or accountant services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your accountant business via word-of-mouth or referrals from satisfied customers.

Operations Plan

This part of your accountant business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an accountant business include reaching $X in sales. Other examples include adding new products or services, expanding to new markets, or opening new locations.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific accountant industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Accountant Business

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Accountant Business

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup accountant business.

Sample Cash Flow Statement for a Startup Accountant Business

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your accountant company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

The goal of any business plan is to provide a roadmap for the future. A winning accountant business plan does this by providing a detailed overview of your company, its operations, and its financials. If you are seeking funding, your business plan should also include an appendix with your full financial projections and supporting documentation.

Finish Your Accounting Firm Business Plan in 1 Day!

Small Business Trends

How to start an accounting business.

Accounting firms play a very important role in the business world by providing key financial services such as bookkeeping, tax preparation, auditing, and consulting, helping businesses manage their finances effectively. If you are looking to start a business in this segment, we’ll take you through all the steps on how to start an accounting business.

Starting an Accounting Business

Of course, there are certain foundational aspects you need to establish before launching your business. For instance, before starting an accounting business, you should get the education and testing you need to become a certified public accountant.

Understanding the Accounting Industry

Before starting an accounting firm, it’s vital to comprehend what accounting is and the dynamics of the accounting industry, including market trends, client needs, and potential competition. Many firms offer both accounting and bookkeeping services. So research the difference between bookkeeping and accounting , along with any other services you might offer.

Developing a Business Plan for Your Accounting Firm

A comprehensive business plan outlines your firm’s mission, target market, services offered, marketing strategies, financial projections, and growth plans, providing a roadmap for success. You’ll also need to choose what type of business structure is best for your business as a separate legal entity. For most firms, the business structure chosen for the CPA firm is the Limited Liability Company, or LLC.

Legal Requirements and Business Registration

Ensure compliance with legal requirements by registering your accounting firm with the appropriate government authorities, obtaining necessary licenses, and adhering to tax regulations. You’ll need an employer identification number or EIN.

Setting Up a Business Bank Account

Open a dedicated business bank account to separate personal and business finances, facilitating easier accounting, tax reporting, and financial management.

Choosing an Accounting Niche

Consider specializing in a specific accounting niche such as tax preparation, forensic accounting, or small business accounting to differentiate your firm and target specific client needs more effectively.

Business Insurance for Your Accounting Firm

Protect your firm from potential liabilities and risks by obtaining appropriate business insurance coverage, including professional liability insurance, general liability insurance, and property insurance.

How to Start an Accounting Business From Home

The obvious advantage to running an accounting business from your home is financial. You’ll save money by not having to pay rent for a commercial space.

Before you do that, however, make sure your local zoning laws allow for a home-based business. There may be restrictions and requirements, such as your allowed hours of operation and having a certain number of parking spaces. Here’s a guide for how to start a business offering accounting services from home.

Designing Your Home Office for Productivity

Designing a home office for productivity involves creating a dedicated workspace with ergonomic furniture, adequate lighting, and minimal distractions.

Consider setting up a designated area free from household distractions to maximize productivity while working from home.

Invest in ergonomic furniture to promote comfort and proper posture, ensuring long hours of focused work.

Additionally, optimize lighting to reduce eye strain and enhance concentration. Organizational tools such as filing systems and storage solutions can also help maintain a clutter-free environment, fostering a conducive atmosphere for efficient work.

Technology and Software for Accounting Firms

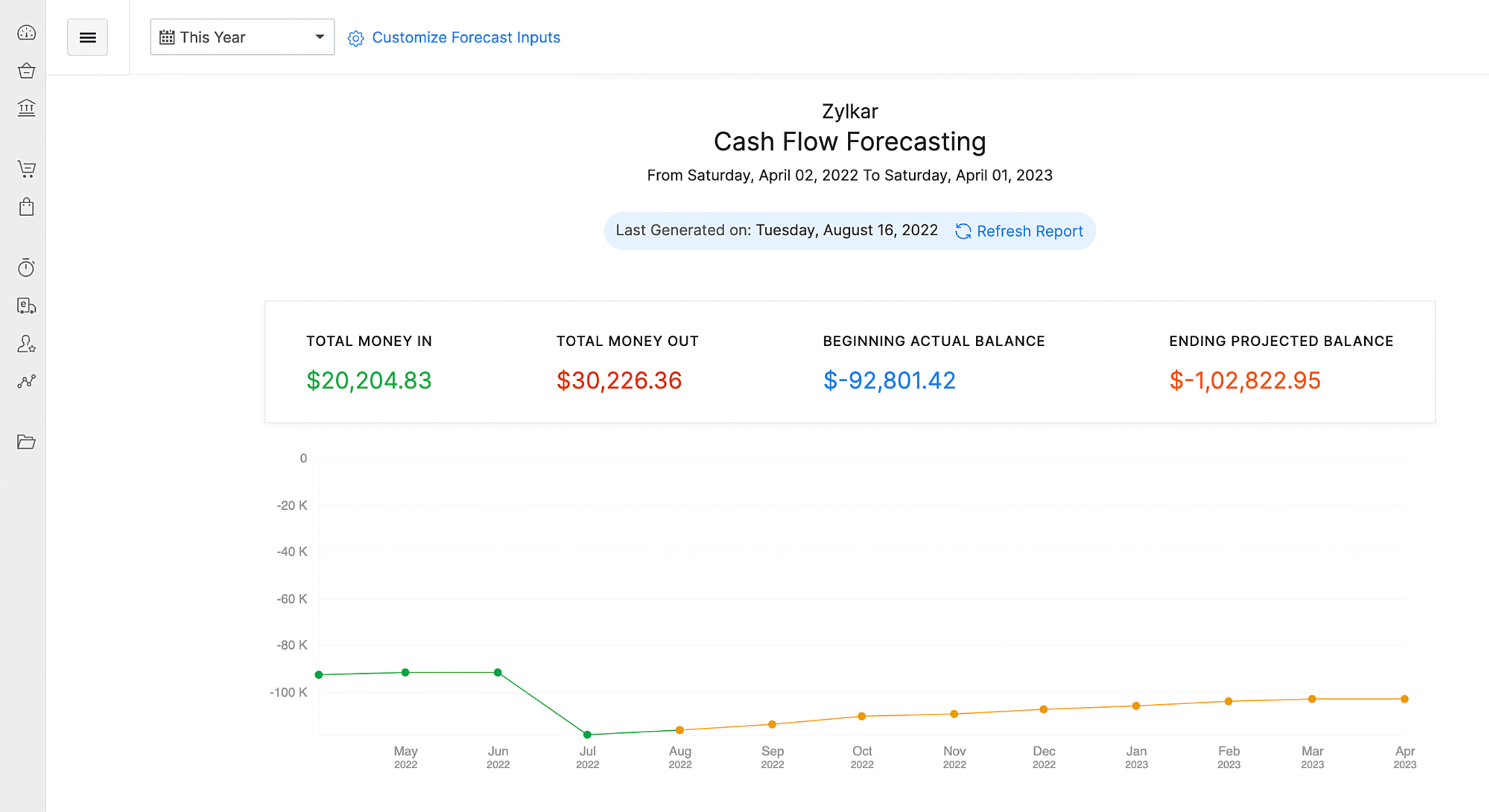

Utilizing technology and software is not just an option but a necessity for accounting firms aiming to streamline their operations and boost efficiency. The integration of cloud-based accounting software, document management systems, and communication tools not only enhances collaboration among team members but also supports remote work environments, which have become increasingly prevalent.

In the context of the digital era, the adoption of technology is crucial for accounting firms to maintain their competitive edge and meet the evolving demands of their clients effectively:

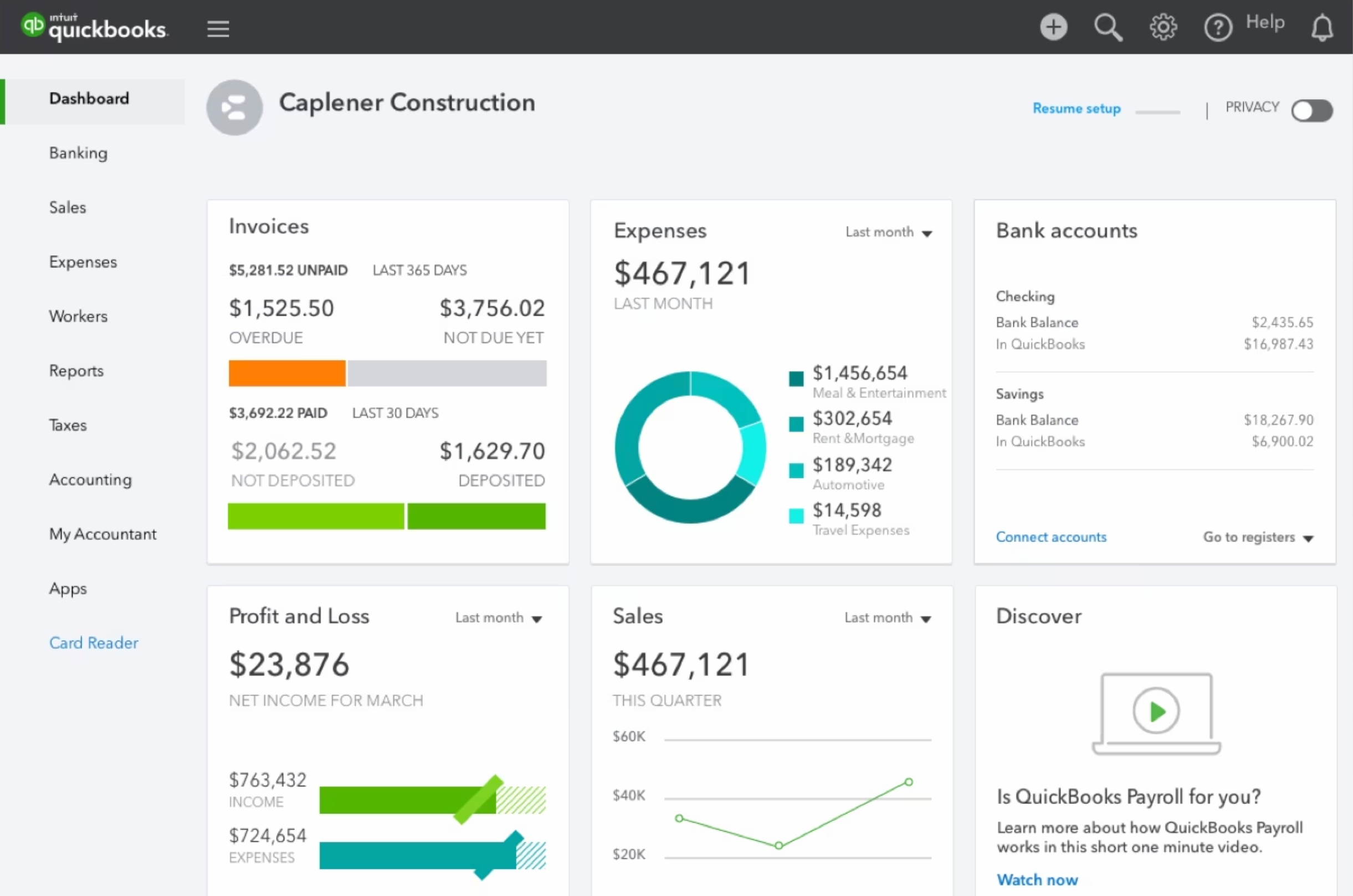

- Cloud-based Accounting Software : Platforms such as QuickBooks, Xero, and Sage offer cloud-based solutions that provide accountants with access to financial data in real time. These tools come with features that automate routine tasks like invoicing, payroll processing, and financial reporting, thereby reducing the chance of human error and freeing up time for more strategic activities. The ability to collaborate online with clients on the same platform ensures transparency and enhances the decision-making process. Some of the best free accounting software options even offer advanced features that professionals may find useful.

- Document Management Systems : Tools like Google Drive, Dropbox, and SharePoint are essential for the secure storage, sharing, and organization of documents. These systems facilitate easy access to files from anywhere, at any time, ensuring that all team members are on the same page. The improved organization and accessibility lead to better workflow efficiency, quicker response times to client inquiries, and a reduction in the use of paper, contributing to environmental sustainability.

- Communication Tools : Applications such as Slack, Microsoft Teams, and Zoom have transformed how teams communicate, allowing for instant messaging, video conferencing, and project collaboration. Whether team members are working remotely or from the office, these tools ensure that everyone can stay connected, share updates, and resolve issues promptly. This constant connectivity fosters a collaborative work environment and enables firms to deliver superior client service.

Integrating these technological solutions into the daily operations of an accounting firm brings numerous benefits:

- Enhanced efficiency through automated processes and reduced manual tasks

- Improved accuracy and reduced risk of errors in financial data

- Seamless collaboration and communication within teams and with clients

- Greater flexibility and scalability to adapt to changing business needs

- Increased security and compliance with data protection regulations

By embracing these technologies, accounting firms can not only optimize their internal processes but also provide more value-added services to their clients, ultimately contributing to the firm’s growth and success in the competitive market.

Marketing Your Accounting Services

As with all new and existing businesses, you need a marketing strategy that leverages both digital and traditional marketing methods. New clients are reached by various strategies.

Building an Online Presence

Building an online presence involves creating a professional website, engaging in social media marketing, and leveraging online networking platforms to showcase expertise and attract potential clients.

Establishing a strong online presence is crucial for reaching a wider audience and attracting potential clients in today’s digital landscape. Create a professional website highlighting your firm’s services, expertise, and client testimonials.

Next, engage in social media marketing to share valuable content, interact with followers, and build brand awareness. Utilize online networking platforms like LinkedIn to connect with industry professionals, join relevant groups, and showcase your expertise through thought leadership articles and posts.

Consistently maintaining and updating your online presence helps build credibility, trust, and visibility, ultimately driving client acquisition and business growth.

Networking and Building Client Relationships

Networking and building client relationships involve attending industry events, joining professional organizations, and offering exceptional customer service to foster trust and loyalty.

Networking is a vital aspect of growing an accounting business, as it provides opportunities to connect with potential clients and industry peers. Attend industry conferences, seminars, and networking events to meet other professionals and exchange insights. Join professional organizations like the American Institute of Certified Public Accountants (AICPA) or local chambers of commerce to expand your network and access potential client referrals.

Building strong client relationships requires delivering exceptional customer service, actively listening to client needs, and providing timely, personalized solutions. For example, some clients may require you to walk them through some generally accepted accounting principles or explain concepts like what is accounting profit. By nurturing these relationships, accounting firms can cultivate trust, loyalty, and long-term client partnerships, leading to business sustainability and referrals.

Launching Your Accounting Firm

Launching an accounting business involves finalizing business offerings, setting competitive fees, and implementing marketing strategies to attract clients.

Before launching the business, finalize the range of services your firm will offer, ensuring they align with client needs and market demand.

Conduct market research to determine competitive pricing strategies that reflect the value of your services while remaining attractive to potential clients.

Develop a marketing plan that includes online and offline strategies to promote your firm’s brand, such as a website startup guide , social media marketing, email campaigns, and networking events.

Additionally, establish efficient business processes and systems to deliver high-quality services consistently. By carefully planning and executing these steps, accounting firms can successfully launch their businesses and position themselves for long-term success and growth.

FAQs: How to Start an Accounting Business

What are the key financial considerations for new accounting firms.

Financial considerations for accounting firms include managing cash flow effectively, budgeting for operational expenses and investments, monitoring profitability ratios, and ensuring compliance with tax obligations. Additionally, prudent financial planning involves setting aside funds for emergencies, investing in professional development, and evaluating the firm’s financial performance regularly to make informed business decisions.

How can new accounting businesses stand out in a crowded market?

A new accounting business can stand out from the competition by offering specialized services tailored to niche markets, providing exceptional customer service, leveraging technology for efficiency and innovation, and building a strong brand identity through effective marketing and networking efforts. By offering the best accounting services for small business users and demonstrating expertise, reliability, and a client-centric approach, accounting firms can differentiate themselves and attract clients seeking tailored solutions and personalized attention.

What role does technology play in the modern accounting firm?

Technology plays a crucial role in modern accounting firms by facilitating efficient workflow management, automating repetitive tasks, enhancing data accuracy, and improving client communication and collaboration. Cloud-based accounting software , document management systems, and communication tools streamline processes, enabling accountants to focus on value-added services and strategic insights. Embracing technology also fosters agility and adaptability, allowing accounting firms to stay competitive in a rapidly evolving digital landscape.

How can accounting firms build lasting partnerships with small businesses?

Accounting firms can build lasting partnerships with small businesses by understanding their unique needs and challenges, providing proactive advice and support, delivering personalized solutions, and fostering open communication and trust. By demonstrating a deep understanding of small business operations, offering strategic guidance for growth and financial management, and consistently delivering value, accounting firms can establish themselves as trusted advisors and long-term partners for small businesses looking to hire an accountant . Regular communication, responsiveness, and a collaborative approach further strengthen the partnership and contribute to mutual growth and prosperity.

Image: Envato Elements

Your email address will not be published. Required fields are marked *

© Copyright 2003 - 2024, Small Business Trends LLC. All rights reserved. "Small Business Trends" is a registered trademark.

Home > Finance > Accounting

The 9 Best Small-Business Accounting Software of 2023

Data as of post date. Offers and availability may vary by location and are subject to change. *Only available for businesses with an annual revenue beneath $50K USD **Current offer: 50% off for 3 mos. or 30-day free trial †Current offer: 50% off for three months or 30-day free trial ‡Current offer: 75% off for 3 mos. Available for new customers only

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

The bottom line: Xero is our favorite accounting service for small businesses. With free unlimited users, it's an excellent pick for collaborative businesses like multi-partner LLCs. Its low starting price and excellent app also make it a prime fit for freelancers, contractors, and other sole proprietors.

Wave Accounting is a good free accounting option for budget-cautious freelancers and small-business owners. QuickBooks Online works well for business owners who value solid reporting and tax tracking. Zoho Books affordably automates key tasks that can suck up business owners’ time. FreshBooks is a good alternative for business owners who want unlimited invoices.

- Wave : Budget pick

- Zoho Books : Best features

- Xero : Best overall accounting software

- QuickBooks : Most user-friendly

- FreshBooks : Best invoicing

If you're searching for accounting software that's user-friendly, full of smart features, and scales with your business, Quickbooks is a great option.

Compare the year's best accounting software

Wave is the most affordable accounting software.

Data as of post date. Offers and availability may vary by location and are subject to change.

For exactly $0, Wave presents you with a slick, user-friendly dashboard and a slew of features that rival those of paid accounting systems. For instance, Wave Accounting includes multi-currency support, expense tracking, unlimited invoicing, unlimited bank account connections and double-entry accounting —a more accurate method of accounting that FreshBooks' basic business accounting plan notably lacks.

Wave also lets you juggle multiple businesses with the same account. If you're an Amazon or eBay seller who also manages a small team of contractors, you can track both sets of finances without paying anything.

Even though Wave has a useful payroll tool , its accounting software isn't necessarily right for businesses with dozens of employees. Since Wave offers just one accounting plan, businesses can't scale up to plans that include more accounting tasks for growing businesses. And Wave's lack of inventory tracking makes it better matched to service-based solopreneurs and freelancers who don't need both accounting and inventory software.

Zoho Books is the most comprehensive accounting software

Data as of post date. Offers and availability may vary by location and are subject to change. *Only available for businesses with an annual revenue of <$50K USD. Paid plans start at $15.00 a month when billed annually.

Zoho Books automates the most common (and, let's face it, boring) bookkeeping tasks —which means you can dedicate more time to your business and customers and less time to the tedious task of data entry. Most notably, it lets you set automatic customer payment reminders, create recurring expense profiles, and manage 1099 contractors.

Plus, Zoho Books is just one piece of software in the larger suite of Zoho products. Each Zoho product integrates easily with the rest, which means that along with accounting, you can use Zoho for project management , inventory management , and customer relationship management (CRM)—just for a start.

Here's the best part: if you make under $50K a year, you can take advantage of Zoho Books' free plan . Otherwise, Zoho Books starts at $15 a month if you pay annually or $20 if you pay month to month. The cheapest plan includes three users, but you can also pay an extra $2.50 per month for each additional user. That’s a standout bargain, especially compared to FreshBooks' extra $10 per user per month. Zoho also offers discounts to nonprofits—one reason it's among our top financial management software picks for nonprofits that need true fund accounting .

Unfortunately, even though it’s a solid accounting tool, Zoho Books has one huge flaw: Zoho doesn't offer a payroll plan integration unless you live in California, Texas, or India. And it doesn't integrate with third-party payroll providers either. Instead, you have to manually update the payroll-related aspects of your books, which detracts from Zoho's primary perk of automation in a big way.

Similarly, Zoho Books’s cheapest plan doesn’t include automatic journal entry creation. Instead, whenever you debit or credit an account, you’ll have to manually create an entry. If you log more than a few transactions a month, the lack of automation adds major time and hassle—you’ll want the $40 a month (or $50, billed monthly) Professional plan instead.

Xero is the best overall accounting software

Data as of post date. Offers and availability may vary by location and are subject to change. *Current promotion: 75% off for three months. Offer available for new customers only.

We love Xero for its robust features and low starting price. For the regular price of just $13 a month, Xero lets you send custom invoices, reconcile bank transactions , capture receipts for easier record keeping, and track inventory.

But as a small-business accounting tool, Xero really stands out on the collaboration front. Unlike nearly every other accounting solution (including QuickBooks and FreshBooks ), all of Xero's accounting and inventory software plans include unlimited users. You don't have to pay extra to delegate responsibilities like bank reconciliation or expense tracking to another team member: time-saving collaboration is built into your price.

However, Xero's $13 a month plan limits you to entering only five bills and sending only 20 invoices a month. You can send unlimited invoices and quotes with only the Growing and Established plans, which start at $37 and $70 a month, respectively. Plus, you can only track expenses with the priciest plan. In contrast, both QuickBooks and FreshBooks offer small-business expense tracking up front.

By signing up I agree to the Terms of Use and Privacy Policy .

QuickBooks Online is the most user-friendly accounting software

Data as of post date. Offers and availability may vary by location and are subject to change. *30-day free trial or 50% off for three months. Price increases to $30.00/mo. after promotional period.

QuickBooks is easily one of the most popular financial, tax, and accounting software options in the world. And while QuickBooks Desktop (especially the fairly comprehensive, comparatively affordable QuickBooks Pro Plus) is still an option for those who prefer desktops, QuickBooks Online is Intuit’s cloud-accounting software solution.

The basic Intuit QuickBooks Online plan includes typical features like invoicing, billing, and receipt scanning along with more comprehensive tracking than many competitors:

- Mileage tracking

- Sales tax tracking

- Automatic tax deduction categorization

- 1099 contractor payment tracking

- Thorough reporting, including accounts receivable

QuickBooks also has the absolute best mobile accounting app you can find. The app can do basically everything the software can (a rarity for any software provider, no matter the industry). If you work on the go, QuickBooks's app, which includes mobile mileage tracking, might make it a good fit.

Intuit QuickBooks's online reporting and tracking features come at a price, though: its cheapest small-business plan starts at $30 a month and restricts you to one user plus an accountant. The priciest plan, which includes 25 users, starts at $200 a month.

At $15 a month, QuickBooks Self-Employed is a cheaper financial management option. However, QuickBooks Self-Employed targets freelancers with just a few clients and limited expenses. Instead, it's primarily an invoicing, mileage-tracking, and tax-tracking plan. That means it helps sole proprietors who file Schedule C forms maximize their tax returns, but it's not a fully featured bookkeeping or accounting app for other business owners.

FreshBooks is the best software for invoicing

Data as of post date. Offers and availability may vary by location and are subject to change. *30-day free trial or 50% off for 3 mos. Price increases to $17.00/mo. when promotional period ends.

FreshBooks’s combination of stellar features, customizable invoices, and well-reviewed mobile apps make it pretty much perfect—especially for freelancers. Unlike Xero , FreshBooks lets you send an unlimited number of invoices and estimates with every plan. Each plan also includes time tracking for easier, more accurate client billing. FreshBooks’s built-in small-business expense tracking helps you maintain a balanced budget. And, like QuickBooks Online, FreshBooks includes built-in mileage tracking—a must for freelancers who plan to claim mileage expenses on their year-end tax forms.

But while FreshBooks doesn’t limit your invoices, it does limit the number of customers you can bill each month. You can send your customers an unlimited amount of invoices, but the cheapest plan limits that client number to just five.

Additionally, FreshBooks doesn’t include bank reconciliation with its cheapest plan. Since bank reconciliation is an absolutely foundational accounting task, we can only recommend FreshBooks’s cheapest plan to freelancers or brand-new startups with just a few transactions a month.

Accounting software honorable mentions

Not sold on our top picks? Here are five more small-business accounting software options that could work better for you.

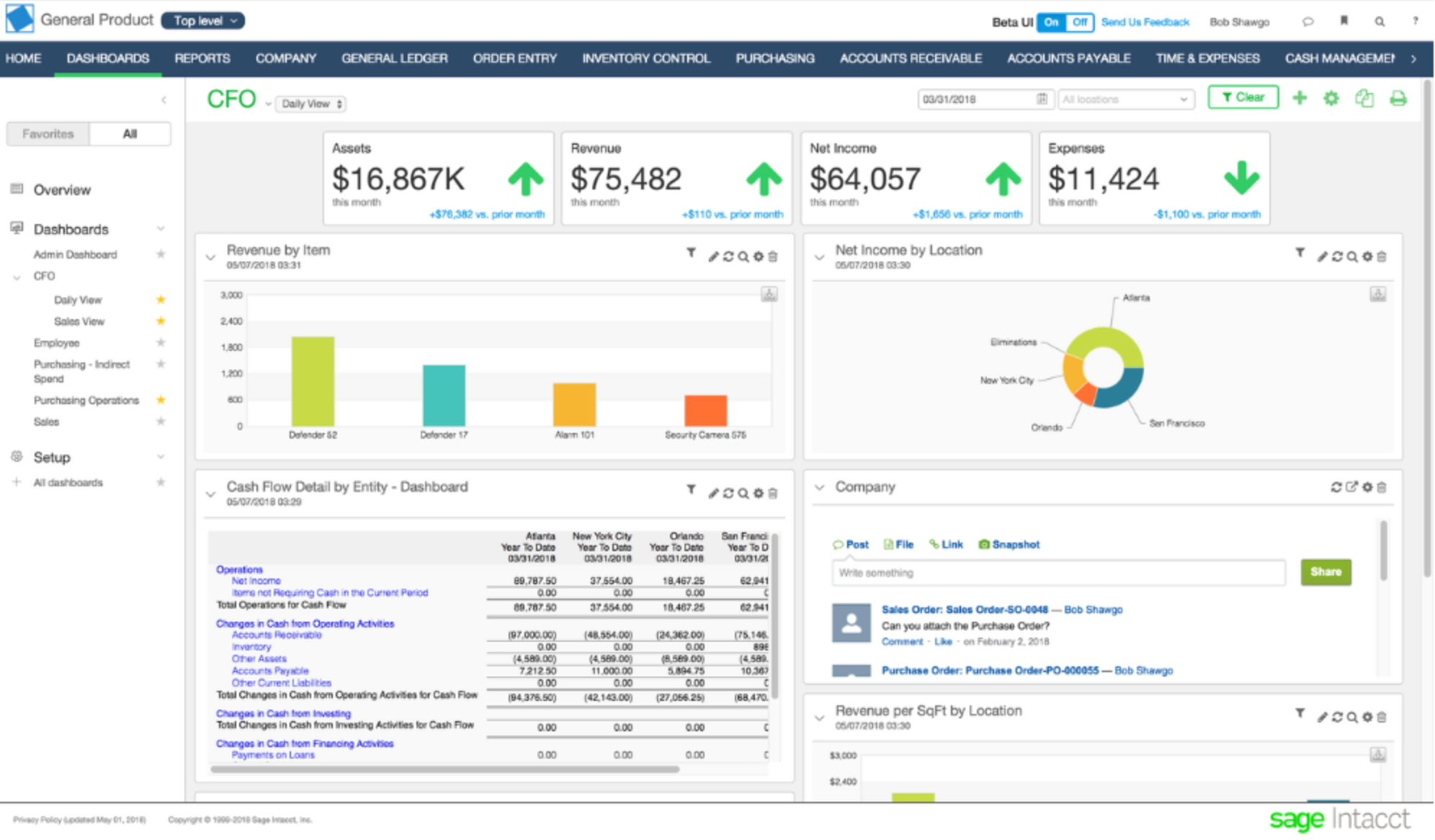

- Sage Accounting : Best user experience runner-up

- OneUp : Best for sales teams

- Kashoo : Easiest setup

- ZipBooks : Most affordable runner-up

Top feature comparison: Accounting software honorable mentions

Sage business cloud accounting: best user-experience runner-up.

Sage Business Cloud Accounting’s cheapest plan lets you create invoices, track amounts owed, and automatically reconcile your bank accounts . If you’re willing to pay a bit more ($25 a month), Sage Accounting adds unlimited users, quotes, estimates, cash flow forecasting, and purchase invoice management.

Unfortunately, Sage charges extra for receipt scanning, a feature competitors like Wave, FreshBooks, Xero, and QuickBooks include for free. And Sage’s pricier plan has built-in features than, say, Xero’s cheapest plan. (On the other hand, Sage's accounting system doesn’t limit your monthly invoice amount).

If you're looking for industry-specific accounting software, Sage some standout solutions beyond Sage Business Cloud Accounting. For instance, Sage 100 Contractor is a preferred accounting option for professionals in the construction business . And Sage Intacct is one of the best accounting services for nonprofits.

Sage Business Cloud is currently offering new customers 70% off for their first six months of Sage Accounting—which typically costs $25 a month. With the discount, your price goes down to $7.50 for six months. If you're considering Sage, we highly recommend taking advantage of the discount to save more than $100.

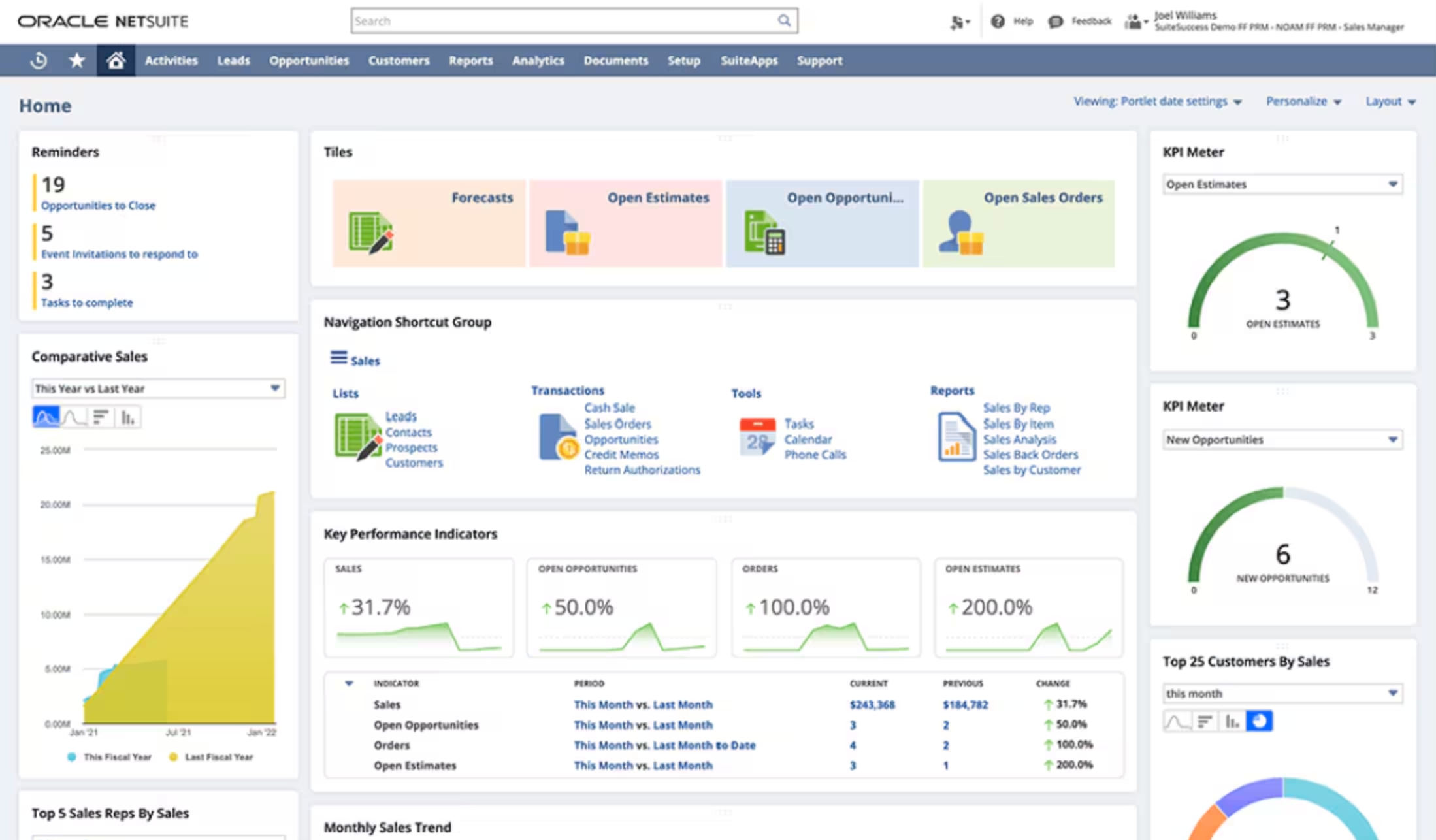

OneUp: Best for sales teams

All of OneUp's plans include customer relationship management (CRM) features, which makes it perfectly suited to sales teams that frequently follow up with customers. Plus, it's affordable: pricing for one user starts at $9 per month. If you’re a Mac user, though, you’re out of luck: OneUp works only for Windows users. And while every OneUp plan includes all of OneUp’s features, its plans limit your user numbers. Only the priciest plan, which starts at $169 a month, includes unlimited users.

Kashoo: Easiest setup

Got a minute to spare? You can set up Kashoo in 60 or so seconds, and the app immediately starts to categorize your expenses and learn your business spending habits. Like Zoho Books, Kashoo's automation is its selling point—and unlike Zoho Books, it syncs with SurePayroll , one of our top payroll providers .

Kashoo's accounting software starts at $20 a month. If you’re looking for a cheaper solution, Kashoo offers an invoice-centric plan for $0.00. Along with sending invoices, you can use the free plan to track expenses, accept online payments, and send estimates. We're not sure if the free plan lets you track income and expenses or not—Kashoo's site gives contradictory answers.

Either way, though, it looks like Kashoo is planning on developing expense and income tracking for its free plan, if it doesn't include those two features already.

ZipBooks: Most affordable runner-up

If you don't need quite as many features as Wave offers, ZipBooks is a solid free accounting software alternative . Even though it's free, it doesn't limit the number of invoices you can send (like Xero) or clients you can bill (like FreshBooks) per month—you can access unlimited customizable invoices and accept payments too. ZipBooks' paid plan starts at $15 a month and offers better bookkeeping and automation features than its free accounting plan. But if you prefer your accounting tools on the go, look elsewhere. ZipBooks' iOS app has disappeared from the App Store, and it's never had a Google Play app worth mentioning.

The takeaway

If you want fully featured accounting software with an excellent app, clean dashboard, and affordable price, we recommend Xero . Based on its features and pricing alone, it's a great bookkeeping and accounting company for most business types, from freelancers to LLCs.

All of our other picks have something to offer too, so if you find Xero isn't a good fit, try one of these alternatives:

- QuickBooks Online is an extremely comprehensive accounting solution with one of the best accounting apps and most thorough financial statements you can find. With up to 25 users, its most expensive plan suits bigger businesses with large, collaborative accounting teams.

- FreshBooks easily offers the best invoicing of any provider on our list. Its invoice, estimate, and payment acceptance features make it ideal for on-the-go contractors and freelancers who frequently collaborate with clients.

- Zoho Books has about as many features as QuickBooks at a lower price and a low additional user fee. Its free plan is perfect for freelancers who want solid reporting and financial tracking without any overwhelming bells and whistles (for instance, QuickBooks' dozens of customizable reports).

- Wave Accounting is the best free accounting solution for most freelancers, contractors, and other small-business owners. While it has fewer financial reports than other accounting systems, it's perfect if you juggle multiple businesses, want to add multiple users, or need unlimited expense tracking.

Finding the best online accounting software for your small business can seriously transform your working life. With less time spent on data entry, you have more time for the things you like most about small-business ownership, whether that's getting to know customers or making products you're proud of.

Most of our top accounting software picks include a free trial, so don't be shy about trying a few different brands if you don't hit on your favorite right away.

Need to pair payroll software with your new small-business bookkeeping and accounting software? Head over to our piece on the best payroll software for small businesses.

Still not sure which accounting provider is right for you? Answer some questions about your small business and we'll pair you with customized software options.

How to choose accounting software

We're going to walk you through the 10 best accounting software solutions below, but these are the best options out there—so how can you decide which one will work best for your business? First of all, you should talk to your accountant or financial professional for their input. Then work with your accountant to evaluate software based on the following criteria:

- Price . Accounting software costs as little as nothing and as much as several hundred dollars a month. Free software usually offers fewer features than paid software, so we recommend it primarily to freelancers, solopreneurs, and businesses with few employees. Bigger businesses should plan on spending quite a bit more per month—or even on outsourcing to a virtual accountant .

- Accounting and bookkeeping features . At minimum, accounting software should sync with your business bank accounts to help you track each financial transaction. Even the most bare-bones financial software should include features like invoicing, expense and income tracking, bank reconciliation , and mileage tracking .

- Automation . Most paid accounting solutions will automatically generate journal entries for your chart of accounts every time you accept a payment or pay a bill. Some automatically reconcile your bank accounts, and still others automatically sync with your payroll software to keep your accounts in order. The more automation, the more time saved (hypothetically, at least)—but the more you'll pay for your software too.

- User-friendly interface . If you can't figure out how to use your software, the amount of bookkeeping features it has doesn't matter. Before you commit to a plan, sign up for a demo or a free trial to get the hang of the software and find out if the interface simplifies your financial life or complicates it.

- Number of users . If you're a sole proprietor, you probably don't need to worry about finding software that lets you add multiple users. (Typically, even the cheapest base plans should include access for both you and an accountant for free.) But if you aren't the only person responsible for your business's finances, you'll want to look into software that lets you add multiple users, potentially with different permission levels.

Want to learn a little more about bookkeeping and accounting before you dive into our top reviews? Start out with our small-business accounting guide .

Accounting software FAQ

Xero offers fantastic accounting features at a reasonable starting price, but the best accounting software option for you depends on your business’s unique needs and budget. For instance, Wave works very well for freelancers on a budget, QuickBooks helps small-business owners who travel a lot for work, and FreshBooks’s customizable invoices are great for business owners who frequently collaborate with clients. Do you work off a Mac? Check out the best small business accounting software for Macs .

QuickBooks Online is definitely among the most popular accounting software for small businesses, and its thorough accounting features definitely make it the best accounting software for many users.

However, being popular isn't the same as being the best. Sure, QuickBooks could be the best software for your small business, or you might find its prices too high and its features too limited. Depending on what you need, another bookkeeping software pick like FreshBooks or Sage could be better for your business. Not sure what your other options are? Check out our list of the year's best QuickBooks alternatives to get started.

What is the easiest accounting software to use?

QuickBooks Online has a longstanding reputation as one of the easiest accounting software programs to use. The dashboard is well organized with clear graphics for each feature and easy-to-read reports that simplify finances for non-accountant business owners.

That said, all five of the best accounting software for small-business owners on our list are impressively user friendly. We especially want to call attention to Xero and Zoho Books: Zoho Books' automation nicely complements its accessible dashboard, and Xero's integration with over 1,000 third-party apps simplifies business processes immensely.

What is accounting software?

Accounting software is software that automates the most important bookkeeping tasks for small businesses. Depending on the type of accounting software you invest in, the software will help you create and send invoices, track projects and spending, and much more.

Most small-business owners don't have an accounting background but need to carefully track their business's finances to make sure they're turning a profit. User-friendly accounting software was built specifically for non-accountant business owners, and it automatically tracks finances for you so you can spend your time on tasks you like more, such as finding customers and completing projects.

Accounting software also generates financial reports for you, which is a crucial part of creating a small business that many first-time business owners aren't aware of. You usually need to submit financial documents like profit and loss reports as part of your business taxes each year. Additionally, you need thorough documentation to secure a small-business loan or appeal to eventual shareholders.

While you can track data and create financial documents by hand, accounting software can do it for you—and while requiring less time, effort, and energy on your part.

What are the benefits of small-business accounting software?

The most important benefit of small-business accounting software is probably the time it saves. Once you sync your bank account and credit cards to your accounting program, the software automatically imports your financial transactions. This ensures you're always working with the most up-to-date numbers as you're making crucial business decisions.

Most accounting software also streamlines traditionally time-consuming tasks like these:

- Invoicing, including sending invoices and late-payment reminders

- Automating bill payments

- Reminding you of quarterly tax deadlines

- Pre-filling some tax forms

- Generating common financial documents that help you (and related parties like lenders and shareholders) see where your business stands

- Tracking mileage to simplify end-of-year tax write-offs

- Uploading receipts for easier categorization

- Automatic expense categorization

Most accounting software also syncs with payroll software so you don't have to transfer your paycheck data into your general ledger by hand.

If you don't use accounting software, you'll probably catalogue your financial transactions by hand using a spreadsheet . This method can be cheaper, but it means you're doing every financial task on your own. Not only will you spend hours of your time painstakingly entering and categorizing data, but you'll have a harder time catching mistakes.

In other words, doing accounting by hand is possible—but it's also more complicated, time consuming, and error-prone.

How much does accounting software for small businesses cost?

Business accounting software can cost as little as $0. Free accounting software options like Wave Accounting and Zoho Books (which has a free plan for businesses that make less than $50K USD in revenue per year) remove the hassle of by-hand financial data entry without subtracting cash from your bottom line.

If you want more features than just the basics, accounting software typically starts around $10 to $15 a month. Xero, for instance, charges $13 for its most basic plan while FreshBooks starts at $15. QuickBooks Online generally has the highest starting prices in the industry at $30 a month for a basic plan.