47 case interview examples (from McKinsey, BCG, Bain, etc.)

One of the best ways to prepare for case interviews at firms like McKinsey, BCG, or Bain, is by studying case interview examples.

There are a lot of free sample cases out there, but it's really hard to know where to start. So in this article, we have listed all the best free case examples available, in one place.

The below list of resources includes interactive case interview samples provided by consulting firms, video case interview demonstrations, case books, and materials developed by the team here at IGotAnOffer. Let's continue to the list.

- McKinsey examples

- BCG examples

- Bain examples

- Deloitte examples

- Other firms' examples

- Case books from consulting clubs

- Case interview preparation

Click here to practise 1-on-1 with MBB ex-interviewers

1. mckinsey case interview examples.

- Beautify case interview (McKinsey website)

- Diconsa case interview (McKinsey website)

- Electro-light case interview (McKinsey website)

- GlobaPharm case interview (McKinsey website)

- National Education case interview (McKinsey website)

- Talbot Trucks case interview (McKinsey website)

- Shops Corporation case interview (McKinsey website)

- Conservation Forever case interview (McKinsey website)

- McKinsey case interview guide (by IGotAnOffer)

- McKinsey live case interview extract (by IGotAnOffer) - See below

2. BCG case interview examples

- Foods Inc and GenCo case samples (BCG website)

- Chateau Boomerang written case interview (BCG website)

- BCG case interview guide (by IGotAnOffer)

- Written cases guide (by IGotAnOffer)

- BCG live case interview with notes (by IGotAnOffer)

- BCG mock case interview with ex-BCG associate director - Public sector case (by IGotAnOffer)

- BCG mock case interview: Revenue problem case (by IGotAnOffer) - See below

3. Bain case interview examples

- CoffeeCo practice case (Bain website)

- FashionCo practice case (Bain website)

- Associate Consultant mock interview video (Bain website)

- Consultant mock interview video (Bain website)

- Written case interview tips (Bain website)

- Bain case interview guide (by IGotAnOffer)

- Digital transformation case with ex-Bain consultant

- Bain case mock interview with ex-Bain manager (below)

4. Deloitte case interview examples

- Engagement Strategy practice case (Deloitte website)

- Recreation Unlimited practice case (Deloitte website)

- Strategic Vision practice case (Deloitte website)

- Retail Strategy practice case (Deloitte website)

- Finance Strategy practice case (Deloitte website)

- Talent Management practice case (Deloitte website)

- Enterprise Resource Management practice case (Deloitte website)

- Footloose written case (by Deloitte)

- Deloitte case interview guide (by IGotAnOffer)

5. Accenture case interview examples

- Case interview workbook (by Accenture)

- Accenture case interview guide (by IGotAnOffer)

6. OC&C case interview examples

- Leisure Club case example (by OC&C)

- Imported Spirits case example (by OC&C)

7. Oliver Wyman case interview examples

- Wumbleworld case sample (Oliver Wyman website)

- Aqualine case sample (Oliver Wyman website)

- Oliver Wyman case interview guide (by IGotAnOffer)

8. A.T. Kearney case interview examples

- Promotion planning case question (A.T. Kearney website)

- Consulting case book and examples (by A.T. Kearney)

- AT Kearney case interview guide (by IGotAnOffer)

9. Strategy& / PWC case interview examples

- Presentation overview with sample questions (by Strategy& / PWC)

- Strategy& / PWC case interview guide (by IGotAnOffer)

10. L.E.K. Consulting case interview examples

- Case interview example video walkthrough (L.E.K. website)

- Market sizing case example video walkthrough (L.E.K. website)

11. Roland Berger case interview examples

- Transit oriented development case webinar part 1 (Roland Berger website)

- Transit oriented development case webinar part 2 (Roland Berger website)

- 3D printed hip implants case webinar part 1 (Roland Berger website)

- 3D printed hip implants case webinar part 2 (Roland Berger website)

- Roland Berger case interview guide (by IGotAnOffer)

12. Capital One case interview examples

- Case interview example video walkthrough (Capital One website)

- Capital One case interview guide (by IGotAnOffer)

13. Consulting clubs case interview examples

- Berkeley case book (2006)

- Columbia case book (2006)

- Darden case book (2012)

- Darden case book (2018)

- Duke case book (2010)

- Duke case book (2014)

- ESADE case book (2011)

- Goizueta case book (2006)

- Illinois case book (2015)

- LBS case book (2006)

- MIT case book (2001)

- Notre Dame case book (2017)

- Ross case book (2010)

- Wharton case book (2010)

Practice with experts

Using case interview examples is a key part of your interview preparation, but it isn’t enough.

At some point you’ll want to practise with friends or family who can give some useful feedback. However, if you really want the best possible preparation for your case interview, you'll also want to work with ex-consultants who have experience running interviews at McKinsey, Bain, BCG, etc.

If you know anyone who fits that description, fantastic! But for most of us, it's tough to find the right connections to make this happen. And it might also be difficult to practice multiple hours with that person unless you know them really well.

Here's the good news. We've already made the connections for you. We’ve created a coaching service where you can do mock case interviews 1-on-1 with ex-interviewers from MBB firms . Start scheduling sessions today!

The IGotAnOffer team

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Private Equity Interviews 101: How to Win Offers

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Private equity interviews can be challenging, but for most candidates, winning interviews is much tougher than succeeding in those interviews.

You do not need to be a math genius or a gifted speaker; you just need to understand the recruiting process and basic arithmetic.

Still, there is more to PE interviews than “2 + 2 = 4,” so let’s take a detailed look at the process:

How to Network and Win Private Equity Interviews

The Private Equity recruiting process differs dramatically depending on your current job and location.

Here are the two extremes:

- Investment Banking Analyst at a Bulge Bracket or Elite Boutique in New York: The process will be highly structured, and interviews will finish at warp speed. In some ways, your bank, group, and academic background matter more than your skill set or deal experience. This one is known as the “on-cycle” process.

- Non-Banker in Another Part of the U.S. or World: The process will be far less structured, it may extend over many months, and your skill set and deal/client experience will matter a lot more. This one is known as the “off-cycle” process.

If you’re in between these categories, the process will also be in between these extremes.

For example, if you’re at a smaller bank in NY, you may complete some on-cycle interviews, but you will almost certainly also go through the off-cycle process at smaller firms.

If you’re in London, there will also be a mix of on-cycle and off-cycle processes, but they tend to start later and move more slowly than the ones in NY.

We have covered PE recruiting previously ( overall process and what to expect in the on-cycle process ), so I am not going to repeat everything here.

Interviews in both on-cycle and off-cycle processes test similar topics , but the importance of each topic varies.

The timing of interviews and start dates, assuming you win offers, also differs.

The Overall Private Equity Interview Process

Regardless of whether you recruit in on-cycle or off-cycle processes, or a combination of both, almost all PE interviews have the following characteristics in common:

- Multiple Rounds: You’ll almost always go through at least 2-3 rounds of interviews (and sometimes many more!) where you speak with junior to senior professionals at the firm.

- Topics Tested: You’ll have to answer fit/background questions, technical questions, deal/client experience questions, questions about the firm’s strategies and portfolio, market/industry questions, and complete case studies and modeling tests.

The differences are as follows:

- Timing and Time Frame: If you’re at a BB/EB bank in NY, and you interview with mega-funds, the process starts and finishes within several months of your start date at the bank (!), and it moves up earlier each year. Interviews at the largest firms start and finish in 24-48 hours, with upper-middle-market and middle-market firms beginning after that.

By contrast, interviews start later at smaller PE firms, and the entire process may last for several weeks up to several months.

- Importance of Topics Tested: At large funds and in the on-cycle process, you need to complete modeling tests quickly and accurately and spin your pitches and early-stage deals into sounding like real deals; at smaller funds and in off-cycle interviews, the reasoning behind your case studies/modeling tests and your real experience with clients and deals matter more.

Firm-specific knowledge and fitting your investment recommendations to the firm’s strategies are also more important.

- Start Date: You interview far in advance if you complete the on-cycle process, and if you win an offer, you might start 1.5 – 2.0 years later. With the off-cycle process, you start right away or soon after you win the offer.

Private Equity Interview Topics

There is not necessarily a correlation between the stage of interviews and the topics that will come up.

You could easily get technical questions early on, and you’ll receive fit/background and deal experience questions throughout the process.

Case studies and modeling tests tend to come up later in the process because PE firms don’t want to spend time administering them until you’ve proven yourself in previous rounds.

However, there are exceptions even to that rule: For example, many funds in London start the process with modeling tests because there’s no point interviewing if you can’t model.

Here’s what to expect on each major topic:

Fit/Background Questions: “Why Private Equity?”

The usual questions about “ Why private equity ,” your story , your strengths/weaknesses , and ability to work in a team will come up, and you need answers for them.

We have covered these in previous articles, so I’ve linked to them above rather than repeating the tips here.

Since on-cycle recruiting takes place at warp speed, you’ll have to draw on your internship experience to come up with stories for these questions, and you’ll have to act as if PE was your goal all along.

By contrast, if you’re interviewing for off-cycle roles, you can use more of your current work experience to answer these questions.

While these questions will always come up, they tend to be less important than in IB interviews because:

- In on-cycle processes, it’s tough to differentiate yourself – everyone else also did multiple finance internships and just started their IB roles.

- They care more about your deal experience, whether real or exaggerated, in both types of interviews.

Technical Questions For PE

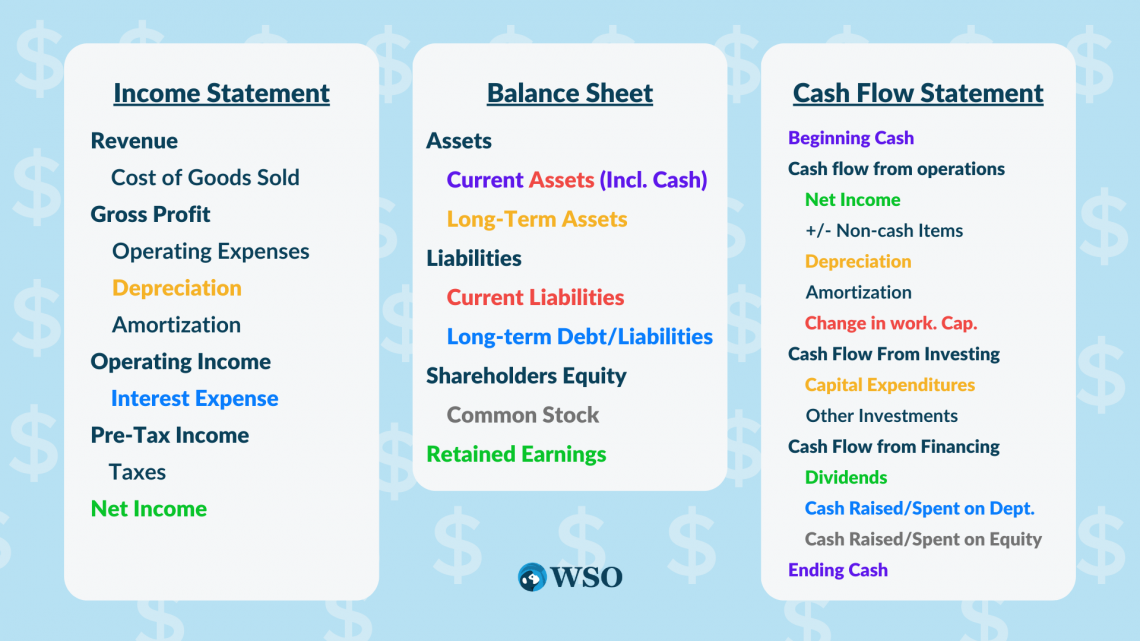

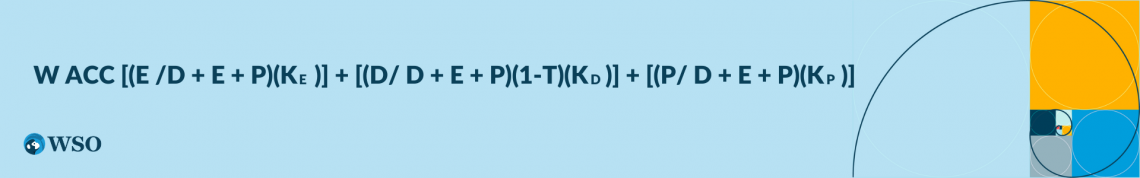

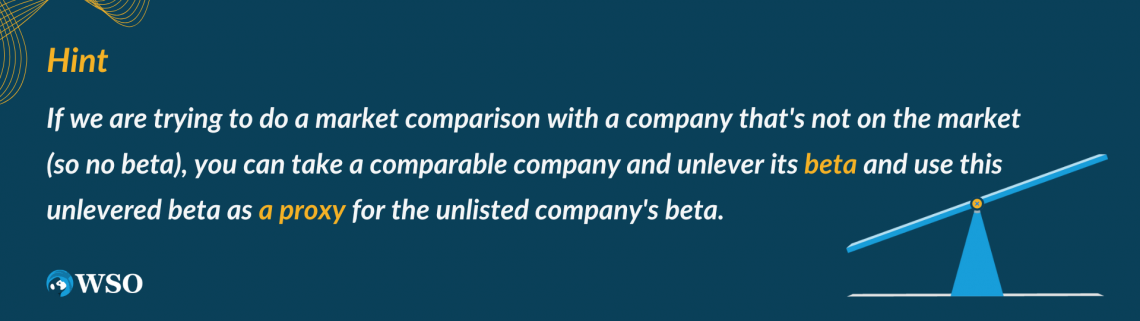

The topics here are similar to the ones in IB interviews: Accounting, equity value and enterprise value , valuation/DCF, merger models, and LBO models.

If you’re in banking, you should know these topics like the back of your hand.

And if you’re not in banking, you need to learn these topics ASAP because firms will not be forgiving.

There are a few differences compared with banking interviews:

- Technical questions tend to be framed in the context of your deal experience – instead of asking generic questions about the WACC formula , they might ask how you calculated it in one specific deal.

- More critical thinking is required. Instead of asking you to walk through the financial statements when Depreciation changes, they might describe companies with different business models and ask how the financial statements and valuation would differ.

- They focus more on LBO models, quick IRR math , and your ability to judge deals quickly.

Most interviewers use technical questions to weed out candidates , so poor technical knowledge will hurt your chances, but exceptional knowledge won’t necessarily get you an offer.

Talking About Deal/Client Experience

This category is huge, and it presents different challenges depending on your background.

If you’re an Analyst at a large bank in New York, and you’re going through on-cycle recruiting, the key challenge will be spinning your pitches and early-stage deals into sounding like actual deals.

If you’re at a smaller bank, and you’re going through off-cycle recruiting, the key challenge will be demonstrating your ability to lead, manage, and close deals .

And if you’re not in investment banking, the key challenge will be spinning your experience into sounding like IB-style deals.

Regardless of your category, you’ll need to know the numbers for each deal or project you present, and you’ll need a strong “investor’s view” of each one.

That’s quite a bit to memorize, so you should plan to present, at most, 2-3 deals or projects.

You can create an outline for each one with these points:

- The company’s industry, approximate revenue/EBITDA, and multiples (or, for non-deals, estimated costs and benefits).

- Whether or not you would invest in the company’s equity/debt or acquire it (or, for non-deals, whether or not you’d pursue the project).

- The qualitative and quantitative factors that support your view.

- The key risk factors and how you might mitigate them.

If you just started working, pick 1-2 of your pitches and pretend that they have progressed beyond pitches into early-stage deals.

Use Capital IQ or Internet research to generate potential buyers or investors, and use the company-provided pitch materials to come up with your projections for the potential stumbling blocks in the transaction.

For your investment recommendation, imagine that each deal is a potential LBO, and build a quick, simple model to determine the rough numbers, such as the IRR in the baseline and downside cases.

For the risk factors, reverse each model assumption (such as the company’s revenue growth and margins) and explain why your numbers might be wrong.

If you’re in the second or third categories above – you need to show evidence of managing/closing deals or evidence of working on IB-style deals – you should still follow these steps.

But you need to highlight your unique contributions to each deal, such as a mistake you found, a suggestion you made that helped move the financing forward, or a buyer you thought of that ended up making an offer for the seller.

If you’re coming in with non-IB experience, such as internal consulting , still use the same framework but point out how each project you worked on was like a deal.

You had to win buy-in from different parties, get information from groups at the company, and justify your proposals by pointing to the numbers and qualitative factors and addressing the risk factors.

Firm Knowledge

Understanding the firm’s investment strategies, portfolio, and exits is very important at smaller firms and in off-cycle processes, and less important in on-cycle interviews at mega-funds.

If you have Capital IQ access, use it to look up the firm.

If not, go to the firm’s website and do extensive Google searches to find the information.

Finding this information should not be difficult, but the tricky point is that firms won’t necessarily evaluate your knowledge by directly asking about it.

Instead, if they give you a take-home case study, they might judge your responses based on how well your investment thesis lines up with theirs.

For example, if the firm makes offline retailers more efficient via cost cuts and store divestitures, you should not present an investment thesis based on overseas expansion or roll-ups of smaller stores.

If they ask for an investor’s view of one of your deals, they might judge your answer based on your ability to frame the deal from their point of view.

For example, if the firm completes roll-ups in fragmented industries, you should not look at a standard M&A deal you worked on and say that you’d acquire the company because the IRR is between XX% and YY% in all scenarios.

Instead, you should point out that with several roll-ups, the IRR would be between XX% and YY%, and even in a downside case without these roll-ups, the IRR would still be at least ZZ%, so you’d pursue the deal.

Market/Industry

In theory, private equity firms should care about your ability to find promising markets or industries.

In practice, open-ended questions such as “Which industry would you invest in?” are unlikely to come up in traditional PE interviews.

If they do come up, they’ll be in response to your deal discussions, and the interviewer will ask you to explain the upsides and downsides of your company’s industry.

These questions are more likely in growth equity and venture capital interviews, so you shouldn’t spend too much time on them if your goal is traditional PE (for more on these fields, see our coverage of venture capital interview questions and the venture capital case study ).

And even if you are interviewing for growth equity or VC roles, you can save time by linking your industry recommendations to your deal experience.

Case Studies and Modeling Tests

You will almost always have to complete a case study or modeling test in PE interviews, but the types of tests span a wide range.

Here are the six most common ones, ranked by rough frequency:

Type #1: “Mental” Paper LBO

This one is closer to an extended technical question than a traditional case study.

To answer these questions, you need to know how to approximate IRR, and you need practice doing the mental math.

The interviewer might ask something like, “A PE firm acquires a $150 EBITDA company for a 10x multiple using 60% Debt. The company’s EBITDA increases to $200 by Year 3, $225 by Year 4, and $250 by Year 5, and it pays off all its Debt by Year 3.

The PE firm sells its stake evenly over Years 3 – 5 at a 10x EBITDA multiple. What’s the approximate IRR?”

Here, the Purchase Enterprise Value is $1.5 billion, and the PE firm contributes 40% * $1.5 billion = $600 million of Investor Equity.

The “average” amount of proceeds is $225 * 10 = $2,250, and the “average” Exit Year is Year 4 (no need to do the full math – think about the numbers – and all the Debt is gone).

So, the PE firm earns $2,250 / $600 = 3.75x over 4 years. Earning 3x in 3 years is a ~45% IRR, so we’d expect the IRR of a 3.75x multiple in 4 years to be a bit less than that.

To approximate a 4x scenario, we could take 300%, divide by 4 years, and multiply by ~55% to account for compounding.

That’s ~41%, and the actual IRR should be a bit lower because it’s a 3.75x multiple rather than a 4.00x multiple.

In Excel, the IRR is just under 40%.

Type #2: Written Paper LBO

The idea is similar, but the numbers are more involved because you can write them down, and you might have 30 minutes to come up with an answer.

You can get a full example of a paper LBO test, including the detailed solutions, here .

You can also check out our simple LBO model tutorial to understand the ropes.

With these case studies, you need to start with the end in mind (i.e., what multiple do you need for an IRR of XX%) and round heavily so you can do the math.

Type #3: 1-3-Hour On-Site or Emailed LBO Model

These case studies are the most common in on-cycle interviews because PE firms want to finish quickly.

And the best way to do that is to give all the candidates the same partially-completed template and ask them to finish it.

You may have to build the model from scratch, but it’s not that likely because doing so defeats the purpose of this test: efficiency.

You’ll almost always receive several pages of instructions and an Excel file, and you’ll have to answer a few questions at the end.

The complexity varies; if it’s a 1-hour test, you probably won’t even build a full 3-statement model .

They might also ask you to use a cash-free debt-free basis or a working capital adjustment to tweak the Sources & Uses slightly.

If it is a 3-hour test, a 3-statement model is more likely (the other parts of the model will be simpler in this case).

Here’s a free example of a timed LBO modeling test ; we have many other examples in the IB Interview Guide and Core Financial Modeling course .

IB Interview Guide

Land investment banking offers with 578+ pages of detailed tutorials, templates and sample answers, quizzes, and 17 Excel-based case studies.

Type #4: Take-Home LBO Model and Presentation

These case studies are open-ended, and in most cases, you will not get a template to complete.

The most common prompts are:

- Build a model and make an investment recommendation for Portfolio Company X, Former Portfolio Company Y, or Potential Portfolio Company Z.

- Pick any company you’re interested in, build a model, and make an investment recommendation.

With these case studies, you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model.

You might have 3-7 days to complete this type of case study and present your findings.

You might be tempted to use that time to build a complex LBO model, but that’s a mistake for three reasons:

- The smaller firms that give open-ended case studies tend not to use that much financial engineering.

- No one will have time to review or appreciate your work.

- Your time would be better spent on industry research and coming up with a sold investment thesis, risk factors, and mitigants.

If you want an example of an open-ended exam like this, see our private equity case study article and follow the video walkthrough or article text.

Your model could be shorter, and your presentation could certainly be shorter, but this is a good example of what to target if you have more time/resources.

Type #5: 3-Statement/Growth Equity Model

At operationally-focused PE firms, growth equity firms, and PE firms in emerging markets such as Brazil , 3-statement projection modeling tests are more common.

The Atlassian case study is a good example of this one, but I would change a few parts of it (we ignored Equity Value vs. Enterprise Value for simplicity, but that was a poor decision).

Also, you’ll never have to answer as many detailed questions as we did in that example.

If you think about it, a 3-statement model is just an LBO model without debt repayment – and the returns are based on multiple expansion, EBITDA growth, and cash generation rather than debt paydown .

You can easily practice these case studies by picking companies you’re interested in, downloading their statements, projecting them, and calculating the IRR and multiples.

Type #6: Consulting-Style Case Study

Finally, at some operationally-focused PE firms, you could also get management consulting-style case studies, where the goal is to advise a company on an expansion strategy, a cost-cutting initiative, or pricing for a new product.

We do not teach this type of case study, so check out consulting-related sites for examples and exercises.

And keep in mind that this one is only relevant at certain types of firms; you’re highly unlikely to receive a consulting-style case study in standard PE interviews.

A Final Word On Case Studies

I’ve devoted a lot of space to case studies, but they are not as important as you might think.

In on-cycle processes, they tend to be a “check the checkbox” item: Interviewers use them to verify that you can model, but you won’t stand out by using fancy Excel tricks.

Arguably, they matter more in off-cycle interviews since you can present unique ideas more easily and demonstrate your communication skills in the process .

What NOT to Worry About In PE Interviews

The topics above may seem overwhelming, so it’s worth pointing out what you do not need to know for interviews.

First, skip super-complex models.

As a specific example, the LBO models on Macabacus are overkill; they’re way too complicated for interviews or even the job itself.

You should aim for Excel files with 100-300 rows, not 1,000+ rows, and skip points like circular references unless they specifically ask for them (for more, see our tutorial on how to remove circular references in Excel )

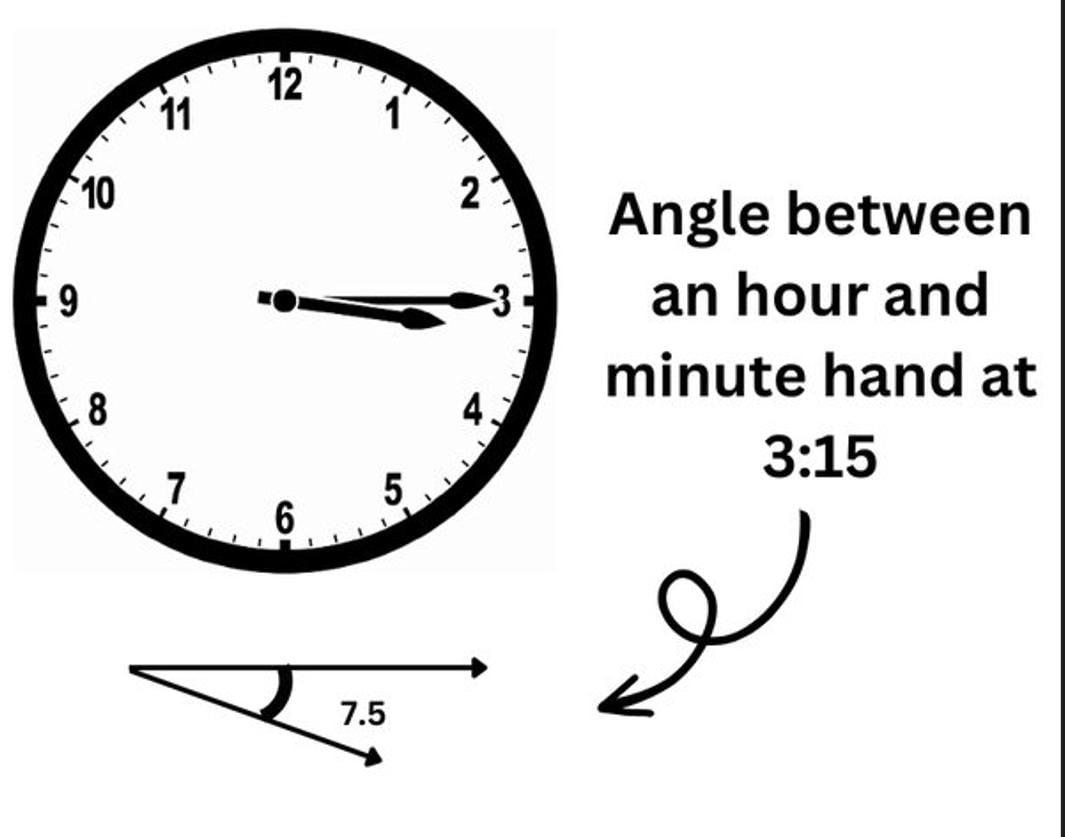

Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm.

Finally, you don’t need to know about the history of the private equity industry or much about PE fund economics beyond the basics.

Your time is better spent learning about a firm’s specific strategy and portfolio.

PE Interview X-Factor(s)

Besides the topics above, competitive tension can make a huge difference in interviews.

If you tell Firm X that you’ve already received an offer from Firm Y, Firm X will immediately become far more likely to give you an offer as well.

Even at the networking stage, competitive tension helps because you always want to tell recruiters that you’re also speaking with Similar Firms A, B, and C.

Also, leverage your group alumni and the 2 nd and 3 rd -year Analysts.

You can read endless articles online about interview prep, but nothing beats real-life conversations with others who have been through the process.

These alumni and older Analysts will also have example case studies they completed, and they can explain how to spin your deal experience effectively.

PE Interview Preparation

The #1 mistake in PE interviews is to focus excessively on modeling tests and technical questions and neglect your deal discussions.

You can avoid this, or at least resist the temptation, by turning your deals into case studies.

If you follow my advice to create simplified LBO models for your deals, you can combine the two topics and get modeling practice while you’re preparing your “investor’s views.”

If you’re working full-time in banking, use your downtime in between tasks to do this , outline your story , and review technical questions.

If you only have 10-15-minute intervals of downtime, break case studies into smaller chunks and aim to finish a specific part in each period.

Finally, start preparing before your full-time job begins .

You’ll have far more time before you start working, and you should use that time to tip the odds in your favor.

The Ugly Truth About PE Interviews

You can read articles like this one, memorize PE interview guides, and get help from dozens of bank/group alumni, but much of the process is still outside of your control.

For example, if you’re in a group like ECM or DCM , it will be tough to win on-cycle interviews at large firms and convert them into offers no matter what you do.

If the mega-funds decide to kick off recruiting one day after you start your full-time job in August, and you’re not prepared, too bad.

If you went to a non-target school and earned a 3.5 GPA, you’ll be at a disadvantage next to candidates from Princeton with 3.9 GPAs no matter what you do.

So, start early and prepare as much as you can… but if you don’t receive an offer, don’t assume it’s because you made a major mistake.

So You Get An Offer: What Next?

If you do receive an offer, you could accept it on the spot, or, if you’re speaking with other firms, you could shop it around and use it to win offers elsewhere.

If you’re not in active discussions with other firms, you’re crazy if you do not accept the offer right away.

If You Get No Offer: What Next?

If you don’t get an offer, follow up with your interviewers, ask for feedback, and ask for referrals to other firms that might be hiring.

If you did reasonably well but came up short in a few areas, you could easily get referrals elsewhere .

If you did not receive an offer because of something that you cannot fix, such as your undergraduate GPA or your previous work experience, you might have to consider other options, such as a Master’s, MBA, or another job first.

But if it was something fixable, you could take another pass at recruiting or keep networking with smaller firms.

To PE Or Not to PE?

That is the question.

And the answer is that if you have the right background, you understand the process, and you start preparing far in advance, you can get into the industry and win a private equity career .

And if not, there are other options, even if you’re an older candidate .

You may not reach the promised land, but at least you can blame it on someone else.

Additional Reading

You might be interested in:

- The Search Fund Internship: Perfect Pathway into Investment Banking and Private Equity Roles?

- Private Equity Analyst Roles: The Best Way to Skip Investment Banking?

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

49 thoughts on “ Private Equity Interviews 101: How to Win Offers ”

Brian, What about personality tests? What is their importance in the overall hiring process eg if you get them as the last stage?

They’re not that important, and even if you do get them, you can’t really “prepare” in any reasonable way (barring a brain transplant to replace your personality and make it more suitable for the firm). It’s also highly unusual to get one in the final stage – a firm doing that is probably just paranoid that you are secretly a serial killer and they want to rule out that possibility.

Hey- for the Fromageries Bel case study, can’t quite make sense of the Tier 4 management incentive returns, what’s the calculation for each tier? Would think it’s Tier 2 less tier 1 * tier 1 marginal profit

Tier 4 is based on a percentage of all profits *above* a 2.5x equity multiple. Each tier below it is based on a percentage of profits between specific multiples, which correspond to specific EUR proceeds amounts.

I have an accounting background (CPA & several years removed from school) and a small amount of finance experience through internships. I’m interviewing for a PE analyst position and managed to get through the first round of interviews. The firm itself doesnt just hire guys with a few years of banking, their team is very diverse with some backgrounds similar to mine.

The first round interview was a mix of technical questions plus a lot about myself and my experience. No behavioral questions. The first round was with an associate for 30 minutes, the second round is an hour with a partner. I managed to answer a lot of the questions about LBO models and what types of companies are good LBO candidates. Thanks to your website for that.

Any advice for a second round interview for a guy like me who doesnt have deal making experience or much experience in finance? Will the subsequent interviews after the first round be more technical-based questions? Or do they lean more on technical questions in round 1 to weed out candidates?

They will usually become more fit-based if they’ve already asked a lot of technical questions in earlier rounds. I would focus on your story and answers to the Why PE / Why This Firm / Are you sure you want to switch?-type questions.

Is it likely too difficult to access the on-cycle process from the CLT office of an In-Between-a-Bank that it would make more sense to focus one’s energy on the MM/LMM? Is the new era of Zoom making geography/distance less of a factor or is the perceived prestige of NY still an obstacle?

Location is somewhat less of a factor now, but it still matters, and working from home will not continue indefinitely into the future. It will be very difficult to participate in on-cycle recruiting at the mega-funds if you’re working in Charlotte at Wells Fargo if that’s your question, but plenty of MM funds are realistic.

What are some of the larger funds that you would consider realistic?

There are dozens of funds out there (it’s not like bulge bracket banks or mega-fund PE firms where there’s only a defined set of 5-10), so I can’t really give you a specific answer. My recommendation would be to look up people who worked at WF on LinkedIn and see the types of funds they are now working at.

I remember I saw a video of yours (might have been YouTube) where you explained the PE process. You talked about do pe firms really add value and then you went over how when a pe firm buys a company, they do a little “trick” where they create a shell company to acquire the target so the debt isn’t on the pe firms books. I’ve been looking all over for this video. Do you know which video I’m referring to?

Yes, that is no longer in video form. It’s still in the written LBO guide but the video from the old course was removed because it was way too long and boring for a video and was better explained in text.

Hi Brian, can you elaborate more on ‘Understanding the firm’s investment strategies, portfolio, and exits’ when you talk about smaller firm and off-cycle processes, simliar point came up under *Type 5*: you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model. What exactly should I pay attention on? I felt funds I checked their investment strategy descirption are pretty broad, and they invest in various type of deals, say even in one industry, they do different purchase range. Also, when talking about growth equity, you mentioned you can practice case by picking companies you’re interested in, downloading their statements, projecting them. What if they are not public companies, how can I get those information? Are you recommending only those companies with 20F available? Or can you just elaborate more on how can I follow your instruction? Thanks

All you can do is go off their website and possibly a Capital IQ description if you have access. See if they focus on growth, leverage for mature companies, operational improvements, or add-on acquisitions and pick something that fits one of those.

You can pick public companies for growth equity or find a public company that is similar to a private one the firm has.

Hey Brian! I have an interview with a family office for a private equity analyst position. The firm is small and not much about it online. I haven’t had much time to prepare as it was not an interview I was expecting. What would you say the most important elements to focus on are for the interview considering the time constraint? I am an undergrad, third year, second internship. (first internship was for a large construction/developer as project coordinator, not finance based)

Focus on your story, the firm’s portfolio companies and strategies, and a few investment ideas you have for specific sectors. Technical questions are fine, but you probably won’t have much time to prepare at the last minute.

How would PE interviews / Technical questions look like for straight out of undergrad PE role look like

e.g Blackstone internships, Goldman Merchant Banking internships etc

Similar to IB ones, with a focus on LBOs?

Largely the same, but less emphasis on deal experience and deal-related questions at the undergraduate level. They may ask slightly more questions on LBOs, but at the undergrad level, they assume you know very little, so questions will span a wide range of topics.

Have you written or seen similar articles on PE operating partner interviews?

No, sorry. There’s hardly any information on that level of interview online because you can’t really make an interview guide or other product to prepare for it, and most people at that level would need 1-on-1 coaching more than a guide. My guess is that they will focus almost exclusively on your past experience turning around and growing businesses and assess how well you can do it for their portfolio companies. They’re not going to give you LBO modeling tests or case studies.

“Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm”

Could you please elaborate on this? Almost every IB interview includes brain teasers so I am wondering why a PE interview shouldn’t?

Brain teasers are not that common in IB interviews in most regions unless you count any math/accounting/finance question as a brain teaser. They are far more common in S&T, quant fund, and prop trading interviews.

The point of this statement is that it’s OK if an occasional brain teaser comes up, but if the interviewer asks you brain teasers for 30 minutes, which have exactly 0% correlation to the real work in PE, you should leave because it’s a sign that the people working at the firm are idiots who don’t know how to conduct proper interviews or test candidates.

This is helpful. I find myself at a fix, I do not think I have had the right exposure, although in a BB I support teams with standard materials in a particular industry group in M&A. However I have interviews with a top global PE next month. Any guidance on how should I prepare for it ?

Thanks in advance

Follow everything in this article… practice spinning/discussing your deals… practice LBO questions and simple case studies.

Brian – thank you for your concise and candid remarks. do you have any insights or advice for someone with 5yrs of BB ECM & DCM experience now at a top full-time MBA program looking to break in?

It’s going to be very difficult if you just have capital markets experience and you’re already in business school. You should probably move to an M&A or strong industry team at a large bank (BB or EB) after business school and then go into private equity from there. It’s tough, but still easier than trying to move into PE directly out of an MBA program with only capital markets experience.

My next interview will highly likely involve a statement/growth equity modeling case. I tried to find the Atlassian Case interview but i am unable to open the link.

Would it be possible to share an example case or more information on that topic?

Many thanks,

The Atlassian case study is all we have. I don’t know why you can’t open the files, but I just tried and they seemed to work. Maybe try again or use a different browser.

Hi M&I team,

I have an opportunity to interview for an Analyst level opening at a boutique PE fund. This is a shop that has just started operations so I am directly communicating with the Partner. I doubt they have any structured recruitment process at this stage of their existence. He asked me to send some written work (memos and spreadsheets) on any public listed co that demonstrates my understanding of investing (basic balance sheet analysis, ratio analysis, valuation multiples).

So I am just wondering what to do? Should I work on projections and prepare a DCF model or do something simpler? I’d really appreciate your guidance on this.

Thanks again for the amazing work you’ll have been doing!

Yes, just create simple projections, a simple valuation/DCF, and maybe a simple LBO model since it is a PE fund that intends to buy and sell companies.

Could you provide some advice for preparing interviews for principal investing role ?

Thank you in advance Laura

We don’t really focus on that, but the articles on private equity and funds of funds on this site might be helpful.

Just wanted to say thank you! After reading everything on this site including all the CV and interview material I have managed to transition from a second year engineering undergrad with no prior experience/spring weeks/insight days, into an intern at Aviva Investors (UK buy side) within the space of one year.

The information you have posted is invaluable and “breaking in” is definitely doable with the right mindset and appetite for rejections!

Thanks again.

Thanks! Congrats on your internship offer.

Hi Brian/Nicole – Im an Economics student from the UK in 3rd year out of a 4 year course at a semi-target college, with 2 finance internships done up until now(not FO). I plan on doing a Msc Finance when I finish and eventually break into IB or Sales/Trading (I know I still haven’t decided which one I really want more). Through a family friend I have an offer to do a short internship this summer in NY in a post-trade regulatory commission. As this isn’t actually sitting at a trading desk experience, or anything related to IB should I decide to go down that road, would this add genuine value to my CV ? How are internships in regulatory commissions looked at for students looking to break into sales/trading? Surely even having any NY Finance experience on the CV will add more substance over here in London when going for internships compared to the majority of UK students who don’t? Appreciate any advice on this matter, Thanks!

I don’t think it would help much because you already have 2 non-FO internships, and a regulatory internship would be yet another non-FO internship. If it’s your best option, you can take it, but you would be better off getting something closer to a real front-office role.

Hey Brian. I am graduating after this semester going into Management consulting (Deliote, AT Kearny, Accenture)but I’m hoping to make a switch into either IB or PE after a couple years. I have one search fund internship which was enough to get me a few 1st and second round ib/pe FT interviews but no offers.My plan is to get into the best online MSF program I can and switch into Finance once I’m done. Do you think, given how close I was to getting in my 1st try, a high GPA from a reputable MSF and good experience in consulting will be enough or should I try to somehow get an IB internship before I apply?

I think you will probably need another internship just before the MSF starts or while it is in progress, not necessarily in IB, but something closer to it. Otherwise you’ll get a lot of questions about why you went from the search fund to consulting.

Thanks. As far as my story is concerned, is it better to do another finance internship before consulting so it’s search fund->ib->consulting->MSF (or MBA not sure)? I only ask because I may be able to get on some m&a projects with the consulting firm and my story could be when exposed to those deals, I realized how big my passion for finance was and that’s when I decided to get my MSF and switch to IB.

No, I think that would make less sense because then you would have to explain why you went from IB to consulting… and are now trying to go back to IB. Saying that you got exposed to M&A deals during the consulting experience would be a better story (and you would still ideally pair it with a transaction-related internship before/during the MSF).

Got it, thanks!

Probably missing something here, but for the first example, where does the 300% and 55% come from?

300% = 4x multiple. If compounding did not exist, we could just say 300% / 4 = 75% annual return. Because of compounding, however, the actual return does not need to be 75% per year in order for us to earn 300% by the end of 4 years. Instead, it can be a fair amount less than that, and we’ll still end up with 300% at the end.

To estimate the impact of compounding, you can multiply this 300% / 4 figure by a “compounding factor,” which varies based on the multiple and time period, but which is around 55% for a 4x return over a standard holding period.

Do you mind explaining how you can estimate a “compounding factor” such as with the 55% here?

There’s no easy-to-calculate-using-mental-math way to get this for all scenarios, but you can memorize quick rules of thumb (based on actual numbers and looking at the ratios) for 3 and 5-year periods and extrapolate from there. I don’t really think it’s worth doing that in-depth, though, because you just have to be roughly correct with these answers.

Do you think you will do a hedge fund interview guide similar to the one you have here?

Potentially, yes, but it’s much harder to give general guidelines for HF interviews because they’re completely dependent on your investment pitches. Also, interest in HFs has declined over the years (we no longer receive as many questions about them).

On that mental paper LBO question, how is the company able to pay off 900 of debt by year 3? It sounds like proceeds from the sale will have to be used in order to fully pay off the debt because EBITDA alone only adds up to 525, and that’s assuming there’s no interest.

Favorable working capital… NOLs… asset sales… the Konami code or other cheat codes. The point is not the numbers but the thought process.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Ace Your Private Equity Interviews

Our Interview Guide has 120+ pages of LBO instruction, deal discussions, LBO practice tests, personal pitch templates, and more.

Investment Banking Case Study Examples – A Guide

If you are preparing for an investment banking interview, you’ll probably need to conquer a case study interview. because case studies are a very crucial component in the investment banking hiring process. particularly if you have never completed a case study before, that will be very challenging for you to get into the investment banking field. this article has covered everything you need to know about investment banking and potential investment banking case studies. there are also tips and practice investment banking case study questions with examples of how to resolve them..

What is Investment Banking?

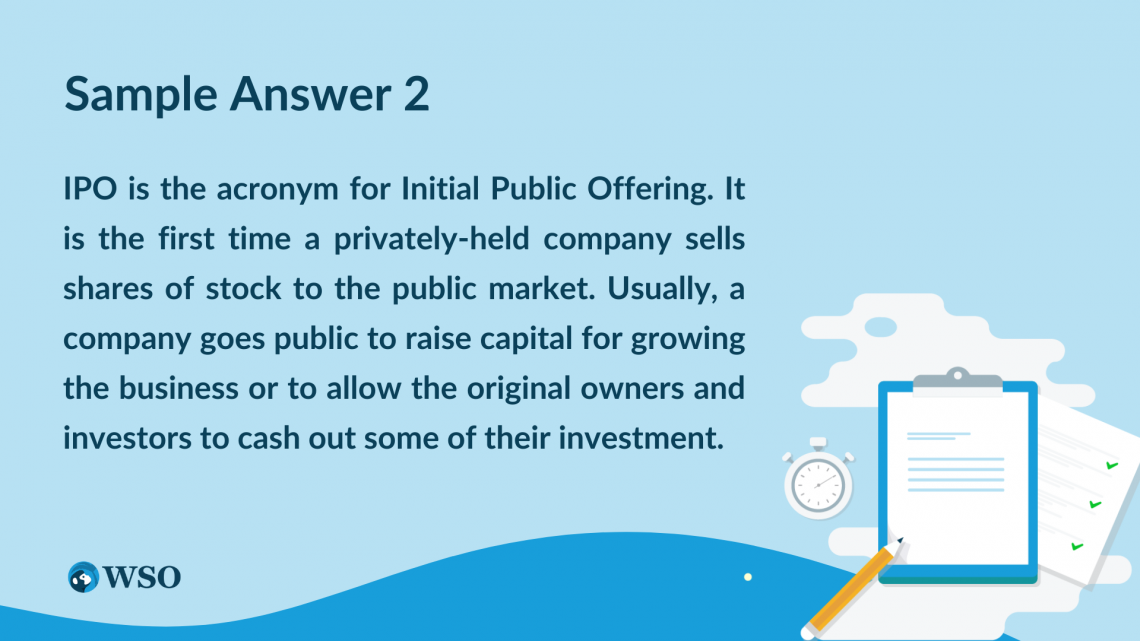

Investment banks are financial firms that perform a variety of tasks, including underwriting, assisting companies with the issuance of stock and debt securities through initial public offerings or fixed-priced offerings enabling mergers and acquisitions on both the buy side and sell side of the deal, corporate restructuring and many other tasks.

To efficiently complete these significant deals, a firm turns into an investment banker when it requires finance services. With some of the best benefits in the businesses, it is an extremely competitive industry.

How Does Investment Banking Work?

Investment banking offers services and serves as the middleman between businesses and investors and focuses mostly on shares and stock exchanges.

Investment banking services help big businesses and organizations in developing a successful investment strategy that includes accurate financial instrument valuation.

When a company conducts an IPO or initial public offering, an investment bank purchases the majority of the shares immediately on the firm’s behalf.

The investment bank, which is now serving as a stand-in for the company then sells these shares on the market. The investment bank improves the company’s revenue in this way while also making sure that all governing rules are observed.

The investment bank makes money by marking up the initial price of shares when selling them to investors, helping the organization in making the most profit possible from this activity.

If a circumstance in the market emerges where the stock becomes overpriced, the investment bank also runs the risk of losing money by selling the stock at a lower price.

An organization should assess its requirements and carefully consider all of its possibilities before seeking guidance from an investor banker. Before the company visits an investment bank, there are a few crucial considerations including the amount of capital being raised and the level of market competition. When the business has clarity in these areas, it can enlist the assistance of investment bankers to find new businesses to invest in.

- Financial Modeling vs Investment Banking

- Guide To Investment Banking

- Financial Services vs Investment Banking

- Investment Banking Business Models

- Career Opportunities In Investment Banking

- Investment Banking Industry

- Investment Banking Courses in Delhi

- Investment Banking Courses in Chennai

- Investment Courses After 12th

Benefits of Investment Banking

Investment banking assists big businesses in a variety of ways to make crucial financial decisions and make sure they maximize revenues. That’s the reason, Investment banks are a prevalent financial institution among these businesses and even governments.

Here Are Some of the Advantages of Investment Banking:

- Investment banks effectively manage their client and provide them with the information they require regarding the advantage and disadvantages of investing their money in other businesses or organizations.

- These banks serve as a bridge between the company and the investor, ensuring a rise in financial capital by helping in major financial transactions like mergers and acquisitions.

- It conducts an in-depth analysis of the deal and project that will be undertaken by its customer to ensure that the client’s money is invested safely and helps to reduce the risks involved with the mentioned deal or project.

What is Investment Banking Case Study?

You must have solved case studies during your investment banking training.

Analyzing a business condition is done in case studies during investment banking interviews.

You would be provided with all the necessary data and have adequate time to examine broad case studies. There you would be asked for your opinion on business-related issues.

Your Task Includes,

- Make the necessary deduction.

- Investigate the matter, which is typically a client’s business.

- Give suggestions for resolving the current issue along with an explanation.

Investment banking case studies are frequently used to evaluate a job candidate’s potential performance in real circumstances, where your interviewers would give you a problem and ask for a detailed recommendation.

By presenting them with a hypothetical scenario similar to those experiences while working in the field, your job is simply to analyze the scenario and give them justified reasons.

Case studies are typically presented at the end of the application process, most frequently at the final interview or during the assessment center.

The majority of questions in investment banking case studies revolve around acquisition, capital raising, or business growth.

- Financial Modeling Course

- Digital Marketing Course

- Technical Writing Course

- Content Writing Course

- Business Accounting And Taxation Course

- CAT Coaching

- Investment Banking Course

- Data Analytics Course

What Are the Types of Case Studies?

Take home investment banking case study.

- You will probably receive the case in advance so you have more time to work on it before the assessment day.

- In the case of take-home case studies, you are given a few days to work on them, complete your analysis, and showcase your recommendation to the bankers over a 30-45 minutes presentation.

- It involves a much deeper analysis including merger/LBO modeling, company procedures, and valuation.

On the Spot or Blind Investment Banking Case Study

- On the day of your assessment center, the case can be presented to you blindly with little time for preparation.

- These are given to you on the day of your interview and within an hour or two you are supposed to present it on the spot.

- The time split for this process would usually be 45-60 minutes of preparation, 10 minutes of presentation followed by a round of question and answer.

- It would not involve such deep study.

- Some case studies on investment banking may occasionally be given as a group task, where the employer will use this as an opportunity to examine the candidate’s analytical skills and teamwork qualities.

Why You Should Prepare for Investment Banking Case Study?

The theory behind these case studies is that because the qualification for various professions varies, bankers don’t trust the conventional method of interviewing applicants.

Case studies are preferred by banking recruiters as a better way to evaluate applicants because they show how you should perform in the workplace.

You don’t need to worry about whether your response is right or wrong in this situation because the interviewer is more interested in how the candidate thinks and how well they can use logic and analysis to come up with an innovative answer to the challenge at that time.

Investment banking case study writers aim to inspire applicants to come up with their ideas and apply critical thinking.

Candidates for these positions must have a variety of skills, but problem-solving ability is one of the most important.

Recruiters are interested in learning how you would approach difficult circumstances and use your intelligence, education, and professional experience to handle them successfully.

Additionally, candidates get an amazing chance to practice their other abilities including presentation, communication, and interpersonal skills.

These factors make case studies significantly more important than the other methods of evaluating applicants in the investment banking hiring process.

How to Prepare for Case Studies Before Assessment Day?

- Read as much deal news as you can while preparing and going through the daily market and business news in popular publications.

- Discover the many valuation methods, how they are calculated, and how they are evaluated then try out your calculations after watching YouTube videos or reading information on valuation methods.

- You must prepare a structure using PowerPoint and Excel consistently, especially for modeling and valuation-based case studies.

- Also, improve your familiarity with software like Microsoft Excel so that you can use spreadsheets effectively.

- You should practice the kinds of questions you might get during your presentation.

- Real case study interview questions used by banks might not be available to you.

- But, knowing that you need to practice, consider contacting a colleague or friend, or mentor you know who has gone through case study rounds for the types of questions they were asked.

How to Solve It and Perform Well During Assessment Day?

- To solve the case study, take an organized strategy.

- Before making a conclusion or deciding how to solve the problem, carefully analyze the case and the questions.

- Professionally prepare Excel and PowerPoint while modeling case studies.

- Every assentation you make should be supported by solid logical arguments, and the first few points should address that case’s most important issues.

- Even if is not necessary, it would be advantageous to have a specialized understanding of the industry being studied.

- Do not beat around the bush as you have limited time and hence be precise as you speak.

Investment Banking Case Study Examples and Answers

The decision-making case and the financial modeling case are two main types of case studies used in investment banking assessments.

Modeling – Investment Banking Case Study

Modeling case studies are typically take-home tasks that require you to perform straightforward valuation and financial modeling.

So rather than being a case study, it is more of a modeling exam.

The investment banker gives an overview of creating models as well as developing a variety of methods for an in-depth and useful understanding of the subject.

The modeling case study will either use a simpler merger or leveraged buyout model or a free cash flow to the business valuation.

To assess whether the firms are overvalued or undervalued, you would be asked to examine their valuation multiples.

In most cases, you will be given a few days to finish your analysis. Then on the day of the interview, you must spend 30-45 minutes presenting your case to the bankers.

Because you will have more time to work on it, the analysis will be considerably more in-depth than in a client case or decision-making case study.

Evaluating Strategic Alternative: Case Study 1

To maximize shareholder value, a magazine publisher is deciding whether to sell, grow organically or make tiny “tuck-in” acquisitions. It is looking for an investment bank to assist it with its alternatives and has asked for a presentation from your company.

Given Materials:

They would provide you with a firm summary with financial statements and five-year forecasts, a ten-page market analysis with main competitors, minor acquisition candidates, and recent transactions.

- First, go through everything to get a sense of the industry, where it’s going, and how much this firm is worth in comparison.

- Complete a quick assessment using publicly available rivals and prior transactions and a DCF.

- Evaluate the figures provided by the value, the company’s potential for organic growth, and the availability of suitable targets for acquisition.

Decide what to do, in most cases it is advisable to say “Sell” unless the industry is expanding rapidly (Above 10% annually) the company is completely undervalued, or these are acquisition candidates that will increase revenue or profit by at least 20-30%.

After you have come to a decision, you must prepare your presentation and decide what to tell the bankers.

If you are analyzing scenarios like this during a 30-minute presentation, choose 10 slides with 3-4 important themes each and attempt to spend 3-4 minutes on each slide.

If you choose to write “Sell the company”, consider the following steps in preparing a presentation:

- List the three main reasons for recommending selling

- Overview of the industry- Is it expanding? Falling off? Or Being Inactive?

- Position of the company in the industry? Leader or Second level position? Or is it strong or weak?

- What would organic growth look like in five to ten years? How much larger or more valuable would the company be?

- Prospective tuck-in acquisition candidates

- Why organic growth and acquisition are not the answers.

- Why selling now will generate the most shareholder value

- Show prior transactions and public comparable valuations

- Display the DCF output and the sensitivity chart valuation

- Summary- State again that the best course of action is to sell your company right away and that neither organic development nor the acquisition of smaller firms would increase your company’s valuation in five to ten years.

Must Check,

- Investment Banking Distance Learning Courses

- Investment Banking Courses in South Africa

- Investment Banking Courses After CA

- Investment Banking Training Institutes in Hyderabad

- Investment Banking Fresher Jobs

- Investment Banking Courses in Bangalore

- Investment Banking Courses in Noida

- Investment Banking Courses in London

- Investment Banking Jobs in Mumbai

Decision Making- Investment Banking Case Study

Case studies that include decision-making are more common than case studies that involve modeling.

In this kind of case study, the applicant is required to decide for their client and offer advice.

The client case study can center on locating financial sources or determining whether or not a proposed merger should go forward.

At the interview, you should be prepared for these questions. Because you will have a set amount of time in which to examine and present the case. You will be given a total of 45-60 minutes to prepare and beforehand 10 minutes presentation with a Q&A round.

Case Study 1

A customer owns her company fully and wants to release some liquidity while keeping a stake in it (Worth £400 million) what suggestions would you provide the client to get the best possible price?

Given Materials:

A corporate overview and details about the company’s performance over the last three years are provided.

Examine all financial information thoroughly and forecast the company’s organic development.

Consider the breakdown of the present valuation if you are provided with the relevant facts.

Think about the client’s industry and the expected trends for that market.

- How does the valuation stack up against others in the field?

- Is the current valuation backed up by reliable industry forecasts?

- Given the slow development of the industry, would it be wise to give up more equity?

- Is it expected that this industry will keep growing?

Consider present customer portfolios, projects, etc., while deciding whether any actions could be performed to boost the company’s value.

Think about suggestions for the client’s negotiation strategy:

- How much equity should they be prepared to give up?

- What number should the client choose as their actual reserve price, in your opinion?

Case Study 2

A publicly traded firm contacts you in the hope to raise money. Analysts’ expectations were met by recent profits and the latest financial report, but the company’s market values are lowest throughout the year. The management of the company has developed a project that it hopes would significantly boost EBIDTA and is looking to raise funding for it. What should the business do to raise the required capital?

Given material:

A summary of the business and its financial statements will be provided to you to prepare for this question.

You must think about whether the organization should raise debt or stock.

Think about the market capitalization, share count, and share price:

- How would the company be affected in this environment if it issued fresh shares?

- In terms of dilution of ownership, would equity financing be an appropriate option?

- How would the effect currently differ from what it would be if the share price were back to normal?

Then examine the provided financial statements:

- Would increasing debt be a better course of action if they are actually under management’s predictions?

- How much they could possibly raise?

- What potential problems could a debt increase bring about?

- How could the cost of interest be reduced?

Prepare your presentation by organizing your ideas clearly and go through your questions and thought process to get at your recommendation.

Also Check,

- Investment Banking Courses in Canada

- Investment Banking Courses in Germany

- Investment Banking Training Programs

- Best Courses For Investment Banking

- Free Investment Banking Courses

- Investment Banking Course Fees and Duration

- Investment Banking Courses Eligibility

- Investment Banking Training

- Investment Banking Graduate Programs

- Investment Banking Courses For Beginners

- Investment Banking Analyst Jobs

Potential Acquisition: Case Study 3

A software company is considering a large acquisition. It has chosen the company it wishes to acquire and has contacted a number of investment banks to obtain their thoughts on the transaction and how much they should pay. Based on these presentation, it will choose an advisor and decide what to do.

Two page summaries of the buyers and seller, each containing financial data as well as statistics and multiples for similar organization.

With a recommendation on whether to move forward with the acquisition and if so, how much to pay for the target, create five minute presentation.

For the very first, you should consider this two question to solve this,

- Should they purchase that target business?

- What price should they want for the target business?

For an example,

Let’s assume that the comparable companies are trading at EBITDA multiples that range from 4 to 8 times, with the median at 6 times and the 75th percentile at 7 times, respectively. You choose the 25th to 75th percentile range of 5x-7x and apply it to the target company’s $10 million EBITDA since the target company’s profit margins and revenue growth are comparable.

Therefore, the purchase price should range between $50 million and $70 million.

If you have access to a computer, you can also design a DSF, but if you are short of time, keep it straightforward and use multiples.

To answer the question “Should they buy?” take note of the following:

- Will the buyer be able to purchase the seller with enough cash, debt, or stock issuances?

- Will the vendor increase the buyer’s revenue and profit?

- Will the buyer benefit from new consumers, new goods, new markets, or other kinds of benefits as a result of the seller’s acquisition?

After concluding these, you can complete your presentation.

Investment Banking Case Study: FAQs

Q. what is an investment banking case study in short terms.

By presenting candidates with a hypothetical scenario that is comparable to those they might face on the job, investment banking case studies are frequently used to evaluate how the candidate would function in real circumstances.

Q. Which skills are tested in investment banking case study interviews?

Candidates’ analytical and financial skills as well as problem-solving, presentation skills, critical thinking, and interpersonal skills are tested during investment banking interviews.

Q. Is there any way to practice investment banking case studies?

There are various tools, financial modeling online courses, and investment banking textbooks accessible to practice investment banking case studies. Additionally, there are certain career services offered at universities and institutions that provide investment banking programs with case studies.

Investment Banking Case Study: Conclusion

The opportunities to demonstrate your abilities and expertise to investment bankers are provided by investment banking case studies, which are a crucial component of an interview process.

We have covered some of the investment banking case study examples that will help you in preparation for an investment banking interview.

No doubt it is a very competitive yet tough field to break into but we hope, through this article you achieve the success ladder in the investment banking industry.

Author: Swati Varli

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Join Our Investment Banking Demo Class

- Phone This field is for validation purposes and should be left unchanged.

Weekend Batch - 25th May 2024

Every Sat & Sun - 10:00 AM - 12:00 PM

7 Seats Left

You May Also Like To Read

Top listed kpo companies in india to consider for career growth, top 7 career opportunities for digital marketing strategist, top short term courses after 12th in 2024, top 6 investment banking courses in mexico, financial modeling course eligibility | fees | duration, how to start a kpo business in easy steps without experience, tricks and tools to generate unique blog post ideas, top 5 investment banking courses in denmark, best grammar checker: 12 prevalent options in 2024.

- 100% assured internships

- Placement Assured Program

- 500+ Hiring Partners

- 100% Money Return Policy

Sunday Batch - 26th May 2024

Sunday 10:00 AM - 2:00 PM (IST)

Share Your Contact Details

- Name This field is for validation purposes and should be left unchanged.

Weekdays Batch - 14th May 2024

Tues & Thur - 8:00 PM - 9:30 PM (IST)

Saturday Batch - 18th May 2024

Saturday 10:00 AM - 1:00 PM (IST)

- Comments This field is for validation purposes and should be left unchanged.

Download Course Brochure

- Hidden Unique ID

Weekdays Batch - 28th May 2024

Every Tue, Wed & Thur - 8:00 PM - 10:00 PM (IST)

Weekend Batch - 19th May 2024

Every Sat & Sun - 10:00 AM - 1:00 PM (IST)

Download Hiring Partners List

- Email This field is for validation purposes and should be left unchanged.

Download Tools List

Request for online demo, weekend batch - 18th may 2024.

Every Sat & Sun - 10:00 AM - 12:00 PM (IST)

- Learn From An Expert

- Steroids To Crack CAT Exam

- Flip The Classroom Concept

- Technology Driven

Request to Speak with MBA ADVISOR

- Select Course * * Select Course Advanced Search Engine Optimization Business Accounting & Taxation Course Business Analytics Master Course Content Writing Master Course Digital Marketing Master Course Data Analytics Master Course Data Science Master Course Financial Modeling Course Investment Banking Course GST Practitioner Certification Course Technical Writing Master Course Tally Advanced Course Other Course

- ADDITIONAL COMMENT

Download Our Student's Success Report

Watch our module 1 recording live for free, get realtime experience of training quality & process we follow during the course delivery.

Talk To An Agent

Talk to our agent, download student's success report, weekday batch - 28th may 2024, request for a callback, weekend batch - 30th may 2024, start hiring.

- Company Name *

- Hiring for * Select Program Content Writer Digital Marketer Data Analyst Financial Modellers Technical Writer Business Accounting & Taxation Search Engine Optimization Investment Banking

- Attach Document * Max. file size: 256 MB.

- Company Name * First

- Select Program Select Program Business Accounting & Taxation Course Content Writing Master Course Digital Marketing Master Course Data Analytics Master Course Financial Modeling Course Search Engine Optimization Technical Writing Master Course

- Select Members Select Mumbers 1-5 6-20 21-50 51-100 100+

- Additional Comments

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Case Studies in Islamic Banking and Finance: Case Questions & Answers

What are the principles of Islamic banking and finance? Case Study 1.The Ijara Contract as a mode of Islamic Finance. Case Study 2. The Musharaka Contract as a mode of Islamic Finance. Case Study 3. The Diminishing Musharaka Contract as a mode of Islamic Finance. Case Study 4.1.The Mudaraba Contract as a mode of Islamic Finance. Case Study 4.2.The Mudaraba contracts with multiple financing options. Case Study 5. Murabaha, Musharaka, Ijara and Ijara Wa-Iktina. Case Study 6. Islamic Mortgages for Home Finance. Case Study 7. Sources of Finance for Islamic Banks: An Application of Profit and Loss Sharing. Case Study 8. Financial Statement Analysis for Islamic Banks. Case Study 9. Islamic Investment Prohibitions. Case Study 10. Issues involved in creating an Islamic bank within a western regulatory framework : the case of the Islamic Bank of Britain. Case Study 11. Leverage and Islamic Banking. Case Study 12. Impact of Loan Defaults on Islamic and Conventional Banks. A glossary of Islami...

Related Papers

Rasem Kayed

ABD HAKIM ABD RAZAK

The raison d'être of this article is to supply basic insights on the origin and characteristics of the Islamic Banking system, its distinguishing features, and related contentious issues that have remained the subject of ongoing debates among Sharia' scholars and members of the academia. These were analyzed by referring to the principles of Muammalat (Islamic economic transaction), which are derived from the Holy Quran, Sunnah of Prophet Muhammad (p.b.u.h.), and Ijma' (consensus) of prominent Sharia' scholars. Contrary to the conventional banks, Islamic banks are required to operate according to the principles of Muammalat, which are identified as the avoidance of Riba', Gharar, Maysir, Hilah, and the promotion of ethical business practices such as justice, fairness and transparency. The 2008 global financial meltdown has created a unique awareness among banking consumers on the need of an alternative to complement the conventional banking system, which was viewed by financial scholars as suffering from a crisis of failed morality as a result of greed, exploitation, and corruption. Likewise, many may viewed that the Islamic Banking system is merely another attempt to capitalize on the pulling power of religion towards people, yet there are a number of interestingly unique features that accentuate it from the other banking alternatives. In essence, it is aspired that this article may assist fellow readers, especially those who are still new to this alternative financial system, in understanding and appreciating its unique features, and further stimulate future research in this field. Insha'Allah (God's willing).

Fakihah Azahari

ali abdullah murtaza

Financial Markets, Institutions and Instruments

Kabir Hassan

Islamic Economic Studies

Nazmira Othman

Islamic Finance

Simon Archer

IJARW Research Publication

Islamic System of Baking and Finance is based on the principles of Sharia Law and is applicable all over the Islamic economies. In this paper, the objective is the study the history of Islamic financial system, its origin, the concepts and terminologies used. The main differences with conventional banking system shall be highlighted. Regulatory bodies like Sharia Auditors and Sharia governing bodies shall also be discussed. The main focus would on discussing the main financial tools used in Islamic banking and the concepts behind those terminologies.

The Huffington Post

Mansur Masih

In recent years, Islamic finance has emerged as a potential tool for curbing poverty and financing development worldwide. This article offers an overview of some of the key issues as well as prospects of Islamic finance and banking in the current globalised era.

Salman Shaikh

RELATED PAPERS

Bulletin of Canadian Petroleum Geology

Paul Broughton

Luciano Gebler

Journal of Applied …

Scott Highhouse

Young-Pil Kim

Veterinary Parasitology

John Karlsson

Journal of Applied Physics

Nuno Santos

Applied Economics

Antonio Afonso

Medycyna Pracy

Katarzyna Konieczko

Scientific reports

Angela Forte

SSRN Electronic Journal

Rosa Abrantes-Metz

Daniel Postan

Interval : Jurnal Ilmiah Matematika

Hagni Wijayanti

Revista Facultad de Ingeniería - Universidad de Tarapacá

Marco Fernández

demetri bouris

Advances in Mechanical Engineering

Mazgar Akram

Andrea Abestano

Ecotoxicology and Environmental Safety

paolo gasco

Henni Rosaini

Jurnal Kesehatan

Sayang A J E N G MARDHIYAH

麦考瑞大学毕业证文凭办理成绩单修改 办理澳洲MQ文凭学位证书学历认证

Rafael Díaz Arias

IEEE Transactions on Applied Superconductivity

Patrizia Livreri

2015 IEEE Symposium Series on Computational Intelligence

Philippe Salembier

Tetrahedron Letters

Barbara Zaleska

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Search Menu

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Urban Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical Literature

- Classical Reception

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Archaeology

- Greek and Roman Epigraphy

- Greek and Roman Law

- Greek and Roman Papyrology

- Late Antiquity

- Religion in the Ancient World

- Digital Humanities