How to Write a Good Service Plan in Case Management

- Small Business

- Business Technology & Customer Support

- Good Customer Service

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

The Purpose of Contingency Planning

Starting a career counseling business, goals & objectives of senior care management care plans.

- How to Operate a Home Health Care Business

- What Do You Need to Start Your Own Mobile Detailing Service?

Children and adults in crises rely on social workers to help them solve problems and cope with everyday living situations. Social workers create a case for each new client and develop a plan of services needed by the client. Case management duties fall to social workers in a variety of settings ranging from healthcare facilities and schools to government agencies. An effective service plan is a critical component of case management and can make a significant difference in the lives of your clients.

Start With a Thorough Interview

The more information you can get from your clients, the more in-depth your service plan can be. You’ll understand the needs of your client best when you uncover your clients' strengths and weaknesses, get a complete history and learn the details of the current situation. Your clients should participate in the service plan creation, and being open and forthcoming in the initial interviews plays a significant role in that involvement.

Develop Intermediate and Long-Term Goals

An effective service plan works backward in that you first write the goals of the plan and then fill in the services that will allow your client to reach those goals. For example, if permanent housing is one of your goals, you’ll first need to identify income sources and arrange for temporary shelter, which could serve as an intermediate goal. As you strive to fulfill the final goal, you’ll fill in the plan with other steps such as attaining job training and employment or setting up your client on a waiting list for public housing.

Build Concurrent Plans

Along with solving the immediate problem and building steps to achieve the goals you’ve created, you should be aware of concurrent themes that must be addressed in the service plan. For example, if addiction is an underlying cause of the homelessness you’re addressing, then substance abuse treatment may be in order. If mental health issues arise in your evaluations, you may need to build in counseling or medical interventions as part of the complete service plan to prevent future problems.

Create Definitive Steps for Implementation

A thorough service plan is built of many steps that you and your client have identified as vital to success. Write each step in the plan and engage the client in the implementation of each step with timelines and results recorded for each step. For example, forms and applications for aid may be required to apply for various services you’ve identified as vital. Your service plan may provide a week for the client to obtain and turn in those forms. Appointments must be made and kept, all duly noted in the service plan. Include instructions for the client in the plan as well as which steps you will assist in completing.

- U.S. Bureau of Labor Statistics: Social Workers

Linda Ray is an award-winning journalist with more than 20 years reporting experience. She's covered business for newspapers and magazines, including the "Greenville News," "Success Magazine" and "American City Business Journals." Ray holds a journalism degree and teaches writing, career development and an FDIC course called "Money Smart."

Related Articles

How to open a non-medical homemaker & companion business, how to analyze the key success factors for plan implementation, how to build a good it manager development plan, how to start a car cleaning business, how do i reply to craigslist emails anonymously, how to start a mobile massage business, how to start a home-based private investigation business, how to write a business plan for critical care transport, how to turn bonjour on, most popular.

- 1 How to Open a Non-Medical Homemaker & Companion Business

- 2 How to Analyze the Key Success Factors for Plan Implementation

- 3 How to Build a Good IT Manager Development Plan

- 4 How to Start a Car Cleaning Business

How to Write a Good Service Plan in Case Management

by Kenya Lucas

Published on 1 Jan 2021

Many small businesses offer case management in their everyday work -- such as community-based health clinics and private senior facilities. No matter your company’s focus, case management involves several key activities, including assessing clients’ needs and strengths, creating a service plan and monitoring individuals as they make progress toward goals. Good service plans are clear, concise, individualized and coordinated with clients, other staff members and external partners. Review and update all plans on a regular basis.

Listing Client Information

A service plan begins with identifying information for a client. List her first, middle and last name -- confirming all spellings. Contact data, such as her address and telephone number, may be separately filed. Add additional information to the service plan that allows you to uniquely track each case. In this way, for example, you avoid duplicate plans for people who have the same name. One option is to enter the client’s Social Security number -- which might also be needed for administrative purposes. Another is to use an arbitrary identification number.

Outlining Goals and Objectives

This section addresses all of the issues a client presents to you. Translate these needs and challenges into goals he can achieve with the support of your services. Draw from the client’s language whenever possible. For instance, he presents the issue, “I get anxious all of the time.” You go on to ask him what he would like to accomplish by addressing his anxiety. His response is, “I’ll be able to finish the things I start -- I won’t use fear as an excuse to give up on commitments so easily.” You therefore list the goal: “Decrease anxiety to allow me to complete more commitments.” Go on to list measurable objectives such as: “Volunteer for one agency activity, devoting at least two hours per week over a three-month period.”

Specifying Actions

Add a section to your service plan that specifies actions to pursue all goals. This information commonly appears in a table or grid format. Each activity is associated with a goal – though a goal may have more than one activity. Briefly and simply state the activity. Note a target date, responsible party and progress or outcomes. A sample activity is: “Enroll in a smoking-cessation program.” A deadline of “Feb.15, 2014” is set. The responsible party is “Jim Taylor.” Progress is noted as “Jim came to our Jan. 15 meeting with a printout of possible programs from his online research. We identified the most convenient options. I will also investigate referrals.”

Signing and Dating

It’s important to have all relevant parties sign and date a service plan. This not only creates client buy-in but executes the plan from an administrative standpoint. In some cases, a person who has legal authority on behalf of your client will sign the document. Your signature, as case manager, is required. A supervisor’s signature is also standard to ensure oversight. Add a note to the plan if a client, or her legal guardian, refuses to sign.

- 800-232-LOWE (5693)

- [email protected]

- 58220 Decatur Road, Cassopolis, MI 49031

How to Create a Customer Service Plan

Digital library > defining and serving a market > customer service, “how to create a customer service plan”.

The fight for market share grows ever fiercer. How can you win and keep customers when the price wars never end? Provide better service! To do it most effectively, you’ll need a plan.

What is Customer Service?

"As the Interactive Age arrives, every enterprise will have to learn how to treat different customers differently." — Enterprise One To One , by Don Peppers and Martha Rogers (Currency Doubleday, 1997).

How does your company meet a customer’s needs?

If you started a business 10 years ago, you’d probably give an indirect answer. You might say that by gaining market share and managing sales and distribution, you could satisfy your customers. If buyers’ needs were met, your business would presumably grow and prosper.

Today, however, meeting the needs and expectations of customers requires that you know your customers — as individuals. That means consistently collecting their input, removing barriers to communicate with them, and taking steps to foster a long-term relationship with them rather than just a limited, transactional one. If potential customers grow overwhelmed, confused, or simply can’t find what they want, your high level of service is the "ace in the hole" that’ll keep them from fleeing.

In creating and evaluating your customer service plan, avoid too much internal analysis. Instead, defer to customers’ perceptions of efficiency, responsiveness, and courtesy. Your own hunches, biases, or interpretations shouldn’t interfere with the unfiltered knowledge that your customers can provide. They are your ultimate judges.

Customer Service as a Competitive Advantage

With even small businesses investing heavily in technology — from database software to Web site development — traditional feature and cost advantages no longer provide a sustainable competitive advantage. More fast-growth companies are focusing on quality of service to distinguish themselves from the rest. They are talking to their customers to determine what’s important to them and how they can further add value. Smart companies now strive to be an extension of their customers, thereby fostering more loyal buyers who’re less apt to change vendors.

Benefits of an Effective Customer Service Initiative

Here’s how you and your business can benefit from a customer service plan:

5 STEPS TO CREATE YOUR CUSTOMER SERVICE PLAN [ top ]

While there’s no single blueprint for an effective customer service program, here are five steps that you can take:

Step 1: Assess Your Customer Service Quotient

In order to establish an effective customer service plan, you need a starting point. Use this self-assessment to map out your strategy. For each statement, rate your business based on the following scale:

1—Are you kidding? 2—Hardly ever 3—Sometimes 4—Usually 5—It’s our way of life!

Source: Adapted from Forum Corporation’s Self-Test for a Customer-Driven Company

Now evaluate how well your organization focuses on customer satisfaction. Low scores suggest opportunities for improvement.

Step 2: Understand Your Customers’ Requirements

Sources of Customer Information

Once you launch a business, you might assume you know your customers’ requirements. You figure that your company’s small size lets you stay close to your buyers. But as you grow, you may need to conduct a more thorough analysis. Here’s how to tell:

If you answered no to any of these questions, that shows you may want to gather customer information more aggressively. Here’s where to look:

Surveys and focus groups are popular methods for gathering information on customer needs. Surveys are written questions given to individuals; focus groups are oral questions posed to groups. A broad questionnaire or focus group may give you lots of information, but you need to devise clear objectives from the outset so that you’re ready to act on what you learn.

As you review your internal data, your employees’ input, and the feedback you collect from vendors, identify the top three customer service issues that arise and compare them with the top three questions, comments, or complaints you’ve heard directly from your buyers. Do you find any overlap? Any surprises?

The Best Kind of Data

More is not necessarily better when it comes to customer data, but getting the right information is critical. Seek these elements in the data you measure:

Step 3: Create Your Customer Vision and Service Policies

When a Washington Post reporter returned from the 1999 PhoCusWright conference on the Internet travel business, he wrote about his experience watching a panel of 12 executives who run big online travel sites. When these CEOs were asked to declare his or her company’s "key distinguishing asset," only two of the 12 mentioned something they deliver to customers.

That’s a stark reminder of how few Internet executives understand and appreciate the role of the customer. An effective customer service plan must be built on a customer-centered vision for your company.

A vision consists of a vivid picture of an ambitious, desirable future state that’s linked to the customer and improves on the status quo in some important way, according to Richard Whiteley, an author and management consultant.

Your vision is what you want your company to become, what you want it "to grow up to be." A client-centered vision takes its direction from the customer and performs two critical functions:

When you craft a vision that spells out what the company seeks to become, you guide all your employees to make better decisions. After all, an employee who knows where the business is headed will probably make more effective decisions that reinforce that goal.

How do you create a vision? It’s easy. Vision statements need not be elaborate. Two examples:

Keep your vision concise. The shorter, the better. That helps you reduce the odds of misunderstanding. In their startup excitement, many entrepreneurs mistakenly write wordy paragraphs that run so long, no one really knows what the vision really means.

When creating a vision, you must decide how you want your company to evolve over time. Use this exercise to "see" the future:

Customer-friendly Policies

Clear, straightforward customer-friendly policies should accompany your vision. While some bigger, bureaucratic companies use their policies as a weapon ("I’m sorry, Mr. Customer, but that’s our rule"), entrepreneurial firms can and should show more flexibility to please buyers.

Some well-intentioned entrepreneurs fall into the trap of adopting policies that clash with customer needs and expectations. If you left a job at a large organization, for example, you may enact certain rules or safeguards in your new business because "that’s the way I’ve done it before."

Take an inventory of your company’s policies. Do they facilitate customer satisfaction or do they only erect barriers and cause customer frustration? If you’re having difficulty identifying these "unfriendly" policies, review your customers’ comments and complaints.

A quick scan of the feedback will direct you to some of the most troublesome policies. Reassess whether such rules are necessary. What would happen if you eliminated such policies? As long as such a move wouldn’t jeopardize legal compliance or cause some other severe problem, then toss it out!

In some cases, you’ll discover some necessary policies that your customers may not like, but that you’re legally bound to keep in force. You can’t do much about these except make them as "friendly" as possible. For instance, if you’re cleaning health-care facilities, and your insurance company restricts you from disposing of certain medical wastes, let your customers know.

At the same time, investigate if there’s a compromise you can make, such as disposing of the waste once it has been properly contained.

Meanwhile, keep your "friendly" necessary policies and strengthen them, if possible. Use customer-friendly policies as a competitive edge to retain your current customers and attract new ones.

Step 4: Deal Effectively With Your Customers

Once you’ve established your customer-centered vision and created customer-friendly policies, you’re ready to sharpen your skills in dealing with your customers. These skills can be segregated into two areas: communication skills and problem-solving skills.

Communication Skills

How you communicate to your customers is just as important as what you say. Follow these guidelines:

Every time a customer interacts with your company, the message should be consistent: you want to provide top service. If a customer calls and gets lost responding to dozens of touch-tone commands (think of the I.R.S. help line), you must simplify the system. Testing a customer’s patience gives them a reason to leave and never return.

It all begins with the proper mind-set: A customer-focused organization is not in business to deliver a product or service, but to enable people to enjoy the benefits of its product or service. A temporary employment agency is in business not to fill job vacancies with temporary personnel, but to help their customers enjoy the benefits that their service provides — immediate placement of highly-skilled individuals. It’s a subtle but vital difference.

Here are some questions you can ask customers to show your eagerness to help:

To ensure you communicate effectively with customers, list three specific steps you and your employees can take to improve in each of these areas:

Build rapport with customers:

Show appreciation:

Seek ways to help customers:

Listen attentively:

Establish a long-term relationship:

Problem-solving Skills

Your customer service plan should include guidelines for your employees to problem-solve. When you take responsibility for a snafu, you can turn a negative customer into a raving fan. Studies show that if a problem is resolved quickly, 98 percent of your customers will buy again and even tell others of their positive experience.

But the longer the problem drags on, the more frustrated a customer becomes. So how do you address problems quickly? Use this four-step process:

Gather the facts. Let the customer speak without interrupting. Listen without getting defensive. Repeat your understanding of the problem to ensure you’ve got it right. Examples:

After you understand the problem, you’re ready to identify what triggered it. First, find out what actions the customer took. Then review with the customer what should have happened had everything run smoothly. Conclude by isolating what went wrong.

Before you suggest possible solutions, ask your customer for ideas. You may learn exactly what you need to do to fix everything. Agree on a course of action by hashing out options and working together to finalize the best one.

Step 5: Educate Your Staff

Now that you’ve learned to assess your customer service quotient, understand your customers’ requirements, create a customer-centered vision, and communicate well with customers, you need to educate your staff on how to carry out your customer service plan.

This involves two steps: communicate and train.

Don’t make this the only time that you talk to your staff about the importance of customers. Work it into your everyday management of the business.

THE FINAL PIECE OF YOUR CUSTOMER SERVICE PLAN [ top ]

When finalizing your plan, step into your customer’s shoes. Imagine what it’s like for a buyer who does business with your company.

Like an airline pilot preparing for take off, create a checklist so that you can confirm you’re ready to "fly right" and provide the kind of positive experience that will please your customers.

Here’s an example:

RESOURCES [ top ]

Sprint’s Customer Service Plan Pro software walks you through the steps to create a customer service plan.

Market-Based Management: Strategies for Growing Customer Value and Profitability , 3rd edition, by Roger J. Best. (Prentice Hall, 2002).

What Customers Value Most: How to Achieve Business Transformation by Focusing on Processes That Touch Your Customers by Stanley A. Brown. (John Wiley & Sons, 1996).

Enterprise One to One: Tools for Competing in the Interactive Age by Don Peppers and Martha Rogers, Ph.D. (Doubleday, 1999).

Customers.Com: How to Create a Profitable Business Strategy for the Internet & Beyond by Patricia B. Seybold. (Times Books, 1998).

The Customer Driven Company: Moving from Talk to Action by Richard C. Whiteley. (Perseus, 2000).

Best Practices in Customer Service by Ron Zemke and John A. Woods. (AMACOM, 1999).

--> Web sites

" Developing Effective Customer Access Strategy ," by Brad Cleveland. Customer Interface 15:10 (November-December, 2002), 16+.

" Make No Mistake? " by Michael Schrage. Fortune 144:13 (December 24, 2001), 184.

" Cleaning Up the Customer Experience with Online Knowledge Bases ," by Ramesh Jayaraman and Rohit Kumar. Customer Inter@ction Solutions 20:4 (October 2001), 28.

" Tough Customers ," by Chris Penttila. Entrepreneur 29:5 (May 2001), 94-97.

All rights reserved. The text of this publication, or any part thereof, may not be reproduced in any manner whatsoever without written permission from the publisher.

Service Plan

Other plans, such as home simple business plan and project plan , can be found in the site. Feel free to go to the home page and search for a specific plan example . All samples are available for download by clicking on the individual download link buttons below the sample. Scroll down the page to see more service plan examples.

Service Plan Template

- Google Docs

Size: A4, US

Service Marketing Plan Template

Cleaning Service Business Plan Template

In purchasing new product or equipment, one does intend to question whether an additional cost of a service plan is worth the money. Service plans offer unique advantages to the consumer and often is a form of added security in purchasing a product.

Customer Service Action Plan Template

Delivery Service Business Plan Template

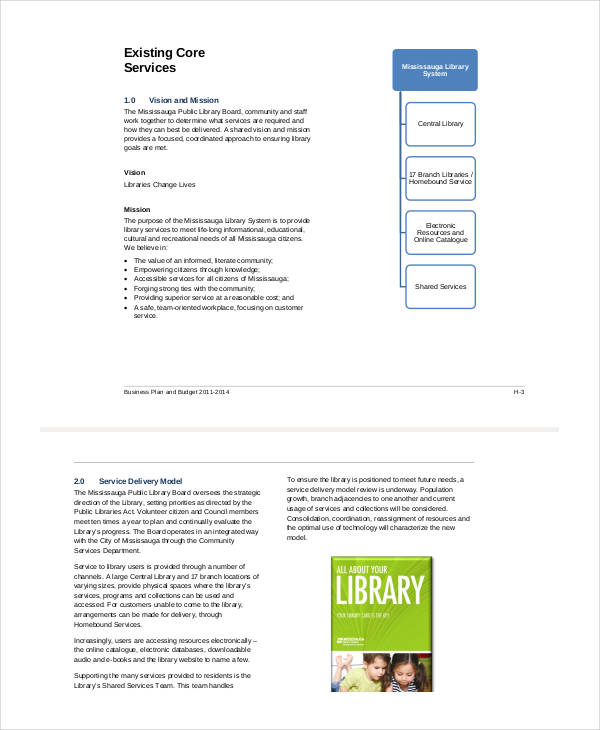

Health Service Plan

Size: 348 kB

Customer Service Plan

Size: 654 kB

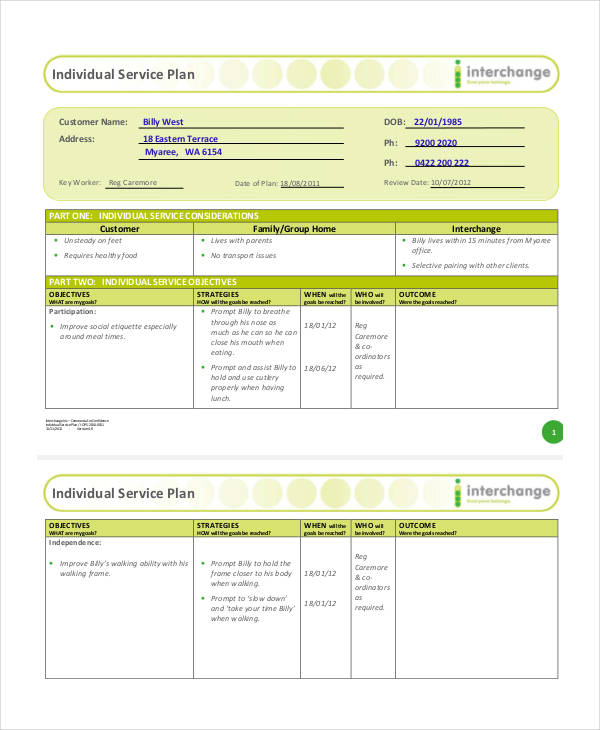

Individual Service Plan

Size: 112 kB

Food Service Plan

Size: 275 kB

What Is a Service Plan?

A service plan is a contract or policy that comes in addition to purchasing a product for an added fee.

How to Write a Service Plan

In writing a service plan, it is important to consider the following points:

- As with any customer or consumer related process, it is important to get a good idea of what the clients think or need from the business. Conducting interviews that provide information from the get go of things greatly help in shaping up your service plan.

- From the interviews, you should be able to get enough information to develop intermediate and long term service plans. Intermediate service plans answer immediate client servicing needs but long term needs should be addressed to help avoid further issues.

- Create and define clear steps in executing the service plan. It is important to get the client’s participation in terms of timeliness for servicing. Engaging the client assures you of timely scheduling of service plans.

Business plan examples in pdf and doc are also found in our site. Be sure to search for an individual example in our home page. Every sample can be downloaded via the download link button below each sample.

Transportation Service Plan

Size: 175 kB

National Service Plan

Service Business Plan

Size: 806 kB

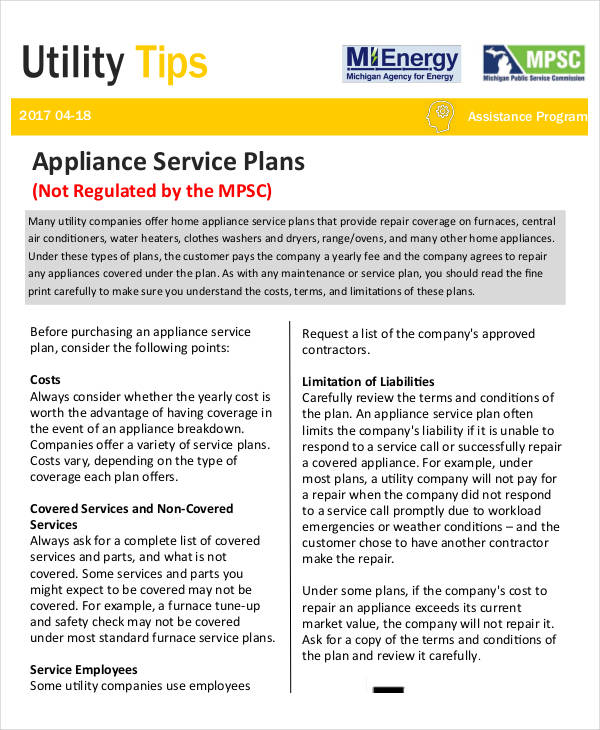

Appliance Service Plan

Size: 242 kB

How Does a Service Plan Work?

Service plans vary depending on the product or item that needs to be serviced. Some items may be sent out for repair, repaired on site, or just make a replacement for the particular item or product.

Free business plan examples can be found in other pages of this site. Just go to the home page and search for the particular example. All samples provided can be downloaded through their individual download links seen below the samples.

Why Is a Customer Service Plan Important?

A customer service plan is important in assessing a customer’s perception and expectation of your business. It can act as a road map in fulfilling the needs of the customers and bringing your state of customer service to a higher level.

An effective customer service plan creates a big, loyal and happy customer base. Through the customer service plan, customers are guaranteed a comfortable and very satisfactory experience.

Action plan examples are also found in the site. Just search for a particular example on the home page. All samples provided for are made to be referenced in the making of your own plan. Be sure to click on the samples to get full access to the files.

Text prompt

- Instructive

- Professional

Create a study plan for final exams in high school

Develop a project timeline for a middle school science fair.

Free Download

10 Questions to Ask

Before hiring a business plan writer.

Not ready to download? Don't worry, it has been sent directly to your inbox.

Business Plan Writing Service

Maximize your chances of getting funded

Our business plan writers develop plans that can help you win funding.

What you can expect working with our Team:

Business planning pros

You’ll work with a professional plan writer who will build a custom business plan for your unique industry

The #1 planning tool

Get free access to LivePlan software, which makes it easier to share and update your plan

A winning format

Our unique business plan format has helped over 1 million businesses

Expert business plan writers for any type of business

Business plans for startups

- Establish milestones to achieve success.

- Outline accurate startup costs.

- Fully establish the vision for your business.

Pitching to investors

- Plans are formatted to meet lenders' expectations.

- Ensures your projected financials are realistic.

- Be prepared with a strong plan to back up your pitch.

Retail, eCommerce, restaurants and other popular industries

- Plan writers with experience and expertise in your industry.

- Insights into what details are vital to succeed in your industry.

- Develop a strong value proposition to stand out from the competition.

What makes our business plan writing services different?

Our business plan format has helped companies raise millions.

Our writers use a business plan structure that has been tested and refined over the past 20 years. So when you hire a LivePlan business plan writer, you'll be maximizing your chances of securing a loan or investment.

Business plan writers trusted by top business schools across the U.S.

Since 1988, Palo Alto Software—the creator of LivePlan—has helped over a million entrepreneurs achieve success. Our business plan structure is even taught at top universities, such as Princeton and Rice.

Get matched with a business plan writer who knows your industry

Our writers are experienced professionals who have written hundreds of business plans. That means there will most likely be someone on our team who has experience in your specific industry.

The best decision I could have made to launch my business in the right direction. I definitely recommend these services to entrepreneurs and future small business owners.

Melinda Holden

Elite Liason Consulting

Maximize your chances of securing funding

Hire a LivePlan business plan writer today

How the process works:

Research and discovery

We first gain an in-depth understanding of your business. Then, we begin market research and examine your growth drivers.

Plan Writing

Once our research is complete, we'll write the body of your business plan and provide you with a draft to review.

Financial modeling

We'll turn your financial assumptions into forecasts that include everything lenders and investors need to see.

Design and review

You'll get a polished business plan with a design that matches your brand. You can then print the plan or share it online with a unique and private link.

Ready to get started?

Fill out the form below to connect with a liveplan team member, your request has been received..

A LivePlan business plan writing expert will email your quote shortly.

Get a head start today:

My plan writer was responsive, and understood my vision from our first communication. I now have a living document that I can use and manipulate as needed going forward.

Marcus Flowers

TimeOut Sports Bar & Grill

Frequently Asked Questions

Business plan writing help and services for hire, will you review my plan and make changes.

Our review-only service just includes feedback, but if you decide you'd like to engage in our full plan writing service after participating in a review, we'll give you a discount.

What if I already started writing my plan?

If you have a partially completed plan, we can work with that. In fact, it helps the plan writing process go faster because we'll have to ask fewer questions, but you'll want to choose the full business plan writing service.

Do you do market research? What does that include?

Yes, we do market research. We have access to industry reports for most industries and we will use them to lend more credibility to your plan and validate the assumptions we are making in your financials.

What is included with the full plan writing service?

When it's all said and done, you'll have a full, lender or investor ready business plan, a one page pitch, and a free year of LivePlan so you can make changes to your plan as well as use our cash flow and business management tools to stay on track.

Can you guarantee that my business will get funded?

There are a lot of factors that go into the decision making process for lending that are beyond our control, like your personal credit. What we can say is that it is very difficult to get funding without a solid business plan and we make solid business plans.

Will you share my information?

We take your privacy very seriously and will not share your information.

How long will it take to finish my plan? / Do you offer an expedited service?

The average business plan completes in 3-6 weeks, depending on your responsiveness to your writer and our work load. We offer expedited services if you are in a rush.

Yes, we can deliver an expedited plan in as little as two weeks for an additional $1,000.

Does my business plan include financials?

What formats do you deliver in.

We deliver in PDF format, Word and we also give you access to edit your plan in a free LivePlan account.

How many pages is the average business plan?

We subscribe to the lean business planning method so we try to keep your plan short and to the point. Depending on the complexity of your business, your finished plan can end up being anywhere from 25-50 pages.

Pricing and Options

How much does this service cost.

The full plan writing service cost can vary depending on your needs. Book a call with us to request a quote. We also offer a lower cost business plan review service and a forecasting service.

Do you offer a la carte services?

We offer a review service (feedback only, no edits), forecast only service or full business plan writing service. If you have a partially completed plan, we can work with that, but you'll want to choose the full business plan writing service.

Do you offer a review service?

Yes. One of our business planning experts can review your plan and financials line by line and give you critical and constructive feedback to help improve your plan and increase your confidence when it comes time to deliver.

Do you offer an expedited service?

What if i don't like my plan.

You'll have the opportunity to review and leave feedback after each draft. We recommend taking the time to be thorough and thoughtful in your feedback as that is your chance to help mold your plan into something that really resonates with you.

Expert Plan Writers and Consultants

Who writes my business plan.

You will be paired with one dedicated individual from our small team of highly trained and experienced business planning professionals. Each one is a uniquely qualified business planning expert who can translate your ideas into a business plan that will appeal to your audience.

Is my plan writer an expert in my industry?

Our business plan writers are experts specifically in business plan writing. We've worked with every industry imaginable so the likelihood that they have some familiarity with your industry is high, but if you are looking for a business consultant this may not be a good fit.

What kind of background will my writer have? Are they outsourced from other countries? Have they been writing business plans for very long?

We are a small team of well educated business planning experts. Each writer's background varies but they all have financial or business education as well as years, small business management or consulting and business plan writing experience. They are all well vetted and really good at what they do, which is write plans that help you get funded.

Small Business Definitions

What is a business plan.

In its simplest form, a business plan is a guide—a roadmap for your business that outlines goals and details how you plan to achieve those goals. At its heart, a business plan is just a plan for how your business is going to work, and how you're going to make it succeed. Read our full article on "What is a business plan" here.

What is in a business plan?

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally only one to two pages. Most people write it last, though.

The opportunity section answers these questions: What are you actually selling and how are you solving a problem (or "need") for your market? Who is your target market and competition?

In the execution chapter of your business plan, you'll answer the question: how are you going to take your opportunity and turn it into a business? This section will cover your marketing and sales plan, operations, and your milestones and metrics for success.

Investors look for great teams in addition to great ideas. Use the company and management chapter to describe your current team and who you need to hire. You will also provide a quick overview of your legal structure, location, and history if you're already up and running.

Your business plan isn't complete without a financial forecast . We'll tell you what to include in your financial plan, but you'll definitely want to start with a sales forecast, cash flow statement, income statement (also called profit and loss), and your balance sheet.

If you need more space for product images or additional information, use the appendix for those details.

Read our full article "How to Write a Business Plan — the Comprehensive Guide" for more information, here.

Why is a business plan important?

There are many reasons why it is important to have a business plan. A business plan is essential if you're seeking a loan or investment, can help you make big spending decisions with confidence and is a solid foundation for ongoing strategic planning and prioritization. Read our full article on "8 Reasons Having a Business Plan is Important" here.

What is a business plan writer/consultant?

A business plan writer/consultant is a business and financial expert who can help guide you through the process of creating a business plan and do much of the labor involved in creating it. They will work with you to understand your business model, do market research, create financial projections and offer guidance as all of those pieces are brought together in a full business plan document.

How to pick a business plan writer/consultant?

Picking a business plan writer or business plan consultant is an important decision — you'll want to find someone dedicated to your success, with experience in your industry or field and that is in it for the long haul. Read our full article on "Things to Look for When Hiring a Business Plan Writer" here.

Why should you pay someone to write your business plan?

You don't have time. Starting a business is time consuming. Oftentimes people have to juggle a regular 9-5 job while working on starting their business. That doesn't leave a lot of time for a big writing project. Hiring a professional to write your business plan can help you give you time to focus on the tasks that are critical to getting your business off the ground.

You want to make sure it is done right, the first time. You only get one chance to make a first impression. Hiring a professional to write your plan for you can give you the peace of mind that your plan is the best it can be when you present it to potential lenders or investors.

Home Go Business Plans | Business Plan

Go Business Plans | Business Plan

Expert business plan writers.

Plan the Launch & Growth of Your Business

We are the largest and best rated business plan company in the United States. We specialize in providing high-quality, comprehensive and beautifully designed business plans at a competitive price point. Our business plans can be used for strategic planning, internal planning, investor fundraising and bank funding. We are the best in the business. Don’t settle for anything less!

- Business.com's #1 Business Plan Company (2016-2022)

- Trusted by 12,000+ Clients within 150 Industries

- Five-Star Rating Across All Review Platforms

Increase Your Chances of Raising Capital

You have only one chance to make that crucial first impression with investors and lenders. A detailed and well-drafted business plan is the key to making your path to funding shorter and simpler. Our business plans writers and consultants handle everything for you so that you are completely prepared for your investor, bank, or grant meeting.

- Suitable for Lenders, Angel Investors & VC/PE

- $3+ Billion in Debt & Capital Raised over 10 Years

- Proven to Increase Funding Odds by 5x

Get Your Free Business Plan Writing Proposal

What you'll get:.

- Business Plan Content Advice

- Market Research Advice

- Business Plan Review

- Our Business Plan Process

- Custom Marketing Advice

- Custom Funding Advice

- Why We Are The Best Choice

- What We Charge

Experienced Business Plan Experts & Advisors at Your Service

Our Proven Engagement Process

Interviews with management team, conduct strategic market research, develop financial projections, business plan documentation, draft review call, editing process & final delivery, expect the absolute best, experienced consultants.

We partner you with a team of senior consultants who have helped entrepreneurs in over 100 industries. No salespeople, junior analysts, or outsourced vendors.

Strategic Advisory Process

We don’t just document your ideas onto paper. As your consultants, we brainstorm, research, and recommend the best strategies to launch and grow your business.

Fully Customized. No Templates.

No templates or long questionnaires. We work with you to strategize your business and build a customized plan to represent your unique vision.

Cost Effective & Results Driven

We understand that time is money. We guarantee the highest quality work at the most competitive price, handling all business plan writing and research so you have more time to focus on launching and growing your business.

Over $1 Billion in Funding Raised

We understand the requirements of financial institutions, angel investors, and institutional capital partners. Our clients also get access to our investor and bank network, that we have built over multiple years.

Growth Strategy Implementation

The business plan is just step one in our process. We can help you through every stage of growth. Including creating a website, generating leads, implementing effective marketing campaigns, bookkeeping, and a lot more.

Market Research Access

We have access to more than 15 reputable market research databases at our disposal, including IBISWorld, Euromonitor, Hoovers, Mintel, Statista, Freedonia, Frost & Sullivan, Forrester, and First Research.

Best Quality, Competitive Pricing

We offer professionally developed business plans at competitive prices. We provide the highest quality business plans in the industry at rates that are half of the price that some of our competitors charge.

Award Winning Service

Guaranteed to exceed your lender & investor's expectations.

Our business plans have helped over 5,000+ companies across 150 industries acquire over $3 Billion in debt and equity funding. We build well-researched, comprehensive business plans that provide you with the highest probability of approval.

Includes your company’s general ownership, incorporation information, operational timelines, and key hiring needs.

Our Clients Are Our #1 Priority

Katharine Walker

Kendra Hendricks

Ronkot Design

What You'll Get In Your Free Proposal

- Business Plan Review

Get Started with America’s Best Rated Business Plan Writing Service.

Schedule your consultation and see why thousands of small business owners trust Go Business Plans with their business planning.

Business Type Existing Business Start-Up

Business Plan Investor Funding Bank Funding L1 Visa E2 Visa EB5 Visa EB2 Visa Business Plan Edits Start-Up Consulting Strategic Planning Other

- Service Area

- Our Clients

- Client Press

- Frequently Asks Questions

Services Overview

- Business Plan Writers

- Investor Presentation

- Business Plan Consultants

- Bank Business Plan

Immigration

- E2 Visa Business Plan

- EB-5 Visa Business Plan

- L1 Visa Business Plan

Fully Customized Business Plans – No Templates

Schedule free consultation.

Our business plain team is here to help

Shedule Consulation

Our business plan team is here to help

View sample

Check example of our work

- Business Plan Consulting

Starting a Business | Buyer's Guide

6 Best Business Plan Writing Services

Published October 21, 2020

Published Oct 21, 2020

WRITTEN BY: Blake Stockton

This article is part of a larger series on Starting a Business .

A well-written, well-researched business plan is vital to the success of a new business or venture. It can attract investors and help you get a bank loan. Not every businessperson has the time or expertise to craft a winning business plan. Fortunately, there are companies with decades of experience that will assist. We evaluated several and found the six below to be the best business plan writing services available.

Top 6 Business Plan Writing Services

How we evaluated business plan writing services.

All the business plan writing services we evaluated had MBA writers and years of experience in many industries. To distinguish the best, we examined the following:

- Price: Most do not list prices, although customer quotes put many of them in the $3,000 range.

- Expertise: We considered years in service, qualifications of the writing and management teams, and industries served.

- Types of Business Plans: Some companies focus only on plans for funding or strategic planning. Others offered more specific plans like visa business plans. Still, others narrowed their focus more tightly. Some also offer pitch decks and presentation-ready formats.

- Turnaround Time: The average business plan turnaround time was two weeks, with additional time for revisions. Always ask about how much time you get for revisions and if there are additional costs involved.

- Additional Services: Several of these companies offer additional services to help you succeed. If you are considering mentorship or know you’ll need some assessment, having one of these companies build your plan could give you a head start in building a relationship.

Bargain Business Plan: Best Overall Business Plan Writing Service

Bargain Business Plan is one of the least expensive business plan services we reviewed. Still, it offers experienced writers and a wide range of plans that includes immigration and visa plans. Overall, it has excellent reviews from customers. You can view samples of their well-designed plans. It’s the only service that provides flat-rate pricing as well.

Visit Bargain Business Plan

Bargain Business Plan Pricing

- Bargain: $1,599. For startup businesses with simple business models looking to apply for small business loans or seeking a blueprint for development

- Economical: $1,999. For startup and existing businesses with a more complex operation, such as restaurants and child care centers

- Optimum: $2,799. For businesses seeking government grants, investments from venture capitalists, and funding through the SBA’s CDC/504 Loan Program

- L-1 Visa: $1,999

- E-2 Visa: $2,199

- EB-5 Visa: $3,499

- Consultations: Free

Bargain Business Plan Services

- Detailed Business Plans: All plans include custom written business plans with market analysis, financial projections, and marketing plans. Higher-level plans offer more details, and each plan is designed for its specific purpose. For example, SBA loan versus visa.

- Quick Turnaround: Drafts are done in seven to 10 days, with 14 days of unlimited revisions.

- Experience: Bargain Business Plan has served 900 industries over the past 12 years and has worked with 500 partners and 10,000 customers. For immigration business plans, they work with immigration experts across the country. User reviews praise their expertise and attention to detail as well as share successes.

Why We Like Bargain Business Plan

Startups don’t always have a big budget for business plans, but it can be a key document for achieving success. Bargain Business Plan offers custom, well-researched, and beautifully designed business plans at excellent prices. The willingness to revise is a big plus as well.

Optimal Thinking: Best Plan Writing Service for Startup and Growing Companies

Optimal Thinking says it best works on business plans for “early stage and existing businesses expanding organically or via acquisition.” It claims a 92% success rate with its business proposals. In addition, it offers other programs to help businesses succeed.

Visit Optimal Thinking

Optimal Thinking Pricing

Varies anywhere from $5,000 to $30,000, depending on plan and scope. Call for a quote.

Optimal Thinking Services

- Expertise: Optimal Thinking has team members who are senior business executives, MBA writers, and industry experts in financing, operating, and marketing companies of all sizes. It also has 27 years’ experience in writing business plans.

- Plans address potential roadblocks: Optimal Thinking helps ensure success by anticipating potential business challenges, such as restrictive government regulations, economic issues, or market industry changes. Then, it includes ways to work around or through these issues.

- Additional Programs: The company offers mentorship, employee motivation programs, and business assessments of communications, resources, opportunities, and more.

Why We Like Optimal Thinking

Optimal Thinking works with large companies such as Red Bull and Warner Brothers. Its writers have extensive experience in financials and business. Applying that knowledge to a business plan, even for a startup, means you will get not only a well-written and well-researched plan but also one that is informed by their years of expertise. This is also a company you can build a relationship with—get coaching and assistance in other areas of your business.

Wise Business Plans: Best Business Plan Writing Service for Specialized Plans

Wise Business Plans has one of the widest varieties of plans of the providers we reviewed. Its business plans are well-researched and thought out, as well as beautifully designed. It works to make sure your ideas and the plan are sound and offer additional services to help you with execution, including funding referrals.

Visit Wise Business Plans

Wise Business Plans Pricing

Pricing varies, though users have quoted prices around $3,000. To get a specific quote, call for a consultation. After the first revision, Wise Business Plans charges $199 per revision.

Wise Business Plans Services

- Investor Business Plan

- Bank Business Plan

- Strategic Business Plan

- Nonprofit Business Plan

- Franchise Business Plan

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Merger And Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

It also offers professional feasibility studies, PowerPoint presentations, pitch decks, and straight market research.

- Bookkeeping Services

- Graphic Design Services

- Logo Design

- Flyer and Brochure Design Services

- Business Printing Services

- Concierge Services

- Business Consulting Services for Startup Company

- Website Design

- Business E-books Resources

- Small Business Marketing Services

- Experience: Wise Business Plans hires MBA writers, financial and market analysts, and graphics designers. The company has done thousands of business plans in over 400 industries.

Why We Like Wise Business Plans

Wise Business Plans has a reputation for doing more than creating a plan for you. It challenges you to make sure your assumptions and ideas are the best they can be. Reviewers on its Facebook page praise the quality of the final product, noting especially the graphics.

Pro Business Plans: Best Business Plan Writing Service for Startups & Canadian Visas

Pro Business Plans gets props for the focus of its plans. While all the services we reviewed will build custom business plans, Pro Business Plans is one of the few that has plans that specifically focus on specific issues. It also has industry experts in finance/accounting and immigration.

Visit Pro Business Plans

Pro Business Plans Pricing

Pricing varies—call for a consultation.

Pro Business Plans Services

- Focus: Pro Business Plans offers the usual range of business plans: SBA/bank, investment, L-1, E-2, EB-5. However, it also has plans specifically for nonprofits, startups, and the Canadian visa (PNP) program. It also has a pure market analysis product if your goal is to understand your industry before launching your business or expanding into a new area.

- Experience: Many Pro Business Plans team members come from major accounting firms or have extensive experience working in venture investment capital. The company has served over 900 industries and has over 500 partners, including contacts in the visa application process.

- Fast Turnaround: You can get your business plan drafted in four to seven calendar days, with seven days of close collaboration to get all the details polished.

Why We Like Pro Business Plans

In addition to the variety of plans and experience of the writers, what impressed us about Pro Business Plans was that users said they often went beyond simply writing the plan, providing advice and coaching during the process. Other reviews praised its market and financial research.

Go Business Plans: Best Business Plan Writing Service for Visa Business Plans

While Go Business Plans can work with any industry, its business consultants have had notable success with E-2, EB-5, and L-1 visa business plans. It can create business plans for investors, Small Business Administration (SBA) loans, and strategic and internal planning.

Visit Go Business Plans

Go Business Plans Pricing

Go Business Plans does custom pricing within the range of $2,000 to $10,000.

Go Business Plans Services

- Customized templates: The writers create custom plans. First, they schedule a one-hour interview with you for the basics, then conduct market research, financial analysis, and company and industry analysis, and compare you to the competition. They work with you to ensure it meets your expectations as well as SBA standards.

- Advice and Assistance: Go Business Plans brainstorms and researches business strategies to advise you and can help with creating a website, generating leads, implementing marketing, and other services.

- Immigration/Visa Business Plans: Go Business Plans has helped entrepreneurs from over 100 countries get their visas. It has drafted plans for 300 lawyers and over 1200 applicants. It works directly with your lawyer to make sure the plan and the legal applications are consistent as well.

- Extensive market research: The business consultants have access to over 15 market research databases, including some of the top-tier ones like IBISWorld, Euromonitor, Hoovers, Mintel, Statista, Freedonia, Frost & Sullivan, Forrester, and First Research.

Why We Like Go Business Plans

This business plan writing service offers expertise at competitive prices, and according to past customers, is willing to go the extra mile to help ensure success. Many customers of its business plans went on to use its other services such as website development.

LivePlan: Best Business Plan Writing Software for DIY

Rather than a consulting service that writes the plans for you, LivePlan is a software that helps you build a business plan. Plans start at $20 per month, and prices decrease if you purchase a six-month or annual plan. It offers additional tools to monitor your company’s progress, as well. This is the right choice for the entrepreneur on a budget or one who has done the research and needs a software to help them put it into an attractive format for presentation.

Visit LivePlan

LivePlan Pricing

LivePlan has a pay-as-you-go system but discounts for multiple months. Your first month is only $10, and it offers a 60-day money-back guarantee.

- $20 per month, for monthly plans (First month $10)

- $18 per month for six months

- $15 per month for 12 months

LivePlan Features

- Ease of use: Start by filling out the questionnaire and follow the instructions to create a basic plan. The software creates the financial tables, charts, and reports. Choose from 10 themes to create a professional-looking report that is SBA-approved.

- Integrations: Sync to your QuickBooks or Xero to create reports or update sections. Export plans to Word or PDF, or put it in PowerPoint to make a slideshow presentation.

- Tools that go beyond the business plan: LivePlan offers real-time performance dashboards to track budgets and goals. Benchmark data shows you how you are faring compared to others in your industry or location. Create and track milestones for measuring your progress as you grow.

- Help features and examples: If you are blocked or unsure how to create a part of your plan, you can access over 500 examples in all types of industries and watch expert tutorials. Have a problem with the software? Reach support by phone, email, or chat.

Why We Like LivePlan

LivePlan offers an economical way for businesses that are comfortable with their data to create professional business plans for investors or banks. Additionally, it lets you create as many as you wish, so you can customize your plans for your audience or need or update them as your company grows. With budgeting and forecasting tools, it also helps you execute your business plan so your company can succeed.

Other Business Plan Writing Services Worth Considering:

- Cayenne Consulting: Cayenne provides a highly qualified team of writers and has experience not only in business plan writing but also in other investment materials and private placements. It’s a good service for those looking for funding.

- Growthink: This company has highly qualified and educated writers with extensive international experience. It is good for international businesses and business plans for strategic planning and mergers or acquisitions.

- Masterplans: This company is more expensive than most on our list (prices ranging from $10,000 to $49,999) but is a highly reputable company that has created over 18,000 business plans for SMBs to multimillion-dollar investment projects.

- Way2markit: This company provides business plans for investing, franchises, nonprofits, banks/SBA loans, and more. It also provides other business services from idea development to website design.

- Freelance: You can find qualified business plan writers on freelance sites like Upwork. They may be less expensive. Before hiring anyone, be sure to check their qualifications and portfolio.

Bottom Line

Business plans are not cheap to create, but they can pay off by getting additional investment, secured loans, visas, or a clear direction for your company’s growth. For research purposes, be sure to know which type of business plan is right for your company. Each of the six business plan writing services reviewed offers decades of experience, high-quality reports, and reasonable prices.

Learn more about How to Start a Business in our complete guide.

About the Author

Find Blake On LinkedIn Twitter

Blake Stockton

Blake Stockton is a staff writer at Fit Small Business focusing on how to start brick-and-mortar and online businesses. He is a frequent guest lecturer at several undergraduate business and MBA classes at University of North Florida . Prior to joining Fit Small Business, Blake consulted with over 700 small biz owners and assisted with starting and growing their businesses.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

15 Ways to Advertise Your Business in 2024

What Is a Proxy Server?

How To Get A Business License In North Dakota (2024)

How To Write An Effective Business Proposal

Best New Hampshire Registered Agent Services Of 2024

Employer Staffing Solutions Group Review 2024: Features, Pricing & More

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Additionally, she is a Columnist at Inc. Magazine.

How to Write a Cleaning Service Business Plan + Free Sample Plan PDF

Elon Glucklich

7 min. read

Updated February 17, 2024

Free Download: Cleaning Service Business Plan Template

With busy schedules and job demands, not everyone has time to clean up after themselves.

That’s why nearly 10 percent of Americans hired residential cleaning services as of 2020, and the demand for cleaners is rising. And despite a resistance to return to the office, commercial cleaning remains a $100 billion industry . Building owners still need pristine spaces if a lease or sale opportunity arises.

If you’re getting into the cleaning industry, or trying to grow your existing business, you’ll need to do some upfront work. That’s where a business plan comes in. This article will help you ensure that you’re meeting the right market opportunity, and that your business brings in enough revenue to be profitable long-term. If you need a bank loan or investment , a business plan will be crucial.

Are you looking for a free, downloadable cleaning service sample business plan PDF to help start your own business plan, Bplans has you covered.

- What should you include in a cleaning service business plan?

Keep your plan concise, and focus only on the most important sections for your business. Your plan will likely include some or all of these sections:

- Executive summary

- Market analysis

- Products and services

- Marketing and sales strategy

- Company overview

- Financial plan

It’s especially important for a cleaning service business plan to consider the wide range of services and related products you may offer. Your business might provide specialized cleaning services, or sell eco-friendly cleaning products along with cleaning homes or office spaces.

You’ll need to detail your strategies for promoting each of these products and services to maximize the revenue you generate from each client.

Here’s an example of a cleaning service business plan outline.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The 8 elements of an effective cleaning service business plan

1. Executive summary

The executive summary is a broad overview of your plan. Without going over one to two pages, outline all of the components of your cleaning service business.

Include a mission statement in your executive summary. This simple, action-oriented statement explains your company’s purpose. Maybe your goal is to grow into your area’s leading residential cleaning service. Or to expand the market for eco-friendly cleaning solutions. It summarizes what your company does for customers, employees, and owners. It also helps someone reading your business understand in greater detail what sets your business apart from competitors, and how it will be profitable.

If you’re writing your plan for a bank or investor, they will start with the executive summary. So it’s where you’ll want to make a good first impression. Try to draw them in right away by showing you have a clear value proposition.

2. Market analysis

The market analysis section is where you make the case that your business can generate enough demand to be successful. To do that, you’ll need to thoroughly assess your market, identifying key trends in the region’s home or commercial real estate sectors that might indicate a need for your services.

Evaluate the size of your potential market , including residential and commercial segments. You should also analyze the competition . Start by identifying the number of existing providers and their service offerings, and highlight any gaps you observe in the market that your business can fill.

3. Cleaning services and products

This section should detail the cleaning services and products you offer. These may include various residential and commercial cleaning services, like standard cleaning, deep cleaning, specialized disinfection services, or eco-friendly cleaning options.

If you plan to use specific cleaning products or specialized equipment, also detail these. Emphasize any services or products that set your business apart from the competition, like allergen-free cleaning services for homes or exclusively green cleaning products.

4 . Marketing and sales strategy

Your marketing and sales strategy is how you put your market research into action to attract and retain customers for your cleaning service.

Start by identifying the most effective marketing channels for reaching your target market, such as online advertising, social media , local flyers, or partnerships with real estate agencies.

To reach the broadest customer base possible, outline your digital and traditional marketing strategies. Discuss the importance of a strong online presence, including a user-friendly website and active social media profiles to build brand awareness and credibility.

You should also provide information about your pricing strategy , and whether you’ll offer special promotions or loyalty programs to encourage repeat business and referrals.

5. Milestones

The milestones section is where you outline the key objectives for your business and timelines for achieving them. This section can be short, with individual milestones listed as bullet points.

Milestones could include securing initial funding, acquiring necessary licenses, launching your marketing campaign, reaching a certain number of clients, or hitting revenue targets. Be sure to list when you expect to achieve each milestone, and which members of your team will be responsible for reaching them.

6. Company overview

The company summary gives a brief overview of your cleaning business. Include the legal structure , target service area, and history of your business if it already exists.

If you’re writing your plan because you’re seeking funding for your business from a bank, clearly state how much you’ll need, how you plan to use it, and how it will benefit the business. Funding uses could include purchasing new equipment to expand your services, or hiring additional staff to widen your service area.

You can also include a brief management team section covering your key employees, their roles, responsibilities, qualifications, and experience.

If you plan to contract with cleaning crews instead of hiring employees, describe how this arrangement will work and why you think it will benefit your business.

7. Financial plan and forecasts

Your financial plan should present detailed financial projections, including revenue , costs , and profitability .

If you’re a new business, list your startup costs , including initial equipment, supplies, licensing, and marketing investments. Also, outline your funding sources, such as loans, investments, or personal savings going into the business.

Include a cash flow statement , income statement , and balance sheet . The financial statements and projections should demonstrate your cleaning service’s potential to generate sustainable profits over the long term.

8. Appendix

The appendix is an optional section for you to add supporting information or documents that don’t fit within the plan. This could include market research data, lease agreements, employee contracts, or licensing and permit documents.

- Writing an effective cleaning service business plan: Key considerations

When writing your cleaning service business plan, focus on these areas to increase your likelihood of success.

1. Offer diverse service offerings

The cleaning industry caters to a wide array of customer needs, from residential homes with regular upkeep, to commercial spaces that need specialized sanitation. Offering services to the broadest customer base you can manage will help you expand your share of the market .

2. Pricing strategy

Your pricing strategy is vital to balance attracting and retaining customers to ensure your business remains profitable.

Extensive market research into competitors should help you understand what represents a competitive pricing structure in your target area. Offering flexible pricing models, like flat rates for certain services or discounts for recurring appointments, can also appeal to a broader customer base. Just make sure your forecasts show that you’ll generate more revenue from repeat business through any discounts you decide to offer.

3. Protect your reputation

Trust and reputation are crucial in the cleaning service industry, where small mistakes can cost you customers. Consider in your marketing plan whether your branding and customer feedback policies emphasize your commitment to quality work and reliable service. And make sure to check how your business is being reviewed online.

4. Professional training and standards

To achieve a reputation as a high-quality cleaning service, your standards as a business owner need to trickle down to your employees. The operations section of your plan should include training your workers on the latest cleaning techniques, customer service best practices, and safety protocols to ensure your team meets those high standards you’ve set.

5. Online marketing and presence

We touched on this in the marketing and sales strategy section, but strong online and social media presences are fairly low-cost tactics for reaching new customers. Consider how much a professionally designed website that’s search engine optimized, active social media engagement, and strategic online advertising might increase your visibility.

- Download your cleaning service sample business plan PDF

Download this cleaning service sample business plan PDF for free right now, or visit Bplans’ gallery of more than 550 sample business plans if you want more options.

Don’t get hung up on finding a sample business plan that exactly matches your cleaning service. Whether you’re setting up a boutique eco-friendly cleaning service or a broad-scale commercial cleaning operation, the core elements of your business plan will largely be consistent.

There are plenty of reasons cleaning service business owners can benefit from writing a business plan — you’ll need one if you’re seeking a loan or investment.

Even if you’re not seeking funding, thinking through every aspect of your business will help you ensure you’re not overlooking anything critical as you grow.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Elon is a marketing specialist at Palo Alto Software, working with consultants, accountants, business instructors and others who use LivePlan at scale. He has a bachelor's degree in journalism and an MBA from the University of Oregon.

.png?format=auto)

Table of Contents

Related Articles

7 Min. Read

How to Write an Arcade Business Plan + Free Sample Plan PDF

How to Write a Real Estate Investment Business Plan + Free Sample Plan PDF

How to Write an Assisted Living Business Plan + Free Sample Plan PDF

5 Min. Read

How to Write a Personal Shopper Business Plan + Example Templates

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Advisory boards aren’t only for executives. Join the LogRocket Content Advisory Board today →

- Product Management

- Solve User-Reported Issues

- Find Issues Faster

- Optimize Conversion and Adoption

What is a one-pager? Examples, rules, template

Communication is key to being a great product manager, and one of the most common questions we get is, “What are you working on next?”

A one-pager is a great way to align the various departments in your business and ensure that your products have the support they need to be successful.

What is a one-pager?