- Search Search Please fill out this field.

What is a Comparative Statement?

How comparative statements work, comparative statement example, comparative statement limitations.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Comparative Statement: Definition, Types, and Examples

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

A comparative statement is a document used to compare a particular financial statement with prior period statements. Previous financials are presented alongside the latest figures in side-by-side columns, enabling investors to identify trends, track a company’s progress and compare it with industry rivals.

Analysts , investors, and business managers use a company’s income statement , balance sheet , and cash flow statement for comparative purposes. They want to see how much is spent chasing revenues from one period to the next and how items on the balance sheet and the movements of cash vary over time.

Investopedia / Jessica Olah

Comparative statements show the effect of business decisions on a company's bottom line . Trends are identified and the performance of managers, new lines of business and new products can be evaluated, without having to flip through individual financial statements.

Comparative statements can also be used to compare different companies, assuming that they follow the same accounting principles . For example, they can show how different businesses operating in the same industry react to market conditions. Reporting just the latest dollar amounts makes it hard to compare the performances of companies of various sizes. Adding prior period figures, complete with percentage changes, helps to eliminate this problem.

- The Securities and Exchange Commission (SEC) requires public companies to publish comparative statements in 10-K and 10-Q reports.

Key Takeaways

- A comparative statement is a document that compares a particular financial statement with prior period statements.

- Previous financials are presented alongside the latest figures in side-by-side columns, enabling investors to easily track a company’s progress and compare it with peers.

Cash Flow Statement

Every business must generate sufficient cash inflows to pay for operations. For example, managers may compare the ending balance in cash each month over the past two years to determine if the ending cash balance is increasing or declining. If company sales are growing, the manufacturer requires more cash to operate each month, which is reflected in the ending cash balance.

A downward trend in the ending cash balance means that the accounts receivable balance is growing and that the firm needs to take steps to collect cash faster.

Income Statement

A percentage of sales presentation is often used to generate comparative financial statements for the income statement — the area of a financial statement dedicated to a company’s revenues and expenses . Presenting each revenue and expense category as a percentage of sales makes it easier to compare periods and assess company performance.

Assume, for example, that a manufacturer's cost of goods sold (COGS) increases from 30% of sales to 45% of sales over three years. Management can use that data to make changes, such as finding more competitive pricing for materials or training employees to lower labor costs. On the other hand, an analyst may see the cost of sales trend and conclude that the higher costs make the company less attractive to investors.

Comparative statements are less reliable when companies undergo huge changes. A big acquisition and move into new end markets can transform businesses, making them different entities from previous reporting periods.

For example, if Company A acquires Company B it may report a sudden sharp jump in sales to account for all the extra revenues that Company B generates. At the same time, profit margins might tighten at an alarming rate because Company B has a less lean manufacturing process, spending more money to produce the goods it sells.

U.S. Securities and Exchange Commission. " Form 10-K ." Accessed Oct. 29, 2020.

:max_bytes(150000):strip_icc():format(webp)/financialstatements-final-d1268249b5284b3989c979ee82f2869e.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Financial Statement Presentation: Structure and Requirements

Preparing financial statements that meet regulatory requirements can be an overwhelming task for many organizations.

This article provides a comprehensive guide to the key components, structure, and presentation standards for financial statements to ensure proper compliance and disclosure.

We will explore the five main financial statements, breakdown the required elements of each statement, review relevant accounting standards from GAAP and IFRS, and provide practical examples and templates to guide your financial statement preparation. By following the recommendations outlined here, you can create accurate, compliant financial statements tailored to your specific reporting needs.

Introduction to Financial Statement Presentation

Financial statements are formal reports that summarize a company's financial performance over a period of time. They communicate key information to internal and external stakeholders to facilitate decision-making. Proper financial statement presentation is vital for businesses to effectively convey their financial position.

This section will provide an overview of financial statement presentation, including its purpose, key components, and regulatory requirements. It will introduce the 5 main components of financial statements and discuss how proper presentation is vital for businesses.

Understanding the 5 Components of Financial Statements

Financial statements generally contain 5 key components:

- Income Statement - Reports revenue, expenses, and profit/loss over a period of time

- Balance Sheet - Snapshot of assets, liabilities, and equity on a certain date

- Cash Flow Statement - Depicts inflows and outflows of cash

- Statement of Stockholders' Equity - Shows changes in equity accounts

- Notes to Financial Statements - Additional disclosures and details

These 5 reports work together to provide a comprehensive view of a company's finances. Proper categorization and presentation of each component is necessary for stakeholders to accurately interpret performance.

Significance of Financial Statement Presentation

Financial statement presentation standards exist to:

- Communicate Performance - Well-structured reports allow readers to clearly see profitability, liquidity, leverage, etc.

- Meet Regulatory Requirements - Public companies must follow strict presentation rules.

- Facilitate Decision-Making - With organized information, internal and external decisions can be made effectively.

Following presentation guidelines ensures transparency and enables financial analysis.

Regulatory Framework: ASC 205 and IAS 1

In the US, the FASB's ASC 205 establishes presentation principles for financial statements. Similarly, the IASB's IAS 1 outlines international standards. These regulations dictate:

- Statement ordering and content

- Classification and aggregation

- Disclosures

Understanding the regulatory presentation framework is key for proper financial reporting.

Proper financial statement presentation acts as the foundation for communicating performance. By classifying information correctly and meeting presentation standards, businesses can clearly convey their financial position.

What are the requirements for fair presentation of financial statements?

Fair presentation of financial statements requires adherence to accounting standards and a faithful representation of the company's financial position. Some key requirements include:

Compliance with Applicable Accounting Standards

Financial statements must comply with the applicable accounting standards framework, such as:

- US GAAP - Generally Accepted Accounting Principles in the United States

- IFRS - International Financial Reporting Standards

This ensures standardized reporting across companies.

Faithful Representation

Financial statements should faithfully represent the economic reality of transactions and events. Information should be complete, neutral, and free from material error.

Understandability

Financial information should be presented clearly and concisely. Companies should provide adequate disclosures and explanation of accounting policies, estimates, and judgements.

Information in financial statements should be relevant to the decision-making needs of users. Only include information that is capable of making a difference in decisions.

Materiality

Companies must provide all material information - those that can reasonably influence users' decisions. Immaterial information can be excluded.

Comparability

Financial reporting should allow users to identify similarities and differences across reporting periods and between entities. Consistent presentation and reporting facilitates comparison.

Following accounting rules and standards, as well as providing relevant, faithful, and clear information is key to achieving fair presentation of financial statements.

How do you present financial statements in a presentation?

When presenting financial statements, it is important to focus on communicating the key information clearly and effectively to your audience. Here are some tips:

Keep it simple

Avoid using complex financial jargon and acronyms that may confuse your audience. Present key figures, trends, and takeaways in easy-to-understand language. Use examples if needed to illustrate your points.

Use visuals

Visual aids like charts, graphs, and tables can help reinforce numbers and make financial data more digestible. Choose clear, uncluttered designs over flashy graphics. Emphasize key metrics and trends.

Tell a story

Structure your presentation to take the audience on a logical journey. Explain the meaning behind the numbers, and how they relate to broader company strategy and performance. Draw connections between financial statements.

Tailor to your audience

Understand what financial information your audience cares about most, and focus on highlighting the relevant key performance indicators that align to their interests or concerns.

Practice effective delivery

Speak slowly and clearly. Maintain eye contact and gauge audience reaction. Be prepared to answer questions on the details behind your summary figures.

Following these tips can lead to financial presentations that clearly communicate meaning and impact.

How should financial statements be presented?

Financial statements should be presented in a clear, structured format that complies with accounting standards and principles.

General Presentation Guidelines

- Financial statements typically include a balance sheet, income statement, statement of cash flows, and statement of stockholders' equity. Notes and disclosures provide important details.

- Assets are generally presented from most liquid to least liquid, while liabilities are presented from short-term to long-term.

- Positive numbers indicate assets and revenues, while negative numbers signify liabilities, equity, expenses or losses.

- Subtotals and totals should be clearly labeled for each financial statement category or section to improve readability.

Disclosure Requirements

Certain disclosures are required by accounting standards like GAAP or IFRS in the footnotes and statement notes. These include:

Accounting policies used

Details on material asset, liability and equity accounts

Segment and geographical reporting

Commitments and contingencies

Disclosures should provide clarity on any aspects of the financial statements that may be unclear or require further explanation.

Following standard presentation guidelines and properly disclosing important details leads to higher quality, more transparent and understandable financial statements.

What are the requirements for financial statements?

Financial statements need to adhere to certain basic requirements to accurately reflect a company's financial position. These include:

Fair Presentation

Financial statements must fairly present the financial position, performance, and cash flows of an entity. This requires compliance with accounting standards as well as providing adequate disclosures and descriptions to give users an accurate picture of the company's finances.

Going Concern

Financial statements are prepared under the assumption that the entity will continue operating in the foreseeable future. If there are doubts about the company's ability to do so, appropriate disclosures must be made.

Accrual Basis

Financial statements are prepared using the accrual basis of accounting, meaning that economic events are recognized when they occur, not when cash is exchanged. This better matches revenues and expenses to the period in which they were incurred.

Materiality and Aggregation

Information is material if omitting or misstating it could influence decisions made by users of the financial statements. Immaterial items can be aggregated to avoid cluttering statements.

No Offsetting

Assets and liabilities, and income and expenses, cannot be offset against each other unless specifically permitted by the accounting standards. Offsetting obscures useful information.

In summary, financial statements must provide a fair, going concern view of the entity's finances on an accrual basis. They should include all material information without aggregation or offsetting. Most companies must prepare financial statements at least annually and include comparative info from prior periods. Consistency in presentation over time is also key.

sbb-itb-beb59a9

Structuring financial statements: a detailed look.

Financial statements are structured reports that summarize a company's financial position and performance over a period of time. The five main financial statements are:

Income Statement Breakdown

The income statement shows a company's revenues, expenses, and net income over a period of time, usually a quarter or year. Key components include:

- Revenue - Money earned from the company's operations, products, or services

- Cost of Goods Sold (COGS) - Direct expenses related to providing products/services

- Operating Expenses - Indirect expenses like marketing, R&D, administration

- Operating Income - Revenue minus COGS and operating expenses

- Other Income/Expenses - Taxes, interest earned/paid

- Net Income - The "bottom line" profit or loss after subtracting all expenses

The income statement shows whether a company made a profit or loss during the period.

Analyzing the Balance Sheet

The balance sheet is a snapshot of a company's financial position at a point in time. Key components include:

Assets - Resources owned by the company with economic value. Common asset types:

- Current Assets - Cash, accounts receivable, inventory

- Fixed Assets - Property, plants, equipment

- Intangible Assets - Patents, trademarks, goodwill

Liabilities - Debts and obligations owed by the company:

- Current Liabilities - Due within 12 months, e.g. accounts payable

- Long-Term Debt - Due after 12 months, e.g. bonds payable

Shareholders' Equity - Value that would be returned to shareholders if assets were liquidated and debts paid off. Includes:

- Paid-in Capital - Amounts invested by shareholders

- Retained Earnings - Company profits not paid out as dividends

The balance sheet shows the company's financial health and liquidity position.

Cash Flow Statement Categorization

The cash flow statement tracks the actual cash coming into and going out of the business. Cash flows are categorized into:

- Operating Activities - Core business operations, e.g. cash received from customers

- Investing Activities - Investments in capital expenditures, securities, etc.

- Financing Activities - Cash from financing sources like loans and equity issuances

Analyzing the sources and uses of cash flow indicates whether the company is generating enough cash to sustain itself.

Presentation of the Statement of Retained Earnings

The statement of retained earnings summarizes changes in retained earnings over a period. It starts with the prior period's retained earnings, adds net income earned during the current period, and subtracts any dividends paid to shareholders.

The ending retained earnings balance is shown on the balance sheet. Tracking changes helps assess how much of the company's profits are being reinvested vs. paid out to shareholders.

Components of the Statement of Shareholders' Equity

The statement of shareholders' equity summarizes changes in the equity accounts over a period. Key components include:

- Paid-in Capital - Additional investments by shareholders

- Treasury Stock - Company repurchases of outstanding shares

- Retained Earnings - Company profits not paid as dividends

- Accumulated Other Comprehensive Income - Certain income statement items

This statement reconciles the beginning and ending shareholders' equity balances on the balance sheet.

Financial Statement Presentation Standards and Requirements

Financial statement presentation is crucial for effectively communicating a company's financial position and performance to stakeholders. Companies must follow strict presentation standards and requirements outlined by accounting regulations like US GAAP and IFRS .

Adhering to US GAAP Financial Statements Format

The FASB Accounting Standards Codification (ASC) Topic 205 summarizes the core presentation requirements for US GAAP financial statements. Key elements include:

- Classifying the balance sheet into current and noncurrent assets and liabilities

- Presenting expenses by function or nature in the income statement

- Including a statement of cash flows and statement of changes in equity

- Disclosing relevant information in footnotes

Companies should reference ASC 205 and related regulations when preparing financials to ensure proper US GAAP format and disclosure.

Compliance with IFRS and IAS 1 Presentation Standards

International Financial Reporting Standards (IFRS) share similarities with US GAAP but have key differences in presentation under IAS 1 (PDF here). These include:

- Stricter requirements about items presented on the balance sheet and income statement

- Different classifications of expenses and equity

- More flexibility in formatting statements

It is critical for multinational companies to understand both US GAAP and IFRS presentation standards.

Navigating SEC Disclosure Requirements

Public companies in the US must also follow Securities and Exchange Commission (SEC) disclosure rules that impact financial statement presentation. Examples include:

- Segment reporting disclosures about products, services, and geographic areas

- Related party transaction footnotes

- Disclosures of risk factors and uncertainties

See PwC's guide for best practices on SEC disclosures.

Avoiding Common Financial Statement Presentation Pitfalls

Some common financial statement presentation mistakes include:

- Inconsistent classification of expenses across periods

- Netting accounts that should be presented gross

- Failing to properly disclose uncertainties or contingencies

Companies should reference EY's presentation guide and have external audits done to identify areas for improvement.

Exploring Disclosures and Supplementary Information

This section will examine common supplementary financial information and disclosures provided alongside or within financial statements, and their significance in providing a complete financial picture.

Detailing Accounting Policies and Disclosures

Financial statements must include significant accounting policies as a footnote, summarizing principles related to revenue recognition, depreciation methods, valuation of inventories, investments, etc. These disclosures ensure transparency on assumptions and estimates made in preparing the statements.

For example, a retail company may disclose:

- Revenue is recognized at the point of sale when goods are sold to customers.

- Inventory is valued using the FIFO method.

- Fixed assets are depreciated over useful lives of 3-10 years using the straight-line method.

Other vital disclosures provide details on litigation risks, contractual obligations, segment performance, related party transactions, pension plan assets and obligations, etc. These offer context for assessing the company's financial health.

Insights from Management's Discussion and Analysis (MD&A)

The MD&A section discusses the company's financial performance, changes in financial position, and outlook. It analyzes trends in liquidity, capital resources, operations, industry conditions, and other factors impacting the business.

For instance, the MD&A may attribute a revenue decline to specific economic or competitive challenges. Or it may link an increase in capital expenditures to investments in new production facilities. This qualitative perspective supplements the quantitative data in financial statements.

Financial Ratio Analysis and Benchmarks

Many companies include key financial ratios like return on equity, profit margin, asset turnover, debt-to-equity alongside industry benchmarks.

For example, an industrial manufacturer may compare its gross margin percentage, inventory turnover ratio, and days sales outstanding ratio to industry averages. This allows contextual assessment of financial performance.

Benchmarking also assists lenders and investors in comparing companies within an industry when making investment decisions.

Types of Disclosures in Financial Statements

Common disclosures in financial statements include:

- Contingencies: Litigation, environmental liabilities, warranties

- Related parties: Transactions with affiliated entities

- Risks: Interest rate, currency, credit risk exposures

- Subsequent events: Significant events occurring after fiscal yearend

- Uncertainties: Potential asset impairments, variability in estimates

- Segment details: Revenue, assets, profitability by product line or geography

Such disclosures increase transparency on uncertainties inherent in financial reporting and assumptions made by management. They provide vital perspective for financial statement users and must be presented appropriately as per accounting standards.

Practical Examples and Guides for Financial Statement Presentation

This section provides practical financial statement presentation examples and explores resources like the PwC and EY financial statement presentation guides.

Financial Statement Presentation Example

Here is an example of a basic financial statement presentation for a fictional company:

Income Statement

- Revenue: $100,000

- Cost of Goods Sold: $60,000

- Gross Profit: $40,000

- Operating Expenses: $20,000

- Operating Income: $20,000

- Interest Expense: $2,000

- Pretax Income: $18,000

- Income Tax: $5,000

- Net Income: $13,000

Balance Sheet

- Cash: $10,000

- Accounts Receivable: $5,000

- Inventory: $15,000

- Total Assets: $30,000

- Liabilities

- Accounts Payable: $4,000

- Total Liabilities: $4,000

- Shareholders' Equity

- Common Stock: $10,000

- Retained Earnings: $16,000

- Total Liabilities and Equity: $30,000

Cash Flow Statement

- Operating Activities

- Changes in Working Capital: $5,000

- Net Cash from Operations: $18,000

- Investing Activities

- Equipment Purchases: -$3,000

- Financing Activities

- Dividends Paid: -$5,000

- Change in Cash: $10,000

This illustrates the core components and layout of financial statements. Companies provide further disclosures and details in the footnotes.

Leveraging the PwC Financial Statement Presentation Guide PDF

The PwC financial statement presentation guide provides a comprehensive overview of financial statement presentation requirements under IFRS . Key aspects covered include:

- General presentation principles

- Statement of financial position structure

- Income statement layout and disclosures

- Standards for the statement of changes in equity

- Cash flow statement preparation

The guide serves as an authoritative reference for ensuring financial statements adhere to the latest standards and presentation best practices. Companies can leverage the guide when structuring their financial reports to improve quality, transparency, and compliance.

Utilizing the EY Financial Statement Presentation Guide

The EY financial statement presentation guide delivers insights into effectively presenting financial information to stakeholders. Areas covered include:

- Optimizing the balance sheet structure

- Enhancing the clarity of the income statement

- Improving cash flow statement usefulness through classification

- Making critical judgment calls on presentation

- Providing high quality disclosures

By consulting the guide, finance teams can apply EY's presentation best practices to their financial reporting processes. This helps improve the understandability and decision-usefulness of statements for investors and regulators.

Conclusion: Mastering Financial Statement Presentation

Proper financial statement presentation is critical for communicating accurate and transparent information to stakeholders. As discussed, key requirements per GAAP and IFRS standards include:

- Presenting comparative financial statements covering at least two reporting periods

- Clearly labeling each financial statement and its components

- Disclosing relevant information in the notes to assist in interpretation

- Following formatting and component ordering conventions

By mastering guidelines around statement structure, organizations build trust and enable sound decision-making. Key lessons for financial professionals include:

- Understand regulatory presentation standards based on jurisdiction

- Analyze comparative trends and performance over time

- Assess which disclosures are material to the reader

- Format statements consistently across periods

- Focus on transparency through clear communication

Meeting presentation requirements takes diligence, but pays dividends in stakeholder confidence. Financial leaders should continue honing their expertise in this critical discipline.

Related posts

- Interim Financial Reporting: GAAP Requirements

- A Closer Look at International Financial Reporting: A Comprehensive Review

- Delving into IFRS Standards: A Comprehensive Review

- A Comparative Review of Top Financial Reporting Tools

Return on Equity Formula: Finance Explained

Contribution Margin vs Gross Margin

How to Manage Overheads in Xero: Keeping Costs Under Control

We've received your job requirements, and our team is working hard to find the perfect candidate for you. If you have more job openings available, feel free to submit another job description, and we'll be happy to assist you.

- Submit a New Job Description

Unlock the Talent Your Business Deserves

Hire Accounting and Finance Professionals from South America.

- Start Interviewing For Free

IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Presentation of Financial Statements (IAS 1)

Last updated: 14 November 2023

IAS 1 serves as the main standard that outlines the general requirements for presenting financial statements. It is applicable to ‘general purpose financial statements’, which are designed to meet the informational needs of users who cannot demand customised reports from an entity. Documents like management commentary or sustainability reports, which are often included in annual reports, fall outside the scope of IFRS, as indicated in IAS 1.13-14. Similarly, financial statements submitted to a court registry are not considered general purpose financial statements (see IAS 1.BC11-13).

The standard primarily focuses on annual financial statements, but its guidelines in IAS 1.15-35 also extend to interim financial reports (IAS 1.4). These guidelines address key elements such as fair presentation, compliance with IFRS, the going concern principle, the accrual basis of accounting, offsetting, materiality, and aggregation. For comprehensive guidance on interim reporting, please refer to IAS 34 .

Note that IAS 1 will be superseded by the upcoming IFRS 18 Presentation and Disclosure in Financial Statements .

Now, let’s explore the general requirements for presenting financial statements in greater detail.

Financial statements

Components of a complete set of financial statements.

Paragraph IAS 1.10 outlines the elements that make up a complete set of financial statements. Companies have the flexibility to use different titles for these documents, but each statement must be presented with equal prominence (IAS 1.11). The terminology used in IAS 1 is tailored for profit-oriented entities. However, not-for-profit organisations or entities without equity (as defined in IAS 32), may use alternative terminology for specific items in their financial statements (IAS 1.5-6).

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Compliance with IFRS

Financial statements must include an explicit and unreserved statement of compliance with IFRS in the accompanying notes. This statement is only valid if the entity adheres to all the requirements of every IFRS standard (IAS 1.16). In many jurisdictions, such as the European Union, laws mandate compliance with a locally adopted version of IFRS.

IAS 1 does consider extremely rare situations where an entity might diverge from a specific IFRS requirement. Such a departure is permissible only if it prevents the presentation of misleading information that would conflict with the objectives of general-purpose financial reporting (IAS 1.20-22). Alternatively, entities can disclose the impact of such a departure in the notes, explaining how the statements would appear if the exception were made (IAS 1.23).

Identification of financial statements

The guidelines for identifying financial statements outlined in IAS 1.49-53 are straightforward and rarely cause issues in practice.

Going concern

The ‘going concern’ principle is a cornerstone of IFRS and other major GAAP. It assumes that an entity will continue to operate for the foreseeable future (at least 12 months). IAS 1 mandates management to assess whether the entity is a ‘going concern’. Should there be any material uncertainties regarding the entity’s future, these must be disclosed (IAS 1.25-26). IFRSs do not provide specific accounting principles for entities that are not going concerns, other than requiring disclosure of the accounting policies used. One of the possible approaches is to measure all assets and liabilities using their liquidation value.

See also this educational material at IFRS.org.

Materiality and aggregation

IAS 1.29-31 emphasise the importance of materiality in preparing user-friendly financial statements. While IFRS mandates numerous disclosures, entities should only include information that is material. This concept should be at the forefront when preparing financial statements, as reminders about materiality are seldom provided in other IFRS standards or publications.

Generally, entities should not offset assets against liabilities or income against expenses unless a specific IFRS standard allows or requires it. IAS 1.32-35 offer guidance on what can and cannot be offset. Offsetting of financial instruments is discussed further in IAS 32 .

Frequency of reporting

Entities are required to present a complete set of financial statements at least annually (IAS 1.36). However, some Public Interest Entities (PIEs) may be obliged to release financial statements more frequently, depending on local regulations. However, these are typically interim financial statements compiled under IAS 34 .

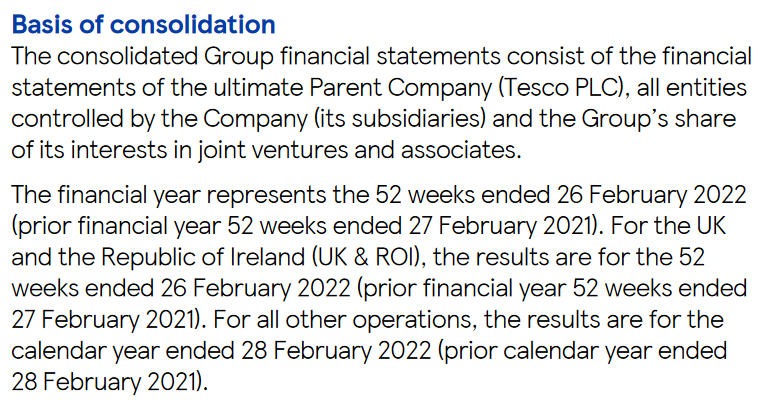

IAS 1 also allows for a 52-week reporting period instead of a calendar year (IAS 1.37). This excerpt from Tesco’s annual report serves to demonstrate this point, showing that the group uses 52-week periods for their financial year, even when some subsidiaries operate on a calendar-year basis:

If an entity changes its reporting period, it must clearly disclose this modification and provide the rationale for the change (IAS 1.36). It is advisable to include an explanatory note with comparative data that aligns with the new reporting period for clarity.

Comparative information

As a general guideline, entities should present comparative data for the prior period alongside all amounts reported for the current period, even when specific guidelines in a given IFRS do not require it. However, there’s no obligation to include narrative or descriptive information about the preceding period if it isn’t pertinent for understanding the current period (IAS 1.38).

If an entity opts to provide comparative data for more than the immediately preceding period, this additional information can be included in selected primary financial statements only. However, these additional comparative periods should also be detailed in the relevant accompanying notes (IAS 1.38C-38D).

IAS 1.40A-46 outlines how to present the statement of financial position when there are changes in accounting policies, retrospective restatements, or reclassifications. This entails producing a ‘third balance sheet’ at the start of the preceding period (which may differ from the earliest comparative period, if more than one is presented). Key points to note are:

- The third balance sheet is required only if there’s a material impact on the opening balance of the preceding period (IAS 1.40A(b)).

- If a third balance sheet is included, there’s no requirement to add a corresponding third column in the notes, although this could be useful where numbers have been altered by the change (IAS 1.40C).

- Interim financial statements do not require a third balance sheet (IAS 1.BC33).

IAS 8 also requires comprehensive disclosures concerning changes in accounting policies and corrections of errors .

Statement of financial position

IAS 1.54 enumerates the line items that must, at a minimum, appear in the statement of financial position. Entities should note that separate lines are not required for immaterial items (IAS 1.31). Additional line items can be added for entity-specific or industry-specific matters. IAS 1 permits the inclusion of subtotals, provided the criteria set out in IAS 1.55A are met.

Additional disclosure requirements are set out in IAS 1.77-80A. Of particular interest are the requirements pertaining to equity (IAS 1.79), which begin with the number of shares and extend to include details such as ‘rights, preferences, and restrictions relating to share capital, including restrictions on the distribution of dividends and the repayment of capital.’ While these kinds of limitations are common across various legal jurisdictions (for example, not all retained earnings can be distributed as dividends), many companies neglect to disclose such limitations in their financial statements.

For guidance on classifying assets and liabilities as either current or non-current, please refer to the separate page dedicated to this topic.

Statement of profit or loss and other comprehensive income

IAS 1 provides two methods for presenting profit or loss (P/L) and other comprehensive income (OCI). Entities can either combine both P/L and OCI into a single statement or present them in separate statements (IAS 1.81A-B). Additionally, the P/L and total comprehensive income for a given period should be allocated between the owners of the parent company and non-controlling interests (IAS 1.81B).

Minimum contents in P/L and OCI

IAS 1.82-82A specifies the minimum items that must appear in the P/L and OCI statements. These items are required only if they materially impact the financial statements (IAS 1.31).

Entities are permitted to add subtotals to the P/L statement if they meet the criteria specified in IAS 1.85A. Operating income is often the most commonly used subtotal in P/L. This practice may be attributed to the 1997 version of IAS 1, which mandated the inclusion of this subtotal—although this is no longer the case. IAS 1.BC56 clarifies that an operating profit subtotal should not exclude items commonly considered operational, such as inventory write-downs, restructuring costs, or depreciation/amortisation expenses.

Profit or loss (P/L)

All items of income and expense must be recognised in P/L (or OCI). This means that no income or expenses should be recognised directly in the statement of changes in equity, unless another IFRS specifically mandates it (IAS 1.88). Direct recognition in equity may also result from intra-group transactions . IAS 1.97-98 require separate disclosure of material items of income and expense, either directly in the income statement or in the notes.

Expenses in P/L can be presented in one of two ways (IAS 1.99-105):

- By their nature (e.g., depreciation, employee benefits); or

- By their function within the entity (e.g., cost of sales, distribution costs, administrative expenses).

When opting for the latter, entities must provide additional details on the nature of the expenses in the accompanying notes (IAS 1.104).

Other comprehensive income (OCI)

OCI encompasses income and expenses that other IFRS specifically exclude from P/L. There is no conceptual basis for deciding which items should appear in OCI rather than in P/L. Most companies present P/L and OCI as separate statements, partly because OCI is generally overlooked by investors and those outside of accounting and financial reporting circles. The concern is that combining the two could reduce net profit to merely a subtotal within total comprehensive income.

All elements that constitute OCI are specifically outlined in IAS 1.7, as part of its definitions.

Reclassification adjustments

A reclassification adjustment refers to the amount reclassified to P/L in the current period that was recognised in OCI in the current or previous periods (IAS 1.7). All items in OCI must be grouped into one of two categories: those that will or will not be subsequently reclassified to P/L (IAS 1.82A). Reclassification adjustments must be disclosed either within the OCI statement or in the accompanying notes (IAS 1.92-96).

To illustrate, foreign exchange differences arising on translation of foreign operations and gains or losses from certain cash flow hedges are examples of items that will be reclassified to P/L. In contrast, remeasurement gains and losses on defined benefit employee plans or revaluation gains on properties will not be reclassified to P/L.

The practice of transferring items from OCI to P/L, commonly known as ‘recycling’, lacks a concrete conceptual basis and the criteria for allowing such transfers in IFRS are often considered arbitrary.

Tax effects

OCI items can be presented either net of tax effects or before tax, with the overall tax impact disclosed separately. In either case, entities must specify the tax amount related to each item in OCI, including any reclassification adjustments (IAS 1.90-91). Interestingly, there is no such requirement to disclose tax effects for individual items in the income statement.

Statement of changes in equity

IAS 1.106 outlines the minimum line items that must be included in the statement of changes in equity. Subsequent paragraphs specify the disclosure requirements, which can be addressed either within the statement itself or in the accompanying notes. It’s crucial to note that changes in equity during a reporting period can arise either from income and expense items or from transactions involving owners acting in their capacity as owners (IAS 1.109). This means that entities cannot adjust equity directly based on changes in assets or liabilities unless these adjustments result from transactions with owners, such as capital contributions or dividend payments, or are otherwise mandated by other IFRSs.

Statement of cash flows

The statement of cash flows is governed by IAS 7 .

- Explanatory notes

Structure of explanatory notes

The structure for explanatory notes is detailed in IAS 1.112-116. In practice, there are several commonly adopted approaches to organising these notes:

Approach #1:

- Primary financial statements (P/L, OCI, etc.)

- Statement of compliance and basis of preparation

- Accounting policies

Approach #1 is logically coherent, as understanding accounting policies is crucial before delving into the financial data. However, in reality, few people read the accounting policies in their entirety. Consequently, users often have to navigate past several pages of accounting policies to reach the explanatory notes.

Approach #2:

- Primary financial statements (P/L, OCI, etc)

In Approach #2, accounting policies are treated as an appendix and positioned at the end of the financial statements. The advantage here is that all numerical data is clustered together, uninterrupted by extensive descriptions of accounting policies.

Approach #3:

- Explanatory notes integrated with relevant accounting policies

Approach #3 pairs accounting policies directly with the associated explanatory notes. For example, accounting policies relating to inventory would appear alongside the explanatory note that breaks down inventory components.

Management of capital

IAS 1.134-136 outline the disclosures related to capital management. These provisions apply to all entities, whether or not they are subject to external capital requirements. An important note here is that entities are not obligated to disclose specific values or ratios concerning capital objectives or requirements.

IAS 1.137 mandates disclosure of dividends proposed or declared before the financial statements were authorised for issue but not recognised as a distribution to owners during the period. Furthermore, entities are required to disclose the amount of any cumulative preference dividends not recognised.

Disclosure of accounting policies

IAS 1 specifies the requirements for disclosing accounting policy information which are discussed here .

Disclosing judgements and sources of estimation uncertainty

IAS 1 mandates disclosing judgements and sources of estimation uncertainty .

Other disclosures

Additional miscellaneous disclosure requirements are detailed in paragraphs IAS 1.138.

IFRS 18 Presentation and Disclosure in Financial Statements

The upcoming IFRS 18 Presentation and Disclosure in Financial Statements , which will supersede IAS 1, aims to enhance the comparability and transparency of financial reporting, focusing on the statement of profit or loss. Key changes include:

- The introduction of two new subtotals in the P/L statement: ‘operating profit’ and ‘profit before financing and income taxes’.

- A requirement for the reconciliation of management-defined performance measures (also known as ‘non-GAAP’ measures) with those specified by IFRS.

- Refined guidelines for the aggregation and disaggregation of information within the primary financial statements.

- Limited changes to the statement of cash flows, establishing operating profit as a starting point for the indirect method and eliminating options for the classification of interest and dividend cash flows.

Learn more in this BDO’s publication .

The release of IFRS 18 is expected in Q2 2024. This new IFRS will be effective from 1 January 2027 with early application permitted.

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Sndl reports first quarter 2024 financial and operational results.

The Company reports increased revenue year-over-year and record profit margin

CALGARY, AB , May 9, 2024 /CNW/ - SNDL Inc. (NASDAQ: SNDL) (" SNDL " or the " Company ") reported its financial and operational results for the first quarter ended March 31, 2024 . All financial information in this press release is reported in millions of Canadian dollars unless otherwise indicated.

SNDL has also posted a supplemental investor presentation on its website, found at https://sndl.com .

The Company will hold a conference call and webcast presentation at 10:30 a.m. EDT ( 8:30 a.m. MDT ) on Thursday, May 9, 2024 . The conference call details can be found below.

FIRST QUARTER 2024 FINANCIAL AND OPERATIONAL HIGHLIGHTS

Net revenue for the first quarter of 2024 was $197.8 million , compared to $191.0 million in the first quarter of 2023, an increase of 4%. This increase is driven by the Cannabis Retail and Cannabis Operations segments, as the Liquor Retail segment reported flat net revenue. The decrease in net revenue in the quarter, as compared to net revenue of $248.5 million in the fourth quarter of 2023, is attributed to seasonality in the Liquor and Cannabis Retail segments, as the fourth quarter is traditionally the strongest retail period, and the first quarter is impacted by decreased consumer spend.

Achieved a gross profit of $50.4 million , representing a record gross margin of 25% of sales in the first quarter of 2024, up from 17% in the first quarter of 2023. The 55% improvement in gross profit year over year highlights the success of the Company's data sales program, as well as the supply chain productivity initiatives, including optimized procurement and cultivation consolidation following the closure of the Olds, Alberta cultivation facility in October 2023 , which significantly enhanced operational efficiencies and reduced costs.

Cash flow was negative $6.1 million in the first quarter of 2024, compared to negative $66.3 million in the first quarter of 2023, a 91% improvement. SNDL is encouraged by this result, as it is achieved in the context of business seasonality that lowers the sales in both Liquor and Cannabis Retail segments during the first quarter.

Free cash flow in the first quarter of 2024 was negative $6.4 million , compared to negative $60.1 million in the first quarter of 2023, an 89% improvement year-over-year underpinned by profitability and working capital management improvements.

Operating loss was $4.4 million for the first quarter of 2024, compared to a loss of $32.2 million in the first quarter of 2023, an 86% improvement primarily driven by margin expansion.

The first quarter of 2024 yielded solid results, and a step change in profitability despite seasonality impacts. There are several additional highlights during the quarter that, coupled with a strong pipeline of future initiatives, position SNDL on a strong path to continue driving sustainable profitable growth:

Opened a new Spiritleaf store in the coveted resort community of Whistler, British Columbia , and added a new Wine and Beyond store in Airdrie , one of the fastest-growing communities in Alberta.

Continued expansion of the proprietary data licensing in Cannabis Retail and initiated the program in the Liquor Retail segment.

Created opportunity for Cannabis Retail growth into British Columbia through the Dutch Love transaction.

Dynamic 29% revenue growth of SNDL's Liquor Retail segment private labels.

Continued productivity initiatives in the Cannabis Operations segment, notably the strategic closure of the Olds, Alberta facility, coupled with a ramp-up in cultivation at the Atholville, New Brunswick facility to ensure stable and increasing supply for retail, B2B and international partners as demand grows.

The Company had $783.2 million of unrestricted cash, marketable securities and investments and no outstanding debt, with $189.0 million of unrestricted cash as at March 31, 2024 . SNDL has not raised cash through share offerings since June 2021 .

"The SNDL team has delivered a solid first quarter result, exemplified by a record gross margin of 25% and the undeniable improvement in the profitability of all of our operating segments over multiple years," said Zach George , Chief Executive Officer of SNDL. "We are well positioned to further expand our retail network and product distribution in Canada where we expect further consolidation and attrition. Building on the momentum of our Canadian operations, the recent completion of Nasdaq's review of our SunStream USA structure creates an opportunity for SNDL to close on U.S. assets currently under restructuring, positioning us to become a leading global cannabis company. We intend to complete a rigorous strategic planning exercise in June of 2024 and are focused on a material reduction in corporate expenses to drive further improvements into the back half of the year. SNDL remains steadfast in its commitment to driving long-term, stabilized profitability. Following our first-ever two quarters of positive free cash flow in 2023, we are targeting the generation of positive free cash flow for the aggregate 2024 calendar year."

FIRST QUARTER 2024 KEY FINANCIAL METRICS

FIRST QUARTER 2024 RESULTS

SNDL's business is operated and reported in four segments: Liquor Retail, Cannabis Retail, Cannabis Operations and Investments.

Liquor Retail

SNDL is Canada's largest private sector liquor retailer, operating 171 locations, predominantly in Alberta, under its three retail banners: " Wine and Beyond ", " Liquor Depot ", and " Ace Liquor ".

Net revenue for Liquor Retail sales for the three banners combined was $116.1 million in the first quarter of 2024, stable compared to $115.9 million for the same period in the year prior.

Same-store sales for stores open in the first quarter of 2023 and 2024 have remained stable year-over-year. Same-store sales refer to the revenue generated by the Company's existing retail liquor locations, which operated during the current and comparative periods.

Gross profit for Liquor Retail was $28.8 million , or 25% of sales, in the first quarter of 2024, compared to $26.3 million , or 23% of sales, in the first quarter of 2023, representing a 10% increase year-over-year. The Company achieved record gross margin for its Liquor Retail segment in March 2024 , with margins reaching 25.3%. This improvement was mainly driven by procurement productivity and product mix management initiatives.

Operating income for Liquor Retail was $2.2 million in the first quarter of 2024, compared to negative $2.0 million in the first quarter of 2023, a 212% improvement.

SNDL started to monetize its proprietary data licensing program for Liquor Retail in the first quarter of 2024, helping to further enhance the segment's profit margins with no associated cost of sales.

Private label sales, a substantial driver of margin accretive profitable growth, increased by 28.9% compared to the first quarter of 2023, and private label sales as a percent of total sales increased from 11.4% in the fourth quarter of 2023 to 12.6% in the first quarter of 2024. This increase is driven by further additions to the private label offerings, particularly within the value segment. The Company plans to extend its private label line-up with wine varietals sourced from distinguished regions and notable winemakers, all priced attractively, which is expected to contribute to further enhance SNDL's consumer value proposition, further distinguishing its Liquor Retail banners.

The Company opened its 13 th Wine and Beyond location in Airdrie, Alberta , to further build on the success of the experiential, destination approach of the banner.

As of May 9, 2024 , the Ace Liquor store count is 138, the Liquor Depot store count is 20, and the Wine and Beyond store count is 13.

Cannabis Retail

With its 63% ownership interest in Nova Cannabis Inc. (" Nova "), SNDL is Canada's largest private-sector cannabis retailer by number of stores, operating 188 locations under its four retail banners: " Value Buds ", " Spiritleaf ", " Superette ", and " Firesale Cannabis ". The Company's Cannabis Retail strategy is based on several pillars, including the quality of its store locations, its range of products, and the unique experiences it provides customers. Using data and insights from a large volume of monthly transactions enables SNDL to leverage technology and analytics to inform and improve its retail strategy.

Net revenue for Cannabis Retail in the first quarter of 2024 was $71.3 million , compared to $67.4 million in the first quarter of 2023. The 6% increase year-over-year was driven by productivity improvements and new stores opened through December 2023 .

Same-store sales increased 2.1% for stores operating in the first quarters of 2023 and 2024. Same-store sales refer to the revenue generated by the Company's existing retail cannabis locations, which operated during the current and comparative periods.

Gross profit for Cannabis Retail was $18.4 million , or 26% of sales, in the first quarter of 2024, compared to $15.8 million , or 24% of sales, in the first quarter of 2023, a 17% increase year-over-year. The increase showcases the Company's efforts in continued margin expansion initiatives, including growth of its data program, in-store productivity programs, and the continued development of private label offerings.

Operating income for the Cannabis Retail was negative $1.0 million in the first quarter of 2024, compared to negative $78,000 in the first quarter of 2023.

SNDL's proprietary data licensing program generated revenue of $3.5 million for the first quarter of 2024, an increase of 139% or $2.0 million from the same period in the year prior.

The Company expanded its Spiritleaf footprint into the coveted community of Whistler, British Columbia in February 2024 .

Subsequent to quarter end, SNDL began the expansion of its Cannabis Retail segment in British Columbia through the Dutch Love transaction, paving the way for the launch of the first Value Buds branded stores in the region. This move enhances the Company's presence and demonstrates the strength of its M&A strategy.

As of May 9, 2024 , the Spiritleaf store count was 84 (20 corporate stores and 64 franchise stores), the Superette store count was 4 corporate stores, the Firesale store count was 1 corporate store, and the Value Buds store count was 99 corporate stores.

Cannabis Operations

SNDL has a diverse brand portfolio from value to premium, emphasizing premium inhalable formats and a full suite of 2.0 products. With enhanced procurement capabilities and plans to continue evolving toward a cost-effective cultivation and manufacturing operation, the Cannabis Operations segment is a key enabler of SNDL's vertical integration strategy. Cannabis Operations include the operations of The Valens Company Inc. (" Valens ") for the period of January 18, 2023 , to December 31, 2023 .

Net revenue for Cannabis Operations for the first quarter of 2024 was $22.4 million , up 17% from $19.1 million in the first quarter of 2023, as a result of increasing provincial board and B2B distribution and a continued focus on consumer innovation, quality and operational efficiencies. Provincial board revenue represented $14.5 million in revenue for the quarter, while wholesale revenue increased 138% to $7.5 million for the quarter.

Record gross profit for the segment in the first quarter of 2024 of $3.2 million , an increase of $12.7 million , from negative $9.5 million in the first quarter of 2023. The 134% improvement in gross profit is largely attributable to several productivity initiatives, including the strategic decision to close the Olds, Alberta facility.

The Company has begun a strategic ramp-up in cultivation production at its Atholville, New Brunswick facility to ensure stable and consistent supply for both its retail B2B and international partners as demand increases.

Operating income for the segment improved 104% for the period, to $0.9 million , compared to negative $18.9 million in the first quarter of 2023. The substantial increase in operating income results from margin expansion and operational efficiencies.

Following SNDL's inaugural international export contract with IM Cannabis Corp (" IMC ") in Israel , the Company is pursuing EU-GMP certification at its Atholville facility to expand its international export footprint further and increase B2B opportunities within emerging global markets such as the UK and Germany .

Subsequent to quarter end, the Company secured approximately 350 additional distribution points within prominent national cannabis retail chains, helping to further drive market share and revenue in future quarters.

Investments

As at March 31, 2024 , the Company has deployed capital to a portfolio of cannabis-related investments with a carrying value of $594.2 million , including $560.3 million to SunStream Bancorp Inc. (" SunStream ").

In the first quarter of 2024, the investment portfolio generated positive operating income of $13.1 million compared to $8.7 million in the quarter of the prior year.

SunStream is a joint venture sponsored by SNDL. During 2023, SunStream directed the formation of the SunStream USA group of companies (" SunStream USA Group ") in connection with the restructuring of certain loans provided by SunStream. SunStream USA Group is anticipated to be a U.S. platform with one or more independent third-party investors, which will be independently managed and governed.

On May 2 , 2024, SNDL announced that SunStream USA Group would proceed with acquiring equity positions in U.S. cannabis assets following the completion of its review by Nasdaq, which confirmed that the proposed structure meets all applicable laws and Nasdaq listing rules.

At the end of the first quarter of 2024, the credit portfolio controlled by SunStream comprised five investments: Jushi Holdings Inc., SKYMINT Brands (" Skymint "), Ascend Wellness Holdings, Surterra Holdings, Inc. d/b/a Parallel (" Parallel "), and Columbia Care Inc.

The previously announced transactions to acquire certain operations and assets of Parallel and Skymint are anticipated to close in 2024 and are subject to certain conditions and regulatory approvals.

SNDL is optimistic about the proposed regulatory reforms in Germany , Florida , and the recent decision by the U.S. federal government to reclassify cannabis. On April 30, 2024 , the U.S. Justice Department, through the U.S. Drug Enforcement Administration, announced that it would move to reclassify marijuana from a Schedule I drug to a Schedule III drug, subject to a formal rulemaking process. Though this decision will not legalize cannabis at a federal level in the United States , it is expected to facilitate various research and permit certain tax deductions for U.S. cannabis businesses. This decision does not directly affect SNDL's operations, which are located solely in Canada , though it is expected to have a favourable effect on the SunStream joint venture investments in the United States . SNDL is closely following the developments of this decision and how it may create opportunities for the Company.

Equity Position

$783.2 million of unrestricted cash, marketable securities and investments, including investments in equity-accounted investees, and no outstanding debt at March 31, 2024 , resulting in a net book value of $1.2 billion .

On November 13, 2023 , the Company announced that its board of directors had approved a renewal of the share repurchase program upon its expiry on November 20, 2023 . The Company's share repurchase program continues to be available to lower the outstanding share float. SNDL will continue to assess opportunities to utilize the program to the extent that management believes it is in the best interest of SNDL's shareholders. For the three months ended March 31, 2024 , the Company did not purchase common shares for cancellation.

This press release is intended to be read in conjunction with the Company's condensed consolidated interim financial statements and the notes thereto for the three months ended March 31, 2024 , and the accompanying Management's Discussion and Analysis. These documents are available under the Company's profile on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.shtml .

CONFERENCE CALL

The Company will hold a conference call and webcast presentation at 10:30 a.m. EDT ( 8:30 a.m. MDT ) on Thursday, May 9, 2024 .

WEBCAST ACCESS

To access the live webcast of the call, please visit the following link: https://services.choruscall.ca/links/sndl2024q1.html

A telephone replay will be available for one month. To access the replay, dial: Canada / USA Toll Free: 1-855-669-9658 or International Toll: +1-604-674-8052 When prompted, enter Replay Access Code: 0888 # The webcast archive will be available for three months via the link provided above.

ABOUT SNDL INC.

SNDL is a public company whose shares are traded on the Nasdaq under the symbol "SNDL." SNDL is the largest private-sector liquor and cannabis retailer in Canada with retail banners that include Ace Liquor, Wine and Beyond, Liquor Depot, Value Buds, Spiritleaf, and Firesale Cannabis. SNDL is a licensed cannabis producer and one of the largest vertically integrated cannabis companies in Canada specializing in low-cost biomass sourcing, indoor cultivation, product innovation, low-cost manufacturing facilities, and a cannabis brand portfolio that includes Top Leaf, Contraband, Palmetto, Bon Jak, Versus, Value Buds, and Vacay. SNDL's investment portfolio seeks to deploy strategic capital through direct and indirect investments and partnerships throughout the North American cannabis industry. For more information on SNDL, please go to https://sndl.com/ .

Forward-Looking Information Cautionary Statement

This news release includes statements containing certain "forward-looking information" within the meaning of applicable securities law (" forward-looking statements "), including, but not limited to, statements regarding the Company's operational goals, the Company's ability to achieve improved profitability, growth and efficiencies across all segments, or its goal of sustainable, positive gross margin and positive free cash flow, revenue generation from the Liquor Retail proprietary data licensing program, expansion of product offerings (including the expected expansion of the Company's wine private label), the impact of productivity initiatives within the Cannabis Operations segment and owned retail locations, the expansion and additional cost savings at the Atholville facility, performance of the Company's investments, including through the SunStream joint venture and SunStream USA Group, implementation of the proposed SunStream USA Group investment structure, the timing and closing of the transactions with Parallel and Skymint, and any other potential forms of shareholder value creation. Forward-looking statements are frequently characterized by words such as "aim", "anticipate", "assume", "believe", "contemplate", "continue", "could", "due", "estimate", "expect", "goal", "intend", "may", "objective", "plan", "predict", "potential", "positioned", "pioneer", "seek", "should", "target", "will", "would", and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the Company's business and the industry in which it operates and management's beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond its control. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Please see "Risk Factors" in the Company's Annual Information Form dated March 20, 2024 , and the risk factors included in our other public disclosure documents for a discussion of the material risk factors that could cause actual results to differ materially from the forward-looking information. The Company is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

Condensed Consolidated Interim Statement of Loss and Comprehensive Loss (Unaudited – expressed in thousands of Canadian dollars, except per share amounts)

Condensed Consolidated Interim Statement of Financial Position (Unaudited – expressed in thousands of Canadian dollars)

Condensed Consolidated Interim Statement of Cash Flows (Unaudited –expressed in thousands of Canadian dollars)

NON-IFRS MEASURES

Certain specified financial measures in this news release are non-IFRS measures. These terms are not defined by IFRS and, therefore, may not be comparable to similar measures reported by other companies. These non-IFRS financial measures should not be considered in isolation or as an alternative for or superior to measures of performance prepared in accordance with IFRS. These measures are presented and described in order to provide shareholders and potential investors with additional measures in understanding the Company's operating results in the same manner as the management team.

ADJUSTED OPERATING INCOME (LOSS)

Adjusted operating income (loss) is a non-IFRS financial measure which the Company uses to evaluate its operating performance. Adjusted operating income (loss) provides information to investors, analysts, and others to aid in understanding and evaluating the Company's operating results in a similar manner to its management team. The Company defines adjusted operating income (loss) as operating income (loss) less restructuring costs (recovery), goodwill and intangible asset impairments and asset impairments triggered by restructuring activities.

The following tables reconcile adjusted operating income (loss) to operating income (loss) for the periods noted.

FREE CASH FLOW

Free cash flow is a non-IFRS financial measure which the Company uses to evaluate its financial performance. Free cash flow provides information which management believes to be useful to investors, analysts and others in understanding and evaluating the Company's ability to generate positive cash flows as it removes cash used for non-operational items. The Company defines free cash flow as the total change in cash and cash equivalents less cash used for common share repurchases, dividends (if any), changes to debt instruments, changes to long-term investments, net cash used for acquisitions plus cash provided by dispositions (if any).

The following table reconciles free cash flow to change in cash and cash equivalents for the periods noted.

View original content to download multimedia: https://www.prnewswire.com/news-releases/sndl-reports-first-quarter-2024-financial-and-operational-results-302140910.html

SOURCE SNDL Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/09/c4983.html

Recommended Stories

Jeff bezos' most prized possession breaks historical auction records at almost $53 million.

Jeff Bezos amassed his wealth through Amazon stocks and owns hundreds of millions of dollars worth of real estate, but one of his most valuable possessions may surprise you: art. Among his collection is the renowned piece "Hurting the Word Radio #2 (1964)" by Ed Ruscha, purchased by Bezos for almost $53 million. This artwork, a prime example of Ruscha’s text-based paintings, stands as a signature piece in Bezos’ collection. As concerns over stock market volatility persist, the world’s wealthiest

Analyst adjusts Nvidia stock price target ahead of earnings

This is what could happen next to Nvidia shares.

Vultures Circle As Elon Musk Says This On Superchargers Following Layoffs

Tesla Chief Executive Elon Musk on Friday said the EV giant is spending half a billion dollars to build out its supercharger stations this year, even as the Tesla head recently dismissed the company's entire supercharger team. Musk took to the social media platform X early Friday claiming that Tesla will spend more than $500 million to expand its supercharger network and "create thousands" of new chargers in 2024. In the first quarter, Tesla supercharger stations totaled 6,249, up 26% vs. Q1 2023.

Nvidia Dethroned: This AI Chip Stock Now Rules This Elite Screen

Broadcom just ended the reign of Nvidia, usurping the top spot on this list of new buys by the best mutual funds.

Dow Jones Cuts Gains After Hot Inflation Data; Nvidia Rallies On Strong TSMC Sales

The Dow Jones cut its gains Friday after hot inflation data. Nvidia stock rallied on strong sales from TSMC on the stock market today.

Enbridge (ENB) Tops Q1 Earnings Estimates

Enbridge (ENB) delivered earnings and revenue surprises of 15.25% and 9.02%, respectively, for the quarter ended March 2024. Do the numbers hold clues to what lies ahead for the stock?

DJT Stock Is Rising. Trump’s Social Media Platform Is Losing Users.

Trump Media & Technology Group stock was rising early Friday as the former president’s high-profile court case continues in New York. The shares rose 1.1% in premarket trading to $55 after climbing 10% on Thursday—they’ve now gained 12% over the past 5 days. The stock has jumped around a lot since merging with a shell company to allow it to float on the stock market at the end of March, trading as high as $66 and as low as $23.

TSMC’s April Sales Jump 60% on Sustained Demand for AI Chips

(Bloomberg) -- Taiwan Semiconductor Manufacturing Co. saw April sales jump 60% to NT$236 billion ($7.3 billion) as sustained artificial intelligence demand was helped by the beginnings of a recovery in consumer electronics.Most Read from BloombergBiden Set to Hit China EVs, Strategic Sectors With TariffsAckman Scolded Over DEI Views at Closed-Door Milken SessionApple Apologizes for iPad Pro Ad, Scraps Plan to Air It on TVElon Musk Changes Tune on Tesla Superchargers After Mass FiringNovavax Soar

Energy Transfer Is Getting a Big Acquisition-Fueled Earnings Boost

Acquisitions are driving stronger-than-expected growth this year.

Adma Biologics (ADMA) Surpasses Q1 Earnings and Revenue Estimates

Adma Biologics (ADMA) delivered earnings and revenue surprises of 60% and 6.75%, respectively, for the quarter ended March 2024. Do the numbers hold clues to what lies ahead for the stock?

IMAGES

VIDEO

COMMENTS

This chapter introduces the general concepts of financial statement presentation and disclosure that underlie the detailed guidance that is covered in the remaining chapters of this guide. Menu. ... In addition, although not required for private companies, ASC 205-10-45-2 encourages comparative statements for all entities. ASC 205-10-45-2.

Comparative Statement: A comparative statement is a document that compares a particular financial statement with prior period statements or with the same financial report generated by another ...

Specific guidance on materiality and its application to the financial statements is included in paragraphs 29-31 of IAS 1 Presentation of Financial Statements. Preparers may also consider Practice Statement 2 Making Materiality Judgements, which provides guidance and examples on applying materiality in the preparation of financial statements.

Comparative Financial Statements, as the word suggests, are the statements that show the financial numbers of more than one year (consecutive periods) of an entity. Moreover, such a type of presentation allows the reader to compare the financial performance of the company with previous years. Generally, a company's comparative statements show ...

Approval by the Board of Classification of Liabilities as Current or Non-current—Deferral of Effective Date issued in July 2020. Classification of Liabilities as Current or Non-current—Deferral of Effective Date, which amended IAS 1, was approved for issue by all 14 members of the International Accounting Standards Board. Hans Hoogervorst.

Comparative financial statements are the complete set of that an entity issues, revealing information for more than one . The financial statements that may be included in this package are as follows: The income statement (showing results for multiple periods) The balance sheet (showing the financial position of the entity as of more than one ...

IAS 1 Presentation of Financial Statements ... Comparative information needs to be disclosed in respect of the previous period for all amounts reported in the financial statements, both on the face of the primary financial statements and in the notes, unless another Standard requires otherwise. Comparative information is provided for narrative ...

IAS 1 sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. It requires an entity to present a complete set of financial statements at least annually, with comparative amounts for the preceding year (including comparative amounts in the notes).

Overview. IAS 1 Presentation of Financial Statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such as going concern, the accrual basis of accounting and the current/non-current distinction. The standard requires a complete set of financial statements to comprise a ...

This chapter focuses on the importance of the presentation of financial statements. ASC 205-10-45-1 explains that the presentation of comparative financial statements in annual reports enhances the usefulness of such reports and brings out more clearly the nature and trends of current changes affecting the enterprise.

This module. This module focuses on the general requirements for presenting financial statements applying Section 3 Financial Statement Presentation of the IFRS for SMEs Standard. It introduces the subject and reproduces the official text along with explanatory notes and examples designed to enhance understanding of the requirements.

Under both IFRS Accounting Standards and U.S. GAAP, a complete set of financial statements consists of the following: a statement of financial position, a statement of profit or loss and OCI, a statement of cash flows, a statement of changes in shareholders' equity, and accompanying notes. The table below shows the key differences between the ...