Journal Press India ®

- Our Journals

- MANTHAN: Journal of Commerce and Management

- Vol 5, Issue 1, January - June 2018

- 10.17492/manthan.v5i01.13049

Literature Review of Life Insurance Markets: Developing a New Perspective to improve the Indian Market

Vol 5, Issue 1, January - June 2018 | Pages: 126-149 | Review paper

Published Online: June 15, 2018

- Author Affiliations

- Article Metrics

Author Details

Despite of being the second most populous country, India’s life insurance penetration and density (the two accepted parameters of performance) are low. To look at the causes of underperformance of this vital market, the existing literature needs to be reviewed. Thus the objective of this paper is to identify research gaps and to suggest an appropriate theoretical framework to study the market. An attempt has been made to review the existing literature in relation to foreign as well as Indian life insurance markets. The review of studies in relation to foreign markets clearly shows the difference in the approach to look at the market across the world and the Indian studies. The literature review reveals that most of the existing Indian studies are descriptive in nature looking only at the profile of companies, buyers; nature of products; comparison of public and private companies; service quality etc. However, in case of foreign studies, informational and behavioural aspects are studied in greater detail vis-à-vis the life insurance market focusing on phenomena like information asymmetry, heuristics and biases etc. There is no study till date that has focused on the informational aspects and bounded rationality with respect to Indian life insurance market. It is therefore suggested that Behavioural Economics framework is the appropriate theoretical framework that can help in identifying the causes of underperformance.

Life insurance; Information; Bounded rationality; Behavioural Economics

- Akerlof, G.A. (1970). The market for lemons: quality uncertainty and the market mechanism. The Quarterly Journal of Economics , 84(3), 488-500.

- Anagol, S, Cole, S. A. & Sarkar, S. (2013). Understanding the advice of commissions-motivated agents: evidence from the Indian life insurance market. Harvard Business School Finance Working Paper No . 12-055.

- Bodla, B.S. & Chaudhary, K. (2012). A study of service quality expected and perceived by the customers of ICICI prudential life insurance company. International Journal of Computing and Business Research (IJCBR ) , 3(2), 1-21.

- Brighetti, G., Lucarelli, C. & Marinelli, N. (2012). Rationality or 'gut feelings': What drives insurance demand? Retrieved from: http://ssrn.com/abstract= 2169940

- Buzatu, C. (2013) The influence of behavioural factors on insurance decision - a Romanian approach. Procedia Economics and Finance , 6, 31-40.

- Cawley, J. & Philipson, T. (1999). An empirical examination of information barriers to trade in insurance . American Economic Review, 89(4), 827-846.

- Chavare, D. T. (2012). A study of brand loyalty with special reference to life insurance corporation of India. international journal of marketing. Financial Services and Management Research , 1(2), 73-88.

- Clifford P.S., Joseph, A.D. & Barnabas, A. (2010). Study on socio economic status and awareness of Indian investors of insurance (Tamil Nadu). E-journal of Business and Economics Issues , V(III), 1-18.

- Cohen, A. & Siegelman, P. (2009). Testing for adverse selection in insurance markets. NBER WORKING PAPER SERIES. Retrieved from: http://www.nber.org/papers/15586 .

- Dar, A. A. (2012). Awareness of life insurance- a study of Jammu and Kashmir state. Shiv Shakti International Journal in Multidisciplinary and Academic Research (SSIJMAR) , 1(3), 1-13.

- Das, S. S. (2004). Role of Agents in competitive regime. The Journal, Insurance Institute of India, January-June , 50-52.

- Dash, G. (2012). An empirical study on the importance of ‘people’ (of 7ps) in life insurance marketing mix. International Journal of Marketing, Financial Services and Management Research , 1(5), 19-26.

- Dhanabhakyam, M. & Anitha, V. (2011). Intruders altering the perception of customers in the life insurance sector of India- a comparative study between public and private life insurance companies. International Journal of Research in Commerce and Management , 2(8), 97-101.

- Dutta, G., Basu, S. & Jose, J. (2008). Development of utility function for life insurance buyers in the Indian market. IIMA W.P. No. 2008-12-05.

- Einav, L. & Finkelstein, A. (2011). Selection in insurance markets: theory and empirics in pictures. NBER Working Paper 16723.

- Ernst & Young (2011). Fraud in insurance on rise survey 2010–11. Retrieved from: https://www.ey.com/Publication/vwLUAssets/Fraud_in_insurance_on_rise/$FILE/Fraud_in_insurance.pdf

- Ernst & Young (2012). Global consumer insurance survey. Retrieved from: https://www.ey.com/gl/en/industries/financial-services/insurance/global-insurance-customer-survey-findings-2012---india---rising-affluence-and-product-awareness

- Fang, H. & Kung, E. (2012). Why do life insurance policyholders lapse? The roles of income, health and bequest motive shocks. NBER Working Paper 17899.

- Finkelstein, A. & Poterba, J. (2004). Adverse selection in insurance markets: policyholder evidence from the U.K. annuity market. Journal of Political Economy , 112(1), 183-208.

- Gautam, V. & Kumar, M. (2012). A study on attitudes of Indian consumers towards insurance services. Management Research and Practice , 4(1), 51-62.

- Ghosh, A. (2010). Insurance revolution and the way ahead!! The Journal, Insurance Institute of India , XXXVI, 46-48.

- Ghosh, A. (2013). Does the insurance reform promote the development of life insurance sector in India? An empirical analysis. Journal of Asia Business Studies , 7(1), 31–43.

- Gottlieb, D. & Smetters, K. (2012). Narrow framing and life insurance. NBER Working Paper 18601.

- Gulati N. C. & Jain, C. M. (2011). Comparative analysis of the performance of all the players of the Indian life insurance industry. VSRD International Journal of Management and Research, 1(8), 561-569.

- Halan, M., Sane, R. & Thomas, S. (2013). Estimating losses to customers on account of mis-selling life insurance policies in India. Indira Gandhi Institute of Development Research, Mumbai, April 2013, WP -2013-007.

- Hedengren D. & Stratmann, T. (2012). Adverse vs. advantageous selection in life insurance markets. Retrieved from: http://ssrn.com/abstract=2194376

- Hendel, I. & Lizzeri, A. (2000). The role of commitment in dynamic contracts: evidence from life insurance. NBER Working Paper 7470.

- Huang, R.J., Muermann, A. & Tzeng, L.Y. (2008). Hidden regret in insurance markets: Adverse and advantageous selection . CFS Working Paper , 14.

- Jain, V. & Saini, B. (2012). Indian consumer demeanor for life insurance. International Journal of Research in Finance & Marketing , 2 ( 11), 29-35.

- Jain, D. (2012). Awareness towards various aspects of insurance: an empirical study in the state of Rajasthan. International Journal of Research in Commerce and Management , 3(9), 95-101.

- Jain, Y. (2013). Economic reforms and world economic crisis: changing Indian life insurance market place. IOSR Journal of Business and Management (IOSR-JBM) , 8(1), 106-115.

- Kannan, R., Sarma, K. P., Rao, A.V & Sarma, S.K (2008). Lapsation and its impact on Indian life insurance industry (2002-07). IRDA Occasional Paper, 1/2008.

- Karunagaran, A. (2006). Bancassurance: A feasible strategy for banks in India? Reserve bank of India Occasional Papers , 27(3), 125-162.

- Kaur, G. (2010). An empirical study on distribution channels of life insurance in India. Bimaquest , 10(2), 31-56.

- Kaur, P. & Negi, M. (2010). A study of customer satisfaction with life insurance in Chandigarh tricity. paradigm. The Journal of Institute of Management Technology, 14(2), 29-44.

- Koijen, R.S. J, Nieuwerburgh, S.V. & Motohiro, Y. (2011). Health and mortality delta: assessing the welfare cost of household insurance choice. NBER Working Paper 17325.

- Krishnamurthy, S., Mony, S.V., Jhaveri, N., Bakhshi, S., Bhat, R. & Dixit, M. R. (2005). Insurance industry in India: Structure, performance, and future challenges. Vikalpa, 30(3), 93-119.

- Krishnan, B. (2010). Claims management and claims settlements in life insurance. The Journal, Insurance Institute of India , XXXVI, 49-57.

- Kumar, J. (2008). Life insurance industry- past, present and future. Bimaquest , VIII(I), 41-55.

- Kunreuther, H., Pauly, M. V. & McMorrow, S. (2013). Insurance and behavioural economics: improving decisions in the most misunderstood industry . New York, U.S : Cambridge University Press.

- Kutty, S. (2008). Life insurance Vision 2010. Bimaquest , VIII(II), 1-10.

- Majumdar, N. (2010). How to increase Life insurance penetration in the next decade. The Journal, Insurance Institute of India, XXXVI, 58-75.

- McCarthy, D. & Mitchell, O. S. (2003). International adverse selection in life insurance and annuities. NBER Working Paper 9975.

- Mitra D & Ghosh, A (2010). Determinants of life insurance demand in India in the post economic reform era (1991-2008). International Journal of Business Management, Economics and Information Technology , 2(1), 19-36.

- Narula, S. (2012). Service quality: a study of life insurance industry in punjab. Thesis, Punjabi University, Patiala . Retrieved from: http://hdl.handle.net/10603/10357

- Palli, M. (2006). A study on assessing life insurance potential in India. Bimaquest , 6(2), 22-38.

- Popli, G. S. & Rao, D. N. (2009). An empirical study of bancassuarance: prospects & challenges for selling insurance products through banks in India. Retrieved from: http://ssrn.com/abstract=1339471

- Prabhakara, G. (2010). The evolution of life insurance industry in the last decade. The Journal, Insurance Institute of India, XXXVI, 3-10.

- Rothschild, M. & Stiglitz, J. (1976). Equilibrium in competitive insurance markets: An essay on the economics of imperfect information. The Quarterly Journal of Economics , 90(4), 629-649.

- Sen, S. (2008). An analysis of life insurance demand determinants for selected Asian economies and India. Madras School of Economics, Working paper 36/2008.

- Shah, A., Mehrotra, P. & Goyal, R. (2011). India-insurance, turning 10, going on 20. The Boston Consulting Group . Retrieved from: http://image-src.bcg.com/Images/India-Insurance-Apr-2011_tcm21-142118.pdf

- Sharma, R. (2012). A comparative study on deliveries of service on life insurance sector: India vs. China. Research Journal of Social Science and Management, 1(11), 7-12.

- Siddiqui, M. H., Khand, V. & Sharma, T.G. (2010). Measuring the customer perceived service quality in life insurance services-an empirical investigation. International Business Research , 3(3), 171-186.

- Singh, B. K. (2009). Empirical study on perception of consumers in insurance sector. E-Journal of Business and Economics Issues , 4(3), 1-17.

- Singh, H. & Lall, M. (2011). An empirical study of life insurance product and services in rural areas. International Journal of Multidisciplinary Research , 1(8), 290-305.

- Tiwari, A. & Yadav, B. (2012). Analytical study on Indian life insurance industry in post liberalization. International Journal of Social Science Tomorrow , 1(2), 1-10.

- Vellakkal, S. (2009). Adverse selection and private health insurance coverage in India: A rational behaviour model of insurance agents under asymmetric information. Indian Council for Research on International Economic Relations, Working paper no. 233.

- Venkatesan, G. A. & Raman, R.S. (2013). SWOT Analysis of life insurance corporation in India – an overview. Indian Streams Research Journal , 3(3), 1-6.

Suggested Citation

By continuing to use this website, you consent to the use of cookies in accordance with our Cookie Policy.

Risk Prediction in Life Insurance Industry Using Machine Learning Techniques—A Review

- Conference paper

- First Online: 23 September 2023

- Cite this conference paper

- Prasanta Baruah 12 &

- Pankaj Pratap Singh ORCID: orcid.org/0000-0003-4079-4485 12

Part of the book series: Lecture Notes in Networks and Systems ((LNNS,volume 755))

Included in the following conference series:

- International Conference on Advances in IoT and Security with AI

165 Accesses

1 Citations

Technological advancement has resulted in producing a large amount of unprocessed data. Data can be collected, processed, analyzed, and stored rather inexpensively. This capability has enabled to make innovations in banking, insurance, financial transactions, health care, communications, Internet, and e-commerce. Risk management is an integral part of the insurance industry as the risk levels determine the premiums of the insurance policies. Usually, insurance companies claim higher premiums from the insurance policy holders having higher risk factors. The higher the accuracy of risk evaluation of an applicant for a policy, the better is the accuracy in the pricing of the premium. Risk classification of customers in insurance companies plays an important role. Risk classification is based on the grouping of customers on the basis of their risk levels calculated by using machine learning algorithms on historical data. Evaluation of risk and calculation of premium are the function of underwriters.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Sivarajah U, Kamal M, Irani Z, Weerakkody V (2017) Critical analysis of big data challenges and analytical methods. J Bus Res 70:263–286

Article Google Scholar

Joly Y, Burton H, Irani Z, Knoppers B, Feze I, Dent T, Pashayan N, Chowdhury S, Foulkes W, Hall A, Hamet P, Kirwan N, Macdonald A, Simard J, Hoyweghen I (2014) Life Insurance: genomicsStratification and risk classification. Eur J Hum Genet 22:575–579

Umamaheswari K, Janakiraman D (2014) Role of data mining in Insurance Industry. Int J Adv Comput Technol 3:961–966

Google Scholar

Fan C, Wang W (2017) A comparison of underwriting decision making between telematics-enabled UBI and traditional auto insurance. Adv Manag Appl Econ 7:17–30

Goleiji L, Tarokh M (2015) Identification of influential features and fraud detection in the Insurance Industry using the data mining techniques (Case study: automobile’s body insurance). Majlesi J Multimed Process 4:1–5

Joudaki H, Rashidian A, Minaei-Bidgoli B, Mahmoodi M, Geraili B, Nasiri M, Arab M (2016) Improving fraud and abuse detection in general physician claims: a data mining study. Int J Health Policy Manag 5:165–172

Nian K, Zhang H, Tayal A, Coleman T, Li Y (2016) Auto insurance fraud detection using unsupervised spectral ranking for anomaly. J. Fin Data Sci. 2:58–75

Bell M, Is analytics the underwriting we know?, https://insurance-journal.ca/article/is-analytics-changing-theunderwriting-we-know . Accessed 16 December 2016

Fang K, Jiang Y, Song M (2016) Customer profitability forecasting using big data analytics: a case study of the insurance industry. Comput Ind Eng 101:554–564

Cummins J, Smith B, Vance R, Vanderhel J (2013) Risk classificaition in life insurance, 1st edn. Springer, New York

Bhalla A (2012) Enhancement in predictive model for insurance underwriting. Int J Comput Sci Eng Technol 3:160–165

Dwivedi S, Mishra A, Gupta A (2020) Risk prediction assessment in life insurance company through dimensionality reduction method. Int J Sci Technol Res 9:1528–1532

Maier MC, Hayley Sanchez F, Balogun S, Merritt S (2019) Transforming underwriting in the life insurance industry. Assoc Adv Artif Intell 31:9373–9380

Noorhannah B, Jayabalan M (2019) Risk prediction in life insurance industry using supervised learning algorithms. Complex Intell Syst 4:145–154

Batty M, Tripathi A, Kroll A, Sheng Peter Wu C, Moore D, Stehno C, Lau L, Guszcza J, Katcher M (2010) Predictive modeling for life insurance. Deloitte Consulting LLP

Hutagaol BJ, Mauritsius T (2020) Risk level prediction of life insurance applicant using machine learning. Int J 9:2213–2220

Mustika WF, Murfi H, Widyaningsih Y (2019) Analysis accuracy of XGBoost model for multiclass classification—a case study of applicant level risk prediction for life insurance. In: 5th International Conference on science in information technology (ICSITech), pp 71–77. IEEE, Yogyakarta, Indonesia

Jain R, Alzubi JA, Jain N, Joshi P (2019) Assessing risk in life insurance using ensemble learning. J Intell Fuzzy Syst 37:2969–2980

Boodhun N, Jayabalan M (2018) Risk prediction in life insurance industry using supervised learning algorithms. Complex Intell Syst. 4:145–154

Biddle R, Liu S, Tilocca P, Xu G (2018) Automated underwriting in life insurance: Predictions and optimisation. In: Wang J, Cong G, Chen J, Qi J (eds) Databases Theory and Applications: 29th Australasian Database Conference, ADC 2018, vol 10837. Lecture Notes in Computer Science. Springer, Cham, pp 135–146

Chapter Google Scholar

Prabhu T, Darshana J, Dharani kumar M, Hansaa Nazreen M (2019) Health risk prediction by machine learning over data analytics. Int Res J Eng Technol 6:606–611

Franch-Pardo IM, Napoletano B, Rosete-Verges F, Billa L (2020) Spatial analysis and GIS in the study of COVID-19. A review. Sci Total Environ 739:140033

Saran S, Singh P, Kumar V, Chauhan P (2020) Review of geospatial technology for infectious disease surveillance: use case on COVID-19. J Indian Soc Remote Sens 48:1121–1138

Zhong H, Xiao J (2017) Enhancing health risk prediction with deep learning on big data and revised fusion node paradigm. Scientific Programming

Download references

Author information

Authors and affiliations.

Central Institute of Technology Kokrajhar, Assam, India

Prasanta Baruah & Pankaj Pratap Singh

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Pankaj Pratap Singh .

Editor information

Editors and affiliations.

Department of Electronics, Deen Dayal Upadhyaya College, University of Delhi, New Delhi, India

Anurag Mishra

Department of Computer Science and Engineering, MNNIT Allahabad, Prayagraj, India

Deepak Gupta

Faculty of Science and Technology, University of Canberra, Bruce, ACT, Australia

Girija Chetty

Rights and permissions

Reprints and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper.

Baruah, P., Singh, P.P. (2023). Risk Prediction in Life Insurance Industry Using Machine Learning Techniques—A Review. In: Mishra, A., Gupta, D., Chetty, G. (eds) Advances in IoT and Security with Computational Intelligence. ICAISA 2023. Lecture Notes in Networks and Systems, vol 755. Springer, Singapore. https://doi.org/10.1007/978-981-99-5085-0_31

Download citation

DOI : https://doi.org/10.1007/978-981-99-5085-0_31

Published : 23 September 2023

Publisher Name : Springer, Singapore

Print ISBN : 978-981-99-5084-3

Online ISBN : 978-981-99-5085-0

eBook Packages : Intelligent Technologies and Robotics Intelligent Technologies and Robotics (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

Genetic discrimination and life insurance: a systematic review of the evidence

1 Department of Human Genetics, Faculty of Medicine, McGill University, 740 Dr Penfield Avenue, Suite 5200, Montreal, H3A 1A5 Canada

Ida Ngueng Feze

Jacques simard.

2 Department of Molecular Medicine, Faculty of Medicine, Laval University, 2705 Boulevard Laurier, Quebec City, G1V 4G2 Canada

Since the late 1980s, genetic discrimination has remained one of the major concerns associated with genetic research and clinical genetics. Europe has adopted a plethora of laws and policies, both at the regional and national levels, to prevent insurers from having access to genetic information for underwriting. Legislators from the United States and the United Kingdom have also felt compelled to adopt protective measures specifically addressing genetics and insurance. But does the available evidence really confirm the popular apprehension about genetic discrimination and the subsequent genetic exceptionalism?

This paper presents the results of a systematic, critical review of over 20 years of genetic discrimination studies in the context of life insurance.

The available data clearly document the existence of individual cases of genetic discrimination. The significance of this initial finding is, however, greatly diminished by four observations. First, the methodology used in most of the studies is not sufficiently robust to clearly establish either the prevalence or the impact of discriminatory practices. Second, the current body of evidence was mostly developed around a small number of 'classic' genetic conditions. Third, the heterogeneity and small scope of most of the studies prevents formal statistical analysis of the aggregate results. Fourth, the small number of reported genetic discrimination cases in some studies could indicate that these incidents took place due to occasional errors, rather than the voluntary or planned choice, of the insurers.

Important methodological limitations and inconsistencies among the studies considered make it extremely difficult, at the moment, to justify policy action taken on the basis of evidence alone. Nonetheless, other empirical and theoretical factors have emerged (for example, the prevalence and impact of the fear of genetic discrimination among patients and research participants, the (un)importance of genetic information for the commercial viability of the private life insurance industry, and the need to develop more equitable schemes of access to life insurance) that should be considered along with the available evidence of genetic discrimination for a more holistic view of the debate.

The prototypical issue used when discussing the ethical, legal and social issues associated with scientific progress in genetics has been genetic discrimination (GD). Lawyers and ethicists have been quick to point out the risk that uninhibited genetic progress would entice governments and institutions to treat people differently on the basis of their genetic constitution [ 1 ]. GD has been defined in many ways, a mark of the influence of divergent sociocultural and scholarly backgrounds. Insurers write of 'rational (actuarial)-irrational discrimination' [ 2 ], lawyers write of 'legal-illegal (illicit) discrimination' [ 3 ], whereas patients generally adopt a much broader definition encompassing all differential, negative treatments of an individual based on his or her genetic makeup [ 4 ]. However defined, widespread GD could potentially result in practices that exclude segments of the population from access to basic social necessities such as healthcare, insurance, housing, reproductive freedom and employment. Mass media has joined the debate, ensuring that the issue of GD is not confined to isolated academic discourse [ 5 ].

Among the fields of potential discrimination, one of the most commonly-debated topics has been the use of genetic information by the insurance industry to select applicants and determine insurance premiums. The dual nature of personal insurance, which is partly considered as both a public and private good in most jurisdictions, and the relatively limited amount of public trust in the practices of the private insurance sector might explain some of this attention. Policymakers themselves have entered the arena of debate following substantial pressure from their constituents. In continental Europe, the legislative response has been swift and strong. GD is prohibited by the Convention on Biomedicine (1997), the Charter of Fundamental Rights of the European Union (2000), and the national legislation of many individual countries [ 6 ]. In the United States, the much-discussed Genetic Information Nondiscrimination Act of 2008 ( GINA ) (2008) offers protection mainly in the domains of health insurance and employment [ 7 ]. In the United Kingdom, the Association of British Insurers and the British government have agreed on a Concordat and Moratorium on Genetics and Insurance that significantly restricts the capacity of British insurers to request genetic information from insurance applicants [ 8 ]. Australian (2008 amendment to the Disability Discrimination Act ), Canadian and East Asian policymakers have also been active in this area, although less so than their European counterparts [ 6 , 9 ].

This paper focuses on GD in the field of life insurance. Life insurance facilitates the economic security of the policy holder. It is often described as a quasi-essential social good, a gateway good necessary to have access to important social and economic activities that provide considerable peace of mind to the policyholder [ 10 ]. Access to life insurance is far from universal and it must generally be purchased through a contractual agreement with a private insurance company. The majority of life insurance applicants are accepted at a standard rate set by insurance companies. Nevertheless, for the small group of individuals excluded from the common pool, the consequences can be dire [ 11 ].

Is the substantial attention given to the question of GD in academic literature, popular media and policymaking circles justified by the empirical evidence currently available? In other words, are the observed concerns and responses based on documented cases of discrimination, anecdotes or other less visible factors? This question prompted us to undertake a study, which to our knowledge is the first attempt to systematically review all available empirical evidence of GD using the life insurance sector as a subject of analysis. This study analyzes actual cases of discrimination, the evidentiary limitations, and the possibility of drawing overarching conclusions from the available evidence.

To assess the state of the evidence, we looked for all studies published in the scientific literature documenting the occurrence of GD in the context of life insurance.

Selection of publications

We developed and applied the following inclusion criteria to identify and select eligible studies: published in English; focused on the collection or capture of information on the occurrence of GD in life insurance whether direct (through patients' or participants' self-report, such as interviews or surveys) or indirect (through professionals such as doctors, genetic counselors and insurers); focused on a primary or follow-up study (multiple publications on the same study were grouped together and treated as a single study). Narrative and systematic reviews were included only if they also presented additional empirical data on the occurrence of GD in the context of life insurance (that is, other than the data contained in the studies reviewed therein).

Eligible studies were excluded if: they did not focus in whole or part on the occurrence of GD in the context of life insurance; they offered insufficient evidence; or they contained serious methodological flaws. Editorial letters with no primary data, comments, opinions, abstracts and unpublished studies were excluded. Studies capturing the fear of GD rather than actual experiences were also excluded.

Literature search

Searches were conducted from March until May 2012 on PubMed, Google Scholar, Social Science Research Network and Hein Online, using the Boolean operators 'OR' and 'AND' with various permutations of the following keywords: 'genetic discrimination', 'study', 'life insurance', 'survey', 'data', 'empirical evidence' and 'genetic test'.

First, we conducted keyword searches that produced a list including 534 search results. Using the terms 'genetic discrimination' and 'life insurance' combined ('AND'), we obtained a list of 29 publications from the database PubMed. We executed a search on Google Scholar including all the following keywords combined ('AND'): 'genetic discrimination', 'study', 'life insurance', 'survey', 'data' and 'empirical evidence'. This produced 155 search results. Our search on Social Science Research Network using the terms 'genetic discrimination' yielded 100 results. Our last search was conducted on Hein Online using the following combination of terms '("genetic discrimination" AND "life insurance") AND "genetic test" OR "data" OR "empirical evidence" OR "survey"', and generated 250 results.

Second, applying our selection criteria, we reviewed the titles and available abstracts of each of the 534 search results identified through our keyword searches, and retained 29 publications.

Third, we performed a systematic hand search in the references list and bibliography of each of the 29 articles to identify additional relevant publications and assess cross-referencing. This led to 16 more eligible studies. Hence, we uncovered a total of 45 eligible studies relevant to GD in the context of life insurance.

Thereafter, eligible studies were each independently assessed for relevance by two researchers (YJ, INF). Applying the selection criteria above, we retained studies documenting experiences of discrimination through both direct and indirect evidence on the occurrence of GD. Based on these criteria, 12 studies were excluded. This final list was also compared with references and resources provided by a recent review dealing with GD in numerous contexts including life insurance [ 9 ]. The 33 studies retained represent a systematic overview of the empirical evidence of GD in the field of life insurance. For an overview of the search strategy, see Figure Figure1 1 .

Methodology for selecting eligible studies .

Data extraction

The vastly different nature of the available studies suggested that formal statistical analysis and comparison of discrimination cases would be inappropriate. Instead, we analyzed the data through a social science comparative approach that incorporates both quantitative descriptive analysis and qualitative content analysis. Key elements of the selected studies were coded independently according to their relevance to pre-selected themes. We extracted information on study scope (country and context), genetic conditions (whether the study focused on a single or multiple conditions), definition of GD (how GD was construed by the researchers), validation (whether a formal validation process was disclosed by the authors), conclusions (how results were qualified: whether evidence of GD was found, whether policies or laws were required), and number of citations (how often the publication was cited by peers). Two trained researchers (YJ, INF) independently evaluated the results and discrepancies were resolved by consensus. Results obtained on individual themes were qualitatively analyzed and, where appropriate, converted to statistical data (values were rounded according to convention; this process was based on the information presented in Table Table1 1 [ 12 - 44 ]).

Revised studies.

a 1 = exist and is a concern; 2 = limited, present only marginal concern; 3 = no evidence; GD: genetic discrimination.

Results and discussion

Scope and context.

Together, the 33 studies represent two decades' worth of research published from 1991 to 2012 (see Table Table1). 1 ). A small peak in the number of studies (eight studies) can be identified between 2006 and 2007, which can be linked to the charged political climate in the US and renewed academic interest that prefaced the adoption of GINA . These studies generally gathered evidence through direct sources (that is, individuals commenting on their own experience with insurance companies), but some obtained their data through secondary sources such as insurers, insurance associations, health professionals or patient groups.

The majority of studies reviewed (73%) aimed at providing evidence of GD in a variety of fields (for example, employment, immigration, adoption and access to healthcare), including that of life insurance. A minority (27%) focused exclusively on the context of life insurance (see Table Table1). 1 ). The majority of the available evidence (58%) comes from studies involving North American population groups (see Figure Figure2 2 and Table Table2 2 ).

Studies on genetic discrimination and life insurance by country .

Distribution of results on the evidence of genetic discrimination.

a Out of 33. GD: genetic discrimination.

Surprisingly, given the rather strong European policy response mentioned above, only six studies (18%) provided empirical data on the situation prevailing in continental Europe, and five of these studies were very specific in nature, addressing the context of familial hypercholesterolemia and hypertrophic cardiomyopathy in the Netherlands, hereditary breast and colorectal cancer in Norway, and Huntington's disease in Germany [ 24 , 38 , 40 , 44 ].

The substantial number of studies carried out in Canada (seven studies), where no specific laws have been adopted to limit the use of genetic information by life insurers, and the absence of studies in a highly legislated European context, could suggest that the number of GD studies carried out in a given country, as well as the number of GD cases reported, does not necessarily have a strong correlative impact on policymaking. A notable exception to this trend could be Australia, whose Disability Act was amended following the publication of major studies on GD and an extensive report from the Australian Law Reform Commission [ 45 ].

Genetic conditions investigated

The mitigated overall results are not easily interpretable and the task is exacerbated by the serious methodological challenges faced in some of these studies. One of the constraints concerns the range of genetic diseases investigated in the literature. Reviewing the scope of the 33 studies, it is apparent that they only uncovered evidence on a very limited number of highly penetrant, familial, adult-onset, relatively well-known genetic conditions.

The majority of the evidence is based on the following five conditions: Huntington's disease, hereditary breast and ovarian cancer, hemochromatosis, familial hypercholesterolemia and hereditary colorectal cancer (see Figure Figure3). 3 ). Of the 33 studies reviewed, 19 (58%) specifically focus on one of these five conditions (see Figure Figure4). 4 ). Moreover, evidence on genetic discrimination in the context of Huntington's disease is provided in over 14 of the 33 studies, and on hereditary breast and ovarian cancer in more than 10 (see Figure Figure3 3 ).

Most studied genetic conditions in genetic discrimination and life insurance studies .

Proportion of studies that focused on a single disease .

The high number of studies focusing on a single condition (see Figure Figure4) 4 ) makes it particularly difficult to generalize from the results of a systematic comparison of the literature to reach a broad, robust conclusion on GD applicable to the whole research or clinical genetic context. Moreover, research on GD in the fields of personalized medicine and/or pharmacogenomics, infectious diseases and genome-wide association studies remains absent in the literature, thereby resulting in a complete lack of data on GD in the context of emerging 'omics' research. This is particularly concerning given that the amount of genomic information in the typical individual's medical record is likely to increase tremendously in the next few years as whole-genome sequencing costs are reduced and personalized medicine becomes more common in clinical settings [ 46 ].

Definition of genetic discrimination

The authors of the 33 studies all struggled with the meaning of GD (examples of GD definitions are provided in Table Table3). 3 ). Several studies refrained from using the term 'genetic discrimination' in their questionnaire so as to avoid biasing responses. However, the paradoxical consequence of this methodological approach was over-reporting due to the tendency of participants to declare any negative outcome they faced while applying for life insurance as an instance of discrimination [ 47 ]. When specifically included in survey questionnaires or data analysis strategies, the definition of GD varied widely (see Table Table3), 3 ), greatly reducing the possibility of meaningful comparison. Indeed, the challenge of defining GD led a study author to conclude that '[t]he notion of finding wholly objective and overt evidence, as opposed to subjective and implicit accounts of discrimination may [n]ot be entirely realistic' [ 42 ]. Studies choosing to adopt a broad definition, or no definition at all, tended to report the highest incidence of GD cases [ 36 ]. Studies using a legal definition of GD obtained lower results [ 3 ]. But, because laws on this topic vary significantly across jurisdictions, these studies are difficult to compare or integrate with one another outside of their national context.

Examples of definitions of genetic discrimination.

To obtain more robust and comparable results, some studies have used the criteria of 'irrational discrimination' - discrimination that is not based on scientifically validated and actuarially relevant genetic information - as a selection criterion to assess the practice of insurers. However, because negative decisions by life insurers against some of the most genetically at-risk individuals who might have pressing need to obtain life insurance (for example, an asymptomatic patient having tested positive for a monogenic dominant serious condition) would not necessarily constitute irrational GD, use of this criterion could arguably be perceived as unethical. The partly subjective nature of the underwriting process (illustrated by the high variability between the guidelines and questionnaires used by different insurance companies) and our limited knowledge of the genomics of complex diseases further limit the use of the rationality criterion to determine objectively the prevalence of GD in insurance.

The context of Huntington's disease can be used to illustrate the impact of definitional choices on the results of GD studies. Because this disease is a relatively well-known autosomal dominant genetic condition, obtaining a positive test result has serious implications for the future health of an asymptomatic individual. This explains the life insurers' interest in being able to use test results or family history information, regarding this particular disease, for underwriting. This is in turn reflected in the results of GD studies. Studies investigating GD in the context of Huntington's disease and using a broad definition of GD or no definition at all would likely identify a significant number of GD cases (exclusion, higher premiums or conditional acceptance). However, studies using a rationality or legality criteria would generally report a much lower number of discrimination incidents.

Evidence of genetic discrimination

Around half of the studies reviewed (48%) found that, although GD had some empirical basis, its incidence was rare and it was not a significant source of insurance denials [ 4 , 14 , 16 , 17 , 19 - 22 , 27 , 31 , 39 , 40 , 42 , 44 ]. A second category, comprising a considerable number of studies (42%), concluded that the existence of GD in life insurance was documented by the evidence they provided and that the situation gave grounds for serious concern. Within this category, Huntington's disease came up often [ 36 - 38 , 43 ]. Early US studies in this category often advocated the adoption of laws and policies to prohibit access to genetic information by life insurers [ 17 ] or the development of a more generous public insurance system that would provide a minimum amount of life insurance to all applicants [ 16 ]. Finally, a minority of studies (9%) found no empirical evidence to support the existence of GD in the life insurance context.

It should be mentioned that some, but not all, of the countries covered by these studies, have already adopted laws prohibiting insurers' access to genetic information (for example, the Netherlands, Norway, and Germany) (see Table Table1). 1 ). Authors of the 9% of studies finding no empirical evidence of GD were often of the opinion that the GD problem was more linked to media hype and fear of discrimination than to GD itself. These studies consequently pointed out the importance of educating the public and reassuring the concerns of patients and research participants about GD [ 22 , 40 ].

Among the 19 studies dealing with a single genetic condition (see Table Table2), 2 ), a significant number of studies (47%) concluded that there was sufficient evidence to raise serious concerns about GD. Half of these studies concerned Huntington's disease [ 36 - 38 , 43 ]. A second important category (42%) found that, while GD existed, it was of rare occurrence [ 19 , 31 , 39 , 40 , 44 ]. Finally, a minority of studies (11%) concluded there was no evidence of GD [ 25 , 28 ].

To highlight the broad trends, it is possible to further group the 33 reviewed studies into two categories: a majority of studies (58%) that believes that GD in the context of life insurance is a negligible issue that does not warrant the substantial societal debate and policy concern generated to date, while a substantial minority (42%) concludes that GD exists and has impacted access to life insurance negatively.

Validation and methodological limitations

Validating the study results (that is, avoiding biases and concealments as well as ensuring that the data reflect cases of 'real' rather than 'perceived' discrimination) was another significant hurdle. For the purpose of our research, validation was considered to be any additional independent step(s) or method(s) taken by the researcher to confirm the accuracy of reported discrimination events. A majority of the reviewed studies (76%) could not be considered as validated (see Table Table1 1 and and2); 2 ); in this case it seems more accurate to talk about studies assessing the 'perceived' level of GD rather than objective manifestations of it. Testifying to the importance of the validation process, Wertz found that, '[W]hen asked to give details of their refusals, almost all [participants] described situations that are characteristic of general insurance practice. They were apparently objecting to what they perceived as unfair insurance practices in general, rather than practices specific to genetics.' [ 20 ].

Studies of patients were not the only ones in which investigators noted the importance of verifying findings. Otlowski et al. observed that insurers surveyed on the topic of GD were likely to under-report unfavorable underwriting decisions [ 3 ].

To attempt to reduce the biases associated with non-validated results, several verification techniques have been used over the years. They include follow-up phone calls or in-person interviews to elicit additional information about reported cases of discrimination; review of the participant's medical file (to verify if an unfavorable decision could be due to a pre-existing condition); audit of the documentation or correspondence relating to any discrimination complaint; corroboration of discrimination reports by independent sources (ombudsman or similar administrative instances); case law; and so on. These validation techniques were used, alone or in combination, with various degrees of rigor by researchers and these choices significantly impacted the results of the reviewed studies.

Other study limitations that impacted the results and their compatibility with one another included the sample size and type of people surveyed. Some studies would include individuals already affected by a genetic disease but asymptomatic [ 16 ], whereas others would include healthy carriers [ 30 ]. Some would include asymptomatic untested individuals with a family history of disease [ 37 ], and some would include information on patients that was obtained from indirect sources (family members, genetic counselors or members of a disease support group) [ 21 ]. The lack of large-scale studies of well-characterized individuals also made it difficult to extrapolate from the results to objectively estimate the prevalence of GD in the life insurance sector.

Treloar and colleagues have written that, 'conceptualizing, investigating and verifying individual's experience of genetic discrimination constitute a challenging endeavour' [ 47 ]. Discrimination surely can take many subtle forms. For example, rather than charging a higher premium or excluding an applicant, an insurance company could decide to process an application more slowly or ignore phone calls and emails in the hope of discouraging pursuit of the application process. In this case, the applicant might not even be aware that she or he has been discriminated against.

Given these serious challenges, it should come as no surprise that the five most influential studies on GD within academia, as measured by Web of Science and Google Scholar citation rates (see Table Table4), 4 ), all suffer from important limitations. For example, the most cited article on GD in life insurance, a precursor 1992 pilot study by Billings et al. , used a broad definition of GD and reported 29 responses describing 41 separate incidents of possible discrimination (32 in the field of insurance) [ 13 ]. The study undertook an extensive advertising campaign (1,119 letters mailed to genetic professionals, an advertisement in the American Journal of Human Genetics, and similar advertisements published in several patient organization newsletters) to elicit this relatively small number of potential discrimination cases from an under-defined population that included symptomatic respondents. The authors of the study acknowledged the limitations of their work stating that it is not meant to demonstrate the prevalence or the full range of discriminatory practices. Nevertheless, their conclusion that unfair and discriminatory use of genetic data existed and that new laws and sanctions should be considered does not seem to accord with the limited data and exploratory methodology provided in the study. Learning from early experiences and challenges in this field, more recent studies tend to draw more cautious or qualified conclusions and to recognize their own substantial methodological limitations [ 32 ].

Most cited studies on genetic discrimination in life insurance.

Conclusions

This systematic review offers evidence that the literature recognizes the existence of incidents of GD in North America, Australia and the UK. We note four key observations. First, the methodology used in most of the studies is not sufficiently robust to clearly establish either the prevalence or impact of discriminatory practices in these regions. Second, the current body of evidence was mostly developed around a very small number of 'classic' genetic conditions. Third, the heterogeneity and small scope of most of the studies prevent formal statistical analysis of the aggregate results. Fourth, the small number of reported cases of GD in some studies could indicate that these incidents of GD took place due to error(s), rather than voluntary or planned choice, of the insurers.

These observations should not be interpreted as dismissing the importance of the significant work that has been accomplished by researchers in this field over the past 20 years. Our review has allowed us to confirm the existence of GD, to identify large areas of evidentiary gaps (for example, discrimination in the context of 'omics' studies) and methodological challenges (defining GD, verification of reported incidents of GD), and to identify promising methodologies to build upon for future studies such as the one used for the Australian Genetic Discrimination Project. In this project, a rich body of evidence was gathered from a variety of sources with special attention given to validation and methodological concerns [ 3 , 32 , 33 , 47 ]. This information can be used by the international research community to continue monitoring and documenting experiences of GD and its psychosocial and economic impact on individuals with improved, more streamlined research strategies.

To return to our original question, can the intense debate around GD in the life insurance context that has taken place this past quarter-century be justified on the basis of the available evidence? We must answer in the negative. With the notable exception of studies on Huntington's disease, none of the studies reviewed here (or their combination) brings irrefutable evidence of a systemic problem of GD that would yield a highly negative societal impact. From an ethical and policy standpoint, looking at the evidence alone suggests that targeted policies (in the case of Huntington's disease) and careful monitoring of the situation as it evolves is likely the most adequate course of action.

Nonetheless, other empirical and theoretical factors have emerged that should be considered along with this empirical data. They include the prevalence and impact of the fear of GD in patients and research participants, the importance (or not) of genetic information for the commercial viability of the private life insurance industry, and the need to develop more equitable schemes of access to life insurance. These factors, along with sociocultural and historical elements linked to particular societies (such as early experience with eugenics), would likely offer a better explanation as to why the GD debate became so polarized in popular and academic media. Finally, we wish to highlight that it remains to be determined whether the current GD dilemma is a sign of a broader discomfort with actuarial practices, public policies and access to life insurance at a time when many increasingly view this type of contractual protection as a good of important psychosocial value that is necessary to obtain other important social and commercial goods in post-industrial countries.

Competing interests

The authors declare that they have no competing interests.

Authors' contributions

YJ provided the concept of the study and drafted the manuscript. INF participated in the research and assisted with drafting the manuscript. JS provided comments on the concept of the study and the draft of the manuscript. All authors read and approved the final manuscript.

Pre-publication history

The pre-publication history for this paper can be accessed here:

http://www.biomedcentral.com/1741-7015/11/25/prepub

Acknowledgements

The authors would like to acknowledge the financial support of the Ministère du Développement économique, de l'Innovation et de l'Exportation (Quebec) and the Canadian Institutes of Health Research.

- Lee C. Creating a genetic underclass: the potential for genetic discrimination by the health insurance industry. Pace Law Rev. 1993; 13 :189–228. [ PubMed ] [ Google Scholar ]

- Nowland W. Human genetics. A rational view of insurance and genetic discrimination. Science. 2002; 297 :195–196. doi: 10.1126/science.1070987. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Otlowski M, Barlow-Stewart K, Taylor S, Stranger M, Trealoar S. Investigating genetic discrimination in the Australian life insurance sector: the use of genetic test results in underwriting, 1999-2003. J Law Med. 2007; 14 :367–396. [ PubMed ] [ Google Scholar ]

- Low L, King S, Wilkie T. Genetic discrimination in life insurance: empirical evidence from a cross sectional survey of genetic support groups in the United Kingdom. BMJ. 1998; 317 :1632–1635. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Cohen A. Can you be fired because of your genes? Time Ideas. 2012. http://ideas.time.com/2012/02/20/can-you-be-fired-for-your-genes/

- Rothstein MA, Joly Y. In: The Handbook of Genetics and Society: Mapping the New Genomic Era. Atkinson P, Glasner P, Lock M, editor. London: Routledge; 2009. Genetic information and insurance underwriting: contemporary issues and approaches in the global economy insurance; pp. 127–144. [ Google Scholar ]

- Rothstein MA. GINA's beauty is only skin deep. Gene Watch. 2009; 22 :9–12. [ Google Scholar ]

- Thomas R. Genetics and insurance in the United Kingdom 1995-2010: the rise and fall of "scientific" discrimination. New Genetics and Society. 2012; 31 :203–222. doi: 10.1080/14636778.2012.662046. [ CrossRef ] [ Google Scholar ]

- Otlowski M, Taylor S, Bombard Y. Genetic discrimination: international perspectives. Annu Rev Genomics Hum Genet. 2012; 13 :433–454. doi: 10.1146/annurev-genom-090711-163800. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- O'Neil M. Genetic information, life insurance and social justice. The Monist. 2006; 89 :567–592. [ Google Scholar ]

- Knoppers BM, Joly Y. Physicians, genetics and life insurance. CMAJ. 2004; 170 :1421–1423. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Neil HAW, Mant D. Cholesterol screening and life assurance. BMJ. 1991; 302 :891–893. doi: 10.1136/bmj.302.6781.891. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Billings P, Khon M, De Cuevas M, Beckwith J, Alper J, Natowicz M. Discrimination as a consequence of genetic testing. Am J Hum Genet. 1992; 50 :476–482. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- McEwen JE, McCarthy K, Reilly PR. A survey of state insurance commissioners concerning genetic testing and life insurance. Am J Hum Genet. 1992; 51 :785–792. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- McEwen JE, McCarthy K, Reilly PR. A survey of medical directors of life insurance companies concerning use of genetic information. Am J Hum Genet. 1993; 55 :33–45. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Alper J, Geller L, Barash C, Billings P, Laden V, Natowicz M. Genetic discrimination and screening for hemochromatosis. J Public Health Policy. 1994; 15 :345–358. doi: 10.2307/3342910. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Geller L, Alper J, Billings P, Barash C, Beckwith J, Natowicz M. Individual, family, and societal dimensions of genetic discrimination: a case study analysis. Sci Eng Ethics. 1996; 2 :71–88. doi: 10.1007/BF02639319. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Lapham EV, Kozma C, Weiss JO. Genetic discrimination: perspectives of consumers. Science. 1996; 274 :621–624. doi: 10.1126/science.274.5287.621. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Rodriguez-Bigas MA, Vasen HF, O'Malley L, Rosenblatt MJ, Farell C, Weber TK, Petrelli NJ. Health, life and disability insurance and hereditary nonpolyposis colorectal cancer. Am J Med Genet. 1998; 62 :736–737. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Wertz DC. "Genetic discrimination": results of a survey of genetics professionals, primary care physicians, patients and public. Health Law Rev. 1999; 7 :7–8. [ PubMed ] [ Google Scholar ]

- Morrison PJ, Steel CM, Nevin NC, Evans DG, Eccles DM, Vasen H, Møller P, Hodgson S, Stoppa-Lyonnet D, Chang-Claude J, Caligo M, Oláh E, Haites NE. Insurance considerations for individuals with a high risk of breast cancer in Europe: some recommendations. CME J Gynecol Oncol. 2000; 5 :272–277. [ Google Scholar ]

- Norum J, Tranebjaerg L. Health, life and disability insurance and hereditary risk for breast or colorectal cancer. Acta Oncol. 2000; 39 :189–193. doi: 10.1080/028418600430752. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Barlow-Stewart K, Keays D. Genetic discrimination in Australia. J L Med. 2001; 8 :250–262. [ Google Scholar ]

- Marang-van de Mheen P, van Maarle M, Stouthard M. Getting insurance after genetic screening on familial hypercholesterolaemia; the need to educate both insurers and the public to increase adherence to national guidelines in the Netherlands. J Epidemiol Community Health. 2002; 56 :145–147. doi: 10.1136/jech.56.2.145. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Armstrong K, Weber B, FitzGerald G, Hershey J, Pauly M, Lemaire J, Subramanian K, Asch D. Life insurance and breast cancer risk assessment: adverse selection, genetic testing decisions, and discrimination. Am J Med Genet A. 2003; 120A :359–364. doi: 10.1002/ajmg.a.20025. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Shaheen NJ, Lawrence LB, Bacon BR, Barton JC, Barton NH, Galanko J, Martin CF, Burnett CK, Sandler RS. Insurance, employment, and psychosocial consequences of a diagnosis of hereditary hemochromatosis in subjects without end organ damage. Am J Gastroenterol. 2003; 98 :1175–1180. doi: 10.1111/j.1572-0241.2003.07405.x. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Apse KA, Biesecker BB, Giardiello FM, Fuller BP, Bernhardt BA. Perceptions of genetic discrimination among at-risk relatives of colorectal cancer patients. Genet Med. 2004; 6 :510–516. [ PubMed ] [ Google Scholar ]

- Neil HA, Hammond T, Mant D, Humphries SE. Effect of statin treatment for familial hypercholesterolaemia on life assurance: results of consecutive surveys in 1990 and 2002. BMJ. 2004; 328 :500–501. doi: 10.1136/bmj.328.7438.500. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Watson M, Foster C, Eeles R, Eccles DM, Ashley S, Davidson R, Mackay J, Morrison PJ, Hopwood P, Evans DG. Psychosocial Study Collaborators. Psychosocial impact of breast/ovarian (BRCA1/2) cancer-predictive genetic testing in a UK multi-centre clinical cohort. Br J Cancer. 2004; 91 :1787–1794. doi: 10.1038/sj.bjc.6602207. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Foster C, Watson M, Eeles R, Ashley S, Davidson R, Mackay J, Morrison PJ, Hopwood P, Evans D. Psychosocial Study Collaborators. Predictive genetic testing for BRCA1/2 in a UK clinical cohort: three-year follow-up. Br J Cancer. 2007; 96 :718–724. doi: 10.1038/sj.bjc.6603610. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Hall M, Barton J, Adams P, McLaren C, Reiss J, Castro O, Ruggiero A, Acton R, Power T, Bent T. Genetic screening for iron overload: no evidence of discrimination at 1 year. J Fam Pract. 2007; 56 :829–834. [ PubMed ] [ Google Scholar ]

- Taylor S, Treloar S, Barlow-Stewart K, Stranger M, Otlowski M. Investigating genetic discrimination in Australia: a large-scale survey of clinical genetics clients. Clin Genet. 2008; 74 :20–30. doi: 10.1111/j.1399-0004.2008.01016.x. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Barlow-Stewart K, Taylor SA, Stranger M, Otlowski M. Verification of consumers' experiences and perceptions of genetic discrimination and its impact on utilization of genetic testing. Genet Med. 2009; 11 :193–201. doi: 10.1097/GIM.0b013e318194ee75. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Otlowski MFA, Stranger MJA, Taylor S, Barlow-Stewart K, Trealoar S. Investigating genetic discrimination in Australia: perceptions and experiences of clinical genetics service clients regarding coercion to test, insurance and employment. Australia Journal of Emerging Technologies and Society. 2007; 5 :63–83. [ Google Scholar ]

- Otlowski MFA, Stranger MJA, Taylor S, Barlow-Stewart K, Trealoar S. The use of legal remedies in Australia for pursuing allegations of genetic discrimination: findings of an empirical study. Int J Discrim Law. 2007; 9 :3–35. doi: 10.1177/135822910700900102. [ CrossRef ] [ Google Scholar ]

- Bombard Y, Penziner E, Suchowersky O, Guttman M, Paulsen JS, Bottorff JL, Hayden MR. Engagement with genetic discrimination: concerns and experiences in the context of Huntington disease. Eur J Hum Genet. 2008; 16 :279–289. doi: 10.1038/sj.ejhg.5201937. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Bombard Y, Veenstra G, Friedman JM, Creighton S, Currie L, Paulsen JS, Bottorff JL, Hayden MR. TCR-HCR Group. Perceptions of genetic discrimination among people at risk for Huntington's disease: a cross sectional survey. BMJ. 2009; 338 :b2175. doi: 10.1136/bmj.b2175. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Lemke T. 'A slap in the face'. An exploratory study of genetic discrimination in Germany. Genomics, Society and Policy. 2009; 5 :22–39. [ Google Scholar ]

- McKinnon W, Banks KC, Skelly J, Kohlmann W, Bennett R, Shannon K, Larson-Haidle J, Ashakaga T, Weitzel JN, Wood M. Survey of unaffected BRCA and mismatch repair (MMR) mutation positive individuals. Fam Cancer. 2009; 8 :363–369. doi: 10.1007/s10689-009-9248-6. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Christiaans I, Kok TM, Langen I, Birnie E, Bonsel G, Wilde A, Smets E. Obtaining insurance after DNA diagnostics: a survey among hypertrophic cardiomyopathy mutation carriers. Eur J Hum Genet. 2010; 18 :251–253. doi: 10.1038/ejhg.2009.145. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Erwin C, Williams JK, Juhl AR, Mengeling M, Mills JA, Bombard Y, Hayden MR, Quaid K, Shoulson I, Taylor S, Paulsen JS. I-RESPOND-HD Investigators of the Huntington Study Group. Perception, experience, and response to genetic discrimination in Huntington disease: the international RESPOND-HD study. Am J Med Genet B Neuropsychia Genet. 2010; 153B :1081–1093. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Klitzman R. Views of discrimination among individuals confronting genetic disease. J Genet Couns. 2010; 19 :68–83. doi: 10.1007/s10897-009-9262-8. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Bombard Y, Palin J, Friedman JM, Veenstra G, Creighton S, Bottorff JL, Hayden MR. The Canadian Respond-HD Collaborative Reseach Group. Beyond the patient: the broader impact of genetic discrimination among individuals at risk of Huntington disease. Am J Med Genet B Neuropsychia Genet. 2012; 159B :217–226. doi: 10.1002/ajmg.b.32016. [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Huijgen R, Homsma S, Hutten B, Kindt I, Vissers M, Kastelein J, van Rijckevorsel J. Improved access to life insurance after genetic diagnosis of familial hypercholesterolaemia: cross-sectional postal questionnaire study. Eur J Hum Genet. 2012; 20 :722–728. doi: 10.1038/ejhg.2012.5. [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Australian Law Reform Commission. ALRC 96 report: essentially yours: the protection of human genetic information in Australia. Canberra: Australian Law Reform Commission; 2003. [ Google Scholar ]

- Rothstein MA. Keeping your genes private. Scientific American. 2008. pp. 64–69. [ PubMed ]

- Treloar S, Taylor S, Otlowski M, Barlow-Stewart K, Stranger M, Chenoweth K. Methodological considerations in the study of genetic discrimination. Comm Genet. 2004; 7 :161–168. doi: 10.1159/000082254. [ PubMed ] [ CrossRef ] [ Google Scholar ]

At the New York Fed, our mission is to make the U.S. economy stronger and the financial system more stable for all segments of society. We do this by executing monetary policy, providing financial services, supervising banks and conducting research and providing expertise on issues that impact the nation and communities we serve.

Introducing the New York Innovation Center: Delivering a central bank innovation execution

Do you have a Freedom of Information request? Learn how to submit it.

Learn about the history of the New York Fed and central banking in the United States through articles, speeches, photos and video.

Markets & Policy Implementation

- Effective Federal Funds Rate

- Overnight Bank Funding Rate

- Secured Overnight Financing Rate

- SOFR Averages & Index

- Broad General Collateral Rate

- Tri-Party General Collateral Rate

- Treasury Securities

- Agency Mortgage-Backed Securities

- Repos & Reverse Repos

- Securities Lending

- Central Bank Liquidity Swaps

- System Open Market Account Holdings

- Primary Dealer Statistics

- Historical Transaction Data

- Agency Commercial Mortgage-Backed Securities

- Agency Debt Securities

- Discount Window

- Treasury Debt Auctions & Buybacks as Fiscal Agent

- Foreign Exchange

- Foreign Reserves Management

- Central Bank Swap Arrangements

- ACROSS MARKETS

- Actions Related to COVID-19

- Statements & Operating Policies

- Survey of Primary Dealers

- Survey of Market Participants

- Annual Reports

- Primary Dealers

- Reverse Repo Counterparties

- Foreign Exchange Counterparties

- Foreign Reserves Management Counterparties

- Operational Readiness

- Central Bank & International Account Services

- Programs Archive

As part of our core mission, we supervise and regulate financial institutions in the Second District. Our primary objective is to maintain a safe and competitive U.S. and global banking system.

The Governance & Culture Reform hub is designed to foster discussion about corporate governance and the reform of culture and behavior in the financial services industry.

Need to file a report with the New York Fed? Here are all of the forms, instructions and other information related to regulatory and statistical reporting in one spot.

The New York Fed works to protect consumers as well as provides information and resources on how to avoid and report specific scams.

The Federal Reserve Bank of New York works to promote sound and well-functioning financial systems and markets through its provision of industry and payment services, advancement of infrastructure reform in key markets and training and educational support to international institutions.

The New York Fed provides a wide range of payment services for financial institutions and the U.S. government.

The New York Fed offers several specialized courses designed for central bankers and financial supervisors.

The New York Fed has been working with tri-party repo market participants to make changes to improve the resiliency of the market to financial stress.

- High School Fed Challenge

- College Fed Challenge

- Teacher Professional Development

- Classroom Visits

- Museum & Learning Center Visits

- Educational Comic Books

- Lesson Plans and Resources

- Economic Education Calendar

We are connecting emerging solutions with funding in three areas—health, household financial stability, and climate—to improve life for underserved communities. Learn more by reading our strategy.

The Economic Inequality & Equitable Growth hub is a collection of research, analysis and convenings to help better understand economic inequality.

This Economist Spotlight Series is created for middle school and high school students to spark curiosity and interest in economics as an area of study and a future career.

« Internal Liquidity’s Value in a Financial Crisis | Main | Monetary Policy and Money Market Funds in Europe »

A Retrospective on the Life Insurance Sector after the Failure of Silicon Valley Bank

Fulvia Fringuellotti and Saketh Prazad

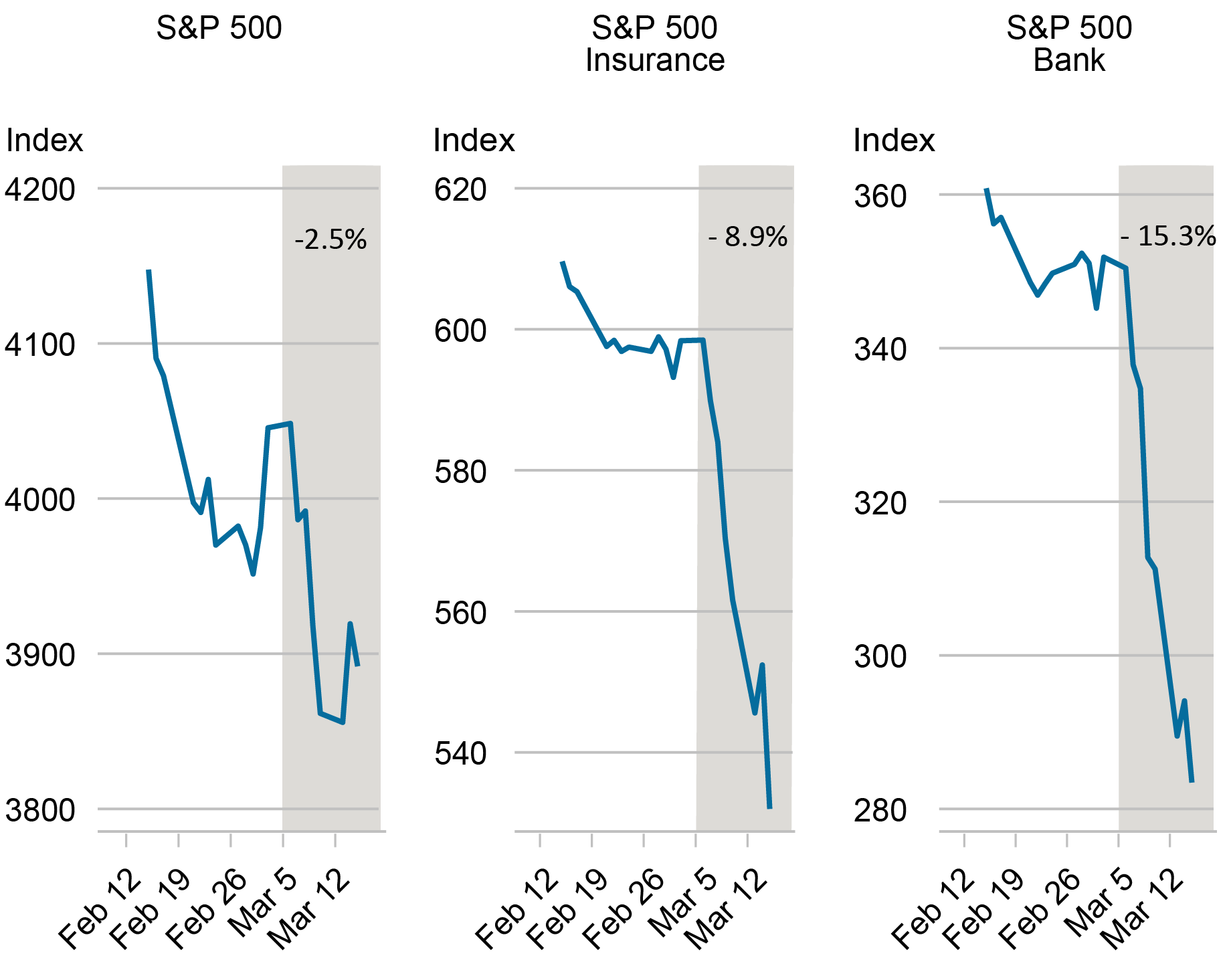

Following the Silicon Valley Bank collapse, the stock prices of U.S banks fell amid concerns about the exposure of the banking sector to interest rate risk. Thus, between March 8 and March 15, 2023, the S&P 500 Bank index dropped 12.8 percent relative to S&P 500 returns (see right panel of the chart below). The stock prices of insurance companies tumbled as well, with the S&P 500 Insurance index losing 6.4 percent relative to S&P 500 returns over the same time interval (see the center panel below). Yet, insurance companies’ direct exposure to the three failed banks (Silicon Valley Bank, Silvergate, and Signature Bank) through debt and equity was modest . In this post, we examine the possible factors behind the reaction of insurance investors to the failure of Silicon Valley Bank.

Stock Price Performance in the Period Surrounding the Collapse of Silicon Valley Bank

Source: Authors’ calculations based on data from S&P Capital IQ. Notes: This chart shows the S&P 500 index, S&P 500 Insurance index and S&P 500 Bank index over the time period February 15-March 15, 2023. The shaded area highlights the percentage change in the three indexes from March 8 to March 15 following the Silicon Valley Bank collapse.

Why Did Stock Prices of Insurance Companies Drop after the Failure of Silicon Valley Bank?

A close look at the asset and the liability sides of insurers’ balance sheets provides some insights on their exposure to interest rate risk. Our focus is on the life insurance sector, which accounts for 71 percent of U.S insurance industry assets.

Life insurance companies held $5 trillion in invested assets at the end of 2022. Corporate bonds represented the asset class in which life insurers invested the most, totaling $2 trillion, or 43 percent of invested assets. Mortgages, common stocks, municipal bonds, and government bonds followed next with portfolio shares of 13 percent, 4 percent, 4 percent, and 3 percent, respectively. Life insurance companies invested almost exclusively in investment grade bonds, but 37 percent of bonds in their portfolios are rated BBB, the lowest credit notch within the investment-grade space.

The vast majority (96 percent) of bond investments are reported in the book at cost, with the remaining being reported at fair value. As a result of the interest rate hikes, unrealized losses from marking-to-market bonds that were reported at cost in the statutory filings represented on aggregate 56 percent of total adjusted capital (the numerator of risk-based capital requirements) of life insurance companies in 2022, with significant heterogeneity across insurers. Thus, our first hypothesis is that the size of life insurers’ unrealized losses on bond investments in 2022 relative to total adjusted capital may have played a role in driving insurance investors’ response to the failure of Silicon Valley Bank.

If and the extent to which these losses may be realized depends on different factors including downgrades of securities, policyholders’ surrenders, and losses experienced on the life insurance and annuity business. On the liability-side, long-term insurance policies and annuities represent the most important sources of funding for the life insurance industry. Annuities accounted for 60 percent of total liabilities related to life, annuity, and deposit-type contracts in the general and separate accounts in 2022.

This funding source is considered quite stable given the limits and costs associated with withdrawals (for example, surrender fees and tax penalties). Surrenders are subject to swings and may increase in an environment of rising interest rates, especially in the case of fixed annuities. In 2022, withdrawable liabilities (that is, contracts that allow discretionary withdrawals) accounted for 55 percent of total liabilities related to life, annuity, and deposit type–contracts. We hypothesize that the size of withdrawable liabilities relative to total liabilities could be an additional factor behind insurance investors’ concerns after the failure of Silicon Valley Bank.

In recent years, particular attention has been devoted by academics and policymakers to variable annuities with minimum return guarantees ( Drexler et al., 2017 ; Ellul et al., 2022 ; Koijen and Yogo, 2022 ), which represented 39 percent of aggregate reserves for annuity contracts in 2022. These consist of saving products where the funds contributed by policyholders are allocated to subaccounts invested in assets and a minimum growth rate in the annuity balance is guaranteed. Since variable annuities balances are mostly invested in stocks , insurers’ liability associated with guaranteed variable annuities increases not only if interest rates decline, but also if the stock market drops. If the returns generated by the investments are not enough to satisfy the guarantees, life insurers face a loss and may need to fund the guarantees by selling assets in their general account. Thus, we hypothesize that the size of variable annuities with minimum guarantees to total liabilities could be a third factor explaining investors’ response to the failure of Silicon Valley Bank.

The Stock Returns of Life Insurers around the Silicon Valley Bank Event Correlate with Their Unrealized Losses and Liability Conditions

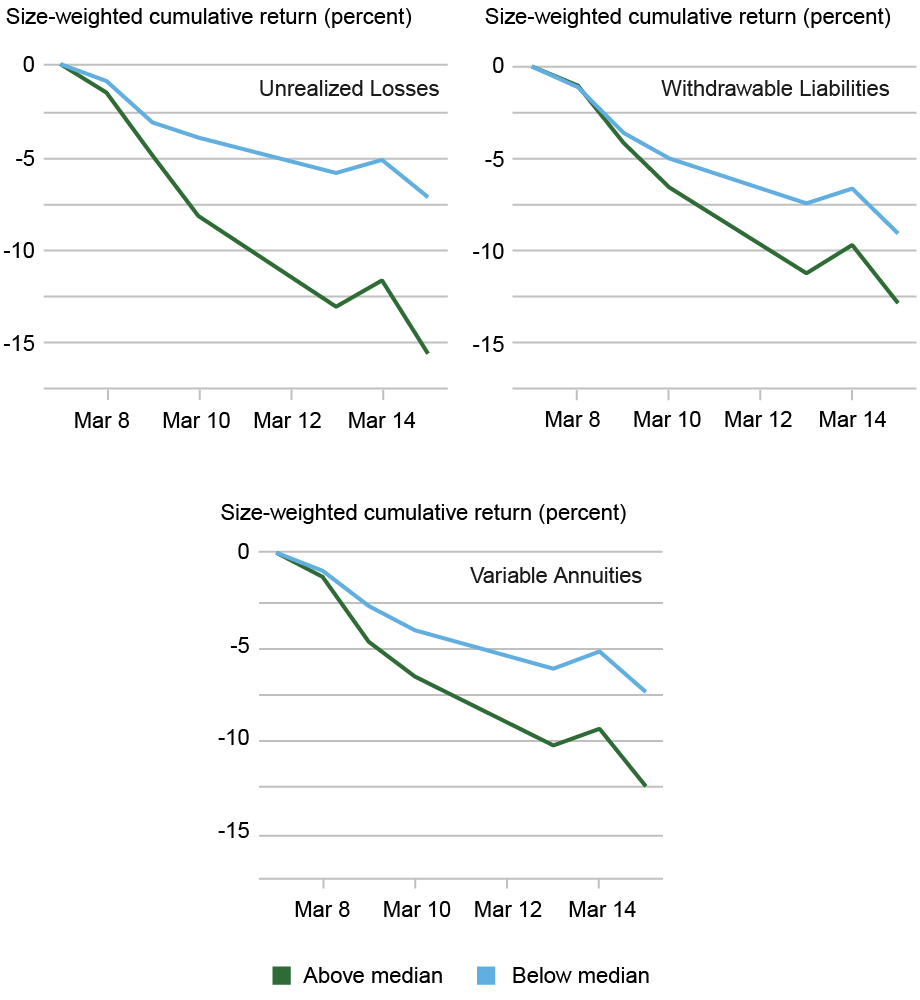

To test our hypotheses, we collect stock prices and balance sheet data on twenty-nine U.S. insurance groups primarily engaged in the life insurance business (henceforth abridged “life insurance firms”). For each firm, we calculate the following three metrics: i) unrealized losses on bonds issued by unaffiliated entities and reported at cost as a percentage of total adjusted capital, ii) withdrawable liabilities as a percentage of total liabilities related to life, annuity, and deposit type-contracts, and iii) guaranteed variable annuity reserves as a percentage of total liabilities related to life, annuity, and deposit type-contracts. Although these metrics exhibit a positive pairwise correlation, they should nevertheless capture different dimensions of risk to some extent. Next, we construct a set of size-weighted portfolios of these publicly listed firms based on whether each of the three metrics is above or below its median in 2022 and then calculate the cumulative stock returns for each portfolio over the time period March 7 to March 15, 2023.

Cumulative Stock Returns of Life Insurers around the Silicon Valley Bank Collapse by Sub-groups based on Unrealized Losses and Liability Conditions

The three plots presented in the chart above provide empirical evidence that is consistent with our hypotheses. In particular, insurance firms with unrealized losses exposure, withdrawable liability exposure, and variable annuity exposure above the median experienced negative cumulative returns that are 8 percent, 4 percent, and 5 percent lower than below-median firms, respectively. Our result for the variable annuity exposure is consistent with Ellul et al. (2022) and Koijen and Yogo (2022) , who document that life insurance firms with large guaranteed variable annuity business exhibited a worse stock performance than the insurance industry during the global financial crisis and the COVID-19 pandemic. Overall, the negative performance of life insurance stocks amid the failure of Silicon Valley Bank exhibits the strongest relation with the size of unrealized losses relative to total adjusted capital.

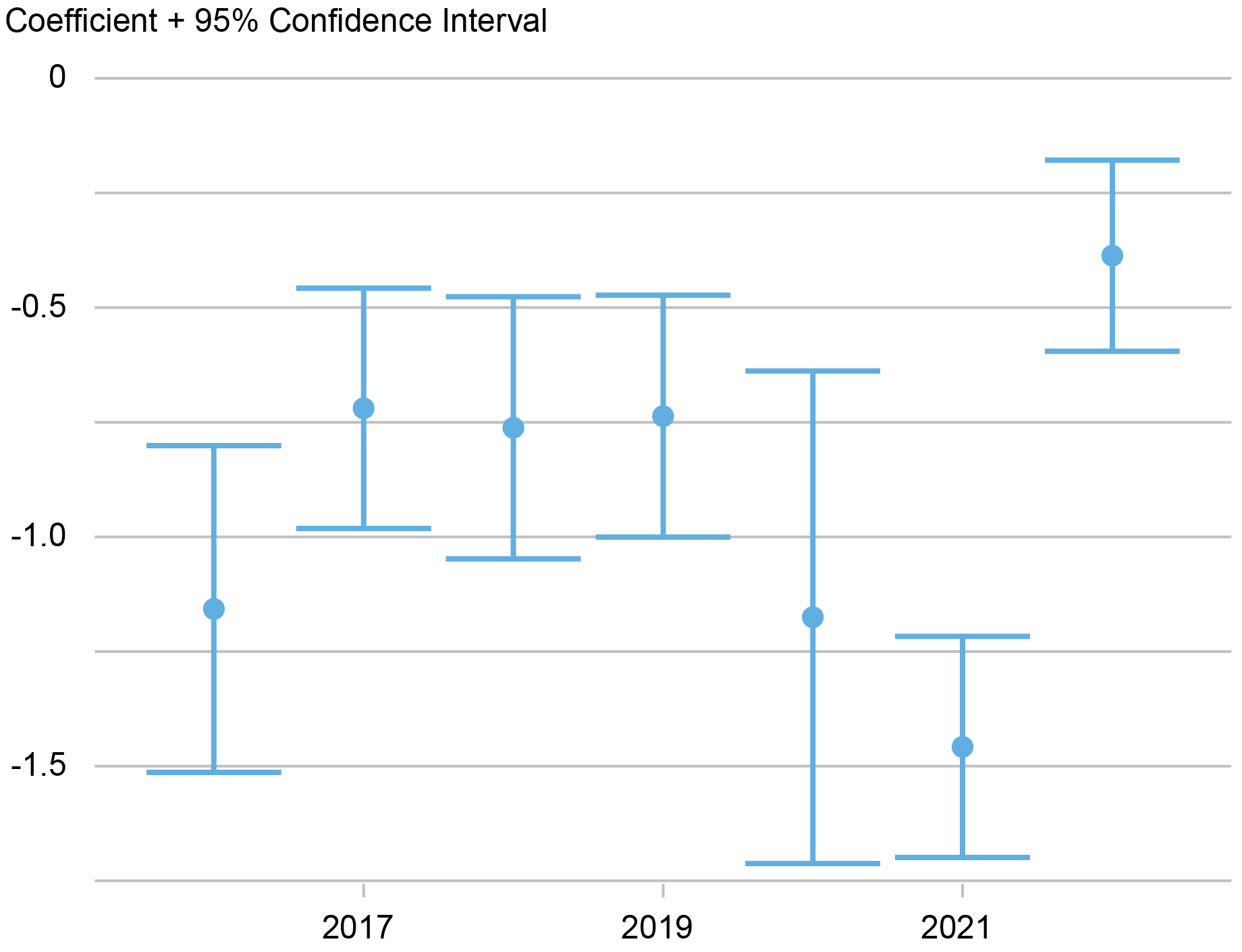

Sensitivity of Life Insurance Companies’ Stock Returns to Bond Returns

Sensitivity of Life Insurers’ Stocks Returns to Interest Rates

How did the overall exposure of life insurance firms to interest rate risk evolve following the interest rate hikes of 2022? To address this question, we estimate the sensitivity of life insurance stock returns to changes in interest rates relying on a two-factor model as in Brewer, Mondschean, and Strahan (1993) and Berends et al. (2013) . The above chart reports the estimates for each year of the coefficient capturing the sensitivity of life insurers’ stock returns to the return on a ten-year Treasury bond. During the 2016-22 period, the response of life insurers’ stock returns to bond returns is negative, consistent with a negative duration gap (that is, liabilities having a longer duration than assets). The upward jump in the estimated coefficient between 2021 and 2022 is consistent with a shortening of liabilities compared to assets (for example, because surrenders are more likely) following the interest rate hikes of 2022. The worse stock performance of insurance firms with larger unrealized losses exposure and withdrawable liability exposure after the failure of Silicon Valley Bank is in line with this market-implied shift in insurers’ exposure to interest rate risk.

Fulvia Fringuellotti is a financial research economist in Non-Bank Financial Institution Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Sakteh Prazad is a senior research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post: Fulvia Fringuellotti and Saketh Prazad, “A Retrospective on the Life Insurance Sector after the Failure of Silicon Valley Bank,” Federal Reserve Bank of New York Liberty Street Economics , April 10, 2024, https://libertystreeteconomics.newyorkfed.org/2024/04/a-retrospective-on-the-life-insurance-sector-after-the-failure-of-silicon-valley-bank/.

You may also be interested in:

Insurance Companies and the Growth of Corporate Loans’ Securitization

Banking System Vulnerability: 2023 Update

Disclaimer The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Share this:

Post a comment

Your email address will not be published. Required fields are marked *

(Name is required. Email address will not be displayed with the comment.)

Liberty Street Economics features insight and analysis from New York Fed economists working at the intersection of research and policy. Launched in 2011, the blog takes its name from the Bank’s headquarters at 33 Liberty Street in Manhattan’s Financial District.

The editors are Michael Fleming, Andrew Haughwout, Thomas Klitgaard, and Asani Sarkar, all economists in the Bank’s Research Group.